Deck 24: Other Property and Liability Insurance Coverages

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 24: Other Property and Liability Insurance Coverages

1

Pedro owns a sixplex apartment building and lives in one unit. The building is insured under the Dwelling Property 1 (basic form) policy for $320,000. The replacement cost of the building is $400,000. Explain to what extent, if any, Pedro will recover for the following losses:

a. A fire occurs in one of the apartments because of defective wiring. The actual cash value of the damage is $20,000, and the replacement cost is $24,000.

b. The tenants move out because the apartment is unfit for normal living. It will take three months to restore the apartment to its former condition. The apartment is normally rented for $900 monthly.

c. A tenant's personal property is damaged in the fire. The actual cash value of the damaged property is $5000, and its replacement cost is $7000.

a. A fire occurs in one of the apartments because of defective wiring. The actual cash value of the damage is $20,000, and the replacement cost is $24,000.

b. The tenants move out because the apartment is unfit for normal living. It will take three months to restore the apartment to its former condition. The apartment is normally rented for $900 monthly.

c. A tenant's personal property is damaged in the fire. The actual cash value of the damaged property is $5000, and its replacement cost is $7000.

Dwelling property program:

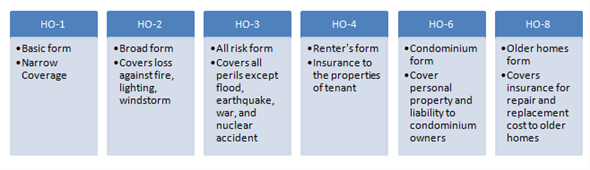

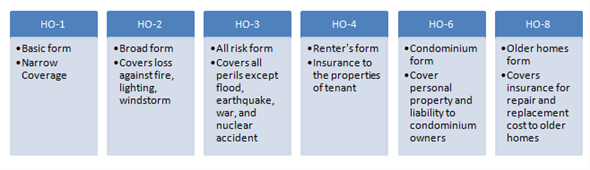

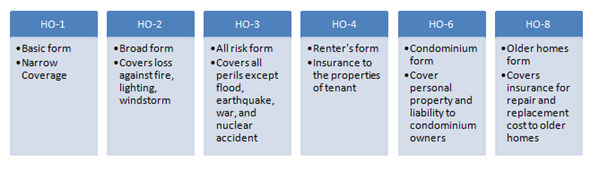

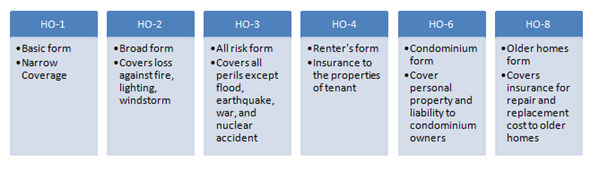

Homeowner's policy provides protection to the owner of home against several perils. The first homeowner policy in United States was provided in 1735. Afterwards, several companies offered different types of homeowner's policies. The different types of homeowner's policies are:

Basic form:

Basic form:

HO‑₁ is the basic form of homeowners' policy. This policy is similar to policy of dwelling property 1. The basic form of policy protects from fire, windstorm, explosion, aircraft and vehicles. This policy is covered under five headings:

Coverage A: Dwelling

Coverage A insures the dwelling place and any necessary structure associated with the dwelling place.

Coverage B: Other structures

Coverage B insures the places other than dwelling place. It insures the structures like fencing, horse stable and other structures.

Coverage C: Personal property

It covers the loss of damages of personal property of the insured person. The personal property may be at anywhere. The maximum amount of coverage is 10 percent of part a.Coverage D: Loss of use

It refers to the additional living expenses due to damages to the dwelling place. The maximum amount of coverage is 20 percent of dwelling amount insurance.

Coverage E: Additional coverage

This coverage is available with additional amount of premium. It includes debris, planting trees, repairs and fire.

a.The fire occurred in the building and the policy was made for $320,000. The actual cash value of the damages is $20,000 however the replacement cost is $24,000. The dollar amount receivable from the insurance policy will be $20,000. (Note: The insurance claim can be made on basis of actual value or replacement value of loss. Generally, it is made on basis of actual cash value of loss.)

b.The cost of rental paid will be covered under Part D (loss of use). The maximum amount of claim is 20 percent of $20,000. It will be $4,000. The actual amount of loss is $2,100 ($900 per month for three months). Hence, the cash value of loss receivable from insurance policy will be $2,100.

c.The personal property damage is claimed under part C of the policy. It will be 10 percent of the damages paid in part A or $2,000. However, the actual cash value of loss is $5,000. The amount payable by the insurance company will be $2,000.

Homeowner's policy provides protection to the owner of home against several perils. The first homeowner policy in United States was provided in 1735. Afterwards, several companies offered different types of homeowner's policies. The different types of homeowner's policies are:

Basic form:

Basic form: HO‑₁ is the basic form of homeowners' policy. This policy is similar to policy of dwelling property 1. The basic form of policy protects from fire, windstorm, explosion, aircraft and vehicles. This policy is covered under five headings:

Coverage A: Dwelling

Coverage A insures the dwelling place and any necessary structure associated with the dwelling place.

Coverage B: Other structures

Coverage B insures the places other than dwelling place. It insures the structures like fencing, horse stable and other structures.

Coverage C: Personal property

It covers the loss of damages of personal property of the insured person. The personal property may be at anywhere. The maximum amount of coverage is 10 percent of part a.Coverage D: Loss of use

It refers to the additional living expenses due to damages to the dwelling place. The maximum amount of coverage is 20 percent of dwelling amount insurance.

Coverage E: Additional coverage

This coverage is available with additional amount of premium. It includes debris, planting trees, repairs and fire.

a.The fire occurred in the building and the policy was made for $320,000. The actual cash value of the damages is $20,000 however the replacement cost is $24,000. The dollar amount receivable from the insurance policy will be $20,000. (Note: The insurance claim can be made on basis of actual value or replacement value of loss. Generally, it is made on basis of actual cash value of loss.)

b.The cost of rental paid will be covered under Part D (loss of use). The maximum amount of claim is 20 percent of $20,000. It will be $4,000. The actual amount of loss is $2,100 ($900 per month for three months). Hence, the cash value of loss receivable from insurance policy will be $2,100.

c.The personal property damage is claimed under part C of the policy. It will be 10 percent of the damages paid in part A or $2,000. However, the actual cash value of loss is $5,000. The amount payable by the insurance company will be $2,000.

2

The ISO dwelling program has several forms. Describe the characteristics of each of the following:

a. Dwelling Property 1 (basic form)

b. Dwelling Property 2 (broad form)

c. Dwelling Property 3 (special form)

a. Dwelling Property 1 (basic form)

b. Dwelling Property 2 (broad form)

c. Dwelling Property 3 (special form)

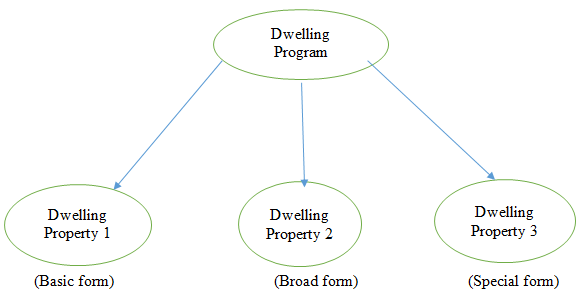

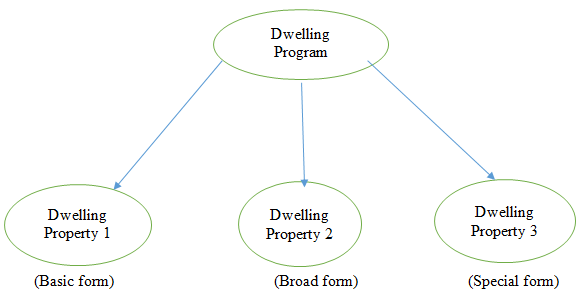

Dwelling program is one of the insurance program that covers the personal property and home of the insured person.

Dwelling insurance is somewhat similar to the homeowner's insurance. The program is mainly designed for people who are ineligible for coverage under homeowner's policy.

The dwelling program includes the three basic forms:

• Dwelling property 1(Basic form): It is a basic form that provides coverage for a limited number of perils.

• Dwelling property 1(Basic form): It is a basic form that provides coverage for a limited number of perils.

The main characteristics of Basic form of dwelling program are the following.

• It provides coverage for direct physical loss caused by fire, lightening, internal explosion, volcanic eruption, riots, smoke etc.• It covers only limited number of perils that apply to both dwelling and personal property.

• Under this. All losses are paid on cash value basis.

• It provides cover to the personal property of the insured person and resident family members.

• Under this, endorsement can be added to the basic form, which provides coverage for additional living expenses.

• Dwelling property 2 (Broad form): The dwelling property 2 is a broad form that includes all perils covered under the basic form and some additional perils.

The main characteristics of Broad form of dwelling program are the followings.

• This form provides broader coverage than the basic form of dwelling program.

• It provides coverage for physical losses caused by fire, lightening and also includes extended coverage perils like vehicles, falling objects, wind hail, smoke, accidental damage etc.• Losses are covered on the basis of replacement cost under broad form of dwelling property.

• It also includes coverage for additional living expenses.

• It also covers damages like electrical damage, collapses, sudden and accidental tearing, burning or bulging.

• Dwelling property 3 (Special form): The Dwelling property 3 is a special form that covers the dwelling and other structures against direct loss to property.

The main characteristics of Special form of dwelling program are the followings.

• It provides the broadest coverage of the three dwelling programs.

• Under this, open perils coverage on real property are included.• It covers gradual and expected losses such as smog, wear and tear, marring, rust, mold and contamination etc.• It also provides coverage for the personal property.

• It also included coverage for losses caused by birds, rodents, insects and other domestic animals.

Dwelling insurance is somewhat similar to the homeowner's insurance. The program is mainly designed for people who are ineligible for coverage under homeowner's policy.

The dwelling program includes the three basic forms:

• Dwelling property 1(Basic form): It is a basic form that provides coverage for a limited number of perils.

• Dwelling property 1(Basic form): It is a basic form that provides coverage for a limited number of perils.The main characteristics of Basic form of dwelling program are the following.

• It provides coverage for direct physical loss caused by fire, lightening, internal explosion, volcanic eruption, riots, smoke etc.• It covers only limited number of perils that apply to both dwelling and personal property.

• Under this. All losses are paid on cash value basis.

• It provides cover to the personal property of the insured person and resident family members.

• Under this, endorsement can be added to the basic form, which provides coverage for additional living expenses.

• Dwelling property 2 (Broad form): The dwelling property 2 is a broad form that includes all perils covered under the basic form and some additional perils.

The main characteristics of Broad form of dwelling program are the followings.

• This form provides broader coverage than the basic form of dwelling program.

• It provides coverage for physical losses caused by fire, lightening and also includes extended coverage perils like vehicles, falling objects, wind hail, smoke, accidental damage etc.• Losses are covered on the basis of replacement cost under broad form of dwelling property.

• It also includes coverage for additional living expenses.

• It also covers damages like electrical damage, collapses, sudden and accidental tearing, burning or bulging.

• Dwelling property 3 (Special form): The Dwelling property 3 is a special form that covers the dwelling and other structures against direct loss to property.

The main characteristics of Special form of dwelling program are the followings.

• It provides the broadest coverage of the three dwelling programs.

• Under this, open perils coverage on real property are included.• It covers gradual and expected losses such as smog, wear and tear, marring, rust, mold and contamination etc.• It also provides coverage for the personal property.

• It also included coverage for losses caused by birds, rodents, insects and other domestic animals.

3

Melissa owns a mobile home that is insured by an endorsement to a Homeowners 3 policy. Explain to what extent, if at all, this policy would pay for each of the following losses:

a. A severe windstorm damages the roof of the mobile home.

b. A built-in range and oven are also damaged in the windstorm.

c. A window air conditioner is badly damaged in the windstorm.

d. Melissa must move to a furnished apartment for three months while the mobile home is being repaired.

a. A severe windstorm damages the roof of the mobile home.

b. A built-in range and oven are also damaged in the windstorm.

c. A window air conditioner is badly damaged in the windstorm.

d. Melissa must move to a furnished apartment for three months while the mobile home is being repaired.

Homeowner's policy:

Homeowner's policy provides protection to the owner of home against several perils. The first homeowner policy in United States was provided in 1735. Afterwards, several companies offered different types of homeowner's policies. The different types of homeowner's policies are:

HO‑₃ is special form of homeowners' policy. It insures the dwelling and structures directly attached to the dwelling place and necessary for the dwelling structure. This policy insures against direct physical loss. The basic coverage under HO‑₃ policy is:

HO‑₃ is special form of homeowners' policy. It insures the dwelling and structures directly attached to the dwelling place and necessary for the dwelling structure. This policy insures against direct physical loss. The basic coverage under HO‑₃ policy is:

Coverage A: Dwelling

Coverage A insures the dwelling place and any necessary structure associated with the dwelling place.

Coverage B: Other structures

Coverage B insures the places other than dwelling place. It insures the structures like fencing, horse stable and other structures. The maximum insurance amount is 10 percent of dwelling.

Coverage C: Personal property

It covers the loss of damages of personal property of the insured person. The personal property may be at anywhere. The maximum amount of coverage for mobile home is 40 percent of part a.Coverage D: Loss of use

It refers to the additional living expenses due to damages to the dwelling place. The maximum amount of coverage is 20 percent of dwelling amount insurance.

Coverage E: Additional coverage

This coverage is available with additional amount of premium. It includes debris, planting trees, repairs and fire.

a.A severe windstorm has damaged the roof of mobile home. The damage of roof will be covered under the Coverage A of homeowners' policy. And the damage claim will be made according to the amount of insurance made for dwelling.

b.The damage of built in oven will be claimed under Coverage C (personal property) of HO‑₃. The maximum amount of damage claim is 40 percent of the amount insured under Coverage a.c.The damage of window conditioner will be claimed under Coverage C (personal property) of HO‑₃. The maximum amount of damage claim is 40 percent of the amount insured under Coverage a.d.The rental value paid for three months will be claimed under Coverage D (loss of use) of HO‑₃. The maximum amount of damage claim is 20 percent of the amount insured under Coverage a.

Homeowner's policy provides protection to the owner of home against several perils. The first homeowner policy in United States was provided in 1735. Afterwards, several companies offered different types of homeowner's policies. The different types of homeowner's policies are:

HO‑₃ is special form of homeowners' policy. It insures the dwelling and structures directly attached to the dwelling place and necessary for the dwelling structure. This policy insures against direct physical loss. The basic coverage under HO‑₃ policy is:

HO‑₃ is special form of homeowners' policy. It insures the dwelling and structures directly attached to the dwelling place and necessary for the dwelling structure. This policy insures against direct physical loss. The basic coverage under HO‑₃ policy is:Coverage A: Dwelling

Coverage A insures the dwelling place and any necessary structure associated with the dwelling place.

Coverage B: Other structures

Coverage B insures the places other than dwelling place. It insures the structures like fencing, horse stable and other structures. The maximum insurance amount is 10 percent of dwelling.

Coverage C: Personal property

It covers the loss of damages of personal property of the insured person. The personal property may be at anywhere. The maximum amount of coverage for mobile home is 40 percent of part a.Coverage D: Loss of use

It refers to the additional living expenses due to damages to the dwelling place. The maximum amount of coverage is 20 percent of dwelling amount insurance.

Coverage E: Additional coverage

This coverage is available with additional amount of premium. It includes debris, planting trees, repairs and fire.

a.A severe windstorm has damaged the roof of mobile home. The damage of roof will be covered under the Coverage A of homeowners' policy. And the damage claim will be made according to the amount of insurance made for dwelling.

b.The damage of built in oven will be claimed under Coverage C (personal property) of HO‑₃. The maximum amount of damage claim is 40 percent of the amount insured under Coverage a.c.The damage of window conditioner will be claimed under Coverage C (personal property) of HO‑₃. The maximum amount of damage claim is 40 percent of the amount insured under Coverage a.d.The rental value paid for three months will be claimed under Coverage D (loss of use) of HO‑₃. The maximum amount of damage claim is 20 percent of the amount insured under Coverage a.

4

Explain how personal liability insurance can be added to a dwelling policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

Morgan has an outboard motorboat insured under a boatowners package policy. Indicate whether each of the following losses would be covered under Morgan's policy. If the loss is not covered, or not completely covered, explain why.

a. Morgan's boat was badly damaged when it struck a log floating in the water.

b. An occupant in Morgan's boat was injured and incurred medical expenses when the boat struck a concrete abutment.

c. The motor was stolen when the boat was docked at a marina.

d. A small child in Morgan's boat was not wearing a life jacket. The child fell overboard and drowned. The child's parents have sued Morgan.

a. Morgan's boat was badly damaged when it struck a log floating in the water.

b. An occupant in Morgan's boat was injured and incurred medical expenses when the boat struck a concrete abutment.

c. The motor was stolen when the boat was docked at a marina.

d. A small child in Morgan's boat was not wearing a life jacket. The child fell overboard and drowned. The child's parents have sued Morgan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

Describe the basic characteristics of inland marine floaters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

Dan has a personal umbrella policy with a $1 million limit. The self-insured retention is $250. Dan has a homeowners policy with no special endorsements and an auto insurance policy. The policies have the following liability limits:

Homeowners policy: $300,000

Personal auto policy: $250,000/$500,000/$50,000

The liability limits meet the umbrella insurer's requirements with respect to the minimum amounts of liability insurance on the underlying contracts. Indicate whether each of the following losses would be covered under Dan's personal umbrella policy. If the loss is not covered, or not covered fully, explain why.

a. Dan coaches a Little League baseball team. A team member sitting behind third base was struck in the face by a line drive and lost the sight in one eye. Dan is sued by the parents, who allege that his coaching and supervision are inadequate. The team member is awarded damages of $1 million.

b. Dan is a member of the board of directors for the local YMCA. The YMCA is a nonprofit organization. Dan is sued by a YMCA member who was seriously injured when a trampoline collapsed. The injured member is awarded damages of $500,000.

c. Dan accuses a male teenager, age 14, of stealing his racing bike valued at $2000. The police arrest the youth and book him. The police later arrest the actual thief and recover the bicycle. Dan is sued by the youth's parents for false arrest. The teenager is awarded damages of $100,000.

d. Dan is driving to his son's soccer game. He fails to stop at a red light, and his car strikes another motorist. The injured motorist is awarded damages of $200,000.

Homeowners policy: $300,000

Personal auto policy: $250,000/$500,000/$50,000

The liability limits meet the umbrella insurer's requirements with respect to the minimum amounts of liability insurance on the underlying contracts. Indicate whether each of the following losses would be covered under Dan's personal umbrella policy. If the loss is not covered, or not covered fully, explain why.

a. Dan coaches a Little League baseball team. A team member sitting behind third base was struck in the face by a line drive and lost the sight in one eye. Dan is sued by the parents, who allege that his coaching and supervision are inadequate. The team member is awarded damages of $1 million.

b. Dan is a member of the board of directors for the local YMCA. The YMCA is a nonprofit organization. Dan is sued by a YMCA member who was seriously injured when a trampoline collapsed. The injured member is awarded damages of $500,000.

c. Dan accuses a male teenager, age 14, of stealing his racing bike valued at $2000. The police arrest the youth and book him. The police later arrest the actual thief and recover the bicycle. Dan is sued by the youth's parents for false arrest. The teenager is awarded damages of $100,000.

d. Dan is driving to his son's soccer game. He fails to stop at a red light, and his car strikes another motorist. The injured motorist is awarded damages of $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

A personal articles floater (PAF) provides broad protection for valuable personal property. Give three examples of property that might require coverage under a PAF instead of a standard homeowners policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

Lori has a personal umbrella policy with a $1 million limit. The self-insured retention is $250. Lori has a homeowners policy with no special endorsements and an auto insurance policy. The policies have the following liability limits:

Homeowners policy: $300,000

Personal auto policy: $250,000/$500,000/ $50,000

The liability limits meet the umbrella insurer's requirements with respect to the minimum amounts of liability insurance on the underlying contracts. Indicate the amount, if any, that would be paid by Lori's umbrella policy for each of the following losses.

a. Lori's dog bites a small child. The parents sue Lori and are awarded damages of $25,000.

b. Lori failed to stop at a red light, and her car hit a school bus. Two children are severely injured. A court awards each child damages in the amount of $350,000.

c. Lori is a volunteer for a local nonprofit charity. While being interviewed on television with other guests, Lori calls one of the guests a "bag lady." The guest sues Lori for defamation of character and is awarded damages of $25,000.

d. Lori is a member of the board of directors for a local bank. She receives an annual fee of $50,000 for her service as a board member. She is also a member of the board's audit committee. The shareholders sue Lori and other board members for not discovering several fraudulent accounting transactions that caused millions of dollars of losses to the shareholders. A court awards the shareholders damages of $5 million.

Homeowners policy: $300,000

Personal auto policy: $250,000/$500,000/ $50,000

The liability limits meet the umbrella insurer's requirements with respect to the minimum amounts of liability insurance on the underlying contracts. Indicate the amount, if any, that would be paid by Lori's umbrella policy for each of the following losses.

a. Lori's dog bites a small child. The parents sue Lori and are awarded damages of $25,000.

b. Lori failed to stop at a red light, and her car hit a school bus. Two children are severely injured. A court awards each child damages in the amount of $350,000.

c. Lori is a volunteer for a local nonprofit charity. While being interviewed on television with other guests, Lori calls one of the guests a "bag lady." The guest sues Lori for defamation of character and is awarded damages of $25,000.

d. Lori is a member of the board of directors for a local bank. She receives an annual fee of $50,000 for her service as a board member. She is also a member of the board's audit committee. The shareholders sue Lori and other board members for not discovering several fraudulent accounting transactions that caused millions of dollars of losses to the shareholders. A court awards the shareholders damages of $5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

Identify the coverages found in a typical boatowners package policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

Why are buildings in flood plains difficult to insure by private insurers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

The National Flood Insurance Program (NFIP) has numerous provisions. Briefly explain each of the following:

a. Write-your-own program

b. Meaning of a flood

c. Waiting period

a. Write-your-own program

b. Meaning of a flood

c. Waiting period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

What is the purpose of a FAIR plan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Describe the basic characteristics of title insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

Briefly explain the basic characteristics of a personal umbrella policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck