Deck 3: Consolidationssubsequent to the Date of Acquisition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/59

العب

ملء الشاشة (f)

Deck 3: Consolidationssubsequent to the Date of Acquisition

1

CCES Corporation acquires a controlling interest in Schmaling, Inc. CCES may utilize any one of three methods to internally account for this investment. Describe each of these methods, and indicate their advantages and disadvantages.

The three options a company can use to internally account for a consolidation investment are:

1. The Equity Method,

2. The Initial Value Method,

3. The Partial Equity Method.

1. The Equity Method:

Under the equity method, the subsidiary's income gets recorded by the parent, and dividends paid by the subsidiary reduce the investment balance of the parent. The advantage of this method is that it is the most accurate of the three methods. However, a disadvantage is that it is the most difficult method to use.

2. The Initial Value Method:

Another option is the initial value method. The initial value method is characterized by only recording dividends from the subsidiary as income. This is different than the equity method because it is easier to calculate but is also a less accurate.

3. The Partial Equity Method:

The third option is the partial equity method. Under the partial equity method the subsidiary's net income and dividends are treated as they are under the equity method. However, adjustments made using the equity method such as fair value amortization adjustments are not made using the partial equity method. Accordingly, this method is not as accurate as the equity method, but it is easier to compute.

1. The Equity Method,

2. The Initial Value Method,

3. The Partial Equity Method.

1. The Equity Method:

Under the equity method, the subsidiary's income gets recorded by the parent, and dividends paid by the subsidiary reduce the investment balance of the parent. The advantage of this method is that it is the most accurate of the three methods. However, a disadvantage is that it is the most difficult method to use.

2. The Initial Value Method:

Another option is the initial value method. The initial value method is characterized by only recording dividends from the subsidiary as income. This is different than the equity method because it is easier to calculate but is also a less accurate.

3. The Partial Equity Method:

The third option is the partial equity method. Under the partial equity method the subsidiary's net income and dividends are treated as they are under the equity method. However, adjustments made using the equity method such as fair value amortization adjustments are not made using the partial equity method. Accordingly, this method is not as accurate as the equity method, but it is easier to compute.

2

Goodwill recognized in a business combination must be allocated among a firm's identified reporting units. If the fair value of a particular reporting unit with recognized goodwill falls below its carrying amount, which of the following is true

A) No goodwill impairment loss is recognized unless the implied value for goodwill exceeds its carrying amount.

B) A goodwill impairment loss is recognized if the carrying amount for goodwill exceeds its implied value.

C) A goodwill impairment loss is recognized for the difference between the reporting unit's fair value and carrying amount.

D) The reporting unit reduces the values assigned to its long-term assets (including any unrecognized intangibles) to reflect its fair value.

A) No goodwill impairment loss is recognized unless the implied value for goodwill exceeds its carrying amount.

B) A goodwill impairment loss is recognized if the carrying amount for goodwill exceeds its implied value.

C) A goodwill impairment loss is recognized for the difference between the reporting unit's fair value and carrying amount.

D) The reporting unit reduces the values assigned to its long-term assets (including any unrecognized intangibles) to reflect its fair value.

The answer to this multiple choice question is "B".

Under US GAAP, goodwill impairment has a two step test on the reporting unit level. If the reporting unit's fair value is greater than the carrying value, there is no impairment. If the carrying value is greater than the fair value, step two of the impairment process needs to be completed. Step two involves comparing the carrying value of the goodwill to the implied value. If the carrying value is greater than the implied value, an impairment loss is recognized. A parent would recognize a goodwill impairment if the above conditions for goodwill impairment were met. The journal entry to account for this is as follows:

Impairment Loss $Goodwill $

Under US GAAP, goodwill impairment has a two step test on the reporting unit level. If the reporting unit's fair value is greater than the carrying value, there is no impairment. If the carrying value is greater than the fair value, step two of the impairment process needs to be completed. Step two involves comparing the carrying value of the goodwill to the implied value. If the carrying value is greater than the implied value, an impairment loss is recognized. A parent would recognize a goodwill impairment if the above conditions for goodwill impairment were met. The journal entry to account for this is as follows:

Impairment Loss $Goodwill $

3

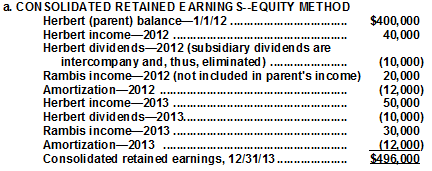

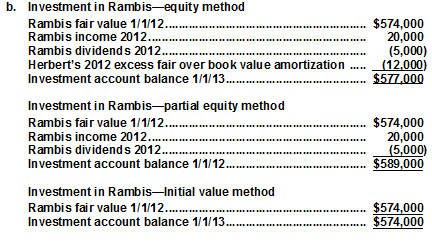

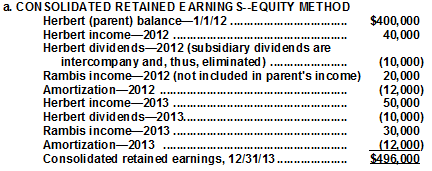

Herbert, Inc., acquired all of Rambis Company's outstanding stock on January 1, 2012, for $574,000 in cash. Annual excess amortization of $12,000 results from this transaction. On the date of the takeover, Herbert reported retained earnings of $400,000, and Rambis reported a $200,000 balance. Herbert reported internal income of $40,000 in 2012 and $50,000 in 2013 and paid $10,000 in dividends each year. Rambis reported net income of $20,000 in 2012 and $30,000 in 2013 and paid $5,000 in dividends each year.

a. Assume that Herbert's internal income figures above do not include any income from the subsidiary.

• If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2013

• Would the amount of consolidated retained earnings change if the parent had applied either the initial value or partial equity method for internal accounting purposes

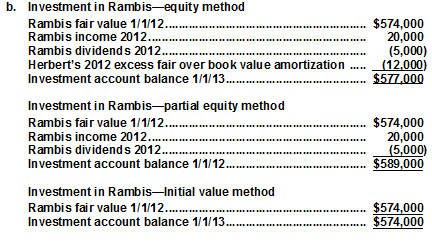

b. Under each of the following situations, what is the Investment in Rambis account balance on Herbert's books on January 1, 2013

• The parent uses the equity method.

• The parent uses the partial equity method.

• The parent uses the initial value method.

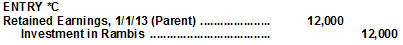

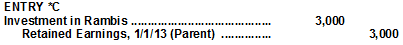

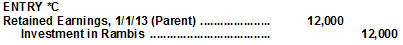

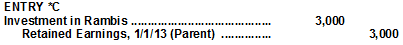

c. Under each of the following situations, what is Entry *C on a 2013 consolidation worksheet

• The parent uses the equity method.

• The parent uses the partial equity method.

• The parent uses the initial value method.

a. Assume that Herbert's internal income figures above do not include any income from the subsidiary.

• If the parent uses the equity method, what is the amount reported as consolidated retained earnings on December 31, 2013

• Would the amount of consolidated retained earnings change if the parent had applied either the initial value or partial equity method for internal accounting purposes

b. Under each of the following situations, what is the Investment in Rambis account balance on Herbert's books on January 1, 2013

• The parent uses the equity method.

• The parent uses the partial equity method.

• The parent uses the initial value method.

c. Under each of the following situations, what is Entry *C on a 2013 consolidation worksheet

• The parent uses the equity method.

• The parent uses the partial equity method.

• The parent uses the initial value method.

(Determine consolidated retained earnings when parent uses various accounting methods. Determine Entry *C for each of these methods)

• PARTIAL EQUITY METHOD AND INITIAL VALUE METHOD

• PARTIAL EQUITY METHOD AND INITIAL VALUE METHOD

Consolidated retained earnings are the same regardless of the method in use: the beginning balance plus the income less the dividends of the parent plus the income of the subsidiary less amortization expense. Thus, December 31, 2013 consolidated retained earnings are $496,000 as computed above.

c. ENTRY *C

c. ENTRY *C

• EQUITY METHOD

No entry is needed to convert the past figures to the equity method since that method has already been applied.

• PARTIAL EQUITY METHOD

Amortization for the prior years (only 2012 in this case) has not been recorded and must be brought into the consolidation through worksheet entry *C:

(To record 2012 amortization in consolidated figures. Expense was omitted because of application of partial equity method.)

(To record 2012 amortization in consolidated figures. Expense was omitted because of application of partial equity method.)

• INITIAL VALUE METHOD

Amortization for the prior years (only 2012 in this case) has not been recorded and must be brought into the consolidation through worksheet entry *C. In addition, only dividend income has been recorded by the parent ($5,000 in 2012). In this prior year, Rambis reported net income of $20,000. Thus, the parent has not recorded the $15,000 income in excess of dividends. That amount must also be included in the consolidation through entry *C:

( To record 2012 unrecognized subsidiary earnings as part of the parent's retained earnings. $15,000 income of subsidiary was not recorded by parent (income in excess of dividends). Amortization expense of $12,000 was not recorded under the initial value method.

( To record 2012 unrecognized subsidiary earnings as part of the parent's retained earnings. $15,000 income of subsidiary was not recorded by parent (income in excess of dividends). Amortization expense of $12,000 was not recorded under the initial value method.

Note that *C adjustments bring the parent's January 1, 2013 Retained Earnings balance equal to that of the equity method.

• PARTIAL EQUITY METHOD AND INITIAL VALUE METHOD

• PARTIAL EQUITY METHOD AND INITIAL VALUE METHOD Consolidated retained earnings are the same regardless of the method in use: the beginning balance plus the income less the dividends of the parent plus the income of the subsidiary less amortization expense. Thus, December 31, 2013 consolidated retained earnings are $496,000 as computed above.

c. ENTRY *C

c. ENTRY *C• EQUITY METHOD

No entry is needed to convert the past figures to the equity method since that method has already been applied.

• PARTIAL EQUITY METHOD

Amortization for the prior years (only 2012 in this case) has not been recorded and must be brought into the consolidation through worksheet entry *C:

(To record 2012 amortization in consolidated figures. Expense was omitted because of application of partial equity method.)

(To record 2012 amortization in consolidated figures. Expense was omitted because of application of partial equity method.)• INITIAL VALUE METHOD

Amortization for the prior years (only 2012 in this case) has not been recorded and must be brought into the consolidation through worksheet entry *C. In addition, only dividend income has been recorded by the parent ($5,000 in 2012). In this prior year, Rambis reported net income of $20,000. Thus, the parent has not recorded the $15,000 income in excess of dividends. That amount must also be included in the consolidation through entry *C:

( To record 2012 unrecognized subsidiary earnings as part of the parent's retained earnings. $15,000 income of subsidiary was not recorded by parent (income in excess of dividends). Amortization expense of $12,000 was not recorded under the initial value method.

( To record 2012 unrecognized subsidiary earnings as part of the parent's retained earnings. $15,000 income of subsidiary was not recorded by parent (income in excess of dividends). Amortization expense of $12,000 was not recorded under the initial value method. Note that *C adjustments bring the parent's January 1, 2013 Retained Earnings balance equal to that of the equity method.

4

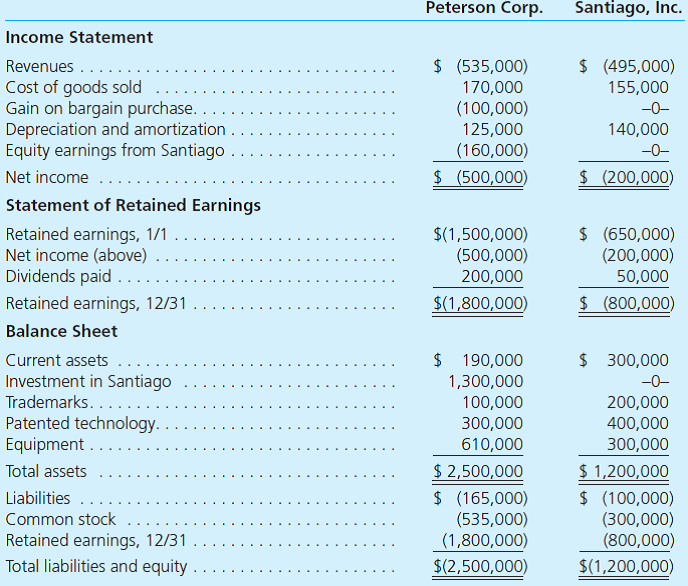

On January 1, 2013, Peterson Corporation exchanged $1,090,000 fair-value consideration for all of the outstanding voting stock of Santiago, Inc. At the acquisition date, Santiago had a book value equal to $950,000. Santiago's individual assets and liabilities had fair values equal to their respective book values except for the patented technology account, which was undervalued by $240,000 with an estimated remaining life of six years. The Santiago acquisition was Peterson's only business combination for the year.

In case expected synergies did not materialize, Peterson Corporation wished to prepare for a potential future spin-off of Santiago, Inc. Therefore, Peterson had Santiago maintain its separate incorporation and independent accounting information system as elements of continuing value.

On December 31, 2013, each company submitted the following financial statements for consolidation.

a. Show how Peterson determined the following account balances

• Gain on bargain purchase

• Earnings from Santiago

• Investment in Santiago

b. Prepare a December 31, 2013, consolidated worksheet for Peterson and Santiago.

In case expected synergies did not materialize, Peterson Corporation wished to prepare for a potential future spin-off of Santiago, Inc. Therefore, Peterson had Santiago maintain its separate incorporation and independent accounting information system as elements of continuing value.

On December 31, 2013, each company submitted the following financial statements for consolidation.

a. Show how Peterson determined the following account balances

• Gain on bargain purchase

• Earnings from Santiago

• Investment in Santiago

b. Prepare a December 31, 2013, consolidated worksheet for Peterson and Santiago.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

5

Jonas Tech Corporation recently acquired Innovation Plus Company. The combined firm consists of three related businesses that will serve as reporting units. In connection with the acquisition, Jonas requests your help with the following asset valuation and allocation issues. Support your answers with references to FASB ASC as appropriate.

Jonas recognizes several identifiable intangibles from its acquisition of Innovation Plus. It expresses the desire to have these intangible assets written down to zero in the acquisition period.

The price Jonas paid for Innovation Plus indicates that it paid a large amount for goodwill. However, Jonas worries that any future goodwill impairment may send the wrong signal to its investors about the wisdom of the Innovation Plus acquisition. Jonas thus wishes to allocate the combined goodwill of all of its reporting units to one account called Enterprise Goodwill. In this way, Jonas hopes to minimize the possibility of goodwill impairment because a decline in goodwill in one business unit could be offset by an increase in the value of goodwill in another business unit.

Required

1. Advise Jonas on the acceptability of its suggested immediate write-off of its identifiable intangibles.

2. Indicate the relevant factors to consider in allocating the value assigned to identifiable intangibles acquired in a business combination to expense over time.

3. Advise Jonas on the acceptability of its suggested treatment of goodwill.

4. Indicate the relevant factors to consider in allocating goodwill across an enterprise's business units.

Jonas recognizes several identifiable intangibles from its acquisition of Innovation Plus. It expresses the desire to have these intangible assets written down to zero in the acquisition period.

The price Jonas paid for Innovation Plus indicates that it paid a large amount for goodwill. However, Jonas worries that any future goodwill impairment may send the wrong signal to its investors about the wisdom of the Innovation Plus acquisition. Jonas thus wishes to allocate the combined goodwill of all of its reporting units to one account called Enterprise Goodwill. In this way, Jonas hopes to minimize the possibility of goodwill impairment because a decline in goodwill in one business unit could be offset by an increase in the value of goodwill in another business unit.

Required

1. Advise Jonas on the acceptability of its suggested immediate write-off of its identifiable intangibles.

2. Indicate the relevant factors to consider in allocating the value assigned to identifiable intangibles acquired in a business combination to expense over time.

3. Advise Jonas on the acceptability of its suggested treatment of goodwill.

4. Indicate the relevant factors to consider in allocating goodwill across an enterprise's business units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

6

Several years ago, Jenkins Company acquired a controlling interest in Lambert Company. Lambert recently borrowed $100,000 from Jenkins. In consolidating the financial records of these two companies, how will this debt be handled

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

7

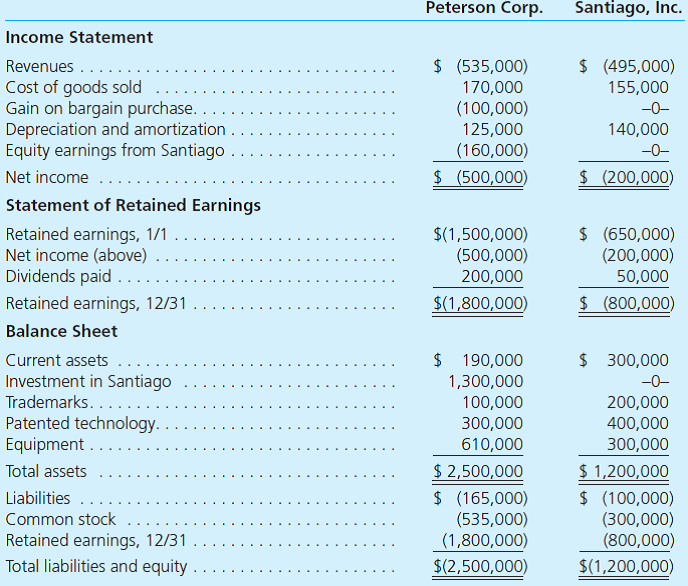

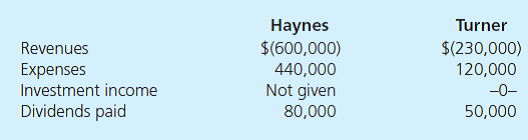

Haynes, Inc., obtained 100 percent of Turner Company's common stock on January 1, 2012, by issuing 9,000 shares of $10 par value common stock. Haynes's shares had a $15 per share fair value. On that date, Turner reported a net book value of $100,000. However, its equipment (with a five-year remaining life) was undervalued by $5,000 in the company's accounting records. Also, Turner had developed a customer list with an assessed value of $30,000, although no value had been recorded on Turner's books. The customer list had an estimated remaining useful life of 10 years.

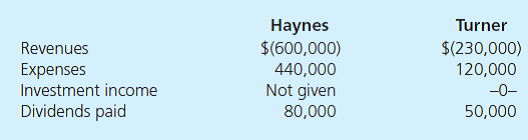

The following figures come from the individual accounting records of these two companies as of December 31, 2012:

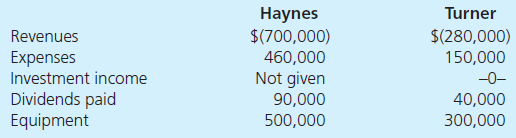

The following figures come from the individual accounting records of these two companies as of December 31, 2013:

a. What balance does Haynes's Investment in Turner account show on December 31, 2013, when the equity method is applied

b. What is the consolidated net income for the year ending December 31, 2013

c. What is the consolidated equipment balance as of December 31, 2013 How would this answer be affected by the investment method applied by the parent

d. If Haynes has applied the initial value method to account for its investment, what adjustment is needed to the beginning of the Retained Earnings on a December 31, 2013, consolidation worksheet How would this answer change if the partial equity method had been in use How would this answer change if the equity method had been in use

The following figures come from the individual accounting records of these two companies as of December 31, 2012:

The following figures come from the individual accounting records of these two companies as of December 31, 2013:

a. What balance does Haynes's Investment in Turner account show on December 31, 2013, when the equity method is applied

b. What is the consolidated net income for the year ending December 31, 2013

c. What is the consolidated equipment balance as of December 31, 2013 How would this answer be affected by the investment method applied by the parent

d. If Haynes has applied the initial value method to account for its investment, what adjustment is needed to the beginning of the Retained Earnings on a December 31, 2013, consolidation worksheet How would this answer change if the partial equity method had been in use How would this answer change if the equity method had been in use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

8

Branson paid $465,000 cash for all of the outstanding common stock of Wolfpack, Inc., on January 1, 2012. On that date, the subsidiary had a book value of $340,000 (common stock of $200,000 and retained earnings of $140,000), although various unrecorded royalty agreements (10-year remaining life) were assessed at a $100,000 fair value. Any remaining excess fair value was considered goodwill.

In negotiating the acquisition price, Branson also promised to pay Wolfpack's former owners an additional $50,000 if Wolfpack's income exceeded $120,000 total over the first two years after the acquisition. At the acquisition date, Branson estimated the probability adjusted present value of this contingent consideration at $35,000. On December 31, 2012, based on Wolfpack's earnings to date, Branson increased the value of the contingency to $40,000.

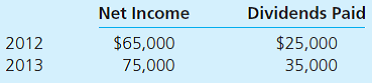

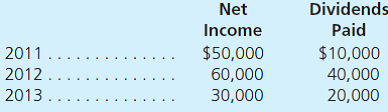

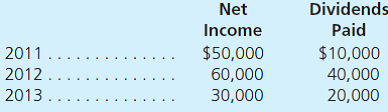

During the subsequent two years, Wolfpack reported the following amounts for income and dividends:

In keeping with the original acquisition agreement, on December 31, 2013, Branson paid the additional $50,000 performance fee to Wolfpack's previous owners.

Prepare each of the following:

a. Branson's entry to record the acquisition of the shares of its Wolfpack subsidiary.

b. Branson's entries at the end of 2012 and 2013 to adjust its contingent performance obligation for changes in fair value and the December 31, 2013, payment.

c. Consolidation worksheet entries as of December 31, 2013, assuming that Branson has applied the equity method.

d. Consolidation worksheet entries as of December 31, 2013, assuming that Branson has applied the initial value method.

In negotiating the acquisition price, Branson also promised to pay Wolfpack's former owners an additional $50,000 if Wolfpack's income exceeded $120,000 total over the first two years after the acquisition. At the acquisition date, Branson estimated the probability adjusted present value of this contingent consideration at $35,000. On December 31, 2012, based on Wolfpack's earnings to date, Branson increased the value of the contingency to $40,000.

During the subsequent two years, Wolfpack reported the following amounts for income and dividends:

In keeping with the original acquisition agreement, on December 31, 2013, Branson paid the additional $50,000 performance fee to Wolfpack's previous owners.

Prepare each of the following:

a. Branson's entry to record the acquisition of the shares of its Wolfpack subsidiary.

b. Branson's entries at the end of 2012 and 2013 to adjust its contingent performance obligation for changes in fair value and the December 31, 2013, payment.

c. Consolidation worksheet entries as of December 31, 2013, assuming that Branson has applied the equity method.

d. Consolidation worksheet entries as of December 31, 2013, assuming that Branson has applied the initial value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

9

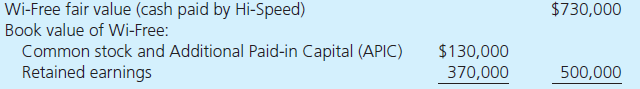

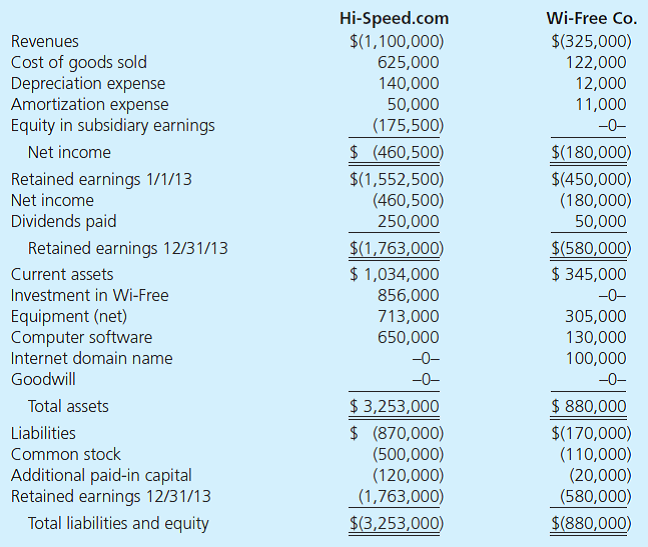

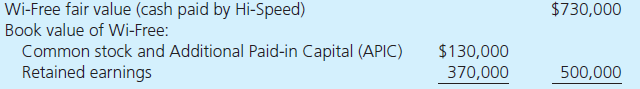

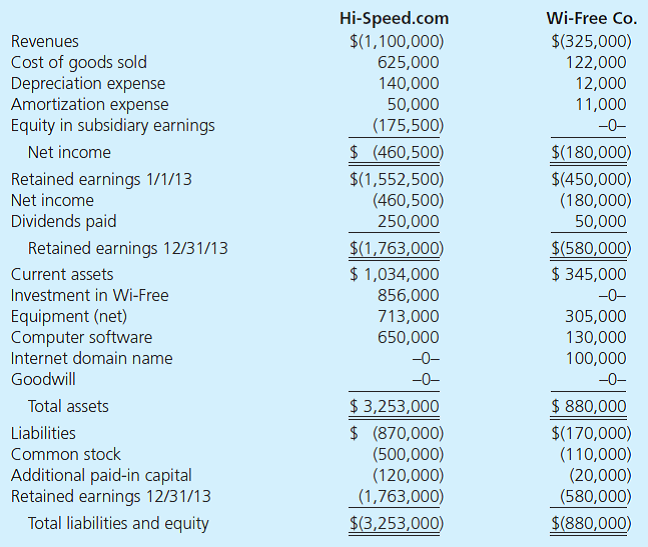

On January 1, 2012, Hi-Speed.com acquired 100 percent of the common stock of Wi-Free Co. for cash of $730,000. The consideration transferred was allocated among Wi-Free's net assets as follows:

At the acquisition date, the computer software had a 4-year remaining life, and the Internet domain name was estimated to have a 10-year life. By the end of 2012, it became clear that the acquired in-process research and development would yield no economic benefits and Hi-Speed.com recognized an impairment loss. At December 31, 2013, Wi-Free's accounts payable include a $30,000 amount owed to Hi-Speed.

The December 31, 2013, trial balances for the parent and subsidiary follow:

Required

a. Using Excel, prepare calculations showing how Hi-Speed derived the $856,000 amount for its investment in Wi-Free.

b. Using Excel, compute consolidated balances for Hi-Speed and Wi-Free. Either use a worksheet approach or compute the balances directly

At the acquisition date, the computer software had a 4-year remaining life, and the Internet domain name was estimated to have a 10-year life. By the end of 2012, it became clear that the acquired in-process research and development would yield no economic benefits and Hi-Speed.com recognized an impairment loss. At December 31, 2013, Wi-Free's accounts payable include a $30,000 amount owed to Hi-Speed.

The December 31, 2013, trial balances for the parent and subsidiary follow:

Required

a. Using Excel, prepare calculations showing how Hi-Speed derived the $856,000 amount for its investment in Wi-Free.

b. Using Excel, compute consolidated balances for Hi-Speed and Wi-Free. Either use a worksheet approach or compute the balances directly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

10

If no legal, regulatory, contractual, competitive, economic, or other factors limit the life of an intangible asset, the asset's assigned value is allocated to expense over which of the following

A) 20 years.

B) 20 years with an annual impairment review.

C) Infinitely.

D) Indefinitely (no amortization) with an annual impairment review until its life becomes finite.

A) 20 years.

B) 20 years with an annual impairment review.

C) Infinitely.

D) Indefinitely (no amortization) with an annual impairment review until its life becomes finite.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

11

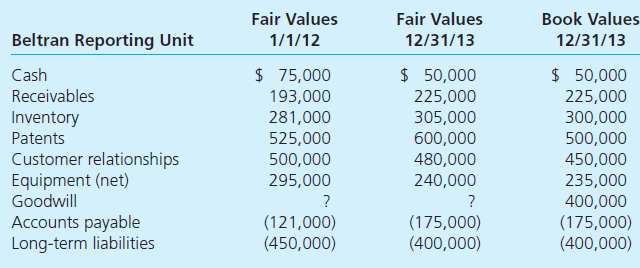

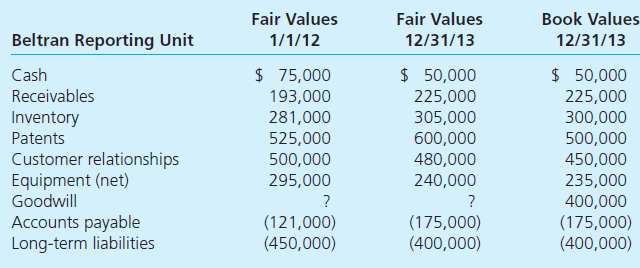

Francisco Inc. acquired 100 percent of the voting shares of Beltran Company on January 1, 2012. In exchange, Francisco paid $450,000 in cash and issued 104,000 shares of its own $1 par value common stock. On this date, Francisco's stock had a fair value of $12 per share. The combination is a statutory merger with Beltran subsequently dissolved as a legal corporation. Beltran's assets and liabilities are assigned to a new reporting unit.

The following reports the fair values for the Beltran reporting unit for January 1, 2012, and December 31, 2013, along with their respective book values on December 31, 2013.

a. Prepare Francisco's journal entry to record the assets acquired and the liabilities assumed in the Beltran merger on January 1, 2012.

b. On December 31, 2013, Francisco opts to forego any goodwill impairment qualitative assessment and estimates that the total fair value of the entire Beltran reporting unit is $1,425,000. What amount of goodwill impairment, if any, should Francisco recognize on its 2013 income statement

The following reports the fair values for the Beltran reporting unit for January 1, 2012, and December 31, 2013, along with their respective book values on December 31, 2013.

a. Prepare Francisco's journal entry to record the assets acquired and the liabilities assumed in the Beltran merger on January 1, 2012.

b. On December 31, 2013, Francisco opts to forego any goodwill impairment qualitative assessment and estimates that the total fair value of the entire Beltran reporting unit is $1,425,000. What amount of goodwill impairment, if any, should Francisco recognize on its 2013 income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

12

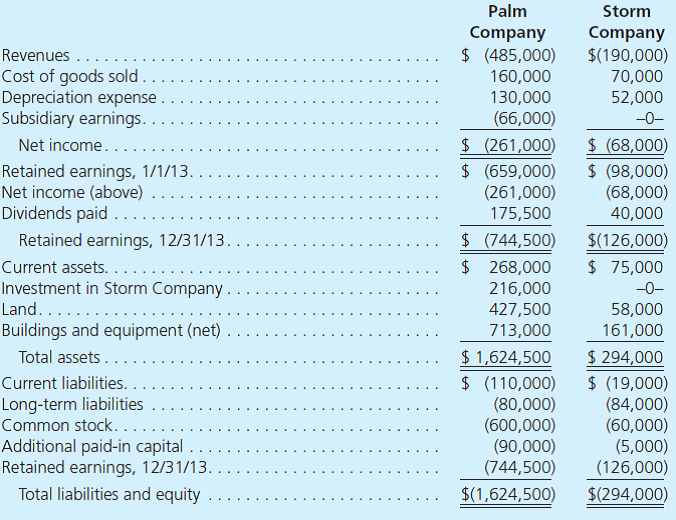

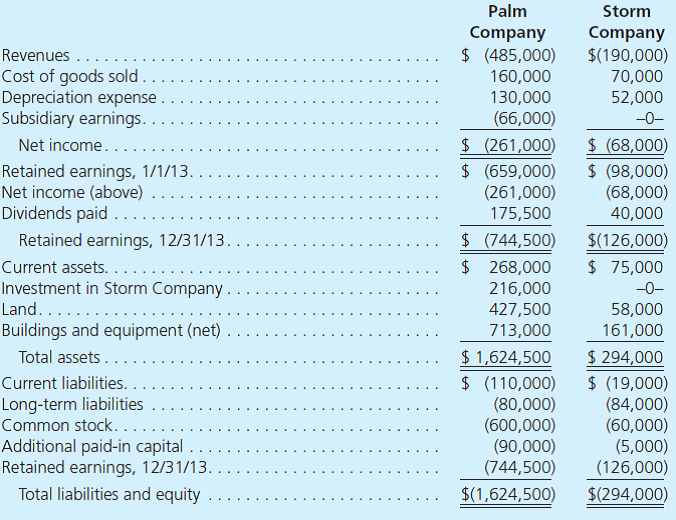

Palm Company acquired 100 percent of Storm Company's voting stock on January 1, 2009, by issuing 10,000 shares of its $10 par value common stock (having a fair value of $14 per share). As of that date, Storm had stockholders' equity totaling $105,000. Land shown on Storm's accounting records was undervalued by $10,000. Equipment (with a five-year life) was undervalued by $5,000. A secret formula developed by Storm was appraised at $20,000 with an estimated life of 20 years.

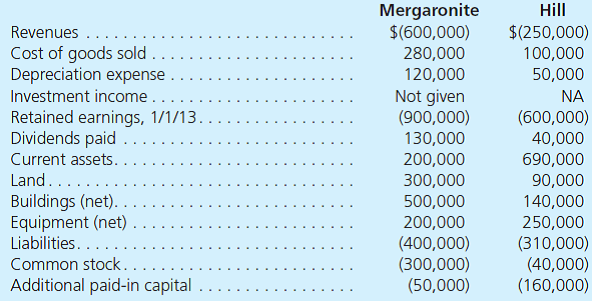

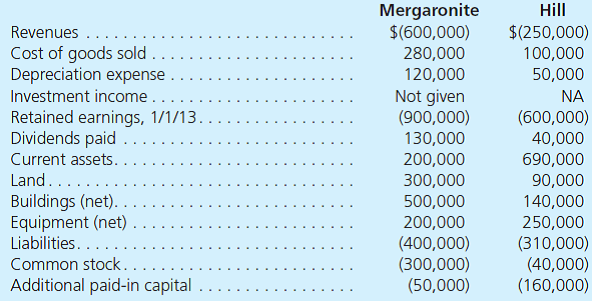

Following are the separate financial statements for the two companies for the year ending December 31, 2013. Credit balances are indicated by parentheses.

a. Explain how Palm derived the $66,000 balance in the Subsidiary Earnings account.

b. Prepare a worksheet to consolidate the financial information for these two companies.

c. Explain how Storm's individual financial records would differ if the push-down method of accounting had been applied.

Following are the separate financial statements for the two companies for the year ending December 31, 2013. Credit balances are indicated by parentheses.

a. Explain how Palm derived the $66,000 balance in the Subsidiary Earnings account.

b. Prepare a worksheet to consolidate the financial information for these two companies.

c. Explain how Storm's individual financial records would differ if the push-down method of accounting had been applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

13

A vice president for operations at Poncho Platforms asks for your help on a financial reporting issue concerning goodwill. Two years ago, the company suffered a goodwill impairment loss for its Chip Integration reporting unit. Since that time, however, the Chip Integration unit has recovered nicely and its current cash flows (and projected cash flows) are at an all-time high. The vice president now asks whether the goodwill loss can be reversed given the reversal of fortunes for the Chip Integration reporting unit.

Are goodwill impairment testing procedures the same under IFRS and U.S. GAAP If not, how is goodwill tested for impairment under IFRS (Refer to IAS 36 , "Impairment of Assets.")

Are goodwill impairment testing procedures the same under IFRS and U.S. GAAP If not, how is goodwill tested for impairment under IFRS (Refer to IAS 36 , "Impairment of Assets.")

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

14

Benns adopts the equity method for its 100 percent investment in Waters. At the end of six years, Benns reports an investment in Waters of $920,000. What figures constitute this balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

15

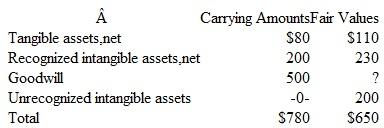

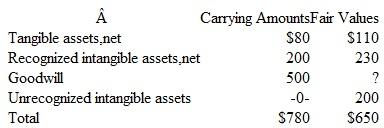

Acme Co., a consolidated enterprise, conducted an impairment reviewfor each of its reportingunits. In its qualitative assessment, one particular reporting unit, Martel,emerged as a candidatefor possible goodwill impairment. Martel has recognized net assets of $780, includinggoodwill of $500. Martel's fair value is assessed at $650 and includes two internallydeveloped unrecognizedintangible assets (a patent and a customer list with fair values of $150 and $50, respectively).Thefollowing table summarizes current financial information for the Martel reportingunit:

a. Show the two quantitative steps to determine the amountof anygoodwill impairment forAcme's Martel reporting unit.

b. After recognition of any goodwill impairment loss, what are the reported bookvalues for the following assets of Acme's reporting unit Martel

• Tangible assets, net.

• Goodwill

• Customer list.

• Patent.

a. Show the two quantitative steps to determine the amountof anygoodwill impairment forAcme's Martel reporting unit.

b. After recognition of any goodwill impairment loss, what are the reported bookvalues for the following assets of Acme's reporting unit Martel

• Tangible assets, net.

• Goodwill

• Customer list.

• Patent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

16

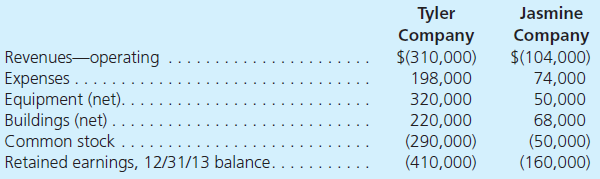

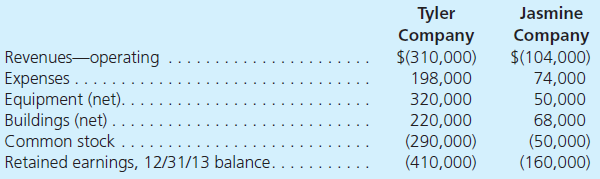

Tyler Company acquired all of Jasmine Company's outstanding stock on January 1, 2011, for $206,000 in cash. Jasmine had a book value of only $140,000 on that date. However, equipment (having an eight-year life) was undervalued by $54,400 on Jasmine's financial records. A building with a 20-year life was overvalued by $10,000. Subsequent to the acquisition, Jasmine reported the following:

In accounting for this investment, Tyler has used the equity method. Selected accounts taken from the financial records of these two companies as of December 31, 2013, follow:

Determine and explain the following account balances as of December 31, 2013:

a. Investment in Jasmine Company (on Tyler's individual financial records).

b. Equity in Subsidiary Earnings (on Tyler's individual financial records).

c. Consolidated Net Income.

d. Consolidated Equipment (net).

e. Consolidated Buildings (net).

f. Consolidated Goodwill (net).

g. Consolidated Common Stock.

h. Consolidated Retained Earnings, 12/31/13.

In accounting for this investment, Tyler has used the equity method. Selected accounts taken from the financial records of these two companies as of December 31, 2013, follow:

Determine and explain the following account balances as of December 31, 2013:

a. Investment in Jasmine Company (on Tyler's individual financial records).

b. Equity in Subsidiary Earnings (on Tyler's individual financial records).

c. Consolidated Net Income.

d. Consolidated Equipment (net).

e. Consolidated Buildings (net).

f. Consolidated Goodwill (net).

g. Consolidated Common Stock.

h. Consolidated Retained Earnings, 12/31/13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

17

In 2009 Nike Corporation reported a large goodwill impairment loss. Referring to Nike's 2009 financial statements and applicable financial reporting standards, answer the following questions:

Why did Nike write down its goodwill in 2009 What are some other indicators for goodwill impairment in general

Why did Nike write down its goodwill in 2009 What are some other indicators for goodwill impairment in general

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

18

Dosmann, Inc., bought all outstanding shares of Lizzi Corporation on January 1, 2011, for $700,000 in cash. This portion of the consideration transferred results in a fair-value allocation of $35,000 to equipment and goodwill of $88,000. At the acquisition date, Dosmann also agrees to pay Lizzi's previous owners an additional $110,000 on January 1, 2013, if Lizzi earns a 10 percent return on the fair value of its assets in 2011 and 2012. Lizzi's profits exceed this threshold in both years. Which of the following is true

A) The additional $110,000 payment is a reduction in consolidated retained earnings.

B) The fair value of the expected contingent payment increases goodwill at the acquisition date.

C) Consolidated goodwill as of January 1, 2013, increases by $110,000.

D) The $110,000 is recorded as an expense in 2013.

A) The additional $110,000 payment is a reduction in consolidated retained earnings.

B) The fair value of the expected contingent payment increases goodwill at the acquisition date.

C) Consolidated goodwill as of January 1, 2013, increases by $110,000.

D) The $110,000 is recorded as an expense in 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

19

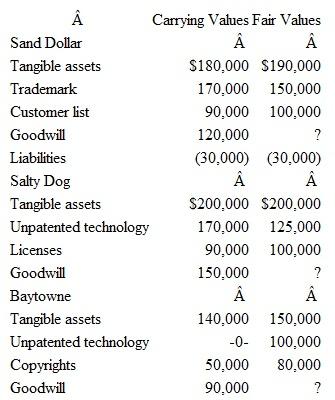

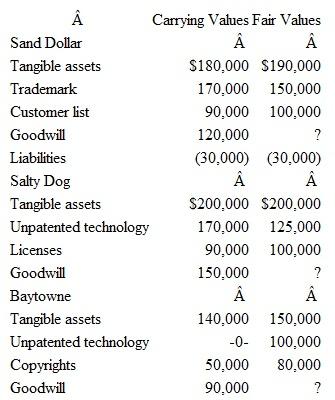

Destin Company recently acquired several businesses and recognized goodwill in each acquisition. Destin has allocated the resulting goodwill to its three reporting units:Sand Dollar, SaltyDog, and Baytowne. Destin performs a quantitative goodwill impairment review annually.

In its current year assessment of goodwill, Destin provides the following individual asset and liability values for each reporting unit:

The fair values for each reporting unit (including goodwill) are $510,000 forSand Dollar, $580,000 for Salty Dog, and$560,000 for Baytowne. To date, Destinhas reportedno goodwillimpairments.

a. Which of Destin's reporting units require both steps to test for goodwillimpairment

b. How much goodwill impairment should Destin report this year

c. What changes to the valuations of Destin's tangible assets and identified intangible assets should be reported based on the goodwill impairment tests

In its current year assessment of goodwill, Destin provides the following individual asset and liability values for each reporting unit:

The fair values for each reporting unit (including goodwill) are $510,000 forSand Dollar, $580,000 for Salty Dog, and$560,000 for Baytowne. To date, Destinhas reportedno goodwillimpairments.

a. Which of Destin's reporting units require both steps to test for goodwillimpairment

b. How much goodwill impairment should Destin report this year

c. What changes to the valuations of Destin's tangible assets and identified intangible assets should be reported based on the goodwill impairment tests

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

20

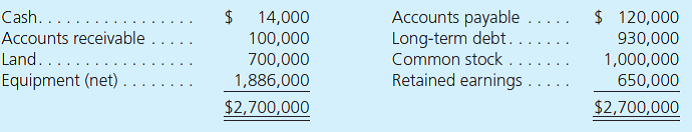

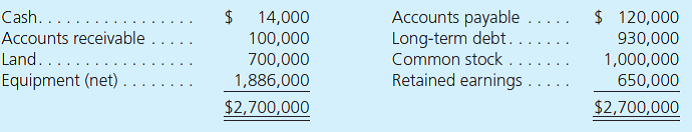

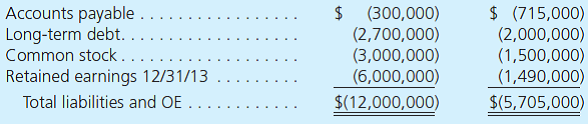

On January 1, 2012, Picante Corporation acquired 100 percent of the outstanding voting stock of Salsa Corporation for $1,765,000 cash. On the acquisition date, Salsa had the following balance sheet:

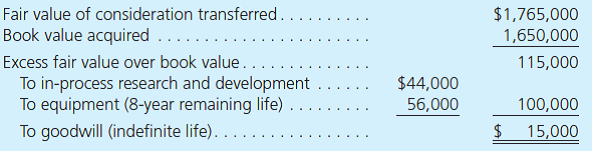

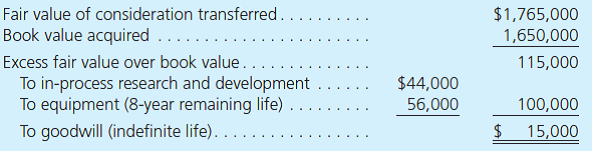

At the acquisition date, the following allocation was prepared:

Although at acquisition date Picante had expected $44,000 in future benefits from Salsa's in-process research and development project, by the end of 2012, it was apparent that the research project was a failure with no future economic benefits.

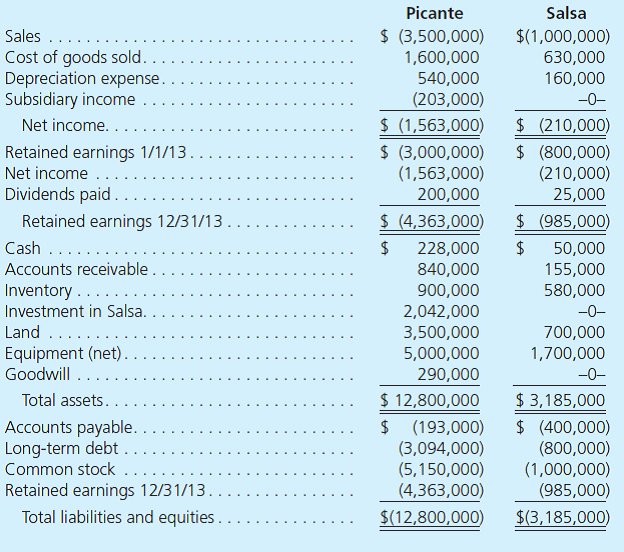

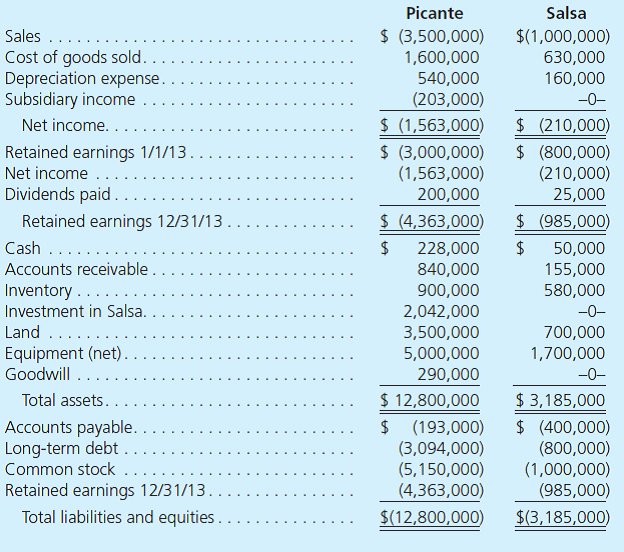

On December 31, 2013, Picante and Salsa submitted the following trial balances for consolidation:

a. Show how Picante derived its December 31, 2013, Investment in Salsa account balance.

b. Prepare a consolidated worksheet for Picante and Salsa as of December 31, 2013.

At the acquisition date, the following allocation was prepared:

Although at acquisition date Picante had expected $44,000 in future benefits from Salsa's in-process research and development project, by the end of 2012, it was apparent that the research project was a failure with no future economic benefits.

On December 31, 2013, Picante and Salsa submitted the following trial balances for consolidation:

a. Show how Picante derived its December 31, 2013, Investment in Salsa account balance.

b. Prepare a consolidated worksheet for Picante and Salsa as of December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company acquires a subsidiary and will prepare consolidated financial statements for external reporting purposes. For internal reporting purposes, the company has decided to apply the equity method. Why might the company have made this decision

A) It is a relatively easy method to apply.

B) Operating results appearing on the parent's financial records reflect consolidated totals.

C) GAAP now requires the use of this particular method for internal reporting purposes.

D) Consolidation is not required when the parent uses the equity method.

A) It is a relatively easy method to apply.

B) Operating results appearing on the parent's financial records reflect consolidated totals.

C) GAAP now requires the use of this particular method for internal reporting purposes.

D) Consolidation is not required when the parent uses the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

22

One company acquired another in a transaction in which $100,000 of the acquisition price is assigned to goodwill. Several years later, a worksheet is being produced to consolidate these two companies. How is the reported value of the goodwill determined at this date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume that Chapman Company acquired Abernethy's common stock for $490,000 in cash. As of January 1, 2012, Abernethy's land had a fair value of $90,000, its buildings were valued at $160,000, and its equipment was appraised at $180,000. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2012, and December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

24

On January 1, Prine, Inc., acquired 100 percent of Lydia Company's common stock for a fair value of $120,000,000 in cash and stock. Lydia's assets and liabilities equaled their fair values except for its equipment, which was undervalued by $500,000 and had a 10-year remaining life.

Prine specializes in media distribution and viewed its acquisition of Lydia as a strategic move into content ownership and creation. Prine expected both cost and revenue synergies from controlling Lydia's artistic content (a large library of classic movies) and its sports programming specialty video operation. Accordingly, Prine allocated Lydia's assets and liabilities (including $50,000,000 of goodwill) to a newly formed operating segment appropriately designated as a reporting unit.

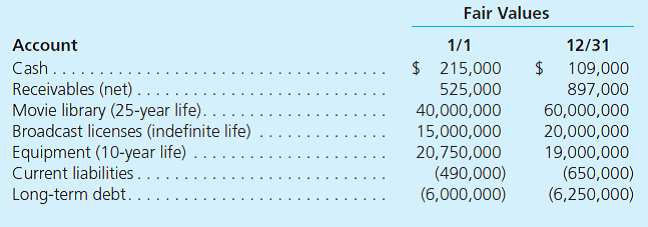

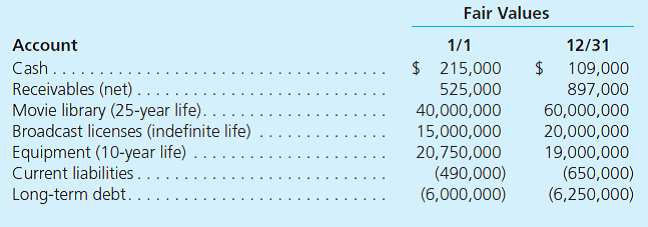

The fair values of the reporting unit's identifiable assets and liabilities through the first year of operations were as follows.

However, Lydia's assets have taken longer than anticipated to produce the expected synergies with Prine's operations. Accordingly, Prine reviewed events and circumstances and concluded that Lydia's fair value was likely less than its carrying amount. At year-end, Prine reduced its assessment of the Lydia reporting unit's fair value to $110,000,000.

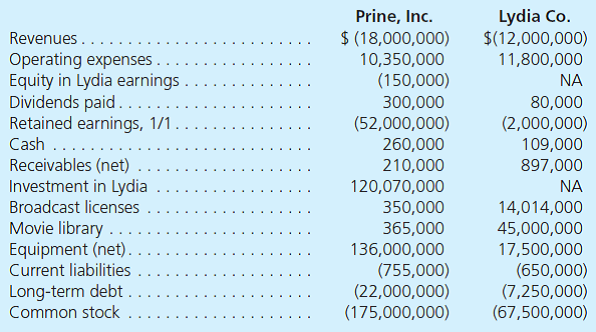

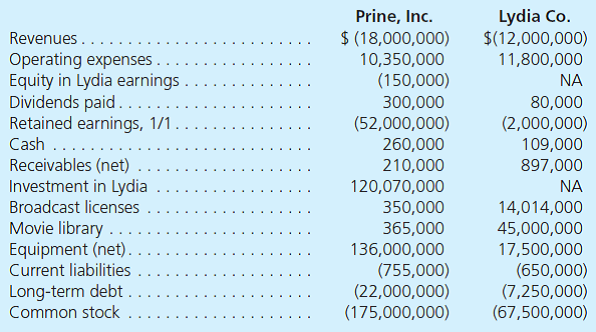

At December 31, Prine and Lydia submitted the following balances for consolidation:

a. What is the relevant initial test to determine whether goodwill could be impaired

b. At what amount should Prine record an impairment loss for its Lydia reporting unit for the year

c. What is consolidated net income for the year

d. What is the December 31 consolidated balance for goodwill

e. What is the December 31 consolidated balance for broadcast licenses

f. Prepare a consolidated worksheet for Prine and Lydia (Prine's trial balance should first be adjusted for any appropriate impairment loss).

Prine specializes in media distribution and viewed its acquisition of Lydia as a strategic move into content ownership and creation. Prine expected both cost and revenue synergies from controlling Lydia's artistic content (a large library of classic movies) and its sports programming specialty video operation. Accordingly, Prine allocated Lydia's assets and liabilities (including $50,000,000 of goodwill) to a newly formed operating segment appropriately designated as a reporting unit.

The fair values of the reporting unit's identifiable assets and liabilities through the first year of operations were as follows.

However, Lydia's assets have taken longer than anticipated to produce the expected synergies with Prine's operations. Accordingly, Prine reviewed events and circumstances and concluded that Lydia's fair value was likely less than its carrying amount. At year-end, Prine reduced its assessment of the Lydia reporting unit's fair value to $110,000,000.

At December 31, Prine and Lydia submitted the following balances for consolidation:

a. What is the relevant initial test to determine whether goodwill could be impaired

b. At what amount should Prine record an impairment loss for its Lydia reporting unit for the year

c. What is consolidated net income for the year

d. What is the December 31 consolidated balance for goodwill

e. What is the December 31 consolidated balance for broadcast licenses

f. Prepare a consolidated worksheet for Prine and Lydia (Prine's trial balance should first be adjusted for any appropriate impairment loss).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

25

Maguire Company obtains 100 percent control over Williams Company. Several years after the takeover, consolidated financial statements are being produced. For each of the following accounts, briefly describe the values that should be included in consolidated totals.

a. Equipment.

b. Investment in Williams Company.

c. Dividends Paid.

d. Goodwill.

e. Revenues.

f. Expenses.

g. Common Stock.

h. Net Income.

a. Equipment.

b. Investment in Williams Company.

c. Dividends Paid.

d. Goodwill.

e. Revenues.

f. Expenses.

g. Common Stock.

h. Net Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

26

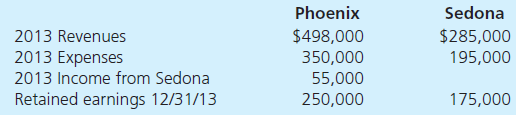

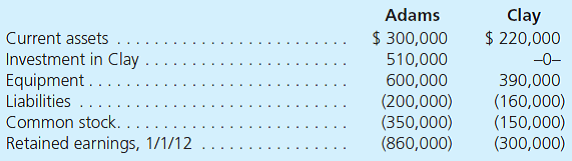

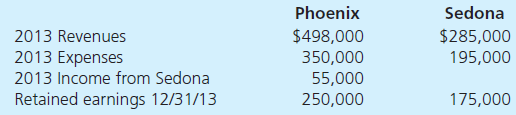

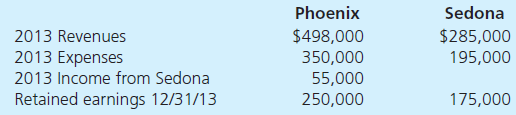

On January 1, 2011, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $600,000 cash. At January 1, 2011, Sedona's net assets had a total carrying amount of $420,000. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $80,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has paid a $20,000 dividend. Sedona recorded income of $70,000 in 2011 and $80,000 in 2012.

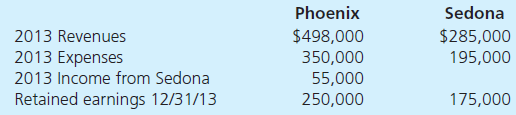

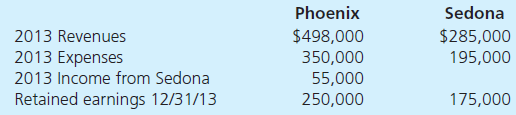

Selected account balances from the two companies' individual records were as follows:

What is consolidated net income for Phoenix and Sedona for 2013

A) $148,000

B) $203,000

C) $228,000

D) $238,000

Selected account balances from the two companies' individual records were as follows:

What is consolidated net income for Phoenix and Sedona for 2013

A) $148,000

B) $203,000

C) $228,000

D) $238,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

27

Assume that Chapman Company acquired Abernethy's common stock for $500,000 in cash. Assume that the equipment and long-term liabilities had fair values of $220,000 and $120,000, respectively, on the acquisition date. Chapman uses the initial value method to account for its investment. Prepare consolidation worksheet entries for December 31, 2012, and December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

28

In 2009 Nike Corporation reported a large goodwill impairment loss. Referring to Nike's 2009 financial statements and applicable financial reporting standards, answer the following questions:

How did Nike reflect this impairment in financial statements

How did Nike reflect this impairment in financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

29

When should a parent consider recognizing an impairment loss for goodwill associated with a subsidiary How should the loss be reported in the financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assume that Chapman Company acquired Abernethy's common stock by paying $520,000 in cash. All of Abernethy's accounts are estimated to have a fair value approximately equal to present book values. Chapman uses the partial equity method to account for its investment. Prepare the consolidation worksheet entries for December 31, 2012, and December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

31

When should a consolidated entity recognize a goodwill impairment loss

A) If both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying amounts.

B) Whenever the entity's fair value declines significantly.

C) If a reporting unit's fair value falls below its original acquisition price.

D) Annually on a systematic and rational basis.

A) If both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying amounts.

B) Whenever the entity's fair value declines significantly.

C) If a reporting unit's fair value falls below its original acquisition price.

D) Annually on a systematic and rational basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

32

On January 1, 2011, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $600,000 cash. At January 1, 2011, Sedona's net assets had a total carrying amount of $420,000. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $80,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has paid a $20,000 dividend. Sedona recorded income of $70,000 in 2011 and $80,000 in 2012.

Selected account balances from the two companies' individual records were as follows:

What is Phoenix's consolidated retained earnings balance at December 31, 2013

A) $250,000

B) $290,000

C) $330,000

D) $360,000

Selected account balances from the two companies' individual records were as follows:

What is Phoenix's consolidated retained earnings balance at December 31, 2013

A) $250,000

B) $290,000

C) $330,000

D) $360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

33

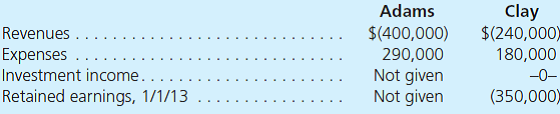

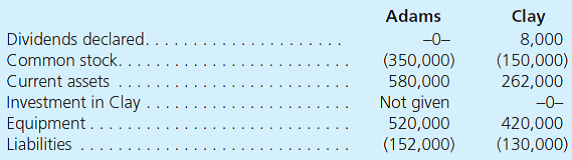

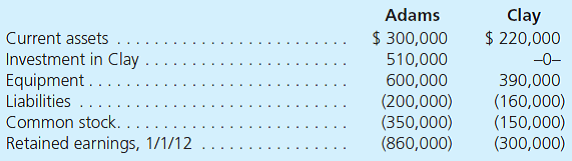

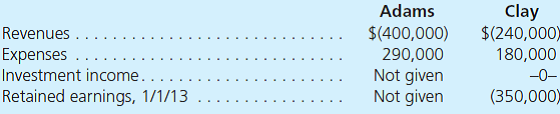

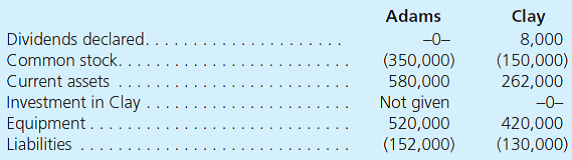

Adams, Inc., acquires Clay Corporation on January 1, 2012, in exchange for $510,000 cash. Immediately after the acquisition, the two companies have the following account balances. Clay's equipment (with a five-year life) is actually worth $440,000. Credit balances are indicated by parentheses.

In 2012, Clay earns a net income of $55,000 and pays a $5,000 cash dividend. In 2012, Adams reports income from its own operations (exclusive of any income from Clay) of $125,000 and declares no dividends. At the end of 2013, selected account balances for the two companies are as follows:

a. What are the December 31, 2013, Investment Income and Investment in Clay account balances assuming Adams uses the:

1. Equity method.

2. Initial value method.

b. How does the parent's internal investment accounting method choice affect the amount reported for expenses in its December 31, 2013, consolidated income statement

c. How does the parent's internal investment accounting method choice affect the amount reported for equipment in its December 31, 2013, consolidated balance sheet

d. What is Adams's January 1, 2013, Retained Earnings account balance assuming Adams accounts for its investment in Clay using the:

1. Equity value method.

2. Initial value method.

e. What worksheet adjustment to Adams's January 1, 2013, Retained Earnings account balance is required if Adams accounts for its investment in Clay using the initial value method

f. Prepare the worksheet entry to eliminate Clay's stockholders' equity.

g. What is consolidated net income for 2013

In 2012, Clay earns a net income of $55,000 and pays a $5,000 cash dividend. In 2012, Adams reports income from its own operations (exclusive of any income from Clay) of $125,000 and declares no dividends. At the end of 2013, selected account balances for the two companies are as follows:

a. What are the December 31, 2013, Investment Income and Investment in Clay account balances assuming Adams uses the:

1. Equity method.

2. Initial value method.

b. How does the parent's internal investment accounting method choice affect the amount reported for expenses in its December 31, 2013, consolidated income statement

c. How does the parent's internal investment accounting method choice affect the amount reported for equipment in its December 31, 2013, consolidated balance sheet

d. What is Adams's January 1, 2013, Retained Earnings account balance assuming Adams accounts for its investment in Clay using the:

1. Equity value method.

2. Initial value method.

e. What worksheet adjustment to Adams's January 1, 2013, Retained Earnings account balance is required if Adams accounts for its investment in Clay using the initial value method

f. Prepare the worksheet entry to eliminate Clay's stockholders' equity.

g. What is consolidated net income for 2013

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a parent company uses the equity method to account for an investment in a subsidiary, why do both the parent's Net Income and Retained Earnings account balances agree with the consolidated totals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

35

Reimers Company acquires Rollins Corporation on January 1, 2012. As part of the agreement, the parent states that an additional $100,000 payment to the former owners of Rollins will be made in 2014, if Rollins achieves certain income thresholds during the first two years following the acquisition. How should Reimers account for this contingency in its 2012 consolidated financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

36

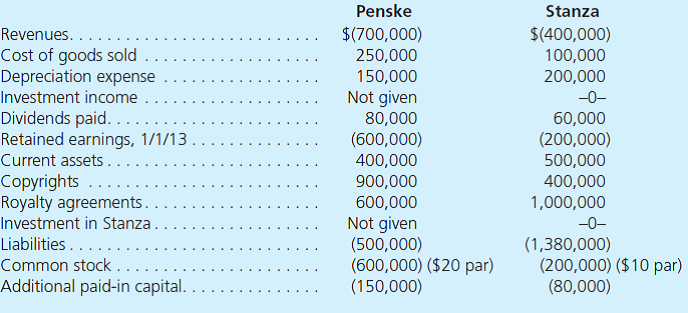

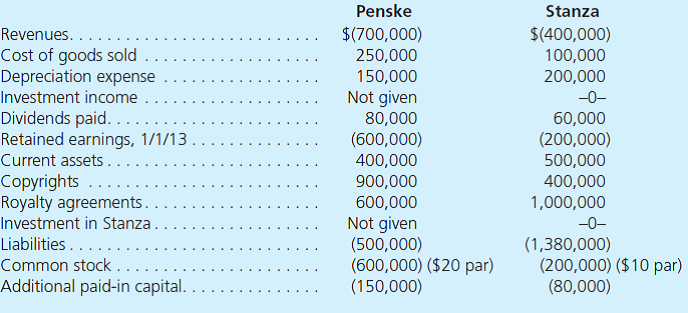

Following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2013:

On January 1, 2013, Penske acquired all of Stanza's outstanding stock for $680,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition copyrights (with a six-year remaining life) have a $440,000 book value but a fair value of $560,000.

a. As of December 31, 2013, what is the consolidated copyrights balance

b. For the year ending December 31, 2013, what is consolidated net income

c. As of December 31, 2013, what is the consolidated retained earnings balance

d. As of December 31, 2013, what is the consolidated balance to be reported for goodwill

On January 1, 2013, Penske acquired all of Stanza's outstanding stock for $680,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition copyrights (with a six-year remaining life) have a $440,000 book value but a fair value of $560,000.

a. As of December 31, 2013, what is the consolidated copyrights balance

b. For the year ending December 31, 2013, what is consolidated net income

c. As of December 31, 2013, what is the consolidated retained earnings balance

d. As of December 31, 2013, what is the consolidated balance to be reported for goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

37

In 2009 Nike Corporation reported a large goodwill impairment loss. Referring to Nike's 2009 financial statements and applicable financial reporting standards, answer the following questions:

How often does Nike test its goodwill for impairment and what are the testing steps

How often does Nike test its goodwill for impairment and what are the testing steps

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

38

On January 1, 2011, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $600,000 cash. At January 1, 2011, Sedona's net assets had a total carrying amount of $420,000. Equipment (eight-year remaining life) was undervalued on Sedona's financial records by $80,000. Any remaining excess fair over book value was attributed to a customer list developed by Sedona (four-year remaining life), but not recorded on its books. Phoenix applies the equity method to account for its investment in Sedona. Each year since the acquisition, Sedona has paid a $20,000 dividend. Sedona recorded income of $70,000 in 2011 and $80,000 in 2012.

Selected account balances from the two companies' individual records were as follows:

On its December 31, 2013, consolidated balance sheet, what amount should Phoenix report for Sedona's customer list

A) $10,000

B) $20,000

C) $25,000

D) $50,000

Selected account balances from the two companies' individual records were as follows:

On its December 31, 2013, consolidated balance sheet, what amount should Phoenix report for Sedona's customer list

A) $10,000

B) $20,000

C) $25,000

D) $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

39

Foxx Corporation acquired all of Greenburg Company's outstanding stock on January 1, 2011, for $600,000 cash. Greenburg's accounting records showed net assets on that date of $470,000, although equipment with a 10-year life was undervalued on the records by $90,000. Any recognized goodwill is considered to have an indefinite life.

Greenburg reports net income in 2011 of $90,000 and $100,000 in 2012. The subsidiary paid dividends of $20,000 in each of these two years.

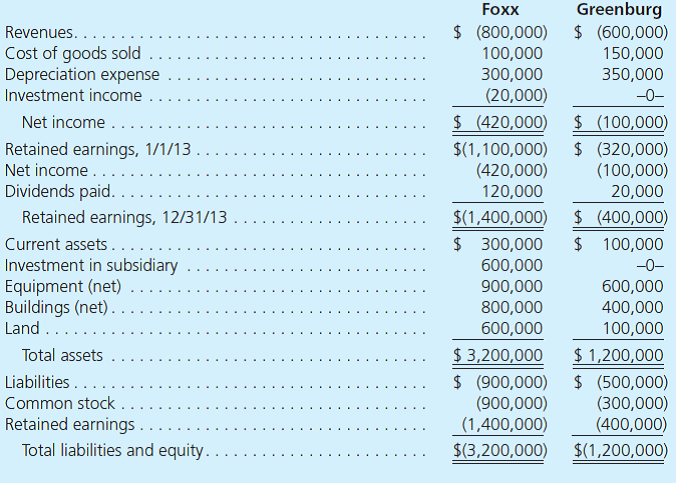

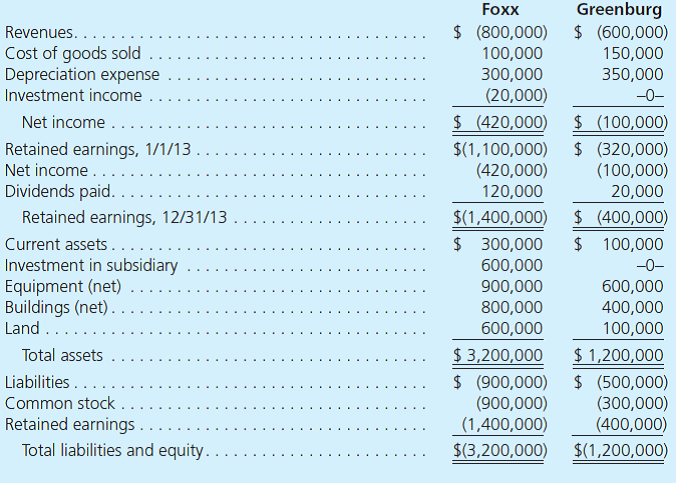

Financial figures for the year ending December 31, 2013, follow. Credit balances are indicated by parentheses.

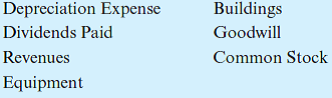

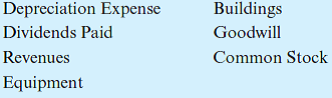

a. Determine the December 31, 2013, consolidated balance for each of the following accounts:

b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes

d. If the parent company had used a different method of accounting for this investment, how could that method have been identified

e. What would be Foxx's balance for retained earnings as of January 1, 2013, if each of the following methods had been in use

Initial value method

Partial equity method

Equity method

Greenburg reports net income in 2011 of $90,000 and $100,000 in 2012. The subsidiary paid dividends of $20,000 in each of these two years.

Financial figures for the year ending December 31, 2013, follow. Credit balances are indicated by parentheses.

a. Determine the December 31, 2013, consolidated balance for each of the following accounts:

b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes

d. If the parent company had used a different method of accounting for this investment, how could that method have been identified

e. What would be Foxx's balance for retained earnings as of January 1, 2013, if each of the following methods had been in use

Initial value method

Partial equity method

Equity method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

40

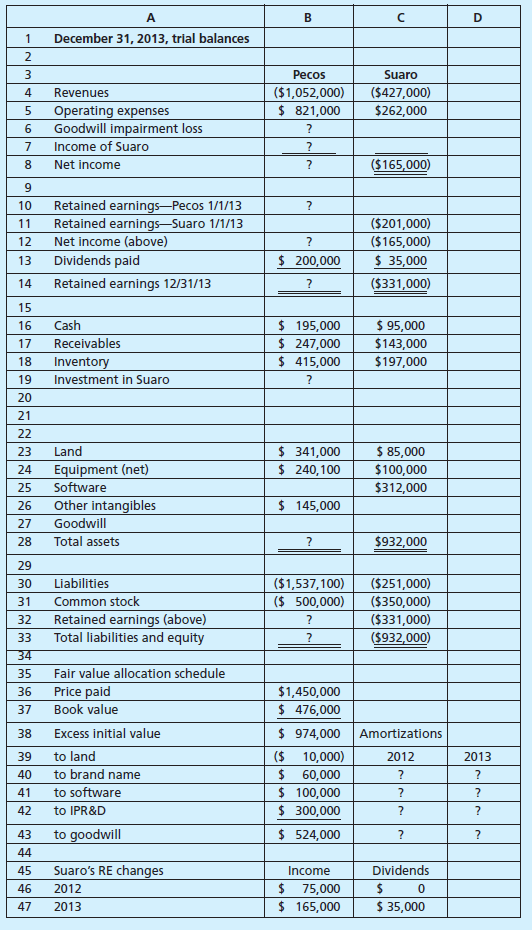

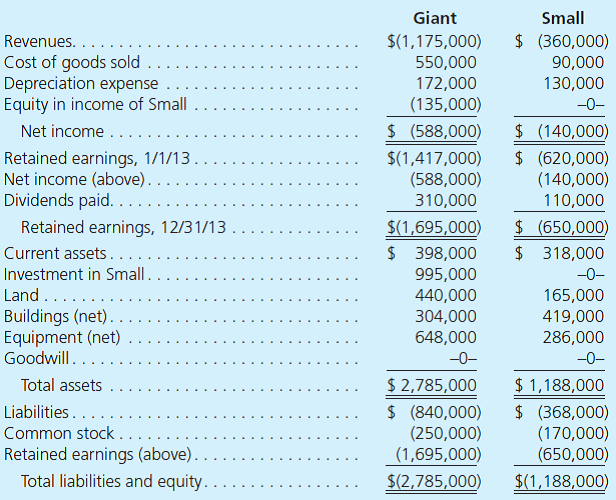

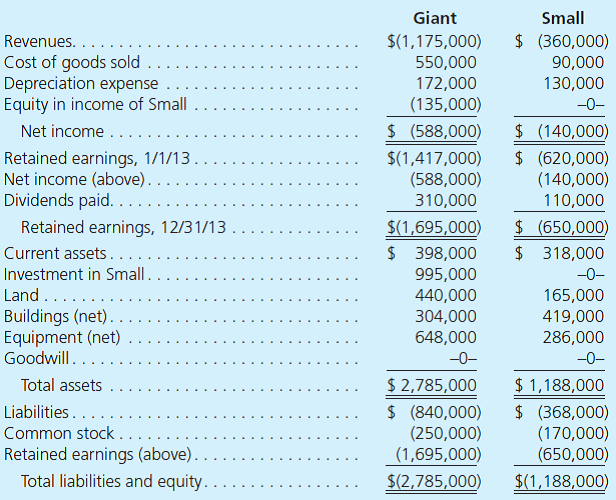

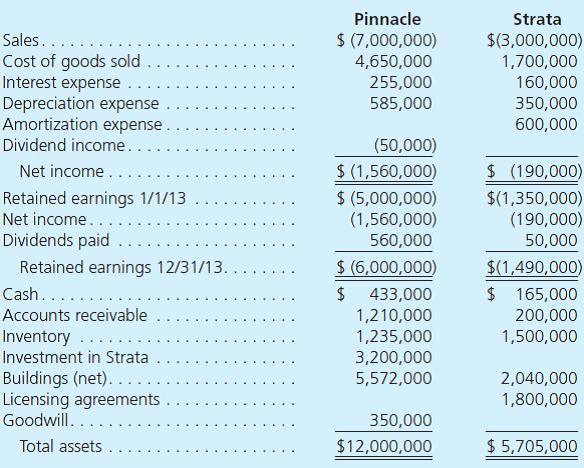

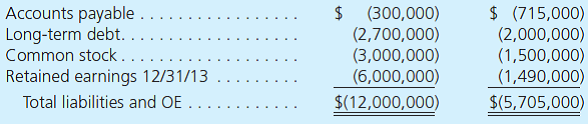

Alternative Investment Methods, Goodwill Impairment, and Consolidated Financial Statements

In this project, you are to provide an analysis of alternative accounting methods for controlling interest investments and subsequent effects on consolidated reporting. The project requires the use of a computer and a spreadsheet software package (e.g., Microsoft Excel, etc.). The use of these tools allows you to assess the sensitivity of alternative accounting methods on consolidated financial reporting without preparing several similar worksheets by hand. Also, by modeling a worksheet process, you can develop a better understanding of accounting for combined reporting entities.

Consolidated Worksheet Preparation

You will be creating and entering formulas to complete four worksheets. The first objective is to demonstrate the effect of different methods of accounting for the investments (equity, initial value, and partial equity) on the parent company's trial balance and on the consolidated worksheet subsequent to acquisition. The second objective is to show the effect on consolidated balances and key financial ratios of recognizing a goodwill impairment loss.

The project requires preparation of the following four separate worksheets:

a. Consolidated information worksheet (follows).

b. Equity method consolidation worksheet.

c. Initial value method consolidation worksheet.

d. Partial equity method consolidation worksheet.

If your spreadsheet package has multiple worksheet capabilities (e.g., Excel), you can use separate worksheets; otherwise, each of the four worksheets can reside in a separate area of a single spreadsheet.

In formulating your solution, each worksheet should link directly to the first worksheet. Also, feel free to create supplemental schedules to enhance the capabilities of your worksheet.

Project Scenario

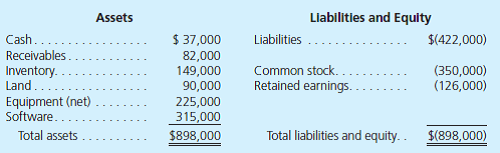

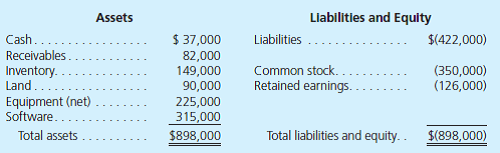

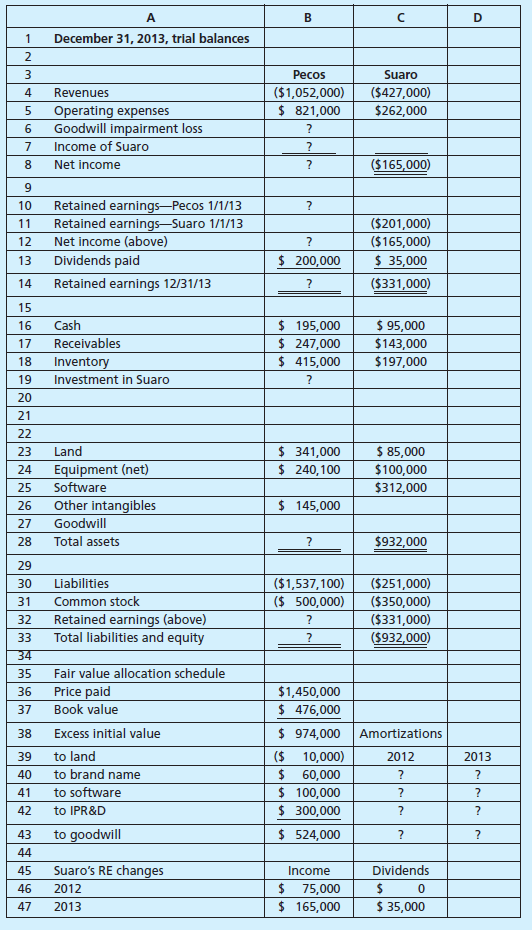

Pecos Company acquired 100 percent of Suaro's outstanding stock for $1,450,000 cash on January 1, 2012, when Suaro had the following balance sheet:

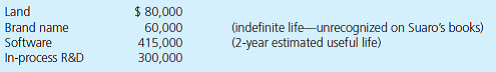

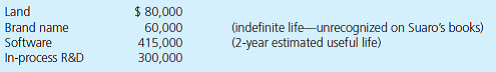

At the acquisition date, the fair values of each identifiable asset and liability that differed from book value were as follows:

Additional Information

• Although at acquisition date Pecos expected future benefits from Suaro's in-process research and development (R D), by the end of 2012, it became clear that the research project was a failure with no future economic benefits.

• During 2012, Suaro earns $75,000 and pays no dividends.

• Selected amounts from Pecos and Suaro's separate financial statements at December 31, 2013, are presented in the consolidated information worksheet. All consolidated worksheets are to be prepared as of December 31, 2013, two years subsequent to acquisition.

• Pecos's January 1, 2013, Retained Earnings balance-before any effect from Suaro's 2012 income-is $(930,000) (credit balance).

• Pecos has 500,000 common shares outstanding for EPS calculations and reported $2,943,100 for consolidated assets at the beginning of the period.

Following is the consolidated information worksheet.

Project Requirements

Complete the four worksheets as follows:

1. Input the consolidated information worksheet provided and complete the fair-value allocation schedule by computing the excess amortizations for 2012 and 2013.

2. Using separate worksheets, prepare Pecos's trial balances for each of the indicated accounting methods (equity, initial value, and partial equity). Use only formulas for the Investment in Suaro, the Income of Suaro, and Retained Earnings accounts.

3. Using references to other cells only (either from the consolidated information worksheet or from the separate method sheets), prepare for each of the three consolidation worksheets:

• Adjustments and eliminations.

• Consolidated balances.

4. Calculate and present the effects of a 2013 total goodwill impairment loss on the following ratios for the consolidated entity:

• Earnings per share (EPS).

• Return on assets.

• Return on equity.

• Debt to equity.

Your worksheets should have the capability to adjust immediately for the possibility that all acquisition goodwill can be considered impaired in 2013.

5. Prepare a word-processed report that describes and discusses the following worksheet results:

a. The effects of alternative investment accounting methods on the parent's trial balances and the final consolidation figures.

b. The relation between consolidated retained earnings and the parent's retained earnings under each of the three (equity, initial value, partial equity) investment accounting methods.

c. The effect on EPS, return on assets, return on equity, and debt-to-equity ratios of the recognition that all acquisition-related goodwill is considered impaired in 2013.

In this project, you are to provide an analysis of alternative accounting methods for controlling interest investments and subsequent effects on consolidated reporting. The project requires the use of a computer and a spreadsheet software package (e.g., Microsoft Excel, etc.). The use of these tools allows you to assess the sensitivity of alternative accounting methods on consolidated financial reporting without preparing several similar worksheets by hand. Also, by modeling a worksheet process, you can develop a better understanding of accounting for combined reporting entities.

Consolidated Worksheet Preparation

You will be creating and entering formulas to complete four worksheets. The first objective is to demonstrate the effect of different methods of accounting for the investments (equity, initial value, and partial equity) on the parent company's trial balance and on the consolidated worksheet subsequent to acquisition. The second objective is to show the effect on consolidated balances and key financial ratios of recognizing a goodwill impairment loss.

The project requires preparation of the following four separate worksheets:

a. Consolidated information worksheet (follows).

b. Equity method consolidation worksheet.

c. Initial value method consolidation worksheet.

d. Partial equity method consolidation worksheet.

If your spreadsheet package has multiple worksheet capabilities (e.g., Excel), you can use separate worksheets; otherwise, each of the four worksheets can reside in a separate area of a single spreadsheet.

In formulating your solution, each worksheet should link directly to the first worksheet. Also, feel free to create supplemental schedules to enhance the capabilities of your worksheet.

Project Scenario

Pecos Company acquired 100 percent of Suaro's outstanding stock for $1,450,000 cash on January 1, 2012, when Suaro had the following balance sheet:

At the acquisition date, the fair values of each identifiable asset and liability that differed from book value were as follows:

Additional Information

• Although at acquisition date Pecos expected future benefits from Suaro's in-process research and development (R D), by the end of 2012, it became clear that the research project was a failure with no future economic benefits.

• During 2012, Suaro earns $75,000 and pays no dividends.

• Selected amounts from Pecos and Suaro's separate financial statements at December 31, 2013, are presented in the consolidated information worksheet. All consolidated worksheets are to be prepared as of December 31, 2013, two years subsequent to acquisition.

• Pecos's January 1, 2013, Retained Earnings balance-before any effect from Suaro's 2012 income-is $(930,000) (credit balance).

• Pecos has 500,000 common shares outstanding for EPS calculations and reported $2,943,100 for consolidated assets at the beginning of the period.

Following is the consolidated information worksheet.

Project Requirements

Complete the four worksheets as follows:

1. Input the consolidated information worksheet provided and complete the fair-value allocation schedule by computing the excess amortizations for 2012 and 2013.

2. Using separate worksheets, prepare Pecos's trial balances for each of the indicated accounting methods (equity, initial value, and partial equity). Use only formulas for the Investment in Suaro, the Income of Suaro, and Retained Earnings accounts.

3. Using references to other cells only (either from the consolidated information worksheet or from the separate method sheets), prepare for each of the three consolidation worksheets:

• Adjustments and eliminations.

• Consolidated balances.

4. Calculate and present the effects of a 2013 total goodwill impairment loss on the following ratios for the consolidated entity:

• Earnings per share (EPS).

• Return on assets.

• Return on equity.

• Debt to equity.

Your worksheets should have the capability to adjust immediately for the possibility that all acquisition goodwill can be considered impaired in 2013.

5. Prepare a word-processed report that describes and discusses the following worksheet results:

a. The effects of alternative investment accounting methods on the parent's trial balances and the final consolidation figures.

b. The relation between consolidated retained earnings and the parent's retained earnings under each of the three (equity, initial value, partial equity) investment accounting methods.

c. The effect on EPS, return on assets, return on equity, and debt-to-equity ratios of the recognition that all acquisition-related goodwill is considered impaired in 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

41

Willkom Corporation bought 100 percent of Szabo, Inc., on January 1, 2011. On that date, Willkom's equipment (10-year life) has a book value of $300,000 but a fair value of $400,000. Szabo has equipment (10-year life) with a book value of $200,000 but a fair value of $300,000. Willkom uses the equity method to record its investment in Szabo. On December 31, 2013, Willkom has equipment with a book value of $210,000 but a fair value of $330,000. Szabo has equipment with a book value of $140,000 but a fair value of $270,000. What is the consolidated balance for the Equipment account as of December 31, 2013

A) $600,000.

B) $490,000.

C) $480,000.

D) $420,000.

A) $600,000.

B) $490,000.

C) $480,000.

D) $420,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

42

When is the use of push-down accounting required, and what is the rationale for its application

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

43

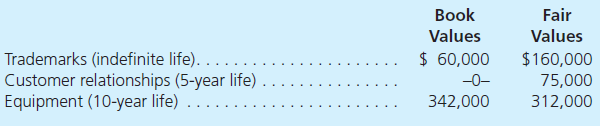

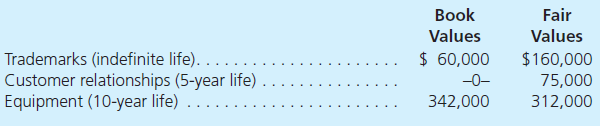

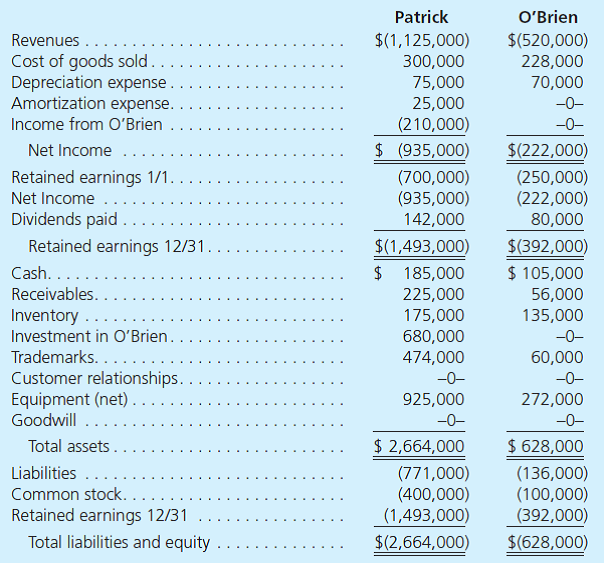

Patrick Corporation acquired 100 percent of O'Brien Company's outstanding common stock on January 1, for $550,000 in cash. O'Brien reported net assets with a carrying amount of $350,000 at that time. Some of O'Brien's assets either were unrecorded (having been internally developed) or had fair values that differed from book values as follows:

Any goodwill is considered to have an indefinite life with no impairment charges during the year.

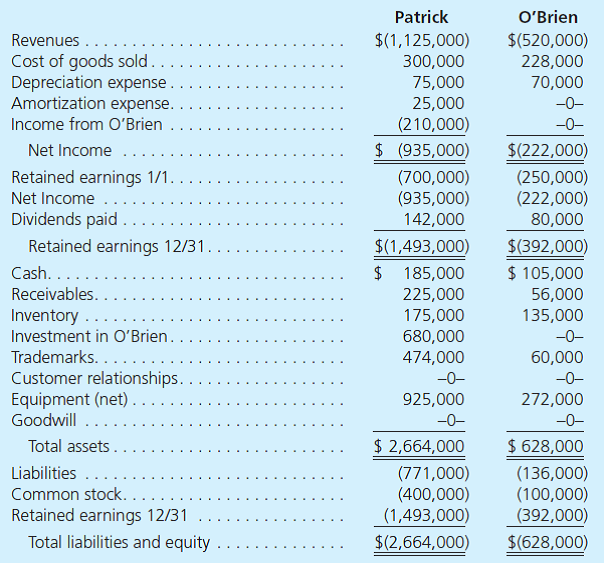

Following are financial statements at the end of the first year for these two companies prepared from their separately maintained accounting systems. Credit balances are indicated by parentheses.

a. Show how Patrick computed the $210,000 Income of O'Brien balance. Discuss how you determined which accounting method Patrick uses for its investment in O'Brien.

b. Without preparing a worksheet or consolidation entries, determine and explain the totals to be reported for this business combination for the year ending December 31.

c. Verify the totals determined in part ( b ) by producing a consolidation worksheet for Patrick and O'Brien for the year ending December 31.

Any goodwill is considered to have an indefinite life with no impairment charges during the year.

Following are financial statements at the end of the first year for these two companies prepared from their separately maintained accounting systems. Credit balances are indicated by parentheses.

a. Show how Patrick computed the $210,000 Income of O'Brien balance. Discuss how you determined which accounting method Patrick uses for its investment in O'Brien.

b. Without preparing a worksheet or consolidation entries, determine and explain the totals to be reported for this business combination for the year ending December 31.

c. Verify the totals determined in part ( b ) by producing a consolidation worksheet for Patrick and O'Brien for the year ending December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

44

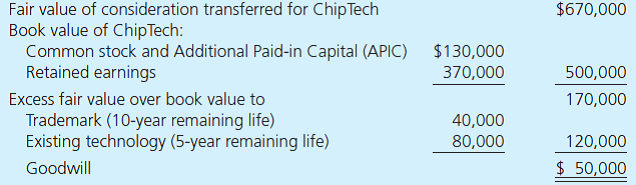

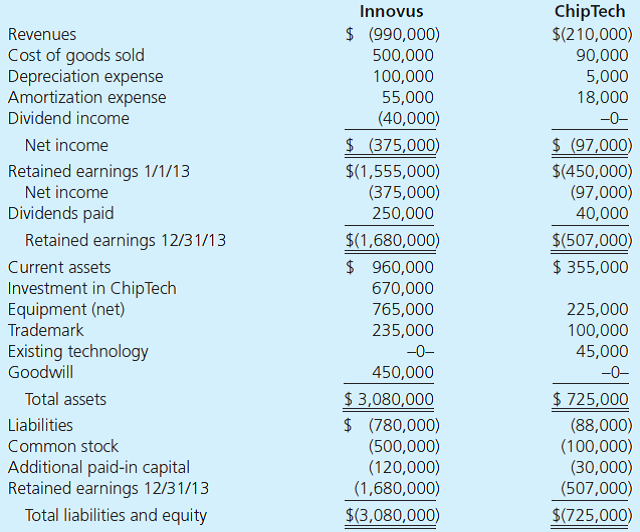

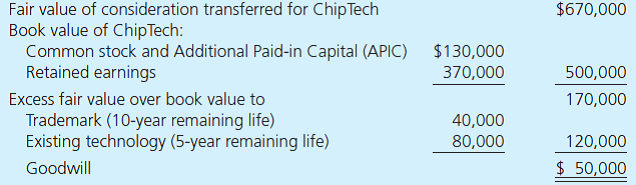

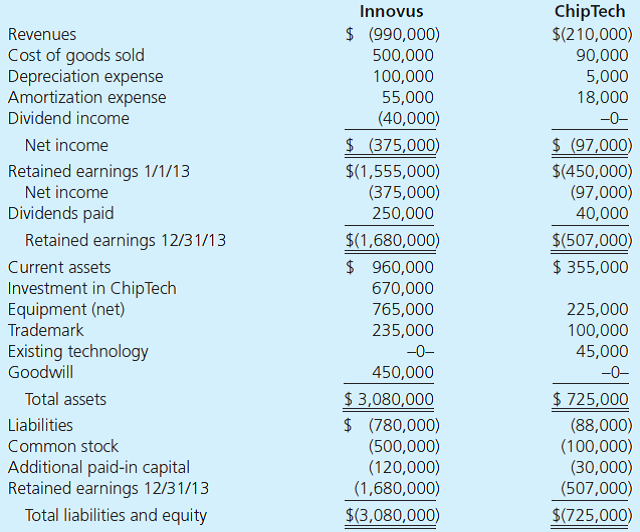

On January 1, 2012, Innovus, Inc., acquired 100 percent of the common stock of ChipTech Company for $670,000 in cash and other fair-value consideration. ChipTech's fair value was allocated among its net assets as follows:

The December 31, 2013, trial balances for the parent and subsidiary follow:

Required

a. Using Excel, compute consolidated balances for Innovus and ChipTech. Either use a worksheet approach or compute the balances directly.

b. Prepare a second spreadsheet that shows a 2013 impairment loss for the entire amount of goodwill from the ChipTech acquisition.

The December 31, 2013, trial balances for the parent and subsidiary follow:

Required

a. Using Excel, compute consolidated balances for Innovus and ChipTech. Either use a worksheet approach or compute the balances directly.

b. Prepare a second spreadsheet that shows a 2013 impairment loss for the entire amount of goodwill from the ChipTech acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

45

When a parent company uses the equity method to account for investment in a subsidiary, the amortization expense entry recorded during the year is eliminated on a consolidation work-sheet as a component of Entry I. What is the necessity of removing this amortization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

46

Kaplan Corporation acquired Star, Inc., on January 1, 2012, by issuing 13,000 shares of common stock with a $10 per share par value and a $23 market value. This transaction resulted in recognizing $62,000 of goodwill. Kaplan also agreed to compensate Star's former owners for any difference if Kaplan's stock is worth less than $23 on January 1, 2013. On January 1, 2013, Kaplan issues an additional 3,000 shares to Star's former owners to honor the contingent consideration agreement. Which of the following is true

A) The fair value of the number of shares issued for the contingency increases the Goodwill account at January 1, 2013.

B) The parent's additional paid-in capital from the contingent equity recorded at the acquisition date is reclassified as a regular common stock issue on January 1, 2013.

C) All of the subsidiary's asset and liability accounts must be revalued for consolidation purposes based on their fair values as of January 1, 2013.

D) The additional shares are assumed to have been issued on January 1, 2012, so that a retrospective adjustment is required.

A) The fair value of the number of shares issued for the contingency increases the Goodwill account at January 1, 2013.

B) The parent's additional paid-in capital from the contingent equity recorded at the acquisition date is reclassified as a regular common stock issue on January 1, 2013.

C) All of the subsidiary's asset and liability accounts must be revalued for consolidation purposes based on their fair values as of January 1, 2013.

D) The additional shares are assumed to have been issued on January 1, 2012, so that a retrospective adjustment is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

47

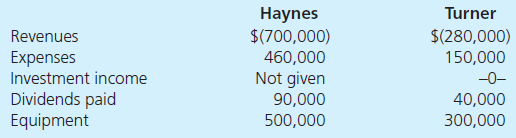

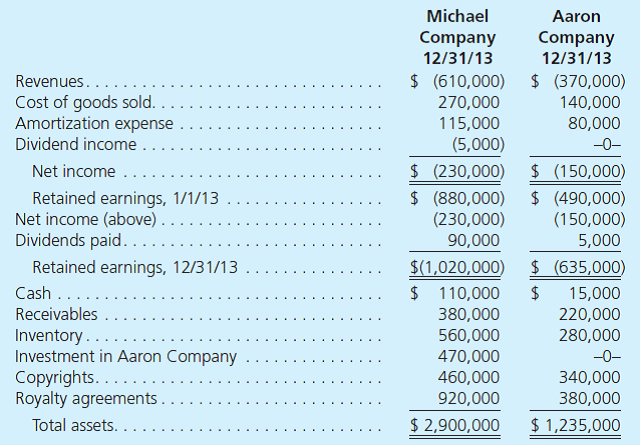

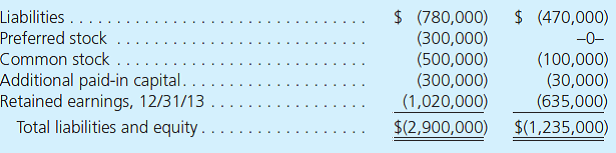

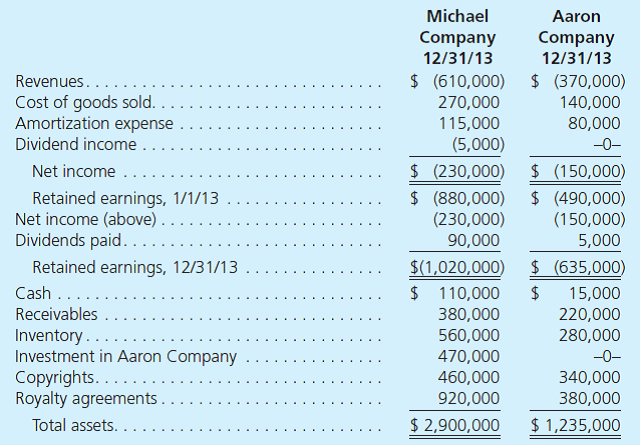

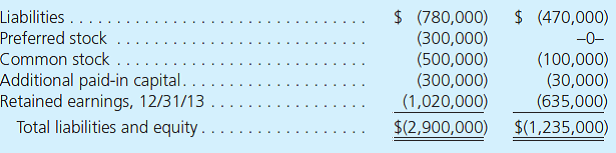

Following are separate financial statements of Michael Company and Aaron Company as of December 31, 2013 (credit balances indicated by parentheses). Michael acquired all of Aaron's outstanding voting stock on January 1, 2009, by issuing 20,000 shares of its own $1 par common stock. On the acquisition date, Michael Company's stock actively traded at $23.50 per share.

On the date of acquisition, Aaron reported retained earnings of $230,000 and a total book value of $360,000. At that time, its royalty agreements were undervalued by $60,000. This intangible was assumed to have a six-year life with no residual value. Additionally, Aaron owned a trademark with a fair value of $50,000 and a 10-year remaining life that was not reflected on its books.

a. Using the preceding information, prepare a consolidation worksheet for these two companies as of December 31, 2013.

b. Assuming that Michael applied the equity method to this investment, what account balances would differ on the parent's individual financial statements

c. Assuming that Michael applied the equity method to this investment, what changes would be necessary in the consolidation entries found on a December 31, 2013, worksheet

d. Assuming that Michael applied the equity method to this investment, what changes would be created in the consolidated figures to be reported by this combination

On the date of acquisition, Aaron reported retained earnings of $230,000 and a total book value of $360,000. At that time, its royalty agreements were undervalued by $60,000. This intangible was assumed to have a six-year life with no residual value. Additionally, Aaron owned a trademark with a fair value of $50,000 and a 10-year remaining life that was not reflected on its books.

a. Using the preceding information, prepare a consolidation worksheet for these two companies as of December 31, 2013.

b. Assuming that Michael applied the equity method to this investment, what account balances would differ on the parent's individual financial statements

c. Assuming that Michael applied the equity method to this investment, what changes would be necessary in the consolidation entries found on a December 31, 2013, worksheet

d. Assuming that Michael applied the equity method to this investment, what changes would be created in the consolidated figures to be reported by this combination

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة