Deck 4: The Balance Sheet and Its Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/10

العب

ملء الشاشة (f)

Deck 4: The Balance Sheet and Its Analysis

1

True or false. If the debt/equity ratio increases, the debt/asset ratio will also increase. Why

Ratio Analysis:

Ratio analysis is comparing one amount with another relating amount to derive meaningful information. Financial statements are analyzed by using various ratios like debt-equity ratio, current-ratio, and asset-turnover ratio.

Effect of increase in debt equity ratio on debt asset ratio:

Debt equity ratio may increase due to increase in debt, decrease in equity, or both.

Let debt is $100,000 and equity is $50,000.

From basic accounting equation

, asset would be $150,000

, asset would be $150,000

Existing debt equity ratio is 2

Existing debt equity ratio is 2

, and debt asset ratio is 0.67

, and debt asset ratio is 0.67

.

.

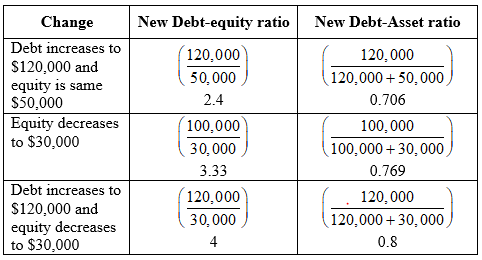

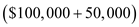

Presentation of effect on change in debt-asset ratio due to increase in debt-equity ratio:

Table (1)

Table (1)

New debt equity ratio is higher than the existing debt-equity ratio of 2. Similarly, debt-asset ratio is also higher than existing ratio of 0.67. Also, with increase in debt equity ratio, debt-asset ratio also increases.

Since debt and equity equates with assets. Increase in debt (numerator) would increase numerator of both the ratios and would increase denominator of debt-asset ratio as well; however, such increase in denominator is equal to increase in numerator. Therefore, it would result in increase in ratio.

Debt equity ratio may also increase due to decrease in equity. This would reduce denominator of both the ratios; therefore, increase in one ratio would result in increase in another ratio as well.

Ratio analysis is comparing one amount with another relating amount to derive meaningful information. Financial statements are analyzed by using various ratios like debt-equity ratio, current-ratio, and asset-turnover ratio.

Effect of increase in debt equity ratio on debt asset ratio:

Debt equity ratio may increase due to increase in debt, decrease in equity, or both.

Let debt is $100,000 and equity is $50,000.

From basic accounting equation

, asset would be $150,000

, asset would be $150,000 Existing debt equity ratio is 2

Existing debt equity ratio is 2 , and debt asset ratio is 0.67

, and debt asset ratio is 0.67 .

.Presentation of effect on change in debt-asset ratio due to increase in debt-equity ratio:

Table (1)

Table (1)New debt equity ratio is higher than the existing debt-equity ratio of 2. Similarly, debt-asset ratio is also higher than existing ratio of 0.67. Also, with increase in debt equity ratio, debt-asset ratio also increases.

Since debt and equity equates with assets. Increase in debt (numerator) would increase numerator of both the ratios and would increase denominator of debt-asset ratio as well; however, such increase in denominator is equal to increase in numerator. Therefore, it would result in increase in ratio.

Debt equity ratio may also increase due to decrease in equity. This would reduce denominator of both the ratios; therefore, increase in one ratio would result in increase in another ratio as well.

2

True or false. A business with a higher working capital will also have a higher current ratio. Why

Ratio Analysis:

Ratio analysis is comparing one amount with another relating amount to derive meaningful information. Financial statements are analyzed by using various ratios like debt-equity ratio, current-ratio, and asset-turnover ratio.

Effect of higher working capital on current ratio:

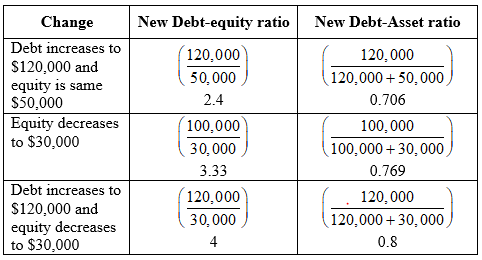

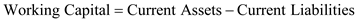

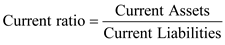

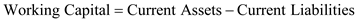

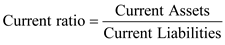

Working capital is computed by using the following formula:

Current ratio is computed by using the following formula:

Current ratio is computed by using the following formula:

Businesses with higher working capital imply a greater positive difference between current assets and current liabilities. That is, current assets are much higher than current liabilities.

Businesses with higher working capital imply a greater positive difference between current assets and current liabilities. That is, current assets are much higher than current liabilities.

Since, current assets are higher than current liabilities, numerator of current ratio would be much higher than its denominator. Consequently, higher the working capital, higher would be the current ratio of the company.

Ratio analysis is comparing one amount with another relating amount to derive meaningful information. Financial statements are analyzed by using various ratios like debt-equity ratio, current-ratio, and asset-turnover ratio.

Effect of higher working capital on current ratio:

Working capital is computed by using the following formula:

Current ratio is computed by using the following formula:

Current ratio is computed by using the following formula: Businesses with higher working capital imply a greater positive difference between current assets and current liabilities. That is, current assets are much higher than current liabilities.

Businesses with higher working capital imply a greater positive difference between current assets and current liabilities. That is, current assets are much higher than current liabilities.Since, current assets are higher than current liabilities, numerator of current ratio would be much higher than its denominator. Consequently, higher the working capital, higher would be the current ratio of the company.

3

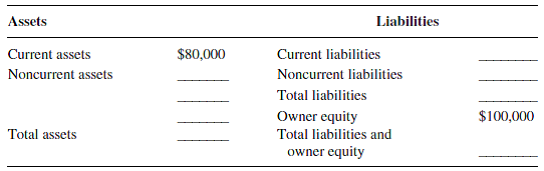

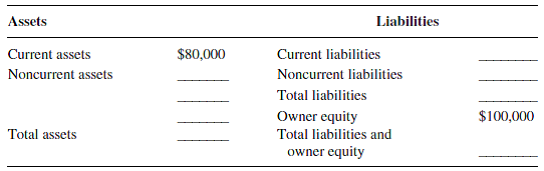

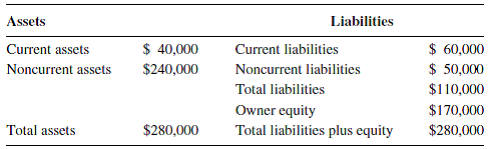

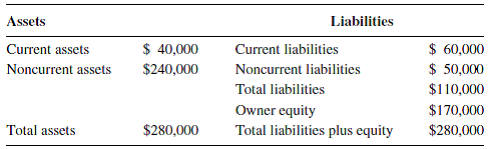

Use your knowledge of balance sheets and ratio analysis to complete the following abbreviated a balance sheet. The current ratio = 2.0 and the debt/equity ratio = 1.0.

Balance Sheet:

It is a financial report prepared at the end of an accounting period, which represents the position of assets, liabilities and equity of a business at a given date.

Completion of missing values in balance sheet by using ratios:

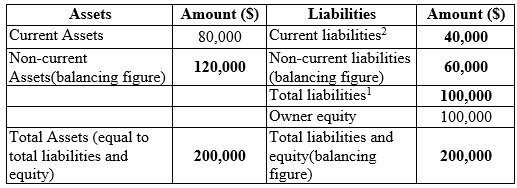

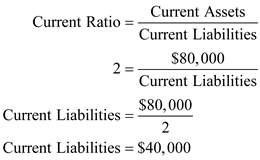

Table (1)

Table (1)

Working Notes:

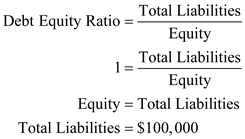

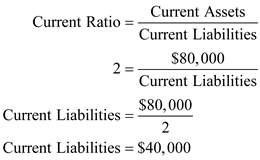

1.

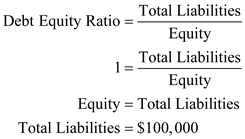

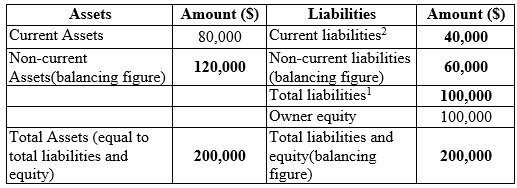

Computation of total liabilities:

2.

2.

Computation of current liabilities:

It is a financial report prepared at the end of an accounting period, which represents the position of assets, liabilities and equity of a business at a given date.

Completion of missing values in balance sheet by using ratios:

Table (1)

Table (1)Working Notes:

1.

Computation of total liabilities:

2.

2.Computation of current liabilities:

4

Can a business be solvent but not liquid

Liquid but not solvent

How

Liquid but not solvent

How

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

5

Does a balance sheet show the annual net farm income for a farm business

Why or why not

Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

6

True or false. Assets + Liabilities = Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume you are an agricultural loan officer for a bank and a customer requests a loan based on the following balance sheet. Conduct a ratio analysis and give your reasons for granting or denying an additional loan. What is the weakest part of this customer's financial position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

8

Why is there no valuation adjustment on a cost-basis balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assume that a mistake was made and the value of market livestock on a balance sheet is $10,000 higher than it should be. How does this error affect measures of liquidity and solvency

Would the same results occur if land had been overvalued by $10,000

Would the same results occur if land had been overvalued by $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

10

Would the following entries to a farm balance sheet be classified as assets or liabilities

As current or noncurrent

a.

Machine shed

b.

Feed bill at local feed store

c.

A 20-year farm mortgage contract

d.

A 36-month certificate of deposit

e.

Newborn calves

As current or noncurrent

a.

Machine shed

b.

Feed bill at local feed store

c.

A 20-year farm mortgage contract

d.

A 36-month certificate of deposit

e.

Newborn calves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck