Deck 3: Governmental Operating Statement Accounts; Budgetary Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/23

العب

ملء الشاشة (f)

Deck 3: Governmental Operating Statement Accounts; Budgetary Accounting

1

Explain why governmental fund financial statements are insufficient for users seeking information about operational accountability.

Governmental Fund:

Governmental fund also known as General fund is a fund that accounts for only financial resources that are current in nature like standing for 1 year.

These can be cash, bank, inventories.

Governmental fund for Operating Statement:

This fund does not record for buildings, land, and items used in fund operations or anything which is not liquid that is cannot be converted into cash.

Further this fund records only those liabilities that can be paid easily with help of fund assets.

The difference between above two is recorded as Fund Equity.

Conclusion:

Operating Statement basically gives the position of the business earnings and related expenses, however General fund takes into account the administrative or other expenses which are fixed and have to be paid irrespective whether business is continuing or not.

In simple words, it does not record the income and cost of services or good consumed to carry on the operations.

Hence, the governmental or general fund is not useful for users to understand operating accountability because this fund focuses only on recording current financial resources as stated above.

Governmental fund also known as General fund is a fund that accounts for only financial resources that are current in nature like standing for 1 year.

These can be cash, bank, inventories.

Governmental fund for Operating Statement:

This fund does not record for buildings, land, and items used in fund operations or anything which is not liquid that is cannot be converted into cash.

Further this fund records only those liabilities that can be paid easily with help of fund assets.

The difference between above two is recorded as Fund Equity.

Conclusion:

Operating Statement basically gives the position of the business earnings and related expenses, however General fund takes into account the administrative or other expenses which are fixed and have to be paid irrespective whether business is continuing or not.

In simple words, it does not record the income and cost of services or good consumed to carry on the operations.

Hence, the governmental or general fund is not useful for users to understand operating accountability because this fund focuses only on recording current financial resources as stated above.

2

Internet Case-Revenue and Expense/Expenditure Classification.Locate a comprehensive annual financial report (CAFR) using a city's Web site, or one from the "Project Pages/Statement 34" link of the GASB's Web site, www.gasb.org.Examine the city's government-wide statement of activities and statement of revenues, expenditures, and changes in fund balances-governmental funds and prepare a brief report responding to the following questions.

a.Referring to the government-wide statement of activities, explain how the program revenues and expenses are classified.Are expenses and program revenues reported using a function or program classification Do any function or program categories show net revenues, or do they all show net expenses Is the fact that most, if not all, functions or programs show a net expense a problem Why or why not

b.Explain how revenues are classified and reported on the statement of revenues, expenditures, and changes in fund balances.Compare the amount reported for property taxes in this statement to the amount reported as general revenue on the statement of activities.Do the two amounts agree If not, can you think of a reasonable explanation for the difference

c.Explain how expenditures are classified and reported on the statement of revenues, expenditures, and changes in fund balances.Compare these amounts to the amounts reported as expenses for the same functions or programs on the statement of activities.Do the amounts agree If not, can you think of a reasonable explanation for the differences

a.Referring to the government-wide statement of activities, explain how the program revenues and expenses are classified.Are expenses and program revenues reported using a function or program classification Do any function or program categories show net revenues, or do they all show net expenses Is the fact that most, if not all, functions or programs show a net expense a problem Why or why not

b.Explain how revenues are classified and reported on the statement of revenues, expenditures, and changes in fund balances.Compare the amount reported for property taxes in this statement to the amount reported as general revenue on the statement of activities.Do the two amounts agree If not, can you think of a reasonable explanation for the difference

c.Explain how expenditures are classified and reported on the statement of revenues, expenditures, and changes in fund balances.Compare these amounts to the amounts reported as expenses for the same functions or programs on the statement of activities.Do the amounts agree If not, can you think of a reasonable explanation for the differences

Students should easily be able to locate a city's Web site, then explore the Finance Department (or comparable name) link and look for links to financial reports. Alternatively, a number of cities have links to their CAFRs from the "Project Pages/Statement 34" link of the GASB Web site ( www.gasb.org ). Responses to each of the questions in this case will depend on how a particular city classifies its revenues and expenses/expenditures.

a.Occasionally, one may find a city that classifies its program revenues and direct expenses by program, but functional classifications, similar to those described in this chapter, are much more common. In most cases, all function or program line items on the statement of activities will report a net expense, with numbers in parentheses.

b.On the statement of revenues, expenditures, and changes in fund balances, revenues and expenditures are reported in separate columns for the General Fund and other major governmental funds. Information for all nonmajor governmental funds is reported in aggregate in a single column. Students will likely find that the revenues reported on this statement are classified by source (taxes, licenses and permits, charges for services, etc.). Some cities will report a different amount for tax revenues on their statement of activities than on their statement of revenues, expenditures, and changes in fund balances because all tax revenues levied for the year will be reported on the former statement, while those that will not be collected during the current fiscal year or within 60 days thereafter will be reported as deferred taxes on the latter statement.

c.Expenditures will generally be classified by function on the statement of revenues, expenditures, and changes in fund balances and, infrequently, by program. Students are almost certain to find different amounts reported for expenses on the statement of activities and expenditures on statement of revenues, expenditures, and changes in fund balances. Among other explanations, expenses exclude outlays for capitalized assets, but include depreciation expense; expenditures include capital outlays but exclude depreciation expense. Generally, expenses and expenditures will not be the same amounts for the reasons just explained.

a.Occasionally, one may find a city that classifies its program revenues and direct expenses by program, but functional classifications, similar to those described in this chapter, are much more common. In most cases, all function or program line items on the statement of activities will report a net expense, with numbers in parentheses.

b.On the statement of revenues, expenditures, and changes in fund balances, revenues and expenditures are reported in separate columns for the General Fund and other major governmental funds. Information for all nonmajor governmental funds is reported in aggregate in a single column. Students will likely find that the revenues reported on this statement are classified by source (taxes, licenses and permits, charges for services, etc.). Some cities will report a different amount for tax revenues on their statement of activities than on their statement of revenues, expenditures, and changes in fund balances because all tax revenues levied for the year will be reported on the former statement, while those that will not be collected during the current fiscal year or within 60 days thereafter will be reported as deferred taxes on the latter statement.

c.Expenditures will generally be classified by function on the statement of revenues, expenditures, and changes in fund balances and, infrequently, by program. Students are almost certain to find different amounts reported for expenses on the statement of activities and expenditures on statement of revenues, expenditures, and changes in fund balances. Among other explanations, expenses exclude outlays for capitalized assets, but include depreciation expense; expenditures include capital outlays but exclude depreciation expense. Generally, expenses and expenditures will not be the same amounts for the reasons just explained.

