Deck 12: State and Local Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/139

العب

ملء الشاشة (f)

Deck 12: State and Local Taxes

1

Businesses engaged in interstate commerce are subject to income tax in every state in which they operate.

False

2

State tax law is comprised solely of legislative authority.

False

3

The Wayfair decision held that an out-of-state mail-order company did not have sales tax collection responsibility because it lacked physical presence.

False

4

The Wayfair decision reversed the Quill decision, which had affirmed that out-of-state businesses must have physical presence within a state before the state may require the collection of sales taxes from in-state customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

5

The state tax base is computed by making adjustments to federal taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

6

All states employ some combination of sales and use tax, income or franchise tax, or property tax to fund their government operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

7

Nondomiciliary businesses are subject to tax everywhere they do business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

8

Use tax liability accrues in the state where taxable purchased property will be used when the seller of the property is not required to collect sales tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

9

Business income is allocated to the state of commercial domicile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

10

Economic presence always creates sales tax nexus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

11

All 50 states impose a sales and use tax system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

12

Businesses subject to income tax in more than one jurisdiction have the right to apportionment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

13

Purchases of inventory for resale are typically exempt from sales and use taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

14

Businesses must pay income tax in their state of commercial domicile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

15

Wyoming imposes an income tax on corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

16

Businesses must collect sales tax only in states where they have sales tax nexus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

17

Failure by a seller to collect and remit sales taxes often results in a larger tax liability than failure to pay income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

18

The sales and use tax base varies from state to state.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

19

Commercial domicile is the location where a business is headquartered and from whence it directs its operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

20

Many states are either starting to or are in the process of expanding the types of services subject to sales tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

21

Business income includes all income earned in the ordinary course of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

22

Public Law 86-272 was a congressional response to Northwestern States Portland Cement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

23

The throwback rule requires a company, for apportionment purposes, to include all sales of inventory sold into a state without income tax nexus rather than from the state from where the inventory was shipped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

24

Several states are now moving from a strict physical presence test toward an economic presence test for income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Mobil decision identified three factors to determine whether a group of companies are unitary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

26

A state's apportionment formula usually is applied using some variation of sales, payroll, and property factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

27

Most state tax laws adopt the federal tax law as of a specific date in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

28

Sales personnel investigating a potential customer's creditworthiness generally are deemed to exceed protected boundaries of solicitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

29

Immaterial violations of the solicitation rules automatically create income tax nexus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

30

A state's apportionment formula divides nonbusiness income among the states where income tax nexus exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

31

Federal/state adjustments correct for differences between two states' tax laws.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

32

Public Law 86-272 protects certain business activities from creating income tax nexus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Wrigley case held that the sale of intangibles is protected by Public Law 86-272.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

34

In Complete Auto Transit the U.S. Supreme Court determined eight criteria for determining whether a state can tax a nondomiciliary company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

35

Giving samples and promotional materials without charge is a protected solicitation activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

36

The trade show rule allows businesses to maintain a sample room for up to four weeks per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

37

Public Law 86-272 protects only companies selling tangible personal property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

38

A unitary-return group includes only companies included in the federal consolidated tax return filing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

39

Delivery of tangible personal property through common carrier is a protected activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

40

Separate-return states require each member of a consolidated group with income tax nexus to file their own state income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following regarding the state tax base is incorrect?

A) It is computed by making adjustments to federal taxable income.

B) It is divided into business and nonbusiness income.

C) It is a necessary step in the state income tax process.

D) It applies only to interstate businesses.

A) It is computed by making adjustments to federal taxable income.

B) It is divided into business and nonbusiness income.

C) It is a necessary step in the state income tax process.

D) It applies only to interstate businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

42

All of the following are false regarding apportionment except?

A) Applies to only business income.

B) Applies to only nonbusiness income.

C) Applies to both business and nonbusiness income.

D) Investment income is subject to apportionment.

A) Applies to only business income.

B) Applies to only nonbusiness income.

C) Applies to both business and nonbusiness income.

D) Investment income is subject to apportionment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following law types is not a primary authority source?

A) Legislative

B) Administrative

C) Judicial

D) Treatises

A) Legislative

B) Administrative

C) Judicial

D) Treatises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements regarding income tax commercial domicile is incorrect?

A) The location where a business is headquartered.

B) The location where a business is incorporated.

C) The location from which a business directs its operations.

D) None of the choices are correct.

A) The location where a business is headquartered.

B) The location where a business is incorporated.

C) The location from which a business directs its operations.

D) None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

45

In recent years, states are weighting the sales factor because it is easier to calculate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

46

Rental income is allocated to the state of commercial domicile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following sales is likely subject to sales and use tax in a state that assesses a sales and use tax?

A) Tax preparation services

B) Automobiles

C) Inventory

D) Food

A) Tax preparation services

B) Automobiles

C) Inventory

D) Food

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

48

Mighty Manny, Incorporated manufactures ice scrapers and distributes them across the midwestern United States. Mighty Manny is incorporated and headquartered in Michigan. It has product sales to customers in Illinois, Indiana, Michigan, Minnesota, and Wisconsin. It has sales personnel only in the states discussed and all these states have adopted Wayfair legislation. Determine the state in which Mighty Manny does not have sales and nexus given the following scenarios:

A) Mighty Manny is incorporated and headquartered in Michigan. It also has property, employees, sales personnel, and intangibles in Michigan.

B) Mighty Manny has a warehouse in Illinois.

C) Mighty Manny has independent sales representatives in Minnesota that make $150,000 of sales on 100 transactions. The representatives distribute ice scraper-related items for over a dozen companies.

D) Mighty Manny has two customers in Wisconsin. Mighty Manny receives $50,000 on 20 orders over the phone and ships goods to its customers using FedEx.

A) Mighty Manny is incorporated and headquartered in Michigan. It also has property, employees, sales personnel, and intangibles in Michigan.

B) Mighty Manny has a warehouse in Illinois.

C) Mighty Manny has independent sales representatives in Minnesota that make $150,000 of sales on 100 transactions. The representatives distribute ice scraper-related items for over a dozen companies.

D) Mighty Manny has two customers in Wisconsin. Mighty Manny receives $50,000 on 20 orders over the phone and ships goods to its customers using FedEx.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following businesses is likely to have taxable sales for purposes of sales and use tax?

A) Campus bookstore selling textbooks and university apparel.

B) An online retailer of textbooks with less than $100,000 in sales on 150 transactions.

C) A local accounting firm.

D) Mail-order clothing company.

A) Campus bookstore selling textbooks and university apparel.

B) An online retailer of textbooks with less than $100,000 in sales on 150 transactions.

C) A local accounting firm.

D) Mail-order clothing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

50

A gross receipts tax is subject to Public Law 86-272.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

51

The payroll factor includes payments to independent contractors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

52

Most services are sourced to the state where the services were performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is incorrect regarding nondomiciliary businesses?

A) Subject to tax only where income tax nexus exists.

B) A business cannot be nondomiciliary where it is headquartered.

C) A business can be nondomiciliary in only one jurisdiction.

D) Subject to tax only where a sufficient connection exists.

A) Subject to tax only where income tax nexus exists.

B) A business cannot be nondomiciliary where it is headquartered.

C) A business can be nondomiciliary in only one jurisdiction.

D) Subject to tax only where a sufficient connection exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

54

Interest and dividends are allocated to the state of commercial domicile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is not a primary revenue source for most states?

A) Income or franchise taxes

B) Sales or use taxes

C) Severance taxes

D) Property taxes

A) Income or franchise taxes

B) Sales or use taxes

C) Severance taxes

D) Property taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

56

The property factor is generally calculated as being the average of the beginning and ending property values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

57

The annual value of rented property is not included in the property factor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following activities will create sales tax nexus?

A) Advertising using television commercials.

B) Salespeople physically located in a state from which they only take orders.

C) Delivery of sales by UPS.

D) $90,000 of sales on 190 online sales transactions.

A) Advertising using television commercials.

B) Salespeople physically located in a state from which they only take orders.

C) Delivery of sales by UPS.

D) $90,000 of sales on 190 online sales transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

59

Most states have shifted away from an equally weighted three-factor to a heavily weighted sales apportionment formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the items is correct regarding a use tax?

A) Use taxes are imposed by every state.

B) Use taxes only apply when the seller is not required to collect the sales tax.

C) Amazon collects use taxes on behalf of all its resellers.

D) States choose to implement either a sales tax or a use tax but not both.

A) Use taxes are imposed by every state.

B) Use taxes only apply when the seller is not required to collect the sales tax.

C) Amazon collects use taxes on behalf of all its resellers.

D) States choose to implement either a sales tax or a use tax but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

61

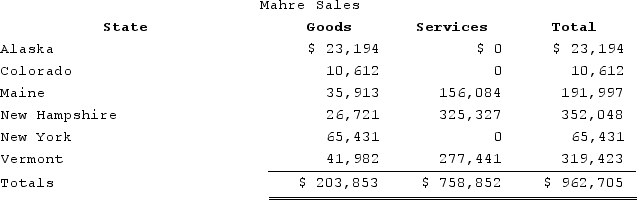

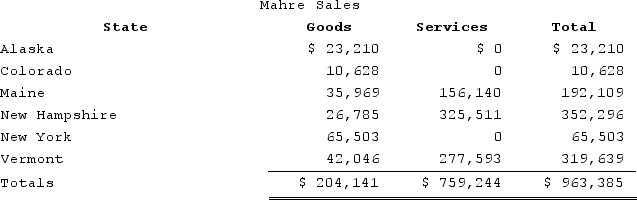

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

A) $10,386

B) $14,543

C) $26,733

D) $61,289

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?A) $10,386

B) $14,543

C) $26,733

D) $61,289

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

62

Bethesda Corporation is unprotected from income tax by Public Law 86-272. Which of the following characteristics likely creates a problem for Bethesda in states other than Maryland?

A) Bethesda does business in Maryland and five other states.

B) Bethesda sells copier equipment and copy center services.

C) All orders are approved in Maryland.

D) All in-state services are limited to solicitation in states other than Maryland.

A) Bethesda does business in Maryland and five other states.

B) Bethesda sells copier equipment and copy center services.

C) All orders are approved in Maryland.

D) All in-state services are limited to solicitation in states other than Maryland.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

63

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $3,100 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence, where she will use the dress. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales tax collection obligation?

A) $0

B) $155 to Virginia

C) $155 sales tax to Virginia and $31 use tax to Maryland

D) $186 to Maryland

A) $0

B) $155 to Virginia

C) $155 sales tax to Virginia and $31 use tax to Maryland

D) $186 to Maryland

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

64

On which of the following transactions should sales tax generally be collected?

A) Architecture plans delivered out of state through the mail.

B) Sales of woolen goods to a state without economic sales tax nexus delivered through common carrier.

C) Accounting services provided in Alaska.

D) Meal purchased at McDonald's.

A) Architecture plans delivered out of state through the mail.

B) Sales of woolen goods to a state without economic sales tax nexus delivered through common carrier.

C) Accounting services provided in Alaska.

D) Meal purchased at McDonald's.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

65

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $1,500 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence, where she will use the dress. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales tax collection obligation?

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

66

Mighty Manny, Incorporated manufactures ice scrapers and distributes them across the midwestern United States. Mighty Manny is incorporated and headquartered in Michigan. It has product sales to customers in Illinois, Indiana, Michigan, Minnesota, Wisconsin, and Wyoming. It has sales personnel only in the states discussed and all these states have adopted Wayfair legislation. Determine the state in which Mighty Manny does not have sales tax nexus given the following scenarios:

A) Mighty Manny has sales personnel that visit Minnesota. These sales employees follow procedures that comply with Public Law 86-272. The orders are received and sent to Michigan for acceptance. The goods are shipped by FedEx into Minnesota.

B) Mighty Manny's trucks drive through Nebraska to deliver goods to Mighty Manny's customers in other states, but the company has no Nebraska sales.

C) Mighty Manny provides design services to another manufacturer located in Wisconsin. While the services are performed in Michigan, Mighty Manny's designers visit Wisconsin at least quarterly to deliver the new designs and receive feedback.

D) Mighty Manny receives online orders from its Illinois client. Because the orders are so large, the goods are delivered weekly on Mighty Manny's trucks.

A) Mighty Manny has sales personnel that visit Minnesota. These sales employees follow procedures that comply with Public Law 86-272. The orders are received and sent to Michigan for acceptance. The goods are shipped by FedEx into Minnesota.

B) Mighty Manny's trucks drive through Nebraska to deliver goods to Mighty Manny's customers in other states, but the company has no Nebraska sales.

C) Mighty Manny provides design services to another manufacturer located in Wisconsin. While the services are performed in Michigan, Mighty Manny's designers visit Wisconsin at least quarterly to deliver the new designs and receive feedback.

D) Mighty Manny receives online orders from its Illinois client. Because the orders are so large, the goods are delivered weekly on Mighty Manny's trucks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

67

Roxy operates a dress shop in Arlington, Virginia. Roxy also ships dresses nationwide upon request. Roxy's Virginia sales are $1,900,000 and out-of-state sales are $218,000. Assuming that Virginia's sales tax rate is 5 percent, what is Roxy's Virginia sales and use tax collection obligation?

A) $0

B) $10,900

C) $95,000

D) $105,900

A) $0

B) $10,900

C) $95,000

D) $105,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following isn't a criterion used to determine whether a unitary relationship exists?

A) Functional integration

B) Centralized management

C) Economies of scale

D) Consolidated return status

A) Functional integration

B) Centralized management

C) Economies of scale

D) Consolidated return status

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

69

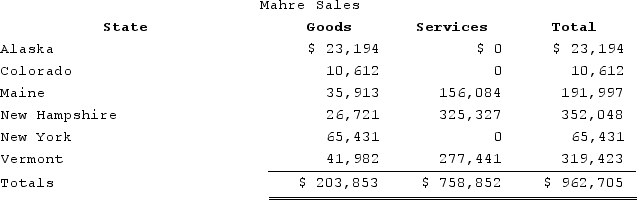

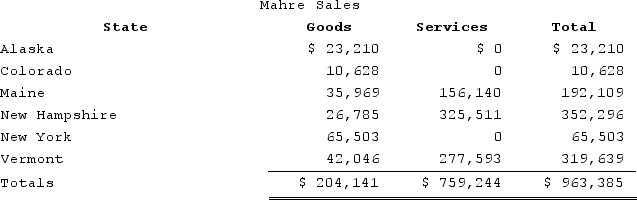

Mahre, Incorporated, a New York corporation, runs ski tours in several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

A) $0

B) $3,053

C) $13,267

D) $16,319

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?A) $0

B) $3,053

C) $13,267

D) $16,319

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following isn't a requirement of Public Law 86-272?

A) The tax is based on net income.

B) The taxpayer sells only tangible personal property.

C) The taxpayer is an intrastate business.

D) The taxpayer is nondomiciliary.

A) The tax is based on net income.

B) The taxpayer sells only tangible personal property.

C) The taxpayer is an intrastate business.

D) The taxpayer is nondomiciliary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

71

Public Law 86-272 protects solicitation from income taxation. Which of the following activities exceeds the solicitation threshold?

A) Any form of advertising.

B) Distribution of samples without charge.

C) Accepting a down payment.

D) Checking a customer's inventory.

A) Any form of advertising.

B) Distribution of samples without charge.

C) Accepting a down payment.

D) Checking a customer's inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

72

What was the Supreme Court's holding in Wayfair?

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reversed the Quill decision that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reversed the Quill decision that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

73

In which of the following state cases did the state not assert economicincome tax nexus?

A) South Dakota with the Wayfair rule.

B) South Carolina in the Geoffrey case.

C) West Virginia in the MBNA case.

D) Wisconsin in Wrigley.

A) South Dakota with the Wayfair rule.

B) South Carolina in the Geoffrey case.

C) West Virginia in the MBNA case.

D) Wisconsin in Wrigley.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

74

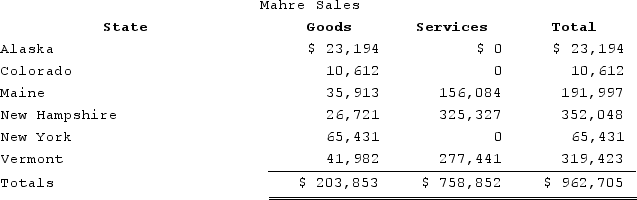

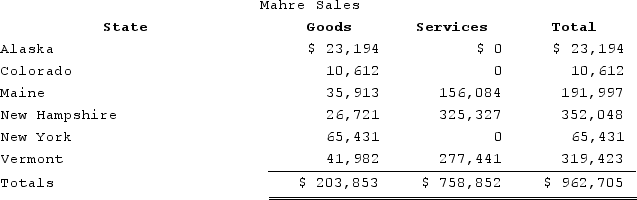

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

A) $10,400

B) $14,470

C) $26,749

D) $61,305

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (0 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?A) $10,400

B) $14,470

C) $26,749

D) $61,305

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

75

Roxy operates a dress shop in Arlington, Virginia. Roxy also ships dresses nationwide upon request. Roxy's Virginia sales are $1,000,000 and out-of-state sales are $200,000. Assuming that Virginia's sales tax rate is 5 percent, what is Roxy's Virginia sales and use tax collection obligation?

A) $0

B) $10,000

C) $50,000

D) $60,000

A) $0

B) $10,000

C) $50,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following is not one of the Complete Auto Transit's criteria for whether a state can tax nondomiciliary companies?

A) Protected activities are exempt.

B) A sufficient connection exists.

C) Only a fair portion of income can be taxed.

D) Tax cannot discriminate against nondomiciliary businesses.

A) Protected activities are exempt.

B) A sufficient connection exists.

C) Only a fair portion of income can be taxed.

D) Tax cannot discriminate against nondomiciliary businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

77

What was the Supreme Court's holding in National Bellas Hess?

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reaffirmed that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

A) An out-of-state mail-order company did not have a sales tax collection responsibility because it lacked physical presence.

B) Reaffirmed that an out-of-state business must have physical presence in the state before the state may require the business to collect sales tax from in-state customers.

C) Spelled out four criteria for determining whether states may subject nondomiciliary companies to an income tax.

D) Defined solicitation for purposes of Public Law 86-272.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

78

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $2,600 dress that is shipped to her Maryland residence using a common carrier. Roxy's total Maryland sales are $33,800 on 15 transactions. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 7 percent, what is Roxy's sales and use tax collection obligation?

A) $0

B) $130 to Virginia

C) $130 sales tax to Virginia and $52 use tax to Maryland

D) $182 to Maryland

A) $0

B) $130 to Virginia

C) $130 sales tax to Virginia and $52 use tax to Maryland

D) $182 to Maryland

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

79

Public Law 86-272 protects a taxpayer from which of the following taxes?

A) Texas Margin Tax (a tax with net income, gross receipts, and capital worth components).

B) Washington Business & Occupation Tax (a gross receipts tax).

C) Ohio Commercial Activity Tax (an excise tax with a gross receipts base).

D) California Franchise Tax (a net income tax).

A) Texas Margin Tax (a tax with net income, gross receipts, and capital worth components).

B) Washington Business & Occupation Tax (a gross receipts tax).

C) Ohio Commercial Activity Tax (an excise tax with a gross receipts base).

D) California Franchise Tax (a net income tax).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

80

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $1,500 dress that is shipped to her Maryland residence using a common carrier. Roxy's total Maryland sales are $20,000 on 15 transactions. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 7 percent, what is Roxy's sales and use tax collection obligation?

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

A) $0

B) $75 to Virginia

C) $75 sales tax to Virginia and $15 use tax to Maryland

D) $90 to Maryland

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck