Deck 12: Reports on Audited Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

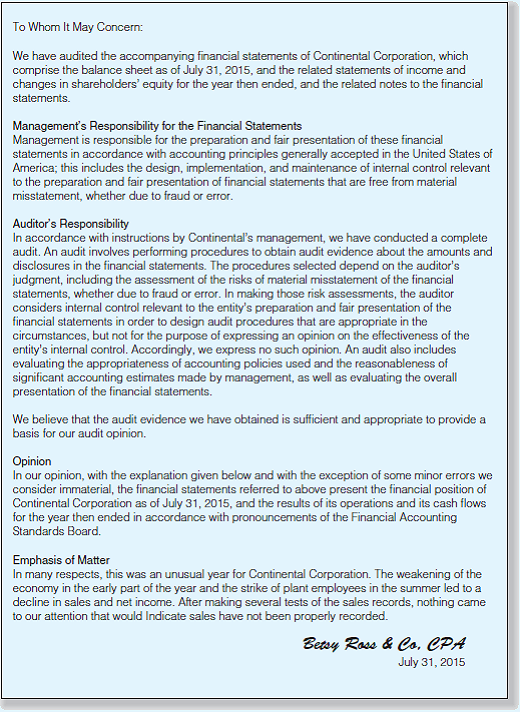

سؤال

سؤال

سؤال

سؤال

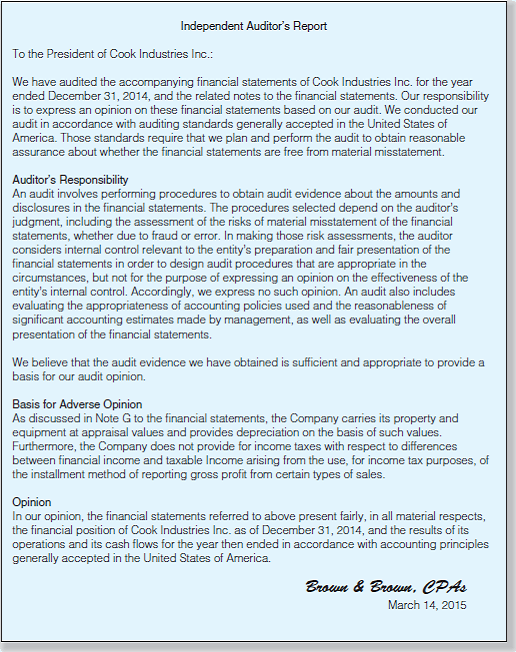

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 12: Reports on Audited Financial Statements

1

If a scope limitation exists but auditors are able to perform alternative procedures, how is the standard (unmodified) report modified to reflect the scope limitation?

If a scope limitation exists and the auditors are able to perform alternative procedures, the standard (unmodified) report should be issued. This report does not need to refer the inability to perform certain procedures or the alternative procedures performed.

2

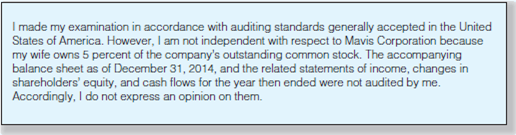

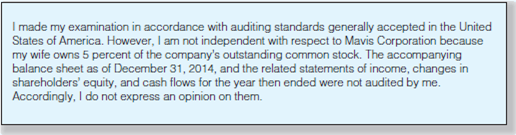

What type of report should be issued when auditors are not independent with respect to the entity?

Independence of Auditors is required to form an opinion.

When auditors are not independent they may issue a disclaimer of opinion by issuing a single paragraph report, which begins with the phrase "We are not independent with respect to the company."

When auditors are not independent they may issue a disclaimer of opinion by issuing a single paragraph report, which begins with the phrase "We are not independent with respect to the company."

3

Basic Reports. The concepts of materiality and pervasiveness are important to auditors in examinations of financial statements and expressions of opinion on these statements.

Required:

How will materiality influence auditors' reporting decisions in the following circumstances? In your response, consider both the matter's materiality and pervasiveness.

a. The entity prohibits confirmation of accounts receivable, and sufficient and appropriate evidence cannot be obtained using alternative procedures.

b. The entity is a gas and electric utility company that follows the practice of recognizing revenue when it is billed to customers. At the end of the year, amounts earned but not yet billed are not recorded in the accounts or reported in the financial statements.

c. The entity leases buildings for its chain of transmission repair shops under terms that qualify as capital leases under ASC 840. These leases are not capitalized as leased property assets and lease obligations.

d. The entity has lost a lawsuit in federal district court. The case is on appeal in an attempt to reduce the amount of damages awarded to the plaintiffs. No loss amount is recorded.

Required:

How will materiality influence auditors' reporting decisions in the following circumstances? In your response, consider both the matter's materiality and pervasiveness.

a. The entity prohibits confirmation of accounts receivable, and sufficient and appropriate evidence cannot be obtained using alternative procedures.

b. The entity is a gas and electric utility company that follows the practice of recognizing revenue when it is billed to customers. At the end of the year, amounts earned but not yet billed are not recorded in the accounts or reported in the financial statements.

c. The entity leases buildings for its chain of transmission repair shops under terms that qualify as capital leases under ASC 840. These leases are not capitalized as leased property assets and lease obligations.

d. The entity has lost a lawsuit in federal district court. The case is on appeal in an attempt to reduce the amount of damages awarded to the plaintiffs. No loss amount is recorded.

a. This is an example of client imposed scope limitation. In the present case, the entity has prohibited confirmation of accounts receivable and sufficient and appropriate evidence cannot be obtained using alternative procedures. Considering that the matter is not only material but also pervasive , the auditor rather than providing an emphasis of matter, should issue a disclaimer of opinion.

b. This refers to departures from GAAP. In the present case, the entity is following the practice of recognizing revenue when it is billed to customers. Considering that the matter is material and not pervasive, the auditor should issue a qualified opinion. If the matter is material and pervasive , the auditor should issue an adverse opinion.

c. This refers to departures from GAAP since the leases qualify as capital leases under ASC 840. In the present case, the entity is not capitalizing leases as leased property assets and lease obligations. In case the matter is material and not pervasive, the auditor should issue a qualified opinion. If the matter is material and pervasive , the auditor should issue an adverse opinion.

d. In the present case, the entity has lost a lawsuit and no loss amount is recorded in the financial statements. Considering the amount is not pervasive and that it does not affect the going concern of the entity, the auditor should add an emphasis of matter paragraph. This helps users in better understanding. If the matter is pervasive , the auditor should issue a qualified opinion.

b. This refers to departures from GAAP. In the present case, the entity is following the practice of recognizing revenue when it is billed to customers. Considering that the matter is material and not pervasive, the auditor should issue a qualified opinion. If the matter is material and pervasive , the auditor should issue an adverse opinion.

c. This refers to departures from GAAP since the leases qualify as capital leases under ASC 840. In the present case, the entity is not capitalizing leases as leased property assets and lease obligations. In case the matter is material and not pervasive, the auditor should issue a qualified opinion. If the matter is material and pervasive , the auditor should issue an adverse opinion.

d. In the present case, the entity has lost a lawsuit and no loss amount is recorded in the financial statements. Considering the amount is not pervasive and that it does not affect the going concern of the entity, the auditor should add an emphasis of matter paragraph. This helps users in better understanding. If the matter is pervasive , the auditor should issue a qualified opinion.

4

Financial Difficulty: The "Going-Concern" Problem. Pitts Company has experienced significant financial difficulty. Current liabilities exceed current assets by $1 million, cash has decreased to $10,000, the interest on the long-term debt has not been paid, and a customer has brought a lawsuit against Pitts for $500,000 on a product liability claim. Significant questions concerning the going-concern status of the company exist. The lawsuit and information about the going-concern status have been appropriately described in footnote 3 to the financial statements.

Required:

a. Draft AOW's report, assuming that the auditors decide that an unmodified opinion instead of a disclaimer of opinion is appropriate in the circumstances.

b. Draft AOW's report, assuming that the auditors decide the uncertainties are so overwhelming that they do not wish to express an opinion on Pitts' financial statements.

Required:

a. Draft AOW's report, assuming that the auditors decide that an unmodified opinion instead of a disclaimer of opinion is appropriate in the circumstances.

b. Draft AOW's report, assuming that the auditors decide the uncertainties are so overwhelming that they do not wish to express an opinion on Pitts' financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a scope limitation exists and auditors cannot perform alternative procedures, what are the auditors' reporting options?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

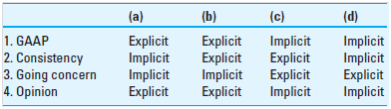

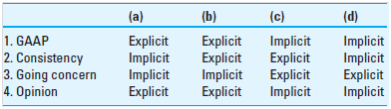

When reporting under GAAS, certain statements are required in all auditors' reports ("explicit") and others are required only under certain conditions ("implicit"). Which combination that follows correctly describes the auditors' responsibilities for reporting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

Departures from GAAP. For each of the following departures from GAAP, indicate the type of opinion that the auditors would issue as well as any modifications that would be made to the standard (unmodified) report.

a. A departure that had an immaterial effect on the financial statements.

b. A departure that had a material effect on the financial statements (this effect was not pervasive and impacted only one account).

c. A departure that had a material effect on the financial statements and was pervasive (impacted a number of accounts on both the balance sheet and income statement).

a. A departure that had an immaterial effect on the financial statements.

b. A departure that had a material effect on the financial statements (this effect was not pervasive and impacted only one account).

c. A departure that had a material effect on the financial statements and was pervasive (impacted a number of accounts on both the balance sheet and income statement).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

Disagreement with Auditors. Officers of Richnow Company do not wish to disclose information about a product liability lawsuit filed by a customer seeking $500,000 in damages. They believe the suit is frivolous and without merit. Outside counsel is more cautious. The auditors insist on disclosure. Angered, Richnow's chair of the board threatens to sue AOW if a standard (unmodified) report is not issued within three days.

Required:

Draft AOW's report appropriate under the circumstances.

Required:

Draft AOW's report appropriate under the circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

When a scope limitation exists, how would the standard (unmodified) report be modified to express (a) a qualified opinion and (b) a disclaimer of opinion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Auditors found that the entity has not capitalized a material amount of leases in the financial statements. When considering the materiality of this departure from GAAP, the auditors would choose between which reporting options?

A) Unmodified opinion or disclaimer of opinion.

B) Unmodified opinion or qualified opinion.

C) Unmodified opinion with an emphasis-of-matter paragraph or an adverse opinion.

D) Qualified opinion or adverse opinion.

A) Unmodified opinion or disclaimer of opinion.

B) Unmodified opinion or qualified opinion.

C) Unmodified opinion with an emphasis-of-matter paragraph or an adverse opinion.

D) Qualified opinion or adverse opinion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Scope Limitations. Situations in which auditors are unable to obtain sufficient appropriate evidence necessary to support their opinion on the entity's financial statements are referred to as scope limitations.

Required:

a. Distinguish between client-imposed scope limitations and circumstance-imposed scope limitations. Which of these is generally of more concern to auditors?

b. Why do scope limitations impact the auditors' ability to express an opinion on the entity's financial statements?

c. Assume that a circumstance-imposed scope limitation prevented auditors from performing procedures they considered to be necessary. How would each of the following factors independently influence the opinion expressed on the entity's financial statements?

1. The account balances affected by the scope limitation are not material to the entity's financial position, results of operations, or cash flows.

2. The account balances affected by the scope limitation are material to the entity's financial position, results of operations, and cash flows. However, the auditors are able to perform alternative procedures that provide evidence supporting the accounts affected by the scope limitation.

3. The account balances affected by the scope limitation are material to the entity's financial position, results of operations, and cash flows. Because of a lack of supporting documentation and key accounting records, auditors are unable to perform alternative procedures that provide evidence supporting the accounts affected by the scope limitation.

d. For each of the situations in (c), briefly describe how the auditors' report on the entity's financial statements would be affected. (Do not rewrite or draft the report that would be issued in each of these circumstances.)

Required:

a. Distinguish between client-imposed scope limitations and circumstance-imposed scope limitations. Which of these is generally of more concern to auditors?

b. Why do scope limitations impact the auditors' ability to express an opinion on the entity's financial statements?

c. Assume that a circumstance-imposed scope limitation prevented auditors from performing procedures they considered to be necessary. How would each of the following factors independently influence the opinion expressed on the entity's financial statements?

1. The account balances affected by the scope limitation are not material to the entity's financial position, results of operations, or cash flows.

2. The account balances affected by the scope limitation are material to the entity's financial position, results of operations, and cash flows. However, the auditors are able to perform alternative procedures that provide evidence supporting the accounts affected by the scope limitation.

3. The account balances affected by the scope limitation are material to the entity's financial position, results of operations, and cash flows. Because of a lack of supporting documentation and key accounting records, auditors are unable to perform alternative procedures that provide evidence supporting the accounts affected by the scope limitation.

d. For each of the situations in (c), briefly describe how the auditors' report on the entity's financial statements would be affected. (Do not rewrite or draft the report that would be issued in each of these circumstances.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

Late Appointment of Auditors. Anderson, Olds, Watershed (AOW) has completed the audit of the financial statements of Musgrave Company for the year ended December 31, 2014, and is now preparing the report.

AOW has audited Musgrave's financial statements for several years, but this year Musgrave delayed the start of the audit work, so AOW was not present to observe the taking of the physical inventory on December 31, 2014. The inventory balance is $194,000, which represents 39 percent of Musgrave's total assets and 69 percent of its current assets. However, AOW performed alternative procedures including (1) examination of shipping and receiving documents with regard to transactions since the date of the financial statements, (2) extensive review of the inventory count sheets, and (3) discussion of the physical inventory procedures with responsible company personnel. AOW also is satisfied about the propriety of the inventory valuation calculations and the consistency of the valuation method. Musgrave determines year-end inventory quantities solely by means of physical count.

Required:

Draft AOW's report on the balance sheet at the end of the current year and on the statements of operations, changes in shareholders' equity, and cash flows for the year then ended. ( Hint: Did the alternative procedures produce sufficient appropriate evidence?)

AOW has audited Musgrave's financial statements for several years, but this year Musgrave delayed the start of the audit work, so AOW was not present to observe the taking of the physical inventory on December 31, 2014. The inventory balance is $194,000, which represents 39 percent of Musgrave's total assets and 69 percent of its current assets. However, AOW performed alternative procedures including (1) examination of shipping and receiving documents with regard to transactions since the date of the financial statements, (2) extensive review of the inventory count sheets, and (3) discussion of the physical inventory procedures with responsible company personnel. AOW also is satisfied about the propriety of the inventory valuation calculations and the consistency of the valuation method. Musgrave determines year-end inventory quantities solely by means of physical count.

Required:

Draft AOW's report on the balance sheet at the end of the current year and on the statements of operations, changes in shareholders' equity, and cash flows for the year then ended. ( Hint: Did the alternative procedures produce sufficient appropriate evidence?)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

Define group auditors and component auditors. What issues are introduced when component auditors examine a division, subsidiary, or segment of group financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

The auditors determined that the entity is suffering financial difficulty and its going-concern status is seriously in doubt. Assuming that the entity adequately disclosed this matter in the financial statements, the auditors must choose between which of the following auditors' report alternatives?

A) Unmodified opinion with a reference to going-concern or disclaimer of opinion.

B) Standard (unmodified) report or a disclaimer of opinion.

C) Qualified opinion or adverse opinion.

D) Standard (unmodified) report or adverse opinion.

A) Unmodified opinion with a reference to going-concern or disclaimer of opinion.

B) Standard (unmodified) report or a disclaimer of opinion.

C) Qualified opinion or adverse opinion.

D) Standard (unmodified) report or adverse opinion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

Scope Limitations. Following are four possible scenarios that reflect scope limitations encountered by J. Bruce, CPA, during the audit of Weaver Inc. In all cases, assume that the ending balance in inventory is material to Weaver's financial position, results of operations, and cash flows.

Scenario A. Because of the late appointment to the audit engagement, Bruce is unable to observe Weaver's physical inventory for the year ended December 31, 2014. However, Weaver maintains extensive perpetual inventory records, and Bruce has been able to perform other substantive procedures and is satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Scenario B. Because of the late appointment to the audit engagement, Bruce is unable to observe Weaver's physical inventory for the year ended December 31, 2014. Because Weaver's accounting records are not complete, Bruce is unable to perform other substantive procedures and is not satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Scenario C. Because of a direct request by Weaver's management, Bruce did not observe Weaver's physical inventory for the year ended December 31, 2014. However, Weaver maintains extensive perpetual inventory records, and Bruce has been able to perform other substantive procedures and is satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Scenario D. Because of a direct request by Weaver's management, Bruce did not observe Weaver's physical inventory for the year ended December 31, 2014. Weaver's accounting records are not complete, so Bruce is unable to perform other substantive procedures and is not satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Required:

For each of these scenarios, indicate what reporting option(s) and factors Bruce should consider in deciding which type of opinion to issue in the circumstances. (Do not draft Bruce's report on Weaver Inc.'s financial statements for the year ended December 31, 2014.)

Scenario A. Because of the late appointment to the audit engagement, Bruce is unable to observe Weaver's physical inventory for the year ended December 31, 2014. However, Weaver maintains extensive perpetual inventory records, and Bruce has been able to perform other substantive procedures and is satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Scenario B. Because of the late appointment to the audit engagement, Bruce is unable to observe Weaver's physical inventory for the year ended December 31, 2014. Because Weaver's accounting records are not complete, Bruce is unable to perform other substantive procedures and is not satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Scenario C. Because of a direct request by Weaver's management, Bruce did not observe Weaver's physical inventory for the year ended December 31, 2014. However, Weaver maintains extensive perpetual inventory records, and Bruce has been able to perform other substantive procedures and is satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Scenario D. Because of a direct request by Weaver's management, Bruce did not observe Weaver's physical inventory for the year ended December 31, 2014. Weaver's accounting records are not complete, so Bruce is unable to perform other substantive procedures and is not satisfied as to the fairness of the ending inventory balance for December 31, 2014.

Required:

For each of these scenarios, indicate what reporting option(s) and factors Bruce should consider in deciding which type of opinion to issue in the circumstances. (Do not draft Bruce's report on Weaver Inc.'s financial statements for the year ended December 31, 2014.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

Audits of Group Financial Statements. The firm of Anderson, Olds, Watershed (AOW) is the group auditor for the December 31, 2014, consolidated financial statements of Ferguson Company and subsidiaries. However, component auditors perform the work on certain subsidiaries for the year under audit amounting to 29% of total assets and 36% of total revenues.

AOW investigated the component auditors, as required by auditing standards, and they furnished AOW their reports. AOW has decided to rely on their work and to refer to the component auditors in their report. None of the audit work revealed any issues with respect to Ferguson Company or its subsidiaries.

Required:

Draft AOW's report.

AOW investigated the component auditors, as required by auditing standards, and they furnished AOW their reports. AOW has decided to rely on their work and to refer to the component auditors in their report. None of the audit work revealed any issues with respect to Ferguson Company or its subsidiaries.

Required:

Draft AOW's report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

Identify the reports that accompany the financial statements of public entities and nonpublic entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

What options are available to group auditors when component auditors are involved in the examination of group financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not a difference in the audit examinations and reports for public and nonpublic entities?

A) Audit examinations for nonpublic entities are based on user demand but based on legislative requirements for public entities.

B) The reports for both public and nonpublic entities express an opinion on the entity's financial statements.

C) Auditors are required to express an opinion on internal control in the audit of nonpublic entities but not in the audit of public entities.

D) Management is responsible for the fairness of the financial statements for public entities, but the auditors are responsible for the fairness of the financial statements for nonpublic entities.

A) Audit examinations for nonpublic entities are based on user demand but based on legislative requirements for public entities.

B) The reports for both public and nonpublic entities express an opinion on the entity's financial statements.

C) Auditors are required to express an opinion on internal control in the audit of nonpublic entities but not in the audit of public entities.

D) Management is responsible for the fairness of the financial statements for public entities, but the auditors are responsible for the fairness of the financial statements for nonpublic entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

Scope Limitations. D. Brady has been engaged as the auditor of Patriot Company and is currently planning the year-end physical inventory counts. Patriot is a retailer that holds significant inventories in its warehouses and stores in six regions across the United States. Because of timing and logistics, Brady is able to observe the physical inventory at only one of Patriot's warehouses, which accounts for 20 percent of Patriot's inventories.

In Brady's professional judgment, the fact that inventories held at only one warehouse can be observed does not provide sufficient evidence with respect to Patriot's inventory balances at the date of the financial statements. Although physical inventory counts could be delayed at the remaining warehouses for Brady to observe the counts, the flow of goods in and out of the warehouses would result in a discrepancy between the inventory quantities on hand at year-end and the inventory quantities on hand at the date of the count.

Required:

a. Assume that Brady observes physical inventory at only the one warehouse and does not perform alternative procedures related to inventories held at the other warehouses. Does this cause a scope limitation? If so, is this a client-imposed or circumstance-imposed scope limitation?

b. What type of opinion would Brady likely issue for the situation in (a)? How would the wording in the standard (unmodified) report be modified to reflect this opinion?

c. What alternative procedures might be available to Brady with respect to this scope limitation? ( Hint: You may wish to refer to Chapter 9 to identify alternative procedures for inventory.)

d. Assume that Brady performs one or more of the alternative procedures in (c) and is able to gather evidence to support the recorded balance in inventory. What type of opinion would Brady issue on Patriot's financial statements (assuming that no other issues were identified in the audit examination)?

In Brady's professional judgment, the fact that inventories held at only one warehouse can be observed does not provide sufficient evidence with respect to Patriot's inventory balances at the date of the financial statements. Although physical inventory counts could be delayed at the remaining warehouses for Brady to observe the counts, the flow of goods in and out of the warehouses would result in a discrepancy between the inventory quantities on hand at year-end and the inventory quantities on hand at the date of the count.

Required:

a. Assume that Brady observes physical inventory at only the one warehouse and does not perform alternative procedures related to inventories held at the other warehouses. Does this cause a scope limitation? If so, is this a client-imposed or circumstance-imposed scope limitation?

b. What type of opinion would Brady likely issue for the situation in (a)? How would the wording in the standard (unmodified) report be modified to reflect this opinion?

c. What alternative procedures might be available to Brady with respect to this scope limitation? ( Hint: You may wish to refer to Chapter 9 to identify alternative procedures for inventory.)

d. Assume that Brady performs one or more of the alternative procedures in (c) and is able to gather evidence to support the recorded balance in inventory. What type of opinion would Brady issue on Patriot's financial statements (assuming that no other issues were identified in the audit examination)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

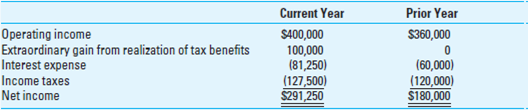

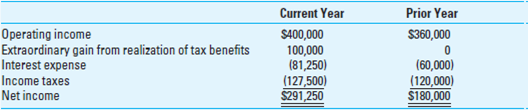

Other Information in a Financial Review Section of an Annual Report. Gustav Humphreys (chair of the board) and Ingrid VanEns (vice president, finance) prepared the draft of the financial review section of the annual report. You are reviewing it for consistency with the audited financial statements. The draft contains the following explanation about income coverage of interest expense:

Last year, operating income before interest and income taxes covered interest expense by a ratio of 6:1. This year, on an incremental basis, the coverage of interest expense increased to a ratio of 6.59:1.

The relevant portion of the audited financial statements showed the following:

Required:

a. Determine whether the financial review section statement about coverage of interest is or is not consistent with the audited financial statements. Be able to show your conclusion with calculations.

b. Assume that you find an inconsistency and the officers disagree with your conclusions. Draft the other-matter paragraph you should include in your auditors' report.

Last year, operating income before interest and income taxes covered interest expense by a ratio of 6:1. This year, on an incremental basis, the coverage of interest expense increased to a ratio of 6.59:1.

The relevant portion of the audited financial statements showed the following:

Required:

a. Determine whether the financial review section statement about coverage of interest is or is not consistent with the audited financial statements. Be able to show your conclusion with calculations.

b. Assume that you find an inconsistency and the officers disagree with your conclusions. Draft the other-matter paragraph you should include in your auditors' report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

What are the audit requirements for nonpublic and public entities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

Is the reference in the auditors' report to work performed by component auditors a scope limitation? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of these situations would require auditors to append an emphasis-of-matter paragraph about consistency to an otherwise unmodified opinion?

A) Entity changed its estimated allowance for uncollectible accounts receivable.

B) Entity corrected a prior mistake in accounting for interest capitalization.

C) Entity sold one of its subsidiaries and consolidated six subsidiaries this year compared to seven last year.

D) Entity changed its inventory costing method from FIFO to LIFO.

A) Entity changed its estimated allowance for uncollectible accounts receivable.

B) Entity corrected a prior mistake in accounting for interest capitalization.

C) Entity sold one of its subsidiaries and consolidated six subsidiaries this year compared to seven last year.

D) Entity changed its inventory costing method from FIFO to LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

Audit of Group Financial Statements. Lando Corporation is a domestic company with two wholly-owned subsidiaries. Michaels, CPA, has been engaged to audit the financial statements of the parent company and one of its subsidiaries and to serve as the group auditor. Thomas, CPA, has audited the financial statements of the other subsidiary whose operations are material in relation to the consolidated financial statements.

The work performed by Michaels is sufficient for serving as the group auditor and to report as such on the financial statements. Michaels has not yet decided whether to refer to the part of the audit performed by Thomas.

Required:

a. What responsibilities does Michaels have with respect to Thomas when deciding whether to rely on the work of Thomas?

b. What are the reporting requirements with which Michaels must comply in naming Thomas and referring to the work done by Thomas?

c. What report should be issued if Michaels does not wish to assume responsibility for Thomas's work or refer to Thomas's work?

The work performed by Michaels is sufficient for serving as the group auditor and to report as such on the financial statements. Michaels has not yet decided whether to refer to the part of the audit performed by Thomas.

Required:

a. What responsibilities does Michaels have with respect to Thomas when deciding whether to rely on the work of Thomas?

b. What are the reporting requirements with which Michaels must comply in naming Thomas and referring to the work done by Thomas?

c. What report should be issued if Michaels does not wish to assume responsibility for Thomas's work or refer to Thomas's work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Departures from GAAP. On January 1, Graham Company purchased land (the site of a new building) for $100,000. Soon thereafter, the state highway department announced that a new feeder road would run next to the site. The effect was a dramatic increase in local property values. Comparable land located nearby sold for $700,000 in December of the current year. Graham presents the land at $700,000 in its accounts and, after reduction for implicit taxes at 33 percent, the fixed asset total is $400,000 higher than historical cost with the same amount shown separately in the shareholder equity account Current Value Increment. The valuation is fully disclosed in a footnote to the financial statements with a letter from a certified property appraiser attesting to the $700,000 value.

Required:

a. Draft the appropriate auditors' report, assuming that you believe the departure from GAAP is material but not pervasive enough to cause you to issue an adverse opinion.

b. Draft the appropriate auditors' report, assuming that you believe an adverse opinion is necessary.

Required:

a. Draft the appropriate auditors' report, assuming that you believe the departure from GAAP is material but not pervasive enough to cause you to issue an adverse opinion.

b. Draft the appropriate auditors' report, assuming that you believe an adverse opinion is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

To whom is the auditors' report addressed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Define e mphasis-of-matter and other-matter paragraphs. What type of information do auditors provide in these paragraphs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

Wolfe became the new auditor for Royal Corporation, succeeding C. Mason, who audited the financial statements last year. Wolfe needs to report on Royal's comparative financial statements and should disclose in the report an explanation about other auditors having audited the prior year

A) Only if Mason's opinion last year was qualified.

B) To describe the prior audit and the opinion but not name Mason as the predecessor auditor.

C) To describe the audit but not reveal the type of opinion issued by Mason.

D) To describe the audit and the opinion and name Mason as the predecessor auditor.

A) Only if Mason's opinion last year was qualified.

B) To describe the prior audit and the opinion but not name Mason as the predecessor auditor.

C) To describe the audit but not reveal the type of opinion issued by Mason.

D) To describe the audit and the opinion and name Mason as the predecessor auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

Various Reporting Situations. Assume that the auditors encountered the following separate situations when deciding on the report to issue for the current-year financial statements.

1. The auditors decided that sufficient appropriate evidence could not be obtained to complete the audit of significant investments the entity held in a foreign entity.

2. The entity failed to capitalize lease assets and obligations but explained them fully in the notes to the financial statements. These lease obligations meet the criteria for capitalization under ASC 840.

3. The entity is defending a lawsuit on product liability claims. (Customers allege that power saw safety guards were improperly installed.) All facts about the lawsuit are disclosed in the notes to the financial statements, but the auditors believe the entity should record a loss based on a probable settlement mentioned by the entity's attorneys.

4. The entity hired the auditors after taking inventory on December 31. The accounting records and other evidence are not reliable enough to enable the auditors to have sufficient evidence about the proper inventory amount.

5. The FASB requires the energy company to present supplementary oil and gas reserve information outside the basic financial statements. The auditors find that this information, which is not required as a part of the basic financial statements, has been omitted.

6. The auditors are group auditors of the parent company, but they reviewed the component auditors' work and reputation and decide not to take responsibility for the work of the component auditors on three subsidiary companies included in the consolidated financial statements. The component auditors' work amounts to 32 percent of the consolidated assets and 39 percent of the consolidated revenues.

7. The entity changed its depreciation method from units of production to straight line, and its auditors believe the straight-line method is the more appropriate method in the circumstances. The change, fully explained in the notes to the financial statements, has a material effect on the year-to-year comparability of the comparative financial statements.

8. Because the entity has experienced significant operating losses and has had to obtain waivers of debt payment requirements from its lenders, the auditors decide that there is substantial doubt that the entity can continue as a going concern. The entity has fully described all problems in a note in the financial statements and the auditors believe that, while material, the uncertainty is not serious enough to warrant a disclaimer of opinion.

Required:

a. What kind of opinion should the auditors express in each separate case?

b. What other modification(s) or addition(s) to the standard (unmodified) report is (are) required for each separate case?

1. The auditors decided that sufficient appropriate evidence could not be obtained to complete the audit of significant investments the entity held in a foreign entity.

2. The entity failed to capitalize lease assets and obligations but explained them fully in the notes to the financial statements. These lease obligations meet the criteria for capitalization under ASC 840.

3. The entity is defending a lawsuit on product liability claims. (Customers allege that power saw safety guards were improperly installed.) All facts about the lawsuit are disclosed in the notes to the financial statements, but the auditors believe the entity should record a loss based on a probable settlement mentioned by the entity's attorneys.

4. The entity hired the auditors after taking inventory on December 31. The accounting records and other evidence are not reliable enough to enable the auditors to have sufficient evidence about the proper inventory amount.

5. The FASB requires the energy company to present supplementary oil and gas reserve information outside the basic financial statements. The auditors find that this information, which is not required as a part of the basic financial statements, has been omitted.

6. The auditors are group auditors of the parent company, but they reviewed the component auditors' work and reputation and decide not to take responsibility for the work of the component auditors on three subsidiary companies included in the consolidated financial statements. The component auditors' work amounts to 32 percent of the consolidated assets and 39 percent of the consolidated revenues.

7. The entity changed its depreciation method from units of production to straight line, and its auditors believe the straight-line method is the more appropriate method in the circumstances. The change, fully explained in the notes to the financial statements, has a material effect on the year-to-year comparability of the comparative financial statements.

8. Because the entity has experienced significant operating losses and has had to obtain waivers of debt payment requirements from its lenders, the auditors decide that there is substantial doubt that the entity can continue as a going concern. The entity has fully described all problems in a note in the financial statements and the auditors believe that, while material, the uncertainty is not serious enough to warrant a disclaimer of opinion.

Required:

a. What kind of opinion should the auditors express in each separate case?

b. What other modification(s) or addition(s) to the standard (unmodified) report is (are) required for each separate case?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

Reporting on an Accounting Change. In December of the current year, Williams Company changed its method of accounting for inventory and cost of goods sold from LIFO to FIFO. The account balances shown in the trial balance have already been recalculated and adjusted retroactively as required by ASC 250. The accounting change and the financial effects are described in Note 2 in the financial statements.

Required:

a. Assume that you believe the accounting change is justified as required by ASC 250. Draft the report appropriate in the circumstances.

b. Assume that you believe the accounting change is not justified and causes the financial statements to be materially distorted. Inventories that would have been reported at $1.5 million (LIFO) are reported at $1.9 million (FIFO); operating income before tax that would have been $130,000 is reported at $530,000. As a result of this change, current assets, total assets, and shareholders' equity have increased by 17 percent, 9 percent, and 14 percent, respectively. Draft the report appropriate in the circumstances.

Required:

a. Assume that you believe the accounting change is justified as required by ASC 250. Draft the report appropriate in the circumstances.

b. Assume that you believe the accounting change is not justified and causes the financial statements to be materially distorted. Inventories that would have been reported at $1.5 million (LIFO) are reported at $1.9 million (FIFO); operating income before tax that would have been $130,000 is reported at $530,000. As a result of this change, current assets, total assets, and shareholders' equity have increased by 17 percent, 9 percent, and 14 percent, respectively. Draft the report appropriate in the circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

Identify the four major sections of the auditors' standard (unmodified) report and the major contents of each section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

What types of matters would result in the auditors' report being modified for consistency?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

When component auditors are involved in the audit of group financial statements, the group auditors may issue a report that

A) Refers to the component auditors, describes the extent of the component auditors' work, and expresses an unmodified opinion.

B) Does not consider or evaluate the component auditors' work but expresses an unmodified opinion in a standard report.

C) Places primary responsibility for the reporting on the component auditors.

D) Names the component auditors, describes their work, and presents only the group auditors' report.

A) Refers to the component auditors, describes the extent of the component auditors' work, and expresses an unmodified opinion.

B) Does not consider or evaluate the component auditors' work but expresses an unmodified opinion in a standard report.

C) Places primary responsibility for the reporting on the component auditors.

D) Names the component auditors, describes their work, and presents only the group auditors' report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

Various Reporting Situations. Assume that Stanford CPAs encountered the following issues during its various audit engagements in 2014:

1. It conducted the audit of Luck, a new client this past year. Last year, Luck was audited by another CPA, who issued an unmodified opinion on its financial statements. Luck is presenting financial statements for 2013 and 2014 in comparative form.

2. One of Stanford's clients is RealCo, a real estate holding company. Assume that RealCo experienced a significant decline in the value of its investment properties during the past year because of a downturn in the economy and has appropriately recognized that decline in market value under GAAP. Stanford wishes to emphasize the decline in the economy and its impact on RealCo's financial position and results of operations for 2014 in its audit report.

3. For the past five years, Stanford has conducted the audits of TechTime, a company that provides technology consulting services, and has always issued unmodified opinions on its financial statements. Based on its 2014 audit, Stanford believes that an unmodified opinion is appropriate; however, Stanford did note that TechTime reported its third consecutive operating loss and has experienced negative cash flows because of the inability of some of its customers to promptly pay for services received.

4. Stanford has assisted Cardinal Inc. with the preparation of its financial statements but has not audited, compiled, or reviewed those financial statements. Cardinal wishes to include these financial statements in a communication that would describe Stanford's involvement in the preparation of the financial statements. Stanford believes that Cardinal's communication is adequate and appropriately describes Stanford's limited role in the preparation of the financial statements.

5. Trees Inc. presents summary financial information along with its financial statements. The summary financial information has been derived from the complete set of financial statements that Stanford has audited (and issued an unmodified opinion on the complete financial statements). A lender has engaged Stanford to evaluate and report on Trees' summary financial information; Stanford believes that the summary financial information is fairly stated in relation to Trees' complete financial statements.

6. Stanford believes that some of the verbiage in Plunkett's Management Discussion Analysis section is inconsistent with the firm's financial statements. Stanford has concluded that Plunkett's financial statements present its financial position, results of operations, and cash flows in accordance with GAAP and has decided to issue an unmodified opinion on Plunkett's financial statements.

7. Oil Patch is a client in the energy industry that is required to present supplementary oil and gas reserve information. Stanford has performed certain procedures regarding this information and concluded that it is presented in accordance with FASB presentation guidelines and does not appear to depart from GAAP. Based on Stanford's audit, it plans to issue an unmodified opinion on Oil Patch's financial statements.

Required:

How would each of these issues affect Stanford's report on the client's financial statements? (Do not draft the report that Stanford would issue in each situation).

1. It conducted the audit of Luck, a new client this past year. Last year, Luck was audited by another CPA, who issued an unmodified opinion on its financial statements. Luck is presenting financial statements for 2013 and 2014 in comparative form.

2. One of Stanford's clients is RealCo, a real estate holding company. Assume that RealCo experienced a significant decline in the value of its investment properties during the past year because of a downturn in the economy and has appropriately recognized that decline in market value under GAAP. Stanford wishes to emphasize the decline in the economy and its impact on RealCo's financial position and results of operations for 2014 in its audit report.

3. For the past five years, Stanford has conducted the audits of TechTime, a company that provides technology consulting services, and has always issued unmodified opinions on its financial statements. Based on its 2014 audit, Stanford believes that an unmodified opinion is appropriate; however, Stanford did note that TechTime reported its third consecutive operating loss and has experienced negative cash flows because of the inability of some of its customers to promptly pay for services received.

4. Stanford has assisted Cardinal Inc. with the preparation of its financial statements but has not audited, compiled, or reviewed those financial statements. Cardinal wishes to include these financial statements in a communication that would describe Stanford's involvement in the preparation of the financial statements. Stanford believes that Cardinal's communication is adequate and appropriately describes Stanford's limited role in the preparation of the financial statements.

5. Trees Inc. presents summary financial information along with its financial statements. The summary financial information has been derived from the complete set of financial statements that Stanford has audited (and issued an unmodified opinion on the complete financial statements). A lender has engaged Stanford to evaluate and report on Trees' summary financial information; Stanford believes that the summary financial information is fairly stated in relation to Trees' complete financial statements.

6. Stanford believes that some of the verbiage in Plunkett's Management Discussion Analysis section is inconsistent with the firm's financial statements. Stanford has concluded that Plunkett's financial statements present its financial position, results of operations, and cash flows in accordance with GAAP and has decided to issue an unmodified opinion on Plunkett's financial statements.

7. Oil Patch is a client in the energy industry that is required to present supplementary oil and gas reserve information. Stanford has performed certain procedures regarding this information and concluded that it is presented in accordance with FASB presentation guidelines and does not appear to depart from GAAP. Based on Stanford's audit, it plans to issue an unmodified opinion on Oil Patch's financial statements.

Required:

How would each of these issues affect Stanford's report on the client's financial statements? (Do not draft the report that Stanford would issue in each situation).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

Mini-Case: Component Auditors. Refer to the mini-case "Something Went Sour at Parmalat" on page C20 and respond to question 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

What date should be used on the auditors' report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

What circumstances lead auditors to have substantial doubt about an entity's ability to continue as a going concern?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

When auditors wish to issue an unmodified opinion but highlight that the entity changed its method of accounting for software development costs, they would most appropriately identify the change in accounting method in which of the following?

A) The introductory paragraph.

B) The opinion paragraph.

C) An emphasis-of-matter paragraph.

D) An other-matter paragraph.

A) The introductory paragraph.

B) The opinion paragraph.

C) An emphasis-of-matter paragraph.

D) An other-matter paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

Various Reporting Situations. For each of the following situations, indicate the type of opinion(s) that auditors could issue (more than one opinion may be appropriate in each circumstance). Unless otherwise noted, assume that no departures from GAAP were identified in the audit engagement. In addition, indicate how the standard (unmodified) report would be modified, if appropriate.

1. Auditors have identified an immaterial departure from GAAP in their examination, but the entity has not adjusted its financial statements for this departure or disclosed this departure in its financial statements or related disclosures.

2. Because they were appointed to the engagement after the date of the financial statements, the auditors have experienced a significant scope limitation and were unable to perform standard auditing procedures used in their engagements. The account(s) affected by this scope limitation were material and pervasive. However, the auditors have been able to completely satisfy themselves as to the fairness of the related account balances and classes of transaction by performing alternative procedures.

3. During the year, the entity changed its method of accounting for inventories from FIFO to LIFO and has disclosed this change in the footnotes to the financial statements and accounted for the change properly. However, the auditors do not agree with the rationale for the change and believe that it was made to report a higher level of earnings.

4. Subsequent to accepting the audit engagement, the auditors determined that they are not independent with respect to the client because of a financial interest in the client held by a newly-admitted partner to the audit firm.

5. Evidence gathered during the audit examination and inquiry of the client's management revealed substantial doubt about the client's ability to continue in existence. The auditors believe that the client has appropriately disclosed the going-concern uncertainties in its financial statements and footnotes.

6. The auditors wish to emphasize the company's acquisition of two large subsidiaries during the most recent year.

7. The auditors have engaged component auditors to conduct a portion of the audit but do not wish to assume responsibility for their work. The auditors have not approached the component auditors about presenting their reports with the company's financial statements and do not plan to do so.

8. The client has not recognized a material loss related to a decline in the market value of its investments. Because the auditors believe this decline in value is not temporary, they believe the financial statements do not present the client's financial position and results of operations in accordance with GAAP.

9. The auditors have experienced a significant scope limitation and are unable to satisfy themselves as to the fairness of the affected account balances through alternative procedures.

1. Auditors have identified an immaterial departure from GAAP in their examination, but the entity has not adjusted its financial statements for this departure or disclosed this departure in its financial statements or related disclosures.

2. Because they were appointed to the engagement after the date of the financial statements, the auditors have experienced a significant scope limitation and were unable to perform standard auditing procedures used in their engagements. The account(s) affected by this scope limitation were material and pervasive. However, the auditors have been able to completely satisfy themselves as to the fairness of the related account balances and classes of transaction by performing alternative procedures.

3. During the year, the entity changed its method of accounting for inventories from FIFO to LIFO and has disclosed this change in the footnotes to the financial statements and accounted for the change properly. However, the auditors do not agree with the rationale for the change and believe that it was made to report a higher level of earnings.

4. Subsequent to accepting the audit engagement, the auditors determined that they are not independent with respect to the client because of a financial interest in the client held by a newly-admitted partner to the audit firm.

5. Evidence gathered during the audit examination and inquiry of the client's management revealed substantial doubt about the client's ability to continue in existence. The auditors believe that the client has appropriately disclosed the going-concern uncertainties in its financial statements and footnotes.

6. The auditors wish to emphasize the company's acquisition of two large subsidiaries during the most recent year.

7. The auditors have engaged component auditors to conduct a portion of the audit but do not wish to assume responsibility for their work. The auditors have not approached the component auditors about presenting their reports with the company's financial statements and do not plan to do so.

8. The client has not recognized a material loss related to a decline in the market value of its investments. Because the auditors believe this decline in value is not temporary, they believe the financial statements do not present the client's financial position and results of operations in accordance with GAAP.

9. The auditors have experienced a significant scope limitation and are unable to satisfy themselves as to the fairness of the affected account balances through alternative procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

Mini-Case: Going-Concern Reporting. Refer to the mini-case "GM: Running on Empty" on page C11 and respond to questions 1, 2, and 3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

What are the major differences in the auditors' report for nonpublic and public entities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

What are auditors' reporting options when going-concern uncertainties are noted?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under which of the following conditions can a disclaimer of opinion never be issued?

A) The entity's going-concern problems are highly material and pervasive.

B) The entity does not allow the auditors access to evidence about important accounts.

C) The auditors own stock in the entity.

D) The auditors have determined that the entity uses the NIFO (next-in, first-out) inventory costing method.

A) The entity's going-concern problems are highly material and pervasive.

B) The entity does not allow the auditors access to evidence about important accounts.

C) The auditors own stock in the entity.

D) The auditors have determined that the entity uses the NIFO (next-in, first-out) inventory costing method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Audit Report Deficiencies. On September 23, 2015, Betsy Ross drafted the following report on Continental Corporation's financial statements.

Required:

List and explain the deficiencies and omissions in the report prepared by Ross on Continental Company's financial statements.

Required:

List and explain the deficiencies and omissions in the report prepared by Ross on Continental Company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

What alternatives are available to auditors for reporting on the financial statements and internal control over financial reporting in the audit of public entities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

What is the auditors' reporting responsibility for (a) other information accompanying the audited financial statements and (b) required supplementary information?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

How is the auditors' responsibility for expressing the opinion on financial statements disclosed in the standard (unmodified) report?

A) Stated explicitly in the Auditor's Responsibility section.

B) Unstated but understood in the Auditor's Responsibility section.

C) Stated explicitly in the opinion paragraph.

D) Stated explicitly in the introductory paragraph.

A) Stated explicitly in the Auditor's Responsibility section.

B) Unstated but understood in the Auditor's Responsibility section.

C) Stated explicitly in the opinion paragraph.

D) Stated explicitly in the introductory paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

Audit Report Deficiencies: Adverse Opinion. The board of directors of Cook Industries Inc. engaged Brown Brown, CPAs, to audit the financial statements for the year ended December 31, 2014.

Required:

Identify the deficiencies in the following draft of the report. Do not rewrite the report.

Required:

Identify the deficiencies in the following draft of the report. Do not rewrite the report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

What are the types of opinions and the conclusion of each type of opinion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

What are comparative financial statements ? What issue is introduced when entities present information in comparative format?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

Company A hired Samson Delilah, CPAs, to audit the financial statements of Company B and deliver the report to Megabank. Who is the client?

A) Megabank.

B) Samson Delilah.

C) Company A.

D) Company B.

A) Megabank.

B) Samson Delilah.

C) Company A.

D) Company B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

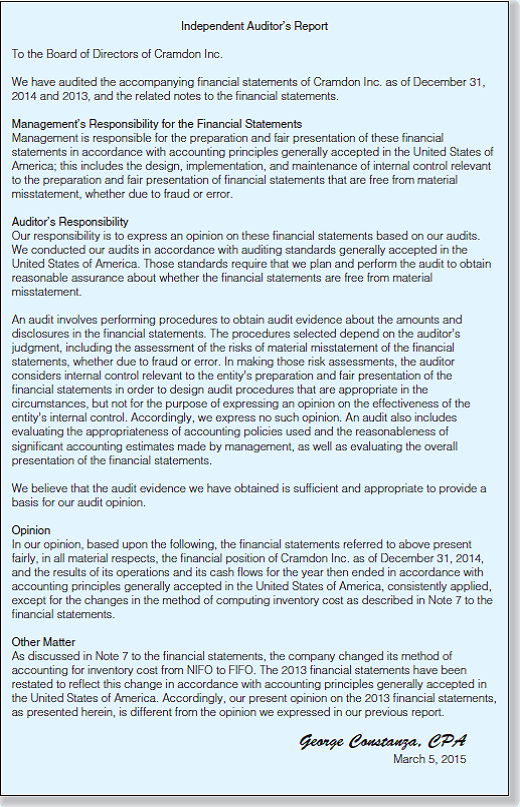

Audit Report Deficiencies: Comparative Reporting. An assistant drafted the following auditors' report at the completion of the audit of Cramdon Inc. on March 5, 2015. The partner in charge of the engagement has decided the opinion on the 2014 financial statements should be modified only with reference to the change in the method of computing the cost of inventory. In 2013, Cramdon used the next-in, first-out (NIFO) method, which is not permissible under GAAP, but in 2014 changed to FIFO and restated the 2013 financial statements. (The auditors' report on the 2013 financial statements expressed an adverse opinion.) The 2013 auditors' report (prepared by the same firm) was dated March 5, 2014.

Required:

Identify the deficiencies and errors in the draft report and write an explanation of the reasons they are errors and deficiencies. Do not rewrite the report.

Required:

Identify the deficiencies and errors in the draft report and write an explanation of the reasons they are errors and deficiencies. Do not rewrite the report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

Explain the effect of pervasiveness on the auditors' report when the entity uses an accounting method that departs from GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is an updated report? What is a reissued report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not included in the standard (unmodified) report on the financial statements?

A) An identification of the financial statements that were audited.

B) A general description of an audit.

C) An opinion that the financial statements present financial position in accordance with GAAP.

D) An emphasis-of-matter paragraph commenting on the effect of economic conditions on the entity.

A) An identification of the financial statements that were audited.

B) A general description of an audit.

C) An opinion that the financial statements present financial position in accordance with GAAP.

D) An emphasis-of-matter paragraph commenting on the effect of economic conditions on the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

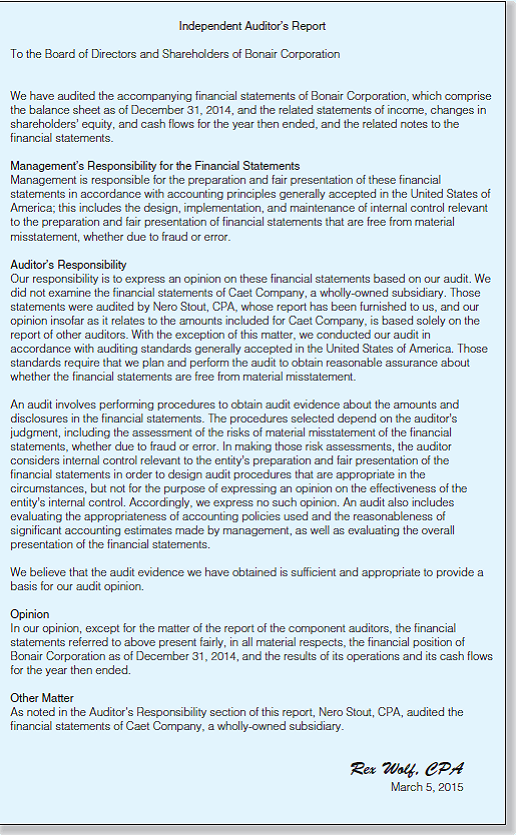

Audit Report Deficiencies: Audits of Group Financial Statements and Other Operating Matters. Following is Rex Wolf's report on Bonair Corporation's financial statements. Bonair publishes general-purpose financial statements for distribution to owners, creditors, potential investors, and the general public.

Required:

Describe the reporting deficiencies and explain why they are considered deficiencies. Organize your response according to each of the paragraphs or sections in the standard (unmodified) report.

Required:

Describe the reporting deficiencies and explain why they are considered deficiencies. Organize your response according to each of the paragraphs or sections in the standard (unmodified) report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

What are the major differences in wording for qualified opinions and adverse opinions issued as a result of departures from GAAP?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

If auditors wish to express a different opinion on prior-years' financial statements in the current report than in a previously-issued report, how should their current report be modified?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

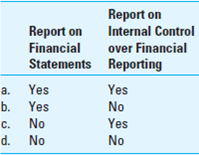

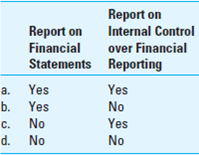

If the auditors decide to present separate reports on the entity's financial statements and internal control over financial reporting, which of the following should be modified to refer to the other report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Audit Report Deficiencies: Disclaimer of Opinion. Your partner drafted the following auditors' report yesterday. You need to describe the reporting deficiencies, explain the reasons for them, and discuss with the partner how the report should be corrected. You have decided to prepare a three-column worksheet showing the deficiencies, reasons, and corrections needed. Your partner's report follows:

Required:

Prepare the three-column worksheet described.

Required:

Prepare the three-column worksheet described.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

How is the auditors' standard (unmodified) report modified for qualified or adverse opinions issued as a result of departures from GAAP?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

What reporting options are available if predecessor auditors examined prior-years' financial statements presented in comparative form?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

When financial statements are presented in comparative form and another firm audited the prior-years' financial statements (but the other firm's report is not presented with the financial statements), the auditors' report on the current-year financial statements should

A) Disclaim an opinion on the prior-years' financial statements.

B) Not refer to the prior-years' financial statements.

C) Refer to any procedures performed by the current auditor to verify the opinion on the prior-years' financial statements.

D) Refer to the report and type of opinion issued by the other firm on the prior-years' financial statements.

A) Disclaim an opinion on the prior-years' financial statements.

B) Not refer to the prior-years' financial statements.

C) Refer to any procedures performed by the current auditor to verify the opinion on the prior-years' financial statements.

D) Refer to the report and type of opinion issued by the other firm on the prior-years' financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

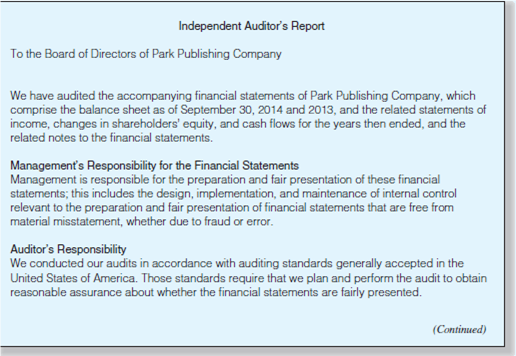

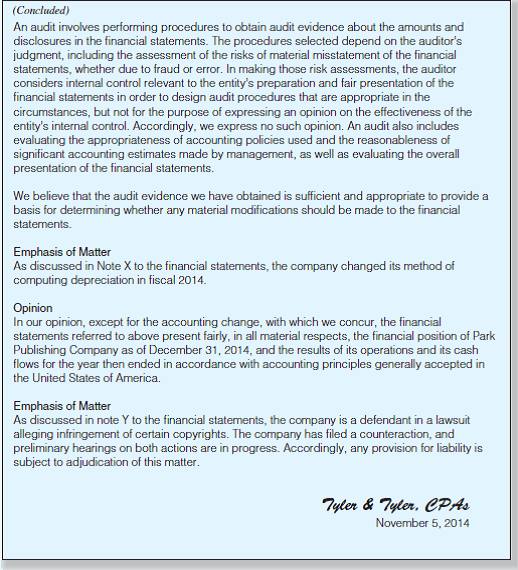

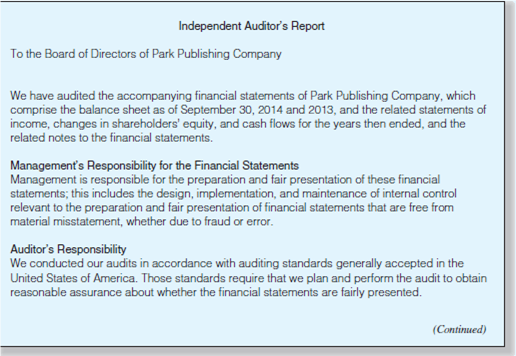

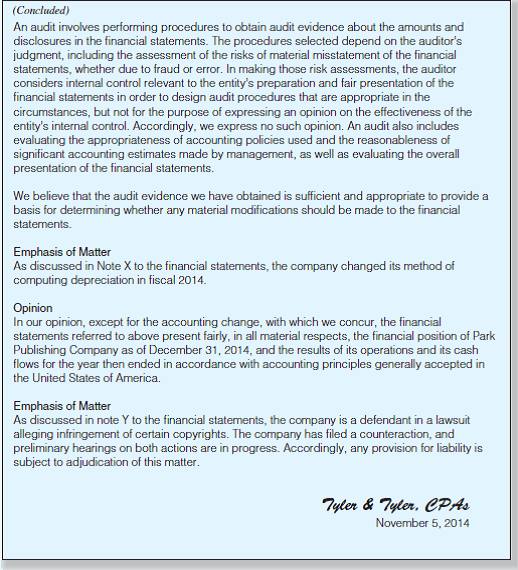

Audit Report Deficiencies: Accounting Change and Uncertainty. The following auditors' report was drafted by Quinn Moore, a staff auditor with Tyler Tyler, CPAs, at the completion of the audit of the financial statements of Park Publishing Company for the year ended September 30, 2014. The engagement partner reviewed the audit documentation and properly decided to issue an unmodified opinion. In drafting the report, Moore considered the following:

• During fiscal year 2014, Park changed its depreciation method. The engagement partner concurred with this change in accounting principles and its justification, and Moore included an emphasis-of-matter paragraph in the report.

• The 2014 financial statements are affected by an uncertainty concerning a lawsuit, the outcome of which cannot presently be estimated. Moore included an emphasis-of-matter paragraph in the report to emphasize this uncertainty.

• The financial statements for the year ended September 30, 2013, are to be presented for comparative purposes. Tyler Tyler previously audited these statements and expressed an unmodified opinion.

Required:

Identify the deficiencies in the auditors' report as drafted by Moore. Group the deficiencies by section or paragraph and in the order in which they appear. Do not rewrite the report.

• During fiscal year 2014, Park changed its depreciation method. The engagement partner concurred with this change in accounting principles and its justification, and Moore included an emphasis-of-matter paragraph in the report.

• The 2014 financial statements are affected by an uncertainty concerning a lawsuit, the outcome of which cannot presently be estimated. Moore included an emphasis-of-matter paragraph in the report to emphasize this uncertainty.

• The financial statements for the year ended September 30, 2013, are to be presented for comparative purposes. Tyler Tyler previously audited these statements and expressed an unmodified opinion.

Required:

Identify the deficiencies in the auditors' report as drafted by Moore. Group the deficiencies by section or paragraph and in the order in which they appear. Do not rewrite the report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Distinguish between client-imposed scope limitations and circumstance-imposed scope limitations. Which of these scope limitations is generally of more concern to auditors?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Briefly describe the options and information provided by auditors when engaged to report on (a) summary financial statements and (b) supplementary information?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the opinion issued on prior-years' financial statements is no longer appropriate and financial statements are presented in comparative form, the auditors' current report should

A) Not reference the prior-years' financial statements.

B) Indicate that the opinion on the prior-years' financial statements cannot be relied upon.

C) Reference the type of opinion issued on the prior-years' financial statements and indicate that the current opinion on these financial statements differs from that expressed in the prior years.

D) Express the revised opinion on the prior-years' financial statements without referencing the previously-issued opinion.

A) Not reference the prior-years' financial statements.

B) Indicate that the opinion on the prior-years' financial statements cannot be relied upon.

C) Reference the type of opinion issued on the prior-years' financial statements and indicate that the current opinion on these financial statements differs from that expressed in the prior years.

D) Express the revised opinion on the prior-years' financial statements without referencing the previously-issued opinion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

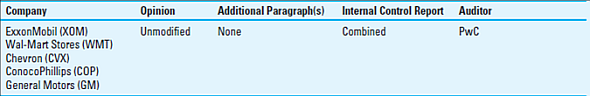

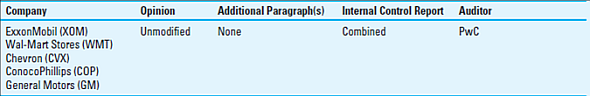

Internet Exercise: Reports on Financial Statements (Public Companies). One of the great resources for auditors is the SEC's Electronic Data Gathering, Analysis and Retrieval (EDGAR) system database at www.sec.gov. Public companies file SEC-required documents electronically. The SEC makes this information available on its web page.

Required:

The following are the largest five companies in the United States, based on the Fortune 500, along with their ticker symbols. After accessing the EDGAR database, download copies of auditors' reports from the Form 10-K filings and complete the following table (ExxonMobil has been done as an example). ( Hint: Search the 10-K filing by using the key word "independent," as in Report of Independent Registered Public Accounting Firm.) Use the following responses in completing the table.

Opinion: Unmodified, Qualified, Adverse, Disclaimer

Additional Paragraphs/Issues: Identify by Type

Internal Control Report: Combined or Separate

Auditor: Identify Name of Firm

Report-Writing Cases

Cases 12.61 through 12.67 require you to draft auditors' reports. The Electronic Workpapers (available on the textbook website listed on the back cover of the text) has a Word file (file name AUDIT) containing the standard (unmodified) report, which can be used as the starting place for a nonstandard report requirement. You can read this file in many word-processing programs to make your report-writing task easier and more professional. Unless instructed otherwise, assume the following in drafting your reports: (1) your firm Anderson, Olds, Watershed (AOW) conducted the audit examination of the identified client, (2) the fiscal year-end is December 31, 2014, (3) the date of the auditors' report is February 10, 2015, and (4) the client is not publicly traded and, therefore, not subject to the auditing and reporting requirements of AS 5.

Required:

The following are the largest five companies in the United States, based on the Fortune 500, along with their ticker symbols. After accessing the EDGAR database, download copies of auditors' reports from the Form 10-K filings and complete the following table (ExxonMobil has been done as an example). ( Hint: Search the 10-K filing by using the key word "independent," as in Report of Independent Registered Public Accounting Firm.) Use the following responses in completing the table.

Opinion: Unmodified, Qualified, Adverse, Disclaimer

Additional Paragraphs/Issues: Identify by Type

Internal Control Report: Combined or Separate

Auditor: Identify Name of Firm