3

Examine the CAFR.Utilizing the CAFR obtained for Exercise 1-1, in Chapter 1, review the governmental fund financial statements and related data and government-wide financial statements.Note particularly these items:

a.Statement of Activities at the Government-wide Level.Has the government prepared statements in compliance with the GASBS 34 financial reporting model Does the statement of activities appear on one page or across two pages What is the most costly governmental function or program operated by the government How much of the cost of governmental activities was borne by taxpayers in the form of general revenues Did the entity increase or decrease its governmental activities unrestricted net assets this year Did the entity increase or decrease its business-type activities unrestricted net assets this year

b.Statement of Revenues, Expenditures, and Changes in Fund Balances for Governmental Funds.

(1) Revenues and Other Financing Sources.What system of classification of revenues is used in the governmental fund financial statements List the three most important sources of General Fund revenues and the most important source of revenue for each major governmental fund.Does the reporting entity depend on any single source for as much as one-third of its General Fund revenues What proportion of revenues is derived from property taxes Do the notes clearly indicate recognition criteria for primary revenue sources

Are charts, graphs, or tables included in the CAFR that show the changes over time in reliance on each revenue source Are interfund transfers reported in the same section of the statement as revenues, or are they reported in other financing sources

(2) Expenditures and Other Financing Uses.What system of classification of expenditures is used in the governmental fund financial statements List the three largest categories of General Fund expenditures; list the largest category of expenditure of each major governmental fund.

Are charts, tables, or graphs presented in the CAFR (most likely in the statistical section) to show the trend of General Fund expenditures, by category, for a period of 10 years Is expenditure data related to nonfinancial measures such as population of the government or workload statistics (e.g., tons of solid waste removed or number of miles of street constructed)

c.Budgetary Comparison Schedule or Statement.Does the government present budgetary comparisons as a basic governmental fund financial statement, or as required supplementary information (RSI) immediately following the notes to the financial statements Is the budgetary comparison title a schedule rather than a statement Does the budgetary comparison present the original budget and the final amended budget Does the budgetary schedule present actual data using the budgetary basis of accounting Has the government presented one or more variance columns Do all blended component units use the same budgetary practices as the primary government of the reporting entity Does the CAFR state this explicitly, or does it indicate that budgetary practices differ by disclosures in the headings of statements, the headings of columns within statements, or by narrative and schedules within the notes to the financial statements

a.Statement of Activities at the Government-wide Level.Has the government prepared statements in compliance with the GASBS 34 financial reporting model Does the statement of activities appear on one page or across two pages What is the most costly governmental function or program operated by the government How much of the cost of governmental activities was borne by taxpayers in the form of general revenues Did the entity increase or decrease its governmental activities unrestricted net assets this year Did the entity increase or decrease its business-type activities unrestricted net assets this year

b.Statement of Revenues, Expenditures, and Changes in Fund Balances for Governmental Funds.

(1) Revenues and Other Financing Sources.What system of classification of revenues is used in the governmental fund financial statements List the three most important sources of General Fund revenues and the most important source of revenue for each major governmental fund.Does the reporting entity depend on any single source for as much as one-third of its General Fund revenues What proportion of revenues is derived from property taxes Do the notes clearly indicate recognition criteria for primary revenue sources

Are charts, graphs, or tables included in the CAFR that show the changes over time in reliance on each revenue source Are interfund transfers reported in the same section of the statement as revenues, or are they reported in other financing sources

(2) Expenditures and Other Financing Uses.What system of classification of expenditures is used in the governmental fund financial statements List the three largest categories of General Fund expenditures; list the largest category of expenditure of each major governmental fund.

Are charts, tables, or graphs presented in the CAFR (most likely in the statistical section) to show the trend of General Fund expenditures, by category, for a period of 10 years Is expenditure data related to nonfinancial measures such as population of the government or workload statistics (e.g., tons of solid waste removed or number of miles of street constructed)

c.Budgetary Comparison Schedule or Statement.Does the government present budgetary comparisons as a basic governmental fund financial statement, or as required supplementary information (RSI) immediately following the notes to the financial statements Is the budgetary comparison title a schedule rather than a statement Does the budgetary comparison present the original budget and the final amended budget Does the budgetary schedule present actual data using the budgetary basis of accounting Has the government presented one or more variance columns Do all blended component units use the same budgetary practices as the primary government of the reporting entity Does the CAFR state this explicitly, or does it indicate that budgetary practices differ by disclosures in the headings of statements, the headings of columns within statements, or by narrative and schedules within the notes to the financial statements

Government Fund financial Statements are statements recording general and special revenue sources, capital projects for acquiring capital assets, debt service and equity funds are prepared based on the present financial resources amount and accrual basis of accounting in which revenue is recognized in the same period in which they are available to finance current disbursements and measured (can be estimated) and not when it is earned.Comprehensive annual financial report is prepared by State and local governments in order to show the outcomes of their yearly activities.

Performance graph and supervision data report are also required for users to decide the operational accountability.It emphases on source, usages, and balances of present financial resources.

1.Government fund accounting demonstrates accountability through reporting financial statements of fiduciary funds which shows properties held in trustee and agency for use by others and not to funding governments own programs.

Statement of net position and statement of activities is included in the Government-wide financial statements.

2.Proprietary Fund is used for internal service funds in which work is done to support other funds and divisions within a government on reimbursement of cost basis.

Fund Accounting is used

a.Control purposes

b.It is used for sympathetic purposes

c.It ensures financial control means the purpose of the fund is stated and money is also allocated for the project

Disadvantages of fund accounting include:

1.Lack of provision for debtors and creditors.

2.It is more complex than private sector report

3.Effective Financial Control on all funds is tough.

4.Consolidation of government accounts becomes difficult with this.

So, in this system government income and its expenditure are considered under a fund planning where institutions and divisions are taken as an individual or separate unit doing separate government activities.

Fund financial statement report is a detailed report about the primary government.Major funds are disclosed individually and nonmajor funds are shown in aggregate.Hence these are sufficient for users but supports like Performance graph and supervision data report are additions required for users to decide the operational accountability.

Performance graph and supervision data report are also required for users to decide the operational accountability.It emphases on source, usages, and balances of present financial resources.

1.Government fund accounting demonstrates accountability through reporting financial statements of fiduciary funds which shows properties held in trustee and agency for use by others and not to funding governments own programs.

Statement of net position and statement of activities is included in the Government-wide financial statements.

2.Proprietary Fund is used for internal service funds in which work is done to support other funds and divisions within a government on reimbursement of cost basis.

Fund Accounting is used

a.Control purposes

b.It is used for sympathetic purposes

c.It ensures financial control means the purpose of the fund is stated and money is also allocated for the project

Disadvantages of fund accounting include:

1.Lack of provision for debtors and creditors.

2.It is more complex than private sector report

3.Effective Financial Control on all funds is tough.

4.Consolidation of government accounts becomes difficult with this.

So, in this system government income and its expenditure are considered under a fund planning where institutions and divisions are taken as an individual or separate unit doing separate government activities.

Fund financial statement report is a detailed report about the primary government.Major funds are disclosed individually and nonmajor funds are shown in aggregate.Hence these are sufficient for users but supports like Performance graph and supervision data report are additions required for users to decide the operational accountability.

4

What benefits do financial statement users derive from the net (expense) revenue format used for the government-wide statement of activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

5

Internet Case - Budgetary Comparison Statements; Budget Basis Compared with GAAP.Refer to Case 3-1 for instructions about how to obtain the CAFR for a city of your choice.Using that CAFR, go to the required supplementary information (RSI) section, immediately following the notes to the financial statements, and locate the budgetary comparison schedule (note: this schedule may be titled schedule of revenues , expenditures , and changes in fund balances-budget and actual ) for the General Fund and major special revenue funds.If this schedule is not included in the RSI, then the city you have selected is one that elects to prepare an audited statement of revenues, expenditures, and changes in fund balances-budget and actual as part of the basic financial statements.Also, locate the GAAP operating statement for governmental funds called the statement of revenues, expenditures, and changes in fund balances- governmental funds in the basic statements (note: this statement does not contain any budgetary information).Examine the schedule and/or statements, as the case may be, and prepare a brief report that responds to the following questions.

a.Are revenues and/or expenditures presented in greater detail in the budgetary comparison schedule (or statement) than in the GAAP operating statement If so, why, in your judgment, is this the case

b.Do actual revenues on the budgetary comparison schedule agree in amount with those on the GAAP operating statement If they differ, is there an explanation provided either in the notes to the financial statements or notes to the RSI to explain the difference What explanations are provided, if any

c.Do actual expenditures on the budgetary comparison schedule agree in amount with those on the GAAP operating statement If they differ, is there an explanation provided either in the notes to the financial statements or notes to the RSI to explain the difference What explanations are provided, if any

d.If no differences were noted in either b or c above, go to item e.If differences were noted, was there a notation in the heading of the budgetary comparison schedule/statement indicating "Non-GAAP Budgetary Basis" or an indication of budget basis in the column heading for actual revenues and expenditures

e.Does the budgetary comparison schedule/statement contain a variance column If so, is the variance the difference between actual and original budget or the difference between actual and final budget

a.Are revenues and/or expenditures presented in greater detail in the budgetary comparison schedule (or statement) than in the GAAP operating statement If so, why, in your judgment, is this the case

b.Do actual revenues on the budgetary comparison schedule agree in amount with those on the GAAP operating statement If they differ, is there an explanation provided either in the notes to the financial statements or notes to the RSI to explain the difference What explanations are provided, if any

c.Do actual expenditures on the budgetary comparison schedule agree in amount with those on the GAAP operating statement If they differ, is there an explanation provided either in the notes to the financial statements or notes to the RSI to explain the difference What explanations are provided, if any

d.If no differences were noted in either b or c above, go to item e.If differences were noted, was there a notation in the heading of the budgetary comparison schedule/statement indicating "Non-GAAP Budgetary Basis" or an indication of budget basis in the column heading for actual revenues and expenditures

e.Does the budgetary comparison schedule/statement contain a variance column If so, is the variance the difference between actual and original budget or the difference between actual and final budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

6

Multiple Choices.Choose the best answer.

1.Which of the following best describes the recommended format for the government-wide statement of activities

a.Revenues minus expenses equals change in net assets.

b.Revenues minus expenditures equals change in net assets.

c.Program revenues minus expenses minus general revenues equals changes in net assets.

d.Expenses minus program revenues minus general revenues equals change in net assets.

2.Expenses that are specifically identified with a program or function are reported in the government-wide statement of activities as:

a.Specific expenses.

b.Direct expenses.

c.Incremental expenses.

d.Program expenses.

3.An extraordinary item differs from a special item in that an extraordinary item is:

a.Reported on a separate line below General Revenues.

b.Within management's control.

c.Both unusual in nature and infrequent in occurrence.

d.Either unusual in nature or infrequent in occurrence.

4.Which of the following neither increases nor decreases fund balance of the General Fund during the current period

a.Deferred revenues.

b.Revenues.

c.Expenditures.

d.Other financing sources.

5.One characteristic that distinguishes other financing sources from revenues is that other financing sources:

a.Arise from debt issuances or interfund transfers in.

b.Increase fund balance when they are closed at year-end.

c.Provide financial resources for the recipient fund.

d.Have a normal credit balance.

6.Under the modified accrual basis of accounting, expenditures generally are not recognized until:

a.They are paid in cash.

b.An obligation is incurred that will be paid from currently available financial resources.

c.Goods or services are ordered.

d.They are approved by the legislative body.

7.According to GASB standards, expenditures are classified by:

a.Fund, function or program, organization unit, source, and character.

b.Fund, function or program, organization unit, activity, character, and object.

c.Fund, appropriation, organization unit, activity, character, and object.

d.Fund, organization unit, encumbrance, activity, character, and object.

8.Under GASB requirements for external financial reporting, one would find the budgetary comparison schedule (or statement) in the:

a.Required supplementary information (RSI).

b.Basic financial statements.

c.Either a or b, as elected by the government.

d.Neither a nor b.

9.If supplies that were ordered by a department financed by the General Fund are received at an actual price that is less than the estimated price on the purchase order, the department's available balance of appropriations for supplies will be:

a.Decreased.

b.Increased.

c.Unaffected.

d.Either a or b, depending on the department's specific budgetary control procedures.

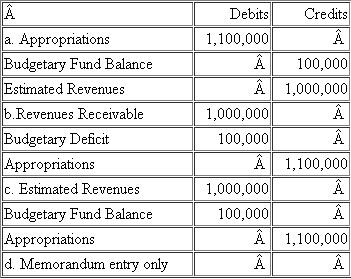

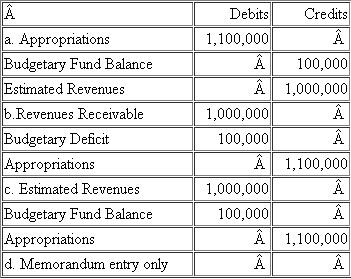

10.Spruce City's finance department recorded the recently adopted General Fund budget at the beginning of the current fiscal year.The budget approved estimated revenues of $1,000,000 and appropriations of $1,100,000.Which of the following is the correct journal entry to record the budget

1.Which of the following best describes the recommended format for the government-wide statement of activities

a.Revenues minus expenses equals change in net assets.

b.Revenues minus expenditures equals change in net assets.

c.Program revenues minus expenses minus general revenues equals changes in net assets.

d.Expenses minus program revenues minus general revenues equals change in net assets.

2.Expenses that are specifically identified with a program or function are reported in the government-wide statement of activities as:

a.Specific expenses.

b.Direct expenses.

c.Incremental expenses.

d.Program expenses.

3.An extraordinary item differs from a special item in that an extraordinary item is:

a.Reported on a separate line below General Revenues.

b.Within management's control.

c.Both unusual in nature and infrequent in occurrence.

d.Either unusual in nature or infrequent in occurrence.

4.Which of the following neither increases nor decreases fund balance of the General Fund during the current period

a.Deferred revenues.

b.Revenues.

c.Expenditures.

d.Other financing sources.

5.One characteristic that distinguishes other financing sources from revenues is that other financing sources:

a.Arise from debt issuances or interfund transfers in.

b.Increase fund balance when they are closed at year-end.

c.Provide financial resources for the recipient fund.

d.Have a normal credit balance.

6.Under the modified accrual basis of accounting, expenditures generally are not recognized until:

a.They are paid in cash.

b.An obligation is incurred that will be paid from currently available financial resources.

c.Goods or services are ordered.

d.They are approved by the legislative body.

7.According to GASB standards, expenditures are classified by:

a.Fund, function or program, organization unit, source, and character.

b.Fund, function or program, organization unit, activity, character, and object.

c.Fund, appropriation, organization unit, activity, character, and object.

d.Fund, organization unit, encumbrance, activity, character, and object.

8.Under GASB requirements for external financial reporting, one would find the budgetary comparison schedule (or statement) in the:

a.Required supplementary information (RSI).

b.Basic financial statements.

c.Either a or b, as elected by the government.

d.Neither a nor b.

9.If supplies that were ordered by a department financed by the General Fund are received at an actual price that is less than the estimated price on the purchase order, the department's available balance of appropriations for supplies will be:

a.Decreased.

b.Increased.

c.Unaffected.

d.Either a or b, depending on the department's specific budgetary control procedures.

10.Spruce City's finance department recorded the recently adopted General Fund budget at the beginning of the current fiscal year.The budget approved estimated revenues of $1,000,000 and appropriations of $1,100,000.Which of the following is the correct journal entry to record the budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

7

Why is depreciation expense typically reported as a direct expense in the government-wide statement of activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

8

Internet Case - Charter Schools.You are an accountant in a state that allows charter schools, or public school academies, to educate kindergarten through 12th grade students and receive public funds to do so.A group of parents and teachers is forming such a school and has asked for your help in establishing an accounting system.Use the Internet to identify resources that may help you in this task.For example, use your favorite search engine to look for information on "charter schools" and "accounting systems," and answer these questions:

a.Would you expect an accounting system for this type of school to be any different than that used by traditional public schools

b.Should you incorporate budgetary accounting ( Hint: Try http://www.uschar- terschools.org and look for "Budgets, Finance, and Fund-raising" under "Resources" and "Starting a Charter School.")

a.Would you expect an accounting system for this type of school to be any different than that used by traditional public schools

b.Should you incorporate budgetary accounting ( Hint: Try http://www.uschar- terschools.org and look for "Budgets, Finance, and Fund-raising" under "Resources" and "Starting a Charter School.")

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

9

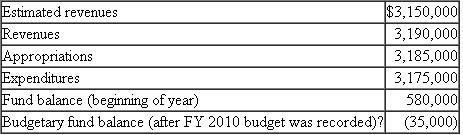

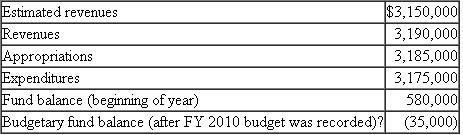

Beginning and Ending Fund Balances.The following information is provided about the Village of Wymette's General Fund operating statement and budgetary accounts for the fiscal year ended June 30, 2010.

Required

Required

a.Did the Village of Wymette engage in imprudent budgeting practice by authorizing a greater amount of expenditures than revenues estimated for the year, or potentially violate village or state balanced-budget laws

b.Calculate the end-of-year balances for the Fund Balance and Budgetary Fund Balance accounts that would be reported on the Village's balance sheet prepared as of June 30, 2010.Show all necessary work.

Required

Required a.Did the Village of Wymette engage in imprudent budgeting practice by authorizing a greater amount of expenditures than revenues estimated for the year, or potentially violate village or state balanced-budget laws

b.Calculate the end-of-year balances for the Fund Balance and Budgetary Fund Balance accounts that would be reported on the Village's balance sheet prepared as of June 30, 2010.Show all necessary work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

10

Indicate whether the following revenues would most likely be classified as program revenues or general revenues on the government-wide statement of activities.

a.Unrestricted operating grants that can be used at the discretion of the city council.

b.Capital grants restricted for highway construction.

c.Charges for building inspections.

d.A special assessment for snow removal.

e.Fines and forfeits.

f.Motor vehicle fuel taxes restricted for road repair.

g.Unrestricted investment earnings.

a.Unrestricted operating grants that can be used at the discretion of the city council.

b.Capital grants restricted for highway construction.

c.Charges for building inspections.

d.A special assessment for snow removal.

e.Fines and forfeits.

f.Motor vehicle fuel taxes restricted for road repair.

g.Unrestricted investment earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

11

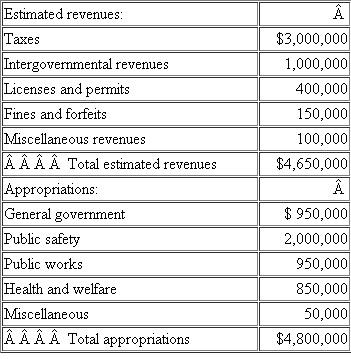

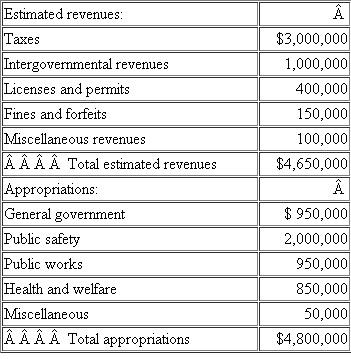

Recording Adopted Budget.The City of Marion adopted the following General Fund budget for fiscal year 2011:

Required

Required

a.Assuming that a city ordinance mandates a balanced budget, what must be the minimum amount in the Fund Balance account of the General Fund at the beginning of FY 2011

b.Prepare the general journal entries to record the adopted budget at the beginning of FY 2011.Show entries in the subsidiary ledger accounts as well as the general ledger accounts.

Required

Required a.Assuming that a city ordinance mandates a balanced budget, what must be the minimum amount in the Fund Balance account of the General Fund at the beginning of FY 2011

b.Prepare the general journal entries to record the adopted budget at the beginning of FY 2011.Show entries in the subsidiary ledger accounts as well as the general ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

12

Explain the essential differences between extraordinary items and special items and how each of these items should be reported on the government-wide statement of activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

13

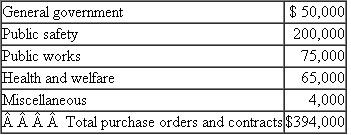

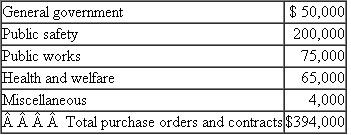

Recording Encumbrances.During July 2010, the first month of the 2011 fiscal year, the City of Marion issued the following purchase orders and contracts (see Problem 3-4):

Required

Required

a.Show the general journal entry to record the issuance of the purchase orders and contracts.Show entries in subsidiary ledger accounts as well as general ledger accounts.

b.Explain why state and local governments generally record the estimated amounts of purchase orders and contracts in the accounts of budgeted governmental funds, whereas business entities generally do not prepare formal entries for purchase orders.

Required

Required a.Show the general journal entry to record the issuance of the purchase orders and contracts.Show entries in subsidiary ledger accounts as well as general ledger accounts.

b.Explain why state and local governments generally record the estimated amounts of purchase orders and contracts in the accounts of budgeted governmental funds, whereas business entities generally do not prepare formal entries for purchase orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

14

Indicate whether each of the following expenditure items should be classified as a function, program, organization unit, activity, character, or object.

a.Mayor's Office.

b.Public Safety.

c.Residential trash disposal.

d.Accident investigation.

e.Salaries and wages.

f.Debt service.

g.Environmental protection.

h.Health and Welfare.

i.Police Department.

j.Printing and postage.

a.Mayor's Office.

b.Public Safety.

c.Residential trash disposal.

d.Accident investigation.

e.Salaries and wages.

f.Debt service.

g.Environmental protection.

h.Health and Welfare.

i.Police Department.

j.Printing and postage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

15

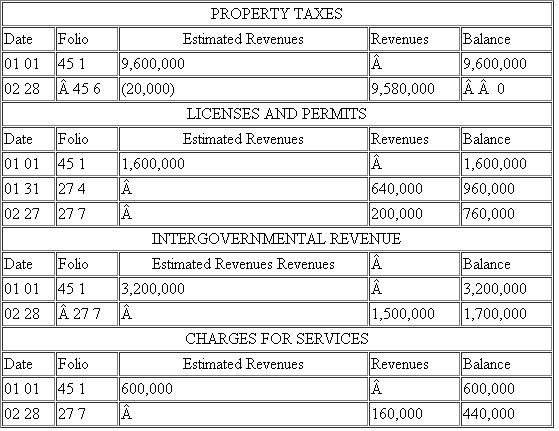

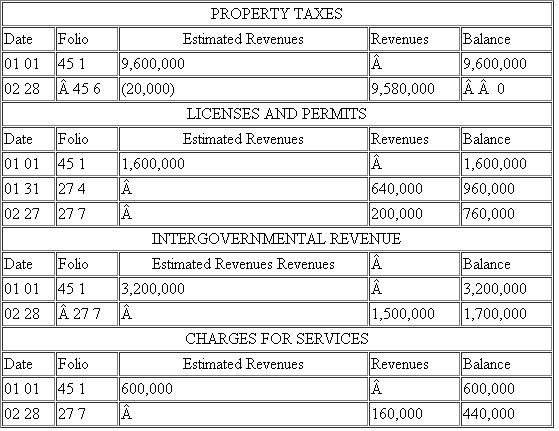

Subsidiary Ledgers.The printout of the Estimated Revenues and Revenues subsidiary ledger accounts for the General Fund of the City of Salem as of February 28, 2011, appeared as follows:

Required

Required

Assuming that this printout is correct in all details and that there are no other General Fund revenue classifications, answer the following questions.Show all necessary computations in good form.

a.What should be the balance of the Estimated Revenues control account

b.What was the original approved budget for Estimated Revenues for 2011

c.(1) Was the FY 2011 Estimated Revenues budget adjusted during the year

(2) If so, when

(3) If so, by how much

(4) If so, was the original budget increased or decreased

d.What should be the balance of the Revenues control account

e.If in the Folio column of the accounts the numerals 45 stand for general journal and the numerals 27 stand for cash receipts journal, what is the most likely reason that revenues from Property Taxes are first recognized in a general journal entry, whereas revenues from the other three sources are first recognized in cash receipts journal entries

Required

Required Assuming that this printout is correct in all details and that there are no other General Fund revenue classifications, answer the following questions.Show all necessary computations in good form.

a.What should be the balance of the Estimated Revenues control account

b.What was the original approved budget for Estimated Revenues for 2011

c.(1) Was the FY 2011 Estimated Revenues budget adjusted during the year

(2) If so, when

(3) If so, by how much

(4) If so, was the original budget increased or decreased

d.What should be the balance of the Revenues control account

e.If in the Folio column of the accounts the numerals 45 stand for general journal and the numerals 27 stand for cash receipts journal, what is the most likely reason that revenues from Property Taxes are first recognized in a general journal entry, whereas revenues from the other three sources are first recognized in cash receipts journal entries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

16

Distinguish between:

a.Expenditures and Encumbrances.

b.Revenues and Estimated Revenues.

c.Reserve for Encumbrances and Encumbrances.

d.Reserve for Encumbrances and Fund Balance.

e.Appropriations and Expenditures.

f.Expenditures and Expenses.

a.Expenditures and Encumbrances.

b.Revenues and Estimated Revenues.

c.Reserve for Encumbrances and Encumbrances.

d.Reserve for Encumbrances and Fund Balance.

e.Appropriations and Expenditures.

f.Expenditures and Expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

17

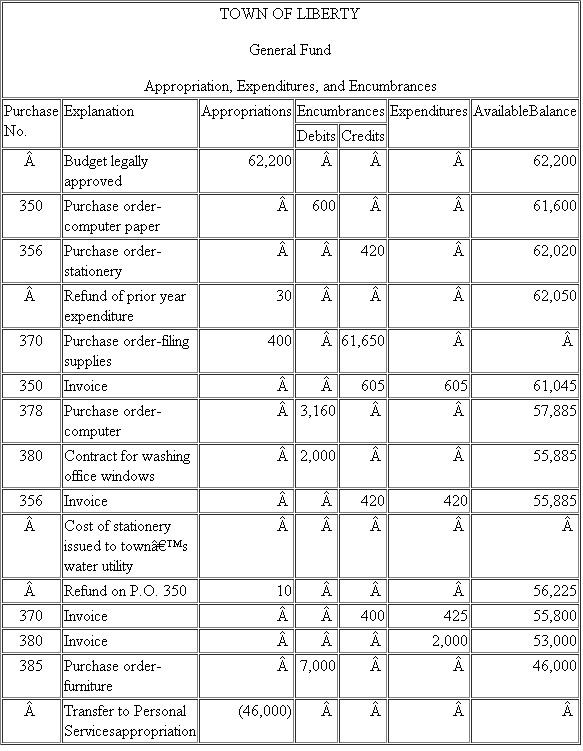

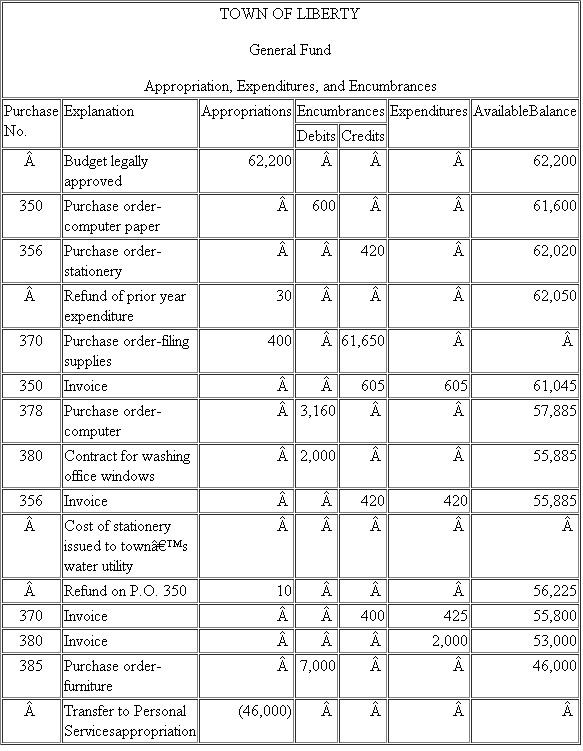

Appropriations, Encumbrances, and Expenditures.The finance director of the Town of Liberty has asked you to determine whether the appropriations, expenditures, and encumbrances comparison for Office Supplies for a certain year (reproduced as follows) presents the information correctly.You determine that the General Fund chart of accounts describes office supplies as "tangible items of relatively short life to be used in a business office." You also determine that the transfer of stationery, at cost, to the town water utility was properly authorized; the Water Utility Fund is to pay the General Fund $330 for the supplies.The transfer of $46,000 from Office Supplies to Personal Services was made by an accounting clerk, without the knowledge of managers, to avoid reporting that the Personal Services appropriation had been overexpended.

Required

To determine whether the following budgetary comparison is correct, you need to compute each of the following.Organize and label your computations so the finance director can understand them

a.The final amended amount of the appropriation for Office Supplies for the year.

b.The valid amount of encumbrances outstanding against this appropriation at the end of the year.

c.The net amount of expenditures made during the year that were properly chargeable to this appropriation.

d.The unencumbered unexpended balance of this appropriation.

Required

To determine whether the following budgetary comparison is correct, you need to compute each of the following.Organize and label your computations so the finance director can understand them

a.The final amended amount of the appropriation for Office Supplies for the year.

b.The valid amount of encumbrances outstanding against this appropriation at the end of the year.

c.The net amount of expenditures made during the year that were properly chargeable to this appropriation.

d.The unencumbered unexpended balance of this appropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

18

State whether each of the following items should be classified as taxes, licenses and permits, intergovernmental revenues, charges for services, fines and forfeits, or miscellaneous revenue in a governmental fund.

a.Sales and use taxes levied by the government.

b.Payments by citizens for library services.

c.Building permits to construct a garage at a residence.

d.Traffic violation penalties.

e.Federal community development block grant.

f.Royalties from an exclusivity contract with a soft drink company.

g.Charges to a local university for extra city police protection during sporting events.

h.Barbers and hairdressers' registration fees.

a.Sales and use taxes levied by the government.

b.Payments by citizens for library services.

c.Building permits to construct a garage at a residence.

d.Traffic violation penalties.

e.Federal community development block grant.

f.Royalties from an exclusivity contract with a soft drink company.

g.Charges to a local university for extra city police protection during sporting events.

h.Barbers and hairdressers' registration fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

19

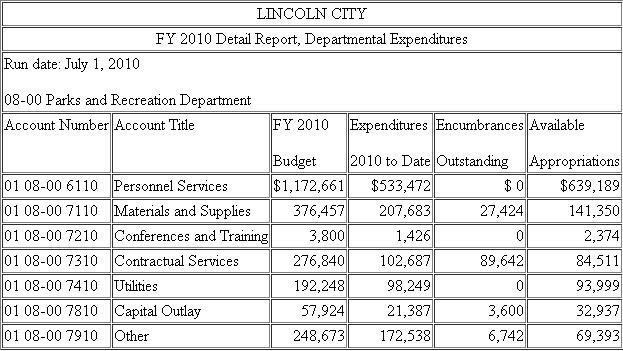

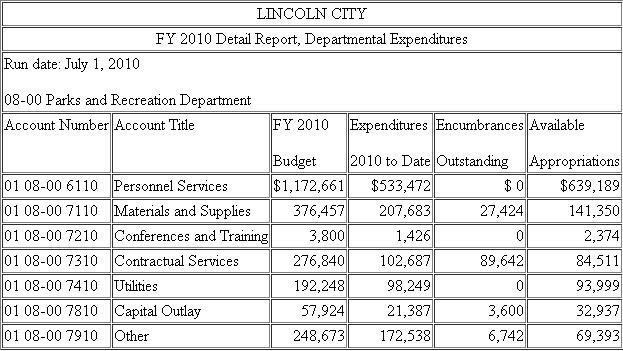

Computerized Accounting System - Departmental Budgetary Comparison Report.Review the computer generated budgetary comparison report presented below for the Lincoln City Parks and Recreation Department as of July 1 of its fiscal year ending December 31, 2010, and respond to the questions that follow.

Required

Required

a.Explain the account code structure being employed by Lincoln City.Does that structure appear consistent with the expenditure classifications required by GASB standards Does it allow for more detailed expenditure classifications, if desired For example, could materials and supplies be further classified as recreational supplies, office supplies, building supplies, and so forth

b.What is the likely reason there are no outstanding encumbrances for the Personnel Services, Conferences and Training, and Utilities accounts

c.Does it appear that the Parks and Recreation Department may overexpend its appropriation for any accounts before the end of FY 2010 If so, which accounts may run short

d.Does it appear that the Parks and Recreation Department may underexpend any of its appropriations for FY 2010 If so, which accounts may have excessive spending authority

e.What factors may explain the expenditure patterns observed in parts c and d

Required

Required a.Explain the account code structure being employed by Lincoln City.Does that structure appear consistent with the expenditure classifications required by GASB standards Does it allow for more detailed expenditure classifications, if desired For example, could materials and supplies be further classified as recreational supplies, office supplies, building supplies, and so forth

b.What is the likely reason there are no outstanding encumbrances for the Personnel Services, Conferences and Training, and Utilities accounts

c.Does it appear that the Parks and Recreation Department may overexpend its appropriation for any accounts before the end of FY 2010 If so, which accounts may run short

d.Does it appear that the Parks and Recreation Department may underexpend any of its appropriations for FY 2010 If so, which accounts may have excessive spending authority

e.What factors may explain the expenditure patterns observed in parts c and d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

20

For which funds are budgetary comparison schedules or statements required Should the actual revenues and expenditures on the budgetary comparison schedules be reported on the GAAP basis Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

21

Recording General Fund Operating Budget and Operating Transactions.

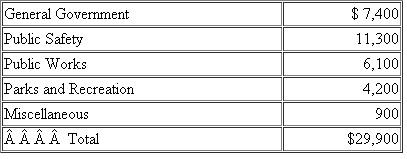

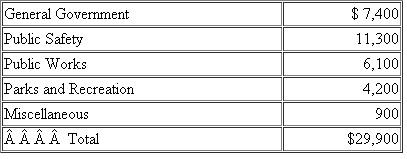

The Town of Bedford Falls approved a General Fund operating budget for the fiscal year ending June 30, 2011.The budget provides for estimated revenues of $2,700,000 as follows: property taxes, $1,900,000; licenses and permits, $350,000; fines and forfeits, $250,000; and intergovernmental (state grants), $200,000.The budget approved appropriations of $2,650,000 as follows: General Government, $500,000; Public Safety, $1,600,000; Public Works, $350,000; Parks and Recreation, $150,000; and Miscellaneous, $50,000.

Required

a.Prepare the journal entry (or entries), including subsidiary ledger entries, to record the Town of Bedford Falls's General Fund operating budget on July 1, 2010, the beginning of the Town's 2011 fiscal year.

b.Prepare journal entries to record the following transactions that occurred during the month of July 2010.

1.Revenues were collected in cash amounting to $31,000 for licenses and permits and $12,000 for fines and forfeits.

2.Supplies were ordered by the following functions in early July 2010 at the estimated costs shown:

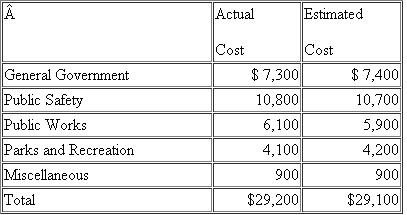

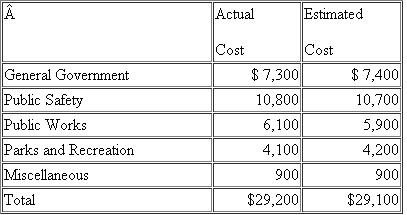

3.During July 2010, supplies were received at the actual costs shown below and were paid in cash.General Government, Parks and Recreation, and Miscellaneous received all supplies ordered.Public Safety and Public Works received part of the supplies ordered earlier in the month at estimated costs of $10,700 and $5,900, respectively.

3.During July 2010, supplies were received at the actual costs shown below and were paid in cash.General Government, Parks and Recreation, and Miscellaneous received all supplies ordered.Public Safety and Public Works received part of the supplies ordered earlier in the month at estimated costs of $10,700 and $5,900, respectively.

c.Calculate and show in good form the amount of budgeted but unrealized revenues in total and from each source as of July 31, 2010.

c.Calculate and show in good form the amount of budgeted but unrealized revenues in total and from each source as of July 31, 2010.

d.Calculate and show in good form the amount of available appropriation in total and for each function as of July 31, 2010.

The Town of Bedford Falls approved a General Fund operating budget for the fiscal year ending June 30, 2011.The budget provides for estimated revenues of $2,700,000 as follows: property taxes, $1,900,000; licenses and permits, $350,000; fines and forfeits, $250,000; and intergovernmental (state grants), $200,000.The budget approved appropriations of $2,650,000 as follows: General Government, $500,000; Public Safety, $1,600,000; Public Works, $350,000; Parks and Recreation, $150,000; and Miscellaneous, $50,000.

Required

a.Prepare the journal entry (or entries), including subsidiary ledger entries, to record the Town of Bedford Falls's General Fund operating budget on July 1, 2010, the beginning of the Town's 2011 fiscal year.

b.Prepare journal entries to record the following transactions that occurred during the month of July 2010.

1.Revenues were collected in cash amounting to $31,000 for licenses and permits and $12,000 for fines and forfeits.

2.Supplies were ordered by the following functions in early July 2010 at the estimated costs shown:

3.During July 2010, supplies were received at the actual costs shown below and were paid in cash.General Government, Parks and Recreation, and Miscellaneous received all supplies ordered.Public Safety and Public Works received part of the supplies ordered earlier in the month at estimated costs of $10,700 and $5,900, respectively.

3.During July 2010, supplies were received at the actual costs shown below and were paid in cash.General Government, Parks and Recreation, and Miscellaneous received all supplies ordered.Public Safety and Public Works received part of the supplies ordered earlier in the month at estimated costs of $10,700 and $5,900, respectively. c.Calculate and show in good form the amount of budgeted but unrealized revenues in total and from each source as of July 31, 2010.

c.Calculate and show in good form the amount of budgeted but unrealized revenues in total and from each source as of July 31, 2010.d.Calculate and show in good form the amount of available appropriation in total and for each function as of July 31, 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

22

Explain how expenditure and revenue classifications for public school systems differ from those for state and local governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

23

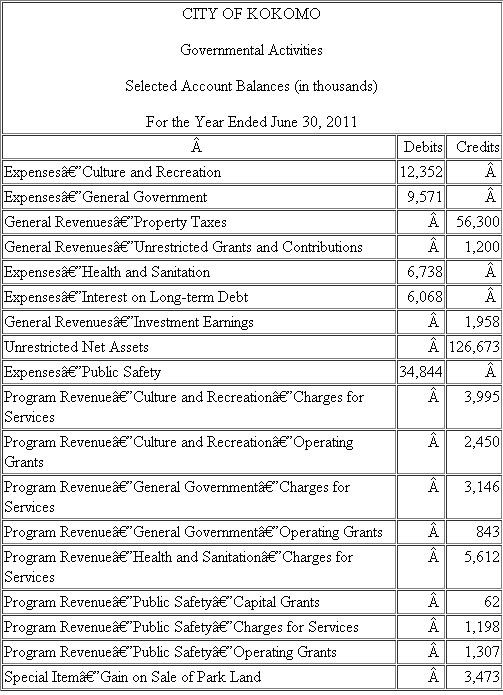

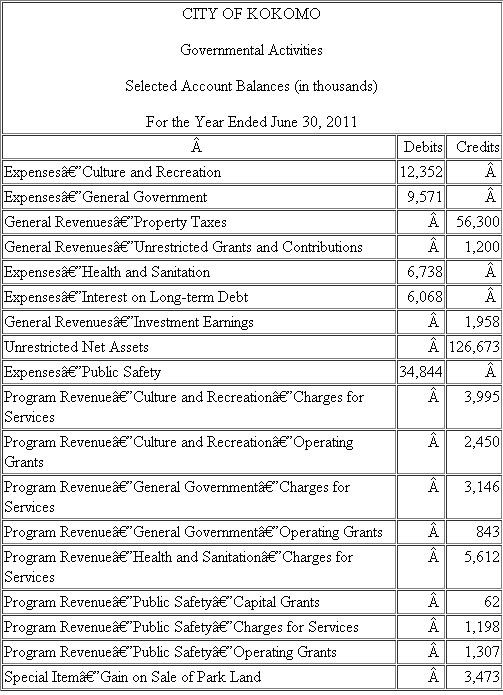

Government-wide Statement of Activities.The following alphabetic listing displays selected balances in the governmental activities accounts of the City of Kokomo as of June 30, 2011.Prepare a (partial) statement of activities in good form.For simplicity, assume that the city does not have business-type activities or component units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck