Deck 16: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/327

العب

ملء الشاشة (f)

Deck 16: Financial Statement Analysis

1

In determining whether a company's financial condition is improving or deteriorating over time, horizontal analysis of financial statement data would be more useful than vertical analysis.

True

2

The formula for total asset turnover is: Total asset turnover = Total assets ÷ Total stockholders' equity.

False

3

A company whose inventory turnover ratio is much slower than the average for its industry may have too much inventory or the wrong sorts of inventory.

True

4

The formula for the average sale period is: Average sale period = Accounts receivable turnover ÷ Inventory turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

5

All other things the same, when a customer purchases an item for cash, the accounts receivable turnover ratio increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

6

All other things the same, when a company increases its inventories in anticipation of later higher sales, the accounts receivable turnover ratio for the current period increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

7

As the accounts receivable turnover ratio decreases, the average collection period increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

8

All other things the same, purchasing merchandise inventory would have no effect on the accounts receivable turnover ratio at a retailer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

9

To increase total asset turnover, management must either increase sales or reduce total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

10

If the acid-test ratio is less than one, then paying off some current liabilities with cash will increase the acid-test (quick) ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

11

Liquidity refers to how quickly an asset can be converted into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a company's operating cycle is much longer than its average payment period for suppliers, it creates the need to borrow money to fund its inventories and accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

13

Acquiring land by taking out a long-term mortgage will not affect the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

14

A common-size financial statement is a vertical analysis in which each financial statement account is expressed as a percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

15

A company could improve its acid-test ratio by selling some equipment it no longer needs for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

16

Purchasing marketable securities with cash will have no effect on a company's acid-test ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

17

Buying inventory in large lots to take advantage of quantity discounts can be responsible for a high inventory turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

18

As the inventory turnover increases, the average sales period decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

19

All other things the same, purchasing inventory would decrease the inventory turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

20

The acid-test ratio is usually greater than the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

21

The gross margin percentage is computed by dividing the gross margin by net income before interest and taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

22

The dividend payout ratio is equal to the dividend per share divided by the earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a retailer sells a product whose contribution margin equals the gross margin percentage, the gross margin percentage will be unaffected by the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

24

The times interest earned ratio is based on net income because that is the amount of earnings that is available for making interest payments. Interest expense is deducted before taxes are determined; creditors have first claim on the earnings before taxes are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

25

The formula for the times interest earned ratio is: Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a company's return on assets is substantially lower than its cost of borrowing, then the common stockholders would normally want the company to have a relatively high debt/equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

27

All other things the same, if the company purchases equipment on credit, this transaction would have no impact on the company's book value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

28

All other things the same, if long-term debt is exchanged for short-term debt, the debt-to-equity ratio will be unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

29

All other things the same, if a company uses long-term debt to purchase land to develop in the future, the company's return on total assets will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

30

When a company sells used equipment for a loss, the net profit margin percentage is unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

31

The formula for the net profit margin percentage is: Net profit margin percentage = Net income ÷ Sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

32

All other things the same, those who hold the company's debt (i.e., its creditors) would like a low debt-to-equity ratio to provide a buffer of protection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

33

A high price-earnings ratio means that investors are willing to pay a premium for the company's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

34

An increase in the number of shares of common stock outstanding will increase a company's price-earnings ratio if the market price per share remains unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

35

When fixed costs are included in the cost of goods sold, the gross margin percentage should increase and decrease with sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

36

When computing the return on total assets, the interest expense is added back to net income to show what earnings would have been if the company had no debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

37

When computing the return on equity, retained earnings should be excluded from the average total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

38

The gross margin percentage is computed by dividing sales by the gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

39

Issuing common stock will decrease a company's financial leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

40

The formula for the return on equity is: Return on equity = Net income ÷ Average total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

41

Sand Company has an acid-test ratio of 0.8. Which of the following actions would improve the acid-test ratio?

A) Collect some accounts receivable.

B) Acquire some inventory on account.

C) Sell some equipment for cash.

D) Use cash to pay off some accounts payable.

A) Collect some accounts receivable.

B) Acquire some inventory on account.

C) Sell some equipment for cash.

D) Use cash to pay off some accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

42

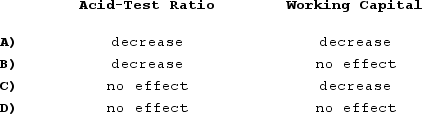

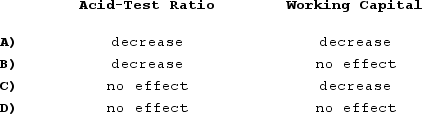

Zack Company has a current ratio of 2.5. What will be the effect of a purchase of inventory with cash on the acid-test ratio and on working capital?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Seabury Corporation has a current ratio of 3.5 and an acid-test ratio of 2.8. The corporation's current assets consist of cash, marketable securities, accounts receivable, and inventories. Inventory equals $49,000. Seabury Corporation's current liabilities must be: (Round your intermediate calculations to 1 decimal place.) Garrison 16e Rechecks 2017-10-04

A) $70,000

B) $100,000

C) $49,000

D) $125,000

A) $70,000

B) $100,000

C) $49,000

D) $125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

44

Earnings per share is computed by multiplying net income by the average number of common shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

45

Accounts receivable turnover will normally decrease as a result of:

A) the write-off of an uncollectible account against the allowance for bad debts.

B) a significant sales volume decrease near the end of the accounting period.

C) an increase in cash sales in proportion to credit sales.

D) a change in credit policy to lengthen the period for cash discounts.

A) the write-off of an uncollectible account against the allowance for bad debts.

B) a significant sales volume decrease near the end of the accounting period.

C) an increase in cash sales in proportion to credit sales.

D) a change in credit policy to lengthen the period for cash discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

46

Norton Incorporated could improve its current ratio of 2 by:

A) paying a previously declared stock dividend.

B) writing off an uncollectible receivable.

C) selling merchandise on credit at a profit.

D) purchasing inventory on credit.

A) paying a previously declared stock dividend.

B) writing off an uncollectible receivable.

C) selling merchandise on credit at a profit.

D) purchasing inventory on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company's current ratio is greater than 1. Purchasing raw materials on credit would:

A) increase the current ratio.

B) decrease the current ratio.

C) increase working capital.

D) decrease working capital.

A) increase the current ratio.

B) decrease the current ratio.

C) increase working capital.

D) decrease working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which one of the following statements about book value per share is most correct?

A) Market price per common share usually approximates book value per common share.

B) Book value per common share is based on past transactions whereas the market price of a share of stock mainly reflects what investors expect to happen in the future.

C) A market price per common share that is greater than book value per common share is an indication of an overvalued stock.

D) Book value per common share is the amount that would be paid to stockholders if the company were sold to another company.

A) Market price per common share usually approximates book value per common share.

B) Book value per common share is based on past transactions whereas the market price of a share of stock mainly reflects what investors expect to happen in the future.

C) A market price per common share that is greater than book value per common share is an indication of an overvalued stock.

D) Book value per common share is the amount that would be paid to stockholders if the company were sold to another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

49

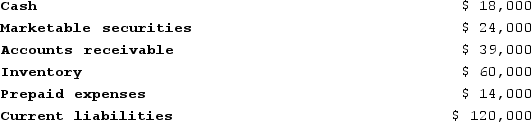

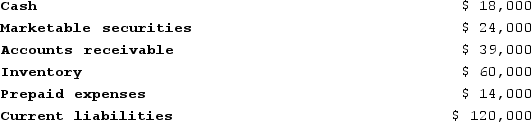

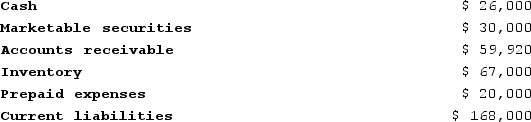

Data from Fontecchio Corporation's most recent balance sheet appear below:  The corporation's acid-test ratio is closest to:

The corporation's acid-test ratio is closest to:

A) 0.35

B) 0.15

C) 0.68

D) 0.79

The corporation's acid-test ratio is closest to:

The corporation's acid-test ratio is closest to:A) 0.35

B) 0.15

C) 0.68

D) 0.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is not a source of financial leverage?

A) Bonds payable.

B) Accounts payable.

C) Taxes payable.

D) Prepaid rent.

A) Bonds payable.

B) Accounts payable.

C) Taxes payable.

D) Prepaid rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

51

The market price of Friden Company's common stock increased from $15 to $18. Earnings per share of common stock remained unchanged. The company's price-earnings ratio would:

A) increase.

B) decrease.

C) remain unchanged.

D) impossible to determine.

A) increase.

B) decrease.

C) remain unchanged.

D) impossible to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company's current ratio and its acid-test ratio are both greater than 1. Payment of an account payable would:

A) increase the current ratio but the acid-test ratio would not be affected.

B) increase the acid-test ratio but the current ratio would not be affected.

C) increase both the current and acid-test ratios.

D) decrease both the current and acid-test ratios.

A) increase the current ratio but the acid-test ratio would not be affected.

B) increase the acid-test ratio but the current ratio would not be affected.

C) increase both the current and acid-test ratios.

D) decrease both the current and acid-test ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

53

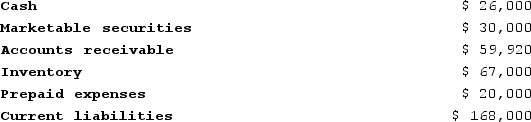

Data from Fontecchio Corporation's most recent balance sheet appear below:  The corporation's acid-test ratio is closest to:

The corporation's acid-test ratio is closest to:

A) 0.33

B) 0.18

C) 0.69

D) 0.51

The corporation's acid-test ratio is closest to:

The corporation's acid-test ratio is closest to:A) 0.33

B) 0.18

C) 0.69

D) 0.51

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

54

The price-earnings ratio is determined by dividing market price per share of stock by the earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

55

The ratio of total cash, marketable securities, and accounts receivable to current liabilities is:

A) the debt-to-equity ratio.

B) the current ratio.

C) the acid-test ratio.

D) working capital.

A) the debt-to-equity ratio.

B) the current ratio.

C) the acid-test ratio.

D) working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

56

Purchasing inventory on credit increases the book value per share of a retailer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following actions would improve a current ratio of 0.8?

A) Use cash to pay off some current liabilities.

B) Purchase additional marketable securities with cash.

C) Acquire a parcel of land in exchange for common stock.

D) Purchase additional inventory on credit.

A) Use cash to pay off some current liabilities.

B) Purchase additional marketable securities with cash.

C) Acquire a parcel of land in exchange for common stock.

D) Purchase additional inventory on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

58

If current assets exceed current liabilities, prepaying an expense on the last day of the year will:

A) decrease the current ratio.

B) increase the acid-test ratio.

C) decrease the acid-test ratio.

D) increase the current ratio.

A) decrease the current ratio.

B) increase the acid-test ratio.

C) decrease the acid-test ratio.

D) increase the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Seabury Corporation has a current ratio of 4.2 and an acid-test ratio of 3.9. The corporation's current assets consist of cash, marketable securities, accounts receivable, and inventories. Inventory equals $18,000. Seabury Corporation's current liabilities must be: (Round your intermediate calculations to 1 decimal place.)

A) $18,000

B) $234,000

C) $60,000

D) $5,400

A) $18,000

B) $234,000

C) $60,000

D) $5,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

60

The gross margin percentage is equal to:

A) (Net operating income + Selling and administrative expenses)/Sales

B) Net operating income/Sales

C) Cost of goods sold/Sales

D) Cost of goods sold/Net income

A) (Net operating income + Selling and administrative expenses)/Sales

B) Net operating income/Sales

C) Cost of goods sold/Sales

D) Cost of goods sold/Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

61

McRae Corporation's total current assets are $452,000, its noncurrent assets are $554,000, its total current liabilities are $376,000, its long-term liabilities are $304,000, and its stockholders' equity is $326,000. Working capital is:

A) $102,000

B) $76,000

C) $178,000

D) $126,000

A) $102,000

B) $76,000

C) $178,000

D) $126,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

62

Windham Corporation has current assets of $400,000 and current liabilities of $500,000. Windham Corporation's current ratio would be increased by:

A) the purchase of $100,000 of inventory on account.

B) the payment of $100,000 of accounts payable.

C) the collection of $100,000 of accounts receivable.

D) refinancing a $100,000 long-term loan with short-term debt.

A) the purchase of $100,000 of inventory on account.

B) the payment of $100,000 of accounts payable.

C) the collection of $100,000 of accounts receivable.

D) refinancing a $100,000 long-term loan with short-term debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

63

Calin Corporation has total current assets of $639,000, total current liabilities of $248,000, total stockholders' equity of $1,207,000, total plant and equipment (net) of $982,000, total assets of $1,621,000, and total liabilities of $414,000. The company's working capital is:

A) $414,000

B) $343,000

C) $391,000

D) $473,000

A) $414,000

B) $343,000

C) $391,000

D) $473,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

64

Feiler Corporation has total current assets of $483,000, total current liabilities of $347,000, total stockholders' equity of $1,057,000, total plant and equipment (net) of $1,031,000, total assets of $1,514,000, and total liabilities of $457,000. The company's current ratio is closest to:

A) 0.32

B) 0.30

C) 1.39

D) 0.95

A) 0.32

B) 0.30

C) 1.39

D) 0.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

65

Dennisport Corporation has an acid-test ratio of 2.6. It has current liabilities of $49,000 and noncurrent assets of $79,000. The corporation's current assets consist of cash, marketable securities, accounts receivable, prepaid expenses, and inventory. If Dennisport's current ratio is 4.1, its inventory and prepaid expenses must be:

A) $121,900

B) $73,500

C) $123,000

D) $78,000

A) $121,900

B) $73,500

C) $123,000

D) $78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

66

Calin Corporation has total current assets of $615,000, total current liabilities of $230,000, total stockholders' equity of $1,183,000, total plant and equipment (net) of $958,000, total assets of $1,573,000, and total liabilities of $390,000. The company's working capital is:

A) $615,000

B) $1,183,000

C) $385,000

D) $958,000

A) $615,000

B) $1,183,000

C) $385,000

D) $958,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

67

Gnas Corporation's total current assets are $252,000, its noncurrent assets are $632,000, its total current liabilities are $188,000, its long-term liabilities are $518,000, and its stockholders' equity is $178,000. The current ratio is closest to:

A) 1.34

B) 0.75

C) 1.42

D) 1.06

A) 1.34

B) 0.75

C) 1.42

D) 1.06

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

68

Dennisport Corporation has an acid-test ratio of 2.5. It has current liabilities of $40,000 and noncurrent assets of $70,000. The corporation's current assets consist of cash, marketable securities, accounts receivable, prepaid expenses, and inventory. If Dennisport's current ratio is 3.1, its inventory and prepaid expenses must be:

A) $12,400

B) $24,000

C) $30,000

D) $40,000

A) $12,400

B) $24,000

C) $30,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

69

Stimac Corporation has total cash of $300,000, no marketable securities, total current receivables of $371,000, total inventory of $187,000, total prepaid expenses of $71,000, total current assets of $929,000, total current liabilities of $315,000, total stockholders' equity of $2,814,000, total assets of $4,115,000, and total liabilities of $1,301,000. The company's acid-test (quick) ratio is closest to:

A) 2.36

B) 1.92

C) 2.95

D) 2.13

A) 2.36

B) 1.92

C) 2.95

D) 2.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

70

Erastic Corporation has $16,000 in cash, $9,000 in marketable securities, $37,000 in account receivable, $44,000 in inventories, and $44,000 in current liabilities. The corporation's current assets consist of cash, marketable securities, accounts receivable, and inventory. The corporation's acid-test ratio is closest to:

A) 1.41

B) 0.84

C) 2.41

D) 1.20

A) 1.41

B) 0.84

C) 2.41

D) 1.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

71

McRae Corporation's total current assets are $380,000, its noncurrent assets are $500,000, its total current liabilities are $340,000, its long-term liabilities are $250,000, and its stockholders' equity is $290,000. Working capital is:

A) $380,000

B) $40,000

C) $250,000

D) $290,000

A) $380,000

B) $40,000

C) $250,000

D) $290,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

72

Orem Corporation's current liabilities are $75,000, its long-term liabilities are $225,000, and its working capital is $100,000. If the corporation's debt-to-equity ratio is 0.30, total long-term assets must equal:

A) $1,000,000

B) $1,300,000

C) $1,125,000

D) $1,225,000

A) $1,000,000

B) $1,300,000

C) $1,125,000

D) $1,225,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

73

Dratif Corporation's working capital is $60,000 and its current liabilities are $192,000. The corporation's current ratio is closest to:

A) 1.31

B) 0.31

C) 2.31

D) 0.76

A) 1.31

B) 0.31

C) 2.31

D) 0.76

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

74

Windham Corporation has current assets of $660,000 and current liabilities of $825,000. Windham Corporation's current ratio would be increased by:

A) the purchase of $360,000 of inventory on account.

B) the payment of $360,000 of accounts payable.

C) the collection of $360,000 of accounts receivable.

D) refinancing a $360,000 long-term loan with short-term debt.

A) the purchase of $360,000 of inventory on account.

B) the payment of $360,000 of accounts payable.

C) the collection of $360,000 of accounts receivable.

D) refinancing a $360,000 long-term loan with short-term debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

75

Feiler Corporation has total current assets of $497,000, total current liabilities of $361,000, total stockholders' equity of $1,071,000, total plant and equipment (net) of $1,045,000, total assets of $1,542,000, and total liabilities of $471,000. The company's current ratio is closest to:

A) 0.77

B) 1.06

C) 1.38

D) 2.22

A) 0.77

B) 1.06

C) 1.38

D) 2.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

76

Dratif Corporation's working capital is $33,000 and its current liabilities are $80,000. The corporation's current ratio is closest to:

A) 1.41

B) 0.59

C) 3.42

D) 0.41

A) 1.41

B) 0.59

C) 3.42

D) 0.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

77

Stimac Corporation has total cash of $210,000, no marketable securities, total current receivables of $281,000, total inventory of $151,000, total prepaid expenses of $53,000, total current assets of $695,000, total current liabilities of $261,000, total stockholders' equity of $1,014,000, total assets of $1,415,000, and total liabilities of $401,000. The company's acid-test (quick) ratio is closest to:

A) 2.08

B) 1.73

C) 2.66

D) 1.88

A) 2.08

B) 1.73

C) 2.66

D) 1.88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

78

Erastic Corporation has $14,000 in cash, $8,000 in marketable securities, $34,000 in account receivable, $40,000 in inventories, and $42,000 in current liabilities. The corporation's current assets consist of cash, marketable securities, accounts receivable, and inventory. The corporation's acid-test ratio is closest to:

A) 1.33

B) 0.81

C) 2.29

D) 1.14

A) 1.33

B) 0.81

C) 2.29

D) 1.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

79

Orem Corporation's current liabilities are $254,840, its long-term liabilities are $1,327,560, and its working capital is $356,800. If the corporation's debt-to-equity ratio is 0.46, total long-term assets must equal:

A) $3,440,000

B) $4,665,600

C) $4,410,760

D) $3,856,760

A) $3,440,000

B) $4,665,600

C) $4,410,760

D) $3,856,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck

80

Gnas Corporation's total current assets are $210,000, its noncurrent assets are $590,000, its total current liabilities are $160,000, its long-term liabilities are $490,000, and its stockholders' equity is $150,000. The current ratio is closest to:

A) 1.31

B) 0.76

C) 0.33

D) 0.36

A) 1.31

B) 0.76

C) 0.33

D) 0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 327 في هذه المجموعة.

فتح الحزمة

k this deck