Deck 16: Corporate Operations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 16: Corporate Operations

1

Corporations may carry a net operating loss sustained in 2020 back two years and forward 20 years.

False

2

Although a corporation may report a temporary book-tax difference for an item of income or deduction for a given year, over the long term the total amount of income or deduction it reports with respect to that item will be the same for both book and tax purposes.

True

3

Income that is included in book income, but excluded from taxable income, results in a favorable, permanent book-tax difference.

True

4

For a corporation, goodwill created in an asset acquisition generally leads to temporary book-tax differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

For tax purposes, a corporation may deduct the entire amount of a net capital loss in the year incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

Corporations may carry a net operating loss sustained in 2020 forward 20 years but it cannot carry it back.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

Corporations and individuals are allowed to claim the qualified business income deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

Corporations have a larger standard deduction than individual taxpayers because they generally have higher revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

A nonqualified stock option will always create a permanent book-tax difference in a given year if it vests during the year but is exercised in a later year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

A corporation may carry a net capital loss back two years and forward 20 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

For incentive stock options, the value of the options that vest in a given year always creates a permanent, unfavorable book-tax difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

A corporation may carry a net capital loss forward five years to offsetnet capital gains in future years but it may not carry a net capital loss back to offsetnet capital gains in previous years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

A corporation may carry a net capital loss back three years and forward five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a given year, Adams Corporation has goodwill impairment in excess of the allowable amortization for tax purposes. Adams has a favorable temporary book-tax difference for that year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

C corporations with annual average gross receipts of $26 million or more are allowed to use the cash method of accounting for at least the first two years of their existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Bingo Corporation incurred a $10 million net operating loss in 2020. Bingo reported taxable income of $12 million in 2021. Bingo can offset the entire $10 million NOL carryover against taxable income in 2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

For tax purposes, companies using nonqualified stock options deduct expenses in the year the options are exercised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

Net operating losses generally create permanent book-tax differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

Federal income tax expense reported on a corporation's books generates a temporary book-tax difference for ScheduleM-1 and Schedule M-3 purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

An unfavorable temporary book-tax difference is so named because it causes taxable income to decrease relative to book income in the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

Corporations compute their dividends received deduction by multiplying the dividend amount by 10 percent, 50 percent, or 100percent, depending on their ownership in the distributing corporation's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Net capital loss carryovers are deductible againstnet capital gains in determining a corporation's net operating loss for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

The dividends received deduction cannot create a net operating loss. The deduction can reduce income to zero but not below zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

Corporations are not allowed to deduct charitable contributions in excess of a percentage of modified taxable income limitation (before the charitable contribution and certain other deductions).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

A C corporation reports its taxable income or loss on Form 1065.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

Corporations are not allowed to deduct charitable contributions in excess of 10percent of the corporation's taxable income (before the charitable contribution and certain other deductions).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

Accrual-method corporations cannot deduct charitable contributions until they actually make payment to the charity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

The dividends received deduction is subject to a limitation based on modified taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Taxable income ofall C corporations is subject to a flat 21 percent tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

Calendar-year C corporations that request an extension for filing their 2019 tax returns will have a tax return due date of October 15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

NOL and capital loss carryovers are deductible in calculating the charitable contribution limit modified taxable income, while capital loss carrybacks are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

The rules for consolidated reporting for financial statement purposes are the same as the rules for consolidated reporting for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

A corporation generally will report a favorable, temporary book-tax difference when it deducts a charitable contribution carryover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

Corporations may carry excess charitable contributions forward five years, but they may not carry them back.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

GenerUs Incorporated board of directors approved a charitable cash contribution to FoodBank, a qualified nonprofit organization, in November of 2020. GenerUs made the payment to FoodBank on February 2, 2021. GenerUs Incorporated (a calendar-year corporation)may claim a deduction for the contribution on its 2020 tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

The dividends received deduction is designed to mitigate the extent to which corporate earnings are subject to more than two levels of taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

Volos Company (a calendar-year corporation)began operations in March of 2018 and was not profitable through December of 2019. Volos has been profitable for the first quarter of 2020 and is trying to determine its first quarter estimated tax payment. It will have no estimated tax payment requirement in 2020 because it had no tax liability for the 2019 tax year and has been in business for at least 12 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

Both Schedules M-1 and M-3 require taxpayers to identify book-tax differences as either temporary or permanent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

Schedule M-1 reconciles from book income to bottom line taxable income (the taxable income that is applied to the tax rates to determine the corporation's gross tax liability).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

An affiliated group must file a consolidated tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements regarding book-tax differences associated with purchased goodwill is false?

A)It is possible to have no book-tax difference in a year.

B)In a year when goodwill is impaired and yet fully amortized for tax purposes (so no tax amortization of the goodwill for that year), the book-tax difference will be unfavorable.

C)Temporary book-tax differences associated with goodwill are always favorable.

D)If goodwill has been fully amortized for tax purposes in a previous year, the book-tax difference is equal to the amount of impairment recognized.

A)It is possible to have no book-tax difference in a year.

B)In a year when goodwill is impaired and yet fully amortized for tax purposes (so no tax amortization of the goodwill for that year), the book-tax difference will be unfavorable.

C)Temporary book-tax differences associated with goodwill are always favorable.

D)If goodwill has been fully amortized for tax purposes in a previous year, the book-tax difference is equal to the amount of impairment recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

Coop Incorporated owns 40percent of Chicken Incorporated. Both Coop and Chicken are corporations. Chicken pays Coop a dividend of $10,000 in the current year. Chicken also reports financial accounting earnings of $20,000 for that year. Assume Coop follows the general rule of accounting for investment in Chicken. What is the amount and nature of the book-tax difference to Coop associated with the dividend distribution (ignoring the dividends received deduction)?

A)$2,000 unfavorable.

B)$2,000 favorable.

C)$10,000 unfavorable.

D)$10,000 favorable.

E)None of the choices is correct.

A)$2,000 unfavorable.

B)$2,000 favorable.

C)$10,000 unfavorable.

D)$10,000 favorable.

E)None of the choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

It is important to distinguish between temporary and permanent book-tax differences for which of the following reasons?

A)Temporary book-tax differences affect the computation of taxable income whereas permanent differences do not.

B)All corporations are required to disclose book-tax differences as permanent or temporary on their tax returns.

C)Temporary book-tax differences will reverse in future years whereas permanent differences will not.

D)Neither temporary nor permanent book-tax differences will reverse in future years.

A)Temporary book-tax differences affect the computation of taxable income whereas permanent differences do not.

B)All corporations are required to disclose book-tax differences as permanent or temporary on their tax returns.

C)Temporary book-tax differences will reverse in future years whereas permanent differences will not.

D)Neither temporary nor permanent book-tax differences will reverse in future years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

TrendSetter Incorporated paid $50,000 in premiums for life insurance coverage for its key employees for which TrendSetter Incorporated is the beneficiary. What is the nature of the book-tax difference created by this expense?

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

AmStore Incorporated sold some of its heavy machinery at a gain. AmStore used the straight-line method for financial accounting depreciation andimmediate expensing for tax cost recovery. If accumulated depreciation for financial accounting purposes is less than accumulated depreciation for tax reporting purposes, what is the nature of the book-tax difference associated with the gain on the sale?

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

Large corporations (corporations with more than $1,000,000 in taxable income in any of the three years prior to the current year)can use their prior tax year liability to determine all required estimated quarterly payments for the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements regarding book-tax differences is true?

A)Corporations are not required to report book-tax differences on their income tax returns.

B)Corporations will eventually recognize the same amount of income for book and tax purposes for income-related temporary book-tax differences.

C)Income excludable for tax purposes usually creates a temporary book-tax difference.

D)None of the choices are correct.

A)Corporations are not required to report book-tax differences on their income tax returns.

B)Corporations will eventually recognize the same amount of income for book and tax purposes for income-related temporary book-tax differences.

C)Income excludable for tax purposes usually creates a temporary book-tax difference.

D)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

Over what time period do corporations amortize purchased goodwill for tax purposes?

A)180 months.

B)150 months.

C)60 months.

D)None of the choices are correct.

A)180 months.

B)150 months.

C)60 months.

D)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

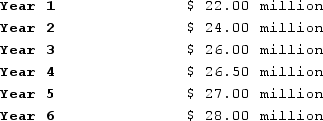

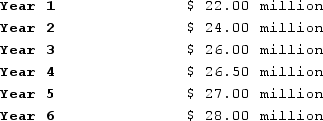

WFO Corporation has gross receipts according to the following schedule:  If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

A)Year 3.

B)Year 4.

C)Year 5.

D)Year 6.

E)None of the choices are correct.

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?A)Year 3.

B)Year 4.

C)Year 5.

D)Year 6.

E)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

Coop Incorporated owns 10 percent of Chicken Incorporated. At the end of the year, Coop has $100,000 in invested Chicken stock and Coop's Chicken stock is worth $115,000. Both Coop and Chicken are corporations. Chicken pays Coop a dividend of $10,000 in the current year. Chicken also reports financial accounting earnings of $20,000 for that year. Assume Coop follows the general rule of accounting for investment in Chicken. What is the amount and nature of the book-tax difference to Coop associated with the dividend distribution (ignoring the dividends received deduction)?

A)$1000 unfavorable.

B)$10,000 favorable.

C)$15,000 unfavorable.

D)$15,000 favorable.

E)None of the choices is correct.

A)$1000 unfavorable.

B)$10,000 favorable.

C)$15,000 unfavorable.

D)$15,000 favorable.

E)None of the choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following does NOT create a permanent book-tax difference?

A)Organizational and start-up expenses.

B)Key employee death benefit income.

C)Fines and penalties expenses.

D)Municipal bond interest income.

A)Organizational and start-up expenses.

B)Key employee death benefit income.

C)Fines and penalties expenses.

D)Municipal bond interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following does NOT create a temporary book-tax difference?

A)Deferred compensation.

B)Bad-debt expense.

C)Depreciation expense.

D)Dividends received deduction.

A)Deferred compensation.

B)Bad-debt expense.

C)Depreciation expense.

D)Dividends received deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

Coop Incorporated owns 36 percent of Chicken Incorporated. Both Coop and Chicken are corporations. Chicken pays Coop a dividend of $20,000 in the current year. Chicken also reports financial accounting earnings of $30,000 for that year. Assume Coop follows the general rule of accounting for investment in Chicken. What is the amount and nature of the book-tax difference to Coop associated with the dividend distribution (ignoring the dividends received deduction)?

A)$9,200 unfavorable.

B)$9,200 favorable.

C)$20,000 unfavorable.

D)$20,000 favorable.

E)None of the choices is correct.

A)$9,200 unfavorable.

B)$9,200 favorable.

C)$20,000 unfavorable.

D)$20,000 favorable.

E)None of the choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

iScope Incorporated paid $3,000 in interest on a loan it used to purchase municipal bonds. What is the nature of the book-tax difference relating to this expense?

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

For estimated tax purposes, a "large" corporation is any corporation with average annual gross receipts of $5,000,000 in the three years prior to the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

Most corporations use the annualized income method to determine their required annual payment for purposes of making quarterly estimated payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

Corporation A receives a dividend from Corporation B. Corporation A includes the dividend in its gross income for tax and financial accounting purposes (no book-tax difference). If A has accounted for the dividend correctly (following the general rule), how much of B stock does A own?

A)A owns less than 20 percent of the stock of B.

B)A owns at least 20 but not more than 50 percent of the stock of B.

C)A owns more than 50 percent of the stock of B.

D)Cannot be determined.

A)A owns less than 20 percent of the stock of B.

B)A owns at least 20 but not more than 50 percent of the stock of B.

C)A owns more than 50 percent of the stock of B.

D)Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

Corporation A receives a dividend from Corporation B. It includes the dividend in gross income for tax purposes but includes a pro-rata portion of B's earnings in its financial accounting income. If A has accounted for the dividend correctly (using the general rule), how much of B's stock does A own?

A)A owns less than 20 percent of the stock of B.

B)A owns at least 20 but not more than 50 percent of the stock of B.

C)A owns more than 50 percent of the stock of B.

D)Cannot be determined.

A)A owns less than 20 percent of the stock of B.

B)A owns at least 20 but not more than 50 percent of the stock of B.

C)A owns more than 50 percent of the stock of B.

D)Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following describes the correct treatment of incentive stock options (ISOs)?

A)Financial accounting-no expense; tax-no deduction.

B)Financial accounting-no expense; tax-deduct bargain element at exercise.

C)Financial-expense value over vesting period; tax-no deduction.

D)Financial-expense value over vesting period; tax-deduct bargain element at exercise.

A)Financial accounting-no expense; tax-no deduction.

B)Financial accounting-no expense; tax-deduct bargain element at exercise.

C)Financial-expense value over vesting period; tax-no deduction.

D)Financial-expense value over vesting period; tax-deduct bargain element at exercise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

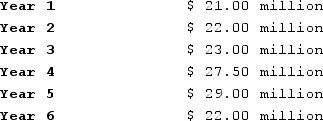

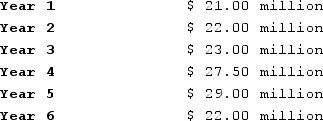

WFO Corporation has gross receipts according to the following schedule:  If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

A)Year 3.

B)Year 4.

C)Year 5.

D)Year 6.

E)None of the choices are correct.

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?

If WFO began business as a cash-method corporation in Year 1, in which year would it have first been required to use the accrual method?A)Year 3.

B)Year 4.

C)Year 5.

D)Year 6.

E)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following statements regarding charitable contributions is false?

A)Only contributions made to qualified charitable organizations are deductible.

B)Charitable contribution deductions are subject to a limitation based on the corporation's taxable income (before certain deductions).

C)Corporations can qualify to deduct a contribution before actually paying the contribution to the charity.

D)The amount deductible for noncash contributions is always the adjusted basis of the property donated.

A)Only contributions made to qualified charitable organizations are deductible.

B)Charitable contribution deductions are subject to a limitation based on the corporation's taxable income (before certain deductions).

C)Corporations can qualify to deduct a contribution before actually paying the contribution to the charity.

D)The amount deductible for noncash contributions is always the adjusted basis of the property donated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is deductible in calculating the charitable contribution limit modified taxable income?

A)Net capital loss carrybacks.

B)Dividends received deduction.

C)NOL carryovers.

D)Charitable contributions.

A)Net capital loss carrybacks.

B)Dividends received deduction.

C)NOL carryovers.

D)Charitable contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

Tatoo Incorporated reported a net capital loss of $13,000 in 2020. The company had a net capital gain of $4,300 in 2018 and $3,000 in 2017. In 2019, although the company suffered a net operating loss, it had net capital gains of $1,000. What is the amount of Tatoo's capital loss carryover to 2021 remaining after it applies the carryback?

A)$4,700.

B)$5,700.

C)$8,700.

D)$13,000.

A)$4,700.

B)$5,700.

C)$8,700.

D)$13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements regarding net operating losses generated in 2020 is true?

A)Corporations can carrythe NOL back two years and forward up to 20 years.

B)A corporation can carry over the NOL indefinitely.

C)A corporation can carrythe NOL back two years and forward indefinitely.

D)When a corporation applies a net operating loss carryover, it reports a favorable, permanent book-tax difference in the amount of the applied carryover.

E)None of these is a true statement.

A)Corporations can carrythe NOL back two years and forward up to 20 years.

B)A corporation can carry over the NOL indefinitely.

C)A corporation can carrythe NOL back two years and forward indefinitely.

D)When a corporation applies a net operating loss carryover, it reports a favorable, permanent book-tax difference in the amount of the applied carryover.

E)None of these is a true statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

Orange Incorporated issued 20,000 nonqualified stock options valued at $40,000 (in total). The options vest over two years-half in 2020 (the year of issue)and half in 2020. One thousand options are exercised in 2021 with a bargain element on each option of $6. What is the 2021 book-tax difference associated with the stock options?

A)$14,000 unfavorable.

B)$6,000 favorable.

C)$24,000 unfavorable.

D)$24,000 favorable.

E)None of the choices are correct.

A)$14,000 unfavorable.

B)$6,000 favorable.

C)$24,000 unfavorable.

D)$24,000 favorable.

E)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is allowable as a deduction in calculating a corporation's net operating loss?

A)Charitable contribution deduction.

B)Net capital loss carryback.

C)Net operating loss carryover from other years.

D)Both charitable contribution deduction and net operating loss carryover from other years are deductible in computing the current-year NOL.

A)Charitable contribution deduction.

B)Net capital loss carryback.

C)Net operating loss carryover from other years.

D)Both charitable contribution deduction and net operating loss carryover from other years are deductible in computing the current-year NOL.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

Tatoo Incorporated reported a net capital loss of $14,800 in 2020. The company had a net capital gain of $6,100 in 2018 and $4,800 in 2017. In 2019, although the company suffered a net operating loss, it had net capital gains of $2,800. What is the amount of Tatoo's capital loss carryover to 2021 remaining after it applies the carryback?

A)$1,100.

B)$3,900.

C)$8,700.

D)$14,800.

A)$1,100.

B)$3,900.

C)$8,700.

D)$14,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

In January 2020, Khors Company issued nonqualified stock options to its CEO, Jenny Svaro. Because the company does not expect Miss Svaro to leave the company, the options vest at the time they are granted with a total value of $50,000. In December of 2020, the company experienced a decline in its stock price, and Miss Svaro exercises the options. The total bargain element at the time of exercise is $40,000. For 2020, what is the nature of the book-tax difference due to the options exercised?

A)Favorable and temporary.

B)Favorable and permanent.

C)Unfavorable and temporary.

D)Unfavorable and permanent.

E)Not enough information to determine.

A)Favorable and temporary.

B)Favorable and permanent.

C)Unfavorable and temporary.

D)Unfavorable and permanent.

E)Not enough information to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements regarding incentive stock options (ISOs)is false?

A)The ISO-related compensation expense is recorded for book purposes as the ISO vests.

B)Book-tax differences related to ISO-related compensation expense are always unfavorable.

C)Book-tax differences associated with ISO-related compensation expenses can be either permanent or temporary.

D)None of these choices is false.

A)The ISO-related compensation expense is recorded for book purposes as the ISO vests.

B)Book-tax differences related to ISO-related compensation expense are always unfavorable.

C)Book-tax differences associated with ISO-related compensation expenses can be either permanent or temporary.

D)None of these choices is false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

BTW Corporation has taxable income in the current year that can be offset with an NOL carryover from a previous year. What is the nature of the book-tax difference created by the net operating loss carryover deduction in the current year?

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

A)Permanent; favorable.

B)Permanent; unfavorable.

C)Temporary; favorable.

D)Temporary; unfavorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

In January 2019, Khors Company issued nonqualified stock options to its CEO, Jenny Svaro. Because the company did not expect Miss Svaro to leave the company, the options vested at the time theywere granted with a total value of $52,250. In December of 2020, the company experienced a surge in its stock price, and Miss Svaro exercised the options. The total bargain element at the time of exercise was $64,500. For 2020, what is the book-tax difference due to the options exercised?

A)$12,250 unfavorable.

B)$12,250 favorable.

C)$52,250 unfavorable.

D)$64,500 favorable.

A)$12,250 unfavorable.

B)$12,250 favorable.

C)$52,250 unfavorable.

D)$64,500 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

Studios reported a net capital loss of $30,000 in Year 5. It reported net capital gains of $14,000 in Year 4 and $27,000 in Year 6. What is the amount and nature of the book-tax difference in Year 6 related to the net capital carryover?

A)$11,000 unfavorable.

B)$11,000 favorable.

C)$16,000 unfavorable.

D)$16,000 favorable.

A)$11,000 unfavorable.

B)$11,000 favorable.

C)$16,000 unfavorable.

D)$16,000 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following statements regarding nonqualified stock options (NQOs)is false?

A)Book-tax differences associated with NQOs may be either permanent or temporary.

B)If the value of the options that vest is greater than the bargain element of options exercised, the book-tax difference for that year is unfavorable.

C)No expense recognition is required for NQOs for financial accounting purposes.

D)All stock option-related book-tax differences are temporary.

A)Book-tax differences associated with NQOs may be either permanent or temporary.

B)If the value of the options that vest is greater than the bargain element of options exercised, the book-tax difference for that year is unfavorable.

C)No expense recognition is required for NQOs for financial accounting purposes.

D)All stock option-related book-tax differences are temporary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is not required to allow an accrual-method corporation to deduct charitable contributions before actually paying the contribution to charity for a calendar year-end corporation?

A)Approval of the payment from the board of directors.

B)Approval from the IRS prior to making the contribution.

C)Payment made within three and one-half months of the tax year-end.

D)All of the choices are necessary.

A)Approval of the payment from the board of directors.

B)Approval from the IRS prior to making the contribution.

C)Payment made within three and one-half months of the tax year-end.

D)All of the choices are necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

For corporations, which of the following regarding net capital losses is true?

A)A corporation that experiences a net capital loss has a favorable book-tax difference in the year of the loss.

B)A corporation that experiences a net capital loss in Year 4 first carries the loss back to Year 3, then Year 2, and then Year 1 before carrying it forward.

C)Net capital loss carrybacks are deductible in determining a corporation's net operating loss.

D)Net capital loss carrybacks and carryovers create temporary book-tax differences if they are used before they expire.

A)A corporation that experiences a net capital loss has a favorable book-tax difference in the year of the loss.

B)A corporation that experiences a net capital loss in Year 4 first carries the loss back to Year 3, then Year 2, and then Year 1 before carrying it forward.

C)Net capital loss carrybacks are deductible in determining a corporation's net operating loss.

D)Net capital loss carrybacks and carryovers create temporary book-tax differences if they are used before they expire.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following describes the correct treatment of the exercise of nonqualified stock options (NQOs)?

A)Financial-no expense; tax-no deduction.

B)Financial-no expense; tax-deduct bargain element at exercise.

C)Financial-expense value over vesting period; tax-no deduction.

D)Financial-expense value over vesting period; tax-deduct bargain element at exercise.

A)Financial-no expense; tax-no deduction.

B)Financial-no expense; tax-deduct bargain element at exercise.

C)Financial-expense value over vesting period; tax-no deduction.

D)Financial-expense value over vesting period; tax-deduct bargain element at exercise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

Studios reported a net capital loss of $38,500 in Year 5. It reported net capital gains of $31,000 in Year 4 and $44,000 in Year 6. What is the amount and nature of the book-tax difference in Year 6 related to the net capital carryover?

A)$36,500 unfavorable.

B)$36,500 favorable.

C)$7,500 unfavorable.

D)$7,500 favorable.

A)$36,500 unfavorable.

B)$36,500 favorable.

C)$7,500 unfavorable.

D)$7,500 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

Orange Incorporated issued 28,500 nonqualified stock options valued at $57,000 (in total). The options vest over two years-half in 2020 (the year of issue)and half in 2020. One thousand options are exercised in 2021 with a bargain element on each option of $7. What is the 2021 book-tax difference associated with the stock options?

A)$21,500 unfavorable.

B)$21,500 favorable.

C)$28,500 unfavorable.

D)$28,500 favorable.

E)None of the choices are correct.

A)$21,500 unfavorable.

B)$21,500 favorable.

C)$28,500 unfavorable.

D)$28,500 favorable.

E)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

In January 2019, Khors Company issued nonqualified stock options to its CEO, Jenny Svaro. Because the company did not expect Miss Svaro to leave the company, the options vested at the time they were granted with a total value of $50,000. In December of 2020, the company experienced a surge in its stock price, and Miss Svaro exercised the options. The total bargain element at the time of exercise was $60,000. For 2020, what is the book-tax difference due to the options exercised?

A)$10,000 unfavorable.

B)$10,000 favorable.

C)$50,000 unfavorable.

D)$60,000 favorable.

A)$10,000 unfavorable.

B)$10,000 favorable.

C)$50,000 unfavorable.

D)$60,000 favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements regarding capital gains and losses is false?

A)In terms of tax treatment, corporations generally prefer capital gains to ordinary income.

B)Like individuals, corporations can deduct $3,000 of net capital losses in a given year.

C)C corporations can carry back net capital losses three years and they can carry them forward for five years.

D)Corporations must apply capital loss carrybacks and carryovers in a particular order.

A)In terms of tax treatment, corporations generally prefer capital gains to ordinary income.

B)Like individuals, corporations can deduct $3,000 of net capital losses in a given year.

C)C corporations can carry back net capital losses three years and they can carry them forward for five years.

D)Corporations must apply capital loss carrybacks and carryovers in a particular order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck