Deck 16: Asset Prices and Interest Rates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 16: Asset Prices and Interest Rates

1

The future value of $100 today will be:

A)more than $100 if the interest rate is positive.

B)more than $100 if the interest rate is zero.

C)less than $100 if the interest rate is positive.

D)$100 if the interest rate is negative.

A)more than $100 if the interest rate is positive.

B)more than $100 if the interest rate is zero.

C)less than $100 if the interest rate is positive.

D)$100 if the interest rate is negative.

more than $100 if the interest rate is positive.

2

A bond's maturity is 2 years, with an annual coupon payment of $10 and a face value of $100. Assuming the interest rate is 5 percent per year, which of the following is the bond's price?

A)$95.24

B)$99.77

C)$109.30

D)$114.29

A)$95.24

B)$99.77

C)$109.30

D)$114.29

$109.30

3

What is the present value of $100 paid in 5 years if the interest rate is 5%?

A)$78.35

B)$95.24

C)$105.00

D)$127.63

A)$78.35

B)$95.24

C)$105.00

D)$127.63

$78.35

4

When we say that the present value of $100 received in one year is $97.56, we are also saying that:

A)you prefer receiving $100 in the future to $97.56 today.

B)you prefer receiving $100 today to $100 in one year.

C)you are indifferent between receiving $100 in the future and $97.56 today.

D)you are indifferent between receiving $97.56 in the future and $100 today.

A)you prefer receiving $100 in the future to $97.56 today.

B)you prefer receiving $100 today to $100 in one year.

C)you are indifferent between receiving $100 in the future and $97.56 today.

D)you are indifferent between receiving $97.56 in the future and $100 today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

What will happen if the current asset price is less than the present value of income?

A)Sellers will raise the asset's price until it equals the present value of income.

B)Buyers will bid up the asset's price until it equals the present value of income.

C)Buyers will bid the asset's price down until it equals the discount rate.

D)Buyers will bid up the asset's price until it is above the present value of income.

A)Sellers will raise the asset's price until it equals the present value of income.

B)Buyers will bid up the asset's price until it equals the present value of income.

C)Buyers will bid the asset's price down until it equals the discount rate.

D)Buyers will bid up the asset's price until it is above the present value of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

A lower interest rate:

A)increases the future value of present money.

B)increases the present value of future money.

C)maintains the same present value of future money.

D)reduces the present value of future money.

A)increases the future value of present money.

B)increases the present value of future money.

C)maintains the same present value of future money.

D)reduces the present value of future money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

A dividend is the:

A)payment from a firm to a stockholder.

B)payment to a firm given by the buyer of a stock.

C)payment from the government to a bondholder.

D)expected level of future profits.

A)payment from a firm to a stockholder.

B)payment to a firm given by the buyer of a stock.

C)payment from the government to a bondholder.

D)expected level of future profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

What will happen if the current asset price is greater than the present value of income?

A)Sellers will lower the asset's price until it equals the present value of income.

B)Buyers will bid the asset's price down until it equals the discount rate.

C)Buyers will bid the asset's price down until it equals the present value of income.

D)Sellers will raise the asset's price until it equals the present value of income.

A)Sellers will lower the asset's price until it equals the present value of income.

B)Buyers will bid the asset's price down until it equals the discount rate.

C)Buyers will bid the asset's price down until it equals the present value of income.

D)Sellers will raise the asset's price until it equals the present value of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

The reason a dollar is worth today compared to the future is that a dollar can be used to .

A)more; earn interest over time

B)the same; buy goods and services

C)less; earn interest over time

D)less; repay loans in the future

A)more; earn interest over time

B)the same; buy goods and services

C)less; earn interest over time

D)less; repay loans in the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

If i is the interest rate per period, which of the following represents the present value, denoted PV, of $100 in period n?

A)PV = $100in

B)PV = $1001/n

C)PV = $100/(1 + i)n

D)PV = $100 × (1 + i)n

A)PV = $100in

B)PV = $1001/n

C)PV = $100/(1 + i)n

D)PV = $100 × (1 + i)n

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the interest rate is 5% per year and you put $100 into a savings account for 5 years, what is the future value of today's $100?

A)$3,125.00

B)$127.63

C)$105.00

D)$78.35

A)$3,125.00

B)$127.63

C)$105.00

D)$78.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

The present value of $100 paid in 5 years will be:

A)less than $100 if the interest rate is positive.

B)less than $100 if the interest rate is zero.

C)more than $100 if the interest rate is positive.

D)$100 if the interest rate is positive.

A)less than $100 if the interest rate is positive.

B)less than $100 if the interest rate is zero.

C)more than $100 if the interest rate is positive.

D)$100 if the interest rate is positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

What is the present value of $100 paid in 10 years if the interest rate is 2% per year?

A)$82.03

B)$98.04

C)$102.00

D)$121.90

A)$82.03

B)$98.04

C)$102.00

D)$121.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

If i is the interest rate per period, which of the following represents the future value, denoted F, of $100 in period n?

A)F = $100 × in

B)F = $100n

C)F = $100 × (1 + i)n

D)F = $100/(1 + i)n

A)F = $100 × in

B)F = $100n

C)F = $100 × (1 + i)n

D)F = $100/(1 + i)n

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is the best definition of an asset price according to the classical theory?

A)It is equal to future value of expected asset income.

B)It is equal to its future price.

C)It is equal to present value of expected asset income.

D)It is equal to present value of known asset income.

A)It is equal to future value of expected asset income.

B)It is equal to its future price.

C)It is equal to present value of expected asset income.

D)It is equal to present value of known asset income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following best explains why we can calculate stock prices from either expected earnings or expected dividends?

A)Because a firm must eventually distribute all its earnings to shareholders, in the long run, earnings determine how much dividends can be paid.

B)Because a firm must eventually distribute all its earnings to shareholders, in the short run, earnings determine how much dividends can be paid.

C)Because a firm must eventually distribute all its earnings to shareholders, if a firm builds up excess earnings, the difference between dividends and earnings goes to the firm's board of directors.

D)Expected earnings never determine the stock price.

A)Because a firm must eventually distribute all its earnings to shareholders, in the long run, earnings determine how much dividends can be paid.

B)Because a firm must eventually distribute all its earnings to shareholders, in the short run, earnings determine how much dividends can be paid.

C)Because a firm must eventually distribute all its earnings to shareholders, if a firm builds up excess earnings, the difference between dividends and earnings goes to the firm's board of directors.

D)Expected earnings never determine the stock price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

The future value of a dollar today is:

A)how many goods and services it can buy today.

B)how many dollars a dollar today can produce at a future date.

C)the value of all goods that a dollar in the future can buy today.

D)the value today of one dollar in the future.

A)how many goods and services it can buy today.

B)how many dollars a dollar today can produce at a future date.

C)the value of all goods that a dollar in the future can buy today.

D)the value today of one dollar in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

A higher interest rate:

A)reduces the present value of future money.

B)increases the present value of future money.

C)maintains the same present value of future money.

D)reduces the future value of present money.

A)reduces the present value of future money.

B)increases the present value of future money.

C)maintains the same present value of future money.

D)reduces the future value of present money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the United States, the interest rate is 4% per year and in Mexico, it is 10% per year. The present value of $100 received in one year is in .

A)lower; the United States

B)higher; the United States

C)higher; Mexico

D)There is not enough information to Answer the question.

A)lower; the United States

B)higher; the United States

C)higher; Mexico

D)There is not enough information to Answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

A bond's maturity is 3 years, with an annual coupon payment of $10 and a face value of $1,000. Assuming the interest rate is 2 percent per year, which of the following is the bond's price?

A)$951.75

B)$961.74

C)$971.16

D)$980.39

A)$951.75

B)$961.74

C)$971.16

D)$980.39

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

A change in interest rates has effect on prices of bonds than on prices of bonds.

A)a larger; short-term; long-term

B)a larger; long-term; short-term

C)a smaller; long-term; short-term

D)the same; long term; short-term

A)a larger; short-term; long-term

B)a larger; long-term; short-term

C)a smaller; long-term; short-term

D)the same; long term; short-term

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

New information about a firm has:

A)little effect on bond prices.

B)little effect on stock prices.

C)a large impact on bond prices.

D)an impact on the exchange rate.

A)little effect on bond prices.

B)little effect on stock prices.

C)a large impact on bond prices.

D)an impact on the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following summarizes the classical theory of asset prices? I. An asset price equals the present value of expected income from the asset. II. The interest rate in the present value formula is the safe interest rate.

III) The risk premium is zero.

A)I only II

B)only III

C)only

D)II and III

III) The risk premium is zero.

A)I only II

B)only III

C)only

D)II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

The risky interest rate is than the risk-free rate because the .

A)greater; risk premium is positive

B)greater; risk premium is negative

C)less; inflation rate is positive

D)greater; risk premium is zero

A)greater; risk premium is positive

B)greater; risk premium is negative

C)less; inflation rate is positive

D)greater; risk premium is zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

The risk premium is the:

A)excess interest rate earned to compensate an asset owner for reducing risk.

B)excess interest rate earned to compensate an asset owner for taking on risk.

C)excess interest rate earned to compensate money holders for the rate of inflation.

D)payment made to people who run the risk of losing their jobs.

A)excess interest rate earned to compensate an asset owner for reducing risk.

B)excess interest rate earned to compensate an asset owner for taking on risk.

C)excess interest rate earned to compensate money holders for the rate of inflation.

D)payment made to people who run the risk of losing their jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

The primary reason for changes in bond rates is:

A)changes in the state of the economy.

B)higher rates of inflation.

C)changes in interest rates.

D)an increase in the likelihood of a war.

A)changes in the state of the economy.

B)higher rates of inflation.

C)changes in interest rates.

D)an increase in the likelihood of a war.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following summarizes the classical theory of asset prices? I. An asset price equals the present value of expected income from the asset.

II) Expected income is the best possible forecast based only on past information.

III) The interest rate in the present value formula is less than the safe interest rate plus a risk premium.

A)I only

B)II only

C)III only

D)I and II

II) Expected income is the best possible forecast based only on past information.

III) The interest rate in the present value formula is less than the safe interest rate plus a risk premium.

A)I only

B)II only

C)III only

D)I and II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

Stock prices change frequently because:

A)the economy is growing and shrinking.

B)of changes in a firm's expected earnings.

C)of old information about a firm.

D)None of the Answer s is correct.

A)the economy is growing and shrinking.

B)of changes in a firm's expected earnings.

C)of old information about a firm.

D)None of the Answer s is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

In present value terms, a risky future dollar is worth compared to a risk-free future dollar because of the .

A)less; risk premium

B)more; risk premium

C)less; inflation rate

D)the same; inflation rate

A)less; risk premium

B)more; risk premium

C)less; inflation rate

D)the same; inflation rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the Fed is worried about inflation, you would expect stock prices to:

A)fall.

B)rise.

C)stay the same.

D)There is not enough information provided to Answer the question.

A)fall.

B)rise.

C)stay the same.

D)There is not enough information provided to Answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following summarizes the classical theory of asset prices? I. An asset price equals the present value of expected income from the asset.

II) Expected income is the second best possible forecast based on all public information.

III) The interest rate in the present value formula is the safe interest rate plus a risk premium.

A)I only

B)II only

C)III only

D)I and III

II) Expected income is the second best possible forecast based on all public information.

III) The interest rate in the present value formula is the safe interest rate plus a risk premium.

A)I only

B)II only

C)III only

D)I and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

When the pain medicine Vioxx was found to increase the risk of heart attack, the stock price of Merck (the manufacturer) because potential buyers of the stock used to predict earnings would .

A)rose; past information; grow

B)rose; adaptive expectations; fall

C)fell; rational expectations; fall

D)fell; adaptive expectations; rise

A)rose; past information; grow

B)rose; adaptive expectations; fall

C)fell; rational expectations; fall

D)fell; adaptive expectations; rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

A higher interest rate asset prices, because it the present value of the .

A)reduces; reduces; risk premium

B)reduces; increases; safe rate

C)reduces; increases; income flow

D)reduces; reduces; expected earnings

A)reduces; reduces; risk premium

B)reduces; increases; safe rate

C)reduces; increases; income flow

D)reduces; reduces; expected earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

The difference between the risk-free and risky interest rate is the:

A)rate of inflation.

B)depreciation rate.

C)zero.

D)risk premium.

A)rate of inflation.

B)depreciation rate.

C)zero.

D)risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Suppose people expect the Fed to increase interest rates. When the rate change happens, stock prices will:

A)stay the same.

B)rise.

C)fall.

D)There is not enough information provided to Answer the question.

A)stay the same.

B)rise.

C)fall.

D)There is not enough information provided to Answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

Suppose you read in the paper that Pfizer has a new drug to cure diabetes. Using , you would expect the stock price to .

A)adaptive expectations; rise

B)rational expectations; rise

C)past information; rise

D)adaptive expectations; fall

A)adaptive expectations; rise

B)rational expectations; rise

C)past information; rise

D)adaptive expectations; fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

If an increase in the safe interest rate is completely offset by a fall in the risk premium, the present value of a risky asset:

A)stays the same.

B)rises.

C)falls.

D)There is not enough information provided to Answer the question.

A)stays the same.

B)rises.

C)falls.

D)There is not enough information provided to Answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

If people base their forecasts on rational expectations, their forecast is the:

A)only forecast based on previous observations.

B)best possible forecast based on all private information.

C)best possible forecast based on past observations.

D)best possible forecast based on all public information.

A)only forecast based on previous observations.

B)best possible forecast based on all private information.

C)best possible forecast based on past observations.

D)best possible forecast based on all public information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose you read in the paper that Pfizer has a new drug to cure diabetes. Using , you would expect the stock price to because .

A)rational expectations; rise; earnings will grow

B)adaptive expectations; rise; earnings will grow

C)past information; rise; costs will grow

D)adaptive expectations; fall; earnings will fall

A)rational expectations; rise; earnings will grow

B)adaptive expectations; rise; earnings will grow

C)past information; rise; costs will grow

D)adaptive expectations; fall; earnings will fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the Fed is worried about inflation, you would expect stock prices to , and if it is worried about falling earnings, you might expect stock prices to .

A)rise; rise

B)fall; rise

C)rise; fall

D)stay the same; rise

A)rise; rise

B)fall; rise

C)rise; fall

D)stay the same; rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

In an asset-price bubble, asset prices rise because:

A)people expect them to rise.

B)interest rates fall, increasing the present value of expected earnings.

C)expected earnings rise.

D)of a fall in the risk premium.

A)people expect them to rise.

B)interest rates fall, increasing the present value of expected earnings.

C)expected earnings rise.

D)of a fall in the risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

An asset-price bubble is defined as a:

A)gradual change in asset prices due to changes in expected earnings.

B)gradual rise in asset prices that is not justified by changes in interest rates or expected earnings.

C)rapid rise in asset prices that is not justified by changes in interest rates or expected earnings.

D)rapid change in asset prices due to changes in interest rates.

A)gradual change in asset prices due to changes in expected earnings.

B)gradual rise in asset prices that is not justified by changes in interest rates or expected earnings.

C)rapid rise in asset prices that is not justified by changes in interest rates or expected earnings.

D)rapid change in asset prices due to changes in interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is a possible indicator that an asset-price crash is over?

A)stock price < past earnings

B)stock price < expected earnings

C)stock price > expected earnings

D)change in stock price < 0

A)stock price < past earnings

B)stock price < expected earnings

C)stock price > expected earnings

D)change in stock price < 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

The largest single-day percentage decline in the Dow Jones stock index occurred in and is called .

A)1921; Bloody Monday

B)1921; Black Monday

C)1987; Black Monday

D)2001; Bloody Tuesday

A)1921; Bloody Monday

B)1921; Black Monday

C)1987; Black Monday

D)2001; Bloody Tuesday

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

A margin requirement:

A)limits the amount an investor can spend on stocks.

B)limits the amount a buyer can borrow to buy stocks.

C)limits the amount of stock a firm can issue.

D)is the ratio of stocks to total assets held by an individual.

A)limits the amount an investor can spend on stocks.

B)limits the amount a buyer can borrow to buy stocks.

C)limits the amount of stock a firm can issue.

D)is the ratio of stocks to total assets held by an individual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

One of the first documented asset-price bubbles occurred in which country and in which market?

A)The Netherlands and tulips

B)Spain and gold

C)the United States and silver

D)Spain and roses

A)The Netherlands and tulips

B)Spain and gold

C)the United States and silver

D)Spain and roses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

The stock market rise during the "Roaring Twenties" reflected which of the following new technologies?

A)the telephone

B)electric appliances

C)air travel

D)railroads

A)the telephone

B)electric appliances

C)air travel

D)railroads

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

A circuit breaker is a requirement that a securities exchange shut down:

A)permanently if prices drop by a specified percentage.

B)temporarily if prices drop by a specified percentage.

C)temporarily if prices drop by 100%.

D)if trading reaches over one million shares sold in a single day.

A)permanently if prices drop by a specified percentage.

B)temporarily if prices drop by a specified percentage.

C)temporarily if prices drop by 100%.

D)if trading reaches over one million shares sold in a single day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

Speculative asset-price bubbles can afflict which markets?

A)stock

B)oil

C)real estate

D)All of the Answer s are correct.

A)stock

B)oil

C)real estate

D)All of the Answer s are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

The yield to maturity is the that equalizes the present value of payments from a bond to its .

A)interest rate; face value

B)interest rate; current price

C)coupon payment; face value

D)time; interest rate

A)interest rate; face value

B)interest rate; current price

C)coupon payment; face value

D)time; interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

At the New York Stock Exchange, trading ceases temporarily if the falls by about .

A)NASDAQ; 10%

B)Russell 2000; 5%

C)Dow Jones Average; 10%

D)Dow Jones Average; 20%

A)NASDAQ; 10%

B)Russell 2000; 5%

C)Dow Jones Average; 10%

D)Dow Jones Average; 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

An asset-price crash is:

A)a small rapid fall in asset prices.

B)a large gradual fall in asset prices.

C)a large rapid fall in asset prices.

D)all asset prices converging to their equilibrium prices.

A)a small rapid fall in asset prices.

B)a large gradual fall in asset prices.

C)a large rapid fall in asset prices.

D)all asset prices converging to their equilibrium prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

The P/E ratio is a company's:

A)profits divided by its earning per share.

B)profits divided by its stock price.

C)stock price divided by its earning per share.

D)stock price divided by its total profits.

A)profits divided by its earning per share.

B)profits divided by its stock price.

C)stock price divided by its earning per share.

D)stock price divided by its total profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

A rising P/E ratio could be explained by:

A)a decline in the Dow Jones Industrial Average.

B)an increase in inflation.

C)a fall in expected earnings.

D)irrational exuberance.

A)a decline in the Dow Jones Industrial Average.

B)an increase in inflation.

C)a fall in expected earnings.

D)irrational exuberance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

A potential asset-price bubble can be seen by examining a in the ratio.

A)gradual increase; price-to-earnings

B)gradual increase; GDP-to-stock market

C)sharp increase; price-to-earnings

D)fall; inflation-unemployment

A)gradual increase; price-to-earnings

B)gradual increase; GDP-to-stock market

C)sharp increase; price-to-earnings

D)fall; inflation-unemployment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

A key reason that the stock market crash of 1987 was so large was the increased use of , and thus provoked the use of .

A)computers and program trading; circuit breakers

B)computers; margin requirements

C)poor expectations; better asset information

D)human error; margin requirements

A)computers and program trading; circuit breakers

B)computers; margin requirements

C)poor expectations; better asset information

D)human error; margin requirements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

An asset-price crash occurs generally because:

A)of one big piece of bad news.

B)people expect price increases to climb forever.

C)of a panic.

D)a CEO makes a bad decision.

A)of one big piece of bad news.

B)people expect price increases to climb forever.

C)of a panic.

D)a CEO makes a bad decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

A key assumption of using price-earnings ratio as a measure of a potential future asset-price bubble is that:

A)past earnings are mirror images of the future.

B)past earnings are a decent guide to future earnings.

C)future earnings are known with certainty.

D)inflation is zero.

A)past earnings are mirror images of the future.

B)past earnings are a decent guide to future earnings.

C)future earnings are known with certainty.

D)inflation is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

Speculative asset-price bubbles can be started by:

A)institutional changes to the economy.

B)a stock analyst.

C)a fall in interest rates.

D)a change in GDP growth.

A)institutional changes to the economy.

B)a stock analyst.

C)a fall in interest rates.

D)a change in GDP growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

Believers in the classical theory of asset prices point to which of the following events as proof that stock markets did not bubble in the late 1990s?

A)the terrorist attacks of September 11, 2001

B)the discovery of false accounting at companies such as Enron

C)the recession of 2001-2002

D)All of the Answer s are correct.

A)the terrorist attacks of September 11, 2001

B)the discovery of false accounting at companies such as Enron

C)the recession of 2001-2002

D)All of the Answer s are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the interest rate , the yield to maturity .

A)rises; falls

B)rises; rises

C)falls; falls

D)rises; stays the same

A)rises; falls

B)rises; rises

C)falls; falls

D)rises; stays the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

If the bond price , the yield to maturity .

A)falls; rises

B)rises; rises

C)falls; stays the same

D)There is not enough information provided to Answer the question.

A)falls; rises

B)rises; rises

C)falls; stays the same

D)There is not enough information provided to Answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

63

The relationship between bond interest rates with different maturities is called the:

A)liquidity preference theory.

B)term structure of interest rates.

C)supply of loanable funds.

D)balance of payments.

A)liquidity preference theory.

B)term structure of interest rates.

C)supply of loanable funds.

D)balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

64

If i (t) and i (t) are the interest rates on a 2-year and 1-year bond issued this year and i (t + 1) 2 1 1

Is the 1-year rate next year, the equilibrium relationship between the 2-year bond and the two

1-year bonds is:

A)i (t) = [i (t + 1) - i (t + 1)]12. 2 1 1

B)i (t) = 2·[i (t) + i (t + 1)]. 2 1 1

C)i (t) = (1/2)[i (t) + i (t + 1)].

D)i (t) = i (t) + i (t + 1). 2 1 1

Is the 1-year rate next year, the equilibrium relationship between the 2-year bond and the two

1-year bonds is:

A)i (t) = [i (t + 1) - i (t + 1)]12. 2 1 1

B)i (t) = 2·[i (t) + i (t + 1)]. 2 1 1

C)i (t) = (1/2)[i (t) + i (t + 1)].

D)i (t) = i (t) + i (t + 1). 2 1 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

65

If P 0

= 110 is the initial price of the security, P

1

= 100 is the price after you hold it for a year,

And represents a direct payment, an asset's rate of return is equal to:

A)-8.2%.

B)-0.045%.

C)0.9%.

D)3.6%.

= 110 is the initial price of the security, P

1

= 100 is the price after you hold it for a year,

And represents a direct payment, an asset's rate of return is equal to:

A)-8.2%.

B)-0.045%.

C)0.9%.

D)3.6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

66

On last night's evening business news show you hear that "bond prices rose"; this is another way of saying that:

A)"interest rates were unchanged."

B)"the risk premium rates rose."

C)"interest rates fell."

D)"interest rates rose."

A)"interest rates were unchanged."

B)"the risk premium rates rose."

C)"interest rates fell."

D)"interest rates rose."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

67

According to the expectations theory of the term structure, the n-period interest rate is the:

A)average of the known interest rates over the next n periods. average of

B)the current one-period rate and expected n-period rate. median of the

C)current one-period rate and expected rates over the next n periods.

D)average of the current one-period rate and expected rates over the next n

A)average of the known interest rates over the next n periods. average of

B)the current one-period rate and expected n-period rate. median of the

C)current one-period rate and expected rates over the next n periods.

D)average of the current one-period rate and expected rates over the next n

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

68

According to the expectations theory of the term structure, the equilibrium relationship between the n-period interest rate and the n 1-year interest rates is:

A)i (t) = (1/n)[i (t) + i (t + 1) + ... + i (t + n - 1)]. n 1 1 1

B)Ei (t) = (1/n)[i (t) + i (t + 1) + … + i (t + n - 1)]. n 1 1 1

C)Ei (t) = n·[i (t) + Ei (t + 1) + ... + Ei (t + n - 1)]. n 1 1 1

D)i (t) = (1/n)[i (t) + Ei (t + 1) + ... + Ei (t + n - 1)].

A)i (t) = (1/n)[i (t) + i (t + 1) + ... + i (t + n - 1)]. n 1 1 1

B)Ei (t) = (1/n)[i (t) + i (t + 1) + … + i (t + n - 1)]. n 1 1 1

C)Ei (t) = n·[i (t) + Ei (t + 1) + ... + Ei (t + n - 1)]. n 1 1 1

D)i (t) = (1/n)[i (t) + Ei (t + 1) + ... + Ei (t + n - 1)].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following definitions is incorrect? I. Capital gain: the increase in an asset holder's wealth from a change in the asset's price

II. Return: the capital gain or loss from holding a security

III. Rate of return: return on a security as a percentage of its initial price

A)I

B)II

C)III

D)All of the Answer s are correct.

II. Return: the capital gain or loss from holding a security

III. Rate of return: return on a security as a percentage of its initial price

A)I

B)II

C)III

D)All of the Answer s are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

70

Historically, most inverted yield curves have been caused by the Fed in an effort to:

A)increase economic growth.

B)slow inflation.

C)increase unemployment.

D)demonstrate their power.

A)increase economic growth.

B)slow inflation.

C)increase unemployment.

D)demonstrate their power.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

71

An unusually steep yield curve suggests that:

A)short-term interest rates are expected to rise.

B)short-term interest rates are expected to fall.

C)the economy is headed for a recession.

D)long-term interest rates will rise.

A)short-term interest rates are expected to rise.

B)short-term interest rates are expected to fall.

C)the economy is headed for a recession.

D)long-term interest rates will rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

72

To account for risk in the expectations theory of the term structure, we:

A)set the period rate equal to the risk premium.

B)add a risk premium to the current period's 1-year interest rate.

C)add a risk premium to the average of the current one-period rate and expected rates over the next periods.

D)divide the average of the current one-period rate and expected rates over the next periods by a risk premium.

A)set the period rate equal to the risk premium.

B)add a risk premium to the current period's 1-year interest rate.

C)add a risk premium to the average of the current one-period rate and expected rates over the next periods.

D)divide the average of the current one-period rate and expected rates over the next periods by a risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

73

If P 0

= 100 is the initial price of the security and P

1

= 103 is the price after you hold it for a

Year, the asset's rate of return is equal to:

A)3%.

B)7%.

C)13%.

D)103%.

= 100 is the initial price of the security and P

1

= 103 is the price after you hold it for a

Year, the asset's rate of return is equal to:

A)3%.

B)7%.

C)13%.

D)103%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

74

The expectations theory of the term structure of interest rates ignores:

A)risk.

B)different maturities.

C)the role of expectations.

D)None of the Answer s is correct.

A)risk.

B)different maturities.

C)the role of expectations.

D)None of the Answer s is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

75

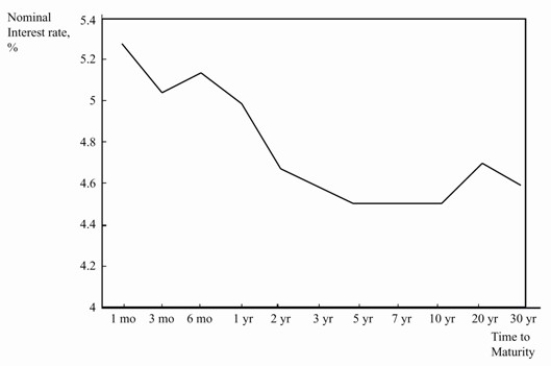

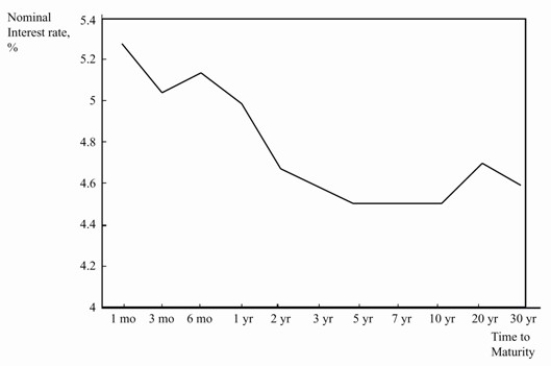

(Figure 16.1 The Yield Curve)  Your mother asks you to explain the yield curve from November 11, 2006. She suspects something is wrong but isn't sure. What do you tell her? And what explanations do you have for why her suspicions are right?

Your mother asks you to explain the yield curve from November 11, 2006. She suspects something is wrong but isn't sure. What do you tell her? And what explanations do you have for why her suspicions are right?

Your mother asks you to explain the yield curve from November 11, 2006. She suspects something is wrong but isn't sure. What do you tell her? And what explanations do you have for why her suspicions are right?

Your mother asks you to explain the yield curve from November 11, 2006. She suspects something is wrong but isn't sure. What do you tell her? And what explanations do you have for why her suspicions are right?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

76

Consider the following two options:

a. You have $100 today and you put it into a savings account for 5 years, earning 5%; or b. You have $100 today and you put it into a savings account for 10 years, earning

2.5%.Which scenario has a higher future value when you take the money from the account? Explain.

a. You have $100 today and you put it into a savings account for 5 years, earning 5%; or b. You have $100 today and you put it into a savings account for 10 years, earning

2.5%.Which scenario has a higher future value when you take the money from the account? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the n 1-year interest rates are expected to remain constant and the term premium rises with maturity, the yield curve would:

A)slope upward.

B)slope downward.

C)be flat.

D)be vertical.

A)slope upward.

B)slope downward.

C)be flat.

D)be vertical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the n 1-year interest rates are expected to fall dramatically, the yield curve would:

A)slope upward.

B)slope downward.

C)be flat.

D)There is not enough information provided to Answer the question.

A)slope upward.

B)slope downward.

C)be flat.

D)There is not enough information provided to Answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

79

If i (2020) denotes the annual interest rate on 2-year bonds issued in 2020 and i (2020) and 2 1

I (2021) represent interest rates on 1-year bonds purchased in 2020 and 2021, the

1

Equilibrium relationship between the 2-year bond and the two 1-year bonds is:

A)i (2020) = i (2020) + i (2021). 2 1 1

B)i (2020) = (1/2)[i (2020) + i (2021)].

C)i (2020) = (1/2)[i (2020) - i (2021)]. 2 1 1

D)i (2020) = 2·[i (2020) + i (2021)]. 2 1 1

I (2021) represent interest rates on 1-year bonds purchased in 2020 and 2021, the

1

Equilibrium relationship between the 2-year bond and the two 1-year bonds is:

A)i (2020) = i (2020) + i (2021). 2 1 1

B)i (2020) = (1/2)[i (2020) + i (2021)].

C)i (2020) = (1/2)[i (2020) - i (2021)]. 2 1 1

D)i (2020) = 2·[i (2020) + i (2021)]. 2 1 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

80

The graph that compares interest rates with different maturities is called the:

A)Phillips curve.

B)Fisher curve.

C)Keynesian cross.

D)yield curve.

A)Phillips curve.

B)Fisher curve.

C)Keynesian cross.

D)yield curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck