Deck 3: Acquiring and Organizing Management Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/10

العب

ملء الشاشة (f)

Deck 3: Acquiring and Organizing Management Information

1

What factors affect the choice of accounting period for farmers and ranchers

Accounting Period:

Accounting period is generally a 12 month period in which transactions are recorded and on the basis of which financial reports are prepared at the end of the period.

Fiscal year as an accounting period:

Accounting period other than a calendar year is termed as a fiscal year. Any period of twelve month could be selected as an accounting period. However, for a farm business, accounting period should be selected in a manner that, major operations fall during the accounting period and accounting period should end when farm operations are slow. Also, fiscal year can be adopted in accordance with income tax return.

In general, calendar year suits farm business; since, during December farm operations are slow. However, for farms which are engaged to produce crops like wheat and other winter crops, there would be a lot of operations that are undertaken during December; in such cases, accounting period other than a calendar year could be adopted.

Therefore, fiscal year can be adopted as an accounting period, when a lot of operations are undertaken during December. Also, fiscal year can be adapted to suit income tax purposes.

Accounting period is generally a 12 month period in which transactions are recorded and on the basis of which financial reports are prepared at the end of the period.

Fiscal year as an accounting period:

Accounting period other than a calendar year is termed as a fiscal year. Any period of twelve month could be selected as an accounting period. However, for a farm business, accounting period should be selected in a manner that, major operations fall during the accounting period and accounting period should end when farm operations are slow. Also, fiscal year can be adopted in accordance with income tax return.

In general, calendar year suits farm business; since, during December farm operations are slow. However, for farms which are engaged to produce crops like wheat and other winter crops, there would be a lot of operations that are undertaken during December; in such cases, accounting period other than a calendar year could be adopted.

Therefore, fiscal year can be adopted as an accounting period, when a lot of operations are undertaken during December. Also, fiscal year can be adapted to suit income tax purposes.

2

How would one construct a balance sheet if the accounting was done using a single-entry, cash system

Single Entry System:

It is a book-keeping system in which, transactions are recorded as and when cash has been exchanged in respect of the made transaction.

Construction of balance sheet in case of single-entry, cash system:

In case of single-entry cash system, transactions are recorded as and when cash is exchanged. Preparation of balance sheet is not possible under cash system; since, real accounts are not maintained under this system.

Therefore, in case single entry system is adopted, then year end balances should be adjusted in accordance with accrual system so that it would facilitate decision making and can form a base for preparation of balance sheet.

It is a book-keeping system in which, transactions are recorded as and when cash has been exchanged in respect of the made transaction.

Construction of balance sheet in case of single-entry, cash system:

In case of single-entry cash system, transactions are recorded as and when cash is exchanged. Preparation of balance sheet is not possible under cash system; since, real accounts are not maintained under this system.

Therefore, in case single entry system is adopted, then year end balances should be adjusted in accordance with accrual system so that it would facilitate decision making and can form a base for preparation of balance sheet.

3

Is it possible to use double-entry with a cash accounting system

If so, what are the advantages and disadvantages

If so, what are the advantages and disadvantages

Cash Accounting System:

In cash accounting system, transactions are recorded as and when cash is exchanged in respect of such transactions.

Double Entry System:

In a double entry system, accounting transactions are recorded by debiting one account and crediting another account so that debit values equate with credit values. Accounts to be debited and credited are governed by basic accounting entry rules.

Double entry with cash accounting system:

Double entry system can be adopted along with cash accounting system. In a cash accounting system, accounts payable, receivables, accrued expenses and incomes are not recorded, apart from that, all other transactions are recorded.

Thus, double entry system can be adopted where transactions are recorded on cash basis. Farm businesses adopting this system generally adjust ending balances according to the accrual concept while preparing books using a double entry cash basis.

Advantages of double entry cash basis accounting system:

• Simple to use and maintain.

• Balance sheet can be prepared after several adjusting accounts on accrual basis.

• Ease in computation of taxes.

Disadvantages of double entry cash basis accounting system:

• Balance sheet cannot be prepared in case accounts are not adjusted.

• Actual profit would not be computed.

In cash accounting system, transactions are recorded as and when cash is exchanged in respect of such transactions.

Double Entry System:

In a double entry system, accounting transactions are recorded by debiting one account and crediting another account so that debit values equate with credit values. Accounts to be debited and credited are governed by basic accounting entry rules.

Double entry with cash accounting system:

Double entry system can be adopted along with cash accounting system. In a cash accounting system, accounts payable, receivables, accrued expenses and incomes are not recorded, apart from that, all other transactions are recorded.

Thus, double entry system can be adopted where transactions are recorded on cash basis. Farm businesses adopting this system generally adjust ending balances according to the accrual concept while preparing books using a double entry cash basis.

Advantages of double entry cash basis accounting system:

• Simple to use and maintain.

• Balance sheet can be prepared after several adjusting accounts on accrual basis.

• Ease in computation of taxes.

Disadvantages of double entry cash basis accounting system:

• Balance sheet cannot be prepared in case accounts are not adjusted.

• Actual profit would not be computed.

4

Is it possible to use single-entry with an accrual system

Why or why not

Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

5

Check advertising material for several computerized farm accounting software programs. Are they cash or accrual systems

Single or double entry

How many of the 12 reports from an accounting system discussed in this chapter are available from each program

Are there any additional reports available

Single or double entry

How many of the 12 reports from an accounting system discussed in this chapter are available from each program

Are there any additional reports available

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

6

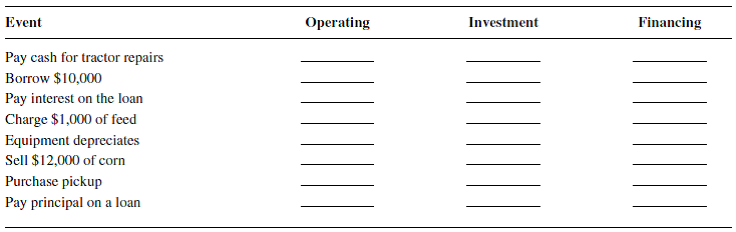

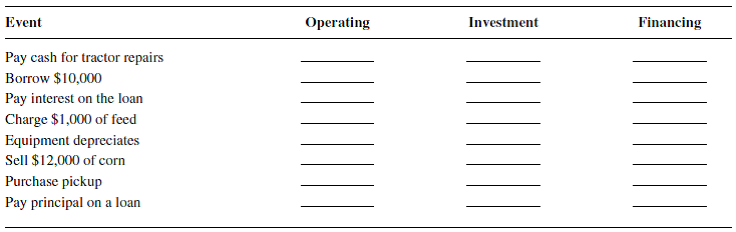

Place an "X" under the column(s) to indicate whether each business event is an operating, investment, or financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

7

Explain the difference between an account payable and an account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

8

What products might a typical farm or ranch have in inventory at the end of a year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is the basic accounting equation

What part of it would a business owner be most interested in seeing increase over time

What part of it would a business owner be most interested in seeing increase over time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

10

Why are the results from an accrual accounting system recommended for use when making management decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck