Deck 6: Supply Demandand Government Policies Part Ill: Markets and Welfare

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 6: Supply Demandand Government Policies Part Ill: Markets and Welfare

1

Lovers of classical music persuade Congress to impose a price ceiling of $40 per concert ticket. As a result of this policy, do more or fewer people attend classical music concerts?

The price ceiling of $40 per concert ticket is a binding constraint on the market. At this price, the number of the concert tickets demanded exceeds the quantity of tickets supplied. There will be a shortage of tickets. So the policy decreases the number of people who attend classical music concerts because the quantity supplied is lower because of the lower price.

2

Give an example of a price ceiling and an example of a price floor.

Price floors sets a minimum price limit on the price of the commodity. It means the price can't go lower than the price set. An effective price floor is where equilibrium price is below the price floor. This will create surplus in the market. The example of price floor is minimum wage law.

Price ceiling puts a maximum price limit on the price of the commodity. It means the price can't go higher than the price set. An effective price ceiling is where equilibrium price is above the price floor. This will create shortage in the market. The example of price ceiling is rent control law.

Price ceiling puts a maximum price limit on the price of the commodity. It means the price can't go higher than the price set. An effective price ceiling is where equilibrium price is above the price floor. This will create shortage in the market. The example of price ceiling is rent control law.

3

The government has decided that the free market price of cheese is too low.

a. Suppose the government imposes a binding price floor in the cheese market. Draw a supply-and-demand diagram to show the effect of this policy on the price of cheese and the quantity of cheese sold. Is there a shortage or surplus of cheese?

b. Farmers complain that the price floor has reduced their total revenue. Is this possible? Explain.

c. In response to farmers' complaints, the government agrees to purchase all the surplus cheese at the price floor. Compared to the basic price floor, who benefits from this new policy? Who loses?

a. Suppose the government imposes a binding price floor in the cheese market. Draw a supply-and-demand diagram to show the effect of this policy on the price of cheese and the quantity of cheese sold. Is there a shortage or surplus of cheese?

b. Farmers complain that the price floor has reduced their total revenue. Is this possible? Explain.

c. In response to farmers' complaints, the government agrees to purchase all the surplus cheese at the price floor. Compared to the basic price floor, who benefits from this new policy? Who loses?

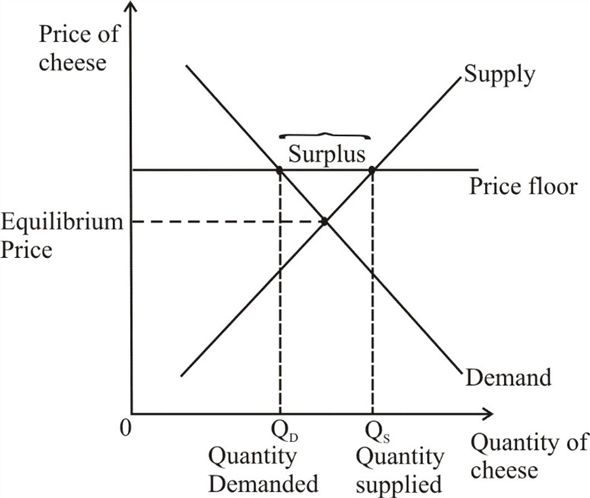

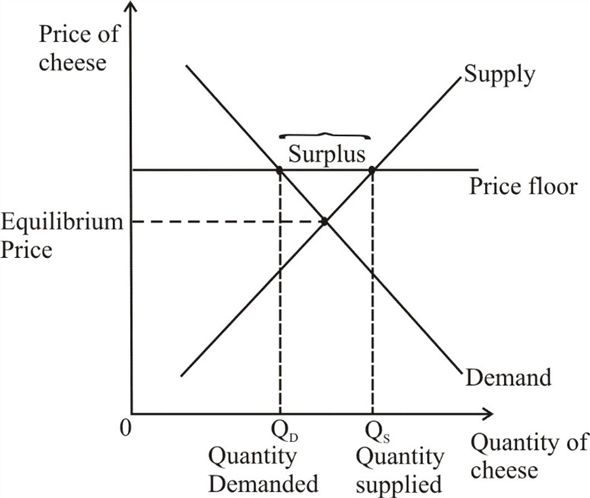

(a) The supply and demand diagram below shows the effect of imposing a binding price floor in the cheese market.

The binding price floor lies above the equilibrium price. Due to the price floor, the quantity supplied is greater than the quantity demanded. Thus, there will be a surplus in the cheese market.

Due to the price floor, the quantity supplied is greater than the quantity demanded. Thus, there will be a surplus in the cheese market.

(b) In case of a price floor, the market price is greater than the equilibrium price of cheese. This makes supply greater than demand, creating a pool of unsold surplus goods in the economy. Thus, farmers cannot sell their full production at the floor price. This causes reduction in the revenues of farmers.

(c) If the government agrees to purchase all of the surplus cheese at the price floor, farmers will benefit from this new policy. However, consumers will lose because they have to purchase cheese at a price higher than the equilibrium price.

The binding price floor lies above the equilibrium price.

Due to the price floor, the quantity supplied is greater than the quantity demanded. Thus, there will be a surplus in the cheese market.

Due to the price floor, the quantity supplied is greater than the quantity demanded. Thus, there will be a surplus in the cheese market.(b) In case of a price floor, the market price is greater than the equilibrium price of cheese. This makes supply greater than demand, creating a pool of unsold surplus goods in the economy. Thus, farmers cannot sell their full production at the floor price. This causes reduction in the revenues of farmers.

(c) If the government agrees to purchase all of the surplus cheese at the price floor, farmers will benefit from this new policy. However, consumers will lose because they have to purchase cheese at a price higher than the equilibrium price.

4

Which causes a shortage of a good-a price ceiling or a price floor? Justify your answer with a graph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

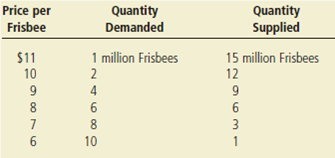

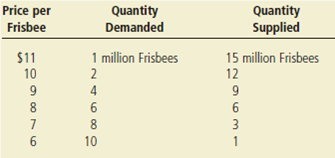

A recent study found that the demand and supply schedules for Frisbees are as follows:

a. What are the equilibrium price and quantity of Frisbees?

b. Frisbee manufacturers persuade the government that Frisbee production improves scientists' understanding of aerodynamics and thus is important for national security. A concerned Congress votes to impose a price floor $2 above the equilibrium price. What is the new market price? How many Frisbees are sold?

c. Irate college students march on Washington and demand a reduction in the price of Frisbees. An even more concerned Congress votes to repeal the price floor and impose a price ceiling $1 below the former price floor. What is the new market price? How many Frisbees are sold?

a. What are the equilibrium price and quantity of Frisbees?

b. Frisbee manufacturers persuade the government that Frisbee production improves scientists' understanding of aerodynamics and thus is important for national security. A concerned Congress votes to impose a price floor $2 above the equilibrium price. What is the new market price? How many Frisbees are sold?

c. Irate college students march on Washington and demand a reduction in the price of Frisbees. An even more concerned Congress votes to repeal the price floor and impose a price ceiling $1 below the former price floor. What is the new market price? How many Frisbees are sold?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

What mechanisms allocate resources when the price of a good is not allowed to bring supply and demand into equilibrium?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose the federal government requires beer drinkers to pay a $2 tax on each case of beer purchased. (In fact, both the federal and state governments impose beer taxes of some sort.)

a. Draw a supply-and-demand diagram of the market for beer without the tax. Show the price paid by consumers, the price received by producers, and the quantity of beer sold. What is the difference between the price paid by consumers and the price received by producers?

b. Now draw a supply-and-demand diagram for the beer market with the tax. Show the price paid by consumers, the price received by producers, and the quantity of beer sold. What is the difference between the price paid by consumers and the price received by producers? Has the quantity of beer sold increased or decreased?

a. Draw a supply-and-demand diagram of the market for beer without the tax. Show the price paid by consumers, the price received by producers, and the quantity of beer sold. What is the difference between the price paid by consumers and the price received by producers?

b. Now draw a supply-and-demand diagram for the beer market with the tax. Show the price paid by consumers, the price received by producers, and the quantity of beer sold. What is the difference between the price paid by consumers and the price received by producers? Has the quantity of beer sold increased or decreased?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

Explain why economists usually oppose controls on prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

A senator wants to raise tax revenue and make workers better off. A staff member proposes raising the payroll tax paid by firms and using part of the extra revenue to reduce the payroll tax paid by workers. Would this accomplish the senator's goal? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose the government removes a tax on buyers of a good and levies a tax of the same size on sellers of the good. How does this change in tax policy affect the price that buyers pay sellers for this good, the amount buyers are out of pocket including the tax, the amount sellers receive net of the tax, and the quantity of the good sold?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the government places a $500 tax on luxury cars, will the price paid by consumers rise by more than $500, less than $500, or exactly $500? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

How does a tax on a good affect the price paid by buyers, the price received by sellers, and the quantity sold?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

Congress and the president decide that the United States should reduce air pollution by reducing its use of gasoline. They impose a $0.50 tax for each gallon of gasoline sold.

a. Should they impose this tax on producers or consumers? Explain carefully using a supply-and-demand diagram.

b. If the demand for gasoline were more elastic, would this tax be more effective or less effective in reducing the quantity of gasoline consumed? Explain with both words and a diagram.

c. Are consumers of gasoline helped or hurt by this tax? Why?

d. Are workers in the oil industry helped or hurt by this tax? Why?

a. Should they impose this tax on producers or consumers? Explain carefully using a supply-and-demand diagram.

b. If the demand for gasoline were more elastic, would this tax be more effective or less effective in reducing the quantity of gasoline consumed? Explain with both words and a diagram.

c. Are consumers of gasoline helped or hurt by this tax? Why?

d. Are workers in the oil industry helped or hurt by this tax? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

What determines how the burden of a tax is divided between buyers and sellers? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

A case study in this chapter discusses the federal minimum- wage law.

a. Suppose the minimum wage is above the equilibrium wage in the market for unskilled labor. Using a supply and- demand diagram of the market for unskilled labor, show the market wage, the number of workers who are employed, and the number of workers who are unemployed. Also show the total wage payments to unskilled workers.

b. Now suppose the secretary of labor proposes an increase in the minimum wage. What effect would this increase have on employment? Does the change in employment depend on the elasticity of demand, the elasticity of supply, both elasticities, or neither?

c. What effect would this increase in the minimum wage have on unemployment? Does the change in unemployment depend on the elasticity of demand, the elasticity of supply, both elasticities, or neither?

d. If the demand for unskilled labor were inelastic, would the proposed increase in the minimum wage raise or lower total wage payments to unskilled workers? Would your answer change if the demand for unskilled labor were elastic?

a. Suppose the minimum wage is above the equilibrium wage in the market for unskilled labor. Using a supply and- demand diagram of the market for unskilled labor, show the market wage, the number of workers who are employed, and the number of workers who are unemployed. Also show the total wage payments to unskilled workers.

b. Now suppose the secretary of labor proposes an increase in the minimum wage. What effect would this increase have on employment? Does the change in employment depend on the elasticity of demand, the elasticity of supply, both elasticities, or neither?

c. What effect would this increase in the minimum wage have on unemployment? Does the change in unemployment depend on the elasticity of demand, the elasticity of supply, both elasticities, or neither?

d. If the demand for unskilled labor were inelastic, would the proposed increase in the minimum wage raise or lower total wage payments to unskilled workers? Would your answer change if the demand for unskilled labor were elastic?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

The U.S. government administers two programs that affect the market for cigarettes. Media campaigns and labeling requirements are aimed at making the public aware of the dangers of cigarette smoking. At the same time, the Department of Agriculture maintains a price-support program for tobacco farmers, which raises the price of tobacco above the equilibrium price.

a. How do these two programs affect cigarette consumption? Use a graph of the cigarette market in your answer.

b. What is the combined effect of these two programs on the price of cigarettes?

c. Cigarettes are also heavily taxed. What effect does this tax have on cigarette consumption?

a. How do these two programs affect cigarette consumption? Use a graph of the cigarette market in your answer.

b. What is the combined effect of these two programs on the price of cigarettes?

c. Cigarettes are also heavily taxed. What effect does this tax have on cigarette consumption?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

At Fenway Park, home of the Boston Red Sox, seating is limited to 39,000. Hence, the number of tickets issued is fixed at that figure. Seeing a golden opportunity to raise revenue, the City of Boston levies a per ticket tax of $5 to be paid by the ticket buyer. Boston sports fans, a famously civic-minded lot, dutifully send in the $5 per ticket. Draw a well-labeled graph showing the impact of the tax. On whom does the tax burden fall-the team's owners, the fans, or both? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

A subsidy is the opposite of a tax. With a $0.50 tax on the buyers of ice-cream cones, the government collects $0.50 for each cone purchased; with a $0.50 subsidy for the buyers of ice-cream cones, the government pays buyers $0.50 for each cone purchased.

a. Show the effect of a $0.50 per cone subsidy on the demand curve for ice-cream cones, the effective price paid by consumers, the effective price received by sellers, and the quantity of cones sold.

b. Do consumers gain or lose from this policy? Do producers gain or lose? Does the government gain or lose?

a. Show the effect of a $0.50 per cone subsidy on the demand curve for ice-cream cones, the effective price paid by consumers, the effective price received by sellers, and the quantity of cones sold.

b. Do consumers gain or lose from this policy? Do producers gain or lose? Does the government gain or lose?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the spring of 2008, Senators John McCain and Hillary Clinton (who were then running for president) proposed a temporary elimination of the federal gasoline tax, effective only during the summer of 2008, in order to help consumers deal with high gasoline prices.

a. During the summer, when gasoline demand is high because of vacation driving, gasoline refiners are operating near full capacity. What does this fact suggest about the price elasticity of supply?

b. In light of your answer to (a), who do you predict would benefit from the temporary gas tax holiday? For further information on topics in this chapter, additional problems, examples, applications, online quizzes, and more, please visit our website at www.cengage.com/economics/mankiw.

a. During the summer, when gasoline demand is high because of vacation driving, gasoline refiners are operating near full capacity. What does this fact suggest about the price elasticity of supply?

b. In light of your answer to (a), who do you predict would benefit from the temporary gas tax holiday? For further information on topics in this chapter, additional problems, examples, applications, online quizzes, and more, please visit our website at www.cengage.com/economics/mankiw.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck