Deck 10: Accounting for Long-Term Debt

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/171

العب

ملء الشاشة (f)

Deck 10: Accounting for Long-Term Debt

1

On January 1, Year 1, Daniels Company issued bonds with a face value of $500,000, receiving $496,000 cash. When the bonds mature, Daniels will have to pay the face value of the bonds to the bondholders.

True

2

For a long-term note payable, repaying a portion of principal along with interest payments is called loan amortization.

True

3

If a company has issued bonds at a premium, the amount of interest expense reported on the income statement each year will be greater than the amount of cash paid to bondholders for interest.

False

4

Serial bonds are issued based on the overall strength of the borrower's credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

5

If the stated interest rate for bonds is the same as the effective interest rate, the bonds will be issued at their face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

6

Companies that issue bonds are required to pay the face value of the bonds at maturity and to make fluctuating periodic interest payments based on the market interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

7

Davis Corporation borrowed $50,000 on January 1, Year 1. The loan is for a 10-year period and has an annual interest rate of 9%. At the end of each year, Davis will make a payment of $7,791, which includes both principal and interest. The amount of the payment for Year 1 that is interest expense is $4,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

8

A line of credit is an agreement that allows a company to borrow a set amount of money for a period of one year or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

9

Park Enterprises issued bonds with a face value of $500,000, a stated rate of interest of 7%, and a 5-year term to maturity. The proceeds from the issuance were $508,000. Interest is payable in cash on December 31 of each year. Assuming straight-line amortization, the amount of interest expense for the first year would be $31,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

10

Amortization of a discount on bonds payable is an asset use transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

11

Davis Corporation borrowed $50,000 on January 1, Year 1. The loan is for a 10-year period and has an annual interest rate of 9%. At the end of each year, Davis will make a payment of $7,791, which includes both principal and interest. The amount of the payment for Year 1 that is repayment of principal is $3,587.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

12

Bonds sold as separate components of a single issue may have different maturity dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

13

A line of credit typically has an interest rate that is fixed (constant)for the length of the agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

14

Peak Enterprises issued bonds with a face value of $500,000, and received cash of $508,000. In recording this transaction, the liability account, Bonds Payable, will be increased by $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

15

If bonds are issued at a premium, the bond issuer will pay the bondholders an amount lower than the issue price at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

16

Davis Corporation borrowed $50,000 on January 1, Year 1. The loan is for a 10-year period and has an annual interest rate of 9%. At the end of each year, Davis will make a payment of $7,791, which includes both principal and interest. With this loan, the amount of interest expense that Davis reports on its income statement will be the same for each year of the loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

17

On January 1, Year 1, Daniels Company issued bonds with a face value of $500,000, receiving $496,000 cash. These bonds were issued at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a bond issuer's bond ratings drop, the company probably will have to pay higher interest rates on bonds that have already been issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a company chooses to call some of its callable bonds before their maturity, generally it will have to pay an amount that is greater than the carrying value of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

20

If bonds with a face value of $200,000 are issued at 98, the amount of cash received from issuing the bonds is $204,082.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

21

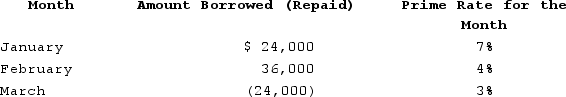

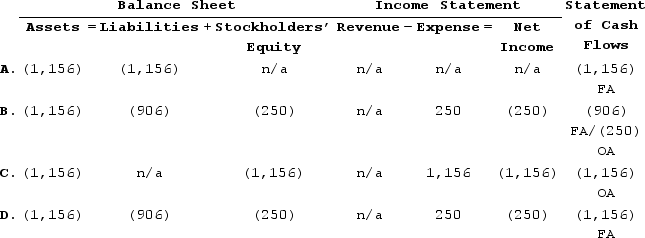

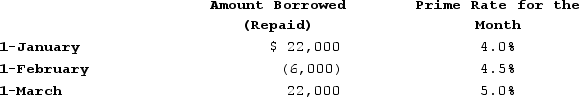

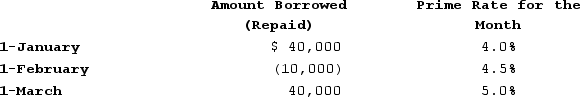

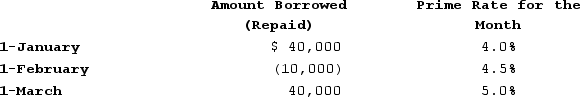

North Woods Company has a line of credit with Olympia State Bank. North Woods agreed to pay interest at an annual rate equal to 2% above the bank's prime rate. Funds are borrowed or repaid on the first day of each month and interest is paid in cash on the last day of each month. Borrowing is shown as a positive amount, and repayments are shown as negative amounts indicated by parentheses. Activity to date is given as follows:  What is the amount of interest paid at the end of March? (Do not round your intermediate calculations.)

What is the amount of interest paid at the end of March? (Do not round your intermediate calculations.)

A)$90.00

B)$150.00

C)$180.00

D)$210.00

What is the amount of interest paid at the end of March? (Do not round your intermediate calculations.)

What is the amount of interest paid at the end of March? (Do not round your intermediate calculations.)A)$90.00

B)$150.00

C)$180.00

D)$210.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

22

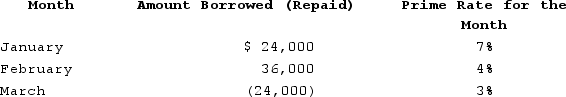

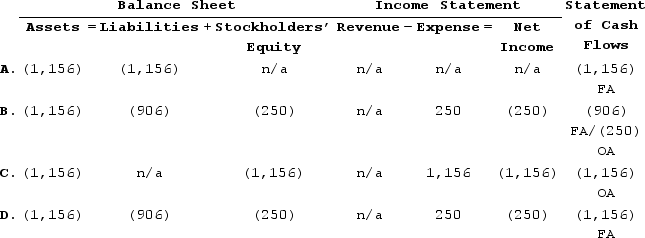

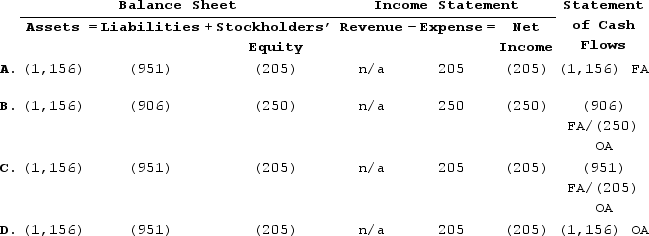

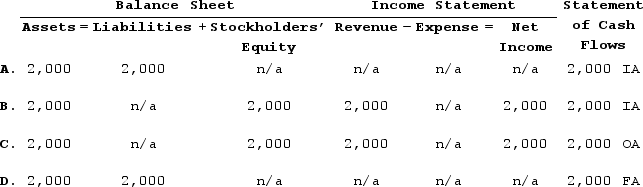

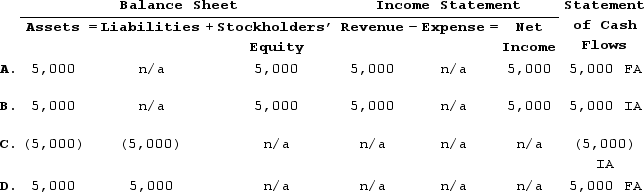

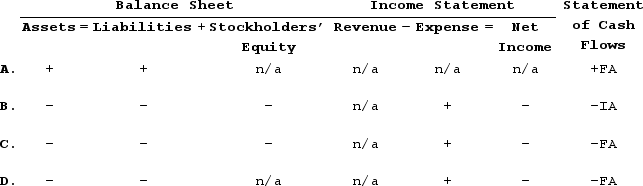

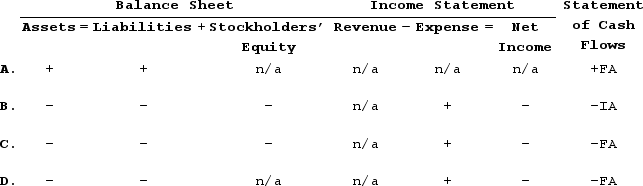

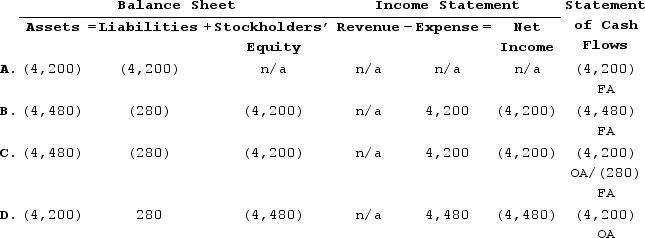

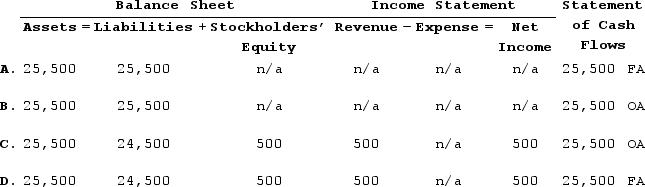

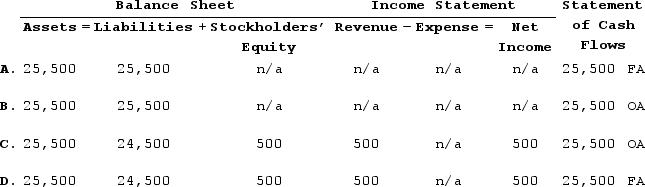

On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal.Which of the following shows the effect of the December 31, Year 1 payment?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

23

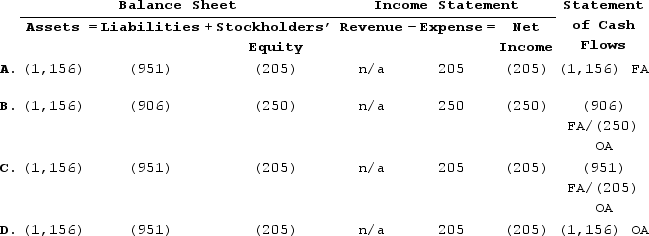

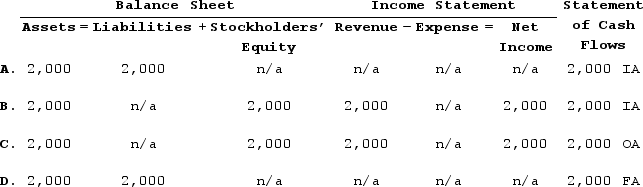

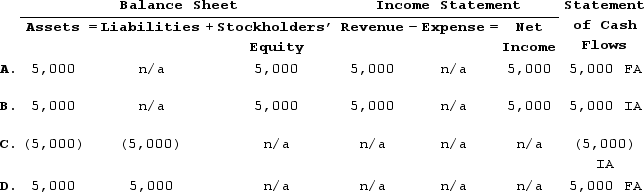

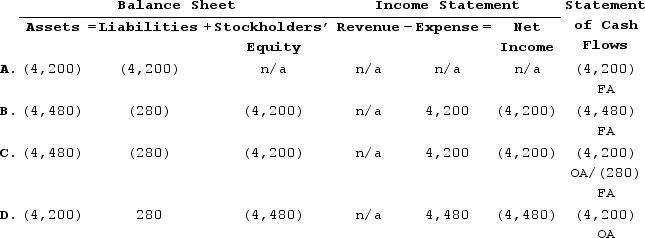

On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal.Which of the following correctly shows the effects of the December 31, Year 2 payment (rounded to the nearest whole dollar)?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

24

The effective interest rate method of amortizing bond discounts and premiums results in a constant amount of interest expense every period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 1, Year 1, Mahoney Company borrowed $182,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $45,583. What is the amount of principal repayment included in the payment made on December 31, Year 1?

A)$14,560

B)$31,023

C)$37,789

D)$41,075

A)$14,560

B)$31,023

C)$37,789

D)$41,075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

26

Currie Company borrowed $20,000 from Sierra Bank by issuing a 10% three-year note. Currie agreed to repay the principal and interest by making annual payments in the amount of $8,042. Based on this information, what is the amount of the interest expense associated with the second payment? (Round your answer to the nearest dollar.)

A)$730

B)$1,396

C)$2,000

D)$8,042

A)$730

B)$1,396

C)$2,000

D)$8,042

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a bond discount is amortized using the effective interest method, the total amount of interest recognized over the life of the bond is the same as if the straight-line method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

28

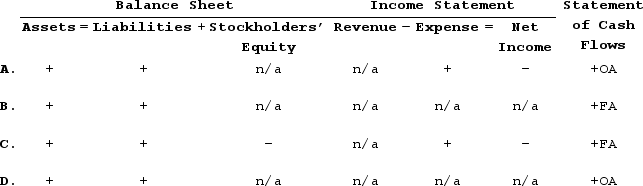

On January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year.Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1, Year 1. Niagara records the first year's interest payment on December 31, Year 1. Centennial's prime rate is 4% for Year 1. Which of the following shows the effect of this event on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

29

The effective rate of interest for a particular bond issue is the market rate of interest for other investments with similar levels of risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

30

Regardless of the specific type of long-term debt, which of the following is normally an expectation with regards to debt transactions?

A)Repayment of the debt

B)Payment of dividends

C)Payment of interest

D)Payment of interest and repayment of the debt

A)Repayment of the debt

B)Payment of dividends

C)Payment of interest

D)Payment of interest and repayment of the debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

31

How does the amortization of the principal balance on an installment note payable affect the amount of interest expense recorded each succeeding year?

A)Reduces the amount of interest expense each year

B)Increase the amount of interest expense each year

C)Has no effect on interest expense each year

D)Cannot be determined from the information provided

A)Reduces the amount of interest expense each year

B)Increase the amount of interest expense each year

C)Has no effect on interest expense each year

D)Cannot be determined from the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following correctly describes an installment note?

A)An installment note requires interest payments with the entire principal balance paid at maturity.

B)An installment note requires payments of interest and principal in which the amount of interest decreases over the life of the note.

C)An installment note requires payments of interest and principal in which the amount of interest increases over the life of the note.

D)The installment note requires decreasing payments of interest and principal in which the amount of interest remains constant over the life of the note.

A)An installment note requires interest payments with the entire principal balance paid at maturity.

B)An installment note requires payments of interest and principal in which the amount of interest decreases over the life of the note.

C)An installment note requires payments of interest and principal in which the amount of interest increases over the life of the note.

D)The installment note requires decreasing payments of interest and principal in which the amount of interest remains constant over the life of the note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

33

On January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year.Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1, Year 1. Which of the following shows the effect of this event on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

34

On January 1, Year 1, Mahoney Company borrowed $324,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $81,150.What is the amount of principal repayment included in the payment made on December 31, Year 1?

A)$25,920

B)$81,150

C)$74,658

D)$55,230

A)$25,920

B)$81,150

C)$74,658

D)$55,230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

35

The times-interest-earned ratio is usually calculated as the ratio of net income to interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

36

The after-tax interest cost of debt equals total interest expense multiplied by the tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

37

Currie Company borrowed $13,000 from Sierra Bank by issuing a 10% three-year note. Currie agreed to repay the principal and interest by making annual payments in the amount of $5,227. Based on this information, what is the amount of the interest expense associated with the second payment? (Round your answer to the nearest dollar.)

A)$596

B)$907

C)$1,300

D)$5,227

A)$596

B)$907

C)$1,300

D)$5,227

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

38

On January 1, Year 1, Mahoney Company borrowed $324,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $81,150.Which of the following shows the effects on the financial statement of the cash payment on December 31, Year 1?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

39

The tax deductibility of interest expense on bonds makes the effective cost of borrowing less than the amount of cash paid for interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

40

On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal.Which of the following correctly shows the effect of the issuance of the note on Platte's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

41

Johansen Company issued a bond at a discount. Which of the following shows how the issuance of the bonds affects the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

42

North Woods Company has a line of credit with Olympia State Bank. North Woods agreed to pay interest at an annual rate equal to 2% above the bank's prime rate. Funds are borrowed or repaid on the first day of each month and interest is paid in cash on the last day of each month. Borrowing is shown as a positive amount, and repayments are shown as negative amounts indicated by parentheses. Activity to date is given as follows:  What is the amount of interest paid at the end of March?

What is the amount of interest paid at the end of March?

A)$150

B)$300

C)$267

D)$250

What is the amount of interest paid at the end of March?

What is the amount of interest paid at the end of March?A)$150

B)$300

C)$267

D)$250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

43

Spokane Company called in bonds at a price that was above the carrying value of the bond liability. Which of the following shows how this event will affect the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a common restrictive covenant included in bond indentures to reduce risk to the investor?

A)Restrictions on increases in executive salaries

B)Restrictions on additional borrowing activities

C)Requirements that the names and addresses of the bondholders be registered with the bond issuer

D)Limitations on the payment of dividends

A)Restrictions on increases in executive salaries

B)Restrictions on additional borrowing activities

C)Requirements that the names and addresses of the bondholders be registered with the bond issuer

D)Limitations on the payment of dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following describes what happens when bonds are issued when the market interest rate is less than the stated interest rate?

A)The bonds are issued at a premium.

B)The bonds are issued at less than their face value.

C)It raises the effective interest rate above the stated rate of interest.

D)The bonds are issued at a premium and the effective interest rate is higher than the stated rate.

A)The bonds are issued at a premium.

B)The bonds are issued at less than their face value.

C)It raises the effective interest rate above the stated rate of interest.

D)The bonds are issued at a premium and the effective interest rate is higher than the stated rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

46

On January 1, Year 1, Bluestone Company issued bonds with a face value of $500,000 at 90. How will this transaction affect Bluestone Company's cash account?

A)Cash will increase by $450,000

B)Cash will increase by $500,000

C)Cash will increase by $470,000

D)Cash will increase by $50,000

A)Cash will increase by $450,000

B)Cash will increase by $500,000

C)Cash will increase by $470,000

D)Cash will increase by $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

47

What is another term used to describe unsecured bonds?

A)Discount bonds

B)Coupon bonds

C)Debentures

D)Par value bonds

A)Discount bonds

B)Coupon bonds

C)Debentures

D)Par value bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is the name used for the type of secured bond that requires a pledge of a designated piece of property in case of default?

A)Debenture bond

B)Indenture bond

C)Mortgage bond

D)Registered bond

A)Debenture bond

B)Indenture bond

C)Mortgage bond

D)Registered bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following describes the characteristics of a convertible bond?

A)Bonds mature at specified intervals throughout the life of the total issuance.

B)Bonds may be exchanged for stock at the discretion of the bondholder.

C)Bonds mature on a specified date in the future.

D)Bonds may be exchanged for stock at the discretion of the issuer.

A)Bonds mature at specified intervals throughout the life of the total issuance.

B)Bonds may be exchanged for stock at the discretion of the bondholder.

C)Bonds mature on a specified date in the future.

D)Bonds may be exchanged for stock at the discretion of the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

50

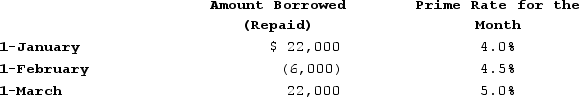

Franklin Company obtained a $85,000 line of credit from State Bank on January 1, Year 1. The company agreed to accept a variable interest rate that was set at 1% above the bank's prime lending rate. The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table. Assume that Franklin borrows or repays on the first day of each month.  What is the amount of interest expense recognized in March? (Do not round your intermediate calculations. Roundyour final answer to the nearest dollar.)

What is the amount of interest expense recognized in March? (Do not round your intermediate calculations. Roundyour final answer to the nearest dollar.)

A)$127

B)$143

C)$158

D)$190

What is the amount of interest expense recognized in March? (Do not round your intermediate calculations. Roundyour final answer to the nearest dollar.)

What is the amount of interest expense recognized in March? (Do not round your intermediate calculations. Roundyour final answer to the nearest dollar.)A)$127

B)$143

C)$158

D)$190

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

51

Franklin Company obtained a $160,000 line of credit from State Bank on January 1, Year 1. The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate. The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table. Assume that Franklin borrows or repays on the first day of each month.  What is the amount of interest expense recognized in March? (Round your answer to the nearest dollar.)

What is the amount of interest expense recognized in March? (Round your answer to the nearest dollar.)

A)$232

B)$262

C)$292

D)$408

What is the amount of interest expense recognized in March? (Round your answer to the nearest dollar.)

What is the amount of interest expense recognized in March? (Round your answer to the nearest dollar.)A)$232

B)$262

C)$292

D)$408

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following describes a callable bond?

A)Can be called for early retirement at the option of the issuer

B)Can be called for early retirement at the option of the bondholder

C)Convertible to common stock at the option of the bondholder

D)Convertible to common stock at the option of the issuer

A)Can be called for early retirement at the option of the issuer

B)Can be called for early retirement at the option of the bondholder

C)Convertible to common stock at the option of the bondholder

D)Convertible to common stock at the option of the issuer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is the term used to describe bonds that mature at specified intervals throughout the life of the issuance?

A)Term bonds

B)Registered bonds

C)Coupon bonds

D)Serial bonds

A)Term bonds

B)Registered bonds

C)Coupon bonds

D)Serial bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

54

On January 1, Year 1, Jones Company issued bonds with a $220,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. What is the amount of interest expense shown on Jones' income statement for the year ending December 31, Year 1?

A)$15,180

B)$19,140

C)$16,500

D)$17,820

A)$15,180

B)$19,140

C)$16,500

D)$17,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

55

On January 1, Year 1, Williams Corporation issued $200,000 of callable bonds at face value. The bonds carried a 2% call premium. If Williams calls the bonds, how would this event affect the company's accounting equation?

A)Decrease stockholders' equity by $4,000.

B)Decrease liabilities by $200,000.

C)Decrease assets by $204,000.

D)All of these answer choices are correct.

A)Decrease stockholders' equity by $4,000.

B)Decrease liabilities by $200,000.

C)Decrease assets by $204,000.

D)All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1, Year 1, Burton Corporation issued bonds with a face value of $200,000 for $196,000 cash.: Which of the following correctly describes the related transaction?

A)Burton issued bonds at 102.

B)Burton issued bonds at 98.

C)Burton issued bonds at a $4,000 premium.

D)Burton signed a note payable for $196,000.

A)Burton issued bonds at 102.

B)Burton issued bonds at 98.

C)Burton issued bonds at a $4,000 premium.

D)Burton signed a note payable for $196,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

57

How are bonds payable usually classified on the balance sheet?

A)Current liabilities

B)Long-term liabilities

C)Investments and funds

D)Other assets

A)Current liabilities

B)Long-term liabilities

C)Investments and funds

D)Other assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

58

Marvin Company issues $125,000 of bonds at face value on January 1. The bonds carry a 6% annual stated rate of interest. Interest is payable in cash on December 31 of each year. Which of the following shows the effect of the first interest payment on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method.What is the amount of interest expense shown on Jones' income statement for the year ending December 31, Year 1?

A)$16,200

B)$21,000

C)$15,000

D)$13,800

A)$16,200

B)$21,000

C)$15,000

D)$13,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

60

Pace Company issued bonds with a face value of $200,000 at 97. How does the issuance affect the company's accounting equation?

A)Assets and liabilities would both increase by $200,000.

B)Assets and liabilities would both increase by $194,000.

C)Assets would increase by $194,000 and liabilities would increase by $200,000.

D)Assets would increase by $200,000, and liabilities would increase by $194,000.

A)Assets and liabilities would both increase by $200,000.

B)Assets and liabilities would both increase by $194,000.

C)Assets would increase by $194,000 and liabilities would increase by $200,000.

D)Assets would increase by $200,000, and liabilities would increase by $194,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

61

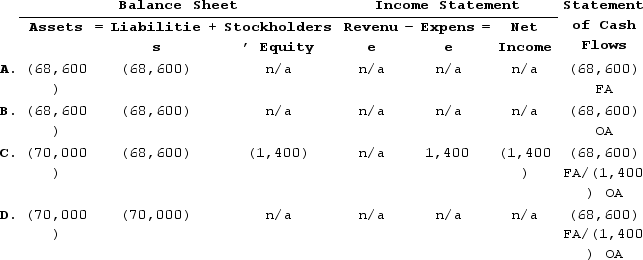

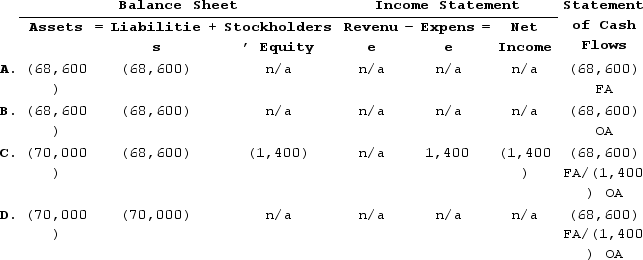

On January 1 Year 1, Gordon Corporation issued bonds with a face value of $70,000, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31 each year. Gordon uses the straight-line method to amortize bond discounts and premiums.Which of the following shows the effect of the first interest payment and amortization of the premium or discount on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

62

On January 1, Year 1, Hanover Corporation issued bonds with a $42,750 face value, a stated rate of interest of 8%, and a 5-yearterm to maturity. The bonds were issued at 97. Hanover uses the straight-line method to amortize bond discounts and premiums. Interest is payable in cash on December 31 each year. How much interest expense will Hanover report on its income statement on December 31, Year 1?

A)$257

B)$1,283

C)$3,420

D)$3,677

A)$257

B)$1,283

C)$3,420

D)$3,677

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

63

On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method.What is the amount of cash outflow from operating activities shown on Jones' statement of cash flows for the year ending December 31, Year 2?

A)$15,000

B)$16,200

C)$13,800

D)$17,400

A)$15,000

B)$16,200

C)$13,800

D)$17,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

64

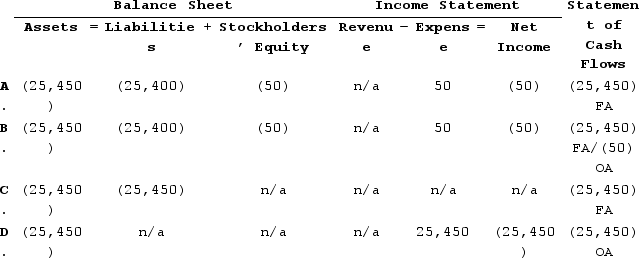

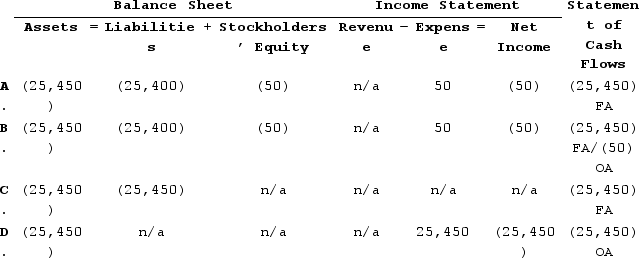

On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums.On January 1, Year 2, Pierce Corporation called the bonds payable at a price of $25,450. Which of the following shows the effect of this transaction on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

65

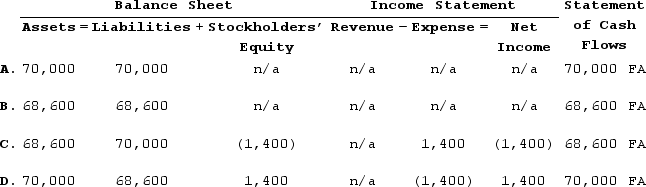

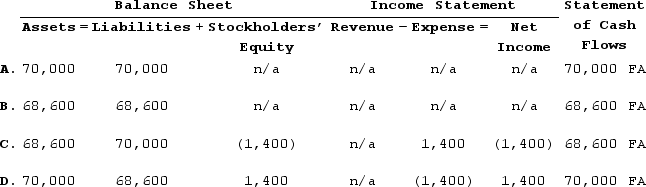

On January 1 Year 1, Gordon Corporation issued bonds with a face value of $70,000, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31 each year. Gordon uses the straight-line method to amortize bond discounts and premiums.On December 31, Year 5, Gordon Corporation records interest and amortization. Immediately after that, Gordon pays off the bonds as scheduled. Which of the following shows the effect of the bond payoff on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

66

On January 1 Year 1, Gordon Corporation issued bonds with a face value of $70,000, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31 each year. Gordon uses the straight-line method to amortize bond discounts and premiums.Which of the following shows the effect of the bond issuance on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

67

On January 1, Year 1, Jones Company issued bonds with a $260,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. What is the total amount of liabilities shown on Jones' balance sheet at December 31, Year 2?

A)$256,880

B)$254,800

C)$252,720

D)$255,840

A)$256,880

B)$254,800

C)$252,720

D)$255,840

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following shows how the cash payment and recognition of interest expense affects the financial statements when a bond is issued at a discount?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

69

On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums.Which of the following shows the effect of the interest payment and amortization on December 31, Year 1?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

70

On January 1, Year 1, Strang Incorporated issued bonds with a face value of $500,000, a stated rate of interest of 8%, and a 5-year term to maturity. The effective rate of interest was 10%. Interest is payable in cash on June 30 and December 31 of each year. Which of the following statements is true?

A)This bond was issued at a premium, and each semiannual cash payment is $25,000.

B)This bond was issued at a discount, and each semiannual cash payment is $20,000.

C)This bond was issued at a discount, and the annual interest expense is $40,000.

D)This bond was issued at a premium, and the annual interest expense is $40,000.

A)This bond was issued at a premium, and each semiannual cash payment is $25,000.

B)This bond was issued at a discount, and each semiannual cash payment is $20,000.

C)This bond was issued at a discount, and the annual interest expense is $40,000.

D)This bond was issued at a premium, and the annual interest expense is $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

71

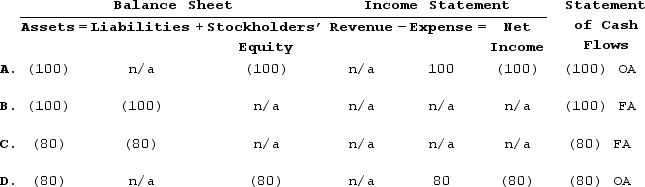

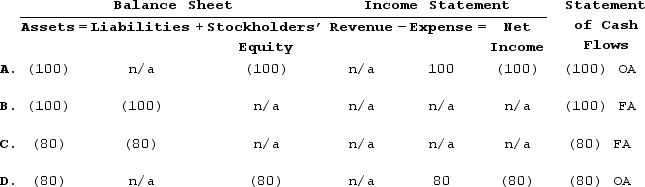

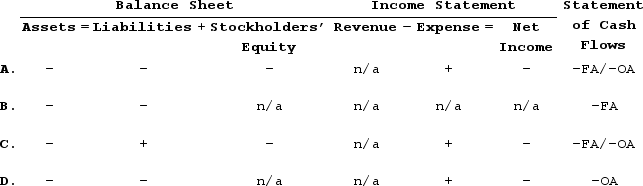

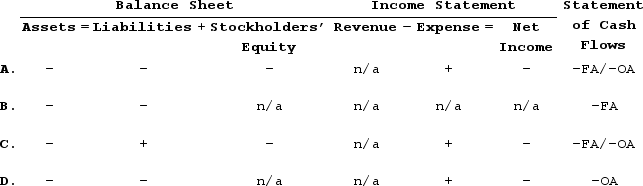

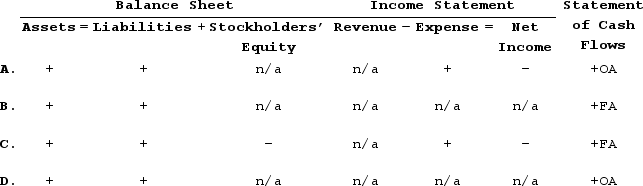

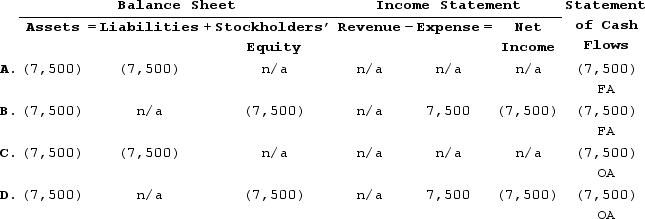

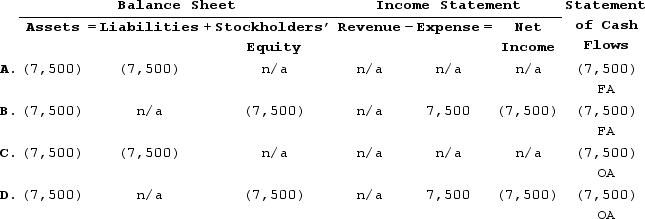

King Company experienced an accounting event that affected its financial statements as indicated below:  Which of the following accounting events could have caused these effects on King's statements?

Which of the following accounting events could have caused these effects on King's statements?

A)Repaid a bond issued at a discount.

B)Borrowed funds through a line-of-credit.

C)Made a payment on an installment loan.

D)Issued a bond at a discount.

Which of the following accounting events could have caused these effects on King's statements?

Which of the following accounting events could have caused these effects on King's statements?A)Repaid a bond issued at a discount.

B)Borrowed funds through a line-of-credit.

C)Made a payment on an installment loan.

D)Issued a bond at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

72

On January 1, Year 1, Denver Company issued bonds with a face value of $81,000, a statedrate of interest of 8%,and a 5-year term to maturity. The bonds were sold at 102.5. Denver uses the straight-line method to amortize bond discounts and premiums. What is the amount of interest expense during Year 1?

A)$6,480

B)$6,075

C)$6,885

D)$6,642

A)$6,480

B)$6,075

C)$6,885

D)$6,642

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

73

On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method.What is the total amount of liabilities shown on Jones' balance sheet at December 31, Year 2?

A)$191,600

B)$194,000

C)$196,400

D)$195,200

A)$191,600

B)$194,000

C)$196,400

D)$195,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

74

On January 1, Year 1, Denver Company issued bonds with a face value of $100,000, a stated rate of interest of 8%, and a 5-year term to maturity. The bonds were sold at 102.5. Denver uses the straight-line method to amortize bond discounts and premiums. What is the amount of interest expense during Year 1?

A)$7,500

B)$8,500

C)$8,000

D)$8,200

A)$7,500

B)$8,500

C)$8,000

D)$8,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following statements regarding the stated rate of interest is true if a bond is sold at 101?

A)The stated rate equals the market rate.

B)The state rate is unrelated to the market rate.

C)The stated rate is higher than the market rate.

D)The stated rate is lower than the market rate.

A)The stated rate equals the market rate.

B)The state rate is unrelated to the market rate.

C)The stated rate is higher than the market rate.

D)The stated rate is lower than the market rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

76

Kier Company issued $480,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 5-year term to maturity. The bonds have a 6.00% stated rate of interest and interest is payable in cash on December 31 each year. Based on this information alone, what are the amounts of interest expense and cash flows from operating activities, respectively, that will be reported in the financial statements for the year ending December 31, Year 1?

A)$28,800 and Zero

B)Zero and $28,800

C)$28,800 and $28,800

D)Zero and Zero

A)$28,800 and Zero

B)Zero and $28,800

C)$28,800 and $28,800

D)Zero and Zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

77

On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 8.5%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. What is the amount of cash outflow from operating activities shown on Jones' statement of cash flows for the year ending December 31, Year 2?

A)$17,000

B)$17,800

C)$16,200

D)$18,600

A)$17,000

B)$17,800

C)$16,200

D)$18,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

78

Why are bonds sometimes issued at a discount?

A)The stated rate of interest is higher than the rate being paid on investments in the securities market with comparable risk.

B)The stated rate of interest is the same as the rate being paid on investments in the securities market with comparable risk.

C)The stated rate of interest is lower than the rate being paid on investments in the securities market with comparable risk.

D)The bonds are being issued between interest payment dates.

A)The stated rate of interest is higher than the rate being paid on investments in the securities market with comparable risk.

B)The stated rate of interest is the same as the rate being paid on investments in the securities market with comparable risk.

C)The stated rate of interest is lower than the rate being paid on investments in the securities market with comparable risk.

D)The bonds are being issued between interest payment dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

79

On January 1, Year 1, Hanover Corporation issued bonds with a $70,500 face value, a stated rate of interest of 8%, and a 5-year term to maturity. The bonds were issued at 97. Hanover uses the straight-line method to amortize bond discounts and premiums. Interest is payable in cash on December 31 each year. How much interest expense will Hanover report on its income statement on December 31, Year 1?

A)$423

B)$2,115

C)$5,640

D)$6,063

A)$423

B)$2,115

C)$5,640

D)$6,063

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

80

On January 1, Year 1, Pierce Corporation issued $25,000 in 8%, 5-year bonds payable at 102. Interest payments are due each December 31. Pierce uses the straight-line method to amortize bond discounts and premiums.Which of the following shows the effect of the bond issuance on January 1, Year 1?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck