Deck 13: Capital Budgeting, Risk Considerations, and Other Special Issues

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/149

العب

ملء الشاشة (f)

Deck 13: Capital Budgeting, Risk Considerations, and Other Special Issues

1

Capital budgeting is:

A)the process through which a firm makes capital expenditure decisions.

B)the process through which a firm makes decisions in financial securities investments.

C)the process of raising capital in the financial markets.

D)the process of determining financing options for various investment decisions

A)the process through which a firm makes capital expenditure decisions.

B)the process through which a firm makes decisions in financial securities investments.

C)the process of raising capital in the financial markets.

D)the process of determining financing options for various investment decisions

the process through which a firm makes capital expenditure decisions.

2

Use the following two statements to answer this question:

I.A firm should accept a project whenever IRR > k.

II.When IRR < k, the NPV will be positive, and vice versa.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

I.A firm should accept a project whenever IRR > k.

II.When IRR < k, the NPV will be positive, and vice versa.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

I is correct, II is incorrect.

3

Which of the following is NOT common between the IRR and NPV methods of capital budgeting analysis?

A)both methods include all cash flows

B)both methods consider the time value of money

C)both methods allow for the use of more than one discount rate

D)both methods are based on an objective rate of return

A)both methods include all cash flows

B)both methods consider the time value of money

C)both methods allow for the use of more than one discount rate

D)both methods are based on an objective rate of return

both methods allow for the use of more than one discount rate

4

Use the following two statements to answer this question:

I.Bottom-up analysis: an investment strategy where capital expenditure decisions are considered in connection with whether the firm should continue in this business or for general industry and economic trends.

II.Top-down analysis: an investment strategy that focuses on strategic decisions, such as which industries or products the firm should be involved in, looking at the overall economic picture.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

I.Bottom-up analysis: an investment strategy where capital expenditure decisions are considered in connection with whether the firm should continue in this business or for general industry and economic trends.

II.Top-down analysis: an investment strategy that focuses on strategic decisions, such as which industries or products the firm should be involved in, looking at the overall economic picture.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

5

The risk-adjusted discount rate is:

A)the overall expected return for investors

B)the after-tax cost of debt of the company

C)the cost of equity financing of the company

D)the discount rate that reflects the project's risk

A)the overall expected return for investors

B)the after-tax cost of debt of the company

C)the cost of equity financing of the company

D)the discount rate that reflects the project's risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

6

The acceptance of an investment project implies that its:

I.IRR is greater than a certain threshold.

II.NPV is greater than its IRR.

III.NPV is greater than or equal to 0.

A)I only

B)II only

C)I and II only

D)I and III only

I.IRR is greater than a certain threshold.

II.NPV is greater than its IRR.

III.NPV is greater than or equal to 0.

A)I only

B)II only

C)I and II only

D)I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is FALSE?

A)Positive NPVs arise only in situations in which a company has a competitive advantage.

B)Projects that produce an NPV of zero should be rejected.

C)The market value of any firm in an efficient market should equal the present value of its expected after-tax cash flows.

D)Because of the competitive nature of today's business environment, we would not expect to see an abundance of positive NPV opportunities to persist for very long.

A)Positive NPVs arise only in situations in which a company has a competitive advantage.

B)Projects that produce an NPV of zero should be rejected.

C)The market value of any firm in an efficient market should equal the present value of its expected after-tax cash flows.

D)Because of the competitive nature of today's business environment, we would not expect to see an abundance of positive NPV opportunities to persist for very long.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

8

Suppose a project requires an initial investment of $10,000 and it will yield $1,500 for 8 years.The discount rate is 10%.What is the NPV of the project and should we accept or reject it?

A)−$1,998; reject

B)$1,998; accept

C)−$2,000; reject

D)$2,000; accept

A)−$1,998; reject

B)$1,998; accept

C)−$2,000; reject

D)$2,000; accept

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

9

A project that requires a $ 100,000 investment will yield cash flows of $50,000 in 6 months and $50,000 in one year.Assuming these are the only cash flows involved the project should be rejected for the following reasons:

I.The cost of time is not incorporated in the calculation

II.The sum of the cash inflows following the investment is equivalent to the initial investment

A)I only

B)II only

C)I and II

D)None of these reasons

I.The cost of time is not incorporated in the calculation

II.The sum of the cash inflows following the investment is equivalent to the initial investment

A)I only

B)II only

C)I and II

D)None of these reasons

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

10

A firm that does not invest effectively will:

A)find itself at a competitive advantage.

B)make itself more attractive in the short run.

C)increase its cost of capital.

D)increase its market prices of debt and equity securities.

A)find itself at a competitive advantage.

B)make itself more attractive in the short run.

C)increase its cost of capital.

D)increase its market prices of debt and equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is a FALSE statement regarding capital expenditures?

A)They are a firm's investments in long-lived assets.

B)They may be tangible assets or intangible assets.

C)They determine a company's future direction.

D)They usually involve large amounts of money and the decisions are frequently recoverable.

A)They are a firm's investments in long-lived assets.

B)They may be tangible assets or intangible assets.

C)They determine a company's future direction.

D)They usually involve large amounts of money and the decisions are frequently recoverable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is NOT one of the distinct steps in the capital budgeting process?

A)Identifying investment alternatives

B)Obtaining the financing to pay for the investment

C)Implementing the chosen investment decisions

D)Monitoring and evaluating the implemented decisions

A)Identifying investment alternatives

B)Obtaining the financing to pay for the investment

C)Implementing the chosen investment decisions

D)Monitoring and evaluating the implemented decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following statements is NOT true?

A)Capital expenditures in good projects will increase the value of the firm.

B)A pending drug patent can be used as collateral.

C)Capital budgeting is a dynamic process and depends on changing conditions.

D)A change in interest rates is not important enough to change a decision about a project.

A)Capital expenditures in good projects will increase the value of the firm.

B)A pending drug patent can be used as collateral.

C)Capital budgeting is a dynamic process and depends on changing conditions.

D)A change in interest rates is not important enough to change a decision about a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is NOT a true statement about net present value (NPV)analysis?

A)The NPV of a project is the sum of the present value of all future after-tax incremental cash flows generated by an initial cash outlay, minus the present value of the investment outlays.

B)Projects that have a positive NPV should be accepted, and projects that have a negative NPV should be rejected.

C)A positive NPV means the project is earning a rate of return less than the discount rate.

D)The firm's after-tax marginal cost of capital is the appropriate discount rate for all projects.

A)The NPV of a project is the sum of the present value of all future after-tax incremental cash flows generated by an initial cash outlay, minus the present value of the investment outlays.

B)Projects that have a positive NPV should be accepted, and projects that have a negative NPV should be rejected.

C)A positive NPV means the project is earning a rate of return less than the discount rate.

D)The firm's after-tax marginal cost of capital is the appropriate discount rate for all projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

15

Michael Porter argues that firms can create competitive advantages for themselves by adopting one of the following strategies:

I.Cost leadership: firms strive to use the latest technology to lower the costs of production.

II.Differentiation: firms can differentiate their products by providing customers with unique delivery alternatives.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

I.Cost leadership: firms strive to use the latest technology to lower the costs of production.

II.Differentiation: firms can differentiate their products by providing customers with unique delivery alternatives.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

16

Suppose a project requires an initial investment of $10,000 and it will yield $10,500 one year later.The NPV of the project is:

A)equal to $500.

B)negative if the discount rate is less than 5.0%.

C)zero if the discount rate is equal to 5.0%..

D)positive if the discount rate is greater than 5.0%..

A)equal to $500.

B)negative if the discount rate is less than 5.0%.

C)zero if the discount rate is equal to 5.0%..

D)positive if the discount rate is greater than 5.0%..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

17

Capital expenditures are

A)a firm's investments in net working capital.

B)a firm's investments in long-lived tangible and non-tangible assets.

C)a firm's investments in financial securities.

D)all of the above.

A)a firm's investments in net working capital.

B)a firm's investments in long-lived tangible and non-tangible assets.

C)a firm's investments in financial securities.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the following two statements to answer this question:

I.Discounted Cash Flow (DCF)methodologies are techniques for making capital expenditure decisions that are consistent with the overriding objective of maximizing shareholder wealth.

II.Discounted Cash Flow (DCF)valuation involves estimating future cash flows and comparing their present values with investment outlays required today.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

I.Discounted Cash Flow (DCF)methodologies are techniques for making capital expenditure decisions that are consistent with the overriding objective of maximizing shareholder wealth.

II.Discounted Cash Flow (DCF)valuation involves estimating future cash flows and comparing their present values with investment outlays required today.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is NOT one of Michael Porter's five critical factors that determine the attractiveness of an industry?

A)Entry barriers.

B)The threat of substitutes.

C)The bargaining power of buyers/suppliers.

D)Coalition among existing competitors.

A)Entry barriers.

B)The threat of substitutes.

C)The bargaining power of buyers/suppliers.

D)Coalition among existing competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

20

The internal rate of return (IRR)is:

A)the discount rate that makes the NPV greater than zero for a given set of cash flows.

B)the discount rate that sets the FV of future CFs equal to the initial cash outlay.

C)the opportunity cost of the capital invested in the project.

D)the economic rate of return of a given project.

A)the discount rate that makes the NPV greater than zero for a given set of cash flows.

B)the discount rate that sets the FV of future CFs equal to the initial cash outlay.

C)the opportunity cost of the capital invested in the project.

D)the economic rate of return of a given project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following ignores late cash flows?

I.Profitability index

II.Discounted payback period

III.Net present value

IV.Payback period

A)I and III only

B)II and IV only

C)I, II, and III only

D)I, III, and IV only

I.Profitability index

II.Discounted payback period

III.Net present value

IV.Payback period

A)I and III only

B)II and IV only

C)I, II, and III only

D)I, III, and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements is FALSE?

A)The NPV profile shows the NPV of a project for various IRRs.

B)Mutually exclusive projects are projects for which the acceptance of one precludes the acceptance of one or more of the alternative projects.

C)The crossover rate is a special discount rate at which the NPV profiles of two projects cross.

D)There may be more than one IRR for cash flow streams where the cash flows change signs more than once.

A)The NPV profile shows the NPV of a project for various IRRs.

B)Mutually exclusive projects are projects for which the acceptance of one precludes the acceptance of one or more of the alternative projects.

C)The crossover rate is a special discount rate at which the NPV profiles of two projects cross.

D)There may be more than one IRR for cash flow streams where the cash flows change signs more than once.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suppose the Canadian Space Agency has two mutually exclusive projects: landing a person on Mars and landing a person on Venus.Project Mars has an IRR of 12% and project Venus has an IRR of 15%.The crossover rate is 9%.The project's appropriate discount rate is 8%.

A)Accept project Mars.

B)Accept project Venus.

C)Accept both projects.

D)Accept neither project.

A)Accept project Mars.

B)Accept project Venus.

C)Accept both projects.

D)Accept neither project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is a discounted cash flow (DCF)approach to capital budgeting decision analysis?

I.Profitability index

II.Internal rate of return

III.Net present value

IV.Payback period

A)I and III only

B)II and III only

C)I, II, and III only

D)I, III, and IV only

I.Profitability index

II.Internal rate of return

III.Net present value

IV.Payback period

A)I and III only

B)II and III only

C)I, II, and III only

D)I, III, and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

25

Suppose projects Mars and Venus are mutually exclusive.Project Mars has an IRR of 10% and project Venus has an IRR of 20%.One can then conclude that:

A)project Venus must always be preferred to Mars.

B)project Mars must always be preferred to Venus.

C)project Mars has a negative NPV while project Venus has a positive NPV.

D)it is impossible to rank the two projects without further information about the timing and amounts of the cash flows.

A)project Venus must always be preferred to Mars.

B)project Mars must always be preferred to Venus.

C)project Mars has a negative NPV while project Venus has a positive NPV.

D)it is impossible to rank the two projects without further information about the timing and amounts of the cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose the Canadian Space Agency has two independent Martian rover projects: Spirit and Endeavour.Project Spirit has an IRR of 10% and project Endeavour has an IRR of 15%.The crossover rate is 9%.The project's appropriate discount rate is 12%.

A)Accept project Spirit.

B)Accept project Endeavour.

C)Accept both projects.

D)Accept neither project.

A)Accept project Spirit.

B)Accept project Endeavour.

C)Accept both projects.

D)Accept neither project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose the Canadian Space Agency has two mutually exclusive projects: landing a person on Mars and landing a person on Venus.Project Mars has an IRR of 12% and project Venus has an IRR of 15%.The crossover rate is 9%.The project's appropriate discount rate is 10%.

A)Accept project Mars.

B)Accept project Venus.

C)Accept both projects.

D)Accept neither project.

A)Accept project Mars.

B)Accept project Venus.

C)Accept both projects.

D)Accept neither project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose the Canadian Space Agency has two independent Martian rover projects: Spirit and Endeavour.Project Spirit has an IRR of 10% and project Endeavour has an IRR of15 %.The crossover rate is 9%.The project's appropriate discount rate is 18%.

A)Accept project Spirit.

B)Accept project Endeavour.

C)Accept both projects.

D)Accept neither project.

A)Accept project Spirit.

B)Accept project Endeavour.

C)Accept both projects.

D)Accept neither project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

29

Suppose a company has an investment that requires an after-tax incremental cash outlay of $12,000 today.It estimates that the expected future after-tax cash flows associated with this investment are $5,000 in years 1 and 2, and $8,000 in year 3.What is the approximate IRR?

A)50%

B)45%

C)21%

D)Cannot be determined

A)50%

B)45%

C)21%

D)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

30

You are the CFO of a major, publicly traded corporation.You must choose between two mutually exclusive projects.You will accept a project based on which of the following?

A)The greatest increase in shareholder value.

B)The highest accounting profit.

C)The greatest tax benefit.

D)The highest internal rate of return.

A)The greatest increase in shareholder value.

B)The highest accounting profit.

C)The greatest tax benefit.

D)The highest internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which one of the following is an example of mutual exclusive projects?

I.A piece of land may be used either for the extension of the existing plant or the building of a more efficient headquarters for the company

II.Expanding the plant or relocating the company's head office to a new location

A)I only

B)II only

C)Both I and II

D)Neither I nor II

I.A piece of land may be used either for the extension of the existing plant or the building of a more efficient headquarters for the company

II.Expanding the plant or relocating the company's head office to a new location

A)I only

B)II only

C)Both I and II

D)Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following are NOT mutually exclusive projects?

A)Building a factory in New Brunswick or Nova Scotia.

B)Building a gas station or a strip mall on a given piece of land.

C)Selling canoes or paddles at different times.

D)An electricity utility building a coal-fired power plant or a natural gas-fired plant.

A)Building a factory in New Brunswick or Nova Scotia.

B)Building a gas station or a strip mall on a given piece of land.

C)Selling canoes or paddles at different times.

D)An electricity utility building a coal-fired power plant or a natural gas-fired plant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose the Canadian Space Agency has two independent Martian rover projects: Spirit and Endeavour.Project Spirit has an IRR of 13% and project Endeavour has an IRR of 15%.The crossover rate is 10%.The project's appropriate discount rate is 12%.

A)Accept project Spirit.

B)Accept project Endeavour.

C)Accept both projects.

D)Accept neither project.

A)Accept project Spirit.

B)Accept project Endeavour.

C)Accept both projects.

D)Accept neither project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

34

The net present value (NPV)method is preferred to the internal rate of return (IRR)method in all of the following situations, EXCEPT for:

I.mutually exclusive projects

II.projects of different scales

III.projects with multiple cash inflows and outflows

A)I is correct, II and III are incorrect.

B)I and II are correct and III are incorrect.

C)I is incorrect, II and III are correct.

D)I, II, and III are correct.

I.mutually exclusive projects

II.projects of different scales

III.projects with multiple cash inflows and outflows

A)I is correct, II and III are incorrect.

B)I and II are correct and III are incorrect.

C)I is incorrect, II and III are correct.

D)I, II, and III are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

35

If projects Mars and Venus are mutually exclusive, the acceptance of project Mars means:

A)project Venus is rejected.

B)project Venus is accepted.

C)project Mars has a higher IRR.

D)project Venus has a shorter payback period.

A)project Venus is rejected.

B)project Venus is accepted.

C)project Mars has a higher IRR.

D)project Venus has a shorter payback period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

36

Suppose the Canadian Space Agency has two mutually exclusive projects: landing a person on Mars and landing a person on Venus.Project Mars has an IRR of 12% and project Venus has an IRR of 15%.The crossover rate is 9%.The project's appropriate discount rate is 18%.

A)Accept project Mars.

B)Accept project Venus.

C)Accept both projects.

D)Accept neither project.

A)Accept project Mars.

B)Accept project Venus.

C)Accept both projects.

D)Accept neither project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is the major assumption in the calculation of IRR?

A)IRR is more intuitive than NPV

B)Every dollar of cash flows is reinvested at the discount rate

C)Every dollar of cash flows is reinvested at the IRR

D)Every dollar of cash flows is measured in real dollars

A)IRR is more intuitive than NPV

B)Every dollar of cash flows is reinvested at the discount rate

C)Every dollar of cash flows is reinvested at the IRR

D)Every dollar of cash flows is measured in real dollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following two statements to answer this question:

I.The NPV assumes that all cash flows are reinvested at the firm's cost of capital.

II.The IRR assumes that all cash flows are reinvested at the project's economic rate of return.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

I.The NPV assumes that all cash flows are reinvested at the firm's cost of capital.

II.The IRR assumes that all cash flows are reinvested at the project's economic rate of return.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct, II is incorrect.

D)I is incorrect, II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose a company has an investment that requires an after-tax incremental cash outlay of $12,000 today.It estimates that the expected future after-tax cash flows associated with this investment are $5,000 in years 1 and 2, and $8,000 in year 3.Using a 12.0% discount rate, determine the project's NPV.

A)$16,071.43

B)$14,144.50

C)$4,071.43

D)$2,144.50

A)$16,071.43

B)$14,144.50

C)$4,071.43

D)$2,144.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

40

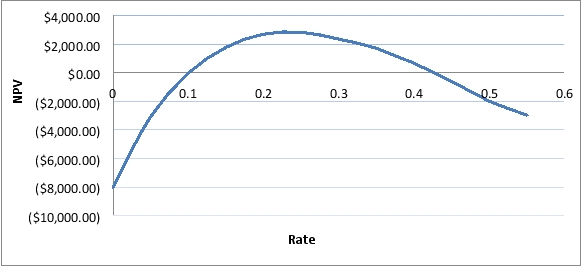

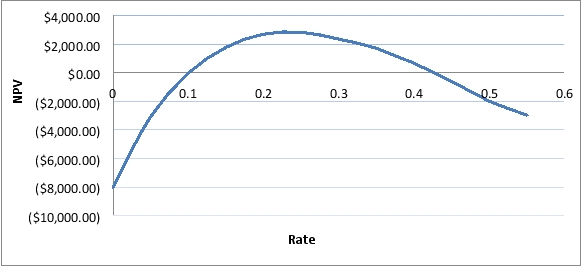

Consider the following graph:  Which capital budget criterion would yield contradictory conclusions about this project?

Which capital budget criterion would yield contradictory conclusions about this project?

A)Net present value

B)Payback period

C)Discounted payback period

D)Internal rate of return

Which capital budget criterion would yield contradictory conclusions about this project?

Which capital budget criterion would yield contradictory conclusions about this project?A)Net present value

B)Payback period

C)Discounted payback period

D)Internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

41

Suppose you have an opportunity to invest in a project, which is expected to generate $6,800 in year 1, $7,200 in year 2, and $7,500 in year 3.The appropriate risk-adjusted discount rate for the project is 10.5%.What is project's initial investment when the project's NPV is $2,609.25? Ignore income taxes for this question.

A)$15,000

B)$17,609

C)$20,218

D)$21,500

A)$15,000

B)$17,609

C)$20,218

D)$21,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose you have an opportunity to invest in a project, which requires an after-tax incremental cash outlay of $25,000 today.The project is expected to generate after-tax cash flows of $7,500 per year for the next six years.What is the project's NPV if the appropriate discount rate is 15%?

A)$141

B)$3,384

C)$7,642

D)$10,884

A)$141

B)$3,384

C)$7,642

D)$10,884

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the NPV of a project is greater than zero, then its profitability index is

A)less than 1.

B)equal to 1.

C)greater than 1.

D)equal to 0.

A)less than 1.

B)equal to 1.

C)greater than 1.

D)equal to 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

44

The risk adjusted discount rate (RADR)is:

A)the firm's after-tax marginal cost of capital.

B)a special discount rate where the NPV of two projects are equal.

C)the real rate of return less a discount for risk.

D)a discount rate that is set based on the overall riskiness of a project.

A)the firm's after-tax marginal cost of capital.

B)a special discount rate where the NPV of two projects are equal.

C)the real rate of return less a discount for risk.

D)a discount rate that is set based on the overall riskiness of a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is FALSE about the payback period?

A)It is used as an informal measure of project risk.

B)It is evaluated by choosing an arbitrary cut-off date.

C)It rejects projects whose payback period is shorter than the projects expected duration.

D)It disregards the time and risk value of money.

A)It is used as an informal measure of project risk.

B)It is evaluated by choosing an arbitrary cut-off date.

C)It rejects projects whose payback period is shorter than the projects expected duration.

D)It disregards the time and risk value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is FALSE about the profitability index?

A)It is an absolute measure of wealth.

B)It is often used when firms are capital constrained.

C)It produces the same accept/reject decisions as does the NPV.

D)It works even when future cash flows change signs.

A)It is an absolute measure of wealth.

B)It is often used when firms are capital constrained.

C)It produces the same accept/reject decisions as does the NPV.

D)It works even when future cash flows change signs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is NOT a disadvantage of the payback period?

A)It disregards the time and risk value of money.

B)It provides an intuitive measure of how long it takes to recover an investment.

C)It does not account for the cash flows received after the cut-off date.

D)The choice of the cut-off date is somewhat arbitrary.

A)It disregards the time and risk value of money.

B)It provides an intuitive measure of how long it takes to recover an investment.

C)It does not account for the cash flows received after the cut-off date.

D)The choice of the cut-off date is somewhat arbitrary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

48

Suppose you have an opportunity to invest in a project, which is expected to generate $6,800 in year 1, $7,200 in year 2, and $7,500 in year 3.The appropriate risk-adjusted discount rate for the project is 10.5%.The project's initial investment is $15,000.What is the profitability index?

A)1.29

B)1.17

C)0.85

D)0.17

A)1.29

B)1.17

C)0.85

D)0.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

49

The NPV method is preferred to the payback period method as a project evaluation criterion because the payback period rule ignores the impact of:

I.the initial cost

II.the timing of cash flows prior to the payback period

III.any cash flows beyond the payback period

A)III only

B)I and II only

C)I and III only

D)II and III only

I.the initial cost

II.the timing of cash flows prior to the payback period

III.any cash flows beyond the payback period

A)III only

B)I and II only

C)I and III only

D)II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose you have an opportunity to invest in a project, which requires a cash outlay of $15,000 today.The project is expected to generate $6,000 in year 1, $6,500 in year 2, and $7,000 in year 3.The appropriate risk-adjusted discount rate for the project is 12%.What is the project's NPV? Ignore income taxes for this question.

A)−$1,1209

B)$521.36

C)$732

D)$2,411

A)−$1,1209

B)$521.36

C)$732

D)$2,411

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

51

The NPV rule is preferred to the discounted payback period as a project evaluation criterion because the discounted payback period rule ignores:

I.The initial cost

II.The timing of cash flows prior to the discounted payback period

III.Any cash flows beyond the discounted payback period

A)III only

B)I and II only

C)I and III only

D)II and III only

I.The initial cost

II.The timing of cash flows prior to the discounted payback period

III.Any cash flows beyond the discounted payback period

A)III only

B)I and II only

C)I and III only

D)II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

52

Consider a project that would change the way your company is doing business.Investing $100,000 would save your company $10,000 a year forever.Calculate the NPV of this project if the risk-adjusted rate is 10%.

A)$10,000

B)$100,000

C)$0

D)$ −90,000

A)$10,000

B)$100,000

C)$0

D)$ −90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

53

Vancouver Salmon Farm Inc.'s current operations will generate cash flows of $100,000 in year one, $115,000 in year two, and $125,000 in year three.The company is considering a new investment, which requires an immediate cash outlay of $300,000.With the new investment, the company can instead expect to have cash flows of $250,000 per year for the next three years.The appropriate discount rate is 15%.What is the incremental NPV of the new investment?

A)$14,704

B)$65,439

C)$256,108

D)$270,806

A)$14,704

B)$65,439

C)$256,108

D)$270,806

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is NOT true about the discounted payback period?

A)It accounts for the time value of money.

B)It ignores cash flows beyond the project lifetime.

C)The choice of the cut-off date is somewhat arbitrary.

D)Projects with discounted payback periods beyond the project lifetime will be accepted.

A)It accounts for the time value of money.

B)It ignores cash flows beyond the project lifetime.

C)The choice of the cut-off date is somewhat arbitrary.

D)Projects with discounted payback periods beyond the project lifetime will be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

55

Consider a 12-year project that costs $48,000 today and will produce after-tax cash flows of $6,000 each year for the first four years, $7,000 each year for the next four years, and $8,000 each year for the last four years.If the cost of capital is 8 %, what is the project's NPV?

A)-$30,092

B)$907

C)$3,230

D)$21,554

A)-$30,092

B)$907

C)$3,230

D)$21,554

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

56

Suppose you have an opportunity to invest in a project, which requires an after-tax incremental cash outlay of $25,000 today.The project is expected to generate its first cash flow of $8,000 two years from now, which will remain the same for a total of 10 years.What is the project's NPV if the appropriate discount rate is 14%?

A)$7,109

B)$9,236

C)$11,604

D)$16,729

A)$7,109

B)$9,236

C)$11,604

D)$16,729

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

57

Suppose your friend came to see you with an opportunity to invest in a project that generates $5,000 in the first and the third year, and $3,000 in the second year is.The initial investment required for the project is $10,000.If the risk-adjusted rate is 15%, she insists that the project is worth the investment.Which method is your friend using?

A)Internal rate of return

B)Payback period

C)Net present value

D)Profitability index

A)Internal rate of return

B)Payback period

C)Net present value

D)Profitability index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following statements to answer the question:

I.The IRR of a project that has a profitability index equal to 1 is equal to the risk-adjusted rate.

II.IRR and NPV results can be contradictory.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The IRR of a project that has a profitability index equal to 1 is equal to the risk-adjusted rate.

II.IRR and NPV results can be contradictory.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following statements to answer the question:

I.The payback period does not take into consideration time value of money

II.In capital budgeting, the most important factor is to recoup the initial investment.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The payback period does not take into consideration time value of money

II.In capital budgeting, the most important factor is to recoup the initial investment.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the NPV of a project is less than zero, then its profitability index is:

A)less than 1.

B)equal to1.

C)greater than 1.

D)equal to 0.

A)less than 1.

B)equal to1.

C)greater than 1.

D)equal to 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the discounted payback period of a project whose profitability index is higher than 1?

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

62

Consider a ten-year project that costs $40,000 today, which is expected to generate $6,000 at the end of the second year and then the cash flows will increase by $1,000 for three years and then stagnate for the rest of the project life.The cost of capital is 8%.What is discounted payback period?

A)8.99 years

B)8.34 years

C)7.71 years

D)7.17 years

A)8.99 years

B)8.34 years

C)7.71 years

D)7.17 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

63

Consider a ten-year project that costs $40,000 today, which is expected to generate $6,000 at the end of the second year and then the cash flows will increase by $1,000 for three years and then stagnate for the rest of the project life.The cost of capital is 8%.What is the project's IRR?

A)14.04%

B)13.85%

C)11.17%

D)9.74%

A)14.04%

B)13.85%

C)11.17%

D)9.74%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the discounted payback period of a project whose NPV is negative?

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the project's NPV if it requires an initial cash outlay of $50,000 and pays $8,000 per year indefinitely? Assume the appropriate discount rate is 15%.Ignore income taxes for this question.

A)-$3,623

B)$1,480

C)$3,333

D)$53,333

A)-$3,623

B)$1,480

C)$3,333

D)$53,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

66

Consider a project that requires an investment of $22,500 today and pays $5,250 per year for ten years.What is the payback period of the project? Assume the cost of capital is 12%.

A)4.29 years

B)4.52 years

C)4.71 years

D)4.93 years

A)4.29 years

B)4.52 years

C)4.71 years

D)4.93 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

67

Suppose project Acquisition and project Merger are mutually exclusive.Project Acquisition requires an initial cash outlay of $50,000 and is expected to provide after-tax cash flows of $15,000 in year 1, $25,000 in year 2, $20,000 in year 3, and $15,000 in year 4.Project Merger requires an initial cash outlay of $75,000 and is expected to provide after-tax cash flows of $20,000 in year 1, $28,000 in year 2, $35,000 in year 3, and $20,000 in year 4.The appropriate discount rate is 12%.What is the crossover rate?

A)4.30%

B)4.87%

C)13.72%

D)18.59%

A)4.30%

B)4.87%

C)13.72%

D)18.59%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the following statements to answer this question:

I.The payback period is always longer than the discounted payback period.

II.Both the discounted payback and payback period ignore cash flows beyond the cut-off period.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The payback period is always longer than the discounted payback period.

II.Both the discounted payback and payback period ignore cash flows beyond the cut-off period.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is the IRR of a project that requires an initial cash outlay of $12,345 and is expected to generate cash flows of $3,600 a year for three years and then $4,200 a year for two more years? Assume the tax rate is zero.

A)14.00%

B)15.50%

C)16.20%

D)17.80%

A)14.00%

B)15.50%

C)16.20%

D)17.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

70

Consider a ten-year project that costs $40,000 today, which is expected to generate $6,000 at the end of the second year and then the cash flows will increase by $1,000 for three years and then stagnate for the rest of the project life.The cost of capital is 8%.What is the project's NPV?

A)$14,897.61

B)$12,718.24

C)$7,162.69

D)$3,764.73

A)$14,897.61

B)$12,718.24

C)$7,162.69

D)$3,764.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is the discounted payback period of a project whose NPV is positive?

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following methods does not consider the time value of the money?

A)Net present value

B)Payback period

C)Internal rate of return

D)All of the above

A)Net present value

B)Payback period

C)Internal rate of return

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

73

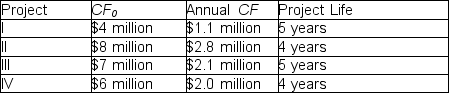

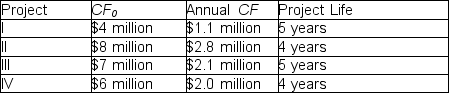

Rank the following four independent investment projects using IRR.Ranking choices are shown from highest IRR to lowest IRR:

A)I, II, III, IV

B)II, III, IV, I

C)III, II, IV, I

D)IV, III, II, I

A)I, II, III, IV

B)II, III, IV, I

C)III, II, IV, I

D)IV, III, II, I

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

74

Consider a project that requires an investment of $28,000 today and generates after-tax cash flows of $10,000 per year for the next four years.The appropriate discount rate is 15%.What are the NPV and IRR for this investment?

A)NPV = -$264; IRR = 14.85%

B)NPV = $336; IRR = 15.34%

C)NPV = $550; IRR = 15.97%

D)NPV = $738; IRR = 16.13%

A)NPV = -$264; IRR = 14.85%

B)NPV = $336; IRR = 15.34%

C)NPV = $550; IRR = 15.97%

D)NPV = $738; IRR = 16.13%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is the payback period of a project whose NPV is positive?

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

A)Equal to the project lifetime

B)Less than the project lifetime

C)Greater than the project lifetime

D)Not enough information to answer the question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company is considering two mutually exclusive projects Adept and Boffo.Project Adept requires an initial investment of $100,000 and is expected to generate after-tax cash flows of $45,000 per year for three years.Project Boffo requires an initial investment of $150,000 and is expected to generate after-tax cash flows of $50,000 per year for four years.The appropriate discount rate is 10%.What is the crossover rate for projects Adept and Boffo?

A)4.06%

B)7.77%

C)12.59%

D)16.65%

A)4.06%

B)7.77%

C)12.59%

D)16.65%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

77

Consider a five-year project that costs $20,000 today, which is expected to generate $6,000 at the end of the second year and then the cash flows will increase by $1,000 per year for each of the remaining years.The cost of capital is 8%.What are the NPV and IRR for this project?

A)NPV = $1,083.24; IRR = 8.96%

B)NPV = $2,706.35; IRR = 11.93%

C)NPV = $3,824.56; IRR = 14.87%

D)NPV = $4,522.85: IRR = 17.09%

A)NPV = $1,083.24; IRR = 8.96%

B)NPV = $2,706.35; IRR = 11.93%

C)NPV = $3,824.56; IRR = 14.87%

D)NPV = $4,522.85: IRR = 17.09%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the approximate IRR of a project that requires an investment of $9,900 today and will generate $1,500 per year for ten years and an additional $10,000 at the end of the tenth year?

A)8.37%

B)11.75%

C)14.43%

D)15.20%

A)8.37%

B)11.75%

C)14.43%

D)15.20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following capital budgeting analysis methods may not use all possible cash flows in its calculations?

A)NPV

B)IRR

C)Payback

D)All of the above

A)NPV

B)IRR

C)Payback

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck

80

What is the payback period of a project that requires an initial cash outlay of $16,000 and provides cash flows of $4,500 in year 1, $5,500 in year 2, $6,500 in year 3, and $7,500 in year 4? Assume the appropriate discount rate is 10%.

A)2.08 years

B)2.36 years

C)2.68 years

D)2.92 years

A)2.08 years

B)2.36 years

C)2.68 years

D)2.92 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 149 في هذه المجموعة.

فتح الحزمة

k this deck