Deck 17: Activity Resource Usage Model and Tactical Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/47

العب

ملء الشاشة (f)

Deck 17: Activity Resource Usage Model and Tactical Decision Making

1

What is tactical decision making?

Tactical decision making consists of choosing among the alternatives with an immediate or limited end in view.

Tactical decision may belongs to short run that an "accepting of special order which is less than the normal selling price" or may belongs to long run that "the company considering making component rather the buying it from outside".

However the tactical decision should support overall objective even if immediate objective is short run or long run. A sound tactical decision achieves not only the limited objective but also serve a larger purpose.

The tactical decision process would be generally as:

1. Recognize and define the problem

2. Identify alternatives as possible solutions to the problem, and eliminate any un feasible alternatives

3. Identify the cost and benefits which associated with each feasible alternative. Eliminate the costs and benefits that are not relevant to the decision.

4. Compare the relevant costs and benefits for each alternative.

5. Asses qualitative factors

6. Select the alternative with the greatest overall benefit.

Tactical decision may belongs to short run that an "accepting of special order which is less than the normal selling price" or may belongs to long run that "the company considering making component rather the buying it from outside".

However the tactical decision should support overall objective even if immediate objective is short run or long run. A sound tactical decision achieves not only the limited objective but also serve a larger purpose.

The tactical decision process would be generally as:

1. Recognize and define the problem

2. Identify alternatives as possible solutions to the problem, and eliminate any un feasible alternatives

3. Identify the cost and benefits which associated with each feasible alternative. Eliminate the costs and benefits that are not relevant to the decision.

4. Compare the relevant costs and benefits for each alternative.

5. Asses qualitative factors

6. Select the alternative with the greatest overall benefit.

2

Make-or-Buy, Traditional Analysis

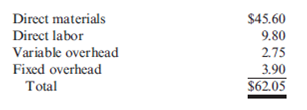

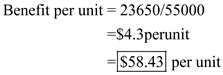

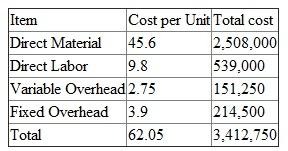

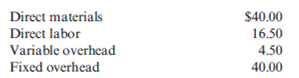

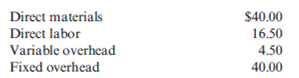

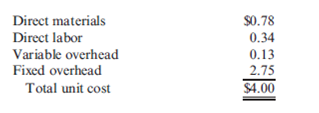

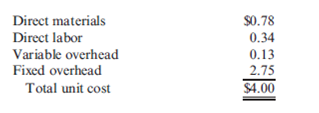

Wehner Company is currently manufacturing Part ABS-43, producing 55,000 units annually. The part is used in the production of several products made by Wehner. The cost per unit for ABS-43 is as follows:

Of the total fixed overhead assigned to ABS-43, $15,400 is direct fixed overhead (the annual lease cost of machinery used to manufacture Part ABS-43), and the remainder is common fixed overhead. An outside supplier has offered to sell the part to Wehner for $58. There is no alternative use for the facilities currently used to produce the part. No significant non-unit-based overhead costs are incurred.

Required:

1. Should Wehner Company make or buy Part ABS-43?

2. What is the maximum amount per unit that Wehner would be willing to pay to an outside supplier?

Wehner Company is currently manufacturing Part ABS-43, producing 55,000 units annually. The part is used in the production of several products made by Wehner. The cost per unit for ABS-43 is as follows:

Of the total fixed overhead assigned to ABS-43, $15,400 is direct fixed overhead (the annual lease cost of machinery used to manufacture Part ABS-43), and the remainder is common fixed overhead. An outside supplier has offered to sell the part to Wehner for $58. There is no alternative use for the facilities currently used to produce the part. No significant non-unit-based overhead costs are incurred.

Required:

1. Should Wehner Company make or buy Part ABS-43?

2. What is the maximum amount per unit that Wehner would be willing to pay to an outside supplier?

Generally when a company needs any item for use it has two options either he can make the same or he can buy the same. This decision is knows as make or buy decision. A company has to decide that which option will be useful for him and which will be not.

Sometime we take a decision and do work according to the same. But option of review is always available with us. So here we are reviewing this decision for Wehner Company who has the option to buy a part which he is currently manufacturing.

Part 1:

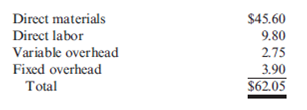

First of all we will calculate total production cost which is as follows:

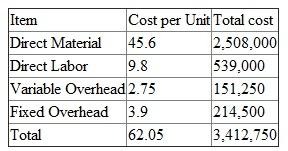

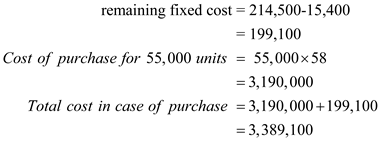

$15,400 is the only fixed cost which will be saved as that is especially for production of this particular component.

$15,400 is the only fixed cost which will be saved as that is especially for production of this particular component.

So it is $23,650 beneficial if we buy the product and stop manufacturing.

So it is $23,650 beneficial if we buy the product and stop manufacturing.

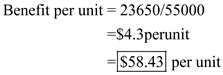

Part 2:

As it is $23,650 beneficial so we can pay this amount extra to buyer.

`

Sometime we take a decision and do work according to the same. But option of review is always available with us. So here we are reviewing this decision for Wehner Company who has the option to buy a part which he is currently manufacturing.

Part 1:

First of all we will calculate total production cost which is as follows:

$15,400 is the only fixed cost which will be saved as that is especially for production of this particular component.

$15,400 is the only fixed cost which will be saved as that is especially for production of this particular component. So it is $23,650 beneficial if we buy the product and stop manufacturing.

So it is $23,650 beneficial if we buy the product and stop manufacturing.Part 2:

As it is $23,650 beneficial so we can pay this amount extra to buyer.

`

3

(2010 CPA Exam) Egan Company owns land that could be developed in the future. Egan estimates it can sell the land for $1,200,000, net of all selling costs. If it is not sold, Egan will continue with its plans to develop the land. As Egan evaluates its options for development or sale of the property, what type of cost would the potential selling price represent in Egan's decision?

A) Sunk

B) Opportunity

C) Future

D) Variable

A) Sunk

B) Opportunity

C) Future

D) Variable

In business operations we have to take decisions which are good and profitable for company. For that we always compare costs and revenue from available options so that we can identify the best decision for us. Some costs are direct costs but some are not.

As Egan company is having an option to sale the land and another option to develop the land. In both cases company will earn profit. If company will opt any option then he will lose other option to earn money which is known as Opportunity Cost.

So correct answer is

- Opportunity Cost

- Opportunity Cost

As Egan company is having an option to sale the land and another option to develop the land. In both cases company will earn profit. If company will opt any option then he will lose other option to earn money which is known as Opportunity Cost.

So correct answer is

- Opportunity Cost

- Opportunity Cost 4

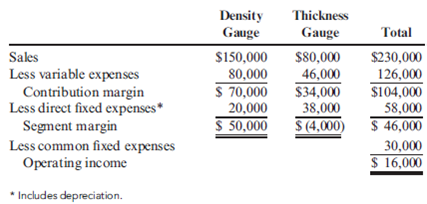

Keep-Or-Drop Decision, Alternatives, Relevant Costs

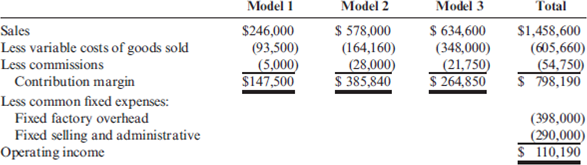

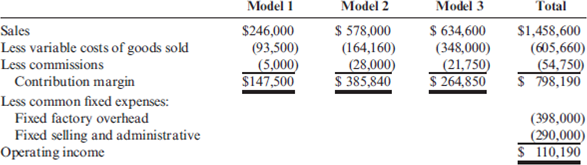

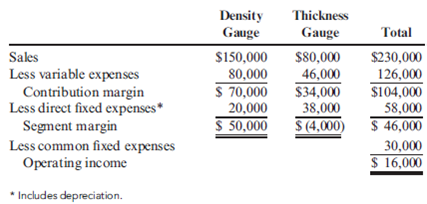

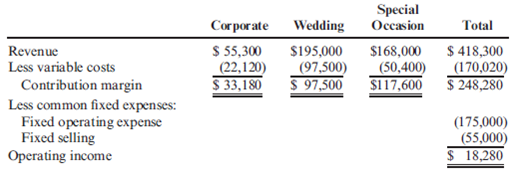

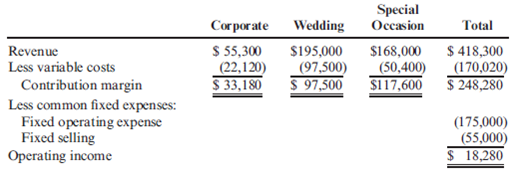

Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dryand wet-vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below.

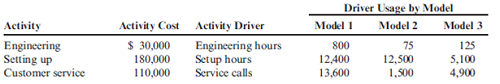

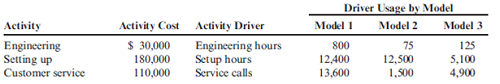

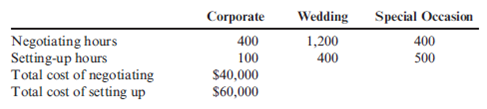

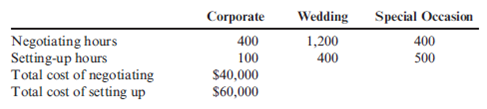

While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered:

In addition, Model 1 requires the rental of specialized equipment costing $20,000 per year.

Required:

1. Reformulate the segmented income statement using the additional information on activities.

2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the alternatives? Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.)

3. What if Reshier Company can only avoid 175 hours of engineering time and 5,000 hours of setup time that are attributable to Model 1? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much?

Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dryand wet-vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below.

While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered:

In addition, Model 1 requires the rental of specialized equipment costing $20,000 per year.

Required:

1. Reformulate the segmented income statement using the additional information on activities.

2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the alternatives? Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.)

3. What if Reshier Company can only avoid 175 hours of engineering time and 5,000 hours of setup time that are attributable to Model 1? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

5

When will flexible resources be relevant to a decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

6

(2010 CPA Exam) A company is offered a one-time special order for its product and has the capacity to take this order without losing current business. Variable costs per unit and fixed costs in total will be the same. The gross profit for the special order will be 10 percent, which is 15 percent less than the usual gross profit. What impact will this order have on total fixed costs and operating income?

A) Total fixed costs increase, and operating income increases.

B) Total fixed costs do not change, and operating income does not change.

C) Total fixed costs do not change, and operating income increases.

D) Total fixed costs increase, and operating income decreases.

A) Total fixed costs increase, and operating income increases.

B) Total fixed costs do not change, and operating income does not change.

C) Total fixed costs do not change, and operating income increases.

D) Total fixed costs increase, and operating income decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

7

"Tactical decisions are often small-scale decisions that serve a larger purpose." Explain what this means.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

8

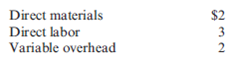

Make-or-Buy, Traditional and ABC Analysis

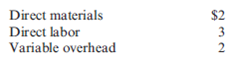

Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows:

Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following:

3 setups-$1,160 each (The setups would be avoided, and total spending could be reduced by $1,160 per setup.)

One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is $12,300 and could be totally avoided if the part were purchased.

Engineering work: 470 hours, $45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.)

75 fewer material moves at $30 per move.

Required:

1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier.

2. Now, using the special study data, repeat the analysis.

3. Discuss the qualitative factors that would affect the decision, including strategic implications.

4. After reviewing the special study, the controller made the following remark: "This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs?" Is the controller right?

Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows:

Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following:

3 setups-$1,160 each (The setups would be avoided, and total spending could be reduced by $1,160 per setup.)

One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is $12,300 and could be totally avoided if the part were purchased.

Engineering work: 470 hours, $45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.)

75 fewer material moves at $30 per move.

Required:

1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier.

2. Now, using the special study data, repeat the analysis.

3. Discuss the qualitative factors that would affect the decision, including strategic implications.

4. After reviewing the special study, the controller made the following remark: "This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs?" Is the controller right?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

9

(2011 CPA Exam) Jones Corp. had an opportunity to use its capacity to produce an extra 5,000 units with a contribution margin of $5 per unit, or to rent out the space for $10,000. What was the opportuity cost of using the capacity?

A) $35,000

B) $25,000

C) $15,000

D) $10,000

A) $35,000

B) $25,000

C) $15,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

10

Special-Order Decision, Alternatives, Relevant Costs

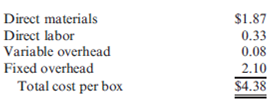

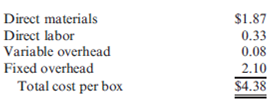

Sequoia Paper Products, Inc., manufactures boxed stationery for sale to specialty shops. Currently, the company is operating at 90 percent of capacity. A chain of drugstores has offered to buy 30,000 boxes of Sequoia's blue-bordered thank-you notes as long as the box can be customized with the drugstore chain's logo. While the normal selling price is $6.00 per box, the chain has offered just $3.10 per box. Sequoia can accommodate the special order without affecting current sales. Unit cost information for a box of thank-you notes follows:

Fixed overhead is $420,000 per year and will not be affected by the special order. Normally, there is a commission of 5 percent of price; this will not be paid on the special order since the drugstore chain is dealing directly with the company. The special order will require additional fixed costs of $14,300 for the design and setup of the machinery to stamp the drugstore chain's logo on each box.

Required:

1. List the alternatives being considered. List the relevant benefits and costs for each alternative.

2. Which alternative is more cost effective and by how much?

3. What if Sequoia Paper Products was operating at capacity and accepting the special order would require rejecting an equivalent number of boxes sold to existing customers? Which alternative would be better?

Sequoia Paper Products, Inc., manufactures boxed stationery for sale to specialty shops. Currently, the company is operating at 90 percent of capacity. A chain of drugstores has offered to buy 30,000 boxes of Sequoia's blue-bordered thank-you notes as long as the box can be customized with the drugstore chain's logo. While the normal selling price is $6.00 per box, the chain has offered just $3.10 per box. Sequoia can accommodate the special order without affecting current sales. Unit cost information for a box of thank-you notes follows:

Fixed overhead is $420,000 per year and will not be affected by the special order. Normally, there is a commission of 5 percent of price; this will not be paid on the special order since the drugstore chain is dealing directly with the company. The special order will require additional fixed costs of $14,300 for the design and setup of the machinery to stamp the drugstore chain's logo on each box.

Required:

1. List the alternatives being considered. List the relevant benefits and costs for each alternative.

2. Which alternative is more cost effective and by how much?

3. What if Sequoia Paper Products was operating at capacity and accepting the special order would require rejecting an equivalent number of boxes sold to existing customers? Which alternative would be better?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

11

When will the cost of committed resources be relevant to a decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

12

(2011 CPA Exam) The ABC Company is trying to decide between keeping an existing machine and replacing it with a new machine. The old machine was purchased just two years ago for $50,000 and had an expected life of 10 years. It now costs $1,000 a month for maintenance and repairs due to a mechanical problem. A new machine is being considered to replace it at a cost of $60,000. The new machine is more efficient and it will only cost $200 a month for maintenance and repairs. The new machine has an expected life of 10 years. In deciding to replace the old machine, which of the following factors, ignoring income taxes, should ABC not consider?

A) Any estimated salvage value on the old machine

B) The original cost of the old machine

C) The estimated useful life of the new machine

D) The lower maintenance cost on the new machine

A) Any estimated salvage value on the old machine

B) The original cost of the old machine

C) The estimated useful life of the new machine

D) The lower maintenance cost on the new machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

13

What is tactical cost analysis? What steps in the tactical decision-making model correspond to tactical cost analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

14

Resource Usage Model, Special Order

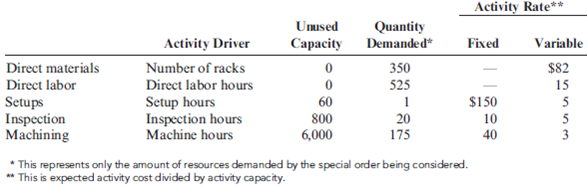

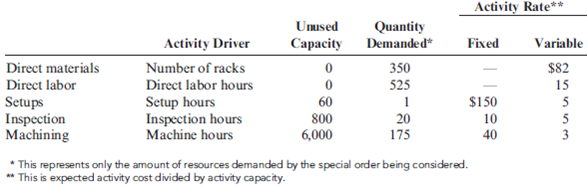

Ehrling, Inc., manufactures metal racks for hanging clothing in retail stores. Ehrling was approached by the CEO of Carly's Corner, a regional nonprofit food bank, with an offer to buy 350 heavy-duty metal racks for storing canned goods and dry food products. While racks normally sell for $245 each, Carly's Corner offered $75 per rack. The CEO explained that the number of families they served had grown significantly over the past two years, and that the charity needed additional storage for the donated food items. Since Ehrling is operating at 80 percent of capacity, and Ehrling employees have "adopted" Carly's Corner as their annual charity, the company wants to make the special order work. Ehrling's controller looked into the cost of the storage racks using the following information from the activity-based accounting system:

Expansion of activity capacity for setups, inspection, and machining must be done in steps. For setups, each step provides an additional 20 hours of setup activity and costs $3,000. For inspection, activity capacity is expanded by 2,000 hours per year, and the cost is $20,000 per year (the salary for an additional inspector). Machine capacity can be leased for a year at a rate of $40 per machine hour. Machine capacity must be acquired, however, in steps of 1,500 machine hours.

Required:

1. Compute the change in income for Ehrling, Inc., if the order is accepted.

2. Does the order require any change in capacity for setups, packing, or machining?

3. Suppose that the packing activity can be eliminated for this order since the customer is in town and does not need to have the racks boxed and shipped. Because of this, direct materials can be reduced by $13 per unit, and direct labor can be reduced by 0.5 hour per unit. How is the analysis affected?

4. Ehrling can find no other cost-saving measures for this special order. Why might the company decide to accept it even if it shows a loss?

Ehrling, Inc., manufactures metal racks for hanging clothing in retail stores. Ehrling was approached by the CEO of Carly's Corner, a regional nonprofit food bank, with an offer to buy 350 heavy-duty metal racks for storing canned goods and dry food products. While racks normally sell for $245 each, Carly's Corner offered $75 per rack. The CEO explained that the number of families they served had grown significantly over the past two years, and that the charity needed additional storage for the donated food items. Since Ehrling is operating at 80 percent of capacity, and Ehrling employees have "adopted" Carly's Corner as their annual charity, the company wants to make the special order work. Ehrling's controller looked into the cost of the storage racks using the following information from the activity-based accounting system:

Expansion of activity capacity for setups, inspection, and machining must be done in steps. For setups, each step provides an additional 20 hours of setup activity and costs $3,000. For inspection, activity capacity is expanded by 2,000 hours per year, and the cost is $20,000 per year (the salary for an additional inspector). Machine capacity can be leased for a year at a rate of $40 per machine hour. Machine capacity must be acquired, however, in steps of 1,500 machine hours.

Required:

1. Compute the change in income for Ehrling, Inc., if the order is accepted.

2. Does the order require any change in capacity for setups, packing, or machining?

3. Suppose that the packing activity can be eliminated for this order since the customer is in town and does not need to have the racks boxed and shipped. Because of this, direct materials can be reduced by $13 per unit, and direct labor can be reduced by 0.5 hour per unit. How is the analysis affected?

4. Ehrling can find no other cost-saving measures for this special order. Why might the company decide to accept it even if it shows a loss?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

15

Identifying Problems and Alternatives, Relevant Costs

Norton Products, Inc., manufactures potentiometers. (A potentiometer is a device that adjusts electrical resistance.) Currently, all parts necessary for the assembly of products are produced internally. Norton has a single plant located in Wichita, Kansas. The facilities for the manufacture of potentiometers are leased, with five years remaining on the lease. All equipment is owned by the company. Because of increases in demand, production has been expanded significantly over the five years of operation, straining the capacity of the leased facilities. Currently, the company needs more warehousing and office space, as well as more space for the production of plastic moldings. The current output of these moldings, used to make potentiometers, needs to be expanded to accommodate the increased demand for the main product.

Leo Tidwell, owner and president of Norton Products, has asked his vice president of marketing, John Tidwell, and his vice president of finance, Linda Thayn, to meet and discuss the problem of limited capacity. This is the second meeting the three have had concerning the problem. In the first meeting, Leo rejected Linda's proposal to build the company's own plant. He believed it was too risky to invest the capital necessary to build a plant at this stage of the company's development. The combination of leasing a larger facility and subleasing the current plant was also considered but was rejected; subleasing would be difficult, if not impossible. At the end of the first meeting, Leo asked John to explore the possibility of leasing another facility comparable to the current one. He also assigned Linda the task of identifying other possible sol-utions. As the second meeting began, Leo asked John to give a report on the leasing alternative.

JOHN : "After some careful research, I'm afraid that the idea of leasing an additional plant is not a very good one. Although we have some space problems, our current level of production doesn't justify another plant. In fact, I expect it will be at least five years before we need to be concerned about expanding into another facility like the one we have now. My market studies reveal a modest growth in sales over the next five years. All this growth can be absorbed by our current production capacity. The large increases in demand that we experienced the past five years are not likely to be repeated. Leasing another plant would be an overkill solution."

LEO : "Even modest growth will aggravate our current space problems. As you both know, we are already operating three production shifts. But, John, you are right-except for plastic moldings, we could expand production, particularly during the graveyard shift. Linda, I hope that you have been successful in identifying some other possible solutions. Some fairly quick action is needed."

LINDA : "Fortunately, I believe that I have two feasible alternatives. One is to rent an additional building to be used for warehousing. By transferring our warehousing needs to the new building, we will free up internal space for offices and for expanding the production of plastic moldings. I have located a building within two miles of our plant that we could use. It has the capacity to handle our current needs and the modest growth that John mentioned. The second alternative may be even more attractive. We currently produce all the parts that we use to manufacture potentiometers, including shafts and bushings. In the last several months, the market has been flooded with these two parts. Prices have tumbled as a result. It might be better to buy shafts and bushings instead of making them. If we stop internal production of shafts and bushings, this would free up the space we need. Well, Leo, what do you think? Are these alternatives feasible? Or should I continue my search for additional solutions?"

LEO : "I like both alternatives. In fact, they are exactly the types of solutions we need to consider. All we have to do now is choose the one best for our company."

Required:

1. Define the problem facing Norton Products.

2. Identify all the alternatives that were considered by Norton Products. Which ones were classified as not feasible? Why? Now identify the feasible alternatives.

3. For the feasible alternatives, what are some potential costs and benefits associated with each alternative? Of the costs that you have identified, which do you think are relevant to the decision?

Norton Products, Inc., manufactures potentiometers. (A potentiometer is a device that adjusts electrical resistance.) Currently, all parts necessary for the assembly of products are produced internally. Norton has a single plant located in Wichita, Kansas. The facilities for the manufacture of potentiometers are leased, with five years remaining on the lease. All equipment is owned by the company. Because of increases in demand, production has been expanded significantly over the five years of operation, straining the capacity of the leased facilities. Currently, the company needs more warehousing and office space, as well as more space for the production of plastic moldings. The current output of these moldings, used to make potentiometers, needs to be expanded to accommodate the increased demand for the main product.

Leo Tidwell, owner and president of Norton Products, has asked his vice president of marketing, John Tidwell, and his vice president of finance, Linda Thayn, to meet and discuss the problem of limited capacity. This is the second meeting the three have had concerning the problem. In the first meeting, Leo rejected Linda's proposal to build the company's own plant. He believed it was too risky to invest the capital necessary to build a plant at this stage of the company's development. The combination of leasing a larger facility and subleasing the current plant was also considered but was rejected; subleasing would be difficult, if not impossible. At the end of the first meeting, Leo asked John to explore the possibility of leasing another facility comparable to the current one. He also assigned Linda the task of identifying other possible sol-utions. As the second meeting began, Leo asked John to give a report on the leasing alternative.

JOHN : "After some careful research, I'm afraid that the idea of leasing an additional plant is not a very good one. Although we have some space problems, our current level of production doesn't justify another plant. In fact, I expect it will be at least five years before we need to be concerned about expanding into another facility like the one we have now. My market studies reveal a modest growth in sales over the next five years. All this growth can be absorbed by our current production capacity. The large increases in demand that we experienced the past five years are not likely to be repeated. Leasing another plant would be an overkill solution."

LEO : "Even modest growth will aggravate our current space problems. As you both know, we are already operating three production shifts. But, John, you are right-except for plastic moldings, we could expand production, particularly during the graveyard shift. Linda, I hope that you have been successful in identifying some other possible solutions. Some fairly quick action is needed."

LINDA : "Fortunately, I believe that I have two feasible alternatives. One is to rent an additional building to be used for warehousing. By transferring our warehousing needs to the new building, we will free up internal space for offices and for expanding the production of plastic moldings. I have located a building within two miles of our plant that we could use. It has the capacity to handle our current needs and the modest growth that John mentioned. The second alternative may be even more attractive. We currently produce all the parts that we use to manufacture potentiometers, including shafts and bushings. In the last several months, the market has been flooded with these two parts. Prices have tumbled as a result. It might be better to buy shafts and bushings instead of making them. If we stop internal production of shafts and bushings, this would free up the space we need. Well, Leo, what do you think? Are these alternatives feasible? Or should I continue my search for additional solutions?"

LEO : "I like both alternatives. In fact, they are exactly the types of solutions we need to consider. All we have to do now is choose the one best for our company."

Required:

1. Define the problem facing Norton Products.

2. Identify all the alternatives that were considered by Norton Products. Which ones were classified as not feasible? Why? Now identify the feasible alternatives.

3. For the feasible alternatives, what are some potential costs and benefits associated with each alternative? Of the costs that you have identified, which do you think are relevant to the decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

16

Sell at Split-Off or Process Further Decision, Alternatives, Relevant Costs

Betram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $74,000, and the result is 6,000 gallons of anderine and 8,000 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $11 per gallon and the dofinol for $6.75 per gallon. Alternatively, the anderine can be processed further at a cost of $8 per gallon (of anderine) into cermine. It takes 3 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $60.

Required:

1. List the alternatives being considered.

2. List the relevant benefits and costs for each alternative.

3. Which alternative is more cost effective and by how much?

4. What if the production of anderine into cermine required additional purchasing and quality inspection activity? Every 500 gallons of anderine that undergo further processing require 20 more purchase orders at $10 each and 15 more quality inspection hours at $25 each. Which alternative would be better and by how much?

Betram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $74,000, and the result is 6,000 gallons of anderine and 8,000 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $11 per gallon and the dofinol for $6.75 per gallon. Alternatively, the anderine can be processed further at a cost of $8 per gallon (of anderine) into cermine. It takes 3 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $60.

Required:

1. List the alternatives being considered.

2. List the relevant benefits and costs for each alternative.

3. Which alternative is more cost effective and by how much?

4. What if the production of anderine into cermine required additional purchasing and quality inspection activity? Every 500 gallons of anderine that undergo further processing require 20 more purchase orders at $10 each and 15 more quality inspection hours at $25 each. Which alternative would be better and by how much?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

17

What are the main differences between a traditional and an activity-based make-or-buy analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

18

Keep-or-Drop for Service Firm, Complementary Effects, Traditional Analysis

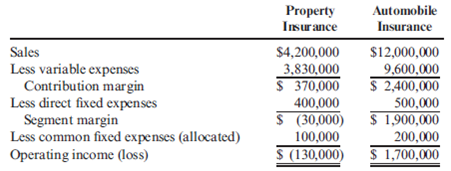

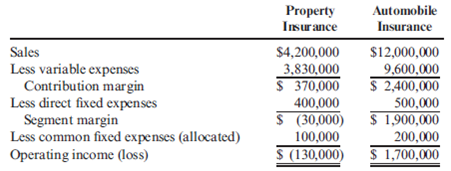

Devern Assurance Company provides both property and automobile insurance. The projected income statements for the two products are as follows:

The president of the company is considering dropping the property insurance. However, some policyholders prefer having their property and automobile insurance with the same company, so if property insurance is dropped, sales of automobile insurance will drop by 12 percent. No significant non-unit-level activity costs are incurred.

Required:

1. If Devern Assurance Company drops property insurance, by how much will income increase or decrease? Provide supporting computations.

2. Assume that dropping all advertising for the property insurance line and increasing the corporate advertising budget by $450,000 will increase sales of property insurance by 10 percent and automobile insurance by 8 percent. Prepare a segmented income statement that reflects the effect of increased advertising. Should advertising be increased?

Devern Assurance Company provides both property and automobile insurance. The projected income statements for the two products are as follows:

The president of the company is considering dropping the property insurance. However, some policyholders prefer having their property and automobile insurance with the same company, so if property insurance is dropped, sales of automobile insurance will drop by 12 percent. No significant non-unit-level activity costs are incurred.

Required:

1. If Devern Assurance Company drops property insurance, by how much will income increase or decrease? Provide supporting computations.

2. Assume that dropping all advertising for the property insurance line and increasing the corporate advertising budget by $450,000 will increase sales of property insurance by 10 percent and automobile insurance by 8 percent. Prepare a segmented income statement that reflects the effect of increased advertising. Should advertising be increased?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

19

Describe a tactical decision you personally have had to make. Apply the tactical decisionmaking model to your decision. How did it turn out? (Hint: You could discuss buying a car, choosing a college, buying a puppy, etc.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

20

Keep-or-Drop: Traditional Versus Activity-Based Analysis

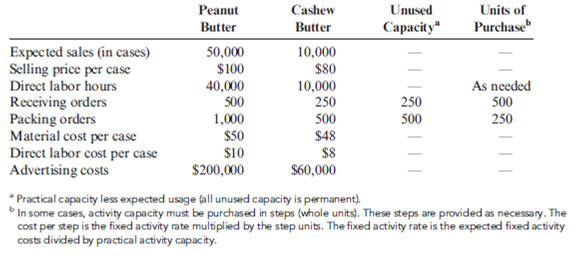

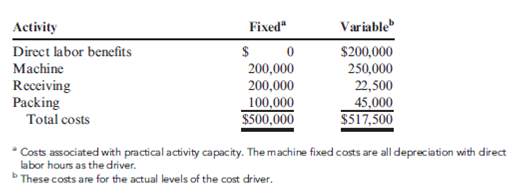

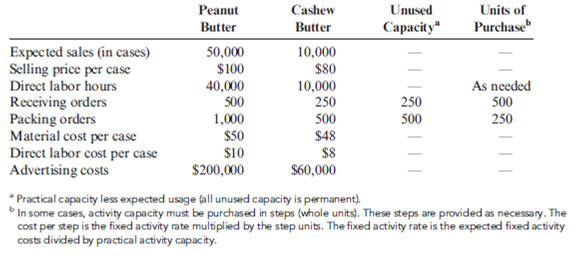

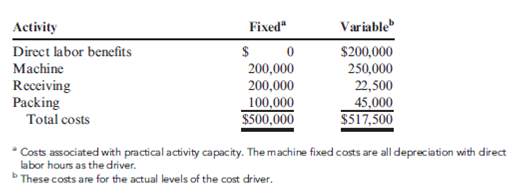

Nutterco, Inc., produces two types of nut butter: peanut butter and cashew butter. Of the two, peanut butter is the more popular. Cashew butter is a specialty line using smaller jars and fewer jars per case. Data concerning the two products follow:

Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver.

Required:

1. Prepare a traditional segmented income statement, using a unit-level overhead rate based on direct labor hours. Using this approach, determine whether the cashew butter product line should be kept or dropped.

2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysis using an ABC approach.

Nutterco, Inc., produces two types of nut butter: peanut butter and cashew butter. Of the two, peanut butter is the more popular. Cashew butter is a specialty line using smaller jars and fewer jars per case. Data concerning the two products follow:

Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver.

Required:

1. Prepare a traditional segmented income statement, using a unit-level overhead rate based on direct labor hours. Using this approach, determine whether the cashew butter product line should be kept or dropped.

2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysis using an ABC approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

21

Special Order, Traditional Analysis

Fiorello Company manufactures two types of cold-pressed olive oil, Refined Oil and Top Quality Oil, out of a joint process. The joint (common) costs incurred are $92,500 for a standard production run that generates 30,000 gallons of Refined Oil and 15,000 gallons of Top Quality Oil. Additional processing costs beyond the split-off point are $2.40 per gallon for Refined Oil and $1.95 per gallon for Top Quality Oil. Refined Oil sells for $4.25 per gallon, while Top Quality Oil sells for $8.30 per gallon.

MangiareBuono, a supermarket chain, has asked Fiorello to supply it with 30,000 gallons of Top Quality Oil at a price of $8 per gallon. MangiareBuono plans to have the oil bottled in 16- ounce bottles with its own MangiareBuono label.

If Fiorello accepts the order, it will save $0.23 per gallon in packaging of Top Quality Oil. There is sufficient excess capacity for the order. However, the market for Refined Oil is saturated, and any additional sales of Refined Oil would take place at a price of $3.10 per gallon. Assume that no significant non-unit-level activity costs are incurred.

Required:

1. What is the profit normally earned on one production run of Refined Oil and Top Quality Oil?

2. Should Fiorello accept the special order? Explain. (CMA adapted)

Fiorello Company manufactures two types of cold-pressed olive oil, Refined Oil and Top Quality Oil, out of a joint process. The joint (common) costs incurred are $92,500 for a standard production run that generates 30,000 gallons of Refined Oil and 15,000 gallons of Top Quality Oil. Additional processing costs beyond the split-off point are $2.40 per gallon for Refined Oil and $1.95 per gallon for Top Quality Oil. Refined Oil sells for $4.25 per gallon, while Top Quality Oil sells for $8.30 per gallon.

MangiareBuono, a supermarket chain, has asked Fiorello to supply it with 30,000 gallons of Top Quality Oil at a price of $8 per gallon. MangiareBuono plans to have the oil bottled in 16- ounce bottles with its own MangiareBuono label.

If Fiorello accepts the order, it will save $0.23 per gallon in packaging of Top Quality Oil. There is sufficient excess capacity for the order. However, the market for Refined Oil is saturated, and any additional sales of Refined Oil would take place at a price of $3.10 per gallon. Assume that no significant non-unit-level activity costs are incurred.

Required:

1. What is the profit normally earned on one production run of Refined Oil and Top Quality Oil?

2. Should Fiorello accept the special order? Explain. (CMA adapted)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is a relevant cost? Explain why depreciation on an existing asset is always irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain why activity-based segmented reporting provides more insight concerning keep-or- drop decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

24

Resource Usage, Special Order

St. John's Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMC's Cath Lab. Each technician is paid a salary of $36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for $250,000. It is expected to last five years. The equipment's capacity is 25,000 procedures over its life. Depreciation is computed on a straight- line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is $120 per test. The technician's report with the outside physician's note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends $50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMC's business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging $850 for the procedure-enough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services).

At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be $550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporary-for one year only. The HMO expects to have its own testing capabilities within one year.

Required:

1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources.

2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning.

3. Assume that SJMC will accept the HMO offer if it reduces the hospital's operating costs. Should the HMO offer be accepted?

4. Jerold Bosserman, SJMC's hospital controller, argued against accepting the HMO's offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesn't even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for $550. Discuss the merits of Jerold's position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation.

5. Chandra Denton, SJMC's administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC won't need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of $2,000 per year. How does this outcome affect the analysis of the HMO offer?

6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activity's first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?

St. John's Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMC's Cath Lab. Each technician is paid a salary of $36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for $250,000. It is expected to last five years. The equipment's capacity is 25,000 procedures over its life. Depreciation is computed on a straight- line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is $120 per test. The technician's report with the outside physician's note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends $50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMC's business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging $850 for the procedure-enough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services).

At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be $550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporary-for one year only. The HMO expects to have its own testing capabilities within one year.

Required:

1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources.

2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning.

3. Assume that SJMC will accept the HMO offer if it reduces the hospital's operating costs. Should the HMO offer be accepted?

4. Jerold Bosserman, SJMC's hospital controller, argued against accepting the HMO's offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesn't even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for $550. Discuss the merits of Jerold's position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation.

5. Chandra Denton, SJMC's administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC won't need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of $2,000 per year. How does this outcome affect the analysis of the HMO offer?

6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activity's first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

25

Determining Relevant Costs

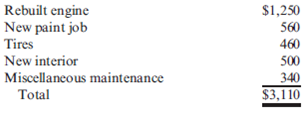

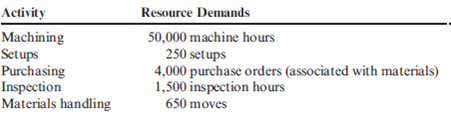

Six months ago, Lee Anna Carver purchased a fire-engine red, used LeBaron convertible for $10,000. Lee Anna was looking forward to the feel of the sun on her shoulders and the wind whipping through her hair as she zipped along the highways of life. Unfortunately, the wind turned her hair into straw, and she didn't do much zipping along since the car spent so much of its time in the shop. So far, she has spent $1,200 on repairs, and she's afraid there is no end in sight. In fact, Lee Anna anticipates the following costs of restoration:

On a visit to a used car dealer, Lee Anna found a five-year-old Honda CR-V in excellent condition for $9,100-Lee Anna thinks she might really be more the sport-utility type anyway. Lee Anna checked the Blue Book values and found that she can sell the LeBaron for only $3,600. If she buys the CR-V, she will pay cash but would need to sell the LeBaron.

Required:

1. In trying to decide whether to restore the LeBaron or buy the CR-V, Lee Anna is distressed because she has already spent $11,200 on the LeBaron. The investment seems too much to give up. How would you react to her concern?

2. List all costs that are relevant to Lee Anna's decision. What advice would you give her?

Six months ago, Lee Anna Carver purchased a fire-engine red, used LeBaron convertible for $10,000. Lee Anna was looking forward to the feel of the sun on her shoulders and the wind whipping through her hair as she zipped along the highways of life. Unfortunately, the wind turned her hair into straw, and she didn't do much zipping along since the car spent so much of its time in the shop. So far, she has spent $1,200 on repairs, and she's afraid there is no end in sight. In fact, Lee Anna anticipates the following costs of restoration:

On a visit to a used car dealer, Lee Anna found a five-year-old Honda CR-V in excellent condition for $9,100-Lee Anna thinks she might really be more the sport-utility type anyway. Lee Anna checked the Blue Book values and found that she can sell the LeBaron for only $3,600. If she buys the CR-V, she will pay cash but would need to sell the LeBaron.

Required:

1. In trying to decide whether to restore the LeBaron or buy the CR-V, Lee Anna is distressed because she has already spent $11,200 on the LeBaron. The investment seems too much to give up. How would you react to her concern?

2. List all costs that are relevant to Lee Anna's decision. What advice would you give her?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

26

Sell or Process Further, Basic Analysis

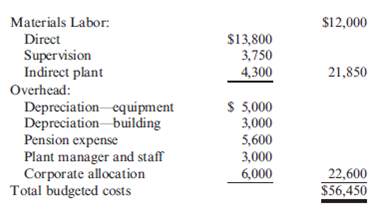

Carleigh, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a common process: sirloin roasts, chops, spare ribs, and the residual. The roasts, chops, and spare ribs are packaged, branded, and sold to supermarkets. The residual consists of organ meats and leftover pieces that are sold to sausage and hot dog processors. The joint costs for a typical week are as follows:

The revenues from each product are as follows: sirloin roasts, $68,000; chops, $71,000; spare ribs, $33,000; and residual, $9,800.

Carleigh's management has learned that certain organ meats are a prized delicacy in Asia. They are considering separating those from the residual and selling them abroad for $52,000. This would bring the value of the residual down to $2,650. In addition, the organ meats would need to be packaged and then air freighted to Asia. Further processing cost per week is estimated to be $27,500 (the cost of renting additional packaging equipment, purchasing materials, and hiring additional direct labor). Transportation cost would be $12,100 per week. Finally, resource spending would need to be expanded for other activities as well (purchasing, receiving, and internal shipping). The increase in resource spending for these activities is estimated to be $3,120 per week.

Required:

1. What is the gross profit earned by the original mix of products for one week?

2. Should the company separate the organ meats for shipment overseas or continue to sell them at split-off? What is the effect of the decision on weekly gross profit?

Carleigh, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a common process: sirloin roasts, chops, spare ribs, and the residual. The roasts, chops, and spare ribs are packaged, branded, and sold to supermarkets. The residual consists of organ meats and leftover pieces that are sold to sausage and hot dog processors. The joint costs for a typical week are as follows:

The revenues from each product are as follows: sirloin roasts, $68,000; chops, $71,000; spare ribs, $33,000; and residual, $9,800.

Carleigh's management has learned that certain organ meats are a prized delicacy in Asia. They are considering separating those from the residual and selling them abroad for $52,000. This would bring the value of the residual down to $2,650. In addition, the organ meats would need to be packaged and then air freighted to Asia. Further processing cost per week is estimated to be $27,500 (the cost of renting additional packaging equipment, purchasing materials, and hiring additional direct labor). Transportation cost would be $12,100 per week. Finally, resource spending would need to be expanded for other activities as well (purchasing, receiving, and internal shipping). The increase in resource spending for these activities is estimated to be $3,120 per week.

Required:

1. What is the gross profit earned by the original mix of products for one week?

2. Should the company separate the organ meats for shipment overseas or continue to sell them at split-off? What is the effect of the decision on weekly gross profit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

27

Activity-Based Resource Usage Model, Make-or-Buy

Brandy Dees recently bought Nievo Enterprises, a company that manufactures ice skates. Brandy decided to assume management responsibilities for the company and appointed herself president shortly after the purchase was completed. When she bought the company, Brandy's investigation revealed that with the exception of the blades, all parts of the skates are produced internally. The investigation also revealed that Nievo once produced the blades internally and still owned the equipment. The equipment was in good condition and was stored in a local warehouse. Nievo's former owner had decided three years earlier to purchase the blades from external suppliers.

Brandy Dees is seriously considering making the blades instead of buying them from external suppliers. The blades are purchased in sets of two and cost $8 per set. Currently, 100,000 sets of blades are purchased annually.

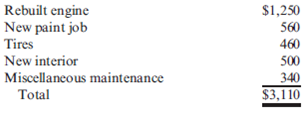

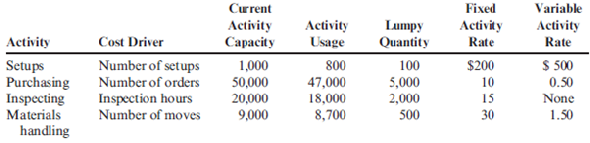

Skates are produced in batches, according to shoe size. Production equipment must be reconfigured for each batch. The blades could be produced using an available area within the plant. Prime costs will average $5.00 per set. There is enough equipment to set up three lines of production, each capable of producing 80,000 sets of blades. A supervisor would need to be hired for each line. Each supervisor would be paid a salary of $40,000. Additionally, it would cost $1.50 per machine hour for power, oil, and other operating expenses. Since three types of blades would be produced, additional demands would be made on the setup activity. Other overhead activities affected include purchasing, inspection, and materials handling. The company's ABC system provides the following information about the current status of the overhead activities that would be affected. (The lumpy quantity indicates how much capacity must be purchased should any expansion of activity supply be needed-the units of purchase. The purchase cost per unit is the fixed activity rate. The variable rate is the cost per unit of resources acquired as needed for each activity.)

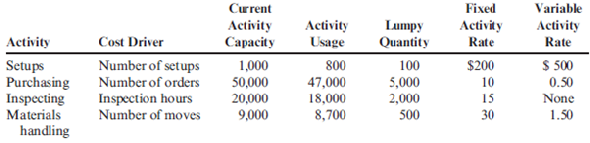

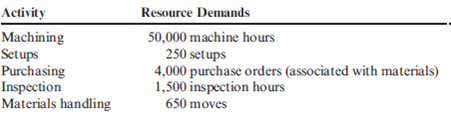

The demands that the production of blades places on the overhead activities are as follows:

If the blades are made, the purchase of the blades from outside suppliers will cease. Therefore, purchase orders will decrease by 6,500 (the number associated with their purchase). Similarly, the moves for the handling of incoming blades will decrease by 400. Any unused activity capacity is viewed as permanent.

Required:

1. Should Nievo make or buy the blades?

2. Explain how the ABC resource usage model helped in the analysis. Also, comment on how a conventional approach would have differed.

Brandy Dees recently bought Nievo Enterprises, a company that manufactures ice skates. Brandy decided to assume management responsibilities for the company and appointed herself president shortly after the purchase was completed. When she bought the company, Brandy's investigation revealed that with the exception of the blades, all parts of the skates are produced internally. The investigation also revealed that Nievo once produced the blades internally and still owned the equipment. The equipment was in good condition and was stored in a local warehouse. Nievo's former owner had decided three years earlier to purchase the blades from external suppliers.

Brandy Dees is seriously considering making the blades instead of buying them from external suppliers. The blades are purchased in sets of two and cost $8 per set. Currently, 100,000 sets of blades are purchased annually.

Skates are produced in batches, according to shoe size. Production equipment must be reconfigured for each batch. The blades could be produced using an available area within the plant. Prime costs will average $5.00 per set. There is enough equipment to set up three lines of production, each capable of producing 80,000 sets of blades. A supervisor would need to be hired for each line. Each supervisor would be paid a salary of $40,000. Additionally, it would cost $1.50 per machine hour for power, oil, and other operating expenses. Since three types of blades would be produced, additional demands would be made on the setup activity. Other overhead activities affected include purchasing, inspection, and materials handling. The company's ABC system provides the following information about the current status of the overhead activities that would be affected. (The lumpy quantity indicates how much capacity must be purchased should any expansion of activity supply be needed-the units of purchase. The purchase cost per unit is the fixed activity rate. The variable rate is the cost per unit of resources acquired as needed for each activity.)

The demands that the production of blades places on the overhead activities are as follows:

If the blades are made, the purchase of the blades from outside suppliers will cease. Therefore, purchase orders will decrease by 6,500 (the number associated with their purchase). Similarly, the moves for the handling of incoming blades will decrease by 400. Any unused activity capacity is viewed as permanent.

Required:

1. Should Nievo make or buy the blades?

2. Explain how the ABC resource usage model helped in the analysis. Also, comment on how a conventional approach would have differed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

28

Give an example of a future cost that is not relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

29

Should joint costs be considered in a sell or process further decision? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

30

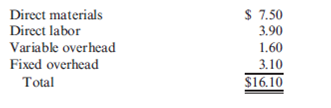

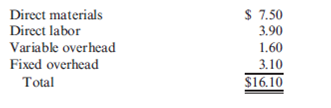

Make-or-Buy, Traditional Analysis, Qualitative Considerations

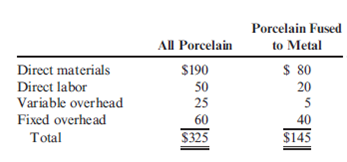

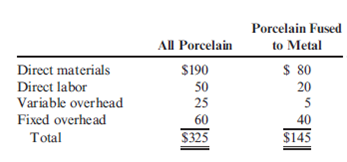

Apollonia Dental Services is part of an HMO that operates in a large metropolitan area. Currently, Apollonia has its own dental laboratory to produce two varieties of porcelain crowns-all porcelain and porcelain fused to metal. The unit costs to produce the crowns are as follows:

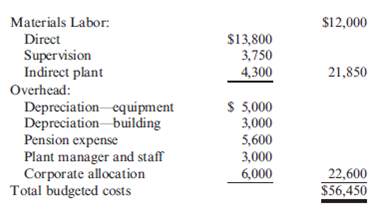

Fixed overhead is detailed as follows:

Overhead is applied on the basis of direct labor hours. The rates above were computed using 8,000 direct labor hours. No significant non-unit-level overhead costs are incurred.

A local dental laboratory has offered to supply Apollonia all the crowns it needs. Its price is $265 for all-porcelain crowns and $145 for porcelain-fused-to-metal crowns; however, the offer is conditional on supplying both types of crowns-it will not supply just one type for the price indicated. If the offer is accepted, the equipment used by Apollonia's laboratory would be scrapped (it is old and has no market value), and the lab facility would be closed. Apollonia uses 2,500 all-porcelain crowns and 1,000 porcelain-fused-to-metal crowns per year.

Required:

1. Should Apollonia continue to make its own crowns, or should they be purchased from the external supplier? What is the dollar effect of purchasing?

2. What qualitative factors should Apollonia consider in making this decision?

3. Suppose that the lab facility is owned rather than rented and that the $22,000 is depreciation rather than rent. What effect does this have on the analysis in Requirement 1?

4. Refer to the original data. Assume that the volume of crowns is 5,000 all porcelain and 2,000 porcelain fused to metal. Should Apollonia make or buy the crowns? Explain the outcome.

Apollonia Dental Services is part of an HMO that operates in a large metropolitan area. Currently, Apollonia has its own dental laboratory to produce two varieties of porcelain crowns-all porcelain and porcelain fused to metal. The unit costs to produce the crowns are as follows:

Fixed overhead is detailed as follows:

Overhead is applied on the basis of direct labor hours. The rates above were computed using 8,000 direct labor hours. No significant non-unit-level overhead costs are incurred.

A local dental laboratory has offered to supply Apollonia all the crowns it needs. Its price is $265 for all-porcelain crowns and $145 for porcelain-fused-to-metal crowns; however, the offer is conditional on supplying both types of crowns-it will not supply just one type for the price indicated. If the offer is accepted, the equipment used by Apollonia's laboratory would be scrapped (it is old and has no market value), and the lab facility would be closed. Apollonia uses 2,500 all-porcelain crowns and 1,000 porcelain-fused-to-metal crowns per year.

Required:

1. Should Apollonia continue to make its own crowns, or should they be purchased from the external supplier? What is the dollar effect of purchasing?

2. What qualitative factors should Apollonia consider in making this decision?

3. Suppose that the lab facility is owned rather than rented and that the $22,000 is depreciation rather than rent. What effect does this have on the analysis in Requirement 1?

4. Refer to the original data. Assume that the volume of crowns is 5,000 all porcelain and 2,000 porcelain fused to metal. Should Apollonia make or buy the crowns? Explain the outcome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

31

Resource Supply and Usage, Special Order, Relevancy

Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of $25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is $1,100 per year. In addition to the salaries, Elliott spends $27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed.

Required:

1. Classify the resources associated with purchasing as (1) flexible or (2) committed.

2. Compute the total activity availability, and break this into activity usage and unused activity.

3. Calculate the total cost of resources supplied (activity cost), and break this into the cost of activity used and the cost of unused activity.

4. (a) Suppose that a large special order will cause an additional 500 purchase orders. What purchasing costs are relevant? By how much will purchasing costs increase if the order is accepted? (b) Suppose that the special order causes 700 additional purchase orders. How will your answer to (a) change?

Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of $25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is $1,100 per year. In addition to the salaries, Elliott spends $27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed.

Required:

1. Classify the resources associated with purchasing as (1) flexible or (2) committed.

2. Compute the total activity availability, and break this into activity usage and unused activity.

3. Calculate the total cost of resources supplied (activity cost), and break this into the cost of activity used and the cost of unused activity.

4. (a) Suppose that a large special order will cause an additional 500 purchase orders. What purchasing costs are relevant? By how much will purchasing costs increase if the order is accepted? (b) Suppose that the special order causes 700 additional purchase orders. How will your answer to (a) change?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

32

Relevant Costs, Foreign Trade Zones

Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about $16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent.

Required:

1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.)

2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)

3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)

Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about $16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent.

Required:

1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.)

2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)

3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

33

Sell or Process Further

Pharmaco Corporation buys three chemicals that are processed to produce two popular ingredients for liquid pain relievers. The three chemicals are in liquid form. The purchased chemicals are blended for two to three hours and then heated for 15 minutes. The results of the process are two separate ingredients, PR1 and PR2. For every 4,300 gallons of chemicals used, 2,000 gallons of each pain reliever are produced. The pain relievers are sold to companies that process them into their final form. The selling prices are $34 per gallon for PR1 and $45 per gallon for PR2. The costs to produce one batch (containing 2,000 gallons of each chemical) are as follows:

The pain relievers are bottled in five-gallon plastic containers and shipped. The cost of each container is $2.10. The costs of shipping are $0.50 per container.

Pharmaco Corporation could process PR1 further by mixing it with inert powders and flavoring to form tablets. The tablets can be sold directly to retail drug stores as a generic brand. If this route is taken, the revenue received per case of tablets would be $13.50, with eight cases produced by every gallon of PR1. The costs of processing into tablets total $11.00 per gallon of PR1. Packaging costs $5.16 per case. Shipping costs are $1.68 per case.

Required:

1. Should Pharmaco sell PR1 at split-off, or should PR1 be processed and sold as tablets?

2. If Pharmaco normally sells 26,000 gallons of PR1 per year, what will be the difference in profits if PR1 is processed further?

Pharmaco Corporation buys three chemicals that are processed to produce two popular ingredients for liquid pain relievers. The three chemicals are in liquid form. The purchased chemicals are blended for two to three hours and then heated for 15 minutes. The results of the process are two separate ingredients, PR1 and PR2. For every 4,300 gallons of chemicals used, 2,000 gallons of each pain reliever are produced. The pain relievers are sold to companies that process them into their final form. The selling prices are $34 per gallon for PR1 and $45 per gallon for PR2. The costs to produce one batch (containing 2,000 gallons of each chemical) are as follows:

The pain relievers are bottled in five-gallon plastic containers and shipped. The cost of each container is $2.10. The costs of shipping are $0.50 per container.

Pharmaco Corporation could process PR1 further by mixing it with inert powders and flavoring to form tablets. The tablets can be sold directly to retail drug stores as a generic brand. If this route is taken, the revenue received per case of tablets would be $13.50, with eight cases produced by every gallon of PR1. The costs of processing into tablets total $11.00 per gallon of PR1. Packaging costs $5.16 per case. Shipping costs are $1.68 per case.

Required:

1. Should Pharmaco sell PR1 at split-off, or should PR1 be processed and sold as tablets?

2. If Pharmaco normally sells 26,000 gallons of PR1 per year, what will be the difference in profits if PR1 is processed further?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

34

Relevant costs always determine which alternative should be chosen. Do you agree or disagree? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

35

Why would a firm ever offer a price on a product that is below its full cost?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 47 في هذه المجموعة.

فتح الحزمة

k this deck

36

Plant Shutdown or Continue Operations, Qualitative Considerations, Traditional Analysis

KarlAuto Corporation manufactures automobiles, vans, and trucks. Among the various Karl- Auto plants around the United States is the Bloomington plant, where vinyl covers and upholstery fabric are sewn. These are used to cover interior seating and other surfaces of KarlAuto products.

Pam Teegin is the plant manager for the Bloomington cover plant-the first KarlAuto plant in the region. As other area plants were opened, Teegin, in recognition of her management ability, was given the responsibility to manage them. Teegin functions as a regional manager, although the budget for her and her staff is charged to the Bloomington plant.