Deck 2: Financial Statements, Taxes, and Cash Flow

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

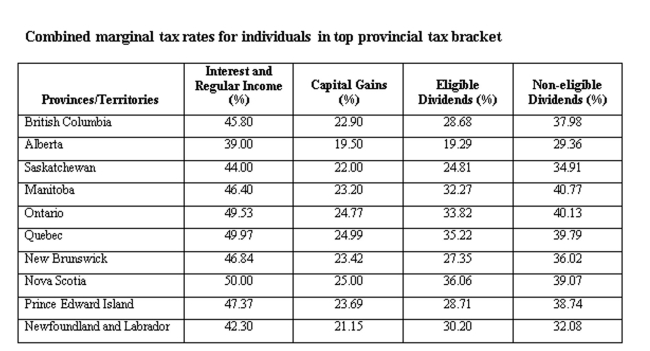

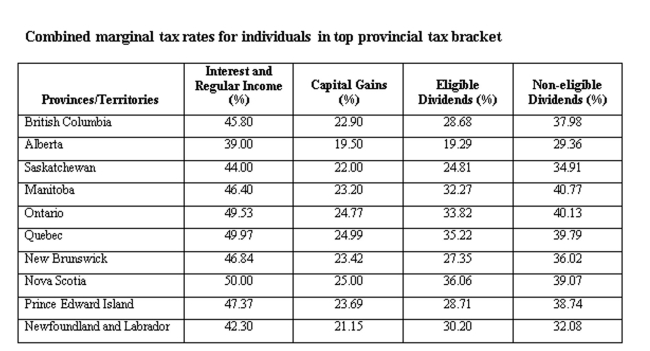

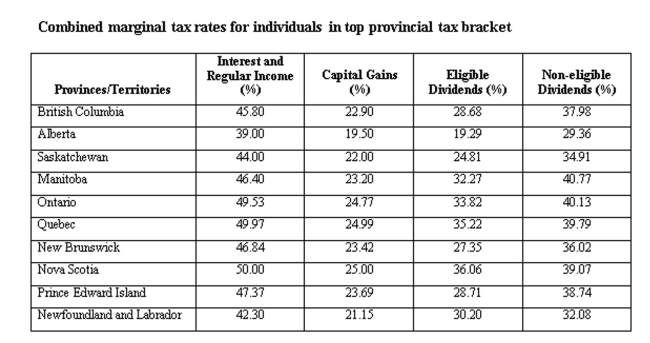

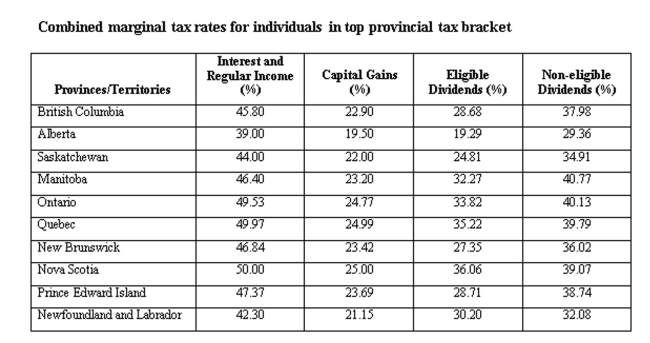

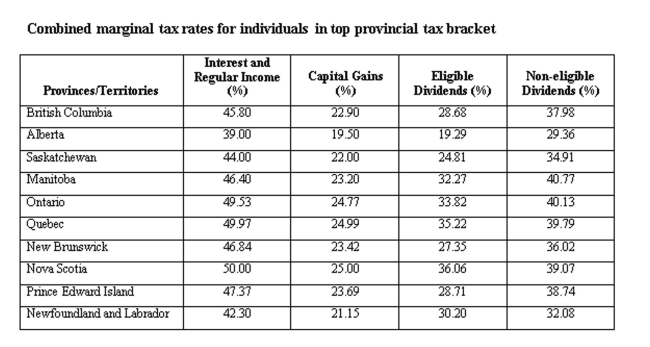

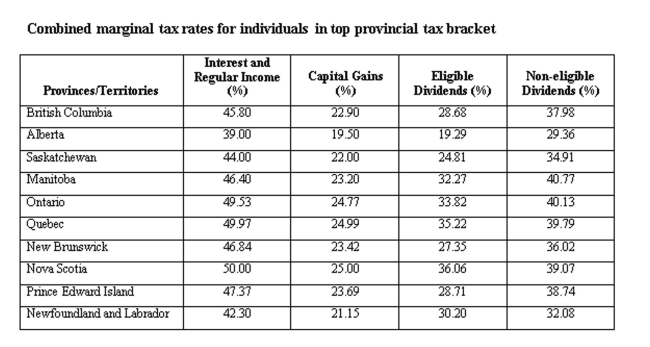

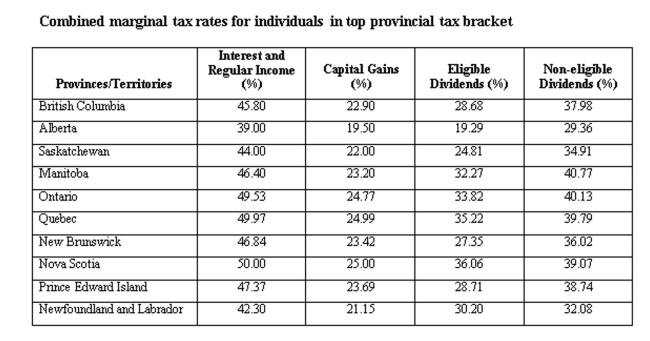

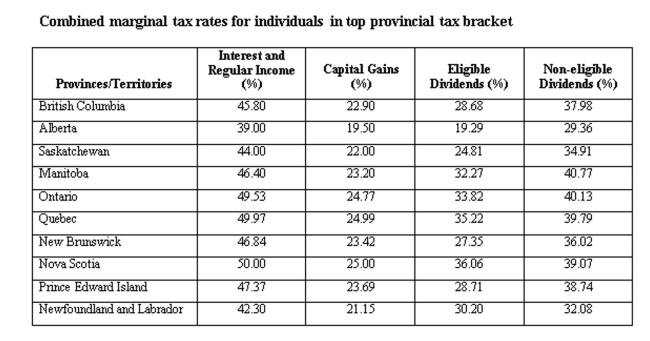

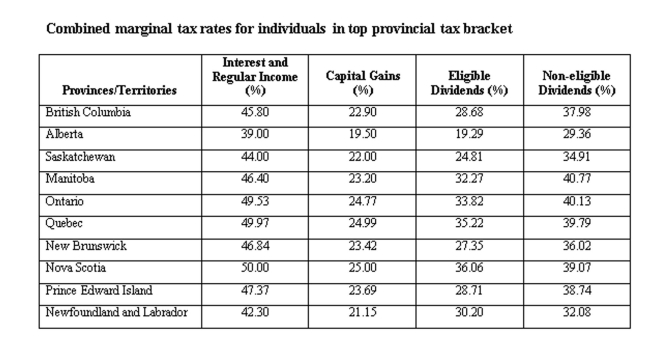

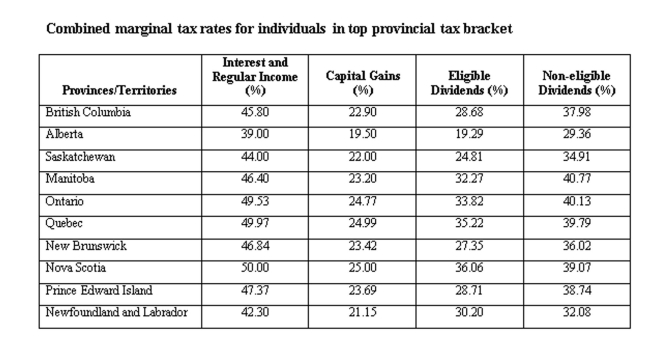

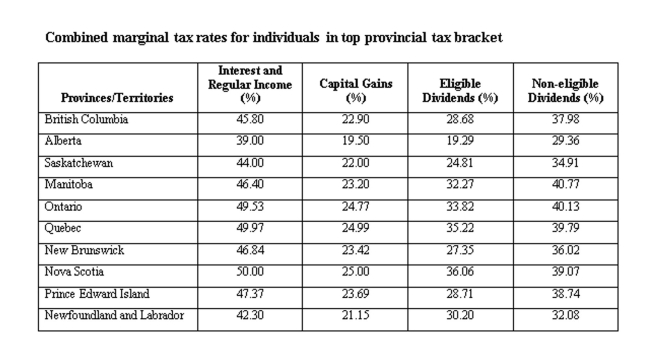

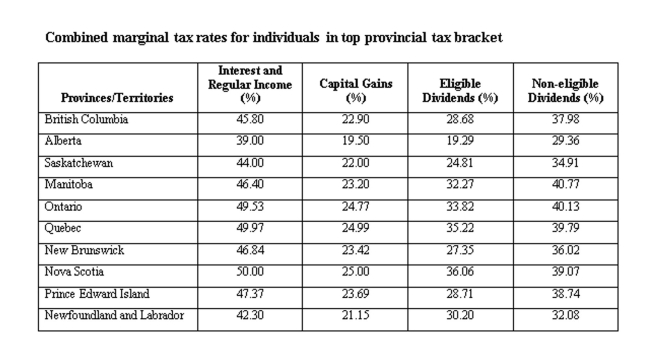

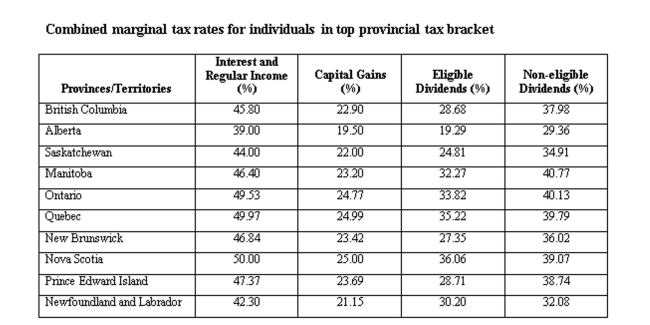

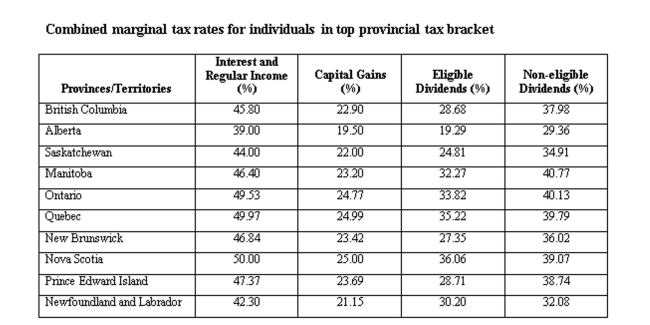

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/412

العب

ملء الشاشة (f)

Deck 2: Financial Statements, Taxes, and Cash Flow

1

A fundamental difference between Canadian GAAP and IFRS is that fair value accounting plays a

more important role under IFRS.

more important role under IFRS.

True

2

According to generally accepted accounting principles (GAAP), assets are generally shown on

financial statements at the higher of current market value or historical cost.

financial statements at the higher of current market value or historical cost.

False

3

Statement of financial position is best described as a financial statement summarizing a firm's

performance over a period of time. Formerly called the income statement.

performance over a period of time. Formerly called the income statement.

False

4

Impairment loss is the amount by which the carrying value of an asset or cash-generating unit

exceeds its recoverable amount.

exceeds its recoverable amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm's marginal tax rate may differ from its average tax rate. However, it is the average tax rate that

is relevant for financial decision-making purposes.

is relevant for financial decision-making purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

6

If an asset has a carrying value of $1,000 and its recoverable amount is $750, then a $250

impairment loss has been incurred.

impairment loss has been incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

7

JanexCorporation had OCF of $250, net capital spending of $500 and change in net working capital of $150. Given this information, determine its cash flow from assets.

A) $400

B) $800

C) $(400)

D) $(800)

E) $150

A) $400

B) $800

C) $(400)

D) $(800)

E) $150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

8

Statement of comprehensive income is also referred to as the balance sheet, is a snapshot of the

firm. It is a convenient means of organizing and summarizing what a firm owns (its assets), what a

firm owes (its liabilities), and the difference between the two (the firm's equity) at a given time.

firm. It is a convenient means of organizing and summarizing what a firm owns (its assets), what a

firm owes (its liabilities), and the difference between the two (the firm's equity) at a given time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

9

The difference between a firm's current assets and its current liabilities is called net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

10

The financial statement summarizing the value of a firm's equity on a particular date is the

statement of comprehensive income.

statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the amount of net new borrowing for 2015 ($ in millions)?

A) -$225

B) -$25

C) $0

D) $25

E) $225

A) -$225

B) -$25

C) $0

D) $25

E) $225

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

12

Net income divided by the total number of outstanding shares is referred to as the profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

13

Patents on new anti-cholesterol drug are considered intangible fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

14

Shareholders' equity in a firm is $500. The firm owes a total of $400 of which 75 percent is payable this year. The firm has net fixed assets of $600. What is the amount of the net working capital?

A) -$200

B) -$100

C) $0

D) $100

E) $200

A) -$200

B) -$100

C) $0

D) $100

E) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is net capital spending for 2015?

A) -$250

B) -$57

C) $0

D) $57

E) $477

A) -$250

B) -$57

C) $0

D) $57

E) $477

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a firm's cash flow to stockholders is negative, then total dividends must have exceeded the value

of net new equity sold by the firm during the year.

of net new equity sold by the firm during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

17

The financial statement summarizing a firm's performance over a period of time is the statement of

cash flows

cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

18

Conceptually, capital cost allowance (CCA) is equivalent to depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

19

Non-cash items refer to expenses charged against revenues that do not directly affect cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

20

If an asset has a carrying value of $2,000 and its recoverable amount is $2,500, then $500

impairment loss has been incurred.

impairment loss has been incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the operating cash flow for the year 2015?

A) $361

B) $995

C) $1,725

D) $1,911

E) $2,455

A) $361

B) $995

C) $1,725

D) $1,911

E) $2,455

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

22

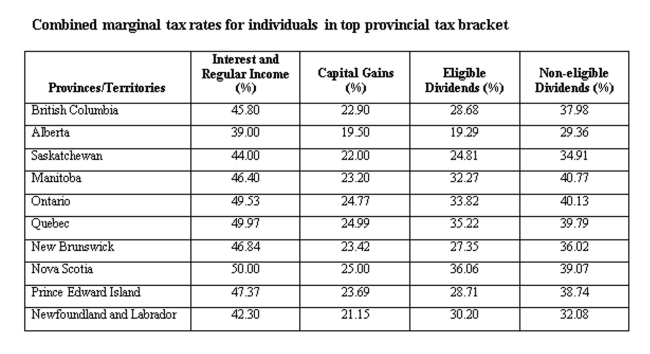

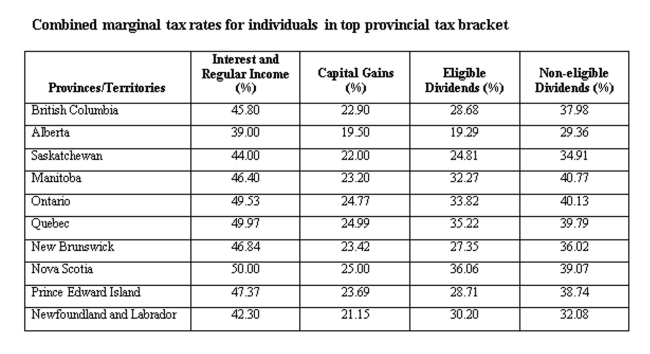

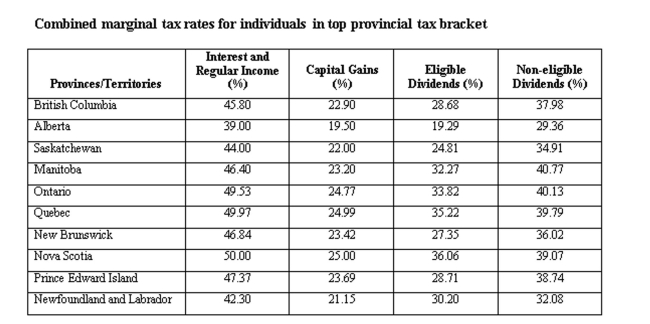

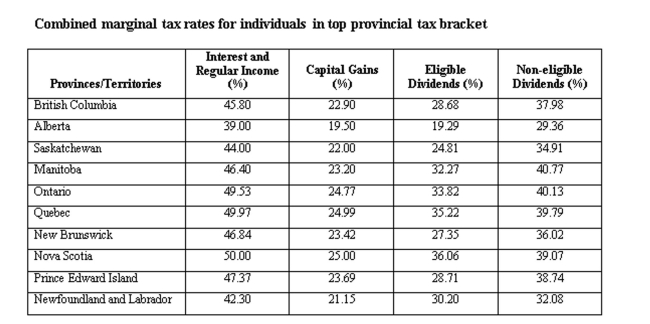

A Quebec resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $8,493

B) $9,493

C) $10,493

D) $11,493

E) $12,493

A) $8,493

B) $9,493

C) $10,493

D) $11,493

E) $12,493

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the operating cash flow for 2015?

A) $520

B) $800

C) $1,015

D) $1,110

E) $1,390

A) $520

B) $800

C) $1,015

D) $1,110

E) $1,390

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

24

Marla's Homemade Cookies has net income of $1,280. During the year, the company sold $50 worth of common stock and paid dividends of $40. What is the amount of the cash flow to

Stockholders?

A) -$90

B) -$10

C) $10

D) $40

E) $90

Stockholders?

A) -$90

B) -$10

C) $10

D) $40

E) $90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

25

If there are 100 shares of stock outstanding, what is the amount of the dividends paid per share?

A) $1.48

B) $1.60

C) $1.86

D) $2.01

E) $3.61

A) $1.48

B) $1.60

C) $1.86

D) $2.01

E) $3.61

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

26

Dale Corporation had beginning fixed assets of $3,500 an ending fixed asset balance of $4,800 invested and depreciation expense of $200. Given this information, determine the net investment

In fixed assets.

A) $1,200

B) $1,300

C) $1,400

D) $1,500

E) $1,600

In fixed assets.

A) $1,200

B) $1,300

C) $1,400

D) $1,500

E) $1,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the firm has 180 million shares of stock outstanding, what is the firm's 2015 dividends per share?

A) $0.50

B) $0.61

C) $1.41

D) $1.83

E)

A) $0.50

B) $0.61

C) $1.41

D) $1.83

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

28

What is the change in the net working capital from 2014 to 2015 ($ in millions)?

A) $1,235

B) $1,035

C) $1,335

D) $3,405

E) $4,740

A) $1,235

B) $1,035

C) $1,335

D) $3,405

E) $4,740

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is the amount of the net capital spending for 2015 ($ in millions)?

A) $240

B) $620

C) $1,480

D) $1,860

E) $2,340

A) $240

B) $620

C) $1,480

D) $1,860

E) $2,340

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the cash flow to stockholders for 2015?

A) -$2,160

B) -$1,840

C) $1,840

D) $2,160

E) $2,320

A) -$2,160

B) -$1,840

C) $1,840

D) $2,160

E) $2,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

31

What is the operating cash flow for 2015 ($ in millions)?

A) $1,060

B) $1,560

C) $1,830

D) $1,920

E) $1,960

A) $1,060

B) $1,560

C) $1,830

D) $1,920

E) $1,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

32

What is the cash flow from assets for 2015?

A) $111

B) $355

C) $1,307

D) $2,259

E) $2,503

A) $111

B) $355

C) $1,307

D) $2,259

E) $2,503

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Burger Joint paid $420 in dividends and $611 in interest expense. The addition to retained earnings is $397.74 and net new equity is $750. The tax rate is 34 percent. Sales are $6,250 and

Depreciation is $710. What are the earnings before interest and taxes?

A) $1,576.67

B) $1,582.16

C) $1,660.00

D) $1,780.82

E) $1,850.00

Depreciation is $710. What are the earnings before interest and taxes?

A) $1,576.67

B) $1,582.16

C) $1,660.00

D) $1,780.82

E) $1,850.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

34

Calculate EBIT given the following information: Cash flow from assets = $24,500; operating cash flow = $8,500; depreciation = $1,000; taxes = $2,500; capital spending = ($14,000); change in net

Working capital = ($2,000).

A) $8,000

B) $9,000

C) $10,000

D) $11,000

E) $12,000

Working capital = ($2,000).

A) $8,000

B) $9,000

C) $10,000

D) $11,000

E) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the cash flow from assets for 2015 ($ in millions)?

A) $430

B) $485

C) $1,340

D) $2,590

E) $3,100

A) $430

B) $485

C) $1,340

D) $2,590

E) $3,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the amount of the net capital spending for 2015 ($ in millions)?

A) -$290

B) $795

C) $1,080

D) $1,660

E) $2,165

A) -$290

B) $795

C) $1,080

D) $1,660

E) $2,165

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is the amount of the cash flow to creditors?

A) -$10

B) $0

C) $10

D) $40

E) $50

A) -$10

B) $0

C) $10

D) $40

E) $50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

38

If there are 250 shares of stock outstanding, what is the amount of the earnings per share?

A) $0.64

B) $0.80

C) $1.21

D) $1.44

E) $2.19

A) $0.64

B) $0.80

C) $1.21

D) $1.44

E) $2.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

39

Martha's Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today's statement of financial position but could actually be sold for

$2,000. Net working capital is $200 and long-term debt is $800. What is the book value of

Shareholders' equity?

A) $200

B) $800

C) $1,200

D) $1,400

E) The answer cannot be determined from the information provided.

$2,000. Net working capital is $200 and long-term debt is $800. What is the book value of

Shareholders' equity?

A) $200

B) $800

C) $1,200

D) $1,400

E) The answer cannot be determined from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

40

RDJ Manufacturing had 300 million shares of stock outstanding at the end of 2015. During 2015, the company reported net income of $600 million, retained earnings of $900 million, and $240 million

In dividends paid. What is RDJ's earnings per share?

A) $0.50

B) $0.67

C) $0.80

D) $1.25

E) $2.00

In dividends paid. What is RDJ's earnings per share?

A) $0.50

B) $0.67

C) $0.80

D) $1.25

E) $2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

41

BassiCorporation had a beginning and ending fixed asset balance of $400 and $650 respectively. During the year its net capital spending was $330. Given this information, determine the company's

Depreciation expense.

A) $80

B) $100

C) $120

D) $140

E) $160

Depreciation expense.

A) $80

B) $100

C) $120

D) $140

E) $160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cantrell Industries spent $386,000 to purchase equipment three years ago. This equipment is currently valued at $276,000 on today's statement of financial position but could actually be sold

For $298,000. Net working capital is $56,000 and long-term debt is $171,000. What is the book

Value of shareholders' equity?

A) $49,000

B) $71,000

C) $105,000

D) $161,000

E) $183,000

For $298,000. Net working capital is $56,000 and long-term debt is $171,000. What is the book

Value of shareholders' equity?

A) $49,000

B) $71,000

C) $105,000

D) $161,000

E) $183,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

43

At the start of the year, Gershon, Inc. had total shareholders' equity = $12,000. If net income during the year was a $200 loss, dividends paid = $400, and $1,000 was raised from the sale of new stock,

What is the end of year value for total shareholders' equity?

A) $10,060

B) $11,800

C) $12,400

D) $12,800

E) $13,200

What is the end of year value for total shareholders' equity?

A) $10,060

B) $11,800

C) $12,400

D) $12,800

E) $13,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

44

A firm has common stock of $5,500, paid-in surplus of $8,200, total liabilities of $6,600, current assets of $7,200, and fixed assets of $16,900. What is the amount of the shareholders' equity?

A) $10,300

B) $13,700

C) $15,600

D) $17,500

E) $20,300

A) $10,300

B) $13,700

C) $15,600

D) $17,500

E) $20,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a firm has taxable income = $74,000, how much will it pay in taxes?

A) $10,050

B) $11,750

C) $13,500

D) $16,750

E) $18,500

A) $10,050

B) $11,750

C) $13,500

D) $16,750

E) $18,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is the change in the net working capital from 2014 to 2015 ($ in millions)?

A) -$40

B) $75

C) $125

D) $2,005

E) $2,140

A) -$40

B) $75

C) $125

D) $2,005

E) $2,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

47

The total tax on an income of $289,600 is:

A) $89,544

B) $96,194

C) $112,944

D) $113,900

E) $128,544

A) $89,544

B) $96,194

C) $112,944

D) $113,900

E) $128,544

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

48

A Nova Scotia resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $12,500

B) $13,000

C) $13,500

D) $14,000

E) $14,500

A) $12,500

B) $13,000

C) $13,500

D) $14,000

E) $14,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

49

Given the following statement of financial position data, calculate net working capital: cash = $110, accounts receivable = $410, inventory = $350, net fixed assets = $1,000, accounts payable = $60,

Short-term debt = $375, and long-term debt = $510.

A) -$590

B) $0

C) $100

D) $435

E) $535

Short-term debt = $375, and long-term debt = $510.

A) -$590

B) $0

C) $100

D) $435

E) $535

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

50

An Ontario resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $15,470

B) $16,470

C) $17,470

D) $18,470

E) $19,470

A) $15,470

B) $16,470

C) $17,470

D) $18,470

E) $19,470

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

51

An Alberta resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $13,105

B) $13,658

C) $14,105

D) $14,658

E) $15,105

A) $13,105

B) $13,658

C) $14,105

D) $14,658

E) $15,105

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is the change in net working capital for 2015?

A) -$643

B) -$122

C) $122

D) $643

E) $765

A) -$643

B) -$122

C) $122

D) $643

E) $765

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

53

A $40,000 asset was purchased and classified as a Class 10 asset for CCA purposes. If the CCA rate is 30%, calculate UCC for the end of year 3.

A) $15,800

B) $16,660

C) $17,400

D) $18,300

E) $19,200

A) $15,800

B) $16,660

C) $17,400

D) $18,300

E) $19,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the cash flow to creditors for 2015?

A) -$170

B) -$35

C) $135

D) $170

E) $205

A) -$170

B) -$35

C) $135

D) $170

E) $205

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

55

A New Brunswick resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $12,710

B) $11,710

C) $10,710

D) $9,710

E) $8,710

A) $12,710

B) $11,710

C) $10,710

D) $9,710

E) $8,710

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Row Boat Cafe has operating cash flow of $36,407. Depreciation is $4,609 and interest paid is $1,105. A net total of $3,780 was paid on long-term debt. The firm spent $18,000 on fixed assets and

Increased net working capital by $3,247. What is the amount of the cash flow to stockholders?

A) $10,275

B) $12,933

C) $15,160

D) $19,998

E) $20,045

Increased net working capital by $3,247. What is the amount of the cash flow to stockholders?

A) $10,275

B) $12,933

C) $15,160

D) $19,998

E) $20,045

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

57

A Prince Edward Island resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

58

Mylexhas current assets of $95, net fixed assets of $250, long-term debt of $40, and owners' equity of $200, what is the value of current liabilities if that is the only other item on the statement of

financial position?

A) -$50

B) $50

C) $105

D) $145

E) $545

financial position?

A) -$50

B) $50

C) $105

D) $145

E) $545

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the firm's cash flow to creditors for 2015 ($ in millions)?

A) $30

B) $47

C) $100

D) $130

E)

A) $30

B) $47

C) $100

D) $130

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the firm's net capital spending for 2015 ($ in millions)?

A) -$32

B) $32

C) $148

D) $328

E)

A) -$32

B) $32

C) $148

D) $328

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

61

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is the net new equity for 2015?

A) -$40

B) -$20

C) $20

D) $40

E) $60

A) -$40

B) -$20

C) $20

D) $40

E) $60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is the operating cash flow for 2015 ($ in millions)?

A) $845

B) $1,930

C) $2,215

D) $2,845

E) $3,060

A) $845

B) $1,930

C) $2,215

D) $2,845

E) $3,060

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

64

If total assets = $550, fixed assets = $375, current liabilities = $140, equity = $265, long-term debt = $145, and current assets is the only remaining item on the statement of financial position, what is

The value of net working capital?

A) -$265

B) $35

C) $190

D) $230

E) $265

The value of net working capital?

A) -$265

B) $35

C) $190

D) $230

E) $265

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

65

Blaze Corporation had OCF of $400, change in net working capital of 300 and cash flow from assets of $320. Given this information, calculate its net capital spending.

A) $(170)

B) $(220)

C) $170

D) $220

E) $150

A) $(170)

B) $(220)

C) $170

D) $220

E) $150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

66

A British Columbia resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,624

B) $18,264

C) $18,808

D) $19,206

E) $19,759

A) $17,624

B) $18,264

C) $18,808

D) $19,206

E) $19,759

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

67

What is the cash flow to stockholders for 2015?

A) $124.40

B) $168.80

C) $171.10

D) $173.60

E) $175.90

A) $124.40

B) $168.80

C) $171.10

D) $173.60

E) $175.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

68

Given the following statement of comprehensive income data, calculate operating cash flow: net sales = $16,500, cost of goods sold = $10,350, operating expenses = $3,118, depreciation = $1,120,

Interest expense = $900, tax rate = 34%.

A) $667.92

B) $1,912.00

C) $2,201.12

D) $2,381.92

E) $2,687.92

Interest expense = $900, tax rate = 34%.

A) $667.92

B) $1,912.00

C) $2,201.12

D) $2,381.92

E) $2,687.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

69

If provincial tax rates are 16% on the first $40,100; 20% on the next $40,100; and 24% on any income after that. If a resident had income of $95,000 then determine the total tax paid.

A) $16,228

B) $17,988

C) $18,288

D) $19,398

E) $20,328

A) $16,228

B) $17,988

C) $18,288

D) $19,398

E) $20,328

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

70

Toby's Pizza has total sales of $987,611 and costs of $724,268. Depreciation is $39,740 and the tax rate is 34 percent. The firm does not have any interest expense. What is the operating cash flow?

A) $147,577.98

B) $187,317.98

C) $191,417.06

D) $213,008.14

E) $223,603.00

A) $147,577.98

B) $187,317.98

C) $191,417.06

D) $213,008.14

E) $223,603.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is the firm's cash flow to stockholders for 2015 ($ in millions)?

A) $89

B) $129

C) $188

D) $363

E)

A) $89

B) $129

C) $188

D) $363

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

72

At the beginning of the year, a firm has current assets of $91,807 and current liabilities of $102,343. At the end of the year, the current assets are $89,476 and the current liabilities are $92,638. What

Is the change in net working capital?

A) -$13,698

B) -$8,407

C) $2,109

D) $7,374

E) $11,991

Is the change in net working capital?

A) -$13,698

B) -$8,407

C) $2,109

D) $7,374

E) $11,991

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

73

What is net new borrowing for 2015?

A) -$40

B) -$20

C) $20

D) $40

E) $60

A) -$40

B) -$20

C) $20

D) $40

E) $60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

74

What is the operating cash flow for 2015?

A) $872

B) $2,013

C) $2,413

D) $2,688

E) $2,813

A) $872

B) $2,013

C) $2,413

D) $2,688

E) $2,813

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

75

The cash flow to creditors for 2015 is ______ while the cash flow to stockholders for 2015 is _____.

A) -$640; $705

B) -$175; $255

C) $175; $255

D) $175; $450

E) $640; $450

A) -$640; $705

B) -$175; $255

C) $175; $255

D) $175; $450

E) $640; $450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

76

A Manitoba resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,191

B) $18,191

C) $19,191

D) $20,191

E) $21,191

A) $17,191

B) $18,191

C) $19,191

D) $20,191

E) $21,191

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

77

What is the firm's cash flow from assets for 2015 ($ in millions)?

A) $21

B) $159

C) $197

D) $431

E)

A) $21

B) $159

C) $197

D) $431

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the net working capital for 2015?

A) $643

B) $1,408

C) $2,055

D) $3,115

E) $5,509

A) $643

B) $1,408

C) $2,055

D) $3,115

E) $5,509

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

79

If provincial tax rates are 16% on the first $40,100; 20% on the next $40,100; and 24% on any income after that. If a resident had income of $102,000, then determine the total tax paid.

A) $19,220

B) $19,668

C) $20,280

D) $20,930

E) $21,320

A) $19,220

B) $19,668

C) $20,280

D) $20,930

E) $21,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck

80

Amy's Dress Shoppe has sales of $421,000 with costs of $342,000. Interest expense is $18,000 and depreciation is $33,000. The tax rate is 34 percent. What is the net income?

A) $9,520

B) $12,420

C) $18,480

D) $30,360

E) $52,140

A) $9,520

B) $12,420

C) $18,480

D) $30,360

E) $52,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 412 في هذه المجموعة.

فتح الحزمة

k this deck