Deck 2: Basic Cost Management Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

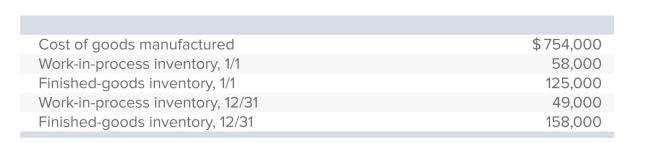

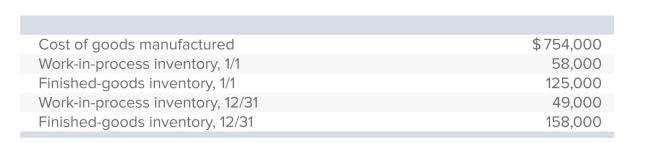

سؤال

سؤال

سؤال

سؤال

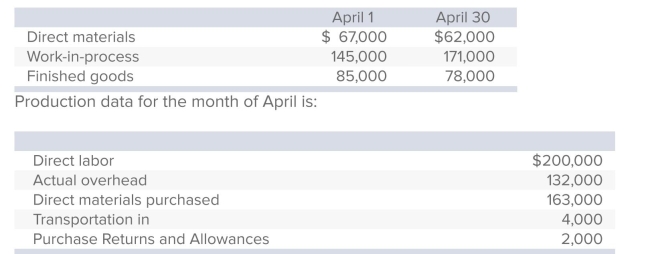

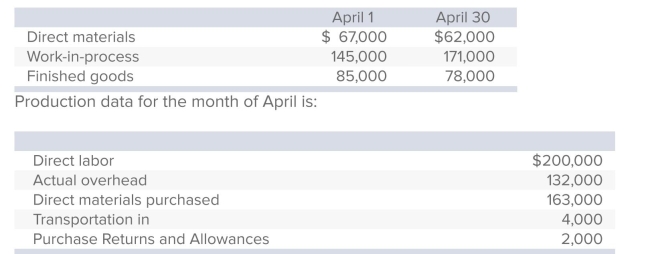

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/127

العب

ملء الشاشة (f)

Deck 2: Basic Cost Management Concepts

1

The following equation -- Beginning finished goods + cost of goods manufactured − ending finished goods -- is used to calculate cost of goods sold during the period.

True

2

There are three standard categories of manufacturing processes.

False

3

The higher the correlation between the cost and the cost driver, the more accurate will be the resulting understanding of cost behavior.

True

4

Different cost concepts and classifications are used for different purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

5

A job shop is generally associated with high production volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

6

Indirect labor is not a component of manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

7

An important first step in studying managerial accounting is to create a framework for thinking about the various types of costs incurred by organizations and how those costs are actively managed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

8

Inventoriable costs are expensed when incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

9

Another term for product cost is cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

10

A cost that is not directly traceable to a particular cost object is called an indirect cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sunk costs are irrelevant to all future decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

12

Selling and administrative costs are always period costs on any type of company's income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

13

Costs that a manager can influence significantly are classified as uncontrollable costs of that manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

14

A suitable cost driver for the amount of direct materials used is the number of direct labor hours worked.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

15

Out-of-pocket costs are defined as the benefit that is sacrificed when the choice of one action precludes taking an alternative course of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

16

Finished goods inventory is ordinarily held for sale by a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

17

The total cost of direct material, direct labor, and manufacturing overhead transferred from work-in- process inventory to finished-goods inventory is called the cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

18

Manufacturing costs are classified into four categories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

19

As activity changes, total variable cost increases or decreases proportionately with the activity change, but unit variable cost remains the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

20

As the activity level increases, total fixed cost remains constant and unit fixed cost remains the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following would not be classified as a product cost?

A)Direct materials.

B)Direct labor.

C)Indirect materials.

D)Insurance on a manufacturing plant.

E)Sales bonuses for meeting quota sales.

A)Direct materials.

B)Direct labor.

C)Indirect materials.

D)Insurance on a manufacturing plant.

E)Sales bonuses for meeting quota sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

22

Product costs are:

A)expensed when incurred.

B)inventoried.

C)treated in the same manner as period costs.

D)treated in the same manner as advertising costs.

E)subtracted from cost of goods sold.

A)expensed when incurred.

B)inventoried.

C)treated in the same manner as period costs.

D)treated in the same manner as advertising costs.

E)subtracted from cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following entities would most likely have raw materials, work in process, and finished goods?

A)A petroleum refiner.

B)A national department store.

C)A carpet cleaning company.

D)A regional airline.

E)A state university.

A)A petroleum refiner.

B)A national department store.

C)A carpet cleaning company.

D)A regional airline.

E)A state university.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

24

Ford Motor Company produces cars and trucks.Which type of production process is most likely used by Ford?

A)Batch.

B)Job Shop.

C)Continuous Flow.

D)Assembly.

E)None of these answers is correct.

A)Batch.

B)Job Shop.

C)Continuous Flow.

D)Assembly.

E)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cost data that are classified and recorded in a particular way for one purpose may be inappropriate for another use.For example, costs that would likely be noncontrollable by a department supervisor include

A)labor used in department production.

B)materials used in department production.

C)insurance on the plant where the department is housed.

D)overtime pay earned by workers in the department.

E)bonuses earned by department workers for on-time production.

A)labor used in department production.

B)materials used in department production.

C)insurance on the plant where the department is housed.

D)overtime pay earned by workers in the department.

E)bonuses earned by department workers for on-time production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is a product cost?

A)Circuitry used in producing hard drives.

B)Monthly advertising in the newspaper.

C)The salary of the vice president-finance.

D)Sales commissions.

E)Research costs for new router development.

A)Circuitry used in producing hard drives.

B)Monthly advertising in the newspaper.

C)The salary of the vice president-finance.

D)Sales commissions.

E)Research costs for new router development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

27

Selling and administrative expenses would likely appear on the balance sheet of:

A)A clothing store.

B)A computer manufacturer.

C)A television network.

D)All of these firms.

E)None of these firms.

A)A clothing store.

B)A computer manufacturer.

C)A television network.

D)All of these firms.

E)None of these firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

28

The accounting records of Younkin Corporation revealed the following selected costs: Sales commissions, $65,000; plant supervision, $190,000; and administrative expenses, $185,000.Younkin's period costs total:

A)$250,000.

B)$440,000.

C)$375,000.

D)$255,000.

E)$185,000.

A)$250,000.

B)$440,000.

C)$375,000.

D)$255,000.

E)$185,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

29

Shu Corporation recently computed total product costs of $567,000 and total period costs of $420,000, excluding $35,000 of sales commissions that were overlooked by the company's administrative assistant.On the basis of this information, Shu's income statement should reveal operating expenses of:

A)$35,000.

B)$420,000.

C)$455,000.

D)$567,000.

E)$602,000.

A)$35,000.

B)$420,000.

C)$455,000.

D)$567,000.

E)$602,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

30

Research and development costs are classified as:

A)product costs.

B)period costs.

C)inventoriable costs.

D)cost of goods sold.

E)labor costs.

A)product costs.

B)period costs.

C)inventoriable costs.

D)cost of goods sold.

E)labor costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

31

At the most basic level, a cost may be defined as a(n):

A)long-term asset.

B)data classified for a specific application.

C)sacrifice made to achieve a particular purpose.

D)useful information for planning.

E)suggestion for improvement.

A)long-term asset.

B)data classified for a specific application.

C)sacrifice made to achieve a particular purpose.

D)useful information for planning.

E)suggestion for improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following inventories would a company ordinarily hold for sale?

A)Raw materials.

B)Work in process.

C)Finished goods.

D)Raw materials and finished goods.

E)Work in process and finished goods.

A)Raw materials.

B)Work in process.

C)Finished goods.

D)Raw materials and finished goods.

E)Work in process and finished goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

33

Costs that are expensed when incurred are called:

A)product costs.

B)direct costs.

C)inventoriable costs.

D)period costs.

E)indirect costs.

A)product costs.

B)direct costs.

C)inventoriable costs.

D)period costs.

E)indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not a period cost?

A)Legal costs.

B)Public relations costs.

C)Sales commissions.

D)Wages of assembly-line workers.

E)The salary of a company's chief financial officer (CFO).

A)Legal costs.

B)Public relations costs.

C)Sales commissions.

D)Wages of assembly-line workers.

E)The salary of a company's chief financial officer (CFO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is true?

A)The word "cost" has the same meaning in all situations in which it is used.

B)Cost data, once classified and recorded for a specific application, are appropriate for use in

C)Different cost concepts and classifications are used for different purposes.

D)All organizations incur the same types of costs.

E)Costs incurred in one year are always meaningful in the following year.

A)The word "cost" has the same meaning in all situations in which it is used.

B)Cost data, once classified and recorded for a specific application, are appropriate for use in

C)Different cost concepts and classifications are used for different purposes.

D)All organizations incur the same types of costs.

E)Costs incurred in one year are always meaningful in the following year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following would not be a period cost?

A)Sales salaries.

B)Sales commissions.

C)Tamper-proof packaging.

D)Legal costs.

E)Accounting costs.

A)Sales salaries.

B)Sales commissions.

C)Tamper-proof packaging.

D)Legal costs.

E)Accounting costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following inventories would a discount retailer report as an asset?

A)Raw materials.

B)Work in process.

C)Finished goods.

D)Merchandise inventory.

E)All of the answers are correct.

A)Raw materials.

B)Work in process.

C)Finished goods.

D)Merchandise inventory.

E)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is a period cost?

A)Direct material.

B)Advertising expense.

C)Indirect labor.

D)Miscellaneous supplies used in production activities.

E)Factory foreman salary for the motor production line.

A)Direct material.

B)Advertising expense.

C)Indirect labor.

D)Miscellaneous supplies used in production activities.

E)Factory foreman salary for the motor production line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

39

The accounting records of Dixon Company revealed the following costs: direct materials used, $250,000; direct labor, $425,000; manufacturing overhead, $375,000; and selling and administrative expenses, $220,000.Dixon's product costs total:

A)$1,050,000.

B)$830,000.

C)$895,000.

D)$1,270,000.

E)None of the answers is correct.

A)$1,050,000.

B)$830,000.

C)$895,000.

D)$1,270,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

40

Cost data that are classified and recorded in a particular way for one purpose may be inappropriate for another use.For example, which of the following costs would not be a reasonable measure of a plant manager's performance?

A)net income compared to other plants.

B)comparison of current period performance costs to planned performance costs of the plant.

C)the increase or decrease in depreciation costs for the plant and its equipment.

D)penalty costs during each period for orders not completed on time by the plant.

E)bonuses earned by plant workers for on-time production.

A)net income compared to other plants.

B)comparison of current period performance costs to planned performance costs of the plant.

C)the increase or decrease in depreciation costs for the plant and its equipment.

D)penalty costs during each period for orders not completed on time by the plant.

E)bonuses earned by plant workers for on-time production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

41

Depreciation of factory equipment would be classified as:

A)operating cost.

B)"other" cost.

C)manufacturing overhead.

D)period cost.

E)administrative cost.

A)operating cost.

B)"other" cost.

C)manufacturing overhead.

D)period cost.

E)administrative cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

42

How should a company that manufactures automobiles classify its partially completed vehicles?

A)Supplies.

B)Raw materials inventory.

C)Finished goods inventory.

D)Cost of goods manufactured.

E)Work-in-process inventory.

A)Supplies.

B)Raw materials inventory.

C)Finished goods inventory.

D)Cost of goods manufactured.

E)Work-in-process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following employees of a commercial printer/publisher would be classified as direct labor?

A)Book binder.

B)Plant security guard.

C)Sales representative.

D)Plant supervisor.

E)Payroll supervisor.

A)Book binder.

B)Plant security guard.

C)Sales representative.

D)Plant supervisor.

E)Payroll supervisor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

44

Conversion costs do not include:

A)Depreciation

B)Direct materials

C)Indirect labor

D)Indirect materials

E)Direct labor

A)Depreciation

B)Direct materials

C)Indirect labor

D)Indirect materials

E)Direct labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

45

What would the cost of fire insurance for a manufacturing plant generally be categorized as?

A)Prime cost.

B)Direct material cost.

C)Period cost.

D)Direct labor cost.

E)Product cost.

A)Prime cost.

B)Direct material cost.

C)Period cost.

D)Direct labor cost.

E)Product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following employees would not be classified as indirect labor?

A)Plant Custodian.

B)Salesperson.

C)An employee that packs products for shipment.

D)Plant security guard.

E)A line employee that produces parts for chairs using a saw and template.

A)Plant Custodian.

B)Salesperson.

C)An employee that packs products for shipment.

D)Plant security guard.

E)A line employee that produces parts for chairs using a saw and template.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which type of production process is likely used for custom yachts built by Hargrave?

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)Direct assembly.

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)Direct assembly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

48

Conversion costs are:

A)direct material, direct labor, and manufacturing overhead.

B)direct material and direct labor.

C)direct labor and manufacturing overhead.

D)prime costs.

E)period costs.

A)direct material, direct labor, and manufacturing overhead.

B)direct material and direct labor.

C)direct labor and manufacturing overhead.

D)prime costs.

E)period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

49

Prime costs are comprised of:

A)direct materials and manufacturing overhead.

B)direct labor and manufacturing overhead.

C)direct materials, direct labor, and manufacturing overhead.

D)direct materials and direct labor.

E)direct materials and indirect materials.

A)direct materials and manufacturing overhead.

B)direct labor and manufacturing overhead.

C)direct materials, direct labor, and manufacturing overhead.

D)direct materials and direct labor.

E)direct materials and indirect materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which type of production process is likely used by a paint manufacturer to produce paint?

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)Direct assembly.

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)Direct assembly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

51

Guaranteed Appliance Co.produces washers and dryers in an assembly-line process.Labor costs incurred during a recent period were: corporate executives, $500,000; assembly-line workers, $180,000; security guards, $45,000; and plant supervisor, $110,000.The total of Guaranteed's direct labor cost was:

A)$110,000.

B)$180,000.

C)$155,000.

D)$235,000.

E)$735,000.

A)$110,000.

B)$180,000.

C)$155,000.

D)$235,000.

E)$735,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements is true?

A)Product costs affect only the balance sheet.

B)Product costs affect only the income statement.

C)Period costs affect only the balance sheet.

D)Neither product costs nor period costs affect the Statement of Retained Earnings.This can

E)Product costs eventually affect both the balance sheet and the income statement.

A)Product costs affect only the balance sheet.

B)Product costs affect only the income statement.

C)Period costs affect only the balance sheet.

D)Neither product costs nor period costs affect the Statement of Retained Earnings.This can

E)Product costs eventually affect both the balance sheet and the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following would not be classified as direct materials by a company that makes automobiles?

A)Wheel lubricant.

B)Tires.

C)Interior leather.

D)CD player.

E)Sheet metal used in the automobile's body.

A)Wheel lubricant.

B)Tires.

C)Interior leather.

D)CD player.

E)Sheet metal used in the automobile's body.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is correct?

A)Overtime premiums should be treated as a component of manufacturing overhead.

B)Overtime premiums should be treated as a component of direct labor.

C)Idle time should be treated as a component of direct labor.

D)Idle time should be accounted for as a special type of loss.

E)Overtime premiums should be treated as a component of direct labor and idle time should be

A)Overtime premiums should be treated as a component of manufacturing overhead.

B)Overtime premiums should be treated as a component of direct labor.

C)Idle time should be treated as a component of direct labor.

D)Idle time should be accounted for as a special type of loss.

E)Overtime premiums should be treated as a component of direct labor and idle time should be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following costs is not a component of manufacturing overhead?

A)Indirect materials.

B)Factory utilities.

C)Factory equipment.

D)Indirect labor.

E)Property taxes on the manufacturing plant.

A)Indirect materials.

B)Factory utilities.

C)Factory equipment.

D)Indirect labor.

E)Property taxes on the manufacturing plant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

56

Comet Computer Company, a manufacturer of computers and peripheral devices, purchases computer parts such as motherboards, computer chips, hard drives, and displays, and then assembles these parts into a variety of non-customized devices, such as tablet computers, laptops, and desktop computers.Comet's products are available in a limited regional distribution.Which type of production process is most likely used by Comet Computer Company?

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)None of these answers is correct.

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the four items listed below is not a type of production process?

A)Batch.

B)Job Shop.

C)Continuous Flow.

D)Job Flow.

E)Assembly.

A)Batch.

B)Job Shop.

C)Continuous Flow.

D)Job Flow.

E)Assembly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

58

The accounting records of Comacho Company revealed the following costs, among others:  Costs that would be considered in the calculation of manufacturing overhead total:

Costs that would be considered in the calculation of manufacturing overhead total:

A)$149,000.

B)$171,000.

C)$186,000.

D)$442,000.

E)None of the answers is correct.

Costs that would be considered in the calculation of manufacturing overhead total:

Costs that would be considered in the calculation of manufacturing overhead total:A)$149,000.

B)$171,000.

C)$186,000.

D)$442,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which type of production process is ideal for a low production volume and one-of-a-kind products?

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)Direct assembly.

A)Batch.

B)Continuous Flow.

C)Job Shop.

D)Assembly.

E)Direct assembly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

60

Cost of goods manufactured for Branson Books for the year was $860,000.Beginning work-in-process inventory was $40,000.Ending work-in-process was $60,000.If the beginning finished goods inventory was $400,000 and the ending finished goods inventory was $990,000 what was the cost of goods sold for the year?

A)$230,000.

B)$270,000.

C)$460,000.

D)$1,240,000.

E)None of these answers is correct.

A)$230,000.

B)$270,000.

C)$460,000.

D)$1,240,000.

E)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

61

Work-in-process inventory is composed of:

A)direct material and direct labor.

B)direct labor and manufacturing overhead.

C)direct material and manufacturing overhead.

D)direct material, direct labor, and manufacturing overhead.

E)direct material only.

A)direct material and direct labor.

B)direct labor and manufacturing overhead.

C)direct material and manufacturing overhead.

D)direct material, direct labor, and manufacturing overhead.

E)direct material only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

62

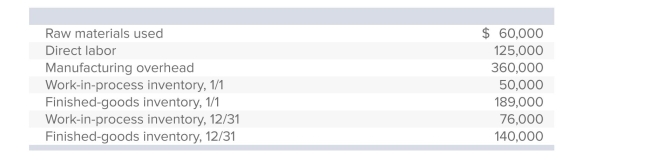

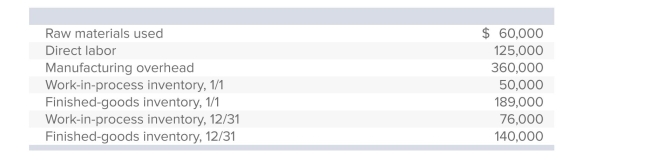

The accounting records of Falcon Company revealed the following information:  Falcon's cost of goods manufactured is:

Falcon's cost of goods manufactured is:

A)$519,000.

B)$522,000.

C)$568,000.

D)$571,000.

E)None of the answers is correct.

Falcon's cost of goods manufactured is:

Falcon's cost of goods manufactured is:A)$519,000.

B)$522,000.

C)$568,000.

D)$571,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

63

The accounting records of Stingray Company revealed the following information:  Stingray's cost of goods sold is:

Stingray's cost of goods sold is:

A)$508,000.

B)$529,000.

C)$531,000.

D)$553,000.

E)None of the answers is correct.

Stingray's cost of goods sold is:

Stingray's cost of goods sold is:A)$508,000.

B)$529,000.

C)$531,000.

D)$553,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

64

The accounting records of Upton Company revealed the following information:  Upton's cost of goods sold is:

Upton's cost of goods sold is:

A)$721,000.

B)$730,000.

C)$778,000.

D)$787,000.

E)None of the answers is correct.

Upton's cost of goods sold is:

Upton's cost of goods sold is:A)$721,000.

B)$730,000.

C)$778,000.

D)$787,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

65

Harrison Industries began July with a finished-goods inventory of $48,000.The finished-goods inventory at the end of July was $56,000 and the cost of goods sold during the month was $125,000. The cost of goods manufactured during July was:

A)$104,000.

B)$125,000.

C)$117,000.

D)$133,000.

E)None of the answers is correct.

A)$104,000.

B)$125,000.

C)$117,000.

D)$133,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the beginning monthly balance of materials inventory was $37,000, the ending balance was $39,500, and $257,800 of materials were used, the cost of materials purchased during the month is:

A)$255,300.

B)$257,800.

C)$260,300.

D)$297,300.

E)None of these answer choices is correct.

A)$255,300.

B)$257,800.

C)$260,300.

D)$297,300.

E)None of these answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

67

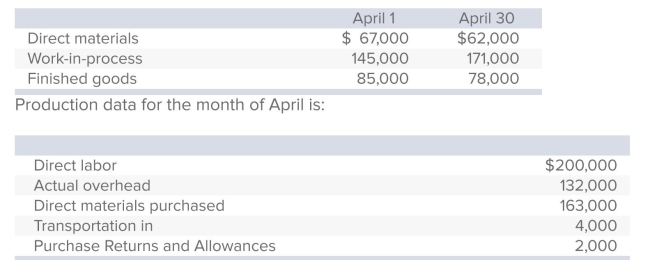

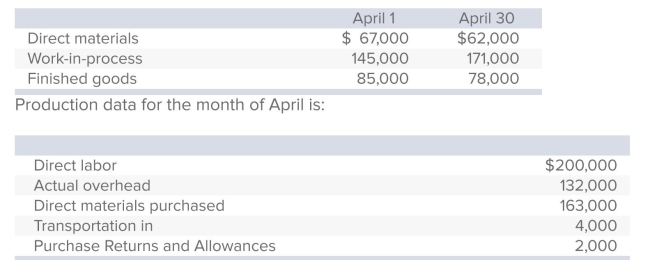

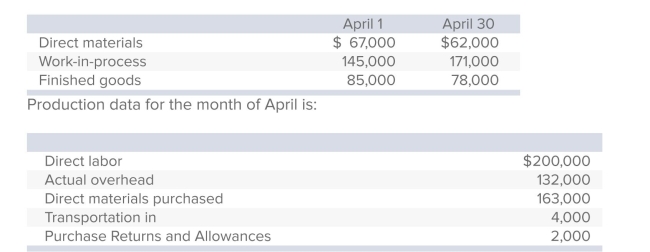

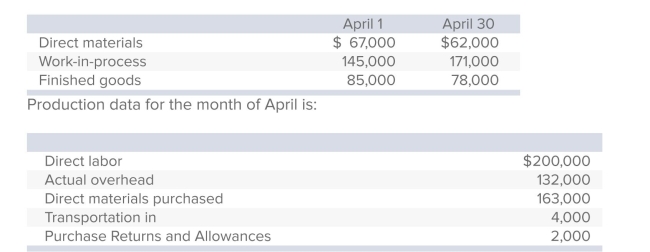

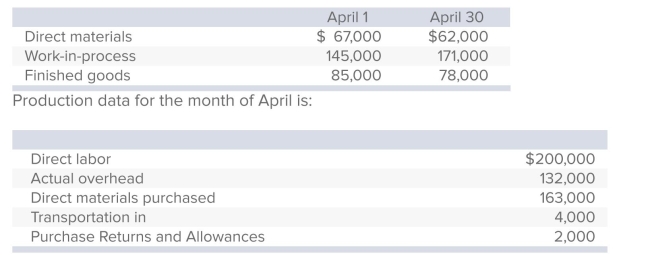

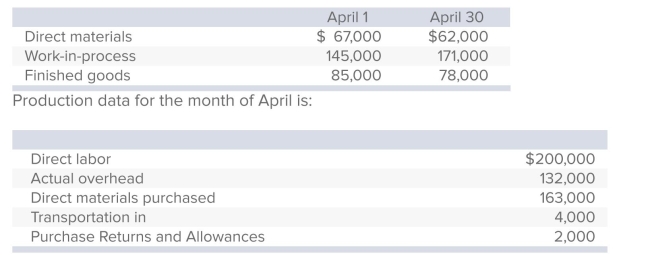

Beckett Industries has the following beginning and ending inventories for the month of April.  Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What was the cost of the materials used by Beckett in April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What was the cost of the materials used by Beckett in April?

A)$370,000.

B)$170,000.

C)$363,000.

D)$168,000.

E)None of the answers is correct.

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What was the cost of the materials used by Beckett in April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What was the cost of the materials used by Beckett in April?A)$370,000.

B)$170,000.

C)$363,000.

D)$168,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

68

Rainier Industries has Raw materials inventory on January 1, 20x8 of $32,500 and Raw materials inventory on December 31, 20x8 of $26,700.If purchases of raw materials were $135,000 during the year, what was the amount of raw materials used during the year?

A)$129,200.

B)$140,800.

C)$135,000.

D)$146,600.

E)None of the answers is correct.

A)$129,200.

B)$140,800.

C)$135,000.

D)$146,600.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

69

Jamison Supplies has a cost of goods manufactured for the year of $860,000.Beginning work-in- process inventory was $50,000 and ending work-in-process was $60,000.If Jamison's beginning finished goods inventory was $500,000 and the ending finished goods inventory was $990,000, what was the company's cost of goods sold for the year?

A)$360,000.

B)$370,000.

C)$490,000.

D)$1,350,000.

E)None of the answers is correct.

A)$360,000.

B)$370,000.

C)$490,000.

D)$1,350,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

70

Beckett Industries has the following beginning and ending inventories for the month of April.  Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's total manufacturing cost for April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's total manufacturing cost for April?

A)$502,000.

B)$503,000.

C)$363,000.

D)$510,000.

E)None of the answers is correct.

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's total manufacturing cost for April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's total manufacturing cost for April?A)$502,000.

B)$503,000.

C)$363,000.

D)$510,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

71

In a manufacturing company, the cost of goods completed during the period would include which of the following elements?

A)Raw materials used.

B)Beginning finished goods inventory.

C)Marketing costs.

D)Depreciation of delivery trucks.

E)All of the answers are correct.

A)Raw materials used.

B)Beginning finished goods inventory.

C)Marketing costs.

D)Depreciation of delivery trucks.

E)All of the answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

72

For the year just ended, Porter Corporation's manufacturing costs (raw materials used, direct labor, and manufacturing overhead) totaled $1,500,000.Beginning and ending work-in-process inventories were $60,000 and $90,000, respectively.Porter's balance sheet also revealed respective beginning and ending finished-goods inventories of $250,000 and $180,000.On the basis of this information, how much would the company report as cost of goods manufactured (CGM) and cost of goods sold (CGS)?

A)CGM, $1,430,000; CGS, $1,460,000.

B)CGM, $1,470,000; CGS, $1,540,000.

C)CGM, $1,530,000; CGS, $1,460,000.

D)CGM, $1,570,000; CGS, $1,540,000.

E)None of these.

A)CGM, $1,430,000; CGS, $1,460,000.

B)CGM, $1,470,000; CGS, $1,540,000.

C)CGM, $1,530,000; CGS, $1,460,000.

D)CGM, $1,570,000; CGS, $1,540,000.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following equations is used to calculate cost of goods sold during the period?

A)Beginning finished goods + cost of goods manufactured + ending finished goods.

B)Beginning finished goods − ending finished goods.

C)Beginning finished goods + cost of goods manufactured.

D)Beginning finished goods + cost of goods manufactured − ending finished goods.

E)Beginning finished goods + ending finished goods − cost of goods manufactured.

A)Beginning finished goods + cost of goods manufactured + ending finished goods.

B)Beginning finished goods − ending finished goods.

C)Beginning finished goods + cost of goods manufactured.

D)Beginning finished goods + cost of goods manufactured − ending finished goods.

E)Beginning finished goods + ending finished goods − cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

74

Texas Plating Company reported a cost of goods manufactured of $520,000, with the firm's year-end balance sheet revealing work in process and finished goods of $70,000 and $134,000, respectively.If supplemental information disclosed raw materials used in production of $80,000, direct labor of $140,000, and manufacturing overhead of $240,000, the company's beginning work in process must have been:

A)$130,000.

B)$10,000.

C)$66,000.

D)$390,000.

E)None of the answers is correct.

A)$130,000.

B)$10,000.

C)$66,000.

D)$390,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

75

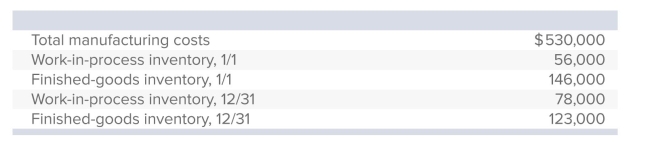

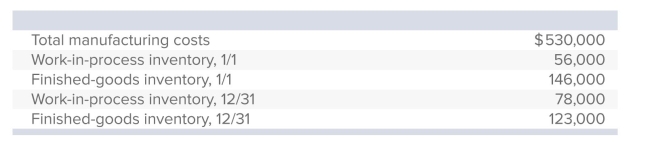

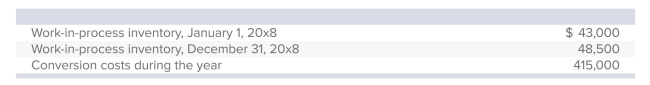

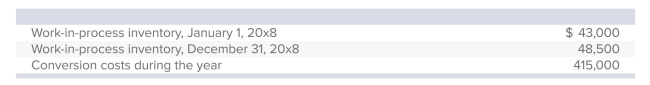

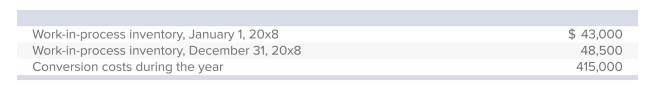

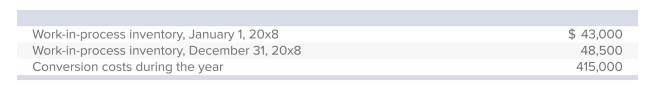

Peyton Manufacturing has the following data:  If direct materials used during the year were $135,000, what was cost of goods manufactured?

If direct materials used during the year were $135,000, what was cost of goods manufactured?

A)$140,500.

B)$539,000.

C)$409,500.

D)$544,500.

E)None of the answers is correct.

If direct materials used during the year were $135,000, what was cost of goods manufactured?

If direct materials used during the year were $135,000, what was cost of goods manufactured?A)$140,500.

B)$539,000.

C)$409,500.

D)$544,500.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

76

Rainier Industries has Raw materials inventory on January 1, 20x8 of $32,500 and Raw materials inventory on December 31, 20x8 of $26,700.If raw materials used during the year were $135,000 what was the amount of raw materials purchased during the year?

A)$129,200.

B)$140,800.

C)$135,000.

D)$146,600.

E)None of the answers is correct.

A)$129,200.

B)$140,800.

C)$135,000.

D)$146,600.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

77

Beckett Industries has the following beginning and ending inventories for the month of April.  Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods sold for April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods sold for April?

A)$476,000.

B)$484,000.

C)$491,000.

D)$502,000.

E)None of the answers is correct.

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods sold for April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods sold for April?A)$476,000.

B)$484,000.

C)$491,000.

D)$502,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

78

Peyton Manufacturing has the following data:  If the cost of goods manufactured for the year was $565,000, what was the amount of direct materials used during the year?

If the cost of goods manufactured for the year was $565,000, what was the amount of direct materials used during the year?

A)$155,500.

B)$140,500.

C)$150,000.

D)$145,500.

E)None of the answers is correct.

If the cost of goods manufactured for the year was $565,000, what was the amount of direct materials used during the year?

If the cost of goods manufactured for the year was $565,000, what was the amount of direct materials used during the year?A)$155,500.

B)$140,500.

C)$150,000.

D)$145,500.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

79

Compton Inc.has a beginning materials inventory balance for May of $27,500, and an ending balance for May of $28,750.Materials used during the month were $128,900.As a result, what is the cost of materials purchased during the month?

A)$101,400.

B)$127,650.

C)$130,150.

D)$157,650.

E)None of the answers is correct.

A)$101,400.

B)$127,650.

C)$130,150.

D)$157,650.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

80

Beckett Industries has the following beginning and ending inventories for the month of April.  Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods transferred to finished goods inventory for April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods transferred to finished goods inventory for April?

A)$469,000.

B)$477,000.

C)$495,000.

D)$484,000.

E)None of the answers is correct.

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods transferred to finished goods inventory for April?

Beckett uses one overhead control account and charges overhead to production at 70% of direct labor cost.The company does not formally recognize over- or underapplied overhead until year-end. What is Beckett's cost of goods transferred to finished goods inventory for April?A)$469,000.

B)$477,000.

C)$495,000.

D)$484,000.

E)None of the answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck