Deck 11: Price and Output Determination: Monopoly and Dominant Firms

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/12

العب

ملء الشاشة (f)

Deck 11: Price and Output Determination: Monopoly and Dominant Firms

1

Is the monopoly on patented pharmaceuticals warranted What barrier to entry prevents the re-importation into the United States of pharmaceuticals sold at lower prices abroad (say, in Canada)

Monopoly on patented pharmaceuticals is not warranted since the governments are likely to buy the unauthorized imitated medicines abroad to reduce the cost of health. The use of generic medicines in the developing countries at the lower cost can lead to illegal importation of medicines from lower cost countries to higher ones. Government can thwart such practice by increasing inspections and surveillances at border areas.

2

Information Resources, Inc. (IRI), collects data on consumer packaged goods at 32,000 scanner checkout counters and in panel surveys of 70,000 households. IRI records indicate that department store-brand pantyhose sell for a gross margin of 43 percent and a contribution margin of 29 percent, and the store inventory turns over 14 times per year.

a. What expenses explain the difference between 43 percent and 29 percent

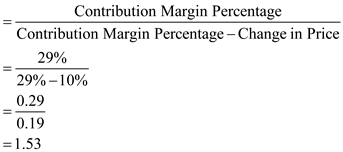

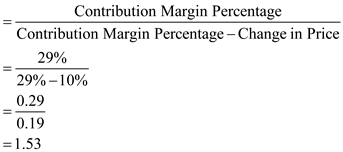

b. What percentage change in unit sales is required to increase total contributions if price is cut by 10 percent

c. Compare store-brand pantyhose with the products in Table Why should Whitman's Sampler sell for a contribution margin of 54 percent when pantyhose sell for 29 percent

Table RALPH LAUREN POLO GOLF SHIRTS (PER COLOR, PER STORE, PER DAY)

a. What expenses explain the difference between 43 percent and 29 percent

b. What percentage change in unit sales is required to increase total contributions if price is cut by 10 percent

c. Compare store-brand pantyhose with the products in Table Why should Whitman's Sampler sell for a contribution margin of 54 percent when pantyhose sell for 29 percent

Table RALPH LAUREN POLO GOLF SHIRTS (PER COLOR, PER STORE, PER DAY)

a) Explanation of difference between the 43 percent and 29 percent.

Gross margins are not same as the contribution margins. Difference between two has been caused by the fixed cost. Gross margins are calculated by subtracting the fixed cost and variable costs.

b) Percentage change unit sale required to increases the total contribution if price is cut by 10 percent.

Following is the formula:-

Hence, 0.53 or 53 % change in sale is required to increase the contribution margins.

Hence, 0.53 or 53 % change in sale is required to increase the contribution margins.

c) Higher Margin for contribution margin for Whiteman's sampler

Expenditures on capital cost, selling price, overhead cost, and advertisement are higher for Whitman's candy. Further, inventory is much less for the Whitman's candy and it leads to the high contribution margin.

Gross margins are not same as the contribution margins. Difference between two has been caused by the fixed cost. Gross margins are calculated by subtracting the fixed cost and variable costs.

b) Percentage change unit sale required to increases the total contribution if price is cut by 10 percent.

Following is the formula:-

Hence, 0.53 or 53 % change in sale is required to increase the contribution margins.

Hence, 0.53 or 53 % change in sale is required to increase the contribution margins. c) Higher Margin for contribution margin for Whiteman's sampler

Expenditures on capital cost, selling price, overhead cost, and advertisement are higher for Whitman's candy. Further, inventory is much less for the Whitman's candy and it leads to the high contribution margin.

3

The contribution margin percentage on pharmaceuticals exceeds the 55 percent to 70 percent margins on ready-to-eat cereals. Identify three reasons why pharmaceutical margins are higher.

The contribution marginal percentage on pharmaceutical is even higher than the 70%. The massive expenditure on the Research and Developmental activities leads to discovery and development of new medicines and drugs. Further, the patent right allocation inflates the profit of firm. In last, the pharmaceutical industry comparatively profitable in the market which increases the profit level of individual firm.

4

Ajax Cleaning Products is a medium-sized firm operating in an industry dominated by one large firm-Tile King. Ajax produces a multiheaded tunnel wall scrubber that is similar to a model produced by Tile King. Ajax decides to charge the same price as Tile King to avoid the possibility of a price war. The price charged by Tile King is $20,000.

Ajax has the following short-run cost curve:

TC = 800,000 - 5,000Q + 100Q 2

a. Compute the marginal cost curve for Ajax.

b. Given Ajax's pricing strategy, what is the marginal revenue function for Ajax

c. Compute the profit-maximizing level of output for Ajax.

d. Compute Ajax's total dollar profits.

Ajax has the following short-run cost curve:

TC = 800,000 - 5,000Q + 100Q 2

a. Compute the marginal cost curve for Ajax.

b. Given Ajax's pricing strategy, what is the marginal revenue function for Ajax

c. Compute the profit-maximizing level of output for Ajax.

d. Compute Ajax's total dollar profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suggest an approach to the big pharmaceutical company problem of differential pricing in the United States, Western Europe, and Japan versus the less-developed world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Lumins Lamp Company, a producer of old-style oil lamps, estimated the following demand function for its product:

Q = 120,000 - 10,000P

where Q is the quantity demanded per year and P is the price per lamp. The firm's fixed costs are $12,000 and variable costs are $1.50 per lamp.

a. Write an equation for the total revenue (TR) function in terms of Q.

b. Specify the marginal revenue function.

c. Write an equation for the total cost (TC) function in terms of Q.

d. Specify the marginal cost function.

e. Write an equation for total profits (n) in terms of Q. At what level of output (Q) are total profits maximized What price will be charged What are total profits at this output level

f. Check your answers in Part (e) by equating the marginal revenue and marginal cost functions, determined in Parts (b) and (d), and solving for Q.

g. What model of market pricing behavior has been assumed in this problem

Q = 120,000 - 10,000P

where Q is the quantity demanded per year and P is the price per lamp. The firm's fixed costs are $12,000 and variable costs are $1.50 per lamp.

a. Write an equation for the total revenue (TR) function in terms of Q.

b. Specify the marginal revenue function.

c. Write an equation for the total cost (TC) function in terms of Q.

d. Specify the marginal cost function.

e. Write an equation for total profits (n) in terms of Q. At what level of output (Q) are total profits maximized What price will be charged What are total profits at this output level

f. Check your answers in Part (e) by equating the marginal revenue and marginal cost functions, determined in Parts (b) and (d), and solving for Q.

g. What model of market pricing behavior has been assumed in this problem

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

7

Unique Creations holds a monopoly position in the production and sale of mag-nometers. The cost function facing Unique is estimated to be

TC = $100,000 + 20Q

a. What is the marginal cost for Unique

b. If the price elasticity of demand for Unique is currently -1.5, what price should Unique charge

c. What is the marginal revenue at the price computed in Part (b)

d. If a competitor develops a substitute for the magnometer and the price elasticity increases to -3.0, what price should Unique charge

TC = $100,000 + 20Q

a. What is the marginal cost for Unique

b. If the price elasticity of demand for Unique is currently -1.5, what price should Unique charge

c. What is the marginal revenue at the price computed in Part (b)

d. If a competitor develops a substitute for the magnometer and the price elasticity increases to -3.0, what price should Unique charge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

8

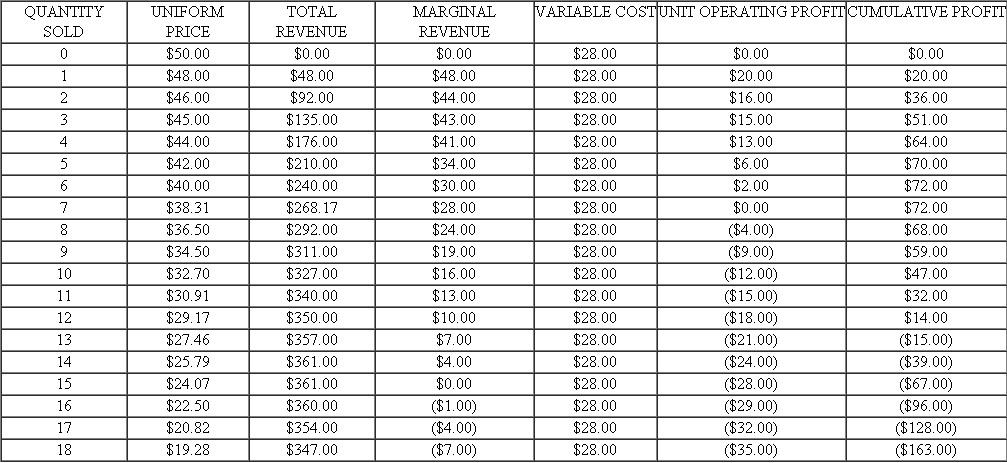

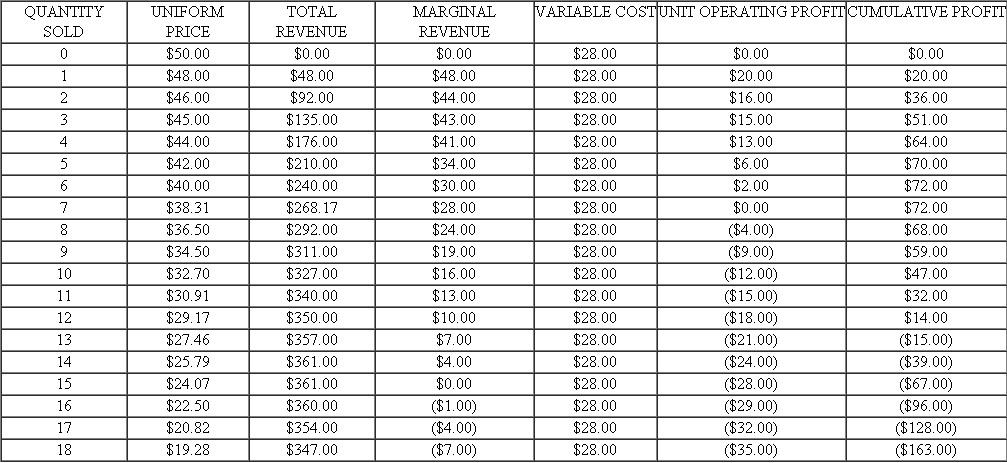

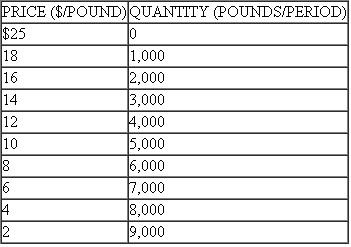

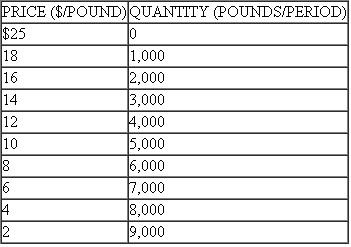

Exotic Metals, Inc., a leading manufacturer of beryllium, which is used in many electronic products, estimates the following demand schedule for its product:

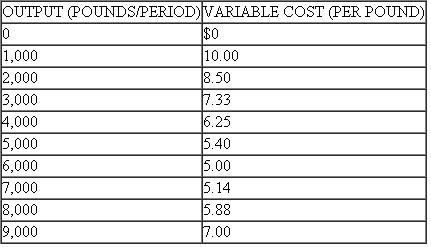

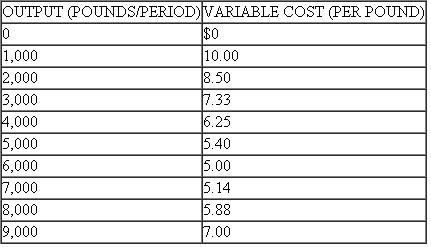

Fixed costs of manufacturing beryllium are $14,000 per period. The firm's variable cost schedule is as follows:

Fixed costs of manufacturing beryllium are $14,000 per period. The firm's variable cost schedule is as follows:

a. Find the total revenue and marginal revenue schedules for the firm.

a. Find the total revenue and marginal revenue schedules for the firm.

b. Determine the average total cost and marginal cost schedules for the firm.

c. What are Exotic Metals' profit-maximizing price and output levels for the production and sale of beryllium

d. What is Exotic's profit (or loss) at the solution determined in Part (c)

e. Suppose that the federal government announces it will sell beryllium, from its extensive wartime stockpile, to anyone who wants it at $6 per pound. How does this affect the solution determined in Part (c) What is Exotic Metals' profit (or loss) under these conditions

Fixed costs of manufacturing beryllium are $14,000 per period. The firm's variable cost schedule is as follows:

Fixed costs of manufacturing beryllium are $14,000 per period. The firm's variable cost schedule is as follows: a. Find the total revenue and marginal revenue schedules for the firm.

a. Find the total revenue and marginal revenue schedules for the firm.b. Determine the average total cost and marginal cost schedules for the firm.

c. What are Exotic Metals' profit-maximizing price and output levels for the production and sale of beryllium

d. What is Exotic's profit (or loss) at the solution determined in Part (c)

e. Suppose that the federal government announces it will sell beryllium, from its extensive wartime stockpile, to anyone who wants it at $6 per pound. How does this affect the solution determined in Part (c) What is Exotic Metals' profit (or loss) under these conditions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

9

Wyandotte Chemical Company sells various chemicals to the automobile industry. Wyandotte currently sells 30,000 gallons of polyol per year at an average price of $15 per gallon. Fixed costs of manufacturing polyol are $90,000 per year and total variable costs equal $180,000. The operations research department has estimated that a 15 percent increase in output would not affect fixed costs but would reduce average variable costs by 60 cents per gallon. The marketing department has estimated the arc elasticity of demand for polyol to be -2.0.

a. How much would Wyandotte have to reduce the price of polyol to achieve a 15 percent increase in the quantity sold

b. Evaluate the impact of such a price cut on (i) total revenue, (ii) total costs, and (iii) total profits.

a. How much would Wyandotte have to reduce the price of polyol to achieve a 15 percent increase in the quantity sold

b. Evaluate the impact of such a price cut on (i) total revenue, (ii) total costs, and (iii) total profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

10

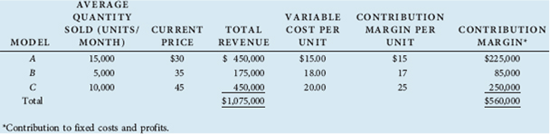

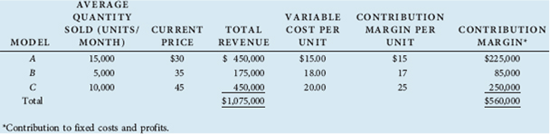

Tennis Products, Inc., produces three models of high-quality tennis rackets. The following table contains recent information on the sales, costs, and profitability of the three models:

The company is considering lowering the price of Model A to $27 in an effort to increase the number of units sold. Based on the results of price changes that have been instituted in the past, Tennis Products' chief economist estimates the arc price elasticity of demand to be -2.5. Furthermore, she estimates the arc cross elasticity of demand between Model A and Model B to be approximately 0.5 and between Model A and Model C to be approximately 0.2. Variable costs per unit are not expected to change over the anticipated changes in volume.

a. Evaluate the impact of the price cut on the (i) total revenue and (ii) contribution margin of Model A. Based on this analysis, should the firm lower the price of Model A

b. Evaluate the impact of the price cut on the (i) total revenue and (ii) contribution margin for the entire line of tennis rackets. Based on this analysis, should the firm lower the price of Model A

The company is considering lowering the price of Model A to $27 in an effort to increase the number of units sold. Based on the results of price changes that have been instituted in the past, Tennis Products' chief economist estimates the arc price elasticity of demand to be -2.5. Furthermore, she estimates the arc cross elasticity of demand between Model A and Model B to be approximately 0.5 and between Model A and Model C to be approximately 0.2. Variable costs per unit are not expected to change over the anticipated changes in volume.

a. Evaluate the impact of the price cut on the (i) total revenue and (ii) contribution margin of Model A. Based on this analysis, should the firm lower the price of Model A

b. Evaluate the impact of the price cut on the (i) total revenue and (ii) contribution margin for the entire line of tennis rackets. Based on this analysis, should the firm lower the price of Model A

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Public Service Company of the Southwest is regulated by an elected state utility commission. The firm has total assets of $500,000. The demand function for its services has been estimated as

P = $250 - $0.15Q The firm faces the following total cost function:

TC = $25,000 + $10Q

(The total cost function does not include the firm's cost of capital.)

a. In an unregulated environment, what price would this firm charge, what output would be produced, what would total profits be, and what rate of return would the firm earn on its asset base

b. The firm has proposed charging a price of $100 for each unit of output. If this price is charged, what will be the total profits and the rate of return earned on the firm's asset base

c. The commission has ordered the firm to charge a price that will provide the firm with no more than a 10 percent return on its assets. What price should the firm charge, what output will be produced, and what dollar level of profits will be earned

P = $250 - $0.15Q The firm faces the following total cost function:

TC = $25,000 + $10Q

(The total cost function does not include the firm's cost of capital.)

a. In an unregulated environment, what price would this firm charge, what output would be produced, what would total profits be, and what rate of return would the firm earn on its asset base

b. The firm has proposed charging a price of $100 for each unit of output. If this price is charged, what will be the total profits and the rate of return earned on the firm's asset base

c. The commission has ordered the firm to charge a price that will provide the firm with no more than a 10 percent return on its assets. What price should the firm charge, what output will be produced, and what dollar level of profits will be earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

12

The Odessa Independent Phone Company (OIPC) is currently engaged in a rate case that will set rates for its Midland-Odessa area customer base. OIPC has total assets of $20 million. The Texas Public Utility Commission has determined that an 11 percent return on assets is fair. OIPC has estimated its annual demand function as follows:

P = 3,514 - 0.08Q Its total cost function (not including the cost of capital) is

TC = 2,300,000 + 130Q

a. OIPC has proposed a rate of $250 per year for each customer. If this rate is approved, what return on assets will OIPC earn

b. What rate can OIPC charge if the commission wants to limit the return on assets to 11 percent

c. What problem of utility regulation does this exercise illustrate

P = 3,514 - 0.08Q Its total cost function (not including the cost of capital) is

TC = 2,300,000 + 130Q

a. OIPC has proposed a rate of $250 per year for each customer. If this rate is approved, what return on assets will OIPC earn

b. What rate can OIPC charge if the commission wants to limit the return on assets to 11 percent

c. What problem of utility regulation does this exercise illustrate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck