Deck 14: Cost of Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/378

العب

ملء الشاشة (f)

Deck 14: Cost of Capital

1

Suppose that new information regarding future inflation in Canada causes investors to become less

risk averse. The SML approach indicates that, all else equal, firm cost of capital will increase.

risk averse. The SML approach indicates that, all else equal, firm cost of capital will increase.

False

2

A potential problem associated with the use of the dividend growth model to compute the cost of

equity is that The estimated cost of equity is sensitive to the estimated dividend growth rate.

equity is that The estimated cost of equity is sensitive to the estimated dividend growth rate.

True

3

A firm's overall cost of equity is highly dependent upon the growth rate and risk level of a firm.

True

4

A firm's overall cost of equity is directly observable in the financial markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

5

The cost of equity is affected by the risk level of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

6

The cost of equity is affected by dividend increases or decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

7

As a means of determining a firm's cost of equity financing for an investment, a weakness in the

dividend growth model is that the model is highly dependent upon the accuracy of the beta

assigned to the firm.

dividend growth model is that the model is highly dependent upon the accuracy of the beta

assigned to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

8

A potential problem associated with the use of the dividend growth model to compute the cost of

equity is that The approach explicitly considers risk.

equity is that The approach explicitly considers risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

9

A firm's overall cost of equity is an estimate only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of equity is affected by the market risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

11

As a means of determining a firm's cost of equity financing for an investment, a weakness in the

dividend growth model is that the model can only be used by dividend-paying firms.

dividend growth model is that the model can only be used by dividend-paying firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

12

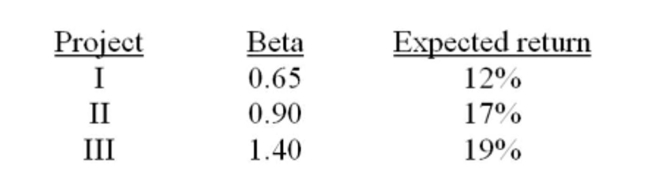

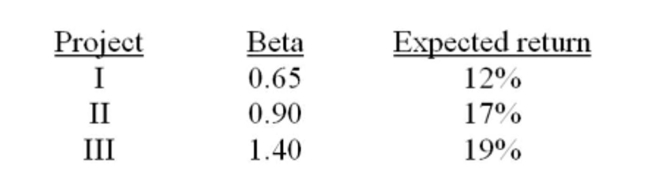

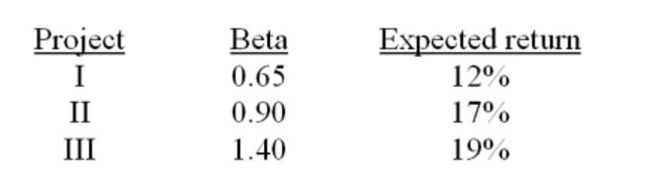

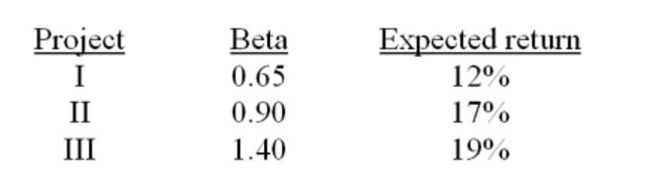

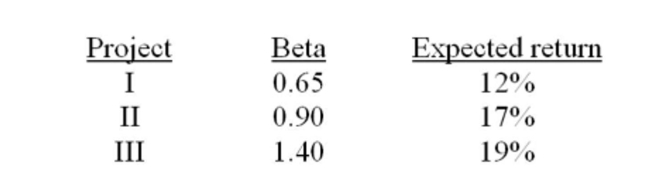

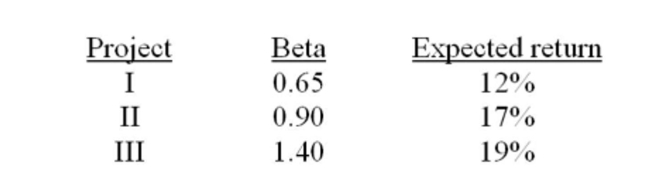

Given the following: the risk-free rate is 8% and the market risk premium is 8.5%. Project II should

be accepted if the firm's beta is 1.2.

be accepted if the firm's beta is 1.2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

13

As a means of determining a firm's cost of equity financing for an investment, a weakness in the

dividend growth model is that the model is highly sensitive to the growth rate of the firm.

dividend growth model is that the model is highly sensitive to the growth rate of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

14

A firm's overall cost of equity is unaffected by changes in the market risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

15

Given the following: the risk-free rate is 8% and the market risk premium is 8.5%. Project I should be

accepted if the firm's beta is 1.2.

accepted if the firm's beta is 1.2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

16

As a means of determining a firm's cost of equity financing for an investment, a weakness in the

dividend growth model is that it fails to specifically address the risk level of the investment.

dividend growth model is that it fails to specifically address the risk level of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

17

Given the following: the risk-free rate is 8% and the market risk premium is 8.5%. Project III should

be accepted if the firm's beta is 1.2.

be accepted if the firm's beta is 1.2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

18

The cost of equity is affected by the growth rate of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

19

In general, for the purpose of estimating the cost of preferred stock, one can ignore the current

level of common stock dividends.

level of common stock dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

20

A potential problem associated with the use of the dividend growth model to compute the cost of

equity is that Everything needed for the model is directly observable except the current dividend.

equity is that Everything needed for the model is directly observable except the current dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

21

For the purpose of estimating the firm's cost of capital, one cannot look only at the coupon rate on

the firm's existing debt.

the firm's existing debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

22

One variable that the security market line approach depends on to estimate the expected return on

a risky asset is the Risk-free rate of return.

a risky asset is the Risk-free rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

23

The cost of debt is affected by the coupon rate of a firm's outstanding bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

24

For the purpose of estimating the firm's cost of debt for a project, one could observe the yield-to-

maturity on recently issued bonds with a similar rating and term-to-maturity.

maturity on recently issued bonds with a similar rating and term-to-maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

25

A decrease in the reward for bearing systematic risk will always decrease a firm's cost of equity,

when calculated using the SML approach.

when calculated using the SML approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

26

The after-tax cost of debt generally increases when the market rate of interest increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

27

The SML approach generally assumes that the reward-to-risk ratio is constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

28

Ignoring taxes, if a firm issues debt at par, then the cost of debt is equal to its coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

29

The after-tax cost of debt generally increases when bond prices decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

30

One variable that the security market line approach depends on to estimate the expected return on

a risky asset is the Systematic risk of the asset.

a risky asset is the Systematic risk of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

31

Ignoring taxes, if a firm issues debt at par, then the cost of debt is equal to its yield to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

32

An increase in the firm's beta will always decrease a firm's cost of equity, when calculated using the

SML approach.

SML approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

33

The cost of debt is affected by investors' risk tolerance level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

34

One variable that the security market line approach depends on to estimate the expected return on

a risky asset is the Market risk premium.

a risky asset is the Market risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

35

The after-tax cost of debt generally increases when tax rates decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

36

Ignoring taxes, if a firm issues debt at par, then the YTM cannot be computed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

37

The after-tax cost of debt generally increases when a firm's bond rating increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cost of debt is affected by marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

39

One variable that the security market line approach depends on to estimate the expected return on

a risky asset is the Marginal tax rate.

a risky asset is the Marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

40

It is considered unlikely that the dividend growth and the SML approaches will result in different

estimates of the cost of equity for a given firm

estimates of the cost of equity for a given firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

41

The interest rate that should be used when evaluating a capital investment project is sometimes

called the appropriate discount rate.

called the appropriate discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

42

The BongoBongo Drum Co. uses debt and equity in its capital structure and has positive earnings.

A decrease in the corporate tax rate would decrease the firm's WACC.

A decrease in the corporate tax rate would decrease the firm's WACC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

43

By using a firm's WACC to analyze all potential investments, we risk incorrectly accepting some

suitable projects.

suitable projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

44

For a profitable firm, an increase in its marginal tax rate will increase its weighted average cost of

capital.

capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a firm uses its WACC as the discount rate for all of the projects it undertakes, then the firm will

tend to become riskier over time.

tend to become riskier over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

46

A firm may have to rely upon a competitor's cost of capital to ascertain the appropriate required

return for a project.

return for a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

47

If a firm uses its WACC as the discount rate for all of the projects it undertakes, then the firm will

tend to reject some positive net present value projects.

tend to reject some positive net present value projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

48

If a firm uses its WACC as the discount rate for all of the projects it undertakes, then the firm will

tend to favor low risk projects over high risk projects.

tend to favor low risk projects over high risk projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

49

The interest rate that should be used when evaluating a capital investment project is sometimes

called the cost of capital.

called the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

50

The cost of capital is also known as the appropriate discount rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

51

The BongoBongo Drum Co. uses debt and equity in its capital structure and has positive earnings.

A decrease in investor risk aversion would decrease the firm's WACC.

A decrease in investor risk aversion would decrease the firm's WACC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

52

By using a firm's WACC to analyze all potential investments, we risk incorrectly accepting some

unsuitable projects.

unsuitable projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

53

A firm that uses its WACC as a cutoff without considering project risk will likely see its WACC rise

over time.

over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

54

The weighted average cost of capital for a firm is dependent upon the firm's level of risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

55

The BongoBongo Drum Co. uses debt and equity in its capital structure and has positive earnings.

An increase in the firm's debt rating from BBB to A would decrease the firm's WACC.

An increase in the firm's debt rating from BBB to A would decrease the firm's WACC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

56

If a firm uses its WACC as the discount rate for all of the projects it undertakes, then the firm will

tend to accept some negative net present value projects.

tend to accept some negative net present value projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

57

The cost of debt is affected by the current yield-to-maturity of the firm's bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

58

It is generally better to base estimates of the WACC on book value weights of debt and equity since

market values, particularly those for equity, tend to fluctuate widely.

market values, particularly those for equity, tend to fluctuate widely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

59

The market value of a firm that invests in projects providing a return equal to its WACC will not

change over time.

change over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

60

The interest rate that should be used when evaluating a capital investment project is sometimes

called the internal rate of return.

called the internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

61

The cost of capital is an opportunity cost that depends on the use of the funds, not the source

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

62

An advantage to using the SML approach for calculating the cost of equity it that unlike the

dividend growth model, the SML approach is not sensitive to the estimates used as inputs in the

model.

dividend growth model, the SML approach is not sensitive to the estimates used as inputs in the

model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

63

The weighted average cost of capital for a firm is dependent upon the firm's tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

64

A firm that uses its WACC as a cutoff without considering project risk tends to accept negative NPV

projects over time.

projects over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

65

The cost of capital is the same as the WACC for projects with equal risk to the firm as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

66

A decrease in the amount of systematic risk will always decrease a firm's cost of equity, when

calculated using the SML approach.

calculated using the SML approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

67

Ignoring the risk level of a project can cause a firm to reject a profitable project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

68

The cost of capital depends primarily on the use of funds, not the source.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

69

The weighted average cost of capital for a firm is dependent upon the firm's coupon rate on the

preferred stock.

preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

70

The risk-free rate of return is considered, directly or indirectly, in the weighted average cost of

capital.

capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

71

The amount of equity financing as a percent of the total financing is considered, directly or

indirectly, in the weighted average cost of capital.

indirectly, in the weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

72

The cost of capital for a project should exclude any tax considerations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

73

The SML approach can be applied to more firms than the dividend growth model can.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

74

The weighted average cost of capital for a firm is dependent upon the firm's debt-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

75

The marginal tax rate of the firm is considered, directly or indirectly, in the weighted average cost of

capital.

capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

76

The cost of capital is the same thing as the required rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

77

A firm that uses its WACC as a cutoff without considering project risk tends to become less risky

over time.

over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

78

The use of the funds is more important than the source of funds in determining the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

79

The SML approach considers the amount of systematic risk associated with an individual firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck

80

The risk tolerance level of investors is considered, directly or indirectly, in the weighted average

cost of capital.

cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 378 في هذه المجموعة.

فتح الحزمة

k this deck