Deck 10: Dispositions of Partnership Interests and Partnership Distributions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/94

العب

ملء الشاشة (f)

Deck 10: Dispositions of Partnership Interests and Partnership Distributions

1

Under the entity concept, a partnership interest is an intangible asset similar to an ownership interest in a corporation. As such, a partnership interest is generally treated as a capital asset, the disposal of which results in capital gain or loss.

True

2

Operating distributions completely terminate a partner's interest in the partnership.

False

3

Catherine is a 30percent partner in the ACW Partnership, with an outside basis of $20,000. ACW distributes land with a basis of $12,000 and fair value of $18,000 to Catherine in complete liquidation of her interest. Catherine recognizes a capital loss of $2,000 on the distribution.

False

4

A partnership making an operating distribution will recognize gain or loss only when the partner that receives the distribution recognizes gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

5

If the partnership has hot assets at the time a partnership interest is sold, the selling partner must allocate a portion of the sale proceeds to these assets and recognize ordinary income (loss).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

6

When determining a partner's gain onthe sale of partnership interest, the selling partner must include her share of partnership debtrelief in the amount realized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the sale of a partnership interest, a selling partner will recognize ordinary income (rather than capital gain) when the partnership assets include cash and land held for five years as an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

8

A partner that receives cash in an operating distribution recognizes loss if the cash distributed is less than the partner's outside basis in the partnership immediately before the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

9

Hot assets include assets other than cash, capital assets, and §1231 assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

10

Jaime has a basis in her partnership interest of $50,000 when the partnership distributes (in an operating distribution) two parcels of land to Jaime, each valued at $30,000. Prior to the distribution, the partnership's basis in parcel A is $40,000 and the basis in parcel B is $20,000. Jaime allocates $20,000 of basis to parcel A and $30,000 of basis to parcel B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

11

A partner recognizes gain when she receives cash in excess of her outside basis in a liquidating distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

12

A partner that receives cash in an operating distribution recognizes gain if the cash distributed exceeds the partner's outside basis in the partnership immediately before the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

13

The purpose of hot asset rules is to ensure that selling partners recognize all gain or loss on the sale of their partnership interests as capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

14

A partner will recognize a loss from a liquidating distribution when the distribution includes only cash, unrealized receivables, and inventory and the partner's outside basis is less than the sum of the bases of the distributed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

15

Barry has a basis in his partnership interest of $50,000 when the partnership distributes $60,000 in cash to Barry. As a result of the distribution, Barry reduces his basis in the partnership interest to $0, has a $60,000 basis in the cash received, and recognizes a gain of $10,000 on the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

16

Federico is a 30percent partner in the FRM Partnership when he sells his entire interest to Maria for $98,000. At the time of the sale, Federico's basis in FRM is $74,000. FRM does not have any debt. In addition, FRM's assets include accounts receivable with zero tax basis and $21,000 fair market value at the date of the sale. The remaining assets of the partnership are capital and §1231 assets. Federico will recognize ordinary income of $24,000 on the sale of his partnership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

17

Cash distributions include decreases in a partner's share of partnership liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

18

In an operating distribution, when a partnership distributes property other than money with a basis that exceeds the partner's outside basis, the partner assigns a carryover basis to the distributed asset and recognizes a gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

19

Ted is a 30percent partner in the TDW Partnership, with an outside basis of $20,000. TDW distributes $15,000 of cash in complete liquidation of Ted's interest. Ted recognizes a capital loss of $5,000 on the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

20

A partner's debt relief from the sale of a partnership interest will decrease his outside basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under which of the following circumstances will a partner recognize a gain from an operating distribution?

A) A partner will never recognize a gain from an operating distribution.

B) A partner will recognize a gain from an operating distribution when the partnership distributes property other than money with an inside basis greater than the partner's basis in the partnership interest.

C) A partner will recognize a gain from an operating distribution when the partnership distributes money in an amount that is less than the partner's basis in the partnership interest.

D) A partner will recognize a gain from an operating distribution when the partnership distributes money in an amount that is greater than the partner's basis in the partnership interest.

A) A partner will never recognize a gain from an operating distribution.

B) A partner will recognize a gain from an operating distribution when the partnership distributes property other than money with an inside basis greater than the partner's basis in the partnership interest.

C) A partner will recognize a gain from an operating distribution when the partnership distributes money in an amount that is less than the partner's basis in the partnership interest.

D) A partner will recognize a gain from an operating distribution when the partnership distributes money in an amount that is greater than the partner's basis in the partnership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

22

Daniel acquires a 30percent interest in the PPZ Partnership from Paolo, an existing partner, for $39,000 of cash. The PPZ Partnership has borrowed $10,000 of recourse liabilities as of the date Daniel bought the interest. What is Daniel's basis in his partnership interest?

A) $39,000.

B) $42,000.

C) $46,000.

D) $49,000.

A) $39,000.

B) $42,000.

C) $46,000.

D) $49,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

23

Daniel acquires a 30percent interest in the PPZ Partnership from Paolo, an existing partner, for $49,000 of cash. The PPZ Partnership has borrowed $20,000 of recourse liabilities as of the date Daniel bought the interest. What is Daniel's basis in his partnership interest?

A) $49,000.

B) $55,000.

C) $63,000.

D) $69,000.

A) $49,000.

B) $55,000.

C) $63,000.

D) $69,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

24

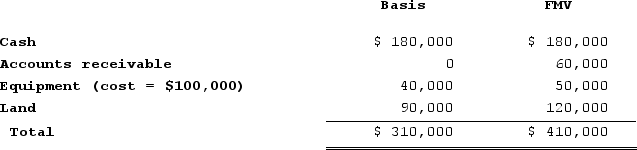

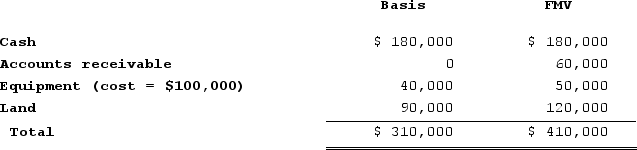

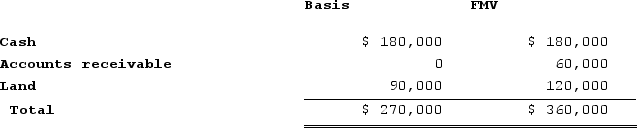

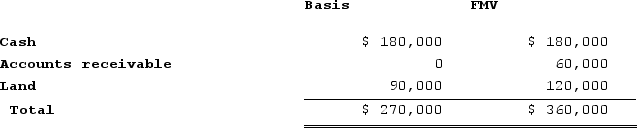

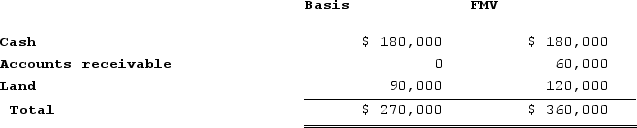

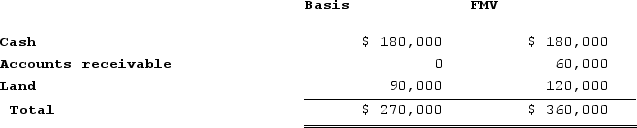

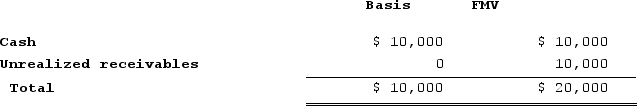

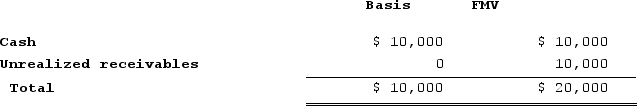

The SSC Partnership, a cash-method partnership, has a balance sheet that includes the following assets on December 31 of the current year:  Which of SSC's assets are considered hot assets under §751(a)?

Which of SSC's assets are considered hot assets under §751(a)?

A) Cash and accounts receivable.

B) Cash and land.

C) Accounts receivable and land.

D) Accounts receivable and inherent recapturein the equipment under §1245.

Which of SSC's assets are considered hot assets under §751(a)?

Which of SSC's assets are considered hot assets under §751(a)?A) Cash and accounts receivable.

B) Cash and land.

C) Accounts receivable and land.

D) Accounts receivable and inherent recapturein the equipment under §1245.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements regarding the sale of a partnership interest is false?

A) The seller's primary tax concern in a partnership interest sale is calculating the amount and character of gain or loss on the sale.

B) The selling partner determines the gain or loss as the difference between the amount realized and her outside basis in the partnership.

C) Hot assets change the character of a gain on the sale from ordinary income to capital gain.

D) Any debt relief increases the amount the partner realizes from the sale.

A) The seller's primary tax concern in a partnership interest sale is calculating the amount and character of gain or loss on the sale.

B) The selling partner determines the gain or loss as the difference between the amount realized and her outside basis in the partnership.

C) Hot assets change the character of a gain on the sale from ordinary income to capital gain.

D) Any debt relief increases the amount the partner realizes from the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

26

Under which of the following circumstances will a partner recognize a loss from an operating distribution?

A) A partner will never recognize a loss from an operating distribution.

B) A partner will recognize a loss from an operating distribution when the partnership distributes property other than money with an inside basis greater than the partner's basis in the partnership interest.

C) A partner will recognize a loss from an operating distribution when the partnership distributes money in an amount that is less than the partner's basis in the partnership interest.

D) A partner will recognize a loss from an operating distribution when the partnership distributes money in an amount that is greater than the partner's basis in the partnership interest.

A) A partner will never recognize a loss from an operating distribution.

B) A partner will recognize a loss from an operating distribution when the partnership distributes property other than money with an inside basis greater than the partner's basis in the partnership interest.

C) A partner will recognize a loss from an operating distribution when the partnership distributes money in an amount that is less than the partner's basis in the partnership interest.

D) A partner will recognize a loss from an operating distribution when the partnership distributes money in an amount that is greater than the partner's basis in the partnership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

27

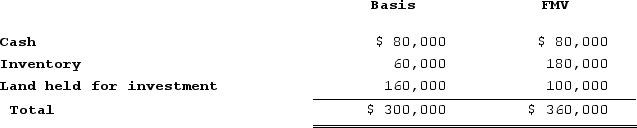

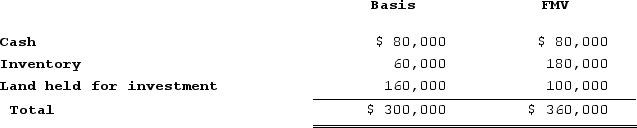

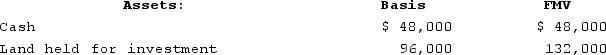

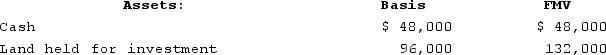

Shauna is a 50 percent partner in the SH Partnership. Shauna sells one-half of her interest to Kara for $60,000 cash. Just before the sale, Shauna's basis in her entire partnership interest is $150,000, including her $60,000 share of the partnership liabilities. SH's assets on the sale date are as follows:  What is the amount and character of Shauna's gain or loss on the sale?

What is the amount and character of Shauna's gain or loss on the sale?

A) $30,000 ordinary incomeand $15,000 capital loss.

B) $45,000 capital gain.

C) $15,000 capital loss.

D) $15,000 ordinary income and $30,000 capital gain.

What is the amount and character of Shauna's gain or loss on the sale?

What is the amount and character of Shauna's gain or loss on the sale?A) $30,000 ordinary incomeand $15,000 capital loss.

B) $45,000 capital gain.

C) $15,000 capital loss.

D) $15,000 ordinary income and $30,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

28

Inventory is substantially appreciated if the fair market value of all inventory items exceeds 100 percent of their basis to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a partner receives more than a proportionate share of hot assets in a distribution, the transaction is treated as though the partnership distributes a proportionate share of cold assets to the partner and then the partner sells some or allof those cold assets back to the partnership at fair market value in exchange for a portion of the hot assets actually received in the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

30

At the end of last year, Cynthia, a 20percent partner in the five-person CYG partnership, has an outside basis of $30,000, including her $15,000 share of CYG debt. On January 1 of the current year, Cynthia sells her partnership interest to Roger for a cash payment of $22,500 and the assumption of her share of CYG's debt. CYG has no hot assets. What is the amount and character of Cynthia's recognized gain or loss on the sale?

A) $7,500 capital loss.

B) $7,500 ordinary loss.

C) $7,500 capital gain.

D) $7,500 ordinary income.

A) $7,500 capital loss.

B) $7,500 ordinary loss.

C) $7,500 capital gain.

D) $7,500 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

31

The SSC, a cash-method partnership, has a balance sheet that includes the following assets on December 31 of the current year:  Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

A) $10,000 capital gain.

B) $10,000 ordinary income.

C) $20,000 ordinary income; $10,000 capital gain.

D) $10,000 capital loss; $20,000 ordinary income.

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $100,000 cash, what is the amount and character of Susan's gain or loss from the sale?A) $10,000 capital gain.

B) $10,000 ordinary income.

C) $20,000 ordinary income; $10,000 capital gain.

D) $10,000 capital loss; $20,000 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

32

Jackson is a 30percent partner in the JJM Partnership when he sells his entire interest to Rhonda for $112,000 cash. At the time of the sale, Jackson's basis in JJM is $64,000. JJM does not have any debt or hot assets. What is Jackson's gain or loss on the sale of his interest?

A) $48,000 capital gain.

B) $48,000 ordinary income.

C) $24,000 capital gain and $24,000 ordinary income.

D) Gain or loss cannot be determined.

A) $48,000 capital gain.

B) $48,000 ordinary income.

C) $24,000 capital gain and $24,000 ordinary income.

D) Gain or loss cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

33

The SSC, a cash-method partnership, has a balance sheetthat includes the following assets on December 31 of the current year:  Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

A) $30,000 ordinary income.

B) $30,000 capital gain.

C) $10,000 ordinary income; $20,000 capital gain.

D) $10,000 capital gain; $20,000 ordinary income.

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?A) $30,000 ordinary income.

B) $30,000 capital gain.

C) $10,000 ordinary income; $20,000 capital gain.

D) $10,000 capital gain; $20,000 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

34

A partner recognizes a loss when she receives cash and other property with inside bases greater than her outside basis in a liquidating distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

35

A disproportionate distribution is a distribution in which the partner's share of the partnership's hot assets either increases or decreases as a result of the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following assets would not be classified as a hot asset?

A) Inventory.

B) Depreciation recapture.

C) Cash.

D) Accounts receivable for a cash-method taxpayer.

A) Inventory.

B) Depreciation recapture.

C) Cash.

D) Accounts receivable for a cash-method taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

37

At the end of last year, Cynthia, a 20percent partner in the five-person CYG partnership, has an outside basis of $23,000, including her $8,500 share of CYG debt. On January 1 of the current year, Cynthia sells her partnership interest to Roger for a cash payment of $16,000 and the assumption of her share of CYG's debt. CYG has no hot assets. What is the amount and character of Cynthia's recognized gain or loss on the sale?

A) $7,000 capital loss.

B) $7,000 ordinary loss.

C) $1,500 capital gain.

D) $7,500 ordinary income.

A) $7,000 capital loss.

B) $7,000 ordinary loss.

C) $1,500 capital gain.

D) $7,500 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

38

In which type of distribution may a partner recognize a loss on the distribution?

A) Operating distributions.

B) Liquidating distributions.

C) Neither operating nor liquidating distributions.

D) Both operating and liquidating distributions.

A) Operating distributions.

B) Liquidating distributions.

C) Neither operating nor liquidating distributions.

D) Both operating and liquidating distributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

39

Sarah is a 50percent partner in the SF Partnership and has an outside basis of $56,000 at the end of the year prior to any distributions. On December 31, Sarah receives a proportionate operating distribution of $20,000 cash. What is the amount and character of Sarah's recognized gain or loss and what is her basis in her partnership interest?

A) $0 gain, $36,000 basis.

B) $0 gain, $56,000 basis.

C) $20,000 ordinary income, $56,000 basis.

D) $20,000 ordinary income, $36,000 basis.

A) $0 gain, $36,000 basis.

B) $0 gain, $56,000 basis.

C) $20,000 ordinary income, $56,000 basis.

D) $20,000 ordinary income, $36,000 basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

40

Martha is a 40percent partner in the MMM Partnership, with an outside basis of $50,000. MMM distributes $40,000 cash and accrual-basis accounts receivable with a basis and fair market value of $20,000. Martha does not recognize gain or loss on the distribution and takes a basis in the cash of $40,000 and a basis in the receivables of $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

41

Randolph is a 30percent partner in the RD Partnership. On January 1, RD distributes $26,000 cash to Randolph in complete liquidation of his interest. RD has only capital assets and no liabilities at the date of the distribution. Randolph's basis in his RD Partnership interest is $37,000. What is the amount and character of Randolph's gain or loss on the distribution?

A) $0 gain or loss.

B) $11,000 capital gain.

C) $11,000 ordinary income.

D) $11,000 capital loss.

A) $0 gain or loss.

B) $11,000 capital gain.

C) $11,000 ordinary income.

D) $11,000 capital loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

42

Under what conditions will a partner recognize a gain in a liquidating distribution?

A) When a partnership distributes only money and the amount of the distribution exceeds the partner's outside basis.

B) When a partnership distributes only money and the amount of the distribution is less than the partner's outside basis.

C) When a partnership distributes money, hot assets, and other property and the amount of the distribution exceeds the partner's outside basis.

D) When a partnership distributes money, hot assets, and other property and the amount of the distribution is less than the partner's outside basis.

A) When a partnership distributes only money and the amount of the distribution exceeds the partner's outside basis.

B) When a partnership distributes only money and the amount of the distribution is less than the partner's outside basis.

C) When a partnership distributes money, hot assets, and other property and the amount of the distribution exceeds the partner's outside basis.

D) When a partnership distributes money, hot assets, and other property and the amount of the distribution is less than the partner's outside basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements is true regarding partnership operating distributions?

A) Partners will never recognize a gain on an operating distribution.

B) Partners receiving a distribution of property other than money will take a basis in the property equal to its fair market value.

C) Partners will never recognize a loss on an operating distribution.

D) None of the statements are true.

A) Partners will never recognize a gain on an operating distribution.

B) Partners receiving a distribution of property other than money will take a basis in the property equal to its fair market value.

C) Partners will never recognize a loss on an operating distribution.

D) None of the statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is true concerning a partner's basis in assets (other than money) distributed in an operating distribution?

A) A partner's bases in the distributed assets will be greater than the partnership's bases in the assets.

B) A partner's bases in the distributed assets will be equal to the partnership's bases in the assets.

C) A partner's bases in the distributed assets will be less than or equal to the partnership's bases in the assets.

D) None of the statements are true.

A) A partner's bases in the distributed assets will be greater than the partnership's bases in the assets.

B) A partner's bases in the distributed assets will be equal to the partnership's bases in the assets.

C) A partner's bases in the distributed assets will be less than or equal to the partnership's bases in the assets.

D) None of the statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

45

Jessica is a 25percent partner in the JRL Partnership. On January 1, JRL distributes $40,000 cash to Jessica. JRL has no hot assets or liabilities at the date of the distribution. Jessica's basis in her JRL partnership interest is $28,000. What is the amount and character of Jessica's gain or loss from the distribution?

A) $0.

B) $12,000 ordinary income.

C) $12,000 capital loss.

D) $12,000 capital gain.

A) $0.

B) $12,000 ordinary income.

C) $12,000 capital loss.

D) $12,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following statements regarding a partner's basis of inventory received in a liquidating distribution is true?

A) Partners may either increase or decrease the basis in inventory distributed in a liquidating distribution.

B) Partners may only increase the basis in inventory distributed in a liquidating distribution.

C) Partners may only decrease the basis in inventory distributed in a liquidating distribution.

D) None of these statements are true.

A) Partners may either increase or decrease the basis in inventory distributed in a liquidating distribution.

B) Partners may only increase the basis in inventory distributed in a liquidating distribution.

C) Partners may only decrease the basis in inventory distributed in a liquidating distribution.

D) None of these statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

47

Kristen and Harrison are equal partners in the KH Partnership. The partners formed the partnership five years ago by contributing cash. Prior to any distributions Harrison has a basis in his partnership interest of $33,000. On December 31, KH makes a proportionate operating distribution of $43,000 cash to Harrison. What is the amount and character of Harrison's recognized gain or loss and what is his remaining basis in KH?

A) $0 gain, $0 basis.

B) $10,000 capital gain, $0 basis.

C) $10,000 capital loss, $0 basis.

D) $10,000 capital gain, $33,000 basis.

A) $0 gain, $0 basis.

B) $10,000 capital gain, $0 basis.

C) $10,000 capital loss, $0 basis.

D) $10,000 capital gain, $33,000 basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements regarding liquidating distributions is true?

A) A partner will recognize a gain when the partnership distributes only money and the amount is greater than the partner's outside basis.

B) A partner will recognize a gain when the partnership distributes only money and hot assets and the inside bases of the distributed assets are greater than the partner's outside basis.

C) A partner will recognize a gain when the partnership distributes money, hot assets, and other property and the inside bases of the distributed assets are greater than the partner's outside basis.

D) A partner will recognize a gain when the partnership distributes only money and the amount is less than the partner's outside basis.

A) A partner will recognize a gain when the partnership distributes only money and the amount is greater than the partner's outside basis.

B) A partner will recognize a gain when the partnership distributes only money and hot assets and the inside bases of the distributed assets are greater than the partner's outside basis.

C) A partner will recognize a gain when the partnership distributes money, hot assets, and other property and the inside bases of the distributed assets are greater than the partner's outside basis.

D) A partner will recognize a gain when the partnership distributes only money and the amount is less than the partner's outside basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

49

Riley is a 50percent partner in the RF Partnership and has an outside basis of $56,000 at the end of the year prior to any distributions. On December 31, Riley receives a proportionate operating distribution of $6,000 cash and a parcel of land with a $14,000 fair value and an $8,000 basis to RF. What is Riley's basis in the distributed property?

A) Cash $6,000, land $0.

B) Cash $6,000, land $8,000.

C) Cash $6,000, land $14,000.

D) Cash $6,000, land $22,000.

A) Cash $6,000, land $0.

B) Cash $6,000, land $8,000.

C) Cash $6,000, land $14,000.

D) Cash $6,000, land $22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

50

Randolph is a 30percent partner in the RD Partnership. On January 1, RD distributes $15,000 cash, an investment with a fair value of $20,000 (inside basis of $10,000), and a parcel of land with a fair value of $10,000 (inside basis of $5,000) to Randolph in complete liquidation of his interest. RD has no liabilities at the date of the distribution. Randolph's basis in his RD Partnership interest is $48,000. What is Randolph's basis in the distributed investment and land?

A) $10,000 investment, $5,000 land.

B) $22,000 investment, $11,000 land.

C) $20,000 investment, $10,000 land.

D) $20,000 investment, $13,000 land.

A) $10,000 investment, $5,000 land.

B) $22,000 investment, $11,000 land.

C) $20,000 investment, $10,000 land.

D) $20,000 investment, $13,000 land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

51

Riley is a 50percent partner in the RF Partnership and has an outside basis of $56,000 at the end of the year prior to any distributions. On December 31, Riley receives a proportionate operating distribution of $6,000 cash and a parcel of land with a $14,000 fair value and an $8,000 basis to RF. What is the amount and character of Riley's recognized gain or loss and what is his basis in his partnership interest?

A) $0 gain, $36,000 basis.

B) $0 gain, $42,000 basis.

C) $0 gain, $50,000 basis.

D) $0 gain, $56,000 basis.

A) $0 gain, $36,000 basis.

B) $0 gain, $42,000 basis.

C) $0 gain, $50,000 basis.

D) $0 gain, $56,000 basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

52

Jenny has a $54,000 basis in her 50percent partnership interest in the JM Partnership before receiving any distributions. This year JM makes a proportionate operating distribution to Jenny of a parcel of land with an $80,000 fair value and a $64,000 basis to JM. The land is encumbered with a $30,000 mortgage (JM's only liability). What is Jenny's basis in the land and her remaining basis in JM after the distribution?

A) $80,000 land basis, $0 JM basis.

B) $64,000 land basis, $0 JM basis.

C) $64,000 land basis, $5,000 JM basis.

D) $80,000 land basis, $5,000 JM basis.

A) $80,000 land basis, $0 JM basis.

B) $64,000 land basis, $0 JM basis.

C) $64,000 land basis, $5,000 JM basis.

D) $80,000 land basis, $5,000 JM basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is true regarding partnership operating distributions?

A) If a partner's outside basis is greater than the bases of the assets distributed in an operating distribution, the partner will recognize a loss.

B) If a partner's outside basis is less than the bases of the assets distributed in an operating distribution, the partner will recognize a loss.

C) If a partner's outside basis is greater than the bases of the assets distributed in an operating distribution, the partner will recognize a gain.

D) None of the statements are true.

A) If a partner's outside basis is greater than the bases of the assets distributed in an operating distribution, the partner will recognize a loss.

B) If a partner's outside basis is less than the bases of the assets distributed in an operating distribution, the partner will recognize a loss.

C) If a partner's outside basis is greater than the bases of the assets distributed in an operating distribution, the partner will recognize a gain.

D) None of the statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

54

Randolph is a 30percent partner in the RD Partnership. On January 1, RD distributes $25,000 cash and inventory with a fair value of $30,400 (inside basis of $15,200) to Randolph in complete liquidation of his interest. RD has no liabilities at the date of the distribution. Randolph's basis in his RD Partnership interest is $43,700. What is the amount and character of Randolph's gain or loss on the distribution?

A) $0 gain or loss.

B) $11,700 capital gain.

C) $11,700 capital loss.

D) $3,500 capital loss.

A) $0 gain or loss.

B) $11,700 capital gain.

C) $11,700 capital loss.

D) $3,500 capital loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

55

Jenny has a $80,100 basis in her 50 percent partnership interest in the JM Partnership before receiving any distributions. This year JM makes a proportionate operating distribution to Jenny of a parcel of land with an $108,000 fair value and a $87,100 basis to JM. The land is encumbered with a $41,550 mortgage (JM's only liability). What is Jenny's basis in the land and her remaining basis in JM after the distribution?

A) $108,000 land basis, $0 JM basis.

B) $87,100 land basis, $0 JM basis.

C) $87,100 land basis, $13,775 JM basis.

D) $108,000 land basis, $13,775 JM basis.

A) $108,000 land basis, $0 JM basis.

B) $87,100 land basis, $0 JM basis.

C) $87,100 land basis, $13,775 JM basis.

D) $108,000 land basis, $13,775 JM basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

56

Marcella has a $65,000 basis in her 50percent partnership interest in the JM Partnership before receiving any distributions. This year JM makes a proportionate operating distribution to Marcella of $10,000 cash and inventory with an $80,000 fair value and a $40,000 basis to JM. What is Marcella's basis in the inventory and her remaining basis in JM after the distribution?

A) $80,000 inventory basis, $0 JM basis.

B) $40,000 inventory basis, $0 JM basis.

C) $40,000 inventory basis, $15,000 JM basis.

D) $80,000 inventory basis, $15,000 JM basis.

A) $80,000 inventory basis, $0 JM basis.

B) $40,000 inventory basis, $0 JM basis.

C) $40,000 inventory basis, $15,000 JM basis.

D) $80,000 inventory basis, $15,000 JM basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements is false concerning partnership liquidating distributions?

A) A partner who receives a liquidating distribution can retain an interest in the partnership.

B) A partnership agreement may restrict the sale of a partnership, making a liquidating distribution the only way a partner can close out his interest in the partnership.

C) Liquidating a single partner's interest is similar in concept to a corporate redemption of a shareholder's interest.

D) None of these statements are false.

A) A partner who receives a liquidating distribution can retain an interest in the partnership.

B) A partnership agreement may restrict the sale of a partnership, making a liquidating distribution the only way a partner can close out his interest in the partnership.

C) Liquidating a single partner's interest is similar in concept to a corporate redemption of a shareholder's interest.

D) None of these statements are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

58

Kristen and Harrison are equal partners in the KH Partnership. The partners formed the partnership five years ago by contributing cash. Prior to any distributions Harrison has a basis in his partnership interest of $44,000. On December 31, KH makes a proportionate operating distribution of $50,000 cash to Harrison. What is the amount and character of Harrison's recognized gain or loss and what is his remaining basis in KH?

A) $0 gain, $0 basis.

B) $6,000 capital gain, $0 basis.

C) $6,000 capital loss, $0 basis.

D) $6,000 capital gain, $44,000 basis.

A) $0 gain, $0 basis.

B) $6,000 capital gain, $0 basis.

C) $6,000 capital loss, $0 basis.

D) $6,000 capital gain, $44,000 basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

59

Randolph is a 30percent partner in the RD Partnership. On January 1, RD distributes $15,000 cash, inventory with a fair value of $20,000 (inside basis of $10,000), and a parcel of land with a fair value of $10,000 (inside basis of $5,000) to Randolph in complete liquidation of his interest. RD has no liabilities at the date of the distribution. Randolph's basis in his RD Partnership interest is $37,000. What is Randolph's basis in the distributed inventory and land?

A) $10,000 inventory, $10,000 land.

B) $10,000 inventory, $5,000 land.

C) $20,000 inventory, $10,000 land.

D) $10,000 inventory, $12,000 land.

A) $10,000 inventory, $10,000 land.

B) $10,000 inventory, $5,000 land.

C) $20,000 inventory, $10,000 land.

D) $10,000 inventory, $12,000 land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

60

Randolph is a 30percent partner in the RD Partnership. On January 1, RD distributes $15,000 cash and inventory with a fair value of $20,000 (inside basis of $10,000) to Randolph in complete liquidation of his interest. RD has no liabilities at the date of the distribution. Randolph's basis in his RD Partnership interest is $27,000. What is the amount and character of Randolph's gain or loss on the distribution?

A) $0 gain or loss.

B) $8,000 capital gain.

C) $8,000 capital loss.

D) $2,000 capital loss.

A) $0 gain or loss.

B) $8,000 capital gain.

C) $8,000 capital loss.

D) $2,000 capital loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

61

Daniela is a 25percent partner in the JRD Partnership. On January 1, JRD makes a proportionate distribution of $16,000 cash, inventory with a $16,000 fair value (inside basis $8,000), and accounts receivable with a fair value of $8,000 (inside basis of $0) to Daniela. JRD has no liabilities at the date of the distribution. Daniela's basis in her JRD Partnership interest is $21,000. What is Daniela's basis in the distributed inventory and accounts receivable?

A) $8,000 inventory, $0 accounts receivable.

B) $6,000 inventory, $1,000 accounts receivable.

C) $5,000 inventory, $0 accounts receivable.

D) $16,000 inventory, $8,000 accounts receivable.

A) $8,000 inventory, $0 accounts receivable.

B) $6,000 inventory, $1,000 accounts receivable.

C) $5,000 inventory, $0 accounts receivable.

D) $16,000 inventory, $8,000 accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements regarding disproportionate distributions is false?

A) A disproportionate distribution occurs when a partner receives more than his proportionate share of the partnership's hot assets.

B) A disproportionate distribution occurs when a partner receives less than his proportionate share of the partnership's hot assets.

C) The tax provisions related to disproportionate distributions attempt to preserve the partners' share of ordinary income potential.

D) Disproportionate distributions will only occur in liquidating distributions.

A) A disproportionate distribution occurs when a partner receives more than his proportionate share of the partnership's hot assets.

B) A disproportionate distribution occurs when a partner receives less than his proportionate share of the partnership's hot assets.

C) The tax provisions related to disproportionate distributions attempt to preserve the partners' share of ordinary income potential.

D) Disproportionate distributions will only occur in liquidating distributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

63

Tyson is a 25percent partner in the KT Partnership. On January 1, KT makes a proportionate distribution of $16,000 cash and land with a $16,000 fair value (inside basis $8,000) to Tyson. KT has no liabilities at the date of the distribution. Tyson's basis in his KT Partnership interest is $20,000. What is Tyson's basis in the distributed land?

A) $0.

B) $4,000.

C) $8,000.

D) $16,000.

A) $0.

B) $4,000.

C) $8,000.

D) $16,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is false concerning special basis adjustments under Section 754?

A) Special basis adjustments are intended to eliminate discrepancies between inside and outside bases.

B) Special basis adjustments are an annual election made by the partnership.

C) Special basis adjustments can occur when a new investor purchases a partnership interest.

D) Special basis adjustments can occur when a partner recognizes a gain or loss from a distribution.

A) Special basis adjustments are intended to eliminate discrepancies between inside and outside bases.

B) Special basis adjustments are an annual election made by the partnership.

C) Special basis adjustments can occur when a new investor purchases a partnership interest.

D) Special basis adjustments can occur when a partner recognizes a gain or loss from a distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

65

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

A) $0.

B) $36,000.

C) $12,000.

D) None of the choices are correct.

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?A) $0.

B) $36,000.

C) $12,000.

D) None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following statements regarding hot assets for purposes of disproportionate distributions is false?

A) Hot assets include unrealized receivables.

B) Hot assets include any inventory.

C) Hot assets include substantially appreciated inventory.

D) The definition of hot assets for distributions and sales of partnership interests differs.

A) Hot assets include unrealized receivables.

B) Hot assets include any inventory.

C) Hot assets include substantially appreciated inventory.

D) The definition of hot assets for distributions and sales of partnership interests differs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

67

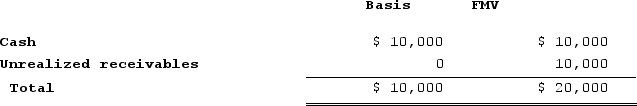

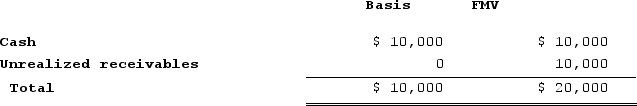

The PW Partnership's balance sheet includes the following assets immediately before it liquidates:  In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Pamela's recognized gain or loss?

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Pamela's recognized gain or loss?

A) $0.

B) $5,000 capital gain.

C) $5,000 ordinary income.

D) $2,500 capital gain and $2,500 ordinary income.

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Pamela's recognized gain or loss?

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Pamela's recognized gain or loss?A) $0.

B) $5,000 capital gain.

C) $5,000 ordinary income.

D) $2,500 capital gain and $2,500 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

68

Kathy is a 25percent partner in the KDP Partnership and receives $120,000 cash in complete liquidation of her partnership interest. Kathy's outside basis immediately before the distribution is $160,000. KDP currently has a §754 election in effect and has no hot assets or liabilities. Which of the following statements is true?

A) KDP will increase the basis of its assets by $40,000 and Kathy will recognize a $40,000 loss on the distribution.

B) KDP will increase the basis of its assets by $40,000 and Kathy will recognize a $40,000 gain on the distribution.

C) KDP will decrease the basis of its assets by $40,000 and Kathy will recognize a $40,000 loss on the distribution.

D) KDP will decrease the basis of its assets by $40,000 and Kathy will recognize a $40,000 gain on the distribution.

A) KDP will increase the basis of its assets by $40,000 and Kathy will recognize a $40,000 loss on the distribution.

B) KDP will increase the basis of its assets by $40,000 and Kathy will recognize a $40,000 gain on the distribution.

C) KDP will decrease the basis of its assets by $40,000 and Kathy will recognize a $40,000 loss on the distribution.

D) KDP will decrease the basis of its assets by $40,000 and Kathy will recognize a $40,000 gain on the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

69

Tyson is a 25percent partner in the KT Partnership. On January 1, KT makes a proportionate distribution of $16,000 cash, inventory with a $16,000 fair value (inside basis $8,000), and land with a fair value of $8,000 (inside basis of $12,000) to Tyson. KT has no liabilities at the date of the distribution. Tyson's basis in his KT Partnership interest is $24,000. What is Tyson's basis in the distributed inventory and land?

A) $8,000 inventory, $12,000 land.

B) $16,000 inventory, $8,000 land.

C) $0 inventory, $8,000 land.

D) $8,000 inventory, $0 land.

A) $8,000 inventory, $12,000 land.

B) $16,000 inventory, $8,000 land.

C) $0 inventory, $8,000 land.

D) $8,000 inventory, $0 land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

70

Tyson is a 25percent partner in the KT Partnership. On January 1, KT makes a proportionate, liquidating distribution of $16,000 cash and land with a $16,000 fair value (inside basis $8,000) to Tyson. KT has no liabilities at the date of the distribution. Tyson's basis in his KT Partnership interest is $20,000. What is the amount and character of Tyson's gain or loss from the distribution?

A) $0.

B) $4,000 capital gain.

C) $12,000 ordinary income.

D) $12,000 capital gain.

A) $0.

B) $4,000 capital gain.

C) $12,000 ordinary income.

D) $12,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

71

Kathy is a 25percent partner in the KDP Partnership and receives a parcel of land with a fair value of $156,000 (inside basis of $112,000) in complete liquidation of her partnership interest. Kathy's outside basis immediately before the distribution is $206,000. KDP currently has a §754 election in effect and has no hot assets or liabilities. What is KDP's special basis adjustment from the distribution?

A) $0.

B) $44,000 positive basis adjustment.

C) $94,000 positive basis adjustment.

D) $94,000 negative basis adjustment.

A) $0.

B) $44,000 positive basis adjustment.

C) $94,000 positive basis adjustment.

D) $94,000 negative basis adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

72

Daniela is a 25percent partner in the JRD Partnership. On January 1, JRD makes a proportionate liquidating distribution of $20,000 cash and inventory with a $15,000 fair value (inside basis $5,000) to Daniela. JRD has no liabilities at the date of the distribution. Daniela's basis in her JRD Partnership interest is $21,000. What is the amount and character of Daniela's gain or loss from the distribution?

A) $0.

B) $14,000 ordinary income.

C) $4,000 capital loss.

D) $4,000 capital gain.

A) $0.

B) $14,000 ordinary income.

C) $4,000 capital loss.

D) $4,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

73

The PW Partnership';s balance sheet includes the following assets immediately before it liquidates:  In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

A) $0.

B) $5,000 capital gain.

C) $5,000 ordinary income.

D) $2,500 capital gain and $2,500 ordinary income.

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners). Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?A) $0.

B) $5,000 capital gain.

C) $5,000 ordinary income.

D) $2,500 capital gain and $2,500 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

74

Brian is a 25percent partner in the BC Partnership. On January 1, BC distributes $20,000 cash and land with a $16,000 fair value (inside basis $8,000) to Brian. BC has no liabilities at the date of the distribution. Brian's basis in his BC Partnership interest is $16,000. What is the amount and character of Brian's gain or loss on the distribution?

A) $0.

B) $4,000 capital gain.

C) $12,000 capital gain.

D) $20,000 capital gain.

A) $0.

B) $4,000 capital gain.

C) $12,000 capital gain.

D) $20,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

75

Daniela is a 25percent partner in the JRD Partnership. On January 1, JRD makes a proportionate, liquidating distribution of $16,000 cash, inventory with a $16,000 fair value (inside basis $8,000), and accounts receivable with a fair value of $8,000 (inside basis of $12,000) to Daniela. JRD has no liabilities at the date of the distribution. Daniela's basis in her JRD Partnership interest is $20,000. What is the amount and character of Daniela's gain or loss from the distribution?

A) $0.

B) $16,000 ordinary income.

C) $16,000 capital gain.

D) $20,000 capital gain.

A) $0.

B) $16,000 ordinary income.

C) $16,000 capital gain.

D) $20,000 capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

76

Tyson is a 25percent partner in the KT Partnership. On January 1, KT makes a proportionate distribution of $16,000 cash, inventory with a $10,000 fair value (inside basis $4,000), land A with a fair value of $8,000 (inside basis of $12,000), and land B with a fair value of $6,000 (inside basis of $4,000) to Tyson. KT has no liabilities at the date of the distribution. Tyson's basis in his KT Partnership interest is $23,000. What is Tyson's basis in the distributed inventory, land A, and land B?

A) $10,000 inventory, $8,000 land A, $6,000 land B.

B) $4,000 inventory, $12,000 land A, $4,000 land B.

C) $0 inventory, $2,857 land A, $143 land B.

D) $4,000 inventory, $2,000 land A, $1,000 land B.

A) $10,000 inventory, $8,000 land A, $6,000 land B.

B) $4,000 inventory, $12,000 land A, $4,000 land B.

C) $0 inventory, $2,857 land A, $143 land B.

D) $4,000 inventory, $2,000 land A, $1,000 land B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

77

Kathy is a 25percent partner in the KDP Partnership and receives a parcel of land with a fair value of $150,000 (inside basis of $100,000) in complete liquidation of her partnership interest. Kathy's outside basis immediately before the distribution is $200,000. KDP currently has a §754 election in effect and has no hot assets or liabilities. What is KDP's special basis adjustment from the distribution?

A) $0.

B) $50,000 positive basis adjustment.

C) $100,000 positive basis adjustment.

D) $100,000 negative basis adjustment.

A) $0.

B) $50,000 positive basis adjustment.

C) $100,000 positive basis adjustment.

D) $100,000 negative basis adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

78

Daniela is a 25percent partner in the JRD Partnership. On January 1, JRD makes a proportionate distribution of $25,000 cash, inventory with a $17,400 fair value (inside basis $8,700), and accounts receivable with a fair value of $8,700 (inside basis of $13,050) to Daniela. JRD has no liabilities at the date of the distribution. Daniela's basis in her JRD Partnership interest is $28,050. What is Daniela's basis in the distributed inventory and accounts receivable?

A) $1,525 inventory, $1,525 accounts receivable.

B) $8,700 inventory, $13,050 accounts receivable.

C) $0 inventory, $4,350 accounts receivable.

D) $17,400 inventory, $8,700 accounts receivable.

A) $1,525 inventory, $1,525 accounts receivable.

B) $8,700 inventory, $13,050 accounts receivable.

C) $0 inventory, $4,350 accounts receivable.

D) $17,400 inventory, $8,700 accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

79

Daniela is a 25percent partner in the JRD Partnership. On January 1, JRD makes a proportionate distribution of $16,000 cash, inventory with a $16,000 fair value (inside basis $8,000), and accounts receivable with a fair value of $8,000 (inside basis of $12,000) to Daniela. JRD has no liabilities at the date of the distribution. Daniela's basis in her JRD Partnership interest is $20,000. What is Daniela's basis in the distributed inventory and accounts receivable?

A) $2,000 inventory, $2,000 accounts receivable.

B) $8,000 inventory, $12,000 accounts receivable.

C) $0 inventory, $4,000 accounts receivable.

D) $16,000 inventory, $8,000 accounts receivable.

A) $2,000 inventory, $2,000 accounts receivable.

B) $8,000 inventory, $12,000 accounts receivable.

C) $0 inventory, $4,000 accounts receivable.

D) $16,000 inventory, $8,000 accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

80

Kathy is a 25percent partner in the KDP Partnership and receives $129,000 cash in complete liquidation of her partnership interest. Kathy's outside basis immediately before the distribution is $151,000. KDP currently has a §754 election in effect and has no hot assets or liabilities. Which of the following statements is true?

A) KDP will increase the basis of its assets by $22,000 and Kathy will recognize a $22,000 loss on the distribution.

B) KDP will increase the basis of its assets by $22,000 and Kathy will recognize a $22,000 gain on the distribution.

C) KDP will decrease the basis of its assets by $22,000 and Kathy will recognize a $22,000 loss on the distribution.

D) KDP will decrease the basis of its assets by $22,000 and Kathy will recognize a $22,000 gain on the distribution.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

84) Joan is a one-third partner in the PDJ Partnership. PDJ Partnership uses the proration method to allocate income and losses to partners with varying interests. On May 1, Joan sells her interest to Freddie for a cash payment of $75,000. On January 1, Joan's basis in PDJ is $57,000. PDJ generates $60,000 of ordinary income and $9,000 of tax-exempt income during the first four months of the year. PDJ has the following assets and no liabilities at the sale date:

What is the amount and character of Joan's gain or loss on the sale?

What is the amount and character of Joan's gain or loss on the sale?

A) KDP will increase the basis of its assets by $22,000 and Kathy will recognize a $22,000 loss on the distribution.

B) KDP will increase the basis of its assets by $22,000 and Kathy will recognize a $22,000 gain on the distribution.

C) KDP will decrease the basis of its assets by $22,000 and Kathy will recognize a $22,000 loss on the distribution.

D) KDP will decrease the basis of its assets by $22,000 and Kathy will recognize a $22,000 gain on the distribution.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

84) Joan is a one-third partner in the PDJ Partnership. PDJ Partnership uses the proration method to allocate income and losses to partners with varying interests. On May 1, Joan sells her interest to Freddie for a cash payment of $75,000. On January 1, Joan's basis in PDJ is $57,000. PDJ generates $60,000 of ordinary income and $9,000 of tax-exempt income during the first four months of the year. PDJ has the following assets and no liabilities at the sale date:

What is the amount and character of Joan's gain or loss on the sale?

What is the amount and character of Joan's gain or loss on the sale?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck