Deck 4: Entities Overview

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 4: Entities Overview

1

Why should a taxpayer be interested in the character of income received

Character of income

Character of income refers to the kind of income at the disposal of the tax payers.It is important to determine the character of income with the tax payers because, the income is taxed according to its character.There are different kinds of character of income,which are explained below;

• Exemtions : Some realized incomes are not taxed as per the tax provisions and hence never form part of gross income for tax purpose.

• Deferrals : Under the tax provisions, some realized income are not taxed in the current year and are allowed to be deferred to the later years when it is taxed.

• Ordinary incomes : This type of realized income/loss are included in the gross income for the current year and are taxed as per the tax rates provided in the tax schedule.

• Qualified dividend : When the taxpayers receives corporate dividends which is referred to as qualified dividend under tax provisions.The qualified dividend is taxed at 15 percent (20 percent for high income individual and 0 percent for low income group) but if a dividend is not treated as qualified, it is taxed at the ordinary rates and not the preferential rate.

• Capital gain : When the tax payers receives any income or incurs loss while disposing off his investments or personal assets, they are subject to tax at a preferential tax rate depending upon the holding period of the investments or the assets.If the holding is more than a year it is termed as long term capital gain and is taxed at 15 percent tax rate (20 percent for high income group and 0 percent for low income group).But if the holding is for less than a year, it is termed as short term capital gain and is taxed at ordinary tax rates.Since there are differential tax rate for different types of income (character of income),the tax payers would be interested in the character of income, with a bid to reduce their tax burden.

Character of income refers to the kind of income at the disposal of the tax payers.It is important to determine the character of income with the tax payers because, the income is taxed according to its character.There are different kinds of character of income,which are explained below;

• Exemtions : Some realized incomes are not taxed as per the tax provisions and hence never form part of gross income for tax purpose.

• Deferrals : Under the tax provisions, some realized income are not taxed in the current year and are allowed to be deferred to the later years when it is taxed.

• Ordinary incomes : This type of realized income/loss are included in the gross income for the current year and are taxed as per the tax rates provided in the tax schedule.

• Qualified dividend : When the taxpayers receives corporate dividends which is referred to as qualified dividend under tax provisions.The qualified dividend is taxed at 15 percent (20 percent for high income individual and 0 percent for low income group) but if a dividend is not treated as qualified, it is taxed at the ordinary rates and not the preferential rate.

• Capital gain : When the tax payers receives any income or incurs loss while disposing off his investments or personal assets, they are subject to tax at a preferential tax rate depending upon the holding period of the investments or the assets.If the holding is more than a year it is termed as long term capital gain and is taxed at 15 percent tax rate (20 percent for high income group and 0 percent for low income group).But if the holding is for less than a year, it is termed as short term capital gain and is taxed at ordinary tax rates.Since there are differential tax rate for different types of income (character of income),the tax payers would be interested in the character of income, with a bid to reduce their tax burden.

2

Isabella provides 30% of the support for her father Hastings who lives in an apartment by himself and has no gross income.Is it possible for Isabella to claim a dependency exemption for her father Explain.

Dependency Exemptions

A dependent is an individual or a group of individuals who rely on a person for financial support.An individual is qualified as a dependent if he or she fulfills the following criteria:

• The individual should be a citizen of Country U, or a resident of Country U, or Country C, or Country M.

• The individual should not file tax returns jointly with spouse.

• The individual should either be considered as 'a qualifying child' or 'a qualifying relative'.To claim a dependency exemption for Ms.I's father, she must satisfy the following tests:

1.Relationship test: The following individuals are qualified as a relative of the tax payer:

• A descendant or ancestor of the taxpayer

• A sibling of the taxpayer

• A son or daughter of the brother or sister of the taxpayer

• A sibling of the taxpayer's mother or father

• An in-law of the taxpayer

• Any individual lies in the principal place of residence for entire year (even if he is not related through a qualifying family relationship).2.Support test: The individuals should qualify the following support tests:

• Any other taxpayer should not pay over one-half of the individual support.

• The tax payer and at least one other person or persons must be provided with more than half support of the individual.The other person who provided support can claim the individual as his/her dependent excluding that they have not provided more than half of the support of the individual.

• The taxpayer must have supported 10% of the individual's support for the particular year.

• The other persons who have supported over 10% of the individual support must furnish a signed statement that not claiming the individual as dependent.3.Gross income test : The personal exemption amount for an individual is $3,900.To qualify gross income test, a qualifying relative must earn an income less than personal exemption amount ($3,900).Claim for dependency exemption

Ms.I's father meets the relationship test and gross income test.But as per support test, Ms.I should provide more than half of the support to claim exemption.But, she provides only 30% of the father's support.Therefore, it is not possible for her to claim for exemption.

A dependent is an individual or a group of individuals who rely on a person for financial support.An individual is qualified as a dependent if he or she fulfills the following criteria:

• The individual should be a citizen of Country U, or a resident of Country U, or Country C, or Country M.

• The individual should not file tax returns jointly with spouse.

• The individual should either be considered as 'a qualifying child' or 'a qualifying relative'.To claim a dependency exemption for Ms.I's father, she must satisfy the following tests:

1.Relationship test: The following individuals are qualified as a relative of the tax payer:

• A descendant or ancestor of the taxpayer

• A sibling of the taxpayer

• A son or daughter of the brother or sister of the taxpayer

• A sibling of the taxpayer's mother or father

• An in-law of the taxpayer

• Any individual lies in the principal place of residence for entire year (even if he is not related through a qualifying family relationship).2.Support test: The individuals should qualify the following support tests:

• Any other taxpayer should not pay over one-half of the individual support.

• The tax payer and at least one other person or persons must be provided with more than half support of the individual.The other person who provided support can claim the individual as his/her dependent excluding that they have not provided more than half of the support of the individual.

• The taxpayer must have supported 10% of the individual's support for the particular year.

• The other persons who have supported over 10% of the individual support must furnish a signed statement that not claiming the individual as dependent.3.Gross income test : The personal exemption amount for an individual is $3,900.To qualify gross income test, a qualifying relative must earn an income less than personal exemption amount ($3,900).Claim for dependency exemption

Ms.I's father meets the relationship test and gross income test.But as per support test, Ms.I should provide more than half of the support to claim exemption.But, she provides only 30% of the father's support.Therefore, it is not possible for her to claim for exemption.

3

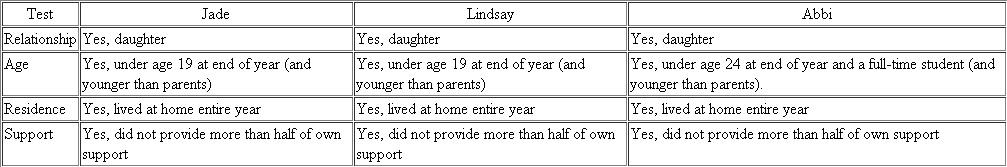

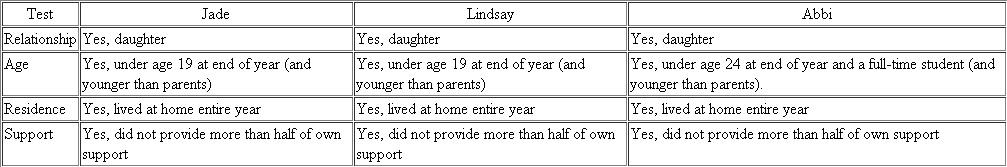

By the end of 2011, Jamel and Jennifer have been married 30 years and have filed a joint return every year of their marriage.Their three daughters, Jade, Lindsay, and Abbi, are ages 12, 17, and 22 respectively and all live at home.None of the daughters provide more than half of her own support.Abbi is a full-time student at a local university and does not have any gross income.

a.How many personal and dependency exemptions are Jamel and Jennifer allowed to claim

b.Assume the original facts except that Abbi is married.She and her husband live with Jamel and Jennifer while attending school and they file a joint return.Abbi and her husband reported a $1,000 tax liability on their 2011 tax return.If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

c.Assume the same facts as part b.except that Abbi and her husband report a $0 tax liability on their 2011 joint tax return.Also, if the couple had filed separately, Abbi would have not had a tax liability on her return, but her husband would have had a $250 tax liability on his separate return.Can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

d.Assume the original facts except that Abbi is married.Abbi files a separate tax return for 2011.Abbi's husband files a separate tax return and reports a $250 tax liability.Can Jamel and Jennifer claim Abbi as a dependent in 2011

a.How many personal and dependency exemptions are Jamel and Jennifer allowed to claim

b.Assume the original facts except that Abbi is married.She and her husband live with Jamel and Jennifer while attending school and they file a joint return.Abbi and her husband reported a $1,000 tax liability on their 2011 tax return.If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

c.Assume the same facts as part b.except that Abbi and her husband report a $0 tax liability on their 2011 joint tax return.Also, if the couple had filed separately, Abbi would have not had a tax liability on her return, but her husband would have had a $250 tax liability on his separate return.Can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

d.Assume the original facts except that Abbi is married.Abbi files a separate tax return for 2011.Abbi's husband files a separate tax return and reports a $250 tax liability.Can Jamel and Jennifer claim Abbi as a dependent in 2011

a.How many personal and dependency exemptions are Jamel and Jennifer allowed to claim

Jamel and Jennifer may claim five exemptions in total. Two personal exemptions for themselves and three exemptions for their daughters who all qualify as their qualifying children as analyzed below. b.Assume the original facts except that Abbi is married. She and her husband live with Jamel and Jennifer while attending school and they file a joint return. Abbi and her husband reported a $1,000 tax liability on their 2011 tax return. If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

b.Assume the original facts except that Abbi is married. She and her husband live with Jamel and Jennifer while attending school and they file a joint return. Abbi and her husband reported a $1,000 tax liability on their 2011 tax return. If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

No, Jamel and Jennifer may not claim Abbi as a dependent because she filed a joint return with her husband, and they reported a tax liability on their joint return.

c.Assume the same facts as part b.except that Abbi and her husband report a $0 tax liability on their 2011 joint tax return. Also, if the couple had filed separately, Abbi would have not had a tax liability on her return, but her husband would have had a $250 tax liability on his separate return. Can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

No. Jamel and Jennifer may not claim Abbi as a dependent even though she is their qualifying child because she fails the joint return test. Even though the couple had no tax liability on their joint return and Abbi would not have had a tax liability on a separate return, because Abbi's husband would have reported a tax liability on his separate return, Jamel and Jennifer may not claim her as a dependent.d.Assume the original facts except that Abbi is married. Abbi files a separate tax return for 2011. Abbi's husband files a separate tax return and reports a $250 tax liability. Can Jamel and Jennifer claim Abbi as a dependent in 2011

Yes. Because Abbi files a separate return, and she meets all other dependency requirements (see answer to part a). Jamel and Jennifer may claim a dependency exemption for Abbi.

Jamel and Jennifer may claim five exemptions in total. Two personal exemptions for themselves and three exemptions for their daughters who all qualify as their qualifying children as analyzed below.

b.Assume the original facts except that Abbi is married. She and her husband live with Jamel and Jennifer while attending school and they file a joint return. Abbi and her husband reported a $1,000 tax liability on their 2011 tax return. If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

b.Assume the original facts except that Abbi is married. She and her husband live with Jamel and Jennifer while attending school and they file a joint return. Abbi and her husband reported a $1,000 tax liability on their 2011 tax return. If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not No, Jamel and Jennifer may not claim Abbi as a dependent because she filed a joint return with her husband, and they reported a tax liability on their joint return.

c.Assume the same facts as part b.except that Abbi and her husband report a $0 tax liability on their 2011 joint tax return. Also, if the couple had filed separately, Abbi would have not had a tax liability on her return, but her husband would have had a $250 tax liability on his separate return. Can Jamel and Jennifer claim Abbi as a dependent on their 2011 tax return Why or why not

No. Jamel and Jennifer may not claim Abbi as a dependent even though she is their qualifying child because she fails the joint return test. Even though the couple had no tax liability on their joint return and Abbi would not have had a tax liability on a separate return, because Abbi's husband would have reported a tax liability on his separate return, Jamel and Jennifer may not claim her as a dependent.d.Assume the original facts except that Abbi is married. Abbi files a separate tax return for 2011. Abbi's husband files a separate tax return and reports a $250 tax liability. Can Jamel and Jennifer claim Abbi as a dependent in 2011

Yes. Because Abbi files a separate return, and she meets all other dependency requirements (see answer to part a). Jamel and Jennifer may claim a dependency exemption for Abbi.

4

Demarco and Janine Jackson have been married for 20 years and have four children who qualify as their dependents.Their income from all sources this year (2011) totaled $200,000 and included a gain from the sale of their home, which they purchased a few years ago for $200,000 and sold this year for $250,000.The gain on the sale qualified for the exclusion from the sale of a principal residence.The Jacksons incurred $16,500 of itemized deductions.

a.What is the Jacksons' taxable income

b.What would their taxable income be if their itemized deductions totaled $6,000 instead of $16,500

c.What would their taxable income be if they had $0 itemized deductions and $6,000 of for AGI deductions

d.Assume the original facts except that they also incurred a loss of $5,000 on the sale of some of their investment assets.What effect does the $5,000 loss have on their taxable income

e.Assume the original facts except that the Jacksons owned investments that appreciated by $10,000 during the year The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year.What is the Jackson's taxable income

a.What is the Jacksons' taxable income

b.What would their taxable income be if their itemized deductions totaled $6,000 instead of $16,500

c.What would their taxable income be if they had $0 itemized deductions and $6,000 of for AGI deductions

d.Assume the original facts except that they also incurred a loss of $5,000 on the sale of some of their investment assets.What effect does the $5,000 loss have on their taxable income

e.Assume the original facts except that the Jacksons owned investments that appreciated by $10,000 during the year The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year.What is the Jackson's taxable income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

Is it easier to describe what a capital asset is or what it is not Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

What requirements do an abandoned spouse and qualifying widow or widower have in common

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

Dean Kastner is 78 years old and lives by himself in an apartment in Chicago.Dean's gross income for the year is $2,500.Dean's support is provided as follows: Himself (5%), his daughters Camille (25%) and Rachel (30%), his son Zander (5%), his friend Frankie (15%), and his niece Sharon (20%).

Absent a multiple support agreement, of the parties mentioned in the problem, who may claim a dependency exemption for Dean as a qualifying relative Under a multiple support agreement, who is eligible to claim a dependency exemption for Dean as a qualifying relative Explain.

Absent a multiple support agreement, of the parties mentioned in the problem, who may claim a dependency exemption for Dean as a qualifying relative Under a multiple support agreement, who is eligible to claim a dependency exemption for Dean as a qualifying relative Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

Camille Sikorski was divorced last year.She currently owns and provides a home for her 15-year-old daughter, Kaly, and 18-year-old son, Parker.Both children lived in Camille's home for the entire year and Camille paid for all the costs of the maintaining the home.She received a salary of $105,000 and contributed $6,000 of it to a qualified retirement account.She also received $10,000 of alimony from her former husband.Finally, Camille paid $5,000 of expenditures that qualified as itemized deductions.The current year is 2011.

