Deck 20: Simultaneous-Equation Methods

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 20: Simultaneous-Equation Methods

1

State whether each of the following statements is true or false:

a. The method of OLS is not applicable to estimate a structural equation in a simultaneous-equation model.

b. In case an equation is not identified, 2SLS is not applicable.

c. The problem of simultaneity does not arise in a recursive simultaneous-equation model.

d. The problems of simultaneity and exogeneity mean the same thing.

e. The 2SLS and other methods of estimating structural equations have desirable statistical properties only in large samples.

f. There is no such thing as an R 2 for the simultaneous-equation model as a whole.

* g. The 2SLS and other methods of estimating structural equations are not applicable if the equation errors are autocorrelated and/or are correlated across equations.

h. If an equation is exactly identified, ILS and 2SLS give identical results.

a. The method of OLS is not applicable to estimate a structural equation in a simultaneous-equation model.

b. In case an equation is not identified, 2SLS is not applicable.

c. The problem of simultaneity does not arise in a recursive simultaneous-equation model.

d. The problems of simultaneity and exogeneity mean the same thing.

e. The 2SLS and other methods of estimating structural equations have desirable statistical properties only in large samples.

f. There is no such thing as an R 2 for the simultaneous-equation model as a whole.

* g. The 2SLS and other methods of estimating structural equations are not applicable if the equation errors are autocorrelated and/or are correlated across equations.

h. If an equation is exactly identified, ILS and 2SLS give identical results.

But there are situations in system of equations in which unidirectional cause and effect relationship is not applicable. It happens when Y is determined by the X 's, and some of the X 's are determined by Y. Thus, there is simultaneous relationship between some of the variables. Such system of equations is known as simultaneous equations.

(a)

True

The OLS method is not suitable to estimate the parameters of a structural equation in a system of simultaneous equations due to the correlation between the stochastic disturbance term and the endogenous explanatory variable. If OLS method is applied to such equation, then estimates the equation are biased and inconsistent even in large samples.

(b)

True

If an equation is not identified, then no method can be used to estimate it parameters. The two-stage least squares (2SLS) method provides the estimates of coefficients of the structural over identified equations.

(c)

True

There is no problem of simultaneity in recursive simultaneous equation model because in recursive model, there is no interdependence between the endogenous variables and there is unilateral causal dependence among the equations.

(d)

False

Problem of simultaneity arises when some of the regressor variables, in a system of equations, are mutually dependent of each other and as a result these variables are related to the error term.

The problem of exogenity occurs when it is not known which variables are endogenous and which are exogenous is a system of simultaneous equations.

(e)

True

The methods of estimating structural equations have some of the desired statistical properties such as consistency and asymptotic efficiency. But the estimators of the coefficients of structural equations from these methods are unbiased only in large samples or when sample size increases indefinitely.

(f)

True

The individual structural equations in a model of simultaneous equations have R 2 values which measures goodness of fit of the equation. The simultaneous equation model as a whole doesn't have R 2 values.

(g)

False

If the equation errors are autocorrelated, the 2SLS and other methods of estimating structural equations can to be modified to deal with autocorrelation problem. Therefore, these methods are appropriate even if the equation errors are autocorrelated.

(h)

True

The two-stage least squares (2SLS) method provides the estimates of coefficients of the structural over identified equations, in the system of simultaneous equations. The indirect least-squares (ILS) method is used to estimate the coefficients of structural exactly identified equations.

Although, the two-stage least squares (2SLS) method can also be applied to estimate the coefficients of structural exactly identified equations, but the results obtained from the method would be same as that obtained from indirect least-squares (ILS) method.

(a)

True

The OLS method is not suitable to estimate the parameters of a structural equation in a system of simultaneous equations due to the correlation between the stochastic disturbance term and the endogenous explanatory variable. If OLS method is applied to such equation, then estimates the equation are biased and inconsistent even in large samples.

(b)

True

If an equation is not identified, then no method can be used to estimate it parameters. The two-stage least squares (2SLS) method provides the estimates of coefficients of the structural over identified equations.

(c)

True

There is no problem of simultaneity in recursive simultaneous equation model because in recursive model, there is no interdependence between the endogenous variables and there is unilateral causal dependence among the equations.

(d)

False

Problem of simultaneity arises when some of the regressor variables, in a system of equations, are mutually dependent of each other and as a result these variables are related to the error term.

The problem of exogenity occurs when it is not known which variables are endogenous and which are exogenous is a system of simultaneous equations.

(e)

True

The methods of estimating structural equations have some of the desired statistical properties such as consistency and asymptotic efficiency. But the estimators of the coefficients of structural equations from these methods are unbiased only in large samples or when sample size increases indefinitely.

(f)

True

The individual structural equations in a model of simultaneous equations have R 2 values which measures goodness of fit of the equation. The simultaneous equation model as a whole doesn't have R 2 values.

(g)

False

If the equation errors are autocorrelated, the 2SLS and other methods of estimating structural equations can to be modified to deal with autocorrelation problem. Therefore, these methods are appropriate even if the equation errors are autocorrelated.

(h)

True

The two-stage least squares (2SLS) method provides the estimates of coefficients of the structural over identified equations, in the system of simultaneous equations. The indirect least-squares (ILS) method is used to estimate the coefficients of structural exactly identified equations.

Although, the two-stage least squares (2SLS) method can also be applied to estimate the coefficients of structural exactly identified equations, but the results obtained from the method would be same as that obtained from indirect least-squares (ILS) method.

2

Why is it unnecessary to apply the two-stage least-squares method to exactly identified equations

The two-stage least squares (2SLS) method provides the estimates of coefficients of the structural over identified equations, in the system of simultaneous equations. The indirect least-squares (ILS) method is used to estimate the coefficients of structural exactly identified equations.

Although, the two-stage least squares (2SLS) method can also be applied to estimate the coefficients of structural exactly identified equations, but the results obtained from the method would be same as that obtained from indirect least-squares (ILS) method. Therefore, it is not necessary to use the two-stage least squares (2SLS) method to obtain the estimates of parameters of exactly identified equations.

Although, the two-stage least squares (2SLS) method can also be applied to estimate the coefficients of structural exactly identified equations, but the results obtained from the method would be same as that obtained from indirect least-squares (ILS) method. Therefore, it is not necessary to use the two-stage least squares (2SLS) method to obtain the estimates of parameters of exactly identified equations.

3

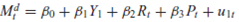

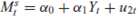

Consider the following modified Keynesian model of income determination:

Ct = 10 + 11 Y t + u 1 t

It = 20 + 21 Y t + 22 Y t 1 + u 2 t

Y t = C t + I t + G t

where C = consumption expenditure

I = investment expenditure

Y = income

G = government expenditure

G t and Y t-1 are assumed predetermined

a. Obtain the reduced-form equations and determine which of the preceding equations are identified (either just or over-).

b. Which method will you use to estimate the parameters of the over identified equation and of the exactly identified equation Justify your answer.

Ct = 10 + 11 Y t + u 1 t

It = 20 + 21 Y t + 22 Y t 1 + u 2 t

Y t = C t + I t + G t

where C = consumption expenditure

I = investment expenditure

Y = income

G = government expenditure

G t and Y t-1 are assumed predetermined

a. Obtain the reduced-form equations and determine which of the preceding equations are identified (either just or over-).

b. Which method will you use to estimate the parameters of the over identified equation and of the exactly identified equation Justify your answer.

Income is that amount of money which an individual gets for the amount of work or investment done by him.

Consumption is that part of money income which is utilized by an individual for his day to day expenses.

The given modified Keynesian model of income determination can be written as shown below: a.

a.

The reduced form of given equations are written below: Here, M = 3 and K = 2. By the order condition, equation of I is identified and equation of C is over identified.

Here, M = 3 and K = 2. By the order condition, equation of I is identified and equation of C is over identified.

b.

In order to estimate the parameters of consumption function (over identified) one should use 2SLS method and to estimate the parameters of investment equation (identified) one should use ILS method.

Consumption is that part of money income which is utilized by an individual for his day to day expenses.

The given modified Keynesian model of income determination can be written as shown below:

a.

a.The reduced form of given equations are written below:

Here, M = 3 and K = 2. By the order condition, equation of I is identified and equation of C is over identified.

Here, M = 3 and K = 2. By the order condition, equation of I is identified and equation of C is over identified. b.

In order to estimate the parameters of consumption function (over identified) one should use 2SLS method and to estimate the parameters of investment equation (identified) one should use ILS method.

4

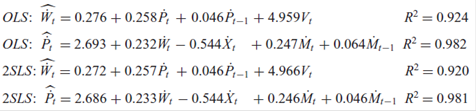

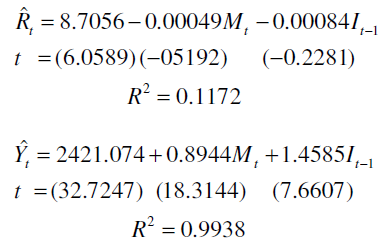

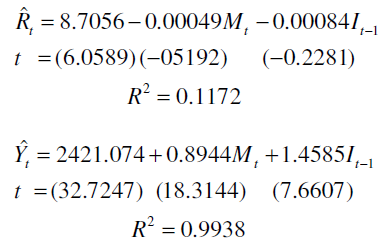

Consider the following results: *

where and

and  are percentage changes in earnings, prices, import prices, and labor productivity (all percentage changes are over the previous year), respectively, and where V t represents unfilled job vacancies (percentage of total number of employees).

are percentage changes in earnings, prices, import prices, and labor productivity (all percentage changes are over the previous year), respectively, and where V t represents unfilled job vacancies (percentage of total number of employees).

"Since the OLS and 2SLS results are practically identical, 2SLS is meaningless." Comment.

where

and

and  are percentage changes in earnings, prices, import prices, and labor productivity (all percentage changes are over the previous year), respectively, and where V t represents unfilled job vacancies (percentage of total number of employees).

are percentage changes in earnings, prices, import prices, and labor productivity (all percentage changes are over the previous year), respectively, and where V t represents unfilled job vacancies (percentage of total number of employees)."Since the OLS and 2SLS results are practically identical, 2SLS is meaningless." Comment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

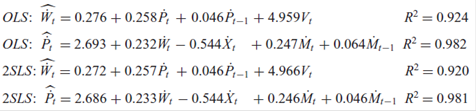

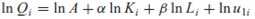

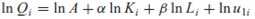

Assume that production is characterized by the Cobb-Douglas production function

where Q = output

K = capital input

L = labor input

A, , and = parameters

i = i th firm

Given the price of final output P, the price of labor W, and the price of capital R , and assuming profit maximization, we obtain the following empirical model of production:

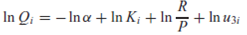

Production function: (1)

(1)

Marginal product of labor function: (2)

(2)

Marginal product of capital function: (3)

(3)

where u 1 , u 2 , and u 3 are stochastic disturbances.

In the preceding model there are three equations in three endogenous variables Q , L , and K. P, R, and W are exogenous.

a. What problems do you encounter in estimating the model if + = 1, that is, when there are constant returns to scale

b. Even if + 1, can you estimate the equations Answer by considering the identifiability of the system.

c. If the system is not identified, what can be done to make it identifiable

Note: Equations (2) and (3) are obtained by differentiating Q with respect to labor and capital, respectively, setting them equal to W/P and R/P, transforming the resulting expressions into logarithms, and adding (the logarithm of) the disturbance terms.

where Q = output

K = capital input

L = labor input

A, , and = parameters

i = i th firm

Given the price of final output P, the price of labor W, and the price of capital R , and assuming profit maximization, we obtain the following empirical model of production:

Production function:

(1)

(1)Marginal product of labor function:

(2)

(2)Marginal product of capital function:

(3)

(3)where u 1 , u 2 , and u 3 are stochastic disturbances.

In the preceding model there are three equations in three endogenous variables Q , L , and K. P, R, and W are exogenous.

a. What problems do you encounter in estimating the model if + = 1, that is, when there are constant returns to scale

b. Even if + 1, can you estimate the equations Answer by considering the identifiability of the system.

c. If the system is not identified, what can be done to make it identifiable

Note: Equations (2) and (3) are obtained by differentiating Q with respect to labor and capital, respectively, setting them equal to W/P and R/P, transforming the resulting expressions into logarithms, and adding (the logarithm of) the disturbance terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

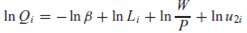

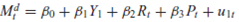

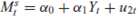

Consider the following demand-and-supply model for money:

Demand for money:

Supply of money:

where M = money

Y = income

R = rate of interest

P = price

Assume that R and P are predetermined.

a. Is the demand function identified

b. Is the supply function identified

c. Which method would you use to estimate the parameters of the identified equation(s) Why

d. Suppose we modify the supply function by adding the explanatory variables Y t-1 and M t-1. What happens to the identification problem Would you still use the method you used in ( c ) Why or why not

Demand for money:

Supply of money:

where M = money

Y = income

R = rate of interest

P = price

Assume that R and P are predetermined.

a. Is the demand function identified

b. Is the supply function identified

c. Which method would you use to estimate the parameters of the identified equation(s) Why

d. Suppose we modify the supply function by adding the explanatory variables Y t-1 and M t-1. What happens to the identification problem Would you still use the method you used in ( c ) Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

Refer to Exercise 18.10. For the two-equation system there obtain the reduced-form equations and estimate their parameters. Estimate the indirect least-squares regression of consumption on income and compare your results with the OLS regression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

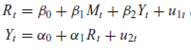

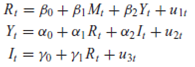

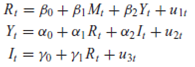

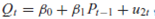

Consider the following model:

where M t (money supply) is exogenous, R t is the interest rate, and Y t is GDP.

a. How would you justify the model

b. Are the equations identified

c. Using the data given in Table 20.2, estimate the parameters of the identified equations. Justify the method(s) you use.

where M t (money supply) is exogenous, R t is the interest rate, and Y t is GDP.

a. How would you justify the model

b. Are the equations identified

c. Using the data given in Table 20.2, estimate the parameters of the identified equations. Justify the method(s) you use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

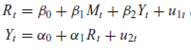

Suppose we change the model in Exercise 20.8 as follows:

a. Find out if the system is identified.

b. Using the data given in Table 20.2, estimate the parameters of the identified equation(s).

a. Find out if the system is identified.

b. Using the data given in Table 20.2, estimate the parameters of the identified equation(s).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

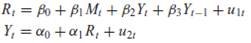

Consider the following model:

where the variables are as defined in Exercise 20.8. Treating I (domestic investment) and M exogenously, determine the identification of the system. Using the data given in Table 20.2, estimate the parameters of the identified equation(s).

where the variables are as defined in Exercise 20.8. Treating I (domestic investment) and M exogenously, determine the identification of the system. Using the data given in Table 20.2, estimate the parameters of the identified equation(s).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

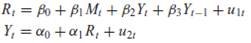

Suppose we change the model of Exercise 20.10 as follows:

Assume that M is determined exogenously.

a. Find out which of the equations are identified.

b. Estimate the parameters of the identified equation(s) using the data given in Table 20.2. Justify your method(s).

Assume that M is determined exogenously.

a. Find out which of the equations are identified.

b. Estimate the parameters of the identified equation(s) using the data given in Table 20.2. Justify your method(s).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

Verify the standard errors reported in Eq. (20.5.3).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

Return to the demand-and-supply model given in Eqs. (20.3.1) and (20.3.2). Suppose the supply function is altered as follows:

where P t -1 is the price prevailing in the previous period.

a. If X (expenditure) and P t-1 are predetermined, is there a simultaneity problem

b. If there is, are the demand and supply functions each identified If they are, obtain their reduced-form equations and estimate them from the data given in Table 20.1.

c. From the reduced-form coefficients, can you derive the structural coefficients Show the necessary computations.

where P t -1 is the price prevailing in the previous period.

a. If X (expenditure) and P t-1 are predetermined, is there a simultaneity problem

b. If there is, are the demand and supply functions each identified If they are, obtain their reduced-form equations and estimate them from the data given in Table 20.1.

c. From the reduced-form coefficients, can you derive the structural coefficients Show the necessary computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

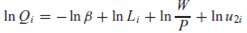

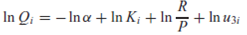

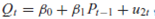

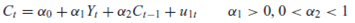

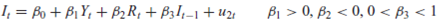

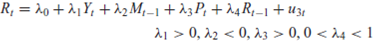

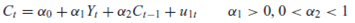

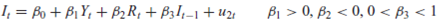

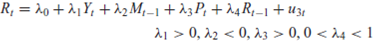

Class Exercise: Consider the following simple macroeconomic model for the U.S. economy, say, for the period 1960-1999.*

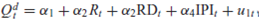

Private consumption function:

Private gross investment function:

A money demand function:

Income identity:

Y t =C t +I t +G t

where C = real private consumption; I = real gross private investment, G = real government expenditure, Y = real GDP, M = M 2 money supply at current prices, R = long-term interest rate (%), and P = Consumer Price Index. The endogenous variables are C, I, R , and Y. The predetermined variables are: C t- 1 , I t- 1 , M t- 1 , P t , R t -1 , and G t plus the intercept term. The u's are the error terms.

a. Using the order condition of identification, determine which of the four equations are identified, either exact or over-.

b. Which method(s) do you use to estimate the identified equations

c. Obtain suitable data from government and/or private sources, estimate the model, and comment on your results.

Private consumption function:

Private gross investment function:

A money demand function:

Income identity:

Y t =C t +I t +G t

where C = real private consumption; I = real gross private investment, G = real government expenditure, Y = real GDP, M = M 2 money supply at current prices, R = long-term interest rate (%), and P = Consumer Price Index. The endogenous variables are C, I, R , and Y. The predetermined variables are: C t- 1 , I t- 1 , M t- 1 , P t , R t -1 , and G t plus the intercept term. The u's are the error terms.

a. Using the order condition of identification, determine which of the four equations are identified, either exact or over-.

b. Which method(s) do you use to estimate the identified equations

c. Obtain suitable data from government and/or private sources, estimate the model, and comment on your results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

In this exercise we examine data for 534 workers obtained from the Current Population Survey (CPS) for 1985. The data can be found as Table 20.10 on the textbook website. * The variables in this table are defined as follows:

W = wages $, per hour; occup = occupation; sector = 1 for manufacturing, 2 for construction, 0 for other; union = 1 if union member, 0 otherwise; educ = years of schooling; exper = work experience in years; age = age in years; sex = 1 for female; marital status = 1 if married; race = 1 for other, 2 for Hispanic, 3 for white; region = 1 if lives in the South.

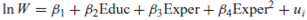

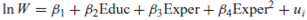

Consider the following simple wage determination model: (1)

(1)

a. Suppose education, like wages, is endogenous. How would you find out that in Equation (1) education is in fact endogenous Use the data given in the table in your analysis.

b. Does the Hausman test support your analysis in ( a ) Explain fully.

W = wages $, per hour; occup = occupation; sector = 1 for manufacturing, 2 for construction, 0 for other; union = 1 if union member, 0 otherwise; educ = years of schooling; exper = work experience in years; age = age in years; sex = 1 for female; marital status = 1 if married; race = 1 for other, 2 for Hispanic, 3 for white; region = 1 if lives in the South.

Consider the following simple wage determination model:

(1)

(1)a. Suppose education, like wages, is endogenous. How would you find out that in Equation (1) education is in fact endogenous Use the data given in the table in your analysis.

b. Does the Hausman test support your analysis in ( a ) Explain fully.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

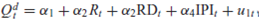

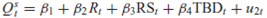

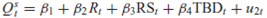

Class Exercise: Consider the following demand-and-supply model for loans of commercial banks to businesses:

Demand:

Supply:

Where Q = total commercial bank loans ($billion); R = average prime rate; RS = 3-month Treasury bill rate; RD = AAA corporate bond rate; IPI = Index of Industrial Production; and TBD = total bank deposits.

a. Collect data on these variables for the period 1980-2007 from various sources, such as www.economagic.com, the website of the Federal Reserve Bank of St. Louis, or any other source.

b. Are the demand and supply functions identified List which variables are endogenous and which are exogenous.

c. How would you go about estimating the demand and supply functions listed above Show the necessary calculations.

d. Why are both R and RS included in the model What is the role of IPI in the model

Demand:

Supply:

Where Q = total commercial bank loans ($billion); R = average prime rate; RS = 3-month Treasury bill rate; RD = AAA corporate bond rate; IPI = Index of Industrial Production; and TBD = total bank deposits.

a. Collect data on these variables for the period 1980-2007 from various sources, such as www.economagic.com, the website of the Federal Reserve Bank of St. Louis, or any other source.

b. Are the demand and supply functions identified List which variables are endogenous and which are exogenous.

c. How would you go about estimating the demand and supply functions listed above Show the necessary calculations.

d. Why are both R and RS included in the model What is the role of IPI in the model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck