Deck 21: The Economics of Energy, the Environment, and Global Climate Changeglossaryindex

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/6

العب

ملء الشاشة (f)

Deck 21: The Economics of Energy, the Environment, and Global Climate Changeglossaryindex

1

Economists regularly suggest that the United States needs to raise the gasoline tax higher.

a) Give the arguments in favor of raising the gasoline tax.

b) Give the arguments against raising the gasoline tax. Who would be hurt?

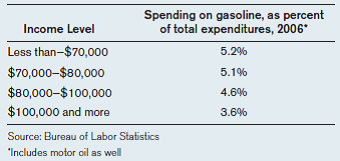

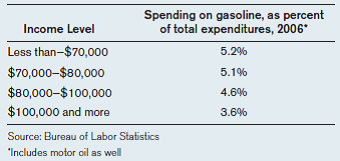

c) The table below lays out the share of expenditures spent on gasoline and motor oil by households with different levels of income. Using the table, explain why a higher gasoline tax would be regressive or progressive.

d) The data for the table comes from 2006. Since then, the price of gasoline has almost doubled. What would you expect has happened to spending on gasoline as a share of total spending?

a) Give the arguments in favor of raising the gasoline tax.

b) Give the arguments against raising the gasoline tax. Who would be hurt?

c) The table below lays out the share of expenditures spent on gasoline and motor oil by households with different levels of income. Using the table, explain why a higher gasoline tax would be regressive or progressive.

d) The data for the table comes from 2006. Since then, the price of gasoline has almost doubled. What would you expect has happened to spending on gasoline as a share of total spending?

Taxes on gasoline in the U.S are very low compare to other developed nations. Different data shows that tax on gasoline in the U.S is ten times lower than many other developed countries.

a)Economists argue for increasing taxes on gasoline. The idea behind raising the tax is to help energy conservation. With increase in tax, price of gasoline will go up and people will demand less. Thus consumption of gasoline will be reduced which will be beneficial for energy conservation.

b)Many economist and politician argue against raising the tax on gasoline. The reason given for this is that unlike other developed nations, the resident of the U.S has to travel a lot to cover the long distances of two cities. Raising tax will put extra burden on them.

Moreover, the tax on gas is regressive, that is, lower income group has to pay more for extra taxes.

Hence, with increase in tax on gasoline, lower income group people will be hurt more.

c)The data shows that lower income group people are spending more percentage of their expenditure on gasoline than higher income group.

Hence, any increase in the tax on gasoline will make lower income group to pay more of their expenditure. Thus the taxation is regressive.

d)Energy usage in the U.S has remained constant for last more than three decades. Thus with same energy consumption, if the price is doubled, the spending on gasoline will be doubled.

Hence, people will have to spend bigger portion of spending on gasoline.

a)Economists argue for increasing taxes on gasoline. The idea behind raising the tax is to help energy conservation. With increase in tax, price of gasoline will go up and people will demand less. Thus consumption of gasoline will be reduced which will be beneficial for energy conservation.

b)Many economist and politician argue against raising the tax on gasoline. The reason given for this is that unlike other developed nations, the resident of the U.S has to travel a lot to cover the long distances of two cities. Raising tax will put extra burden on them.

Moreover, the tax on gas is regressive, that is, lower income group has to pay more for extra taxes.

Hence, with increase in tax on gasoline, lower income group people will be hurt more.

c)The data shows that lower income group people are spending more percentage of their expenditure on gasoline than higher income group.

Hence, any increase in the tax on gasoline will make lower income group to pay more of their expenditure. Thus the taxation is regressive.

d)Energy usage in the U.S has remained constant for last more than three decades. Thus with same energy consumption, if the price is doubled, the spending on gasoline will be doubled.

Hence, people will have to spend bigger portion of spending on gasoline.

2

Say whether each of the following statements is true or false.

a) Energy usage per person has risen in the United States in recent years.

b) One reason for the high energy usage per person in the United States is the large size of the country.

c) A profit-maximizing oil producer will keep pumping and selling oil as long as the marginal cost of extraction is less than the market price.

d) Coal's share of the world's energy supply has increased since 1973.

e) When the price of gasoline goes up, consumers buy more of it.

f) Government can encourage conservation by putting a tax on energy.

g) One negative externality from pollution is harm to environmental amenities.

h) We can estimate the monetary value of ecological damage to the environment by using revealed preference techniques.

i) When the government orders a polluting factory to shut down, that's an example of a market-based approach.

a) Energy usage per person has risen in the United States in recent years.

b) One reason for the high energy usage per person in the United States is the large size of the country.

c) A profit-maximizing oil producer will keep pumping and selling oil as long as the marginal cost of extraction is less than the market price.

d) Coal's share of the world's energy supply has increased since 1973.

e) When the price of gasoline goes up, consumers buy more of it.

f) Government can encourage conservation by putting a tax on energy.

g) One negative externality from pollution is harm to environmental amenities.

h) We can estimate the monetary value of ecological damage to the environment by using revealed preference techniques.

i) When the government orders a polluting factory to shut down, that's an example of a market-based approach.

a)Energy usage per person in the U.S. has increased till 1970 of oil shocks; however, since then it remained constant.

Hence, the statement is

.

.

b)Because of large size of the country, in U.S people have to travel a lot to cover the distances of two cities. This causes higher consumption of energy.

Hence, the statement is

.

.

c)Marginal cost of extraction is the cost incurred for extracting last one gallons of oil. Profit of the company depends, when the market price is higher than the marginal cost.

Hence, the statement is

.

.

d)As per data of International Energy Agency, share of coal in the world's source of energy has increased from 24.4% in 1973 to 25.1% in 2005.

Hence, the statement is

.

.

e)When the price of gasoline goes up, people will have to pay more to buy same amount of gasoline. Thus, they will tend to buy less gasoline by reducing the demand for it.

Hence, the statement is

.

.

f)One of the various measures adopted by government to conserve energy is to tax the energy. With this taxation, demand and supply is reduced.

Hence, the statement is

.

.

g)Negative externalities are the negative side effects on other than seller and buyer. Pollution harms environmental amenities, that is, effects of pollution on the natural resources available to people.

Hence, the statement is

.

.

h)

Economists use two methods the find the monetary value of ecological damages to the environment. These methods are revealed preference, and, stated preference.

Hence, the statement is

.

.

i)When government issues orders to combat for energy conservation, its called command- and -control approach. Under this approach, government orders to businesses what to do and what not to do. Government can order for shutting down a polluting factory.

Hence, the statement is

.

.

Hence, the statement is

.

.b)Because of large size of the country, in U.S people have to travel a lot to cover the distances of two cities. This causes higher consumption of energy.

Hence, the statement is

.

.c)Marginal cost of extraction is the cost incurred for extracting last one gallons of oil. Profit of the company depends, when the market price is higher than the marginal cost.

Hence, the statement is

.

.d)As per data of International Energy Agency, share of coal in the world's source of energy has increased from 24.4% in 1973 to 25.1% in 2005.

Hence, the statement is

.

.e)When the price of gasoline goes up, people will have to pay more to buy same amount of gasoline. Thus, they will tend to buy less gasoline by reducing the demand for it.

Hence, the statement is

.

.f)One of the various measures adopted by government to conserve energy is to tax the energy. With this taxation, demand and supply is reduced.

Hence, the statement is

.

.g)Negative externalities are the negative side effects on other than seller and buyer. Pollution harms environmental amenities, that is, effects of pollution on the natural resources available to people.

Hence, the statement is

.

.h)

Economists use two methods the find the monetary value of ecological damages to the environment. These methods are revealed preference, and, stated preference.

Hence, the statement is

.

.i)When government issues orders to combat for energy conservation, its called command- and -control approach. Under this approach, government orders to businesses what to do and what not to do. Government can order for shutting down a polluting factory.

Hence, the statement is

.

. 3

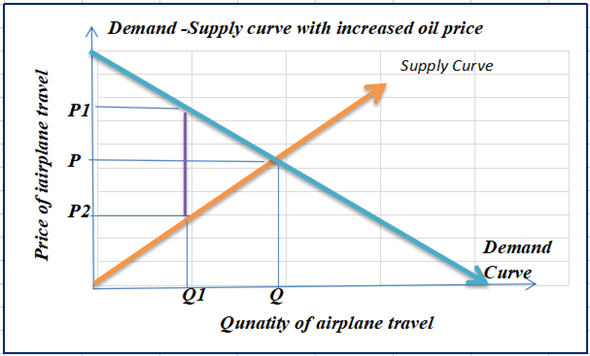

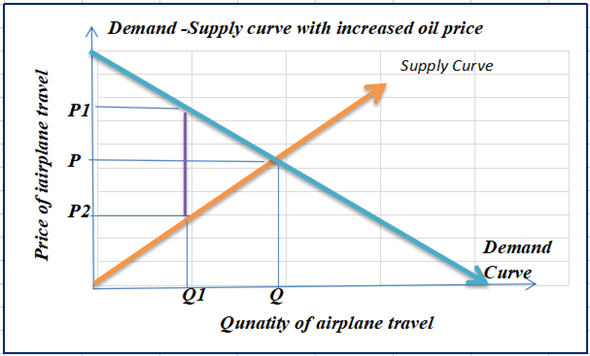

In 2008 the price of jet fuel soared because of the sharp increase in the price of crude oil.

a) What effect did that price increase have on the supply curve for airplane travel?

b) Show on a supply-demand diagram what changed.

c) What happened to the price of air travel tickets?

d) What happened to the quantity of air travel?

a) What effect did that price increase have on the supply curve for airplane travel?

b) Show on a supply-demand diagram what changed.

c) What happened to the price of air travel tickets?

d) What happened to the quantity of air travel?

Price of a good or service is determined by demand-supply curve of the good or service.

a)With increase in price of jet fuel, because of sharp increase in oil prices, Airplane Company will increase the fare. The travelers will have to pay more for same service. Hence, the demand for airplane travel will decrease and will move along the supply curve to meet at higher price.

b)With increase in jet fuel, cost of fare increased and supply curve moves alongside demand curve, as given below.

As the graph represents, demand of airplane travel decreased to Q1.

As the graph represents, demand of airplane travel decreased to Q1.

c)With increased jet fuel prices, price that a traveler pays is increased to P1 from original P , without rise in oil price, while P2 is the reduced price that Airplane Company is getting.

d)As airplane travel costs more to traveler, the quantity of air travel have reduced to Q1 form originally Q as appeared in the graph.

a)With increase in price of jet fuel, because of sharp increase in oil prices, Airplane Company will increase the fare. The travelers will have to pay more for same service. Hence, the demand for airplane travel will decrease and will move along the supply curve to meet at higher price.

b)With increase in jet fuel, cost of fare increased and supply curve moves alongside demand curve, as given below.

As the graph represents, demand of airplane travel decreased to Q1.

As the graph represents, demand of airplane travel decreased to Q1.c)With increased jet fuel prices, price that a traveler pays is increased to P1 from original P , without rise in oil price, while P2 is the reduced price that Airplane Company is getting.

d)As airplane travel costs more to traveler, the quantity of air travel have reduced to Q1 form originally Q as appeared in the graph.

4

It is common to use the tax system to help support new energy technologies. The federal government, for example, offers a tax credit for some hybrid vehicles (gas-electric combinations that use less gasoline than conventional internal combustion engines).

a) What effect does the tax credit have on the number of hybrid vehicles sold?

b) Show the effect of the tax credit on a supply-demand diagram (Hint: It's like a tax, except that the amount paid by the buyer, after the rebate, is less than the amount received by the seller).

c) Does the tax credit raise or lower the price charged by sellers of hybrid vehicles?

a) What effect does the tax credit have on the number of hybrid vehicles sold?

b) Show the effect of the tax credit on a supply-demand diagram (Hint: It's like a tax, except that the amount paid by the buyer, after the rebate, is less than the amount received by the seller).

c) Does the tax credit raise or lower the price charged by sellers of hybrid vehicles?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suppose a town has lots of noisy restaurants which disturb their neighbors. The citizens would like to reduce the noise level, but without driving the restaurants away.

a) Based on this chapter, what are three approaches for controlling noise?

b) What are the advantages and disadvantages of each?

c) Which one would you pick?

a) Based on this chapter, what are three approaches for controlling noise?

b) What are the advantages and disadvantages of each?

c) Which one would you pick?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

6

Every household produces garbage, some more than others. In town A the local sanitation department will collect all the garbage that households put out. In town B the residents have to pay per bag to have their garbage collected. In all other respects the towns are identical.

a) Is garbage an externality? Explain.

b) In which town would the residents produce less garbage? Explain.

c) Suppose town A finds itself with soaring garbage costs because too many households put out 5 or 10 bags of garbage. To solve this problem the town imposes a new rule saying that households could only put out three bags of garbage. Who would be hurt by this rule?

d) Would you prefer to live in town A (with the maximum number bag rule) or town B? Explain.

a) Is garbage an externality? Explain.

b) In which town would the residents produce less garbage? Explain.

c) Suppose town A finds itself with soaring garbage costs because too many households put out 5 or 10 bags of garbage. To solve this problem the town imposes a new rule saying that households could only put out three bags of garbage. Who would be hurt by this rule?

d) Would you prefer to live in town A (with the maximum number bag rule) or town B? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck