Deck 33: Aggregate Demand and Aggregate Supply

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/24

العب

ملء الشاشة (f)

Deck 33: Aggregate Demand and Aggregate Supply

1

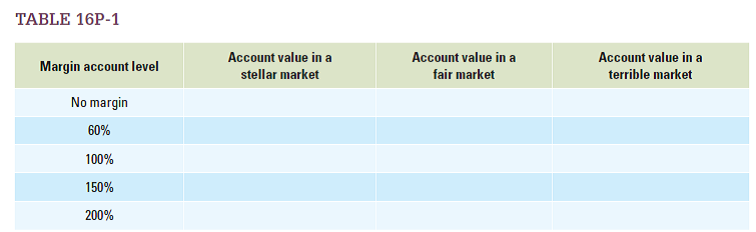

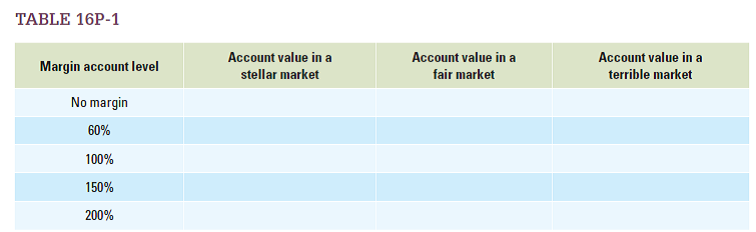

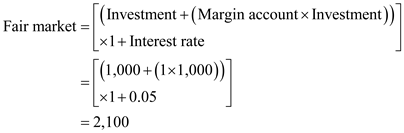

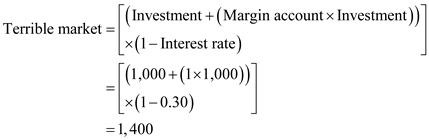

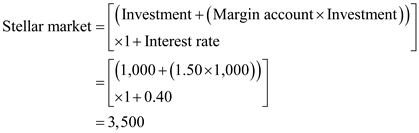

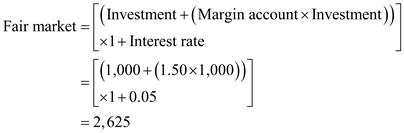

Ike, an investor, is considering opening a margin account and investing $1,000 in Mike's mutual fund. The terms of the account require that he pay back the amount he borrowed on the margin by the end of the year with 10 percent interest. Ike is trying to decide what level of margin he wants. For example, if he chooses an account at the level of 50 percent, the bank will let him borrow and invest an additional $500, or 50 percent of his original $1,000. Complete Table 16P-1 by filling in Ike's account value at the end of the year, given varying levels of the margin account and mutual fund performance. Assume that Mike's mutual fund will return 40 percent per year in a stellar market and 5 percent per year in a fair market, and that in a terrible market, it will lose 30 percent.

Given:

• Investment in opening the margin account in mutual fund with an amount of $1,000.

• Interest rate of 10%.

• Mutual fund return in stellar market is 40%.

• Mutual fund return in fair market is 5%.

• Mutual fund return in terrible market is -30%.

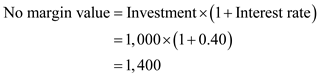

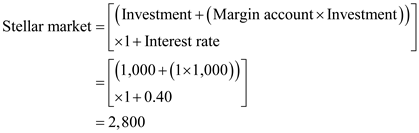

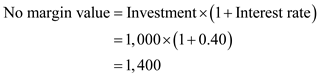

No margin account level in stellar market: Therefore, the no margin account level in stellar market is

Therefore, the no margin account level in stellar market is  .

.

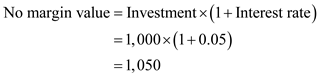

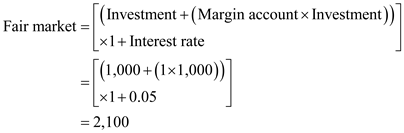

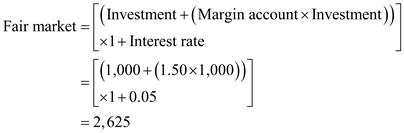

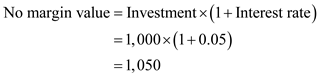

No margin account level in fair market: Therefore, the no margin account level in fair market is

Therefore, the no margin account level in fair market is  .

.

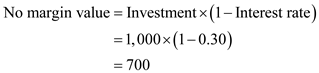

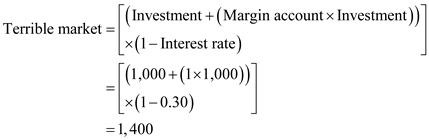

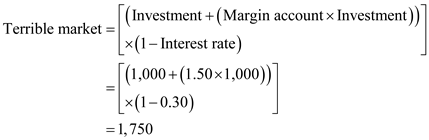

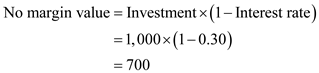

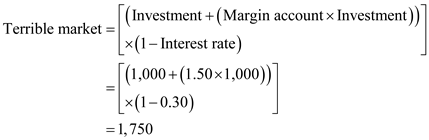

No margin account level in terrible market: Therefore, the no margin account level in terrible market is

Therefore, the no margin account level in terrible market is  .

.

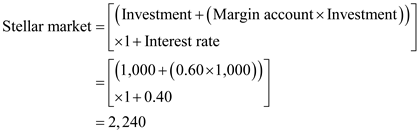

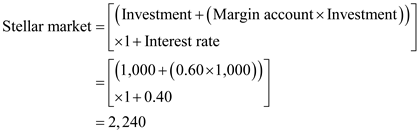

Account value in stellar market with 60%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

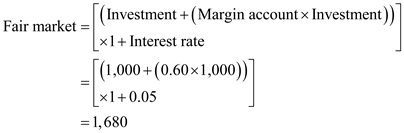

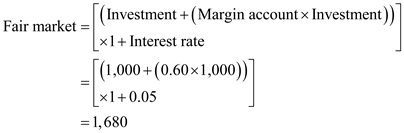

Account value in fair market with 5%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

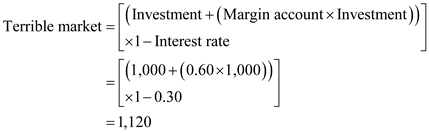

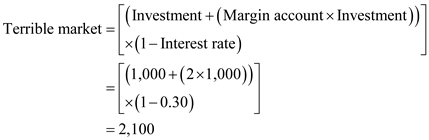

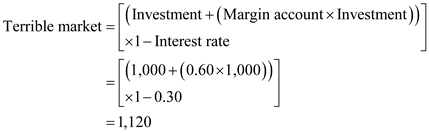

Account value in terrible market with 5%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

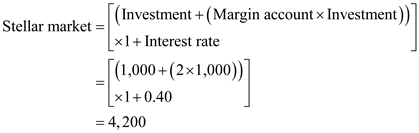

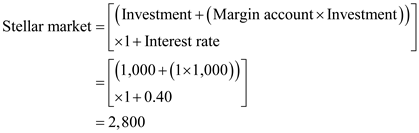

Account value in stellar market with 100%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

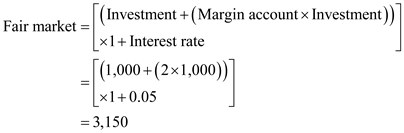

Account value in fair market with 100%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

Account value in terrible market with 100%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

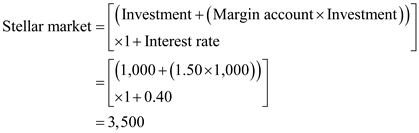

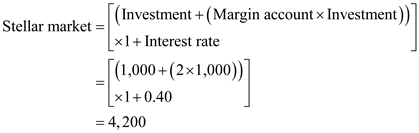

Account value in stellar market with 150%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

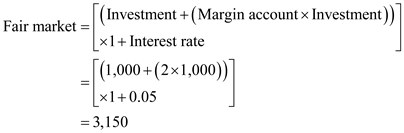

Account value in fair market with 150%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

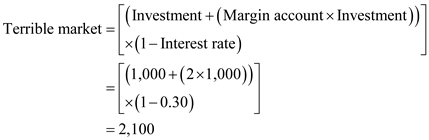

Account value in terrible market with 150%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

Account value in stellar market with 200%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

Account value in fair market with 200%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

Account value in terrible market with 200%: Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.

• Investment in opening the margin account in mutual fund with an amount of $1,000.

• Interest rate of 10%.

• Mutual fund return in stellar market is 40%.

• Mutual fund return in fair market is 5%.

• Mutual fund return in terrible market is -30%.

No margin account level in stellar market:

Therefore, the no margin account level in stellar market is

Therefore, the no margin account level in stellar market is  .

.No margin account level in fair market:

Therefore, the no margin account level in fair market is

Therefore, the no margin account level in fair market is  .

.No margin account level in terrible market:

Therefore, the no margin account level in terrible market is

Therefore, the no margin account level in terrible market is  .

.Account value in stellar market with 60%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in fair market with 5%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in terrible market with 5%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in stellar market with 100%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in fair market with 100%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in terrible market with 100%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in stellar market with 150%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in fair market with 150%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in terrible market with 150%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in stellar market with 200%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in fair market with 200%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

.Account value in terrible market with 200%:

Therefore, the account value in stellar market is

Therefore, the account value in stellar market is  .

. 2

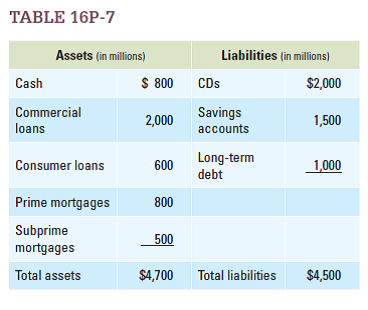

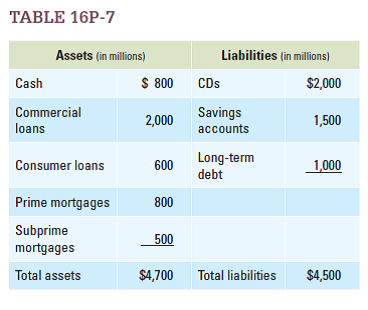

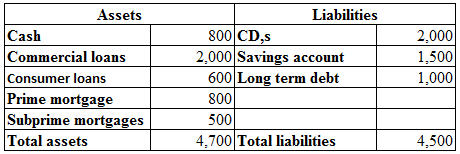

Table 16P-7 shows the balance sheet of a bank in millions of dollars.

a. What is the bank's net worth?

b. Assume housing prices increase and defaults on subprime mortgages rise, causing the bank's assets in subprime mortgages to decrease from 500 to 350. What are total assets now? What is the bank's new net worth?

c. How far would the value of subprime mortgages have to fall to cause the bank to be insolvent (that is, for liabilities to be greater than assets)?

a. What is the bank's net worth?

b. Assume housing prices increase and defaults on subprime mortgages rise, causing the bank's assets in subprime mortgages to decrease from 500 to 350. What are total assets now? What is the bank's new net worth?

c. How far would the value of subprime mortgages have to fall to cause the bank to be insolvent (that is, for liabilities to be greater than assets)?

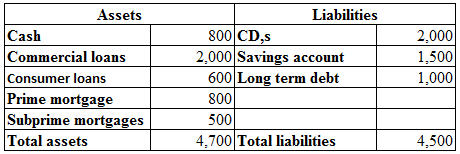

Given information:

Table -1shows the bank balance sheet.

Table -1 a.)Bank's net worth:

a.)Bank's net worth:

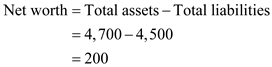

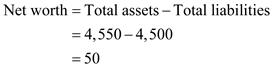

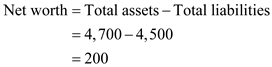

Net worth can be calculated as follows: Therefore, the net worth is

Therefore, the net worth is  .

.

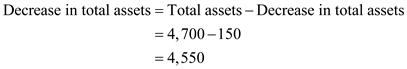

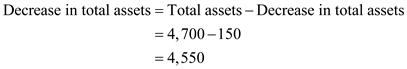

b.)Decrease in total assets:

Decrease in total assets can be calculated as follows: Therefore, the total assets are

Therefore, the total assets are  .

.

Net worth:

Net worth can be calculated as follows: Therefore, the net worth is

Therefore, the net worth is  .

.

c.)Extent of the sub-prime mortgages to fall:

The extent though which the subprime loans would fall will be, where total assets and total liabilities are equal. And the greater the subprime falls, there will be an insolvency prevailing. So, in order to be insolvent, the bank should have total assets less than the total liabilities. Previously, the bank had a total asset of $4,700 million and total liabilities of $4,500 million. Hence, the net worth was $200 million. Therefore, if the subprime loans falls more than $200 million, then the banks would be insolvent.

Table -1shows the bank balance sheet.

Table -1

a.)Bank's net worth:

a.)Bank's net worth: Net worth can be calculated as follows:

Therefore, the net worth is

Therefore, the net worth is  .

.b.)Decrease in total assets:

Decrease in total assets can be calculated as follows:

Therefore, the total assets are

Therefore, the total assets are  .

.Net worth:

Net worth can be calculated as follows:

Therefore, the net worth is

Therefore, the net worth is  .

.c.)Extent of the sub-prime mortgages to fall:

The extent though which the subprime loans would fall will be, where total assets and total liabilities are equal. And the greater the subprime falls, there will be an insolvency prevailing. So, in order to be insolvent, the bank should have total assets less than the total liabilities. Previously, the bank had a total asset of $4,700 million and total liabilities of $4,500 million. Hence, the net worth was $200 million. Therefore, if the subprime loans falls more than $200 million, then the banks would be insolvent.

3

What is leverage, and how can it make an asset pricing bubble worse?

Leverage:

Leverage refers to the monetary contracts or borrowed capital, which is used to increase the investment. In other words refers to the debt amount which is used to finance for a firm's assets. Therefore, a firm with more debt is said to be leverage.

Asset pricing bubble:

An asset pricing bubble refers to the trade in an asset, at a price which deviates from the assets fundamental value. Worsening of asset pricing bubble by leverage:

An unreasonable excitement can push up prices higher and make it very easy and comfortable for the firms to borrow money and use it for investments. And, if the increasing prices are caused by the bubbles, then, the borrowed capital will worsen the situation by encouraging more investment when the firms are unable to pay the loans back.

Leverage refers to the monetary contracts or borrowed capital, which is used to increase the investment. In other words refers to the debt amount which is used to finance for a firm's assets. Therefore, a firm with more debt is said to be leverage.

Asset pricing bubble:

An asset pricing bubble refers to the trade in an asset, at a price which deviates from the assets fundamental value. Worsening of asset pricing bubble by leverage:

An unreasonable excitement can push up prices higher and make it very easy and comfortable for the firms to borrow money and use it for investments. And, if the increasing prices are caused by the bubbles, then, the borrowed capital will worsen the situation by encouraging more investment when the firms are unable to pay the loans back.

4

As the Federal Reserve responded to the recent housing crisis, how did this affect its balance sheet? Can you think of what caused the balance sheet's size to change so much?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

5

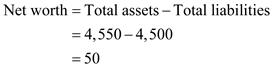

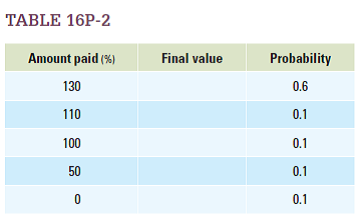

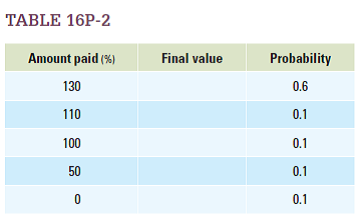

Assume that a subprime mortgage involves a loan of $1,000 and is to be paid back in full with 30 percent interest after one year.

a. Sometimes borrowers will not be able to pay off the entire mortgage or may default entirely. Calculate the final amount of money an investor earns under the payback rates shown in Table 16P-2. (Note that a rate of 130 percent means that the whole loan is paid off, plus the additional 30 percent of interest.)

b. Assume investors are unwilling to invest in these loans unless the expected rate of return is 10 percent.

Calculate the expected rate of return for this loan by adding up all of the products of the final value and the probability that that value will occur. Will investors want to invest in this loan?

a. Sometimes borrowers will not be able to pay off the entire mortgage or may default entirely. Calculate the final amount of money an investor earns under the payback rates shown in Table 16P-2. (Note that a rate of 130 percent means that the whole loan is paid off, plus the additional 30 percent of interest.)

b. Assume investors are unwilling to invest in these loans unless the expected rate of return is 10 percent.

Calculate the expected rate of return for this loan by adding up all of the products of the final value and the probability that that value will occur. Will investors want to invest in this loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

6

Japan's economic situation throughout its Lost Decade and beyond can be explained in terms of problems with monetary policy via interest rates. Explain what happened. Identify what Japan's central bank should have done.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

7

Explain why it's possible for tranching to make investing in a mortgage-backed security more risky than investing in a single subprime loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the "zero lower bound" that must be considered in monetary policy, and how can it cause problems in enacting such policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

9

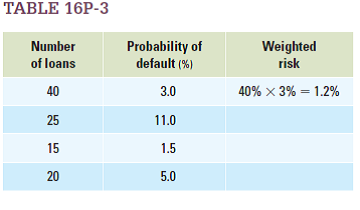

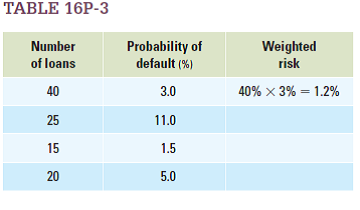

A single bank is considering two options: First, it can make a $200,000 mortgage loan for a customer with a 10 percent probability of default, or, second, it can buy a $200,000 security representing a bundle of 100 mortgage loans, which break down as shown in Table 16P-3.

You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first tier includes 40 loans, which is 40 ___ 100 5 40% of the total) times the probability of default on loans of that category. Do so for each type of loan, then add together the weighted risks to come up with an overall expected default risk for this financial investment. If the bank is willing to take on only projects for which the default risk is 6 percent or less, which option(s) should it choose?

You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first tier includes 40 loans, which is 40 ___ 100 5 40% of the total) times the probability of default on loans of that category. Do so for each type of loan, then add together the weighted risks to come up with an overall expected default risk for this financial investment. If the bank is willing to take on only projects for which the default risk is 6 percent or less, which option(s) should it choose?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

10

Consider an economy with $10 billion in base money and a multiplier of 4. The money supply is currently $10 billion 3 4 5 $40 billion. Now let's say that the amount of base money rises by 50 percent, to $15 billion. How must the multiplier change for the money supply to remain unaffected by this change in base money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

11

Explain how a mortgage-backed security can increase loan availability to those with little credit or bad credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is quantitative easing, and when might it be used?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

13

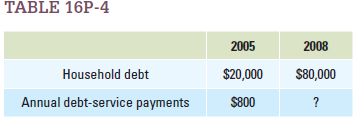

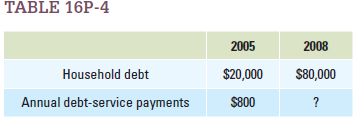

Table 16P-4 shows hypothetical levels of average household debt and debt service payments in two years, 2005 and 2008. At what annual interest rate would consumers have had to borrow for the debt-service payments in 2008 to equal the debt-service payments in 2005, despite the increase in household debt? Assume households are paying only interest on their debt and not part of the principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

14

Explain the role that leverage played in the recent housing bubble.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

15

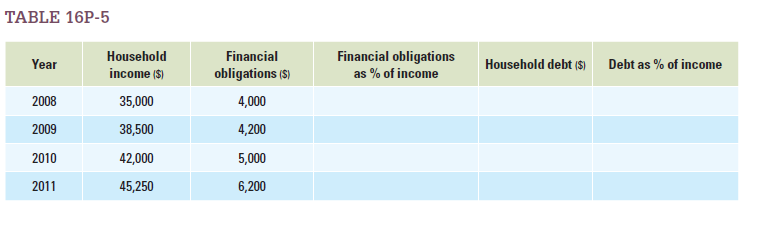

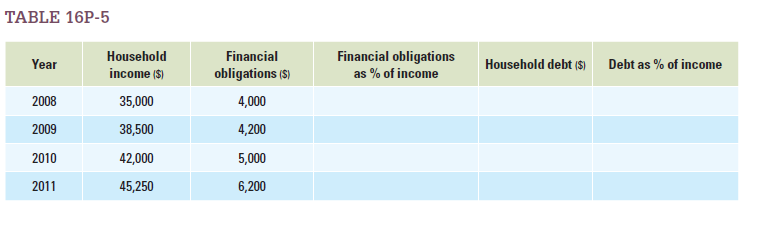

Table 16P-5 gives information on income and debt for a small nation for the years 2008 through 2011. The nation had average household debt of $34,000 at the end of 2007. Use this information to fill in the blanks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

16

How did government policies and asymmetric information problems make the recent housing bubble worse?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

17

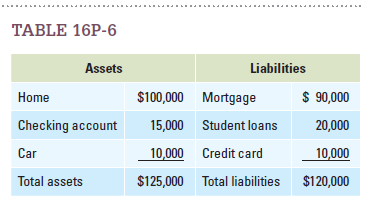

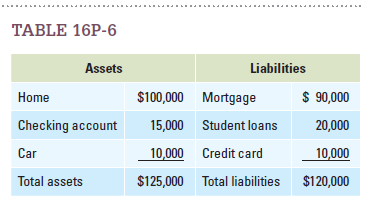

Imagine that your personal finances are summarized by the account balances shown in Table 16P-6. Assume also that your decision to save is a function of your income and net worth. More specifically, assume that your savings each year will be equal to: 0.2I - NW, where "I" is your income and "NW" is your net worth.

a. If your income is $60,000, how much will you save this year?

b. Assume the value of your house decreases by 20 percent. What is your net worth now? How much will you save?

a. If your income is $60,000, how much will you save this year?

b. Assume the value of your house decreases by 20 percent. What is your net worth now? How much will you save?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

18

Many subprime borrowers entered into "adjustable- rate mortgages" with low teaser rates. These mortgages allowed borrowers to pay a low interest rate for the first two years on their mortgage, before the rate jumped to market levels. But the loan documents sometimes made it difficult for borrowers to understand that the rate would increase. Explain why this practice could lead to a bubble in housing prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the rate currently payable on 10-year Treasury bonds is 4.8 percent and the risk spread is 2 percent, what is the average rate on other forms of commercial lending?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

20

How did the recent housing crisis affect the aggregate demand curve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

21

Determine whether or not each of the following is an example of irrational expectations.

a. The price of Amazon's stock rises after tech blogs reveal that the company plans to release a new tablet, rumored to be competitive with Apple's iPad.

b. The CEO of a new start-up producing applications for tablets is quoted as proclaiming a new era of media, in which thirst for content will rise indefinitely as information becomes more and more convenient for people to digest. An economics blog continues the discussion a year later, discussing returns to investment that have never before been contemplated. Stock prices for media companies are consistently outperforming historical levels by 50 percent and seem to be on a permanent rise.

c. After an unusually cool summer, investors in Papa's Popsicles decide to sell, believing demand for popsicles will never reach historic levels again because of the weather.

d. The Justice Department reveals allegations against the CEO of a food and beverage company, alleging misconduct within the company. A trial could cost the company millions of dollars. The stock price falls by 5 percent by the day's end.

a. The price of Amazon's stock rises after tech blogs reveal that the company plans to release a new tablet, rumored to be competitive with Apple's iPad.

b. The CEO of a new start-up producing applications for tablets is quoted as proclaiming a new era of media, in which thirst for content will rise indefinitely as information becomes more and more convenient for people to digest. An economics blog continues the discussion a year later, discussing returns to investment that have never before been contemplated. Stock prices for media companies are consistently outperforming historical levels by 50 percent and seem to be on a permanent rise.

c. After an unusually cool summer, investors in Papa's Popsicles decide to sell, believing demand for popsicles will never reach historic levels again because of the weather.

d. The Justice Department reveals allegations against the CEO of a food and beverage company, alleging misconduct within the company. A trial could cost the company millions of dollars. The stock price falls by 5 percent by the day's end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following policies were used in response to the latest financial crisis? Of those used, which are examples of monetary policy? Of fiscal policy?

a. Aggressive controlling of inflation by raising interest rates.

b. Providing short-term financing directly to small businesses to jump-start investment.

c. Bailing out banks that have large amounts of risky mortgage-backed securities.

d. Purchasing long-term bonds to increase the money supply.

e. Raising the Social Security eligibility age by five years to encourage people to work.

a. Aggressive controlling of inflation by raising interest rates.

b. Providing short-term financing directly to small businesses to jump-start investment.

c. Bailing out banks that have large amounts of risky mortgage-backed securities.

d. Purchasing long-term bonds to increase the money supply.

e. Raising the Social Security eligibility age by five years to encourage people to work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

23

Your best friend comes to you for financial investment advice. She is wondering whether she should invest in (a) a sector of the economy that has been performing extremely well in the last five years relative to historical levels or (b) one that has been performing extremely poorly in the last five years relative to historical levels. What would you advise? How might irrational expectations affect your recommendations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

24

Imagine what would have happened if the Federal Reserve was not in place to act as a lender of last resort during the financial crisis. Absent government involvement, what would be the likely effect on aggregate supply? Why? What would be the likely effect on aggregate demand? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck