Deck 13: Differential Analysis: the Key to Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/432

العب

ملء الشاشة (f)

Deck 13: Differential Analysis: the Key to Decision Making

1

Future costs that do not differ between the alternatives in a decision are avoidable costs.

False

2

. A cost that will be incurred regardless of which alternative is selected is not relevant when choosing between the alternatives.

True

3

Sunk costs are never relevant in decision making.

True

4

A complete income statement need not be prepared as part of a differential cost analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

5

A cost that is traceable to a segment through activity-based costing is always an avoidable cost for decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

6

Sunk costs and future costs that do not differ between the alternatives may or may not be relevant in a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

7

Future costs that do differ among the alternatives are not relevant in a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

8

An avoidable cost is a sunk cost that can be eliminated (in whole or in part) as a result of choosing one alternative over another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

9

The book value of an old machine is always considered an opportunity cost in a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

10

The variable costs of a product are relevant in a decision concerning whether to eliminate the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

11

Variable costs are always relevant costs in decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

12

Fixed costs are irrelevant in decisions about whether a product should be dropped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

13

Fixed costs are sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

14

Opportunity costs represent costs that can be reduced by effective management of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

15

Consistency demands that a cost that is relevant in one decision be regarded as relevant in other decisions as well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

16

Sunk costs are costs that have proven to be unproductive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

17

A cost that is assigned to a product using activity-based costing may or may not be a relevant cost in a decision involving that product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

18

Avoidable costs are irrelevant costs in decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

19

It may be a good decision to replace an asset before its original cost has been fully recovered through increased revenues or decreased costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

20

Fixed costs may be relevant in a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

21

In a factory operating at capacity, every machine and person should be working at the maximum possible rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

22

The term joint cost is used to describe the costs incurred up to the split-off point in a process involving joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a special order situation that involves using capacity that is not idle, opportunity costs are zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

24

In a decision to drop a product, the product should be charged for rent in proportion to the space it occupies even if the space has no alternative use and the rental payment is unavoidable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

25

One way to increase the effective utilization of a bottleneck is to reduce the number of defective units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

26

When a company has a production constraint, total contribution margin will be maximized by emphasizing the products with the highest contribution margin per unit of the constrained resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

27

The split-off point in a process that produces joint products is the point in the manufacturing process at which the joint products can be recognized as separate products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

28

Eliminating nonproductive processing time is particularly important in a bottleneck operation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

29

An avoidable fixed production cost incurred before the split-off point in a joint process is relevant in a sell or process further decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

30

A disadvantage of vertical integration is that by pooling demand for parts from a number of companies, a supplier may be able to enjoy economies of scale that result in higher quality and lower cost than if every company makes its own parts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

31

A product whose revenues do not cover its variable costs and its traceable fixed costs should usually be dropped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

32

It is profitable to continue processing joint products after the split-off point if their total revenues exceed the joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

33

A vertically integrated company is less dependent on its suppliers than a company that is not vertically integrated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

34

Payment of overtime to a worker in order to relax a production constraint could increase the profits of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

35

The absorption costing approach to cost-plus pricing will result in attaining the company's required rate of return only if forecasted unit sales are realized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

36

When a company has a production constraint, the product with the lowest contribution margin per unit of the constrained resource should usually be given highest priority.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

37

In a special order situation, any fixed cost associated with the order would be irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a company is involved in more than one activity in the entire value chain, it is vertically integrated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

39

Variable selling and administrative costs are excluded from the cost base used to set a selling price under the absorption approach to cost-plus pricing described in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

40

Two or more products that are produced from a common input are known as joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

41

In the absorption approach to cost-plus pricing, the anticipated markup in dollars is equal to the anticipated profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

42

Generally speaking, managers should set higher prices when demand is elastic and lower prices when demand is inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

43

All other things equal including costs, if customers are more sensitive to price for one product than another, then to maximize profit the first product should have a higher price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under the absorption approach to cost-plus pricing described in the text, all fixed costs are included in the cost base in setting a selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

45

Companies that use value-based pricing establish selling prices based on the economic value of the benefits that their products and services provide to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

46

In target costing, the cost of a product is the starting point and the selling price follows from the cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

47

"Cost-plus" pricing means that all costs--manufacturing, selling, and administrative--are included in the cost base from which the target selling price is derived.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

48

Most of the opportunities to reduce the cost of a product come from outsourcing production to where labor is relatively inexpensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

49

The markup over cost under the absorption costing approach would decrease if the required rate of return increases, holding everything else constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

50

In value-based pricing, the economic value to the customer equals the reference value less the differentiation value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

51

The markup over cost under the absorption costing approach would decrease if the unit product cost increases, holding everything else constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

52

Demand for a product is said to be elastic if a change in price has little effect on the number of units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

53

Target costing involves adding a target profit per unit to actual unit cost to determine the selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

54

The sensitivity of unit sales to changes in price is called the price elasticity of demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

55

Target costing is primarily used with well-established products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

56

The target costing approach was developed in recognition of two important characteristics of markets and costs. First, many companies have less control over price than they like to think. Second, most of a product's cost is determined when it is designed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

57

A product's economic value to the customer is the variable cost of the product plus the value of what differentiates the product from that alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

58

The opportunity cost of making a component part in a factory with excess capacity for which there is no alternative use is:

A) the variable manufacturing cost of the component.

B) the total manufacturing cost of the component.

C) the fixed manufacturing cost of the component.

D) zero.

A) the variable manufacturing cost of the component.

B) the total manufacturing cost of the component.

C) the fixed manufacturing cost of the component.

D) zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

59

In value-based pricing, the value of what differentiates a product from the best available alternative is known as the differentiation value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the formula for the markup percentage on absorption cost is used for setting prices, then the company's desired return on investment (ROI) will be attained regardless of how many units are actually sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

61

Otool Incorporated is considering using stocks of an old raw material in a special project. The special project would require all 190 kilograms of the raw material that are in stock and that originally cost the company $2,456 in total. If the company were to buy new supplies of this raw material on the open market, it would cost $7 per kilogram. However, the company has no other use for this raw material and would sell it at the discounted price of $6.10 per kilogram if it were not used in the special project. The sale of the raw material would involve delivery to the purchaser at a total cost of $63 for all 190 kilograms. What is the relevant cost of the 190 kilograms of the raw material when deciding whether to proceed with the special project?

A) $1,159

B) $1,096

C) $1,273

D) $1,292

A) $1,159

B) $1,096

C) $1,273

D) $1,292

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

62

A joint product is:

A) any product which consists of several parts.

B) any product produced by a company with more than one product line.

C) any product involved in a make or buy decision.

D) one of several products produced from a common input.

A) any product which consists of several parts.

B) any product produced by a company with more than one product line.

C) any product involved in a make or buy decision.

D) one of several products produced from a common input.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

63

Product X-547 is one of the joint products in a joint manufacturing process. Management is considering whether to sell X-547 at the split-off point or to process X-547 further into Xylene. The following data have been gathered:Selling price of X-547Variable cost of processing X-547 into Xylene.The avoidable fixed costs of processing X-547 into Xylene.The selling price of Xylene.The joint cost of the process from which X-547 is produced.Which of the above items are relevant in a decision of whether to sell the X-547 as is or process it further into Xylene?

A) I, II, and IV.

B) I, II, III, and IV.

C) II, III, and V.

D) I, II, III, and V.

A) I, II, and IV.

B) I, II, III, and IV.

C) II, III, and V.

D) I, II, III, and V.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

64

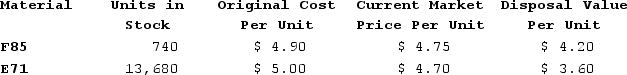

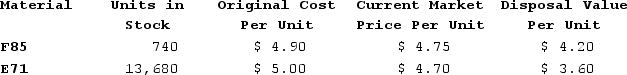

Winder Corporation is a specialty component manufacturer with idle capacity. Management would like to use its extra capacity to generate additional profits. A potential customer has offered to buy 3,000 units of component QEA. Each unit of QEA requires 5 units of material F85 and 5 units of material E71. Data concerning these two materials follow:  Material F85 is in use in many of the company's products and is routinely replenished. Material E71 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product QEA?

Material F85 is in use in many of the company's products and is routinely replenished. Material E71 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product QEA?

A) $126,702

B) $141,750

C) $126,295

D) $145,965

Material F85 is in use in many of the company's products and is routinely replenished. Material E71 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product QEA?

Material F85 is in use in many of the company's products and is routinely replenished. Material E71 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product QEA?A) $126,702

B) $141,750

C) $126,295

D) $145,965

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

65

United Industries manufactures a number of products at its highly automated factory. The products are very popular, with demand far exceeding the factory's capacity. To maximize profit, management should rank products based on their:

A) gross margin

B) contribution margin

C) selling price

D) contribution margin per unit of the constrained resource

A) gross margin

B) contribution margin

C) selling price

D) contribution margin per unit of the constrained resource

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

66

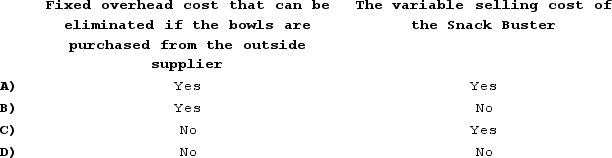

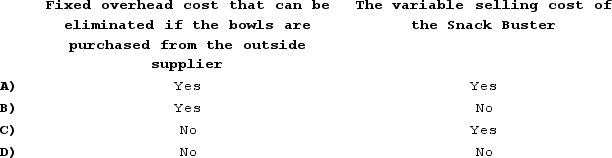

The Jabba Corporation manufactures the "Snack Buster" which consists of a wooden snack chip bowl with an attached porcelain dip bowl. Which of the following would be relevant in Jabba's decision to make the dip bowls or buy them from an outside supplier?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

67

Milford Corporation has in stock 16,100 kilograms of material R that it bought five years ago for $5.75 per kilogram. This raw material was purchased to use in a product line that has been discontinued. Material R can be sold as is for scrap for $3.91 per kilogram. An alternative would be to use material R in one of the company's current products, S88Y, which currently requires 2 kilograms of a raw material that is available for $7.60 per kilogram. Material R can be modified at a cost of $0.77 per kilogram so that it can be used as a substitute for this material in the production of product S88Y. However, after modification, 4 kilograms of material R is required for every unit of product S88Y that is produced. Milford Corporation has now received a request from a company that could use material R in its production process. Assuming that Milford Corporation could use all of its stock of material R to make product S88Y or the company could sell all of its stock of the material at the current scrap price of $3.91 per kilogram, what is the minimum acceptable selling price of material R to the company that could use material R in its own production process? (Round your intermediate calculations to 2 decimal places.)

A) $0.88 per kilogram

B) $3.03 per kilogram

C) $4.57 per kilogram

D) $3.91 per kilogram

A) $0.88 per kilogram

B) $3.03 per kilogram

C) $4.57 per kilogram

D) $3.91 per kilogram

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

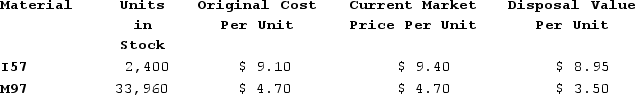

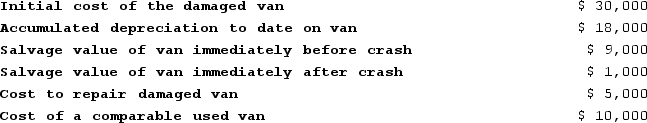

68

Munafo Corporation is a specialty component manufacturer with idle capacity. Management would like to use its extra capacity to generate additional profits. A potential customer has offered to buy 6,500 units of component VGI. Each unit of VGI requires 1 unit of material I57 and 5 units of material M97. Data concerning these two materials follow:  Material I57 is in use in many of the company's products and is routinely replenished. Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product VGI?

Material I57 is in use in many of the company's products and is routinely replenished. Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product VGI?

A) $174,850

B) $213,130

C) $213,850

D) $171,925

Material I57 is in use in many of the company's products and is routinely replenished. Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product VGI?

Material I57 is in use in many of the company's products and is routinely replenished. Material M97 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up.What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product VGI?A) $174,850

B) $213,130

C) $213,850

D) $171,925

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

69

Otool Incorporated is considering using stocks of an old raw material in a special project. The special project would require all 240 kilograms of the raw material that are in stock and that originally cost the company $2,112 in total. If the company were to buy new supplies of this raw material on the open market, it would cost $9.25 per kilogram. However, the company has no other use for this raw material and would sell it at the discounted price of $8.35 per kilogram if it were not used in the special project. The sale of the raw material would involve delivery to the purchaser at a total cost of $71 for all 240 kilograms. What is the relevant cost of the 240 kilograms of the raw material when deciding whether to proceed with the special project?

A) $1,933

B) $2,004

C) $2,220

D) $2,112

A) $1,933

B) $2,004

C) $2,220

D) $2,112

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

70

Hodge Incorporated has some material that originally cost $74,600. The material has a scrap value of $57,400 as is, but if reworked at a cost of $1,500, it could be sold for $54,400. What would be the financial advantage (disadvantage) of reworking and selling the material rather than selling it as is as scrap?

A) ($79,100)

B) ($21,700)

C) ($4,500)

D) $52,900

A) ($79,100)

B) ($21,700)

C) ($4,500)

D) $52,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

71

Schickel Incorporated regularly uses material B39U and currently has in stock 460 liters of the material for which it paid $3,128 several weeks ago. If this were to be sold as is on the open market as surplus material, it would fetch $5.95 per liter. New stocks of the material can be purchased on the open market for $6.45 per liter, but it must be purchased in lots of 1,000 liters. You have been asked to determine the relevant cost of 760 liters of the material to be used in a job for a customer. The relevant cost of the 760 liters of material B39U is:

A) $4,902

B) $4,672

C) $4,522

D) $6,450

A) $4,902

B) $4,672

C) $4,522

D) $6,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

72

In a sell or process further decision, consider the following costs:A variable production cost incurred prior to split-off.A variable production cost incurred after split-off.An avoidable fixed production cost incurred after split-off.Which of the above costs is (are) not relevant in a decision regarding whether the product should be processed further?

A) Only I

B) Only III

C) Only I and II

D) Only I and III

A) Only I

B) Only III

C) Only I and II

D) Only I and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

73

Schickel Incorporated regularly uses material B39U and currently has in stock 457 liters of the material for which it paid $2,619 several weeks ago. If this were to be sold as is on the open market as surplus material, it would fetch $5.21 per liter. New stocks of the material can be purchased on the open market for $5.81 per liter, but it must be purchased in lots of 1,000 liters. You have been asked to determine the relevant cost of 700 liters of the material to be used in a job for a customer. The relevant cost of the 700 liters of material B39U is:

A) $5,810

B) $3,647

C) $3,794

D) $4,067

A) $5,810

B) $3,647

C) $3,794

D) $4,067

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

74

Costs that can be eliminated in whole or in part if a particular business segment is discontinued are called:

A) sunk costs.

B) opportunity costs.

C) avoidable costs.

D) irrelevant costs.

A) sunk costs.

B) opportunity costs.

C) avoidable costs.

D) irrelevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

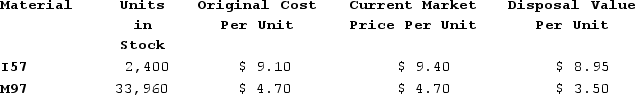

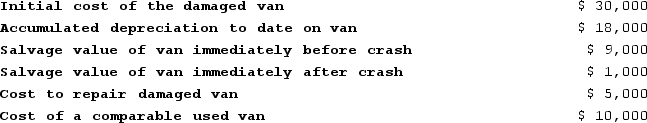

75

One of the employees of Davenport Corporation recently was involved in an accident with one of the corporation's delivery vans. The corporation is either going to repair the damaged van or sell it as is and buy a comparable used van. Information related to this decision is provided below:  Based on the information above, Davenport would be financially better off:

Based on the information above, Davenport would be financially better off:

A) $1,000 by buying the comparable van.

B) $2,000 by buying the comparable van.

C) $2,000 by repairing the damaged van.

D) $4,000 by repairing the damaged van.

Based on the information above, Davenport would be financially better off:

Based on the information above, Davenport would be financially better off:A) $1,000 by buying the comparable van.

B) $2,000 by buying the comparable van.

C) $2,000 by repairing the damaged van.

D) $4,000 by repairing the damaged van.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

76

Kinsi Corporation manufactures five different products. All five of these products must pass through a stamping machine in its fabrication department. This machine is Kinsi's constrained resource. Kinsi would make the most profit if it produces the product that:

A) uses the least amount of stamping time.

B) generates the highest contribution margin per unit.

C) generates the highest contribution margin ratio.

D) generates the highest contribution margin per stamping machine hour.

A) uses the least amount of stamping time.

B) generates the highest contribution margin per unit.

C) generates the highest contribution margin ratio.

D) generates the highest contribution margin per stamping machine hour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following costs are always irrelevant in decision making?

A) avoidable costs

B) sunk costs

C) opportunity costs

D) fixed costs

A) avoidable costs

B) sunk costs

C) opportunity costs

D) fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

78

Hamby Corporation is preparing a bid for a special order that would require 780 liters of material W34C. The company already has 640 liters of this raw material in stock that originally cost $8.30 per liter. Material W34C is used in the company's main product and is replenished on a periodic basis. The resale value of the existing stock of the material is $7.60 per liter. New stocks of the material can be readily purchased for $8.35 per liter. What is the relevant cost of the 780 liters of the raw material when deciding how much to bid on the special order?

A) $6,481

B) $6,376

C) $6,513

D) $5,928

A) $6,481

B) $6,376

C) $6,513

D) $5,928

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

79

Accepting a special order will improve overall net operating income if the revenue from the special order exceeds:

A) the contribution margin on the order.

B) the incremental costs associated with the order.

C) the variable costs associated with the order.

D) the sunk costs associated with the order.

A) the contribution margin on the order.

B) the incremental costs associated with the order.

C) the variable costs associated with the order.

D) the sunk costs associated with the order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck

80

Lusk Corporation produces and sells 16,100 units of Product X each month. The selling price of Product X is $31 per unit, and variable expenses are $25 per unit. A study has been made concerning whether Product X should be discontinued. The study shows that $71,000 of the $111,000 in monthly fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the monthly financial advantage (disadvantage) for the company of eliminating this product should be:

A) ($56,600)

B) $14,400

C) $54,400

D) ($54,400)

A) ($56,600)

B) $14,400

C) $54,400

D) ($54,400)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 432 في هذه المجموعة.

فتح الحزمة

k this deck