Deck 3: Working With Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/414

العب

ملء الشاشة (f)

Deck 3: Working With Financial Statements

1

Days' sales in inventory of car dealerships are generally lower when compared to grocery stores.

False

2

Another name for return on equity is return on total capitalization.

False

3

The statement of cash flows cannot be standardized.

False

4

Days' sales in inventory of car dealerships are generally higher when compared to grocery stores.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

5

When comparing the financial statements of one firm with those of another firm, a problem that may

be encountered is that the two firms may be seasonal in nature and have different fiscal year ends.

be encountered is that the two firms may be seasonal in nature and have different fiscal year ends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a firm has only current assets and no fixed assets of any kind, its times interest earned ratio must

exceed its cash coverage ratio.

exceed its cash coverage ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

7

An increase in long-term debt is source of cash?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

8

Days' sales in inventory of grocery stores are generally higher when compared to car dealerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

9

Common size statements can only be completed on the statement of comprehensive income and

statement of financial position.

statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

10

The most effective methods of directly evaluating the financial performance of a firm is to compare

the current financial ratios to those of the same firm from prior time periods and compare a firm's

financial ratios to those of other firms in the firm's peer group who have similar operations.

the current financial ratios to those of the same firm from prior time periods and compare a firm's

financial ratios to those of other firms in the firm's peer group who have similar operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

11

A poor industry outlook along with low investor opinion of the firm are most apt to cause a firm to

have a higher price-earnings ratio?

have a higher price-earnings ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

12

When comparing the financial statements of one firm with those of another firm, a problem that may

be encountered is that the operations of the two firms may vary geographically.

be encountered is that the operations of the two firms may vary geographically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

13

Payment of a note payable and repurchase of common stock are uses of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a firm uses cash to purchase inventory, its quick ratio will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a firm uses part of the cash it received from payment of an account receivable to buy inventory

and leaves the rest in its bank account, its current ratio will remain unchanged.

and leaves the rest in its bank account, its current ratio will remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

16

Due to the difficulty of access the true enterprise value, one can use the market cap as a proxy for

enterprise value to calculate the EV/EBITDA ratio.

enterprise value to calculate the EV/EBITDA ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

17

When comparing the financial statements of one firm with those of another firm, a problem that may

be encountered is that either one, or both, of the firms may be conglomerates and thus have

unrelated lines of business.

be encountered is that either one, or both, of the firms may be conglomerates and thus have

unrelated lines of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

18

The equity multiplier, the profit margin and the total asset turnover are the three parts of the Du

Pont identity.

Pont identity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

19

When comparing the financial statements of one firm with those of another firm, a problem that may

be encountered is that the firms may use differing accounting methods for inventory purposes.

be encountered is that the firms may use differing accounting methods for inventory purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

20

Days' sales in inventory of grocery stores are generally lower when compared to car dealerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

21

Calculate the value of total equity given the following information: total debt ratio = 0.52; total assets = $25,000.

A) $11,000

B) $11,250

C) $11,500

D) $11,750

E) $12,000

A) $11,000

B) $11,250

C) $11,500

D) $11,750

E) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

22

An Edmonton firm has a debt-equity ratio of 62 %, a total asset turnover of 1.39, and a profit margin of 7.8 %. The total equity is $672,100. What is the amount of the net income?

A) $118,048

B) $119,600

C) $120,202

D) $121,212

E) $124,097

A) $118,048

B) $119,600

C) $120,202

D) $121,212

E) $124,097

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

23

Bentley and Moore has net working capital of $6,900, net fixed assets of $86,100, sales of $156,000, and current liabilities of $41,700. How many dollars' worth of sales are generated from

Every $1 in total assets?

A) $1.13

B) $1.16

C) $1.22

D) $1.25

E) $1.27

Every $1 in total assets?

A) $1.13

B) $1.16

C) $1.22

D) $1.25

E) $1.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

24

Atlasta Limo Corp. has an average collection period of 36.5 days. Sales are $300,001. What is the average investment in receivables?

A) $4,441

B) $8,219

C) $10,000

D) $30,000

E) $36,500

A) $4,441

B) $8,219

C) $10,000

D) $30,000

E) $36,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm has a total debt ratio of .47. This means that that firm has 47 cents in debt for every:

A) $1.00 in equity.

B) $1.00 in total sales.

C) $1.00 in current assets.

D) $0.53 in equity.

E) $0.53 in total assets.

A) $1.00 in equity.

B) $1.00 in total sales.

C) $1.00 in current assets.

D) $0.53 in equity.

E) $0.53 in total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

26

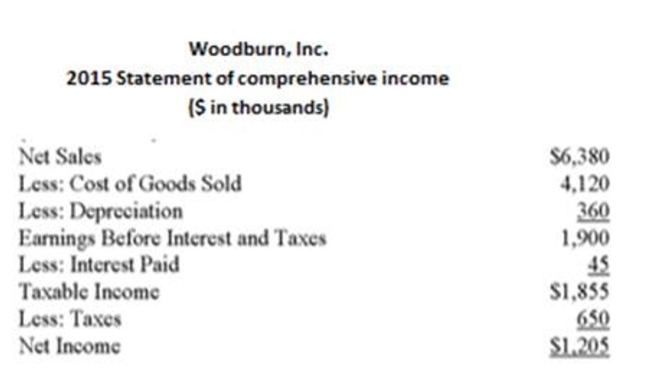

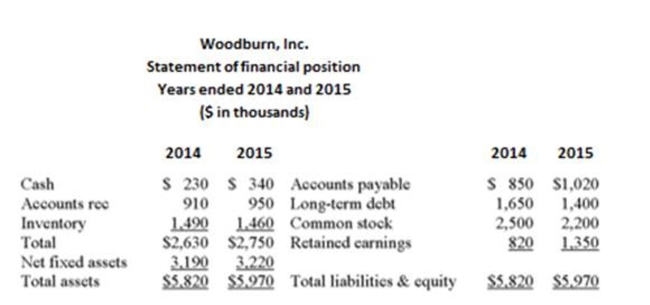

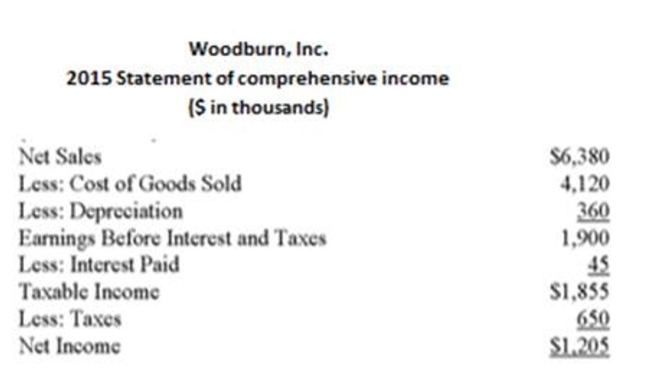

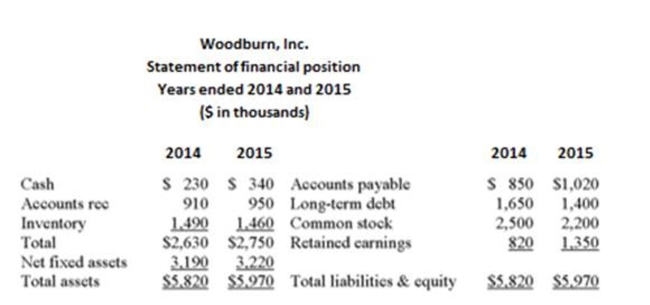

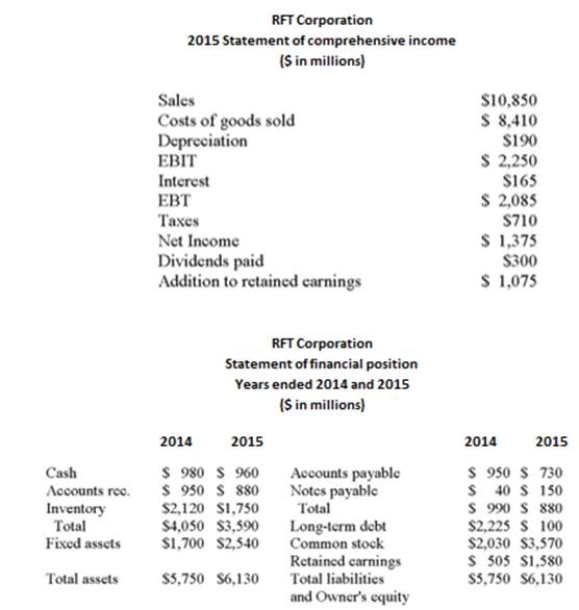

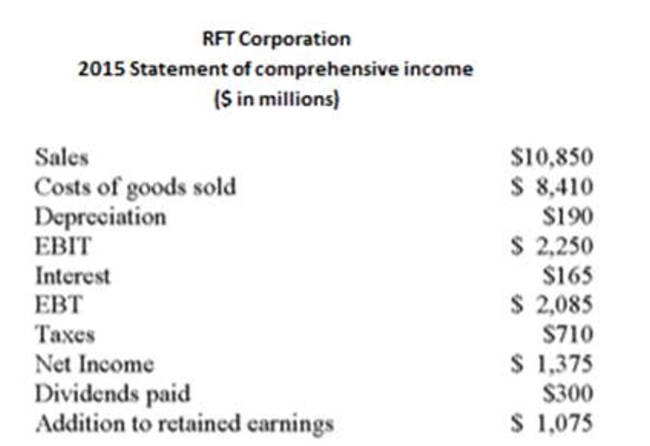

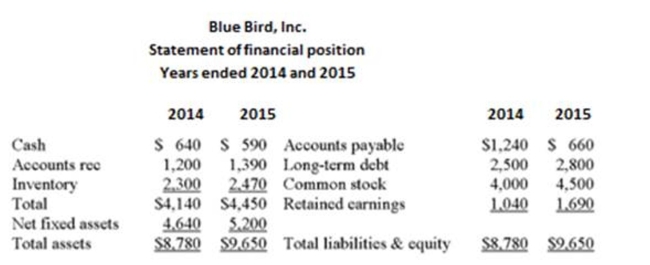

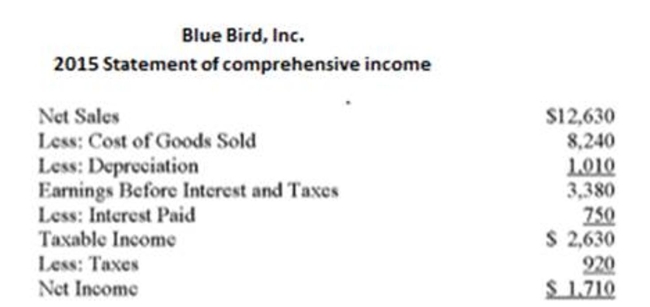

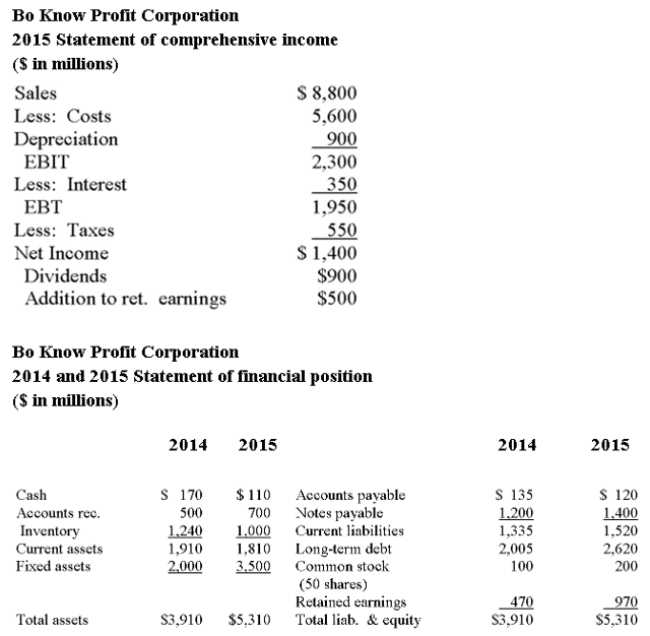

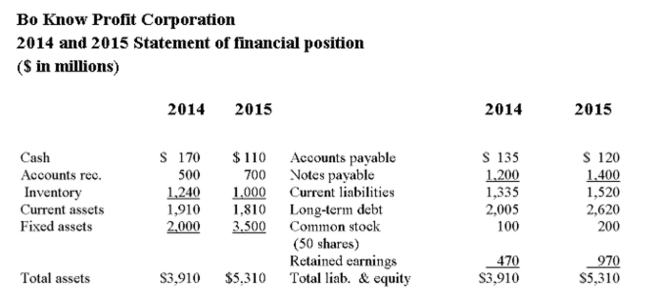

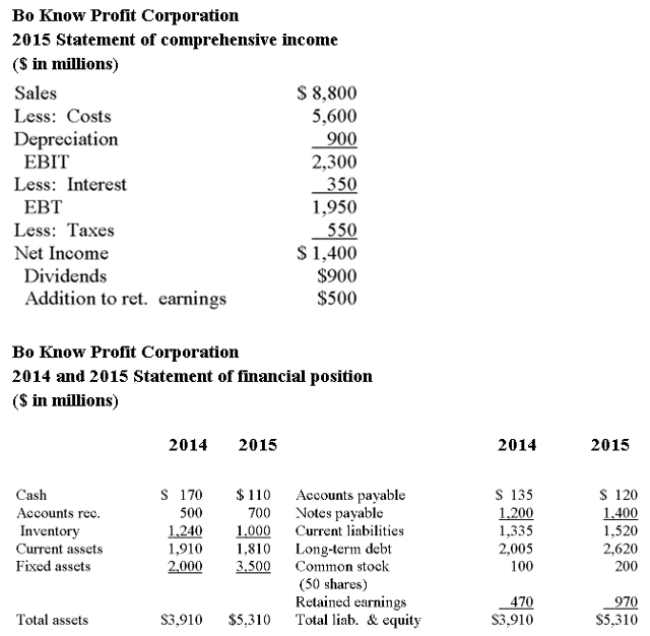

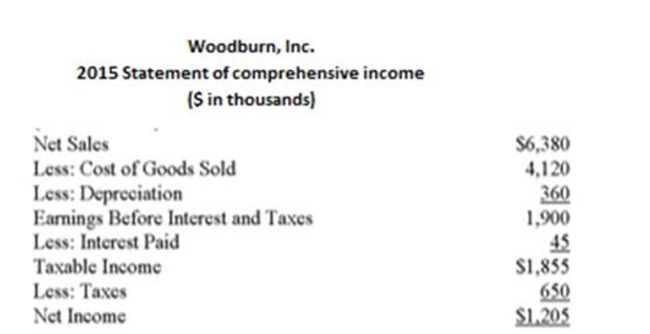

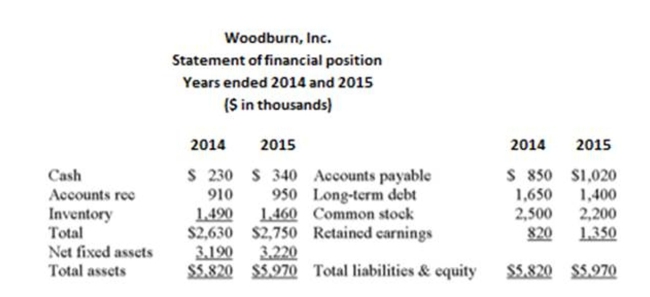

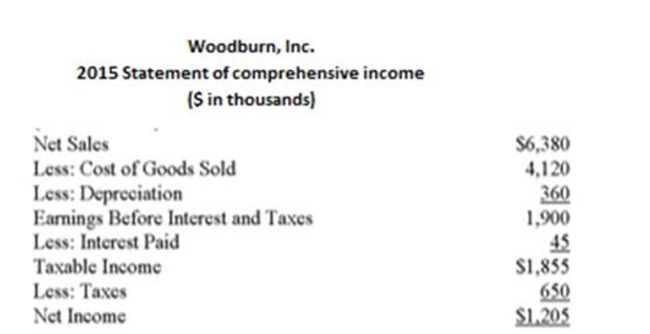

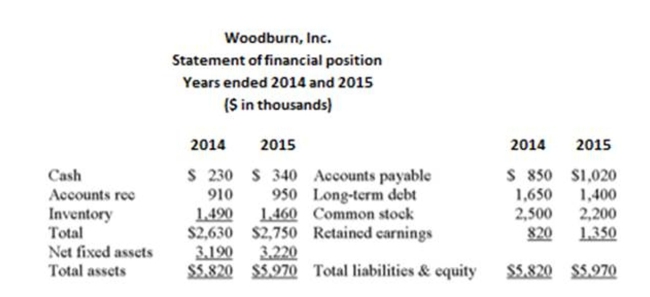

The following statement of financial position and statement of comprehensive income should be used.

How many dollars of sales are being generated by every $1 that Woodburn has in total assets($ in

How many dollars of sales are being generated by every $1 that Woodburn has in total assets($ in

Thousands)? (Use 2015 assets)

A) $1.01

B) $1.07

C) $1.09

D) $1.12

E) $1.16

How many dollars of sales are being generated by every $1 that Woodburn has in total assets($ in

How many dollars of sales are being generated by every $1 that Woodburn has in total assets($ inThousands)? (Use 2015 assets)

A) $1.01

B) $1.07

C) $1.09

D) $1.12

E) $1.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

27

During the year, Doug's Bakery decreased its accounts receivable by $50, increased its inventory by $100, and decreased its accounts payable by $50. For these three accounts, the firm has a net:

A) $200 use of cash.

B) $100 use of cash.

C) $0 use of cash.

D) $100 source of cash.

E) $200 source of cash.

A) $200 use of cash.

B) $100 use of cash.

C) $0 use of cash.

D) $100 source of cash.

E) $200 source of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

28

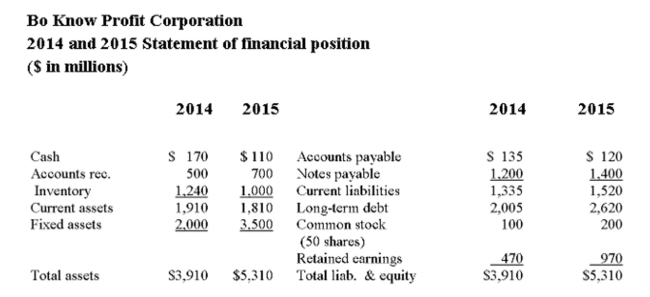

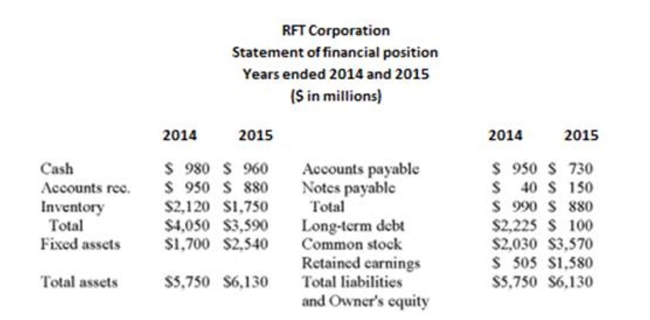

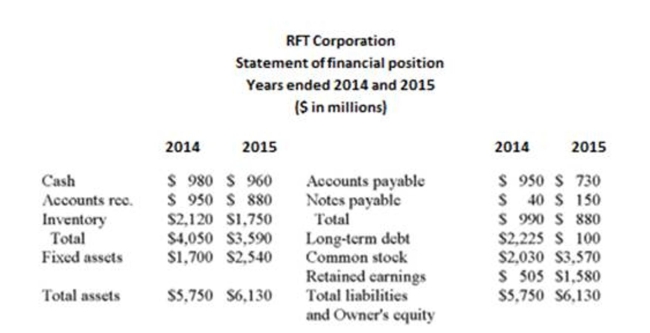

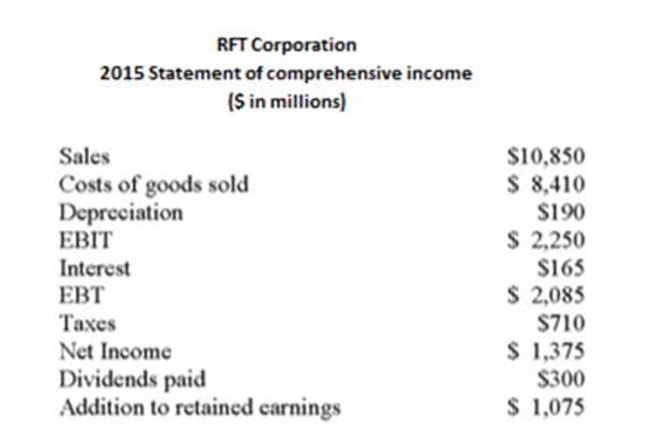

How many additional assets can RTF, Inc. acquire if the company issues an additional $1,000 in common stock($ in millions)?

How many additional assets can RTF, Inc. acquire if the company issues an additional $1,000 in common stock($ in millions)?A) $1,000

B) $1,190

C) $1,500

D) $1,780

E) Cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

29

Calculate depreciation expense given the following information. Interest expense $2,000; times interest earned 5; cash coverage ratio 5.5.

A) $1,000

B) $1,200

C) $1,400

D) $1,600

E) $1,800

A) $1,000

B) $1,200

C) $1,400

D) $1,600

E) $1,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

30

A Kinston firm has net working capital of $2,580, net fixed assets of $13,120, sales of $22,580, and current liabilities of $1,610. How many dollars' worth of sales are generated from every $1 in total

Assets?

A) $1.27

B) $1.30

C) $1.67

D) $1.72

E) $1.75

Assets?

A) $1.27

B) $1.30

C) $1.67

D) $1.72

E) $1.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

31

Given the following information, calculate sales value. Total asset turnover 0.80; total liabilities $5,000; total equity $5,000.

A) $8,600

B) $8,000

C) $10,600

D) $11,600

E) $12,600

A) $8,600

B) $8,000

C) $10,600

D) $11,600

E) $12,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

32

Freda's, Inc. has sales of $3,200, current liabilities of $900, total assets of $3,000, and net working capital of $500. How many dollars' worth of sales are generated from every $1 in net fixed assets?

A) $.91

B) $1.07

C) $1.67

D) $2.00

E) $2.29

A) $.91

B) $1.07

C) $1.67

D) $2.00

E) $2.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

33

Determine the value of cash given the following information: cash ratio = 2; cash equivalents = $600 ; current liabilities = $800.

A) $1,000

B) $1,100

C) $1,200

D) $1,300

E) $1,400

A) $1,000

B) $1,100

C) $1,200

D) $1,300

E) $1,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

34

Calculate sales given the following data. Total fixed assets $400,000; long-term liabilities $155,000; total liabilities $280,000; total shareholders' equity $320,000; net working capital turnover 20.

A) $1,500,000

B) $1,700,000

C) $1,900,000

D) $2,100,000

E) $2,250,000

A) $1,500,000

B) $1,700,000

C) $1,900,000

D) $2,100,000

E) $2,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

35

Calculate net income given the following information: tax rate = 30%; times interest earned = 10.75 times; sales = $4,500; cost of goods sold = $1,600; general and administrative expenses = $750.

A) $965

B) $1,065

C) $1,165

D) $1,265

E) $1,365

A) $965

B) $1,065

C) $1,165

D) $1,265

E) $1,365

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

36

Swenson Motors has total debt of $682,400 and a debt-equity ratio of .65. What is the value of the total assets?

A) $1,049,846

B) $1,364,800

C) $1,414,141

D) $1,578,002

E) $1,732,246

A) $1,049,846

B) $1,364,800

C) $1,414,141

D) $1,578,002

E) $1,732,246

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

37

A Waterloo firm with net income of $500,000 pays 48% of net income out in dividends. If the firm has 150,000 shares of common stock outstanding, what is the dividend paid per share of stock?

A) $0.30

B) $1.44

C) $1.60

D) $1.73

E) $3.33

A) $0.30

B) $1.44

C) $1.60

D) $1.73

E) $3.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

38

A Quebec City firm has a debt-equity ratio of .65. From this, you can determine that the firm has _____ in assets for every $1 in equity.

A) $.54

B) $.65

C) $1.54

D) $1.65

E) $2.54

A) $.54

B) $.65

C) $1.54

D) $1.65

E) $2.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

39

Calculate total asset value given the following information: ROA = 5%; Total equity = $600,000 and ROE = 8%.

A) $960,000

B) $1,100,000

C) $1,200,000

D) $1,300,000

E) $1,400,000

A) $960,000

B) $1,100,000

C) $1,200,000

D) $1,300,000

E) $1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

40

Calculate net income given the following information: tax rate = 30%; accounts receivable = $900; receivable turnover = 5 times; inventory = $500; inventory turnover = 3.20 times; operating

Expenses = $700; interest expense = $200.

A) $1,400

B) $1,465

C) $1,565

D) $1,665

E) $1,765

Expenses = $700; interest expense = $200.

A) $1,400

B) $1,465

C) $1,565

D) $1,665

E) $1,765

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

41

Calculate net income given the following information: tax rate = 30%; accounts receivable = $15,000; receivable turnover = 6 times; inventory = $4,000; inventory turnover = 6.25 times;

Operating expenses = $15,000; interest expense = $9,000.

A) $29,700

B) $28,700

C) $27,700

D) $26,700

E) $25,700

Operating expenses = $15,000; interest expense = $9,000.

A) $29,700

B) $28,700

C) $27,700

D) $26,700

E) $25,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

42

Supreme Corporation's total current assets are valued at $35,000 and are comprised of cash, accounts receivable and inventory. Determine the value of the cash account given the following

Information: sales = $140,000; cost of goods sold = $120,000; accounts receivable turnover = 17.50

Times; inventory turnover = 8 times.

A) $11,000

B) $12,000

C) $13,000

D) $14,000

E) $15,000

Information: sales = $140,000; cost of goods sold = $120,000; accounts receivable turnover = 17.50

Times; inventory turnover = 8 times.

A) $11,000

B) $12,000

C) $13,000

D) $14,000

E) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

43

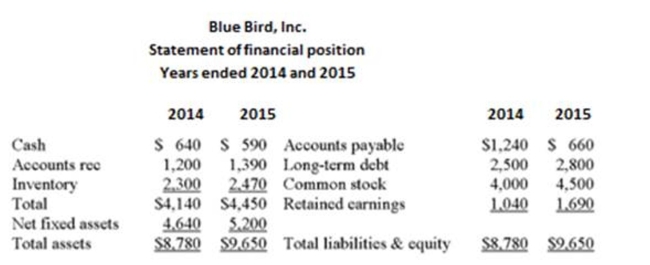

If you were to prepare a statement of cash flows, what is the net cash flow from financing activities ($ in millions)?

If you were to prepare a statement of cash flows, what is the net cash flow from financing activities ($ in millions)?A) - $678

B) - $108

C) $15

D) $1,325

E) $3,003

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

44

During the year, Douglass Industries decreased the accounts receivable by $230, decreased the inventory by $150, and increased the accounts payable by $110. These three changes represent a

_____ of cash.

A) $270 use

B) $490 use

C) $190 source

D) $270 source

E) $490 source

_____ of cash.

A) $270 use

B) $490 use

C) $190 source

D) $270 source

E) $490 source

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

45

Gwen's Pastry Shop has annual sales of $238,000, a profit margin of 6 %, and a return on assets of 7.7 %. The firm has _____ in total assets.

A) $176,067

B) $185,455

C) $220,984

D) $224,528

E) $256,326

A) $176,067

B) $185,455

C) $220,984

D) $224,528

E) $256,326

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

46

Calculate net income given the following information: fixed asset turnover = 4 times; profit margin = 20%; net fixed assets = $25,000.

A) $16,000

B) $18,000

C) $20,000

D) $22,000

E) $24,000

A) $16,000

B) $18,000

C) $20,000

D) $22,000

E) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

47

Calculate the value of cost of goods sold for Molson's Brewing Company given the following information: Current liabilities = $340,000; Quick ratio = 1.8; Inventory turnover = 4.0; Current ratio =

3)3.

A) $2,040,000

B) $3,060,000

C) $3,999,999

D) $4,180,222

E) $5,888,100

3)3.

A) $2,040,000

B) $3,060,000

C) $3,999,999

D) $4,180,222

E) $5,888,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

48

A firm has sales of $500, total assets of $300, and a debt/equity ratio of 1. If its return on equity is 15%, what is its net income?

A) $7.50

B) $15.00

C) $22.50

D) $32.50

E) $50.00

A) $7.50

B) $15.00

C) $22.50

D) $32.50

E) $50.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

49

Calculate cash given the following information. Total current assets $57,000; supplies $4,000; average collection period 60.83 days; days' sales in inventory 97.33 days; sales 90,000; cost of

Goods sold 75,000.

A) $24,000

B) $22,000

C) $20,000

D) $18,000

E) $16,000

Goods sold 75,000.

A) $24,000

B) $22,000

C) $20,000

D) $18,000

E) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

50

A firm has a total book value of equity of $2 million, a market to book ratio of 2, and a book value per share of $5.00. What is the total market value of the firm's equity?

A) $10

B) $500,000

C) $2 million

D) $4 million

E) $20 million

A) $10

B) $500,000

C) $2 million

D) $4 million

E) $20 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

51

Calculate net income given the following information: shares outstanding = 1,250,000; stock price = $35/share; PE ratio = 12.50.

A) $2,500,000

B) $2,750,000

C) $3,000,000

D) $3,250,000

E) $3,500,000

A) $2,500,000

B) $2,750,000

C) $3,000,000

D) $3,250,000

E) $3,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

52

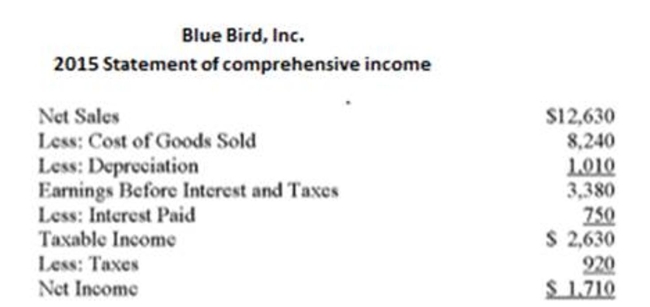

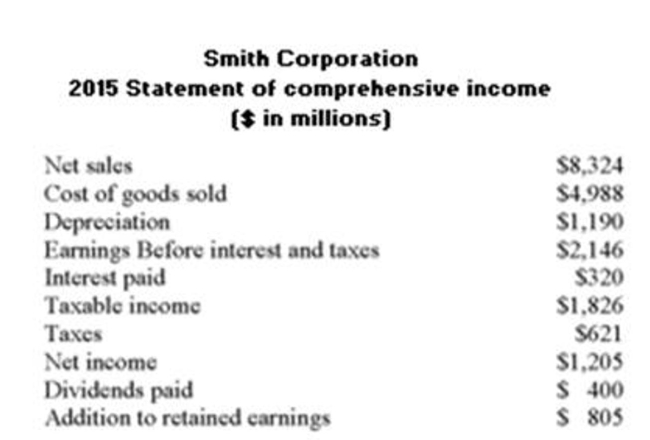

Use the following statement of financial position and statement of comprehensive income

Blue Bird, Inc. has 1,500 shares of stock outstanding. The price-earnings ratio for 2015 is 21. What is the market price per share of stock?

Blue Bird, Inc. has 1,500 shares of stock outstanding. The price-earnings ratio for 2015 is 21. What is the market price per share of stock?

A) $18.90

B) $21.00

C) $23.94

D) $24.16

E) $26.87

Blue Bird, Inc. has 1,500 shares of stock outstanding. The price-earnings ratio for 2015 is 21. What is the market price per share of stock?

Blue Bird, Inc. has 1,500 shares of stock outstanding. The price-earnings ratio for 2015 is 21. What is the market price per share of stock?A) $18.90

B) $21.00

C) $23.94

D) $24.16

E) $26.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

53

A firm has total debt of $1,850 and a debt-equity ratio of .64. What is the value of the total assets?

A) $1,128.05

B) $1,184.00

C) $2,571.95

D) $3,034.00

E) $4,740.63

A) $1,128.05

B) $1,184.00

C) $2,571.95

D) $3,034.00

E) $4,740.63

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

54

If you were to prepare a statement of cash flows, what is the cash flow from investment activities($ in millions)?

If you were to prepare a statement of cash flows, what is the cash flow from investment activities($ in millions)?A) -$1,500

B) -$2,400

C) -$3,400

D) $4,500

E) $4,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

55

Calculate gross profit given the following information: accounts receivable = $3,500; inventory = $4,500; receivable turnover = 80 times; inventory turnover = 18 times.

A) $199,000

B) $209,000

C) $219,000

D) $229,000

E) $239,000

A) $199,000

B) $209,000

C) $219,000

D) $229,000

E) $239,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is the change in net working capital($ in millions)?

What is the change in net working capital($ in millions)?A) -$3,655

B) -$3,015

C) $3,655

D) $6,670

E) $10,755

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

57

Given a profit margin = 10%, ROE = 20%, D/E = 1.5, and assets = $200, calculate sales.

A) $10

B) $160

C) $250

D) $640

E) $1,000

A) $10

B) $160

C) $250

D) $640

E) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

58

Calculate the value of long-term debt given the following information: total debt = $320,000; debt/equity ratio = 0.80; long-term debt ratio = 0.3750.

A) $230,000

B) $235,000

C) $240,000

D) $245,000

E) $250,000

A) $230,000

B) $235,000

C) $240,000

D) $245,000

E) $250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

59

During the year, The Train Stop decreased its accounts receivable by $60, increased its inventory by $130, and decreased its accounts payable by $20. For these three accounts, the firm has a net:

A) $90 use of cash.

B) $50 use of cash.

C) $170 use of cash.

D) $90 source of cash.

E) $50 source of cash.

A) $90 use of cash.

B) $50 use of cash.

C) $170 use of cash.

D) $90 source of cash.

E) $50 source of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

60

Determine the value of cash given the following information: cash ratio = 1.5625; cash equivalents = $500 ; current liabilities = $1,600.

A) $1,500

B) $2,000

C) $2,500

D) $3,000

E) $3,500

A) $1,500

B) $2,000

C) $2,500

D) $3,000

E) $3,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

61

A firm has a profit margin of 9% on sales of $400,000. There are 10,000 shares of common stock outstanding. What is the earnings per share?

A) $1.80

B) $3.60

C) $4.00

D) $36.00

E) $40.00

A) $1.80

B) $3.60

C) $4.00

D) $36.00

E) $40.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

62

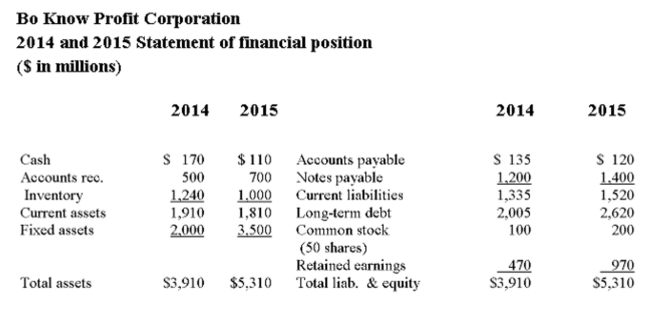

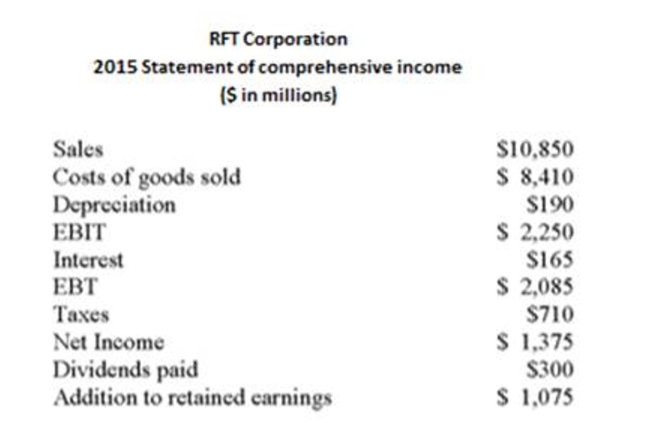

The net cash from financing activity for 2015 is ($ in millions):

The net cash from financing activity for 2015 is ($ in millions):A) -$975

B) -$775

C) -$475

D) $475

E) $775

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Frasier Company has a long-term debt ratio of 0.5 and a current ratio of 1.3. Current liabilities are $900, sales are $6,000, profit margin is 10%, and ROE is 19&. What is the amount of the firm's

Net fixed assets?

A) $7,546

B) $7,046

C) $6,556

D) $6,046

E) $5,556

Net fixed assets?

A) $7,546

B) $7,046

C) $6,556

D) $6,046

E) $5,556

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the firm is currently carrying a price/earnings ratio of 2, what is the firm's approximate market price per share?

If the firm is currently carrying a price/earnings ratio of 2, what is the firm's approximate market price per share?A) $8

B) $11

C) $56

D) $78

E) $129

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

65

Calculate gross profit given the following information: accounts receivable = $40,000; inventory = $80,000; receivable turnover = 25 times; inventory turnover = 6 times.

A) $500,000

B) $520,000

C) $540,000

D) $580,000

E) $620,000

A) $500,000

B) $520,000

C) $540,000

D) $580,000

E) $620,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

66

Calculate total current assets given the following information. Cash $10,000; supplies $3,000; average collection period 54.75 days; days' sales in inventory 91.25 days; sales $80,000; COGS

$60,000.

A) $42,000

B) $40,000

C) $38,000

D) $36,000

E) $34,000

$60,000.

A) $42,000

B) $40,000

C) $38,000

D) $36,000

E) $34,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

67

Calculate the value of total assets given the following information: total debt ratio = 0.26; total equity = $32,560.

A) $11,000

B) $22,000

C) $33,000

D) $44,000

E) $55,000

A) $11,000

B) $22,000

C) $33,000

D) $44,000

E) $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

68

Jorge Corp. of North Bay has 100,000 shares outstanding. EBIT is $1 million and interest paid is $200,001. If the corporate tax rate is 34%, what is Jorge's earnings per share?

A) $2.72

B) $3.40

C) $5.28

D) $6.60

E) $10.00

A) $2.72

B) $3.40

C) $5.28

D) $6.60

E) $10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

69

How would a $5,000 increase in AR and a $2,000 decrease in inventory affect cash?

A) $5,000 source; $2,000 use

B) $2,000 source; $5,000 use

C) $5,000 source; $2,000 source

D) $3,000 source

E) $7,000 source

A) $5,000 source; $2,000 use

B) $2,000 source; $5,000 use

C) $5,000 source; $2,000 source

D) $3,000 source

E) $7,000 source

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

70

Danny Corporation's total current assets are valued at $233,000 and are comprised of cash, accounts receivable and inventory. Determine the value of the cash account given the following

Information: sales = $225,000; cost of goods sold = $135,000; accounts receivable turnover = 3

Times; inventory turnover = 1.5 times.

A) $68,000

B) $66,000

C) $64,000

D) $62,000

E) $60,000

Information: sales = $225,000; cost of goods sold = $135,000; accounts receivable turnover = 3

Times; inventory turnover = 1.5 times.

A) $68,000

B) $66,000

C) $64,000

D) $62,000

E) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

71

Calculate net income given the following information: fixed asset turnover = 8 times; profit margin = 18.75%; net fixed assets = $30,000.

A) $42,000

B) $43,000

C) $44,000

D) $45,000

E) $46,000

A) $42,000

B) $43,000

C) $44,000

D) $45,000

E) $46,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

72

The net cash from investment activity for 2015 is ($ in millions):

The net cash from investment activity for 2015 is ($ in millions):A) -$1,030

B) -$840

C) -$650

D) $840

E) $1,030

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

73

Calculate the value of total equity given the following information: total debt ratio = 0.76; total assets = $1,250.

A) $300

B) $325

C) $350

D) $375

E) $400

A) $300

B) $325

C) $350

D) $375

E) $400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

74

Calculate the value of short-term debt given the following information: total debt = $100,000; debt/equity ratio = 0.40; long-term debt ratio = 0.2308.

A) $20,000

B) $25,000

C) $30,000

D) $35,000

E) $40,000

A) $20,000

B) $25,000

C) $30,000

D) $35,000

E) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

75

Etling Eccentricities has 400,000 shares of common stock outstanding, net income after tax of $1.2 million, retained earnings of $17 million, and total equity of $35 million. What is EE's earnings per

Share?

A) $3.00

B) $4.00

C) $4.25

D) $8.75

E) $13.50

Share?

A) $3.00

B) $4.00

C) $4.25

D) $8.75

E) $13.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

76

Sandwiches-To-Go has a return on equity of 12 % and a debt-equity ratio of .40. The total asset turnover is 1.63 and the profit margin is 5 %. The total equity is $21,400. What is the amount of the

Net income?

A) $2,568

B) $3,819

C) $4,186

D) $6,283

E) $6,420

Net income?

A) $2,568

B) $3,819

C) $4,186

D) $6,283

E) $6,420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

77

The following statement of financial position and statement of comprehensive income should be used.

How will Woodburn's accounts receivable appear on the statement of cash flows for 2015($ in

How will Woodburn's accounts receivable appear on the statement of cash flows for 2015($ in

Thousands)?

A) $40 operating activity cash outflow.

B) $40 investment activity cash outflow.

C) $40 operating activity cash inflow.

D) $40 investment activity cash inflow.

E) $40 financing activity cash inflow.

How will Woodburn's accounts receivable appear on the statement of cash flows for 2015($ in

How will Woodburn's accounts receivable appear on the statement of cash flows for 2015($ inThousands)?

A) $40 operating activity cash outflow.

B) $40 investment activity cash outflow.

C) $40 operating activity cash inflow.

D) $40 investment activity cash inflow.

E) $40 financing activity cash inflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

78

Calculate the value of total assets given the following information: total debt ratio = 0.55; total equity = $7,700.

A) $11,000

B) $17,111

C) $33,000

D) $44,000

E) $55,000

A) $11,000

B) $17,111

C) $33,000

D) $44,000

E) $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

79

Calculate the value of long-term debt given the following information: total debt = $100,000; debt/equity ratio = 0.40; long-term debt ratio = 0.2308.

A) $75,000

B) $70,000

C) $65,000

D) $60,000

E) $55,000

A) $75,000

B) $70,000

C) $65,000

D) $60,000

E) $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck

80

A Halifax firm generates net income of $530. The depreciation expense is $60 and dividends paid are $80. Accounts payable decrease by $40, accounts receivable decrease by $30, inventory

Increases by $20, and net fixed assets decrease by $40. What is the net cash from operating

Activity?

A) $480

B) $530

C) $560

D) $580

E) $600

Increases by $20, and net fixed assets decrease by $40. What is the net cash from operating

Activity?

A) $480

B) $530

C) $560

D) $580

E) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 414 في هذه المجموعة.

فتح الحزمة

k this deck