Deck 20: International Financial Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/46

العب

ملء الشاشة (f)

Deck 20: International Financial Policy

1

Support the following statement: "It is best to offset a capital and financial account surplus with a current account deficit."

It has been stated that balance of payments must always balance. But this balance is acknowledged in accounting sense only. This balance in accounting sense implies that credit and debit side of balance of payments must always balance each other.

Suppose, current account is in deficit, this implies that residents of the country are spending more on imports of goods and services than the income they are earning from exports of goods and services. This deficit on current account will force the government to sell assets such as gold or foreign exchange reserves of a country which will show up as positive item in the capital and financial account.

Thus, deficit on current account creates surplus in capital and financial account which keeps the balance of payments equal to zero.

Therefore, in order to keep the balance of payment equal to zero that is in balance it is best to offset a capital and financial account surplus with a current account deficit.

Suppose, current account is in deficit, this implies that residents of the country are spending more on imports of goods and services than the income they are earning from exports of goods and services. This deficit on current account will force the government to sell assets such as gold or foreign exchange reserves of a country which will show up as positive item in the capital and financial account.

Thus, deficit on current account creates surplus in capital and financial account which keeps the balance of payments equal to zero.

Therefore, in order to keep the balance of payment equal to zero that is in balance it is best to offset a capital and financial account surplus with a current account deficit.

2

S.nflation is 2 percent, the European Union's inflation rate is 4 percent, and the nominal U.S.ollar exchange rate rises by 3 percent relative to the euro, what happens to the real exchange rate of the dollar

Given information:

Inflation rate in Country U is 2%.

Inflation rate in Country E is 4%.

Nominal exchange rate in Country U increases by 3%.

Real exchange rate:

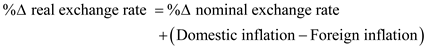

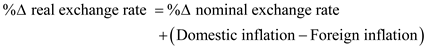

The change in real exchange rate is calculated using the following formula: …… (1)

…… (1)

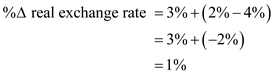

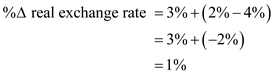

Change in nominal exchange rate is 3%.

Domestic inflation is 2%.

Foreign inflation is 4%.

Substitute the values in Equation-1 to get the value of the change in real exchange rate as follows: Thus, the real exchange rate of dollar comparative to the euro increases by

Thus, the real exchange rate of dollar comparative to the euro increases by  .

.

Inflation rate in Country U is 2%.

Inflation rate in Country E is 4%.

Nominal exchange rate in Country U increases by 3%.

Real exchange rate:

The change in real exchange rate is calculated using the following formula:

…… (1)

…… (1)Change in nominal exchange rate is 3%.

Domestic inflation is 2%.

Foreign inflation is 4%.

Substitute the values in Equation-1 to get the value of the change in real exchange rate as follows:

Thus, the real exchange rate of dollar comparative to the euro increases by

Thus, the real exchange rate of dollar comparative to the euro increases by  .

. 3

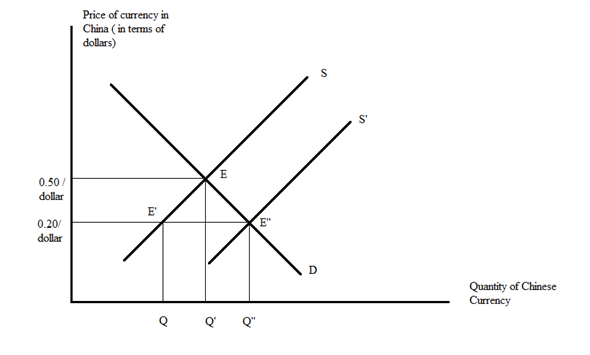

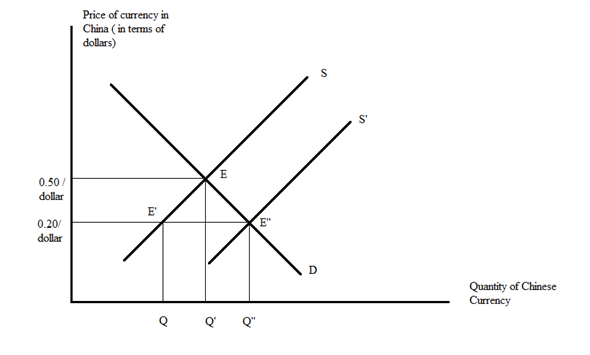

In the early 2000s, China was running a large current account surplus.

a.What did this suggest about its financial and capital account

b.China's private balance of payments was in surplus.hat does this suggest about its exchange rate regime

c.What actions was the Chinese central bank likely undertaking in the foreign exchange markets Demonstrate the situation with supply and demand graphs.

d.If the Chinese central bank pulled out of the foreign exchange market, what would likely happen to the yuan

a.What did this suggest about its financial and capital account

b.China's private balance of payments was in surplus.hat does this suggest about its exchange rate regime

c.What actions was the Chinese central bank likely undertaking in the foreign exchange markets Demonstrate the situation with supply and demand graphs.

d.If the Chinese central bank pulled out of the foreign exchange market, what would likely happen to the yuan

Balance of Payments (BoP) is the record of all transactions made by a nation involving foreign exchange during a year. Current account and Capital account are the components of Balance of Payments (BoP). Current account takes the value of exported goods and services minus value of imported goods and services while Capital account transactions involve the change in capital stock.

In the early 2000s, china was running a large current account surplus.

a. Financial and capital account of china was in deficit. Because, there is sufficient foreign reserve which is due to larger export than import of goods and services. Sum of current account and capital account is zero. In order to maintain level financial and capital account will run in deficit.

b. If china's Private BoP was in surplus then china can have fixed or flexible exchange rate regime. China will fix its currency value relative to foreign currency under equilibrium rate.

c. Central bank of china will sell its currency to the foreign market in order to set at new equilibrium. Suppose, equilibrium exchange rate is 0.50/dollar and china wants to set new rate under equilibrium E at 0.20/dollar. Here it is seen the quantity demanded of Chinese currency (Q) exceeds quantity supplied of Chinese currency (Q''). To keep the 0.20 / dollar central bank of china needs to sell its currency to the foreign market and will shift the supply curve from S to S'. d. If central bank of china pulled out of the foreign exchange market then the value of yuan will likely to rise. Larger export than import will take place in Chinese market.

d. If central bank of china pulled out of the foreign exchange market then the value of yuan will likely to rise. Larger export than import will take place in Chinese market.

In the early 2000s, china was running a large current account surplus.

a. Financial and capital account of china was in deficit. Because, there is sufficient foreign reserve which is due to larger export than import of goods and services. Sum of current account and capital account is zero. In order to maintain level financial and capital account will run in deficit.

b. If china's Private BoP was in surplus then china can have fixed or flexible exchange rate regime. China will fix its currency value relative to foreign currency under equilibrium rate.

c. Central bank of china will sell its currency to the foreign market in order to set at new equilibrium. Suppose, equilibrium exchange rate is 0.50/dollar and china wants to set new rate under equilibrium E at 0.20/dollar. Here it is seen the quantity demanded of Chinese currency (Q) exceeds quantity supplied of Chinese currency (Q''). To keep the 0.20 / dollar central bank of china needs to sell its currency to the foreign market and will shift the supply curve from S to S'.

d. If central bank of china pulled out of the foreign exchange market then the value of yuan will likely to rise. Larger export than import will take place in Chinese market.

d. If central bank of china pulled out of the foreign exchange market then the value of yuan will likely to rise. Larger export than import will take place in Chinese market. 4

If you were the finance minister of Never-Never Land, how would you estimate the long-run exchange rate of your currency, the neverback Defend your choice as well as discuss its possible failings.Difficult)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

5

The government of Never-Never Land, after much deliberation, finally decides to switch to a fixed exchange rate policy.t does this because the value of its currency, the neverback, is so high that the trade deficit is enormous.he finance minister fixes the rate at $10 a neverback, which is lower than the equilibrium rate of $20 a neverback.

a.hat trade or traditional macro policy options could accomplish this lower exchange rate

b.sing the laws of supply and demand, show graphically how possible equilibria are reached.

a.hat trade or traditional macro policy options could accomplish this lower exchange rate

b.sing the laws of supply and demand, show graphically how possible equilibria are reached.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

6

What are four economic advantages of the euro for Europe

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

7

In general, would it be easier for the United States to push the value of the dollar down or up Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

8

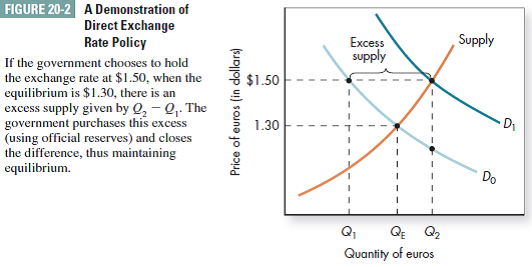

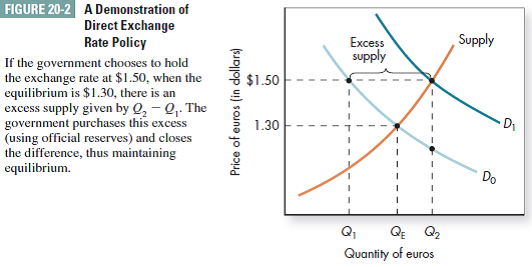

In Figure 20-2, a foreign government chooses to maintain an equilibrium market exchange rate of U.S.1.30 per unit of its own currency.iscuss the implications of the government trying to maintain a higher fixed rate-say at $1.50.

Reference Figure 20-2

Reference Figure 20-2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

9

What are two disadvantages of the euro for Europe

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

10

Nobel Prize-winning economist James Tobin has suggested that a method of decreasing unwanted sudden capital flows among countries would be to place a small tax on such flows.ost-Keynesian economist Paul Davidson argued against doing so because it won't solve the problem, suggesting that it is like using a pebble when a boulder is needed.hat might Davidson's argument be (Hint: It is related to the role of expectations.) (Post-Keynesian)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

11

Does government intervention stabilize exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

12

Support the following statement: "It is best to offset a capital and financial account deficit with a current account surplus."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

13

Draw the schematics to show the effect of expansionary monetary policy on the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

14

In the early 1980s, the U.S.conomy fell into a recession (the government faced the problem of both a high federal deficit and a high trade deficit, called the twin deficits), and the dollar was very strong.an you provide an explanation for this sequence of events (Difficult)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

15

ollar Bill believes price stability is the main goal of central bank policy.s the doctor more likely to prefer fixed or flexible exchange rates Why (Difficult)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

16

How did Greece's adoption of the euro as its currency make its recent problems more difficult to solve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

17

If you, a U.S.itizen, are traveling abroad, where will your expenditures show up in the balance of payments accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

18

What effect does the lowering of a country's interest rates have on exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

19

What effect on the U.S.rade deficit and exchange rate would result if Japan ran an expansionary monetary policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

20

If all currencies were on a gold standard, there would be no exchange rates between currencies and we would not face the difficulties presented by fluctuating exchange rates.

a.hat would be the benefit of having all currencies on a gold standard

b.hat would be the cost (Austrian)

a.hat would be the benefit of having all currencies on a gold standard

b.hat would be the cost (Austrian)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

21

Most economists favor lowering barriers to trade.ut even among mainstream economists there is far less support for financial liberalization-the removal of government regulation of financial and capital markets-than for trade liberalization.It is a seductive idea," says free-trader Jagdish Bhagwati, "but the claims of enormous benefit from free capital mobility are not persuasive." In addition, capital market liberalization entails substantial risks because it strips away the regulations intended to control the flow of short-term loans and contracts in and out of a country.he IMF, on the other hand, remains an unabashed supporter of free financial markets, arguing that they are a precondition for a developing country attracting long-term foreign investment.

a.ho has it right

b.s financial liberalization a good or bad policy, especially for developing countries (Radical)

a.ho has it right

b.s financial liberalization a good or bad policy, especially for developing countries (Radical)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

22

What would be the effect on the U.S.xchange rate if Japan ran a contractionary fiscal policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a country is running a balance of trade deficit, will its current account be in deficit Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

24

State whether the following will show up on the current account or the capital and financial account:

a.BM's exports of computers to Japan.

b.BM's hiring of a British merchant bank as a consultant.

c. foreign national living in the United States repatriates money.

d.ord Motor Company's profit in Hungary.

e.ord Motor Company uses that Hungarian profit to build a new plant in Hungary.

a.BM's exports of computers to Japan.

b.BM's hiring of a British merchant bank as a consultant.

c. foreign national living in the United States repatriates money.

d.ord Motor Company's profit in Hungary.

e.ord Motor Company uses that Hungarian profit to build a new plant in Hungary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

25

What effect will a combination of expansionary fiscal policy and contractionary monetary policy have on the exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

26

During the 1995-96 Republican presidential primaries, Patrick Buchanan wrote an editorial in The Wall Street Journal beginning, "Since the Nixon era the dollar has fallen 75 percent against the yen, 60 percent against the mark." What trade policies do you suppose he was promoting He went on to outline a series of tariffs.gree or disagree with his policies.Difficult)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

27

One of the basic laws of economics is the law of one price.t says that given certain assumptions one would expect that if free trade is allowed, the prices of goods in multiple countries should converge.his law underlies purchasing power parity.

a.hat are the three assumptions likely to be

b.hould the law of one price hold for labor also Why or why not

c.hould it hold for capital more so or less so than for labor Why or why not

a.hat are the three assumptions likely to be

b.hould the law of one price hold for labor also Why or why not

c.hould it hold for capital more so or less so than for labor Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a country's actual exchange rate is 20 units per dollar and its purchasing power parity exchange rate is 25, is its currency under or overvalued Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

29

How can net investment income be positive if a country is a net debtor nation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

30

What effect would contractionary monetary policy have on a country's exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

31

conomist always tries to travel to a country where the purchasing power parity exchange rate is lower than the market exchange rate.hy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

32

According to Gary North in Priorities and Dominion: An Economic Commentary on Matthew, in the book of Matthew, Jesus teaches about the rate of exchange between earthly wealth and eternal wealth.

a.ould Jesus argue for a high or low exchange rate for earthly riches Explain your answer.

b.o wealthy people believe the exchange rate is high or low

c.o you believe the perceived exchange rate falls or rises as one approaches death (Religious)

a.ould Jesus argue for a high or low exchange rate for earthly riches Explain your answer.

b.o wealthy people believe the exchange rate is high or low

c.o you believe the perceived exchange rate falls or rises as one approaches death (Religious)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

33

Will the following be suppliers or demanders of U.S.ollars in foreign exchange markets

a. U.S.ourist in Latin America.

b. German foreign exchange trader who believes that the dollar exchange rate will fall.

c. U.S.oreign exchange trader who believes that the dollar exchange rate will fall.

d. Costa Rican tourist in the United States.

e. Russian capitalist who wants to protect his wealth from expropriation.

f. British investor in the United States.

a. U.S.ourist in Latin America.

b. German foreign exchange trader who believes that the dollar exchange rate will fall.

c. U.S.oreign exchange trader who believes that the dollar exchange rate will fall.

d. Costa Rican tourist in the United States.

e. Russian capitalist who wants to protect his wealth from expropriation.

f. British investor in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

34

S.nflation is 4 percent and Japan's inflation is 1 percent, and the nominal U.S.ollar exchange rate falls by 3 percent relative to the yen, what happens to the real exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

35

When someone sends 100 British pounds to a friend in the United States, will this transaction show up on the financial and capital account or current account Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

36

Should Canada, the United States, and Mexico adopt a common currency Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

37

How is forcing governments to make adjustments to meet their international problems both an advantage and disadvantage of fixed exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

38

In an op-ed article, Paul Volcker, former chairman of the Board of Governors of the Federal Reserve, asked the following question: "Is it really worth spending money in the exchange markets, modifying monetary policy, and taking care to balance the budget just to save another percentage or two [of value of exchange rates] " What's your answer to this question (Difficult)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

39

What is the net effect of expansionary fiscal policy on the exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which is preferable: a fixed or a flexible exchange rate Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

41

Why don't most governments leave determination of the exchange rate to the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

42

If currency traders expect the government to devalue a currency, what will they likely do Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

43

A Wall Street Journal article, "As Fear of Deficits Falls, Some See a Larger Threat," describes the following threat of a high U.S.udget deficit:

[T]he investors who finance our deficits by buying Treasury bonds and bills, especially the foreigners who buy a larger share of them than ever, will question our ability to repay them, and balk at lending more- triggering a big drop in the dollar and much higher interest rates.

a.hy would a drop in foreign confidence in the U.S.bility to repay debt lead to a drop in the dollar and much higher interest rates

b.n what way are higher interest rates and a lower value of the dollar bad for the U.S.conomy

[T]he investors who finance our deficits by buying Treasury bonds and bills, especially the foreigners who buy a larger share of them than ever, will question our ability to repay them, and balk at lending more- triggering a big drop in the dollar and much higher interest rates.

a.hy would a drop in foreign confidence in the U.S.bility to repay debt lead to a drop in the dollar and much higher interest rates

b.n what way are higher interest rates and a lower value of the dollar bad for the U.S.conomy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

44

Most traders in currencies are men.

a.hy is this

b.hy has it remained even though there is supposed to be no discrimination in employment

c.he language of traders is often quite coarse; does this fact provide a possible answer to both a and b

d.id you think of it before you read c (Feminist)

a.hy is this

b.hy has it remained even though there is supposed to be no discrimination in employment

c.he language of traders is often quite coarse; does this fact provide a possible answer to both a and b

d.id you think of it before you read c (Feminist)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

45

If expansionary monetary policy immediately increases inflationary expectations and the price level, how might the effect of monetary policy on the exchange rate be different from that presented in this chapter

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

46

In mid-1994 the value of the dollar fell sufficiently to warrant coordinated intervention among 17 countries.till, the dollar went on falling.ne economist stated, "[The intervention] was clearly a failure...t's a good indication something else has to be done." Why would the United States and foreign countries want to keep up the value of the dollar

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck