Deck 1: An Introduction to Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

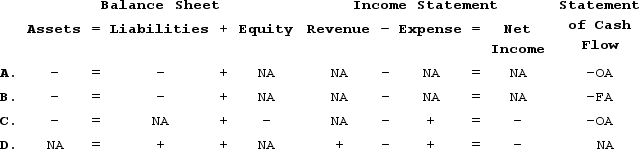

سؤال

سؤال

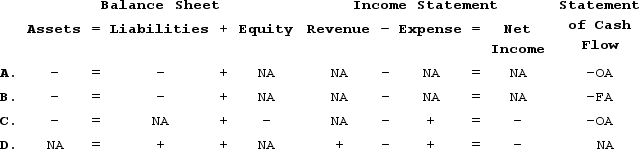

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

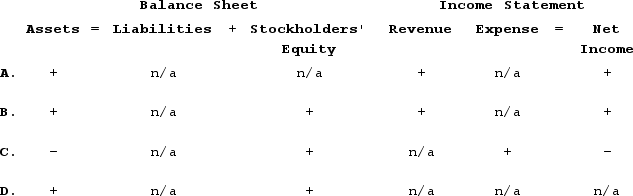

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

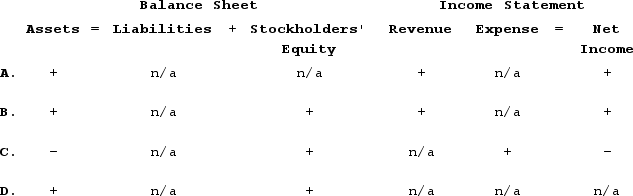

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/204

العب

ملء الشاشة (f)

Deck 1: An Introduction to Accounting

1

Liabilities represent the future obligations of a business entity.

True

2

Stockholders' equity is a source of a business's assets, but liabilities are not.

False

3

In a market, a company that manufactures cars would be referred to as a business.

True

4

Borrowing money from the bank is an example of an asset source transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

5

An asset source transaction increases a business's assets and the claims to assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

6

The stockholders of a business have a priority claim to its assets in the event of liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Financial Accounting Standards Board is a privately funded organization with authority for establishing accounting standards for businesses in the US.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

8

Retained earnings reduces a company's commitment to use its assets for the benefit of its stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

9

An asset use transaction does not affect the total amount of claims to a company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

10

The value created by a business may be called assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is false regarding managerial accounting information?

A) It is often used by investors.

B) It is more detailed than financial accounting information.

C) It can include nonfinancial information.

D) It focuses on divisional rather than overall profitability.

A) It is often used by investors.

B) It is more detailed than financial accounting information.

C) It can include nonfinancial information.

D) It focuses on divisional rather than overall profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which resource providers lend financial resources to a business with the expectation of repayment with interest?

A) Consumers

B) Creditors

C) Investors

D) Owners

A) Consumers

B) Creditors

C) Investors

D) Owners

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which type of accounting information is intended to satisfy the needs of external users of accounting information?

A) Cost accounting

B) Managerial accounting

C) Tax accounting

D) Financial accounting

A) Cost accounting

B) Managerial accounting

C) Tax accounting

D) Financial accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

14

The four financial statements prepared by a business bear no relationship to each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Heritage Company is a manufacturer of office furniture. Which term best describes Heritage's role in society?

A) Business

B) Regulatory agency

C) Consumer

D) Resource owner

A) Business

B) Regulatory agency

C) Consumer

D) Resource owner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

16

Detailed information about accounts is maintained in the various elements of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

17

The types of resources needed by a business are financial, physical, and labor resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

18

Financial accounting standards are known collectively as GAAP. What does that acronym stand for?

A) Generally Accepted Accounting Principles

B) Generally Applied Accounting Procedures

C) Governmentally Approved Accounting Practices

D) Generally Authorized Auditing Principles

A) Generally Accepted Accounting Principles

B) Generally Applied Accounting Procedures

C) Governmentally Approved Accounting Practices

D) Generally Authorized Auditing Principles

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

19

Financial accounting information is usually less detailed than managerial accounting information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

20

The historical cost concept requires that most assets be recorded at the amount paid for them, regardless of increases in market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

21

If Ballard Company reported assets of $500 and liabilities of $200, Ballard's stockholders' equity equals:

A) $300.

B) $500.

C) $700.

D) Cannot be determined.

A) $300.

B) $500.

C) $700.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

22

Stosch Company's balance sheet reported assets of $142,000, liabilities of $35,000 and common stock of $32,000 as of December 31, Year 1. If Retained Earnings on the balance sheet as of December 31, Year 2, amount to $98,000 and Stosch paid a $34,000 dividend during Year 2, then the amount of net income for Year 2 was which of the following?

A) $23,000

B) $57,000

C) $75,000

D) $34,000

A) $23,000

B) $57,000

C) $75,000

D) $34,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

23

The balance sheet of the Algonquin Company reported assets of $50,000, liabilities of $22,000 and common stock of $15,000. Based on this information only, what is the amount of retained earnings?

A) $7,000.

B) $57,000.

C) $13,000.

D) $87,000.

A) $7,000.

B) $57,000.

C) $13,000.

D) $87,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

24

Stosch Company's balance sheet reported assets of $40,000, liabilities of $15,000 and common stock of $12,000 as of December 31, Year 1. If Retained Earnings on the balance sheet as of December 31, Year 2, amount to $18,000 and Stosch paid a $14,000 dividend during Year 2, then the amount of net income for Year 2 was which of the following?

A) $17,000

B) $19,000

C) $13,000

D) $21,000

A) $17,000

B) $19,000

C) $13,000

D) $21,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

25

If total assets decrease, then which of the following statements is true?

A) Liabilities must increase and retained earnings must decrease.

B) Common stock must decrease and retained earnings must increase.

C) Liabilities, common stock, or retained earnings must decrease.

D) Liabilities, common stock, or retained earnings must increase.

A) Liabilities must increase and retained earnings must decrease.

B) Common stock must decrease and retained earnings must increase.

C) Liabilities, common stock, or retained earnings must decrease.

D) Liabilities, common stock, or retained earnings must increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

26

Ellen Gatsby and her siblings, Ben and Sarah, started Gatsby Company when they each invested $100,000 in the company. After the investments there will be

A) One reporting entity

B) Two reporting entities

C) Three reporting entities

D) Four reporting entities

A) One reporting entity

B) Two reporting entities

C) Three reporting entities

D) Four reporting entities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements about liabilities is true?

A) They represent obligations to repay debts.

B) They may increase when assets increase.

C) They are found on the claims side of the accounting equation.

D) All of the answers are characteristics of liabilities.

A) They represent obligations to repay debts.

B) They may increase when assets increase.

C) They are found on the claims side of the accounting equation.

D) All of the answers are characteristics of liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is an accurate definition of the term "asset?"

A) An obligation to creditors

B) A resource that will be used to produce revenue

C) A transfer of wealth from the business to its stockholders

D) A sacrifice incurred from operating the business

A) An obligation to creditors

B) A resource that will be used to produce revenue

C) A transfer of wealth from the business to its stockholders

D) A sacrifice incurred from operating the business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not an element of the financial statements?

A) Net income

B) Revenue

C) Assets

D) Cash

A) Net income

B) Revenue

C) Assets

D) Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is (are) source(s) of assets to a business?

A) Creditors

B) Investors

C) Operations

D) All the answers represent sources of assets.

A) Creditors

B) Investors

C) Operations

D) All the answers represent sources of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

31

International accounting standards are formulated by the IASB. What does that acronym stand for?

A) Internationally Accepted Standards Board

B) International Accounting Standards Board

C) International Accountability Standards Bureau

D) International Accounting and Sustainability Board

A) Internationally Accepted Standards Board

B) International Accounting Standards Board

C) International Accountability Standards Bureau

D) International Accounting and Sustainability Board

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which term describes assets generated through operations that have been reinvested into the business?

A) Liability

B) Dividend

C) Common stock

D) Retained earnings

A) Liability

B) Dividend

C) Common stock

D) Retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following items is an example of revenue?

A) Cash received from a bank loan

B) Cash received from investors from the sale of common stock

C) Cash received from customers at the time services were provided

D) Cash received from the sale of land for its original selling price

A) Cash received from a bank loan

B) Cash received from investors from the sale of common stock

C) Cash received from customers at the time services were provided

D) Cash received from the sale of land for its original selling price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is an accurate depiction of the accounting equation?

A) Assets = Liabilities + Common Stock + Retained Earnings

B) Assets = Liabilities + Common Stock − Expenses

C) Assets = Liabilities + Retained Earnings − Dividends

D) Assets = Liabilities + Common Stock + Dividends

A) Assets = Liabilities + Common Stock + Retained Earnings

B) Assets = Liabilities + Common Stock − Expenses

C) Assets = Liabilities + Retained Earnings − Dividends

D) Assets = Liabilities + Common Stock + Dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which term describes a distribution of the business's assets back to the owners of the business?

A) Liability

B) Dividend

C) Retained earnings

D) Common stock

A) Liability

B) Dividend

C) Retained earnings

D) Common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

36

Hazeltine Company issued common stock for $200,000 cash. As a result of this event, which of the following statements is true?

A) Assets increased.

B) Stockholders' equity increased.

C) Claims increased.

D) Assets, claims, and stockholders' equity all increased.

A) Assets increased.

B) Stockholders' equity increased.

C) Claims increased.

D) Assets, claims, and stockholders' equity all increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

37

Finn Company reported assets of $1,000 and stockholders' equity of $600. What amount will Finn report for liabilities?

A) $400

B) $600

C) $1,600

D) Cannot be determined

A) $400

B) $600

C) $1,600

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

38

Jack Henry borrowed $800,000 from Walt Bank to open a new bike store called Wooden Wheels. Jack transferred $650,000 of the cash he borrowed to Wooden Wheels on the first day of the year. Which of the following appropriately reflects the cash transactions between these reporting entities?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a company's total assets increased while liabilities and common stock were unchanged, then which of the following statements is true?

A) Revenues were greater than expenses.

B) Retained earnings were less than net income during the period.

C) No dividends were paid during the period.

D) The company must have purchased assets with cash.

A) Revenues were greater than expenses.

B) Retained earnings were less than net income during the period.

C) No dividends were paid during the period.

D) The company must have purchased assets with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

40

Jack Henry borrowed $800,000 from Walt Bank to open a new bike store called Wooden Wheels. Jack transferred $650,000 of the cash that he borrowed to the store on the first day of the year. How many reporting entities exist in this scenario?

A) One reporting entity

B) Two reporting entities

C) Three reporting entities

D) Four reporting entities

A) One reporting entity

B) Two reporting entities

C) Three reporting entities

D) Four reporting entities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following could describe the effects of an asset exchange transaction on the accounting equation?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

42

At the end of Year 2, retained earnings for the Baker Company was $2,650. Revenue earned by the company in Year 2 was $2,900, expenses paid during the period were $1,550, and dividends paid during the period were $950. Based on this information alone, what was the amount of retained earnings at the beginning of Year 2?

A) $3,050

B) $2,250

C) $5,800

D) $1,300

A) $3,050

B) $2,250

C) $5,800

D) $1,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

43

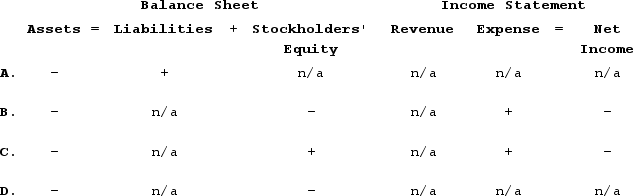

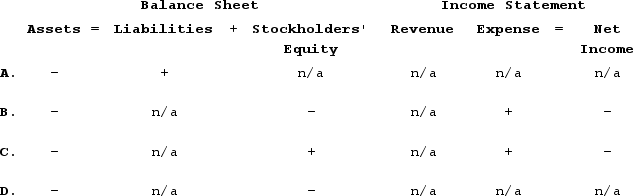

Which of the following does not describe the effects of an asset use transaction on the accounting equation?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

44

Wing Company provided services for $30,000 cash. Which of the following shows the impact of this transaction on Wing's accounting equation?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

45

As of December 31, Year 2, Bristol Company had $100,000 of assets, $40,000 of liabilities and $25,000 of retained earnings. What percentage of Bristol's assets were obtained from investors?

A) 60%

B) 25%

C) 40%

D) 35%

A) 60%

B) 25%

C) 40%

D) 35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

46

Wing Company paid $20,000 cash in salaries to its employees. Which of the following shows the impact of this transaction on Wing's accounting equation?

A.

B.

C.

D.

A) Option B

B) Option A

C) Option C

D) Option D

A.

B.

C.

D.

A) Option B

B) Option A

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

47

During the year, Millstone Company earned $6,500 of cash revenue, paid cash dividends of $1,000 to stockholders and paid $4,000 for cash expenses. Liabilities were unchanged. Which of the following accurately describes the effect of these events on the elements of the company's financial statements?

A) Assets increased by $6,500.

B) Assets increased by $1,500.

C) Stockholders' equity increased by $2,500.

D) Assets increased by $5,500.

A) Assets increased by $6,500.

B) Assets increased by $1,500.

C) Stockholders' equity increased by $2,500.

D) Assets increased by $5,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following cash transactions results in an increase to one asset account and a decrease to another asset account?

A) Borrowing cash from a bank

B) Issuing common stock for cash

C) Purchasing land for cash

D) Providing services for cash

A) Borrowing cash from a bank

B) Issuing common stock for cash

C) Purchasing land for cash

D) Providing services for cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

49

At the end of Year 2, retained earnings for the Baker Company was $3,500. Revenue earned by the company in Year 2 was $1,500, expenses paid during the period were $800, and dividends paid during the period were $500. Based on this information alone, what was the amount of retained earnings at the beginning of Year 2?

A) $3,300

B) $3,700

C) $2,800

D) $3,800

A) $3,300

B) $3,700

C) $2,800

D) $3,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

50

Wing Company paid $5,000 cash to purchase land. Which of the following shows the impact of this transaction on Wing's accounting equation?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

51

At the time of liquidation, Fairchild Company reported assets of $200,000, liabilities of $120,000, common stock of $90,000 and retained earnings of ($10,000). What amount of Fairchild's assets are the shareholders entitled to receive?

A) $200,000

B) $80,000

C) $90,000

D) $100,000

A) $200,000

B) $80,000

C) $90,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not an asset use transaction?

A) Paying cash dividends

B) Paying cash expenses

C) Paying off the principal of a loan

D) Paying cash to purchase land

A) Paying cash dividends

B) Paying cash expenses

C) Paying off the principal of a loan

D) Paying cash to purchase land

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following items appears in the investing activities section of the statement of cash flows?

A) Cash inflow from interest revenue.

B) Cash inflow from the issuance of common stock.

C) Cash outflow for the payment of dividends.

D) Cash outflow for the purchase of land.

A) Cash inflow from interest revenue.

B) Cash inflow from the issuance of common stock.

C) Cash outflow for the payment of dividends.

D) Cash outflow for the purchase of land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

54

Wing Company borrowed $70,000 cash from Metropolitan Bank. Which of the following shows the impact of this transaction on Wing's accounting equation?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

55

On January 1, Year 2, Chavez Company had beginning balances as follows:

During Year 2, Chavez paid dividends to its stockholders of $2,000. Given that ending retained earnings was $6,000, what was Chavez's net income for the Year 2?

A) $3,000

B) $5,000

C) $7,000

D) $2,000

During Year 2, Chavez paid dividends to its stockholders of $2,000. Given that ending retained earnings was $6,000, what was Chavez's net income for the Year 2?

A) $3,000

B) $5,000

C) $7,000

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

56

Li Company paid cash to purchase land. As a result of this accounting event, which of the following statements is true?

A) Total assets decreased.

B) Total assets were unaffected.

C) Total stockholders' equity decreased.

D) Both assets and total stockholders' equity decreased.

A) Total assets decreased.

B) Total assets were unaffected.

C) Total stockholders' equity decreased.

D) Both assets and total stockholders' equity decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

57

Turner Company reported assets of $20,000 (including cash of $9,000), liabilities of $8,000, common stock of $7,000, and retained earnings of $5,000. Based on this information, what can be concluded?

A) 25% of Turner's assets are the result of prior earnings.

B) $5,000 is the maximum dividend that can be paid to shareholders.

C) 40% of Turner's assets are the result of borrowing from creditors.

D) 25% of Turner's assets are from prior earnings, $5,000 is the maximum possible dividend, and 40% of assets are the result of borrowed resources.

A) 25% of Turner's assets are the result of prior earnings.

B) $5,000 is the maximum dividend that can be paid to shareholders.

C) 40% of Turner's assets are the result of borrowing from creditors.

D) 25% of Turner's assets are from prior earnings, $5,000 is the maximum possible dividend, and 40% of assets are the result of borrowed resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

58

Wyatt Company was formed on January 1, Year 1, when it acquired $50,000 cash from issuing common stock. Which of the following shows the impact of this transaction on Wyatt's accounting equation?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

59

The transaction, "provided services for cash," affects which two accounts?

A) Revenue and Expense

B) Cash and Revenue

C) Cash and Expense

D) Cash and Dividends

A) Revenue and Expense

B) Cash and Revenue

C) Cash and Expense

D) Cash and Dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

60

Borrowing cash from the bank is an example of which type of transaction?

A) Asset source

B) Claims exchange

C) Asset use

D) Asset exchange

A) Asset source

B) Claims exchange

C) Asset use

D) Asset exchange

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

61

The amount of retained earnings is shown on the

A) income statement.

B) balance sheet.

C) statement of cash flows.

D) statement of changes in stockholders' equity.

E) balance sheet and statement of changes in stockholders' equity.

A) income statement.

B) balance sheet.

C) statement of cash flows.

D) statement of changes in stockholders' equity.

E) balance sheet and statement of changes in stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

62

The year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $50,000; Liabilities = ?; Common Stock = $15,000; Revenue = $22,000; Dividends = $1,500; Beginning Retained Earnings = $3,500; Ending Retained Earnings = $7,500. The amount of liabilities reported on the end-of-period balance sheet was:

A) $27,500.

B) $31,500.

C) $35,000.

D) $42,500.

A) $27,500.

B) $31,500.

C) $35,000.

D) $42,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

63

In which section of a statement of cash flows would the payment of cash dividends be reported?

A) Investing activities

B) Operating activities

C) Financing activities

D) Dividends are not reported on the statement of cash flows.

A) Investing activities

B) Operating activities

C) Financing activities

D) Dividends are not reported on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

64

Dividends are reported on which financial statement?

A) Balance Sheet

B) Income Statement

C) Statement of Changes in Stockholders' Equity

D) Both the income statement and statement of changes in stockholders' equity

A) Balance Sheet

B) Income Statement

C) Statement of Changes in Stockholders' Equity

D) Both the income statement and statement of changes in stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following shows the effects of providing services for cash on the balance sheet and income statement?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following transactions would be reported on the statement of changes in stockholders' equity?

A) Borrowed $5,000 cash from the bank

B) Paid a $100 cash dividend to the stockholders

C) Purchased land for $2,000 cash

D) Paid $1,500 cash to pay off a portion of its note payable

A) Borrowed $5,000 cash from the bank

B) Paid a $100 cash dividend to the stockholders

C) Purchased land for $2,000 cash

D) Paid $1,500 cash to pay off a portion of its note payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which financial statement matches asset increases from operating a business with asset decreases from operating the business?

A) Balance sheet

B) Statement of changes in stockholders' equity

C) Income statement

D) Statement of cash flows

A) Balance sheet

B) Statement of changes in stockholders' equity

C) Income statement

D) Statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

68

Jackson Company had a net increase in cash from operating activities of $10,000 and a net decrease in cash from financing activities of $2,000. If the beginning and ending cash balances for the company were $4,000 and $11,000, respectively, what is the net cash change from investing activities?

A) An outflow or decrease of $1,000.

B) An inflow or increase of $2,000.

C) An inflow or increase of $1,000.

D) Zero

A) An outflow or decrease of $1,000.

B) An inflow or increase of $2,000.

C) An inflow or increase of $1,000.

D) Zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

69

The year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $30,000; Liabilities = ?; Common Stock = $6,000; Revenue = $13,000; Dividends = $1,250; Beginning Retained Earnings = $4,250; Ending Retained Earnings = $8,000. The amount of liabilities reported on the end-of-period balance sheet was:

A) $22,000.

B) $24,000.

C) $16,000.

D) $19,750.

A) $22,000.

B) $24,000.

C) $16,000.

D) $19,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

70

Kelly Company experienced the following events during its first accounting period.

(1) Issued common stock for $10,000 cash.

(2) Earned $8,000 of cash revenue.

(3) Paid $1,000 cash to purchase land.

(4) Paid cash dividends amounting to $500.

(5) Paid $4,400 of cash expenses.

Based on this information, what is the amount of net income?

A) $2,100

B) $2,600

C) $3,600

D) $5,600

(1) Issued common stock for $10,000 cash.

(2) Earned $8,000 of cash revenue.

(3) Paid $1,000 cash to purchase land.

(4) Paid cash dividends amounting to $500.

(5) Paid $4,400 of cash expenses.

Based on this information, what is the amount of net income?

A) $2,100

B) $2,600

C) $3,600

D) $5,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following shows the effects of paying a cash dividend on the balance sheet and income statement?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

72

Salaries expense appears in the:

A) Liabilities section of the balance sheet

B) Financing activities section of the statement of cash flows

C) Asset section of the balance sheet

D) Expense section of the income statement

A) Liabilities section of the balance sheet

B) Financing activities section of the statement of cash flows

C) Asset section of the balance sheet

D) Expense section of the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

73

The year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $50,000; Liabilities = ?; Common Stock = $15,000; Revenue = $22,000; Dividends = $1,500; Beginning Retained Earnings = $3,500; Ending Retained Earnings = $7,500.Based on this information, the amount of expenses on Calloway's income statement was:

A) $18,500.

B) $13,000.

C) $16,500.

D) $10,000.

A) $18,500.

B) $13,000.

C) $16,500.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following accounts are permanent?

A) Retained earnings

B) All income statement accounts

C) Dividends

D) All balance sheet accounts including dividends.

A) Retained earnings

B) All income statement accounts

C) Dividends

D) All balance sheet accounts including dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following financial statements provides information about a company as of a specific point in time?

A) Income statement

B) Balance sheet

C) Statement of cash flows

D) Statement of changes in stockholders' equity

A) Income statement

B) Balance sheet

C) Statement of cash flows

D) Statement of changes in stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

76

Chow Company earned $3,700 of cash revenue, paid $2,100 for cash expenses, and paid a $750 cash dividend to its stockholders. Which of the following statements is true?

A) The net cash inflow from operating activities was $850.

B) The net cash outflow for investing activities was $750.

C) The net cash inflow from operating activities was $1,600.

D) The net cash outflow for investing activities was $850.

A) The net cash inflow from operating activities was $850.

B) The net cash outflow for investing activities was $750.

C) The net cash inflow from operating activities was $1,600.

D) The net cash outflow for investing activities was $850.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

77

The year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $33,000; Liabilities = ?; Common Stock = $6,300; Revenue = $13,600; Dividends = $1,400; Beginning Retained Earnings = $4,400; Ending Retained Earnings = $8,300.Based on this information, the amount of expenses on Calloway's income statement was

A) $8,300.

B) $500.

C) $10,700.

D) $3,900.

A) $8,300.

B) $500.

C) $10,700.

D) $3,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

78

Jackson Company had a net increase in cash from operating activities of $11,400 and a net decrease in cash from financing activities of $4,000. If the beginning and ending cash balances for the company were $5,000 and $10,600, respectively, what is the net cash change from investing activities?

A) An outflow or decrease of $1,800.

B) An inflow or increase of $4,000.

C) An inflow or increase of $1,800.

D) Zero.

A) An outflow or decrease of $1,800.

B) An inflow or increase of $4,000.

C) An inflow or increase of $1,800.

D) Zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

79

The statement of changes in stockholders' equity shows changes in which of the following accounts?

A) Retained Earnings and Assets

B) Assets and Liabilities

C) Common Stock and Retained Earnings

D) Liabilities and Common Stock

A) Retained Earnings and Assets

B) Assets and Liabilities

C) Common Stock and Retained Earnings

D) Liabilities and Common Stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck

80

At the beginning of Year 2, Jones Company had a balance in common stock of $300,000 and a balance of retained earnings of $15,000. During Year 2, the following transactions occurred: · Issued common stock for $90,000

· Earned net income of $50,000

· Paid dividends of $8,000

· Issued a note payable for $20,000

Based on the information provided, what is the total stockholders' equity on December 31, Year 2?

A) $147,000

B) $357,000

C) $427,000

D) $447,000

· Earned net income of $50,000

· Paid dividends of $8,000

· Issued a note payable for $20,000

Based on the information provided, what is the total stockholders' equity on December 31, Year 2?

A) $147,000

B) $357,000

C) $427,000

D) $447,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 204 في هذه المجموعة.

فتح الحزمة

k this deck