Deck 6: Variable Costing and Segment Reporting: Tools for Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/392

العب

ملء الشاشة (f)

Deck 6: Variable Costing and Segment Reporting: Tools for Management

1

A company has two divisions, each selling several products. If segment reports are prepared for each product, the division managers' salaries should be considered as common fixed costs of the products.

True

2

Lean production should result in reduced inventories. If lean production is successfully implemented, the difference in net operating income computed under the absorption and variable costing methods should be reduced.

True

3

Under variable costing, only variable production costs are treated as product costs.

True

4

The salary paid to a store manager is not a traceable fixed expense of the store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under variable costing, an increase in fixed manufacturing overhead will affect the unit product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

6

Variable costing is more compatible with cost-volume-profit analysis than is absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

7

Allocating common fixed costs to segments on segmented income statements increases the usefulness of such statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the absorption costing method, a company can increase profits simply by increasing the number of units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

9

Variable costing net operating income is usually closer to the net cash flow of a period than is absorption costing net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under variable costing, fixed manufacturing overhead is treated as a product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

11

Assuming the LIFO inventory flow assumption, when production exceeds sales for the period, absorption costing net operating income will exceed variable costing net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under absorption costing, a portion of fixed manufacturing overhead cost is released from inventory when production volume exceeds sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

13

Absorption costing treats all manufacturing costs as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under variable costing, all variable production costs are treated as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

15

When reconciling variable costing and absorption costing net operating income, fixed manufacturing overhead costs deferred in inventory under absorption costing should be deducted from variable costing net operating income to arrive at the absorption costing net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

16

Segment margin is sales less variable expenses less traceable fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

17

Absorption costing treats all fixed costs as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

18

All other things the same, if a division's traceable fixed expenses decrease then the division's segment margin will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

19

Net operating income computed using absorption costing will always be less than net operating income computed using variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the LIFO inventory flow assumption, if the number of units in inventories increase between the beginning and end of the period, absorption costing net operating income will generally be greater than variable costing net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following costs at a manufacturing company would be treated as a product cost under variable costing?

A) direct material cost

B) property taxes on the factory building

C) sales manager's salary

D) sales commissions

A) direct material cost

B) property taxes on the factory building

C) sales manager's salary

D) sales commissions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

22

All differences between super-variable costing and variable costing net operating income are explained by the accounting for manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

23

The super-variable costing net operating income period can be computed by multiplying the number of units sold by the gross margin per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

24

If a cost must be arbitrarily allocated in order to be assigned to a particular segment, then that cost should be considered a common cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

25

Generally speaking, net operating income under variable and absorption costing will:

A) always be equal.

B) never be equal.

C) be equal only when production and sales are equal.

D) be equal only when production exceeds sales.

A) always be equal.

B) never be equal.

C) be equal only when production and sales are equal.

D) be equal only when production exceeds sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

26

A reason why absorption costing income statements are sometimes difficult to interpret is that:

A) they omit variable expenses entirely in computing net operating income.

B) they shift portions of fixed manufacturing overhead from period to period according to changing levels of inventories.

C) they include all fixed manufacturing overhead on the income statement each year as a period cost.

D) they ignore inventory levels in determining cost of goods sold.

A) they omit variable expenses entirely in computing net operating income.

B) they shift portions of fixed manufacturing overhead from period to period according to changing levels of inventories.

C) they include all fixed manufacturing overhead on the income statement each year as a period cost.

D) they ignore inventory levels in determining cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

27

The costing method that treats all fixed costs as period costs is:

A) absorption costing.

B) job-order costing.

C) variable costing.

D) process costing.

A) absorption costing.

B) job-order costing.

C) variable costing.

D) process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

28

When using segmented income statements, the dollar sales for a company to break even equals the traceable fixed expenses divided by the overall CM ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

29

Common fixed expenses should not be allocated to business segments when performing break-even calculations and making decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assuming that direct labor is a variable cost, the primary difference between the absorption and variable costing is that:

A) variable costing treats only direct materials and direct labor as product cost while absorption costing treats direct materials, direct labor, and the variable portion of manufacturing overhead as product costs.

B) variable costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs while absorption costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs.

C) variable costing treats only direct materials, direct labor, the variable portion of manufacturing overhead, and the variable portion of selling and administrative expenses as product cost while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs.

D) variable costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs.

A) variable costing treats only direct materials and direct labor as product cost while absorption costing treats direct materials, direct labor, and the variable portion of manufacturing overhead as product costs.

B) variable costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs while absorption costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs.

C) variable costing treats only direct materials, direct labor, the variable portion of manufacturing overhead, and the variable portion of selling and administrative expenses as product cost while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs.

D) variable costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

31

When sales exceed production and the company uses the LIFO inventory flow assumption, the net operating income reported under variable costing generally will be:

A) less than net operating income reported under absorption costing.

B) greater than net operating income reported under absorption costing.

C) equal to net operating income reported under absorption costing.

D) higher or lower because no generalization can be made.

A) less than net operating income reported under absorption costing.

B) greater than net operating income reported under absorption costing.

C) equal to net operating income reported under absorption costing.

D) higher or lower because no generalization can be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is true of a company that uses absorption costing?

A) Net operating income fluctuates directly with changes in sales volume.

B) Fixed production and fixed selling costs are considered to be product costs.

C) Unit product costs can change as a result of changes in the number of units manufactured.

D) Variable selling expenses are included in product costs.

A) Net operating income fluctuates directly with changes in sales volume.

B) Fixed production and fixed selling costs are considered to be product costs.

C) Unit product costs can change as a result of changes in the number of units manufactured.

D) Variable selling expenses are included in product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

33

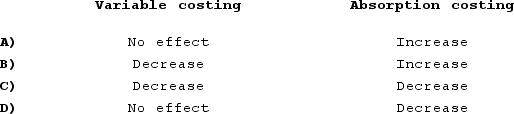

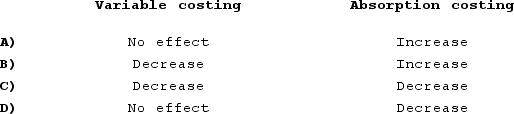

In its first year of operations, Bronfren Corporation produced 800,000 sets and sold 780,000 sets of artificial tan lines. What would have happened to net operating income in this first year under the following costing methods if Bronfren had produced 20,000 fewer sets? (Assume that Bronfren has both variable and fixed production costs.)

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

34

When unit sales are constant, but the number of units produced fluctuates and everything else remains the same, net operating income under variable costing will:

A) fluctuate in direct proportion to changes in production.

B) remain constant.

C) fluctuate inversely with changes in production.

D) be greater than net operating income under absorption costing.

A) fluctuate in direct proportion to changes in production.

B) remain constant.

C) fluctuate inversely with changes in production.

D) be greater than net operating income under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

35

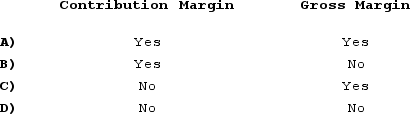

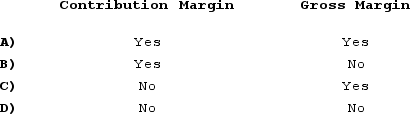

Which of the following will usually be found on an income statement prepared using absorption costing?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

36

Segmented statements for internal use should not be prepared using the contribution format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

37

Net operating income computed under variable costing would exceed net operating income computed using absorption costing if:

A) units sold exceed units produced.

B) units sold are less than units produced.

C) units sold equal units produced.

D) the average fixed cost per unit is zero.

A) units sold exceed units produced.

B) units sold are less than units produced.

C) units sold equal units produced.

D) the average fixed cost per unit is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

38

When computing the break even for a segment, the calculations include the company's common fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

39

A cost that would be included in product costs under both absorption costing and variable costing is:

A) supervisory salaries.

B) factory rent.

C) variable manufacturing costs.

D) variable selling expenses.

A) supervisory salaries.

B) factory rent.

C) variable manufacturing costs.

D) variable selling expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

40

Super-variable costing is a costing method that treats direct labor and manufacturing overhead costs as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

41

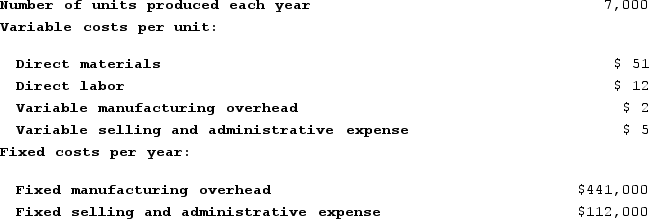

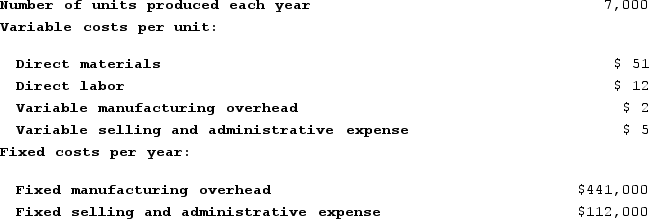

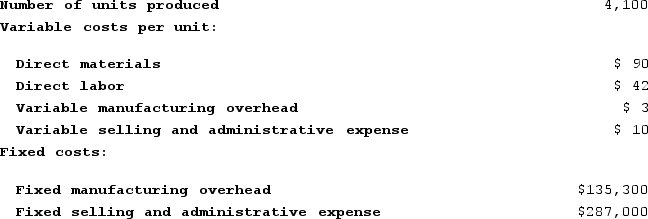

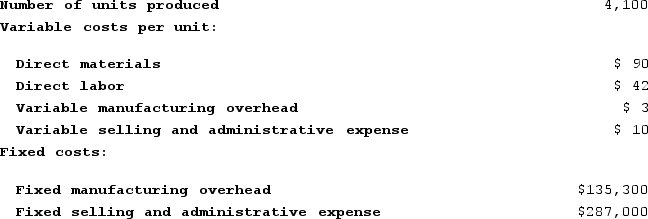

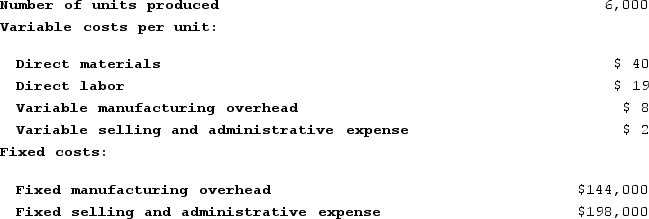

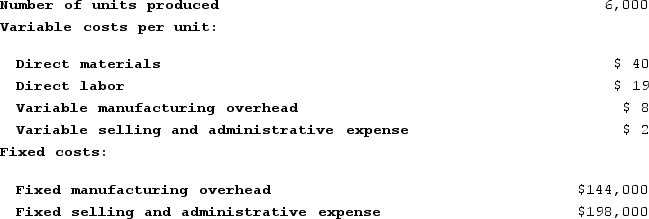

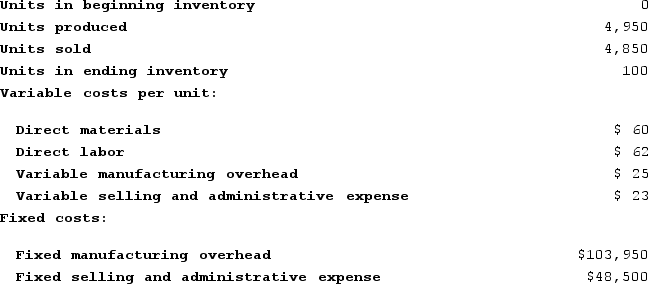

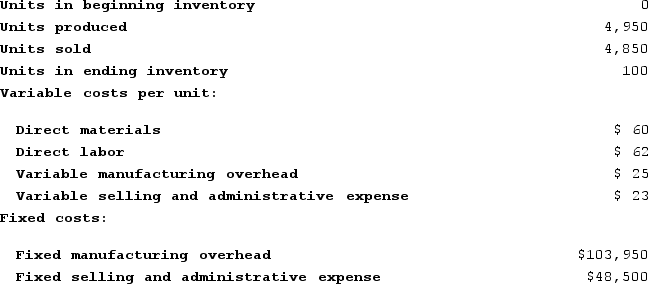

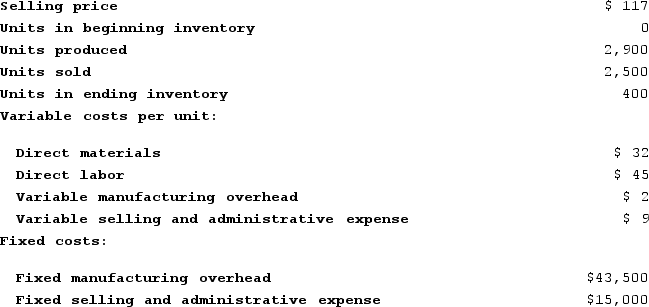

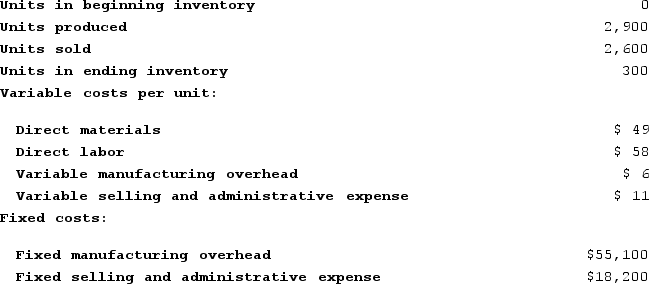

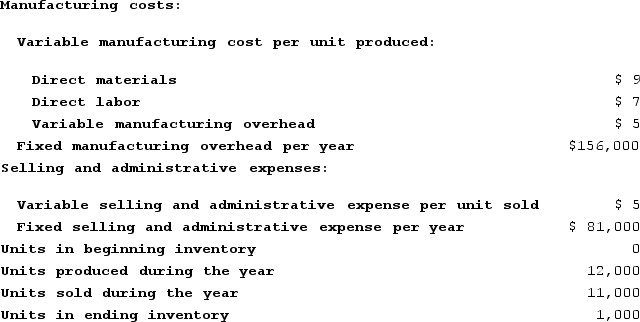

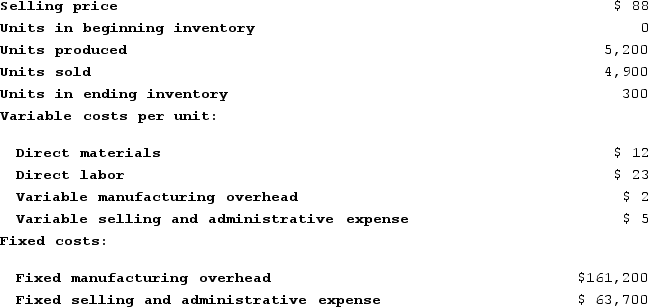

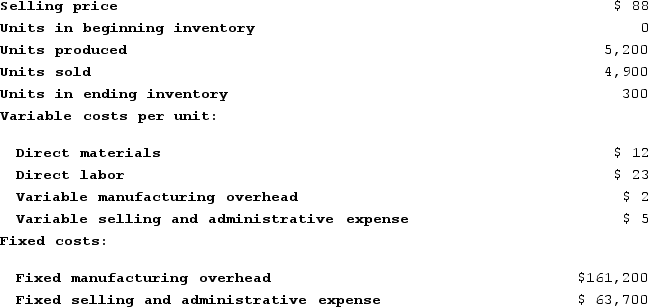

Mullee Corporation produces a single product and has the following cost structure:  The absorption costing unit product cost is:

The absorption costing unit product cost is:

A) $149 per unit

B) $65 per unit

C) $63 per unit

D) $128 per unit

The absorption costing unit product cost is:

The absorption costing unit product cost is:A) $149 per unit

B) $65 per unit

C) $63 per unit

D) $128 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

42

Allocating common fixed expenses to business segments:

A) may cause managers to erroneously discontinue business segments.

B) may cause managers to erroneously keep business segments that should be dropped.

C) ensures that all costs are covered.

D) helps managers make good decisions.

A) may cause managers to erroneously discontinue business segments.

B) may cause managers to erroneously keep business segments that should be dropped.

C) ensures that all costs are covered.

D) helps managers make good decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

43

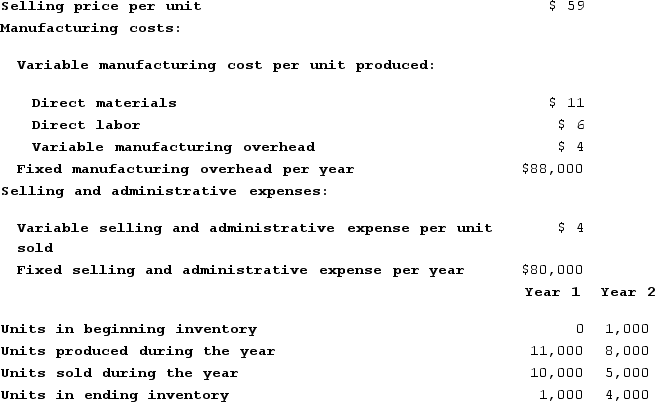

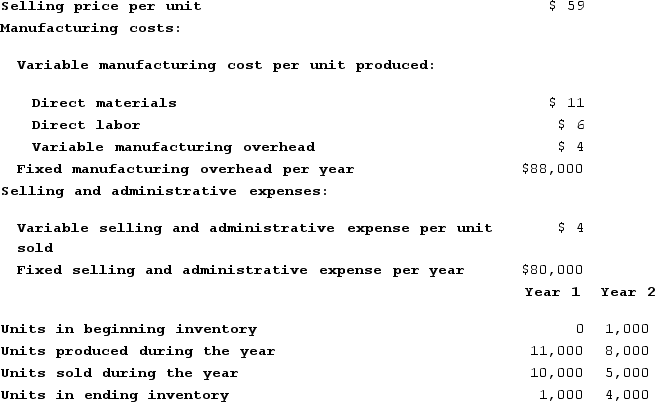

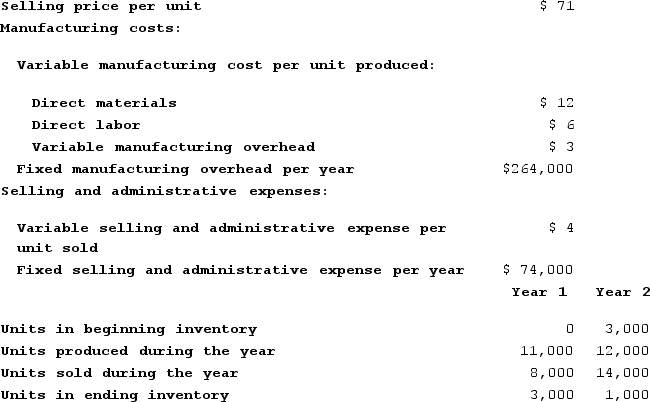

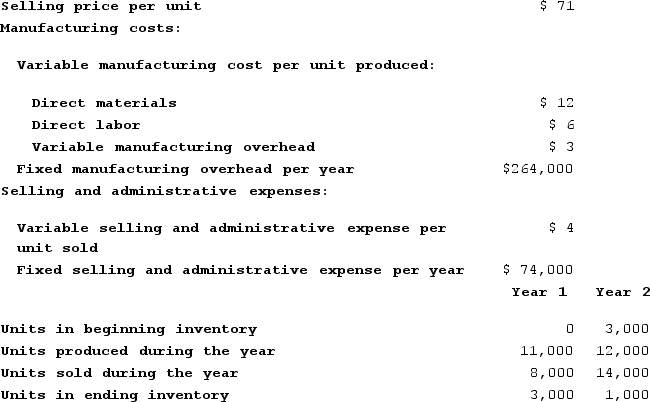

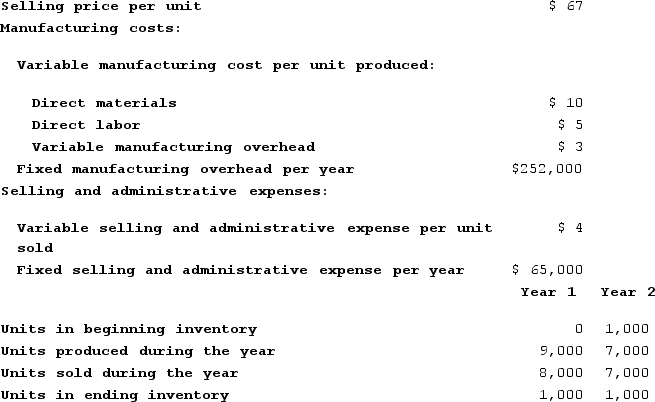

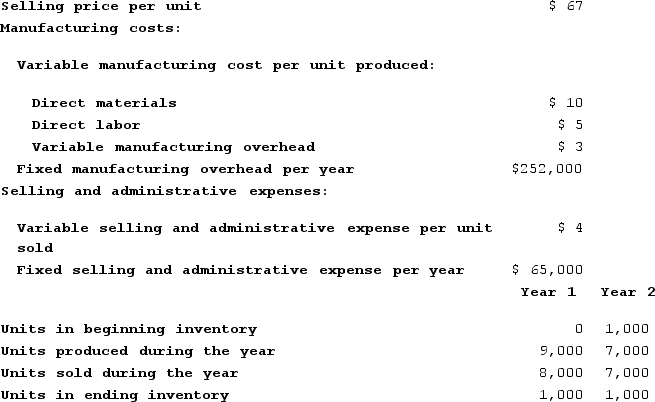

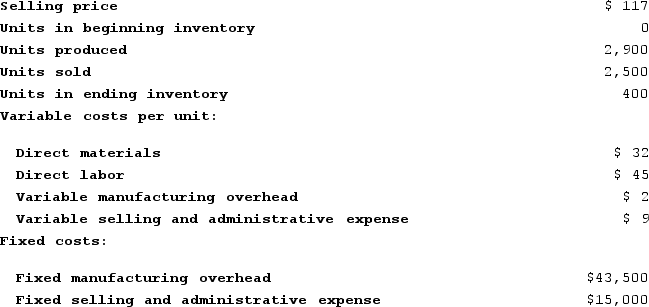

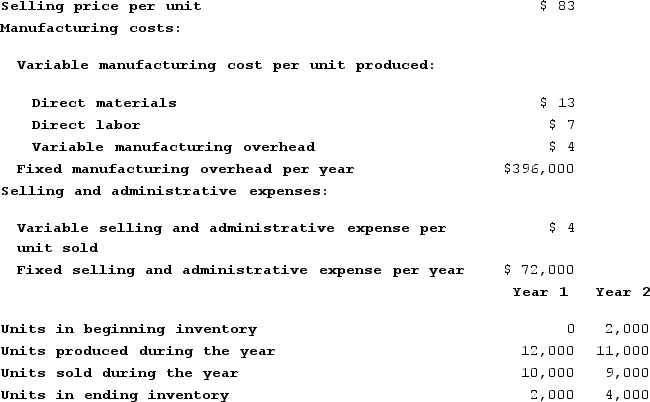

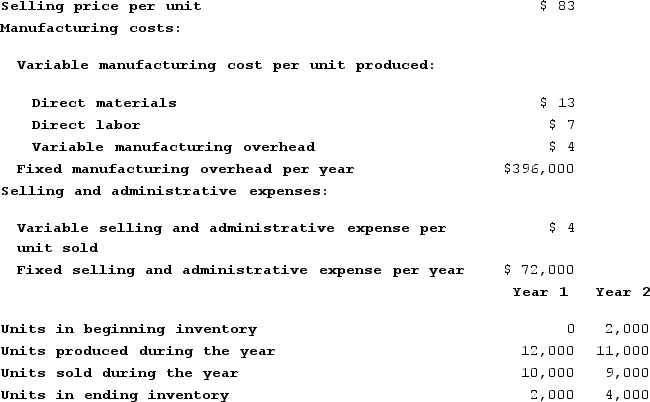

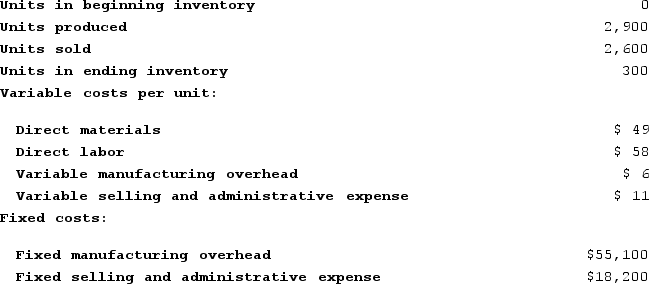

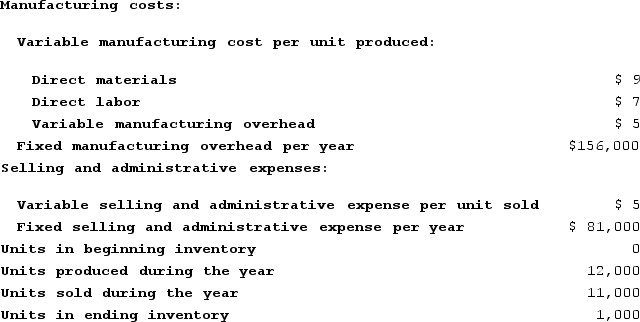

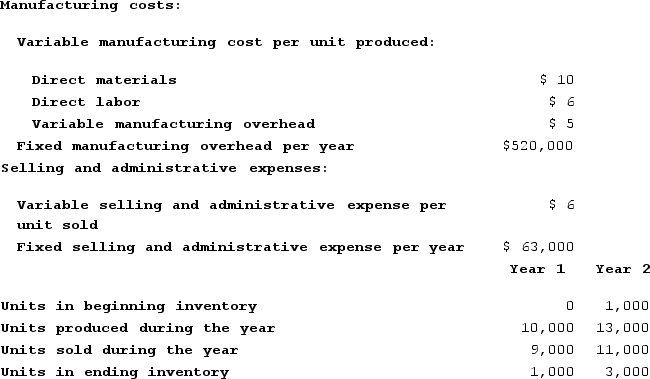

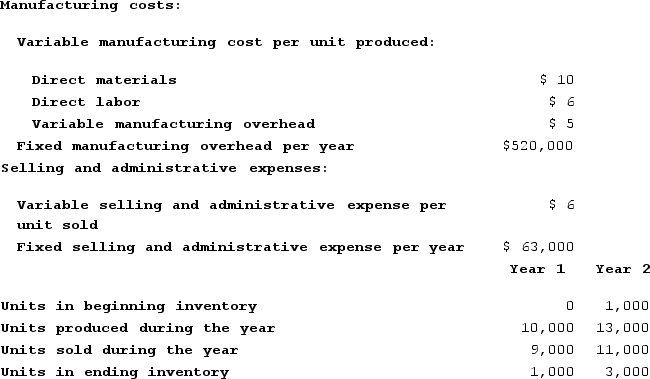

Mccrone Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under variable costing in Year 1 is closest to:

The net operating income (loss) under variable costing in Year 1 is closest to:

A) $380,000

B) $340,000

C) $180,000

D) $172,000

The net operating income (loss) under variable costing in Year 1 is closest to:

The net operating income (loss) under variable costing in Year 1 is closest to:A) $380,000

B) $340,000

C) $180,000

D) $172,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

44

Hayworth Corporation has just segmented last year's income statement into its ten product lines. The chief executive officer (CEO) is curious as to what effect dropping one of the product lines at the beginning of last year would have had on overall company profit. What is the best number for the CEO to look at to determine the effect of this elimination on the net operating income of the company as a whole?

A) the product line's sales dollars

B) the product line's contribution margin

C) the product line's segment margin

D) the product line's segment margin minus an allocated portion of common fixed expenses

A) the product line's sales dollars

B) the product line's contribution margin

C) the product line's segment margin

D) the product line's segment margin minus an allocated portion of common fixed expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

45

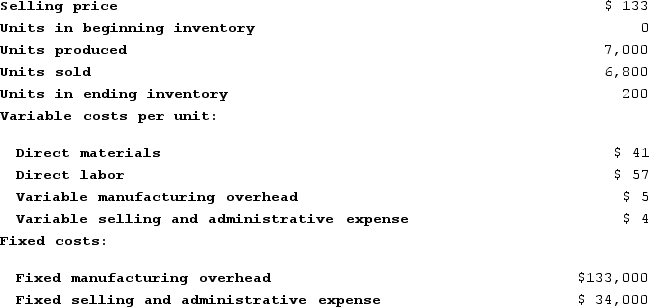

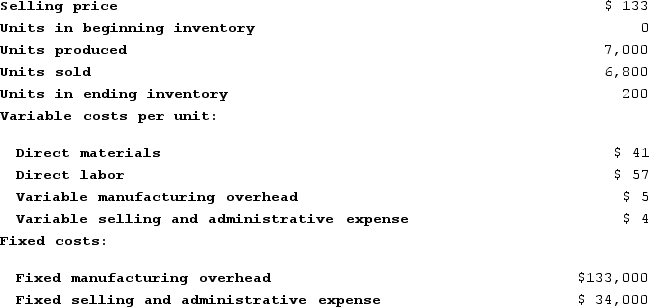

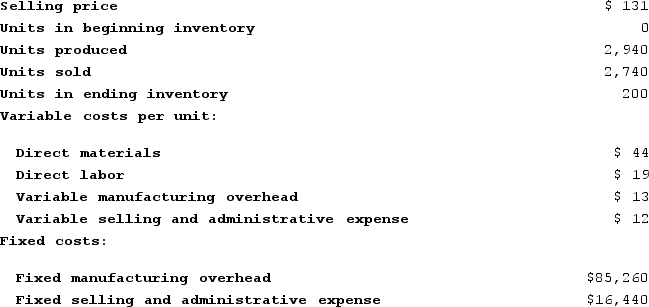

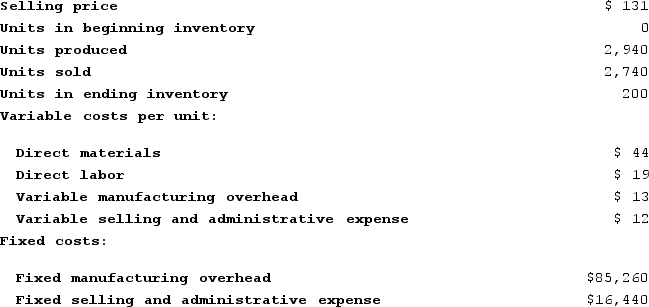

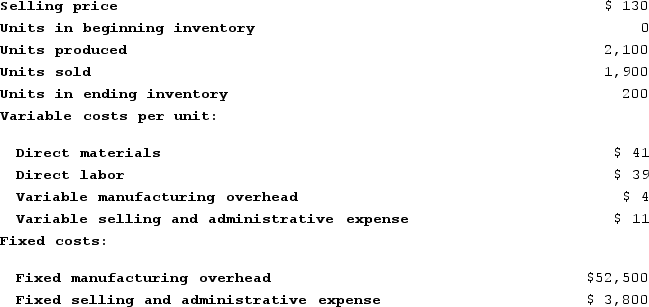

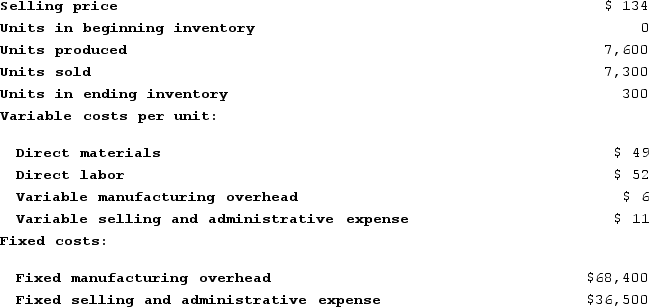

Beamish Incorporated, which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories. The absorption costing unit product cost was:

There were no beginning or ending inventories. The absorption costing unit product cost was:

A) $132 per unit

B) $168 per unit

C) $135 per unit

D) $248 per unit

There were no beginning or ending inventories. The absorption costing unit product cost was:

There were no beginning or ending inventories. The absorption costing unit product cost was:A) $132 per unit

B) $168 per unit

C) $135 per unit

D) $248 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

46

When using data from a segmented income statement, the dollar sales for a segment to break even is equal to:

A) Traceable fixed expenses ÷ Segment CM ratio

B) Common fixed expenses ÷ Segment CM ratio

C) (Traceable fixed expenses + Common fixed expenses) ÷ Segment CM ratio

D) Non-traceable fixed expenses ÷ Segment CM ratio

A) Traceable fixed expenses ÷ Segment CM ratio

B) Common fixed expenses ÷ Segment CM ratio

C) (Traceable fixed expenses + Common fixed expenses) ÷ Segment CM ratio

D) Non-traceable fixed expenses ÷ Segment CM ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

47

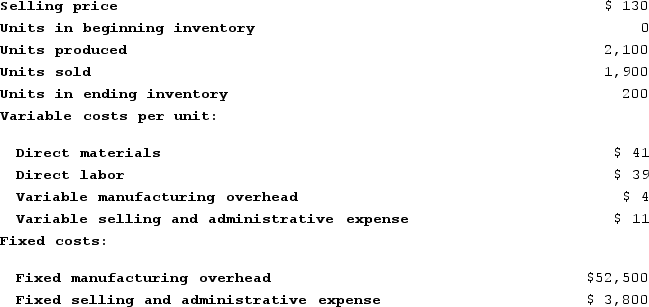

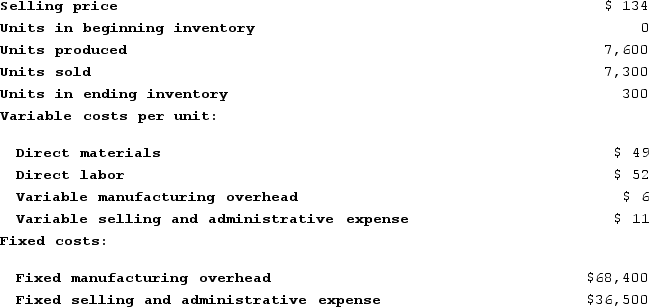

Beamish Incorporated, which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories. The absorption costing unit product cost was:

There were no beginning or ending inventories. The absorption costing unit product cost was:

A) $93 per unit

B) $97 per unit

C) $136 per unit

D) $194 per unit

There were no beginning or ending inventories. The absorption costing unit product cost was:

There were no beginning or ending inventories. The absorption costing unit product cost was:A) $93 per unit

B) $97 per unit

C) $136 per unit

D) $194 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

48

The impact on net operating income of a small change in sales for a segment is best predicted by using:

A) the contribution margin ratio.

B) the segment margin.

C) the ratio of the segment margin to sales.

D) net sales less segment fixed costs.

A) the contribution margin ratio.

B) the segment margin.

C) the ratio of the segment margin to sales.

D) net sales less segment fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

49

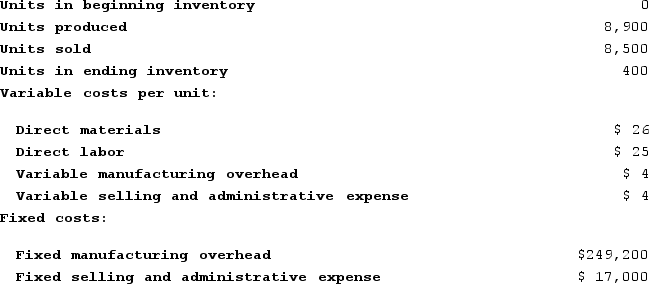

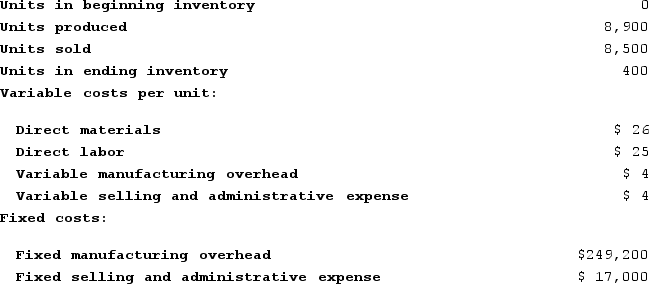

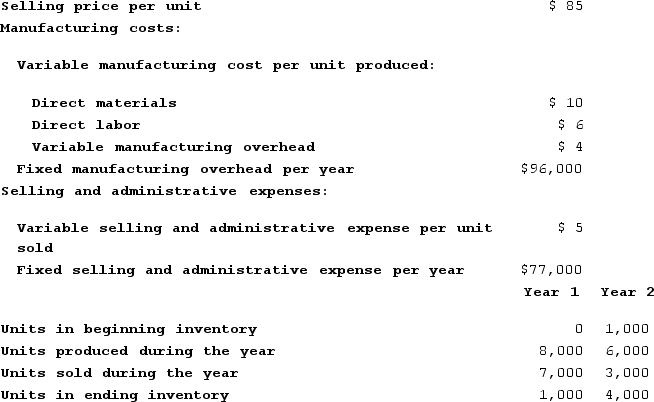

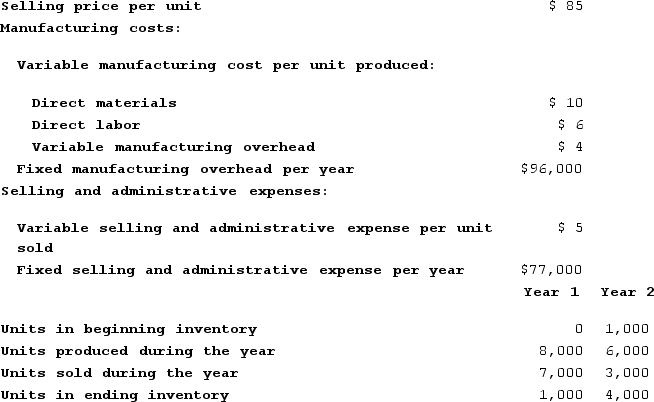

Homeyer Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under absorption costing in Year 1 is closest to:

The net operating income (loss) under absorption costing in Year 1 is closest to:

A) $102,000

B) $30,000

C) $176,000

D) $208,000

The net operating income (loss) under absorption costing in Year 1 is closest to:

The net operating income (loss) under absorption costing in Year 1 is closest to:A) $102,000

B) $30,000

C) $176,000

D) $208,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

50

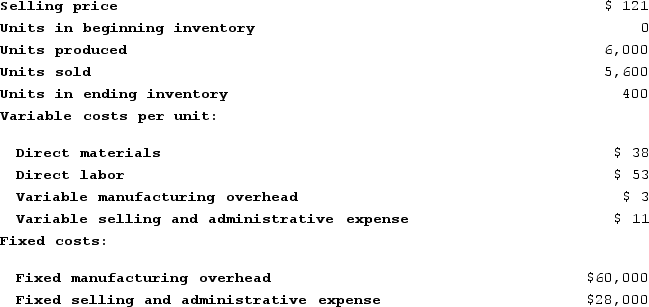

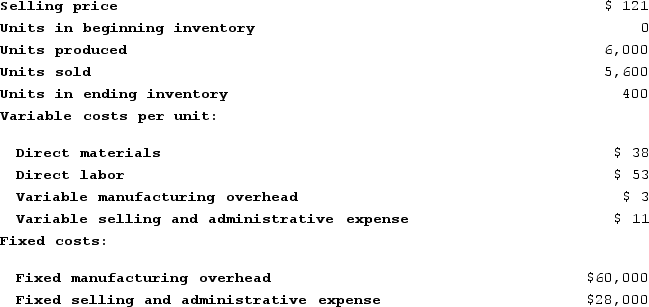

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the variable costing unit product cost for the month?

What is the variable costing unit product cost for the month?

A) $59 per unit

B) $83 per unit

C) $87 per unit

D) $55 per unit

What is the variable costing unit product cost for the month?

What is the variable costing unit product cost for the month?A) $59 per unit

B) $83 per unit

C) $87 per unit

D) $55 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

51

Rhea Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under absorption costing in Year 2 is closest to:

The net operating income (loss) under absorption costing in Year 2 is closest to:

A) $6,000

B) $99,000

C) ($2,000)

D) $71,000

The net operating income (loss) under absorption costing in Year 2 is closest to:

The net operating income (loss) under absorption costing in Year 2 is closest to:A) $6,000

B) $99,000

C) ($2,000)

D) $71,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company produces a single product. Variable production costs are $12.60 per unit and variable selling and administrative expenses are $3.60 per unit. Fixed manufacturing overhead totals $42,000 and fixed selling and administration expenses total $46,000. Assuming a beginning inventory of zero, production of 4,600 units and sales of 3,900 units, the dollar value of the ending inventory under variable costing would be:

A) $8,820

B) $15,120

C) $11,340

D) $6,300

A) $8,820

B) $15,120

C) $11,340

D) $6,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

53

A company produces a single product. Variable production costs are $21 per unit and variable selling and administrative expenses are $4 per unit. Fixed manufacturing overhead totals $30,000 and fixed selling and administration expenses total $36,000. Assuming a beginning inventory of zero, production of 6,000 units and sales of 5,600 units, the dollar value of the ending inventory under variable costing would be:

A) $10,000

B) $8,400

C) $12,000

D) $14,400

A) $10,000

B) $8,400

C) $12,000

D) $14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

54

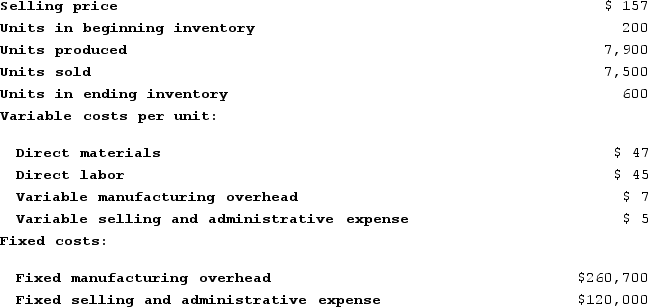

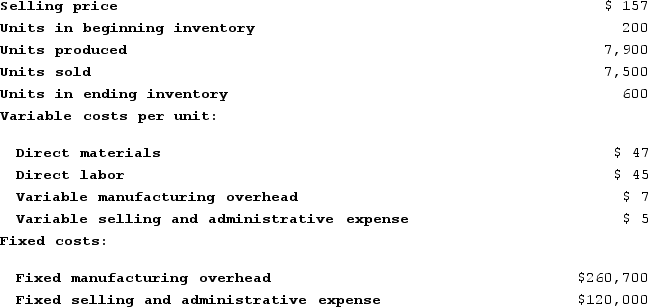

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?

A) $260,700

B) $157,500

C) $380,700

D) $418,200

What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?A) $260,700

B) $157,500

C) $380,700

D) $418,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

55

Higado Confectionery Corporation has a number of store locations throughout North America. In income statements segmented by store, which of the following would be considered a common fixed cost with respect to the stores?

A) store manager salaries

B) store building depreciation expense

C) the cost of corporate advertising aired during the Super Bowl

D) cost of goods sold at each store

A) store manager salaries

B) store building depreciation expense

C) the cost of corporate advertising aired during the Super Bowl

D) cost of goods sold at each store

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

56

Kray Incorporated, which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories. The variable costing unit product cost was:

There were no beginning or ending inventories. The variable costing unit product cost was:

A) $91 per unit

B) $67 per unit

C) $69 per unit

D) $61 per unit

There were no beginning or ending inventories. The variable costing unit product cost was:

There were no beginning or ending inventories. The variable costing unit product cost was:A) $91 per unit

B) $67 per unit

C) $69 per unit

D) $61 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

57

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under absorption costing?

What is the total period cost for the month under absorption costing?

A) $61,200

B) $133,000

C) $34,000

D) $194,200

What is the total period cost for the month under absorption costing?

What is the total period cost for the month under absorption costing?A) $61,200

B) $133,000

C) $34,000

D) $194,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

58

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?

A) $149,600

B) $60,000

C) $88,000

D) $89,600

What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?A) $149,600

B) $60,000

C) $88,000

D) $89,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

59

Kray Incorporated, which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories. The variable costing unit product cost was:

There were no beginning or ending inventories. The variable costing unit product cost was:

A) $145 per unit

B) $66 per unit

C) $70 per unit

D) $62 per unit

There were no beginning or ending inventories. The variable costing unit product cost was:

There were no beginning or ending inventories. The variable costing unit product cost was:A) $145 per unit

B) $66 per unit

C) $70 per unit

D) $62 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

60

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the variable costing unit product cost for the month?

What is the variable costing unit product cost for the month?

A) $170 per unit

B) $191 per unit

C) $147 per unit

D) $149 per unit

What is the variable costing unit product cost for the month?

What is the variable costing unit product cost for the month?A) $170 per unit

B) $191 per unit

C) $147 per unit

D) $149 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following data pertain to last year's operations at Clarkson, Incorporated, a company that produces a single product:  What was the absorption costing net operating income last year?

What was the absorption costing net operating income last year?

A) $44,000

B) $48,000

C) $50,000

D) $49,000

What was the absorption costing net operating income last year?

What was the absorption costing net operating income last year?A) $44,000

B) $48,000

C) $50,000

D) $49,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

62

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:

A) $72,500

B) $95,100

C) $20,000

D) $57,500

The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:A) $72,500

B) $95,100

C) $20,000

D) $57,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

63

Bellue Incorporated manufactures a single product. Variable costing net operating income was $84,700 last year and its inventory decreased by 2,700 units. Fixed manufacturing overhead cost was $3 per unit for both units in beginning and in ending inventory. What was the absorption costing net operating income last year?

A) $8,100

B) $76,600

C) $84,700

D) $87,400

A) $8,100

B) $76,600

C) $84,700

D) $87,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

64

Badoni Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under variable costing in Year 2 is closest to:

The net operating income (loss) under variable costing in Year 2 is closest to:

A) $180,000

B) $195,000

C) $59,000

D) $7,000

The net operating income (loss) under variable costing in Year 2 is closest to:

The net operating income (loss) under variable costing in Year 2 is closest to:A) $180,000

B) $195,000

C) $59,000

D) $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

65

Kaaua Corporation has provided the following data for its two most recent years of operation:  Which of the following statements is true for Year 2?

Which of the following statements is true for Year 2?

A) The amount of fixed manufacturing overhead deferred in inventories is $534,000

B) The amount of fixed manufacturing overhead released from inventories is $78,000

C) The amount of fixed manufacturing overhead released from inventories is $534,000

D) The amount of fixed manufacturing overhead deferred in inventories is $78,000

Which of the following statements is true for Year 2?

Which of the following statements is true for Year 2?A) The amount of fixed manufacturing overhead deferred in inventories is $534,000

B) The amount of fixed manufacturing overhead released from inventories is $78,000

C) The amount of fixed manufacturing overhead released from inventories is $534,000

D) The amount of fixed manufacturing overhead deferred in inventories is $78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

66

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:

A) $71,240

B) $21,920

C) $107,020

D) $117,820

The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:A) $71,240

B) $21,920

C) $107,020

D) $117,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

67

Silver Corporation produces a single product. Last year, the company's variable production costs totaled $7,500 and its fixed manufacturing overhead costs totaled $4,500. The company produced 3,000 units during the year and sold 2,400 units. There were no units in the beginning inventory. Which of the following statements is true?

A) Under variable costing, the units in the ending inventory will be costed at $4.00 each.

B) The net operating income under absorption costing for the year will be $900 lower than the net operating income under variable costing.

C) The ending inventory under variable costing will be $900 lower than the ending inventory under absorption costing.

D) Under absorption costing, the units in ending inventory will be costed at $2.50 each.

A) Under variable costing, the units in the ending inventory will be costed at $4.00 each.

B) The net operating income under absorption costing for the year will be $900 lower than the net operating income under variable costing.

C) The ending inventory under variable costing will be $900 lower than the ending inventory under absorption costing.

D) Under absorption costing, the units in ending inventory will be costed at $2.50 each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

68

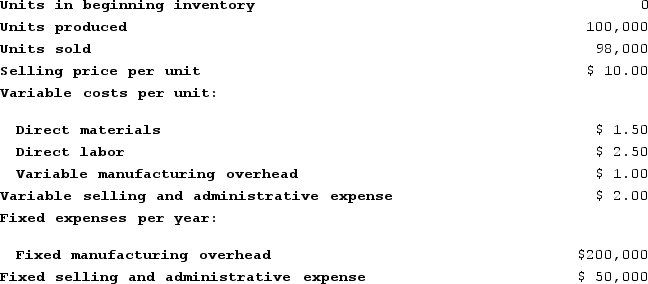

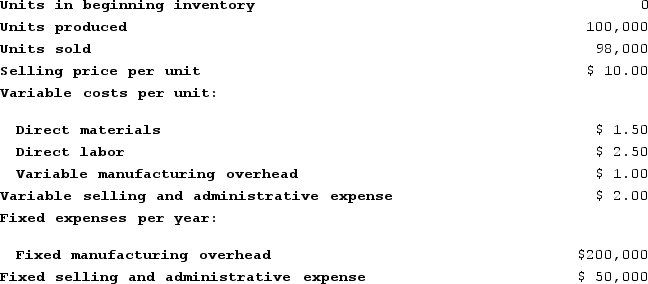

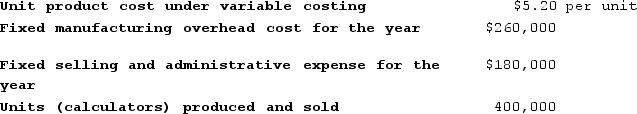

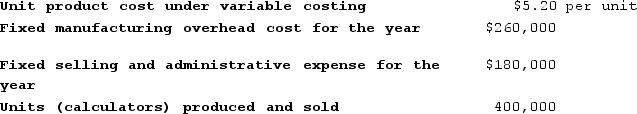

Shun Corporation manufactures and sells a hand held calculator. The following information relates to Shun's operations for last year:  What is Shun's absorption costing unit product cost for last year?

What is Shun's absorption costing unit product cost for last year?

A) $4.10 per unit

B) $4.55 per unit

C) $5.85 per unit

D) $6.30 per unit

What is Shun's absorption costing unit product cost for last year?

What is Shun's absorption costing unit product cost for last year?A) $4.10 per unit

B) $4.55 per unit

C) $5.85 per unit

D) $6.30 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

69

Bellue Incorporated manufactures a single product. Variable costing net operating income was $96,300 last year and its inventory decreased by 2,600 units. Fixed manufacturing overhead cost was $1 per unit for both units in beginning and in ending inventory. What was the absorption costing net operating income last year?

A) $2,600

B) $93,700

C) $96,300

D) $98,900

A) $2,600

B) $93,700

C) $96,300

D) $98,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

70

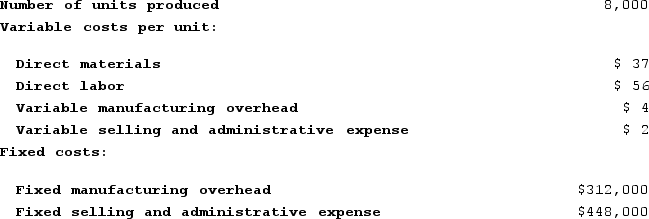

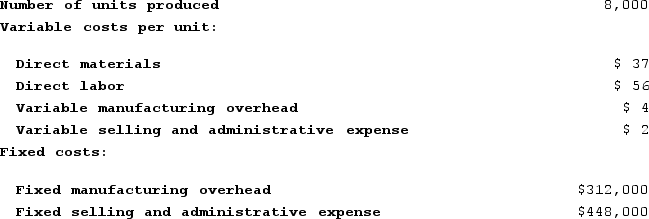

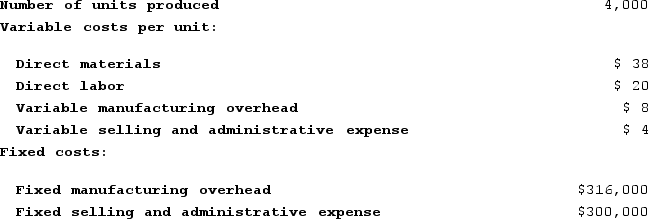

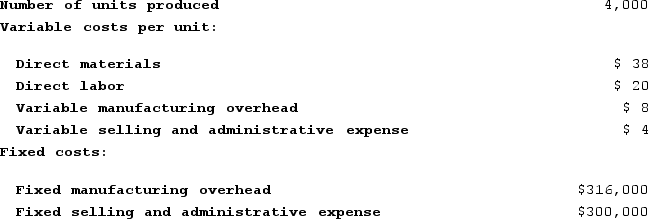

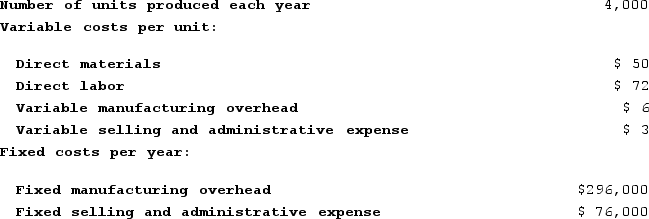

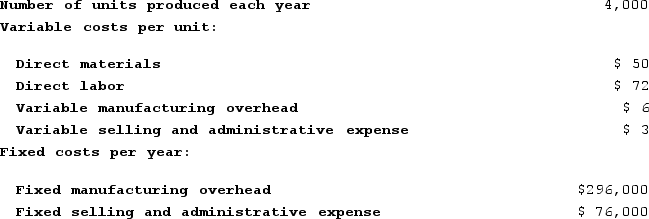

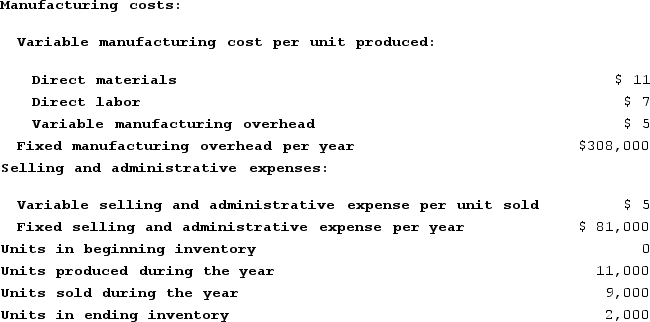

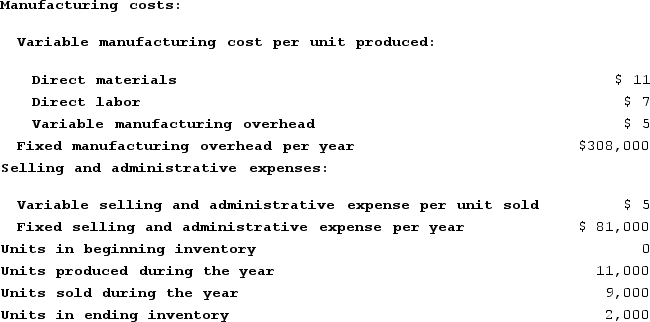

Stoneberger Corporation produces a single product and has the following cost structure:  The variable costing unit product cost is:

The variable costing unit product cost is:

A) $128 per unit

B) $125 per unit

C) $202 per unit

D) $131 per unit

The variable costing unit product cost is:

The variable costing unit product cost is:A) $128 per unit

B) $125 per unit

C) $202 per unit

D) $131 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

71

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the absorption costing unit product cost for the month?

What is the absorption costing unit product cost for the month?

A) $124 per unit

B) $132 per unit

C) $113 per unit

D) $143 per unit

What is the absorption costing unit product cost for the month?

What is the absorption costing unit product cost for the month?A) $124 per unit

B) $132 per unit

C) $113 per unit

D) $143 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company that produces a single product had a net operating income of $65,000 using variable costing and a net operating income of $95,000 using absorption costing. Total fixed manufacturing overhead was $60,000 and production was 10,000 units. This year was the first year of operations. Between the beginning and the end of the year, the inventory level:

A) decreased by 5,000 units

B) increased by 5,000 units

C) decreased by 30,000 units

D) increased by 30,000 units

A) decreased by 5,000 units

B) increased by 5,000 units

C) decreased by 30,000 units

D) increased by 30,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

73

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?

A) $15,200

B) $(6,600)

C) $10,200

D) $5,000

What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?A) $15,200

B) $(6,600)

C) $10,200

D) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company that produces a single product had a net operating income of $82,000 using variable costing and a net operating income of $108,790 using absorption costing. Total fixed manufacturing overhead was $54,570 and production was 10,700 units. This year was the first year of operations. Between the beginning and the end of the year, the inventory level:

A) decreased by 26,790 units

B) increased by 26,790 units

C) decreased by 5,253 units

D) increased by 5,253 units

A) decreased by 26,790 units

B) increased by 26,790 units

C) decreased by 5,253 units

D) increased by 5,253 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

75

Croft Corporation produces a single product. Last year, the company had a net operating income of $93,800 using absorption costing and $81,600 using variable costing. The fixed manufacturing overhead cost was $10 per unit. There were no beginning inventories. If 28,000 units were produced last year, then sales last year were:

A) 15,800 units

B) 26,780 units

C) 29,220 units

D) 40,200 units

A) 15,800 units

B) 26,780 units

C) 29,220 units

D) 40,200 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

76

Bitonti Corporation has provided the following data for its most recent year of operation:  The unit product cost under absorption costing is closest to:

The unit product cost under absorption costing is closest to:

A) $34.00

B) $21.00

C) $13.00

D) $39.00

The unit product cost under absorption costing is closest to:

The unit product cost under absorption costing is closest to:A) $34.00

B) $21.00

C) $13.00

D) $39.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

77

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

A) $11,900

B) $(20,200)

C) $14,600

D) $2,700

What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?A) $11,900

B) $(20,200)

C) $14,600

D) $2,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

78

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total contribution margin for the month under variable costing is:

The total contribution margin for the month under variable costing is:

A) $64,200

B) $249,900

C) $225,400

D) $98,000

The total contribution margin for the month under variable costing is:

The total contribution margin for the month under variable costing is:A) $64,200

B) $249,900

C) $225,400

D) $98,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

79

Simila Corporation has provided the following data for its most recent year of operation:  Which of the following statements is true?

Which of the following statements is true?

A) The amount of fixed manufacturing overhead released from inventories is $459,000

B) The amount of fixed manufacturing overhead deferred in inventories is $56,000

C) The amount of fixed manufacturing overhead released from inventories is $56,000

D) The amount of fixed manufacturing overhead deferred in inventories is $459,000

Which of the following statements is true?

Which of the following statements is true?A) The amount of fixed manufacturing overhead released from inventories is $459,000

B) The amount of fixed manufacturing overhead deferred in inventories is $56,000

C) The amount of fixed manufacturing overhead released from inventories is $56,000

D) The amount of fixed manufacturing overhead deferred in inventories is $459,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck

80

Foggs Corporation has provided the following data for its two most recent years of operation:  The unit product cost under absorption costing in Year 2 is closest to:

The unit product cost under absorption costing in Year 2 is closest to:

A) $40.00

B) $21.00

C) $67.00

D) $61.00

The unit product cost under absorption costing in Year 2 is closest to:

The unit product cost under absorption costing in Year 2 is closest to:A) $40.00

B) $21.00

C) $67.00

D) $61.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 392 في هذه المجموعة.

فتح الحزمة

k this deck