Deck 7: Cost Allocation: Theory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/32

العب

ملء الشاشة (f)

Deck 7: Cost Allocation: Theory

1

Phonetex

Phonetex is a medium-size manufacturer of telephone sets and switching equipment. Its primary business is government contracts, especially defense contracts, which are very profitable. The company has two plants: Southern and Westbury. The larger plant, Southern, is running at capacity producing a phone system for a new missile installation. Existing government contracts will require Southern to operate at capacity for the next nine months. The missile contract is a firm, fixed-price contract. Part of the contract specifies that 3,000 phones will be produced to meet government specifications. The price paid per phone is $300.

The second Phonetex plant, Westbury, is a small, old facility acquired two years ago to produce residential phone systems. Phonetex feared that defense work was cyclical, so to stabilize earnings, a line of residential systems was developed at the small plant. In the event that defense work deteriorated, the excess capacity at Southern could be used to produce residential systems. However, just the opposite has happened. The current recession has temporarily depressed the residential business. Although Westbury is losing money ($10,000 per month), top management considers this an investment. Westbury has developed a line of systems that are reasonably well received. Part of its workforce has already been laid off. It has a very good workforce remaining, with many specialized and competent supervisors, engineers, and skilled craftspeople. Another 20 percent of Westbury's workforce could be cut without affecting output. Current operations are meeting the reduced demand. If demand does not increase in the next three months, this 20 percent will have to be cut.

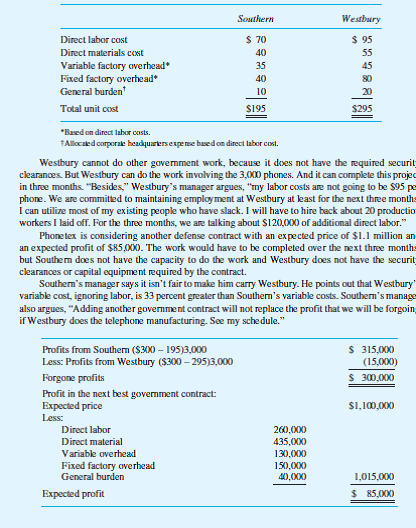

The plant manager at Westbury has tried to convince top management to shift the missile contract phones over to his plant. Even though his total cost to manufacture the phones is higher than at Southern, he argues that this will free up some excess capacity at Southern to add more government work. The unit cost data for the 3,000 phones are as follows:

Required :

Top management has reviewed the Southern manager's data and believes his cost estimates on the new contract to be accurate. Should Phonetex shift the 3,000 phones to Westbury and take the new contract or not? Prepare an analysis supporting your conclusions.

Phonetex is a medium-size manufacturer of telephone sets and switching equipment. Its primary business is government contracts, especially defense contracts, which are very profitable. The company has two plants: Southern and Westbury. The larger plant, Southern, is running at capacity producing a phone system for a new missile installation. Existing government contracts will require Southern to operate at capacity for the next nine months. The missile contract is a firm, fixed-price contract. Part of the contract specifies that 3,000 phones will be produced to meet government specifications. The price paid per phone is $300.

The second Phonetex plant, Westbury, is a small, old facility acquired two years ago to produce residential phone systems. Phonetex feared that defense work was cyclical, so to stabilize earnings, a line of residential systems was developed at the small plant. In the event that defense work deteriorated, the excess capacity at Southern could be used to produce residential systems. However, just the opposite has happened. The current recession has temporarily depressed the residential business. Although Westbury is losing money ($10,000 per month), top management considers this an investment. Westbury has developed a line of systems that are reasonably well received. Part of its workforce has already been laid off. It has a very good workforce remaining, with many specialized and competent supervisors, engineers, and skilled craftspeople. Another 20 percent of Westbury's workforce could be cut without affecting output. Current operations are meeting the reduced demand. If demand does not increase in the next three months, this 20 percent will have to be cut.

The plant manager at Westbury has tried to convince top management to shift the missile contract phones over to his plant. Even though his total cost to manufacture the phones is higher than at Southern, he argues that this will free up some excess capacity at Southern to add more government work. The unit cost data for the 3,000 phones are as follows:

Required :

Top management has reviewed the Southern manager's data and believes his cost estimates on the new contract to be accurate. Should Phonetex shift the 3,000 phones to Westbury and take the new contract or not? Prepare an analysis supporting your conclusions.

Manufacturing Overheads:

These are the expenses incurred by the company or the organization during the course of manufacturing of the product. These can be direct or indirect.

Variable Costs:

These cost changes with the level of output. Variable costs are considered relevant under relevant costing.

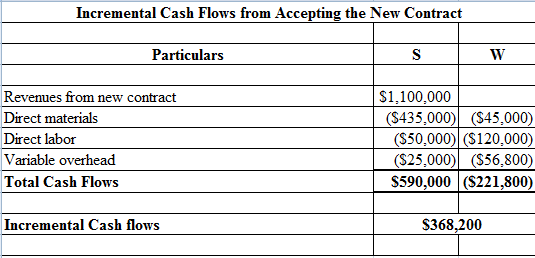

In the present case P Company manufactures phones and owned two plants namely S and W. Plant S is also engaged in some government work and unit cost of the phone under S plant is $195 which is $295 under W plant.

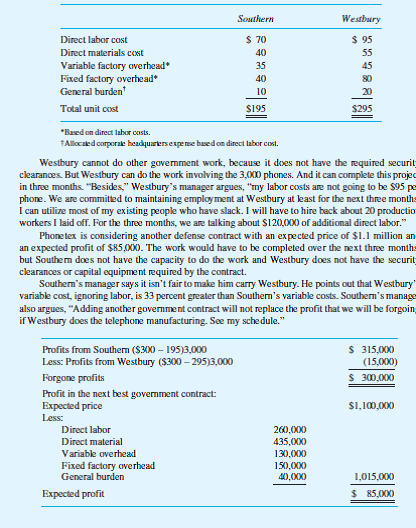

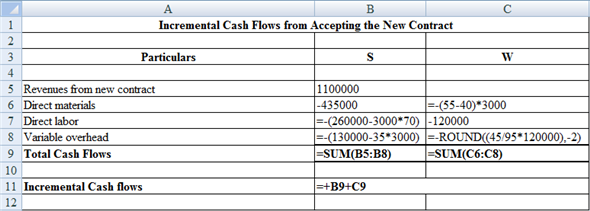

In case the 3,000 phones get manufactured under plant S then its opportunity cost is $85,000. On the other hand plant, W contains some sunk cost in form of labor cost and variable overheads as these costs can't get reduced and only further labor cost is relevant for the calculation of incremental cash flows.

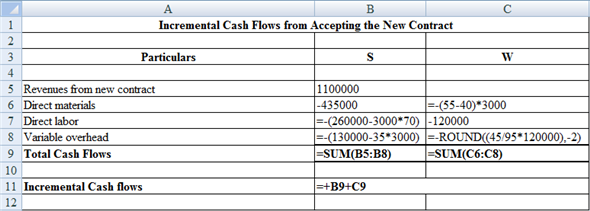

Prepare a schedule to compute the incremental cash flows using MS Excel, which will be shown as follows:

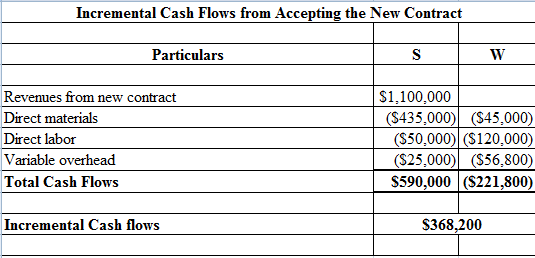

The result of above will be as follows:

The result of above will be as follows:

The incremental cash flows from making of 3,000 phones under plant S will be $368,200.

The incremental cash flows from making of 3,000 phones under plant S will be $368,200.

These are the expenses incurred by the company or the organization during the course of manufacturing of the product. These can be direct or indirect.

Variable Costs:

These cost changes with the level of output. Variable costs are considered relevant under relevant costing.

In the present case P Company manufactures phones and owned two plants namely S and W. Plant S is also engaged in some government work and unit cost of the phone under S plant is $195 which is $295 under W plant.

In case the 3,000 phones get manufactured under plant S then its opportunity cost is $85,000. On the other hand plant, W contains some sunk cost in form of labor cost and variable overheads as these costs can't get reduced and only further labor cost is relevant for the calculation of incremental cash flows.

Prepare a schedule to compute the incremental cash flows using MS Excel, which will be shown as follows:

The result of above will be as follows:

The result of above will be as follows: The incremental cash flows from making of 3,000 phones under plant S will be $368,200.

The incremental cash flows from making of 3,000 phones under plant S will be $368,200. 2

MRI

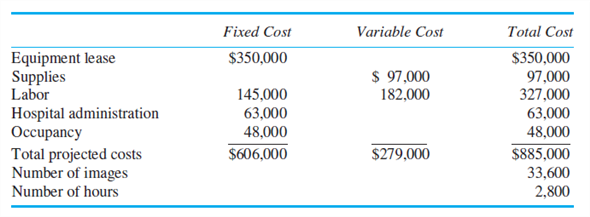

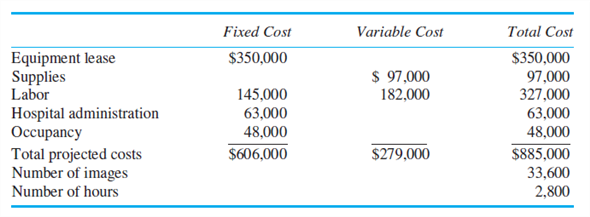

Magnetic resonance imaging (MRI) is a noninvasive medical diagnostic device that uses magnets and radio waves to produce a picture of an area under investigation inside the body. A patient is positioned in the MRI and a series of images of the area (say, the knee or abdomen) is generated. Radiologists then read the resulting image to diagnose cancers and internal injuries. The MRI at Memorial Hospital has the following projected operating data for next year.

Memorial Hospital serves two types of patients: elderly, whose hospital bills are covered by governments (state and federal reimbursement), and other patients, who are covered by private insurance (such as Blue Cross and Blue Shield). About one-third of Memorial's patients are elderly. Elderly patients using MRI services normally require more time per MRI image. The typical elderly patient requires one hour of MRI time to produce the 10 MRI images needed for the radiologist. Other patients only require about 45 minutes per patient to generate the 10 MRI images.

Governments reimburse MRI imaging based on the reported cost by the hospital. Reimbursable costs include both the fixed and variable costs of providing MRIs. Private insurers reimburse MRI imaging based on a standard fee schedule set by the insurance company. These fee schedules are independent of the hospitals' cost of providing MRI services.

Required:

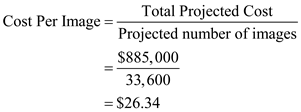

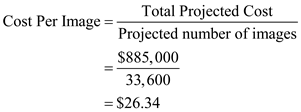

a. Calculate Memorial Hospital's projected cost per MRI image.

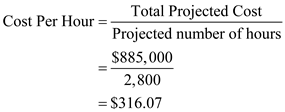

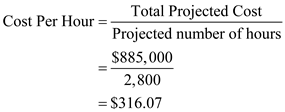

b. Calculate Memorial Hospital's projected cost per hour of MRI time.

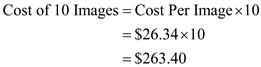

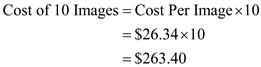

c. Suppose a typical elderly patient at Memorial Hospital requires 10 MRI images and takes one hour of MRI time. Calculate the cost of providing this service if Memorial Hospital calculates MRI costs based on cost per image.

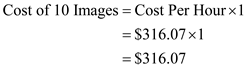

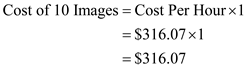

d. Suppose a typical elderly patient at Memorial Hospital requires 10 MRI images and takes one hour of MRI time. Calculate the cost of providing this service if Memorial Hospital calculates MRI costs based on cost per hour of MRI time.

e. Should Memorial Hospital calculate the cost of MRI services based on the cost per image or the cost per MRI hour? Explain why.

Magnetic resonance imaging (MRI) is a noninvasive medical diagnostic device that uses magnets and radio waves to produce a picture of an area under investigation inside the body. A patient is positioned in the MRI and a series of images of the area (say, the knee or abdomen) is generated. Radiologists then read the resulting image to diagnose cancers and internal injuries. The MRI at Memorial Hospital has the following projected operating data for next year.

Memorial Hospital serves two types of patients: elderly, whose hospital bills are covered by governments (state and federal reimbursement), and other patients, who are covered by private insurance (such as Blue Cross and Blue Shield). About one-third of Memorial's patients are elderly. Elderly patients using MRI services normally require more time per MRI image. The typical elderly patient requires one hour of MRI time to produce the 10 MRI images needed for the radiologist. Other patients only require about 45 minutes per patient to generate the 10 MRI images.

Governments reimburse MRI imaging based on the reported cost by the hospital. Reimbursable costs include both the fixed and variable costs of providing MRIs. Private insurers reimburse MRI imaging based on a standard fee schedule set by the insurance company. These fee schedules are independent of the hospitals' cost of providing MRI services.

Required:

a. Calculate Memorial Hospital's projected cost per MRI image.

b. Calculate Memorial Hospital's projected cost per hour of MRI time.

c. Suppose a typical elderly patient at Memorial Hospital requires 10 MRI images and takes one hour of MRI time. Calculate the cost of providing this service if Memorial Hospital calculates MRI costs based on cost per image.

d. Suppose a typical elderly patient at Memorial Hospital requires 10 MRI images and takes one hour of MRI time. Calculate the cost of providing this service if Memorial Hospital calculates MRI costs based on cost per hour of MRI time.

e. Should Memorial Hospital calculate the cost of MRI services based on the cost per image or the cost per MRI hour? Explain why.

Variable and Fixed Cost

There are two components to the cost of a product from the point of the manufacturer. One is the fixed cost which remains fixed at any level of sales and one is the variable cost which is directly propionate to the level of sales.

If the quantity increases variable cost increases and quantity decreases the variable cost also decreases. Variable costs are relevant cost and fixed cost are irrelevant costs.

a.In the present case, M Hospital has projected its fixed cost for $606,000, variable cost for $279,000 and number of hours for 2,800. The majority of patients of M Hospital belongs to privately insured individuals.

Compute the projected cost per image with the help of the following equation, which is as follows:

Hence, the projected cost per image is

Hence, the projected cost per image is

.

.

b.Compute the projected cost per hour with the help of the following equation, which is as follows:

Hence, the projected cost per hour is

Hence, the projected cost per hour is

.

.

c

Compute the projected cost of 10 images in one hour on cost per image basis with the help of the following equation, which is as follows:

Hence, the projected cost of 10 images in one hour on cost per image basis is

Hence, the projected cost of 10 images in one hour on cost per image basis is

.

.

d

Compute the projected cost of 10 images in one hour on cost per hour basis with the help of the following equation, which is as follows:

Hence, the projected cost of 10 images in one hour on cost per hour basis is

Hence, the projected cost of 10 images in one hour on cost per hour basis is

.

.

e.Since the amount of MRI images of patients is get reimbursed either by the government or by insurance company hence M hospital should go with the cost of the image on per hour basis as it will increase the collection of the hospital without affecting the pockets of patients.

There are two components to the cost of a product from the point of the manufacturer. One is the fixed cost which remains fixed at any level of sales and one is the variable cost which is directly propionate to the level of sales.

If the quantity increases variable cost increases and quantity decreases the variable cost also decreases. Variable costs are relevant cost and fixed cost are irrelevant costs.

a.In the present case, M Hospital has projected its fixed cost for $606,000, variable cost for $279,000 and number of hours for 2,800. The majority of patients of M Hospital belongs to privately insured individuals.

Compute the projected cost per image with the help of the following equation, which is as follows:

Hence, the projected cost per image is

Hence, the projected cost per image is .

. b.Compute the projected cost per hour with the help of the following equation, which is as follows:

Hence, the projected cost per hour is

Hence, the projected cost per hour is .

. c

Compute the projected cost of 10 images in one hour on cost per image basis with the help of the following equation, which is as follows:

Hence, the projected cost of 10 images in one hour on cost per image basis is

Hence, the projected cost of 10 images in one hour on cost per image basis is .

. d

Compute the projected cost of 10 images in one hour on cost per hour basis with the help of the following equation, which is as follows:

Hence, the projected cost of 10 images in one hour on cost per hour basis is

Hence, the projected cost of 10 images in one hour on cost per hour basis is .

.e.Since the amount of MRI images of patients is get reimbursed either by the government or by insurance company hence M hospital should go with the cost of the image on per hour basis as it will increase the collection of the hospital without affecting the pockets of patients.

3

Durango Plastics

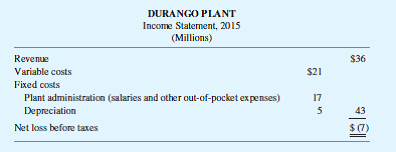

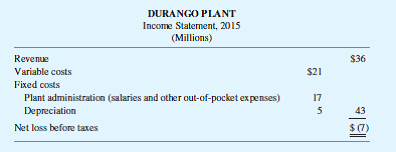

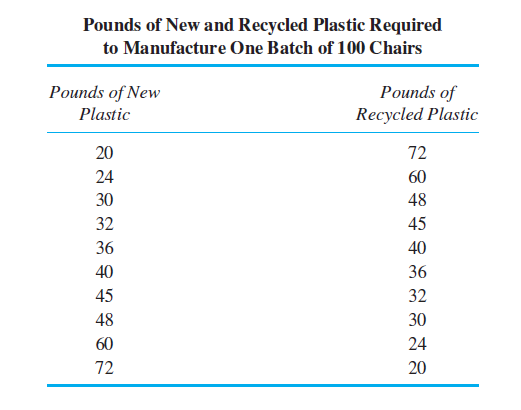

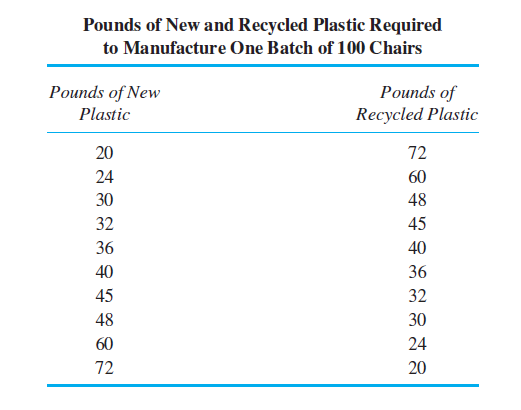

SCX is a $2 billion chemical company with a plastics plant located in Durango, Colorado. The Durango plastics plant of SCX was started 30 years ago to produce a particular plastic film for snack food packages. The Durango plant is a profit center that markets its product to film producers. It is the only SCX facility that produces this plastic.

A few years ago, worldwide excess capacity for this plastic developed as a number of new plants were opened and some food companies began shifting to a more environmentally safe plastic that cannot be produced with the Durango plant technology.

Last year, with Durango's plant utilization down to 60 percent, senior management of SCX began investigating alternative uses of the Durango plant. The Durango plant's current annual operating statement appears in the accompanying table

One alternative use of the Durango plant's excess capacity is a new high-strength plastic used by the auto industry to reduce the weight of cars. Additional equipment required to produce the automotive plastic at the Durango plant can be leased for $3 million per year. Automotive plastic revenues are projected to be $28 million and variable costs are $11 million. Additional fixed costs for marketing, distribution, and plant overhead attributable solely to auto plastics are expected to be $4 million.

All of SCX's divisions are evaluated on a before-tax basis.

Required:

a. Evaluate the auto industry plastic proposal. Compare the three alternatives: (1) close Durango, (2) produce only film plastic at Durango, and (3) produce both film and auto plastic at Durango. Which of the three do you suggest accepting? (If Durango is closed, additional one-time plant closing costs just offset the proceeds from selling the plant.)

b. Suppose the Durango plant begins manufacturing both film and auto plastic. Prepare a performance report for the two divisions for the first year, assuming that the initial projections are realized and the film division's 2016 revenue and expenses are the same as in 2015. Plant administration ($17 million) and depreciation ($5 million) are common costs to both the film and auto plastics divisions. For performance evaluation purposes, these costs are assigned to the two divisions based on sales revenue. All costs incurred for the Auto Plastics division should be charged to that division.

c. Does the performance report in part ( b ) accurately reflect the relative performance of the two divisions? Why or why not?

d. In the year 2017, the Durango plant is able to negotiate a $1 million reduction in property taxes. Property taxes are included in the "plant administration account." In addition, the Film Division is able to add $3 million in additional revenues (with $2.1 of additional variable cost) by selling film to European food packagers. Assuming that these are the only changes at the Durango plant between 2016 and 2017, how does the Auto Plastics Division's performance change between these two years? Allocate the common costs using the method described in part ( b ).

e. Write a short memo evaluating the performance of the Auto Plastics Division in light of the events in the year 2017 and describing how these events affect the reported performance of the Auto Plastics Division.

SCX is a $2 billion chemical company with a plastics plant located in Durango, Colorado. The Durango plastics plant of SCX was started 30 years ago to produce a particular plastic film for snack food packages. The Durango plant is a profit center that markets its product to film producers. It is the only SCX facility that produces this plastic.

A few years ago, worldwide excess capacity for this plastic developed as a number of new plants were opened and some food companies began shifting to a more environmentally safe plastic that cannot be produced with the Durango plant technology.

Last year, with Durango's plant utilization down to 60 percent, senior management of SCX began investigating alternative uses of the Durango plant. The Durango plant's current annual operating statement appears in the accompanying table

One alternative use of the Durango plant's excess capacity is a new high-strength plastic used by the auto industry to reduce the weight of cars. Additional equipment required to produce the automotive plastic at the Durango plant can be leased for $3 million per year. Automotive plastic revenues are projected to be $28 million and variable costs are $11 million. Additional fixed costs for marketing, distribution, and plant overhead attributable solely to auto plastics are expected to be $4 million.

All of SCX's divisions are evaluated on a before-tax basis.

Required:

a. Evaluate the auto industry plastic proposal. Compare the three alternatives: (1) close Durango, (2) produce only film plastic at Durango, and (3) produce both film and auto plastic at Durango. Which of the three do you suggest accepting? (If Durango is closed, additional one-time plant closing costs just offset the proceeds from selling the plant.)

b. Suppose the Durango plant begins manufacturing both film and auto plastic. Prepare a performance report for the two divisions for the first year, assuming that the initial projections are realized and the film division's 2016 revenue and expenses are the same as in 2015. Plant administration ($17 million) and depreciation ($5 million) are common costs to both the film and auto plastics divisions. For performance evaluation purposes, these costs are assigned to the two divisions based on sales revenue. All costs incurred for the Auto Plastics division should be charged to that division.

c. Does the performance report in part ( b ) accurately reflect the relative performance of the two divisions? Why or why not?

d. In the year 2017, the Durango plant is able to negotiate a $1 million reduction in property taxes. Property taxes are included in the "plant administration account." In addition, the Film Division is able to add $3 million in additional revenues (with $2.1 of additional variable cost) by selling film to European food packagers. Assuming that these are the only changes at the Durango plant between 2016 and 2017, how does the Auto Plastics Division's performance change between these two years? Allocate the common costs using the method described in part ( b ).

e. Write a short memo evaluating the performance of the Auto Plastics Division in light of the events in the year 2017 and describing how these events affect the reported performance of the Auto Plastics Division.

not answer

4

Fair Allocations

Choosing among alternative cost allocation methodologies typically is based on one of the following criteria: cause-and-effect, benefits derived, fairness, or ability to bear. Discuss how the "fairness" criterion can be used in selecting a cost allocation methodology.

Choosing among alternative cost allocation methodologies typically is based on one of the following criteria: cause-and-effect, benefits derived, fairness, or ability to bear. Discuss how the "fairness" criterion can be used in selecting a cost allocation methodology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

5

Slawson

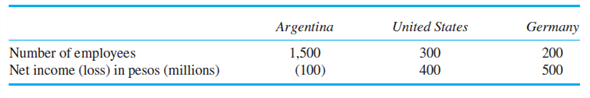

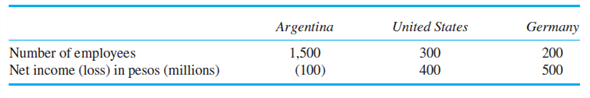

Slawson is a publicly traded Argentine company with three operating companies located in Argentina, the United States, and Germany. Slawson's corporate headquarters in Buenos Aires oversees the three operating companies. The annual cost of the corporate headquarters, including office expenses, salaries, and legal and accounting fees, is 2.4 million pesos. The following table summarizes operating details of each of the three operating companies.

Required:

a. Allocate the 2.4 million pesos corporate headquarters cost to the three operating companies using number of employees in each operating company.

b. Allocate the 2.4 million pesos corporate headquarters cost to the three operating companies using net income of each operating company as the allocation base.

c. Discuss the advantages and disadvantages of allocating corporate headquarters costs using (1) employees and (2) net income.

Slawson is a publicly traded Argentine company with three operating companies located in Argentina, the United States, and Germany. Slawson's corporate headquarters in Buenos Aires oversees the three operating companies. The annual cost of the corporate headquarters, including office expenses, salaries, and legal and accounting fees, is 2.4 million pesos. The following table summarizes operating details of each of the three operating companies.

Required:

a. Allocate the 2.4 million pesos corporate headquarters cost to the three operating companies using number of employees in each operating company.

b. Allocate the 2.4 million pesos corporate headquarters cost to the three operating companies using net income of each operating company as the allocation base.

c. Discuss the advantages and disadvantages of allocating corporate headquarters costs using (1) employees and (2) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Corporate Jet

A large corporation maintains a fleet of three 30-passenger corporate jets that provide (weather permitting) daily scheduled service between Detroit and several cities that are home to its production facilities. The jets are used for business, not personal, travel. Corporate executives book reservations through a centralized transportation office. Because of the limited number of seats available, the planes almost always fly full, at least in the nonwinter months. Excess demand for seats is assigned by executive rank within the firm. The executive's budget is charged for the flight at the end of the month. The charge is based on the jet's total operating expenses during the month (including fuel, pilot's salary and fringes, maintenance, licensing fees, landing fees, and 1/12 of the annual accounting depreciation) divided by the actual passenger miles logged in the month. This rate per passenger mile is multiplied by each passenger's mileage flown in the month.

Required:

a. Describe the formula being used to calculate the cost per passenger mile flown.

b. As passenger miles flown increases, what happens to the cost per passenger mile?

c. Describe what causes the monthly charge per passenger mile flown to fluctuate.

d. What other problems are present in the current system and what improvements do you suggest making?

A large corporation maintains a fleet of three 30-passenger corporate jets that provide (weather permitting) daily scheduled service between Detroit and several cities that are home to its production facilities. The jets are used for business, not personal, travel. Corporate executives book reservations through a centralized transportation office. Because of the limited number of seats available, the planes almost always fly full, at least in the nonwinter months. Excess demand for seats is assigned by executive rank within the firm. The executive's budget is charged for the flight at the end of the month. The charge is based on the jet's total operating expenses during the month (including fuel, pilot's salary and fringes, maintenance, licensing fees, landing fees, and 1/12 of the annual accounting depreciation) divided by the actual passenger miles logged in the month. This rate per passenger mile is multiplied by each passenger's mileage flown in the month.

Required:

a. Describe the formula being used to calculate the cost per passenger mile flown.

b. As passenger miles flown increases, what happens to the cost per passenger mile?

c. Describe what causes the monthly charge per passenger mile flown to fluctuate.

d. What other problems are present in the current system and what improvements do you suggest making?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

7

Massey Electronics

Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the devices consist of many small fins cut in the metal to increase its surface area and hence its ability to dissipate the heat. For example, Intel Pentium and Celeron processors are first mounted onto heat sinks and then attached to circuit boards. These processors generate heat that will ultimately destroy the processor and other components on the circuit board without a heat sink to disperse the heat.

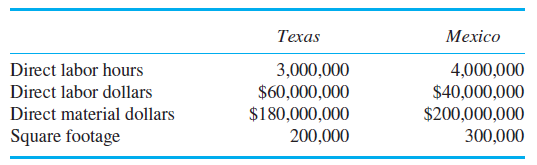

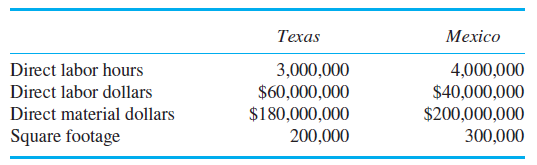

Massey has two production facilities, one in Texas and the other in Mexico. Both produce a wide range of heat sinks that are sold by the three Massey lines of business: laptops and PCs, servers, and telecommunications. The three lines of business are profit centers, whereas the two plants are cost centers. Products produced by each plant are charged to the lines of business selling the heat sinks at full absorption cost, including all manufacturing overheads. Both plants supply heat sinks to each line of business.

The Texas plant produces more complicated heat sinks that require tighter engineering tolerances. The Texas workforce is more skilled, but also more expensive. The Mexico plant is larger and employs more people. Both facilities utilize a set of shared manufacturing resources: a common manufacturing IT system that schedules and controls the manufacturing process, inventory control, and cost accounting, industrial engineers, payroll processing, and quality control. These shared manufacturing overhead resources cost Massey $9.5 million annually.

Massey is considering four ways to allocate this $9.5 million manufacturing overhead cost pool: direct labor hours, direct labor dollars, direct material dollars, or square footage of the two plants. The following table summarizes the operations of the two plants:

Massey has significant tax loss carryforwards due to prior losses and hence expects no income tax liability in any tax jurisdiction where it operates for the next five years.

Required:

a. Prepare a table showing how the $9.5 million would be allocated using each of the four proposed allocation schemes (direct labor hours, direct labor dollars, direct material dollars, and square footage of the two plants).

b. Discuss the advantages and disadvantages of each of the four proposed allocation methods (direct labor hours, direct labor dollars, direct material dollars, and square footage of the two plants).

Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the devices consist of many small fins cut in the metal to increase its surface area and hence its ability to dissipate the heat. For example, Intel Pentium and Celeron processors are first mounted onto heat sinks and then attached to circuit boards. These processors generate heat that will ultimately destroy the processor and other components on the circuit board without a heat sink to disperse the heat.

Massey has two production facilities, one in Texas and the other in Mexico. Both produce a wide range of heat sinks that are sold by the three Massey lines of business: laptops and PCs, servers, and telecommunications. The three lines of business are profit centers, whereas the two plants are cost centers. Products produced by each plant are charged to the lines of business selling the heat sinks at full absorption cost, including all manufacturing overheads. Both plants supply heat sinks to each line of business.

The Texas plant produces more complicated heat sinks that require tighter engineering tolerances. The Texas workforce is more skilled, but also more expensive. The Mexico plant is larger and employs more people. Both facilities utilize a set of shared manufacturing resources: a common manufacturing IT system that schedules and controls the manufacturing process, inventory control, and cost accounting, industrial engineers, payroll processing, and quality control. These shared manufacturing overhead resources cost Massey $9.5 million annually.

Massey is considering four ways to allocate this $9.5 million manufacturing overhead cost pool: direct labor hours, direct labor dollars, direct material dollars, or square footage of the two plants. The following table summarizes the operations of the two plants:

Massey has significant tax loss carryforwards due to prior losses and hence expects no income tax liability in any tax jurisdiction where it operates for the next five years.

Required:

a. Prepare a table showing how the $9.5 million would be allocated using each of the four proposed allocation schemes (direct labor hours, direct labor dollars, direct material dollars, and square footage of the two plants).

b. Discuss the advantages and disadvantages of each of the four proposed allocation methods (direct labor hours, direct labor dollars, direct material dollars, and square footage of the two plants).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

8

Avid Pharmaceuticals

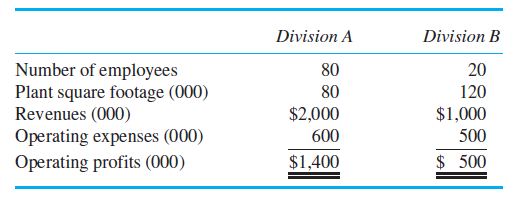

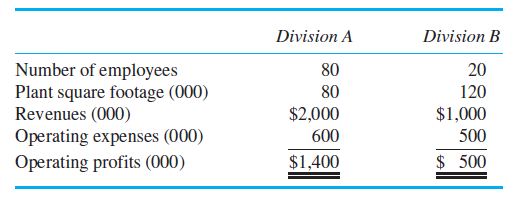

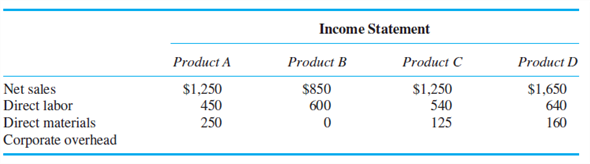

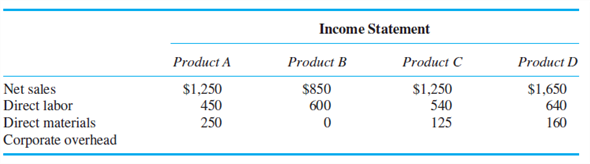

Avid, a small, privately held biotech pharmaceutical manufacturing firm, specializes in developing and producing a set of drugs for rare classes of cancers. Avid has two divisions that share the same manufacturing and research facility. The two divisions, while producing and selling two different classes of products to different market segments, share a common underlying science and related manufacturing processes. It is not unusual for the divisions to exchange technical know-how, personnel, and equipment. The following table summarizes their most current year's operating performance:

Avid's corporate overhead amounts to $900,000 per year. Management is debating various ways to allocate the corporate overhead to the two divisions. Allocation bases under consideration include: number of employees, plant square footage, revenues, operating expenses, and operating profits. Each division is treated as a separate profit center with each manager receiving a bonus based on his or her division's net income (operating profits less allocated corporate overhead).

Required:

a. For each of the five proposed allocation bases, compute Division A's and Division B's net income (operating income less allocated corporate overhead).

b. Recommend one of the five methods (or no allocation of corporate overhead) to allocate corporate overhead to the two divisions. Be sure to justify your recommendation.

Avid, a small, privately held biotech pharmaceutical manufacturing firm, specializes in developing and producing a set of drugs for rare classes of cancers. Avid has two divisions that share the same manufacturing and research facility. The two divisions, while producing and selling two different classes of products to different market segments, share a common underlying science and related manufacturing processes. It is not unusual for the divisions to exchange technical know-how, personnel, and equipment. The following table summarizes their most current year's operating performance:

Avid's corporate overhead amounts to $900,000 per year. Management is debating various ways to allocate the corporate overhead to the two divisions. Allocation bases under consideration include: number of employees, plant square footage, revenues, operating expenses, and operating profits. Each division is treated as a separate profit center with each manager receiving a bonus based on his or her division's net income (operating profits less allocated corporate overhead).

Required:

a. For each of the five proposed allocation bases, compute Division A's and Division B's net income (operating income less allocated corporate overhead).

b. Recommend one of the five methods (or no allocation of corporate overhead) to allocate corporate overhead to the two divisions. Be sure to justify your recommendation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

9

Wasley

Wasley has three operating divisions. Each manager of a division is evaluated on that division's total operating income. Managers are paid 10 percent of operating income as a bonus. The AB division makes products A and B. The C division makes product C. The D division makes product D. All four products use only direct labor and direct materials. However, a fixed (unavoidable) $1,784 corporate overhead is applied to each division (or product) based on direct labor dollars. In the following operating income statement for the first quarter of the year, all numbers are in 000s.

Required:

a. Allocate the corporate overhead and compute divisional operating income (after allocating corporate overhead) for each of the three divisions.

b. One day, the manager of the AB division, Shirley Chen, announces that starting in the second quarter she will be discontinuing product B (replacing it with nothing and letting the labor go, cutting all direct costs attributable to the product). She reasons that product B is losing money for her division and the company. Recompute first-quarter operating income for both division AB and the corporation without division AB's product B (as though the manager had already dropped product B).

c. Is Shirley Chen, the manager of the AB division, better off this way? Why or why not?

d. Is the corporation better off this way? Why or why not?

e. What problems do you see with the reporting/evaluation/incentive system currently in place?

Wasley has three operating divisions. Each manager of a division is evaluated on that division's total operating income. Managers are paid 10 percent of operating income as a bonus. The AB division makes products A and B. The C division makes product C. The D division makes product D. All four products use only direct labor and direct materials. However, a fixed (unavoidable) $1,784 corporate overhead is applied to each division (or product) based on direct labor dollars. In the following operating income statement for the first quarter of the year, all numbers are in 000s.

Required:

a. Allocate the corporate overhead and compute divisional operating income (after allocating corporate overhead) for each of the three divisions.

b. One day, the manager of the AB division, Shirley Chen, announces that starting in the second quarter she will be discontinuing product B (replacing it with nothing and letting the labor go, cutting all direct costs attributable to the product). She reasons that product B is losing money for her division and the company. Recompute first-quarter operating income for both division AB and the corporation without division AB's product B (as though the manager had already dropped product B).

c. Is Shirley Chen, the manager of the AB division, better off this way? Why or why not?

d. Is the corporation better off this way? Why or why not?

e. What problems do you see with the reporting/evaluation/incentive system currently in place?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

10

Hallsite Imaging

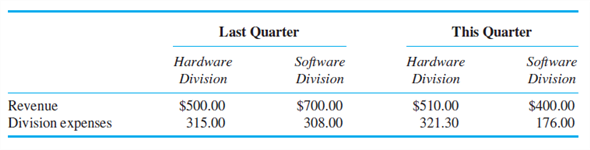

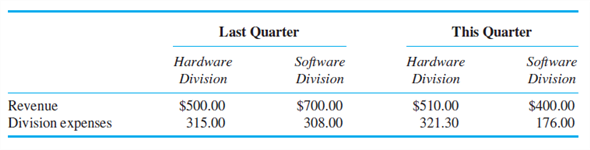

Hallsite Imaging produces hardware and software for imaging the structures of the human eye and the optic nerve. Hallsite systems are in most major medical centers and leading ophthalmology clinics. Hallsite has three divisions: Hardware, Software, and Marketing. All three are profit centers, and the three divisional presidents are compensated based on their division's profits. The Hardware Division produces the equipment that captures the images, which are then viewed on desktop PCs. The Software Division produces the software that runs on both Hallsite imaging equipment and the users' PCs to view, manipulate, and manage the images. Hallsite hardware only works with the Hallsite software, and the software can only be used for images captured by Hallsite hardware. The Marketing Division produces the marketing materials and has a direct sales force of 1,000 Hallsite people that sells both the hardware and software in the United States (Hallsite operates only in the United States). To assess the profits of the Hardware and Software Divisions, the costs of the Marketing Division are allocated back to the Hardware and Software Divisions based on the revenues of the two divisions. The following table summarizes the divisional sales and divisional expenses (before allocation of Marketing Division costs) for the Hardware and Software Divisions for last quarter and this quarter. (All figures are in millions of dollars.)

The Marketing Division reported divisional costs of $320 million last quarter and $370 million this quarter.

Required:

a. Allocate the Marketing Division's costs to the Hardware and Software Divisions for last quarter and this quarter.

b. Calculate the Hardware and Software Divisions' profits for this quarter and last quarter after allocating the Marketing Division's expenses to each division.

c. After receiving her division's profit report for this quarter (which included the Hardware Division's share of the Marketing Division's costs), the president of the Hardware Division called Hallsite's chief financial officer (whose office prepared the report) and said, "There must be something wrong with my division's profit report. Hardware's sales rose and our expenses were in line with what they should have been given last quarter's operating margins. But my profits tanked. Now I know that there was a major problem with Software's new version 7.0 that hurt new sales of upgrades to version 7.0 and required more Marketing resources to address our customers' concerns with this new software. But why am I getting hammered? I didn't cause the software problems. My hardware continues to sell well because version 6.8 of the software still works great. This is really very unfair."

Write a memo from Hallsite's chief financial offer to the Hardware Division president explaining that the Hardware Division's current quarter profit report (which includes the Division's share of the Marketing expenses) is in fact correct and outlining the various rationales as to why Hallsite allocates the Marketing Division's expenses to the other two divisions.

Hallsite Imaging produces hardware and software for imaging the structures of the human eye and the optic nerve. Hallsite systems are in most major medical centers and leading ophthalmology clinics. Hallsite has three divisions: Hardware, Software, and Marketing. All three are profit centers, and the three divisional presidents are compensated based on their division's profits. The Hardware Division produces the equipment that captures the images, which are then viewed on desktop PCs. The Software Division produces the software that runs on both Hallsite imaging equipment and the users' PCs to view, manipulate, and manage the images. Hallsite hardware only works with the Hallsite software, and the software can only be used for images captured by Hallsite hardware. The Marketing Division produces the marketing materials and has a direct sales force of 1,000 Hallsite people that sells both the hardware and software in the United States (Hallsite operates only in the United States). To assess the profits of the Hardware and Software Divisions, the costs of the Marketing Division are allocated back to the Hardware and Software Divisions based on the revenues of the two divisions. The following table summarizes the divisional sales and divisional expenses (before allocation of Marketing Division costs) for the Hardware and Software Divisions for last quarter and this quarter. (All figures are in millions of dollars.)

The Marketing Division reported divisional costs of $320 million last quarter and $370 million this quarter.

Required:

a. Allocate the Marketing Division's costs to the Hardware and Software Divisions for last quarter and this quarter.

b. Calculate the Hardware and Software Divisions' profits for this quarter and last quarter after allocating the Marketing Division's expenses to each division.

c. After receiving her division's profit report for this quarter (which included the Hardware Division's share of the Marketing Division's costs), the president of the Hardware Division called Hallsite's chief financial officer (whose office prepared the report) and said, "There must be something wrong with my division's profit report. Hardware's sales rose and our expenses were in line with what they should have been given last quarter's operating margins. But my profits tanked. Now I know that there was a major problem with Software's new version 7.0 that hurt new sales of upgrades to version 7.0 and required more Marketing resources to address our customers' concerns with this new software. But why am I getting hammered? I didn't cause the software problems. My hardware continues to sell well because version 6.8 of the software still works great. This is really very unfair."

Write a memo from Hallsite's chief financial offer to the Hardware Division president explaining that the Hardware Division's current quarter profit report (which includes the Division's share of the Marketing expenses) is in fact correct and outlining the various rationales as to why Hallsite allocates the Marketing Division's expenses to the other two divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

11

Rowe Waste Removal (B)

Continuing the problem started in Rowe Waste Removal (A) in Chapter 2, Rowe Waste Removal hires Sue Lingle to manage the apartment complex collection service and enters the apartment refuse removal market. To provide Lingle incentives to maximize Rowe's profit, she will receive a bonus tied to the profits of her apartment waste collection business. Apartment profits are calculated based on the apartment waste collection revenues less the costs of the apartment waste service (truck lease, dumpsters, driver, fuel, oil, licensing, landfill charges, and Lingle's salary and benefits). (Note: Any bonus paid to Lingle is not included in calculating the profits of the apartment waste service.) In addition to these direct costs of the apartment refuse collection service, Lingle is charged a fee of $50 per 25-unit apartment complex to cover her share of the billing, accounting, legal costs, and general operating expenses of Rowe.

Required:

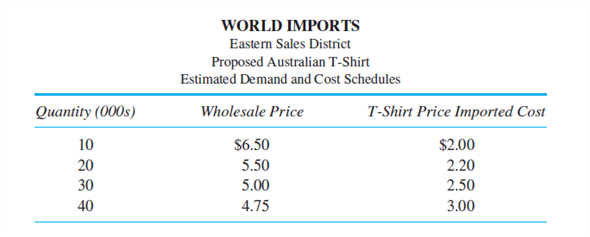

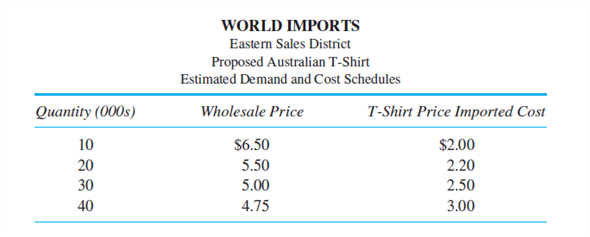

a. Assume all the costs in Rowe Waste Removal (A) in Chapter 2 remain the same and in addition to the $54,000 per month cost of the truck, driver, etc., Lingle's salary and benefits are $72,000 per year. What price-quantity combination will Lingle select to maximize her bonus?

b. Explain why the price-quantity combination Sue Lingle chooses in part (a) is the same or differs from the firm-profit maximizing price-quantity combination chosen in part (b) of Rowe Waste Removal (A) in Chapter 2.

c. In computing Sue Lingle's apartment waste collection profits for determining her bonus, should she be charged a fee of $50 per 25-unit apartment complex to cover her share of the billing, accounting, legal costs, and general operating expenses of Rowe?

Continuing the problem started in Rowe Waste Removal (A) in Chapter 2, Rowe Waste Removal hires Sue Lingle to manage the apartment complex collection service and enters the apartment refuse removal market. To provide Lingle incentives to maximize Rowe's profit, she will receive a bonus tied to the profits of her apartment waste collection business. Apartment profits are calculated based on the apartment waste collection revenues less the costs of the apartment waste service (truck lease, dumpsters, driver, fuel, oil, licensing, landfill charges, and Lingle's salary and benefits). (Note: Any bonus paid to Lingle is not included in calculating the profits of the apartment waste service.) In addition to these direct costs of the apartment refuse collection service, Lingle is charged a fee of $50 per 25-unit apartment complex to cover her share of the billing, accounting, legal costs, and general operating expenses of Rowe.

Required:

a. Assume all the costs in Rowe Waste Removal (A) in Chapter 2 remain the same and in addition to the $54,000 per month cost of the truck, driver, etc., Lingle's salary and benefits are $72,000 per year. What price-quantity combination will Lingle select to maximize her bonus?

b. Explain why the price-quantity combination Sue Lingle chooses in part (a) is the same or differs from the firm-profit maximizing price-quantity combination chosen in part (b) of Rowe Waste Removal (A) in Chapter 2.

c. In computing Sue Lingle's apartment waste collection profits for determining her bonus, should she be charged a fee of $50 per 25-unit apartment complex to cover her share of the billing, accounting, legal costs, and general operating expenses of Rowe?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

12

Winterton Group

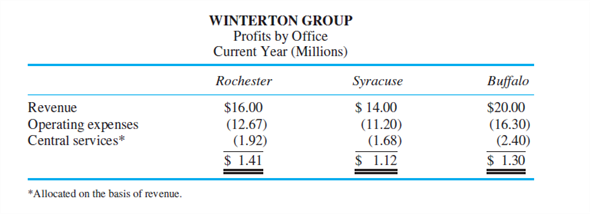

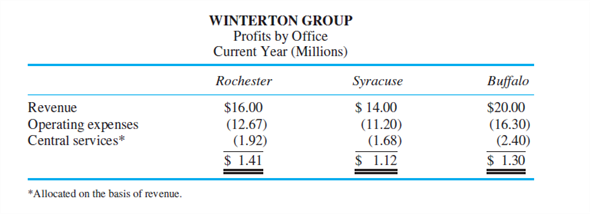

The Winterton Group is an investment advisory firm specializing in high-income investors in upstate New York. Winterton has offices in Rochester, Syracuse, and Buffalo. Operating as a profit center, each office receives central services, including information technology, marketing, accounting, and payroll. Winterton has 20 investment advisors, 7 each in Syracuse and Rochester, and 6 in Buffalo. Each investment advisor is paid a fixed salary, a commission based on the revenue generated from clients, plus 2 percent of regional office profits and 1 percent of firm profits. One of the senior investment advisors in each office is designated as the office manager and is responsible for running the office. The office manager receives 8 percent of the regional office profits instead of 2 percent.

Regional office expenses include commissions paid to investment advisors. The following regional profits are calculated before the 2 percent profit sharing. Firm profits are the sum of the three regional office profits.

This table summarizes the current profits per office after allocating central service costs based on office revenues.

The manager of the Buffalo office sent the following e-mail to the other office managers, the president, and the chief financial officer:

One of the primary criteria by which all cost allocation schemes are to be judged is fairness. The costs allocated to those bearing them should view the system as fair. Our current system, which allocates central services using office revenues, fails this important test of fairness. Receiving more allocated costs penalizes those offices generating more revenues. A fairer, and hence more defensible, system would be to allocate these central services based on the number of investment advisors in each office.

Required:

a. Recalculate each office's profits before any profit sharing assuming the Buffalo manager's proposal is adopted.

b. Do you believe the Buffalo manager's proposal results in a fairer allocation scheme than the current one? Why or why not?

c. Why is the Buffalo manager concerned about fairness?

The Winterton Group is an investment advisory firm specializing in high-income investors in upstate New York. Winterton has offices in Rochester, Syracuse, and Buffalo. Operating as a profit center, each office receives central services, including information technology, marketing, accounting, and payroll. Winterton has 20 investment advisors, 7 each in Syracuse and Rochester, and 6 in Buffalo. Each investment advisor is paid a fixed salary, a commission based on the revenue generated from clients, plus 2 percent of regional office profits and 1 percent of firm profits. One of the senior investment advisors in each office is designated as the office manager and is responsible for running the office. The office manager receives 8 percent of the regional office profits instead of 2 percent.

Regional office expenses include commissions paid to investment advisors. The following regional profits are calculated before the 2 percent profit sharing. Firm profits are the sum of the three regional office profits.

This table summarizes the current profits per office after allocating central service costs based on office revenues.

The manager of the Buffalo office sent the following e-mail to the other office managers, the president, and the chief financial officer:

One of the primary criteria by which all cost allocation schemes are to be judged is fairness. The costs allocated to those bearing them should view the system as fair. Our current system, which allocates central services using office revenues, fails this important test of fairness. Receiving more allocated costs penalizes those offices generating more revenues. A fairer, and hence more defensible, system would be to allocate these central services based on the number of investment advisors in each office.

Required:

a. Recalculate each office's profits before any profit sharing assuming the Buffalo manager's proposal is adopted.

b. Do you believe the Buffalo manager's proposal results in a fairer allocation scheme than the current one? Why or why not?

c. Why is the Buffalo manager concerned about fairness?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

13

National Training Institute

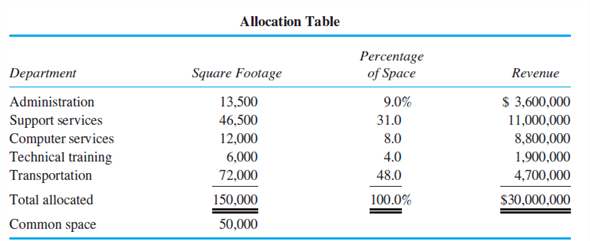

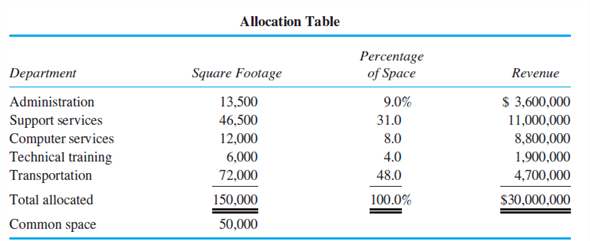

Five departments of National Training Institute, a nonprofit organization, share a rented building. Four of the departments provide services to educational agencies and have little or no competition for their services. The fifth department, Technical Training, provides educational services to the business community in a competitive market with other nonprofit and private organizations. Each department is a cost center. Revenues received by Technical Training are based on a fee for services, identified as tuition.

All five departments have dedicated space as listed in the accompanying table. Common shared space, including hallways, restrooms, meeting rooms, and dining areas, is not included in these allocations. National Training Institute rents space at $10 per square foot.

In addition to its assigned space, the technical training department offers training during offhours using many of the areas allocated to other departments. Technical Training also uses off-site facilities for the same purpose. About 50 percent of its training activities are in off-site facilities, which have excess capacity, charge no rent, and are available only during off-hours.

John Daniels, the administration department's business manager, proposed a rental allocation plan based on each department's percentage of dedicated square footage plus the same percentage of the common space. The technical training department would be charged an additional amount for the space it uses during off-hours that is dedicated to other departments. This additional amount would be based on planned usage per year.

Jane Richards, director of technical training, claims this allocation method will cause her to increase the price of services. As a result, she will lose business to competition. She would rather see the allocation method use the percentage of department revenue in relation to total revenue.

Required:

Comment on Daniels's and Richards's proposed rent allocation plans. Make appropriate recommendations.

Five departments of National Training Institute, a nonprofit organization, share a rented building. Four of the departments provide services to educational agencies and have little or no competition for their services. The fifth department, Technical Training, provides educational services to the business community in a competitive market with other nonprofit and private organizations. Each department is a cost center. Revenues received by Technical Training are based on a fee for services, identified as tuition.

All five departments have dedicated space as listed in the accompanying table. Common shared space, including hallways, restrooms, meeting rooms, and dining areas, is not included in these allocations. National Training Institute rents space at $10 per square foot.

In addition to its assigned space, the technical training department offers training during offhours using many of the areas allocated to other departments. Technical Training also uses off-site facilities for the same purpose. About 50 percent of its training activities are in off-site facilities, which have excess capacity, charge no rent, and are available only during off-hours.

John Daniels, the administration department's business manager, proposed a rental allocation plan based on each department's percentage of dedicated square footage plus the same percentage of the common space. The technical training department would be charged an additional amount for the space it uses during off-hours that is dedicated to other departments. This additional amount would be based on planned usage per year.

Jane Richards, director of technical training, claims this allocation method will cause her to increase the price of services. As a result, she will lose business to competition. She would rather see the allocation method use the percentage of department revenue in relation to total revenue.

Required:

Comment on Daniels's and Richards's proposed rent allocation plans. Make appropriate recommendations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

14

Colorado BBQ

Colorado BBQ makes a unique barbecue sauce that involves slow roasting very spicy chili peppers from India, pureeing the peppers to remove the seeds, and then flash frying the roasted peppers with the other ingredients before bottling. The sauce is sold throughout the United States. Colorado BBQ is considering entering the Canadian BBQ market with a slightly different recipe and bottle design and label. In order to be able to export its Colorado BBQ sauce into Canada without paying Canadian customs duty at 7 percent of the wholesale price (U.S. $8.99), Colorado BBQ must certify that at least 90 percent of the total manufacturing cost of the Canadian BBQ sauce is from products sourced entirely within the North American Free Trade Agreement or NAFTA (Canada, Mexico, and the United States). If more than 10 percent of the total product cost is determined to be from ingredients sourced outside of NAFTA (Canada, Mexico, and United States), then the product is subject to a 7 percent Canadian import duty. Given the competitive nature of the Canadian BBQ market, Colorado BBQ is unable to pass any Canadian customs duty on to its Canadian importer.

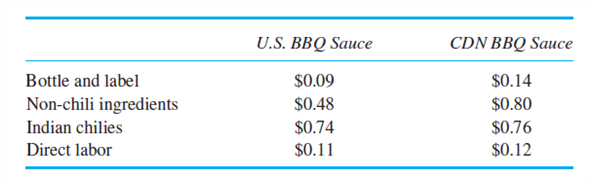

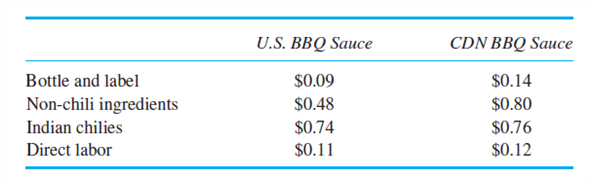

The current breakdown of the direct costs (excluding allocated manufacturing overheads) of the U.S. and Canadian BBQ sauces is (all amounts are U.S. dollars):

The manufacturing overhead for the factory that may produce both the U.S. and Canadian Colorado BBQ sauces is $383,000 per year, and 65,000 bottles will be produced for the U.S. market and 22,000 bottles for the Canadian market. Manufacturing overhead will be allocated to the two BBQ sauces using direct labor cost. All of the manufacturing costs, ingredients, and packaging (except the Indian chilies) are sourced entirely within the NAFTA countries.

Required:

a. Calculate the manufacturing overhead allocated per bottle of the Canadian BBQ sauce.

b. Calculate what, if any, Canadian import customs duty Colorado BBQ must pay on the importation of its BBQ sauce based on NAFTA.

c. Before beginning the production of its Canadian sauce, Colorado BBQ learns of a very similar chili pepper from Mexico that can be used in the Canadian BBQ sauce without altering the sauce's flavor or consistency. The cost of the Mexican chili is $1.26 per Canadian bottle of BBQ sauce instead of the $0.76 per bottle for the Indian chili. Substituting the Mexican chilies for the Indian chilies in the Canadian sauce does not alter any of the other costs of the Canadian sauce. Should Colorado BBQ substitute the Mexican chili for the Indian chili in its Canadian BBQ sauce it plans to export to Canada? What advice would you give to the managers of Colorado BBQ regarding the production, cost certification for Canadian customs under NAFTA, and exportation of its Canadian Colorado BBQ sauce?

Colorado BBQ makes a unique barbecue sauce that involves slow roasting very spicy chili peppers from India, pureeing the peppers to remove the seeds, and then flash frying the roasted peppers with the other ingredients before bottling. The sauce is sold throughout the United States. Colorado BBQ is considering entering the Canadian BBQ market with a slightly different recipe and bottle design and label. In order to be able to export its Colorado BBQ sauce into Canada without paying Canadian customs duty at 7 percent of the wholesale price (U.S. $8.99), Colorado BBQ must certify that at least 90 percent of the total manufacturing cost of the Canadian BBQ sauce is from products sourced entirely within the North American Free Trade Agreement or NAFTA (Canada, Mexico, and the United States). If more than 10 percent of the total product cost is determined to be from ingredients sourced outside of NAFTA (Canada, Mexico, and United States), then the product is subject to a 7 percent Canadian import duty. Given the competitive nature of the Canadian BBQ market, Colorado BBQ is unable to pass any Canadian customs duty on to its Canadian importer.

The current breakdown of the direct costs (excluding allocated manufacturing overheads) of the U.S. and Canadian BBQ sauces is (all amounts are U.S. dollars):

The manufacturing overhead for the factory that may produce both the U.S. and Canadian Colorado BBQ sauces is $383,000 per year, and 65,000 bottles will be produced for the U.S. market and 22,000 bottles for the Canadian market. Manufacturing overhead will be allocated to the two BBQ sauces using direct labor cost. All of the manufacturing costs, ingredients, and packaging (except the Indian chilies) are sourced entirely within the NAFTA countries.

Required:

a. Calculate the manufacturing overhead allocated per bottle of the Canadian BBQ sauce.

b. Calculate what, if any, Canadian import customs duty Colorado BBQ must pay on the importation of its BBQ sauce based on NAFTA.

c. Before beginning the production of its Canadian sauce, Colorado BBQ learns of a very similar chili pepper from Mexico that can be used in the Canadian BBQ sauce without altering the sauce's flavor or consistency. The cost of the Mexican chili is $1.26 per Canadian bottle of BBQ sauce instead of the $0.76 per bottle for the Indian chili. Substituting the Mexican chilies for the Indian chilies in the Canadian sauce does not alter any of the other costs of the Canadian sauce. Should Colorado BBQ substitute the Mexican chili for the Indian chili in its Canadian BBQ sauce it plans to export to Canada? What advice would you give to the managers of Colorado BBQ regarding the production, cost certification for Canadian customs under NAFTA, and exportation of its Canadian Colorado BBQ sauce?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

15

Ball Brothers Purchasing Department

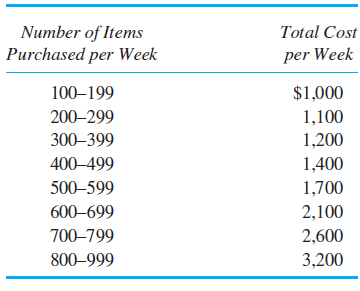

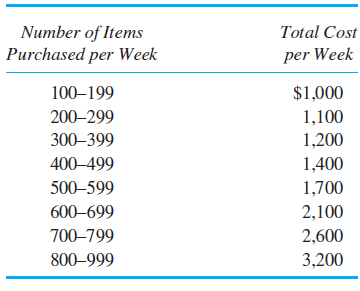

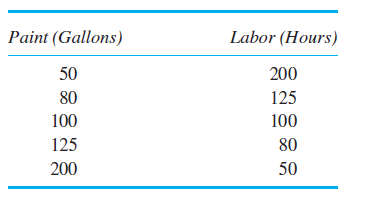

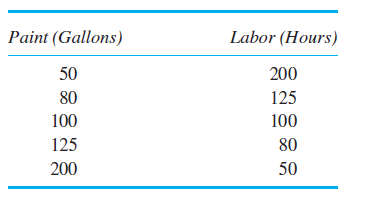

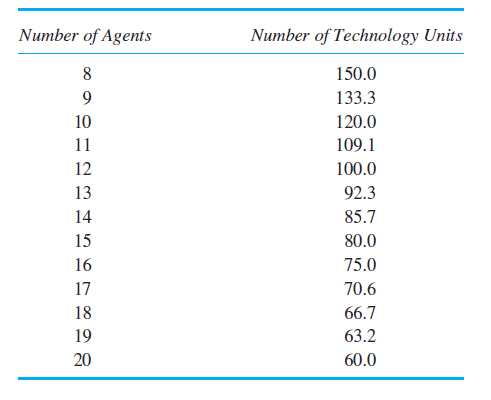

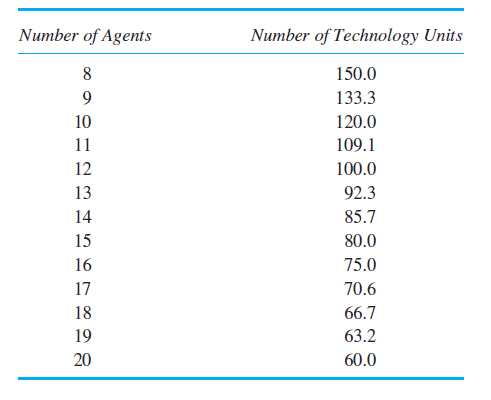

The purchasing department of Ball Brothers purchases raw materials and supplies for the various divisions in the firm. Most of the purchasing department's costs are labor costs. The costs of the purchasing department depend on the number of items purchased. The manager of the purchasing department estimates how her department's costs will vary with different levels of demand by the divisions. The following table provides her estimates of how the costs of purchasing vary with the aggregate number of items purchased by all divisions.

In deriving this table, the manager of purchasing projects expanding the size of the department in order to keep roughly constant the time to purchase an item and the quality of the purchasing department's services at all levels of demand placed on the department. That is, if the department is processing 750 items per week, it will provide the same quality of services given a budget of $2,600 as it would processing 250 items per week given a budget of $1,100.

Required:

a. Suppose the purchasing department is currently purchasing 610 items per week. Should the department's costs of $2,100 per week be allocated back to the divisions, making the purchases at a charge of $3.44 per item purchased ($2,100 ÷ 610)? Explain why or why not.

b. Suppose the purchasing department is currently purchasing 210 items per week. Should the department's costs of $1,100 per week be allocated back to the divisions, making the purchases at a charge of $5.23 per item purchased ($1,100 ÷ 210)? Explain why or why not.

c. Reconcile (explain) why your answers to parts (a) and (b) are either the same or different.

The purchasing department of Ball Brothers purchases raw materials and supplies for the various divisions in the firm. Most of the purchasing department's costs are labor costs. The costs of the purchasing department depend on the number of items purchased. The manager of the purchasing department estimates how her department's costs will vary with different levels of demand by the divisions. The following table provides her estimates of how the costs of purchasing vary with the aggregate number of items purchased by all divisions.

In deriving this table, the manager of purchasing projects expanding the size of the department in order to keep roughly constant the time to purchase an item and the quality of the purchasing department's services at all levels of demand placed on the department. That is, if the department is processing 750 items per week, it will provide the same quality of services given a budget of $2,600 as it would processing 250 items per week given a budget of $1,100.

Required:

a. Suppose the purchasing department is currently purchasing 610 items per week. Should the department's costs of $2,100 per week be allocated back to the divisions, making the purchases at a charge of $3.44 per item purchased ($2,100 ÷ 610)? Explain why or why not.

b. Suppose the purchasing department is currently purchasing 210 items per week. Should the department's costs of $1,100 per week be allocated back to the divisions, making the purchases at a charge of $5.23 per item purchased ($1,100 ÷ 210)? Explain why or why not.

c. Reconcile (explain) why your answers to parts (a) and (b) are either the same or different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

16

Dewan Locks

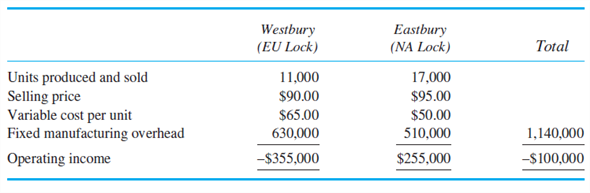

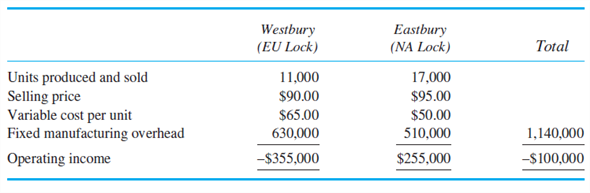

Dewan Locks produces and sells a keyless bicycle lock that uses a small wireless fob to lock and unlock the lock without the need of a key. Dewan produces two models: one for the European market (EU) and one for North America (NA). Dewan started producing the North American lock at its Eastbury plant, and then introduced the EU model, which was also assembled in the Eastbury plant. When demand for both models grew and exceeded the capacity of Eastbury, Dewan leased the Westbury plant. Following the weakening global economy, Dewan saw the demand for its locks from both Europe and North America fall. This caused Dewan's total profits to plummet. The following table summarizes operations for the last fiscal quarter.

To address the current operating loss of $100,000, Dewan owners are moving the EU lock production from the Westbury plant to the Eastbury plant where it now has excess capacity due to the declining sales of the NA lock, and since the lease on the Westbury plant is expiring soon. By canceling the lease of the Westbury plant and moving the EU locks back to the Eastbury plant, the fixed manufacturing overhead of producing EU locks will fall from its current level of $630,000 to $210,000. In other words, Dewan will save the lease and occupancy cost of the Westbury plant ($630,000) but will have to incur additional fixed manufacturing cost of $210,000 in Eastbury to produce the EU locks in Eastbury. Stated differently, with both plants in operation, Dewan's total fixed manufacturing overhead is $1,140,000 ($630,000 + $510,000). Total manufacturing overhead will be $720,000 ($510,000 + $210,000) by consolidating both NA and EU lock production into the Eastbury plant.

The EU and the NA locks are separate profit centers with the managers of the two profit centers evaluated and compensated based on the operating income of their respective profit centers.

Required:

a. Dewan still expects to sell 11,000 locks in Europe and 17,000 in North America. By closing the Westbury plant and producing both the NA and the EU locks in Eastbury, what happens to Dewan's operating income?

b. After consolidating production of the NA and EU locks in the Eastbury plant, Dewan needs to allocate the $720,000 of common fixed manufacturing overhead of the Eastbury plant to the two profit centers (NA locks and EU locks). The $720,000 of Eastbury's common fixed manufacturing overhead to the two profit centers is to be allocated using total contribution margin (unit sales times the difference between selling price and variable cost per unit) as the allocation base. Using total contribution margin to allocate the manufacturing overhead to the two profit centers, prepare operating income statements for the NA locks and EU locks profit centers for last quarter as if the Westbury plant has closed and all locks are produced in Eastbury.

c. After seeing the operating income statements prepared in part b, the manager of the NA lock profit center argues, "Something must be wrong in these operating income statements. Why should the NA lock operating income change just because EU locks are now being produced in Eastbury? I haven't done anything differently, so why is NA Locks being penalized for closing Westbury plant and moving the EU locks into Eastbury? All of the benefits of closing Westbury seem to accrue to EU Locks and none to NA Locks." Write a memo to Dewan's president explaining whether the arguments by the manager of the NA Locks profit center have any merits.

d. Would you recommend using the overhead allocation scheme described in part (b), or would you propose an alternative allocation scheme? And if so, what scheme would you recommend, and why?

Dewan Locks produces and sells a keyless bicycle lock that uses a small wireless fob to lock and unlock the lock without the need of a key. Dewan produces two models: one for the European market (EU) and one for North America (NA). Dewan started producing the North American lock at its Eastbury plant, and then introduced the EU model, which was also assembled in the Eastbury plant. When demand for both models grew and exceeded the capacity of Eastbury, Dewan leased the Westbury plant. Following the weakening global economy, Dewan saw the demand for its locks from both Europe and North America fall. This caused Dewan's total profits to plummet. The following table summarizes operations for the last fiscal quarter.

To address the current operating loss of $100,000, Dewan owners are moving the EU lock production from the Westbury plant to the Eastbury plant where it now has excess capacity due to the declining sales of the NA lock, and since the lease on the Westbury plant is expiring soon. By canceling the lease of the Westbury plant and moving the EU locks back to the Eastbury plant, the fixed manufacturing overhead of producing EU locks will fall from its current level of $630,000 to $210,000. In other words, Dewan will save the lease and occupancy cost of the Westbury plant ($630,000) but will have to incur additional fixed manufacturing cost of $210,000 in Eastbury to produce the EU locks in Eastbury. Stated differently, with both plants in operation, Dewan's total fixed manufacturing overhead is $1,140,000 ($630,000 + $510,000). Total manufacturing overhead will be $720,000 ($510,000 + $210,000) by consolidating both NA and EU lock production into the Eastbury plant.

The EU and the NA locks are separate profit centers with the managers of the two profit centers evaluated and compensated based on the operating income of their respective profit centers.

Required:

a. Dewan still expects to sell 11,000 locks in Europe and 17,000 in North America. By closing the Westbury plant and producing both the NA and the EU locks in Eastbury, what happens to Dewan's operating income?

b. After consolidating production of the NA and EU locks in the Eastbury plant, Dewan needs to allocate the $720,000 of common fixed manufacturing overhead of the Eastbury plant to the two profit centers (NA locks and EU locks). The $720,000 of Eastbury's common fixed manufacturing overhead to the two profit centers is to be allocated using total contribution margin (unit sales times the difference between selling price and variable cost per unit) as the allocation base. Using total contribution margin to allocate the manufacturing overhead to the two profit centers, prepare operating income statements for the NA locks and EU locks profit centers for last quarter as if the Westbury plant has closed and all locks are produced in Eastbury.

c. After seeing the operating income statements prepared in part b, the manager of the NA lock profit center argues, "Something must be wrong in these operating income statements. Why should the NA lock operating income change just because EU locks are now being produced in Eastbury? I haven't done anything differently, so why is NA Locks being penalized for closing Westbury plant and moving the EU locks into Eastbury? All of the benefits of closing Westbury seem to accrue to EU Locks and none to NA Locks." Write a memo to Dewan's president explaining whether the arguments by the manager of the NA Locks profit center have any merits.

d. Would you recommend using the overhead allocation scheme described in part (b), or would you propose an alternative allocation scheme? And if so, what scheme would you recommend, and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

17

Diagnostic Imaging Software

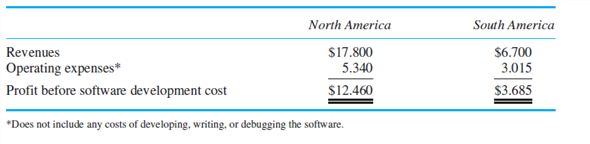

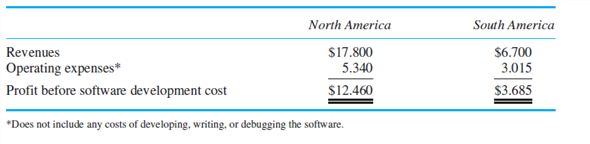

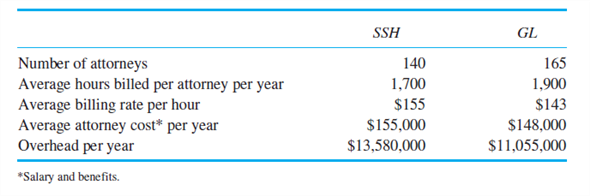

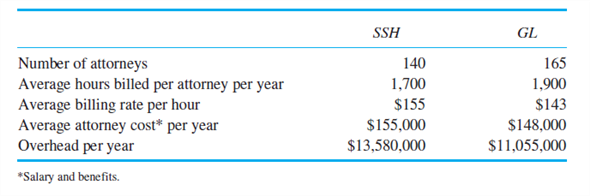

Diagnostic Imaging Software (DIS) is the leading producer of imaging software for the health sciences. DIS develops, writes, produces, and sells its software through two direct selling organizations: North America and South America. Each of these direct selling forces is evaluated and rewarded as profit centers. The remaining world sales of DIS software are handled through independent distributors in Europe, Asia, and Africa. DIS has a software development group that designs, writes, and debugs the software before turning it over to the direct sales organizations (North and South America) and the independent distributors who then sell the software. The cost of designing, writing, and debugging the software is $12 million this year.

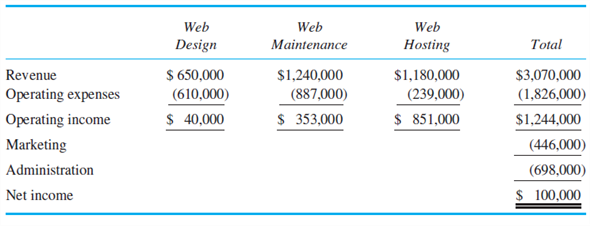

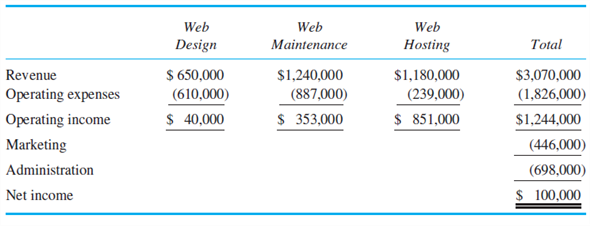

The following table presents the income statements of the two divisions (millions of $) for this year:

Senior management of DIS wants to allocate the software costs to the two direct-selling forces in order to evaluate and reward their performance.

Required:

a. Calculate the profits of the two direct selling organizations (North and South America) after allocating the software costs of $12 million based on the relative revenues of the two organizations. (Round all decimals to three significant digits.)

b. Calculate the profits of the two direct selling organizations (North and South America) after allocating the software cost of $12 million based on the relative profits before software development cost of the two organizations. (Round all decimals to three significant digits.)

c. Calculate the profits of the two direct selling organizations (North and South America) after allocating the software cost of $12 million where 75 percent of the cost is assigned to North America and 25 percent to South America. (Round all decimals to three significant digits.)

d. Discuss the advantages and disadvantages of each of the three allocation methods used in parts (a), (b), and (c).

Diagnostic Imaging Software (DIS) is the leading producer of imaging software for the health sciences. DIS develops, writes, produces, and sells its software through two direct selling organizations: North America and South America. Each of these direct selling forces is evaluated and rewarded as profit centers. The remaining world sales of DIS software are handled through independent distributors in Europe, Asia, and Africa. DIS has a software development group that designs, writes, and debugs the software before turning it over to the direct sales organizations (North and South America) and the independent distributors who then sell the software. The cost of designing, writing, and debugging the software is $12 million this year.

The following table presents the income statements of the two divisions (millions of $) for this year:

Senior management of DIS wants to allocate the software costs to the two direct-selling forces in order to evaluate and reward their performance.

Required:

a. Calculate the profits of the two direct selling organizations (North and South America) after allocating the software costs of $12 million based on the relative revenues of the two organizations. (Round all decimals to three significant digits.)

b. Calculate the profits of the two direct selling organizations (North and South America) after allocating the software cost of $12 million based on the relative profits before software development cost of the two organizations. (Round all decimals to three significant digits.)

c. Calculate the profits of the two direct selling organizations (North and South America) after allocating the software cost of $12 million where 75 percent of the cost is assigned to North America and 25 percent to South America. (Round all decimals to three significant digits.)

d. Discuss the advantages and disadvantages of each of the three allocation methods used in parts (a), (b), and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

18

Fuentes Systems