Deck 3: Consolidationssubsequent to the Date of Acquisition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/123

العب

ملء الشاشة (f)

Deck 3: Consolidationssubsequent to the Date of Acquisition

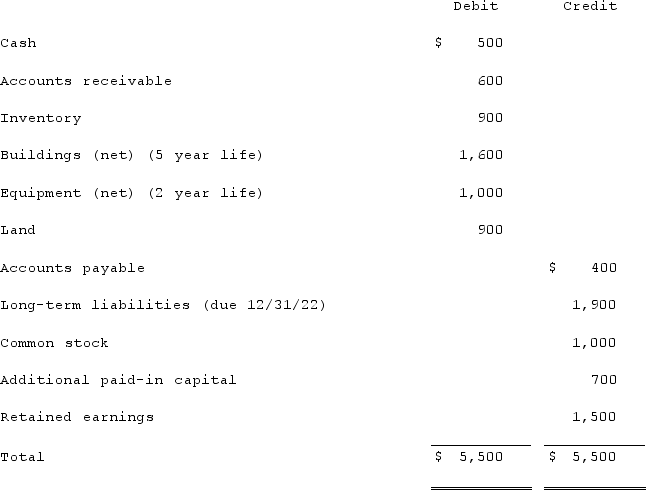

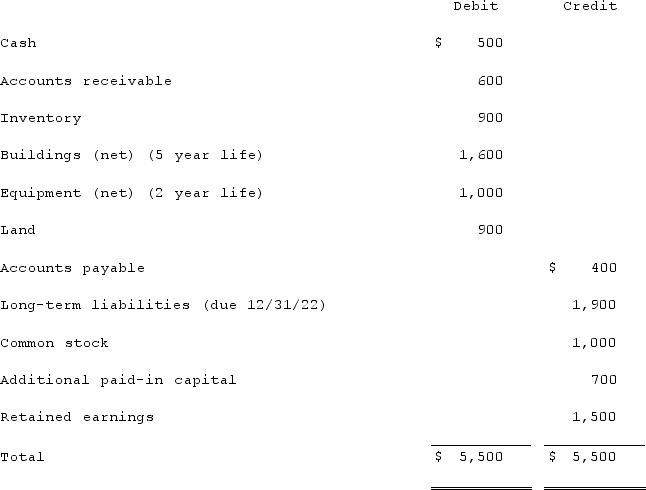

1

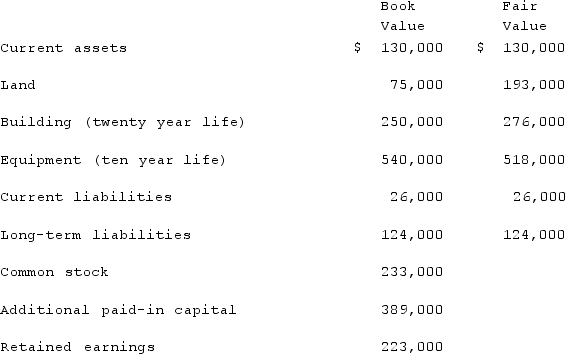

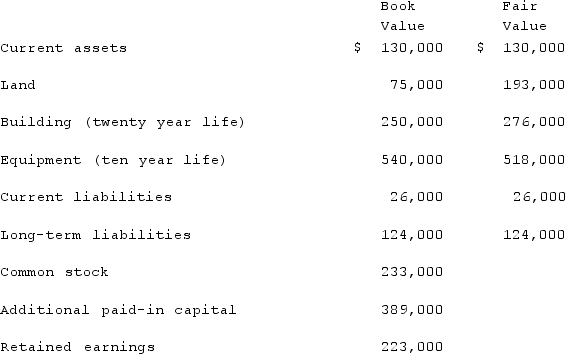

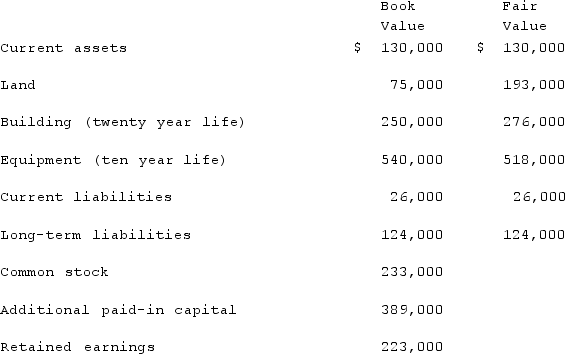

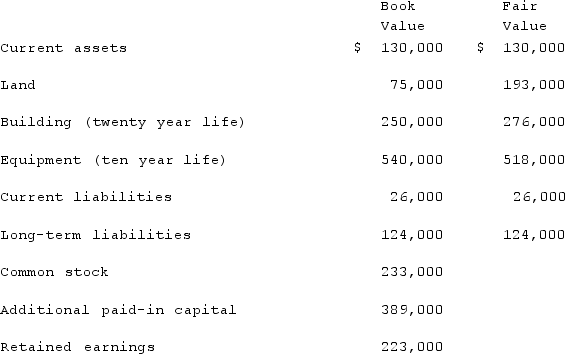

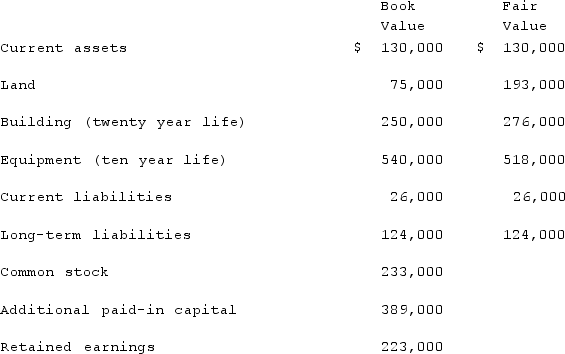

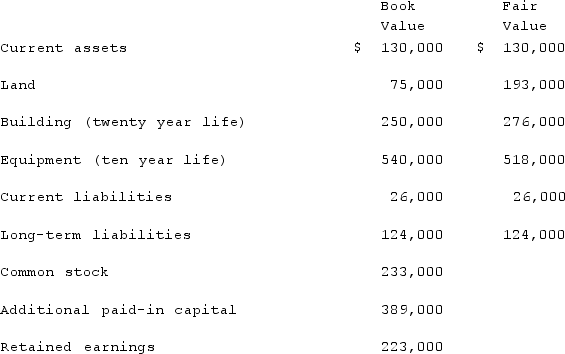

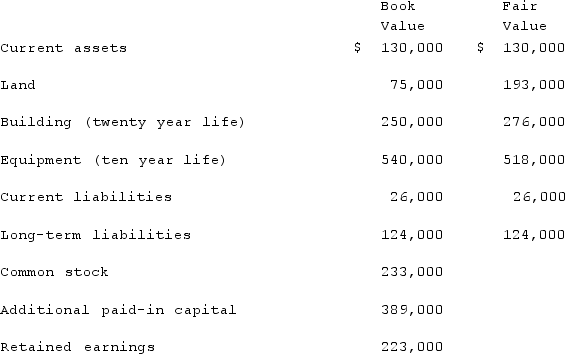

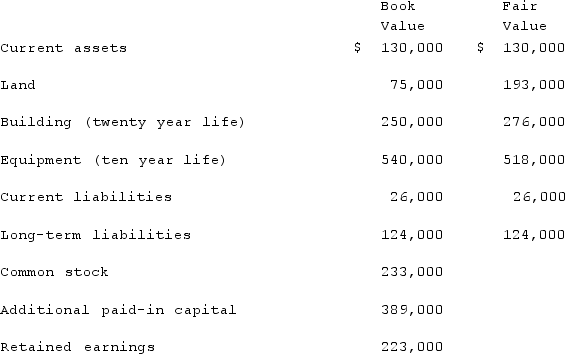

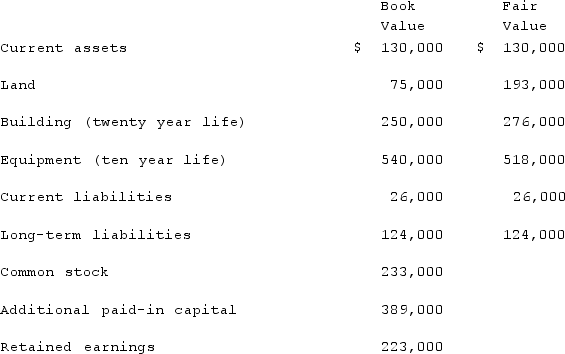

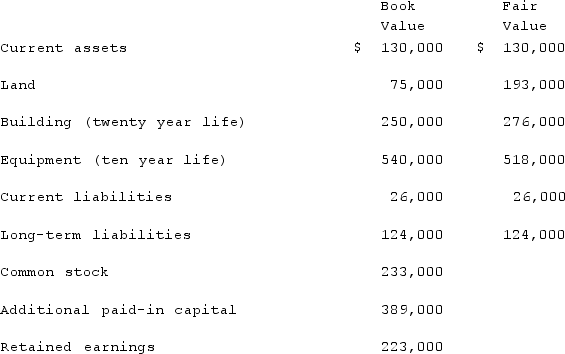

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.At the end of 2020, the consolidation entry to eliminate Barber's accrual of Thompson's earnings would include a credit to Investment in Thompson Co. for

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.At the end of 2020, the consolidation entry to eliminate Barber's accrual of Thompson's earnings would include a credit to Investment in Thompson Co. for

A)$83,000.

B)$133,100.

C)$134,000.

D)$134,900.

E)$0.

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.At the end of 2020, the consolidation entry to eliminate Barber's accrual of Thompson's earnings would include a credit to Investment in Thompson Co. for

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.At the end of 2020, the consolidation entry to eliminate Barber's accrual of Thompson's earnings would include a credit to Investment in Thompson Co. forA)$83,000.

B)$133,100.

C)$134,000.

D)$134,900.

E)$0.

D

2

Craft Corp. acquired all of the common stock of Pitts Co. in 2019. Pitts maintained its incorporation. Which of Craft's account balances would vary between the equity method and the initial value method?

A)Goodwill, Investment in Pitts Co., and Retained Earnings.

B)Expenses, Investment in Pitts Co., and Equity in Subsidiary Earnings.

C)Investment in Pitts Co., Equity in Subsidiary Earnings, and Retained Earnings.

D)Common Stock, Goodwill, and Investment in Pitts Co.

E)Expenses, Goodwill, and Investment in Pitts Co.

A)Goodwill, Investment in Pitts Co., and Retained Earnings.

B)Expenses, Investment in Pitts Co., and Equity in Subsidiary Earnings.

C)Investment in Pitts Co., Equity in Subsidiary Earnings, and Retained Earnings.

D)Common Stock, Goodwill, and Investment in Pitts Co.

E)Expenses, Goodwill, and Investment in Pitts Co.

C

3

Vaughn Inc. acquired all of the outstanding common stock of Roberts Co. on January 1, 2020, for $276,000. Annual amortization of $21,000 resulted from this acquisition. Vaughn reported net income of $80,000 in 2020 and $60,000 in 2021 and paid $24,000 in dividends each year. Roberts reported net income of $50,000 in 2020 and $57,000 in 2021 and paid $12,000 in dividends each year. What is the Investment in Roberts Co. balance on Vaughn's books as of December 31, 2021, if the equity method has been applied?

A)$317,000.

B)$326,000.

C)$341,000.

D)$368,000.

E)$383,000.

A)$317,000.

B)$326,000.

C)$341,000.

D)$368,000.

E)$383,000.

A

4

Reeder Corp. acquired one hundred percent of O'Neill Inc. on January 1, 2019, at a price in excess of the subsidiary's fair value. On that date, Reeder's equipment (ten-year life)had a book value of $380,000 but a fair value of $460,000. O'Neill had equipment (ten-year life)with a book value of $240,000 and a fair value of $370,000. Reeder used the partial equity method to record its investment in O'Neill. On December 31, 2021, Reeder had equipment with a book value of $270,000 and a fair value of $400,000. O'Neill had equipment with a book value of $180,000 and a fair value of $300,000. What is the consolidated balance for the Equipment account as of December 31, 2021?

A)$450,000.

B)$531,000.

C)$541.000.

D)$567,000.

E)$580,000.

A)$450,000.

B)$531,000.

C)$541.000.

D)$567,000.

E)$580,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

5

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

A)($2,200).

B)($900).

C)$(1,300).

D)$(2,100).

E)$3,500.

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to beA)($2,200).

B)($900).

C)$(1,300).

D)$(2,100).

E)$3,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

6

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.What is the balance in Barber's investment in subsidiary account at the end of 2020?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.What is the balance in Barber's investment in subsidiary account at the end of 2020?

A)$1,211,000.

B)$1,242,100.

C)$1,243,000.

D)$1,243,900.

E)$1,294,000.

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.What is the balance in Barber's investment in subsidiary account at the end of 2020?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.What is the balance in Barber's investment in subsidiary account at the end of 2020?A)$1,211,000.

B)$1,242,100.

C)$1,243,000.

D)$1,243,900.

E)$1,294,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following varies between the equity, initial value, and partial equity methods of accounting for an investment?

A)The amount of consolidated net income.

B)Total assets on the consolidated balance sheet.

C)Total liabilities on the consolidated balance sheet.

D)The balance in the investment account on the parent's books.

E)The amount of consolidated cost of goods sold.

A)The amount of consolidated net income.

B)Total assets on the consolidated balance sheet.

C)Total liabilities on the consolidated balance sheet.

D)The balance in the investment account on the parent's books.

E)The amount of consolidated cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which one of the following accounts would not appear in the consolidated financial statements at the end of the first fiscal period of the combination?

A)Goodwill.

B)Equipment.

C)Retained Earnings.

D)Common Stock.

E)Equity in Subsidiary Earnings.

A)Goodwill.

B)Equipment.

C)Retained Earnings.

D)Common Stock.

E)Equity in Subsidiary Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under the initial value method, the parent recognizes income when

A)Dividends are received from the investee.

B)Dividends are declared by the investee.

C)The related expense has been incurred.

D)The related contract is signed by the subsidiary.

E)It is earned by the subsidiary.

A)Dividends are received from the investee.

B)Dividends are declared by the investee.

C)The related expense has been incurred.

D)The related contract is signed by the subsidiary.

E)It is earned by the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

10

On January 1, 2020, Hemingway Co. acquired all of the common stock of Crotec Corp. For 2020, Crotec earned net income of $375,000 and paid dividends of $200,000. Amortization of the patent allocation that was included in the acquisition was $8,000.How much difference would there have been in Hemingway's income with regard to the effect of the investment, between using the equity method or using the initial value method of internal recordkeeping?

A)$8,000.

B)$167,000.

C)$175,000.

D)$200,000.

E)$375,000.

A)$8,000.

B)$167,000.

C)$175,000.

D)$200,000.

E)$375,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

11

How does the partial equity method differ from the equity method?

A)In the total assets reported on the consolidated balance sheet.

B)In the treatment of dividends.

C)In the total liabilities reported on the consolidated balance sheet.

D)Under the partial equity method, subsidiary income does not increase the balance in the parent's investment account.

E)Under the partial equity method, the balance in the investment account is not decreased by amortization on allocations made in the acquisition of the subsidiary.

A)In the total assets reported on the consolidated balance sheet.

B)In the treatment of dividends.

C)In the total liabilities reported on the consolidated balance sheet.

D)Under the partial equity method, subsidiary income does not increase the balance in the parent's investment account.

E)Under the partial equity method, the balance in the investment account is not decreased by amortization on allocations made in the acquisition of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not an example of an intangible asset?

A)Customer list

B)Database

C)Lease agreement

D)Broken equipment

E)Trademark

A)Customer list

B)Database

C)Lease agreement

D)Broken equipment

E)Trademark

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

13

An impairment model is used

A)To assess whether asset write-downs are appropriate for indefinite-lived assets.

B)To calculate the fair value of intangible assets.

C)To calculate the amortization of indefinite-lived assets over their useful lives.

D)To determine whether the fair value of assets should be recognized.

E)To determine the likelihood that the fair value of an assumed liability will increase.

A)To assess whether asset write-downs are appropriate for indefinite-lived assets.

B)To calculate the fair value of intangible assets.

C)To calculate the amortization of indefinite-lived assets over their useful lives.

D)To determine whether the fair value of assets should be recognized.

E)To determine the likelihood that the fair value of an assumed liability will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

14

Vaughn Inc. acquired all of the outstanding common stock of Roberts Co. on January 1, 2020, for $276,000. Annual amortization of $21,000 resulted from this acquisition. Vaughn reported net income of $80,000 in 2020 and $60,000 in 2021 and paid $24,000 in dividends each year. Roberts reported net income of $50,000 in 2020 and $57,000 in 2021 and paid $12,000 in dividends each year. What is the Investment in Roberts Co. balance on Vaughn's books as of December 31, 2021, if the partial equity method has been applied?

A)$317,000.

B)$326,000.

C)$359,000.

D)$368,000.

E)$383,000.

A)$317,000.

B)$326,000.

C)$359,000.

D)$368,000.

E)$383,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

15

Vaughn Inc. acquired all of the outstanding common stock of Roberts Co. on January 1, 2020, for $276,000. Annual amortization of $21,000 resulted from this acquisition. Vaughn reported net income of $80,000 in 2020 and $60,000 in 2021 and paid $24,000 in dividends each year. Roberts reported net income of $50,000 in 2020 and $57,000 in 2021 and paid $12,000 in dividends each year. What is the Investment in Roberts Co. balance on Vaughn's books as of December 31, 2021, if the initial value method has been applied?

A)$276,000.

B)$317,000.

C)$359,000.

D)$368,000.

E)$383,000.

A)$276,000.

B)$317,000.

C)$359,000.

D)$368,000.

E)$383,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

16

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.In Barber's accounting records, what amount would appear on December 31, 2020 for equity in subsidiary earnings?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.In Barber's accounting records, what amount would appear on December 31, 2020 for equity in subsidiary earnings?

A)$83,000.

B)$133,100.

C)$134,000.

D)$134,900.

E)$185,000.

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.In Barber's accounting records, what amount would appear on December 31, 2020 for equity in subsidiary earnings?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.In Barber's accounting records, what amount would appear on December 31, 2020 for equity in subsidiary earnings?A)$83,000.

B)$133,100.

C)$134,000.

D)$134,900.

E)$185,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

17

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.If Barber Corp. had net income of $468,000 in 2020, exclusive of the investment, what is the amount of consolidated net income?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.If Barber Corp. had net income of $468,000 in 2020, exclusive of the investment, what is the amount of consolidated net income?

A)$468,000.

B)$519,000.

C)$602,000.

D)$602,900.

E)$691,000.

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.If Barber Corp. had net income of $468,000 in 2020, exclusive of the investment, what is the amount of consolidated net income?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.If Barber Corp. had net income of $468,000 in 2020, exclusive of the investment, what is the amount of consolidated net income?A)$468,000.

B)$519,000.

C)$602,000.

D)$602,900.

E)$691,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following internal record-keeping methods can a parent choose to account for a subsidiary acquired in a business combination?

A)Initial value or book value.

B)Initial value, lower-of-cost-or-market-value, or equity.

C)Initial value, equity, or partial equity.

D)Initial value, equity, or book value.

E)Initial value, lower-of-cost-or-market-value, or partial equity.

A)Initial value or book value.

B)Initial value, lower-of-cost-or-market-value, or equity.

C)Initial value, equity, or partial equity.

D)Initial value, equity, or book value.

E)Initial value, lower-of-cost-or-market-value, or partial equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under the partial equity method, the parent recognizes income when

A)Dividends are received from the investee.

B)Dividends are declared by the investee.

C)The related expense has been incurred.

D)The related contract is signed by the subsidiary.

E)It is earned by the subsidiary.

A)Dividends are received from the investee.

B)Dividends are declared by the investee.

C)The related expense has been incurred.

D)The related contract is signed by the subsidiary.

E)It is earned by the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

20

On January 1, 2020, Hemingway Co. acquired all of the common stock of Crotec Corp. For 2020, Crotec earned net income of $375,000 and paid dividends of $200,000. Amortization of the patent allocation that was included in the acquisition was $8,000.How much difference would there have been in Hemingway's income with regard to the effect of the investment, between using the equity method or using the partial equity method of internal recordkeeping?

A)$8,000.

B)$167,000.

C)$175,000.

D)$200,000.

E)$375,000.

A)$8,000.

B)$167,000.

C)$175,000.

D)$200,000.

E)$375,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

21

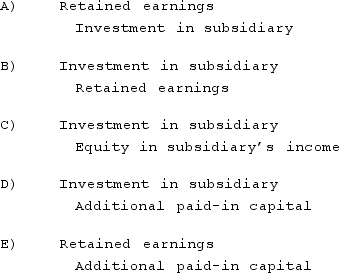

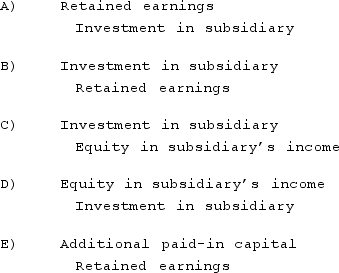

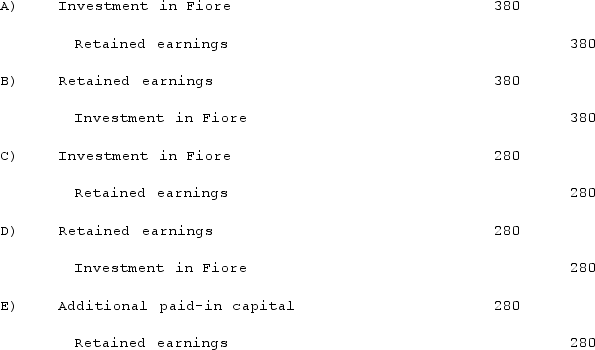

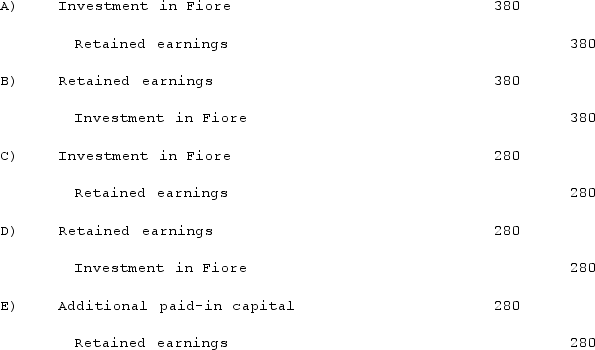

When a company applies the partial equity method in accounting for its investment in a subsidiary and the subsidiary's equipment has a fair value greater than its book value, what consolidation worksheet entry is made to convert to full-accrual totals in a year subsequent to the initial acquisition of the subsidiary?

A)A above.

B)B above.

C)C above.

D)D above.

E)E above.

A)A above.

B)B above.

C)C above.

D)D above.

E)E above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

22

Scott Co. paid $2,800,000 to acquire all of the common stock of Dawn Corp. on January 1, 2020. Dawn's reported earnings for 2020 totaled $512,000, and it paid $160,000 in dividends during the year. The amortization of allocations related to the investment was $28,000. Scott's net income, not including the investment, was $3,310,000, and it paid dividends of $950,000.On the consolidated financial statements for 2020, what amount should have been shown for Equity in Subsidiary Earnings?

A)$-0-

B)$132,000.

C)$160,000.

D)$484,000.

E)$512,000.

A)$-0-

B)$132,000.

C)$160,000.

D)$484,000.

E)$512,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

23

All of the following are acceptable methods to account for a majority-owned investment in subsidiary except

A)The equity method.

B)The initial value method.

C)The partial equity method.

D)The fair-value method.

A)The equity method.

B)The initial value method.

C)The partial equity method.

D)The fair-value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

24

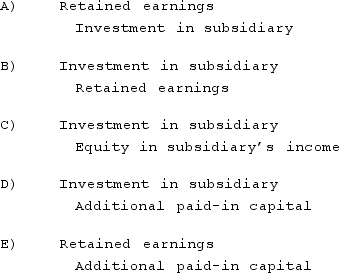

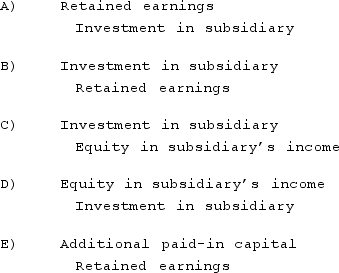

When a company applies the initial value method in accounting for its investment in a subsidiary, and the subsidiary reports income in excess of dividends paid, what entry would be made to convert to full-accrual totals in a consolidation worksheet for the second year?

A)A above.

B)B above.

C)C above.

D)D above.

E)E above.

A)A above.

B)B above.

C)C above.

D)D above.

E)E above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

25

According to GAAP regarding amortization of goodwill, which of the following statements is true?

A)Goodwill recognized in consolidation must be amortized over 20 years.

B)Goodwill recognized in consolidation must be expensed in the period of acquisition.

C)Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment.

D)Goodwill recognized in consolidation can never be written off.

E)Goodwill recognized in consolidation must be amortized over 40 years.

A)Goodwill recognized in consolidation must be amortized over 20 years.

B)Goodwill recognized in consolidation must be expensed in the period of acquisition.

C)Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment.

D)Goodwill recognized in consolidation can never be written off.

E)Goodwill recognized in consolidation must be amortized over 40 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

26

Under the partial equity method of accounting for an investment,

A)The investment account remains at initial value.

B)Dividends received are recorded as revenue.

C)The allocations for excess fair value allocations over book value of net assets at date of acquisition are applied over their useful lives to reduce the investment account.

D)Amortization of the excess of fair value allocations over book value is ignored in regard to the investment account.

E)Dividends received increase the investment account.

A)The investment account remains at initial value.

B)Dividends received are recorded as revenue.

C)The allocations for excess fair value allocations over book value of net assets at date of acquisition are applied over their useful lives to reduce the investment account.

D)Amortization of the excess of fair value allocations over book value is ignored in regard to the investment account.

E)Dividends received increase the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

27

Consolidated net income using the equity method for an acquisition combination is computed as follows:

A)Parent company's revenues from its own operations plus subsidiary retained earnings.

B)Parent's reported net income plus subsidiary dividends.

C)Combined revenues less combined expenses less equity in subsidiary's earnings less amortization of fair-value allocations in excess of book value.

D)Parent's revenues less expenses for its own operations plus the equity from subsidiary's earnings less subsidiary dividends.

E)None of these answer choices are correct.

A)Parent company's revenues from its own operations plus subsidiary retained earnings.

B)Parent's reported net income plus subsidiary dividends.

C)Combined revenues less combined expenses less equity in subsidiary's earnings less amortization of fair-value allocations in excess of book value.

D)Parent's revenues less expenses for its own operations plus the equity from subsidiary's earnings less subsidiary dividends.

E)None of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not a factor to be considered when determining the useful life of an intangible asset?

A)Legal, regulatory or contractual provisions.

B)The effects of obsolescence.

C)The expected use of the asset by the organization.

D)The fair value of the asset.

E)The level of maintenance expenditures that will be required to obtain expected future benefits.

A)Legal, regulatory or contractual provisions.

B)The effects of obsolescence.

C)The expected use of the asset by the organization.

D)The fair value of the asset.

E)The level of maintenance expenditures that will be required to obtain expected future benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

29

Scott Co. paid $2,800,000 to acquire all of the common stock of Dawn Corp. on January 1, 2020. Dawn's reported earnings for 2020 totaled $512,000, and it paid $160,000 in dividends during the year. The amortization of allocations related to the investment was $28,000. Scott's net income, not including the investment, was $3,310,000, and it paid dividends of $950,000.On the consolidated financial statements for 2020, what amount should have been shown for consolidated dividends?

A)$-0-

B)$160,000.

C)$922,000.

D)$950,000.

E)$1,110,000.

A)$-0-

B)$160,000.

C)$922,000.

D)$950,000.

E)$1,110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

30

Black Co. acquired 100% of Blue, Inc. on January 1, 2020. On that date, Blue had land with a book value of $38,000 and a fair value of $49,000. Also, on the date of acquisition, Blue had a building with a book value of $250,000 and a fair value of $460,000. Blue had equipment with a book value of $340,000 and a fair value of $280,000. The building had a 10-year remaining useful life and the equipment had a 5-year remaining useful life. How much total expense will be in the consolidated financial statements for the year ended December 31, 2020 related to the acquisition allocations of Blue?

A)$0.

B)$9,000.

C)$12,000.

D)$21,000.

E)$30,000.

A)$0.

B)$9,000.

C)$12,000.

D)$21,000.

E)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

31

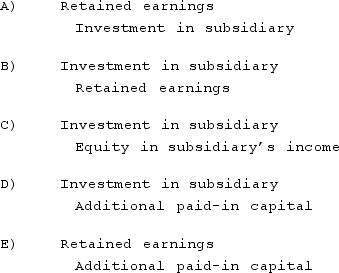

When a company applies the initial value method in accounting for its investment in a subsidiary and the subsidiary reports income less than dividends paid, what entry would be made to convert to full-accrual totals in a consolidation worksheet for the second year?

A)A above.

B)B above.

C)C above.

D)D above.

E)E above.

A)A above.

B)B above.

C)C above.

D)D above.

E)E above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

32

With respect to identifiable intangible assets other than goodwill, which of the following is true?

A)If the value of the identified asset meets a de minimis exception, the entity may elect to treat it as goodwill.

B)An identifiable intangible asset with an indefinite useful life must be assessed for impairment once every three years.

C)If the average fair value of the asset is less than the average carrying amount of the asset with respect to, and determined for, the preceding three-year period, the asset is considered impaired and the entity may recognize a loss.

D)A quantitative evaluation of value is required each year regardless of circumstances.

E)If a qualitative assessment of the asset performed by an entity indicates impairment is likely, a quantitative assessment must be performed to determine whether there has been a loss in fair value.

A)If the value of the identified asset meets a de minimis exception, the entity may elect to treat it as goodwill.

B)An identifiable intangible asset with an indefinite useful life must be assessed for impairment once every three years.

C)If the average fair value of the asset is less than the average carrying amount of the asset with respect to, and determined for, the preceding three-year period, the asset is considered impaired and the entity may recognize a loss.

D)A quantitative evaluation of value is required each year regardless of circumstances.

E)If a qualitative assessment of the asset performed by an entity indicates impairment is likely, a quantitative assessment must be performed to determine whether there has been a loss in fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is false regarding contingent consideration in business combinations?

A)Contingent consideration payable in cash is reported under liabilities.

B)Contingent consideration payable in stock shares is reported under stockholders' equity.

C)Contingent consideration is recorded because of its substantial probability of eventual payment.

D)The contingent consideration fair value is recognized as part of the acquisition regardless of whether eventual payment is based on future performance of the target firm or future stock price of the acquirer.

E)Contingent consideration is reflected in the acquirer's balance sheet at the present value of the potential expected future payment.

A)Contingent consideration payable in cash is reported under liabilities.

B)Contingent consideration payable in stock shares is reported under stockholders' equity.

C)Contingent consideration is recorded because of its substantial probability of eventual payment.

D)The contingent consideration fair value is recognized as part of the acquisition regardless of whether eventual payment is based on future performance of the target firm or future stock price of the acquirer.

E)Contingent consideration is reflected in the acquirer's balance sheet at the present value of the potential expected future payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

34

When consolidating a subsidiary under the equity method, which of the following statements is true with regard to the subsidiary subsequent to the year of acquisition?

A)All net assets are revalued to fair value and must be amortized over their useful lives.

B)Only net assets that had excess fair value over book value when acquired by the parent must be amortized over their useful lives.

C)All depreciable net assets are revalued to fair value at date of acquisition and must be amortized over their useful lives.

D)Only depreciable net assets that have excess fair value over book value must be amortized over their useful lives.

E)Only assets that have excess fair value over book value must be amortized over their useful lives.

A)All net assets are revalued to fair value and must be amortized over their useful lives.

B)Only net assets that had excess fair value over book value when acquired by the parent must be amortized over their useful lives.

C)All depreciable net assets are revalued to fair value at date of acquisition and must be amortized over their useful lives.

D)Only depreciable net assets that have excess fair value over book value must be amortized over their useful lives.

E)Only assets that have excess fair value over book value must be amortized over their useful lives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

35

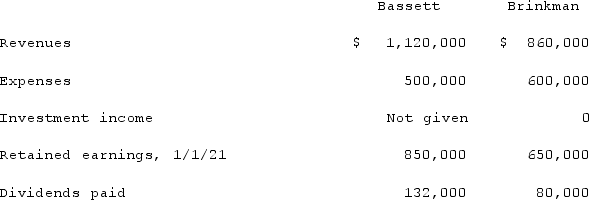

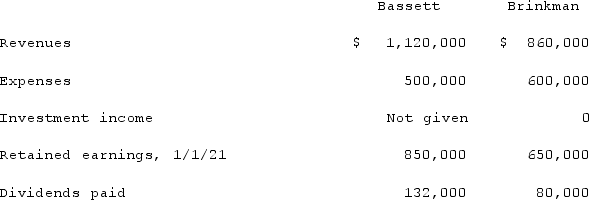

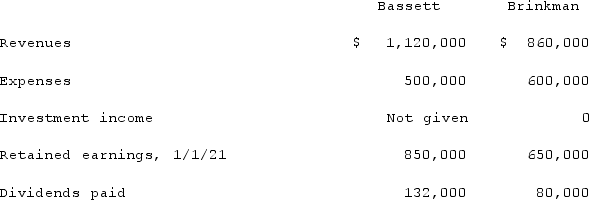

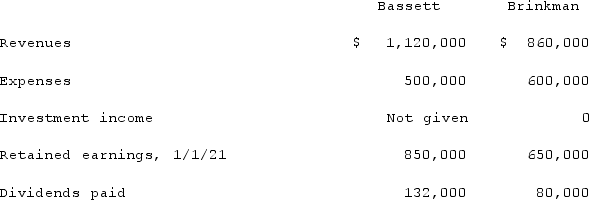

Bassett Inc. acquired all of the outstanding common stock of Brinkman Corp. on January 1, 2019, for $422,000. Equipment with a ten-year life was undervalued on Brinkman's financial records by $48,000. Brinkman also owned an unrecorded customer list with an assessed fair value of $71,000 and an estimated remaining life of five years.Brinkman earned reported net income of $185,000 in 2019 and $226,000 in 2020. Dividends of $75,000 were paid in each of these two years. Selected account balances as of December 31, 2021, for the two companies follow.  If the partial equity method had been applied, what was 2021 consolidated net income?

If the partial equity method had been applied, what was 2021 consolidated net income?

A)$260,000.

B)$620,000.

C)$861,000.

D)$880,000.

E)$1,291,000.

If the partial equity method had been applied, what was 2021 consolidated net income?

If the partial equity method had been applied, what was 2021 consolidated net income?A)$260,000.

B)$620,000.

C)$861,000.

D)$880,000.

E)$1,291,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under the equity method of accounting for an investment:

A)The investment account remains at initial value.

B)Dividends received are recorded as revenue.

C)Goodwill is amortized over 20 years.

D)Income reported by the subsidiary increases the investment account.

E)Dividends received increase the investment account.

A)The investment account remains at initial value.

B)Dividends received are recorded as revenue.

C)Goodwill is amortized over 20 years.

D)Income reported by the subsidiary increases the investment account.

E)Dividends received increase the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

37

Scott Co. paid $2,800,000 to acquire all of the common stock of Dawn Corp. on January 1, 2020. Dawn's reported earnings for 2020 totaled $512,000, and it paid $160,000 in dividends during the year. The amortization of allocations related to the investment was $28,000. Scott's net income, not including the investment, was $3,310,000, and it paid dividends of $950,000.What is the amount of consolidated net income for the year 2020?

A)$3,150,000.

B)$3,282,000.

C)$3,310,000.

D)$3,794,000.

E)$3,822,000.

A)$3,150,000.

B)$3,282,000.

C)$3,310,000.

D)$3,794,000.

E)$3,822,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

38

When consolidating parent and subsidiary financial statements, which of the following statements is true?

A)Goodwill is never recognized.

B)Goodwill required is amortized over 20 years.

C)Goodwill may be recorded on the parent company's books.

D)The value of any goodwill should be tested annually for impairment in value.

E)Goodwill should be expensed in the year of acquisition.

A)Goodwill is never recognized.

B)Goodwill required is amortized over 20 years.

C)Goodwill may be recorded on the parent company's books.

D)The value of any goodwill should be tested annually for impairment in value.

E)Goodwill should be expensed in the year of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under the initial value method, when accounting for an investment in a subsidiary,

A)Dividends received by the subsidiary decrease the investment account.

B)The investment account is adjusted to fair value at year-end.

C)Income reported by the subsidiary increases the investment account.

D)The investment account does not change from year to year.

E)Dividends received are ignored.

A)Dividends received by the subsidiary decrease the investment account.

B)The investment account is adjusted to fair value at year-end.

C)Income reported by the subsidiary increases the investment account.

D)The investment account does not change from year to year.

E)Dividends received are ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

40

Bassett Inc. acquired all of the outstanding common stock of Brinkman Corp. on January 1, 2019, for $422,000. Equipment with a ten-year life was undervalued on Brinkman's financial records by $48,000. Brinkman also owned an unrecorded customer list with an assessed fair value of $71,000 and an estimated remaining life of five years.Brinkman earned reported net income of $185,000 in 2019 and $226,000 in 2020. Dividends of $75,000 were paid in each of these two years. Selected account balances as of December 31, 2021, for the two companies follow.  If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

A)$806,000.

B)$811,000.

C)$863,000.

D)$920,000.

E)$1,036,000.

If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?A)$806,000.

B)$811,000.

C)$863,000.

D)$920,000.

E)$1,036,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

41

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the partial equity method is applied. How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

A)$400

B)$300

C)$380

D)$280

E)$480

A)$400

B)$300

C)$380

D)$280

E)$480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

42

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the equity method is applied. How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

A)$400

B)$300

C)$380

D)$280

E)$480

A)$400

B)$300

C)$380

D)$280

E)$480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

43

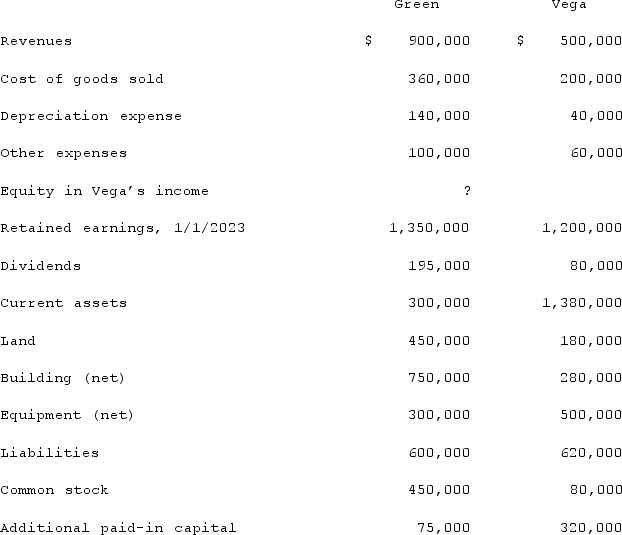

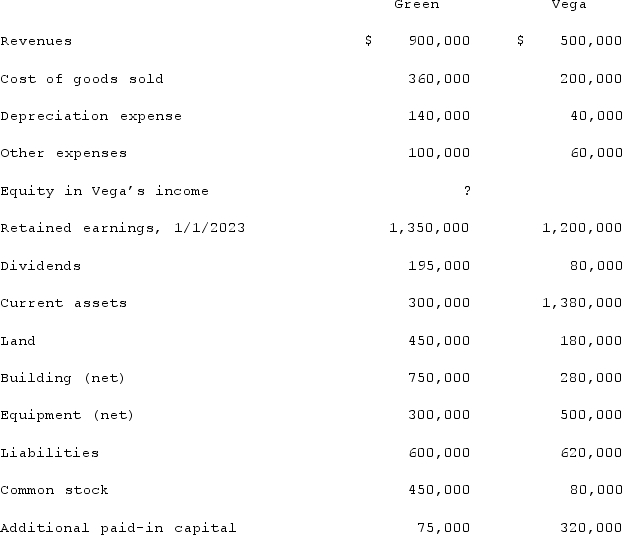

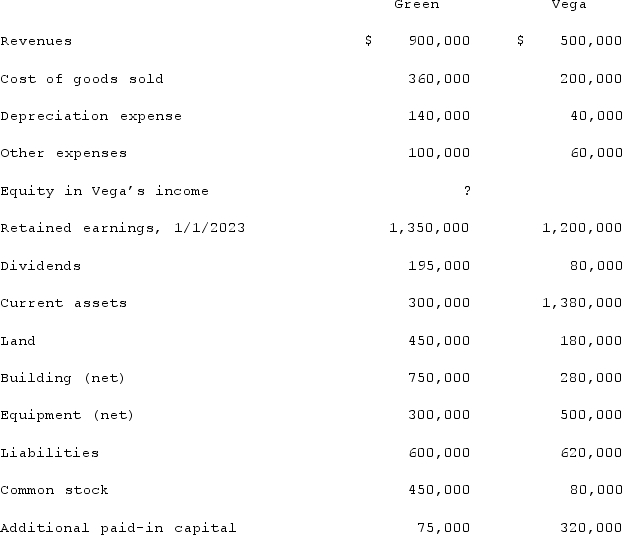

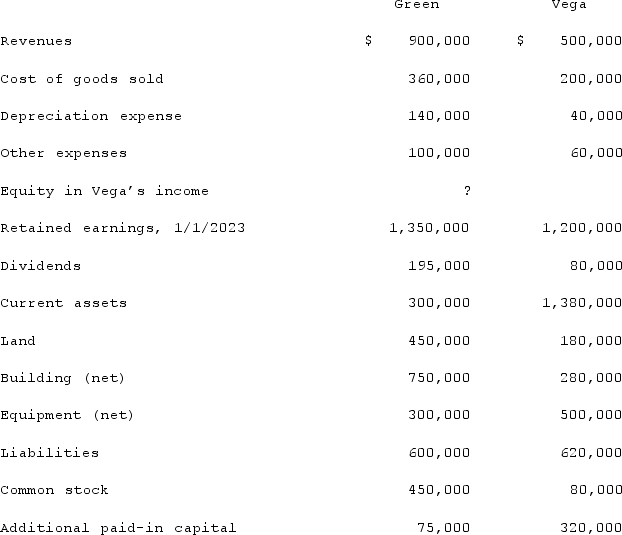

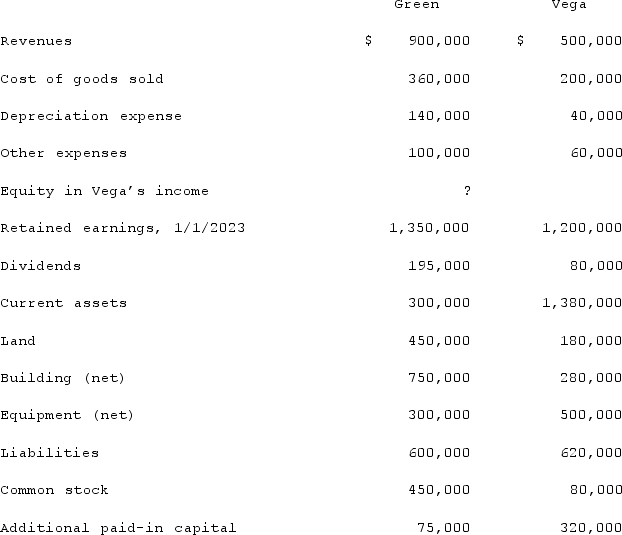

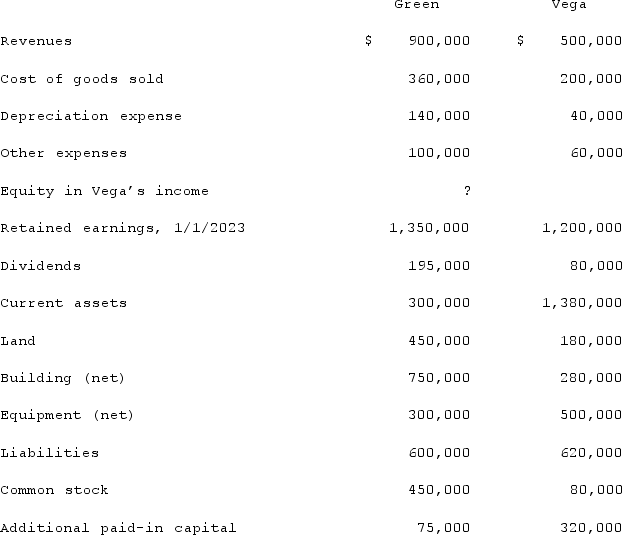

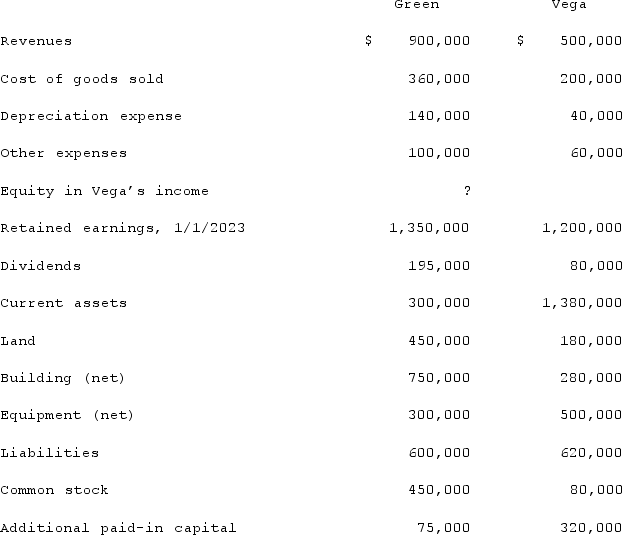

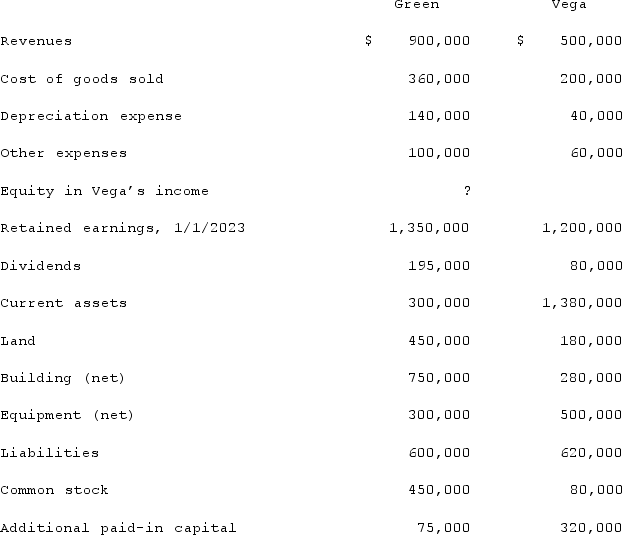

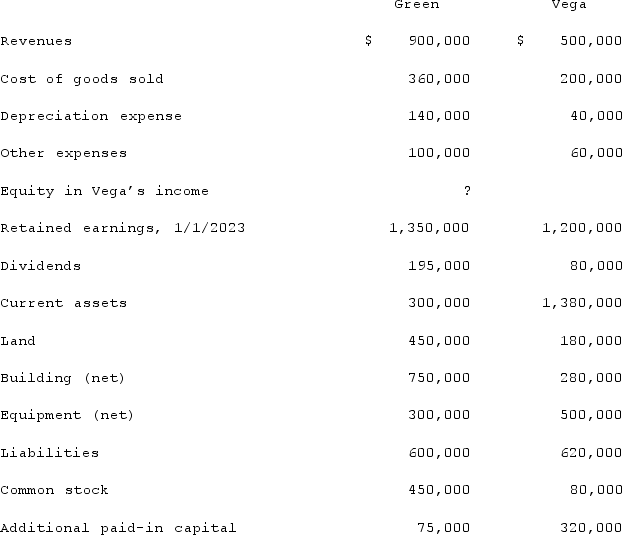

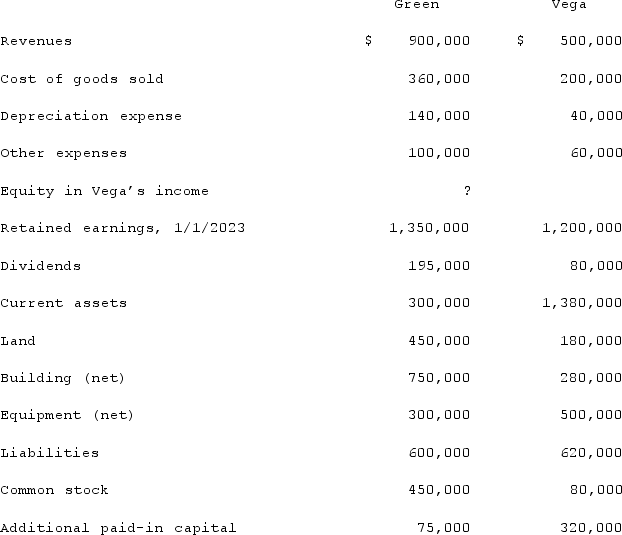

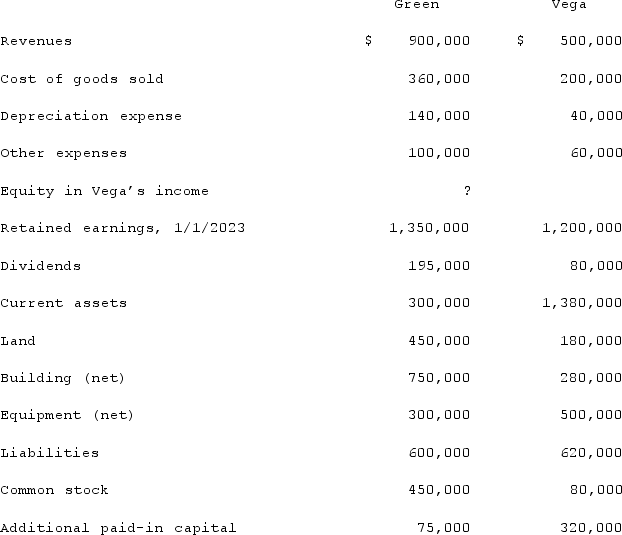

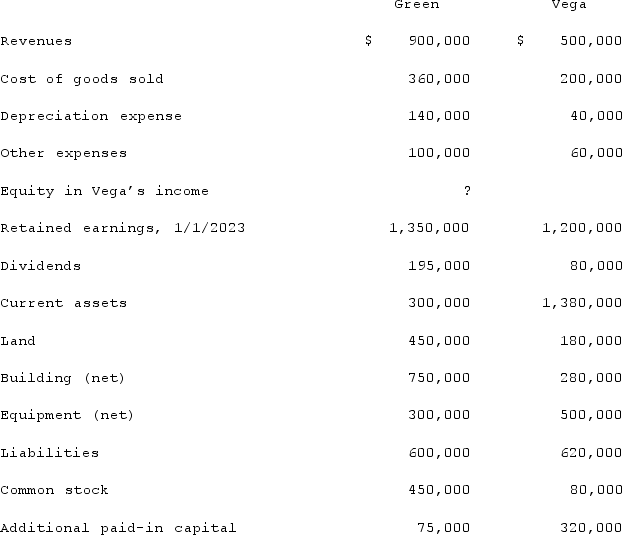

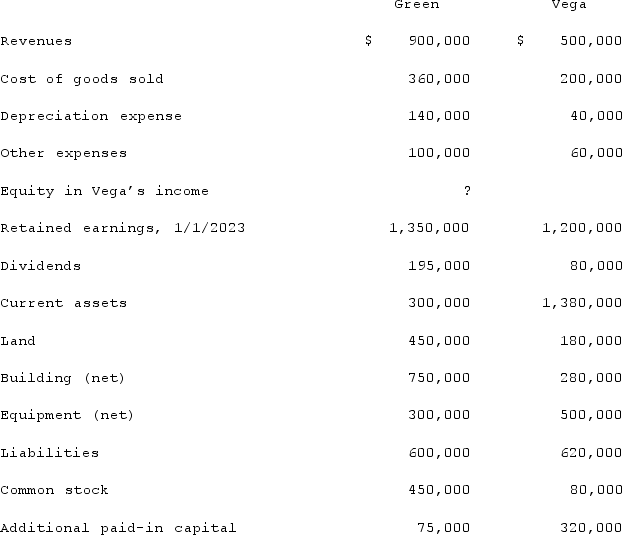

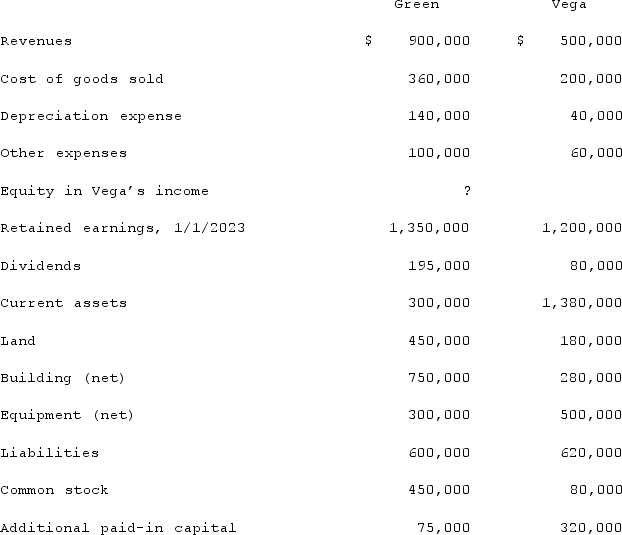

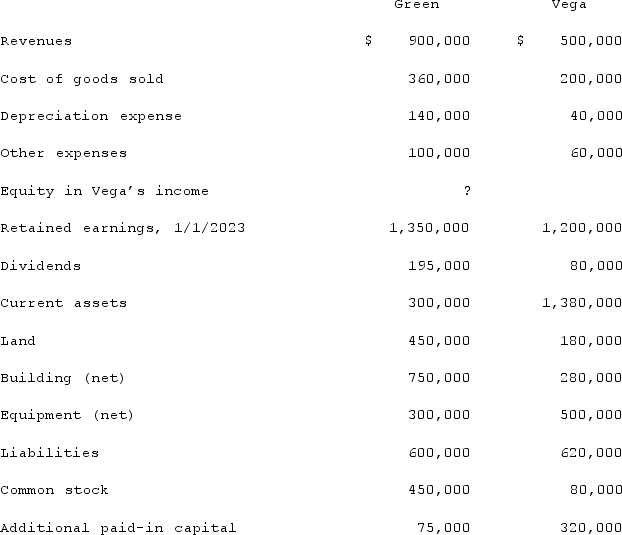

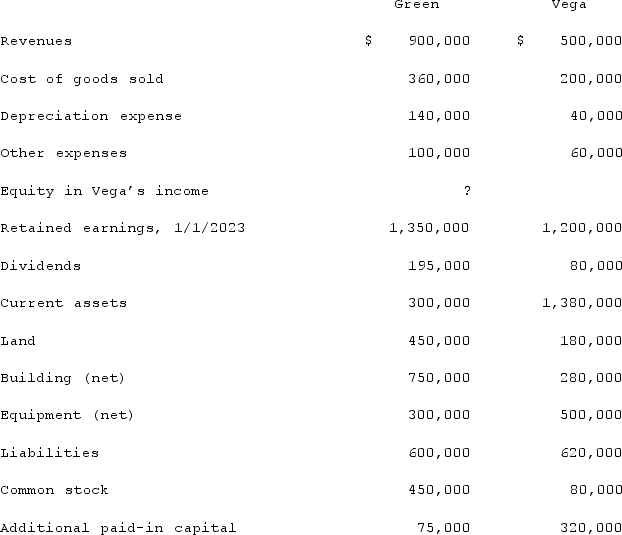

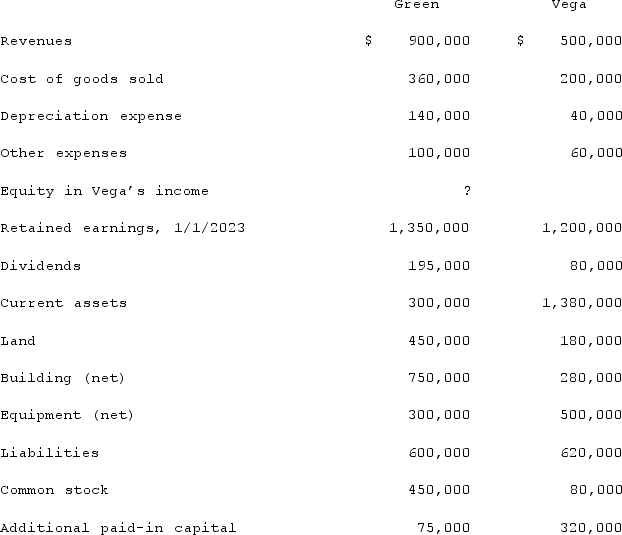

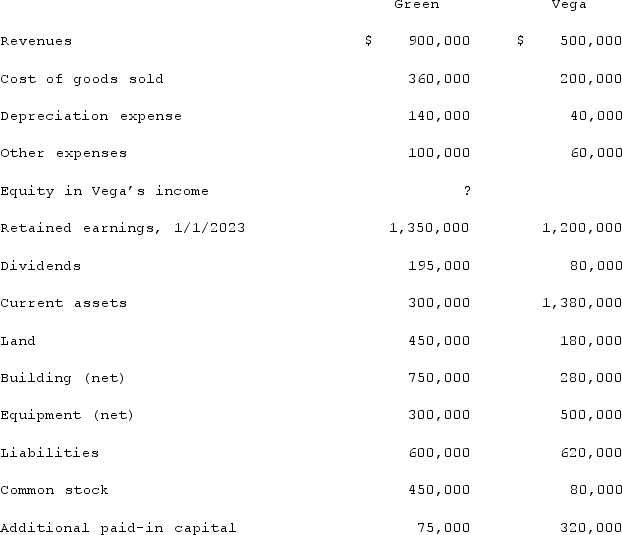

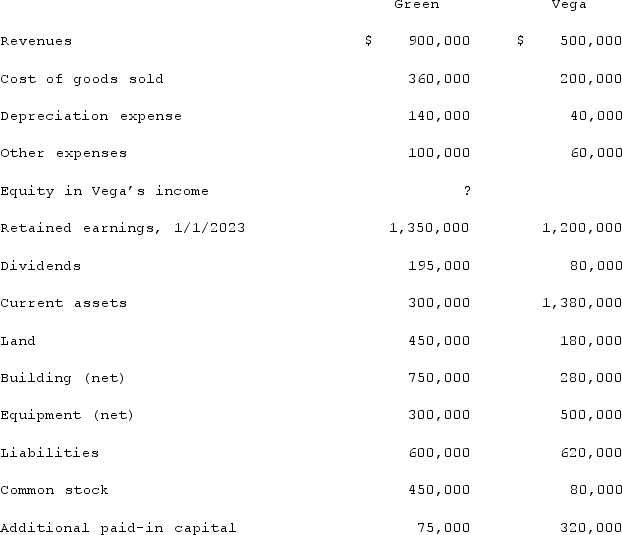

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated buildings.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated buildings.

A)$1,037,500.

B)$1,007,500.

C)$1,000,000.

D)$1,022,500.

E)$1,012,500.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated buildings.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated buildings.A)$1,037,500.

B)$1,007,500.

C)$1,000,000.

D)$1,022,500.

E)$1,012,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

44

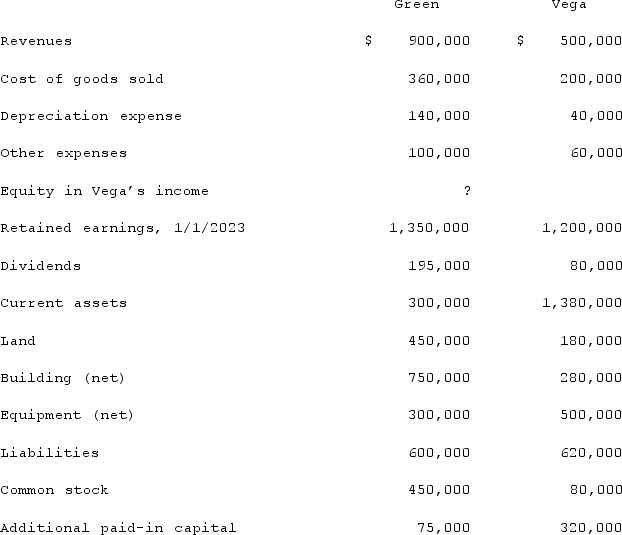

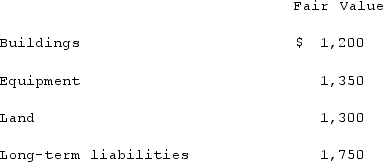

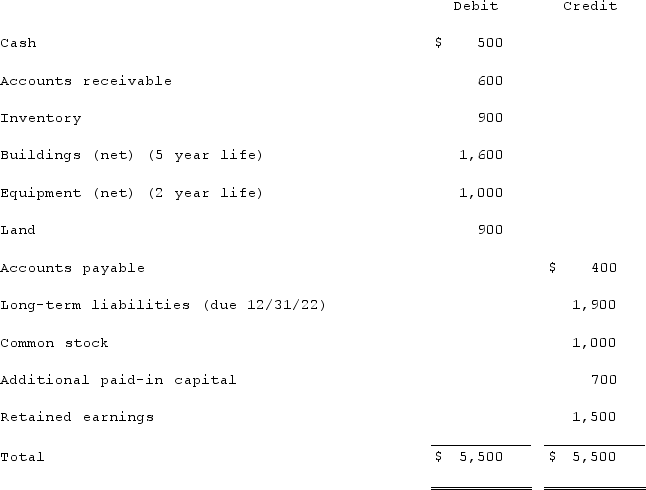

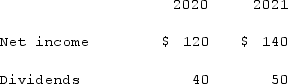

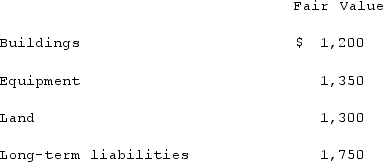

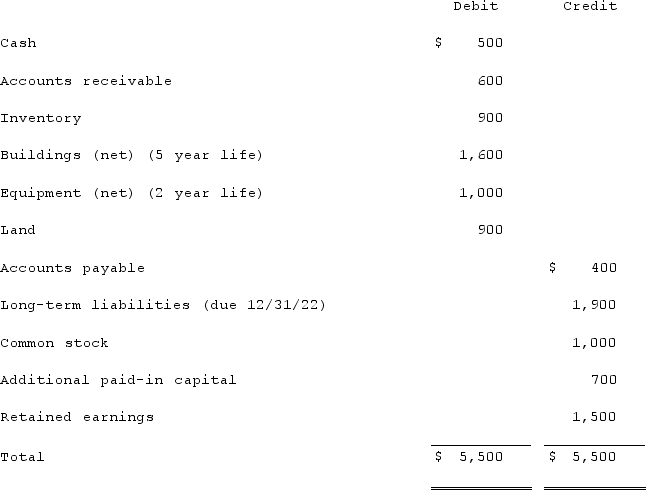

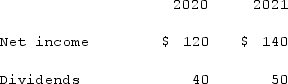

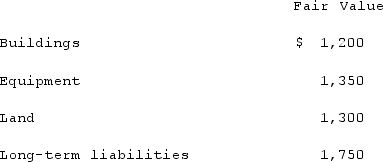

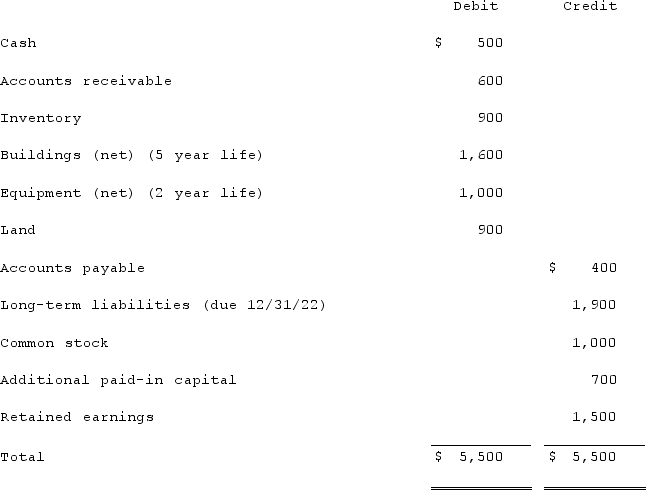

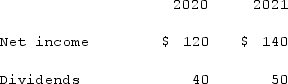

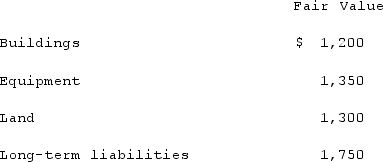

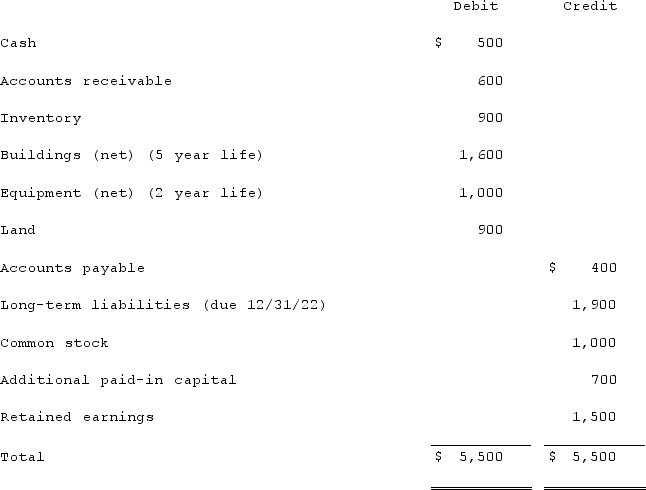

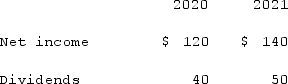

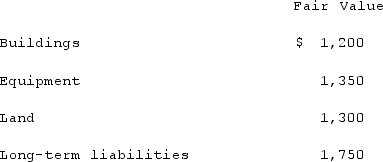

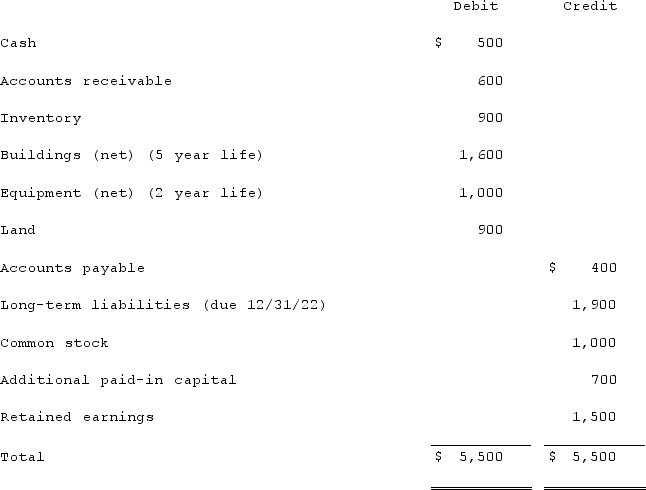

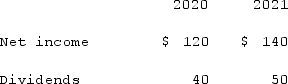

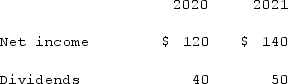

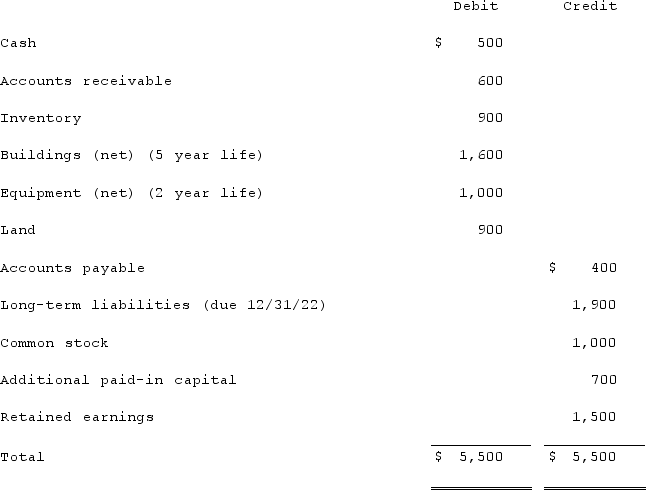

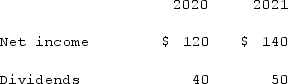

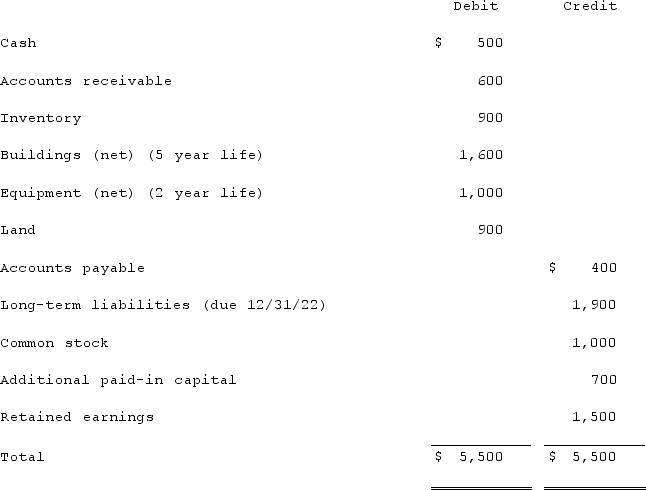

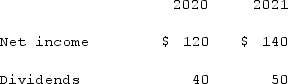

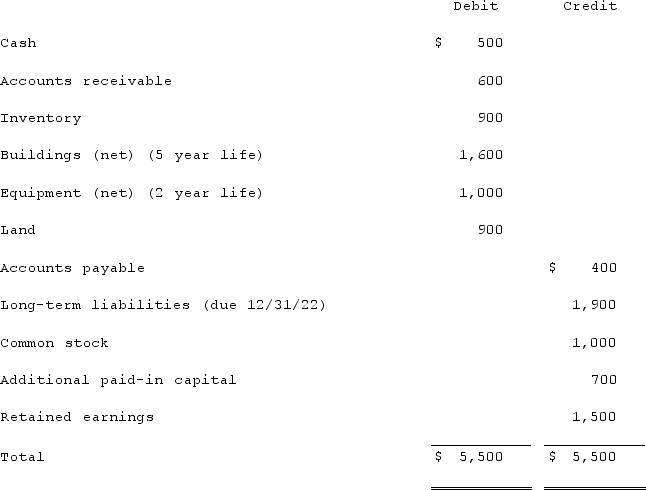

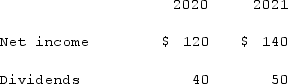

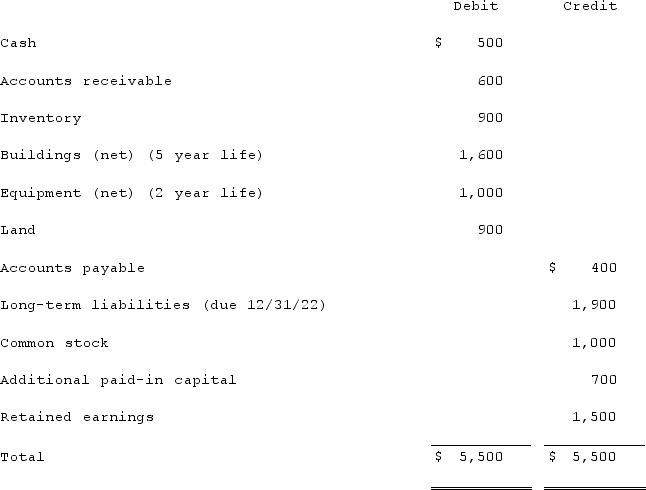

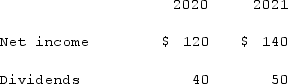

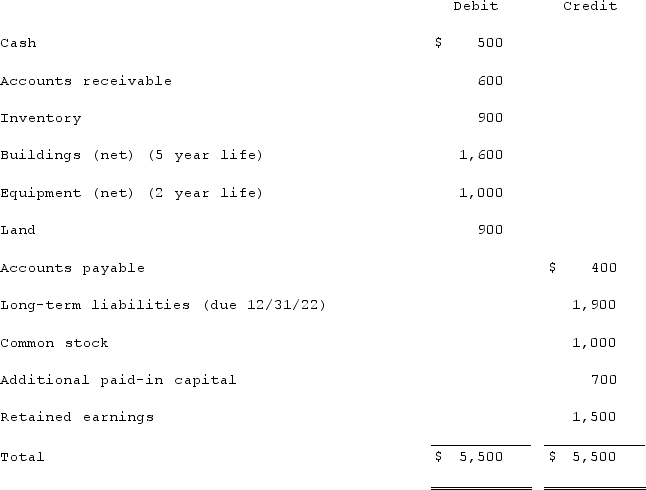

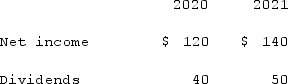

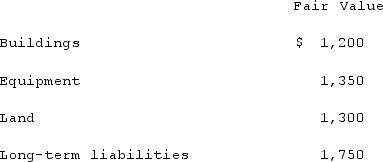

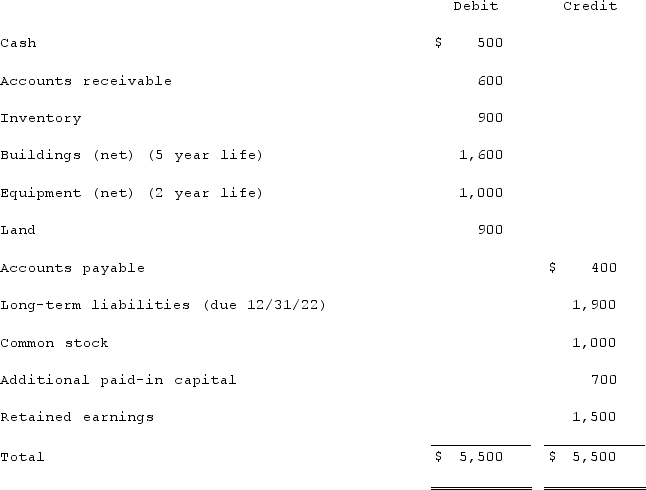

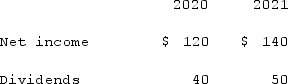

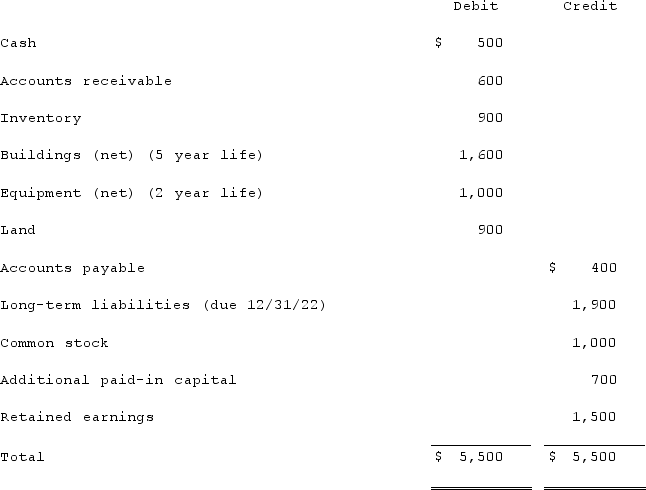

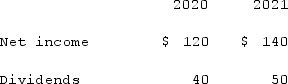

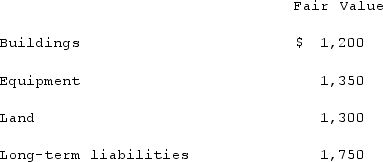

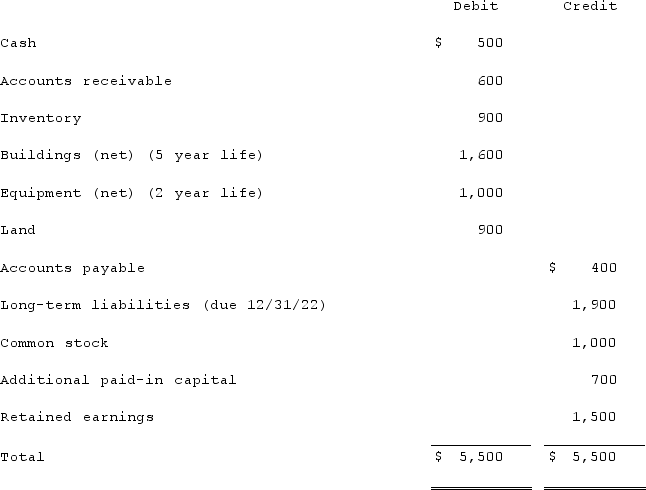

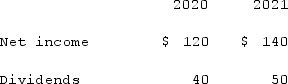

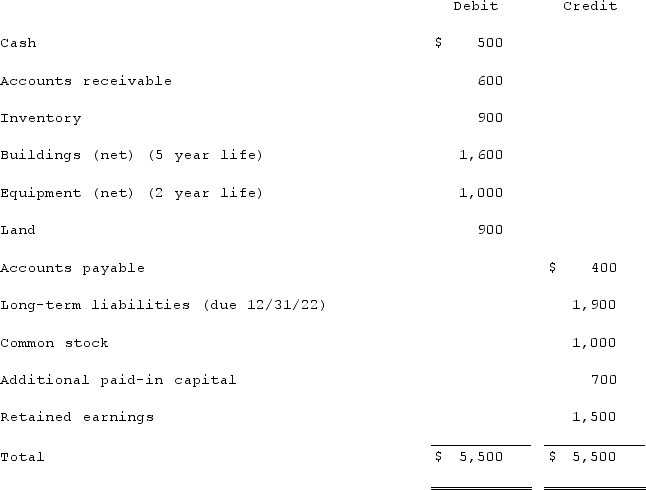

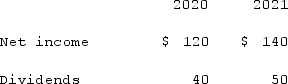

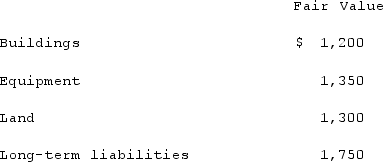

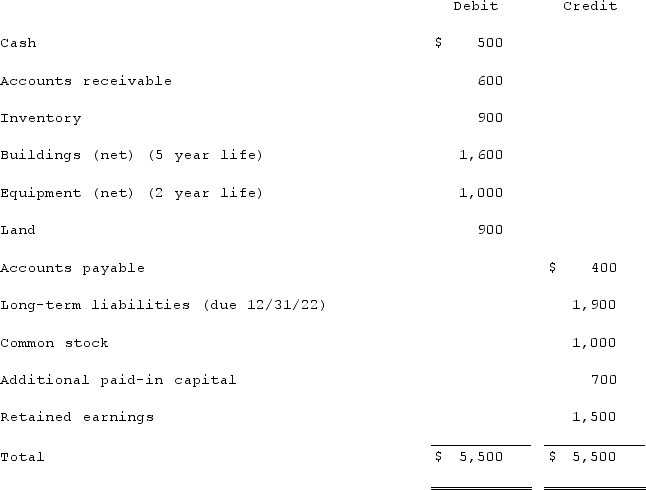

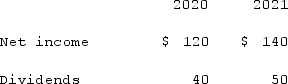

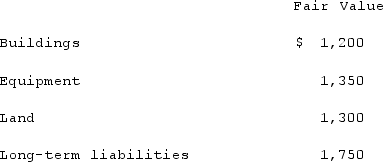

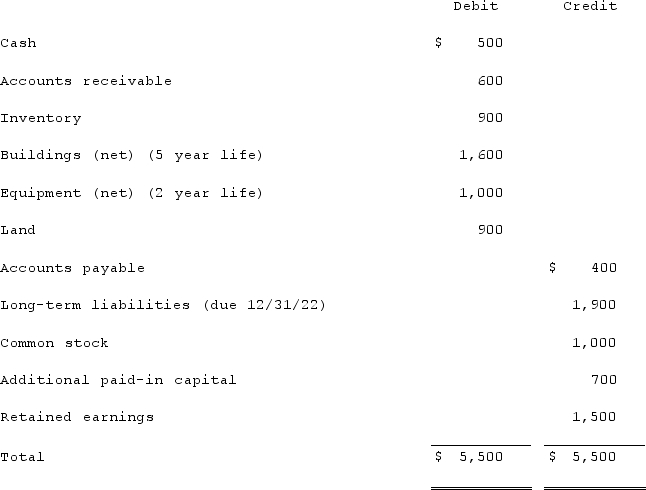

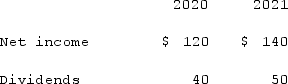

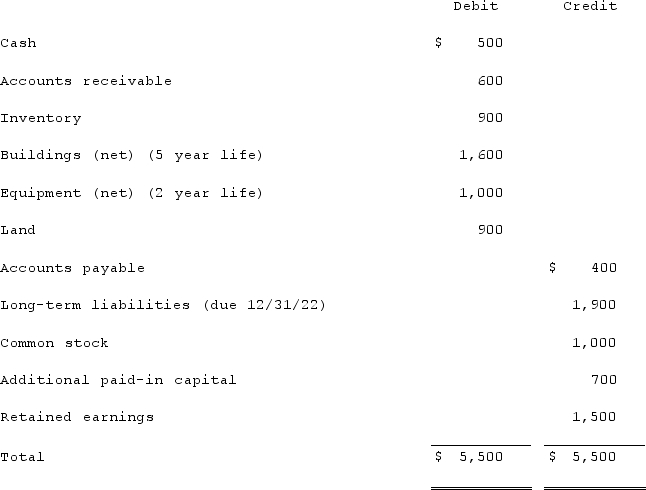

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

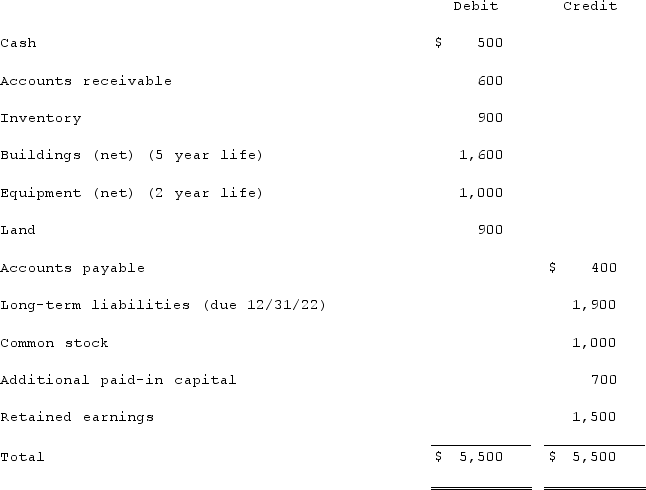

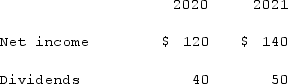

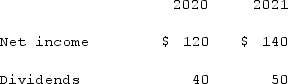

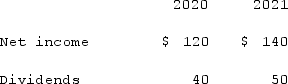

Net income and dividends reported by Clark for 2020 and 2021 follow:

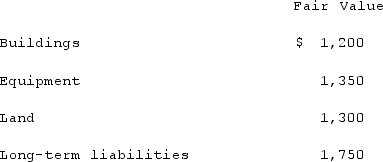

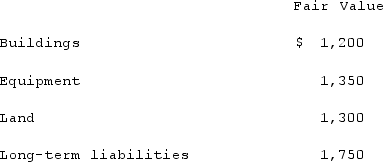

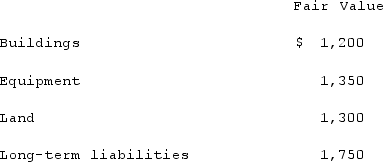

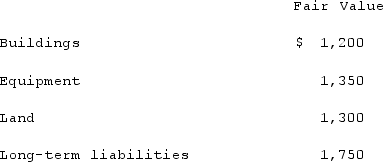

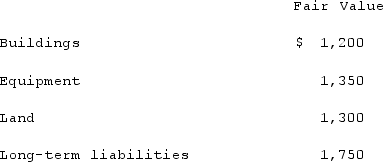

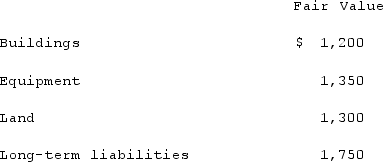

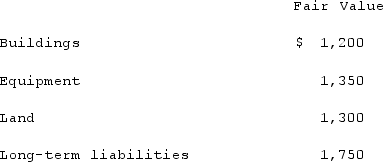

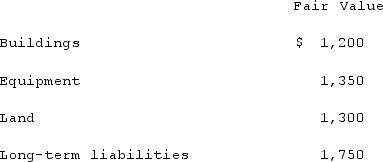

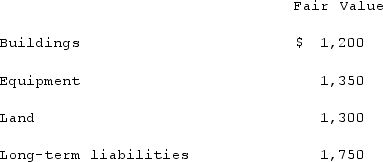

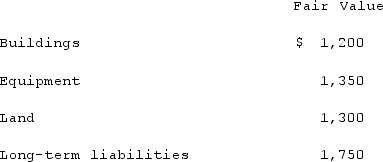

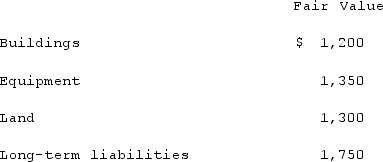

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2021, consolidated balance sheet.

A)$1,750.

B)$1,800.

C)$1,850.

D)$1,900.

E)$2,000.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2021, consolidated balance sheet.A)$1,750.

B)$1,800.

C)$1,850.

D)$1,900.

E)$2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

45

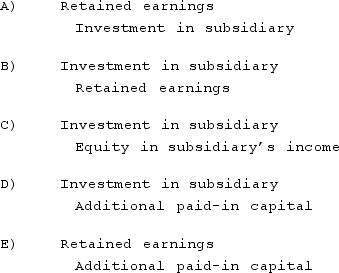

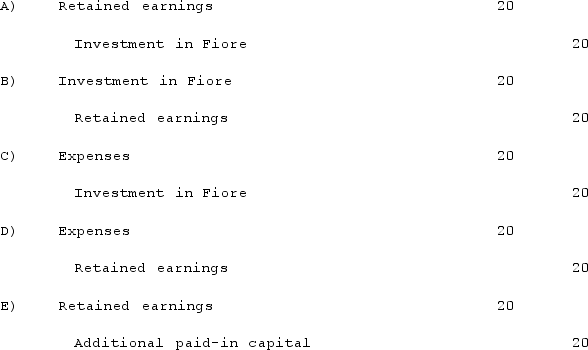

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the initial value method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

46

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

A)$1,700.

B)$1,750.

C)$1,800.

D)$1,850.

E)$1,900.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.A)$1,700.

B)$1,750.

C)$1,800.

D)$1,850.

E)$1,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

47

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2021, consolidated balance sheet.

A)$1,200.

B)$1,280.

C)$1,360.

D)$1,440.

E)$1,600.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2021, consolidated balance sheet.A)$1,200.

B)$1,280.

C)$1,360.

D)$1,440.

E)$1,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

48

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

A)$620,000.

B)$280,000.

C)$900,000.

D)$909,625.

E)$299,625.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated total expenses.A)$620,000.

B)$280,000.

C)$900,000.

D)$909,625.

E)$299,625.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

49

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the consideration transferred in excess of book value acquired at January 1, 2020.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the consideration transferred in excess of book value acquired at January 1, 2020.

A)$900.

B)$1,400.

C)$1,900.

D)$2,400.

E)$2,600.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the consideration transferred in excess of book value acquired at January 1, 2020.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the consideration transferred in excess of book value acquired at January 1, 2020.A)$900.

B)$1,400.

C)$1,900.

D)$2,400.

E)$2,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

50

Hoyt Corporation agreed to the following terms in order to acquire the net assets of Brown Company on January 1, 2021:To issue 400 shares of common stock ($10 par)with a fair value of $45 per share.To assume Brown's liabilities which have a book value of $1,600 and a fair value of $1,500.On the date of acquisition, the consideration transferred for Hoyt's acquisition of Brown would be

A)$18,000.

B)$16,500.

C)$20,000.

D)$18,500.

E)$19,500.

A)$18,000.

B)$16,500.

C)$20,000.

D)$18,500.

E)$19,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

51

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's land that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's land that would be reported in a December 31, 2021, consolidated balance sheet.

A)$400.

B)$900.

C)$1,300.

D)$1,500.

E)$2,200.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's land that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's land that would be reported in a December 31, 2021, consolidated balance sheet.A)$400.

B)$900.

C)$1,300.

D)$1,500.

E)$2,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

52

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's inventory that would be reported in a January 1, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's inventory that would be reported in a January 1, 2020, consolidated balance sheet.

A)$0.

B)$100.

C)$400.

D)$550.

E)$900.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's inventory that would be reported in a January 1, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's inventory that would be reported in a January 1, 2020, consolidated balance sheet.A)$0.

B)$100.

C)$400.

D)$550.

E)$900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

53

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the initial value method is applied. How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

A)$400

B)$300

C)$380

D)$100

E)$210

A)$400

B)$300

C)$380

D)$100

E)$210

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

54

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

A)$997,500.

B)$857,500.

C)$1,200,000.

D)$1,600,000.

E)$827,500.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.A)$997,500.

B)$857,500.

C)$1,200,000.

D)$1,600,000.

E)$827,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

55

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2021, consolidated balance sheet.

A)$0.

B)$1,000.

C)$1,175.

D)$1,350.

E)$1,700.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2021, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2021, consolidated balance sheet.A)$0.

B)$1,000.

C)$1,175.

D)$1,350.

E)$1,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

56

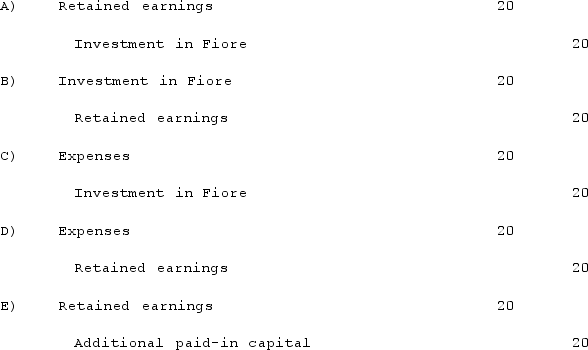

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the partial equity method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes, but is not required for the equity method?

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

A)Entry A.

B)Entry B.

C)Entry C.

D)Entry D.

E)Entry E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

57

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2020, consolidated balance sheet.

A)$825.

B)$1,000.

C)$1,175.

D)$1,350.

E)$1,525.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2020, consolidated balance sheet.A)$825.

B)$1,000.

C)$1,175.

D)$1,350.

E)$1,525.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

58

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated revenues.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated revenues.

A)$1,400,000.

B)$800,000.

C)$500,000.

D)$1,590,375.

E)$1,390,375.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated revenues.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated revenues.A)$1,400,000.

B)$800,000.

C)$500,000.

D)$1,590,375.

E)$1,390,375.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

59

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

A)$1,200.

B)$1,280.

C)$1,520.

D)$1,600.

E)$1,680.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's buildings that would be reported in a December 31, 2020, consolidated balance sheet.A)$1,200.

B)$1,280.

C)$1,520.

D)$1,600.

E)$1,680.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

60

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow:

The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below:

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute goodwill, if any, at January 1, 2020.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute goodwill, if any, at January 1, 2020.

A)$0.

B)$100.

C)$400.

D)$900.

E)$1,300.

Net income and dividends reported by Clark for 2020 and 2021 follow:

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute goodwill, if any, at January 1, 2020.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute goodwill, if any, at January 1, 2020.A)$0.

B)$100.

C)$400.

D)$900.

E)$1,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

61

Beatty, Inc. acquires 100% of the voting stock of Gataux Company on January 1, 2020 for $80,000, consisting of $20,000 in cash and 6,000 shares of stock. A contingent payment of $12,000 in cash will be paid on April 1, 2021 if Gataux generates cash flows from operations of $26,500 or more in the next year. Beatty estimates that there is a 30% probability that Gataux will generate at least $26,500 next year, and uses an interest rate of 4% to incorporate the time value of money. The fair value of $12,000 at 4%, using a probability-weighted approach, is $3,461. A contingent payment of $20,000, payable in stock, will be paid to the former owners of Gataux on April 1, 2021 if the market value of Beatty stock drops below $10 per share. Beatty estimates there is a 15% probability that its share price will not exceed that threshold. Using the same interest rate and probability-weighted approach, Beatty calculates the market value of the stock contingency to be $2,884.What will Beatty record as its Investment in Gataux on January 1, 2020?

A)$12,000.

B)$80,000.

C)$83,461.

D)$86,345.

E)$26,500.

A)$12,000.

B)$80,000.

C)$83,461.

D)$86,345.

E)$26,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

62

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

A)$450,000.

B)$530,000.

C)$555,000.

D)$635,000.

E)$525,000.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.A)$450,000.

B)$530,000.

C)$555,000.

D)$635,000.

E)$525,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

63