Deck 7: Activity-Based Costing and Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 7: Activity-Based Costing and Management

1

Interview questions are asked to determine

A) what activities are being performed.

B) who performs the activities.

C) the relative amount of time spent on each activity by individual workers.

D) possible activity drivers for assigning costs to products.

E) All of these.

A) what activities are being performed.

B) who performs the activities.

C) the relative amount of time spent on each activity by individual workers.

D) possible activity drivers for assigning costs to products.

E) All of these.

Option e is the correct answer.

Interview questions are asked to gather all of the following information:

1. What activities are performed?

2. Who performs the activities

3. The amount of relative amount of time spent on each activity by individual workers

4. Possible activity drivers for assigning costs to products.

Interview questions are asked to gather all of the following information:

1. What activities are performed?

2. Who performs the activities

3. The amount of relative amount of time spent on each activity by individual workers

4. Possible activity drivers for assigning costs to products.

2

Which of the following are nonvalue-added activities?

A) Moving goods

B) Storing goods

C) Inspecting finished goods

D) Reworking a defective product

E) All of these.

A) Moving goods

B) Storing goods

C) Inspecting finished goods

D) Reworking a defective product

E) All of these.

Option e is the correct answer.

All of these are non value added activities:

a. Moving goods

b. Storing goods

c. Inspecting finished goods

d. Reworking a defective product

All of these are non value added activities:

a. Moving goods

b. Storing goods

c. Inspecting finished goods

d. Reworking a defective product

3

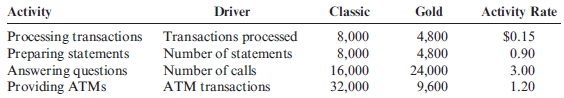

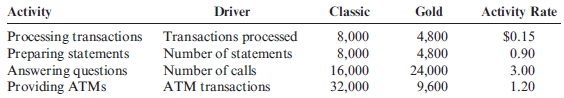

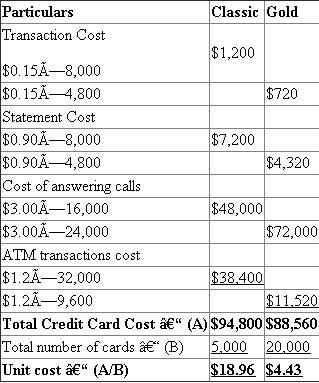

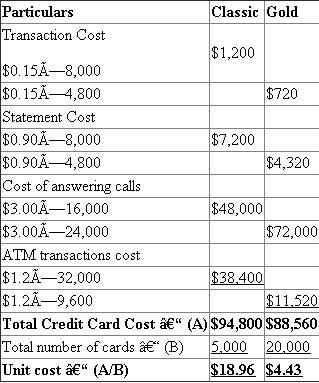

Calculating ABC Unit Costs

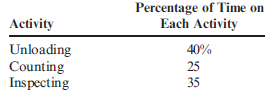

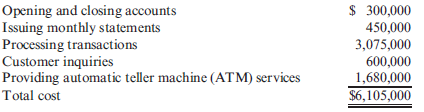

Perry National Bank has collected the following information for four activities and two types of credit cards:

There are 5,000 holders of Classic cards and 20,000 holders of the Gold cards.

Required:

Calculate the unit cost (rounded to the nearest cent) for Classic and Gold credit cards.

Perry National Bank has collected the following information for four activities and two types of credit cards:

There are 5,000 holders of Classic cards and 20,000 holders of the Gold cards.

Required:

Calculate the unit cost (rounded to the nearest cent) for Classic and Gold credit cards.

Calculation of unit cost for Classic and Gold credit cards:

4

Cycle Time and Velocity

In the first quarter of operations, a manufacturing cell produced 80,000 stereo speakers, using 20,000 production hours. In the second quarter, the cycle time was 10 minutes per unit with the same number of production hours as were used in the first quarter.

Required:

1. Compute the velocity (per hour) for the first quarter.

2. Compute the cycle time for the first quarter (minutes per unit produced).

3. How many units were produced in the second quarter?

In the first quarter of operations, a manufacturing cell produced 80,000 stereo speakers, using 20,000 production hours. In the second quarter, the cycle time was 10 minutes per unit with the same number of production hours as were used in the first quarter.

Required:

1. Compute the velocity (per hour) for the first quarter.

2. Compute the cycle time for the first quarter (minutes per unit produced).

3. How many units were produced in the second quarter?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

Classification of Environmental Costs

Consider the following independent environmental activities:

a. A company takes actions to reduce the amount of material in its packages.

b. After its useful life, a soft-drink producer returns the activated carbon used for purifying water for its beverages to the supplier. The supplier reactivates the carbon for a second use in nonfood applications. As a consequence, many tons of material are prevented from entering landfills.

c. An evaporator system is installed to treat wastewater and to collect usable solids for other uses.

d. The inks used to print snack packages (for chips) contain heavy metals.

e. Processes are inspected to ensure compliance with environmental standards.

f. Delivery boxes are used five times and then recycled. This prevents 112 million pounds of cardboard from entering landfills and saves two million trees per year.

g. Scrubber equipment is installed to ensure that air emissions are less than the level permitted by law.

h. Local residents are incurring medical costs from illnesses caused by air pollution from automobile exhaust pollution.

i. As part of implementing an environmental perspective for a balanced performance measurement system, environmental performance measures are developed.

j. Because of liquid and solid residues being discharged into a local lake, it is no longer fit for swimming, fishing, and other recreational activities.

k. To reduce energy consumption, magnetic ballasts are replaced with electronic ballasts, and more efficient light bulbs and lighting sensors are installed. As a result, 2.3 million kilowatthours of electricity are saved per year.

l. Because of a legal settlement, a chemical company must spend $20,000,000 to clean up contaminated soil.

m. A soft-drink company uses the following practice: In all bottling plants, packages damaged during filling are collected and recycled (glass, plastic, and aluminum).

n. Products are inspected to ensure that the gaseous emissions produced during operation follow legal and company guidelines.

o. Costs are incurred to operate pollution-control equipment.

p. An internal audit is conducted to verify that environmental policies are being followed.

Required:

Classify these environmental activities as prevention, detection, internal failure, or external failure costs. For external failure costs, classify the costs as societal or realized. Also, label those activities that are compatible with sustainable development with ''SD.''

Consider the following independent environmental activities:

a. A company takes actions to reduce the amount of material in its packages.

b. After its useful life, a soft-drink producer returns the activated carbon used for purifying water for its beverages to the supplier. The supplier reactivates the carbon for a second use in nonfood applications. As a consequence, many tons of material are prevented from entering landfills.

c. An evaporator system is installed to treat wastewater and to collect usable solids for other uses.

d. The inks used to print snack packages (for chips) contain heavy metals.

e. Processes are inspected to ensure compliance with environmental standards.

f. Delivery boxes are used five times and then recycled. This prevents 112 million pounds of cardboard from entering landfills and saves two million trees per year.

g. Scrubber equipment is installed to ensure that air emissions are less than the level permitted by law.

h. Local residents are incurring medical costs from illnesses caused by air pollution from automobile exhaust pollution.

i. As part of implementing an environmental perspective for a balanced performance measurement system, environmental performance measures are developed.

j. Because of liquid and solid residues being discharged into a local lake, it is no longer fit for swimming, fishing, and other recreational activities.

k. To reduce energy consumption, magnetic ballasts are replaced with electronic ballasts, and more efficient light bulbs and lighting sensors are installed. As a result, 2.3 million kilowatthours of electricity are saved per year.

l. Because of a legal settlement, a chemical company must spend $20,000,000 to clean up contaminated soil.

m. A soft-drink company uses the following practice: In all bottling plants, packages damaged during filling are collected and recycled (glass, plastic, and aluminum).

n. Products are inspected to ensure that the gaseous emissions produced during operation follow legal and company guidelines.

o. Costs are incurred to operate pollution-control equipment.

p. An internal audit is conducted to verify that environmental policies are being followed.

Required:

Classify these environmental activities as prevention, detection, internal failure, or external failure costs. For external failure costs, classify the costs as societal or realized. Also, label those activities that are compatible with sustainable development with ''SD.''

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

Explain how costs are assigned to activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose that a company is spending $60,000 per year for inspecting, $30,000 for purchasing, and $40,000 for reworking products. A good estimate of nonvalue-added costs would be

A) $70,000.

B) $130,000.

C) $40,000.

D) $90,000.

E) $100,000.

A) $70,000.

B) $130,000.

C) $40,000.

D) $90,000.

E) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assigning Costs to Activities

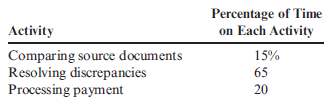

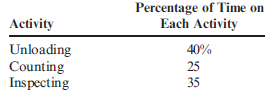

Baker Company produces small engines for lawnmower producers. The accounts payable department at Baker has six clerks who process and pay supplier invoices. The total cost of their salaries is $320,000. The work distribution for the activities that they perform is as follows:

Required:

Assign the cost of labor to each of the three activities in the accounts payable department.

Baker Company produces small engines for lawnmower producers. The accounts payable department at Baker has six clerks who process and pay supplier invoices. The total cost of their salaries is $320,000. The work distribution for the activities that they perform is as follows:

Required:

Assign the cost of labor to each of the three activities in the accounts payable department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

Product-Costing Accuracy, Consumption Ratios

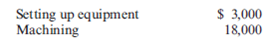

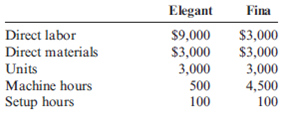

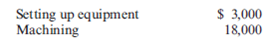

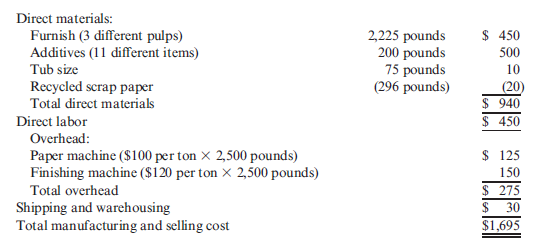

Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead activities, with the following costs:

The controller has collected the expected annual prime costs for each briefcase, the machine hours, the setup hours, and the expected production.

Required:

1. CONCEPTUAL CONNECTION Do you think that the direct labor costs and direct materials costs are accurately traced to each briefcase? Explain.

2. Calculate the consumption ratios for each activity. Round to two decimal places.

3. Calculate the overhead cost per unit for each briefcase by using a plantwide rate based on direct labor costs. Round rates to the nearest cent. Comment on this approach to assigning overhead.

4. CONCEPTUAL CONNECTION Calculate the overhead cost per unit for each briefcase by using overhead rates based on machine hours and setup hours. Explain why these assignments are more accurate than using the direct labor costs.

Plata Company produces two products: a mostly handcrafted soft leather briefcase sold under the label Maletin Elegant and a leather briefcase produced largely through automation and sold under the label Maletin Fina. The two products use two overhead activities, with the following costs:

The controller has collected the expected annual prime costs for each briefcase, the machine hours, the setup hours, and the expected production.

Required:

1. CONCEPTUAL CONNECTION Do you think that the direct labor costs and direct materials costs are accurately traced to each briefcase? Explain.

2. Calculate the consumption ratios for each activity. Round to two decimal places.

3. Calculate the overhead cost per unit for each briefcase by using a plantwide rate based on direct labor costs. Round rates to the nearest cent. Comment on this approach to assigning overhead.

4. CONCEPTUAL CONNECTION Calculate the overhead cost per unit for each briefcase by using overhead rates based on machine hours and setup hours. Explain why these assignments are more accurate than using the direct labor costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

Activity-Based Costing, Distorted Product Costs

Sharp Paper Inc. has three paper mills, one of which is located in Memphis, Tennessee. The Memphis mill produces 300 different types of coated and uncoated specialty printing papers. Management was convinced that the value of the large variety of products more than offset the extra costs of the increased complexity.

During 2015, the Memphis mill produced 120,000 tons of coated paper and 80,000 tons of uncoated paper. Of the 200,000 tons produced, 180,000 were sold. Sixty products account for 80% of the tons sold. Thus, 240 products are classified as low-volume products.

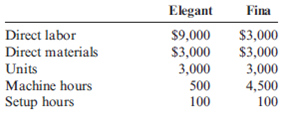

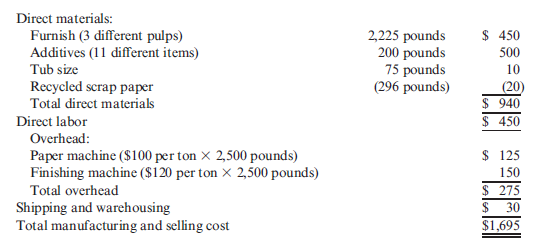

Lightweight lime hopsack in cartons (LLHC) is one of the low-volume products. LLHC is produced in rolls, converted into sheets of paper, and then sold in cartons. In 2015 the cost to produce and sell one ton of LLHC was as follows:

Overhead is applied by using a two-stage process. First, overhead is allocated to the paper and finishing machines by using the direct method of allocation with carefully selected cost drivers. Second, the overhead assigned to each machine is divided by the budgeted tons of output. These rates are then multiplied by the number of pounds required to produce one good ton.

In 2015, LLHC sold for $2,400 per ton, making it one of the most profitable products. A similar examination of some of the other low-volume products revealed that they also had very respectable profit margins. Unfortunately, the performance of the high volume products was less impressive, with many showing losses or very low profit margins. This situation led Ryan Chesser to call a meeting with his marketing vice president, Jennifer Woodruff, and his controller, Kaylin Penn.

Ryan: The above-average profitability of our low-volume specialty products and the poor profit performance of our high-volume products make me believe that we should switch our marketing emphasis to the low-volume line. Perhaps we should drop some of our high-volume products, particularly those showing a loss.

Jennifer: I'm not convinced that solution is the right one. I know our high-volume products are of high quality, and I'm convinced that we are as efficient in our production as other firms. I think that somehow our costs are not being assigned correctly. For example, the shipping and warehousing costs are assigned by dividing these costs by the total tons of paper sold. Yet …

Kaylin: Jennifer, I hate to disagree, but the $30-per-ton charge for shipping and warehousing seems reasonable. I know that our method to assign these costs is identical to a number of other paper companies.

Jennifer: Well, that may be true, but do these other companies have the variety of products that we have? Our low-volume products require special handling and processing, but when we assign shipping and warehousing costs, we average these special costs across our entire product line. Every ton produced in our mill passes through our mill shipping department and is either sent directly to the customer or to our distribution center and then eventually to customers. My records indicate quite clearly that virtually all of the high-volume products are sent directly to customers, whereas most of the low-volume products are sent to the distribution center. Now, all of the products passing through the mill shipping department should receive a share of the $2,000,000 annual shipping costs. I'm not convinced, however, that all products should receive a share of the receiving and shipping costs of the distribution center as currently practiced.

Ryan: Kaylin, is this true?Does our systemallocate our shipping and warehousing costs in this way?

Kaylin: Yes, I'm afraid it does. Jennifer may have a point. Perhaps we need to reevaluate our method to assign these costs to the product lines.

Ryan: Jennifer, do you have any suggestions concerning how the shipping and warehousing costs should be assigned?

Jennifer: It seems reasonable to make a distinction between products that spend time in the distribution center and those that do not. We should also distinguish between the receiving and shipping activities at the distribution center. All incoming shipments are packed on pallets and weigh one ton each (there are 14 cartons of paper per pallet). In 2015, the receiving department processed 56,000 tons of paper. Receiving employs 15 people at an annual cost of $600,000. Other receiving costs total about $500,000. I would recommend that these costs be assigned by using tons processed.

Shipping, however, is different. There are two activities associated with shipping: picking the order from inventory and loading the paper. We employ 30 people for picking and 10 for loading, at an annual cost of $1,200,000. Other shipping costs total $1,100,000. Picking and loading are more concerned with the number of shipping items than with tonnage. That is, a shipping item may consist of two or three cartons instead of pallets. Accordingly, the shipping costs of the distribution center should be assigned by using the number of items shipped. In 2015, for example, we handled 190,000 shipping items.

Ryan: These suggestions have merit. Kaylin, I would like to see what effect Jennifer's suggestions have on the per-unit assignment of shipping and warehousing for LLHC. If the effect is significant, then we will expand the analysis to include all products.

Kaylin: I'm willing to compute the effect, but I'd like to suggest one additional feature. Currently, we have a policy to carry about 25 tons of LLHC in inventory. Our current costing system totally ignores the cost of carrying this inventory. Since it costs us $1,665 to produce each ton of this product, we are tying up a lot of money in inventory-money that could be invested in other productive opportunities. In fact, the return lost is about 16% per year. This cost should also be assigned to the units sold.

Ryan: Kaylin, this also sounds good to me. Go ahead and include the carrying cost in your computation.

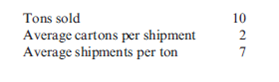

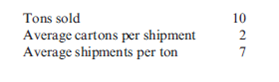

To help in the analysis, Kaylin gathered the following data for LLHC for 2015:

Required:

1. Identify the flaws associated with the current method of assigning shipping and warehousing costs to Sharp's products.

2. Compute the shipping and warehousing cost per ton of LLHC sold by using the new method suggested by Jennifer and Kaylin. Round rates and the cost per ton to two decimal places.

3. Using the new costs computed in Requirement 2, compute the profit per ton of LLHC. Compare this with the profit per ton computed by using the old method. Do you think that this same effect would be realized for other low-volume products? Explain.

4. Comment on Ryan's proposal to drop some high-volume products and place more emphasis on low-volume products. Discuss the role of the accounting system in supporting this type of decision making.

5. After receiving the analysis of LLHC, Ryan decided to expand the analysis to all products. He also had Kaylin reevaluate the way in which mill overhead was assigned to products. After the restructuring was completed, Ryan took the following actions: (a) the prices of most low-volume products were increased, (b) the prices of several high-volume products were decreased, and (c) some low-volume products were dropped. Explain why his strategy changed so dramatically.

Sharp Paper Inc. has three paper mills, one of which is located in Memphis, Tennessee. The Memphis mill produces 300 different types of coated and uncoated specialty printing papers. Management was convinced that the value of the large variety of products more than offset the extra costs of the increased complexity.

During 2015, the Memphis mill produced 120,000 tons of coated paper and 80,000 tons of uncoated paper. Of the 200,000 tons produced, 180,000 were sold. Sixty products account for 80% of the tons sold. Thus, 240 products are classified as low-volume products.

Lightweight lime hopsack in cartons (LLHC) is one of the low-volume products. LLHC is produced in rolls, converted into sheets of paper, and then sold in cartons. In 2015 the cost to produce and sell one ton of LLHC was as follows:

Overhead is applied by using a two-stage process. First, overhead is allocated to the paper and finishing machines by using the direct method of allocation with carefully selected cost drivers. Second, the overhead assigned to each machine is divided by the budgeted tons of output. These rates are then multiplied by the number of pounds required to produce one good ton.

In 2015, LLHC sold for $2,400 per ton, making it one of the most profitable products. A similar examination of some of the other low-volume products revealed that they also had very respectable profit margins. Unfortunately, the performance of the high volume products was less impressive, with many showing losses or very low profit margins. This situation led Ryan Chesser to call a meeting with his marketing vice president, Jennifer Woodruff, and his controller, Kaylin Penn.

Ryan: The above-average profitability of our low-volume specialty products and the poor profit performance of our high-volume products make me believe that we should switch our marketing emphasis to the low-volume line. Perhaps we should drop some of our high-volume products, particularly those showing a loss.

Jennifer: I'm not convinced that solution is the right one. I know our high-volume products are of high quality, and I'm convinced that we are as efficient in our production as other firms. I think that somehow our costs are not being assigned correctly. For example, the shipping and warehousing costs are assigned by dividing these costs by the total tons of paper sold. Yet …

Kaylin: Jennifer, I hate to disagree, but the $30-per-ton charge for shipping and warehousing seems reasonable. I know that our method to assign these costs is identical to a number of other paper companies.

Jennifer: Well, that may be true, but do these other companies have the variety of products that we have? Our low-volume products require special handling and processing, but when we assign shipping and warehousing costs, we average these special costs across our entire product line. Every ton produced in our mill passes through our mill shipping department and is either sent directly to the customer or to our distribution center and then eventually to customers. My records indicate quite clearly that virtually all of the high-volume products are sent directly to customers, whereas most of the low-volume products are sent to the distribution center. Now, all of the products passing through the mill shipping department should receive a share of the $2,000,000 annual shipping costs. I'm not convinced, however, that all products should receive a share of the receiving and shipping costs of the distribution center as currently practiced.

Ryan: Kaylin, is this true?Does our systemallocate our shipping and warehousing costs in this way?

Kaylin: Yes, I'm afraid it does. Jennifer may have a point. Perhaps we need to reevaluate our method to assign these costs to the product lines.

Ryan: Jennifer, do you have any suggestions concerning how the shipping and warehousing costs should be assigned?

Jennifer: It seems reasonable to make a distinction between products that spend time in the distribution center and those that do not. We should also distinguish between the receiving and shipping activities at the distribution center. All incoming shipments are packed on pallets and weigh one ton each (there are 14 cartons of paper per pallet). In 2015, the receiving department processed 56,000 tons of paper. Receiving employs 15 people at an annual cost of $600,000. Other receiving costs total about $500,000. I would recommend that these costs be assigned by using tons processed.

Shipping, however, is different. There are two activities associated with shipping: picking the order from inventory and loading the paper. We employ 30 people for picking and 10 for loading, at an annual cost of $1,200,000. Other shipping costs total $1,100,000. Picking and loading are more concerned with the number of shipping items than with tonnage. That is, a shipping item may consist of two or three cartons instead of pallets. Accordingly, the shipping costs of the distribution center should be assigned by using the number of items shipped. In 2015, for example, we handled 190,000 shipping items.

Ryan: These suggestions have merit. Kaylin, I would like to see what effect Jennifer's suggestions have on the per-unit assignment of shipping and warehousing for LLHC. If the effect is significant, then we will expand the analysis to include all products.

Kaylin: I'm willing to compute the effect, but I'd like to suggest one additional feature. Currently, we have a policy to carry about 25 tons of LLHC in inventory. Our current costing system totally ignores the cost of carrying this inventory. Since it costs us $1,665 to produce each ton of this product, we are tying up a lot of money in inventory-money that could be invested in other productive opportunities. In fact, the return lost is about 16% per year. This cost should also be assigned to the units sold.

Ryan: Kaylin, this also sounds good to me. Go ahead and include the carrying cost in your computation.

To help in the analysis, Kaylin gathered the following data for LLHC for 2015:

Required:

1. Identify the flaws associated with the current method of assigning shipping and warehousing costs to Sharp's products.

2. Compute the shipping and warehousing cost per ton of LLHC sold by using the new method suggested by Jennifer and Kaylin. Round rates and the cost per ton to two decimal places.

3. Using the new costs computed in Requirement 2, compute the profit per ton of LLHC. Compare this with the profit per ton computed by using the old method. Do you think that this same effect would be realized for other low-volume products? Explain.

4. Comment on Ryan's proposal to drop some high-volume products and place more emphasis on low-volume products. Discuss the role of the accounting system in supporting this type of decision making.

5. After receiving the analysis of LLHC, Ryan decided to expand the analysis to all products. He also had Kaylin reevaluate the way in which mill overhead was assigned to products. After the restructuring was completed, Ryan took the following actions: (a) the prices of most low-volume products were increased, (b) the prices of several high-volume products were decreased, and (c) some low-volume products were dropped. Explain why his strategy changed so dramatically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

The receiving department employs one worker, who spends 25% of his time on the receiving activity and 75% of his time on inspecting products. His salary is $40,000. The amount of cost assigned to the receiving activity is

A) $34,000.

B) $40,000.

C) $10,000.

D) $30,000.

E) None of these.

A) $34,000.

B) $40,000.

C) $10,000.

D) $30,000.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

The cost of inspecting incoming parts is most likely to be reduced by

A) activity sharing.

B) activity elimination.

C) activity reduction.

D) activity selection.

E) None of these.

A) activity sharing.

B) activity elimination.

C) activity reduction.

D) activity selection.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

Activity-Based Customer Costing

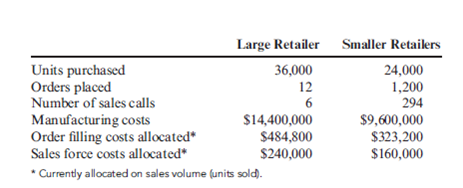

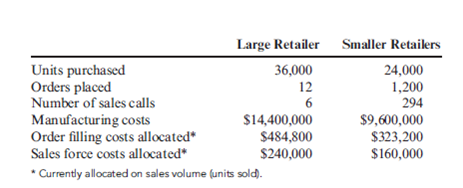

Dormirbien Company produces mattresses for 20 retail outlets. Of the 20 retail outlets, 19 are small, separately owned furniture stores and one is a retail chain. The retail chain buys 60% of the mattresses produced. The 19 smaller customers purchase mattresses in approximately equal quantities, where the orders are about the same size. Data concerning Dormirbien's customer activity are as follows:

Currently, customer-driven costs are assigned to customers based on units sold, a unit-level driver.

Required:

Assign costs to customers by using an ABC approach. Round activity rates and activity costs to the nearest dollar.

Dormirbien Company produces mattresses for 20 retail outlets. Of the 20 retail outlets, 19 are small, separately owned furniture stores and one is a retail chain. The retail chain buys 60% of the mattresses produced. The 19 smaller customers purchase mattresses in approximately equal quantities, where the orders are about the same size. Data concerning Dormirbien's customer activity are as follows:

Currently, customer-driven costs are assigned to customers based on units sold, a unit-level driver.

Required:

Assign costs to customers by using an ABC approach. Round activity rates and activity costs to the nearest dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

Product-Costing Accuracy, Consumption Ratios, Activity Rates, Activity Costing

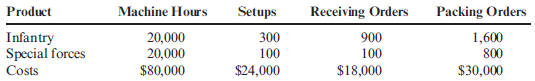

Tristar Manufacturing produces two types of battery-operated toy soldiers: infantry and special forces. The soldiers are produced by using one continuous process. Four activities have been identified: machining, setups, receiving, and packing. Resource drivers have been used to assign costs to each activity. The overhead activities, their costs, and the other related data are as follows:

Required:

1. Calculate the total overhead assigned to each product by using only machine hours to calculate a plantwide rate.

2. Calculate consumption ratios for each activity. (Round to two decimal places.)

3. Calculate a rate for each activity by using the associated driver. (Round to two decimal places.)

4. Assign the overhead costs to each product by using the activity rates computed in Requirement 3.

5. CONCEPTUAL CONNECTION Comment on the difference between the assignment in Requirement 1 and the activity-based assignment.

Tristar Manufacturing produces two types of battery-operated toy soldiers: infantry and special forces. The soldiers are produced by using one continuous process. Four activities have been identified: machining, setups, receiving, and packing. Resource drivers have been used to assign costs to each activity. The overhead activities, their costs, and the other related data are as follows:

Required:

1. Calculate the total overhead assigned to each product by using only machine hours to calculate a plantwide rate.

2. Calculate consumption ratios for each activity. (Round to two decimal places.)

3. Calculate a rate for each activity by using the associated driver. (Round to two decimal places.)

4. Assign the overhead costs to each product by using the activity rates computed in Requirement 3.

5. CONCEPTUAL CONNECTION Comment on the difference between the assignment in Requirement 1 and the activity-based assignment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

Activity-Based Product Costing and Ethical Behavior

Consider the following conversation between Leonard Bryner, president and manager of a firm engaged in job manufacturing, and Chuck Davis, certified management accountant, the firm's controller.

Leonard: Chuck, as you know, our firm has been losing market share over the past 3 years. We have been losing more and more bids, and I don't understand why. At first, I thought that other firms were undercutting simply to gain business, but after examining some of the public financial reports, I believe that they are making a reasonable rate of return. I am beginning to believe that our costs and costing methods are at fault.

Chuck: I can't agree with that. We have good control over our costs. Like most firms in our industry, we use a normal job-costing system. I really don't see any significant waste in the plant.

Leonard: After talking with some other managers at a recent industrial convention, I'm not so sure that waste by itself is the issue. They talked about activity-based management, activitybased costing, and continuous improvement. They mentioned the use of something called ''activity drivers'' to assign overhead. They claimed that these new procedures can help to produce more efficiency in manufacturing, better control of overhead, and more accurate product costing. A big deal was made of eliminating activities that added no value. Maybe our bids are too high because these other firms have found ways to decrease their overhead costs and to increase the accuracy of their product costing.

Chuck: I doubt it. For one thing, I don't see how we can increase product costing accuracy. So many of our costs are indirect costs. Furthermore, everyone uses some measure of production activity to assign overhead costs. I imagine that what they are calling ''activity drivers'' is just some new buzzword for measures of production volume. Fads in costing come and go. I wouldn't worry about it. I'll bet that our problems with decreasing sales are temporary. You might recall that we experienced a similar problem about 12 years ago-it was 2 years before it straightened out.

Required:

1. Do you agree or disagree with Chuck Davis and the advice that he gave Leonard Bryner? Explain.

2. Was there anything wrong or unethical in the behavior that Chuck Davis displayed? Explain your reasoning.

3. Do you think that Chuck was well informed-that he was aware of the accounting implications of ABC and that he knew what was meant by cost drivers? Should he have been well informed? Review (in Chapter 1) the first category of the Statement of Ethical Professional Practice for management accountants. Do any of these standards apply in Chuck's case?

Consider the following conversation between Leonard Bryner, president and manager of a firm engaged in job manufacturing, and Chuck Davis, certified management accountant, the firm's controller.

Leonard: Chuck, as you know, our firm has been losing market share over the past 3 years. We have been losing more and more bids, and I don't understand why. At first, I thought that other firms were undercutting simply to gain business, but after examining some of the public financial reports, I believe that they are making a reasonable rate of return. I am beginning to believe that our costs and costing methods are at fault.

Chuck: I can't agree with that. We have good control over our costs. Like most firms in our industry, we use a normal job-costing system. I really don't see any significant waste in the plant.

Leonard: After talking with some other managers at a recent industrial convention, I'm not so sure that waste by itself is the issue. They talked about activity-based management, activitybased costing, and continuous improvement. They mentioned the use of something called ''activity drivers'' to assign overhead. They claimed that these new procedures can help to produce more efficiency in manufacturing, better control of overhead, and more accurate product costing. A big deal was made of eliminating activities that added no value. Maybe our bids are too high because these other firms have found ways to decrease their overhead costs and to increase the accuracy of their product costing.

Chuck: I doubt it. For one thing, I don't see how we can increase product costing accuracy. So many of our costs are indirect costs. Furthermore, everyone uses some measure of production activity to assign overhead costs. I imagine that what they are calling ''activity drivers'' is just some new buzzword for measures of production volume. Fads in costing come and go. I wouldn't worry about it. I'll bet that our problems with decreasing sales are temporary. You might recall that we experienced a similar problem about 12 years ago-it was 2 years before it straightened out.

Required:

1. Do you agree or disagree with Chuck Davis and the advice that he gave Leonard Bryner? Explain.

2. Was there anything wrong or unethical in the behavior that Chuck Davis displayed? Explain your reasoning.

3. Do you think that Chuck was well informed-that he was aware of the accounting implications of ABC and that he knew what was meant by cost drivers? Should he have been well informed? Review (in Chapter 1) the first category of the Statement of Ethical Professional Practice for management accountants. Do any of these standards apply in Chuck's case?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

Describe the two-stage process associated with plantwide overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

Describe the value of activity-based customer costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

Thom Company produces 60 units in 10 hours. The cycle time for Thom

a. is 6 units per hour.

b. is 10 hours per unit.

c. is 10 minutes per unit.

d. is 6 minutes per unit.

e. cannot be calculated.

a. is 6 units per hour.

b. is 10 hours per unit.

c. is 10 minutes per unit.

d. is 6 minutes per unit.

e. cannot be calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

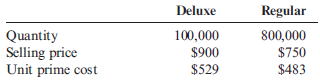

Activity-Based Supplier Costing

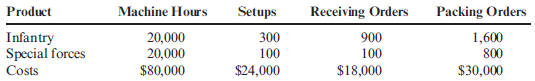

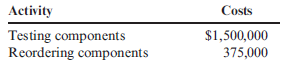

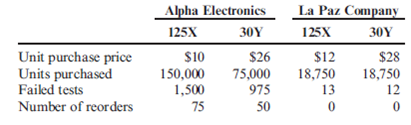

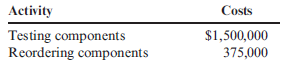

LissenPhones uses Alpha Electronics and La Paz Company to buy two electronic components used in the manufacture of its cell phones: Component 125X and Component 30Y. Consider two activities: testing and reordering components. After the two components are inserted, testing is done to ensure that the two components in the phones are working properly. Reordering occurs because one or both of the components have failed the test and it is necessary to replenish component inventories. Activity cost information and other data needed for supplier costing are as follows:

I. Activity Costs Caused by Suppliers (testing failures and reordering as a result)

II. Supplier Data

Required:

Determine the cost of each supplier by using ABC. Round unit costs to two decimal places.

LissenPhones uses Alpha Electronics and La Paz Company to buy two electronic components used in the manufacture of its cell phones: Component 125X and Component 30Y. Consider two activities: testing and reordering components. After the two components are inserted, testing is done to ensure that the two components in the phones are working properly. Reordering occurs because one or both of the components have failed the test and it is necessary to replenish component inventories. Activity cost information and other data needed for supplier costing are as follows:

I. Activity Costs Caused by Suppliers (testing failures and reordering as a result)

II. Supplier Data

Required:

Determine the cost of each supplier by using ABC. Round unit costs to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

Formation of an Activity Dictionary

A hospital is in the process of implementing an ABC system. A pilot study is being done to assess the effects of the costing changes on specific products. Of particular interest is the cost of caring for patients who receive in-patient recovery treatment for illness, surgery (noncardiac), and injury. These patients are housed on the third and fourth floors of the hospital (the floors are dedicated to patient care and have only nursing stations and patient rooms). A partial transcript of an interview with the hospital's nursing supervisor is as follows:

1. How many nurses are in the hospital?

2. Of these 100 nurses, how many are assigned to the third and fourth floors?

3. What do these nurses do (please describe)?

4. And what do you do?

5. What other lodging and care activities are done for the third and fourth floors by persons other than the nurses?

6. Do patients use any equipment?

7. Who or what uses the activity output?

Required:

Prepare an activity dictionary with three categories: activity name, activity description, and activity driver.

A hospital is in the process of implementing an ABC system. A pilot study is being done to assess the effects of the costing changes on specific products. Of particular interest is the cost of caring for patients who receive in-patient recovery treatment for illness, surgery (noncardiac), and injury. These patients are housed on the third and fourth floors of the hospital (the floors are dedicated to patient care and have only nursing stations and patient rooms). A partial transcript of an interview with the hospital's nursing supervisor is as follows:

1. How many nurses are in the hospital?

2. Of these 100 nurses, how many are assigned to the third and fourth floors?

3. What do these nurses do (please describe)?

4. And what do you do?

5. What other lodging and care activities are done for the third and fourth floors by persons other than the nurses?

6. Do patients use any equipment?

7. Who or what uses the activity output?

Required:

Prepare an activity dictionary with three categories: activity name, activity description, and activity driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

A batch-level driver is consumed by a product each and every time that

A) a batch of products is produced.

B) a unit is produced.

C) a purchase order is issued.

D) a customer complains.

E) None of these.

A) a batch of products is produced.

B) a unit is produced.

C) a purchase order is issued.

D) a customer complains.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume that the moving activity has an expected cost of $80,000. Expected direct labor hours are 20,000, and expected number of moves is 40,000. The best activity rate for moving is

a. $4 per move.

b. $1.33 per hour-move.

c. $4 per hour.

d. $2 per move.

e. None of these.

a. $4 per move.

b. $1.33 per hour-move.

c. $4 per hour.

d. $2 per move.

e. None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

Thom Company produces 60 units in 10 hours. The velocity for Thom

a. is 6 units per hour.

b. is 10 hours per unit.

c. is 10 minutes per unit.

d. 6 minutes per unit.

e. cannot be calculated.

a. is 6 units per hour.

b. is 10 hours per unit.

c. is 10 minutes per unit.

d. 6 minutes per unit.

e. cannot be calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

Nonvalue-Added Costs

Boothe Inc. has the following two activities: (1) Retesting reworked products, cost: $480,000. The retesting cost of the most efficient competitor is $150,000. (2) Welding subassemblies, cost: $900,000 (45,000 welding hours). A benchmarking study reveals that the most efficient level for Boothe would use 36,000 welding hours and entail a cost of $720,000.

Required:

Determine the nonvalue-added cost of each activity.

Boothe Inc. has the following two activities: (1) Retesting reworked products, cost: $480,000. The retesting cost of the most efficient competitor is $150,000. (2) Welding subassemblies, cost: $900,000 (45,000 welding hours). A benchmarking study reveals that the most efficient level for Boothe would use 36,000 welding hours and entail a cost of $720,000.

Required:

Determine the nonvalue-added cost of each activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

Activity Rates and Activity-Based Product Costing

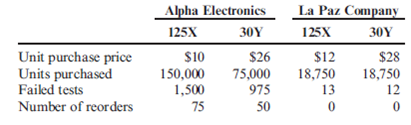

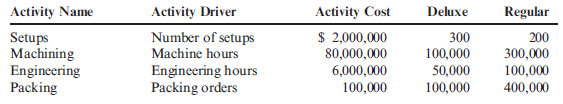

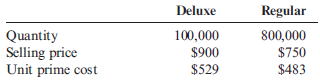

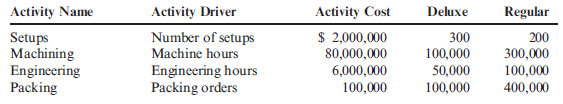

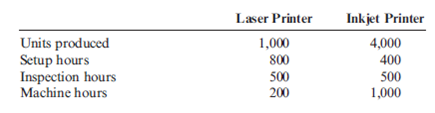

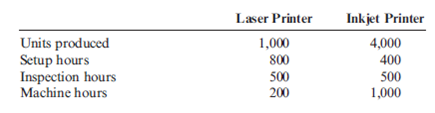

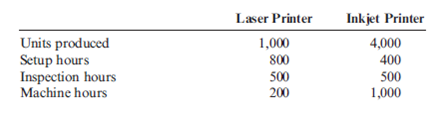

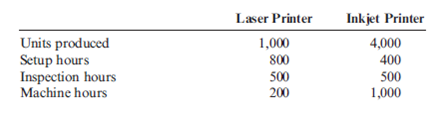

Hammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: the deluxe and the regular. At the beginning of the year, the following data were prepared for this plant:

In addition, the following information was provided so that overhead costs could be assigned to each product:

Required:

1. Calculate the overhead rates for each activity. (Round to two decimal places.)

2. Calculate the per-unit product cost for each product. (Round to the nearest dollar.)

Hammer Company produces a variety of electronic equipment. One of its plants produces two laser printers: the deluxe and the regular. At the beginning of the year, the following data were prepared for this plant:

In addition, the following information was provided so that overhead costs could be assigned to each product:

Required:

1. Calculate the overhead rates for each activity. (Round to two decimal places.)

2. Calculate the per-unit product cost for each product. (Round to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

Describe the two-stage process for departmental overhead rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

Explain how ABC can help a firm identify its true low-cost suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

Striving to produce the same activity output with lower costs for the input used is concerned with which of the following dimensions of activity performance?

A) Quality

B) Time

C) Activity sharing

D) Effectiveness

E) Efficiency

A) Quality

B) Time

C) Activity sharing

D) Effectiveness

E) Efficiency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

Velocity and Cycle Time

Karsen Company takes 7,200 hours to produce 28,800 units of a product.

Required:

What is the velocity? Cycle time?

Karsen Company takes 7,200 hours to produce 28,800 units of a product.

Required:

What is the velocity? Cycle time?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

Value- and Nonvalue-Added Costs

Waterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its attention on processes and activities. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good driver for receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 employees). These fixed costs provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders.

Required:

1. CONCEPTUAL CONNECTION Explain why receiving would be viewed as a value-added activity. List all possible reasons. Also, list some possible reasons that explain why the demand for receiving is more than the efficient level of 36,000 orders.

2. Break the cost of receiving into its value-added and nonvalue-added components.

Waterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was making an effort to reduce costs. As part of this effort, management implemented an activity-based management system and began focusing its attention on processes and activities. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good driver for receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 employees). These fixed costs provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders.

Required:

1. CONCEPTUAL CONNECTION Explain why receiving would be viewed as a value-added activity. List all possible reasons. Also, list some possible reasons that explain why the demand for receiving is more than the efficient level of 36,000 orders.

2. Break the cost of receiving into its value-added and nonvalue-added components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is a nonunit-level driver?

A) Direct labor hours

B) Machine hours

C) Direct materials

D) Setup hours

E) Assembly hours

A) Direct labor hours

B) Machine hours

C) Direct materials

D) Setup hours

E) Assembly hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is a true statement about activity-based customer costing?

A) Customer diversity requires multiple drivers to trace costs accurately to customers.

B) Customers consume customer-driven activities in the same proportions.

C) It seldom produces changes in the company's customer mix.

D) It never improves profitability.

E) None of the above are true.

A) Customer diversity requires multiple drivers to trace costs accurately to customers.

B) Customers consume customer-driven activities in the same proportions.

C) It seldom produces changes in the company's customer mix.

D) It never improves profitability.

E) None of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is a quality prevention cost?

A) Quality planning

B) Supplier evaluation and selection

C) Quality audits

D) Field trials

E) All of these.

A) Quality planning

B) Supplier evaluation and selection

C) Quality audits

D) Field trials

E) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

Consumption Ratios; Activity Rates

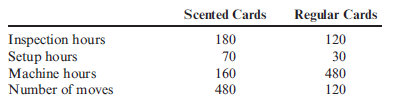

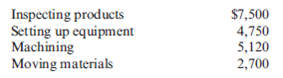

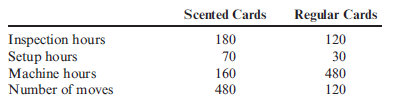

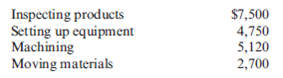

Bienestar Company produces two types of get-well cards: scented and regular. Drivers for the four activities are as follows:

The following activity data have been collected:

Required:

1. Calculate the consumption ratios for the four drivers (round to two decimal places).

2. CONCEPTUAL CONNECTION Is there evidence of product diversity? Explain the significance of product diversity for decision making if the company chooses to use machine hours to assign all overhead.

3. Calculate the activity rates that would be used to assign costs to each product (round to two decimal places).

4. Suppose that the activity rate for inspecting products is $20 per inspection hour. How many hours of inspection are expected for the coming year?

Bienestar Company produces two types of get-well cards: scented and regular. Drivers for the four activities are as follows:

The following activity data have been collected:

Required:

1. Calculate the consumption ratios for the four drivers (round to two decimal places).

2. CONCEPTUAL CONNECTION Is there evidence of product diversity? Explain the significance of product diversity for decision making if the company chooses to use machine hours to assign all overhead.

3. Calculate the activity rates that would be used to assign costs to each product (round to two decimal places).

4. Suppose that the activity rate for inspecting products is $20 per inspection hour. How many hours of inspection are expected for the coming year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Functional-Based versus Activity-Based Costing

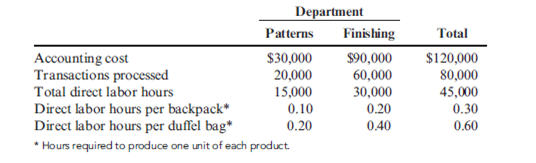

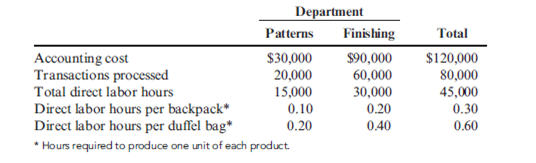

For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped.

Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the company's market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line.

Upon investigation, they were informed that the only real change in product costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products:

The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number.

During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior year's output for that product.

Required:

( Note: Round rates and unit cost to the nearest cent.)

1. CONCEPTUAL CONNECTION Compute the amount of accounting cost assigned to a backpack before the duffel-bag line was added by using a plantwide rate approach based on units produced. Is this assignment accurate? Explain.

2. Suppose that the company decided to assign the accounting costs directly to the product lines by using the number of transactions as the activity driver. What is the accounting cost per unit of backpacks? Per unit of duffel bags?

3. Compute the amount of accounting cost assigned to each backpack and duffel bag by using departmental rates based on direct labor hours.

4. CONCEPTUAL CONNECTION Which way of assigning overhead does the best job-the functional-based approach by using departmental rates or the activity-based approach by using transactions processed for each product? Explain. Discuss the value of ABC before the duffel-bag line was added.

For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line of duffel bags. With this addition, the company began assigning overhead costs by using departmental rates. (Prior to this, the company used a predetermined plantwide rate based on units produced.) Surprisingly, after the addition of the duffel-bag line and the switch to departmental rates, the costs to produce the backpacks increased, and their profitability dropped.

Josie, the marketing manager, and Steve, the production manager, both complained about the increase in the production cost of backpacks. Josie was concerned because the increase in unit costs led to pressure to increase the unit price of backpacks. She was resisting this pressure because she was certain that the increase would harm the company's market share. Steve was receiving pressure to cut costs also, yet he was convinced that nothing different was being done in the way the backpacks were produced. After some discussion, the two managers decided that the problem had to be connected to the addition of the duffel-bag line.

Upon investigation, they were informed that the only real change in product costing procedures was in the way overhead costs are assigned. A two-stage procedure was now in use. First, overhead costs are assigned to the two producing departments, Patterns and Finishing. Second, the costs accumulated in the producing departments are assigned to the two products by using direct labor hours as a driver (the rate in each department is based on direct labor hours). The managers were assured that great care was taken to associate overhead costs with individual products. So that they could construct their own example of overhead cost assignment, the controller provided them with the information necessary to show how accounting costs are assigned to products:

The controller remarked that the cost of operating the accounting department had doubled with the addition of the new product line. The increase came because of the need to process additional transactions, which had also doubled in number.

During the first year of producing duffel bags, the company produced and sold 100,000 backpacks and 25,000 duffel bags. The 100,000 backpacks matched the prior year's output for that product.

Required:

( Note: Round rates and unit cost to the nearest cent.)

1. CONCEPTUAL CONNECTION Compute the amount of accounting cost assigned to a backpack before the duffel-bag line was added by using a plantwide rate approach based on units produced. Is this assignment accurate? Explain.

2. Suppose that the company decided to assign the accounting costs directly to the product lines by using the number of transactions as the activity driver. What is the accounting cost per unit of backpacks? Per unit of duffel bags?

3. Compute the amount of accounting cost assigned to each backpack and duffel bag by using departmental rates based on direct labor hours.

4. CONCEPTUAL CONNECTION Which way of assigning overhead does the best job-the functional-based approach by using departmental rates or the activity-based approach by using transactions processed for each product? Explain. Discuss the value of ABC before the duffel-bag line was added.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

What are nonunit-level overhead activities? Nonunit-based cost drivers? Give some examples.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is driver analysis? What role does it play in process-value analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is an appraisal cost (quality)?

a. Manager of an inspection team

b. Quality reporting

c. Design reviews

d. Warranties

e. Retesting

a. Manager of an inspection team

b. Quality reporting

c. Design reviews

d. Warranties

e. Retesting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

Activity Rates

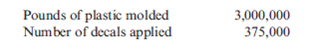

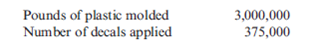

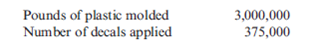

Patten Company uses activity-based costing (ABC). Patten manufactures toy cars using two activities: plastic injection molding and decal application. Patten's 2015 total budgeted overhead costs for these two activities are $675,000 (80% for injection molding and 20% for decal application). Molding overhead costs are driven by the number of pounds of plastic that are molded together. Decal application overhead costs are driven by the number of decals applied to toys. The budgeted activity data for 2015 are as follows:

Required:

1. Calculate the activity rate for the plastic injection molding activity (round to two decimal places).

2. Calculate the activity rate for the decal application activity (round to two decimal places).

Patten Company uses activity-based costing (ABC). Patten manufactures toy cars using two activities: plastic injection molding and decal application. Patten's 2015 total budgeted overhead costs for these two activities are $675,000 (80% for injection molding and 20% for decal application). Molding overhead costs are driven by the number of pounds of plastic that are molded together. Decal application overhead costs are driven by the number of decals applied to toys. The budgeted activity data for 2015 are as follows:

Required:

1. Calculate the activity rate for the plastic injection molding activity (round to two decimal places).

2. Calculate the activity rate for the decal application activity (round to two decimal places).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

Plantwide versus Departmental Rates, Product-Costing Accuracy: Activity-Based Costing

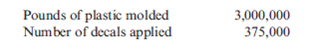

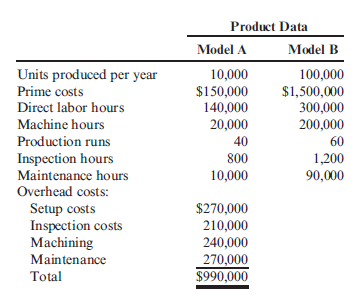

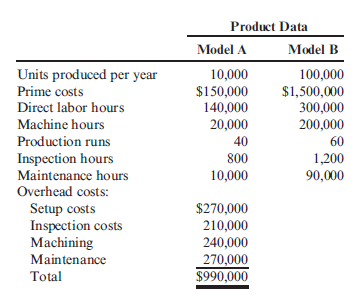

Ramsey Company produces speakers (Model A and Model B). Both products pass through two producing departments. Model A's production is much more labor-intensive than that of Model B. Model B is also the more popular of the two speakers. The following data have been gathered for the two products:

Required:

1. Compute the overhead cost per unit for each product by using a plantwide rate based on direct labor hours. ( Note : Round to two decimal places.)

2. Compute the overhead cost per unit for each product by using ABC. ( Note: Round rates and unit overhead cost to two decimal places.)

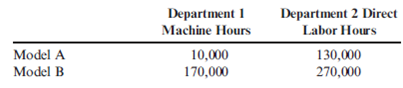

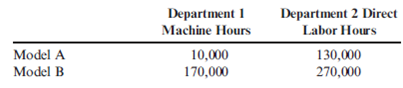

3. Suppose that Ramsey decides to use departmental overhead rates. There are two departments: Department 1 (machine intensive) with a rate of $3.50 per machine hour and Department 2 (labor intensive) with a rate of $0.90 per direct labor hour. The consumption of these two drivers is as follows:

Compute the overhead cost per unit for each product by using departmental rates. ( Note: Round to two decimal places.)

4. CONCEPTUAL CONNECTION Using the activity-based product costs as the standard, comment on the ability of departmental rates to improve the accuracy of product costing. Did the departmental rates do better than the plantwide rate?

Ramsey Company produces speakers (Model A and Model B). Both products pass through two producing departments. Model A's production is much more labor-intensive than that of Model B. Model B is also the more popular of the two speakers. The following data have been gathered for the two products:

Required:

1. Compute the overhead cost per unit for each product by using a plantwide rate based on direct labor hours. ( Note : Round to two decimal places.)

2. Compute the overhead cost per unit for each product by using ABC. ( Note: Round rates and unit overhead cost to two decimal places.)

3. Suppose that Ramsey decides to use departmental overhead rates. There are two departments: Department 1 (machine intensive) with a rate of $3.50 per machine hour and Department 2 (labor intensive) with a rate of $0.90 per direct labor hour. The consumption of these two drivers is as follows:

Compute the overhead cost per unit for each product by using departmental rates. ( Note: Round to two decimal places.)

4. CONCEPTUAL CONNECTION Using the activity-based product costs as the standard, comment on the ability of departmental rates to improve the accuracy of product costing. Did the departmental rates do better than the plantwide rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

Consider the information given on two products and their activity usage:

Refer to the information above. The consumption ratios for the inspection activity for each product are

A) 0.167; 0.833.

B) 0.333; 0.667.

C) 0.500; 0.500.

D) 0.667; 0.333.

E) None of these.

Refer to the information above. The consumption ratios for the inspection activity for each product are

A) 0.167; 0.833.

B) 0.333; 0.667.

C) 0.500; 0.500.

D) 0.667; 0.333.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is a true statement about activity-based supplier costing?

a. The cost of a supplier is the purchase price of the components or materials acquired.

b. It encourages managers to increase the number of suppliers.

c. It encourages managers to evaluate suppliers based on purchase cost.

d. Suppliers can affect many internal activities of a firm and significantly increase the cost of purchasing.

e. All of the above are true.

a. The cost of a supplier is the purchase price of the components or materials acquired.

b. It encourages managers to increase the number of suppliers.

c. It encourages managers to evaluate suppliers based on purchase cost.

d. Suppliers can affect many internal activities of a firm and significantly increase the cost of purchasing.

e. All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is an internal failure cost (quality)?

a. Supplier evaluation and selection

b. Packaging inspection

c. Retesting

d. Product liability

e. Complaint adjustment

a. Supplier evaluation and selection

b. Packaging inspection

c. Retesting

d. Product liability

e. Complaint adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

Comparing ABC and Plantwide Overhead Cost Assignments

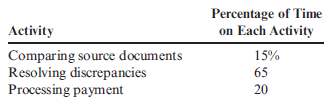

The Sabroso Chocolate Company uses activity-based costing (ABC). The controller identified two activities and their budgeted costs:

Setting up equipment is based on setup hours, and other overhead is based on oven hours.

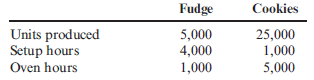

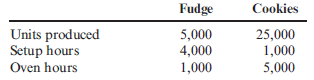

Oscuro produces two products, Fudge and Cookies. Information on each product is as follows:

Required:

( Note: Round answers to two decimal places.)

1. Calculate the activity rate for (a) setting up equipment and (b) other overhead.

2. How much total overhead is assigned to Fudge using ABC?

3. What is the unit overhead assigned to Fudge using ABC?

4. Now, ignoring the ABC results, calculate the plantwide overhead rate, based on oven hours.

5. How much total overhead is assigned to Fudge using the plantwide overhead rate?

6. CONCEPTUAL CONNECTION Explain why the total overhead assigned to Fudge is different under the ABC system (i.e., using the activity rates) than under the nonABC system (i.e., using the plantwide rate).

The Sabroso Chocolate Company uses activity-based costing (ABC). The controller identified two activities and their budgeted costs:

Setting up equipment is based on setup hours, and other overhead is based on oven hours.

Oscuro produces two products, Fudge and Cookies. Information on each product is as follows:

Required:

( Note: Round answers to two decimal places.)

1. Calculate the activity rate for (a) setting up equipment and (b) other overhead.

2. How much total overhead is assigned to Fudge using ABC?

3. What is the unit overhead assigned to Fudge using ABC?

4. Now, ignoring the ABC results, calculate the plantwide overhead rate, based on oven hours.

5. How much total overhead is assigned to Fudge using the plantwide overhead rate?

6. CONCEPTUAL CONNECTION Explain why the total overhead assigned to Fudge is different under the ABC system (i.e., using the activity rates) than under the nonABC system (i.e., using the plantwide rate).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

Production-Based Costing versus Activity-Based Costing, Assigning Costs to Activities, Resource Drivers

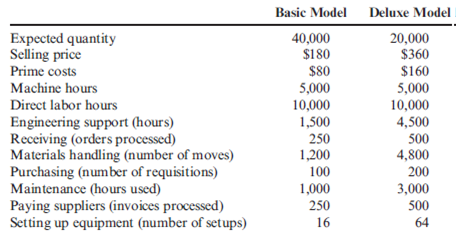

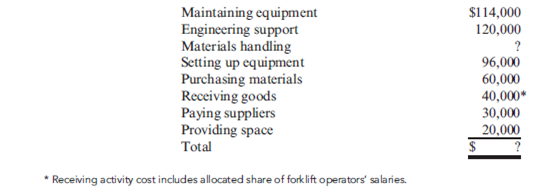

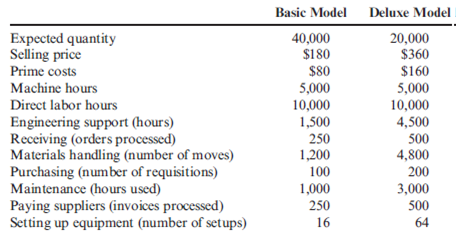

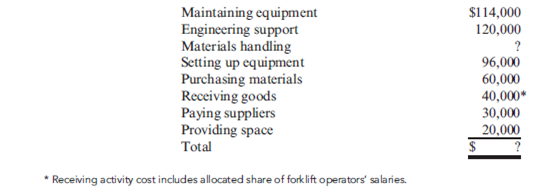

Willow Company produces lawn mowers. One of its plants produces two versions of mowers: a basic model and a deluxe model. The deluxe model has a sturdier frame, a higher horsepower engine, a wider blade, and mulching capability. At the beginning of the year, the following data were prepared for this plant:

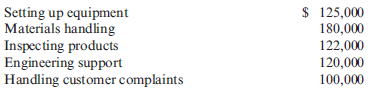

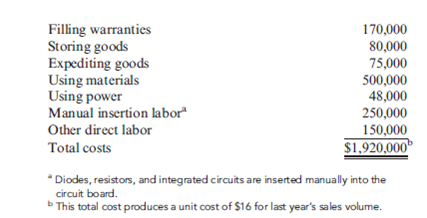

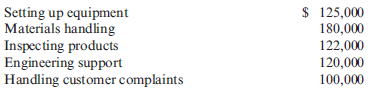

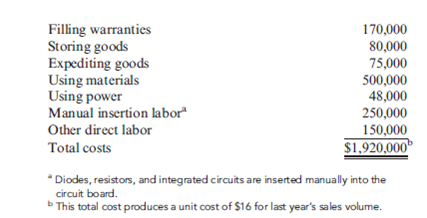

Additionally, the following overhead activity costs are reported:

Facility-level costs are allocated in proportion to machine hours (provides a measure of time the facility is used by each product). Receiving and materials handling use three inputs: two forklifts, gasoline to operate the forklift, and three operators. The three operators are paid a salary of $40,000 each. The operators spend 25% of their time on the receiving activity and 75% on moving goods (materials handling). Gasoline costs $3 per move. Depreciation amounts to $8,000 per forklift per year.

Required:

( Note: Round answers to two decimal places.)

1. Calculate the cost of the materials handling activity. Label the cost assignments as driver tracing or direct tracing. Identify the resource drivers.

2. Calculate the cost per unit for each product by using direct labor hours to assign all overhead costs.

3. Calculate activity rates, and assign costs to each product. Calculate a unit cost for each product, and compare these costs with those calculated in Requirement 2.

4. Calculate consumption ratios for each activity.

5. CONCEPTUAL CONNECTION Explain how the consumption ratios calculated in Requirement 4 can be used to reduce the number of rates. Calculate the rates that would apply under this approach.

Willow Company produces lawn mowers. One of its plants produces two versions of mowers: a basic model and a deluxe model. The deluxe model has a sturdier frame, a higher horsepower engine, a wider blade, and mulching capability. At the beginning of the year, the following data were prepared for this plant:

Additionally, the following overhead activity costs are reported:

Facility-level costs are allocated in proportion to machine hours (provides a measure of time the facility is used by each product). Receiving and materials handling use three inputs: two forklifts, gasoline to operate the forklift, and three operators. The three operators are paid a salary of $40,000 each. The operators spend 25% of their time on the receiving activity and 75% on moving goods (materials handling). Gasoline costs $3 per move. Depreciation amounts to $8,000 per forklift per year.

Required:

( Note: Round answers to two decimal places.)

1. Calculate the cost of the materials handling activity. Label the cost assignments as driver tracing or direct tracing. Identify the resource drivers.

2. Calculate the cost per unit for each product by using direct labor hours to assign all overhead costs.

3. Calculate activity rates, and assign costs to each product. Calculate a unit cost for each product, and compare these costs with those calculated in Requirement 2.

4. Calculate consumption ratios for each activity.

5. CONCEPTUAL CONNECTION Explain how the consumption ratios calculated in Requirement 4 can be used to reduce the number of rates. Calculate the rates that would apply under this approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is meant by ''product diversity''?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

What are value-added activities? Value-added costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is an external failure cost (quality)?

a. Design reviews

b. Retesting

c. Rework

d. Lost sales

e. All of these.

a. Design reviews

b. Retesting

c. Rework

d. Lost sales

e. All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

Activity-Based Product Costing

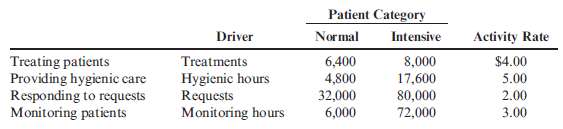

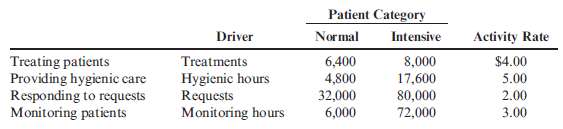

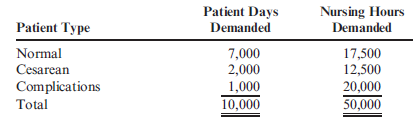

Suppose that a surgical ward has gathered the following information for four nursing activities and two types of patients:

Required:

1. Determine the total nursing costs assigned to each patient category.

2. Output is measured in patient days. Assuming that the normal patient category uses 8,000 patient days and the intensive patient category uses 6,400 patient days, calculate the nursing cost per patient day for each type of patient. (Round to two decimal places.)

3. CONCEPTUAL CONNECTION The supervisor of the surgical ward has suggested that patient days is the only driver needed to assign nursing costs to each type of patient. Calculate the charge per patient day (rounded to the nearest cent) using this approach and then explain to the supervisor why this would be a bad decision.

Suppose that a surgical ward has gathered the following information for four nursing activities and two types of patients:

Required:

1. Determine the total nursing costs assigned to each patient category.

2. Output is measured in patient days. Assuming that the normal patient category uses 8,000 patient days and the intensive patient category uses 6,400 patient days, calculate the nursing cost per patient day for each type of patient. (Round to two decimal places.)

3. CONCEPTUAL CONNECTION The supervisor of the surgical ward has suggested that patient days is the only driver needed to assign nursing costs to each type of patient. Calculate the charge per patient day (rounded to the nearest cent) using this approach and then explain to the supervisor why this would be a bad decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

Activity Costing, Assigning Resource Costs, Primary and Secondary Activities

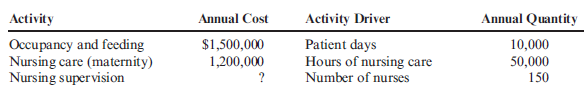

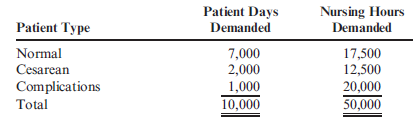

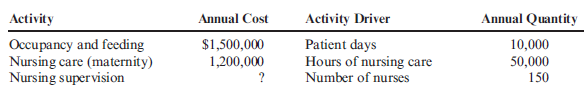

Elmo Clinic has identified three activities for daily maternity care: occupancy and feeding, nursing, and nursing supervision. The nursing supervisor oversees 150 nurses, 25 of whom are maternity nurses (the other nurses are located in other care areas such as the emergency room and intensive care). The nursing supervisor has three assistants, a secretary, several offices, computers, phones, and furniture. The three assistants spend 75% of their time on the supervising activity and 25% of their time as surgical nurses. They each receive a salary of $60,000. The nursing supervisor has a salary of $80,000. She spends 100% of her time supervising. The secretary receives a salary of $35,000 per year. Other costs directly traceable to the supervisory activity (depreciation, utilities, phone, etc.) average $170,000 per year.

Daily care output is measured as ''patient days.'' The clinic has traditionally assigned the cost of daily care by using a daily rate (a rate per patient day). Daily rates can differ between units, but within units the daily rates are the same for all patients. Under the traditional approach, the daily rate is computed by dividing the annual costs of occupancy and feeding, nursing, and a share of supervision by the unit's capacity expressed in patient days. The cost of supervision is assigned to each care area based on the number of nurses. A single driver (patient days) is used to assign the costs of daily care to each patient.