a.What is Camille's taxable income

b.What would Camille's taxable income be if she incurred $14,000 of itemized deductions instead of $5,000

c.Assume the original facts except that Camille's daughter Kaly is 25 years old and a full-time student.Kaly's gross income for the year was $5,000.Kaly provided $3,000 of her own support and Camille provided $5,000 of support.What is Camille's taxable income

a.What is Camille's taxable income

b.What would Camille's taxable income be if she incurred $14,000 of itemized deductions instead of $5,000

c.Assume the original facts except that Camille's daughter Kaly is 25 years old and a full-time student.Kaly's gross income for the year was $5,000.Kaly provided $3,000 of her own support and Camille provided $5,000 of support.What is Camille's taxable income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

Are all capital gains (gains on the sale or disposition of capital assets) taxed at the same rate Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

True or False.For purposes of determining head of household filing status, the taxpayer's mother or father is considered to be a qualifying person of the taxpayer (even if the mother or father does not qualify as the taxpayer's dependent) as long as the taxpayer pays more than half the costs of maintaining the household of the mother or father.Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

Mel and Cindy Gibson's 12-year-old daughter Rachel was abducted on her way home from school on March 15, 2011.Police reports indicated that a stranger had physically dragged Rachel into a waiting car and sped away.Everyone hoped that the kidnapper and Rachel would be located quickly.However, as of the end of the year, Rachel was still missing.The police were still pursuing several promising leads and had every reason to believe that Rachel was still alive.In 2012, Rachel was returned safely to her parents.

a.Are the Gibsons allowed to claim an exemption deduction for Rachel in 2011 even though she only lived in the Gibson's home for two and one half months Explain and cite your authority.

b.Assume the original facts except that Rachel is unrelated to the Gibsons, but she has been living with them since January 2006.The Gibsons have claimed a dependency exemption for Rachel for the years 2006 through 2010.Are the Gibsons allowed to claim a dependency exemption for Rachel in 2011 Explain and cite your authority.

a.Are the Gibsons allowed to claim an exemption deduction for Rachel in 2011 even though she only lived in the Gibson's home for two and one half months Explain and cite your authority.

b.Assume the original facts except that Rachel is unrelated to the Gibsons, but she has been living with them since January 2006.The Gibsons have claimed a dependency exemption for Rachel for the years 2006 through 2010.Are the Gibsons allowed to claim a dependency exemption for Rachel in 2011 Explain and cite your authority.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

In 2011, Tiffany is unmarried and has a 15-year-old qualifying child.Tiffany has determined her tax liability to be $3,525, and her employer has withheld $1,500 of federal taxes from her paycheck.Tiffany is allowed to claim a $1,000 child tax credit for her qualifying child.What amount of taxes will Tiffany owe (or what amount will she receive as a refund) when she files her tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

Are taxpayers allowed to deduct net capital losses (capital losses in excess of capital gains) Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

Is a qualifying relative always a qualifying person for purposes of determining head of household filing status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

Bob Ryan filed his 2011 tax return and claimed a dependency exemption for his 16-year-old son Dylan.Both Bob and Dylan are citizens and residents of the United States.Dylan meets all the necessary requirements to be considered a qualifying child; however, when Bob filed the tax return he didn't know Dylan's Social Security number and, therefore, didn't include an identifying number for his son on the tax return.Instead, Bob submitted an affidavit with his tax return stating he had requested Dylan's Social Security number from Dylan's birth state.Is Bob allowed to claim a dependency exemption for Dylan without including Dylan's identifying number on the return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

Compare and contrast for and from AGI deductions.Why are for AGI deductions likely more valuable to taxpayers than from AGI deductions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

For tax purposes, why is the married filing jointly tax status generally preferable to the married filing separately filing status Why might a married taxpayer prefer not to file a joint return with the taxpayer's spouse

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

Kimberly is divorced and the custodial parent of five-year-old twins, Bailey and Cameron.All three live with Kimberly's parents, who pay all the costs of maintaining the household (such as mortgage, property taxes, and food).Kimberly pays for the children's clothing, entertainment, and health-insurance costs.These costs comprised only a small part of the total costs of maintaining the household.

a.Determine the appropriate filing status for Kimberly.

What if Kimberly lived in her own home and provided all the costs of maintaining the household

a.Determine the appropriate filing status for Kimberly.

What if Kimberly lived in her own home and provided all the costs of maintaining the household

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the difference between gross income and adjusted gross income, and what is the difference between adjusted gross income and taxable income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

What does it mean to say that a married couple filing a joint tax return has joint and several liability for the taxes associated with the return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

Juan and Bonita are married and have two dependent children living at home.This year, Juan is killed in an avalanche while skiing.

a.What is Bonita's filing status this year

b.Assuming Bonita doesn't remarry and still has two dependent children living at home, what will her filing status be next year

c.Assuming Bonita doesn't remarry and doesn't have any dependents next year, what will her filing status be next year

a.What is Bonita's filing status this year

b.Assuming Bonita doesn't remarry and still has two dependent children living at home, what will her filing status be next year

c.Assuming Bonita doesn't remarry and doesn't have any dependents next year, what will her filing status be next year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

How do taxpayers determine whether they should deduct their itemized deductions or utilize the standard deduction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

Jeremy earned $100,000 in salary and $6,000 in interest income during the year.Jeremy has two qualifying dependent children who live with him.He qualifies to file as head of household and has $17,000 in itemized deductions.Neither of his dependents qualifies for the child tax credit.

a.Use the 2011 tax rate schedules to determine Jeremy's taxes due.

b.Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000.What is Jeremy's tax liability including the tax on the capital gain (use the tax rate schedules rather than the tax tables)

c.Assume the original facts except that Jeremy had only $7,000 in itemized deductions.What is Jeremy's total income tax liability (use the tax rate schedules rather than the tax tables)

a.Use the 2011 tax rate schedules to determine Jeremy's taxes due.

b.Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000.What is Jeremy's tax liability including the tax on the capital gain (use the tax rate schedules rather than the tax tables)

c.Assume the original facts except that Jeremy had only $7,000 in itemized deductions.What is Jeremy's total income tax liability (use the tax rate schedules rather than the tax tables)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

Gary and Lakesha were married on December 31 last year.They are now preparing their taxes for the April 15 deadline and are unsure of their filing status.

a.What filing status options do Gary and Lakesha have for last year

b.Assume instead that Gary and Lakesha were married on January 1 of this year.What is their filing status for last year (neither has been married before and neither had any dependents last year)

a.What filing status options do Gary and Lakesha have for last year

b.Assume instead that Gary and Lakesha were married on January 1 of this year.What is their filing status for last year (neither has been married before and neither had any dependents last year)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

Why are some deductions called "above-the-line" deductions and others are called "below-the-line" deductions What is the "line"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

David and Lilly Fernandez have determined their tax liability on their joint tax return to be $1,700.They have made prepayments of $1,500 and also have a child tax credit of $1,000.What is the amount of their tax refund or taxes due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

Elroy, who is single, has taken over the care of his mother Irene in her old age.Elroy pays the bills relating to Irene's home.He also buys all her groceries and provides the rest of her support.Irene has no gross income.

a.What is Elroy's filing status

b.Assume the original facts except that Elroy has taken over the care of his grandmother, Renae, instead of his mother.What is Elroy's filing status

c.Assume the original facts except that Elroy's mother Irene lives with him and that she receives an annual $4,500 taxable distribution from her retirement account.Elroy still pays all the costs to maintain the household.What is his filing status

a.What is Elroy's filing status

b.Assume the original facts except that Elroy has taken over the care of his grandmother, Renae, instead of his mother.What is Elroy's filing status

c.Assume the original facts except that Elroy's mother Irene lives with him and that she receives an annual $4,500 taxable distribution from her retirement account.Elroy still pays all the costs to maintain the household.What is his filing status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

What is the difference between a tax deduction and a tax credit Is one more beneficial than the other Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

In 2011, Rick, who is single, has been offered a position as a city landscape consultant.The position pays $125,000 in cash wages.Assume Rick files single and is entitled to one personal exemption.Rick deducts the standard deduction instead of itemized deductions

a.What is the amount of Rick's after-tax compensation (ignore payroll taxes)

b.Suppose Rick receives a competing job offer of $120,000 in cash compensation and nontaxable (excluded) benefits worth $4,000.What is the amount of Rick's after-tax compensation for the competing offer Which job should he take if taxes were the only concern

a.What is the amount of Rick's after-tax compensation (ignore payroll taxes)

b.Suppose Rick receives a competing job offer of $120,000 in cash compensation and nontaxable (excluded) benefits worth $4,000.What is the amount of Rick's after-tax compensation for the competing offer Which job should he take if taxes were the only concern

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

Kano and his wife Hoshi have been married for 10 years and have two children under the age of 12.The couple has been living apart for the last two years and both children live with Kano.Kano has provided all the means necessary to support himself and his children.Kano and Hoshi do not file a joint return.

What is Kano's filing status Assume the original facts except that Kano and Hoshi separated in May of the current year.What is Kano's filing status Assume the original facts except that Kano and Hoshi separated in November of this year.What is Kano's filing status Assume the original facts except that Kano's parents, not Kano, paid more than half of the cost of maintaining the home in which Kano and his children live.What is Kano's filing status

What is Kano's filing status Assume the original facts except that Kano and Hoshi separated in May of the current year.What is Kano's filing status Assume the original facts except that Kano and Hoshi separated in November of this year.What is Kano's filing status Assume the original facts except that Kano's parents, not Kano, paid more than half of the cost of maintaining the home in which Kano and his children live.What is Kano's filing status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

What types of federal income-based taxes, other than the regular income tax, might taxpayers be required to pay In general terms, what is the tax base for each of these other taxes on income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

Through November 2011, Tex has received gross income of $120,000.For December, Tex is considering whether to accept one more work engagement for the year.Engagement 1 will generate $7,000 of revenue at a cost of $4,000, which is deductible for AGI.In contrast, engagement 2 will generate $7,000 of revenue at a cost of $3,000, which is deductible as an itemized deduction.Tex files as a single taxpayer.

a.Calculate Tex's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2.Assume he has no itemized deductions other than those generated by engagement 2.

b.Calculate Tex's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2.Assume he has $4,500 of itemized deductions other than those generated by engagement 2.

c.Calculate Tex's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2.Assume he has $7,000 of itemized deductions other than those generated by engagement 2.

a.Calculate Tex's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2.Assume he has no itemized deductions other than those generated by engagement 2.

b.Calculate Tex's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2.Assume he has $4,500 of itemized deductions other than those generated by engagement 2.

c.Calculate Tex's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2.Assume he has $7,000 of itemized deductions other than those generated by engagement 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

Horatio and Kelly were divorced at the end of 2010.Neither Horatio nor Kelly remarried during 2011 and Horatio moved out of state.Determine the filing status of Horatio and Kelly for 2011 in the following independent situations:

a.Horatio and Kelly did not have any children and neither reported any dependents in 2011.

b.Horatio and Kelly had one child Amy who turned 10 years of age in 2011.Amy lived with Kelly for all of 2011, and Kelly provided all of her support.

c.Assume the same facts as in b.but Kelly released the exemption for Amy to Horatio even though Amy did not reside with him at all during 2011.

d.Assume the original facts except that during 2011 Madison a 17-year old friend of the family lived with (for the entire year) and was fully supported by Kelly.

e.Assume the original facts except that during 2011 Kelly's mother Janet lived with Kelly.For 2011, Kelly was able to claim a dependency exemption for her mother under a multiple support agreement.

a.Horatio and Kelly did not have any children and neither reported any dependents in 2011.

b.Horatio and Kelly had one child Amy who turned 10 years of age in 2011.Amy lived with Kelly for all of 2011, and Kelly provided all of her support.

c.Assume the same facts as in b.but Kelly released the exemption for Amy to Horatio even though Amy did not reside with him at all during 2011.

d.Assume the original facts except that during 2011 Madison a 17-year old friend of the family lived with (for the entire year) and was fully supported by Kelly.

e.Assume the original facts except that during 2011 Kelly's mother Janet lived with Kelly.For 2011, Kelly was able to claim a dependency exemption for her mother under a multiple support agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

Identify three ways taxpayers can pay their income taxes to the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

Matteo, who is single and has no dependents, was planning on spending the weekend repairing his car.On Friday, Matteo's employer called and offered him $500 in overtime pay if he would agree to work over the weekend.Matteo could get his car repaired over the weekend at Autofix for $400.If Matteo works over the weekend, he will have to pay the $400 to have his car repaired, but he will earn $500.Assume Matteo pays tax at a flat rate of 15 percent rate

a.Strictly considering tax factors, should Matteo work or repair his car if the $400 he must pay to have his car fixed is not deductible

b.Strictly considering tax factors, should Matteo work or repair his car if the $400 he must pay to have his car fixed is deductible for AGI

a.Strictly considering tax factors, should Matteo work or repair his car if the $400 he must pay to have his car fixed is not deductible

b.Strictly considering tax factors, should Matteo work or repair his car if the $400 he must pay to have his car fixed is deductible for AGI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

In each of the following independent situations, determine the taxpayer's filing status and the number of personal and dependency exemptions the taxpayer is allowed to claim.

a.Frank is single and supports his 17-year-old brother, Bill.Bill earned $3,000 and did not live with Frank.

b.Geneva and her spouse reside with their son, Steve, who is a 20-year-old undergraduate student at State University.Steve earned $13,100 at a part-time summer job, but he deposited this money in a savings account for graduate school.Geneva paid all of the $12,000 cost of supporting Steve.

c.Hamish's spouse died last year, and Hamish has not remarried.Hamish supports his father Reggie, age 78, who lives in a nursing home and had interest income this year of $2,500.

d.Irene is married but has not seen her spouse since February.She supports her spouse's 18-year-old child Dolores, who lives with Irene.Dolores earned $4,500 this year.

a.Frank is single and supports his 17-year-old brother, Bill.Bill earned $3,000 and did not live with Frank.

b.Geneva and her spouse reside with their son, Steve, who is a 20-year-old undergraduate student at State University.Steve earned $13,100 at a part-time summer job, but he deposited this money in a savings account for graduate school.Geneva paid all of the $12,000 cost of supporting Steve.

c.Hamish's spouse died last year, and Hamish has not remarried.Hamish supports his father Reggie, age 78, who lives in a nursing home and had interest income this year of $2,500.

d.Irene is married but has not seen her spouse since February.She supports her spouse's 18-year-old child Dolores, who lives with Irene.Dolores earned $4,500 this year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a person is considered to be a qualifying child or qualifying relative of a taxpayer, is the taxpayer automatically entitled to claim a dependency exemption for the person

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

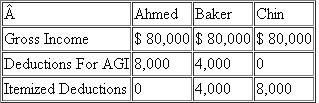

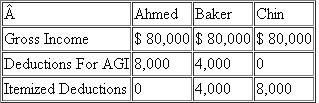

Rank the following three single taxpayers in order of the magnitude of taxable income for 2011 (from lowest to highest) and explain your results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

In each of the following independent cases, determine the taxpayer's filing status and the number of personal and dependency exemptions the taxpayer is allowed to claim.

a.Alexandra is a blind widow (spouse died five years ago) who provides a home for her 18-year-old nephew, Newt.Newt's parents are dead, and so Newt supports himself.Newt's gross income is $5,000.

b.Bharati supports and maintains a home for her daughter, Daru, and son-in-law, Sam.Sam earned $15,000 and filed a joint return with Daru, who had no income.

c.Charlie intended to file a joint return with his spouse, Sally.However, Sally died in December.Charlie has not remarried.

d.Deshi cannot convince his spouse to consent to signing a joint return.The couple has not separated.

e.Edith and her spouse support their 35-year-old son, Slim.Slim is a full-time college student who earned $5,500 over the summer in part-time work.

a.Alexandra is a blind widow (spouse died five years ago) who provides a home for her 18-year-old nephew, Newt.Newt's parents are dead, and so Newt supports himself.Newt's gross income is $5,000.

b.Bharati supports and maintains a home for her daughter, Daru, and son-in-law, Sam.Sam earned $15,000 and filed a joint return with Daru, who had no income.

c.Charlie intended to file a joint return with his spouse, Sally.However, Sally died in December.Charlie has not remarried.

d.Deshi cannot convince his spouse to consent to signing a joint return.The couple has not separated.

e.Edith and her spouse support their 35-year-old son, Slim.Slim is a full-time college student who earned $5,500 over the summer in part-time work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

Emily and Tony are recently married college students.Can Emily qualify as her parents' dependent Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

Aishwarya's husband passed away in 2010.She needs to determine whether Jasmine, her 17-year old step-daughter who is single, qualifies as her dependent in 2011.Jasmine is a resident but not a citizen of the United States.She lived in Aishwarya's home from June 15 through December 31, 2011.Aishwarya provided more than half of Jasmine's support for the 2011.

a.Is Aishwarya allowed to claim a dependency exemption for Jasmine for 2011

b.Would Aishwarya be allowed to claim a dependency exemption for Jasmine for 2011 if Aishwarya provided more than half of Jasmine's support in 2011, Jasmine lived in Aishwarya's home from July 15 through December 31 of 2011, and Jasmine reported gross income of $5,000 in 2011

c.Would Aishwarya be allowed to claim a dependency exemption for Jasmine for 2011 if Aishwarya provided more than half of Jasmine's support in 2011, Jasmine lived in Aishwarya's home from July 15 through December 31 of 2011, and Jasmine reported gross income of $2,500 in 2011

a.Is Aishwarya allowed to claim a dependency exemption for Jasmine for 2011

b.Would Aishwarya be allowed to claim a dependency exemption for Jasmine for 2011 if Aishwarya provided more than half of Jasmine's support in 2011, Jasmine lived in Aishwarya's home from July 15 through December 31 of 2011, and Jasmine reported gross income of $5,000 in 2011

c.Would Aishwarya be allowed to claim a dependency exemption for Jasmine for 2011 if Aishwarya provided more than half of Jasmine's support in 2011, Jasmine lived in Aishwarya's home from July 15 through December 31 of 2011, and Jasmine reported gross income of $2,500 in 2011

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

42

Jasper and Crewella Dahvill were married in year 0.They filed joint tax returns in years 1 and 2.In year 3, their relationship was strained and Jasper insisted on filing a separate tax return.In year 4, the couple divorced.Both Jasper and Crewella filed single tax returns in year 4.In year 5, the IRS audited the couple's joint year 2 tax return and each spouse's separate year 3 tax returns.The IRS determined that the year 2 joint return and Crewella's separate year 3 tax return understated Crewella's self-employment income causing the joint return year 2 tax liability to be understated by $4,000 and Crewella's year 3 separate return tax liability to be understated by $6,000.The IRS also assessed penalties and interest on both of these tax returns.Try as it might, the IRS has not been able to locate Crewella, but they have been able to find Jasper.

a.What amount of tax can the IRS require Jasper to pay for the Dahvill's year 2 joint return Explain.

b.What amount of tax can the IRS require Jasper to pay for Crewella's year 3 separate tax return Explain.

a.What amount of tax can the IRS require Jasper to pay for the Dahvill's year 2 joint return Explain.

b.What amount of tax can the IRS require Jasper to pay for Crewella's year 3 separate tax return Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

43

How are realized income, gross income, and taxable income similar, and how are they different

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

44

Compare and contrast the relationship test requirements for a qualifying child with the relationship requirements for a qualifying relative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Samsons are trying to determine whether they can claim their 22-year-old adopted son, Jason, as a dependent.Jason is currently a full-time student at an out-of-state university.Jason lived in his parents' home for three months of the year, and he was away at school for the rest of the year.He received $9,500 in scholarships this year for his outstanding academic performance and earned $3,900 of income working a part-time job during the year.The Samsons paid a total of $4,000 to support Jason while he was away at college.Jason used the scholarship, the earnings from the part-time job, and the money from the Samsons as his only sources of support.

a.Can the Samsons claim Jason as their dependent

b.Assume the original facts except that Jason's grandparents, not the Samsons, provided him with the $4,000 worth of support.Can the Samsons (Jason's parents) claim Jason as their dependent Why or why not

Assume the original facts except substitute Jason's grandparents for his parents.Determine whether Jason's grandparents can claim Jason as a dependent.d.Assume the original facts except that Jason earned $4,500 while working part-time and used this amount for his support.Can the Samsons claim Jason as their dependent Why or why not

a.Can the Samsons claim Jason as their dependent

b.Assume the original facts except that Jason's grandparents, not the Samsons, provided him with the $4,000 worth of support.Can the Samsons (Jason's parents) claim Jason as their dependent Why or why not

Assume the original facts except substitute Jason's grandparents for his parents.Determine whether Jason's grandparents can claim Jason as a dependent.d.Assume the original facts except that Jason earned $4,500 while working part-time and used this amount for his support.Can the Samsons claim Jason as their dependent Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

46

Janice Traylor is single.She has an 18-year-old son named Marty.Marty is Janice's only child.Marty has lived with Janice his entire life.However, Marty recently joined the Marines and was sent on a special assignment to Australia.During 2011, Marty spent nine months in Australia.Marty was extremely homesick while in Australia, since he had never lived away from home.However, Marty knew this assignment was only temporary, and he couldn't wait to come home and find his room just the way he left it.Janice has always filed as head of household, and Marty has always been considered a qualifying child (and he continues to meet all the tests with the possible exception of the residence test due to his stay in Australia).However, this year Janice is unsure whether she qualifies as head of household due to Marty's nine-month absence during the year.Janice has come to you for advice on whether she qualifies for head of household filing status in 2011.What do you tell her

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

47

Are taxpayers required to include all realized income in gross income Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

48

In general terms, what are the differences in the rules for determining who is a qualifying child and who qualifies as a dependent as a qualifying relative Is it possible for someone to be a qualifying child and a qualifying relative of the same taxpayer Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

49

John and Tara Smith are married and have lived in the same home for over 20 years.John's uncle Tim, who is 64 years old, has lived with the Smiths since March of this year.Tim is searching for employment but has been unable to find any-his gross income for the year is $2,000.Tim used all $2,000 toward his own support.The Smiths provided the rest of Tim's support by providing him with lodging valued at $5,000 and food valued at $2,200.

a.Are the Smiths able to claim a dependency exemption for Tim

b.Assume the original facts except that Tim earned $10,000 and used all the funds for his own support.Are the Smiths able to claim Tim as a dependent

c.Assume the original facts except that Tim is a friend of the family and not John's uncle.

d.Assume the original facts except that Tim is a friend of the family and not John's uncle and Tim lived with the Smiths for the entire year.

a.Are the Smiths able to claim a dependency exemption for Tim

b.Assume the original facts except that Tim earned $10,000 and used all the funds for his own support.Are the Smiths able to claim Tim as a dependent

c.Assume the original facts except that Tim is a friend of the family and not John's uncle.

d.Assume the original facts except that Tim is a friend of the family and not John's uncle and Tim lived with the Smiths for the entire year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

50

Doug Jones timely submitted his 2011 tax return and elected married filing jointly status with his wife Darlene.Doug and Darlene did not request an extension for their 2011 tax return.Doug and Darlene owed and paid the IRS $124,000 for their 2011 tax year.Two years later, Doug amended his return and claimed married filing separate status.By changing his filing status, Doug sought a refund for an overpayment for the tax year 2011 (he paid more tax in the original joint return than he owed on a separate return).Is Doug allowed to change his filing status for the 2011 tax year and receive a tax refund with his amended return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

51

All else equal, should taxpayers prefer to exclude income or defer it Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

52

How do two taxpayers determine who has priority to claim the dependency exemption for a qualifying child of both taxpayers when neither taxpayer is a parent of the child (assume the child does not qualify as a qualifying child for any parent) How do parents determine who gets to deduct the dependency exemption for a qualifying child of both parents when the parents are divorced or file separate returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

53

Francine's mother Donna and her father Darren separated and divorced in September of this year.Francine lived with both parents until the separation.Francine does not provide more than half of her own support.Francine is 15 years old at the end of the year.

a.Is Francine a qualifying child to Donna

b.Is Francine a qualifying child to Darren

c.Assume Francine spends more time living with Darren than Donna after the separation.Who may claim Francine as a dependency exemption for tax purposes

d.Assume Francine spends an equal number of days with her mother and her father and that Donna has AGI of $52,000 and Darren has AGI of $50,000.Who may claim a dependency exemption for Francine

a.Is Francine a qualifying child to Donna

b.Is Francine a qualifying child to Darren

c.Assume Francine spends more time living with Darren than Donna after the separation.Who may claim Francine as a dependency exemption for tax purposes

d.Assume Francine spends an equal number of days with her mother and her father and that Donna has AGI of $52,000 and Darren has AGI of $50,000.Who may claim a dependency exemption for Francine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

54

Marc and Michelle are married and earned salaries this year (2011) of $64,000 and $12,000, respectively.In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds.Marc and Michelle also paid $2,500 of qualifying moving expenses, and Marc paid alimony to a prior spouse in the amount of $1,500.Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year.Thus, Marc and Michelle are allowed to claim a $1,000 child tax credit for Matthew.Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $5,500 in federal income taxes withheld from their paychecks during the course of the year.

a.What is Marc and Michelle's gross income

b.What is Marc and Michelle's adjusted gross income

c.What is the total amount of Marc and Michelle's deductions from AGI

d.What is Marc and Michelle's taxable income

e.What is Marc and Michelle's taxes payable or refund due for the year (use the tax rate schedules)

a.What is Marc and Michelle's gross income

b.What is Marc and Michelle's adjusted gross income

c.What is the total amount of Marc and Michelle's deductions from AGI

d.What is Marc and Michelle's taxable income

e.What is Marc and Michelle's taxes payable or refund due for the year (use the tax rate schedules)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck