Deck 18: International Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/7

العب

ملء الشاشة (f)

Deck 18: International Finance

1

BALANCE OF PAYMENTS The following are hypothetical data for the U.S. balance of payments. Use the data to calculate each of the following:

a. Merchandise trade balance

b. Balance on goods and services

c. Balance on current account

d. Financial account balance

e. Statistical discrepancy 11eb5b3a_fa29_666e_a9f3_0f2993e9b2c4

a. Merchandise trade balance

b. Balance on goods and services

c. Balance on current account

d. Financial account balance

e. Statistical discrepancy 11eb5b3a_fa29_666e_a9f3_0f2993e9b2c4

a. Merchandise trade balance

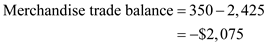

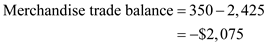

Merchandise trade balance is merchandise exports minus merchandise imports. The merchandise trade balance is

The merchandise trade balance is  billion.

billion.

b. Balance on goods and service

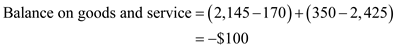

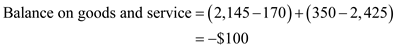

Balance on goods and service is the export of goods and services minus import of goods and services. The balance on goods and service is

The balance on goods and service is  billion.

billion.

c. Balance on current account

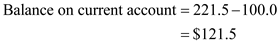

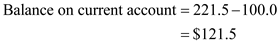

Balance on current account is the net income transferred minus inflow of foreign currency. The balance on current account is

The balance on current account is  billion.

billion.

d. Financial account balance

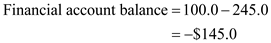

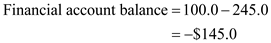

Financial account balance is capital inflow minus capital outflow. The financial account balance is

The financial account balance is  billion.

billion.

e.

Statistical discrepancy

Statistical discrepancy is capital outflow minus net income transferred. Hence, the statistical discrepancy is

Hence, the statistical discrepancy is  0

0

billion.

Merchandise trade balance is merchandise exports minus merchandise imports.

The merchandise trade balance is

The merchandise trade balance is  billion.

billion. b. Balance on goods and service

Balance on goods and service is the export of goods and services minus import of goods and services.

The balance on goods and service is

The balance on goods and service is  billion.

billion. c. Balance on current account

Balance on current account is the net income transferred minus inflow of foreign currency.

The balance on current account is

The balance on current account is  billion.

billion. d. Financial account balance

Financial account balance is capital inflow minus capital outflow.

The financial account balance is

The financial account balance is  billion.

billion. e.

Statistical discrepancy

Statistical discrepancy is capital outflow minus net income transferred.

Hence, the statistical discrepancy is

Hence, the statistical discrepancy is  0

0billion.

2

BALANCE OF PAYMENTS Explain where in the U.S. balance of payments an entry would be recorded for each of the following:

a. A Hong Kong financier buys some U.S. corporate stock.

b. A U.S. tourist in Paris buys some perfume to take home.

c. A Japanese company sells machinery to a pineapple company in Hawaii.

d. U.S. farmers make a gift of food to starving children in Ethiopia.

e. The U.S. Treasury sells a bond to a Saudi Arabian prince.

f. A U.S. tourist flies to France on Air France.

g. A U.S. company sells insurance to a foreign firm.

a. A Hong Kong financier buys some U.S. corporate stock.

b. A U.S. tourist in Paris buys some perfume to take home.

c. A Japanese company sells machinery to a pineapple company in Hawaii.

d. U.S. farmers make a gift of food to starving children in Ethiopia.

e. The U.S. Treasury sells a bond to a Saudi Arabian prince.

f. A U.S. tourist flies to France on Air France.

g. A U.S. company sells insurance to a foreign firm.

a. Capital inflow

A Hong Kong financier buys some U.S. corporate stock; thus means that the Hong Kong financier will pay to its U.S. counterpart. Hence, the cash flow will be recorded in capital inflow account in the U.S balance of payment.

b. Merchandise import

A U.S. tourist purchased a perfume in Paris to take home. Since this is imported by a U.S. tourist, this trading will be registered in merchandise import account in the U.S balance of payment.

c. Merchandise import

A Japanese company sold its machinery to a U.S. based company. Since this is imported by a U.S. company, this trading will be registered in merchandise import account in the U.S balance of payment.

d. Net unilateral transfers

U.S. farmers made a gift of food to the starving children of Ethiopia. Since this is not a part of trading activity, this will be recorded in net unilateral transfers in the U.S balance of payment.

e.

Capital inflow

The U.S. treasury sold a bond to a Saudi Arabian prince. Since selling bond is a capital transaction, this will be recorded in capital inflow account in the U.S balance of payment.

f.

Service imports

A U.S. tourist flew to France on Air France. This will be recorded in the service imports in the U.S balance of payment.

g.

Service exports

A U.S. company sold insurance to a foreign firm. This will be recorded in the service exports in the U.S balance of payment.

A Hong Kong financier buys some U.S. corporate stock; thus means that the Hong Kong financier will pay to its U.S. counterpart. Hence, the cash flow will be recorded in capital inflow account in the U.S balance of payment.

b. Merchandise import

A U.S. tourist purchased a perfume in Paris to take home. Since this is imported by a U.S. tourist, this trading will be registered in merchandise import account in the U.S balance of payment.

c. Merchandise import

A Japanese company sold its machinery to a U.S. based company. Since this is imported by a U.S. company, this trading will be registered in merchandise import account in the U.S balance of payment.

d. Net unilateral transfers

U.S. farmers made a gift of food to the starving children of Ethiopia. Since this is not a part of trading activity, this will be recorded in net unilateral transfers in the U.S balance of payment.

e.

Capital inflow

The U.S. treasury sold a bond to a Saudi Arabian prince. Since selling bond is a capital transaction, this will be recorded in capital inflow account in the U.S balance of payment.

f.

Service imports

A U.S. tourist flew to France on Air France. This will be recorded in the service imports in the U.S balance of payment.

g.

Service exports

A U.S. company sold insurance to a foreign firm. This will be recorded in the service exports in the U.S balance of payment.

3

DETERMINING THE EXCHANGE RATE Use these data to answer the following questions about the market for British pounds: 11eb5b3a_fa2a_02b9_a9f3_1596f1afda3f

a. Draw the demand and supply curves for pounds, and determine the equilibrium exchange rate (dollars per pound).

b. Suppose that the supply of pounds doubles. Draw the new supply curve.

c. What is the new equilibrium exchange rate?

d. Has the dollar appreciated or depreciated?

e. What happens to U.S. imports of British goods?

a. Draw the demand and supply curves for pounds, and determine the equilibrium exchange rate (dollars per pound).

b. Suppose that the supply of pounds doubles. Draw the new supply curve.

c. What is the new equilibrium exchange rate?

d. Has the dollar appreciated or depreciated?

e. What happens to U.S. imports of British goods?

a. Equilibrium price of pound:

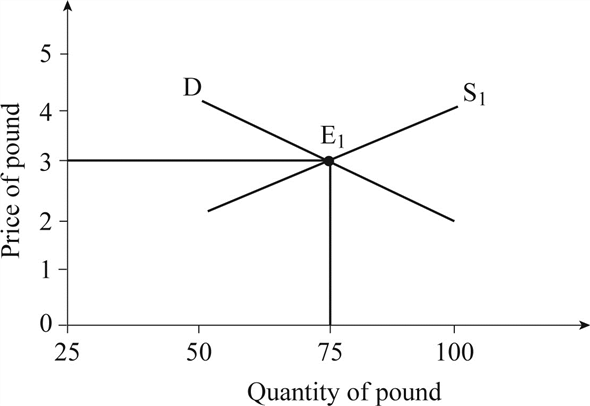

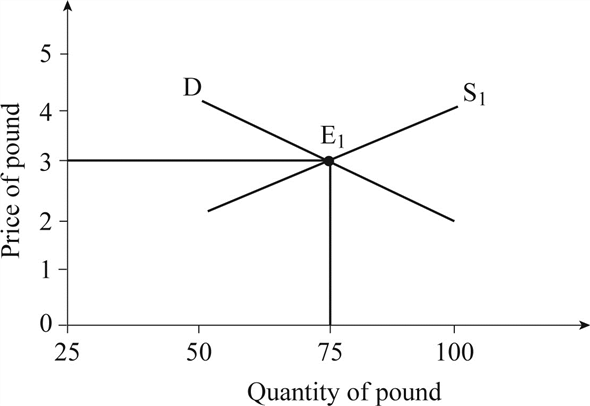

In Figure-1, price of pound is presented in vertical axis and quantity demand of pounds is presented in horizontal axis. The equilibrium level of price is $3 and quantity demand is 75 pounds. Figure - 1

Figure - 1

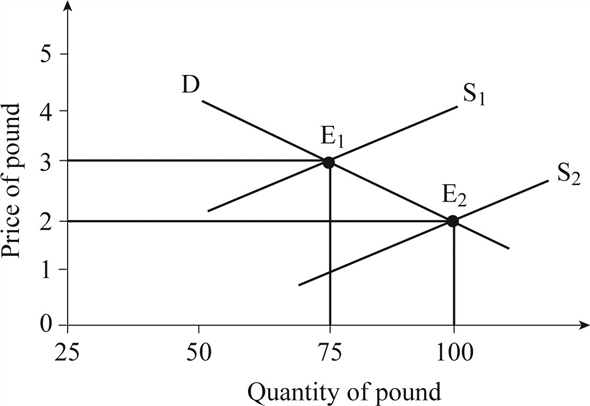

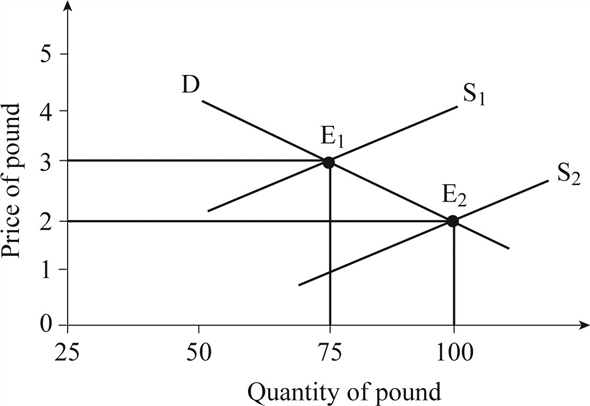

b. Increase in pound supply:

Since the supply of pound is doubled, the supply curve shifts from to

to  .

.  Figure - 2

Figure - 2

c. Equilibrium price:

The equilibrium level of price is $2 and quantity is 100 pounds.

d. Dollar appreciated:

Since the price of pound falls from $3 to $2, the value of dollar is appreciated.

e.

Increase in import:

Since the value of dollar appreciated, the U.S. importers have to pay less for the imported goods. Hence, the U.S. imports of British goods will increase.

In Figure-1, price of pound is presented in vertical axis and quantity demand of pounds is presented in horizontal axis. The equilibrium level of price is $3 and quantity demand is 75 pounds.

Figure - 1

Figure - 1b. Increase in pound supply:

Since the supply of pound is doubled, the supply curve shifts from

to

to  .

.  Figure - 2

Figure - 2c. Equilibrium price:

The equilibrium level of price is $2 and quantity is 100 pounds.

d. Dollar appreciated:

Since the price of pound falls from $3 to $2, the value of dollar is appreciated.

e.

Increase in import:

Since the value of dollar appreciated, the U.S. importers have to pay less for the imported goods. Hence, the U.S. imports of British goods will increase.

4

Describe the purchasing power parity theory (Purchasing Power Parity Theory) What is the purchasing power parity theory. Is it a short-run or a long-run theory. Why may it not always work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 7 في هذه المجموعة.

فتح الحزمة

k this deck

5

Trace the evolution of exchange rate regimes from the gold standard to the current system (Exchange Rate Regimes) Briefly trace the exchange rate regimes beginning with the gold standard up to our current system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 7 في هذه المجموعة.

فتح الحزمة

k this deck

6

Trace the evolution of exchange rate regimes from the gold standard to the current system (Exchange Rates) Discuss the differences between a flexible exchange rate and a fixed exchange rate. What measures can the government take to maintain fixed exchange rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 7 في هذه المجموعة.

فتح الحزمة

k this deck

7

THE CURRENT SYSTEM: MANAGED FLOAT What is a managed float? What are the disadvantages of freely floating exchange rates that led countries to the managed float system?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 7 في هذه المجموعة.

فتح الحزمة

k this deck