Deck 19: The Secondary Mortgage Market Pass-Through Securities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 19: The Secondary Mortgage Market Pass-Through Securities

1

Two 25-year maturity mortgage-backed bonds are issued. The first bond has a par value of $10,000 and promises to pay a 10.5 percent annual coupon, while the second is a zero coupon bond that promises to pay $10,000 (par) after 25 years, including accrued interest at 10 percent. At issue, bond market investors require a 12 percent interest rate on both bonds.

a. What is the initial price on each bond?

b. Assume both bonds promise interest at 10.5 percent, compounded semiannually. What will be the initial price for each bond?

c. If market interest rates fall to 9.5 percent at the end of five years, what will be the value of each bond, assuming annual payments as in ( a ) (state both as a percentage of par value and actual dollar value)?

a. What is the initial price on each bond?

b. Assume both bonds promise interest at 10.5 percent, compounded semiannually. What will be the initial price for each bond?

c. If market interest rates fall to 9.5 percent at the end of five years, what will be the value of each bond, assuming annual payments as in ( a ) (state both as a percentage of par value and actual dollar value)?

Mortgage-backed bonds (MBB):

Mortgage backed bond (MBB) is a type of security that is backed by an asset. It means if the issuer fails to make periodic payment of interest, then bond holder can get their money by forcing company to sell that asset.Zero-Coupon Bond:

It is a financial instrument which is traded at discount and don not render any interest payments to the bond holder. It is traded at less than its face value with yielding any periodic payments of interest. And thus, zero coupon bond generates yield at its maturity.a.

Computation of initial price of each bond:

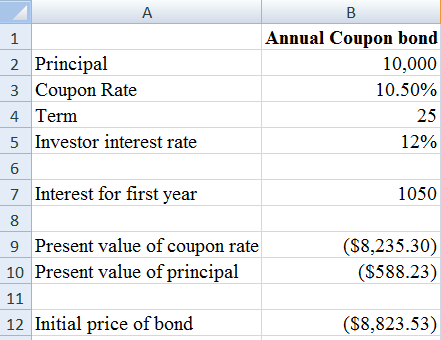

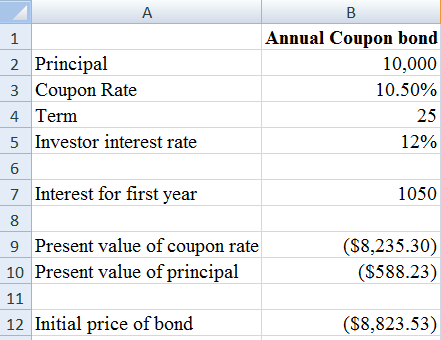

Initial price of coupon bond is can be computed with the help of principal amount, coupon rate, investor's interest rate and the term of bond.For Annual Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is

, investor's interest rate is

, investor's interest rate is

, and term period of bond is

, and term period of bond is

years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (1)

Fig (1)

The resultant figure from the excel sheet is given below. Fig (2)

Fig (2)

Hence, the initial price of annual coupon bond is

.

.

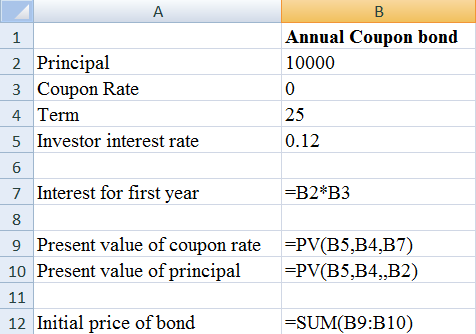

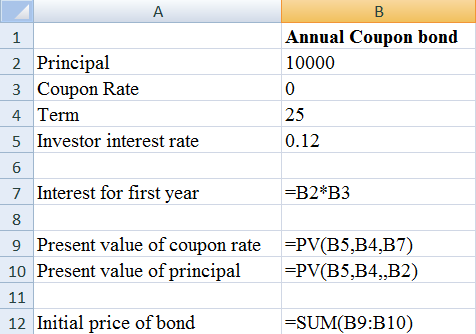

For Zero Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is

, investor's interest rate is

, investor's interest rate is

, and term period of bond is

, and term period of bond is

years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (3)

Fig (3)

The resultant figure from the excel sheet is given below. Fig (4)

Fig (4)

Hence, the initial price of annual coupon bond is

.

.

b.

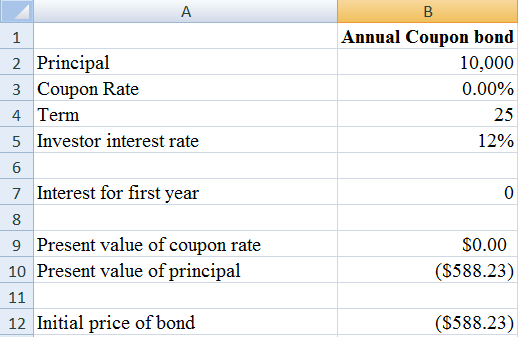

Computation of initial price of each bond compounded semi-annually:

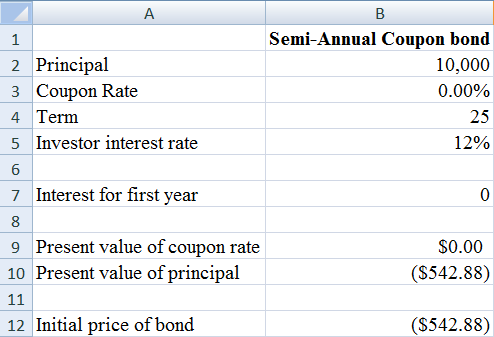

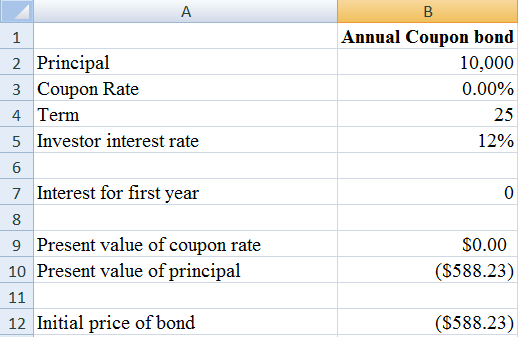

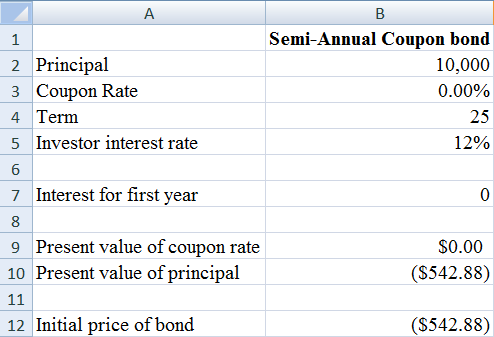

Initial price of coupon bond is can be computed with the help of principal amount, coupon rate, investor's interest rate and the term of bond.For Semi-annual Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is

, investor's interest rate is

, investor's interest rate is

, and term period of bond is

, and term period of bond is

years.Calculation of initial price of bond is given in below excel.

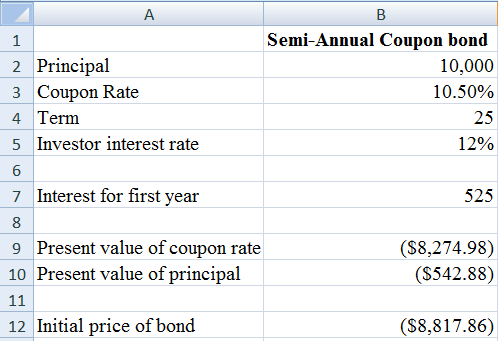

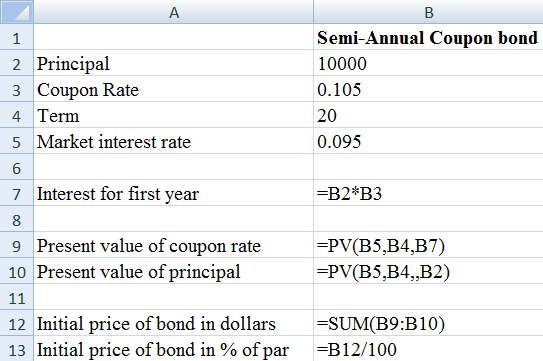

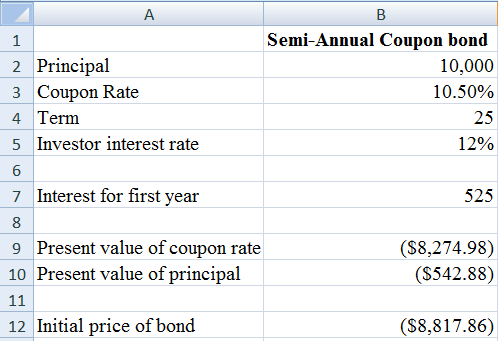

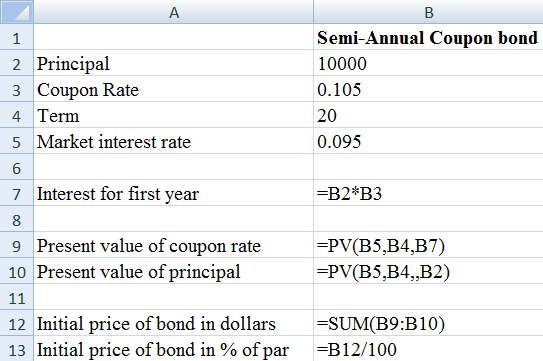

years.Calculation of initial price of bond is given in below excel.  Fig (5)

Fig (5)

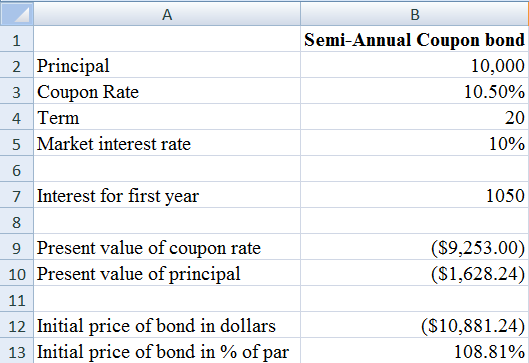

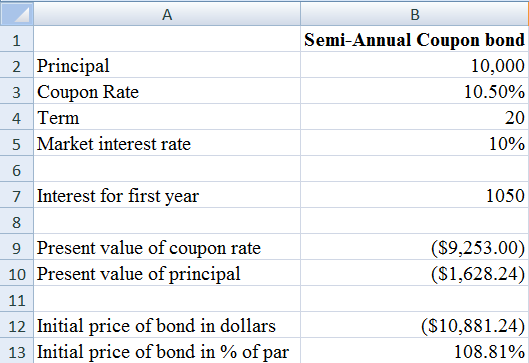

The resultant figure from the excel sheet is given below. Fig (6)

Fig (6)

Hence, the initial price of semi-annual coupon bond is

.

.

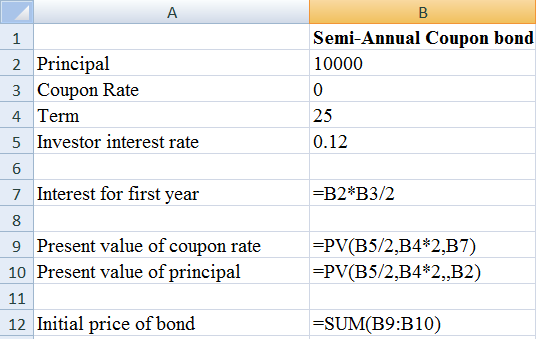

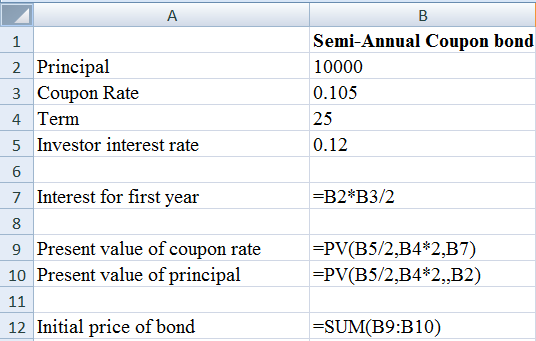

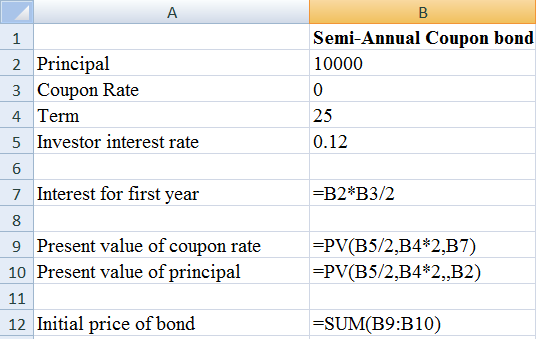

For Zero Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is

, investor's interest rate is

, investor's interest rate is

, and term period of bond is

, and term period of bond is

years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (7)

Fig (7)

The resultant figure from the excel sheet is given below. Fig (8)

Fig (8)

Hence, the initial price of semi-annual coupon bond is

.

.

c.

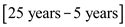

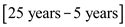

Computation of initial price of each bond at the end of fifth year:

Initial price of coupon bond is can be computed with the help of principal amount, coupon rate, investor's interest rate and the term of bond.For Annual Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is

, market interest rate is

, market interest rate is

, and term period of bond is

, and term period of bond is

years

years

.Calculation of initial price of bond is given in below excel.

.Calculation of initial price of bond is given in below excel.  Fig (1)

Fig (1)

The resultant figure from the excel sheet is given below. Fig (2)

Fig (2)

Hence, the initial price of annual coupon bond at the end of fifth year is

and in percentage it is

and in percentage it is

.

.

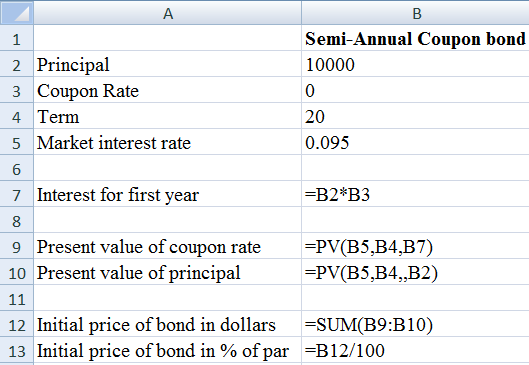

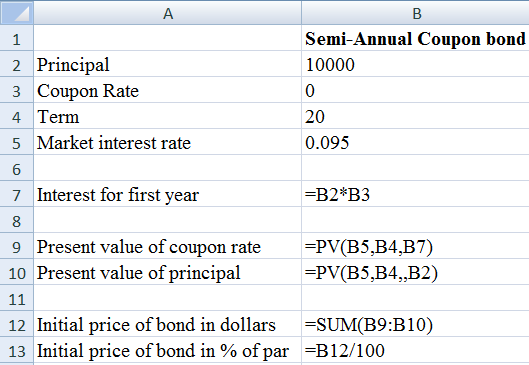

For Zero Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is

, market interest rate is

, market interest rate is

, and term period of bond is

, and term period of bond is

years

years

.Calculation of initial price of bond is given in below excel.

.Calculation of initial price of bond is given in below excel.  Fig (3)

Fig (3)

The resultant figure from the excel sheet is given below. Fig (4)

Fig (4)

Hence, the initial price of annual zero-coupon bond at the end of fifth year is

and in percentage it is

and in percentage it is

.

.

Mortgage backed bond (MBB) is a type of security that is backed by an asset. It means if the issuer fails to make periodic payment of interest, then bond holder can get their money by forcing company to sell that asset.Zero-Coupon Bond:

It is a financial instrument which is traded at discount and don not render any interest payments to the bond holder. It is traded at less than its face value with yielding any periodic payments of interest. And thus, zero coupon bond generates yield at its maturity.a.

Computation of initial price of each bond:

Initial price of coupon bond is can be computed with the help of principal amount, coupon rate, investor's interest rate and the term of bond.For Annual Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is  , investor's interest rate is

, investor's interest rate is  , and term period of bond is

, and term period of bond is  years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (1)

Fig (1)The resultant figure from the excel sheet is given below.

Fig (2)

Fig (2)Hence, the initial price of annual coupon bond is

.

. For Zero Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is  , investor's interest rate is

, investor's interest rate is  , and term period of bond is

, and term period of bond is  years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (3)

Fig (3)The resultant figure from the excel sheet is given below.

Fig (4)

Fig (4)Hence, the initial price of annual coupon bond is

.

. b.

Computation of initial price of each bond compounded semi-annually:

Initial price of coupon bond is can be computed with the help of principal amount, coupon rate, investor's interest rate and the term of bond.For Semi-annual Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is  , investor's interest rate is

, investor's interest rate is  , and term period of bond is

, and term period of bond is  years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (5)

Fig (5)The resultant figure from the excel sheet is given below.

Fig (6)

Fig (6)Hence, the initial price of semi-annual coupon bond is

.

. For Zero Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is  , investor's interest rate is

, investor's interest rate is  , and term period of bond is

, and term period of bond is  years.Calculation of initial price of bond is given in below excel.

years.Calculation of initial price of bond is given in below excel.  Fig (7)

Fig (7)The resultant figure from the excel sheet is given below.

Fig (8)

Fig (8)Hence, the initial price of semi-annual coupon bond is

.

. c.

Computation of initial price of each bond at the end of fifth year:

Initial price of coupon bond is can be computed with the help of principal amount, coupon rate, investor's interest rate and the term of bond.For Annual Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is  , market interest rate is

, market interest rate is  , and term period of bond is

, and term period of bond is  years

years  .Calculation of initial price of bond is given in below excel.

.Calculation of initial price of bond is given in below excel.  Fig (1)

Fig (1)The resultant figure from the excel sheet is given below.

Fig (2)

Fig (2)Hence, the initial price of annual coupon bond at the end of fifth year is

and in percentage it is

and in percentage it is  .

. For Zero Coupon Bond:

Principal amount is

, coupon rate is

, coupon rate is  , market interest rate is

, market interest rate is  , and term period of bond is

, and term period of bond is  years

years .Calculation of initial price of bond is given in below excel.

.Calculation of initial price of bond is given in below excel.  Fig (3)

Fig (3)The resultant figure from the excel sheet is given below.

Fig (4)

Fig (4)Hence, the initial price of annual zero-coupon bond at the end of fifth year is

and in percentage it is

and in percentage it is  .

. 2

What is the secondary mortgage market? List three reasons why it is important.

Secondary Mortgage Market:

The market in which mortgage aggregator and investors can do buying and selling of mortgage service and loans rights is known as secondary mortgage market. This market also provides easy access for the credit availability for the borrowers which are located across geographical locations.Importance of secondary mortgage market:

The three importance of the secondary mortgage market is given below.• Mortgage financial companies can sell the mortgages that are exists in the current market with the help of secondary mortgage market and hence, regenerate the funds through which origination of new loans can be done.• Secondary mortgage market also allows the financial mortgage companies to provide loan outside the geographical location.• Secondary mortgage market generates more options that can be used for investments by the investors or institutions.

The market in which mortgage aggregator and investors can do buying and selling of mortgage service and loans rights is known as secondary mortgage market. This market also provides easy access for the credit availability for the borrowers which are located across geographical locations.Importance of secondary mortgage market:

The three importance of the secondary mortgage market is given below.• Mortgage financial companies can sell the mortgages that are exists in the current market with the help of secondary mortgage market and hence, regenerate the funds through which origination of new loans can be done.• Secondary mortgage market also allows the financial mortgage companies to provide loan outside the geographical location.• Secondary mortgage market generates more options that can be used for investments by the investors or institutions.

3

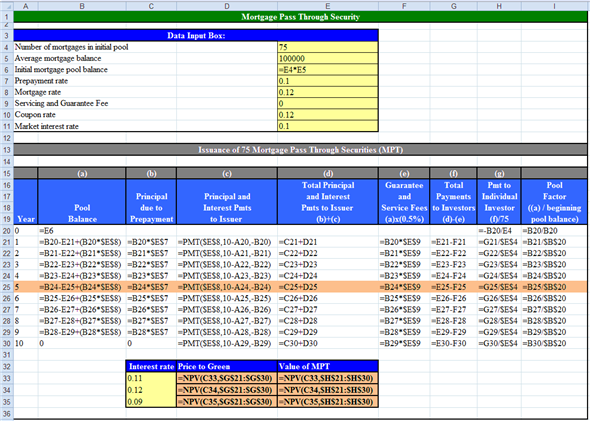

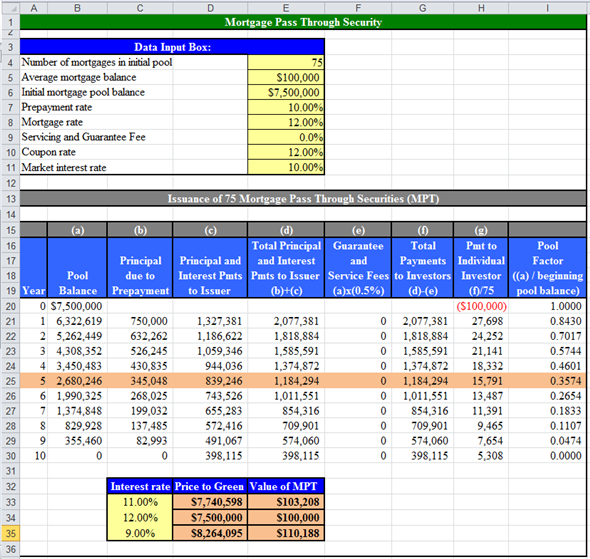

The Green S L originated a pool containing 75 ten-year fixed interest rate mortgages with an average balance of $100,000 each. All mortgages in the pool carry a coupon of 12 percent. (For simplicity, assume all mortgage payments are made annually at 12 percent interest.) Green would now like to sell the pool to FNMA.

a. Assuming a constant annual prepayment rate of 10 percent (for simplicity assume that prepayments are based on the pool balance at the end of the preceding year and begin at the end of year 1), what is the price that Green could obtain if market interest rates were (1) 11 percent? (2) 12 percent? (3) 9 percent?

b. Assume that five years have passed since the date in (a). What will the pool factor be? If market interest rates are 12 percent, what price can Green obtain now?

c. Instead of selling the pool of mortgages in (a), Green decides to securitize the mortgages by issuing 100 pass-through securities. The coupon rate will be 11.5 percent and the servicing and guarantee fee will be 0.5 percent. However, the current market rate of return is 10.5 percent. How much will Green obtain for this offering of MPTs? What will each purchaser pay for an MPT security, assuming the same prepayment rate as in (a)?

d. Assume now that immediately after purchase in (c), interest rates fall to 9 percent and that the prepayment rates are expected to accelerate to 20 percent per year, beginning at the end of the first year. What will the MPT security be worth now?

a. Assuming a constant annual prepayment rate of 10 percent (for simplicity assume that prepayments are based on the pool balance at the end of the preceding year and begin at the end of year 1), what is the price that Green could obtain if market interest rates were (1) 11 percent? (2) 12 percent? (3) 9 percent?

b. Assume that five years have passed since the date in (a). What will the pool factor be? If market interest rates are 12 percent, what price can Green obtain now?

c. Instead of selling the pool of mortgages in (a), Green decides to securitize the mortgages by issuing 100 pass-through securities. The coupon rate will be 11.5 percent and the servicing and guarantee fee will be 0.5 percent. However, the current market rate of return is 10.5 percent. How much will Green obtain for this offering of MPTs? What will each purchaser pay for an MPT security, assuming the same prepayment rate as in (a)?

d. Assume now that immediately after purchase in (c), interest rates fall to 9 percent and that the prepayment rates are expected to accelerate to 20 percent per year, beginning at the end of the first year. What will the MPT security be worth now?

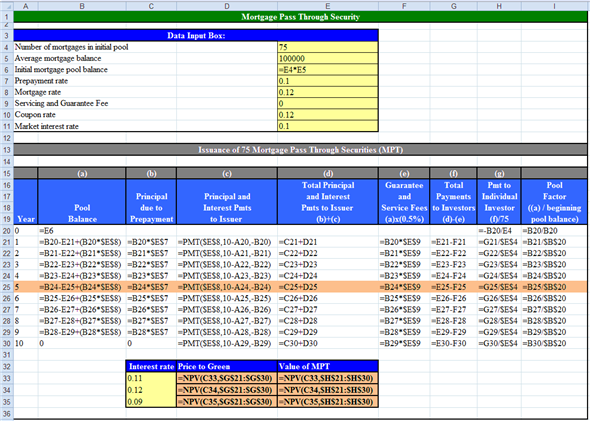

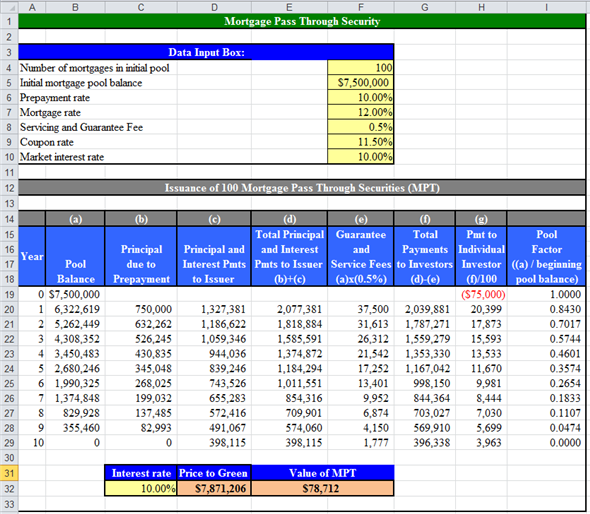

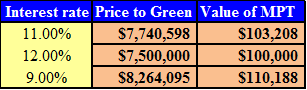

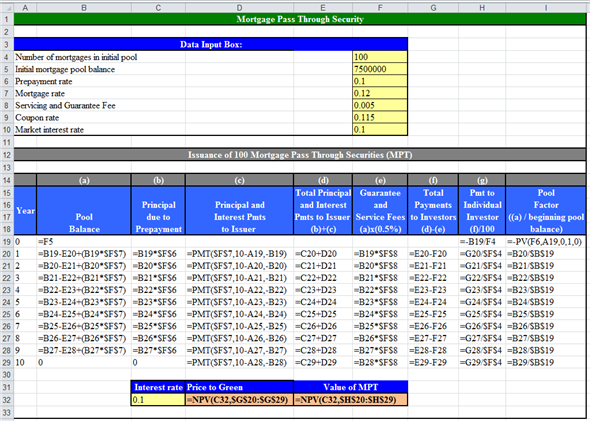

a.Compute value of security to issuer and individual investor at given market interest rates.Use spreadsheet for the required computation. Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'.  Image - A.1

Image - A.1

Obtained results are shown below. Image - A.2

Image - A.2

Answers are provided below. b.

b.

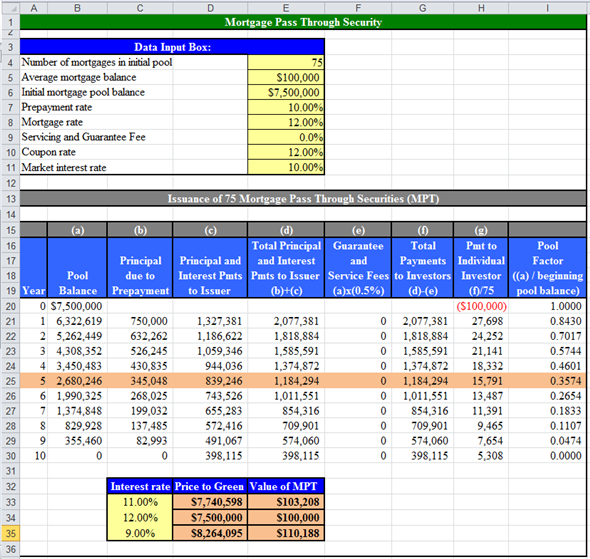

This change would not affect the results provided in Image - A.2.It is evident from the Image - A.2, that in the year-5 price to Green and pol factor are

and

and

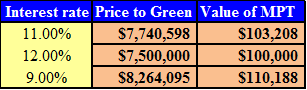

respectively.c.Compute value of security to issuer and individual investor at given market interest rates.Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'.

respectively.c.Compute value of security to issuer and individual investor at given market interest rates.Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'.  Image - A.3

Image - A.3

Image - A.4

Image - A.4

Thus, the price to Green and individual investors are

and

and

respectively.d.

respectively.d.

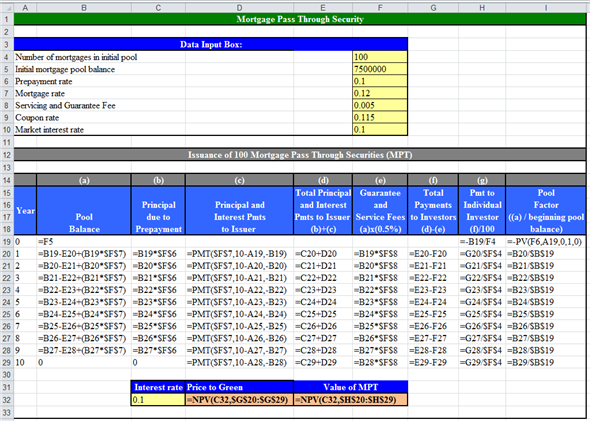

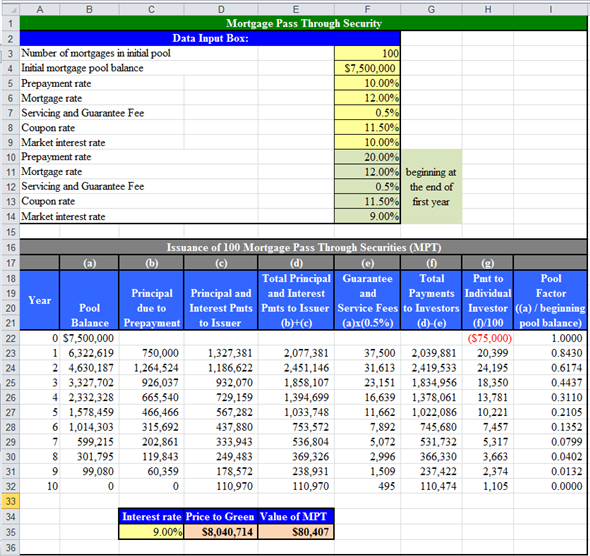

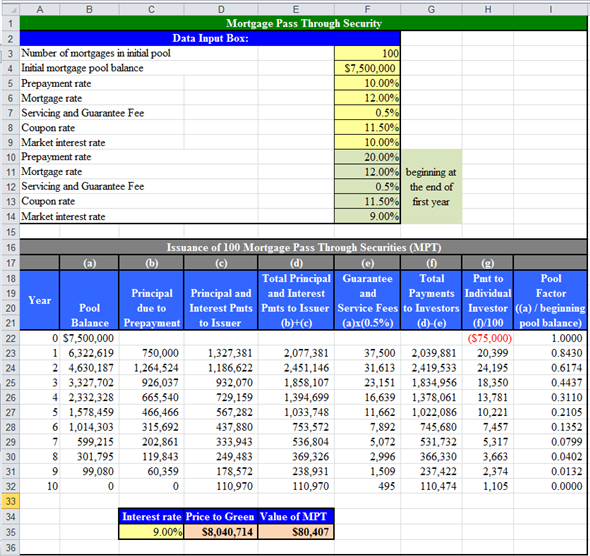

Compute value of security to issuer and individual investor at given market interest rates.Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'. Image - A.5

Image - A.5

Image - A.6

Image - A.6

Thus, the price to Green and individual investors are

and

and

respectively.

respectively.

Image - A.1

Image - A.1Obtained results are shown below.

Image - A.2

Image - A.2Answers are provided below.

b.

b. This change would not affect the results provided in Image - A.2.It is evident from the Image - A.2, that in the year-5 price to Green and pol factor are

and

and respectively.c.Compute value of security to issuer and individual investor at given market interest rates.Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'.

respectively.c.Compute value of security to issuer and individual investor at given market interest rates.Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'.  Image - A.3

Image - A.3 Image - A.4

Image - A.4Thus, the price to Green and individual investors are

and

and respectively.d.

respectively.d. Compute value of security to issuer and individual investor at given market interest rates.Enter given values and formulas in the spreadsheet as shown in the image below. Answers are highlighted in 'Orange'.

Image - A.5

Image - A.5 Image - A.6

Image - A.6Thus, the price to Green and individual investors are

and

and respectively.

respectively. 4

What were the three principal activities of FNMA under its 1954 charter? What is its principal function now?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

Excel. Refer to the "Ch19 MPS" tab in the Excel Workbook provided on the Web site.

a. Find the value of the cash flows to the issuer and to individual investors based on a required rate of return of 7.5 percent.

b. Find the value of the cash flows to the issuer and to individual investors based on a required rate of return of 11.5 percent.

a. Find the value of the cash flows to the issuer and to individual investors based on a required rate of return of 7.5 percent.

b. Find the value of the cash flows to the issuer and to individual investors based on a required rate of return of 11.5 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

Name two ways that FNMA currently finances its secondary mortgage operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

When did GNMA come into existence? What was its original function? What is its main function now?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

Why was the formation of FHLMC so important?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is a mortgage-related security? What are the similarities and differences between mortgage securities and corporate bonds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

Name the principal types of mortgage-related securities. What are the difference between them?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

There are several ways that mortgages can be sold in the secondary market. Choose two and compare and contrast their length of distribution channel, relative ease of transaction, and efficiency as it relates to maximizing funds flow from sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is the function of the optional delivery commitment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

What is a mortgage swap certificate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Name five important characteristics of mortgage pools. Tell why each is important.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

In general, would a falling rate of market interest cause the price of an MPT security to increase or decrease? Would the increase or decrease be greater if the security was issued at a discount? Would an increase in prepayment be likely or unlikely? Describe with an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck