Deck 24: Performance Eva Uation for Decentra Ized Operations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 24: Performance Eva Uation for Decentra Ized Operations

1

Ethics and professional conduct in business

Rambotix Company has two divisions, the Semiconductor Division and the X-ray Division. The X-ray Division may purchase semiconductors from the Semiconductor Division or from outside suppliers. The Semiconductor Division sells semiconductor products both internally and externally. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard:

Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help.

Howard: You've got that right. We're producing and selling at about 90% of our capacity to outsiders. Last year we were selling 100% of capacity. Would it be possible for your division to pick up some of our excess capacity After all, we are part of the same company.

Dave: What kind of price could you give me

Howard: Well, you know as well as I that we are under strict profit responsibility in our divisions, so I would expect to get market price, $100 for 100 semiconductors.

Dave: I'm not so sure we can swing that. I was expecting a price break from a "sister" division.

Howard: Hey, I can only take this "sister" stuff so far. If I give you a price break, our profits will fall from last year's levels. I don't think I could explain that. I'm sorry, but I must remain firm-market price. After all, it's only fair-that's what you would have to pay from an external supplier.

Dave: Fair or not, I think we'll pass. Sorry we couldn't have helped.

Was Dave behaving ethically by trying to force the Semiconductor Division into a price break Comment on Howard's reactions.

Rambotix Company has two divisions, the Semiconductor Division and the X-ray Division. The X-ray Division may purchase semiconductors from the Semiconductor Division or from outside suppliers. The Semiconductor Division sells semiconductor products both internally and externally. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard:

Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help.

Howard: You've got that right. We're producing and selling at about 90% of our capacity to outsiders. Last year we were selling 100% of capacity. Would it be possible for your division to pick up some of our excess capacity After all, we are part of the same company.

Dave: What kind of price could you give me

Howard: Well, you know as well as I that we are under strict profit responsibility in our divisions, so I would expect to get market price, $100 for 100 semiconductors.

Dave: I'm not so sure we can swing that. I was expecting a price break from a "sister" division.

Howard: Hey, I can only take this "sister" stuff so far. If I give you a price break, our profits will fall from last year's levels. I don't think I could explain that. I'm sorry, but I must remain firm-market price. After all, it's only fair-that's what you would have to pay from an external supplier.

Dave: Fair or not, I think we'll pass. Sorry we couldn't have helped.

Was Dave behaving ethically by trying to force the Semiconductor Division into a price break Comment on Howard's reactions.

Comment on H's reactions:

• 'R' Company includes two divisions which are semiconductor divisions and x-ray divisions for which D.D and H.H are the controller's respectively-ray dimensions requires semiconductors from semiconductors divisions with reduced price as semiconductor divisions were unable to market 10% of their semiconductors the previous year.

• Definitely D.D the controller of the x-ray division behaved in an ethical and in a philosophical manner by trying to force the semiconductor division for a price break.if both the controllers arrives to a deal ,there would not be any stock left over and x-ray division no need to purchase the products for high price. The deals satisfies both the conditions by improving sales and fetching profits as both the departments works for one same company.

• H.H, the controller of the semi-conductor division is awkward and grim in his approach and reaction. H.H was so stubborn and stringent in looking at his personal aspects instead of organization's welfare and integrity.

• 'R' Company includes two divisions which are semiconductor divisions and x-ray divisions for which D.D and H.H are the controller's respectively-ray dimensions requires semiconductors from semiconductors divisions with reduced price as semiconductor divisions were unable to market 10% of their semiconductors the previous year.

• Definitely D.D the controller of the x-ray division behaved in an ethical and in a philosophical manner by trying to force the semiconductor division for a price break.if both the controllers arrives to a deal ,there would not be any stock left over and x-ray division no need to purchase the products for high price. The deals satisfies both the conditions by improving sales and fetching profits as both the departments works for one same company.

• H.H, the controller of the semi-conductor division is awkward and grim in his approach and reaction. H.H was so stubborn and stringent in looking at his personal aspects instead of organization's welfare and integrity.

2

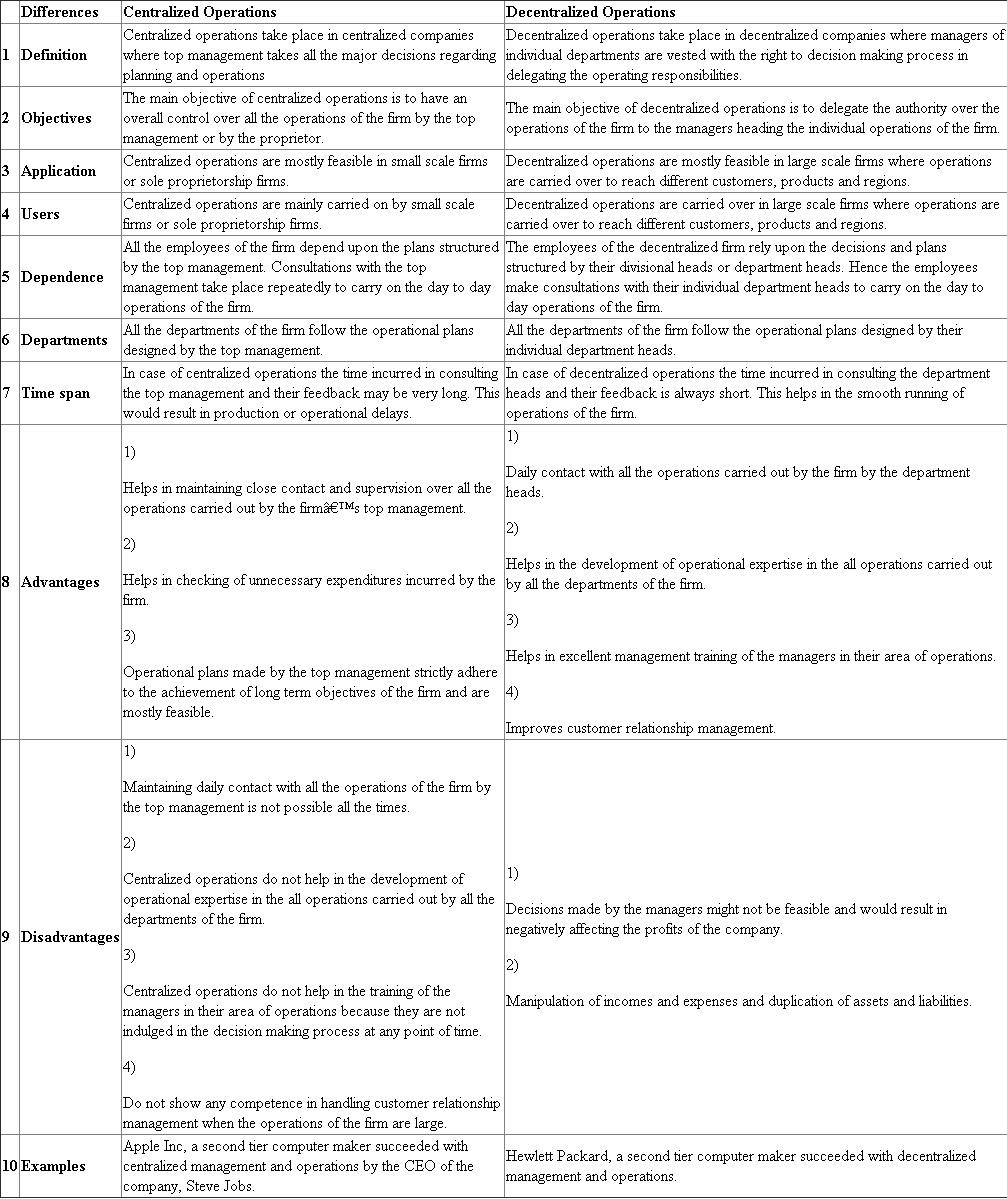

Differentiate between centralized and decentralized operations.

Difference between Centralized Operations and Decentralized Operations

3

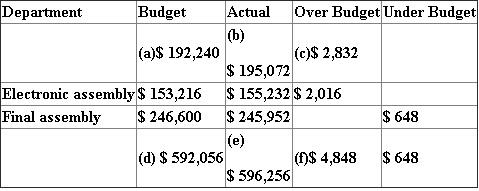

Budget performance reports for cost centers

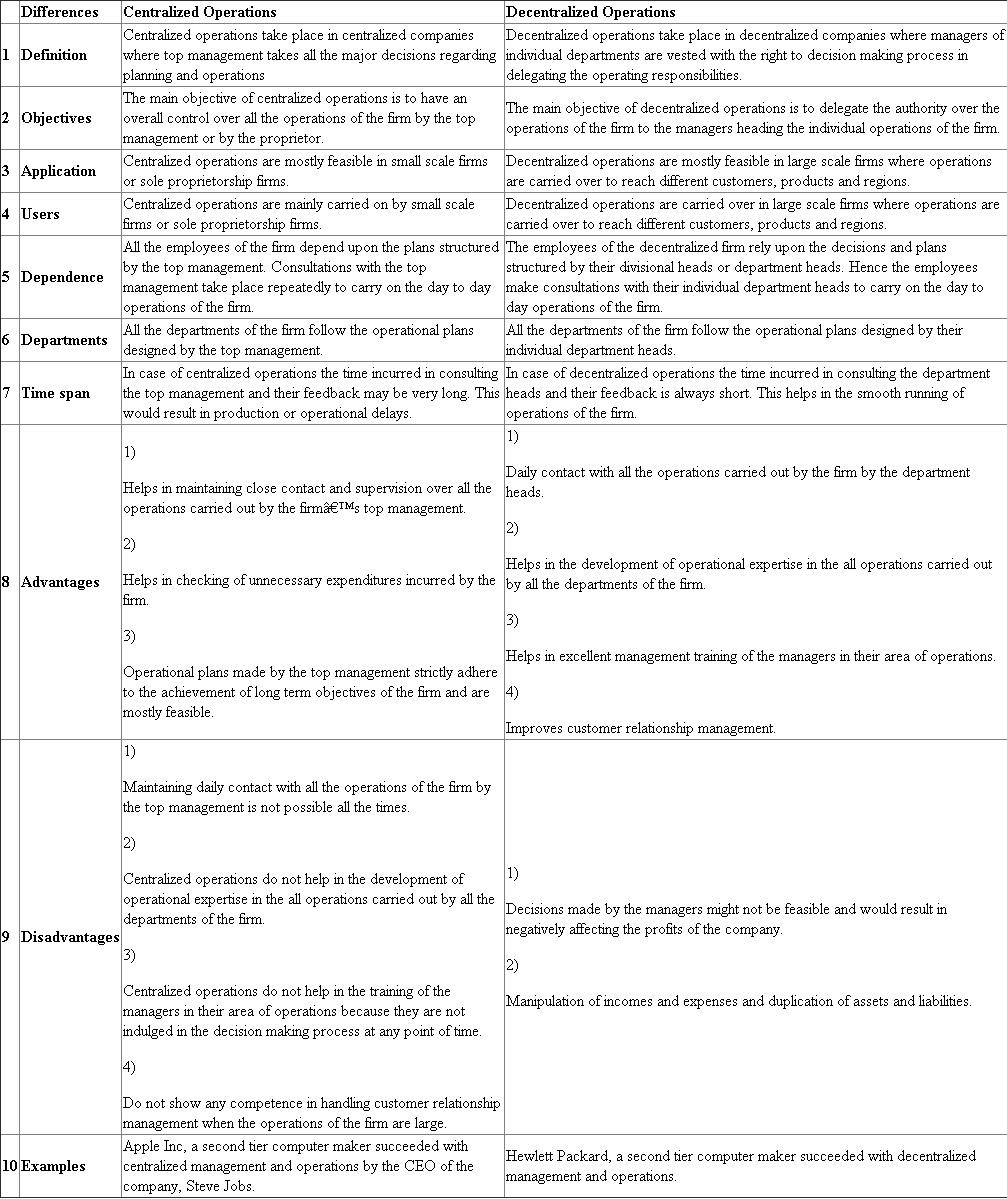

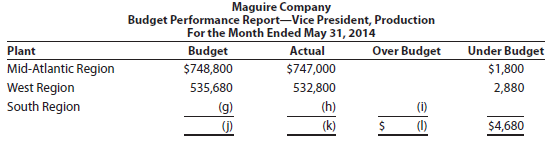

Partially completed budget performance reports for Maguire Company, a manufacturer of air conditioners, are provided on the following page.

a. Complete the budget performance reports by determining the correct amounts for the lettered spaces.

b. Compose a memo to Holly Keller, vice president of production for Maguire Company, explaining the performance of the production division for May.

Partially completed budget performance reports for Maguire Company, a manufacturer of air conditioners, are provided on the following page.

a. Complete the budget performance reports by determining the correct amounts for the lettered spaces.

b. Compose a memo to Holly Keller, vice president of production for Maguire Company, explaining the performance of the production division for May.

Cost center

Cost center is a decision making unit pertaining to an entire manufacturing or a service rendering company. There might be many cost centers inside a cost center. Managers of cost centers are usually held responsible in controlling costs of the cost centers of a firm.

Example:

• Production department of a car manufacturing company

• Admissions department of a hospital

A)

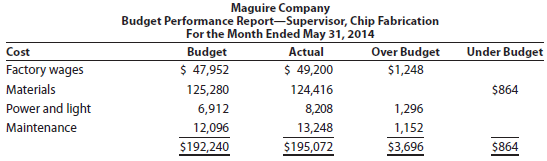

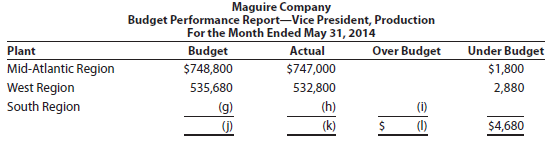

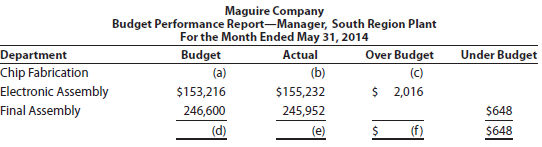

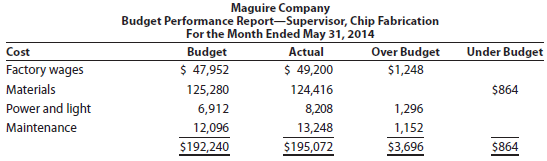

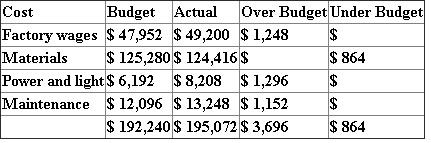

Budget performance reports for cost centers

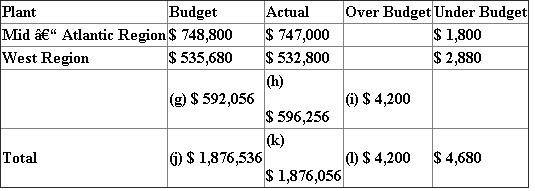

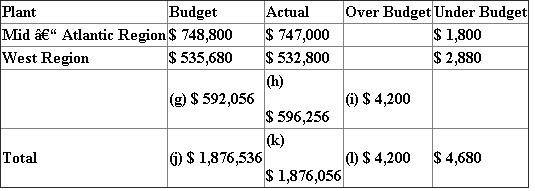

Maguire Company Budget Performance Report - Vice President Production for the month ended May 31 st 2014

Maguire Company Budget Performance Report -Manger South Region, Plant for the month ended May 31 st 2014

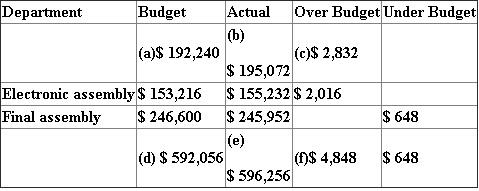

Maguire Company Budget Performance Report -Manger South Region, Plant for the month ended May 31 st 2014

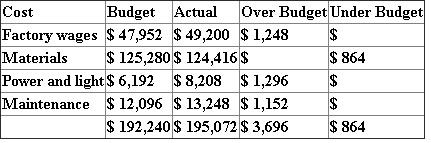

Maguire Company Budget Performance Report - Supervisor, Chip Fabrication for the month ended May 31 st 2014

Maguire Company Budget Performance Report - Supervisor, Chip Fabrication for the month ended May 31 st 2014

Comparison of division incomes is not possible as the divisions might vary in terms of different attributes like number of customers, products, size of the market and others. However each division income has to be compared with the budgeted income.

Comparison of division incomes is not possible as the divisions might vary in terms of different attributes like number of customers, products, size of the market and others. However each division income has to be compared with the budgeted income.

B)

MEMORANDUM

Maguire Company,

California,

USA,

3-07-2014

To : Holley Keller, Vice-president of Production, Maguire Company

From : ABC, Finance executive, Maguire Company

Subject: Performance of the production division during the month of May, 2014

I would like to present you the details of the production departments of chip fabrication, electronic assembly and Final assembly during the month of May 2014 for the three plants of Maguire Company namely Mid- Atlantic, West and south regions of USA.

The chip fabrication department of south region was over budgeted by $ 2,832. The expenses of factory wages, power and light and maintenance were over budgeted by $ 1,152. The materials expenses were only under the budget. So, all these budgeted expenses must have to revise before preparing budget for the upcoming month of June 2014. However the expenses of Mid-Atlantic region and west region are predicted according to the requirements as they are under the budget estimates for the month of May 2014.

I would here by inform you that we would estimate the expenses of the South region in preparing the budget for the month of June 2014 by reviewing the actual expenses incurred during the month of May 2014.

ABC, Finance Executive

Maguire Company

Cost center is a decision making unit pertaining to an entire manufacturing or a service rendering company. There might be many cost centers inside a cost center. Managers of cost centers are usually held responsible in controlling costs of the cost centers of a firm.

Example:

• Production department of a car manufacturing company

• Admissions department of a hospital

A)

Budget performance reports for cost centers

Maguire Company Budget Performance Report - Vice President Production for the month ended May 31 st 2014

Maguire Company Budget Performance Report -Manger South Region, Plant for the month ended May 31 st 2014

Maguire Company Budget Performance Report -Manger South Region, Plant for the month ended May 31 st 2014  Maguire Company Budget Performance Report - Supervisor, Chip Fabrication for the month ended May 31 st 2014

Maguire Company Budget Performance Report - Supervisor, Chip Fabrication for the month ended May 31 st 2014  Comparison of division incomes is not possible as the divisions might vary in terms of different attributes like number of customers, products, size of the market and others. However each division income has to be compared with the budgeted income.

Comparison of division incomes is not possible as the divisions might vary in terms of different attributes like number of customers, products, size of the market and others. However each division income has to be compared with the budgeted income.B)

MEMORANDUM

Maguire Company,

California,

USA,

3-07-2014

To : Holley Keller, Vice-president of Production, Maguire Company

From : ABC, Finance executive, Maguire Company

Subject: Performance of the production division during the month of May, 2014

I would like to present you the details of the production departments of chip fabrication, electronic assembly and Final assembly during the month of May 2014 for the three plants of Maguire Company namely Mid- Atlantic, West and south regions of USA.

The chip fabrication department of south region was over budgeted by $ 2,832. The expenses of factory wages, power and light and maintenance were over budgeted by $ 1,152. The materials expenses were only under the budget. So, all these budgeted expenses must have to revise before preparing budget for the upcoming month of June 2014. However the expenses of Mid-Atlantic region and west region are predicted according to the requirements as they are under the budget estimates for the month of May 2014.

I would here by inform you that we would estimate the expenses of the South region in preparing the budget for the month of June 2014 by reviewing the actual expenses incurred during the month of May 2014.

ABC, Finance Executive

Maguire Company

4

Budgetary performance for cost center

Mandel Company's costs were over budget by $252,000. The company is divided into West and East regions. The East Region's costs were under budget by $74,000. Determine the amount that the West Region's costs were over or under budget.

Conley Company's costs were under budget by $198,000. The company is divided into North and South regions. The North Region's costs were over budget by $52,000. Determine the amount that the South Region's costs were over or under budget.

Mandel Company's costs were over budget by $252,000. The company is divided into West and East regions. The East Region's costs were under budget by $74,000. Determine the amount that the West Region's costs were over or under budget.

Conley Company's costs were under budget by $198,000. The company is divided into North and South regions. The North Region's costs were over budget by $52,000. Determine the amount that the South Region's costs were over or under budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

Budget performance report for a cost center

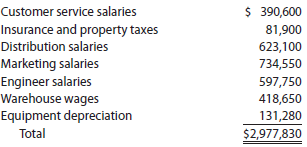

E-Net Company sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division for the month ended January 31, 2014, is as follows (in thousands):

During January, the costs incurred in the Consumer Products Division were as follows:

Instructions

1. Prepare a budget performance report for the director of the Consumer Products Division for the month of January.

2. For which costs might the director be expected to request supplemental reports

E-Net Company sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division for the month ended January 31, 2014, is as follows (in thousands):

During January, the costs incurred in the Consumer Products Division were as follows:

Instructions

1. Prepare a budget performance report for the director of the Consumer Products Division for the month of January.

2. For which costs might the director be expected to request supplemental reports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

Budget performance report for a cost center

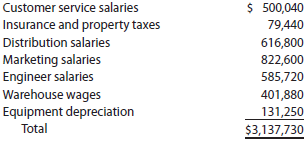

The Eastern District of Adelson Inc. is organized as a cost center. The budget for the Eastern District of Adelson Inc. for the month ended December 31, 2014, is as follows:

During December, the costs incurred in the Eastern District were as follows:

Instructions

1. Prepare a budget performance report for the manager of the Eastern District of Adelson for the month of December.

2. For which costs might the supervisor be expected to request supplemental reports

The Eastern District of Adelson Inc. is organized as a cost center. The budget for the Eastern District of Adelson Inc. for the month ended December 31, 2014, is as follows:

During December, the costs incurred in the Eastern District were as follows:

Instructions

1. Prepare a budget performance report for the manager of the Eastern District of Adelson for the month of December.

2. For which costs might the supervisor be expected to request supplemental reports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

Service department charges

The Customer Service Department of Door Industries Inc. asked the Publications Department to prepare a brochure for its training program. The Publications Department delivered the brochures and charged the Customer Service Department a rate that was 25% higher than could be obtained from an outside printing company. The policy of the company required the Customer Service Department to use the internal publications group for brochures. The Publications Department claimed that it had a drop in demand for its services during the fiscal year, so it had to charge higher prices in order to recover its payroll and fixed costs.

Should the cost of the brochure be transferred to the Customer Service Department in order to hold the Customer Service Department head accountable for the cost of the brochure What changes in policy would you recommend

The Customer Service Department of Door Industries Inc. asked the Publications Department to prepare a brochure for its training program. The Publications Department delivered the brochures and charged the Customer Service Department a rate that was 25% higher than could be obtained from an outside printing company. The policy of the company required the Customer Service Department to use the internal publications group for brochures. The Publications Department claimed that it had a drop in demand for its services during the fiscal year, so it had to charge higher prices in order to recover its payroll and fixed costs.

Should the cost of the brochure be transferred to the Customer Service Department in order to hold the Customer Service Department head accountable for the cost of the brochure What changes in policy would you recommend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

Differentiate between a profit center and an investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

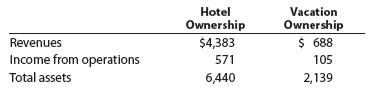

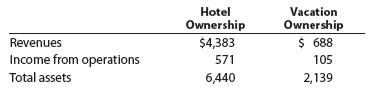

Divisional income statements

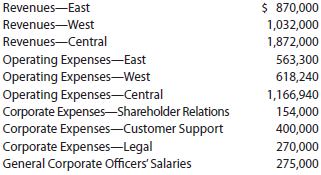

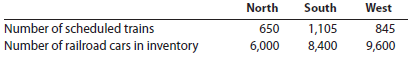

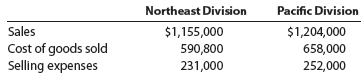

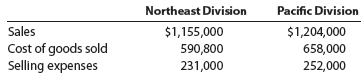

The following data were summarized from the accounting records for Endless River Construction Company for the year ended June 30, 2014:

Prepare divisional income statements for Endless River Construction Company.

The following data were summarized from the accounting records for Endless River Construction Company for the year ended June 30, 2014:

Prepare divisional income statements for Endless River Construction Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

Service department charges

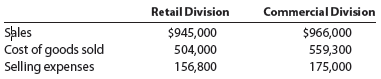

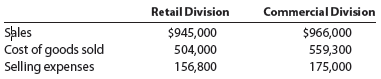

The centralized employee travel department of Kensy Company has expenses of $435,000. The department has serviced a total of 4,000 travel reservations for the period. The Northeast Division has made 1,800 reservations during the period, and the Pacific Division has made 2,200 reservations. How much should each division be charged for travel services

The centralized computer technology department of Lee Company has expenses of $264,000. The department has provided a total of 2,500 hours of service for the period. The Retail Division has used 1,125 hours of computer technology service during the period, and the Commercial Division has used 1,375 hours of computer technology service. How much should each division be charged for computer technology department services

The centralized employee travel department of Kensy Company has expenses of $435,000. The department has serviced a total of 4,000 travel reservations for the period. The Northeast Division has made 1,800 reservations during the period, and the Pacific Division has made 2,200 reservations. How much should each division be charged for travel services

The centralized computer technology department of Lee Company has expenses of $264,000. The department has provided a total of 2,500 hours of service for the period. The Retail Division has used 1,125 hours of computer technology service during the period, and the Commercial Division has used 1,375 hours of computer technology service. How much should each division be charged for computer technology department services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

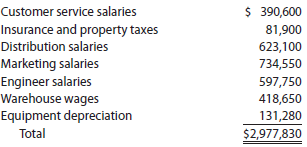

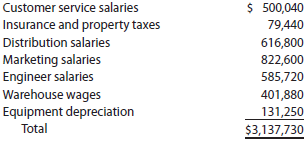

Profit center responsibility reporting

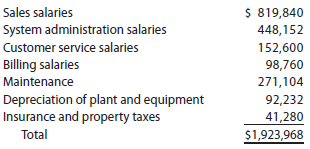

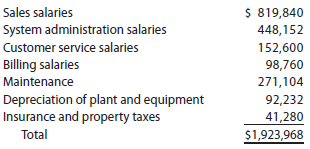

Traxonia Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using income from operations as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 2014:

The company operates three service departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the company's point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is an activity base for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is an activity base for this work. The following additional information has been gathered:

Instructions

1. Prepare quarterly income statements showing income from operations for the three divisions. Use three column headings: East, West, and Central.

2. Identify the most successful division according to the profit margin.

3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.

Traxonia Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using income from operations as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 2014:

The company operates three service departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the company's point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is an activity base for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is an activity base for this work. The following additional information has been gathered:

Instructions

1. Prepare quarterly income statements showing income from operations for the three divisions. Use three column headings: East, West, and Central.

2. Identify the most successful division according to the profit margin.

3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

Profit center responsibility reporting

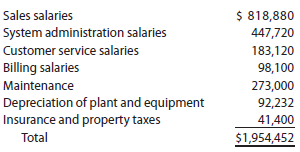

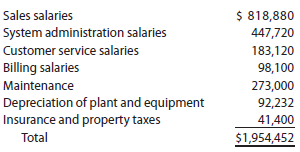

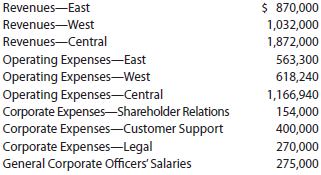

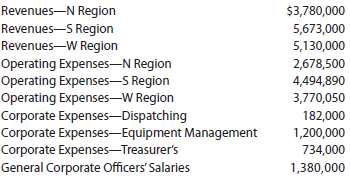

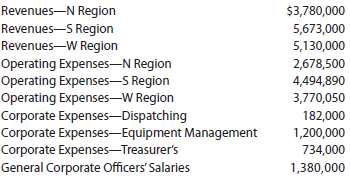

Thomas Railroad Company organizes its three divisions, the North (N), South (S), and West (W) regions, as profit centers. The chief executive officer (CEO) evaluates divisional performance, using income from operations as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 2014:

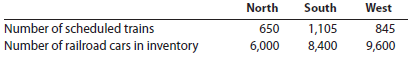

The company operates three service departments: the Dispatching Department, the Equipment Management Department, and the Treasurer's Department. The Dispatching Department manages the scheduling and releasing of completed trains. The Equipment Management Department manages the railroad cars inventories. It makes sure the right freight cars are at the right place at the right time. The Treasurer's Department conducts a variety of services for the company as a whole. The following additional information has been gathered:

Instructions

1. Prepare quarterly income statements showing income from operations for the three regions. Use three column headings: North, South, and West.

2. Identify the most successful region according to the profit margin.

3. Provide a recommendation to the CEO for a better method for evaluating the performance of the regions. In your recommendation, identify the major weakness of the present method.

Thomas Railroad Company organizes its three divisions, the North (N), South (S), and West (W) regions, as profit centers. The chief executive officer (CEO) evaluates divisional performance, using income from operations as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 2014:

The company operates three service departments: the Dispatching Department, the Equipment Management Department, and the Treasurer's Department. The Dispatching Department manages the scheduling and releasing of completed trains. The Equipment Management Department manages the railroad cars inventories. It makes sure the right freight cars are at the right place at the right time. The Treasurer's Department conducts a variety of services for the company as a whole. The following additional information has been gathered:

Instructions

1. Prepare quarterly income statements showing income from operations for the three regions. Use three column headings: North, South, and West.

2. Identify the most successful region according to the profit margin.

3. Provide a recommendation to the CEO for a better method for evaluating the performance of the regions. In your recommendation, identify the major weakness of the present method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

Evaluating divisional performance

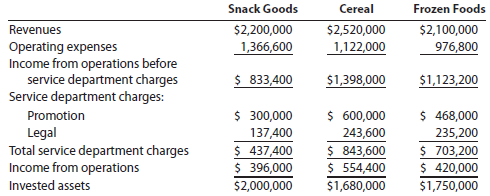

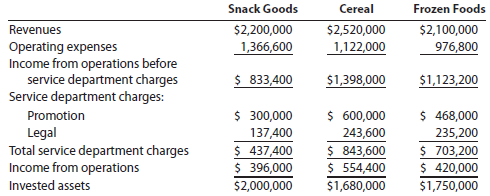

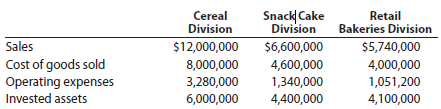

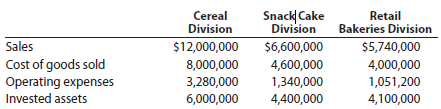

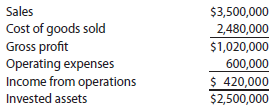

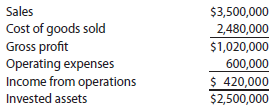

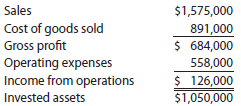

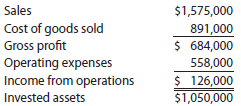

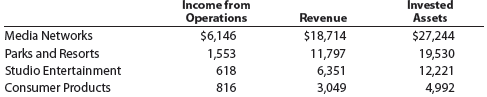

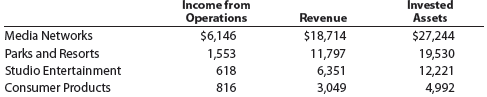

The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

1. Which division is making the best use of invested assets and should be given priority for future capital investments

2. Assuming that the minimum acceptable rate of return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions

3. Can you identify opportunities for improving the company's financial performance

The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

1. Which division is making the best use of invested assets and should be given priority for future capital investments

2. Assuming that the minimum acceptable rate of return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions

3. Can you identify opportunities for improving the company's financial performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

Weyerhaeuser developed a system that assigns service department expenses to user divisions on the basis of actual services consumed by the division. Here are a number of Weyerhaeuser's activities in its central Financial Services Department:

• Payroll

• Accounts payable

• Accounts receivable

• Database administration-report preparation For each activity, identify an activity base that could be used to charge user divisions for service.

• Payroll

• Accounts payable

• Accounts receivable

• Database administration-report preparation For each activity, identify an activity base that could be used to charge user divisions for service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

Service department charges and activity bases

For each of the following service departments, identify an activity base that could be used for charging the expense to the profit center.

a. Legal

b. Duplication services

c. Electronic data processing

d. Central purchasing

e. Telecommunications

f. Accounts receivable

For each of the following service departments, identify an activity base that could be used for charging the expense to the profit center.

a. Legal

b. Duplication services

c. Electronic data processing

d. Central purchasing

e. Telecommunications

f. Accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

Income from operations for profit center

Using the data for Kensy Company from Practice Exercise 24-2A along with the data provided below, determine the divisional income from operations for the Northeast and Pacific divisions.

Using the data for Lee Company from Practice Exercise 24-2B along with the data provided below, determine the divisional income from operations for the Retail Division and the Commercial Division.

Using the data for Kensy Company from Practice Exercise 24-2A along with the data provided below, determine the divisional income from operations for the Northeast and Pacific divisions.

Using the data for Lee Company from Practice Exercise 24-2B along with the data provided below, determine the divisional income from operations for the Retail Division and the Commercial Division.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

Divisional income statements and rate of return on investment analysis

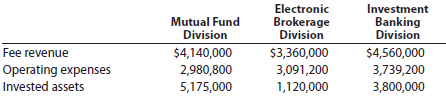

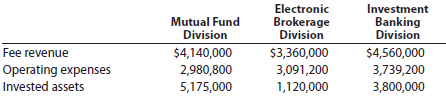

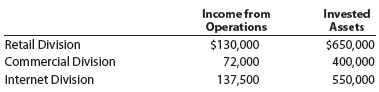

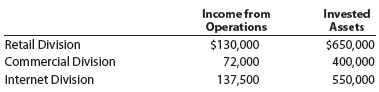

E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 2014, are as follows:

The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations.

Instructions

1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, compute the profit margin, investment turnover, and rate of return on investment for each division.

3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2) Explain.

E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 2014, are as follows:

The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations.

Instructions

1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, compute the profit margin, investment turnover, and rate of return on investment for each division.

3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2) Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

Divisional income statements and rate of return on investment analysis

The Whole Earth Food Company is a diversified food company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 2014, are as follows:

The management of The Whole Earth Food Company is evaluating each division as a basis for planning a future expansion of operations.

Instructions

1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, compute the profit margin, investment turnover, and rate of return on investment for each division.

3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2) Explain.

The Whole Earth Food Company is a diversified food company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 2014, are as follows:

The management of The Whole Earth Food Company is evaluating each division as a basis for planning a future expansion of operations.

Instructions

1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, compute the profit margin, investment turnover, and rate of return on investment for each division.

3. If available funds permit the expansion of operations of only one division, which of the divisions would you recommend for expansion, based on parts (1) and (2) Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

Evaluating division performance over time

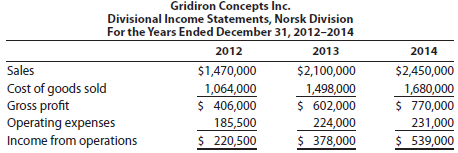

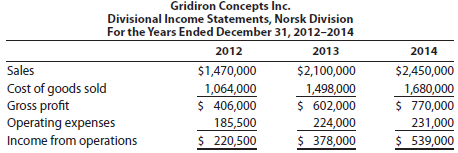

The Norsk Division of Gridiron Concepts Inc. has been experiencing revenue and profit growth during the years 2012-2014. The divisional income statements are provided below.

Assume that there are no charges from service departments. The vice president of the division, Tom Yang, is proud of his division's performance over the last three years. The president of Gridiron Concepts Inc., Anna Evans, is discussing the division's performance with Tom, as follows:

Tom: As you can see, we've had a successful three years in the Norsk Division.

Anna: I'm not too sure.

Tom: What do you mean Look at our results. Our income from operations has more than doubled, while our profit margins are improving.

Anna: I am looking at your results. However, your income statements fail to include one very important piece of information; namely, the invested assets. You have been investing a great deal of assets into the division. You had $735,000 in invested assets in 2012, $1,500,000 in 2013, and $3,500,000 in 2014.

Tom: You are right. I've needed the assets in order to upgrade our technologies and expand our operations. The additional assets are one reason we have been able to grow and improve our profit margins. I don't see that this is a problem.

Anna: The problem is that we must maintain a 15% rate of return on invested assets.

1. Determine the profit margins for the Norsk Division for 2012-2014.

2. Compute the investment turnover for the Norsk Division for 2012-2014. Round to two decimal places.

3. Compute the rate of return on investment for the Norsk Division for 2012-2014.

4. Evaluate the division's performance over the 2012-2014 time period. Why was Anna concerned about the performance

The Norsk Division of Gridiron Concepts Inc. has been experiencing revenue and profit growth during the years 2012-2014. The divisional income statements are provided below.

Assume that there are no charges from service departments. The vice president of the division, Tom Yang, is proud of his division's performance over the last three years. The president of Gridiron Concepts Inc., Anna Evans, is discussing the division's performance with Tom, as follows:

Tom: As you can see, we've had a successful three years in the Norsk Division.

Anna: I'm not too sure.

Tom: What do you mean Look at our results. Our income from operations has more than doubled, while our profit margins are improving.

Anna: I am looking at your results. However, your income statements fail to include one very important piece of information; namely, the invested assets. You have been investing a great deal of assets into the division. You had $735,000 in invested assets in 2012, $1,500,000 in 2013, and $3,500,000 in 2014.

Tom: You are right. I've needed the assets in order to upgrade our technologies and expand our operations. The additional assets are one reason we have been able to grow and improve our profit margins. I don't see that this is a problem.

Anna: The problem is that we must maintain a 15% rate of return on invested assets.

1. Determine the profit margins for the Norsk Division for 2012-2014.

2. Compute the investment turnover for the Norsk Division for 2012-2014. Round to two decimal places.

3. Compute the rate of return on investment for the Norsk Division for 2012-2014.

4. Evaluate the division's performance over the 2012-2014 time period. Why was Anna concerned about the performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

What is the major shortcoming of using income from operations as a performance measure for investment centers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

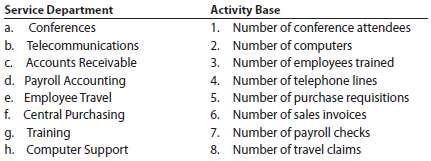

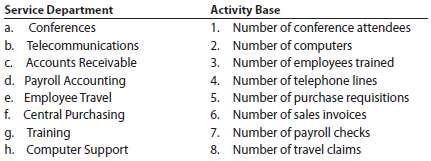

Activity bases for service department charges

For each of the following service departments, select the activity base listed that is most appropriate for charging service expenses to responsible units.

For each of the following service departments, select the activity base listed that is most appropriate for charging service expenses to responsible units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

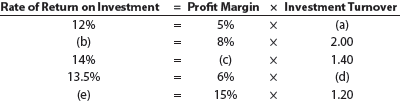

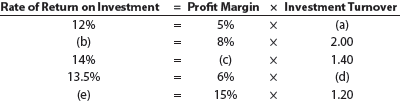

Profit margin, investment turnover, and ROI

McBreen Company has income from operations of $96,000, invested assets of $400,000, and sales of $1,200,000. Use the DuPont formula to compute the rate of return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the rate of return on investment.

Briggs Company has income from operations of $36,000, invested assets of $180,000, and sales of $720,000. Use the DuPont formula to compute the rate of return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the rate of return on investment.

McBreen Company has income from operations of $96,000, invested assets of $400,000, and sales of $1,200,000. Use the DuPont formula to compute the rate of return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the rate of return on investment.

Briggs Company has income from operations of $36,000, invested assets of $180,000, and sales of $720,000. Use the DuPont formula to compute the rate of return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the rate of return on investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

Effect of proposals on divisional performance

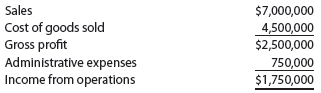

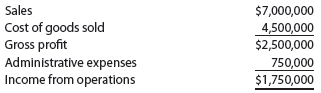

A condensed income statement for the Commercial Division of Maxell Manufacturing Inc.for the year ended December 31, 2014, is as follows:

Assume that the Commercial Division received no charges from service departments. The president of Maxell Manufacturing has indicated that the division's rate of return on a $2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering the following three proposals:

Proposal 1: Transfer equipment with a book value of $312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $105,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged.

Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $560,000. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,875,000 for the year.

Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $595,000, reduce cost of goods sold by $406,700, and reduce operating expenses by $175,000. Assets of $1,338,000 would be transferred to other divisions at no gain or loss.

Instructions

1. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for the Commercial Division for the past year.

2. Prepare condensed estimated income statements and compute the invested assets for each proposal.

3. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each proposal.

4. Which of the three proposals would meet the required 21% rate of return on investment

5. If the Commercial Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 21% rate of return on investment Round to one decimal place.

A condensed income statement for the Commercial Division of Maxell Manufacturing Inc.for the year ended December 31, 2014, is as follows:

Assume that the Commercial Division received no charges from service departments. The president of Maxell Manufacturing has indicated that the division's rate of return on a $2,500,000 investment must be increased to at least 21% by the end of the next year if operations are to continue. The division manager is considering the following three proposals:

Proposal 1: Transfer equipment with a book value of $312,500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $105,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged.

Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $560,000. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,875,000 for the year.

Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $595,000, reduce cost of goods sold by $406,700, and reduce operating expenses by $175,000. Assets of $1,338,000 would be transferred to other divisions at no gain or loss.

Instructions

1. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for the Commercial Division for the past year.

2. Prepare condensed estimated income statements and compute the invested assets for each proposal.

3. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each proposal.

4. Which of the three proposals would meet the required 21% rate of return on investment

5. If the Commercial Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 21% rate of return on investment Round to one decimal place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

Effect of proposals on divisional performance

A condensed income statement for the Electronics Division of Gihbli Industries Inc. for the year ended December 31, 2014, is as follows:

Assume that the Electronics Division received no charges from service departments. The president of Gihbli Industries Inc. has indicated that the division's rate of return on a $1,050,000 investment must be increased to at least 20% by the end of the next year if operations are to continue. The division manager is considering the following three proposals:

Proposal 1: Transfer equipment with a book value of $300,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would be less than the amount of depreciation expense on the old equipment by $31,400. This decrease in expense would be included as part of the cost of goods sold. Sales would remain unchanged.

Proposal 2: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $180,000, reduce cost of goods sold by $119,550, and reduce operating expenses by $60,000. Assets of $112,500 would be transferred to other divisions at no gain or loss.

Proposal 3: Purchase new and more efficient machinery and thereby reduce the cost of goods sold by $189,000. Sales would remain unchanged, and the old machinery, which has no remaining book value, would be scrapped at no gain or loss. The new machinery would increase invested assets by $918,750 for the year.

Instructions

1. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for the Electronics Division for the past year. Round investment turnover and the rate of return to one decimal place.

2. Prepare condensed estimated income statements and compute the invested assets for each proposal.

3. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each proposal.

4. Which of the three proposals would meet the required 20% rate of return on investment

5. If the Electronics Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 20% rate of return on investment Round to one decimal place.

A condensed income statement for the Electronics Division of Gihbli Industries Inc. for the year ended December 31, 2014, is as follows:

Assume that the Electronics Division received no charges from service departments. The president of Gihbli Industries Inc. has indicated that the division's rate of return on a $1,050,000 investment must be increased to at least 20% by the end of the next year if operations are to continue. The division manager is considering the following three proposals:

Proposal 1: Transfer equipment with a book value of $300,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would be less than the amount of depreciation expense on the old equipment by $31,400. This decrease in expense would be included as part of the cost of goods sold. Sales would remain unchanged.

Proposal 2: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $180,000, reduce cost of goods sold by $119,550, and reduce operating expenses by $60,000. Assets of $112,500 would be transferred to other divisions at no gain or loss.

Proposal 3: Purchase new and more efficient machinery and thereby reduce the cost of goods sold by $189,000. Sales would remain unchanged, and the old machinery, which has no remaining book value, would be scrapped at no gain or loss. The new machinery would increase invested assets by $918,750 for the year.

Instructions

1. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for the Electronics Division for the past year. Round investment turnover and the rate of return to one decimal place.

2. Prepare condensed estimated income statements and compute the invested assets for each proposal.

3. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each proposal.

4. Which of the three proposals would meet the required 20% rate of return on investment

5. If the Electronics Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 20% rate of return on investment Round to one decimal place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

Evaluating division performance

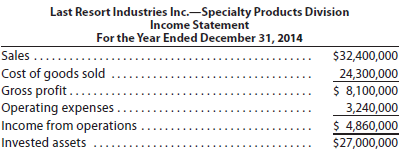

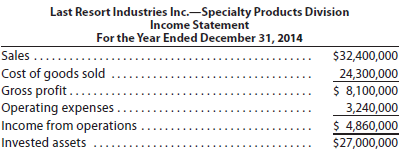

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no service department charges, is as follows:

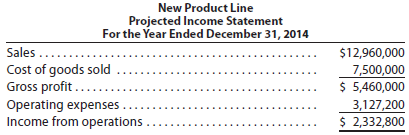

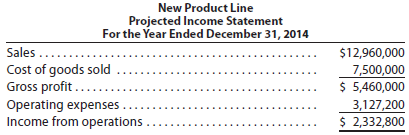

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A projected income statement for the new product line is as follows:

The Specialty Products Division currently has $27,000,000 in invested assets, and Last Resort Industries Inc.'s overall rate of return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional rate of return on investment. A bonus is paid, in $8,000 increments, for each whole percentage point that the division's rate of return on investment exceeds the company average.

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons why the Specialty Products Division manager rejected the new product line.

1. Determine the rate of return on investment for the Specialty Products Division for the past year.

2. Determine the Specialty Products Division manager's bonus for the past year.

3. Determine the estimated rate of return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places.

4. Why might the manager of the Specialty Products Division decide to reject the new product line Support your answer by determining the projected rate of return on investment for 2014, assuming that the new product line was launched in the Specialty Products Division, and 2014 actual operating results were similar to those of 2013.

5. Can you suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and rate of return on investment

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no service department charges, is as follows:

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A projected income statement for the new product line is as follows:

The Specialty Products Division currently has $27,000,000 in invested assets, and Last Resort Industries Inc.'s overall rate of return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional rate of return on investment. A bonus is paid, in $8,000 increments, for each whole percentage point that the division's rate of return on investment exceeds the company average.

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons why the Specialty Products Division manager rejected the new product line.

1. Determine the rate of return on investment for the Specialty Products Division for the past year.

2. Determine the Specialty Products Division manager's bonus for the past year.

3. Determine the estimated rate of return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places.

4. Why might the manager of the Specialty Products Division decide to reject the new product line Support your answer by determining the projected rate of return on investment for 2014, assuming that the new product line was launched in the Specialty Products Division, and 2014 actual operating results were similar to those of 2013.

5. Can you suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and rate of return on investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a decentralized company in which the divisions are organized as investment centers, how could a division be considered the least profitable even though it earned the largest amount of income from operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

Service department charges

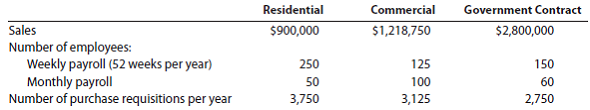

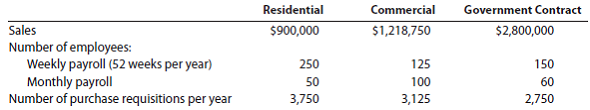

In divisional income statements prepared for Wilborne Construction Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll checks, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $119,280, and the Purchasing Department had expenses of $57,750 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records:

a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division.

b. Using the activity base information in (a), determine the annual amount of payroll and purchasing costs charged back to the Residential, Commercial, and Government Contract divisions from payroll and purchasing services.

c. Why does the Residential Division have a larger service department charge than the other two divisions, even though its sales are lower

In divisional income statements prepared for Wilborne Construction Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll checks, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $119,280, and the Purchasing Department had expenses of $57,750 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records:

a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division.

b. Using the activity base information in (a), determine the annual amount of payroll and purchasing costs charged back to the Residential, Commercial, and Government Contract divisions from payroll and purchasing services.

c. Why does the Residential Division have a larger service department charge than the other two divisions, even though its sales are lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

Residual income

The Consumer Division of Hernandez Company has income from operations of $90,000 and assets of $450,000. The minimum acceptable rate of return on assets is 10%. What is the residual income for the division

The Commercial Division of Herring Company has income from operations of $420,000 and assets of $910,000. The minimum acceptable rate of return on assets is 8%. What is the residual income for the division

The Consumer Division of Hernandez Company has income from operations of $90,000 and assets of $450,000. The minimum acceptable rate of return on assets is 10%. What is the residual income for the division

The Commercial Division of Herring Company has income from operations of $420,000 and assets of $910,000. The minimum acceptable rate of return on assets is 8%. What is the residual income for the division

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

Divisional performance analysis and evaluation

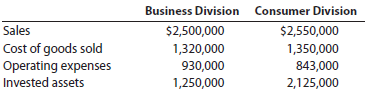

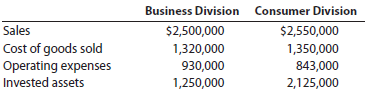

The vice president of operations of Pavone Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows:

Instructions

1. Prepare condensed divisional income statements for the year ended December 31, 2014, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each division.

3. If management desires a minimum acceptable rate of return of 17%, determine the residual income for each division.

4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).

The vice president of operations of Pavone Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows:

Instructions

1. Prepare condensed divisional income statements for the year ended December 31, 2014, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each division.

3. If management desires a minimum acceptable rate of return of 17%, determine the residual income for each division.

4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

Divisional performance analysis and evaluation

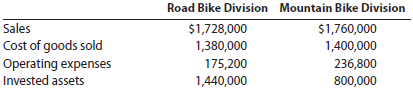

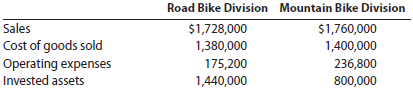

The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows:

Instructions

1. Prepare condensed divisional income statements for the year ended December 31, 2014, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each division.

3. If management's minimum acceptable rate of return is 10%, determine the residual income for each division.

4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).

The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows:

Instructions

1. Prepare condensed divisional income statements for the year ended December 31, 2014, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each division.

3. If management's minimum acceptable rate of return is 10%, determine the residual income for each division.

4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

How does using the rate of return on investment facilitate comparability between divisions of decentralized companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

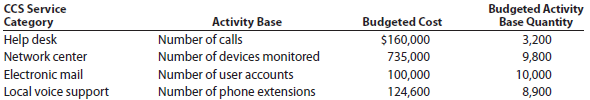

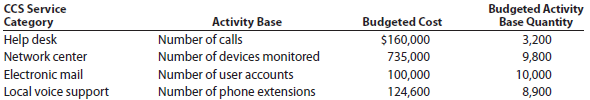

Service department charges and activity bases

Middler Corporation, a manufacturer of electronics and communications systems, uses a service department charge system to charge profit centers with Computing and Communications Services (CCS) service department costs. The following table identifies an abbreviated list of service categories and activity bases used by the CCS department. The table also includes some assumed cost and activity base quantity information for each service for October.

One of the profit centers for Middler Corporation is the Communication Systems (COMM) sector. Assume the following information for the COMM sector:

• The sector has 5,200 employees, of whom 25% are office employees.

• All the office employees have a phone, and 96% of them have a computer on the network.

• One hundred percent of the employees with a computer also have an e-mail account.

• The average number of help desk calls for October was 1.5 calls per individual with a computer.

• There are 600 additional printers, servers, and peripherals on the network beyond the personal computers.

a. Determine the service charge rate for the four CCS service categories for October.

b. Determine the charges to the COMM sector for the four CCS service categories for October.

Middler Corporation, a manufacturer of electronics and communications systems, uses a service department charge system to charge profit centers with Computing and Communications Services (CCS) service department costs. The following table identifies an abbreviated list of service categories and activity bases used by the CCS department. The table also includes some assumed cost and activity base quantity information for each service for October.

One of the profit centers for Middler Corporation is the Communication Systems (COMM) sector. Assume the following information for the COMM sector:

• The sector has 5,200 employees, of whom 25% are office employees.

• All the office employees have a phone, and 96% of them have a computer on the network.

• One hundred percent of the employees with a computer also have an e-mail account.

• The average number of help desk calls for October was 1.5 calls per individual with a computer.

• There are 600 additional printers, servers, and peripherals on the network beyond the personal computers.

a. Determine the service charge rate for the four CCS service categories for October.

b. Determine the charges to the COMM sector for the four CCS service categories for October.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

Transfer pricing

The materials used by the North Division of Horton Company are currently purchased from outside suppliers at $60 per unit. These same materials are produced by Horton's South Division. The South Division can produce the materials needed by the North Division at a variable cost of $42 per unit. The division is currently producing 200,000 units and has capacity of 250,000 units. The two divisions have recently negotiated a transfer price of $52 per unit for 30,000 units. By how much will each division's income increase as a result of this transfer

The materials used by the Multinomah Division of Isbister Company are currently purchased from outside suppliers at $90 per unit. These same materials are produced by the Pembroke Division. The Pembroke Division can produce the materials needed by the Multinomah Division at a variable cost of $75 per unit. The division is currently producing 120,000 units and has capacity of 150,000 units. The two divisions have recently negotiated a transfer price of $82 per unit for 15,000 units. By how much will each division's income increase as a result of this transfer

The materials used by the North Division of Horton Company are currently purchased from outside suppliers at $60 per unit. These same materials are produced by Horton's South Division. The South Division can produce the materials needed by the North Division at a variable cost of $42 per unit. The division is currently producing 200,000 units and has capacity of 250,000 units. The two divisions have recently negotiated a transfer price of $52 per unit for 30,000 units. By how much will each division's income increase as a result of this transfer

The materials used by the Multinomah Division of Isbister Company are currently purchased from outside suppliers at $90 per unit. These same materials are produced by the Pembroke Division. The Pembroke Division can produce the materials needed by the Multinomah Division at a variable cost of $75 per unit. The division is currently producing 120,000 units and has capacity of 150,000 units. The two divisions have recently negotiated a transfer price of $82 per unit for 15,000 units. By how much will each division's income increase as a result of this transfer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

Transfer pricing

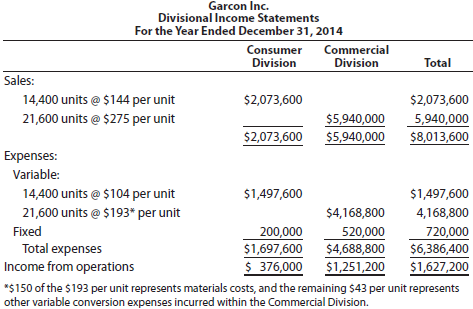

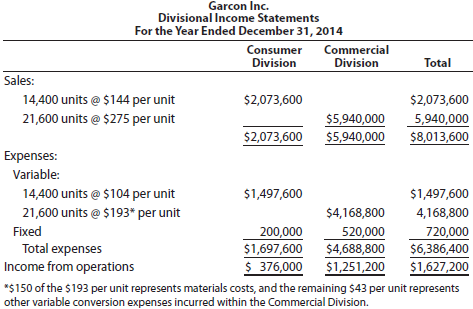

Garcon Inc. manufactures electronic products, with two operating divisions, the Consumer and Commercial divisions. Condensed divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are as follows:

The Consumer Division is presently producing 14,400 units out of a total capacity of 17,280 units. Materials used in producing the Commercial Division's product are currently purchased from outside suppliers at a price of $150 per unit. The Consumer Division is able to produce the materials used by the Commercial Division. Except for the possible transfer of materials between divisions, no changes are expected in sales and expenses.

Instructions

1. Would the market price of $150 per unit be an appropriate transfer price for Garcon Inc. Explain.

2. If the Commercial Division purchases 2,880 units from the Consumer Division, rather than externally, at a negotiated transfer price of $115 per unit, how much would the income from operations of each division and the total company income from operations increase

3. Prepare condensed divisional income statements for Garcon Inc. based on the data in part (2).

4. If a transfer price of $126 per unit is negotiated, how much would the income from operations of each division and the total company income from operations increase

5. a. What is the range of possible negotiated transfer prices that would be acceptable for Garcon Inc.

b. Assuming that the managers of the two divisions cannot agree on a transfer price, what price would you suggest as the transfer price

Garcon Inc. manufactures electronic products, with two operating divisions, the Consumer and Commercial divisions. Condensed divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are as follows:

The Consumer Division is presently producing 14,400 units out of a total capacity of 17,280 units. Materials used in producing the Commercial Division's product are currently purchased from outside suppliers at a price of $150 per unit. The Consumer Division is able to produce the materials used by the Commercial Division. Except for the possible transfer of materials between divisions, no changes are expected in sales and expenses.

Instructions

1. Would the market price of $150 per unit be an appropriate transfer price for Garcon Inc. Explain.

2. If the Commercial Division purchases 2,880 units from the Consumer Division, rather than externally, at a negotiated transfer price of $115 per unit, how much would the income from operations of each division and the total company income from operations increase

3. Prepare condensed divisional income statements for Garcon Inc. based on the data in part (2).

4. If a transfer price of $126 per unit is negotiated, how much would the income from operations of each division and the total company income from operations increase

5. a. What is the range of possible negotiated transfer prices that would be acceptable for Garcon Inc.

b. Assuming that the managers of the two divisions cannot agree on a transfer price, what price would you suggest as the transfer price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

Transfer pricing

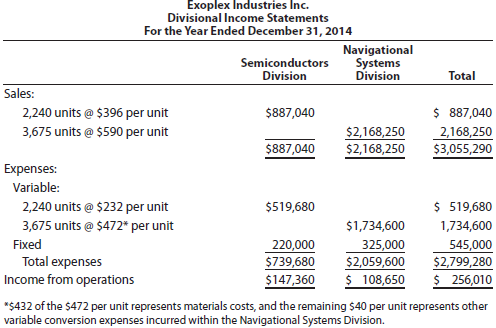

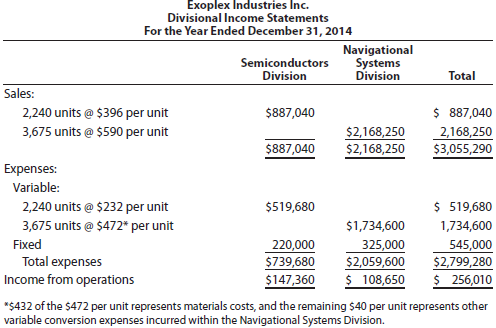

Exoplex Industries Inc. is a diversified aerospace company, including two operating divisions, Semiconductors and Navigational Systems divisions. Condensed divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are as follows:

The Semiconductors Division is presently producing 2,240 units out of a total capacity of 2,820 units. Materials used in producing the Navigational Systems Division's product are currently purchased from outside suppliers at a price of $432 per unit. The Semiconductors Division is able to produce the components used by the Navigational Systems Division. Except for the possible transfer of materials between divisions, no changes are expected in sales and expenses.

Instructions

1. Would the market price of $432 per unit be an appropriate transfer price for Exoplex Industries Inc. Explain.

2. If the Navigational Systems Division purchases 580 units from the Semiconductors Division, rather than externally, at a negotiated transfer price of $310 per unit, how much would the income from operations of each division and total company income from operations increase

3. Prepare condensed divisional income statements for Exoplex Industries Inc. based on the data in part (2).

4. If a transfer price of $340 per unit is negotiated, how much would the income from operations of each division and total company income from operations increase

5. a. What is the range of possible negotiated transfer prices that would be acceptable for Exoplex Industries Inc.

b. Assuming that the managers of the two divisions cannot agree on a transfer price, what price would you suggest as the transfer price

Exoplex Industries Inc. is a diversified aerospace company, including two operating divisions, Semiconductors and Navigational Systems divisions. Condensed divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are as follows:

The Semiconductors Division is presently producing 2,240 units out of a total capacity of 2,820 units. Materials used in producing the Navigational Systems Division's product are currently purchased from outside suppliers at a price of $432 per unit. The Semiconductors Division is able to produce the components used by the Navigational Systems Division. Except for the possible transfer of materials between divisions, no changes are expected in sales and expenses.

Instructions

1. Would the market price of $432 per unit be an appropriate transfer price for Exoplex Industries Inc. Explain.

2. If the Navigational Systems Division purchases 580 units from the Semiconductors Division, rather than externally, at a negotiated transfer price of $310 per unit, how much would the income from operations of each division and total company income from operations increase

3. Prepare condensed divisional income statements for Exoplex Industries Inc. based on the data in part (2).

4. If a transfer price of $340 per unit is negotiated, how much would the income from operations of each division and total company income from operations increase

5. a. What is the range of possible negotiated transfer prices that would be acceptable for Exoplex Industries Inc.

b. Assuming that the managers of the two divisions cannot agree on a transfer price, what price would you suggest as the transfer price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

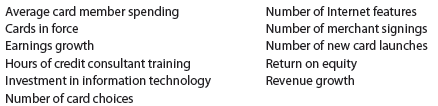

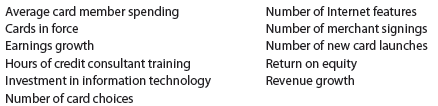

Why would a firm use a balanced scorecard in evaluating divisional performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

Divisional income statements with service department charges

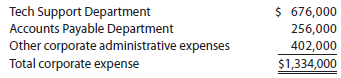

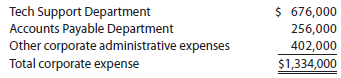

Van Emburgh Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Accounts Payable. The corporate expenses for the year ended December 31, 2014, are as follows:

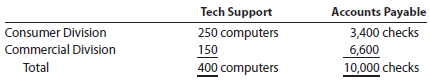

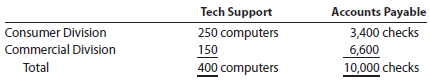

The other corporate administrative expenses include officers' salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Accounts Payable Department charges divisions for services, based on the number of checks issued for each department. The usage of service by the two divisions is as follows:

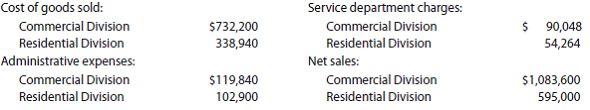

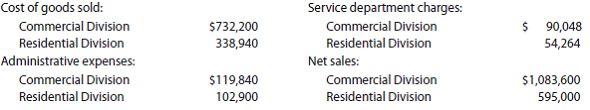

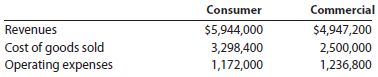

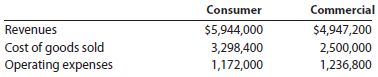

The service department charges of the Tech Support Department and the Accounts Payable Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows:

Prepare the divisional income statements for the two divisions.

Van Emburgh Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Accounts Payable. The corporate expenses for the year ended December 31, 2014, are as follows:

The other corporate administrative expenses include officers' salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Accounts Payable Department charges divisions for services, based on the number of checks issued for each department. The usage of service by the two divisions is as follows:

The service department charges of the Tech Support Department and the Accounts Payable Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows:

Prepare the divisional income statements for the two divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is the objective of transfer pricing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

Corrections to service department charges

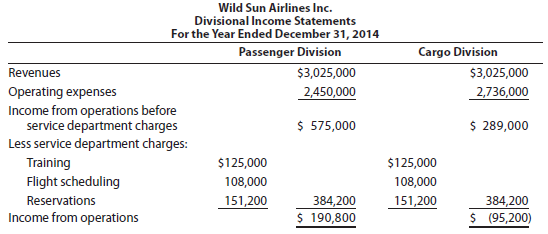

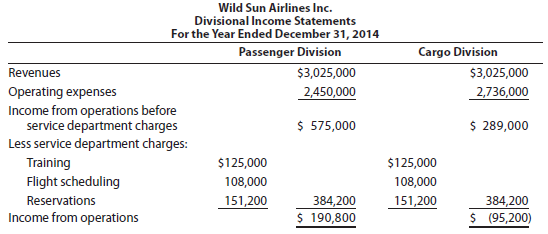

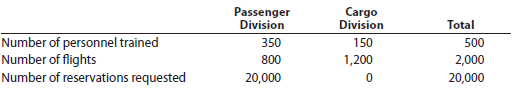

Wild Sun Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared:

The service department charge rate for the service department costs was based on revenues. Since the revenues of the two divisions were the same, the service department charges to each division were also the same.

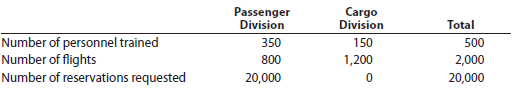

The following additional information is available:

a. Does the income from operations for the two divisions accurately measure performance Explain.

b. Correct the divisional income statements, using the activity bases provided above in revising the service department charges.

Wild Sun Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared:

The service department charge rate for the service department costs was based on revenues. Since the revenues of the two divisions were the same, the service department charges to each division were also the same.

The following additional information is available:

a. Does the income from operations for the two divisions accurately measure performance Explain.

b. Correct the divisional income statements, using the activity bases provided above in revising the service department charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

When is the negotiated price approach preferred over the market price approach in setting transfer prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

Profit center responsibility reporting

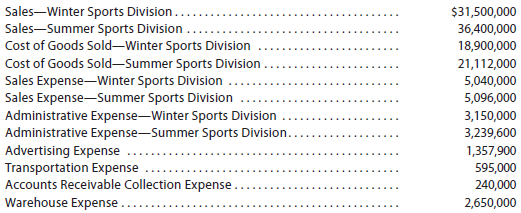

Full Throttle Sporting Goods Co. operates two divisions-the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 2014, the end of the current fiscal year, after all adjustments, including those for inventories, were recorded and posted:

The bases to be used in allocating expenses, together with other essential information, are as follows: