Deck 18: Policies and Prospects for Global Economic Growth

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/17

العب

ملء الشاشة (f)

Deck 18: Policies and Prospects for Global Economic Growth

1

Seeking to Unlock Kenya's Growth Potential via Ownership Rights

In recent years, foreign investment has increased considerably in the nations of Sub-Saharan Africa. One country among these is Kenya, in which most cities contain sprawling shantytowns populated with residences and thousands of tiny businesses. Also commonplace, particularly in shantytowns, are unsightly piles of rubble strewn along unpaved, rutted paths and criminals who lie in wait to prey on residents. Nevertheless, many homes and firms situated within the borders of these shantytowns have significant value to their residents. The values of these structures undoubtedly would increase as investment funds flow into Kenya--if only private ownership rights to shantytown structures existed.

Evans Omondi Jack, a 60-year-old Nairobi man who over the years has been forcibly evicted four times from the shantytown in which he was born, has launched a court case to establish who has titles of ownership in shantytowns. Omondi's attorneys argue that under Kenyan law, most parcels of shantytown lands, which largely are government-owned, should have been sold at public auction years ago. They are hopeful that Omondi and the other two-thirds of Kenyan citizens who reside within the 2 percent of Kenyan lands containing the shantytowns will be granted or offered a chance to buy formal titles of ownership to existing buildings. If so, the structures may be transformed from dead capital to tradable capital goods that people can further develop as foreign investment in Kenya increases.

Why do residents of the shantytowns have little incentive to remove rubble?

In recent years, foreign investment has increased considerably in the nations of Sub-Saharan Africa. One country among these is Kenya, in which most cities contain sprawling shantytowns populated with residences and thousands of tiny businesses. Also commonplace, particularly in shantytowns, are unsightly piles of rubble strewn along unpaved, rutted paths and criminals who lie in wait to prey on residents. Nevertheless, many homes and firms situated within the borders of these shantytowns have significant value to their residents. The values of these structures undoubtedly would increase as investment funds flow into Kenya--if only private ownership rights to shantytown structures existed.

Evans Omondi Jack, a 60-year-old Nairobi man who over the years has been forcibly evicted four times from the shantytown in which he was born, has launched a court case to establish who has titles of ownership in shantytowns. Omondi's attorneys argue that under Kenyan law, most parcels of shantytown lands, which largely are government-owned, should have been sold at public auction years ago. They are hopeful that Omondi and the other two-thirds of Kenyan citizens who reside within the 2 percent of Kenyan lands containing the shantytowns will be granted or offered a chance to buy formal titles of ownership to existing buildings. If so, the structures may be transformed from dead capital to tradable capital goods that people can further develop as foreign investment in Kenya increases.

Why do residents of the shantytowns have little incentive to remove rubble?

People staying in the shantytowns are living a life of a temporary dweller because they can be thrown out of their residence at any time. This has been the case with most of the people living in shantytowns. The problem is associated with property rights. Residents in this area have no legal property rights to any existing buildings.

Piles of rubble strewn along unpaved rutted paths are also visible. Due to this, there are criminals lying in the pavement to prey on the resident. This is the reason why they do not have any incentive to remove the rubble.

Piles of rubble strewn along unpaved rutted paths are also visible. Due to this, there are criminals lying in the pavement to prey on the resident. This is the reason why they do not have any incentive to remove the rubble.

2

Growth Arithmetic and Russia

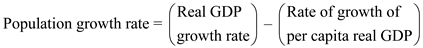

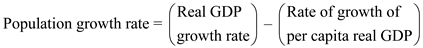

Recall that the basic arithmetic of economic growth indicates that a nation's economic growth rate is equal to the rate of growth of its overall real GDP minus its rate of population growth. People without training in economics who look at this relationship often jump to the conclusion that this relationship implies that a positive rate of population growth necessarily reduces economic growth. By implication, humanity would be economically better off with a shrinking population.

Russia's experience is instructive in evaluating this logic. Russia's birthrate has declined steadily over the past two de-cades. Hence, as of 2015 there are almost 24 million Russian residents who are in their twenties, but in another decade there will be onlY 14 million. By the logic of population-growth critics, Russia's rate of economic growth should be higher than it once was. In fact, Russia's annual rate of eco-nomic growth has steadily decreased and has averaged only 0.5 percent over the past 20 years. Current projections in-dicate that die nation's long-term economic growth rate likely will be at or even less than zero within a. decade from now, largely because a growing percentage of Russia's shrinking population is poorly educated.

Lessons from the Experience of South Korea

Unlike Russia's rate of population growth, that of South Korea has remained positive, and its population of young people in their twenties has increased slightly over time. Yet South Korea's average annual rate of economic growth over the past twenty years has exceeded 4 percent-more than eight times Russia's. As South Korea has added new young people to its population, its residents have spent in excess of 3 percent of their total incomes on education, the highest percentage of all of the world's advanced nations. Higher labor productivity has allowed South Korea to maintain a sufficiently high rate of real GDP growth to more than compensate for population growth's negative effect on: economic growth.

The contrasting experiences of Russia and South Korea sum up what economic reasoning adds to the basic arithmetic of economic growth. On the one hand, a growing world population will maintain or boost positive economic growth if the young people who replace their elders are highly productive, and economically free human resources. If so, real GDP growth can rise at a faster pace than the population. On the other hand, a shrinking world population yields lower economic growth and development if new generations are poorly trained and have fewer economic freedoms.

Why might Russia's long-run economic growth rate in-crease if it allows increased immigration from China and other nations?

Recall that the basic arithmetic of economic growth indicates that a nation's economic growth rate is equal to the rate of growth of its overall real GDP minus its rate of population growth. People without training in economics who look at this relationship often jump to the conclusion that this relationship implies that a positive rate of population growth necessarily reduces economic growth. By implication, humanity would be economically better off with a shrinking population.

Russia's experience is instructive in evaluating this logic. Russia's birthrate has declined steadily over the past two de-cades. Hence, as of 2015 there are almost 24 million Russian residents who are in their twenties, but in another decade there will be onlY 14 million. By the logic of population-growth critics, Russia's rate of economic growth should be higher than it once was. In fact, Russia's annual rate of eco-nomic growth has steadily decreased and has averaged only 0.5 percent over the past 20 years. Current projections in-dicate that die nation's long-term economic growth rate likely will be at or even less than zero within a. decade from now, largely because a growing percentage of Russia's shrinking population is poorly educated.

Lessons from the Experience of South Korea

Unlike Russia's rate of population growth, that of South Korea has remained positive, and its population of young people in their twenties has increased slightly over time. Yet South Korea's average annual rate of economic growth over the past twenty years has exceeded 4 percent-more than eight times Russia's. As South Korea has added new young people to its population, its residents have spent in excess of 3 percent of their total incomes on education, the highest percentage of all of the world's advanced nations. Higher labor productivity has allowed South Korea to maintain a sufficiently high rate of real GDP growth to more than compensate for population growth's negative effect on: economic growth.

The contrasting experiences of Russia and South Korea sum up what economic reasoning adds to the basic arithmetic of economic growth. On the one hand, a growing world population will maintain or boost positive economic growth if the young people who replace their elders are highly productive, and economically free human resources. If so, real GDP growth can rise at a faster pace than the population. On the other hand, a shrinking world population yields lower economic growth and development if new generations are poorly trained and have fewer economic freedoms.

Why might Russia's long-run economic growth rate in-crease if it allows increased immigration from China and other nations?

The theory of economic growth suggests that educated human capital can turn the fortunes of growth in the favor of the country. A nation with squeezing population, appears to be retarding in growth. However, this is not true as the evidence of country SK indicates that the amount of income spent by population on education is true factor of development.

In this sense, if country RU allows people from any other country to migrate there, especially a productive one, then its own economic growth will rise. These people will increase the overall productivity of the nation.

In this sense, if country RU allows people from any other country to migrate there, especially a productive one, then its own economic growth will rise. These people will increase the overall productivity of the nation.

3

A country's real GDP is growing at an annual rate of 3.1 percent, and the current rate of growth of per capita real GDP is 0.3 percent per year. What is the population growth rate in this nation?

Population growth rate is the index showing the growth with respect to real GDP and Per capita. This is given by the formula:  Substitute the values of Real GDP growth rate = 3.1%, Rate of growth of per capita real GDP = 0.3% in above formula:

Substitute the values of Real GDP growth rate = 3.1%, Rate of growth of per capita real GDP = 0.3% in above formula:  Therefore, the population growth rate iS2.8%.

Therefore, the population growth rate iS2.8%.

Substitute the values of Real GDP growth rate = 3.1%, Rate of growth of per capita real GDP = 0.3% in above formula:

Substitute the values of Real GDP growth rate = 3.1%, Rate of growth of per capita real GDP = 0.3% in above formula:  Therefore, the population growth rate iS2.8%.

Therefore, the population growth rate iS2.8%. 4

Seeking to Unlock Kenya's Growth Potential via Ownership Rights

In recent years, foreign investment has increased considerably in the nations of Sub-Saharan Africa. One country among these is Kenya, in which most cities contain sprawling shantytowns populated with residences and thousands of tiny businesses. Also commonplace, particularly in shantytowns, are unsightly piles of rubble strewn along unpaved, rutted paths and criminals who lie in wait to prey on residents. Nevertheless, many homes and firms situated within the borders of these shantytowns have significant value to their residents. The values of these structures undoubtedly would increase as investment funds flow into Kenya--if only private ownership rights to shantytown structures existed.

Evans Omondi Jack, a 60-year-old Nairobi man who over the years has been forcibly evicted four times from the shantytown in which he was born, has launched a court case to establish who has titles of ownership in shantytowns. Omondi's attorneys argue that under Kenyan law, most parcels of shantytown lands, which largely are government-owned, should have been sold at public auction years ago. They are hopeful that Omondi and the other two-thirds of Kenyan citizens who reside within the 2 percent of Kenyan lands containing the shantytowns will be granted or offered a chance to buy formal titles of ownership to existing buildings. If so, the structures may be transformed from dead capital to tradable capital goods that people can further develop as foreign investment in Kenya increases.

How might granting titles of ownership lead to improved shantytown conditions? Sources are listed at the end of this chapter.

In recent years, foreign investment has increased considerably in the nations of Sub-Saharan Africa. One country among these is Kenya, in which most cities contain sprawling shantytowns populated with residences and thousands of tiny businesses. Also commonplace, particularly in shantytowns, are unsightly piles of rubble strewn along unpaved, rutted paths and criminals who lie in wait to prey on residents. Nevertheless, many homes and firms situated within the borders of these shantytowns have significant value to their residents. The values of these structures undoubtedly would increase as investment funds flow into Kenya--if only private ownership rights to shantytown structures existed.

Evans Omondi Jack, a 60-year-old Nairobi man who over the years has been forcibly evicted four times from the shantytown in which he was born, has launched a court case to establish who has titles of ownership in shantytowns. Omondi's attorneys argue that under Kenyan law, most parcels of shantytown lands, which largely are government-owned, should have been sold at public auction years ago. They are hopeful that Omondi and the other two-thirds of Kenyan citizens who reside within the 2 percent of Kenyan lands containing the shantytowns will be granted or offered a chance to buy formal titles of ownership to existing buildings. If so, the structures may be transformed from dead capital to tradable capital goods that people can further develop as foreign investment in Kenya increases.

How might granting titles of ownership lead to improved shantytown conditions? Sources are listed at the end of this chapter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

5

Growth Arithmetic and Russia

Recall that the basic arithmetic of economic growth indicates that a nation's economic growth rate is equal to the rate of growth of its overall real GDP minus its rate of population growth. People without training in economics who look at this relationship often jump to the conclusion that this relationship implies that a positive rate of population growth necessarily reduces economic growth. By implication, humanity would be economically better off with a shrinking population.

Russia's experience is instructive in evaluating this logic. Russia's birthrate has declined steadily over the past two de-cades. Hence, as of 2015 there are almost 24 million Russian residents who are in their twenties, but in another decade there will be onlY 14 million. By the logic of population-growth critics, Russia's rate of economic growth should be higher than it once was. In fact, Russia's annual rate of eco-nomic growth has steadily decreased and has averaged only 0.5 percent over the past 20 years. Current projections in-dicate that die nation's long-term economic growth rate likely will be at or even less than zero within a. decade from now, largely because a growing percentage of Russia's shrinking population is poorly educated.

Lessons from the Experience of South Korea

Unlike Russia's rate of population growth, that of South Korea has remained positive, and its population of young people in their twenties has increased slightly over time. Yet South Korea's average annual rate of economic growth over the past twenty years has exceeded 4 percent-more than eight times Russia's. As South Korea has added new young people to its population, its residents have spent in excess of 3 percent of their total incomes on education, the highest percentage of all of the world's advanced nations. Higher labor productivity has allowed South Korea to maintain a sufficiently high rate of real GDP growth to more than compensate for population growth's negative effect on: economic growth.

The contrasting experiences of Russia and South Korea sum up what economic reasoning adds to the basic arithmetic of economic growth. On the one hand, a growing world population will maintain or boost positive economic growth if the young people who replace their elders are highly productive, and economically free human resources. If so, real GDP growth can rise at a faster pace than the population. On the other hand, a shrinking world population yields lower economic growth and development if new generations are poorly trained and have fewer economic freedoms.

How could South Korea's long-run rate of growth of real GDP per capita shrink to or below zero if its long-term rate of total real GDP growth were to drop to nearly zero? (Hint: What is the difference between the rate of economic growth and the rate of growth of real GDP?)

Recall that the basic arithmetic of economic growth indicates that a nation's economic growth rate is equal to the rate of growth of its overall real GDP minus its rate of population growth. People without training in economics who look at this relationship often jump to the conclusion that this relationship implies that a positive rate of population growth necessarily reduces economic growth. By implication, humanity would be economically better off with a shrinking population.

Russia's experience is instructive in evaluating this logic. Russia's birthrate has declined steadily over the past two de-cades. Hence, as of 2015 there are almost 24 million Russian residents who are in their twenties, but in another decade there will be onlY 14 million. By the logic of population-growth critics, Russia's rate of economic growth should be higher than it once was. In fact, Russia's annual rate of eco-nomic growth has steadily decreased and has averaged only 0.5 percent over the past 20 years. Current projections in-dicate that die nation's long-term economic growth rate likely will be at or even less than zero within a. decade from now, largely because a growing percentage of Russia's shrinking population is poorly educated.

Lessons from the Experience of South Korea

Unlike Russia's rate of population growth, that of South Korea has remained positive, and its population of young people in their twenties has increased slightly over time. Yet South Korea's average annual rate of economic growth over the past twenty years has exceeded 4 percent-more than eight times Russia's. As South Korea has added new young people to its population, its residents have spent in excess of 3 percent of their total incomes on education, the highest percentage of all of the world's advanced nations. Higher labor productivity has allowed South Korea to maintain a sufficiently high rate of real GDP growth to more than compensate for population growth's negative effect on: economic growth.

The contrasting experiences of Russia and South Korea sum up what economic reasoning adds to the basic arithmetic of economic growth. On the one hand, a growing world population will maintain or boost positive economic growth if the young people who replace their elders are highly productive, and economically free human resources. If so, real GDP growth can rise at a faster pace than the population. On the other hand, a shrinking world population yields lower economic growth and development if new generations are poorly trained and have fewer economic freedoms.

How could South Korea's long-run rate of growth of real GDP per capita shrink to or below zero if its long-term rate of total real GDP growth were to drop to nearly zero? (Hint: What is the difference between the rate of economic growth and the rate of growth of real GDP?)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

6

The annual rate of growth of real GDP in a developing nation is 0.3 percent. Initially, the country's population was stable from year to year. Recently, however, a significant increase in the nation's birthrate has raised the annual rate of population growth to 0.5 percent.

a. What was the rate of growth of per capita real GDP before the increase in population growth?

b. If the rate of growth of real GDP remains unchanged, what is the new rate of growth of per capita real GDP following the increase in the birthrate?

a. What was the rate of growth of per capita real GDP before the increase in population growth?

b. If the rate of growth of real GDP remains unchanged, what is the new rate of growth of per capita real GDP following the increase in the birthrate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

7

A developing country has determined that each additional $1 billion of net investment in capital goods adds 0.01 percentage point to its long-run average annual rate of growth of per capita real GDP.

a. Domestic entrepreneurs recently began to seek official approval to open a range of businesses employing capital resources valued at $20 billion. If the entrepreneurs undertake these investments, by what fraction of a percentage point will the nation's long-run average annual rate of growth of per capita real GDP increase, other things being equal?

b. After weeks of effort trying to complete the first of 15 stages of bureaucratic red tape necessary to obtain authorization to start their businesses, a number of entrepreneurs decide to drop their investment plans completely, and the amount of official investment that actually takes place turns out to be $10 billion. Other things being equal, by what fraction of a percentage point will this decision reduce the nation's long-run average annual rate of growth of per capita real GDP from what it would have been if investment had been $20 billion?

a. Domestic entrepreneurs recently began to seek official approval to open a range of businesses employing capital resources valued at $20 billion. If the entrepreneurs undertake these investments, by what fraction of a percentage point will the nation's long-run average annual rate of growth of per capita real GDP increase, other things being equal?

b. After weeks of effort trying to complete the first of 15 stages of bureaucratic red tape necessary to obtain authorization to start their businesses, a number of entrepreneurs decide to drop their investment plans completely, and the amount of official investment that actually takes place turns out to be $10 billion. Other things being equal, by what fraction of a percentage point will this decision reduce the nation's long-run average annual rate of growth of per capita real GDP from what it would have been if investment had been $20 billion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

8

Consider the estimates that the World Bank has assembled for the following nations:

Rank the nations in order starting with the one you would expect to have the highest rate of economic growth, other things being equal. Explain your reasoning.

Rank the nations in order starting with the one you would expect to have the highest rate of economic growth, other things being equal. Explain your reasoning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

9

Suppose that every $500 billion of dead capital reduces the average rate of growth in worldwide per capita real GDP by 0.1 percentage point. If there is $10 trillion in dead capital in the world, by how many percentage points does the existence of dead capital reduce average worldwide growth of per capita real GDP?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

10

Assume that each $1 billion in net capital investment generates 0.3 percentage point of the average percentage rate of growth of per capita real GDP, given the nation's labor resources. Firms have been investing exactly $6 billion in capital goods each year, so the annual average rate of growth of per capita real GDP has been 1.8 percent. Now a government that fails to consistently adhere to the rule of law has come to power, and firms must pay $100 million in bribes to gain official approval for every $1 billion in investment in capital goods. In response, companies cut back their total investment spending to $4 billion per year. If other things are equal and companies maintain this rate of investment, what will be the nation's new average annual rate of growth of per capita real GDP?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

11

During the past year, several large banks extended $200 million in loans to the government and several firms in a developing nation. International investors also purchased $150 million in bonds and $350 million in stocks issued by domestic firms. Of the stocks that foreign investors purchased, $100 million were shares that amounted to less than a 10 percent interest in domestic firms. This was the first year this nation had ever permitted inflows of funds from abroad.

a. Based on the investment category definitions discussed in this chapter, what was the amount of portfolio investment in this nation during the past year?

b. What was the amount of foreign direct investment in this nation during the past year?

a. Based on the investment category definitions discussed in this chapter, what was the amount of portfolio investment in this nation during the past year?

b. What was the amount of foreign direct investment in this nation during the past year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

12

Last year, $100 million in outstanding bank loans to a developing nation's government were not renewed, and the developing nation's government paid off $50 million in maturing government bonds that had been held by foreign residents. During that year, however, a new group of banks participated in a $125 million loan to help finance a major government construction project in the capital city. Domestic firms also issued $50 million in bonds and $75 million in stocks to foreign investors. All of the stocks issued gave the foreign investors more than 10 percent shares of the domestic firms.

a. What was gross foreign investment in this nation last year?

b. What was net foreign investment in this nation last year?

a. What was gross foreign investment in this nation last year?

b. What was net foreign investment in this nation last year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

13

Identify which of the following situations currently faced by international investors are examples of adverse selection and which are examples of moral hazard.

A) Among the governments of several developing countries that are attempting to issue new bonds this year, it is certain that a few will fail to collect taxes to repay the bonds when they mature. It is difficult, however, for investors considering buying government bonds to predict which governments will experience this problem.

B) Foreign investors are contemplating purchasing stock in a company that, unknown to them, may have failed to properly establish legal ownership over a crucial capital resource.

C) Companies in a less developed nation have already issued bonds to finance the purchase of new capital goods. After receiving the funds from the bond issue, however, the company's managers pay themselves large bonuses instead.

D) When the government of a developing nation received a bank loan three years ago, it ultimately repaid the loan but had to reschedule its payments after officials misused the funds for unworthy projects. Now the government, which still has many of the same officials, is trying to raise funds by issuing bonds to foreign investors, who must decide whether or not to purchase them.

A) Among the governments of several developing countries that are attempting to issue new bonds this year, it is certain that a few will fail to collect taxes to repay the bonds when they mature. It is difficult, however, for investors considering buying government bonds to predict which governments will experience this problem.

B) Foreign investors are contemplating purchasing stock in a company that, unknown to them, may have failed to properly establish legal ownership over a crucial capital resource.

C) Companies in a less developed nation have already issued bonds to finance the purchase of new capital goods. After receiving the funds from the bond issue, however, the company's managers pay themselves large bonuses instead.

D) When the government of a developing nation received a bank loan three years ago, it ultimately repaid the loan but had to reschedule its payments after officials misused the funds for unworthy projects. Now the government, which still has many of the same officials, is trying to raise funds by issuing bonds to foreign investors, who must decide whether or not to purchase them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

14

Identify which of the following situations currently faced by the World Bank or the International Monetary Fund are examples of adverse selection and which are examples of moral hazard.

A) The World Bank has extended loans to the government of a developing country to finance construction of a canal with a certain future flow of earnings. Now, however, the government has decided to redirect those funds to build a casino that may or may not generate sufficient profits to allow the government to repay the loan.

B) The IMF is considering extending loans to several nations that failed to fully repay loans they received from the IMF during the past decade but now claim to be better credit risks. Now the IMF is not sure in advance which of these nations are unlikely to fully repay new loans.

C) The IMF recently extended a loan to a government directed by democratically elected officials that would permit the nation to adjust to an abrupt reduction in private flows of funds from abroad. A coup has just occurred, however, in response to newly discovered corruption within the government's elected leadership. The new military dictator has announced tentative plans to disburse some of the funds in equal shares to all citizens.

A) The World Bank has extended loans to the government of a developing country to finance construction of a canal with a certain future flow of earnings. Now, however, the government has decided to redirect those funds to build a casino that may or may not generate sufficient profits to allow the government to repay the loan.

B) The IMF is considering extending loans to several nations that failed to fully repay loans they received from the IMF during the past decade but now claim to be better credit risks. Now the IMF is not sure in advance which of these nations are unlikely to fully repay new loans.

C) The IMF recently extended a loan to a government directed by democratically elected officials that would permit the nation to adjust to an abrupt reduction in private flows of funds from abroad. A coup has just occurred, however, in response to newly discovered corruption within the government's elected leadership. The new military dictator has announced tentative plans to disburse some of the funds in equal shares to all citizens.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

15

For each of the following situations, explain which of the policy issues discussed in this chapter is associated with the stance the institution has taken.

A) The World Bank offers to make a loan to a company in an impoverished nation at a lower interest rate than the company had been about to agree to pay to borrow the same amount from a group of private banks.

B) The World Bank makes a loan to a company in a developing nation that has not yet received formal approval to operate there, even though the government approval process typically takeS15 months.

C) The IMF extends a loan to a developing nation's government, with no preconditions, to enable the government to make already overdue payments on a loan it had previously received from the World Bank.

A) The World Bank offers to make a loan to a company in an impoverished nation at a lower interest rate than the company had been about to agree to pay to borrow the same amount from a group of private banks.

B) The World Bank makes a loan to a company in a developing nation that has not yet received formal approval to operate there, even though the government approval process typically takeS15 months.

C) The IMF extends a loan to a developing nation's government, with no preconditions, to enable the government to make already overdue payments on a loan it had previously received from the World Bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

16

For each of the following situations, explain which of the policy issues discussed in this chapter is associated with the stance the institution has taken.

A) The IMF extends a long-term loan to a nation's government to help it maintain publicly supported production of goods and services that the government otherwise would have turned over to private companies.

B) The World Bank makes a loan to companies in an impoverished nation in which government officials typically demand bribes equal to 50 percent of companies' profits before allowing them to engage in any new investment projects.

C) The IMF offers to make a loan to banks in a country in which the government's rulers commonly require banks to extend credit to finance high-risk investment projects headed by the rulers' friends and relatives.

A) The IMF extends a long-term loan to a nation's government to help it maintain publicly supported production of goods and services that the government otherwise would have turned over to private companies.

B) The World Bank makes a loan to companies in an impoverished nation in which government officials typically demand bribes equal to 50 percent of companies' profits before allowing them to engage in any new investment projects.

C) The IMF offers to make a loan to banks in a country in which the government's rulers commonly require banks to extend credit to finance high-risk investment projects headed by the rulers' friends and relatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck

17

Answer the following questions concerning proposals to reform long-term development lending programs currently offered by the IMF and World Bank.

a. Why might the World Bank face moral hazard problems if it were to offer to provide funds to governments that promise to allocate the funds to major institutional reforms aimed at enhancing economic growth?

b. How does the IMF face an adverse selection problem if it is considering making loans to governments in which the ruling parties have already shown predispositions to try to "buy" votes by creating expensive public programs in advance of elections? How might following an announced rule in which the IMF cuts off future loans to governments that engage in such activities reduce this problem and promote increased economic growth in nations that do receive IMF loans?

a. Why might the World Bank face moral hazard problems if it were to offer to provide funds to governments that promise to allocate the funds to major institutional reforms aimed at enhancing economic growth?

b. How does the IMF face an adverse selection problem if it is considering making loans to governments in which the ruling parties have already shown predispositions to try to "buy" votes by creating expensive public programs in advance of elections? How might following an announced rule in which the IMF cuts off future loans to governments that engage in such activities reduce this problem and promote increased economic growth in nations that do receive IMF loans?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 17 في هذه المجموعة.

فتح الحزمة

k this deck