Deck 20: Cost of Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/68

العب

ملء الشاشة (f)

Deck 20: Cost of Capital

1

The required rate of return on Montreal Computing Power's equity is 15% and the yield on their debt is 7%.There are no taxes and all cash flows are perpetuities.If the value of the debt is $1,000 and value of the equity is $1,000, what level of earnings must Montreal Computing Power earn in order to support the current valuation?

A)$290

B)$300

C)$330

D)$220

A)$290

B)$300

C)$330

D)$220

$220

2

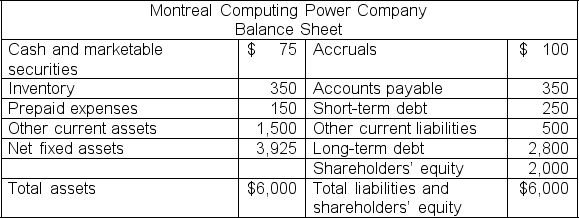

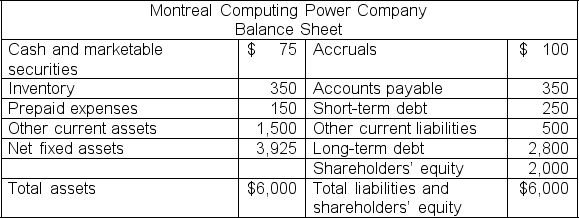

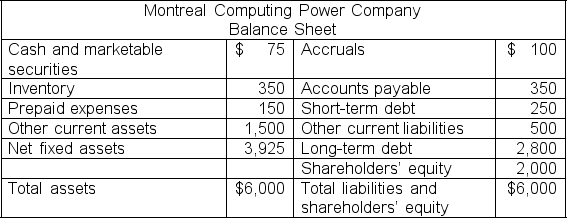

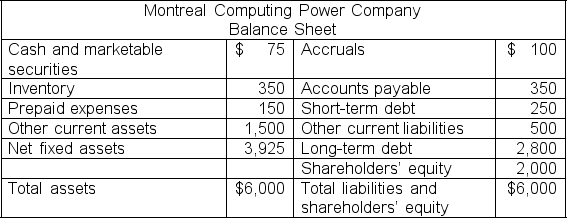

Using the following information, determine the market-to-book ratio for Montreal Computing Power Company.

Montreal Computing Power Company has 1,000 common shares outstanding.The shares were issued 10 years ago at $4 per share and currently trade at a price of $3..Note that there are no preferred shares issued or outstanding.

A)0.667

B)0.933

C)1.400

D)1.500

Montreal Computing Power Company has 1,000 common shares outstanding.The shares were issued 10 years ago at $4 per share and currently trade at a price of $3..Note that there are no preferred shares issued or outstanding.

A)0.667

B)0.933

C)1.400

D)1.500

1.500

3

A firm has a capital structure that uses 45% equity, 20% preferred shares, and 35% debt.The preferred shares have a current yield of 5.5%.The debt has a coupon rate of 10% and a current yield to maturity of 6.5%.The common shares have a yield of 8%.The firm has an income tax rate of 25%.What is the firm's WACC?

A)5.231%

B)6.700%

C)6.406%

D)6.975%

A)5.231%

B)6.700%

C)6.406%

D)6.975%

6.406%

4

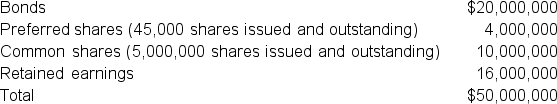

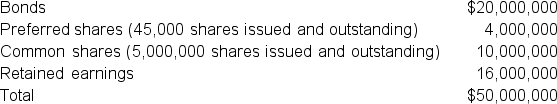

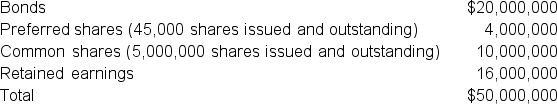

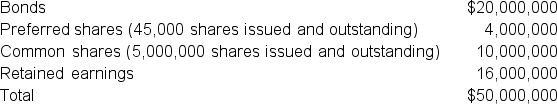

Using the following information, determine the debt-to-equity ratio for Montreal Computing Power Company.Note that there are no preferred shares issued or outstanding.

A)1.400

B)1.525

C)1.775

D)1.950

A)1.400

B)1.525

C)1.775

D)1.950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm has 2 million common shares outstanding, which are currently trading at $45 per share and have a dividend yield of 10%.The firm also has $40 million of 6% bonds outstanding that are currently trading at 110 with a 5-year maturity.There are no preferred shares and no income taxes.What is the WACC?

A)7.70%

B)7.85%

C)7.95%

D)8.77%

A)7.70%

B)7.85%

C)7.95%

D)8.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

6

MinMax Corp has the following capital structure: 55% common equity (giving a return of 9%), 10% preferred shares (with a yield of 6%), and 35% debt (with a coupon rate of 10% and yield to maturity of 6.5%).If MinMax Corp.has an income tax rate of 40%, what is the firm's WACC?

A)10.333%

B)9.050%

C)7.825%

D)6.915%

A)10.333%

B)9.050%

C)7.825%

D)6.915%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

7

In estimating a firm's cost of debt, which of the following should be used?

A)The yield to maturity when the bonds were issued.

B)The yield to maturity of the bonds based on current bond prices.

C)The coupon rate payable on the bonds.

D)The coupon rate payable on similar bonds.

A)The yield to maturity when the bonds were issued.

B)The yield to maturity of the bonds based on current bond prices.

C)The coupon rate payable on the bonds.

D)The coupon rate payable on similar bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is NOT correct regarding the equity portion of the WACC?

A)Preferred equity is separate from common equity

B)Market values rather than book values should be used

C)Retained earnings is not included

D)Both equity and debt have a tax shield

A)Preferred equity is separate from common equity

B)Market values rather than book values should be used

C)Retained earnings is not included

D)Both equity and debt have a tax shield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

9

A firm's cost of debt can best be estimated:

A)by adding a risk premium to the coupon rate.

B)using the yield-to-maturity on newly issued debt of other firms.

C)using the firm's borrowing rate on short-term loans.

D)using the yield-to-maturity on the firm's outstanding debt.

A)by adding a risk premium to the coupon rate.

B)using the yield-to-maturity on newly issued debt of other firms.

C)using the firm's borrowing rate on short-term loans.

D)using the yield-to-maturity on the firm's outstanding debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

10

A firm has 2 million common shares outstanding, which are currently trading at $45 per share and have a dividend yield of 10%.The firm also has $40 million of 6% bonds outstanding that are currently trading at 110, with a yield to maturity of 3%.There are no preferred shares and no income taxes.Based on this information what is the WACC?

A)7.70%

B)7.85%

C)8.69%

D)8.77%

A)7.70%

B)7.85%

C)8.69%

D)8.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

11

Using the following information, determine the earnings per share (EPS)for Montreal Computing Power Company.

Montreal Computing Power Company has 1,000 common shares outstanding and no preferred shares.The shares were issued 10 years ago at $1.25 per share and currently trade at $3 per share.

A)-$1.00

B)$0.80

C)$1.00

D)$2.00

Montreal Computing Power Company has 1,000 common shares outstanding and no preferred shares.The shares were issued 10 years ago at $1.25 per share and currently trade at $3 per share.

A)-$1.00

B)$0.80

C)$1.00

D)$2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

12

Argus Mining Company is financed by $2 million in debt (yield of 8%)and $1 million in equity (returning a rate of 22%).If we assume no taxes and perpetual cash flows, what level of earnings must Argus Mining Company earn in order to be considered a value-creating company?

A)$380,000

B)$400,000

C)$520,000

D)$630,000

A)$380,000

B)$400,000

C)$520,000

D)$630,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is the least permanent source of capital for a firm?

A)A 10% coupon bond purchased 3 years ago

B)Preferred shares

C)10% coupon bonds issued 10 years ago

D)Accounts payable

A)A 10% coupon bond purchased 3 years ago

B)Preferred shares

C)10% coupon bonds issued 10 years ago

D)Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements is/are true about the marginal cost of capital?

A)It is the weighted average cost of the next dollar of financing raised.

B)For most levels of financing, it equals the weighted average cost of capital.

C)It exceeds the weighted average cost of capital due to flotation costs.

D)All of the above are true.

A)It is the weighted average cost of the next dollar of financing raised.

B)For most levels of financing, it equals the weighted average cost of capital.

C)It exceeds the weighted average cost of capital due to flotation costs.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

15

MinMax Corp has the following capital structure: 55% common equity (giving a return of 9%), 10% preferred shares (with a yield of 6%), and 35% debt (with a coupon rate of 10% and yield to maturity of 6.5%).If there are no taxes, what is the firm's WACC?

A)10.333%

B)9.050%

C)7.825%

D)6.915%

A)10.333%

B)9.050%

C)7.825%

D)6.915%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the following statements to answer this question:

I.Regulated industries offer their shareholders a limited required rate of return.

II.Regulated industries have a very low level of debt.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.Regulated industries offer their shareholders a limited required rate of return.

II.Regulated industries have a very low level of debt.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not needed to determine a firm's WACC?

A)The book value of the equity.

B)The market value of the debt.

C)The current share price.

D)The current yield on preferred shares.

A)The book value of the equity.

B)The market value of the debt.

C)The current share price.

D)The current yield on preferred shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

18

A firm has a capital structure that uses 45% equity, 20% preferred shares, and 35% debt.The preferred shares have a current yield of 5.5%.The debt has a coupon rate of 10% and a current yield to maturity of 6.5%.The common shares have a yield of 8%.Ignoring income taxes, what is the firm's WACC?

A)6.575%

B)6.975%

C)7.275%

D)8.200%

A)6.575%

B)6.975%

C)7.275%

D)8.200%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

19

An analyst has obtained the following information about Maudite Brewers Co.:

Book value of assets $25,000

Book value of common equity $10,000, with 4,000 shares outstanding, currently trading at $5 per share

Book value of preferred shares $5,000, with 3,000 preferred shares outstanding which are currently trading at $2 per share.

The yield on the debt equals the coupon rate.

The weights used to determine the weighted average cost of capital are:

Common Equity: Preferred Equity: Debt:

A)55.56% 16.67% 27.77%

B)40% 20% 40%

C)80% 10% 10%

D)Cannot be determined because we need the market value of debt.

Book value of assets $25,000

Book value of common equity $10,000, with 4,000 shares outstanding, currently trading at $5 per share

Book value of preferred shares $5,000, with 3,000 preferred shares outstanding which are currently trading at $2 per share.

The yield on the debt equals the coupon rate.

The weights used to determine the weighted average cost of capital are:

Common Equity: Preferred Equity: Debt:

A)55.56% 16.67% 27.77%

B)40% 20% 40%

C)80% 10% 10%

D)Cannot be determined because we need the market value of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the following statements to answer this question:

I.Without taxes, the benefit of having debt on the WACC largely vanishes.

II.Preferred shares cost the same as common equity financing.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.Without taxes, the benefit of having debt on the WACC largely vanishes.

II.Preferred shares cost the same as common equity financing.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following statements to answer this question:

I.The source of volatility in operating income is caused by fixed costs.

II.Operating leverage does not necessarily increase with increases in the volatility of net income.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The source of volatility in operating income is caused by fixed costs.

II.Operating leverage does not necessarily increase with increases in the volatility of net income.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

22

Toronto Skaters Co.has a return on equity of 8% and pays out 20% of its earnings in dividends.The expected growth in dividends is:

A)1.6%

B)6.4%

C)8%

D)20%

A)1.6%

B)6.4%

C)8%

D)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a firm's debt-to-equity ratio is 3, what is the weighted average cost of capital for the firm if the required rate of return on equity is 12.4% and the cost of debt is 8.4 %?

A)11.40%

B)11.06%

C)9.73%

D)9.40%

A)11.40%

B)11.06%

C)9.73%

D)9.40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

24

The cost of a security to a company may differ from the security's yield in the capital markets due to:

I.Flotation costs

II.Agency costs

III.Taxes

A)I only

B)I and II only

C)I and III only

D)I and II and III

I.Flotation costs

II.Agency costs

III.Taxes

A)I only

B)I and II only

C)I and III only

D)I and II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

25

According to The Boston Consulting Group, a firm with a low present value of existing operations but a high present value of growth opportunities would be classified as:

A)A dog

B)A cash cow

C)A star

D)A turnaround firm

A)A dog

B)A cash cow

C)A star

D)A turnaround firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

26

According to The Boston Consulting Group, a star is characterized by:

A)High present value of operations now and low present value of growth opportunities

B)High present value of operations now and high present value of growth opportunities

C)Low present value of operations now and low present value of growth opportunities

D)Low present value of operations now and high present value of growth opportunities

A)High present value of operations now and low present value of growth opportunities

B)High present value of operations now and high present value of growth opportunities

C)Low present value of operations now and low present value of growth opportunities

D)Low present value of operations now and high present value of growth opportunities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

27

The return on equity of KillerApps Inc.is 20% of which it pays out 30% as dividends and reinvests the rest in the company.The company is expected to pay a dividend of $1.50 next year and the current stock price is $30.The cost of equity of KillerApps is:

A)11.30%

B)19.00%

C)19.70%

D)30.00%

A)11.30%

B)19.00%

C)19.70%

D)30.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

28

A company with a debt-to-equity (D/E)ratio of 0.5 has:

A)66.66% debt

B)66.66% equity

C)33.33% equity

D)50.00% debt

A)66.66% debt

B)66.66% equity

C)33.33% equity

D)50.00% debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

29

A firm has 750,000 preferred shares outstanding.Each share has a stated dividend amount of $1.65 per share and are currently priced to yield 7.5%.What is the cost of the preferred shares if the firm's income tax rate is 27% and flotation costs on any new preferred share issue will be 2% before tax?

A)7.50%

B)7.61%

C)7.65%

D)30.0%

A)7.50%

B)7.61%

C)7.65%

D)30.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

30

James Bay Water Park Company's preferred shares pay an annual dividend of $3 per share.What is the cost of preferred stock if the current price is $80 per share and after-tax flotation costs are $6 per share?

A)4.05%

B)3.75%

C)7.50%

D)7.79%

A)4.05%

B)3.75%

C)7.50%

D)7.79%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

31

Laurentide Union Bank is expected to pay a dividend of $4.20 per common share in one year.The dividend is expected to grow at a rate of 5% for the foreseeable.If the current market price for a share of Laurentide Union Bank is $40, what is the cost of equity?

A)5.00%

B)9.52%

C)10.50%

D)15.50%

A)5.00%

B)9.52%

C)10.50%

D)15.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

32

The long-term debt of Laurentide Union Bank is currently selling at 103.The issue matures in 20 years and pays an annual coupon of 8%.The corporate tax rate is 40%.What is the after-tax cost of debt for Laurentide Union?

A)3.08%

B)4.62%

C)4.80%

D)7.70%

A)3.08%

B)4.62%

C)4.80%

D)7.70%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

33

When determining the costs of each component of a firm's capital structure, the firm must evaluate the:

A)marginal cost of new funds

B)total cost of new funds

C)average cost of new funds

D)average cost of old and new funds

A)marginal cost of new funds

B)total cost of new funds

C)average cost of new funds

D)average cost of old and new funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

34

Greengrocer Foods will pay a dividend of $3.75 per share in one year and expects this dividend to grow at a rate of 4% for the foreseeable future.If its common shares are currently trading at $50, what is the cost of Greengrocer Foods' equity?

A)7.50%

B)11.50%

C)12.25%

D)15.75%

A)7.50%

B)11.50%

C)12.25%

D)15.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a company increases the proportion of debt in a firm's capital structure, then:

A)the increased debt is not covered by the tax shield.

B)holders of common shares will expect a higher rate of return

C)the company's equity beta will decrease

D)the firm's WACC remains unchanged.

A)the increased debt is not covered by the tax shield.

B)holders of common shares will expect a higher rate of return

C)the company's equity beta will decrease

D)the firm's WACC remains unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

36

Laurentide Union Bank is expected just paid a dividend of $4.20 per common share.Laurentide Union Bank expects dividends to grow at a rate of 5% for the foreseeable.If the current market price for a share of Laurentide Union Bank is $40, what is the cost of equity?

A)10.50%

B)11.02%

C)15.50%

D)16.02%

A)10.50%

B)11.02%

C)15.50%

D)16.02%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

37

Poutine Company is considering offering long-term contracts to many of its non-contract employees (a switch from variable labour costs to fixed labour costs).What is the impact of this decision?

A)The increase in operating leverage results in greater variability in operating income.

B)The increase in operating leverage results in less variability in operating income.

C)The decrease in operating leverage results in greater variability in operating income.

D)The decrease in operating leverage results in less variability in operating income.

A)The increase in operating leverage results in greater variability in operating income.

B)The increase in operating leverage results in less variability in operating income.

C)The decrease in operating leverage results in greater variability in operating income.

D)The decrease in operating leverage results in less variability in operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following statements to answer this question:

I.The cost of debt of the firm is always constant.

II.The estimation of the cost of debt using the yield to maturity requires the price of the bonds now.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The cost of debt of the firm is always constant.

II.The estimation of the cost of debt using the yield to maturity requires the price of the bonds now.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is most relevant for estimating a firm's cost of debt?

A)The yield to maturity at issuance.

B)The return bondholders would demand for new debt.

C)The coupon rate on existing debt.

D)None of the above is relevant.

A)The yield to maturity at issuance.

B)The return bondholders would demand for new debt.

C)The coupon rate on existing debt.

D)None of the above is relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

40

The management of James Bay Water Park is concerned about the volatility of the firm's net income.In order to reduce this volatility, they are planning on issuing new shares to repurchase debt and to enter into more fixed contracts with suppliers.The effect of these actions is likely to be:

A)A reduction of volatility of net income due to the reduction in financial leverage.

B)An increase in volatility of net income due to the reduction in financial leverage.

C)A reduction of volatility of net income due to the reduction in financial leverage and increase in operating leverage.

D)The impact on the volatility of net income is unclear as the effects of the reduction in financial leverage and increase in operating leverage are opposite.

A)A reduction of volatility of net income due to the reduction in financial leverage.

B)An increase in volatility of net income due to the reduction in financial leverage.

C)A reduction of volatility of net income due to the reduction in financial leverage and increase in operating leverage.

D)The impact on the volatility of net income is unclear as the effects of the reduction in financial leverage and increase in operating leverage are opposite.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

41

The CFO of Cynergy Inc.decides to recalculate the company's WACC based on higher growth expectations for the firm, thus making the new WACC:

A)Lower than the previous WACC because the cost of debt decreases.

B)Lower than the previous WACC because the cost of equity decreases.

C)Higher than the previous WACC because the cost of debt increases.

D)Higher than the previous WACC because the cost of equity increases.

A)Lower than the previous WACC because the cost of debt decreases.

B)Lower than the previous WACC because the cost of equity decreases.

C)Higher than the previous WACC because the cost of debt increases.

D)Higher than the previous WACC because the cost of equity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

42

The manager of Montreal Trustco has noticed that as the dividend payout ratio of the firm increases the value of the firm's equity declines.This is most likely due to:

A)The firm's return on equity is lower than the required return on equity

B)The firm's return on equity is higher than the required return on equity

C)The firm's return on equity is equal to the required return on equity

D)None of the above is a likely explanation

A)The firm's return on equity is lower than the required return on equity

B)The firm's return on equity is higher than the required return on equity

C)The firm's return on equity is equal to the required return on equity

D)None of the above is a likely explanation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

43

Activa Sports Gyms is considering a project that is virtually risk-free.It has a beta of 1.5 and a D/E ratio of 0.6.The appropriate discount rate to use in analyzing this project is:

A)The cost of equity computed from its beta.

B)The adjusted WACC based on a beta of 1.0.

C)The WACC based on market values.

D)The Treasury-bill rate.

A)The cost of equity computed from its beta.

B)The adjusted WACC based on a beta of 1.0.

C)The WACC based on market values.

D)The Treasury-bill rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Saguenay Tourism Company has a beta of 1.30, the risk-free rate is 3%, and the return on the market is 4%.The required return on the firm's equity is:

A)3.9%

B)6.5%

C)4.30%

D)9.50%

A)3.9%

B)6.5%

C)4.30%

D)9.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Third Cup Company has just paid a dividend of $3 per share.The dividends are expected to grow at a rate of 4% per year forever.The current stock price is $25 per share.The firm faces a tax rate of 40% and flotation costs of 5% on new stock issues.The cost of equity for new funds is:

A)9.89%

B)10.12%

C)16.48%

D)16.87%

A)9.89%

B)10.12%

C)16.48%

D)16.87%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

46

Montreal Trustco expects to pay a dividend of $5 next year.Dividends are expected to grow at 3% for the foreseeable future and the market requires a rate of return of 7% on its stock.Montreal Trustco can issue new stock at $125 per share with after-tax flotation costs of $20 per share.The cost of issuing new equity to Montreal Trustco is:

A)3.00%

B)7.00%

C)7.76%

D)11.76%

A)3.00%

B)7.00%

C)7.76%

D)11.76%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

47

The manager of Montreal Trustco has noticed that as the dividend payout ratio of the firm increases the value of the firm's equity increases.This is most likely due to:

A)The firm's return on equity is lower than the required return on equity

B)The firm's return on equity is higher than the required return on equity

C)The firm's return on equity is equal to the required return on equity

D)None of the above is a likely explanation.

A)The firm's return on equity is lower than the required return on equity

B)The firm's return on equity is higher than the required return on equity

C)The firm's return on equity is equal to the required return on equity

D)None of the above is a likely explanation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

48

Toronto Skaters Company is an all-equity company and is able to fund a $1 million investment using cash.The company has a beta of 1.4, the risk-free rate is3%, and the return on the market is 8%.Flotation costs for new equity are 2%.The tax rate is 40%.What is the WACC of the investment?

A)14.2%

B)10%

C)8%

D)6.6%

A)14.2%

B)10%

C)8%

D)6.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

49

According to The Boston Consulting Group, a cash cow is characterized by:

A)High present value of existing operations and low present value of growth opportunities

B)High present value of existing operations and high present value of growth opportunities

C)Low present value of existing operations and low present value of growth opportunities

D)Low present value of existing operations and high present value of growth opportunities

A)High present value of existing operations and low present value of growth opportunities

B)High present value of existing operations and high present value of growth opportunities

C)Low present value of existing operations and low present value of growth opportunities

D)Low present value of existing operations and high present value of growth opportunities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

50

Explain why when calculating the weighted average cost of capital for a firm, retained earnings is never included in the calculations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

51

Cynergy Inc.currently has a debt-equity ratio of 0.70, an after-tax cost of debt of 7.5%, and a cost of equity of 14%.If the firm changes its debt-equity ratio to 0.40, it will:

A)Decrease the firm's WACC.

B)Increase the firm's total debt.

C)Cause the NPV of projects under consideration to decrease.

D)Not have an effect on the firm's capital budgeting decisions.

A)Decrease the firm's WACC.

B)Increase the firm's total debt.

C)Cause the NPV of projects under consideration to decrease.

D)Not have an effect on the firm's capital budgeting decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

52

The current T-Bill rate is 3%, and the market risk premium is 9%.If Arabica Coffee Company has a beta of 1.75, its required return on equity is:

A)9.0%

B)13.50%

C)15.75%

D)18.75%

A)9.0%

B)13.50%

C)15.75%

D)18.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following statements to answer this question:

I.A firm's growth depends on its reinvestment opportunities.

II.Increasing the firm's retention ratio does not always increase the value of the firm.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.A firm's growth depends on its reinvestment opportunities.

II.Increasing the firm's retention ratio does not always increase the value of the firm.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Third Cup Company has just paid a dividend of $3 per share.The dividends are expected to grow at a rate of 4% per year for the foreseeable future.The current stock price is $25 per share.The firm faces a tax rate of 40% and flotation costs of 5% on new stock issues.The cost of equity for internal funds is:

A)9.89%

B)10.12%

C)16.48%

D)16.87%

A)9.89%

B)10.12%

C)16.48%

D)16.87%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Saguenay Tourism Company is an all-equity company and is able to fund a $1 million investment using cash.The company has a beta of 1.4, the risk-free rate is 2%, and the return on the market is 8%.After-tax flotation costs for new equity are 5%.The appropriate cost of capital is:

A)0.00%

B)5.00%

C)10.40%

D)10.95%

A)0.00%

B)5.00%

C)10.40%

D)10.95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Saguenay Tourism Company has a beta of .80, the risk-free rate is 4%, and the market risk premium is 6%.The required return on the firm's equity is:

A)4.0%

B)5.6%

C)8.8%

D)6.0%

A)4.0%

B)5.6%

C)8.8%

D)6.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Montreal Film Festival Company has a book value per share of $10 and a current return on equity of 7%.The firm expects to invest $100 next year and earn a return of 10% on that investment.The market requires a rate of return of 5% on the firm's equity.Given this information, what are the present value of existing opportunities (PVEO)and the present value of growth opportunities (PVGO)?

A)PVEO = $95.24; PVGO = $14.00

B)PVEO = $14.00; PVGO = $95.24

C)PVEO = $10.00; PVGO = $100.00

D)PVEO = $100.00; PVGO = $10.00

A)PVEO = $95.24; PVGO = $14.00

B)PVEO = $14.00; PVGO = $95.24

C)PVEO = $10.00; PVGO = $100.00

D)PVEO = $100.00; PVGO = $10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following statements to answer this question:

I.The WACC is the most appropriate rate to discount future cash flows of average risk.

II.The investment opportunities schedule uses WACC as a threshold for investment.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

I.The WACC is the most appropriate rate to discount future cash flows of average risk.

II.The investment opportunities schedule uses WACC as a threshold for investment.

A)I and II are correct.

B)I and II are incorrect.

C)I is correct and II is incorrect.

D)I is incorrect and II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

59

Toronto Skaters Company is an all-equity company and is able to fund a $1 million investment using cash.The company has a beta of 1.4, the risk-free rate is 3%, and the return on the market is 8%.Flotation costs for new equity are 3%.Ignore income taxes for this question.The appropriate cost of capital is:

A)0% as the firm is using cash.

B)0% as the firm is using funds that have already been raised from the capital markets.

C)The required return on the outstanding equity.

D)The cost of equity taking into account the flotation costs.

A)0% as the firm is using cash.

B)0% as the firm is using funds that have already been raised from the capital markets.

C)The required return on the outstanding equity.

D)The cost of equity taking into account the flotation costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Third Cup Company has a return on equity of 10% and pays out 30% of its earnings as dividends.The company is expected to pay a dividend of $2 next year and the current stock price is $20.The cost of equity of The Third Cup Company is:

A)17%

B)13%

C)10%

D)7%

A)17%

B)13%

C)10%

D)7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

61

Regent Fireplaces Ltd.is establishing an appropriate discount rate to apply to this year's investment projects.The controller has suggested the weighted average cost of capital (WACC)would be an appropriate rate and has gathered the following information as a start to finding the WACC:

Selected information from the December 31, 2022 Balance Sheet

The bonds, which have 15 years to maturity, have a coupon rate of 6.0% with interest paid semi-annually.Current market yields on this risk security are currently about 4.5%.Flotation costs would be 1.0% of the issue price.

The preferred shares with a fixed dividend $4.10 per share currently trade at $82.00 per share.Flotation expenses of a new issue of preferred would be $3.20 per share.

The common shares are currently trading at $8.00 per share.The most recent dividend was $0.12 per share.Flotation expenses would be $0.25 per share.The risk-free rate is currently 1.75%, and the market rate of return is 7.25%.Regent Fireplaces Ltd.has a beta of 1.25.

Regent's tax rate is 30%.All flotation costs are stated as after-tax.

Calculate the weighted average cost of capital of Regent.

Selected information from the December 31, 2022 Balance Sheet

The bonds, which have 15 years to maturity, have a coupon rate of 6.0% with interest paid semi-annually.Current market yields on this risk security are currently about 4.5%.Flotation costs would be 1.0% of the issue price.

The preferred shares with a fixed dividend $4.10 per share currently trade at $82.00 per share.Flotation expenses of a new issue of preferred would be $3.20 per share.

The common shares are currently trading at $8.00 per share.The most recent dividend was $0.12 per share.Flotation expenses would be $0.25 per share.The risk-free rate is currently 1.75%, and the market rate of return is 7.25%.Regent Fireplaces Ltd.has a beta of 1.25.

Regent's tax rate is 30%.All flotation costs are stated as after-tax.

Calculate the weighted average cost of capital of Regent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

62

A firm is going to finance a new project 100% with debt, through a new bond issue.Since the firm is only using debt to finance the project, the NPV of the project should be calculated using the cost of debt as the discount rate.Is this statement true, false, or uncertain? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

63

Multiplex Entertainment has 9 million common shares outstanding, 250,000 preferred shares with a 6% dividend, and 105,000 semi-annual bonds at 7.5% (with par value of $1000 each).Common shares sell at $34/share (beta 1.25), preferred stock at $91/share, and the bonds at 93% of par with 15 years to maturity.The market risk premium is 8.5%, T-Bills are yielding 5%, and the corporate tax rate is 35%.

What is the Multiplex Entertainment's WACC?

If Multiplex Entertainment is evaluating a new investment project with the same risk as the firm's typical projects, what should the firm use to discount the project's cash flows?

What is the Multiplex Entertainment's WACC?

If Multiplex Entertainment is evaluating a new investment project with the same risk as the firm's typical projects, what should the firm use to discount the project's cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

64

Regent Fireplaces Ltd.is establishing an appropriate discount rate to apply to this year's investment projects.The controller has suggested the weighted average cost of capital (WACC)would be an appropriate rate and has gathered the following information as a start to finding the WACC:

Selected information from the December 31, 2022 Balance Sheet

The bonds, which have 15 years to maturity, have a coupon rate of 6.0% with interest paid semi-annually.Current market yields on similar bonds are currently 4.5%.Flotation costs would be 1.0% of the issue price.

The preferred shares with a fixed dividend $7.10 per share currently trade at $102.00 per share.Flotation expenses of a new issue of preferred would be $3.20 per share.

The common shares are currently trading at $8.00 per share.The most recent dividend was $0.12 per share with a projected annual growth rate of 10% annually.Flotation expenses would be $0.25 per share.

Regent's tax rate is 35%.All flotation costs are stated as after-tax.

Calculate the weighted average cost of capital of Regent.

Selected information from the December 31, 2022 Balance Sheet

The bonds, which have 15 years to maturity, have a coupon rate of 6.0% with interest paid semi-annually.Current market yields on similar bonds are currently 4.5%.Flotation costs would be 1.0% of the issue price.

The preferred shares with a fixed dividend $7.10 per share currently trade at $102.00 per share.Flotation expenses of a new issue of preferred would be $3.20 per share.

The common shares are currently trading at $8.00 per share.The most recent dividend was $0.12 per share with a projected annual growth rate of 10% annually.Flotation expenses would be $0.25 per share.

Regent's tax rate is 35%.All flotation costs are stated as after-tax.

Calculate the weighted average cost of capital of Regent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

65

Laurentide Resort has just paid a dividend of $3.The current stock price is $25.The beta of the company is 1.3, the risk-free rate is 2%, and the market risk premium is 6%.The firm earns a return on equity of 10%.Is this a growth firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the cost of internally generated funds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

67

Pataty Patata Company is considering a project that costs $1 million.The project will generate constant perpetual earnings.The firm has just paid a common share dividend of $5 and dividends are expected to be constant for the foreseeable future.The current value of one common share is $25.The firm has 100,000 common shares outstanding.

The firm also has perpetual debt with a market value of $3 million and annual coupon payments of $300,000.

The firm has an income tax rate of 35%.The firm will not need to issue new securities to finance the project.Determine the minimum annual cash flows that must be generated by the project in order for the project to be undertaken.Demonstrate that the project will satisfy the requirements of the capital providers.

The firm also has perpetual debt with a market value of $3 million and annual coupon payments of $300,000.

The firm has an income tax rate of 35%.The firm will not need to issue new securities to finance the project.Determine the minimum annual cash flows that must be generated by the project in order for the project to be undertaken.Demonstrate that the project will satisfy the requirements of the capital providers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

68

Toronto Skaters Company has a D/E ratio of 1.5.The company has 1,000 shares outstanding and a beta of 1.2.The risk-free rate is 3% and the market risk premium is 5%.The company has 10-year debt with a face value of $1 million and annual coupons of 4%.The debt is currently trading at 105.The tax rate is 35%.Calculate the weighted average cost of capital for Toronto Skaters Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck