Deck 15: Raising Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/342

العب

ملء الشاشة (f)

Deck 15: Raising Capital

1

The Western Power Company, a regional electric utility, sells 500,000 shares of common stock to

investors at large. This is most likely to be a "best efforts" offering.

investors at large. This is most likely to be a "best efforts" offering.

False

2

The venture capitalist's exit strategy is an important factor when choosing a venture capitalist.

True

3

Venture capital is relatively easy to acquire in today's market.

False

4

Award: 2.00 points

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

5

An initial public offering (IPO) occurs when a firm that is not currently publicly traded issues stock to

the public.

the public.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

6

Venture capitalists often are pension funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

7

Venture capitalists tend to avoid involvement in the actual running of a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

8

Venture capital is considered private debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

9

Venture capitalists often are insurance companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

10

Venture capitalists tend to be long-term investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

11

The financial strength of the venture capitalist is an important factor when choosing a venture

capitalist.

capitalist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

12

Venture capital firms generally pool funds from various sources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

13

Venture capitalists often are university endowment funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

14

Venture capitalists frequently assume active roles in the management of the financed firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

15

Venture capitalists are often given a 40% share in the firm's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

16

The risk that new securities will be sold at a loss is transferred from the issuing firm to the

underwriter in best efforts underwriting.

underwriter in best efforts underwriting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

17

Venture capitalists often hold voting preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

18

In regards to the cost of issuing securities, substantial economies of scale exist as related to

issuance size.

issuance size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

19

"Best efforts" underwriting is the most common type of underwriting in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

20

Venture capitalists often assume 40 percent or more ownership in a firm as a condition of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

21

Arguments that have been presented to support IPO underpricing include rewarding institutional

investors for sharing their opinion of a stock's market value.

investors for sharing their opinion of a stock's market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

22

General cash offers is considered private debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

23

Indirect expenses is a cost of a secondary equity offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

24

A reason why many IPOs are underpriced is to reward large institutional investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

25

Green shoe option is a cost of a secondary equity offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

26

Arguments that have been presented to support IPO underpricing include counteracting the

"winner's curse".

"winner's curse".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

27

Arguments that have been presented to support IPO underpricing include diminishing the risk to

the underwriter who has agreed to a firm commitment underwriting.

the underwriter who has agreed to a firm commitment underwriting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

28

Underpricing is a cost of a secondary equity offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

29

All else equal, the greater the subscription price of shares in a rights offering, the smaller the

number of rights needed to buy one new share.

number of rights needed to buy one new share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

30

A reason why many IPOs are underpriced is to help prevent lawsuits against underwriters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

31

A reason why many IPOs are underpriced is to meet the Regulation A requirements of the OSC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

32

In regards to the cost of issuing securities, underpricing for firm commitment offers is typically larger

than for best efforts.

than for best efforts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

33

In regards to the cost of issuing securities, the costs of underpricing can exceed direct issuance

costs.

costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

34

A general cash offer is an offering of debt or equity securities to fewer than 40 investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

35

A reason why many IPOs are underpriced is to counteract the winner's curse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

36

Large rights offerings are more common in industrialized nations other than Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

37

Arguments that have been presented to support IPO underpricing include diminishing the odds that

investors will sue investment banks.

investors will sue investment banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

38

Empirical evidence suggests that, on average, the shares in initial public offerings have not been

significantly underpriced.

significantly underpriced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

39

Term loans is considered private debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

40

Private placements is considered private debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

41

A shareholder currently owns 500 shares of ABC. Each share is currently priced at $15. The company has just released a rights offering at $12 plus 4 rights. What is the value of one right?

A) $0.25

B) $0.60

C) $.072

D) $1.50

E) $3.00

A) $0.25

B) $0.60

C) $.072

D) $1.50

E) $3.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

42

The main difference between direct private long-term debt financing and public issues of debt is

that direct placements are limited to a total value of $10 million.

that direct placements are limited to a total value of $10 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

43

According to the textbook, the market value of a firm's outstanding shares are most likely to fall

upon the announcement of a new equity offering.

upon the announcement of a new equity offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

44

Assuming a price greater than zero, it is virtually impossible to overprice a rights offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

45

The main difference between direct private long-term debt financing and public issues of debt is

that registration costs are lower for direct placements.

that registration costs are lower for direct placements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

46

Spread is a cost of a secondary equity offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

47

The value of a right granted by a rights offering depends upon the price-earnings ratio of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

48

One of the drawbacks of a rights offering is that the price of the stock falls, harming existing

stockholders.

stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

49

The market value of DC Wholesalers common stock is $17 a share. The company has decided to raise funds through a rights offering. Shareholders will receive one right for each share of stock

They own. The new shares are priced at $15 plus four rights. What is the value of one right?

A) $.37

B) $.40

C) $.44

D) $.50

E) $.53

They own. The new shares are priced at $15 plus four rights. What is the value of one right?

A) $.37

B) $.40

C) $.44

D) $.50

E) $.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

50

According to the textbook, direct flotation costs and the offering size (as measured by gross

proceeds) are positively related.

proceeds) are positively related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

51

Empirical evidence suggests that the market price of a firm's existing shares is most likely to decline

upon the announcement of a new equity issue. An equity issue is a signal that the firm may have

too little liquidity has been advanced as a possible explanation for this phenomenon.

upon the announcement of a new equity issue. An equity issue is a signal that the firm may have

too little liquidity has been advanced as a possible explanation for this phenomenon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

52

Empirical evidence suggests that the market price of a firm's existing shares is most likely to decline

upon the announcement of a new equity issue. Management will issue equity only when it believes

that existing shares are undervalued has been advanced as a possible explanation for this

phenomenon.

upon the announcement of a new equity issue. Management will issue equity only when it believes

that existing shares are undervalued has been advanced as a possible explanation for this

phenomenon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

53

The value of a right granted by a rights offering depends upon the number of rights required to

purchase one new share.

purchase one new share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

54

The value of a right granted by a rights offering depends upon the market price of the security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

55

The main difference between direct private long-term debt financing and public issues of debt is

that it is easier to renegotiate a term loan or private placement in the event of a default.

that it is easier to renegotiate a term loan or private placement in the event of a default.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

56

Historically, general cash offers have had average flotation costs higher than pure rights offerings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

57

Empirical evidence suggests that the market price of a firm's existing shares is most likely to decline

upon the announcement of a new equity issue. Issuing new equity requires the firm to incur

substantial issue costs has been advanced as a possible explanation for this phenomenon.

upon the announcement of a new equity issue. Issuing new equity requires the firm to incur

substantial issue costs has been advanced as a possible explanation for this phenomenon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

58

In regards to the cost of issuing securities, the total costs involved with seasoned issues are

typically higher than for IPOs.

typically higher than for IPOs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

59

The value of a right granted by a rights offering depends upon the subscription price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

60

The main difference between direct private long-term debt financing and public issues of debt is

that direct placements are less likely to have restrictive covenants.

that direct placements are less likely to have restrictive covenants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

61

The Green Hornet wants to raise $25 million in a rights offering. The stock price is $48 a share, the subscription price is $40 a share, and there are 4 million shares outstanding. What is the value of

One right?

A) $0.97

B) $1.03

C) $1.08

D) $1.11

E) $1.33

One right?

A) $0.97

B) $1.03

C) $1.08

D) $1.11

E) $1.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

62

You decide to take your company public by offering a total of 50,000 shares of common stock to the public in an initial public offering (IPO). You hire an underwriter who arranges a full commitment

Underwriting and suggests an initial selling price of $28 a share with an 8 percent spread. As it

Turns out, the underwriters only sell 48,500 shares. How much cash will you receive from your IPO?

A) $1,249,360

B) $1,288,000

C) $1,299,360

D) $1,308,600

E) $1,400,000

Underwriting and suggests an initial selling price of $28 a share with an 8 percent spread. As it

Turns out, the underwriters only sell 48,500 shares. How much cash will you receive from your IPO?

A) $1,249,360

B) $1,288,000

C) $1,299,360

D) $1,308,600

E) $1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

63

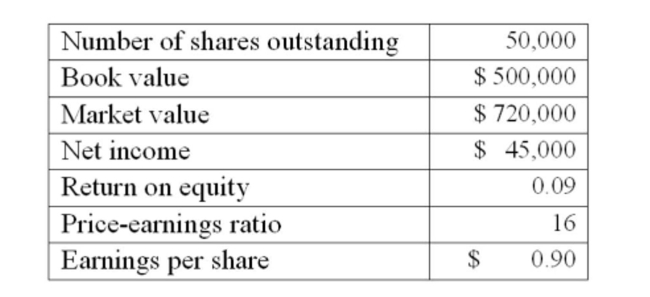

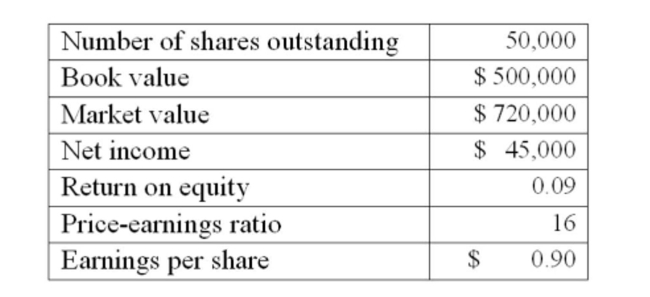

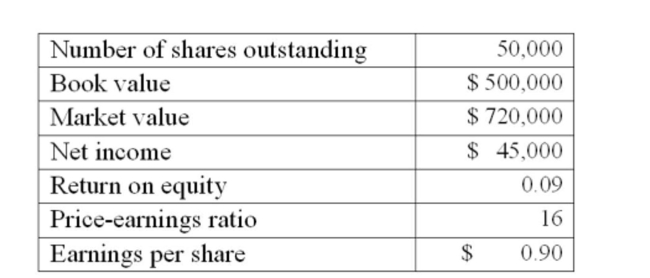

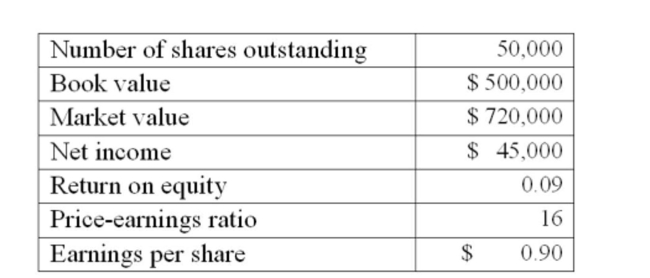

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of

financing the project. What will the new book value per share be after the project is implemented

Given the following current information on the firm?

A) $9.97

B) $10.88

C) $11.34

D) $13.15

E) $15.70

financing the project. What will the new book value per share be after the project is implemented

Given the following current information on the firm?

A) $9.97

B) $10.88

C) $11.34

D) $13.15

E) $15.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

64

Allied Corporation offers 40,000 shares of common stock to the public in an initial public offering (IPO). The underwriters agree to provide their services in a best efforts underwriting. The offering

Price is set at $28. The gross spread is $3. After completing their sales efforts the underwriters

Determine that they were able to sell a total of 36,750 shares. How much cash did Allied

Corporation receive from their IPO?

A) $880,000

B) $918,750

C) $1,029,000

D) $1,120,000

E) $1,139,250

Price is set at $28. The gross spread is $3. After completing their sales efforts the underwriters

Determine that they were able to sell a total of 36,750 shares. How much cash did Allied

Corporation receive from their IPO?

A) $880,000

B) $918,750

C) $1,029,000

D) $1,120,000

E) $1,139,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

65

An Edmonton firm has 800,000 shares outstanding at a market price of $120 a share. It wants to raise $16 million via a rights offering. The subscription price is $100 per share. What will the firm be

Worth after the offering?

A) $96.0 million

B) $98.4 million

C) $105.0 million

D) $112.0 million

E) $115.8 million

Worth after the offering?

A) $96.0 million

B) $98.4 million

C) $105.0 million

D) $112.0 million

E) $115.8 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

66

You decide to raise $2 million in additional funding via a rights offering. Every shareholder will receive one right for every share of stock they own. The offering consists of a total of 250,000 new

Shares. The current market price of your stock is $10. Currently, there are 1 million shares

Outstanding. What is the value of one right?

A) $.25

B) $.40

C) $.75

D) $1.20

E) $1.50

Shares. The current market price of your stock is $10. Currently, there are 1 million shares

Outstanding. What is the value of one right?

A) $.25

B) $.40

C) $.75

D) $1.20

E) $1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

67

Wagner Trucking is considering investing in a new project that will cost $6 million and increase net income by 5 percent. This project will be completely funded by issuing new equity shares.

Currently, the firm has 2 million shares of stock outstanding with a market price of $30 per share.

The current earnings per share are $1.60. What will the earnings per share be if the project is

Implemented?

A) $1.39

B) $1.45

C) $1.53

D) $1.60

E) $1.68

Currently, the firm has 2 million shares of stock outstanding with a market price of $30 per share.

The current earnings per share are $1.60. What will the earnings per share be if the project is

Implemented?

A) $1.39

B) $1.45

C) $1.53

D) $1.60

E) $1.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

68

A Windsor firm has 800,000 shares outstanding at a market price of $120 a share. It wants to raise $16 million via a rights offering. The subscription price is $100 per share. What is the ex-rights price?

A) $100.00

B) $113.33

C) $115.50

D) $116.67

E) $120.00

A) $100.00

B) $113.33

C) $115.50

D) $116.67

E) $120.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

69

Assume that Classique decides to set the subscription price at $4 rather than $2. Now what will the value of a right be? (Assume all other information remains the same.)

A) $0.25

B) $0.40

C) $0.80

D) $1.20

E) $2.50

A) $0.25

B) $0.40

C) $0.80

D) $1.20

E) $2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

70

TOYSrYOU needs to raise $5 million in a rights offering. If the subscription price is $10 per share, the stock price is $12.50 per share, and there are 4 million shares outstanding, what will the stock

Sell for ex-rights?

A) $7.50

B) $11.46

C) $12.22

D) $12.36

E) $12.50

Sell for ex-rights?

A) $7.50

B) $11.46

C) $12.22

D) $12.36

E) $12.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

71

You decide to raise $8 million in additional funding via a rights offering. One right is being granted for every share of stock currently outstanding. The offering consists of a total of 400,000 new

Shares. Currently, there are 2.5 million shares outstanding at a market price of $31 per share. What

Is the value of one right?

A) $.71

B) $1.15

C) $1.24

D) $1.37

E) $1.52

Shares. Currently, there are 2.5 million shares outstanding at a market price of $31 per share. What

Is the value of one right?

A) $.71

B) $1.15

C) $1.24

D) $1.37

E) $1.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

72

Frank Enterprises is sponsoring a rights offering wherein every shareholder will receive one right for every share of stock they own. The new shares in this offering are priced at $25 plus 5 rights.

The current market price of Frank Enterprises stock is $31 a share. What is the value of one right?

A) $0.25

B) $.60

C) $1.00

D) $1.20

E) $1.50

The current market price of Frank Enterprises stock is $31 a share. What is the value of one right?

A) $0.25

B) $.60

C) $1.00

D) $1.20

E) $1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

73

TOYSrYOU needs to raise $5 million in a rights offering. If the subscription price is $10 per share, the stock price is $12.50 per share, and there are 4 million shares outstanding, what is the value of

A right?

A) $0.14

B) $0.28

C) $1.04

D) $2.50

E) $5.00

A right?

A) $0.14

B) $0.28

C) $1.04

D) $2.50

E) $5.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

74

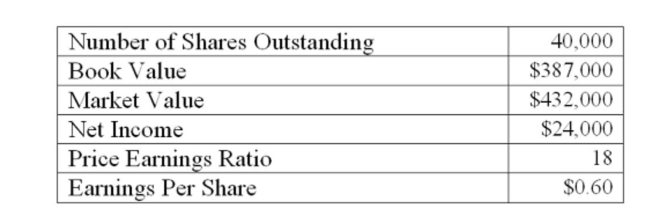

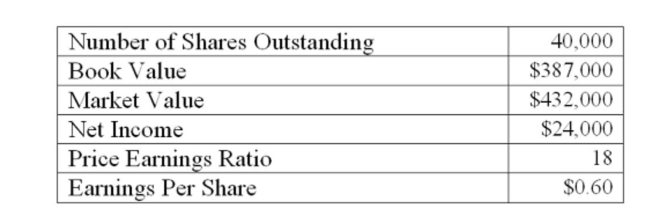

A Calgary firm is considering a new project which requires the purchase of $370,000 of new equipment. The net present value of the project is $67,000. The price-earnings ratio of the project

Equals that of the existing firm. What will the new market value per share be after the project is

Implemented given the following current information on the firm?

A) $11.70

B) $12.19

C) $12.49

D) $13.01

E) $13.13

Equals that of the existing firm. What will the new market value per share be after the project is

Implemented given the following current information on the firm?

A) $11.70

B) $12.19

C) $12.49

D) $13.01

E) $13.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

75

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of

financing the project. The price-earnings ratio of the project equals that of the existing firm. What

Will the new market value per share be after the project is implemented given the following current

Information on the firm?

A) $10.00

B) $10.37

C) $12.07

D) $14.68

E) $15.04

financing the project. The price-earnings ratio of the project equals that of the existing firm. What

Will the new market value per share be after the project is implemented given the following current

Information on the firm?

A) $10.00

B) $10.37

C) $12.07

D) $14.68

E) $15.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

76

Summit Health Care is sponsoring a rights offering wherein every shareholder will receive one right for each share of stock they own. The new shares in this offering are priced at $42 plus 8 rights.

The current market price of Summit stock is $48 a share. What is the value of one right?

A) $.50

B) $.58

C) $.63

D) $.67

E) $.75

The current market price of Summit stock is $48 a share. What is the value of one right?

A) $.50

B) $.58

C) $.63

D) $.67

E) $.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

77

Wexford Industries offers 60,000 shares of common stock to the public in an initial public offering (IPO). The underwriters agree to pay $35 a share and to provide their services in a best efforts

Underwriting. The offer price is set at $39. After completing their sales efforts the underwriters

Determine that they were able to sell a total of 48,250 shares. How much cash did Wexford

Industries receive from their IPO?

A) $1,688,750

B) $1,703,250

C) $1,881,750

D) $2,100,000

E) $2,340,000

Underwriting. The offer price is set at $39. After completing their sales efforts the underwriters

Determine that they were able to sell a total of 48,250 shares. How much cash did Wexford

Industries receive from their IPO?

A) $1,688,750

B) $1,703,250

C) $1,881,750

D) $2,100,000

E) $2,340,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

78

Glasses, Etc. is offering 100,000 shares of common stock to the public in an initial public offering (IPO). The underwriters agree to pay $18 a share and to provide their services in a best efforts

Underwriting. The offer price is set at $19.50. The underwriters sell a total of 91,700 shares to the

General public. How much cash did Glasses, Etc. receive from its IPO?

A) $1,650,600

B) $1,720,500

C) $1,788,150

D) $1,800,000

E) $1,950,000

Underwriting. The offer price is set at $19.50. The underwriters sell a total of 91,700 shares to the

General public. How much cash did Glasses, Etc. receive from its IPO?

A) $1,650,600

B) $1,720,500

C) $1,788,150

D) $1,800,000

E) $1,950,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

79

The Purple Nickel is seeking to raise $8 million through a rights offering. Two rights will be required to purchase each new share of stock. Currently, there are 1.6 million shares outstanding at a market

Price of $12 per share. What is the ex-rights price?

A) $11.00

B) $11.33

C) $11.50

D) $11.58

E) $11.77

Price of $12 per share. What is the ex-rights price?

A) $11.00

B) $11.33

C) $11.50

D) $11.58

E) $11.77

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck

80

The stock of Byron Enterprises is currently selling for $48 a share. The company has decided to raise funds through a rights offering wherein every shareholder will receive one right for every

Share of stock they own. The new shares being offered are priced at $42 plus five rights. What is

The value of one right?

A) $0.20

B) $0.50

C) $1.00

D) $5.00

E) $6.00

Share of stock they own. The new shares being offered are priced at $42 plus five rights. What is

The value of one right?

A) $0.20

B) $0.50

C) $1.00

D) $5.00

E) $6.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 342 في هذه المجموعة.

فتح الحزمة

k this deck