Deck 9: Production Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 9: Production Cycle

1

What inventory information should auditors document?

The auditors are required to document the following inventory information:

1) Whether the client's personnel are properly following the inventory instructions.

2) The test counts taken for counting physical inventory, including description, and quantity

3) The ticket or count sheet numbers that were used as well as the numbers of voided and unused tickets

4) The last receiving reports and shipping documents used, and the number of the next unused item

5) The accounting method of inventory Like: LIFO, FIFO etc.6) The difference of inventory's book value and its market value

7) Proper classification of inventory

8) The condition of the inventory

9) Any inventory on hand that is not owned by the client

10) Any unusual items noticed during the count

1) Whether the client's personnel are properly following the inventory instructions.

2) The test counts taken for counting physical inventory, including description, and quantity

3) The ticket or count sheet numbers that were used as well as the numbers of voided and unused tickets

4) The last receiving reports and shipping documents used, and the number of the next unused item

5) The accounting method of inventory Like: LIFO, FIFO etc.6) The difference of inventory's book value and its market value

7) Proper classification of inventory

8) The condition of the inventory

9) Any inventory on hand that is not owned by the client

10) Any unusual items noticed during the count

2

From the auditors' point of view, inventory counts are more acceptable prior to the year-end when

A) Internal control is weak.

B) Accurate perpetual inventory records are maintained.

C) Inventory is slow moving.

D) Significant amounts of inventory are held on a consignment basis.

A) Internal control is weak.

B) Accurate perpetual inventory records are maintained.

C) Inventory is slow moving.

D) Significant amounts of inventory are held on a consignment basis.

When inventory is slow- moving or non-moving in nature then there will not be much of the intervening transactions to be vouched even if physical count is done at a date other than the balance sheet date. Accurate perpetual stock records should be maintained. Therefore, the correct answer is b.

3

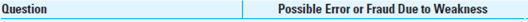

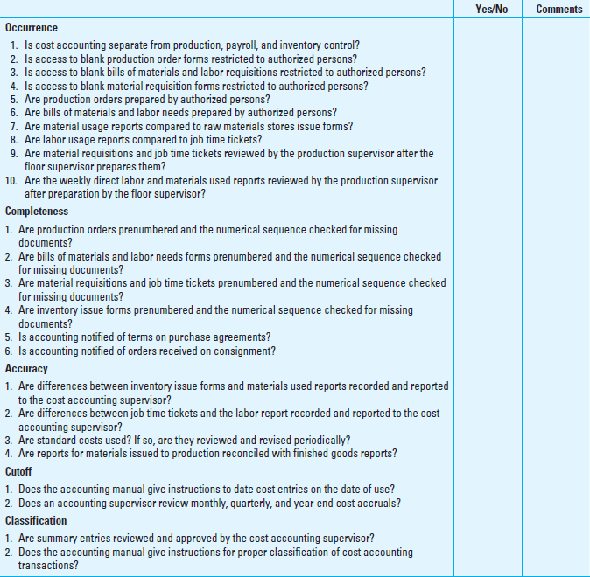

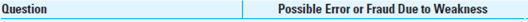

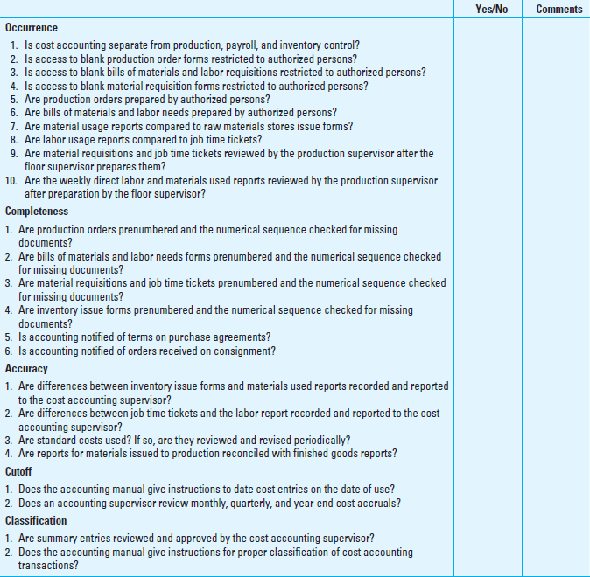

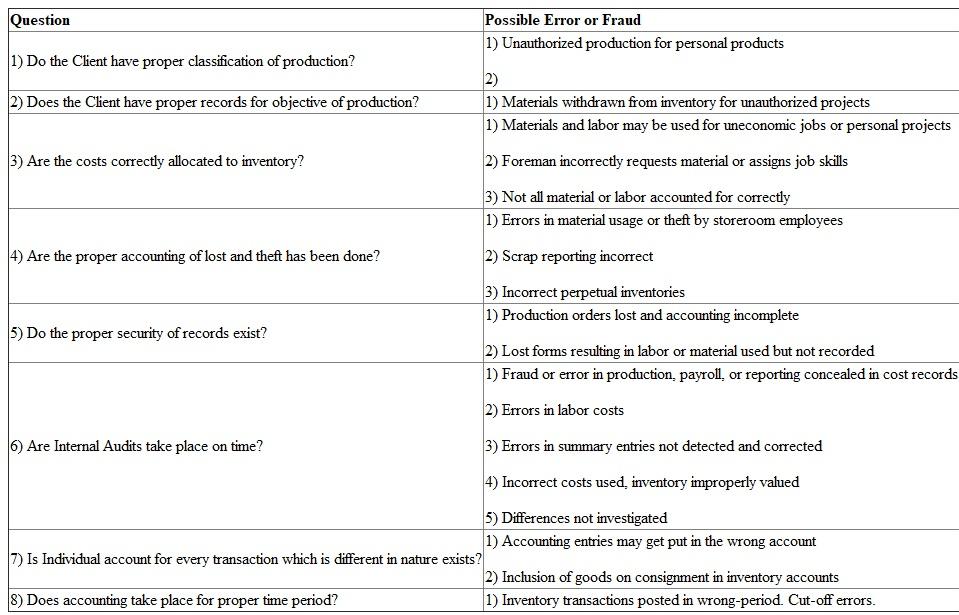

Internal Control Questionnaire Items: Possible Error or Fraud Due to Weakness. Refer to the internal control questionnaire for the production cycle (Appendix Exhibit 9A.1) and assume that the answer to each question is "no." Prepare a table matching questions to errors or frauds that could occur because of the absence of the control. Your column headings should be as follows:

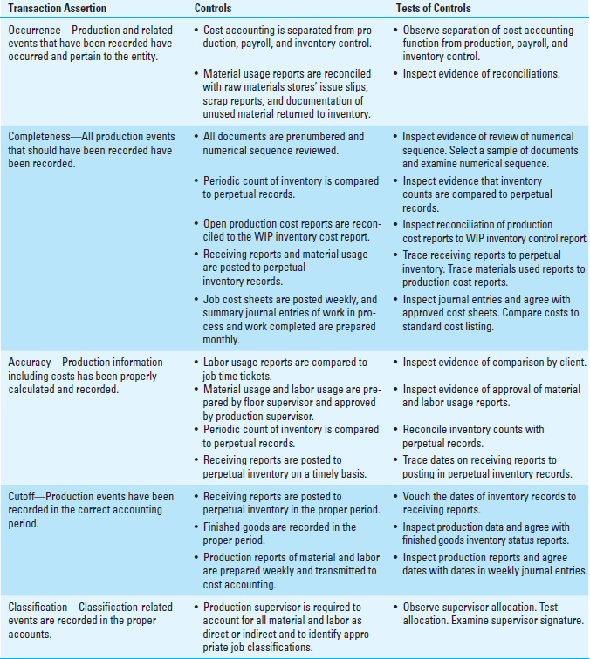

EXHIBIT 9A.1 Production Cycle

EXHIBIT 9A.1 Production Cycle

The required table is given below:

The required table is given below: 4

Why is it important to obtain shipping and receiving cutoff information during the inventory observation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following internal control activities most likely addresses the completeness assertion for inventory?

A) The work-in-process account is periodically reconciled with subsidiary inventory records.

B) Employees responsible for custody of finished goods do not perform the receiving function.

C) Receiving reports are prenumbered, and the numbering sequence is checked periodically.

D) There is a separation of duties between the payroll department and inventory accounting personnel.

A) The work-in-process account is periodically reconciled with subsidiary inventory records.

B) Employees responsible for custody of finished goods do not perform the receiving function.

C) Receiving reports are prenumbered, and the numbering sequence is checked periodically.

D) There is a separation of duties between the payroll department and inventory accounting personnel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

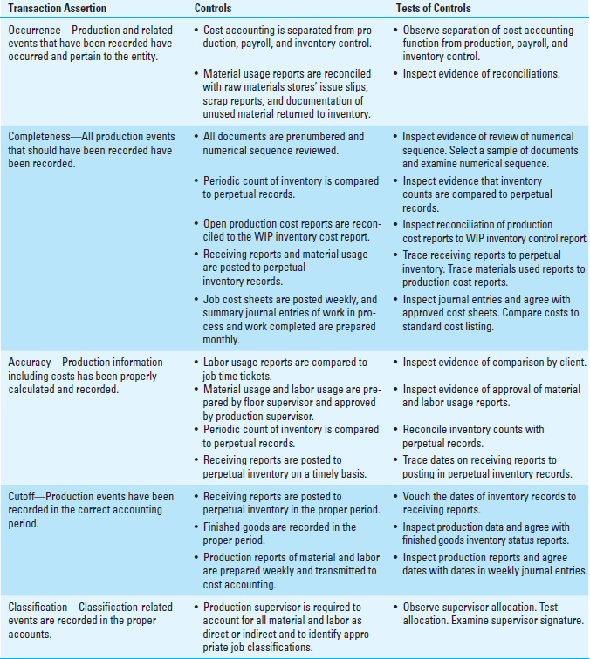

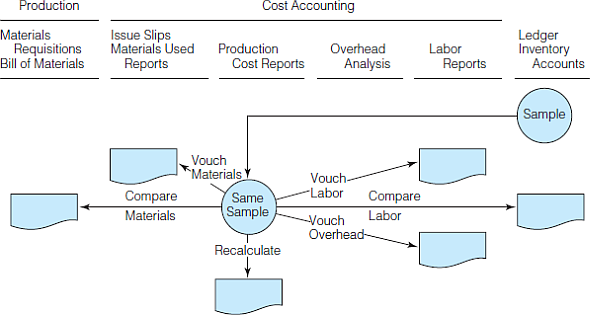

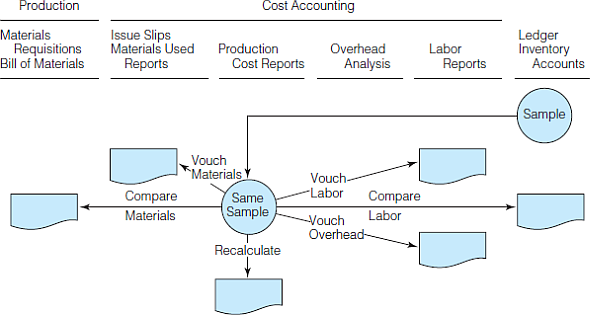

Tests of Controls Related to Controls and Assertions. Each of the following tests of controls could be performed during the audit of the controls in the production cycle.

Required:

For each procedure, identify (a) the internal control activity (strength) being tested and (b) the assertion(s) being addressed.

1. Balance and reconcile detailed production cost sheets to the work-in-process inventory control account.

2. Scan closed production cost sheets for missing numbers in the sequence.

3. Vouch a sample of open and closed production cost sheet entries to (a) labor reports and (b) issue forms and materials used reports.

4. Locate the material issue forms and determine whether they are (a) prenumbered, (b) kept in a secure location, and (c) available to unauthorized persons.

5. Select several summary journal entries in the work-in-process inventory and (a) vouch them to weekly labor and material reports and to production cost sheets and (b) trace them to the control account.

6. Select a sample of the material issue forms in the production department file. Examine them for

a. Issue date and materials used report date.

b. Production order number.

c. Floor supervisor's signature or initials.

d. Name and number of material.

e. Raw materials stores clerk's signature or initials.

f. Material requisition in raw materials stores file, noting the date of requisition.

7. Determine by inquiry and inspection whether cost clerks review dates on reports of units completed for accounting in the proper period.

Required:

For each procedure, identify (a) the internal control activity (strength) being tested and (b) the assertion(s) being addressed.

1. Balance and reconcile detailed production cost sheets to the work-in-process inventory control account.

2. Scan closed production cost sheets for missing numbers in the sequence.

3. Vouch a sample of open and closed production cost sheet entries to (a) labor reports and (b) issue forms and materials used reports.

4. Locate the material issue forms and determine whether they are (a) prenumbered, (b) kept in a secure location, and (c) available to unauthorized persons.

5. Select several summary journal entries in the work-in-process inventory and (a) vouch them to weekly labor and material reports and to production cost sheets and (b) trace them to the control account.

6. Select a sample of the material issue forms in the production department file. Examine them for

a. Issue date and materials used report date.

b. Production order number.

c. Floor supervisor's signature or initials.

d. Name and number of material.

e. Raw materials stores clerk's signature or initials.

f. Material requisition in raw materials stores file, noting the date of requisition.

7. Determine by inquiry and inspection whether cost clerks review dates on reports of units completed for accounting in the proper period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

What procedures do auditors employ to audit inventory when the physical inventory count is taken on a cycle basis or on a statistical plan but never a complete count on a single date?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

When auditing inventories, an auditor would least likely verify that

A) All inventory owned by the client is on hand at the time of the count.

B) The client has used proper inventory pricing.

C) The financial statement presentation of inventories is appropriate.

D) Damaged goods and obsolete items have been properly accounted for.

A) All inventory owned by the client is on hand at the time of the count.

B) The client has used proper inventory pricing.

C) The financial statement presentation of inventories is appropriate.

D) Damaged goods and obsolete items have been properly accounted for.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

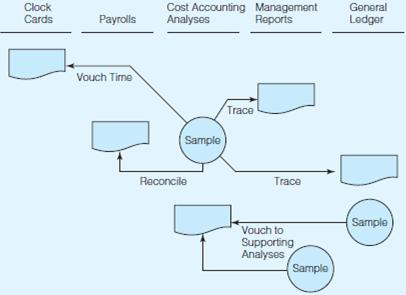

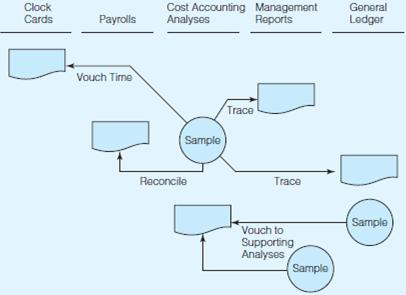

Cost Accounting Tests of Controls. The diagram in Exhibit 9.47.1 describes several cost accounting tests of controls. It shows the direction of the tests, leading from samples of cost accounting analyses, management reports, and the general ledger to blank squares.

Required:

For each blank square in Exhibit 9.47.1, write a cost accounting test of controls procedure and describe the evidence it can produce. ( Hint: Refer to Exhibits 9.4 and 9.6)

EXHIBIT 9.47.1

Diagram of Cost Accounting Tests of Controls

EXHIBIT 9.4 Assertions about Classes of Transactions and Events: Production Cycle

EXHIBIT 9.6 Test of Production Cost Controls: Occurrence Direction

Required:

For each blank square in Exhibit 9.47.1, write a cost accounting test of controls procedure and describe the evidence it can produce. ( Hint: Refer to Exhibits 9.4 and 9.6)

EXHIBIT 9.47.1

Diagram of Cost Accounting Tests of Controls

EXHIBIT 9.4 Assertions about Classes of Transactions and Events: Production Cycle

EXHIBIT 9.6 Test of Production Cost Controls: Occurrence Direction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

What could be happening when a client's managers take notes of auditors' test counts while an inventory is being counted?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

A client maintains perpetual inventory records in quantities and in dollars. If the assessed control risk is high, an auditor would probably

A) Apply gross profit tests to ascertain the reasonableness of the physical inventory counts.

B) Increase the extent of tests of controls relevant to the inventory cycle.

C) Request the client to schedule the physical inventory count at the end of the year.

D) Insist that the client perform physical inventory counts of inventory items several times during the year.

A) Apply gross profit tests to ascertain the reasonableness of the physical inventory counts.

B) Increase the extent of tests of controls relevant to the inventory cycle.

C) Request the client to schedule the physical inventory count at the end of the year.

D) Insist that the client perform physical inventory counts of inventory items several times during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

Inventory Count Observation: Planning and Substantive Procedures. Sammy Smith is the partner in charge of the audit of Blue Distributing Corporation, a wholesaler that owns one warehouse containing 80 percent of its inventory. Smith is reviewing the audit documentation that was prepared to support the firm's opinion on Blue's financial statements and wants to be certain that essential audit procedures are well documented.

Required:

a. What evidence should Smith expect to find indicating that the observation of the client's physical count of inventory was well planned and that assistants were properly supervised?

b. What substantive procedures should Smith find in the audit documentation of management's balance assertions about existence and completeness of inventory quantities at the end of the year? (Refer to Appendix 9B for the audit plan's procedures.)

Required:

a. What evidence should Smith expect to find indicating that the observation of the client's physical count of inventory was well planned and that assistants were properly supervised?

b. What substantive procedures should Smith find in the audit documentation of management's balance assertions about existence and completeness of inventory quantities at the end of the year? (Refer to Appendix 9B for the audit plan's procedures.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

What functions are normally associated with the production cycle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

What analytical procedures might reveal obsolete or slow-moving inventory?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

An auditor selected items for test counts while observing a client's physical inventory count. The auditor then traced the test counts to the client's inventory listing. This procedure most likely obtained evidence concerning management's balance assertion of

A) Rights and obligations.

B) Completeness.

C) Existence.

D) Valuation and allocation.

A) Rights and obligations.

B) Completeness.

C) Existence.

D) Valuation and allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

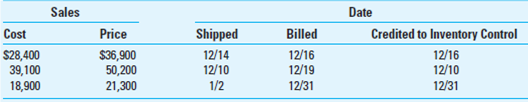

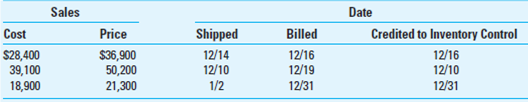

Sales/Inventory Cutoff. Your client took a complete physical inventory count under your observation as of December 15 and adjusted the inventory control account (perpetual inventory method) to agree with the physical inventory count. After considering the count adjustments as of December 15 and after reviewing the transactions recorded from December 16 to December 31, you are almost ready to accept the inventory balance as fairly stated. However, your review of the sales cutoff as of December 15 and December 31 disclosed the following items not previously considered:

Required:

What adjusting journal entries, if any, would you make for each of these items? Explain why each adjustment is necessary.

Required:

What adjusting journal entries, if any, would you make for each of these items? Explain why each adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

What inventory costing methods do GAAP recognize?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

What steps should auditors take if the client has multiple locations being counted?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following auditing procedures probably would provide the most reliable evidence concerning the entity's assertion of rights and obligations related to inventories?

A) Trace test counts noted during the entity's physical count to the entity's summarization of quantities.

B) Inspect agreements to determine whether any inventory is pledged as collateral or subject to any liens.

C) Select the last few shipping documents used before the physical count and determine whether the shipments were recorded as sales.

D) Inspect the open purchase order file for significant commitments that should be considered for disclosure.

A) Trace test counts noted during the entity's physical count to the entity's summarization of quantities.

B) Inspect agreements to determine whether any inventory is pledged as collateral or subject to any liens.

C) Select the last few shipping documents used before the physical count and determine whether the shipments were recorded as sales.

D) Inspect the open purchase order file for significant commitments that should be considered for disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

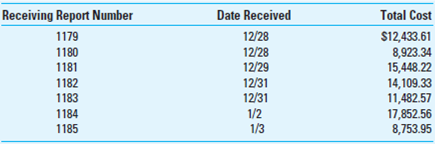

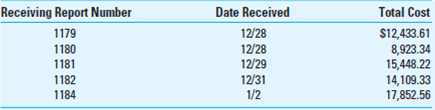

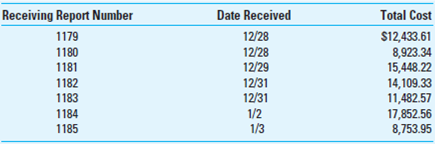

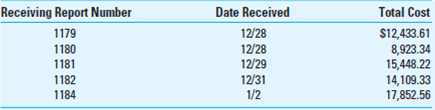

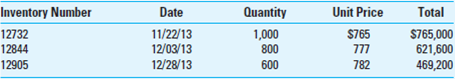

Purchasing Cutoff. When tracing using the cutoff information from the December 31 inventory count of Thermo-Tempur Mattresses, you note the following information:

The purchases list shows that the following items were recorded in December.

The documentation indicates that the last receiving report included in the inventory count was Receiving Report 1182. Receiving Reports 1183 and 1184 were for goods received on the company's truck but not unloaded. Receiving report 1185 was for goods received on January 3.

Required:

Prepare a correcting journal entry assuming that Thermo-Tempur uses (a) a periodic inventory system and (b) a perpetual inventory system that was updated for the inventory count.

The purchases list shows that the following items were recorded in December.

The documentation indicates that the last receiving report included in the inventory count was Receiving Report 1182. Receiving Reports 1183 and 1184 were for goods received on the company's truck but not unloaded. Receiving report 1185 was for goods received on January 3.

Required:

Prepare a correcting journal entry assuming that Thermo-Tempur uses (a) a periodic inventory system and (b) a perpetual inventory system that was updated for the inventory count.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

Describe a walkthrough of a production transaction from receiving production orders to making an entry in the finished goods perpetual inventory records. What document copies would be collected? What controls noted? What duties separated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is an inventory roll forward? What roll-forward tests should be performed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

An auditor most likely would analyze inventory turnover rates to obtain evidence concerning management's balance assertions about

A) Existence.

B) Rights and obligations.

C) Completeness.

D) Valuation and allocation.

A) Existence.

B) Rights and obligations.

C) Completeness.

D) Valuation and allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

Statistical Sampling Used to Estimate Inventory. ACE Corporation does not conduct a complete annual physical count of purchased parts and supplies in its principal warehouse but uses statistical sampling to estimate the year-end inventory. ACE maintains a perpetual inventory record of parts and supplies. Management believes that statistical sampling is highly effective in determining inventory values and is sufficiently reliable, making a physical count of each item of inventory unnecessary.

Required:

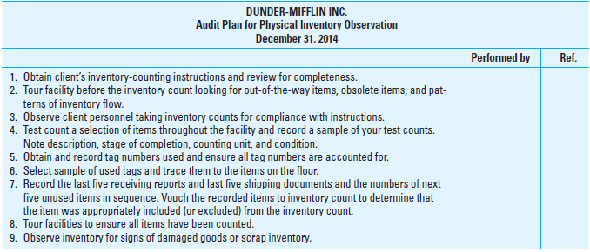

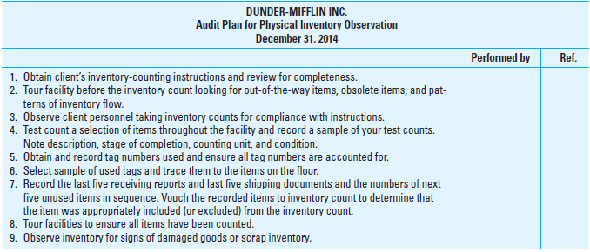

a. List at least 10 normal audit procedures that should be performed to verify physical quantities whenever a client conducts a periodic physical count of all or part of its inventory (see Appendix Exhibit 9B.1 for procedures).

b. Identify the audit procedures you should use that change or are in addition to normal required audit procedures (in addition to those listed in your solution to part a) when a client utilizes statistical sampling to determine inventory value and does not conduct a 100 percent annual physical count of inventory items.

EXHIBIT 9B.1

Required:

a. List at least 10 normal audit procedures that should be performed to verify physical quantities whenever a client conducts a periodic physical count of all or part of its inventory (see Appendix Exhibit 9B.1 for procedures).

b. Identify the audit procedures you should use that change or are in addition to normal required audit procedures (in addition to those listed in your solution to part a) when a client utilizes statistical sampling to determine inventory value and does not conduct a 100 percent annual physical count of inventory items.

EXHIBIT 9B.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

When auditors want to use a client's sales forecast for general familiarity with the production cycle or for evaluation of slow-moving inventory, what kind of procedures should be performed with respect to the forecast?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following methods for determining inventory cost is not allowed by GAAP?

A) Average cost.

B) FIFO.

C) LIFO.

D) Standard cost.

A) Average cost.

B) FIFO.

C) LIFO.

D) Standard cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

An auditor would vouch inventory on the inventory status report to the vendor's invoice to obtain evidence concerning management's balance assertions about

A) Existence.

B) Rights and obligations.

C) Completeness.

D) Valuation.

A) Existence.

B) Rights and obligations.

C) Completeness.

D) Valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

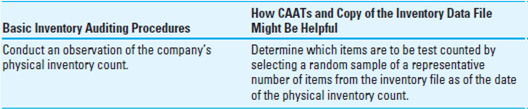

Inventory Procedures Using Computer-Assisted Audit Techniques (CAATs). You are conducting an audit of the financial statements of a wholesale cosmetics distributor with an inventory consisting of thousands of individual items. The distributor keeps its inventory in its own distribution center and in two public warehouses. A perpetual inventory computer database is maintained on a computer disk. The database is updated at the end of each business day. Each individual record of the perpetual inventory database contains the following data:

Item number.

Location of item.

Description of item.

Quantity on hand.

Cost per item.

Date of last purchase.

Date of last sale.

Quantity sold during year.

You are planning to observe the distributor's physical count of inventories as of a given date. The client will provide a computer file of the preceding items taken from its database as of the date of the physical inventory count. Your firm has a computer audit plan that will be ideal for analyzing the inventory records.

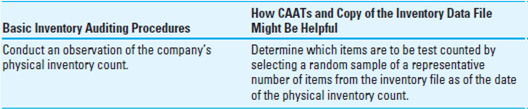

Required:

List the basic inventory auditing procedures and, for each, describe how the use of CAATs and the computerized perpetual inventory database might be helpful to the auditor in performing such auditing procedures. (See Appendix 9B for substantive procedures for inventory.)

Organize your answer as follows:

Item number.

Location of item.

Description of item.

Quantity on hand.

Cost per item.

Date of last purchase.

Date of last sale.

Quantity sold during year.

You are planning to observe the distributor's physical count of inventories as of a given date. The client will provide a computer file of the preceding items taken from its database as of the date of the physical inventory count. Your firm has a computer audit plan that will be ideal for analyzing the inventory records.

Required:

List the basic inventory auditing procedures and, for each, describe how the use of CAATs and the computerized perpetual inventory database might be helpful to the auditor in performing such auditing procedures. (See Appendix 9B for substantive procedures for inventory.)

Organize your answer as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the actual sales for the year are substantially lower than the sales forecasted at the beginning of the year, what potential valuation problems could arise in the production cycle accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which cycle is not directly linked to the production cycle?

A) Acquisition and expenditure cycle.

B) Payroll cycle.

C) Revenue and collection cycle.

D) Finance and investment cycle.

A) Acquisition and expenditure cycle.

B) Payroll cycle.

C) Revenue and collection cycle.

D) Finance and investment cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

When evaluating inventory controls, an auditor would be least likely to

A) Inspect documents.

B) Make inquiries.

C) Observe procedures.

D) Consider policy and procedure manuals.

A) Inspect documents.

B) Make inquiries.

C) Observe procedures.

D) Consider policy and procedure manuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

CAATs Application: Inventory. Your client, Boos Becker Inc., is a medium-size manufacturer of products for the leisure-time activities market (camping equipment, scuba gear, bows and arrows, and the like). During the past year, a computer system was installed, and inventory records of finished goods and parts were converted to computerized processing. Each record of the inventory master file contains the following information:

Item or part number.

Description.

Size.

Quantity on hand.

Cost per unit.

Total value of inventory on hand at cost.

Date of last sale or usage.

Quantity used or sold this year.

Reorder point (quantity).

Economic order quantity.

Code number of major vendor or code number of secondary vendor.

In preparation for year-end inventory, the client has two identical sets of preprinted inventory cards prepared from the master file. One set is for the client's inventory counts and the other is for your use to make audit test counts. The following information has been included on the preprinted cards:

Item or part number.

Description.

Size.

Unit of measure code.

In taking the year-end count, the client's personnel will write the actual counted quantity on the face of each card. When all counts are complete, the counted quantity will be processed against the master file, and quantity-on-hand figures will be adjusted to reflect the actual count. A computer list will be prepared to show any missing inventory count cards and all quantity adjustments of more than $100 in value. Client personnel will investigate these items and will make all required adjustments. When adjustments have been completed, the final year-end balances will be computed and posted to the general ledger.

Your firm has available an audit software package that will run on the client's computer and can process both cards and disk master files.

Required:

a. In general and without regard to the preceding facts, discuss the nature of CAATs and list the various audit uses of such packages.

b. List and describe at least five ways CAATs can be used to assist in all aspects of the audit of the inventory of Boos Becker Inc. (For example, CAATs can be used to read the inventory master file and list items and parts with a high unit cost or total value. Such items can be included in the test counts to increase the dollar coverage of the audit verification.) ( Hint: Think of the normal audit procedures in gathering evidence on inventory when the client makes a periodic count; then think of how these could help in this particular client situation.)

Item or part number.

Description.

Size.

Quantity on hand.

Cost per unit.

Total value of inventory on hand at cost.

Date of last sale or usage.

Quantity used or sold this year.

Reorder point (quantity).

Economic order quantity.

Code number of major vendor or code number of secondary vendor.

In preparation for year-end inventory, the client has two identical sets of preprinted inventory cards prepared from the master file. One set is for the client's inventory counts and the other is for your use to make audit test counts. The following information has been included on the preprinted cards:

Item or part number.

Description.

Size.

Unit of measure code.

In taking the year-end count, the client's personnel will write the actual counted quantity on the face of each card. When all counts are complete, the counted quantity will be processed against the master file, and quantity-on-hand figures will be adjusted to reflect the actual count. A computer list will be prepared to show any missing inventory count cards and all quantity adjustments of more than $100 in value. Client personnel will investigate these items and will make all required adjustments. When adjustments have been completed, the final year-end balances will be computed and posted to the general ledger.

Your firm has available an audit software package that will run on the client's computer and can process both cards and disk master files.

Required:

a. In general and without regard to the preceding facts, discuss the nature of CAATs and list the various audit uses of such packages.

b. List and describe at least five ways CAATs can be used to assist in all aspects of the audit of the inventory of Boos Becker Inc. (For example, CAATs can be used to read the inventory master file and list items and parts with a high unit cost or total value. Such items can be included in the test counts to increase the dollar coverage of the audit verification.) ( Hint: Think of the normal audit procedures in gathering evidence on inventory when the client makes a periodic count; then think of how these could help in this particular client situation.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

What features of the cost accounting system would be expected to prevent the omission of recording materials used in production?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

To determine the client's planned amount and timing of production of a product, the auditor reviews the

A) Sales forecast.

B) Inventory reports.

C) Production plan.

D) Purchases journal.

A) Sales forecast.

B) Inventory reports.

C) Production plan.

D) Purchases journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

When testing a company's cost accounting system, the auditor uses procedures that are primarily designed to determine that

A) Quantities on hand have been computed based on acceptable cost accounting techniques that reasonably approximate actual quantities on hand.

B) Physical inventory counts agree substantially with book inventories.

C) The system is in accordance with generally accepted accounting principles and is functioning as planned.

D) Costs have been properly assigned to finished goods, work-in-process, and cost of goods sold.

A) Quantities on hand have been computed based on acceptable cost accounting techniques that reasonably approximate actual quantities on hand.

B) Physical inventory counts agree substantially with book inventories.

C) The system is in accordance with generally accepted accounting principles and is functioning as planned.

D) Costs have been properly assigned to finished goods, work-in-process, and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

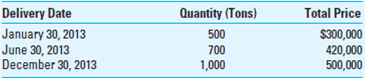

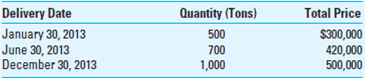

Inventory Evidence and Long-Term Purchase Contracts. During the audit of Mason Company Inc., for the calendar year 2014, you noted that the company produces aluminum cans at the rate of about 40 million units annually. On the plant tour, you noticed a large stockpile of raw aluminum in storage. Your inventory observation and pricing procedures showed this stockpile to be the raw materials inventory of 400 tons valued at $240,000 (LIFO cost). Inquiry with the production chief yielded the information that 400 tons was about a four-month supply of raw materials.

Suppose you learn that Mason had executed a firm long-term purchase contract with All Purpose Aluminum Company to purchase raw materials on the following schedule:

Because of recent economic conditions, principally a decline in the demand for raw aluminium and a consequent oversupply, the price stood at 20 cents per pound as of January 15, 2015. Commodities experts predict that this low price will prevail for 12 to 15 months or until there is a general economic recovery.

Required:

a. Describe the procedures you would employ to gather evidence about this contract (including its initial discovery).

b. What facts recited in the problem would you have to discover for yourself in an audit?

c. Discuss the effect this contract has on the financial statements.

Suppose you learn that Mason had executed a firm long-term purchase contract with All Purpose Aluminum Company to purchase raw materials on the following schedule:

Because of recent economic conditions, principally a decline in the demand for raw aluminium and a consequent oversupply, the price stood at 20 cents per pound as of January 15, 2015. Commodities experts predict that this low price will prevail for 12 to 15 months or until there is a general economic recovery.

Required:

a. Describe the procedures you would employ to gather evidence about this contract (including its initial discovery).

b. What facts recited in the problem would you have to discover for yourself in an audit?

c. Discuss the effect this contract has on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

Describe how the functions of (a) authorization of production transactions, (b) recording of these transactions, and (c) physical custody of inventories can be separated among the production, inventory, and cost accounting departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

An auditor reviews job cost sheets to test which transaction assertion?

A) Occurrence.

B) Completeness.

C) Accuracy.

D) Classification.

A) Occurrence.

B) Completeness.

C) Accuracy.

D) Classification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

The auditor tests the quantity of materials charged to work-in-process by vouching these quantities to

A) Cost ledgers.

B) Perpetual inventory records.

C) Receiving reports.

D) Material requisitions.

A) Cost ledgers.

B) Perpetual inventory records.

C) Receiving reports.

D) Material requisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

Tracing the Inventory Count. You have been assigned to trace the results of the observation of Brightware China's physical inventory count to its pricing and compilation. You note the following conditions.

1. The last inventory tag documented by Mark Hulse, the auditor who observed the inventory, was 1732, but you notice a number of items with count ticket numbers higher than 1732. You contact the client's controller, Marcia Vines, who tells you the client found a storage room full of a new product that Brightware had just produced and added it to the inventory.

2. The count tickets recorded by Hulse agree to the inventory list, but some of the other count tickets you select are substantially different from it. Vines tells you these are input errors and she will have them corrected.

3. Hulse described several boxes of goods as being dusty and even broken. They are included in the inventory at cost. Vines's explanation is that china never "goes bad" and the goods themselves were not broken.

Required:

a. Prepare an audit plan for tracing the information from the inventory count to the compilation.

b. What might have caused the conditions you found? What effect might they have on the financial statements?

c. What steps will you take to follow up on Vines's explanations?

1. The last inventory tag documented by Mark Hulse, the auditor who observed the inventory, was 1732, but you notice a number of items with count ticket numbers higher than 1732. You contact the client's controller, Marcia Vines, who tells you the client found a storage room full of a new product that Brightware had just produced and added it to the inventory.

2. The count tickets recorded by Hulse agree to the inventory list, but some of the other count tickets you select are substantially different from it. Vines tells you these are input errors and she will have them corrected.

3. Hulse described several boxes of goods as being dusty and even broken. They are included in the inventory at cost. Vines's explanation is that china never "goes bad" and the goods themselves were not broken.

Required:

a. Prepare an audit plan for tracing the information from the inventory count to the compilation.

b. What might have caused the conditions you found? What effect might they have on the financial statements?

c. What steps will you take to follow up on Vines's explanations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

How does the production order record provide a control over the quantity of materials used in production?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is an internal control weakness for a company whose inventory of supplies consists of a large number of individual items?

A) Supplies of relatively little value are expensed when purchased.

B) The cycle basis is used for physical inventory counts.

C) The warehouse manager is responsible for maintenance of perpetual inventory records.

D) Perpetual inventory records are maintained only for items of significant value.

A) Supplies of relatively little value are expensed when purchased.

B) The cycle basis is used for physical inventory counts.

C) The warehouse manager is responsible for maintenance of perpetual inventory records.

D) Perpetual inventory records are maintained only for items of significant value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Your client counts inventory three months before the end of the fiscal year because controls over inventory are excellent. Which procedure is not necessary for the roll-forward?

A) Check that shipping documents for the last three months agree with perpetual records.

B) Trace receiving reports for the last three months to perpetual records.

C) Compare gross margin percentages for the last three months.

D) Request the client to recount inventory at the end of the year.

A) Check that shipping documents for the last three months agree with perpetual records.

B) Trace receiving reports for the last three months to perpetual records.

C) Compare gross margin percentages for the last three months.

D) Request the client to recount inventory at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

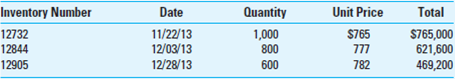

FIFO Inventory Pricing. You are auditing Martha's Prison Clothes Inc., as of December 31, 2014. The inventory for orange jumpsuits shows 1,263 suits at $782 for a total of $987,666. When you look at the invoices for the jumpsuits, you see the following:

Required:

a. Determine the adjusting entry, if any, for the cost of inventory at December 31, 2014.

b. Would your answer to part (a) be different if you saw an invoice dated January 9, 2015, for 500 suits at $750?

Instructions for Problems 9.57, 9.58 and 9.59

The cases in Problems 9.57, 9.58, and 9.59 are similar to the one in the chapter. They give the problem and the amount. Your assignment is to write the audit approach portion of the case organized around these sections:

Objective. Express the objective in terms of the facts supposedly asserted in the financial records, accounts, and statements.

Control. Write a brief explanation of desirable controls, missing controls, and especially the types of deviations that might arise from the situation described in the case.

Tests of controls. Write some procedures for obtaining evidence about controls, especially procedures that could discover control deviations. If there are no controls to test, there are no procedures to perform; go to the next section. A procedure should instruct someone about the source(s) of evidence to tap and the work to do.

Audit of balance. Write some procedures for obtaining evidence about the balance assertions of existence, rights and obligations, completeness, valuation, and accuracy identified in your objective section.

Discovery summary. Write a short statement about the discovery you expect to accomplish with your procedures.

Inventory and deferred cost overstatement. Follow the preceding instructions. Write the audit approach section following the cases in the chapter.

Required:

a. Determine the adjusting entry, if any, for the cost of inventory at December 31, 2014.

b. Would your answer to part (a) be different if you saw an invoice dated January 9, 2015, for 500 suits at $750?

Instructions for Problems 9.57, 9.58 and 9.59

The cases in Problems 9.57, 9.58, and 9.59 are similar to the one in the chapter. They give the problem and the amount. Your assignment is to write the audit approach portion of the case organized around these sections:

Objective. Express the objective in terms of the facts supposedly asserted in the financial records, accounts, and statements.

Control. Write a brief explanation of desirable controls, missing controls, and especially the types of deviations that might arise from the situation described in the case.

Tests of controls. Write some procedures for obtaining evidence about controls, especially procedures that could discover control deviations. If there are no controls to test, there are no procedures to perform; go to the next section. A procedure should instruct someone about the source(s) of evidence to tap and the work to do.

Audit of balance. Write some procedures for obtaining evidence about the balance assertions of existence, rights and obligations, completeness, valuation, and accuracy identified in your objective section.

Discovery summary. Write a short statement about the discovery you expect to accomplish with your procedures.

Inventory and deferred cost overstatement. Follow the preceding instructions. Write the audit approach section following the cases in the chapter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

From what population of documents would an auditor sample to determine whether (a) all authorized production was completed and placed in inventory or recorded as scrap and (b) finished goods inventory was actually produced and the costs were accounted for properly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

To make a year-to-year comparison of inventory turnover most meaningful, the auditor performs the analysis

A) For the company as a whole.

B) By division.

C) By product.

D) All of the above.

A) For the company as a whole.

B) By division.

C) By product.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

An auditor is examining a nonpublic company's inventory procurement system and has decided to perform tests of controls. Under which of the following conditions do GAAS require tests of controls be performed by an auditor?

A) Significant weaknesses were found in the company's internal control.

B) The auditor hopes to reduce the amount of work to be done in assessing inherent risk.

C) The auditor believes that testing the controls could lead to a reduction in overall audit time and cost.

D) Tests of controls are always performed when the auditor begins to assess control risk.

A) Significant weaknesses were found in the company's internal control.

B) The auditor hopes to reduce the amount of work to be done in assessing inherent risk.

C) The auditor believes that testing the controls could lead to a reduction in overall audit time and cost.

D) Tests of controls are always performed when the auditor begins to assess control risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

Toying around with the Numbers. Mattel Inc., a manufacturer of toys, failed to write off obsolete inventory, thereby overstating inventory and improperly deferred tooling costs, both of which understated cost of goods sold and overstated income.

"Excess" inventory was identified by comparing types of toys (wheels, general toys, dolls, and games), parts, and raw materials with the forecasted sales or usage; lower of cost or market (LCM) determinations then were made to calculate the obsolescence write-off. Obsolescence was expected and the target for the year was $700,000. The first comparison computer run showed $21 million "excess" inventory! The company "adjusted" the forecast by increasing the quantities of expected sales for many toy lines. (Forty percent of items had forecasted sales more than their actual recent sales.) Another "adjustment" was to forecast toy closeout sales not at reduced prices but at regular prices. In addition, certain parts were labeled "interchangeable" without the normal reference to a new toy product. These adjustments to the forecast reduced the excess inventory exposed to LCM valuation and write-off.

The cost of setting up machines, preparing dies, and other preparations for manufacture are tooling costs. They benefit the lifetime run of the toy manufactured. The company capitalized them as prepaid expenses and amortized them in the ratio of current-year sales to expected product lifetime sales (much like a natural resource depletion calculation). To lower the amortization cost, the company transferred unamortized tooling costs from toys with low forecasted sales to ones with high forecasted sales. This caused the year's amortization ratio to be lower, the calculated cost write-off lower, and the cost of goods sold lower than it should have been.

The computerized forecast runs of expected usage of interchangeable parts provided a space for a reference to the code number of the new toy where the part would be used. Some of these references contained the code number of the part itself, not a new toy. In other cases, the forecast of toy sales and parts usage contained the quantity on hand, not a forecast number.

In the tooling cost detailed records, unamortized cost was classified by lines of toys (similar to classifying asset cost by asset name or description). Unamortized balances were carried forward to the next year. The company changed the classifications shown at the prior year-end to other toy lines that had no balances or different balances. In other words, the balances of unamortized cost at the end of the prior year did not match the beginning balances of the current year except for the total prepaid expense amount.

For lack of obsolescence write-offs, inventory was overstated at $4 million. The company recorded a $700,000 obsolescence write-off. It should have been about $4.7 million, as later determined. The tooling cost manipulations overstated the prepaid expense by $3.6 million.

The company reported net income (after taxes) of $12.1 million in the year before the manipulations took place. If pretax income were in the $20 to $28 million range in the year of the misstatements, the obsolescence and tooling misstatements alone amounted to about 32 percent income overstatement.

"Excess" inventory was identified by comparing types of toys (wheels, general toys, dolls, and games), parts, and raw materials with the forecasted sales or usage; lower of cost or market (LCM) determinations then were made to calculate the obsolescence write-off. Obsolescence was expected and the target for the year was $700,000. The first comparison computer run showed $21 million "excess" inventory! The company "adjusted" the forecast by increasing the quantities of expected sales for many toy lines. (Forty percent of items had forecasted sales more than their actual recent sales.) Another "adjustment" was to forecast toy closeout sales not at reduced prices but at regular prices. In addition, certain parts were labeled "interchangeable" without the normal reference to a new toy product. These adjustments to the forecast reduced the excess inventory exposed to LCM valuation and write-off.

The cost of setting up machines, preparing dies, and other preparations for manufacture are tooling costs. They benefit the lifetime run of the toy manufactured. The company capitalized them as prepaid expenses and amortized them in the ratio of current-year sales to expected product lifetime sales (much like a natural resource depletion calculation). To lower the amortization cost, the company transferred unamortized tooling costs from toys with low forecasted sales to ones with high forecasted sales. This caused the year's amortization ratio to be lower, the calculated cost write-off lower, and the cost of goods sold lower than it should have been.

The computerized forecast runs of expected usage of interchangeable parts provided a space for a reference to the code number of the new toy where the part would be used. Some of these references contained the code number of the part itself, not a new toy. In other cases, the forecast of toy sales and parts usage contained the quantity on hand, not a forecast number.

In the tooling cost detailed records, unamortized cost was classified by lines of toys (similar to classifying asset cost by asset name or description). Unamortized balances were carried forward to the next year. The company changed the classifications shown at the prior year-end to other toy lines that had no balances or different balances. In other words, the balances of unamortized cost at the end of the prior year did not match the beginning balances of the current year except for the total prepaid expense amount.

For lack of obsolescence write-offs, inventory was overstated at $4 million. The company recorded a $700,000 obsolescence write-off. It should have been about $4.7 million, as later determined. The tooling cost manipulations overstated the prepaid expense by $3.6 million.

The company reported net income (after taxes) of $12.1 million in the year before the manipulations took place. If pretax income were in the $20 to $28 million range in the year of the misstatements, the obsolescence and tooling misstatements alone amounted to about 32 percent income overstatement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

What characteristics do auditors consider in reviewing a client's inventory-taking instructions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following procedures would best prevent or detect the theft of valuable items from an inventory that consists of hundreds of different items selling for $1 to $10 and a few items selling for hundreds of dollars?

A) Maintain a perpetual inventory of only the more valuable items with frequent periodic verification of the accuracy of the perpetual inventory record.

B) Have an independent accounting firm prepare an internal control report on the effectiveness of the controls over inventory.

C) Have separate warehouse space for the more valuable items with frequent periodic physical inventory counts and comparison to perpetual inventory records.

D) Require a manager's signature for the removal of any inventory item with a value of more than $50.

A) Maintain a perpetual inventory of only the more valuable items with frequent periodic verification of the accuracy of the perpetual inventory record.

B) Have an independent accounting firm prepare an internal control report on the effectiveness of the controls over inventory.

C) Have separate warehouse space for the more valuable items with frequent periodic physical inventory counts and comparison to perpetual inventory records.

D) Require a manager's signature for the removal of any inventory item with a value of more than $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following management assertions is an auditor most likely testing if the audit objective states that all inventory on hand is reflected in the ending inventory balance?

A) The entity has rights to the inventory.

B) Inventory is properly valued.

C) Inventory is properly presented in the financial statements.

D) Inventory is complete.

A) The entity has rights to the inventory.

B) Inventory is properly valued.

C) Inventory is properly presented in the financial statements.

D) Inventory is complete.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

No Defense for These Charges. Follow the instructions preceding Problem 9.57. Write the audit approach section following the case in the chapter.

SueCan Corporation manufactured electronic and other equipment for private customers and government defense contracts. It deferred costs under the heading of defense contract claims for reimbursement and deferred tooling labor costs, thus overstating assets, understating cost of goods sold, and overstating income.

Near the end of the year, the company used a journal entry to remove $110,000 from cost of goods sold and defer it as deferred tooling cost. This $110,000 was purported to be labor cost associated with preparing tools and dies for large production runs.

The company opened a receivables account for "cost overrun reimbursement receivable" as a claim for reimbursement on defense contracts ($378,000).

The company altered the labor time records for the tooling costs in an effort to provide substantiating documentation. Company employees prepared new work orders numbered in the series used late in the fiscal year and attached labor time records dated much earlier in the year. The production orders originally charged with the labor cost were left completed but with no labor charges!

The claim for reimbursement on defense contracts did not have documentation specifically identifying the labor costs as being related to the contract. There were no work orders. (Auditors know that Defense Department auditors insist on documentation and justification before approving such a claim.)

SueCan reported net income of about $442,000 for the year, an overstatement of approximately 60 percent.

SueCan Corporation manufactured electronic and other equipment for private customers and government defense contracts. It deferred costs under the heading of defense contract claims for reimbursement and deferred tooling labor costs, thus overstating assets, understating cost of goods sold, and overstating income.

Near the end of the year, the company used a journal entry to remove $110,000 from cost of goods sold and defer it as deferred tooling cost. This $110,000 was purported to be labor cost associated with preparing tools and dies for large production runs.

The company opened a receivables account for "cost overrun reimbursement receivable" as a claim for reimbursement on defense contracts ($378,000).

The company altered the labor time records for the tooling costs in an effort to provide substantiating documentation. Company employees prepared new work orders numbered in the series used late in the fiscal year and attached labor time records dated much earlier in the year. The production orders originally charged with the labor cost were left completed but with no labor charges!

The claim for reimbursement on defense contracts did not have documentation specifically identifying the labor costs as being related to the contract. There were no work orders. (Auditors know that Defense Department auditors insist on documentation and justification before approving such a claim.)

SueCan reported net income of about $442,000 for the year, an overstatement of approximately 60 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

Explain dual-direction sampling in the context of inventory test counts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

An auditor usually traces the details of the test counts made during the observation of physical inventory counts to a final inventory compilation. This audit procedure is undertaken to provide evidence that items physically present and observed by the auditor at the time of the physical inventory count are

A) Owned by the client.

B) Not obsolete.

C) Physically present at the time of the preparation of the final inventory schedule.

D) Included in the final inventory schedule.

A) Owned by the client.

B) Not obsolete.

C) Physically present at the time of the preparation of the final inventory schedule.

D) Included in the final inventory schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

A portion of a client's inventory is in public warehouses. Evidence of the existence of this merchandise can most efficiently be acquired through which of the following methods?

A) Observation.

B) Confirmation.

C) Calculation.

D) Inspection.

A) Observation.

B) Confirmation.

C) Calculation.

D) Inspection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Chips Ahoy. Follow the instructions preceding Problem 9.57. Write the audit approach section following the cases in the chapter.

The following is an excerpt from an article, "Memory Chip Trader Gets 14 Years for Bank Fraud," The Straits Times (Singapore), February 13, 2009:

Through most of the 1990s, entrepreneur Kelvin Ang Ah Peng rode the crest of a wave as his company traded in memory chips and recycled used ones for sale at a good price. His story, which follows the ebb and flow of the integrated circuit (IC) chip business, started at ECAsia International (ECI) in 1993. Computer chips were expensive, so his business did well. A major earthquake in Taiwan in 1999 totaled the computer chip factories there. Production halted and the market price of computer chips soared even higher. The bubble burst the following year, when the Taiwan factories recovered and several computer chip businesses folded. In 2001, as ECI struggled to keep afloat, Ang started abusing its credit facilities. Between that year and early 2007, he bought and sold worthless memory chips and created fake orders and invoices to receive payment from banks.

He was charged in October 2008 on 687 charges involving US$290 million; last month, he pleaded guilty to 30 charges-28 for cheating and 2 for money laundering and falsifying revenues in ECI's initial public offering (IPO) prospectus. Deputy Public Prosecutor David Chew Siong Tai said that, to secure credit in the absence of incoming orders, Ang fashioned an elaborate scheme with the help of Hong Kong firms. He got ECI's partners to issue the necessary trade documents and to circulate computer chips and money between Hong Kong and Singapore. Chips were actually shipped in these sham transactions as if they were bona fide business trades. In reality these were worthless, defective chips due for scrapping by ECI. In November 2006 when asked about ECI's unusually large inventory in Hong Kong and the huge debts owed by the firm's Hong Kong "customers," Ang confessed to an ECI subsidiary's director that 90 per cent of the inventory did not exist and that its billings were all faked.

Yesterday, Ang, 44, was jailed for 14 years for having swindled banks of US$23 million (S$35 million) and laundering these proceeds through Hong Kong. The Australian-listed ECI is now being liquidated, and Ang was declared a bankrupt last year.

The following is an excerpt from an article, "Memory Chip Trader Gets 14 Years for Bank Fraud," The Straits Times (Singapore), February 13, 2009:

Through most of the 1990s, entrepreneur Kelvin Ang Ah Peng rode the crest of a wave as his company traded in memory chips and recycled used ones for sale at a good price. His story, which follows the ebb and flow of the integrated circuit (IC) chip business, started at ECAsia International (ECI) in 1993. Computer chips were expensive, so his business did well. A major earthquake in Taiwan in 1999 totaled the computer chip factories there. Production halted and the market price of computer chips soared even higher. The bubble burst the following year, when the Taiwan factories recovered and several computer chip businesses folded. In 2001, as ECI struggled to keep afloat, Ang started abusing its credit facilities. Between that year and early 2007, he bought and sold worthless memory chips and created fake orders and invoices to receive payment from banks.

He was charged in October 2008 on 687 charges involving US$290 million; last month, he pleaded guilty to 30 charges-28 for cheating and 2 for money laundering and falsifying revenues in ECI's initial public offering (IPO) prospectus. Deputy Public Prosecutor David Chew Siong Tai said that, to secure credit in the absence of incoming orders, Ang fashioned an elaborate scheme with the help of Hong Kong firms. He got ECI's partners to issue the necessary trade documents and to circulate computer chips and money between Hong Kong and Singapore. Chips were actually shipped in these sham transactions as if they were bona fide business trades. In reality these were worthless, defective chips due for scrapping by ECI. In November 2006 when asked about ECI's unusually large inventory in Hong Kong and the huge debts owed by the firm's Hong Kong "customers," Ang confessed to an ECI subsidiary's director that 90 per cent of the inventory did not exist and that its billings were all faked.

Yesterday, Ang, 44, was jailed for 14 years for having swindled banks of US$23 million (S$35 million) and laundering these proceeds through Hong Kong. The Australian-listed ECI is now being liquidated, and Ang was declared a bankrupt last year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why is it important for auditors to obtain control information over inventory count sheets or tickets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

A retailer's physical count of inventory was higher than that shown by the perpetual records. Which of the following could explain the difference?

A) Inventory items had been counted but the tags placed on the items had not been taken off and added to the inventory accumulation sheets.

B) Credit memos for several items returned by customers had not been recorded.

C) No journal entry had been made on the retailer's books for several items returned to its suppliers.

D) An item purchased FOB shipping point had not arrived at the date of the inventory count and had not been reflected in the perpetual records.

A) Inventory items had been counted but the tags placed on the items had not been taken off and added to the inventory accumulation sheets.

B) Credit memos for several items returned by customers had not been recorded.

C) No journal entry had been made on the retailer's books for several items returned to its suppliers.

D) An item purchased FOB shipping point had not arrived at the date of the inventory count and had not been reflected in the perpetual records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

The purpose of tracing a sample of inventory tags to a client's computerized listing of inventory items is to determine whether the inventory items

A) Represented by tags were included on the listing.

B) Included on the listing were properly counted.

C) Represented by tags were reduced to the lower of cost or market.

D) Included in the listing were properly valued.

A) Represented by tags were included on the listing.

B) Included on the listing were properly counted.

C) Represented by tags were reduced to the lower of cost or market.

D) Included in the listing were properly valued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

Detection of Errors and Fraud. For each of the following independent events, indicate the (1) effect of the error or fraud on the financial statements and (2) what auditing procedures could have detected the misstatement resulting from error or fraud.

a. The physical inventory count of J. Payne Enterprises, which has a December 31 yearend, was conducted on August 31 without incident. In September, the perpetual inventory was not reduced for the cost of sales.

b. Holmes Drug Stores counted its inventory on December 31, which is its fiscal year-end. The auditors observed the count at 20 of Holmes's 86 locations. The company falsified the inventory at 20 of the locations not visited by the auditors by including fictitious goods in the counts.

c. Pope Automotive inadvertently included in its inventory automobiles that it was holding on consignment for other dealers.

d. Peffer Electronics Inc. overstated its inventory by pricing wiring at $200 per hundred feet instead of $200 per thousand feet.

e. Goldman Sporting Goods counted boxes of baseballs as having one dozen baseballs per box when they had only six per box.

a. The physical inventory count of J. Payne Enterprises, which has a December 31 yearend, was conducted on August 31 without incident. In September, the perpetual inventory was not reduced for the cost of sales.

b. Holmes Drug Stores counted its inventory on December 31, which is its fiscal year-end. The auditors observed the count at 20 of Holmes's 86 locations. The company falsified the inventory at 20 of the locations not visited by the auditors by including fictitious goods in the counts.

c. Pope Automotive inadvertently included in its inventory automobiles that it was holding on consignment for other dealers.

d. Peffer Electronics Inc. overstated its inventory by pricing wiring at $200 per hundred feet instead of $200 per thousand feet.

e. Goldman Sporting Goods counted boxes of baseballs as having one dozen baseballs per box when they had only six per box.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck