Deck 21: Incremental Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 21: Incremental Analysis

1

McFricndly Software recently developed new spreadsheet software. Easy-Calc, which it intends to market by mail through ads in computer magazines. Just prior to introducing Easy-Calc, McF'riendly receives an unexpected offer from Jupiter Computer to buy all rights to the software for $10 million cash.

Instructions

a. Is the $10 million offer "relevant" financial information?

b. Describe McFriendly's opportunity cost if it (1) accepts Jupiter's offer and (2) turns down the offer and markets Easy-Calc itself. Would these opportunity costs be recorded in McFriendly's accounting records? If so, explain the journal entry to record these costs.

c. Briefly describe the extent to which the dollar amounts of the two opportunity costs described in part b are known to management at the time the decision is made to accept or reject Jupiter's offer.

d. Might there be any other opportunity costs to consider at the time of making this decision? If so explain briefly.

Instructions

a. Is the $10 million offer "relevant" financial information?

b. Describe McFriendly's opportunity cost if it (1) accepts Jupiter's offer and (2) turns down the offer and markets Easy-Calc itself. Would these opportunity costs be recorded in McFriendly's accounting records? If so, explain the journal entry to record these costs.

c. Briefly describe the extent to which the dollar amounts of the two opportunity costs described in part b are known to management at the time the decision is made to accept or reject Jupiter's offer.

d. Might there be any other opportunity costs to consider at the time of making this decision? If so explain briefly.

NO ANSWER

2

A friend offers you a ticket to a Chicago Cubs baseball game for $50: You know you can sell the ticket to another friend for $75. What is the opportunity cost of buying the ticket but then choosing to go to the game?

cost means benefit foregone by not pursuing an alternative course of action. Here he foregone the opportunity to sell the ticket to his friend so the opportunity cost is $ 75.

3

Assume Harley-Davidson Motorcycle Company is analyzing an offer to buy from a supplier a component that would replace a component it currently makes for its motorcycles. What additional factors beyond price should Harley-Davidson take into account in this make or buy decision?

Other factors that Harley-Davidson Motorcycle company should consider in make or buy decision include the following:-

1) The quality of the supplier's products.

2) The shipping reliability of the supplier.

3) Alternative uses of production capacity.

4) The long-term financial stability of the supplier.

5) The impact on the current workforce if employees are laid off.

6) Other suppliers' ability to provide the product.

1) The quality of the supplier's products.

2) The shipping reliability of the supplier.

3) Alternative uses of production capacity.

4) The long-term financial stability of the supplier.

5) The impact on the current workforce if employees are laid off.

6) Other suppliers' ability to provide the product.

4

"When special orders are accepted that are below full product cost (variable cost plus fixed costs), companies run the risk of filling up their capacity with products that do not provide enough contribution to cover fixed costs such as rent and management salaries." Do you agree or disagree with this statement (explain why)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

Discuss the importance of incremental costs and revenue when considering alternative courses of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

What nonfinancial considerations should be taken into account when deciding whether to accept a special order?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

Road Master Shocks has 20,000 units of a defective product on hand that cost $123,500 to manufacture. The company can either sell this product as scrap for $4.18 per unit or it can sell the product for $10 per unit by reworking the units and correcting the defects at a cost of $119,200. What should the company do? Prepare a schedule in support of your recommendation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

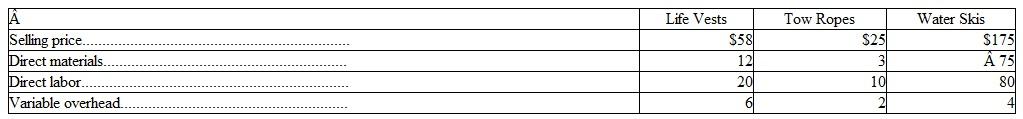

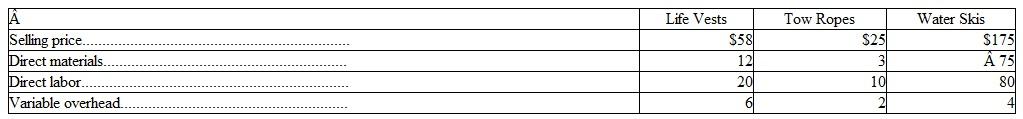

Gulf Breeze Corporation produces three products for water skiing enthusiasts: life vests, tow ropes, and water skis. Information relating to each product line is as follows:

Gulf Breeze pays its direct labor workers an average of $10 per hour. At full capacity, 65,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: life vests (25,000 units), tow ropes (15,000 units), and water skis (5,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.

Gulf Breeze pays its direct labor workers an average of $10 per hour. At full capacity, 65,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: life vests (25,000 units), tow ropes (15,000 units), and water skis (5,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.

a. What products should Gulf Breeze produce to maximize its operating income?

b. The company's marketing manager believes that the production of the least profitable product is needed to "support" the demand for the most profitable products. How may this influence management's decision regarding the company's production schedule?

Gulf Breeze pays its direct labor workers an average of $10 per hour. At full capacity, 65,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: life vests (25,000 units), tow ropes (15,000 units), and water skis (5,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.

Gulf Breeze pays its direct labor workers an average of $10 per hour. At full capacity, 65,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: life vests (25,000 units), tow ropes (15,000 units), and water skis (5,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.a. What products should Gulf Breeze produce to maximize its operating income?

b. The company's marketing manager believes that the production of the least profitable product is needed to "support" the demand for the most profitable products. How may this influence management's decision regarding the company's production schedule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

Home Depot 's Financial Statements: Incremental, Sunk, and Opportunity Costs

Read the footnote in Appendix A referring to Home Depot 's decision to close all of its remaining big box stores in China. Write a short paragraph identifying the incremental, sunk, and opportunity costs associated with this decision. Assume that any cost savings will be invested elsewhere in more productive stores.

Read the footnote in Appendix A referring to Home Depot 's decision to close all of its remaining big box stores in China. Write a short paragraph identifying the incremental, sunk, and opportunity costs associated with this decision. Assume that any cost savings will be invested elsewhere in more productive stores.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

Special Order Decisions and Opportunity Costs

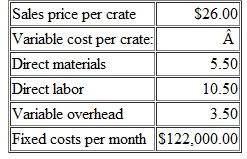

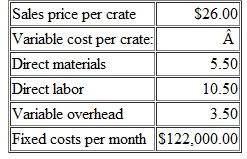

Poppycrock, Inc., manufactures large crates of microwaveable popcorn that are typically sold to distributors. Its main factory has the capacity to manufacture and sell 35,000 crates per month. The following information is available for the factory:

Boys and Girl's of Canada is a not-for-profit organization that raises funds each year by selling popcorn door-to-door. It offers to pay Poppycrock $22 per crate for a special-order batch of 5,000 crates. The special-order popcorn would include a unique label with information about the Boys and Girls of Canada. The additional cost of the label is estimated at $1.00 per crate. In addition, the variable overhead for these special-order crates would decrease by $.50 because there would be no distribution costs.

Boys and Girl's of Canada is a not-for-profit organization that raises funds each year by selling popcorn door-to-door. It offers to pay Poppycrock $22 per crate for a special-order batch of 5,000 crates. The special-order popcorn would include a unique label with information about the Boys and Girls of Canada. The additional cost of the label is estimated at $1.00 per crate. In addition, the variable overhead for these special-order crates would decrease by $.50 because there would be no distribution costs.

a.? What is the incremental cost of creating a normal crate of popcorn? A special-order crate of popcorn?

b.? Show the impact on Poppycrock's monthly operating profit if it accepts the offer and it is producing and distributing 30,000 normal crates per month. What is the opportunity cost of not accepting the offer?

c.? Show the impact on Poppycrock's monthly operating profit if it accepts the offer and it is producing and selling 35,000 normal crates per month. What is the opportunity cost of accepting the offer?

Poppycrock, Inc., manufactures large crates of microwaveable popcorn that are typically sold to distributors. Its main factory has the capacity to manufacture and sell 35,000 crates per month. The following information is available for the factory:

Boys and Girl's of Canada is a not-for-profit organization that raises funds each year by selling popcorn door-to-door. It offers to pay Poppycrock $22 per crate for a special-order batch of 5,000 crates. The special-order popcorn would include a unique label with information about the Boys and Girls of Canada. The additional cost of the label is estimated at $1.00 per crate. In addition, the variable overhead for these special-order crates would decrease by $.50 because there would be no distribution costs.

Boys and Girl's of Canada is a not-for-profit organization that raises funds each year by selling popcorn door-to-door. It offers to pay Poppycrock $22 per crate for a special-order batch of 5,000 crates. The special-order popcorn would include a unique label with information about the Boys and Girls of Canada. The additional cost of the label is estimated at $1.00 per crate. In addition, the variable overhead for these special-order crates would decrease by $.50 because there would be no distribution costs.a.? What is the incremental cost of creating a normal crate of popcorn? A special-order crate of popcorn?

b.? Show the impact on Poppycrock's monthly operating profit if it accepts the offer and it is producing and distributing 30,000 normal crates per month. What is the opportunity cost of not accepting the offer?

c.? Show the impact on Poppycrock's monthly operating profit if it accepts the offer and it is producing and selling 35,000 normal crates per month. What is the opportunity cost of accepting the offer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

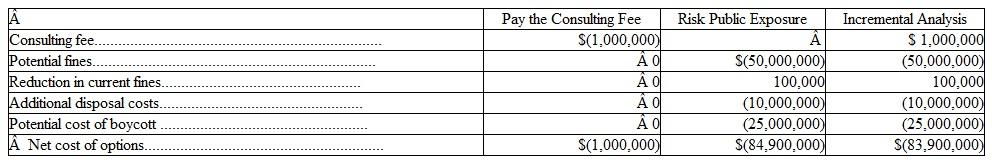

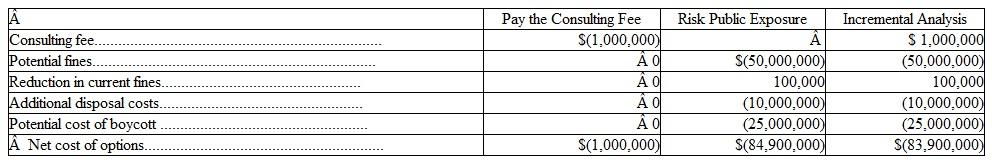

McKay Chemical Company is based in the town of Swampton. The company is Swampton's "economic lifeblood," generating annual income of $100 million and employing nearly 75 percent of its workforce. McKay produces many hazardous wastes as byproducts of its manufacturing processes. Proper disposal of these byproducts in compliance with environmental regulations would cost McKay in excess of $10 million per year. Rather than comply, McKay has chosen for two decades to dump its hazardous wastes in a field at the outskirts of Swampton's city limits. For doing so, it pays a fine of $100,000 per year. The following information also pertains to McKay Chemical Company and the town of Swampton:

1. A reporter has threatened to expose McKay Chemical Company on a 60-minute, prime-time television news program. The story could result in a national boycott of the company's products and fines of up to $50 million. A boycott could reduce the company's income by as much as $25 million per year. However, the reporter has agreed not to air the story if McKay pays her a consulting fee of $1 million per year.

2. The townspeople are becoming increasingly concerned that the illegal dumping may eventually pollute the groundwater and present a serious health hazard. However, most are equally concerned that if the company's practices are exposed, Swampton and its inhabitants would face financial ruin.

3. The judge who hands down the $100,000 line each year is also a major shareholder of McKay Chemical Company and serves on its board of directors. The town board invests the annual fine in a scholarship fund available on the basis of need to children of McKay's employees. Over the years, many of the scholarship recipients have gone on to become successful doctors, teachers. Scientists, and other productive members of society.

Assume that you have just been appointed as the new chief executive officer of McKay Chemical. You have been presented with the facts described in this case, along with the following incremental analysis performed by an assistant:

Instructions

Instructions

a. Identify am shortcomings in the preceding incremental analysis.

b. Draft a memorandum to the board of directors summarizing what you intend to do about this situation.

1. A reporter has threatened to expose McKay Chemical Company on a 60-minute, prime-time television news program. The story could result in a national boycott of the company's products and fines of up to $50 million. A boycott could reduce the company's income by as much as $25 million per year. However, the reporter has agreed not to air the story if McKay pays her a consulting fee of $1 million per year.

2. The townspeople are becoming increasingly concerned that the illegal dumping may eventually pollute the groundwater and present a serious health hazard. However, most are equally concerned that if the company's practices are exposed, Swampton and its inhabitants would face financial ruin.

3. The judge who hands down the $100,000 line each year is also a major shareholder of McKay Chemical Company and serves on its board of directors. The town board invests the annual fine in a scholarship fund available on the basis of need to children of McKay's employees. Over the years, many of the scholarship recipients have gone on to become successful doctors, teachers. Scientists, and other productive members of society.

Assume that you have just been appointed as the new chief executive officer of McKay Chemical. You have been presented with the facts described in this case, along with the following incremental analysis performed by an assistant:

Instructions

Instructions a. Identify am shortcomings in the preceding incremental analysis.

b. Draft a memorandum to the board of directors summarizing what you intend to do about this situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

Explain the concept of complementary products and why this concept is important in incremental decisions about individual products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

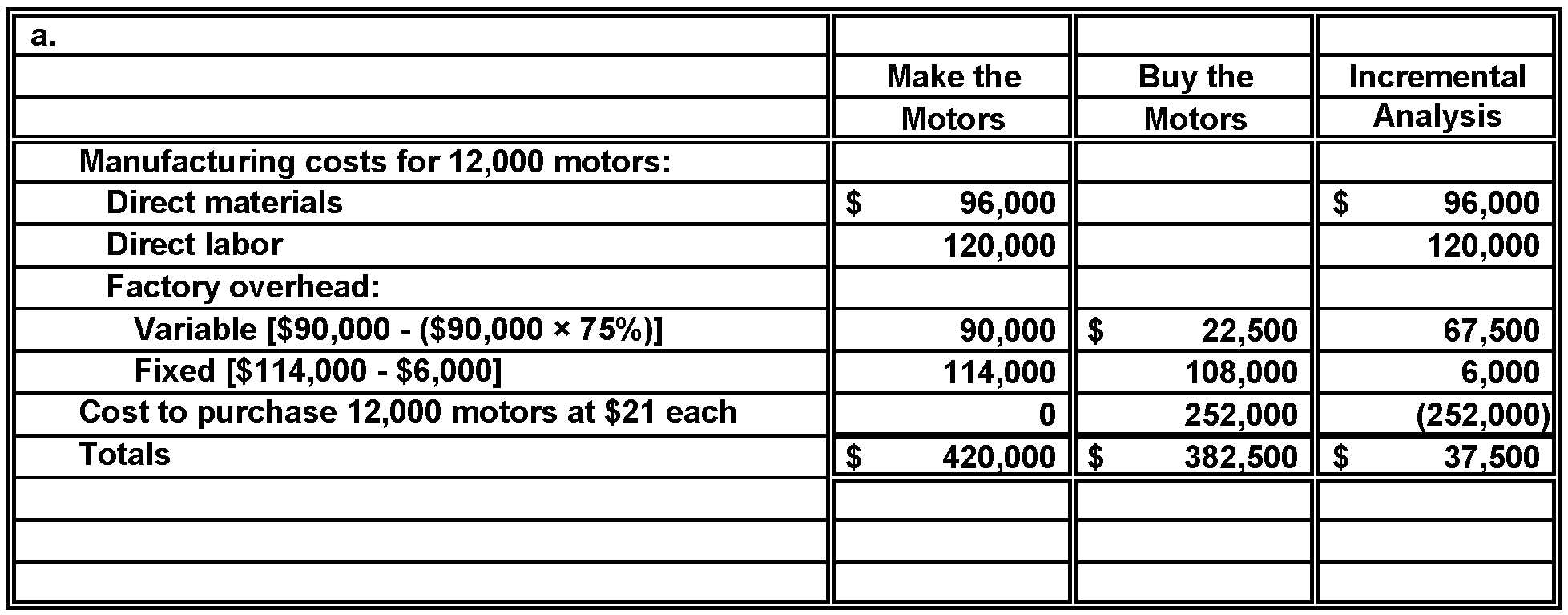

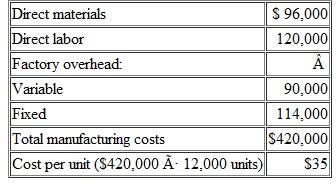

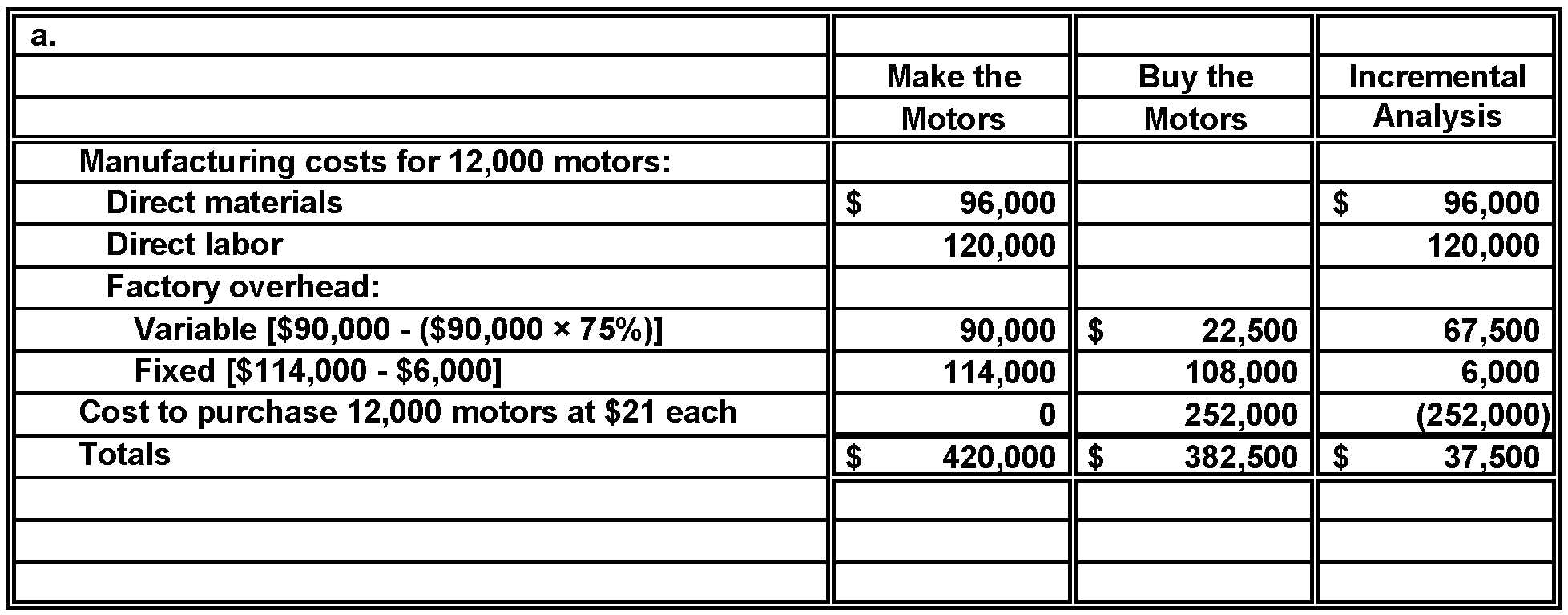

Make or Buy Decision

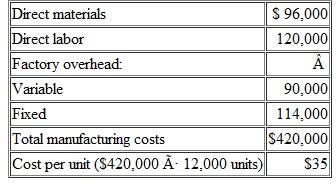

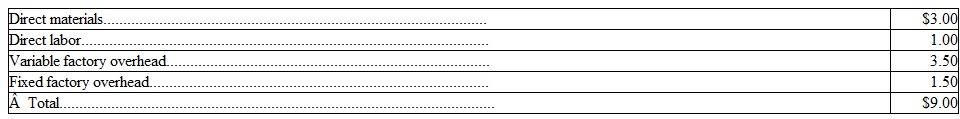

Easyuse Tool Co. manufactures an electric motor that it uses in several of its products. Management is considering whether to continue manufacturing the motors or to buy them from an outside source. The following information is available:

1.? The company needs 12,000 motors per year. The motors can be purchased from an outside supplier at a cost of $21 per unit.

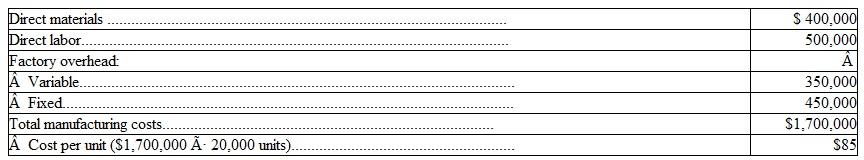

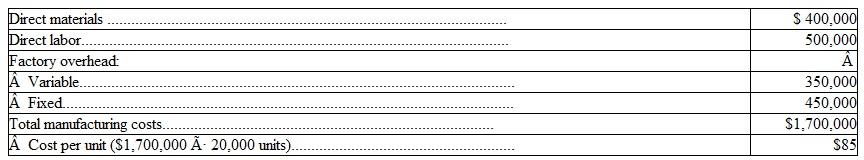

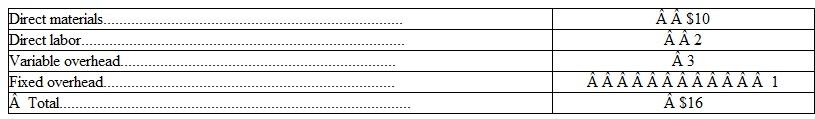

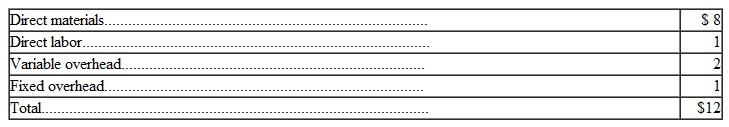

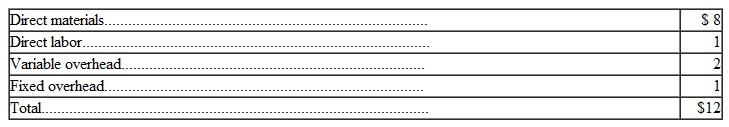

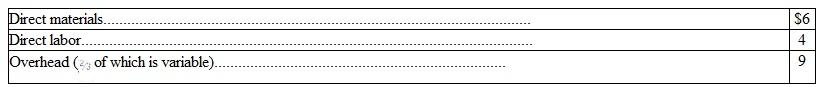

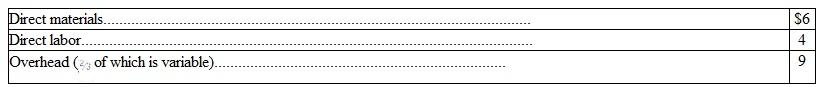

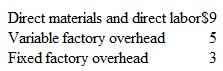

2.? The unit cost of manufacturing the motors is $35, computed as follows:

3.? Discontinuing the manufacture of motors will eliminate all the raw materials and direct labor costs but will eliminate only 75 percent of the variable factory overhead costs.

3.? Discontinuing the manufacture of motors will eliminate all the raw materials and direct labor costs but will eliminate only 75 percent of the variable factory overhead costs.

4.? If the motors are purchased from an outside source, machinery used in the production of motors will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale of this machinery would also eliminate $6,000 in fixed costs associated with depreciation and taxes. No other reductions in fixed factory overhead will result from discontinuing the production of motors.

Instructions

a.? Prepare a schedule in the format illustrated in Exhibit 21-6 to determine the incremental cost or benefit of buying the motors from thé outside supplier. Using this schedule, would you recommend that the company manufacture the motors or buy them from the outside source?

b.? Assume that if the motors are purchased from the outside source, the factory space previously used to produce motors can be used to manufacture an additional 4,000 power trimmers per year. Power trimmers have an estimated contribution margin of $8 per unit. The manufacture of the additional power trimmers would have no effect on fixed factory overhead. Would this new assumption change your recommendation as to whether to make or buy the motors? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying the motors from the outside source and using the factory space to produce additional power trimmers.

Easyuse Tool Co. manufactures an electric motor that it uses in several of its products. Management is considering whether to continue manufacturing the motors or to buy them from an outside source. The following information is available:

1.? The company needs 12,000 motors per year. The motors can be purchased from an outside supplier at a cost of $21 per unit.

2.? The unit cost of manufacturing the motors is $35, computed as follows:

3.? Discontinuing the manufacture of motors will eliminate all the raw materials and direct labor costs but will eliminate only 75 percent of the variable factory overhead costs.

3.? Discontinuing the manufacture of motors will eliminate all the raw materials and direct labor costs but will eliminate only 75 percent of the variable factory overhead costs.4.? If the motors are purchased from an outside source, machinery used in the production of motors will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale of this machinery would also eliminate $6,000 in fixed costs associated with depreciation and taxes. No other reductions in fixed factory overhead will result from discontinuing the production of motors.

Instructions

a.? Prepare a schedule in the format illustrated in Exhibit 21-6 to determine the incremental cost or benefit of buying the motors from thé outside supplier. Using this schedule, would you recommend that the company manufacture the motors or buy them from the outside source?

b.? Assume that if the motors are purchased from the outside source, the factory space previously used to produce motors can be used to manufacture an additional 4,000 power trimmers per year. Power trimmers have an estimated contribution margin of $8 per unit. The manufacture of the additional power trimmers would have no effect on fixed factory overhead. Would this new assumption change your recommendation as to whether to make or buy the motors? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying the motors from the outside source and using the factory space to produce additional power trimmers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

Decision to Sell or Rebuild Deficient Units

Louie Optics manufactures a underwater digital camera. The company's newest model is very popular, but it has an inventory of 5,000 old models for which there is little demand. The company is considering the following options for disposing of these old models:

1. Sell them to a discount mail-order company at a total price of $1,900,000. The mail-order firm would then sell these old models at a unit price of $480.

2. Convert them to new models at a remanufacturing cost of $600 per unit. These new models then could be sold to camera stores for $1,000 each. The old models had been manufactured at a cost of $525 per unit. The cost of manufacturing new models, however, normally amounts to $700 per unit.

Instructions

a. Perform an incremental analysis of the revenue, costs, and profit resulting from converting the old models to new models as compared with selling them to the mail-order firm.

b. Identify any sunk costs, out-of-pocket costs, and possible opportunity costs.

c. Indicate which of these options you would select and explain your reasoning, assuming that Louie Optics currently:

1. Has substantial excess capacity.

2. Is operating at full capacity manufacturing new models.

Louie Optics manufactures a underwater digital camera. The company's newest model is very popular, but it has an inventory of 5,000 old models for which there is little demand. The company is considering the following options for disposing of these old models:

1. Sell them to a discount mail-order company at a total price of $1,900,000. The mail-order firm would then sell these old models at a unit price of $480.

2. Convert them to new models at a remanufacturing cost of $600 per unit. These new models then could be sold to camera stores for $1,000 each. The old models had been manufactured at a cost of $525 per unit. The cost of manufacturing new models, however, normally amounts to $700 per unit.

Instructions

a. Perform an incremental analysis of the revenue, costs, and profit resulting from converting the old models to new models as compared with selling them to the mail-order firm.

b. Identify any sunk costs, out-of-pocket costs, and possible opportunity costs.

c. Indicate which of these options you would select and explain your reasoning, assuming that Louie Optics currently:

1. Has substantial excess capacity.

2. Is operating at full capacity manufacturing new models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

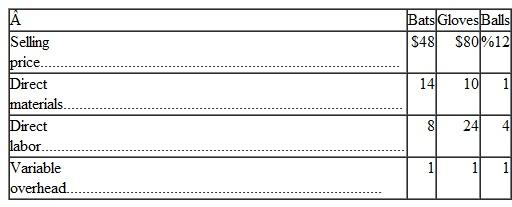

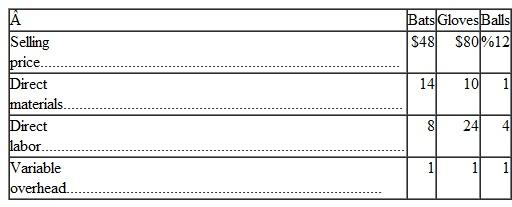

Home Run Corporation produces three products for baseball enthusiasts: bats, gloves, and balls. Information relating to each product line is as follows:

Home Run pays its direct labor workers an average of $8 per hour. At full capacity, 60,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: bats (60,000 units), gloves (20,000 units), and balls (100,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.

Home Run pays its direct labor workers an average of $8 per hour. At full capacity, 60,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: bats (60,000 units), gloves (20,000 units), and balls (100,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.

Instructions

a. What products should Home Run produce to maximize its operating income?

b. The company's marketing manager believes that the production of the least profitable product is needed to "support" the demand for the most profitable products. How may this influence management's decision regarding the company's production schedule?

Home Run pays its direct labor workers an average of $8 per hour. At full capacity, 60,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: bats (60,000 units), gloves (20,000 units), and balls (100,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.

Home Run pays its direct labor workers an average of $8 per hour. At full capacity, 60,000 direct labor hours are available per year. The marketing department has just released the following sales estimates for the upcoming year: bats (60,000 units), gloves (20,000 units), and balls (100,000 units). Based on these figures, demand for the current year is expected to exceed the company's direct labor capacity.Instructions

a. What products should Home Run produce to maximize its operating income?

b. The company's marketing manager believes that the production of the least profitable product is needed to "support" the demand for the most profitable products. How may this influence management's decision regarding the company's production schedule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

Home Depot 's Costs of Corporate Responsibility

Visit the Home Depot 's website and follow the "Corporate Responsibility" link to "The Home Depot Foundation." Read about the company's Team Depot initiative to learn how this particular program brings together volunteerism, do-it-yourself expertise, product donations, and monetary grants to support the communities where Home Depot associates live and work.

Use Exhibit 21-1 to identify the types of relevant costs and revenue that Home Depot 's management might consider when engaging in a service project through its Team Depot program.

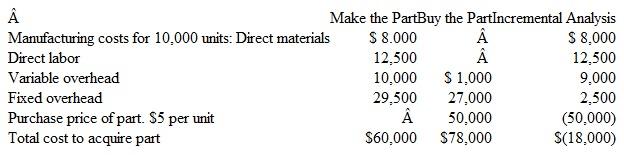

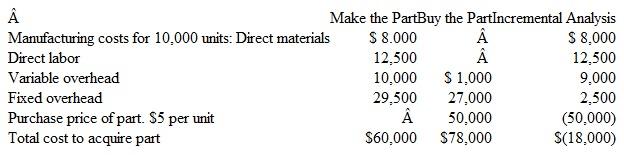

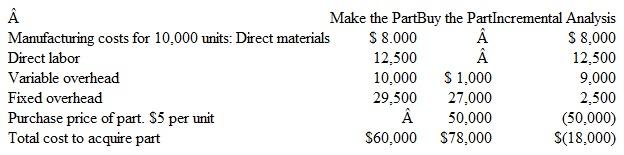

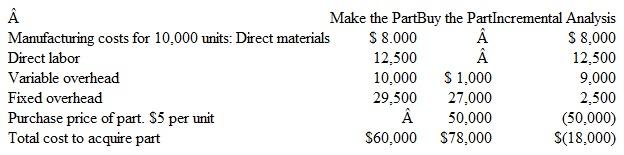

EXHIBIT 21-6 Incremental Analysis for a Make or Buy Decision

Visit the Home Depot 's website and follow the "Corporate Responsibility" link to "The Home Depot Foundation." Read about the company's Team Depot initiative to learn how this particular program brings together volunteerism, do-it-yourself expertise, product donations, and monetary grants to support the communities where Home Depot associates live and work.

Use Exhibit 21-1 to identify the types of relevant costs and revenue that Home Depot 's management might consider when engaging in a service project through its Team Depot program.

EXHIBIT 21-6 Incremental Analysis for a Make or Buy Decision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

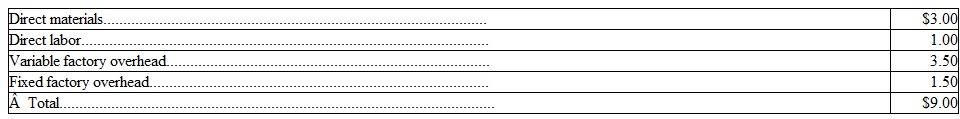

Matchless Corp. manufactures radios that it uses in several of its products. Management is considering whether to continue manufacturing the radios or to buy them from an outside source. The following information is available:

1. The company needs 20,000 radios per year. The radios can be purchased from an outside supplier at a cost of $50 per unit.

2. The unit cost of manufacturing the radios is $85, computed as follows:

3. Discontinuing the manufacture of radios will eliminate all the raw materials and direct labor costs but will eliminate only 80 percent of the variable factory overhead costs.

3. Discontinuing the manufacture of radios will eliminate all the raw materials and direct labor costs but will eliminate only 80 percent of the variable factory overhead costs.

4. If the radios are purchased from an outside source, machinery used in the production of radios will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale of this machinery would also eliminate $5,000 in fixed costs associated with depreciation and taxes. No other reductions in fixed factory overhead will result from discontinuing the production of radios.

Instructions

a. Prepare a schedule in the format illustrated in Exhibit 21-5 of the text to determine the incremental cost or benefit of buying the radios from the outside supplier. Based on this schedule, would you recommend that the company manufacture the radios or buy them from the outside source?

b. Assume that if the radios are purchased from the outside source, the factory space previously used to produce radios can be used to manufacture an additional 8,000 timepieces per year. Timepieces have an estimated contribution margin of $15 per unit. The manufacture of the additional timepieces would have no effect on fixed factory overhead. Would this new assumption change your recommendation as to whether to make or buy the radios? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying the radios from the outside source and using the factory space to produce additional timepieces.

1. The company needs 20,000 radios per year. The radios can be purchased from an outside supplier at a cost of $50 per unit.

2. The unit cost of manufacturing the radios is $85, computed as follows:

3. Discontinuing the manufacture of radios will eliminate all the raw materials and direct labor costs but will eliminate only 80 percent of the variable factory overhead costs.

3. Discontinuing the manufacture of radios will eliminate all the raw materials and direct labor costs but will eliminate only 80 percent of the variable factory overhead costs.4. If the radios are purchased from an outside source, machinery used in the production of radios will be sold at its book value. Accordingly, no gain or loss will be recognized. The sale of this machinery would also eliminate $5,000 in fixed costs associated with depreciation and taxes. No other reductions in fixed factory overhead will result from discontinuing the production of radios.

Instructions

a. Prepare a schedule in the format illustrated in Exhibit 21-5 of the text to determine the incremental cost or benefit of buying the radios from the outside supplier. Based on this schedule, would you recommend that the company manufacture the radios or buy them from the outside source?

b. Assume that if the radios are purchased from the outside source, the factory space previously used to produce radios can be used to manufacture an additional 8,000 timepieces per year. Timepieces have an estimated contribution margin of $15 per unit. The manufacture of the additional timepieces would have no effect on fixed factory overhead. Would this new assumption change your recommendation as to whether to make or buy the radios? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying the radios from the outside source and using the factory space to produce additional timepieces.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

Decision to Sell or Rebuild Deficient Units

Toops manufactures TVs. The company's high-definition TVs are very popular, but it has an inventory of 400 large-screen, standard-definition TVs for which there is little demand. Toops is considering the following options for disposing of these TVs:

1. Sell them to a discount mail-order company at a total price of $36,000. The mail-order firm would then sell these large-screen, standard-definition TVs at a unit price of $180.

2. Convert them to high-definition TVs at a remanufacturing cost of $650 per unit. These converted TVs then could be sold to TV stores for $1,200 each. The standard-definition TVs were manufactured at a cost of $250 per unit. The cost of manufacturing high-definition TVs of the same size, however, normally amounts to $700 per unit.

Instructions

a. Perform an incremental analysis of the revenue, costs, and profit resulting from converting the standard-definition TVs to high definition as compared with selling them to the mail-order firm.

b. Identify any sunk costs, out-of-pocket costs, and possible opportunity costs.

c. Indicate which of these options you would select and explain your reasoning, assuming that Toops currently:

1. Has substantial excess capacity.

2. Is operating at full capacity manufacturing high-definition TVs.

Toops manufactures TVs. The company's high-definition TVs are very popular, but it has an inventory of 400 large-screen, standard-definition TVs for which there is little demand. Toops is considering the following options for disposing of these TVs:

1. Sell them to a discount mail-order company at a total price of $36,000. The mail-order firm would then sell these large-screen, standard-definition TVs at a unit price of $180.

2. Convert them to high-definition TVs at a remanufacturing cost of $650 per unit. These converted TVs then could be sold to TV stores for $1,200 each. The standard-definition TVs were manufactured at a cost of $250 per unit. The cost of manufacturing high-definition TVs of the same size, however, normally amounts to $700 per unit.

Instructions

a. Perform an incremental analysis of the revenue, costs, and profit resulting from converting the standard-definition TVs to high definition as compared with selling them to the mail-order firm.

b. Identify any sunk costs, out-of-pocket costs, and possible opportunity costs.

c. Indicate which of these options you would select and explain your reasoning, assuming that Toops currently:

1. Has substantial excess capacity.

2. Is operating at full capacity manufacturing high-definition TVs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

Selling at Split-off or Processing Further

A variety of products-chicken wings, drumsticks, thighs, and so on-are the result of a joint production process of butchering a chicken that costs $0.25 per pound. The wings can be sold at the split-off point for $0.35 per pound, or they can be processed further by cooking them in barbecue sauce and selling them as buffalo wings for $0.46 per pound. The cooking process can accommodate 1,300 pounds of wings at a time and còsts $90 for sauce, cooking time, and labor. Should the wings be processed further to make buffalo wings?

A variety of products-chicken wings, drumsticks, thighs, and so on-are the result of a joint production process of butchering a chicken that costs $0.25 per pound. The wings can be sold at the split-off point for $0.35 per pound, or they can be processed further by cooking them in barbecue sauce and selling them as buffalo wings for $0.46 per pound. The cooking process can accommodate 1,300 pounds of wings at a time and còsts $90 for sauce, cooking time, and labor. Should the wings be processed further to make buffalo wings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

Dow Corporation produces a wide variety of products ranging from raw chemicals that are used as inputs by other firms to final goods that are sold to consumers. Access Dow 's home page at the following address:

Instructions

a. Choose two or three product areas to explore on the Web site. Based on your investigations, what types of incremental decisions are most likely to be made for each of the product areas?

b. What do you think Dow 's limiting resources might be?

c. In addition to profit considerations, what other qualitative factors might be considered in Dow 's incremental decision making?

Internet sites are time and date sensitive. It is the purpose of these exercises to have you explore the Internet. You may need to use the Yahoo! search engine http//:www.yahoo.com ( or another favorite search engine ) to find a company's current Web address.

Instructions

a. Choose two or three product areas to explore on the Web site. Based on your investigations, what types of incremental decisions are most likely to be made for each of the product areas?

b. What do you think Dow 's limiting resources might be?

c. In addition to profit considerations, what other qualitative factors might be considered in Dow 's incremental decision making?

Internet sites are time and date sensitive. It is the purpose of these exercises to have you explore the Internet. You may need to use the Yahoo! search engine http//:www.yahoo.com ( or another favorite search engine ) to find a company's current Web address.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following are sunk, out-of-pocket, or opportunity costs:

a. The amount you will pay to go to the movies next week.

b. The insurance payment on your car last year.

c. The amount of rent you could receive if you were to sublet your apartment and live in a tent for spring term.

d. The difference between the price of a 12-pack of soda at the convenience store versus the price of the same product at the discount warehouse.

e. Tuition payments made this term.

f. Book costs for next semester.

a. The amount you will pay to go to the movies next week.

b. The insurance payment on your car last year.

c. The amount of rent you could receive if you were to sublet your apartment and live in a tent for spring term.

d. The difference between the price of a 12-pack of soda at the convenience store versus the price of the same product at the discount warehouse.

e. Tuition payments made this term.

f. Book costs for next semester.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

Wolvo Company has defective products in inventory. It has the opportunity to either sell, scrap, or rebuild the detective products. Identify several factors Wolvo Company should consider before making a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

Define opportunity costs and explain why they represent a common source of error in making cost analyses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

Harvey Corporation produces several joint products from common materials and shared production processes. Why are costs incurred up to the split-off point not relevant in deciding which products Harvey sells at the split-off point and which products it processes further?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

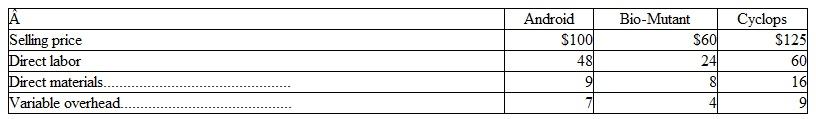

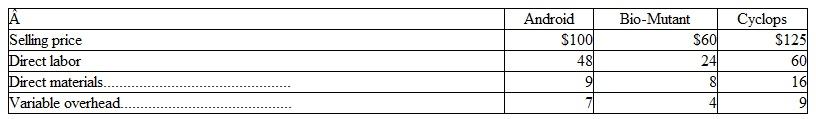

Gunst Company produces three video games: Android, Bio-Mutant, and Cyclops. Cost and revenue data pertaining to each product are as follows:

At the present time, demand for each of the company's products far exceeds its capacity to produce them. Thus management is trying to determine which of its games to concentrate on next week in filling its backlog of orders. Gunst's direct labor rate is $12 per hour, and only 1,000 hours of direct labor are available each week. Determine the maximum total contribution margin the company can make by its best use of the 1,000 available hours.

At the present time, demand for each of the company's products far exceeds its capacity to produce them. Thus management is trying to determine which of its games to concentrate on next week in filling its backlog of orders. Gunst's direct labor rate is $12 per hour, and only 1,000 hours of direct labor are available each week. Determine the maximum total contribution margin the company can make by its best use of the 1,000 available hours.

At the present time, demand for each of the company's products far exceeds its capacity to produce them. Thus management is trying to determine which of its games to concentrate on next week in filling its backlog of orders. Gunst's direct labor rate is $12 per hour, and only 1,000 hours of direct labor are available each week. Determine the maximum total contribution margin the company can make by its best use of the 1,000 available hours.

At the present time, demand for each of the company's products far exceeds its capacity to produce them. Thus management is trying to determine which of its games to concentrate on next week in filling its backlog of orders. Gunst's direct labor rate is $12 per hour, and only 1,000 hours of direct labor are available each week. Determine the maximum total contribution margin the company can make by its best use of the 1,000 available hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

Incremental Analysis: Accepting a Special Order

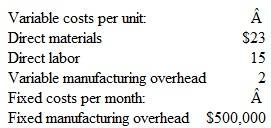

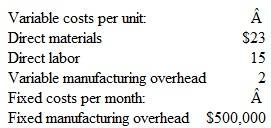

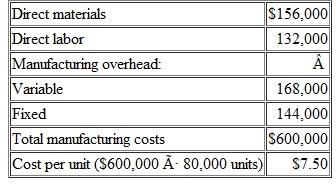

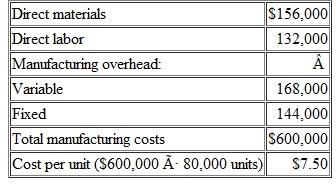

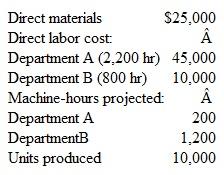

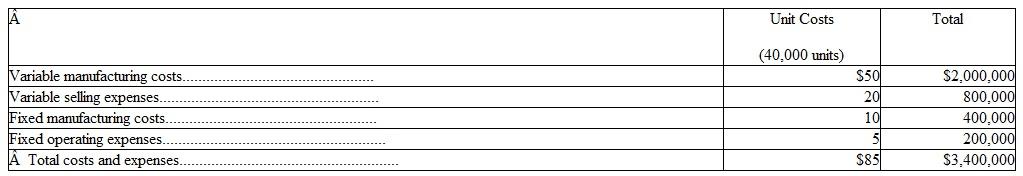

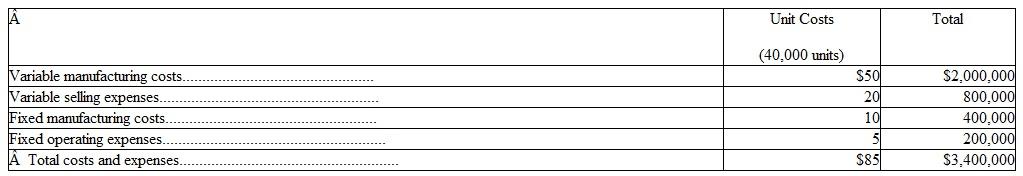

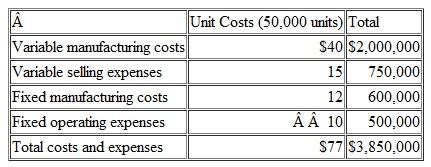

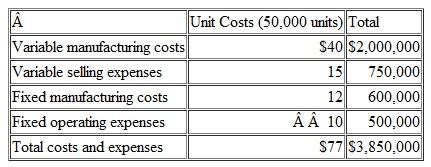

Sutherland manufactures and sells 50,000 laser printers each month. A principal component part in each printer is its paper feed drive. Sutherland's plant currently has the monthly capacity to produce 80,000 drives. The unit costs of manufacturing these drives (up to 80,000 per month) are as follows:

Desk-Mate Printers has offered to buy 10,000 paper feed drives from Sutherland to be used in its own printers. Compute the following:

a. The average unit cost of manufacturing each paper feed drive assuming that Sutherland manufactures only enough drives for its own laser printers.

b. The incremental unit cost of producing an additional paper feed drive.

c. The per-unit sales price that Sutherland should charge Desk-Mate to earn $120,000 in monthly pretax profit on the sale of drives to Desk-Mate.

Sutherland manufactures and sells 50,000 laser printers each month. A principal component part in each printer is its paper feed drive. Sutherland's plant currently has the monthly capacity to produce 80,000 drives. The unit costs of manufacturing these drives (up to 80,000 per month) are as follows:

Desk-Mate Printers has offered to buy 10,000 paper feed drives from Sutherland to be used in its own printers. Compute the following:

a. The average unit cost of manufacturing each paper feed drive assuming that Sutherland manufactures only enough drives for its own laser printers.

b. The incremental unit cost of producing an additional paper feed drive.

c. The per-unit sales price that Sutherland should charge Desk-Mate to earn $120,000 in monthly pretax profit on the sale of drives to Desk-Mate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

Incremental Analysis: Make or Buy Decision

The cost to Swank Company of manufacturing 15,000 units of a particular part is $135,000, of which $60,000 is fixed and $75,000 is variable. The company can buy the part from an outside supplier for $6 per unit. Fixed costs will remain the same regardless of Swank's decision. Should the company buy the part or continue to manufacture it? Prepare a comparative schedule in the format illustrated in Exhibit 21-6.

EXHIBIT 21-6 Incremental Analysis for a Make or Buy Decision

The cost to Swank Company of manufacturing 15,000 units of a particular part is $135,000, of which $60,000 is fixed and $75,000 is variable. The company can buy the part from an outside supplier for $6 per unit. Fixed costs will remain the same regardless of Swank's decision. Should the company buy the part or continue to manufacture it? Prepare a comparative schedule in the format illustrated in Exhibit 21-6.

EXHIBIT 21-6 Incremental Analysis for a Make or Buy Decision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

Vickery Machining Company is nearly finished constructing a specially designed piece of machining equipment when the customer declares bankruptcy and cannot pay for the equipment. Vickery estimates that the cost associated with making the uncompleted equipment was $1,693,000. Since the machining equipment was specially designed for the customer, there are no other buyers for the equipment unless it is rebuilt. The cost to rebuild is $450,000, after which the product can be sold for $500,000, or the equipment can be scrapped for $30,000. Identify each of the costs in this scenario as sunk, out-of-pocket, or incremental. What should Vickery do?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

A company regularly sells 100,000 washing machines at an average price of $250. The average cost of producing these machines is $180. Under what circumstances might the company accept a special order for 20,000 washing machines at $175 per machine?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

Make or Buy Decision

Parsons Plumbing Heating manufactures thermostats that it uses in several of its products. Management is considering whether to continue manufacturing the thermostats or to buy them from an outside source. The following information is available:

1.? The company needs 80,000 thermostats per year. Thermostats can be purchased from an outside supplier at a cost of $6 per unit.

2.? The cost of manufacturing thermostats is $7.50 per unit, computed as follows:

3.? Discontinuing the manufacture of the thermostats will eliminate all of the direct materials and direct labor costs but will eliminate only 60 percent of the variable overhead costs.

3.? Discontinuing the manufacture of the thermostats will eliminate all of the direct materials and direct labor costs but will eliminate only 60 percent of the variable overhead costs.

4.? If the thermostats are purchased from an outside source, certain machinery used in the production process would no longer have to be leased. Accordingly, $9,200 of fixed overhead costs could be avoided. No other reductions will result from discontinuing production of the thermostats.

Instructions

a.? Prepare a schedule to determine the incremental cost or benefit of buying thermostats from the outside supplier. On the basis of this schedule, would you recommend that the company manufacture thermostats or buy them from the outside source?

b.? Assume that if thermostats are purchased from the outside source, the factory space previously used to produce thermostats can be used to manufacture an additional 6,000 heat-flow regulators per year. These regulators have an estimated contribution margin of $18 per unit. The manufacture of the additional heat-flow regulators would have no effect on fixed overhead.

?Would this new assumption change your recommendation as to whether to make or buy thermostats? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying thermostats from the outside source and using the factory space to produce additional heat-flow regulators.

Parsons Plumbing Heating manufactures thermostats that it uses in several of its products. Management is considering whether to continue manufacturing the thermostats or to buy them from an outside source. The following information is available:

1.? The company needs 80,000 thermostats per year. Thermostats can be purchased from an outside supplier at a cost of $6 per unit.

2.? The cost of manufacturing thermostats is $7.50 per unit, computed as follows:

3.? Discontinuing the manufacture of the thermostats will eliminate all of the direct materials and direct labor costs but will eliminate only 60 percent of the variable overhead costs.

3.? Discontinuing the manufacture of the thermostats will eliminate all of the direct materials and direct labor costs but will eliminate only 60 percent of the variable overhead costs.4.? If the thermostats are purchased from an outside source, certain machinery used in the production process would no longer have to be leased. Accordingly, $9,200 of fixed overhead costs could be avoided. No other reductions will result from discontinuing production of the thermostats.

Instructions

a.? Prepare a schedule to determine the incremental cost or benefit of buying thermostats from the outside supplier. On the basis of this schedule, would you recommend that the company manufacture thermostats or buy them from the outside source?

b.? Assume that if thermostats are purchased from the outside source, the factory space previously used to produce thermostats can be used to manufacture an additional 6,000 heat-flow regulators per year. These regulators have an estimated contribution margin of $18 per unit. The manufacture of the additional heat-flow regulators would have no effect on fixed overhead.

?Would this new assumption change your recommendation as to whether to make or buy thermostats? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying thermostats from the outside source and using the factory space to produce additional heat-flow regulators.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

Silent Sentry manufactures gas leak detectors that are sold to homeowners throughout the United States at $25 apiece. Each detector is equipped with a sensory cell that is guaranteed to last two full years before needing to be replaced. The company currently has 50,000 gas leak detectors in its inventory that contain sensory cells that had been purchased from a discount vendor. Silent Sentry engineers estimate that these sensory cells will last only 18 months before needing to be replaced. The company has incurred the following unit costs related to the 50,000 detectors:

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:

1. Scrap the inferior sensory cell in each unit and replace it with a new one at a cost of $8 each. The units could then be sold at their full unit price of $25.

2. Sell the units with the inferior sensory cells at a discounted unit price of $24. This option would also involve changing the packaging of each unit to inform the buyer that the estimated life of the sensory cell is 18 months. The estimated out-of-pocket cost associated with the packaging changes is $3 per unit.

3. Sell each unit "as is" with its current packaging to a discount buyer in a foreign country. The buyer has offered to pay Silent Sentry a unit price of $22.

Instructions

a. Perform an incremental analysis of these options. Based on the analysis, which option should Silent Sentry choose?

b. What nonfinancial concerns should the company take into consideration?

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:

Silent Sentry is currently evaluating three options regarding the 50,000 detectors:1. Scrap the inferior sensory cell in each unit and replace it with a new one at a cost of $8 each. The units could then be sold at their full unit price of $25.

2. Sell the units with the inferior sensory cells at a discounted unit price of $24. This option would also involve changing the packaging of each unit to inform the buyer that the estimated life of the sensory cell is 18 months. The estimated out-of-pocket cost associated with the packaging changes is $3 per unit.

3. Sell each unit "as is" with its current packaging to a discount buyer in a foreign country. The buyer has offered to pay Silent Sentry a unit price of $22.

Instructions

a. Perform an incremental analysis of these options. Based on the analysis, which option should Silent Sentry choose?

b. What nonfinancial concerns should the company take into consideration?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

How do cash effects differ among out-of-pocket costs, sunk costs, and opportunity costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Gilster Company

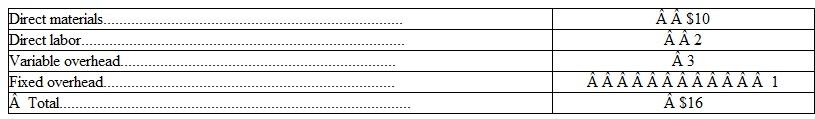

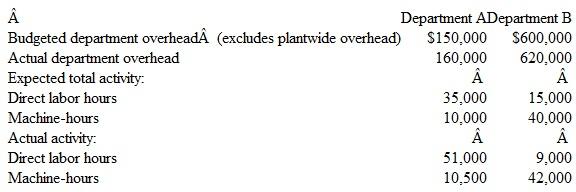

The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Falls, Minnesota, uses a job order costing system for its batch production processes. The St. Falls plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $240,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Falls plant for the past year are as follows:

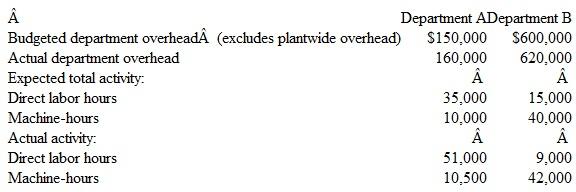

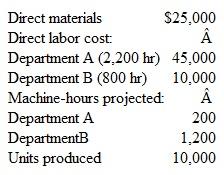

For the coming year, the accountants at St. Falls are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows:

Instructions

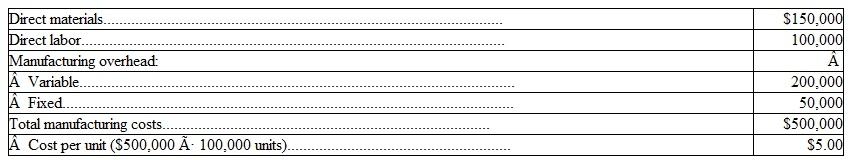

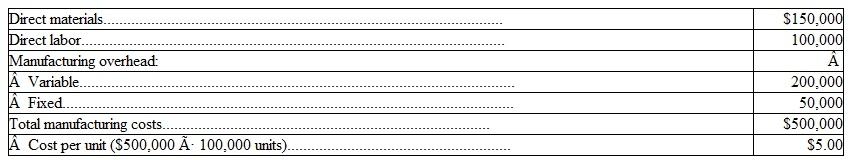

a. Assume the St. Falls plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs. Use expected total direct labor hours to compute the overhead rate. What is the expected cost per unit produced for job no. 110?

b. Recalculate the projected manufacturing costs for job no. 110 using three separate rates: one rate for plantwide overhead and two separate department overhead rates, all based on machine-hours.

c. The sales policy at St. Falls dictates that job bids be calculated by adding 40 percent to total manufacturing costs. What would be the bid for job no. 110 using ( 1 ) the overhead rate from part a and ( 2 ) the overhead rate from part b? Explain why the bids differ. Which of the overhead allocation methods would you recommend and why?

d. Using the allocation rates in part b, compute the under-or overapplied overhead for the St. Falls plant for the year. Explain the impact on net income of assigning the under-or overapplied overhead to cost of goods sold rather than prorating the amount between inventories and cost of goods sold.

e. A St. Falls subcontractor has offered to produce the parts for job no. 110 for a price of $12 per unit. Assume the St. Falls sales force has already committed to the bid price based on the calculations in part b. Should St. Falls buy the $12 per unit part from the subcontractor or continue to make the parts for job no. 110 itself?

f. Would your response to part e change if the St. Falls plant could use the facilities necessary to produce parts for job no. 110 for another job that could earn an incremental profit of $20,000?

g. If the subcontractor mentioned in part e is located in Mexico, what additional international environmental issues, other than price, will Gilster and St. Falls management need to evaluate?

h. If Gilster Company management decides to undertake a target costing approach to pricing its jobs, what types of changes will it need to make for such an approach to be successful?

The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Falls, Minnesota, uses a job order costing system for its batch production processes. The St. Falls plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $240,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Falls plant for the past year are as follows:

For the coming year, the accountants at St. Falls are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows:

Instructions

a. Assume the St. Falls plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs. Use expected total direct labor hours to compute the overhead rate. What is the expected cost per unit produced for job no. 110?

b. Recalculate the projected manufacturing costs for job no. 110 using three separate rates: one rate for plantwide overhead and two separate department overhead rates, all based on machine-hours.

c. The sales policy at St. Falls dictates that job bids be calculated by adding 40 percent to total manufacturing costs. What would be the bid for job no. 110 using ( 1 ) the overhead rate from part a and ( 2 ) the overhead rate from part b? Explain why the bids differ. Which of the overhead allocation methods would you recommend and why?

d. Using the allocation rates in part b, compute the under-or overapplied overhead for the St. Falls plant for the year. Explain the impact on net income of assigning the under-or overapplied overhead to cost of goods sold rather than prorating the amount between inventories and cost of goods sold.

e. A St. Falls subcontractor has offered to produce the parts for job no. 110 for a price of $12 per unit. Assume the St. Falls sales force has already committed to the bid price based on the calculations in part b. Should St. Falls buy the $12 per unit part from the subcontractor or continue to make the parts for job no. 110 itself?

f. Would your response to part e change if the St. Falls plant could use the facilities necessary to produce parts for job no. 110 for another job that could earn an incremental profit of $20,000?

g. If the subcontractor mentioned in part e is located in Mexico, what additional international environmental issues, other than price, will Gilster and St. Falls management need to evaluate?

h. If Gilster Company management decides to undertake a target costing approach to pricing its jobs, what types of changes will it need to make for such an approach to be successful?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

James Lighting manufactures switches that it uses in several of its products. Management is considering whether to continue manufacturing the switches or to buy them from an outside source. The following information is available:

1. The company needs 100,000 switches per year. Switches can be purchased from an outside supplier at a cost of $4 per unit.

2. The cost of manufacturing switches is $5 per unit, computed as follows:

3. Discontinuing the manufacture of the switches will eliminate all of the direct materials and direct labor costs but will eliminate only 70 percent of the variable overhead costs.

3. Discontinuing the manufacture of the switches will eliminate all of the direct materials and direct labor costs but will eliminate only 70 percent of the variable overhead costs.

4. If the switches are purchased from an outside source, certain machinery used in the production process would no longer have to be leased. Accordingly, $19,000 of fixed overhead costs could be avoided. No other reduction will result from discontinuing production of the switches.

Instructions

a. Prepare a schedule to determine the incremental cost or benefit of buying switches from the outside supplier. Based on this schedule, would you recommend that the company manufacture the switches or buy them from the outside source?

b. Assume that if switches are purchased from the outside source, the factory space previously used to produce switches can be used to manufacture an additional 10,000 dimmers per year. These dimmers have an estimated contribution margin of $14 per unit. The manufacture of the additional dimmers would have no effect on fixed overhead. Would this new assumption change your recommendation as to whether to make or buy switches? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying switches from the outside source and using the factory space to produce additional dimmers.

1. The company needs 100,000 switches per year. Switches can be purchased from an outside supplier at a cost of $4 per unit.

2. The cost of manufacturing switches is $5 per unit, computed as follows:

3. Discontinuing the manufacture of the switches will eliminate all of the direct materials and direct labor costs but will eliminate only 70 percent of the variable overhead costs.

3. Discontinuing the manufacture of the switches will eliminate all of the direct materials and direct labor costs but will eliminate only 70 percent of the variable overhead costs.4. If the switches are purchased from an outside source, certain machinery used in the production process would no longer have to be leased. Accordingly, $19,000 of fixed overhead costs could be avoided. No other reduction will result from discontinuing production of the switches.

Instructions

a. Prepare a schedule to determine the incremental cost or benefit of buying switches from the outside supplier. Based on this schedule, would you recommend that the company manufacture the switches or buy them from the outside source?

b. Assume that if switches are purchased from the outside source, the factory space previously used to produce switches can be used to manufacture an additional 10,000 dimmers per year. These dimmers have an estimated contribution margin of $14 per unit. The manufacture of the additional dimmers would have no effect on fixed overhead. Would this new assumption change your recommendation as to whether to make or buy switches? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying switches from the outside source and using the factory space to produce additional dimmers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

Fire Code manufactures smoke detectors that are sold to homeowners throughout the United States at $20 apiece. Each detector is equipped with a sensory cell that is guaranteed to last two full years before needing to be replaced. The company currently has 80,000 smoke detectors in its inventory, which contain sensory cells that had been purchased from a discount vendor. Fire Code engineers estimate that these sensory cells will last only 18 months before needing to be replaced. The company has incurred the following unit costs related to the 80,000 detectors:

Fire Code is currently evaluating three options regarding the 80,000 detectors:

Fire Code is currently evaluating three options regarding the 80,000 detectors:

1. Scrap the inferior sensory cell in each unit and replace it with a new one at a cost of $6 each. The units could then be sold at their full unit price of $20.

2. Sell the units with the inferior sensory cells at a discounted unit price of $18. This option would also involve changing the packaging of each unit to inform the buyer that the estimated life of the sensory cell is 18 months. The estimated out-of-pocket cost associated with the packaging changes is $2 per unit.

3. Sell each unit "as is" with its current packaging to a discount buyer in a foreign country. The buyer has offered to pay Fire Code a unit price of $ 17.

Instructions

a. Perform an incremental analysis of these options. Based on your analysis, which option should Fire Code choose?

b. What nonfinancial concerns should the company take into consideration?

Fire Code is currently evaluating three options regarding the 80,000 detectors:

Fire Code is currently evaluating three options regarding the 80,000 detectors:1. Scrap the inferior sensory cell in each unit and replace it with a new one at a cost of $6 each. The units could then be sold at their full unit price of $20.

2. Sell the units with the inferior sensory cells at a discounted unit price of $18. This option would also involve changing the packaging of each unit to inform the buyer that the estimated life of the sensory cell is 18 months. The estimated out-of-pocket cost associated with the packaging changes is $2 per unit.

3. Sell each unit "as is" with its current packaging to a discount buyer in a foreign country. The buyer has offered to pay Fire Code a unit price of $ 17.

Instructions

a. Perform an incremental analysis of these options. Based on your analysis, which option should Fire Code choose?

b. What nonfinancial concerns should the company take into consideration?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

Treadwell Pharmaceuticals produces two medications in a joint process: Amoxiphore and Benidrate. With each production run, Treadwell incurs $4,000 in common costs up to the split-off point.

Amoxiphore can be sold for $2,700 at the split-off point or be processed further at a cost of $1,600, at which time it can be sold for $4,200. However, if Amoxiphore is sold at the split-off point, its side effects include nausea and headaches. If it is processed further, these side effects are diminished. Demand for Amoxiphore far exceeds Treadwell's production capacity,

Benidrate can be sold for $2,400 at the split-off point or be processed further at a cost of $3,700, at which time it can be sold for $6,000.

a. Determine which product is more profitable to process beyond the split-off point.

b. With a group of three students identify and discuss the ethical issues the company faces regarding its processing decisions.

Amoxiphore can be sold for $2,700 at the split-off point or be processed further at a cost of $1,600, at which time it can be sold for $4,200. However, if Amoxiphore is sold at the split-off point, its side effects include nausea and headaches. If it is processed further, these side effects are diminished. Demand for Amoxiphore far exceeds Treadwell's production capacity,

Benidrate can be sold for $2,400 at the split-off point or be processed further at a cost of $3,700, at which time it can be sold for $6,000.

a. Determine which product is more profitable to process beyond the split-off point.

b. With a group of three students identify and discuss the ethical issues the company faces regarding its processing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

We have made the point that managers often attempt to maximize the contribution margin per unit of a particular resource that limits output capacity. The following arc five familiar types of businesses:

1. Small medical or dental practice

2. Restaurant

3. Supermarket

4. Builder of residential housing

5. Auto dealer's service department

Instructions

With a group of students:

a. For each type of business, identify the factor that you believe is most likely to limit potential output capacity.

b. Suggest several ways (other than raising prices) the business can maximize the contribution margin per unit of this limiting resource. (Hint: These businesses often do implement the types of strategies you are likely to suggest. Thus your solution to this case may explain basic characteristics of businesses that you personally have observed.)

1. Small medical or dental practice

2. Restaurant

3. Supermarket

4. Builder of residential housing

5. Auto dealer's service department

Instructions

With a group of students:

a. For each type of business, identify the factor that you believe is most likely to limit potential output capacity.

b. Suggest several ways (other than raising prices) the business can maximize the contribution margin per unit of this limiting resource. (Hint: These businesses often do implement the types of strategies you are likely to suggest. Thus your solution to this case may explain basic characteristics of businesses that you personally have observed.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

Outsourcing a Product

Sounds, Inc., is a company that produces sound systems for car stereos. It is considering outsourcing its customer service operation. It has a bid of $4 per call from Callers Service Company. Its current costs to service customers are estimated to be $3 per call, but it could use the idle space currently occupied by the customer service operation to earn an additional $24,000 per year. Sounds, Inc., currently receives about 1,500 customer calls per month. Should Sounds, Inc., outsource its customer service operation? What nonfinancial factors should be considered?

Sounds, Inc., is a company that produces sound systems for car stereos. It is considering outsourcing its customer service operation. It has a bid of $4 per call from Callers Service Company. Its current costs to service customers are estimated to be $3 per call, but it could use the idle space currently occupied by the customer service operation to earn an additional $24,000 per year. Sounds, Inc., currently receives about 1,500 customer calls per month. Should Sounds, Inc., outsource its customer service operation? What nonfinancial factors should be considered?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

Allocating Productive Capacity with Constrained Resources

A local gym has 20 stationary bicycles that are available for classes a combined total of 840 hours per week. The bicycles are used in two different exercise programs. A cycling class lasts one hour and earns a contribution margin of $18 per customer. A combo class using both bicycles and floor routines lasts two hours. It generates a contribution margin of $20 per customer. If demand for the cycling class is limited to 340 hours per week, how much total contribution margin could the gym generate from both programs when operating at full capacity?

A local gym has 20 stationary bicycles that are available for classes a combined total of 840 hours per week. The bicycles are used in two different exercise programs. A cycling class lasts one hour and earns a contribution margin of $18 per customer. A combo class using both bicycles and floor routines lasts two hours. It generates a contribution margin of $20 per customer. If demand for the cycling class is limited to 340 hours per week, how much total contribution margin could the gym generate from both programs when operating at full capacity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

Why is the contribution margin an important concept for incremental decision making?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the difference between short-run business decisions and long-run strategic plans?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

Until recently, the SEC was reluctant to hit companies with big fines for wrongdoing because the penalties hurt shareholders whose stock prices had already been hammered by scandal. But the Sarbanes-Oxley Act now lets the SEC use the fine funds to repay stockholders. For example, recent accounting frauds cost WorldCom (now MCI Inc. ) $750 million and Adelphia $715 million in fines. Recent pressure from Congress has encouraged the SEC to try to create some objective measures for fines so there can be continuity from case to case. The SEC board has been meeting to try to define which behaviors should get which punishments.

The SEC wants a series of objective measures so there can be continuity from case to case. Many believe a good starting point is whether a company benefited from its wrongdoing, in which case fines would be higher. Commissioners also will debate how much credit a company should get for cooperating with the SEC, in which case fines would be lower. Some individuals argue that any signposts will be better than today's unmarked landscape.

Instructions

With a group of students identified by your instructor, write a one-page discussion that uses Exhibit 21-1 to Identify how SEC policies have the potential to change managers' decision processes. In particular, focus on decisions managers make when considering whether to commit fraud. Consider the relevant costs and earnings that managers might consider in making this type of decision. Use the ideas in this chapter that are related to what is relevant to a particular decision to help with your analysis. In the conclusion of your paper, state whether your group thinks objective measures for fines will change the decision processes of managers who are considering fraud.

The SEC wants a series of objective measures so there can be continuity from case to case. Many believe a good starting point is whether a company benefited from its wrongdoing, in which case fines would be higher. Commissioners also will debate how much credit a company should get for cooperating with the SEC, in which case fines would be lower. Some individuals argue that any signposts will be better than today's unmarked landscape.

Instructions

With a group of students identified by your instructor, write a one-page discussion that uses Exhibit 21-1 to Identify how SEC policies have the potential to change managers' decision processes. In particular, focus on decisions managers make when considering whether to commit fraud. Consider the relevant costs and earnings that managers might consider in making this type of decision. Use the ideas in this chapter that are related to what is relevant to a particular decision to help with your analysis. In the conclusion of your paper, state whether your group thinks objective measures for fines will change the decision processes of managers who are considering fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Procter and Gamble sells Gillette razors near or below their manufacturing cost. It also sells razor blades that have a relatively high contribution margin. Explain why P G does not eliminate its unprofitable razor line and sell only blades.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

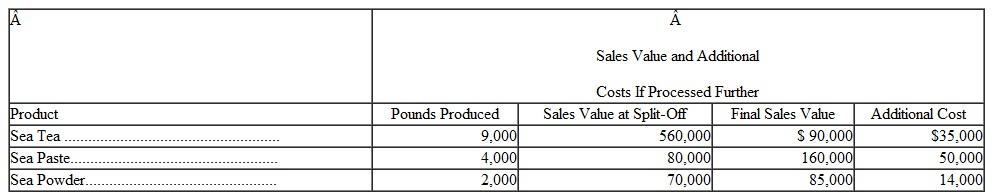

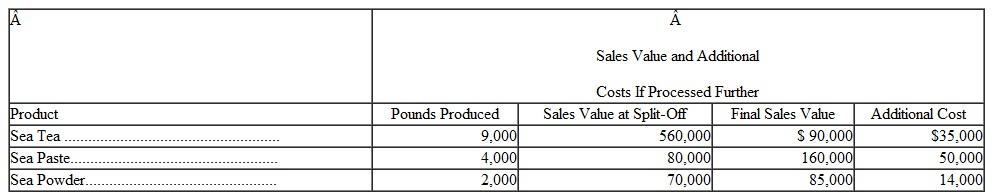

Joint Processes: Sell or Process Further

BioMorphs Corporation produces three products in a monthly joint production process. During the first stage of the process liquids and chemicals costing $60,000 are heated and three different compounds emerge: 3,000 gallons of Molecue worth $22 per gallon are created from the steam; 10,000 gallons of Borphue worth $15 are drained from the tank; and 1,000 gallons of the tank residue, labeled as Polygard, are sold as fertilizer for $5.50 per gallon. Before Molecue is sold, it must be purified in another process that costs $10,000, and before the Polygard fertilizer is sold, it must be bottled at a price of $1.50 per gallon.

a. What is the profitability of the joint process?

b. Is it profitable to process Molecue further if it can be sold at split-off for $5 per gallon?

c. BioMorphs has an offer to buy Polygard bulk at the split-off point without bottling for $3,500

per month. What is the incremental profit (loss) to BioMorphs if it accepts the offer?

d. What are the sunk costs related to the decision to accept the Polygard offer?

BioMorphs Corporation produces three products in a monthly joint production process. During the first stage of the process liquids and chemicals costing $60,000 are heated and three different compounds emerge: 3,000 gallons of Molecue worth $22 per gallon are created from the steam; 10,000 gallons of Borphue worth $15 are drained from the tank; and 1,000 gallons of the tank residue, labeled as Polygard, are sold as fertilizer for $5.50 per gallon. Before Molecue is sold, it must be purified in another process that costs $10,000, and before the Polygard fertilizer is sold, it must be bottled at a price of $1.50 per gallon.

a. What is the profitability of the joint process?

b. Is it profitable to process Molecue further if it can be sold at split-off for $5 per gallon?

c. BioMorphs has an offer to buy Polygard bulk at the split-off point without bottling for $3,500

per month. What is the incremental profit (loss) to BioMorphs if it accepts the offer?

d. What are the sunk costs related to the decision to accept the Polygard offer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

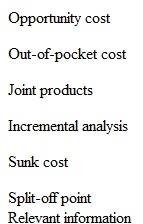

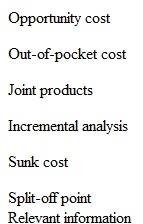

Listed below are seven technical accounting terms introduced or emphasized in this chapter.

Each of the following statements may (or may not) describe one of these terms. For each statement, indicate the accounting term or terms described, or answer "none" if the statement does not correctly describe any of these terms.

Each of the following statements may (or may not) describe one of these terms. For each statement, indicate the accounting term or terms described, or answer "none" if the statement does not correctly describe any of these terms.

a. Examination of differences between costs to be incurred and revenue to be earned under different courses of action.