Deck 9: Money, Banking, and Financial Institutions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/24

العب

ملء الشاشة (f)

Deck 9: Money, Banking, and Financial Institutions

1

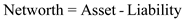

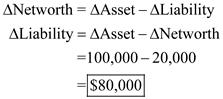

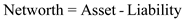

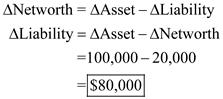

Suppose the assets of the Silver Lode Bank are $100,000 higher than on the previous day and its net worth is up $20,000. By how much and in what direction must its liabilities have changed from the day before? LO1

Net worth is calculated as follows:  .

.

When asset is up by $100,000 and net worth up by $20,000 then, liability must be up by $80,000 is calculated as shown below:

.

.When asset is up by $100,000 and net worth up by $20,000 then, liability must be up by $80,000 is calculated as shown below:

2

What is meant when economists say that the Federal Reserve Banks are central banks, quasi-public banks, and bankers' banks? What are the seven basic functions of the Federal Reserve System?

The Federal Reserve System of United States holds the position of the central banking system of the nation that includes board of governors, Federal Reserve banks and FOMC.

There are twelve Federal Reserve banks which work as central bank for United States. The name central bank refers to the functionality of implementing the banking/monetary policies of United States which are formulated by Board of Governors with aid of FOMC in order to bring some desired economic condition in economy.

These banks are also termed as quasi-public banks because of the nature of their ownership. These banks blend private ownership and public control. This means that each federal reserve is owned by private commercial banks in its district but pursue the policies set by board of governors of Federal Reserve System. Thus, unlike private banks they are not motivated by profit and hence practically work as public banks.

These banks are also called as bankers' bank because they perform the functions of a bank for all banks and thrifts such as accepting deposit, giving loan, lender of last resort etc.

The seven main functions of the Federal Reserve are as follows:

1) Issuing currency : It involves issuing notes and paper currency used in U.S monetary system.

2) Setting reserve requirement and holding reserves: Every bank has to keep some percentage of reserve with the Federal and this percentage is decided by the Federal only which is known as reserve ratios.

3) Lending: It also gives loans to banks and thrifts from time to time at some interest known as discount rate.

4) Providing for check allocation: It serves as a mean for collecting checks among banks.

5) Fiscal agent: The federal provides financial services such as collecting tax, sells and redeem bonds to Federal government.

6) Supervising banks: It supervises the operations of banks, conducts period assessment, checks their compliance with regulation and uncover questionable practices.

7) Controls money supply: These banks manage the nations' money supply and makes sure that enough supply of money is there in economy without an excess.

There are twelve Federal Reserve banks which work as central bank for United States. The name central bank refers to the functionality of implementing the banking/monetary policies of United States which are formulated by Board of Governors with aid of FOMC in order to bring some desired economic condition in economy.

These banks are also termed as quasi-public banks because of the nature of their ownership. These banks blend private ownership and public control. This means that each federal reserve is owned by private commercial banks in its district but pursue the policies set by board of governors of Federal Reserve System. Thus, unlike private banks they are not motivated by profit and hence practically work as public banks.

These banks are also called as bankers' bank because they perform the functions of a bank for all banks and thrifts such as accepting deposit, giving loan, lender of last resort etc.

The seven main functions of the Federal Reserve are as follows:

1) Issuing currency : It involves issuing notes and paper currency used in U.S monetary system.

2) Setting reserve requirement and holding reserves: Every bank has to keep some percentage of reserve with the Federal and this percentage is decided by the Federal only which is known as reserve ratios.

3) Lending: It also gives loans to banks and thrifts from time to time at some interest known as discount rate.

4) Providing for check allocation: It serves as a mean for collecting checks among banks.

5) Fiscal agent: The federal provides financial services such as collecting tax, sells and redeem bonds to Federal government.

6) Supervising banks: It supervises the operations of banks, conducts period assessment, checks their compliance with regulation and uncover questionable practices.

7) Controls money supply: These banks manage the nations' money supply and makes sure that enough supply of money is there in economy without an excess.

3

Suppose that Serendipity Bank has excess reserves of $8000 and checkable deposits of $150,000. If the reserve ratio is 20 percent, what is the size of the bank's actual reserves? LO2

Required Reserve= 20/100 of $150,000= $30,000

National Bank of Commerce has $8000 excess reserve,

Actual Reserve= Required Reserve + Excess Reserve

= $30,000 + $8,000

= $38,000

The National Bank of Commerce has $38,000 actual reserves.

National Bank of Commerce has $8000 excess reserve,

Actual Reserve= Required Reserve + Excess Reserve

= $30,000 + $8,000

= $38,000

The National Bank of Commerce has $38,000 actual reserves.

4

How do each of the following relate to the financial crisis of 2007-2008: declines in real estate values, subprime mortgage loans, mortgage backed securities, AIG. LO5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

5

The Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio is 20 percent. Households deposit $5000 in currency into the bank and that currency is added to reserves. What level of excess reserves does the bank now have? LO3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is TARP and how was it funded? What is meant by the term "lender of last resort" and how does it relate to the financial crisis of 2007-2008? How do government and Federal Reserve emergency loans relate to the concept of moral hazard? LO6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume that the following asset values (in millions of dollars) exist in Ironmania: Federal Reserve Notes in circulation = $700; Money market mutual funds (MMMFs) held by individuals = $400; Corporate bonds = $300; Iron ore deposits = $50; Currency in commercial banks = $100; Savings deposits, including money market deposit accounts (MMDAs) = $140; Checkable deposits = $1500 ; Small-denominated (less than $100,000) time deposits = $100; Coins in circulation = $40. LO1

a. What is M 1 in Ironmania?

b. What is M 2 in Ironmania?

a. What is M 1 in Ironmania?

b. What is M 2 in Ironmania?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

8

The balance sheet below is for Big Bucks Bank. The reserve ratio is 20 percent.

a. What is the maximum amount of new loans that Big Bucks Bank can make? Show in columns 1 and 1' how the bank's balance sheet will appear after die bank has lent this additional amount.

b. By how much has die supply of money changed?

c. How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against the bank? Show the new balance sheet in columns 2 and 2'.

d. Answer questions a , b , and c on die assumption that the reserve ratio is 15 percent.

a. What is the maximum amount of new loans that Big Bucks Bank can make? Show in columns 1 and 1' how the bank's balance sheet will appear after die bank has lent this additional amount.

b. By how much has die supply of money changed?

c. How will the bank's balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against the bank? Show the new balance sheet in columns 2 and 2'.

d. Answer questions a , b , and c on die assumption that the reserve ratio is 15 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

9

What are the three basic functions of money? Describe how rapid inflation can undermine money's ability to perform each of the three functions. LO1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

10

What are the major categories of firms that make up the U.S. financial services industry? Are there more or fewer banks today than before the start of the financial crisis of 2007-2008? Why are the lines between the categories of financial firms even more blurred than they were before the crisis? How did the Wall Street Reform and Consumer Protection Act of 2010 try to address some of the problems that helped cause the crisis? LO7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

11

Assume that Jimmy Cash has $2000 in his checking account at Folsom Bank and uses his checking account card to withdraw $200 of cash from the bank's ATM machine. By what dollar amount did the M 1 money supply change as a result of this single, isolated transaction? LO1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system. All figures are in billions. The reserve ratio is 25 percent. LO5

Assets

?(1)

Liabilities and Net Worth

??????????(2)

Reserves

Securities

Loans

$ 52 ___

48 ___

100 ___

Checkable deposits

$200 ___

a. What amount of excess reserves does the commercial banking system have? What is the maximum amount the banking system might lend? Show in column 1 how the consolidated balance sheet would look after this amount has been lent. What is the monetary multiplier?

Assets

?(1)

Liabilities and Net Worth

??????????(2)

Reserves

Securities

Loans

$ 52 ___

48 ___

100 ___

Checkable deposits

$200 ___

a. What amount of excess reserves does the commercial banking system have? What is the maximum amount the banking system might lend? Show in column 1 how the consolidated balance sheet would look after this amount has been lent. What is the monetary multiplier?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which two of the following financial institutions offer checkable deposits included within the M 1 money supply: mutual fund companies; insurance companies; commercial banks; securities firms; thrift institutions? Which of the following items is not included in either M 1 or M 2: currency held by the public; checkable deposits; money market mutual fund balances; small-denominated (less than $100,000) time deposits; currency held by banks; savings deposits? LO1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the difference between an asset and a liability on a bank's balance sheet? How does net worth relate to each? Why must a balance sheet always balance? What are the major assets and claims on a commercial bank's balance sheet? LO1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

15

Suppose the price level and value of the U.S. dollar in year 1 are 1 and $1, respectively. If the price level rises to 1.25 in year 2, what is the new value of the dollar? If, instead, the price level falls to.50, what is the value of the dollar? LO2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the required reserve ratio is 10 percent, what is the monetary multiplier? If the monetary multiplier is 4, what is the required reserve ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

17

What are the components of the M 1 money supply? What is the largest component? Which of the components of M 1 is legal tender? Why is the face value of a coin greater than its intrinsic value? What near-monies are included in the M 2 money supply? LO1, LO2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

18

Why does the Federal Reserve require that commercial banks have reserves? What are excess reserves? How do you calculate the amount of excess reserves held by a bank? What is the significance of excess reserves?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

19

Suppose that Lady Gaga goes to Las Vegas to play poker and at the last minute her record company says it will reimburse her for 50 percent of any gambling losses that she incurs. Will Lady Gaga wager more or less as a result of the reimbursement offer? What economic concept does your answer illustrate? LO5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

20

"Whenever currency is deposited in a commercial bank, cash goes out of circulation and, as a result, the M1 supply of money is reduced." Do you agree? Explain why or why not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

21

How does the purchasing power of the dollar relate to the nation's price level?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

22

Explain why a single commercial bank can safely lend only an amount equal to its excess reserves but the commercial banking system can lend by a multiple of its excess reserves. What is the monetary multiplier, and how does it relate to the reserve ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume that securitization combined with borrowing and irrational exuberance in Hyperville have driven up the value of existing financial securities at a geometric rate, specifically from $2 to $4 to $8 to $16 to $32 to $64 over a 6-year time period. Over the same period, the value of the assets underlying the securities rose at an arithmetic rate from $2 to $3 to $4 to $5 to $6 to $7. If these patterns hold for decreases as well as for increases, by how much would the value of the financial securities decline if the value of the underlying asset suddenly and unexpectedly fell by $5? LO5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

24

Who selects the chairperson of the Federal Reserve System? Describe the relationship between the Board of Governors of the Federal Reserve System and the 12 Federal Reserve Banks. What is the composition and purpose of the Federal Open Market Committee (FOMC)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck