Deck 7: Applications of Simple Interest

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

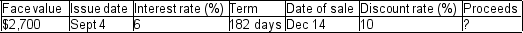

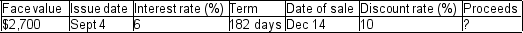

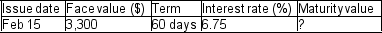

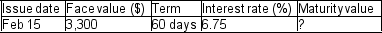

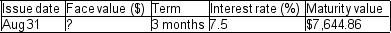

سؤال

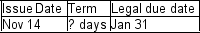

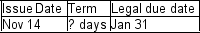

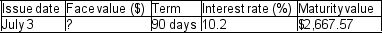

سؤال

سؤال

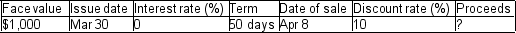

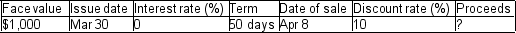

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/128

العب

ملء الشاشة (f)

Deck 7: Applications of Simple Interest

1

At the end of April, Brad had $7,500 in his daily interest savings account. On the 13th of May he deposited another $3,500. He made no other deposits or withdrawals in May. The simple interest rate throughout May was 3.7%. How much interest did Brad earn on this savings account in May?

A) $16.83

B) $30.31

C) $21.99

D) $39.52

E) $46.17

A) $16.83

B) $30.31

C) $21.99

D) $39.52

E) $46.17

$30.31

2

A contract requires payments of $2,000 and $3,000, 90 days and 120 days, respectively, from today. What is the value of the contract today if the payments are discounted to yield a rate of return of 12% simple interest?

A) $4,824.06

B) $4,828.66

C) $4,831.48

D) $4,837.87

E) $5,177.53

A) $4,824.06

B) $4,828.66

C) $4,831.48

D) $4,837.87

E) $5,177.53

$4,828.66

3

A 4-month Guaranteed Investment Certificate with a face value of $55,000 will have a maturity value of $56,100. What simple annual interest rate is it carrying?

A) 6.00%

B) 10.20%

C) 2.00%

D) 8.00%

E) 20.00%

A) 6.00%

B) 10.20%

C) 2.00%

D) 8.00%

E) 20.00%

6.00%

4

Commercial Paper with a face value of $1,000,000 issued at a discount rate of 7.5% simple interest has a term of 360 days. At what price was it issued?

A) $944,736

B) $1,000,000

C) $925,000

D) $1,073,973

E) $931,122

A) $944,736

B) $1,000,000

C) $925,000

D) $1,073,973

E) $931,122

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is the price of a $50,000, 182-day T-bill on its issue date if the market rate of return on this date was 6.875% simple interest?

A) $48,342.77

B) $48,262.15

C) $48,285.96

D) $48,148.15

E) $48,320.53

A) $48,342.77

B) $48,262.15

C) $48,285.96

D) $48,148.15

E) $48,320.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

6

270-Day Commercial Paper with a face value of $500,000 was sold 206 days after it was issued at a price that would provide a simple rate of interest to the purchaser of 9.85%. What was the price?

A) $473,668

B) $508,636

C) $491,511

D) $527,796

E) $490,929

A) $473,668

B) $508,636

C) $491,511

D) $527,796

E) $490,929

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

7

An investment will pay $3,000 six months from now. What purchase price will provide a rate of return of 12% simple interest?

A) $2,830.19

B) $3,180.00

C) $2,000.00

D) $2,500.00

E) $2,724.17

A) $2,830.19

B) $3,180.00

C) $2,000.00

D) $2,500.00

E) $2,724.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

8

Determine the issue price of a 91-day, $100,000 Government of Alberta Treasury Bill that was issued at a discount rate of 5.75% simple interest.

A) $98,587

B) $94,250

C) $96,194

D) $100,000

E) $101,434

A) $98,587

B) $94,250

C) $96,194

D) $100,000

E) $101,434

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

9

On February 1, John signed a contract to pay Janet $4,500 plus interest on April 2 and $5,500 plus interest on July 31. Both payments carried a 6.5% simple interest annually. Janet then sold both contracts to Fred on May 1 at a rate of 4.5% annually. Determine how much she received.

A) $10,145.20

B) $10,300.18

C) $10,451.07

D) $10,618.30

E) $11,863.54

A) $10,145.20

B) $10,300.18

C) $10,451.07

D) $10,618.30

E) $11,863.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

10

An investment earning 16% simple interest has a maturity value of $9,440.00 after eight months. What was the initial amount invested?

A) $8,530.12

B) $10,446.93

C) $7,228.92

D) $8,853.33

E) $7,780.22

A) $8,530.12

B) $10,446.93

C) $7,228.92

D) $8,853.33

E) $7,780.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the simple interest rate of a 7-month GIC that grows from $30,000 to its maturity value of $31,500?

A) 5.00%

B) 8.16%

C) 8.57%

D) 8.95%

E) 9.88%

A) 5.00%

B) 8.16%

C) 8.57%

D) 8.95%

E) 9.88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

12

At the end of September Andy had $9,000 in his daily interest savings account. On the 12th of October he withdrew $4,000. He made no other withdrawals or deposits in October. The simple interest rate throughout October was 4.2%. How much interest did Andy earn on this savings account in October?

A) $9.21

B) $41.31

C) $22.90

D) $19.82

E) $26.17

A) $9.21

B) $41.31

C) $22.90

D) $19.82

E) $26.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

13

How much simple interest would be earned by a six-month, $30,000 Guaranteed Investment Certificate at 5.7%?

A) $143

B) $696

C) $763

D) $855

E) $978

A) $143

B) $696

C) $763

D) $855

E) $978

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

14

What simple interest rate was used to discount 270-day, $750,000 commercial paper when it was issued for $710,000?

A) 7.21%

B) 7.62%

C) 5.33%

D) 6.63%

E) 6.94%

A) 7.21%

B) 7.62%

C) 5.33%

D) 6.63%

E) 6.94%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

15

The current rates on 90- and 180-day GICs are 5.5% and 6% simple interest, respectively. An investor is trying to decide whether to purchase a 90-day GIC and then reinvest its maturity value in a second 90-day GIC. What would the interest rate on 90-day GICs have to be 90 days from now for the investor to end up in the same financial position with either alternative?

A) 5.595%

B) 6.500%

C) 6.249%

D) 6.413%

E) 7.000%

A) 5.595%

B) 6.500%

C) 6.249%

D) 6.413%

E) 7.000%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

16

On January 15, Mario signed a contract to pay Stephan $12,000 plus 9% simple interest on May 15 and $18,000 plus 10% interest on September 12. On August 15, Stephan then sold the first contract to Sally at a rate of 11% and the other contract to Anna for 12%. Determine the amount Stephan received on August 15.

A) $33,333.33

B) $31,030.33

C) $30,130.33

D) $29,313.33

E) $26,613.33

A) $33,333.33

B) $31,030.33

C) $30,130.33

D) $29,313.33

E) $26,613.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

17

A 7-month, $75,400 Guaranteed Investment Certificate pays simple interest of 6.85%. Calculate the maturity value.

A) $72,912

B) $76,201

C) $76,309

D) $86,112

E) $78,413

A) $72,912

B) $76,201

C) $76,309

D) $86,112

E) $78,413

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

18

Calculate the maturity value of a 300-day, $6,000 term deposit earning 5.15% simple interest.

A) $5,756.34

B) $6,253.97

C) $6,309.00

D) $6,111.78

E) $7,021.99

A) $5,756.34

B) $6,253.97

C) $6,309.00

D) $6,111.78

E) $7,021.99

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

19

What will be the maturity value of $25,000 placed in a 90-day term deposit paying a simple interest rate of 4.75%?

A) $24,710.58

B) $25,396.77

C) $25,292.81

D) $25,306.77

E) $25,302.57

A) $24,710.58

B) $25,396.77

C) $25,292.81

D) $25,306.77

E) $25,302.57

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

20

A 182-day, $250,000 Treasury Bill originally issued at 6.6% was sold at 5.9% simple interest, 82 days after it was issued. What was the selling price?

A) $245,560

B) $250,000

C) $246,730

D) $246,347

E) $246,023

A) $245,560

B) $250,000

C) $246,730

D) $246,347

E) $246,023

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

21

On July 1, David borrowed $9,500 from his revolving line of credit. At the time the annual simple interest rate was 3.80%. On September 15, the annual interest rate was lowered to 3.60%. Determine the interest paid from July 1st to December 31st.

A) $99.62

B) $171.47

C) $180.99

D) $164.05

E) $176.22

A) $99.62

B) $171.47

C) $180.99

D) $164.05

E) $176.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

22

On September 12, Claire had $8,000 in student loans outstanding. She agreed to $125 per month payments to repay these loans. From September 12 to October 8, the simple interest rates were 5.0%, but decreased to 4.5% thereafter. Calculate the balance outstanding on October 31.

A) $7,800.76

B) $7,808.96

C) $7,819.27

D) $7,826.34

E) $7,855.68

A) $7,800.76

B) $7,808.96

C) $7,819.27

D) $7,826.34

E) $7,855.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

23

On January 12, Alex has student loans totalling $14,000. Alex agreed to a $200 per month repayment schedule at which time the annual interest rate was 5.5% simple interest. Determine the balance of the loan at the end of January.

A) $13,840.08

B) $13,845.20

C) $13,881.91

D) $13,728.47

E) $13,990.64

A) $13,840.08

B) $13,845.20

C) $13,881.91

D) $13,728.47

E) $13,990.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

24

On October 15, Jerome had $9,000 of student loans. He agreed to a payment plan of $150 per month at an annual rate of 9.60% simple interest. Determine how much of the $150 will go towards the principal at the end of December.

A) $77.81

B) $78.18

C) $79.27

D) $80.08

E) $81.18

A) $77.81

B) $78.18

C) $79.27

D) $80.08

E) $81.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

25

On September 15, Miguel has student loans totalling $25,000. Miguel agreed to a $350 per month repayment schedule at which time the annual simple interest rate was 7.45%. Determine the balance of the loan at the end of November.

A) $25,666.55

B) $25,555.44

C) $24,444.55

D) $24,333.22

E) $24,666,33

A) $25,666.55

B) $25,555.44

C) $24,444.55

D) $24,333.22

E) $24,666,33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

26

Ada had $12,500 in student loans. On Sept 3, she began repayments of $450 per month when simple interest rates were 9.2% annually. On October 8 the interest rates rose to 9.5%. By what amount will the principal be reduced given the $450 payment on October 31?

A) $361.42

B) $355.18

C) $352.09

D) $350.01

E) $347.78

A) $361.42

B) $355.18

C) $352.09

D) $350.01

E) $347.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

27

Alice purchased a $100,000 180-day Acme Corporation Commercial Paper when it was first issued at a yield simple interest rate of 7.45%. 50 days later she sold it to Betty at a rate that would provide Betty with a return of 8.45% if Betty held it to maturity. What annual simple rate did Alice actually realize over the period that she held the Commercial Paper?

A) 6.45%

B) 4.71%

C) 7.45%

D) 6.98%

E) 7.95%

A) 6.45%

B) 4.71%

C) 7.45%

D) 6.98%

E) 7.95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

28

On January 5, Steven received a $25,000 advance on a revolving line of credit at 3.75% annual rate. On march 5, the annual rate increased to 4.25%. Determine the simple interest to be paid from January 5th to August 15th.

A) $626.03

B) $632.03

C) $638.03

D) $644.03

E) $650.03

A) $626.03

B) $632.03

C) $638.03

D) $644.03

E) $650.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

29

Liam had $5,200 in student loans. On August 9, he began repayments of $50 per month when simple interest rates were 9.2% annually. On September 8, the interest rates rose to 9.5%. By what amount will the principal be reduced given the $50 payment on September 30?

A) $8.90

B) $9.91

C) $10.90

D) $11.90

E) $12.90

A) $8.90

B) $9.91

C) $10.90

D) $11.90

E) $12.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

30

An $8,000 demand loan at a fixed simple interest rate of 10.5% was advanced on May 10. A payment of $2,000 was made on July 15 and a final payment was made on Sept. 5. What was the size of the final payment?

A) $6,241.64

B) $6,243.92

C) $6,363.61

D) $6,151.89

E) $8,152.90

A) $6,241.64

B) $6,243.92

C) $6,363.61

D) $6,151.89

E) $8,152.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

31

On April 7, Madeline had $10,500 in student loans outstanding. She agreed to $75 per month payments to repay these loans. From April 7 to May 5, the interest rates were 3.25%, but increased to 4.5% thereafter. Calculate the amount of simple interest paid for the month of May.

A) $37.93

B) $38.01

C) $38.14

D) $38.88

E) $39.25

A) $37.93

B) $38.01

C) $38.14

D) $38.88

E) $39.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

32

On February 22, Jonathan had $20,000 of student loans. He agreed to a payment plan of $225 per month at an annual simple interest rate of 8.40%. Determine how much of the $225 will go towards the principal at the end of March.

A) $80.25

B) $81.68

C) $83.72

D) $84.58

E) $88.92

A) $80.25

B) $81.68

C) $83.72

D) $84.58

E) $88.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

33

A $500,000 268-day Treasury Bill was issued to Buyer #1 at 4.1 % simple interest. 168 days before the T-Bill reached maturity it was sold by Buyer #1 at a rate that would provide Buyer #2 with a return of 3.4% if Buyer #2 held the T-Bill to maturity. What annual simple rate did Buyer #1 actually realize over the period that Buyer #1 held the T-Bill?

A) 4.10%

B) 3.09%

C) 5.19%

D) 4.47%

E) 6.77%

A) 4.10%

B) 3.09%

C) 5.19%

D) 4.47%

E) 6.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

34

On January 20, Derek signed a contract to pay Violet $1,800 plus interest on August 15 and $2,200 plus interest on September 12. Both payments carried a 6% simple interest annually. Violet then sold both contracts to Stephanie on May 10 at a rate of 3.5% annually. Determine how much she received Round to the nearest $100.

A) $5,267.29

B) $4,859.27

C) $4,459.27

D) $4,039.27

E) $3,827.29

A) $5,267.29

B) $4,859.27

C) $4,459.27

D) $4,039.27

E) $3,827.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

35

On May 1, Gladis borrowed $10,000 on a line of credit with an annual rate of 7.75%. On August 15, Gladis repaid half of the loan. From August 15 to December 31, the interest rate decreased to an annual rate of 7.50%. Determine the total simple interest charged from May 1 to December 31, when Gladis repaid all obligations.

A) $358.67

B) $366.85

C) $371.91

D) $383.42

E) $397.86

A) $358.67

B) $366.85

C) $371.91

D) $383.42

E) $397.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

36

Calculate the simple rate of return on a $1,000,000 181-day Treasury Bill that was issued for $970,639.

A) 6.1%

B) 5.9%

C) 4.9%

D) 5.5%

E) 7.7%

A) 6.1%

B) 5.9%

C) 4.9%

D) 5.5%

E) 7.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

37

On March 17, Luke borrowed $4,500 from his revolving line of credit. The current annual interest rate at the time was 5.30%. On April 30, Luke repaid $1,500, and concurrently the annual interest rate decreased to 5.10%. On June 30, Luke repaid the total amount borrowed, along with interest. Determine the simple interest amount to be repaid.

A) $51.80

B) $52.67

C) $53.48

D) $54.32

E) $55.15

A) $51.80

B) $52.67

C) $53.48

D) $54.32

E) $55.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

38

On January 20, Samantha borrowed $17,000 from her revolving line of credit. The current annual simple interest rate at the time was 4.5%. On May 5, Samantha borrowed another $10,000. Due to an increase in borrowing, the annual interest rate increased to 4.75%. On August 12, Samantha repaid the total amount borrowed, along with interest. Determine the interest amount to be repaid.

A) $516.35

B) $544.22

C) $567.92

D) $606.38

E) $641.12

A) $516.35

B) $544.22

C) $567.92

D) $606.38

E) $641.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

39

An investor purchased a 91-day, $100,000 T-bill on its date of issue for $97,500, and sold it 40 days later for $98,475. What simple interest rate of return did the original investor actually realize during the 40-day holding period?

A) 2.5%

B) 8.898%

C) 10.027%

D) 4.011%

E) 9.125%

A) 2.5%

B) 8.898%

C) 10.027%

D) 4.011%

E) 9.125%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

40

On January 1, Natalie had $15,000 in student loans outstanding. She agreed to $90 per month payments to repay these loans. From January 1 to February 14, the simple interest rates were 7.0%, but increased to 7.5% thereafter. Calculate the amount of interest paid for the month of February.

A) $87.80

B) $86.70

C) $85.60

D) $84.30

E) $83.40

A) $87.80

B) $86.70

C) $85.60

D) $84.30

E) $83.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

41

What do you need to know to be able to calculate the fair market value of an investment that will deliver two future payments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

42

If you purchase an investment privately, how do you determine the maximum price you are prepared to pay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

43

For principal amounts of $5,000 to $49,999, a bank pays an interest rate of 0.95% on 180- to 269-day non-redeemable GICs, and 1.00% on 270- to 364-day non-redeemable GICs. Ranjit has $10,000 to invest for 364 days. Because he thinks interest rates will be higher six months from now, he is debating whether to choose a 182-day GIC now (and reinvest its maturity value in another 182-day GIC) or to choose a 364-day GIC today. What would the simple interest rate on 182-day GICs have to be on the reinvestment date for both alternatives to yield the same maturity value 364 days from now?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

44

Calculate the price on its issue date of $100,000 face value, 90-day commercial paper issued by G E Capital Canada if the prevailing market rate of return is 0.932 simple interest%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

45

Joan has savings of $12,000 on June 1. Since she may need some of the savings during the next 3 months, she is considering two options at her bank. (1) An Investment Builder savings account earns a 0.25% rate of interest. The interest is calculated on the daily closing balance and paid on the first day of the following month. (2) A 90- to 179-day cashable term deposit earns a rate of 0.8%, paid at maturity. If simple interest rates do not change and Joan does not withdraw any of the funds, how much more will she earn from the term deposit up to September 1? (Keep in mind that savings account interest paid on the first day of the month will itself subsequently earn interest during the subsequent month.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

46

On a $10,000 principal investment, a bank offered simple interest rates of 1.45% on 270- to 364-day GIC's and 1.15% on 180- to 269-day GICs. How much more will an investor earn from a 364-day GIC than from two consecutive 182-day GICs? (Assume that the interest rate on 180- to 269-day GICs will be the same on the renewal date as it is today. Remember that both the principal and the interest from the first 182-day GIC can be invested in the second 182-day GIC.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

47

An Investment Savings account offered by a trust company pays a rate of 0.25% on the first $1,000 of daily closing balance, 0.5% on the portion of the balance between $1,000 and $3,000, and 0.75% on any balance in excess of $3,000. What simple interest will be paid for the month of April if the opening balance was $2,439, $950 was deposited on April 10, and $500 was withdrawn on April 23?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

48

Suppose that the current rates on 60 and 120-day GICs are 1.50% and 1.75% simple interest, respectively. An investor is weighing the alternatives of purchasing a 120-day GIC versus purchasing a 60-day GIC and then reinvesting its maturity value in a second 60-day GIC. What would the interest rate on 60-day GICs have to be 60 days from now for the investor to end up in the same financial position with either alternative?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

49

An assignable loan contract executed three months ago requires two payments to be paid five and ten months after the contract date. Each payment consists of a principal portion of $1,800 plus interest at 5% on $1,800 from the date of the contract. The payee is offering to sell the contract to a finance company in order to raise cash. If the finance company requires a return of 10% simple interest, what price will it be prepared to pay today for the contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

50

Claude Scales, a commercial fisherman, bought a new navigation system for $10,000 from Coast Marine Electronics on March 20. He paid $2,000 in cash and signed a conditional sales contract requiring a payment on July 1 of $3,000 plus interest on the $3,000 at a rate of 8%, and another payment on September 1 of $5,000 plus interest at 8% from the date of the sale. The vendor immediately sold the contract to a finance company, which discounted the payments at its required return of 12% simple interest. What proceeds did Coast Marine receive from the sale of the contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

51

An assignable loan contract executed 3 months ago requires two payments of $3,200 plus interest at 9% from the date of the contract, to be paid 4 and 8 months after the contract date. The payee is offering to sell the contract to a finance company in order to raise urgently needed cash. If the finance company requires a 16% simple interest rate of return, what price will it be prepared to pay today for the contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

52

An agreement stipulates payments of $4,500, $3,000, and $5,500 in 4, 8, and 12 months, respectively, from today. What is the highest price an investor will offer today to purchase the agreement if he requires a minimum simple interest rate of return of 5.5%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

53

A contract requires payments of $1,500, $2,000, and $1,000 in 100, 150, and 200 days, respectively, from today. What is the value of the contract today if the payments are discounted to yield a 3.5% simple interest rate of return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

54

For amounts between $10,000 and $24,999, a credit union pays a rate of 1.25% simple interest on term deposits with maturities in the 91 to 120-day range. However, early redemption will result in a rate of 0.55% being applied. How much more interest will a 91-day $20,000 term deposit earn if it is held until maturity than if it is redeemed after 80 days?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

55

A money market mutual fund purchased $1 million face value of Honda Canada Finance Inc. 90-day commercial paper 28 days after its issue. What price was paid if the paper was discounted at 2.10% simple interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

56

Paul has $20,000 to invest for 6 months. For this amount, his bank pays 1.3% simple interest on a 90-day GIC and 1.5% on a 180-day GIC. If the interest rate on a 90-day GIC is the same 3 months from now, how much more interest will Paul earn by purchasing the 180-day GIC than by buying a 90-day GIC and then reinvesting its maturity value in a second 90-day GIC?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

57

Calculate the price of a $25,000, 91-day Province of British Columbia Treasury bill on its issue date if the current market rate of return is 3.672% simple interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

58

A savings account pays interest of 1.5% simple interest. Interest is calculated on the daily closing balance and paid at the close of business on the last day of the month. A depositor had a $2,239 opening balance on September 1, deposited $734 on September 7 and $627 on September 21, and withdrew $300 on both September 10 and September 21. What interest will be credited to the account at the month's end?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

59

An agreement stipulates payments of $4,000, $2,500, and $5,000 in 3, 6, and 9 months, respectively, from today. What is the highest price an investor will offer today to purchase the agreement if he requires a minimum simple interest rate of return of 6.25%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

60

A conditional sale contract requires two payments 3 and 6 months after the date of the contract. Each payment consists of $1,900 principal plus simple interest at 10.5% on $1,900 from the date of the contract. One month into the contract, what price would a finance company pay for the contract if it requires an 16% rate of return on its purchases?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

61

Monica finished her program at New Brunswick Community College on June 3 with Canada Student Loans totalling $6,800. She decided to capitalize the interest that accrued (at prime plus 2.5%) during the grace period. In addition to regular end-of-month payments of $200, she made an extra $500 lump payment on March 25 that was applied entirely to principal. The prime rate dropped from 5% to 4.75% effective September 22, and declined another 0.5% effective March 2. Calculate the balance owed on the floating rate option after the regular March 31 payment. The relevant February had 28 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

62

A $100,000, 182-day Province of New Brunswick Treasury bill was issued 66 days ago. What will it sell at today to yield the purchaser 2.48% simple interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

63

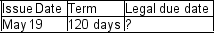

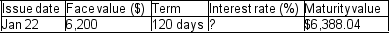

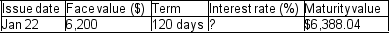

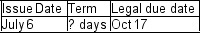

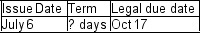

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

64

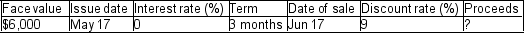

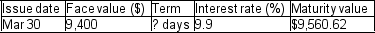

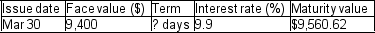

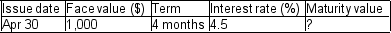

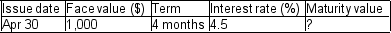

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

65

A $100,000, 90-day commercial paper certificate issued by Bell Canada Enterprises was sold on its issue date for $98,950. What annual simple interest rate of return (to the nearest 0.001%) will it yield to the buyer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

66

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

67

A $100,000, 91-day Province of Ontario Treasury bill was issued 37 days ago. What will it sell at today in order to yield the purchaser 3.14% simple interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

68

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

69

A $100,000, 90-day commercial paper certificate issued by Wells Fargo Financial Canada was sold on its issue date for $99,250. What simple interest rate of return will it yield to the buyer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

70

A 168-day, $100,000 T-bill was initially issued at a price that would yield the buyer 4.19% simple interest. If the yield required by the market remains at 4.19%, how many days before its maturity date will the T-bill's market price first exceed $99,000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

71

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

72

Calculate and compare the market values of a $100,000 face value Government of Canada Treasury bill on dates that are 91 days, 61 days, 31 days, and one day before maturity. Assume that the rate of return required in the market stays constant at 3% simple interest over the lifetime of the T-bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

73

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

74

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

75

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

76

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

77

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

78

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

79

Over the past 35 years, the prevailing market yield or discount rate on 90-day T-bills has ranged from a low of 0.17% in February 2010 to a high of 20.82% simple interest in August of 1981. (The period from 1979 to 1990 was a time of historically high inflation rates and interest rates.) How much more would you have paid for a $100,000 face value 90-day T-bill at the February 2010 discount rate than at the August 1981 discount rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

80

Calculate missing value for the promissory note:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck