Deck 12: Money Creation and the Federal Reserve

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/269

العب

ملء الشاشة (f)

Deck 12: Money Creation and the Federal Reserve

1

The discount window gives banks a buffer in the reserves market against unexpected day-to-day fluctuations in the demand and supply of reserves.

True

2

What is the interest rate for money borrowed to satisfy daily reserve requirements?

A) federal funds rate

B) discount rate

C) prime rate

D) subprime rate

A) federal funds rate

B) discount rate

C) prime rate

D) subprime rate

federal funds rate

3

The Fed announced in September 2013 that it would postpone winding down its monetary stimulus until the economic recovery was stronger. When the Fed does begin to reduce bond purchases

A) interest rates will rise.

B) interest rates will fall.

C) stock prices will rise.

D) bond prices will rise.

A) interest rates will rise.

B) interest rates will fall.

C) stock prices will rise.

D) bond prices will rise.

interest rates will rise.

4

About how many U.S. depository institutions are bound by the Fed's reserve requirements?

A) 1,500

B) 13,000

C) 150,000

D) 1.5 million

A) 1,500

B) 13,000

C) 150,000

D) 1.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a bank makes a loan of $5,000, which is then withdrawn in cash and spent in another country, the money supply will not grow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

6

When Antonio deposits money in his bank, this initial transaction creates new money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

7

If Abigail withdraws $300 cash from her checking account, her bank's assets

A) do not change but liabilities fall by $300.

B) fall by $300 but liabilities do not change.

C) fall by $300 and liabilities fall by $300.

D) fall by $300 and liabilities rise by $300.

A) do not change but liabilities fall by $300.

B) fall by $300 but liabilities do not change.

C) fall by $300 and liabilities fall by $300.

D) fall by $300 and liabilities rise by $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

8

Sumit deposits $1,500 cash into his checking account, which his bank puts in the vault. The reserve requirement is 25%. What is the change in his bank's excess reserves?

A) $0

B) $375

C) $1,125

D) $1,500

A) $0

B) $375

C) $1,125

D) $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

9

About 2/3 of U.S. dollars are held outside the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

10

All of these actions are performed by the Federal Reserve regional banks EXCEPT

A) distributing coins and currency.

B) setting reserve requirements.

C) regulating and supervising member banks.

D) providing a nationwide payments system.

A) distributing coins and currency.

B) setting reserve requirements.

C) regulating and supervising member banks.

D) providing a nationwide payments system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

11

A bank has excess reserves of $5,000 and demand deposits of $40,000; the reserve requirement is 20%. If the reserve requirement is increased to 25%, the maximum amount of new loans this bank can make is

A) $1,500.

B) $2,000.

C) $2,500.

D) $3,000.

A) $1,500.

B) $2,000.

C) $2,500.

D) $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

12

The target federal funds rate is the Fed's primary approach to monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

13

The discount rate is the rate that banks charge their best customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

14

If the Fed wanted to use all three of its primary tools to increase the money supply, it should

A) raise the reserve requirement, lower the discount rate, and conduct an open market sale.

B) raise the reserve requirement, raise the discount rate, and conduct an open market sale.

C) lower the reserve requirement, raise the discount rate, and conduct an open market purchase.

D) lower the reserve requirement, lower the discount rate, and conduct an open market purchase.

A) raise the reserve requirement, lower the discount rate, and conduct an open market sale.

B) raise the reserve requirement, raise the discount rate, and conduct an open market sale.

C) lower the reserve requirement, raise the discount rate, and conduct an open market purchase.

D) lower the reserve requirement, lower the discount rate, and conduct an open market purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

15

The _____ oversee(s) the main tool of monetary policy.

A) 12 regional Federal Reserve banks

B) Federal Open Market Committee

C) Council of Economic Advisers

D) Congressional Budget Office

A) 12 regional Federal Reserve banks

B) Federal Open Market Committee

C) Council of Economic Advisers

D) Congressional Budget Office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the federal funds rate falls to zero, the Federal Reserve loses its ability to stimulate the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Federal Reserve's Board of Governors is based in which city?

A) Boston

B) New York

C) Philadelphia

D) Washington, D.C.

A) Boston

B) New York

C) Philadelphia

D) Washington, D.C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Fed has been reluctant to frequently change the reserve requirement because doing so can contribute to economic instability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a bank does not have enough funds in its reserves, it can borrow through either the federal funds market or the discount window.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which measure would decrease the money supply?

A) increasing the reserve requirement

B) decreasing the discount rate

C) buying government bonds

D) decreasing the federal funds rate

A) increasing the reserve requirement

B) decreasing the discount rate

C) buying government bonds

D) decreasing the federal funds rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

21

Open market operations are powerful because of the dollar-for-dollar change in reserves that comes from buying or selling government securities in the open market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

22

The main policymaking arm of the Fed is the

A) Federal Open Market Committee.

B) Council of Economic Advisers.

C) Money Committee.

D) Beige Book Committee.

A) Federal Open Market Committee.

B) Council of Economic Advisers.

C) Money Committee.

D) Beige Book Committee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

23

If there is a general rise in fear of the financial system, then the actual money multiplier is likely to fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the reserve requirement is 10%, then the potential money multiplier is _____ and the actual money multiplier is _____.

A) 10; greater than 10

B) 10; equal to or less than 10

C) 100; greater than 100

D) 100; less than 100

A) 10; greater than 10

B) 10; equal to or less than 10

C) 100; greater than 100

D) 100; less than 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

25

If the reserve requirement is 15%, a withdrawal of $3,000 leads to a potential increase in the money supply of $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

26

The money multiplier is

A) interest payment divided by yield.

B) yield divided by interest payment.

C) 1/(1 - MPS).

D) 1 divided by the reserve requirement.

A) interest payment divided by yield.

B) yield divided by interest payment.

C) 1/(1 - MPS).

D) 1 divided by the reserve requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a large number of borrowers default on their loans, the bank risks a solvency crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

28

In 2007, the Fed reduced the stigma of borrowing from it by auctioning money for banks to borrow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which statement concerning the structure of the Federal Reserve System is correct?

A) The Fed's Board of Governors consists of 12 members.

B) The chair and vice chair of the Board of Governors are appointed by the president and confirmed by the Senate for terms of 4 years.

C) There are 10 regional Federal Reserve banks.

D) The Federal Open Market Committee (FOMC) has seven members.

A) The Fed's Board of Governors consists of 12 members.

B) The chair and vice chair of the Board of Governors are appointed by the president and confirmed by the Senate for terms of 4 years.

C) There are 10 regional Federal Reserve banks.

D) The Federal Open Market Committee (FOMC) has seven members.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Fed works independently of political parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

31

The following passage is the opening paragraph from the April 13, 2016 Beige Book: Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand in late February and March, though the pace of growth varied across Districts. Most Districts said that economic growth was in the modest to moderate range and that contacts expected growth would remain in that range going forward. Consumer spending increased modestly in most Districts and reports on tourism were mostly positive. Labor market conditions continued to strengthen and business spending generally expanded across most Districts. Demand for nonfinancial services grew moderately overall. Manufacturing activity increased in most Districts. Construction and real estate activity also expanded. Credit conditions improved, on net, in most Districts. Low prices weighed on energy and mining output as well as prospects for agricultural producers. Overall, prices increased modestly across the majority of Districts, and input cost pressures continued to ease.

From the passage, you might expect that the Fed would have given priority to

A) the promotion of economic growth.

B) maintaining full employment.

C) stable prices.

D) moderate long-term interest rates.

From the passage, you might expect that the Fed would have given priority to

A) the promotion of economic growth.

B) maintaining full employment.

C) stable prices.

D) moderate long-term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

32

The national economic objectives that the Fed attempts to achieve include all actions EXCEPT

A) promoting economic growth accompanied by full employment.

B) maintaining moderate long-term interest rates.

C) keeping the price level stable.

D) keeping tax rates low.

A) promoting economic growth accompanied by full employment.

B) maintaining moderate long-term interest rates.

C) keeping the price level stable.

D) keeping tax rates low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

33

Federal Reserve board members serve for _____ years, but the chair serves for _____.

A) 4; 14 years

B) 14; 4 years

C) 4; 4 years

D) 14; life

A) 4; 14 years

B) 14; 4 years

C) 4; 4 years

D) 14; life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the Fed wants to raise the federal funds rate, it will _____ bonds, which _____ bond prices.

A) sell; lowers

B) sell; raises

C) buy; lowers

D) buy; raises

A) sell; lowers

B) sell; raises

C) buy; lowers

D) buy; raises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

35

In February 2010, the Central Bank of Brazil raised reserve requirements. By raising those requirements, Brazil was attempting to

A) increase its money supply.

B) stabilize its money supply.

C) decrease its money supply.

D) improve the liquidity of its banks.

A) increase its money supply.

B) stabilize its money supply.

C) decrease its money supply.

D) improve the liquidity of its banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

36

The discount rate is

A) now set below the federal funds rate.

B) the interest rate banks charge one another when they lend or borrow reserves.

C) the Fed's most effective monetary policy tool.

D) the rate regional Federal Reserve banks charge depository institutions to borrow reserves.

A) now set below the federal funds rate.

B) the interest rate banks charge one another when they lend or borrow reserves.

C) the Fed's most effective monetary policy tool.

D) the rate regional Federal Reserve banks charge depository institutions to borrow reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

37

Money leakages make it more difficult to use monetary policy to pull the economy out of a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

38

When the Fed buys bonds, its demand raises the price of bonds, in turn raising nominal interest rates in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

39

A lower reserve requirement

A) increases the ability of banks to make loans.

B) further limits deposit creation.

C) lowers the money multiplier.

D) restricts the borrowing capability of borrowers.

A) increases the ability of banks to make loans.

B) further limits deposit creation.

C) lowers the money multiplier.

D) restricts the borrowing capability of borrowers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

40

Monetary policy involves all of these EXCEPT increases in

A) bank reserves.

B) interest rates.

C) personal taxes.

D) buying securities.

A) bank reserves.

B) interest rates.

C) personal taxes.

D) buying securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

41

One of the responsibilities of the Federal Reserve Bank is to serve as the banker for the U.S. Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

42

Appointments to the Federal Reserve Board are staggered so that one member's term expires every other year. This provision was enacted to ensure

A) that Federal Reserve Board members would serve their entire term.

B) that the Fed would be accountable to Congress.

C) stability and continuity on the Board.

D) that regional considerations would not impact the Board's decisions.

A) that Federal Reserve Board members would serve their entire term.

B) that the Fed would be accountable to Congress.

C) stability and continuity on the Board.

D) that regional considerations would not impact the Board's decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

43

All of these are considered monetary policy lags EXCEPT _____ lag.

A) speculation

B) decision

C) implementation

D) information

A) speculation

B) decision

C) implementation

D) information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the potential money multiplier is 4, then the reserve requirement is

A) 4.

B) 0.25.

C) 0.2.

D) 0.1.

A) 4.

B) 0.25.

C) 0.2.

D) 0.1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which characteristic of the Fed was NOT designed to help maintain the Fed's independence?

A) The Fed's actions are not subject to executive branch control. If the Fed chooses a course counter to what the president might wish, the president has no means to prevent it.

B) Fed Board members are elected but confirmed by the president and the Senate. Board members do not have to worry about pleasing an electorate once elected and confirmed.

C) Instead of going through the congressional appropriation process, the Fed's budget comes from its earnings on its open market operations.

D) Board members serve 14-year terms and cannot be reappointed. The board members do not have an incentive to please Congress and the president in hopes of being reappointed.

A) The Fed's actions are not subject to executive branch control. If the Fed chooses a course counter to what the president might wish, the president has no means to prevent it.

B) Fed Board members are elected but confirmed by the president and the Senate. Board members do not have to worry about pleasing an electorate once elected and confirmed.

C) Instead of going through the congressional appropriation process, the Fed's budget comes from its earnings on its open market operations.

D) Board members serve 14-year terms and cannot be reappointed. The board members do not have an incentive to please Congress and the president in hopes of being reappointed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

46

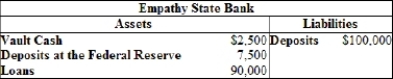

(Table) SCENARIO: Assume that Empathy State Bank begins with the balance sheet and is fully loaned-up. This bank's reserve ratio is

A) 0.025.

B) 0.075.

C) 0.10.

D) 0.25.

A) 0.025.

B) 0.075.

C) 0.10.

D) 0.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose a bank has $1 million in deposits, a reserve requirement of 10%, and bank reserves of $300,000. The bank has excess reserves of

A) $50,000.

B) $100,000.

C) $200,000.

D) $300,000.

A) $50,000.

B) $100,000.

C) $200,000.

D) $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Federal Reserve's Board of Governors consists of _____ members who are appointed by the _____ and confirmed by the _____.

A) five; president; Senate

B) seven; president; Senate

C) seven; Senate; president

D) twelve; Congress; president

A) five; president; Senate

B) seven; president; Senate

C) seven; Senate; president

D) twelve; Congress; president

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

49

About 10% of U.S. dollars are held outside the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

50

The two types of reserves are federal reserves and required reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assume the reserve requirement is 25% and the Federal Open Market Committee buys $4 million of U.S. government bonds from the public. As a result of this transaction, the supply of money is

A) not directly affected but has the potential to be increased by a total of $12 million.

B) directly increased by $4 million and has the potential to be increased by another $12 million.

C) directly reduced by $4 million and has the potential to be reduced by another $12 million.

D) directly increased by $4 million and has the potential to be increased by another $8 million.

A) not directly affected but has the potential to be increased by a total of $12 million.

B) directly increased by $4 million and has the potential to be increased by another $12 million.

C) directly reduced by $4 million and has the potential to be reduced by another $12 million.

D) directly increased by $4 million and has the potential to be increased by another $8 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

52

Money leakages tend to _____ during recessions, causing the actual money multiplier to _____.

A) rise; rise

B) rise; fall

C) fall; rise

D) fall; fall

A) rise; rise

B) rise; fall

C) fall; rise

D) fall; fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

53

When Vanessa deposits cash in her bank, the net change in M1 is equal to the size of her deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the reserve requirement is 1%, a $10,000 decrease in deposits means that the actual money supply will decrease by more than $1 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

55

If a bank's required reserve ratio is 2.5%, an initial injection of $4,000 has the potential to increase the overall money supply by up to $160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

56

Banks

A) cannot create money.

B) create money by making loans using the deposits of their customers.

C) create money by printing it.

D) create money by getting currency from the U.S. Bureau of Engraving and Printing and handing it out to favored clients.

A) cannot create money.

B) create money by making loans using the deposits of their customers.

C) create money by printing it.

D) create money by getting currency from the U.S. Bureau of Engraving and Printing and handing it out to favored clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Blue Book is used by the Board of Governors and the Federal Open Market Committee to help create monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

58

The formula for calculating the reserve ratio is

A) total deposits divided by the reserve requirement.

B) reserves times the reserve requirement.

C) reserves divided by the reserve requirement.

D) reserves divided by total deposits.

A) total deposits divided by the reserve requirement.

B) reserves times the reserve requirement.

C) reserves divided by the reserve requirement.

D) reserves divided by total deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

59

Term auctions are considered to be the last resort for stimulating the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which statement is correct?

A) The Fed's actions are subject to executive branch control.

B) Politically controlled banks are better at fighting inflation than independent central banks are.

C) The Federal Reserve is considered to be an independent central bank.

D) The Federal Reserve System is not subject to congressional oversight.

A) The Fed's actions are subject to executive branch control.

B) Politically controlled banks are better at fighting inflation than independent central banks are.

C) The Federal Reserve is considered to be an independent central bank.

D) The Federal Reserve System is not subject to congressional oversight.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

61

During the 2007-2009 recession, the Federal Reserve was not able to counteract any of the effects of a falling money multiplier on the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

62

If the reserve requirement is 10%, then the actual money multiplier is 10 and the potential money multiplier is less than 10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

63

In open market operations, the Federal Reserve buys and sells gold on the open market to preserve the value of the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

64

When the Open Market Committee buys $1 million worth of bonds, $1 million of reserves is instantly put into the banking system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

65

The money multiplier

A) is equal to the reserve requirement.

B) measures the maximum amount the money supply can increase when new deposits enter the banking system.

C) works only for increases in the money supply and never for decreases.

D) demonstrates that small changes in reserves have a negligible impact on the total money supply.

A) is equal to the reserve requirement.

B) measures the maximum amount the money supply can increase when new deposits enter the banking system.

C) works only for increases in the money supply and never for decreases.

D) demonstrates that small changes in reserves have a negligible impact on the total money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

66

If a bank is subject to a reserve requirement of 10% and if its reserve ratio is 33%, then all of these are true EXCEPT that it

A) can make additional loans.

B) has excess reserves.

C) must limit withdrawals.

D) is considered highly liquid.

A) can make additional loans.

B) has excess reserves.

C) must limit withdrawals.

D) is considered highly liquid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Federal Open Market Committee oversees the buying and selling of government securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

68

Assume the reserve requirement is 10%. If the Federal Open Market Committee buys a $10,000 bond from Bank A, Bank A's reserves

A) decrease by $10,000.

B) increase by $9,000.

C) increase by $1,000.

D) increase by $10,000.

A) decrease by $10,000.

B) increase by $9,000.

C) increase by $1,000.

D) increase by $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

69

If the reserve requirement is 25%, a new deposit of $1,000 leads to a potential increase in the money supply of

A) $250.

B) $4,000.

C) $5,000.

D) $10,000.

A) $250.

B) $4,000.

C) $5,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which set of statements is correct?

A) The Federal Reserve has 12 regional banks. The Board of Governors has fourteen members, each serving a 7-year term.

B) The Federal Reserve has 14 regional banks. The Board of Governors has twelve members, each serving a 7-year term.

C) The Federal Reserve has 12 regional banks. The Board of Governors has seven members, each serving a 14-year term.

D) The Federal Reserve has 14 regional banks. The Board of Governors has seven members, each serving a 12-year term.

A) The Federal Reserve has 12 regional banks. The Board of Governors has fourteen members, each serving a 7-year term.

B) The Federal Reserve has 14 regional banks. The Board of Governors has twelve members, each serving a 7-year term.

C) The Federal Reserve has 12 regional banks. The Board of Governors has seven members, each serving a 14-year term.

D) The Federal Reserve has 14 regional banks. The Board of Governors has seven members, each serving a 12-year term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

71

The U.S. economy is currently experiencing high unemployment and low inflation. To lessen the unemployment problem, the Federal Reserve could

A) raise the reserve requirement, thereby enabling banks to lend more money, increase the money supply, stimulate spending, and create jobs.

B) lower the discount rate, thereby enabling banks to increase liquidity, lend more money, decrease the money supply, stimulate spending, and create jobs.

C) buy bonds through open market operations, thereby enabling banks to lend more money, increase the money supply, stimulate spending, and create jobs.

D) sell bonds through open market operations, thereby enabling banks to lend more money, increase the money supply, stimulate spending, and create jobs.

A) raise the reserve requirement, thereby enabling banks to lend more money, increase the money supply, stimulate spending, and create jobs.

B) lower the discount rate, thereby enabling banks to increase liquidity, lend more money, decrease the money supply, stimulate spending, and create jobs.

C) buy bonds through open market operations, thereby enabling banks to lend more money, increase the money supply, stimulate spending, and create jobs.

D) sell bonds through open market operations, thereby enabling banks to lend more money, increase the money supply, stimulate spending, and create jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

72

Federal Reserve banks are located in all of these cities EXCEPT

A) Dallas.

B) Augusta.

C) Richmond.

D) Boston.

A) Dallas.

B) Augusta.

C) Richmond.

D) Boston.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

73

The target for the federal funds rate is set by the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Fed buys a bond from Sumit and deposits $1,500 cash into his checking account. The reserve requirement is 25%. What is the maximum amount the money supply can increase?

A) $0

B) $1,125

C) $1,500

D) $6,000

A) $0

B) $1,125

C) $1,500

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

75

A bank's equity is the sum of its assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assume that the Federal Reserve sets the reserve requirement at 10%. If a bank has $100 million in deposits, then its required reserves must equal

A) $1 million.

B) $10 million.

C) $90 million.

D) $110 million.

A) $1 million.

B) $10 million.

C) $90 million.

D) $110 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the reserve requirement is 25% and a new deposit leads to a potential increase in the money supply of $4,000, the amount of the new deposit must equal

A) $1,000.

B) $4,000.

C) $5,000.

D) $10,000.

A) $1,000.

B) $4,000.

C) $5,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which item is NOT one of the primary tools of the Fed?

A) reserve requirements

B) open market operations

C) tax rates

D) discount rate

A) reserve requirements

B) open market operations

C) tax rates

D) discount rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

79

Suppose the Fed increases required reserves from 10% to 20% of deposits. Assuming that banks are fully loaned-up, the money supply will _____ and the value of the money multiplier will _____ to _____.

A) rise; fall; 10

B) fall; rise; 2

C) rise; rise; 4

D) fall; fall; 5

A) rise; fall; 10

B) fall; rise; 2

C) rise; rise; 4

D) fall; fall; 5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck

80

A bank has excess reserves of $4,000 and demand deposits of $40,000; the reserve requirement is 20%. Its current level of total reserves is _____. If the reserve requirement is increased to 25%, the new level of excess reserves would be _____.

A) $15,000; $4,000

B) $12,000; $2,000

C) $25,000; $3,000

D) $30,000; $5,000

A) $15,000; $4,000

B) $12,000; $2,000

C) $25,000; $3,000

D) $30,000; $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 269 في هذه المجموعة.

فتح الحزمة

k this deck