Deck 8: Acquisition and Expenditure Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 8: Acquisition and Expenditure Cycle

1

What primary functions should be separated in the acquisition and expenditure cycle?

The Primary Functions that should be separated in the acquisition Expenditure cycle are as follows:-

1. There should be separation of duties between Purchasing, Receiving, Accounting Department

2. The Purchase order should be supported by invoices.

3. Recorded Purchases expenditures supported by invoices.

4. Purchase Contracts are authorized at the appropriate level and accounting made aware of all significant terms.

5. Comparison of invoice quantities and prices with purchase orders receiving reports.

6. Date of receiving report compared with invoice date.

1. There should be separation of duties between Purchasing, Receiving, Accounting Department

2. The Purchase order should be supported by invoices.

3. Recorded Purchases expenditures supported by invoices.

4. Purchase Contracts are authorized at the appropriate level and accounting made aware of all significant terms.

5. Comparison of invoice quantities and prices with purchase orders receiving reports.

6. Date of receiving report compared with invoice date.

2

Which of the following accounts does not appear in the acquisition and expenditure cycle?

A) Cash.

B) Purchases returns.

C) Sales returns.

D) Prepaid insurance.

A) Cash.

B) Purchases returns.

C) Sales returns.

D) Prepaid insurance.

Accounts appear in Acquisition and Expenditure cycle includes:

• Cash account

• Purchase Return.

• Prepaid insurance.Sales return does not appear in the acquisition and expenditure cycle, as it is a part of revenue and collection cycle.Therefore, the correct options is (c)

• Cash account

• Purchase Return.

• Prepaid insurance.Sales return does not appear in the acquisition and expenditure cycle, as it is a part of revenue and collection cycle.Therefore, the correct options is (c)

3

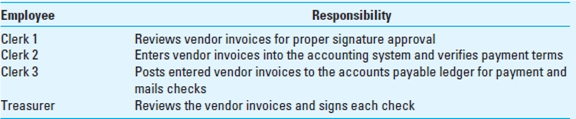

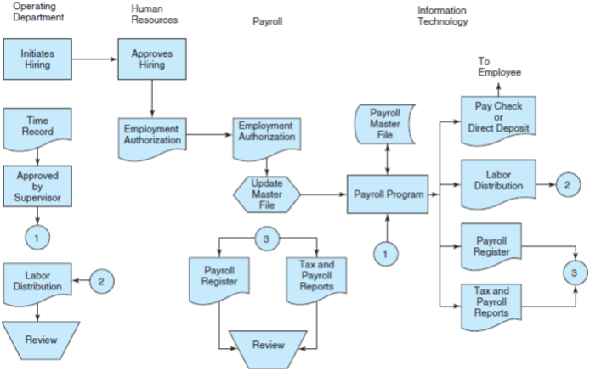

A company employs three accounts payable clerks and one treasurer. Their responsibilities are as follows:

Which of the following would indicate a weakness in the company's internal control?

A) Clerk 1 opens all of the incoming mail.

B) Clerk 2 reconciles the accounts payable ledger with the general ledger monthly.

C) Clerk 3 mails the checks and remittances after they have been signed.

D) The treasurer uses a stamp for signing checks.

Which of the following would indicate a weakness in the company's internal control?

A) Clerk 1 opens all of the incoming mail.

B) Clerk 2 reconciles the accounts payable ledger with the general ledger monthly.

C) Clerk 3 mails the checks and remittances after they have been signed.

D) The treasurer uses a stamp for signing checks.

Financial Statement

The statements that are prepared for a specific period of time, comprising the financial information of the organization are known as financial statements. It includes a statement of income which shows the profitability of the business, balance sheet which shows the monetary position with regards to assets, liabilities, and capital, and cash flow statement which represents the flow of cash for the accounting period.Accounts Payable

When goods are purchased from a particular supplier and payment is yet to be made, then accounts payable is credited in the books of accounts. It is a short-term liability.

a.A clerk is allowed to open all the incoming mails, the mails must be delivered o the relevant departments according to the name mentioned on the mails. If the clerk opens the all the mails the chances of fraud decreases as the clerk knows all the information of the mail so the further fraud by other clerks is easily detected by the clerk 1.

Hence the option a is an incorrect answer.

b.The clerk reconciles the account payable with the general ledger monthly, if the updating is made monthly then the company has strong internal controls as the monthly updating will detect any discrepancies in the accounts and other works by the employees. This is the strong point of the company.

Hence, the option b is the incorrect answer.

c.the clerk mails the checks after the checks are signed the checks are mailed once they are checked by the clerk that all checks are signed properly or not.

Hence, the option c is the incorrect option.

d.Using a stamp for signing checks indicates a weakness in the company's internal control. The properly verified signature should be used instead of only using a stamp for signing checks. In case of mishandling of stamp or forging of the stamp, the company will have to bear huge losses as clerk 3 mails the checks and remittances after they have been signed.Therefore, the correct option is

.

.

The statements that are prepared for a specific period of time, comprising the financial information of the organization are known as financial statements. It includes a statement of income which shows the profitability of the business, balance sheet which shows the monetary position with regards to assets, liabilities, and capital, and cash flow statement which represents the flow of cash for the accounting period.Accounts Payable

When goods are purchased from a particular supplier and payment is yet to be made, then accounts payable is credited in the books of accounts. It is a short-term liability.

a.A clerk is allowed to open all the incoming mails, the mails must be delivered o the relevant departments according to the name mentioned on the mails. If the clerk opens the all the mails the chances of fraud decreases as the clerk knows all the information of the mail so the further fraud by other clerks is easily detected by the clerk 1.

Hence the option a is an incorrect answer.

b.The clerk reconciles the account payable with the general ledger monthly, if the updating is made monthly then the company has strong internal controls as the monthly updating will detect any discrepancies in the accounts and other works by the employees. This is the strong point of the company.

Hence, the option b is the incorrect answer.

c.the clerk mails the checks after the checks are signed the checks are mailed once they are checked by the clerk that all checks are signed properly or not.

Hence, the option c is the incorrect option.

d.Using a stamp for signing checks indicates a weakness in the company's internal control. The properly verified signature should be used instead of only using a stamp for signing checks. In case of mishandling of stamp or forging of the stamp, the company will have to bear huge losses as clerk 3 mails the checks and remittances after they have been signed.Therefore, the correct option is

.

. 4

How does a company ensure that terminated employees are removed from the payroll?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

Payroll Authorization in a Computerized System. Two accountants were discussing control activities and tests of controls for payroll systems. The senior accountant in charge of the engagement said: "It is impossible to determine who authorizes transactions when the payroll account is computerized."

Required:

Evaluate the senior accountant's statement about control in a computerized payroll system. List the points in the flow of payroll information where authorization takes place.

Required:

Evaluate the senior accountant's statement about control in a computerized payroll system. List the points in the flow of payroll information where authorization takes place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

What feature of the acquisition and expenditure control would be expected to prevent an employee's embezzling cash through creation of fictitious vouchers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

For which of the following accounts would the matching concept be the most appropriate?

A) Cost of goods sold.

B) Research and development.

C) Depreciation expense.

D) Sales.

A) Cost of goods sold.

B) Research and development.

C) Depreciation expense.

D) Sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following tests of details most likely would help an auditor determine whether accounts payable have been misstated?

A) Examining reported purchase returns that appear too low.

B) Examining vendor statements for amounts not reported as purchases.

C) Searching for customer-returned goods that were not reported as returns.

D) Reviewing bank transfers recorded as cash received from customers.

A) Examining reported purchase returns that appear too low.

B) Examining vendor statements for amounts not reported as purchases.

C) Searching for customer-returned goods that were not reported as returns.

D) Reviewing bank transfers recorded as cash received from customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

Describe a walkthrough of the payroll transaction flow from hiring authorization to payroll check disbursement. (a) What document copies would be collected? (b) What controls should be noted?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

Payroll Processed by a Service Organization. Assume that you are the audit senior conducting a review of a new client's payroll system. In the process of interviewing the payroll department manager, she makes the following statement: "We don't need many controls because our payroll is done outside the company by Automated Information Processing, a service bureau."

Required:

Evaluate the payroll department manager's statement and describe how a service organization affects an auditor's review of controls.

Required:

Evaluate the payroll department manager's statement and describe how a service organization affects an auditor's review of controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

How would substantive procedures for accounts payable be affected by (a) a low risk of material misstatement or (b) a high risk of material misstatement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would not overstate current-period net income?

A) Capitalizing an expenditure that should be expensed.

B) Failing to record a liability as an expense.

C) Failing to record a check paying an item in Vouchers Payable.

D) All of the above would overstate net income.

A) Capitalizing an expenditure that should be expensed.

B) Failing to record a liability as an expense.

C) Failing to record a check paying an item in Vouchers Payable.

D) All of the above would overstate net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

Payable ICQ Items: Assertions, Tests of Controls, and Possible Errors or Frauds. Following is a selection of items from internal control questionnaires.

1. Are purchase orders above a certain level approved by an officer?

2. Are the quantity and quality of goods received determined at the time of receipt by receiving personnel independent of the purchasing department?

3. Are vendors' invoices matched against purchase orders and receiving reports before a liability is recorded?

4. Are journal entries authorized at appropriate levels?

Required:

For each preceding item:

a. Identify the management assertion to which it applies.

b. Specify one test of controls auditors could use to determine whether the control was operating effectively.

c. Give an example of an error or fraud that could occur if the control were absent or ineffective.

d. Write a substantive procedure that could find errors or frauds that could result from the absence or ineffectiveness of the control items.

1. Are purchase orders above a certain level approved by an officer?

2. Are the quantity and quality of goods received determined at the time of receipt by receiving personnel independent of the purchasing department?

3. Are vendors' invoices matched against purchase orders and receiving reports before a liability is recorded?

4. Are journal entries authorized at appropriate levels?

Required:

For each preceding item:

a. Identify the management assertion to which it applies.

b. Specify one test of controls auditors could use to determine whether the control was operating effectively.

c. Give an example of an error or fraud that could occur if the control were absent or ineffective.

d. Write a substantive procedure that could find errors or frauds that could result from the absence or ineffectiveness of the control items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

What documents should be included in an employee's personnel file?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

Payroll Audit Procedures, Computers, and Sampling. You are the senior auditor in charge of the annual audit of Onward Manufacturing Corporation for the year ending December 31. The company is of medium size with only 300 employees. All 300 employees are union members paid by the hour at rates set forth in a union contract, a copy of which is furnished to you. Job and pay rate classifications are determined by a joint union- management conference, and a formal memorandum is placed in each employee's personnel file.

Every week, clock cards prepared and approved in the shop are collected and transmitted to the payroll department. The total of labor hours is summed on a calculator and entered on each clock card. Batch and hash totals are obtained for the following: (1) labor hours and (2) last four digits of Social Security numbers. These data are input into a disk file, batch balanced, and batch processed. The clock cards (with cost classification data) are sent to the cost accounting department.

The payroll system is computerized. As each person's payroll record is processed, the Social Security number is matched to a table (in a separate master file) to obtain job classification and pay rate data, then the pay rate is multiplied by the number of hours, and the check is printed. (Ignore payroll deductions for the following requirements.)

Required:

a. What audit procedures would you recommend to obtain evidence that payroll data are accurately totaled and transformed into machine-readable records? What deviation rate might you expect? What tolerable deviation rate would you set? What "items" would you sample? What factors should you consider in setting the size of your sample?

b. What audit procedures would you recommend to obtain evidence that the pay rates are appropriately assigned and used in figuring gross pay? In what way, if any, would these procedures be different if the gross pay were calculated by hand instead of on a computer?

Every week, clock cards prepared and approved in the shop are collected and transmitted to the payroll department. The total of labor hours is summed on a calculator and entered on each clock card. Batch and hash totals are obtained for the following: (1) labor hours and (2) last four digits of Social Security numbers. These data are input into a disk file, batch balanced, and batch processed. The clock cards (with cost classification data) are sent to the cost accounting department.

The payroll system is computerized. As each person's payroll record is processed, the Social Security number is matched to a table (in a separate master file) to obtain job classification and pay rate data, then the pay rate is multiplied by the number of hours, and the check is printed. (Ignore payroll deductions for the following requirements.)

Required:

a. What audit procedures would you recommend to obtain evidence that payroll data are accurately totaled and transformed into machine-readable records? What deviation rate might you expect? What tolerable deviation rate would you set? What "items" would you sample? What factors should you consider in setting the size of your sample?

b. What audit procedures would you recommend to obtain evidence that the pay rates are appropriately assigned and used in figuring gross pay? In what way, if any, would these procedures be different if the gross pay were calculated by hand instead of on a computer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

Describe the purpose and give examples of audit procedures in the search for unrecorded liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

A client's purchasing system ends with the recording of a liability and its eventual payment. Which of the following best describes auditors' primary concern with respect to liabilities resulting from the purchasing system?

A) Accounts payable are not materially understated.

B) Authority to incur liabilities is restricted to one designated person.

C) Acquisition of materials is not made from one vendor or one group of vendors.

D) Commitments for all purchases are made only after established competitive bidding procedures are followed.

A) Accounts payable are not materially understated.

B) Authority to incur liabilities is restricted to one designated person.

C) Acquisition of materials is not made from one vendor or one group of vendors.

D) Commitments for all purchases are made only after established competitive bidding procedures are followed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

Unrecorded Liabilities Procedures. You are in the final stages of your audit of the financial statements of Ozine Corporation for the year ended December 31, 2014, when the corporation's president consults you. The president believes there is no point to your examining the 2015 voucher register and testing data in support of 2015 entries. She stated that any bills pertaining to 2014 that were received too late to be included in the December voucher register were recorded by a year-end journal entry and the internal auditor tested for unrecorded liabilities after the year-end. The president will provide you a letter certifying that there are no unrecorded liabilities.

Required:

a. Should your procedures for unrecorded liabilities be affected by the fact that the client made a journal entry to record 2014 bills that were received later? Explain.

b. Should your test for unrecorded liabilities be affected by the fact that a letter is obtained in which a responsible management official certifies that, to the best of that person's knowledge, all liabilities have been recorded? Explain.

c. Should your test for unrecorded liabilities be eliminated or reduced because of the internal audit work? Explain.

d. What sources, in addition to the 2015 voucher register, should you consider for locating possible unrecorded liabilities?

Required:

a. Should your procedures for unrecorded liabilities be affected by the fact that the client made a journal entry to record 2014 bills that were received later? Explain.

b. Should your test for unrecorded liabilities be affected by the fact that a letter is obtained in which a responsible management official certifies that, to the best of that person's knowledge, all liabilities have been recorded? Explain.

c. Should your test for unrecorded liabilities be eliminated or reduced because of the internal audit work? Explain.

d. What sources, in addition to the 2015 voucher register, should you consider for locating possible unrecorded liabilities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

What features of a payroll system could be expected to prevent or detect the (a) payment of a fictitious employee and (b) omission of payment to an employee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

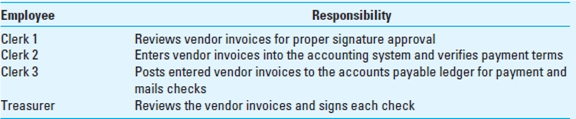

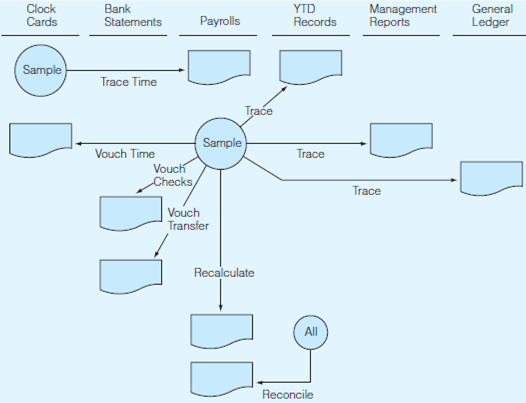

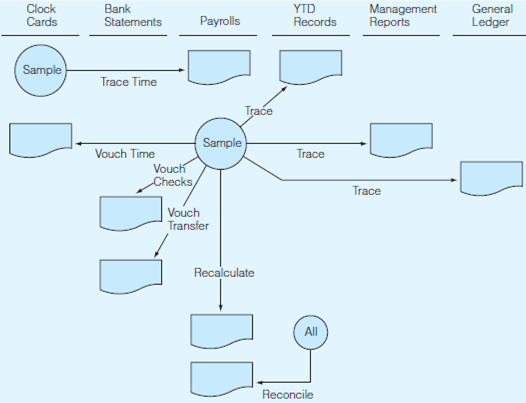

Payroll Tests of Controls. The diagram in Exhibit 8C.22.1 describes several payroll tests of controls. It shows the direction of the tests, leading from samples of clock cards, payrolls, and cumulative year-to-date earnings records to blank squares.

Required:

For each blank square in Appendix Exhibit 8C.22.1, write a payroll test of controls procedure and describe the evidence it can produce. ( Hint: Refer to Exhibit 5.12.)

EXHIBIT 8C.22.1

Diagram of Payroll Tests of Controls

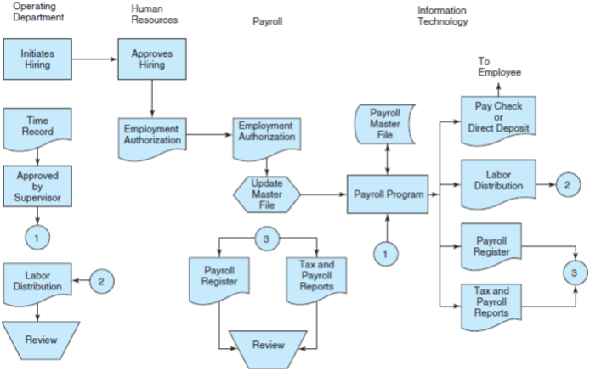

EXHIBIT 5.12 Payroll System Flowchart

Required:

For each blank square in Appendix Exhibit 8C.22.1, write a payroll test of controls procedure and describe the evidence it can produce. ( Hint: Refer to Exhibit 5.12.)

EXHIBIT 8C.22.1

Diagram of Payroll Tests of Controls

EXHIBIT 5.12 Payroll System Flowchart

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

In substantive procedures, why is the emphasis on the completeness assertion for liabilities instead of on the existence assertion as in the audit of assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is an internal control activity that could prevent a paid disbursement voucher from being presented for payment a second time?

A) Vouchers should be prepared by individuals who are responsible for signing disbursement checks.

B) Disbursement vouchers should be approved by at least two responsible management officials.

C) The date on a disbursement voucher should be within a few days of the date the voucher is presented for payment.

D) The official who signs the check should compare the check with the voucher and should stamp "PAID" on the voucher documents.

A) Vouchers should be prepared by individuals who are responsible for signing disbursement checks.

B) Disbursement vouchers should be approved by at least two responsible management officials.

C) The date on a disbursement voucher should be within a few days of the date the voucher is presented for payment.

D) The official who signs the check should compare the check with the voucher and should stamp "PAID" on the voucher documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

Accounts Payable Confirmations. Partners Clark and Kent, both CPAs, are preparing their audit plan for the audit of accounts payable on Marlboro Corporation's annual audit. Saturday afternoon they reviewed the thick file of last year's documentation and they both remembered too well the six days they spent last year on accounts payable.

Last year, Clark had suggested that they mail confirmations to 100 of Marlboro's suppliers. The company regularly purchases from about 1,000 suppliers and these account payable balances fluctuate widely, depending on the volume of purchase and the terms Marlboro's purchasing agent is able to negotiate. Clark's sample of 100 was designed to include accounts with large balances. In fact, the 100 accounts confirmed last year covered 80 percent of the total dollars in accounts payable. Both Clark and Kent had spent many hours tracking down minor differences reported in confirmation responses. Nonresponding accounts were investigated by comparing Marlboro's balance with monthly statements received from suppliers.

Required:

a. Identify the accounts payable audit objectives that auditors must consider in determining the audit procedures to be performed.

b. Identify situations when auditors should use accounts payable confirmations and discuss whether they are required to use them.

c. Discuss why the use of large dollar balances as the basis for selecting accounts payable for confirmation is not the most effective approach and indicate a more effective sample selection procedure that could be followed when choosing accounts payable for confirmation.

Last year, Clark had suggested that they mail confirmations to 100 of Marlboro's suppliers. The company regularly purchases from about 1,000 suppliers and these account payable balances fluctuate widely, depending on the volume of purchase and the terms Marlboro's purchasing agent is able to negotiate. Clark's sample of 100 was designed to include accounts with large balances. In fact, the 100 accounts confirmed last year covered 80 percent of the total dollars in accounts payable. Both Clark and Kent had spent many hours tracking down minor differences reported in confirmation responses. Nonresponding accounts were investigated by comparing Marlboro's balance with monthly statements received from suppliers.

Required:

a. Identify the accounts payable audit objectives that auditors must consider in determining the audit procedures to be performed.

b. Identify situations when auditors should use accounts payable confirmations and discuss whether they are required to use them.

c. Discuss why the use of large dollar balances as the basis for selecting accounts payable for confirmation is not the most effective approach and indicate a more effective sample selection procedure that could be followed when choosing accounts payable for confirmation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

What are the most common errors and frauds in the personnel and payroll cycle? Which control characteristics are auditors looking for to prevent or detect these errors and frauds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

How do audit procedures for prepaid expenses and accrued liabilities also provide audit evidence about related expense accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

Budd, the purchasing agent of Lake Hardware Wholesalers, has a relative who owns a retail hardware store. Budd arranged for hardware to be delivered by manufacturers to the retail store on a cash-on-delivery (COD) basis, thereby enabling his relative to buy at Lake's wholesale prices. Budd was probably able to accomplish this because of Lake's poor internal control over

A) Purchase requisitions.

B) Cash receipts.

C) Perpetual inventory records.

D) Purchase orders.

A) Purchase requisitions.

B) Cash receipts.

C) Perpetual inventory records.

D) Purchase orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

Search for Unrecorded Liabilities. C. Marsh, CPA, is the independent auditor for Compufast Corporation (Compufast), which sells personal computers, peripheral equipment (printers, data storage), and a wide variety of programs for business and games. From experience on Compufast's previous audits, Marsh knew that the company's accountants were very much concerned with timely recording of revenues and receivables and somewhat less concerned with keeping up-to-date records of accounts payable and other liabilities. Marsh knew that the control environment was strong in the asset area and weak in the liability area.

Required:

List substantive procedures that Marsh and the audit staff can perform to obtain reasonable assurance that Compufast's unrecorded liabilities are discovered and adjusted in the financial statements currently under audit.

Required:

List substantive procedures that Marsh and the audit staff can perform to obtain reasonable assurance that Compufast's unrecorded liabilities are discovered and adjusted in the financial statements currently under audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

An audit team most likely would assess control risk at the maximum if the payroll department supervisor is responsible for

A) Examining authorization forms for new employees.

B) Comparing payroll registers with original batch transmittal data.

C) Authorizing payroll rate changes for all employees.

D) Hiring all subordinate payroll department employees.

A) Examining authorization forms for new employees.

B) Comparing payroll registers with original batch transmittal data.

C) Authorizing payroll rate changes for all employees.

D) Hiring all subordinate payroll department employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

What assertions found in PP E, investments, and intangibles accounts are of interest to an auditor during the examination of the expenditure and acquisition cycle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is the best audit procedure for determining the existence of unrecorded liabilities?

A) Examine confirmation requests returned by creditors whose accounts are on a subsidiary trial balance of accounts payable.

B) Examine a sample of cash disbursements in the period subsequent to year-end.

C) Examine a sample of invoices a few days prior to and subsequent to the year-end to ascertain whether they have been properly recorded.

D) Examine unusual relationships between monthly accounts payable and recorded purchases.

A) Examine confirmation requests returned by creditors whose accounts are on a subsidiary trial balance of accounts payable.

B) Examine a sample of cash disbursements in the period subsequent to year-end.

C) Examine a sample of invoices a few days prior to and subsequent to the year-end to ascertain whether they have been properly recorded.

D) Examine unusual relationships between monthly accounts payable and recorded purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

Fictitious Vendors, Theft, and Embezzlement. The following cases are designed like the ones in the chapter. Your assignment is to write the audit approach portion of the cases organized around these sections:

Objective. Express the objective in terms of the facts supposedly asserted in financial records, accounts, and statements.

Control. Write a brief explanation of desirable controls, missing controls, and especially the kinds of "deviations" that could arise from the situation described in the case.

Tests of cont rols. Write some procedures for getting evidence about existing controls, especially procedures that could discover deviations from controls. If there are no controls to test, then there are no procedures to perform; go to the next section. A "procedure" should instruct someone about the source(s) of evidence to tap and the work to do.

Audit of balance. Write some procedures for getting evidence about the existence, completeness, valuation or allocation, or rights and obligations assertions identified in your objective section.

Discovery summary. Write a short statement about the discovery you expect to accomplish with your procedures.

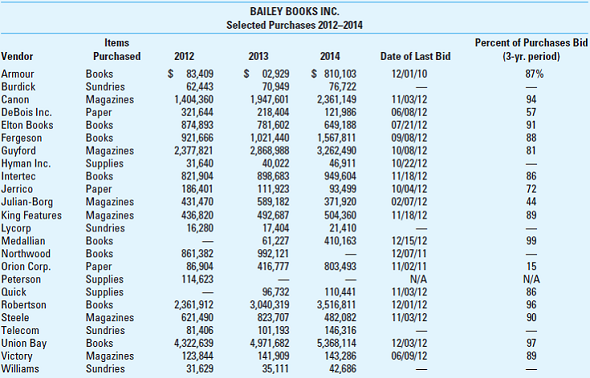

Purchasing Stars

Bailey Books Inc. is a retail distributor of upscale books, periodicals, and magazines. Bailey has 431 retail stores throughout the southeastern states. Three full-time purchasing agents work at corporate headquarters. They are responsible for purchasing all inventory at the best prices available from wholesale suppliers. They can purchase with or without obtaining competitive bids. The three purchasing agents are R. McGuire in charge of purchasing books, M. Garza in charge of purchasing magazines and periodicals, and L. Collins (manager of purchasing) in charge of ordering miscellaneous items such as paper products and store supplies.

One of the purchasing agents is suspected of taking kickbacks from vendors. In return, Bailey is thought to be paying inflated prices, which first are recorded in inventory and then in cost of goods sold and other expense accounts as the assets are sold or used.

The duties of Collins, the manager in charge, do not include audit or inspection of the performance of the other two purchasing agents. No one audits or reviews Collins's performance.

The purchasing system is computerized and detail records are retained. An extract from these records is in Exhibit 8.45.1.

This kickback scheme has been going on for two or three years. Bailey Books could have overpaid by several hundred thousand dollars.

EXHIBIT 8.45.1

Objective. Express the objective in terms of the facts supposedly asserted in financial records, accounts, and statements.

Control. Write a brief explanation of desirable controls, missing controls, and especially the kinds of "deviations" that could arise from the situation described in the case.

Tests of cont rols. Write some procedures for getting evidence about existing controls, especially procedures that could discover deviations from controls. If there are no controls to test, then there are no procedures to perform; go to the next section. A "procedure" should instruct someone about the source(s) of evidence to tap and the work to do.

Audit of balance. Write some procedures for getting evidence about the existence, completeness, valuation or allocation, or rights and obligations assertions identified in your objective section.

Discovery summary. Write a short statement about the discovery you expect to accomplish with your procedures.

Purchasing Stars

Bailey Books Inc. is a retail distributor of upscale books, periodicals, and magazines. Bailey has 431 retail stores throughout the southeastern states. Three full-time purchasing agents work at corporate headquarters. They are responsible for purchasing all inventory at the best prices available from wholesale suppliers. They can purchase with or without obtaining competitive bids. The three purchasing agents are R. McGuire in charge of purchasing books, M. Garza in charge of purchasing magazines and periodicals, and L. Collins (manager of purchasing) in charge of ordering miscellaneous items such as paper products and store supplies.

One of the purchasing agents is suspected of taking kickbacks from vendors. In return, Bailey is thought to be paying inflated prices, which first are recorded in inventory and then in cost of goods sold and other expense accounts as the assets are sold or used.

The duties of Collins, the manager in charge, do not include audit or inspection of the performance of the other two purchasing agents. No one audits or reviews Collins's performance.

The purchasing system is computerized and detail records are retained. An extract from these records is in Exhibit 8.45.1.

This kickback scheme has been going on for two or three years. Bailey Books could have overpaid by several hundred thousand dollars.

EXHIBIT 8.45.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following departments most likely would approve changes in pay rates and deductions from employee salaries?

A) Personnel.

B) Treasurer.

C) Controller.

D) Payroll.

A) Personnel.

B) Treasurer.

C) Controller.

D) Payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

What items in a client's PP E and depreciation schedule give auditors points of departure (assertions) for audit procedures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following procedures is least likely to be performed before the balance-sheet date?

A) Observation of inventory.

B) Review of internal control over cash disbursements.

C) Search for unrecorded liabilities.

D) Confirmation of receivables.

A) Observation of inventory.

B) Review of internal control over cash disbursements.

C) Search for unrecorded liabilities.

D) Confirmation of receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

Bidding Process. Maine Construction builds office buildings. The buildings generally cost between $5 million and $8 million to build, and the plumbing can cost between $300,000 and $600,000 depending on the building requirements. Therefore, Maine always sends the plumbing work out for bid before deciding on whom to use as a subcontractor. The company has had 21 projects over the last five years with $10 million dollars in plumbing contracts being sent out for bids.

Over the past five years, Maine has asked for bids from three contractors: Beltran Plumbing; Delgado Plumbing Services; Wright Contracting-Plumbing Specialists. Each vendor has been reviewed by Maine and is on Maine's approved vendor list.

For each of the following situations (each situation is independent), determine whether the auditor should be concerned about the controls over the bidding process. If yes, what control would you recommend to Maine to ensure a fair and honest bidding process?

a. Of the 21 projects sent out for bid, Wright had the winning bid on 12 of the projects.

b. Of the 21 projects sent out for bid Wright had the winning bid on 12 of the projects. In each of these bidding processes, Wright's bid was the last bid received.

c. Of the 21 projects sent out for bid, each vendor had the winning bid on 7 of the projects.

d. Of the 21 projects sent out for bid, Delgado was awarded 5 contracts even though he did not have the lowest bid.

Over the past five years, Maine has asked for bids from three contractors: Beltran Plumbing; Delgado Plumbing Services; Wright Contracting-Plumbing Specialists. Each vendor has been reviewed by Maine and is on Maine's approved vendor list.

For each of the following situations (each situation is independent), determine whether the auditor should be concerned about the controls over the bidding process. If yes, what control would you recommend to Maine to ensure a fair and honest bidding process?

a. Of the 21 projects sent out for bid, Wright had the winning bid on 12 of the projects.

b. Of the 21 projects sent out for bid Wright had the winning bid on 12 of the projects. In each of these bidding processes, Wright's bid was the last bid received.

c. Of the 21 projects sent out for bid, each vendor had the winning bid on 7 of the projects.

d. Of the 21 projects sent out for bid, Delgado was awarded 5 contracts even though he did not have the lowest bid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

Matthew Corp. has changed from a system of recording time worked on clock cards to a computerized payroll system in which employees record time in and out with magnetic cards. The computerized system automatically updates all payroll records. Because of this change

A) A generalized computer audit plan must be used.

B) Part of the audit trail is altered.

C) The potential for payroll-related fraud is diminished.

D) Transactions must be processed in batches.

A) A generalized computer audit plan must be used.

B) Part of the audit trail is altered.

C) The potential for payroll-related fraud is diminished.

D) Transactions must be processed in batches.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

What four methods are used to audit other expense accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

To determine whether accounts payable are complete, auditors perform a test to verify that all merchandise received has been recorded. The population for this test consists of all

A) Vendors' invoices.

B) Purchase orders.

C) Receiving reports.

D) Canceled checks.

A) Vendors' invoices.

B) Purchase orders.

C) Receiving reports.

D) Canceled checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

Grounds for Dismissal. This case is designed like the ones in the chapter. Your assignment is to write the "audit approach" portion of the case organized around these sections:

Objective. Express the objective in terms of the facts supposedly asserted in financial records, accounts, and statements.

Control. Write a brief explanation of desirable controls, missing controls, and especially the types of "deviations" that might arise from the situation described in the case.

Tests of controls. Write some audit procedures for getting evidence about existing controls, especially procedures that could discover deviations from controls. If there are no controls to test, then there are no procedures to perform; go to the next section. A "procedure" should instruct someone about the source(s) of evidence to tap and the work to do.

Audit of balance. Write some procedures for getting evidence about the existence, completeness, valuation or allocation, or rights and obligations assertions identified in your objective section.

Discovery summary. Write a short statement about the discovery you expect to accomplish with your procedures.

A. Doe, IT application manager for The Coffee Company, signed a consulting services agreement with Fictitious Consulting Company (FCC). Doe was required to obtain written approval of the contract from a supervisor but forged the supervisor's signature. More than 100 invoices came in, which were approved with Doe's initials. Even though Doe's approval authority was only $5,000, many of the invoices were for more than $40,000.

FCC was not registered in the state or listed in telephone directories. The phone number was for a cell phone registered to Doe and the mailing address was a post office box. When Doe's supervisor asked to meet the FCC consultants, Doe was evasive, saying they "had just left" or "they were working away from the office." Ultimately, Doe told her supervisor that she had dismissed FCC, but she simply moved the charges to capital accounts that the supervisor did not monitor.

The Coffee Co. paid more than $3.7 million to FCC between December 1999 and August 2000. (Source: M. Atkinson and M. Biliske, "Grounds for Dismissal," Internal Auditor, February 2005.)

Objective. Express the objective in terms of the facts supposedly asserted in financial records, accounts, and statements.

Control. Write a brief explanation of desirable controls, missing controls, and especially the types of "deviations" that might arise from the situation described in the case.

Tests of controls. Write some audit procedures for getting evidence about existing controls, especially procedures that could discover deviations from controls. If there are no controls to test, then there are no procedures to perform; go to the next section. A "procedure" should instruct someone about the source(s) of evidence to tap and the work to do.

Audit of balance. Write some procedures for getting evidence about the existence, completeness, valuation or allocation, or rights and obligations assertions identified in your objective section.

Discovery summary. Write a short statement about the discovery you expect to accomplish with your procedures.

A. Doe, IT application manager for The Coffee Company, signed a consulting services agreement with Fictitious Consulting Company (FCC). Doe was required to obtain written approval of the contract from a supervisor but forged the supervisor's signature. More than 100 invoices came in, which were approved with Doe's initials. Even though Doe's approval authority was only $5,000, many of the invoices were for more than $40,000.

FCC was not registered in the state or listed in telephone directories. The phone number was for a cell phone registered to Doe and the mailing address was a post office box. When Doe's supervisor asked to meet the FCC consultants, Doe was evasive, saying they "had just left" or "they were working away from the office." Ultimately, Doe told her supervisor that she had dismissed FCC, but she simply moved the charges to capital accounts that the supervisor did not monitor.

The Coffee Co. paid more than $3.7 million to FCC between December 1999 and August 2000. (Source: M. Atkinson and M. Biliske, "Grounds for Dismissal," Internal Auditor, February 2005.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

Effective control over the cash payroll function would mandate which of the following?

A) The payroll clerk should fill the envelopes with cash and a computation of the net wages.

B) Unclaimed payroll envelopes should be retained by the paymaster.

C) Each employee should be asked to sign a receipt.

D) A separate checking account for payroll should be maintained.

A) The payroll clerk should fill the envelopes with cash and a computation of the net wages.

B) Unclaimed payroll envelopes should be retained by the paymaster.

C) Each employee should be asked to sign a receipt.

D) A separate checking account for payroll should be maintained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

What items could indicate a significant risk of fraud in the acquisition and expenditure cycle (i.e., be red flags)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

When verifying debits to the perpetual inventory records of a nonmanufacturing company, auditors would be most interested in examining a sample of purchase

A) Approvals.

B) Requisitions.

C) Invoices.

D) Orders.

A) Approvals.

B) Requisitions.

C) Invoices.

D) Orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

PP E Assertions and Substantive Procedures. This question contains three items that are management assertions about property and equipment. Following them are several substantive procedures for obtaining evidence about management's assertions.

Assertions

1. The entity has legal right to property and equipment acquired during the year.

2. Recorded property and equipment represent assets that actually exist at the balance-sheet date.

3. Net property and equipment are properly valued at the balance-sheet date.

Substantive Procedures

a. Trace opening balances in the summary schedules to the prior-year audit documentation.

b. Review the provision for depreciation expense and determine whether depreciable lives and methods used in the current year are consistent with those used in the prior year.

c. Determine whether the responsibility for maintaining the property and equipment records is separated from the responsibility for custody of property and equipment.

d. Examine deeds and title insurance certificates.

e. Perform cutoff tests to verify that property and equipment additions are recorded in the proper period.

f. Determine whether property and equipment are adequately insured.

g. Physically examine all major property and equipment additions.

Required:

For each of the three assertions (1, 2, and 3), select the one best substantive audit procedure (a-g) for obtaining competent evidence. A procedure may be selected only once or not at all.

Assertions

1. The entity has legal right to property and equipment acquired during the year.

2. Recorded property and equipment represent assets that actually exist at the balance-sheet date.

3. Net property and equipment are properly valued at the balance-sheet date.

Substantive Procedures

a. Trace opening balances in the summary schedules to the prior-year audit documentation.

b. Review the provision for depreciation expense and determine whether depreciable lives and methods used in the current year are consistent with those used in the prior year.

c. Determine whether the responsibility for maintaining the property and equipment records is separated from the responsibility for custody of property and equipment.

d. Examine deeds and title insurance certificates.

e. Perform cutoff tests to verify that property and equipment additions are recorded in the proper period.

f. Determine whether property and equipment are adequately insured.

g. Physically examine all major property and equipment additions.

Required:

For each of the three assertions (1, 2, and 3), select the one best substantive audit procedure (a-g) for obtaining competent evidence. A procedure may be selected only once or not at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

A large retail enterprise has established a policy that requires the paymaster to deliver all unclaimed payroll checks to the internal audit department at the end of each payroll distribution day. This policy was most likely adopted to

A) Ensure that employees who were absent on a payroll distribution day are not paid for that day.

B) Prevent the paymaster from cashing checks that are unclaimed for several weeks.

C) Prevent a bona fide employee's check from being claimed by another employee.

D) Detect any fictitious employee who may have been placed on the payroll.

A) Ensure that employees who were absent on a payroll distribution day are not paid for that day.

B) Prevent the paymaster from cashing checks that are unclaimed for several weeks.

C) Prevent a bona fide employee's check from being claimed by another employee.

D) Detect any fictitious employee who may have been placed on the payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

What are the short-term effects and the long-term effects of improperly capitalizing expenditures on the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

Describe the purpose and give examples of specific fraud detection procedures in the acquisition and expenditure cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

A furniture company ordered 84 tables from a supplier. The supplier accidentally sent only 48 tables, but the receiving department at the furniture company accepted the tables. The invoice was eventually received but was for the original 84 tables. The furniture company paid the entire amount. Which of the following controls would have been least likely to have prevented this erroneous payment?

A) The copy of the purchase order sent to the furniture company's receiving department should not have shown an expected quantity.

B) Personnel in the furniture company's accounts payable department should compare the receiving report to the purchase invoice before creation of the voucher.

C) Personnel in the furniture company's cash disbursements department should compare the check that is prepared to all of the backup documentation.

D) Personnel in the furniture company's purchasing department should compare the purchase requisition with the purchase order.

A) The copy of the purchase order sent to the furniture company's receiving department should not have shown an expected quantity.

B) Personnel in the furniture company's accounts payable department should compare the receiving report to the purchase invoice before creation of the voucher.

C) Personnel in the furniture company's cash disbursements department should compare the check that is prepared to all of the backup documentation.

D) Personnel in the furniture company's purchasing department should compare the purchase requisition with the purchase order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

Assertions and Substantive Procedures for Property, Plant, and Equipment (PP E). Following are the four assertions about account balances that can be applied to the audit of a company's PP E, including assets the company has constructed itself: existence, rights and obligations, completeness, and valuation and allocation.

Required:

For each of the following substantive procedures, (1) cite one assertion most closely related to the evidence the procedure will produce (the primary assertion) and (2) when appropriate, cite one or more other assertions that also are related to the evidence the procedure will produce-the secondary assertion(s).

a. For major amounts charged to PP E and a sample of smaller charges, examine supporting documentation for expenditure amounts, budgetary approvals, and capital work orders.

b. For a sample of capitalized PP E, examine construction work orders in detail.

c. For a sample of construction work orders, vouch time and material charges to supporting payroll and material usage records. Review the reasonableness of the hours worked, the work description, and the material used.

d. Evaluate the policy and procedures for allocating overhead to the work orders and recalculate their application.

e. Determine whether corresponding retirements of replaced PP E have occurred and have been properly entered in the detail records.

f. Select major additions for the year and a random sample of other additions and inspect the physical assets.

g. Vouch a sample of charges in the Repairs account and determine whether they are proper repairs, not capital items.

h. Review the useful lives, depreciation methods, and salvage values for reasonableness. Recalculate depreciation.

i. Study loan documents for terms and security of loans obtained for purchase of PP E.

j. Inspect title documents for automotive and real estate assets.

k. Analyze the productive economic use of PP E to determine whether any other-thantemporary impairment is evident.

Required:

For each of the following substantive procedures, (1) cite one assertion most closely related to the evidence the procedure will produce (the primary assertion) and (2) when appropriate, cite one or more other assertions that also are related to the evidence the procedure will produce-the secondary assertion(s).

a. For major amounts charged to PP E and a sample of smaller charges, examine supporting documentation for expenditure amounts, budgetary approvals, and capital work orders.

b. For a sample of capitalized PP E, examine construction work orders in detail.

c. For a sample of construction work orders, vouch time and material charges to supporting payroll and material usage records. Review the reasonableness of the hours worked, the work description, and the material used.

d. Evaluate the policy and procedures for allocating overhead to the work orders and recalculate their application.

e. Determine whether corresponding retirements of replaced PP E have occurred and have been properly entered in the detail records.

f. Select major additions for the year and a random sample of other additions and inspect the physical assets.

g. Vouch a sample of charges in the Repairs account and determine whether they are proper repairs, not capital items.

h. Review the useful lives, depreciation methods, and salvage values for reasonableness. Recalculate depreciation.

i. Study loan documents for terms and security of loans obtained for purchase of PP E.

j. Inspect title documents for automotive and real estate assets.

k. Analyze the productive economic use of PP E to determine whether any other-thantemporary impairment is evident.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

Auditors ordinarily ascertain whether payroll checks are properly endorsed during the audit of

A) Clock cards.

B) The voucher system.

C) Cash in bank.

D) Accrued payroll.

A) Clock cards.

B) The voucher system.

C) Cash in bank.

D) Accrued payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is a voucher?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

Are these specific fraud detection procedures designed to detect fraudulent financial reporting or misappropriation of assets? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

Curtis, a maintenance supervisor, submitted maintenance invoices from a phony repair company and received the checks at a post office box. This should have been prevented by

A) Comparison of the company name to the approved vendor list by the check signer.

B) Recognition of the excess maintenance costs by Curtis's supervisor.

C) Refusal by the purchasing department to approve the vendor.

D) All of the above.

A) Comparison of the company name to the approved vendor list by the check signer.

B) Recognition of the excess maintenance costs by Curtis's supervisor.

C) Refusal by the purchasing department to approve the vendor.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

CAATs Application-PP E. You are supervising the audit fieldwork of Sparta Springs Company and need certain information from Sparta's equipment records, which are maintained on a computer file. The particular information is (1) net book value of assets so that your assistant can reconcile the subsidiary ledger to the general ledger control accounts (the general ledger contains an account for each asset type at each plant location) and (2) sufficient data to enable your assistant to find and inspect selected assets. The record layout of the master file follows:

Asset number.

Description.

Asset type.

Location code.

Year acquired.

Cost.

Accumulated depreciation, end of year (includes accumulated depreciation at the beginning of the year plus depreciation for year to date).

Depreciation for the year to date.

Useful life.

Required:

From the data file described earlier,

a. List the information needed to verify correspondence of the subsidiary detail records with the general ledger accounts. Does this work complete the audit of PP E?

b. What additional data are needed to enable your assistant to inspect the assets?

Asset number.

Description.

Asset type.

Location code.

Year acquired.

Cost.

Accumulated depreciation, end of year (includes accumulated depreciation at the beginning of the year plus depreciation for year to date).

Depreciation for the year to date.

Useful life.

Required:

From the data file described earlier,

a. List the information needed to verify correspondence of the subsidiary detail records with the general ledger accounts. Does this work complete the audit of PP E?

b. What additional data are needed to enable your assistant to inspect the assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

In determining the effectiveness of an entity's policies and procedures relating to the occurrence assertion for payroll transactions, auditors most likely would inquire about and

A) Observe the separation of duties concerning personnel responsibilities and payroll disbursement.

B) Inspect evidence of accounting for prenumbered payroll checks.

C) Recompute the payroll deductions for employee benefits.

D) Verify the preparation of the monthly payroll account bank reconciliation.

A) Observe the separation of duties concerning personnel responsibilities and payroll disbursement.

B) Inspect evidence of accounting for prenumbered payroll checks.

C) Recompute the payroll deductions for employee benefits.

D) Verify the preparation of the monthly payroll account bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

How can purchasing managers use their position to defraud the company? What can be done to prevent it?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

What key control concept was missing at Argus Productions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

An audit team would most likely examine the detail support for charges to which of the following accounts?

A) Payroll expense.

B) Cost of goods sold.

C) Supplies expense.

D) Legal expense.

A) Payroll expense.

B) Cost of goods sold.

C) Supplies expense.

D) Legal expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

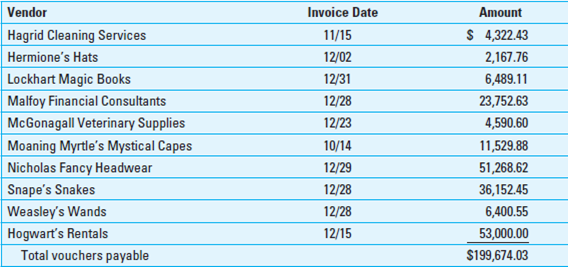

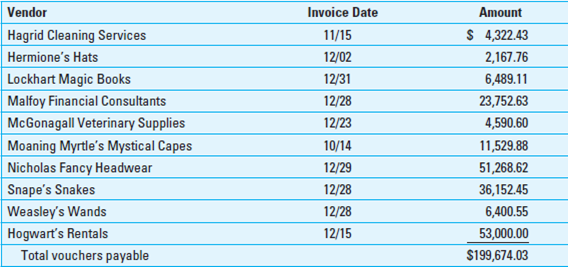

Search for Unrecorded Liabilities. The list of vouchers payable for Potter's Magic Shoppe at December 31 is as follows:

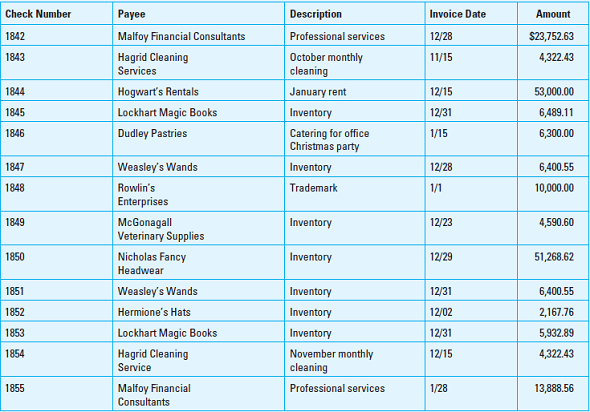

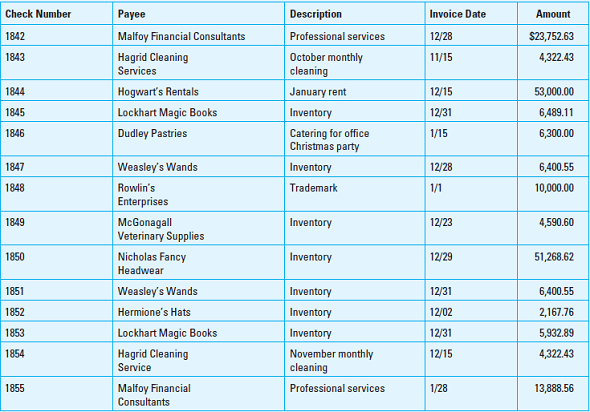

Checks written in the following January are:

Required:

a. Prepare an audit plan for the audit of unrecorded liabilities for Potter's Magic Shoppe.

b. Prepare an adjusting journal entry to correct accounts payable. Potter's maintains perpetual inventory records and the inventory was counted and adjusted on December 31.

Checks written in the following January are:

Required:

a. Prepare an audit plan for the audit of unrecorded liabilities for Potter's Magic Shoppe.

b. Prepare an adjusting journal entry to correct accounts payable. Potter's maintains perpetual inventory records and the inventory was counted and adjusted on December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following activities most likely would be considered a weakness in an entity's internal control over payroll?

A) A voucher for the amount of the payroll is prepared in the general accounting department based on the payroll department's payroll summary.

B) Payroll checks are prepared by the accounts payable department and signed by the treasurer.

C) The employee who distributes payroll check returns unclaimed payroll checks to the payroll department.

D) The personnel department sends employees' termination notices to the payroll department.

A) A voucher for the amount of the payroll is prepared in the general accounting department based on the payroll department's payroll summary.

B) Payroll checks are prepared by the accounts payable department and signed by the treasurer.

C) The employee who distributes payroll check returns unclaimed payroll checks to the payroll department.

D) The personnel department sends employees' termination notices to the payroll department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

Why is a "blind" purchase order used as a receiving report document?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

What evidence could the verbal inquiry audit procedure provide in "Printing (Copying) Money"?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following accounts would most likely be audited in connection with a related balance-sheet account?

A) Property Tax Expense.

B) Payroll Expense.

C) Research and Development.

D) Legal Expense.

A) Property Tax Expense.

B) Payroll Expense.

C) Research and Development.

D) Legal Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

Kaplan CPA Exam Simulation: Unrecorded Liabilities

Required

Go to the Kaplan website link at http://www.mhhe.com/louwers6e, click on Client's Check Register (Unrecorded Liabilities) AUD TBS, and complete your answers.

Required

Go to the Kaplan website link at http://www.mhhe.com/louwers6e, click on Client's Check Register (Unrecorded Liabilities) AUD TBS, and complete your answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following payroll control activities would most effectively ensure that payment is made only for work performed?

A) Require all employees to record arrival and departure by using the time clock.

B) Have a payroll clerk recalculate all time cards.

C) Require all employees to sign their time cards.

D) Require employees to have their direct supervisors approve their time cards.

A) Require all employees to record arrival and departure by using the time clock.

B) Have a payroll clerk recalculate all time cards.

C) Require all employees to sign their time cards.

D) Require employees to have their direct supervisors approve their time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

Where could an auditor look to find evidence of (a) losses on purchase commitments or (b) unrecorded liabilities to vendors?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

If Lee had not been seen taking employees out in a limousine, how else could she have been caught?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

When auditing account balances of liabilities, auditors are most concerned with management's assertion about

A) Existence.

B) Rights and obligations.

C) Completeness.

D) Valuation and allocation.

A) Existence.

B) Rights and obligations.

C) Completeness.

D) Valuation and allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

What functional responsibilities are associated with the payroll cycle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following activities performed by a department supervisor most likely would help to prevent or detect a payroll fraud?

A) Distributing paychecks directly to department employees.

B) Setting the pay rate for departmental employees.

C) Hiring employees and authorizing them to be added to payroll.

D) Approving a summary of hours each employee worked during the pay period.

A) Distributing paychecks directly to department employees.

B) Setting the pay rate for departmental employees.

C) Hiring employees and authorizing them to be added to payroll.

D) Approving a summary of hours each employee worked during the pay period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

List the management reports and computer files that can be used for audit evidence. What information in them can be useful to auditors?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

How would a policy of mandatory vacations have helped discover the Beta fraud?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

In a test of controls, auditors may trace receiving reports to vouchers recorded in the voucher register. This is a test for

A) Occurrence.

B) Completeness.

C) Classification.

D) Cutoff.

A) Occurrence.

B) Completeness.

C) Classification.

D) Cutoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which duties should be separated in the payroll cycle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

Major Risks in Payroll Cycle. Prepare a schedule of the major risks in the payroll cycle. Identify the financial statement assertions related to each. Create a two-column schedule like this:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck