Deck 20: The Economics of Retirement and Health Care

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/10

العب

ملء الشاشة (f)

Deck 20: The Economics of Retirement and Health Care

1

Say whether each of the following statements is true or false.

a) In the life cycle theory of retirement, people save when they are retired.

b) In the life cycle theory of retirement, net worth peaks in middle age.

c) The retirement uncertainty problem arises because you don't know how long you will live after retirement.

d) The retirement poverty problem arises because you don't want to be poor during retirement.

e) A defined benefit retirement plan pays you a predetermined amount of money monthly when you retire.

f) Part-time workers are more likely than full-time workers to participate in defined contribution plans.

g) Employer retirement plans are useful in solving the retirement poverty problem.

h) Social Security transfers money from current workers to current retirees.

i) Social Security is not an important source of income for current retirees.

j) Health care's share of GDP has been shrinking.

k) The adverse selection problem means that healthier people are less likely to buy health insurance because they are less likely to need it.

l) High-wage workers are more likely to be covered by employer-provided health care plans than are low-wage workers.

m) Medicare is completely funded by a payroll tax paid by employees and employers.

n) One reason why health care costs are rising quickly is third-party payments.

a) In the life cycle theory of retirement, people save when they are retired.

b) In the life cycle theory of retirement, net worth peaks in middle age.

c) The retirement uncertainty problem arises because you don't know how long you will live after retirement.

d) The retirement poverty problem arises because you don't want to be poor during retirement.

e) A defined benefit retirement plan pays you a predetermined amount of money monthly when you retire.

f) Part-time workers are more likely than full-time workers to participate in defined contribution plans.

g) Employer retirement plans are useful in solving the retirement poverty problem.

h) Social Security transfers money from current workers to current retirees.

i) Social Security is not an important source of income for current retirees.

j) Health care's share of GDP has been shrinking.

k) The adverse selection problem means that healthier people are less likely to buy health insurance because they are less likely to need it.

l) High-wage workers are more likely to be covered by employer-provided health care plans than are low-wage workers.

m) Medicare is completely funded by a payroll tax paid by employees and employers.

n) One reason why health care costs are rising quickly is third-party payments.

a)In life-cycle theory, youth spend on education and create assets, middle age creates savings, while retired people use the savings towards medical and living costs.

Hence, retired people do not save.

Hence, the given statement is

b)In life-cycle theory, youth borrow for home and education, while old age people use the savings for medical and livings. Only middle age people build savings, which touches peak during middle age.

b)In life-cycle theory, youth borrow for home and education, while old age people use the savings for medical and livings. Only middle age people build savings, which touches peak during middle age.

Hence, the given statement is

c)Individuals are not aware about their longevity, that is, the number of years they will live after retirement. This uncertainty in deciding the number of years they will live after retirement is known as a retirement uncertainty problem.

c)Individuals are not aware about their longevity, that is, the number of years they will live after retirement. This uncertainty in deciding the number of years they will live after retirement is known as a retirement uncertainty problem.

Hence, the given statement is

d)Retirement poverty problem arises, as people are not able to generate enough income to create a fund for retired life.

d)Retirement poverty problem arises, as people are not able to generate enough income to create a fund for retired life.

Hence, this statement is

e)A defined benefit retirement plan is a retirement plan, where, retirees are expected to get a predetermined amount once they retire.

e)A defined benefit retirement plan is a retirement plan, where, retirees are expected to get a predetermined amount once they retire.

Hence, this statement is

f)Under a defined contribution plan, payments to retirees depend on the return of investments made during a contribution period. In this plan, full-time workers are more likely to participate in a defined contribution plan than part-time workers.

f)Under a defined contribution plan, payments to retirees depend on the return of investments made during a contribution period. In this plan, full-time workers are more likely to participate in a defined contribution plan than part-time workers.

Hence, the given statement is

g)Under employer retirement plans, the employer contributes to the plan on behalf of the employee. Thus it is useful in solving the retirement poverty problem.

g)Under employer retirement plans, the employer contributes to the plan on behalf of the employee. Thus it is useful in solving the retirement poverty problem.

Hence, this statement is

h)Social security was introduced to help the retirement poverty problem. Under social security, current workers are taxed to provide support to current retirees, Hence, money transfers from current workers to current retirees.

h)Social security was introduced to help the retirement poverty problem. Under social security, current workers are taxed to provide support to current retirees, Hence, money transfers from current workers to current retirees.

Hence, the given statement is

i)Social security is the major source of income for old aged people or retirees.

i)Social security is the major source of income for old aged people or retirees.

Hence, the given statement is

j)National healthcare expenditure as percentage of GDP is increasing year after year.

j)National healthcare expenditure as percentage of GDP is increasing year after year.

Hence, the given statement is

k)Persons who are likely to claim under insurance are having a high tendency to purchase the insurance, while healthier people, who need it less likely buy the health insurance.

k)Persons who are likely to claim under insurance are having a high tendency to purchase the insurance, while healthier people, who need it less likely buy the health insurance.

Hence, the given statement is

l)Under employer-provided health plan, employer and employee contribute to insurance company. High wage workers are more likely to be covered under the plan than are low wage workers.

l)Under employer-provided health plan, employer and employee contribute to insurance company. High wage workers are more likely to be covered under the plan than are low wage workers.

Hence, the given statement is

m)Medicare is partly funded by a payroll tax paid by employees and employers and partly by general tax revenue and participant's premium.

m)Medicare is partly funded by a payroll tax paid by employees and employers and partly by general tax revenue and participant's premium.

Hence, the given statement is

n)Under third-party payments payment decision are taken by doctors and patients, while insurance company makes the payment. Hence, patients are less likely to go for lower cost treatment. This leads to a rise in health care cost.

n)Under third-party payments payment decision are taken by doctors and patients, while insurance company makes the payment. Hence, patients are less likely to go for lower cost treatment. This leads to a rise in health care cost.

Hence, the given statement is

Hence, retired people do not save.

Hence, the given statement is

b)In life-cycle theory, youth borrow for home and education, while old age people use the savings for medical and livings. Only middle age people build savings, which touches peak during middle age.

b)In life-cycle theory, youth borrow for home and education, while old age people use the savings for medical and livings. Only middle age people build savings, which touches peak during middle age. Hence, the given statement is

c)Individuals are not aware about their longevity, that is, the number of years they will live after retirement. This uncertainty in deciding the number of years they will live after retirement is known as a retirement uncertainty problem.

c)Individuals are not aware about their longevity, that is, the number of years they will live after retirement. This uncertainty in deciding the number of years they will live after retirement is known as a retirement uncertainty problem. Hence, the given statement is

d)Retirement poverty problem arises, as people are not able to generate enough income to create a fund for retired life.

d)Retirement poverty problem arises, as people are not able to generate enough income to create a fund for retired life. Hence, this statement is

e)A defined benefit retirement plan is a retirement plan, where, retirees are expected to get a predetermined amount once they retire.

e)A defined benefit retirement plan is a retirement plan, where, retirees are expected to get a predetermined amount once they retire. Hence, this statement is

f)Under a defined contribution plan, payments to retirees depend on the return of investments made during a contribution period. In this plan, full-time workers are more likely to participate in a defined contribution plan than part-time workers.

f)Under a defined contribution plan, payments to retirees depend on the return of investments made during a contribution period. In this plan, full-time workers are more likely to participate in a defined contribution plan than part-time workers. Hence, the given statement is

g)Under employer retirement plans, the employer contributes to the plan on behalf of the employee. Thus it is useful in solving the retirement poverty problem.

g)Under employer retirement plans, the employer contributes to the plan on behalf of the employee. Thus it is useful in solving the retirement poverty problem.Hence, this statement is

h)Social security was introduced to help the retirement poverty problem. Under social security, current workers are taxed to provide support to current retirees, Hence, money transfers from current workers to current retirees.

h)Social security was introduced to help the retirement poverty problem. Under social security, current workers are taxed to provide support to current retirees, Hence, money transfers from current workers to current retirees. Hence, the given statement is

i)Social security is the major source of income for old aged people or retirees.

i)Social security is the major source of income for old aged people or retirees. Hence, the given statement is

j)National healthcare expenditure as percentage of GDP is increasing year after year.

j)National healthcare expenditure as percentage of GDP is increasing year after year. Hence, the given statement is

k)Persons who are likely to claim under insurance are having a high tendency to purchase the insurance, while healthier people, who need it less likely buy the health insurance.

k)Persons who are likely to claim under insurance are having a high tendency to purchase the insurance, while healthier people, who need it less likely buy the health insurance. Hence, the given statement is

l)Under employer-provided health plan, employer and employee contribute to insurance company. High wage workers are more likely to be covered under the plan than are low wage workers.

l)Under employer-provided health plan, employer and employee contribute to insurance company. High wage workers are more likely to be covered under the plan than are low wage workers. Hence, the given statement is

m)Medicare is partly funded by a payroll tax paid by employees and employers and partly by general tax revenue and participant's premium.

m)Medicare is partly funded by a payroll tax paid by employees and employers and partly by general tax revenue and participant's premium. Hence, the given statement is

n)Under third-party payments payment decision are taken by doctors and patients, while insurance company makes the payment. Hence, patients are less likely to go for lower cost treatment. This leads to a rise in health care cost.

n)Under third-party payments payment decision are taken by doctors and patients, while insurance company makes the payment. Hence, patients are less likely to go for lower cost treatment. This leads to a rise in health care cost. Hence, the given statement is

2

Fill in the blank in each statement.

a) Only _____ percent of families save regularly.

b) ____ are a type of employment retirement plan that allows participants to save part of their pretax income, with the employer matching all or part of the contribution.

c) In 2007 _____ percent of private sector workers participated in a defined contribution plan.

d) The Social Security payroll tax paid by employees is _____ percent of wages and salaries up to a maximum.

e) The old-age dependency ratio will go from 0.2 to _____ over the next 70 years.

f) In 2037 the size of the gap between Social Security income and expenditures is expected to be _____ percent of GDP.

g) In 2006 health care spending accounted for _____ percent of GDP.

h) __ occurs because the poor cannot afford to pay for health insurance.

i) Health care funding comes from individual spending, _____, and government programs.

j) ____ percent of private sector workers in low-wage occupations participate in employer-provided health care plans.

k) The government program _____ covers the health care costs of older citizens.

a) Only _____ percent of families save regularly.

b) ____ are a type of employment retirement plan that allows participants to save part of their pretax income, with the employer matching all or part of the contribution.

c) In 2007 _____ percent of private sector workers participated in a defined contribution plan.

d) The Social Security payroll tax paid by employees is _____ percent of wages and salaries up to a maximum.

e) The old-age dependency ratio will go from 0.2 to _____ over the next 70 years.

f) In 2037 the size of the gap between Social Security income and expenditures is expected to be _____ percent of GDP.

g) In 2006 health care spending accounted for _____ percent of GDP.

h) __ occurs because the poor cannot afford to pay for health insurance.

i) Health care funding comes from individual spending, _____, and government programs.

j) ____ percent of private sector workers in low-wage occupations participate in employer-provided health care plans.

k) The government program _____ covers the health care costs of older citizens.

a)Poor people do not earn to save enough for retired life. Data of the Federal Reserve, Survey revealed that, only 40 percent of families do the saving regularly.

Hence, blank space can be filled with

b)Defined contribution plan is a retirement plan, where both employee and employer contribute towards an investment, from their pretax income, which the employee will get after retirement.

b)Defined contribution plan is a retirement plan, where both employee and employer contribute towards an investment, from their pretax income, which the employee will get after retirement.

Hence, blank space can be filled with

c)AS per data of 2007, 20 percent of all workers in private sector participated in defined benefit plan, while 43 percent of all workers participated in defined contribution plan.

c)AS per data of 2007, 20 percent of all workers in private sector participated in defined benefit plan, while 43 percent of all workers participated in defined contribution plan.

Hence, blank space can be filled with

d)Contribution under social security is defined as 6.2 percent of one's wages with wage cap of $97,500 can be collected. Similar amount is paid by employer as well.

d)Contribution under social security is defined as 6.2 percent of one's wages with wage cap of $97,500 can be collected. Similar amount is paid by employer as well.

Hence, blank space can be filled with

e)Old-age dependency ratio is the ratio of population of old age people of age 65 years and above to working age population of age 20 through 64. The projection of old-age dependency ratio will go from 0.2 to 0.4 in next 70 years , as size of working age population is not matching with the size of older people.

e)Old-age dependency ratio is the ratio of population of old age people of age 65 years and above to working age population of age 20 through 64. The projection of old-age dependency ratio will go from 0.2 to 0.4 in next 70 years , as size of working age population is not matching with the size of older people.

Hence, blank space can be filled with

f)Social security is working on the concept of transfer of money from current workers to current retirees. But, with decreasing population of working age people, the gap of financing and expenditure is widening. As per estimate, by 2037, the gap will be about 1.5 percent of GDP.

f)Social security is working on the concept of transfer of money from current workers to current retirees. But, with decreasing population of working age people, the gap of financing and expenditure is widening. As per estimate, by 2037, the gap will be about 1.5 percent of GDP.

Hence, blank space can be filled with

g)Health care spending has been increasing constantly over years. In year 2006, total spending on health care was 16 percent of GDP.

g)Health care spending has been increasing constantly over years. In year 2006, total spending on health care was 16 percent of GDP.

Hence, blank space can be filled with

h)When the poor family or low income family does not earn enough to pay for health insurance, the condition is called health poverty problem.

h)When the poor family or low income family does not earn enough to pay for health insurance, the condition is called health poverty problem.

Hence, the blank space can be filled with

i)Health care funding sources are combinations of individual spending and government programs apart from employer health insurance plans.

i)Health care funding sources are combinations of individual spending and government programs apart from employer health insurance plans.

Hence, blank space can be filled with

j)A total of 57 percent workers of low wage occupation are having access to employer provided health care plans, but, only 37 percent have participated in it.

j)A total of 57 percent workers of low wage occupation are having access to employer provided health care plans, but, only 37 percent have participated in it.

Hence, blank space can be filled with

k)The government covers two health care programs. One is Medicare to the health care cost of older citizens, while another is Medicaid, intended to cover, low income children and their families.

k)The government covers two health care programs. One is Medicare to the health care cost of older citizens, while another is Medicaid, intended to cover, low income children and their families.

Hence, blank space can be filled with

Hence, blank space can be filled with

b)Defined contribution plan is a retirement plan, where both employee and employer contribute towards an investment, from their pretax income, which the employee will get after retirement.

b)Defined contribution plan is a retirement plan, where both employee and employer contribute towards an investment, from their pretax income, which the employee will get after retirement. Hence, blank space can be filled with

c)AS per data of 2007, 20 percent of all workers in private sector participated in defined benefit plan, while 43 percent of all workers participated in defined contribution plan.

c)AS per data of 2007, 20 percent of all workers in private sector participated in defined benefit plan, while 43 percent of all workers participated in defined contribution plan. Hence, blank space can be filled with

d)Contribution under social security is defined as 6.2 percent of one's wages with wage cap of $97,500 can be collected. Similar amount is paid by employer as well.

d)Contribution under social security is defined as 6.2 percent of one's wages with wage cap of $97,500 can be collected. Similar amount is paid by employer as well.Hence, blank space can be filled with

e)Old-age dependency ratio is the ratio of population of old age people of age 65 years and above to working age population of age 20 through 64. The projection of old-age dependency ratio will go from 0.2 to 0.4 in next 70 years , as size of working age population is not matching with the size of older people.

e)Old-age dependency ratio is the ratio of population of old age people of age 65 years and above to working age population of age 20 through 64. The projection of old-age dependency ratio will go from 0.2 to 0.4 in next 70 years , as size of working age population is not matching with the size of older people.Hence, blank space can be filled with

f)Social security is working on the concept of transfer of money from current workers to current retirees. But, with decreasing population of working age people, the gap of financing and expenditure is widening. As per estimate, by 2037, the gap will be about 1.5 percent of GDP.

f)Social security is working on the concept of transfer of money from current workers to current retirees. But, with decreasing population of working age people, the gap of financing and expenditure is widening. As per estimate, by 2037, the gap will be about 1.5 percent of GDP.Hence, blank space can be filled with

g)Health care spending has been increasing constantly over years. In year 2006, total spending on health care was 16 percent of GDP.

g)Health care spending has been increasing constantly over years. In year 2006, total spending on health care was 16 percent of GDP.Hence, blank space can be filled with

h)When the poor family or low income family does not earn enough to pay for health insurance, the condition is called health poverty problem.

h)When the poor family or low income family does not earn enough to pay for health insurance, the condition is called health poverty problem. Hence, the blank space can be filled with

i)Health care funding sources are combinations of individual spending and government programs apart from employer health insurance plans.

i)Health care funding sources are combinations of individual spending and government programs apart from employer health insurance plans. Hence, blank space can be filled with

j)A total of 57 percent workers of low wage occupation are having access to employer provided health care plans, but, only 37 percent have participated in it.

j)A total of 57 percent workers of low wage occupation are having access to employer provided health care plans, but, only 37 percent have participated in it.Hence, blank space can be filled with

k)The government covers two health care programs. One is Medicare to the health care cost of older citizens, while another is Medicaid, intended to cover, low income children and their families.

k)The government covers two health care programs. One is Medicare to the health care cost of older citizens, while another is Medicaid, intended to cover, low income children and their families. Hence, blank space can be filled with

3

Consider the life cycle theory of retirement.

a) Explain the three stages of the theory.

b) In which stage do workers accumulate savings for retirement?

c) What can go wrong for an individual in this model?

a) Explain the three stages of the theory.

b) In which stage do workers accumulate savings for retirement?

c) What can go wrong for an individual in this model?

a)Life cycle theory is based on hypothesis that in absence of any government or business support how will be the life of elderly or retired people.

The theory says that, during young age, people spend more, while their income is low. Their spending is on education and creating assets.

As one age grows, income starts peaking up and people save money with clearing off the debts.

In the old age, when one income has dried up, people spend the money, what they saved earlier.

This theory explains that during young age, net worth is negative, while in middle age, net worth is at peak, which starts depleting during old age.

b)In first stage, in early years, people spend more on education and creating asset, while in older age, they do not have any source of income, and they spend the savings. Only in the middle age, when income rises, people accumulate savings for retirement.

c)In the last stage of life cycle, spending is done on the accumulation of savings done in middle age. But, savings will remain positive or turn out to be negative, depending upon how many more years one lives after retirement.

The theory says that, during young age, people spend more, while their income is low. Their spending is on education and creating assets.

As one age grows, income starts peaking up and people save money with clearing off the debts.

In the old age, when one income has dried up, people spend the money, what they saved earlier.

This theory explains that during young age, net worth is negative, while in middle age, net worth is at peak, which starts depleting during old age.

b)In first stage, in early years, people spend more on education and creating asset, while in older age, they do not have any source of income, and they spend the savings. Only in the middle age, when income rises, people accumulate savings for retirement.

c)In the last stage of life cycle, spending is done on the accumulation of savings done in middle age. But, savings will remain positive or turn out to be negative, depending upon how many more years one lives after retirement.

4

Employer retirement plans are an important element of retirement income.

a) Explain the difference between defined benefit and defined contribution retirement plans.

b) Suppose an employer offers a plan that invests a sum of your money as well as its own money in the stock market each year. Then, when you retire, you get the current value of the invested money. Is this a defined benefit or a defined contribution plan?

a) Explain the difference between defined benefit and defined contribution retirement plans.

b) Suppose an employer offers a plan that invests a sum of your money as well as its own money in the stock market each year. Then, when you retire, you get the current value of the invested money. Is this a defined benefit or a defined contribution plan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

5

In most defined contribution retirement plans, workers have a choice about whether to participate.

a) What would a worker gain by not participating?

b) What would a worker lose by not participating?

c) Do you think workers should have the choice of opting into such plans or opting out? Why?

a) What would a worker gain by not participating?

b) What would a worker lose by not participating?

c) Do you think workers should have the choice of opting into such plans or opting out? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

6

The labor force participation rate of an age group is the percentage of people of that age who are either working or actively looking for jobs. Would you expect the existence of Social Security to increase or decrease the labor force participation rate for people aged 65 and over? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

7

List and explain the four policy responses to the Social Security financial gap. What are their pluses and minuses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

8

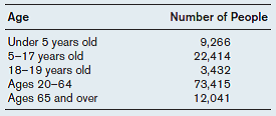

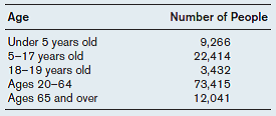

The following table gives the population at different ages for the city of Elizabeth, New Jersey, in the 2000 census.

a) What is the old-age dependency ratio in Elizabeth?

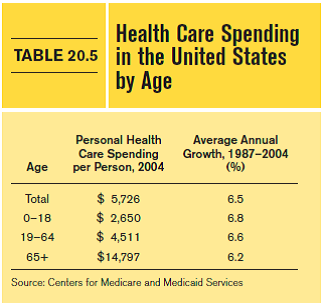

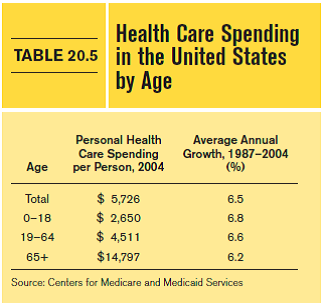

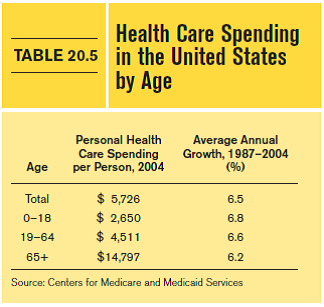

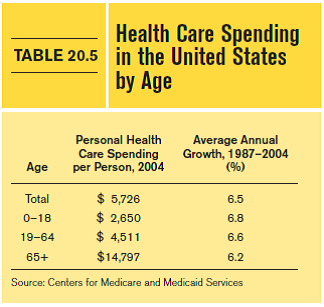

b) Table 20.5 showed the annual cost of health care per person, by age. Suppose the annual cost of educating the average 10-year-old is $10,000. According to the data in Table 20.5, is the cost of education plus health care for a 10-year-old greater or less than the health care cost for an adult older than 65?

Reference Table 20.5

a) What is the old-age dependency ratio in Elizabeth?

b) Table 20.5 showed the annual cost of health care per person, by age. Suppose the annual cost of educating the average 10-year-old is $10,000. According to the data in Table 20.5, is the cost of education plus health care for a 10-year-old greater or less than the health care cost for an adult older than 65?

Reference Table 20.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

9

In this chapter we identify several kinds of events that can affect your health.

a) Name them and explain their differences.

b) Which ones are covered by employer health care plans?

a) Name them and explain their differences.

b) Which ones are covered by employer health care plans?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

10

In this chapter we identify several reasons which might explain why health care costs have risen so rapidly.

a) Name them and explain their differences.

b) Take a look at Table 20.5, which shows that the cost of health care for the young is rising as fast as the overall costs. Which of the reasons you list in part (a) would not explain this fact?

Reference Table 20.5

a) Name them and explain their differences.

b) Take a look at Table 20.5, which shows that the cost of health care for the young is rising as fast as the overall costs. Which of the reasons you list in part (a) would not explain this fact?

Reference Table 20.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck