Deck 15: Income Inequality and Poverty

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/14

العب

ملء الشاشة (f)

Deck 15: Income Inequality and Poverty

1

Do you think the current distribution of income in the United States is too unequal? Why or why not? What criteria do you think should be used to judge the fairness of the distribution of income? Is the final outcome more important than the process that generates the income?

The presence of income inequality in the U.S. does not mean that the distribution of income is too unequal.

Income inequality is a natural consequence of the market process. Market process allocates income on the basis of existing differences in the level of skills, talent, education, preferences, nature of family, family size, and so on.

Therefore, to judge income inequality solely on the basis of outcome would be unfair. Rather, along with the outcome, the market process also needs to be considered to determine whether the income distribution is too equal or too unequal.

The criteria to judge whether the distribution of income is fair or not, both the outcome and the process should be considered. The process criteria determine what needs to be changed with the existing system and the outcome criteria determine the magnitude of the income distribution and why such outcome resulted. The analysis of both the criteria provides a way out, but not the surest way, to determine what should or could be the policies to redistribute income in an effective way.

Neither the final outcome nor the process is more important. Rather both are important and relevant to the issue of the fairness of the distribution of income.

Income inequality is a natural consequence of the market process. Market process allocates income on the basis of existing differences in the level of skills, talent, education, preferences, nature of family, family size, and so on.

Therefore, to judge income inequality solely on the basis of outcome would be unfair. Rather, along with the outcome, the market process also needs to be considered to determine whether the income distribution is too equal or too unequal.

The criteria to judge whether the distribution of income is fair or not, both the outcome and the process should be considered. The process criteria determine what needs to be changed with the existing system and the outcome criteria determine the magnitude of the income distribution and why such outcome resulted. The analysis of both the criteria provides a way out, but not the surest way, to determine what should or could be the policies to redistribute income in an effective way.

Neither the final outcome nor the process is more important. Rather both are important and relevant to the issue of the fairness of the distribution of income.

2

*Is annual money income a good measure of economic status? Is a family with an $80,000 annual income able to purchase twice the quantity of goods and services as a family with $40,000 of annual income? Is the standard of living of the $80,000 family twice as high as that of the $40,000 family? Discuss.

Annual monetary income cannot serve as a yardstick for determining economic status. Economic status of a person depends upon other factors, as well; namely, non-monetary income, size of family, amount of taxes paid, cost of living, and so on. If these factors are taken into account, the annual income as a measure of economic status becomes less effective.

High-earning individuals generally have less non-monetary income, have larger family, pay relatively more taxes, and they have a higher cost of living. Thus monetary income cannot be a true measure for comparing the standard of living or economic status of high-income and low-income groups.

High-earning individuals generally have less non-monetary income, have larger family, pay relatively more taxes, and they have a higher cost of living. Thus monetary income cannot be a true measure for comparing the standard of living or economic status of high-income and low-income groups.

3

What is income mobility? If there is substantial income mobility in a society, how does this influence the importance of income distribution data?

Income mobility or inter-generational mobility refers to the changes in income-distribution rankings due to the movement of families and individuals up and down the income ladder over a period of time.

Economists have established that income mobility affects income distribution, although the correlation between the two is a weak positive one. When the income mobility becomes substantial, then the importance of income distribution data becomes irrelevant and misleading. This is because data on income distribution does not capture such movements effectively as they provide income distribution only on the basis of the annual money income.

Economists have established that income mobility affects income distribution, although the correlation between the two is a weak positive one. When the income mobility becomes substantial, then the importance of income distribution data becomes irrelevant and misleading. This is because data on income distribution does not capture such movements effectively as they provide income distribution only on the basis of the annual money income.

4

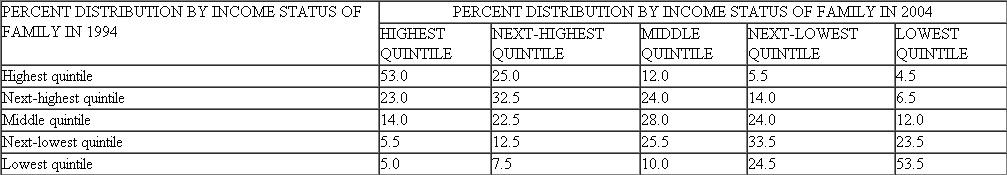

*Consider a table such as Exhibit in which the family income of parents is grouped by quintiles down the first column, and that of their offspring is grouped by quintiles across the other columns. If there were no intergenerational mobility in this country, what pattern of numbers would appear in the table? If the nation had attained complete equality of opportunity, what pattern of numbers would emerge? Explain.

Exhibit

Income Mobility-Income Ranking, 1994 and 2004

Source: Katherine Bradbury and Jane Katz, Federal Reserve Bank of Boston (http://www.bos.frb.org/economic/dynamicdata/module2/index.htm).

Source: Katherine Bradbury and Jane Katz, Federal Reserve Bank of Boston (http://www.bos.frb.org/economic/dynamicdata/module2/index.htm).

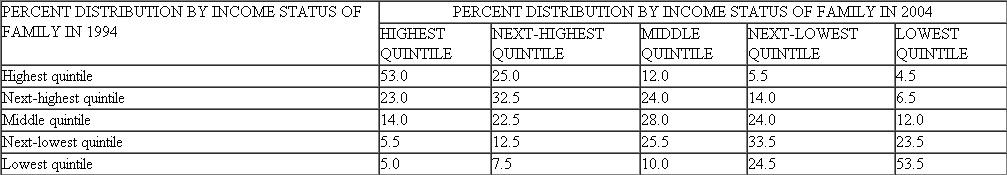

Exhibit

Income Mobility-Income Ranking, 1994 and 2004

Source: Katherine Bradbury and Jane Katz, Federal Reserve Bank of Boston (http://www.bos.frb.org/economic/dynamicdata/module2/index.htm).

Source: Katherine Bradbury and Jane Katz, Federal Reserve Bank of Boston (http://www.bos.frb.org/economic/dynamicdata/module2/index.htm).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

5

Do individuals have a property right to income they acquire from market transactions? Is it a proper function of government to tax some people in order to provide benefits to others? Why or why not? Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

6

*Because income transfers to the poor typically increase the implicit marginal tax rate they confront, does a $1,000 transfer payment necessarily increase the income of poor recipients by $1,000? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

7

*Sue is a single parent with two children. She is considering a part-time job that pays $800 per month. She is currently drawing monthly cash benefits of $300, food stamp benefits of $100, and Medicaid benefits valued at $80. If she accepts the job, she will be liable for employment taxes of $56 per month and lose all transfer benefits. What is Sue's implicit marginal tax rate for this job?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

8

What groups are overrepresented among those with relatively low incomes? Do the poor in the United States generally stay poor? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

9

Some people argue that taxes exert little effect on people's incentive to earn income. Suppose you were required to pay a tax rate of 50 percent on all money income you earn while in school. Would this affect your employment? How might you minimize the personal effects of this tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

10

Large income transfers are targeted toward the elderly, farmers, and the unemployed, regardless of their economic condition. Why do you think this is so? Do you think there would be less income inequality if the government levied higher taxes in order to make larger income transfers? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

11

The outcome of a state lottery game is certainly a very unequal distribution of the prize income. Some players are made very rich, whereas others lose their money. Using this example, discuss whether the fairness of the process or the fairness of the outcome is more important, and how they differ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

12

"Means-tested transfer payments reduce the current poverty rate. However, they also create an incentive structure that discourages self-sufficiency and self-improvement. Thus, they tend to increase the future poverty rate. Welfare programs essentially purchase a lower poverty rate today in exchange for a higher poverty rate in the future." Evaluate this statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

13

Was the poverty rate increasing or decreasing prior to the War on Poverty initiated by the Johnson administration? As income-transfer programs accompanying the War on Poverty increased beginning in the latter half of the 1960s, what happened to the poverty rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck

14

Suppose one family has $100,000 whereas another has only $20,000. Is this outcome fair? What is your initial reaction? Compare and contrast your views depending on the following:

a. The family with the higher income has both a husband and wife working, whereas the other family has chosen for the wife to remain home with the children rather than work in the labor force.

b. The family with the higher income is headed by a person who completed a college degree, whereas the other family is headed by someone who dropped out of high school.

c. The family with the higher income derived most of its income from the farm subsidy program.

d. The family with the higher income received it as an inheritance from parents who just died.

*Asterisk denotes questions for which answers are given in Appendix B.

a. The family with the higher income has both a husband and wife working, whereas the other family has chosen for the wife to remain home with the children rather than work in the labor force.

b. The family with the higher income is headed by a person who completed a college degree, whereas the other family is headed by someone who dropped out of high school.

c. The family with the higher income derived most of its income from the farm subsidy program.

d. The family with the higher income received it as an inheritance from parents who just died.

*Asterisk denotes questions for which answers are given in Appendix B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 14 في هذه المجموعة.

فتح الحزمة

k this deck