Deck 16: Depreciation Methods

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/53

العب

ملء الشاشة (f)

Deck 16: Depreciation Methods

1

A major energy production company has the following information regarding the acquisition of new-generation equipment.

Purchase price = $580,000

Transoceanic shipping and delivery cost = $4300

Installation cost (1 technician at $1600 per day for 4 days) = $6400

Tax recovery period = 15 years

Book depreciation recovery period = 10 years

Salvage value = 10% of purchase price

Operating cost (with technician) = $185,000 per year

The manager of the department asked the newest hire to enter the appropriate data in the tax accounting program. For the MACRS method, what are the values of B , n, and S in depreciating the asset for tax purposes

Purchase price = $580,000

Transoceanic shipping and delivery cost = $4300

Installation cost (1 technician at $1600 per day for 4 days) = $6400

Tax recovery period = 15 years

Book depreciation recovery period = 10 years

Salvage value = 10% of purchase price

Operating cost (with technician) = $185,000 per year

The manager of the department asked the newest hire to enter the appropriate data in the tax accounting program. For the MACRS method, what are the values of B , n, and S in depreciating the asset for tax purposes

Depreciation is way of accounting the value of asset as deferred expense in account books. Depreciation is not an actual expense that is made in that year, as it is just an accounting entry. Depreciation can be calculated by several ways.

The book value B here will be sum of purchase price i.e. $580,000, installation cost i.e. $6,400 and delivery cost i.e. $4,300, which will be equal to $590,700. The value of n will be 15 years and salvage value S is always considered to be zero in MACRs depreciation method.

The book value B here will be sum of purchase price i.e. $580,000, installation cost i.e. $6,400 and delivery cost i.e. $4,300, which will be equal to $590,700. The value of n will be 15 years and salvage value S is always considered to be zero in MACRs depreciation method.

2

Exactly 10 years ago, Boyditch Professional Associates purchased $100,000 in depreciable assets with an estimated salvage of $10,000. For tax depreciation, the SL method with n =10 years was used, but for book depreciation, Boyditch applied the DDB method with n = 7 years and neglected the salvage estimate. The company sold the assets today for $12,500.

a) Compare the sales price today with the book values using the SL and DDB methods.

b) If the salvage of $12,500 had been estimated exactly 10 years ago, determine the depreciation for each method in year 10.

a) Compare the sales price today with the book values using the SL and DDB methods.

b) If the salvage of $12,500 had been estimated exactly 10 years ago, determine the depreciation for each method in year 10.

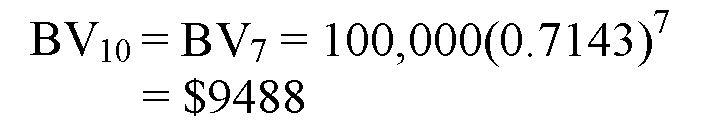

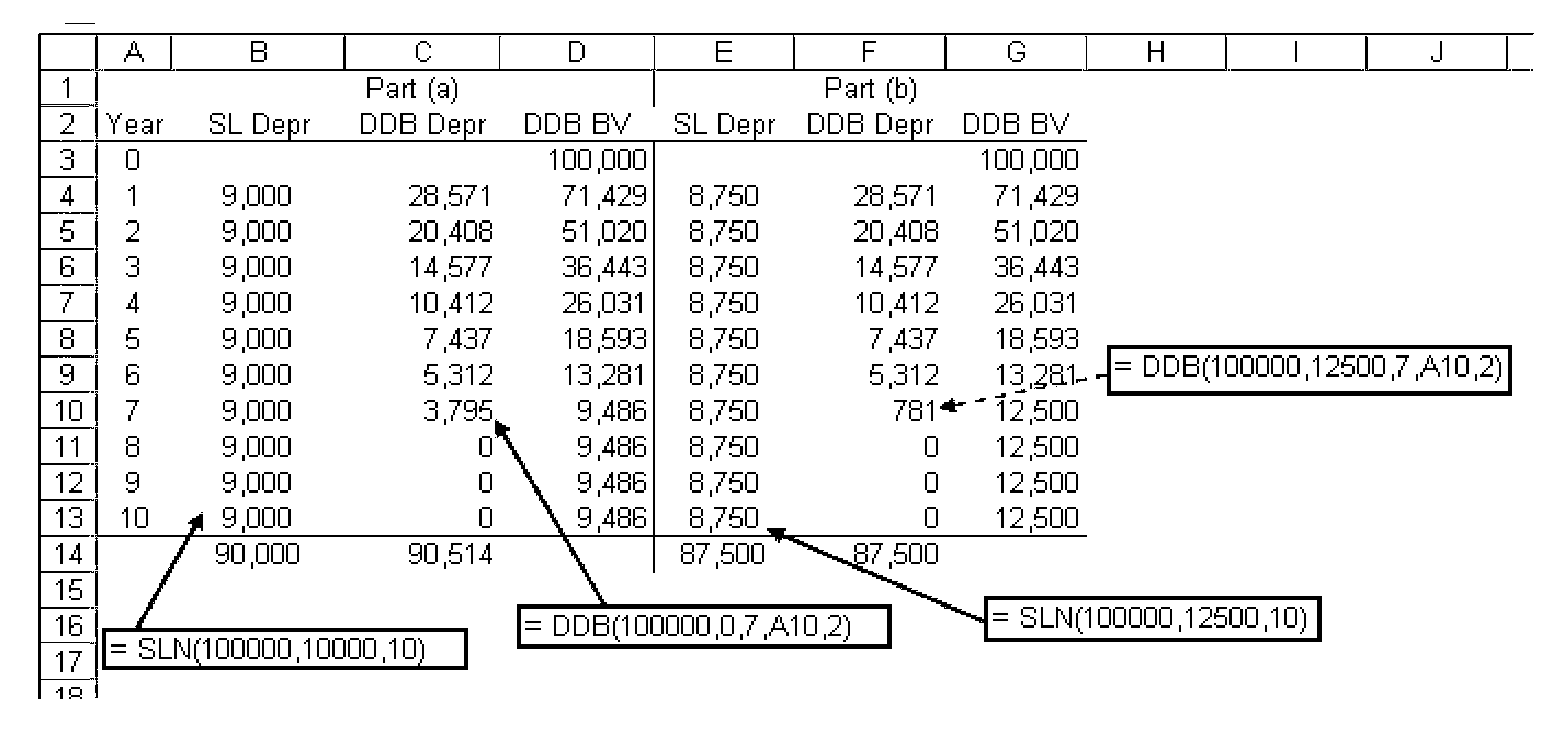

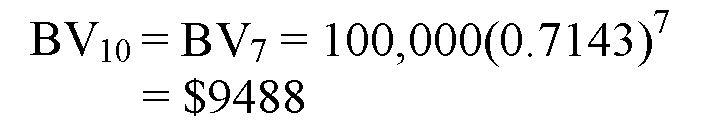

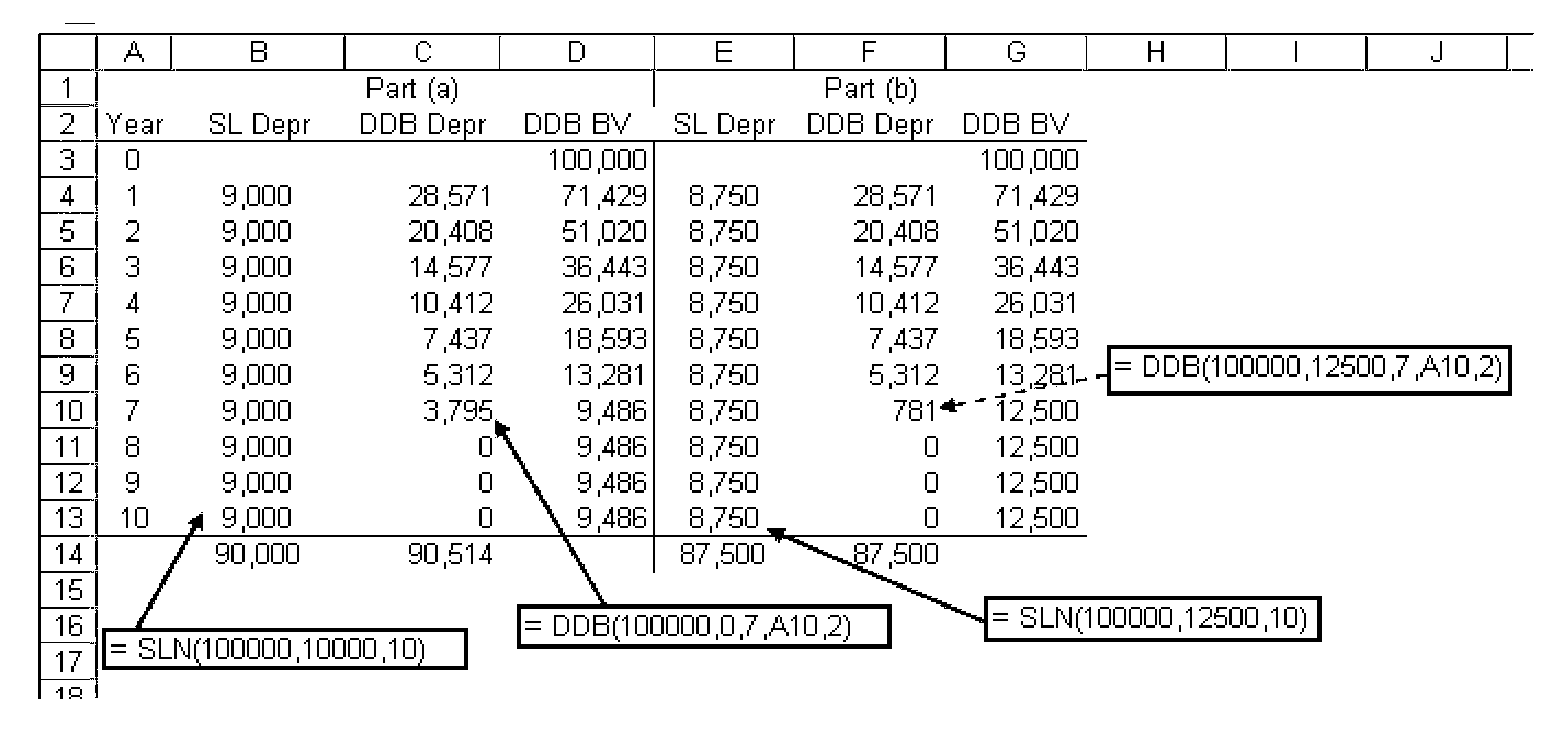

16.23 (a) SL: BV 10 = $10,000 by definition

DDB: Determine if the implied S $10,000 with d = 2/7 = 0.2857 Both salvage values are less than the market value of $12,500

Both salvage values are less than the market value of $12,500

(b) SL: D 10 = (100,000-12,500)/10 = $8750 per year

DDB: D 10 = 0, since n = 7 years

Spreadsheet solution for both parts follows.

DDB: Determine if the implied S $10,000 with d = 2/7 = 0.2857

Both salvage values are less than the market value of $12,500

Both salvage values are less than the market value of $12,500(b) SL: D 10 = (100,000-12,500)/10 = $8750 per year

DDB: D 10 = 0, since n = 7 years

Spreadsheet solution for both parts follows.

3

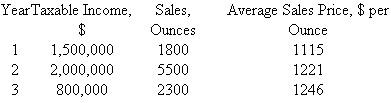

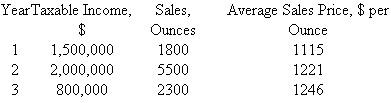

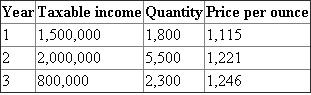

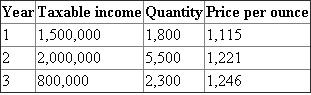

A company owns gold mining operations in the United States, Australia, and South Africa. The Colorado mine has the taxable income and sales results summarized below. Determine the annual percentage depletion amount for the gold mine.

Given information:

Table -1 shows the information regarding price quantity and taxable income for three years.

Table -1 Total income:

Total income:

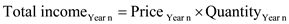

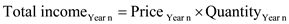

Total income can be calculated by using the following formula: …… (1)

…… (1)

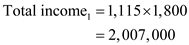

Total income for fist year:

Substitute the respective values in equation (1) to calculate the total income for the first year: First year total income is

First year total income is  .

.

Value of depletion gold:

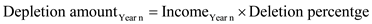

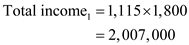

Value of depletion of gold can be calculated by using the following formula. …… (2)

…… (2)

First year value of depletion gold:

Percentage of depletion is 15%. Thus, percentage of depletion gold for first year can be calculated by substituting the respective values in Equation (2). Value of depletion of gold in the first year is

Value of depletion of gold in the first year is  .

.

Allowed depletion:

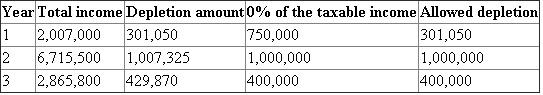

If the value of depletion is 50% to the taxable income, then depletion is allowed. IF the depletion amount is exceeds the value of 50% of the taxable income, then allowed depletion amount is equal to the 50% of the taxable income.

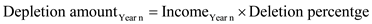

Table -2 shows the value of total income, depletion amount that obtained by using Equation (1) and (2).

The value of 50% for the taxable income is obtained by multiplying the value of taxable income into 0.5.

Table -2 Note:

Note:

For the first year the depletion mount is less than the 50% of the taxable income. Thus, it is allowed.

In the second and third year, depletion amount is greater than the 50% of the taxable income. Thus, depletion is allowed equal to 50% taxable income.

Table -1 shows the information regarding price quantity and taxable income for three years.

Table -1

Total income:

Total income: Total income can be calculated by using the following formula:

…… (1)

…… (1)Total income for fist year:

Substitute the respective values in equation (1) to calculate the total income for the first year:

First year total income is

First year total income is  .

.Value of depletion gold:

Value of depletion of gold can be calculated by using the following formula.

…… (2)

…… (2)First year value of depletion gold:

Percentage of depletion is 15%. Thus, percentage of depletion gold for first year can be calculated by substituting the respective values in Equation (2).

Value of depletion of gold in the first year is

Value of depletion of gold in the first year is  .

.Allowed depletion:

If the value of depletion is 50% to the taxable income, then depletion is allowed. IF the depletion amount is exceeds the value of 50% of the taxable income, then allowed depletion amount is equal to the 50% of the taxable income.

Table -2 shows the value of total income, depletion amount that obtained by using Equation (1) and (2).

The value of 50% for the taxable income is obtained by multiplying the value of taxable income into 0.5.

Table -2

Note:

Note:For the first year the depletion mount is less than the 50% of the taxable income. Thus, it is allowed.

In the second and third year, depletion amount is greater than the 50% of the taxable income. Thus, depletion is allowed equal to 50% taxable income.

4

Stahmann Products paid $350,000 for a numerical controller during the last month of 2007 and had it installed at a cost of $50,000. The recovery period was 7 years with an estimated salvage value of 10% of the original purchase price. Stahmann sold the system at the end of 2011 for $45,000.

a) What numerical values are needed to develop a depreciation schedule at purchase time

b) State the numerical values for the following: remaining life at sale time, market value in 2011, book value at sale time if 65% of the basis had been depreciated.

a) What numerical values are needed to develop a depreciation schedule at purchase time

b) State the numerical values for the following: remaining life at sale time, market value in 2011, book value at sale time if 65% of the basis had been depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

5

Shirley is studying depreciation in her engineering management course. The instructor asked her to graphically compare the total percent of first cost depreciated for an asset costing B dollars over a life of n = 5 years for DDB and 125% DB depreciation. Help her by developing the plots of percent of B depreciated versus years. Use a spreadsheet unless otherwise instructed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

6

A highway construction company operates a quarry. During the last 5 years, the amount extracted each year was 60,000, 50,000, 58,000 60,000, and 65,000 tons. The mine is estimated to contain a total of 2.5 million tons of usable stones and gravel. The quarry land had an initial cost of $3.2 million. The company had a per-ton gross income of $30 for the first year, $25 for the second year, $35 for the next 2 years, and $40 for the last year.

a) Determine the depletion charge each year, using the larger of the values for the two depletion methods. Assume all depletion amounts are less than 50% of taxable income.

b) Compute the percent of the initial cost that has been written off in these 5 years, using the depletion charges in part

a).

c) If the quarry operation is reevaluated after the first 3 years of operation and estimated to contain a total of 1.5 million tons remaining, rework parts

a) and b).

a) Determine the depletion charge each year, using the larger of the values for the two depletion methods. Assume all depletion amounts are less than 50% of taxable income.

b) Compute the percent of the initial cost that has been written off in these 5 years, using the depletion charges in part

a).

c) If the quarry operation is reevaluated after the first 3 years of operation and estimated to contain a total of 1.5 million tons remaining, rework parts

a) and b).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

7

An asset with an unadjusted basis of $50,000 was depreciated over n tax = 10 years for tax depreciation purposes and n book = 5 years for book depreciation purposes. The annual depreciation was 1/n using the relevant life value. Use a spreadsheet to plot on one graph the annual book value for both methods of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

8

Explain the difference between an accelerated depreciation method and one that is not accelerated. Give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

9

All of the following types of real property are depreciable except:

A) Warehouses

B) Land

C) Office buildings

D) Test facilities

A) Warehouses

B) Land

C) Office buildings

D) Test facilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the depreciation rate d t per year for an asset that has an 8-year useful life and is straight line depreciated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

11

What was one of the prime reasons that MACRS depreciation was initiated in the mid-1980s

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

12

According to information on the IRS website, a taxpayer can take a depreciation deduction as long as the property meets all of the following requirements except:

a) The taxpayer must own the property.

b) The taxpayer must use the property in an income-producing activity.

c) The taxpayer must use the property for personal purposes.

d) The property must have a determinable useful life of more than 1 year.

a) The taxpayer must own the property.

b) The taxpayer must use the property in an income-producing activity.

c) The taxpayer must use the property for personal purposes.

d) The property must have a determinable useful life of more than 1 year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

13

Pneumatics Engineering purchased a machine that had a first cost of $40,000, an expected useful life of 8 years, a recovery period of 10 years, and a salvage value of $10,000. The operating cost of the machine is expected to be $15,000 per year. The inflation rate is 6% per year and the company's MARR is 11% per year. Determine

a) the depreciation charge for year 3, b) the present worth of the third-year depreciation charge in year 0, the time of asset purchase, and c) the book value for year 3 according to the straight line method.

a) the depreciation charge for year 3, b) the present worth of the third-year depreciation charge in year 0, the time of asset purchase, and c) the book value for year 3 according to the straight line method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

14

A company just purchased an intelligent robot, which has a first cost of $80,000. Since the robot is unique in its capabilities, the company expects to be able to sell it in 4 years for $95,000.

a) If the company spends $10,000 per year in maintenance and operation of the robot, what will the company's MACRS depreciation charge be in year 2 Assume the recovery period for robots is 5 years and the company's MARR is 16% per year when the inflation rate is 9% per year.

b) Determine the book value of the robot at the end of year 2.

a) If the company spends $10,000 per year in maintenance and operation of the robot, what will the company's MACRS depreciation charge be in year 2 Assume the recovery period for robots is 5 years and the company's MARR is 16% per year when the inflation rate is 9% per year.

b) Determine the book value of the robot at the end of year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

15

A machine with a 5-year life has a first cost of $20,000 and a $2000 salvage value. Its annual operating cost is $8000 per year. According to the classical straight line method, the depreciation charge in year 2 is nearest to:

A) $2800

B) $3600

C) $4500

D) $5300

A) $2800

B) $3600

C) $4500

D) $5300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

16

An asset that is book-depreciated over a 5-year period by the straight line method has BV 3 = $62,000 with a depreciation charge of $26,000 per year. Determine

a) the first cost of the asset and b) the assumed salvage value.

a) the first cost of the asset and b) the assumed salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

17

Animatics Corp. of Santa Clara, California, makes small servo systems with built-in controllers, amplifiers, and encoders so that they can control entire machines. The company purchased an asset 2 years ago that has a 5-year recovery period. The depreciation charge by the MACRS method for year 2 is $24,320.

a) What was the first cost of the asset

b) How much was the depreciation charge in year 1

c) Develop the complete MACRS depreciation and book value schedule using the VDB function.

a) What was the first cost of the asset

b) How much was the depreciation charge in year 1

c) Develop the complete MACRS depreciation and book value schedule using the VDB function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

18

A machine with a 10-year life is MACRS - depreciated. The machine has a first cost of $40,000 with a $5000 salvage value. Its annual operating cost is $7000 per year, and d t for years 1, 2, and 3 is 10.00%, 18.00%, and 14.40%, respectively. The depreciation charge in year 3 is nearest to:

A) $5800

B) $7200

C) $8500

D) $9300

A) $5800

B) $7200

C) $8500

D) $9300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

19

Lee Company of Westbrook, Connecticut, manufactures pressure relief inserts for thermal relief and low-flow hydraulic pressure relief applications where zero leakage is required. A machine purchased 3 years ago has been book-depreciated by the straight line method using a 5-year useful life. If the book value at the end of year 3 is $30,000 and the company assumed that the machine would be worthless at the end of its 5-year useful life,

a) what is the book depreciation charge each year and b) what was the first cost of the machine

a) what is the book depreciation charge each year and b) what was the first cost of the machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

20

A plant manager for a large cable company knows that the remaining invested value of certain types of manufacturing equipment is more closely approximated when the equipment is depreciated linearly by the SL method compared to a rapid write-off method such as MACRS. Therefore, he keeps two sets of books, one for tax purposes (MACRS) and one for equipment management purposes (SL). For an asset that has a first cost of $80,000, a depreciable life of 5 years, and a salvage value equal to 25% of the first cost, determine the difference in the book values shown in the two sets of books at the end of year 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

21

A coal mine purchased for $5 million has enough coal to operate for 10 years. The annual cost is expected to be $200,000 per year. The coal is expected to sell for $150 per ton, with annual production expected to be 10,000 tons. Coal has a depletion percentage rate of 10%. The depletion charge for year 6 according to the percentage depletion method would be closest to:

A) $75,000

B) $100,000

C) $125,000

D) $150,000

A) $75,000

B) $100,000

C) $125,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

22

An asset has an unadjusted basis of $200,000, a salvage value of $10,000, and a recovery period of 7 years. Write a single-cell spreadsheet function to display the book value after 5 years of straight line depreciation. Use your function to determine the book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

23

The manager of a Glidden Paint manufacturing plant is aware that MACRS and DDB are both accelerated depreciation methods; however, out of curiosity, she wants to determine which one provides the faster write-off in the first 3 years for a recently purchased mixer that has a first cost of $300,000, a 5-year recovery period, and a $60,000 salvage value. Determine which method yields the lower book value and by how much after 3 years. The annual MACRS depreciation rates are 20%, 32%, and 19.2% for years 1, 2, and 3, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

24

The depreciation charge for a 5-year, straight line depreciated vehicle is $3000 in year 4. If the first cost was $20,000, the salvage value used in the depreciation calculation was closest to:

a) $0

b) $5000

c) $2500

d) $7500

a) $0

b) $5000

c) $2500

d) $7500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

25

Bristol Myers Squibb purchased a tablet-forming machine in 2008 for $750,000. The company planned to use the machine for 10 years; however, due to rapid obsolescence it will be retired after only 4 years in 2012. Develop a spreadsheet for depreciation and book value amounts necessary to answer the following.

a) What is the amount of capital investment remaining when the asset is prematurely retired

b) If the asset is sold at the end of 4 years for $175,000, what is the amount of capital investment lost based on straight line depreciation

c) If the new-technology machine has an estimated cost of $300,000, how many more years should the company retain and depreciate the currently owned machine to make its book value and the first cost of the new machine equal to each other

a) What is the amount of capital investment remaining when the asset is prematurely retired

b) If the asset is sold at the end of 4 years for $175,000, what is the amount of capital investment lost based on straight line depreciation

c) If the new-technology machine has an estimated cost of $300,000, how many more years should the company retain and depreciate the currently owned machine to make its book value and the first cost of the new machine equal to each other

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

26

Railroad cars used to transport coal from Wyoming mines to Texas power plants cost $1.2 million and have an estimated salvage value of $300,000. Develop the depreciation and book value schedules for the GDS MACRS method by using two methods on a spreadsheet-the VDB function and the MACRS rates. Are the book value series the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

27

The book value of an asset that was DDB- depreciated over a 10-year period was $5832 at the end of year 4. If the first cost of the asset was $80,000, the salvage value that was used in the depreciation calculation was closest to:

A) $0

B) $2000

C) $5000

D) $8000

A) $0

B) $2000

C) $5000

D) $8000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

28

A special-purpose graphics workstation acquired by Busbee Consultants has B = $50,000 with a 4-year recovery period. Tabulate the values for SL depreciation, accumulated depreciation, and book value for each year if

a) S = 0 and b) S = $16,000. c) Use a spreadsheet to plot the book value over the 4 years on one chart for both salvage value estimates.

a) S = 0 and b) S = $16,000. c) Use a spreadsheet to plot the book value over the 4 years on one chart for both salvage value estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

29

A 120-metric-ton telescoping crane that cost $320,000 is owned by Upper State Power. Salvage is estimated at $75,000.

a) Compare book values for MACRS and standard SL depreciation over a 7-year recovery period. b) Explain how the estimated salvage is treated using MACRS.

a) Compare book values for MACRS and standard SL depreciation over a 7-year recovery period. b) Explain how the estimated salvage is treated using MACRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

30

For an asset that has B = $100,000, S = $40,000, and a 10-year depreciable life, the book value at the end of year 4 according to the MACRS method would be closest to ( d t values for years 1, 2, 3, 4, and 5 are 10.00%, 18.00%, 14.40%, 11.52%, and 9.22%, respectively):

A) $58,700

B) $62,400

C) $53,900

D) $46,100

A) $58,700

B) $62,400

C) $53,900

D) $46,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

31

How does depreciation affect a company's cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company owns the same asset in a U.S. plant (New York) and in a EU plant (Paris). It has B = $2,000,000 and a salvage value of 20% of B. For tax depreciation purposes, the United States allows a straight line write-off over 5 years, while the EU allows SL write-off over 8 years. The general managers of the two plants want to know the difference in

a) the depreciation amount for year 5 and b) the book value after 5 years. Using a spreadsheet, write cell functions in only two cells to answer both questions.

a) the depreciation amount for year 5 and b) the book value after 5 years. Using a spreadsheet, write cell functions in only two cells to answer both questions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

33

Youngblood Shipbuilding Yard just purchased $800,000 in capital equipment for ship repairing functions on dry-docked ships. Estimated salvage is $150,000 for any year after 5 years of use. Compare the depreciation and book value for year 3 for each of the following depreciation methods.

a) GDS MACRS where a recovery period of 10 years is allowed

b) Double declining balance with a recovery period of 15 years

c) ADS straight line as an alternative to MACRS, with a recovery period of 15 years

a) GDS MACRS where a recovery period of 10 years is allowed

b) Double declining balance with a recovery period of 15 years

c) ADS straight line as an alternative to MACRS, with a recovery period of 15 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

34

An asset that was depreciated over a 5-year period by the MACRS method had a BV of $33,025 at the end of year 3. If the MACRS depreciation rates for years 1, 2, and 3, were 0.20, 0.32, and 0.192, respectively, the basis of the asset was closest to:

a) $158,000

b) $172,000

c) $185,000

d) $193,000

a) $158,000

b) $172,000

c) $185,000

d) $193,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the difference between book value and market value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

36

When declining balance (DB) depreciation is applied, there can be three different depreciation rates involved- d , d max , and d t. Explain the differences between these rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

37

Basketball.com has installed $100,000 worth of depreciable software and equipment that represents the latest in Internet teaming and basket competition, intended to allow anyone to enjoy the sport on the Web or in the alley. No salvage value is estimated. The company can depreciate using MACRS for a 5-year recovery period or opt for the ADS alternate system over 10 years using the straight line method. The SL rates require the half-year convention; that is, only 50% of the regular annual rate applies for years 1 and 11.

a) Construct the book value curves for both methods on one graph. Show hand or spreadsheet computations as instructed.

b) After 3 years of use, what percentage of the $100,000 basis is removed for each method Compare the two percentages.

a) Construct the book value curves for both methods on one graph. Show hand or spreadsheet computations as instructed.

b) After 3 years of use, what percentage of the $100,000 basis is removed for each method Compare the two percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

38

A lumber company purchased a tract of land for $70,000 that contained an estimated 25,000 usable trees. The value of the land was estimated at $20,000. In the first year of operation, the lumber company cut down 5000 trees. According to the cost depletion method, the depletion deduction for year 1 is closest to:

A) $2000

B) $7000

C) $10,000

D) $14,000

A) $2000

B) $7000

C) $10,000

D) $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

39

State the difference between book depreciation and tax depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

40

Equipment for immersion cooling of electronic components has an installed value of $182,000 with an estimated trade-in value of $40,000 after 15 years. For years 2 and 10, use DDB book depreciation to determine

a) the depreciation charge and b) the book value.

a) the depreciation charge and b) the book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

41

A coal mine purchased 3 years ago for $7 million was estimated to contain 4,000,000 tons of coal. During the past 3 years the amount of coal removed was 21,000, 18,000, and 20,000 tons, respectively. The gross income obtained in these 3 years was $257,000 for the first year, $320,000 for the second year, and $340,000 for the third year. Determine (a) the cost depletion allowance for each year and (b) the percentage of the purchase price depleted thus far.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

42

An asset with a first cost of $50,000 and an estimated salvage value of $10,000 is depreciated by the MACRS method. If its book value at the end of year 3 is $21,850 and its market value is $25,850, the total amount of depreciation charged against the asset up to this time is closest to:

A) $18,850

B) $21,850

C) $25,850

D) $28,150

A) $18,850

B) $21,850

C) $25,850

D) $28,150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

43

State the difference between unadjusted and adjusted basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

44

A cooling-water pumping station at the LCRA plant costs $600,000 to construct, and it is projected to have a 25-year life with an estimated salvage value of 15% of the construction cost. However, the station will be book-depreciated to zero over a recovery period of 30 years. Calculate the annual depreciation charge for years 4, 10, and 25, using

a) straight line depreciation and b) DDB depreciation. c) What is the implied salvage value for DDB d) Use a spreadsheet to build the depreciation and book value schedules for both methods to verify your answers.

a) straight line depreciation and b) DDB depreciation. c) What is the implied salvage value for DDB d) Use a spreadsheet to build the depreciation and book value schedules for both methods to verify your answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

45

NA Forest Resources purchased forest acreage for $500,000 from which an estimated 200 million board feet of lumber is recoverable. The company will sell the lumber for $0.10 per board foot. No lumber will be sold for the next 2 years because an environmental impact statement must be completed before harvesting can begin. In years 3 to 10, however, the company expects to remove 20 million board feet per year. The inflation rate is 8%, and the company's MARR is 10%.

a) Determine the depletion amount in year 2 by the cost depletion method.

b) Determine the depletion amount in year 5 by the percentage depletion method.

a) Determine the depletion amount in year 2 by the cost depletion method.

b) Determine the depletion amount in year 5 by the percentage depletion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under the General Depreciation System (GDS) of asset classification, any asset that is not in a stated class is automatically assigned a recovery period of:

a) 5 years

b) 7 years

c) 10 years

d) 15 years

a) 5 years

b) 7 years

c) 10 years

d) 15 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

47

Explain why the recovery period used for tax depreciation purposes may be different from the estimated n value in an engineering economy study.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

48

A video recording system was purchased 3 years ago at a cost of $30,000. A 5-year recovery period and DDB depreciation have been used to write off the basis. The system is to be replaced this year with a trade-in value of $5000. What is the difference between the book value and the trade-in value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

49

A sand and gravel pit purchased for $900,000 is expected to yield 50,000 tons of gravel and 80,000 tons of sand per year. The gravel will sell for $6 per ton and the sand for $9 per ton.

a) Determine the depletion charge according to the percentage depletion method. The percentage depletion rate for sand and gravel is 5%.

b) If taxable income is $100,000 for the year, is this depletion charge allowed If not, how much is allowed

a) Determine the depletion charge according to the percentage depletion method. The percentage depletion rate for sand and gravel is 5%.

b) If taxable income is $100,000 for the year, is this depletion charge allowed If not, how much is allowed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

50

All of the following statements about the Alternative Depreciation System (ADS) are true except:

a) The half-year convention applies.

b) Salvage value is neglected.

c) The recovery periods are shorter than in GDS.

d) The straight line method is required.

a) The half-year convention applies.

b) Salvage value is neglected.

c) The recovery periods are shorter than in GDS.

d) The straight line method is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

51

Visit the U.S. Internal Revenue Service website at www.irs.gov and answer the following questions about depreciation and MACRS by consulting Publication 946, How to Depreciate Property.

a) What is the definition of depreciation according to the IRS

b) What is the description of the term salvage value

c) What are the two depreciation systems within MACRS, and what are the major differences between them

d) What are the properties listed that cannot be depreciated under MACRS

e) When does depreciation begin and end

f) What is a Section 179 deduction

a) What is the definition of depreciation according to the IRS

b) What is the description of the term salvage value

c) What are the two depreciation systems within MACRS, and what are the major differences between them

d) What are the properties listed that cannot be depreciated under MACRS

e) When does depreciation begin and end

f) What is a Section 179 deduction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

52

An engineer with Accenture Middle East BV in Dubai was asked by her client to help him understand the difference between 150% DB and DDB depreciation. Answer these questions if B = $180,000, n = 12 years, and S = $30,000.

a) What are the book values after 12 years for both methods

b) How do the estimated salvage and these book values compare in value after 12 years

c) Which of the two methods, when calculated correctly considering S = $30,000, writes off more of the first cost over 12 years

a) What are the book values after 12 years for both methods

b) How do the estimated salvage and these book values compare in value after 12 years

c) Which of the two methods, when calculated correctly considering S = $30,000, writes off more of the first cost over 12 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck

53

Vesco Mineral Resources purchased mineral rights to land in the foothills of the Santa Cristo mountains. The cost of the purchase was $9 million. Vesco originally thought that it would be able to extract 200,000 tons of lignite from the land, but further exploration revealed that 280,000 tons could be economically removed. If the company sold 20,000 tons in year 1 and 30,000 tons in year 2, what would the depletion charges be each year according to the cost depletion method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 53 في هذه المجموعة.

فتح الحزمة

k this deck