Deck 14: Capital Investment Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 14: Capital Investment Decisions

1

Explain the difference between independent projects and mutually exclusive projects.

The process of making the capital investment decisions is known as capital budgeting. In capital budgeting basically two types of projects will be considered which are given below:

• Independent projects

• Mutually exclusive projects

Independent projects are those projects whose acceptance or rejection does affect the cash flows of other projects, whereas the mutually exclusive projects are those projects whose acceptance precludes the acceptance of all other competing projects.

• Independent projects

• Mutually exclusive projects

Independent projects are those projects whose acceptance or rejection does affect the cash flows of other projects, whereas the mutually exclusive projects are those projects whose acceptance precludes the acceptance of all other competing projects.

2

Conduct a relevant analysis of the special sales offer by calculating the following:

a. The relevant revenues associated with the special sales offer

b. The relevant costs associated with the special sales offer

c. The relevant profit associated with the special sales offer

a. The relevant revenues associated with the special sales offer

b. The relevant costs associated with the special sales offer

c. The relevant profit associated with the special sales offer

a. NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in NoFat snack foods, including ruffles, lays, Doritos and Tostitos brand products. For each of the past three years, sales of olestra have been far less than the expected annual volume of 125,000 pounds.

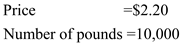

One company, Patterson union (PU), a toxic waste cleanup company offered to buy 10,000 of olestra from NoFat during December for a price of $2.20 per pound.

For the special offer NoFat would bear $1,000 cost of the inspection team.

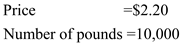

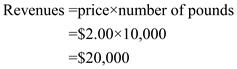

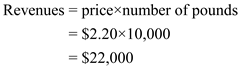

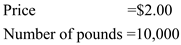

From the relevant information given in the case the relevant revenues from the special sales offer is computed as follows:

Given:

Hence, the relevant revenue from the special offer is $22,000.

Hence, the relevant revenue from the special offer is $22,000.

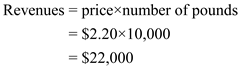

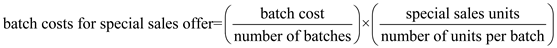

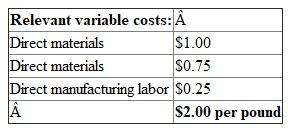

b. Relevant costs from the special offer are computed as follows:

Given:

Given:

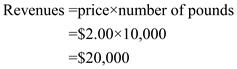

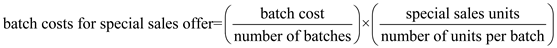

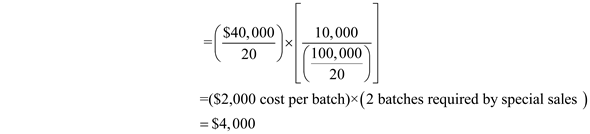

A relevant fixed cost is calculated as follows:

A relevant fixed cost is calculated as follows:

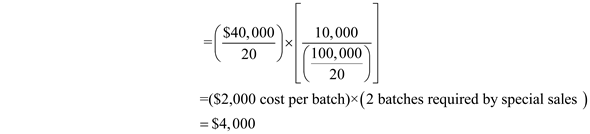

If the special sale is accepted the plant inspection team cost is:

If the special sale is accepted the plant inspection team cost is:

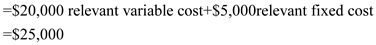

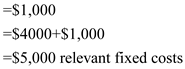

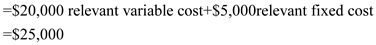

The relevant cost from the special sales offer is

The relevant cost from the special sales offer is

Hence, the relevant cost associated with the special offer is $25,000.

Hence, the relevant cost associated with the special offer is $25,000.

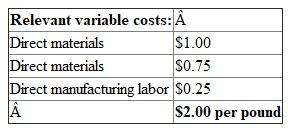

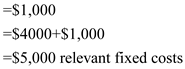

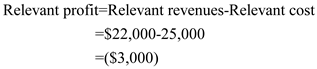

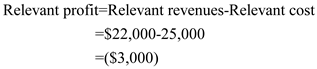

c. The relevant profit associated with the special sales offer is:

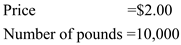

One company, Patterson union (PU), a toxic waste cleanup company offered to buy 10,000 of olestra from NoFat during December for a price of $2.20 per pound.

For the special offer NoFat would bear $1,000 cost of the inspection team.

From the relevant information given in the case the relevant revenues from the special sales offer is computed as follows:

Given:

Hence, the relevant revenue from the special offer is $22,000.

Hence, the relevant revenue from the special offer is $22,000.b. Relevant costs from the special offer are computed as follows:

Given:

Given:

A relevant fixed cost is calculated as follows:

A relevant fixed cost is calculated as follows:

If the special sale is accepted the plant inspection team cost is:

If the special sale is accepted the plant inspection team cost is: The relevant cost from the special sales offer is

The relevant cost from the special sales offer is Hence, the relevant cost associated with the special offer is $25,000.

Hence, the relevant cost associated with the special offer is $25,000.c. The relevant profit associated with the special sales offer is:

3

Capital investments should

A) always produce an increase in market share.

B) only be analyzed using the ARR.

C) earn back their original capital outlay plus a reasonable return.

D) always be done using a payback criterion.

E) do none of these.

A) always produce an increase in market share.

B) only be analyzed using the ARR.

C) earn back their original capital outlay plus a reasonable return.

D) always be done using a payback criterion.

E) do none of these.

C. Earn back their original capital outlay.

Capital investments should earn back their original capital outlay. The capital investments are basically long term and huge investments. These should be invested in such a way that the initial outflow is earned back.

Capital investments should earn back their original capital outlay. The capital investments are basically long term and huge investments. These should be invested in such a way that the initial outflow is earned back.

4

Explain why the timing and quantity of cash flows are important in capital investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

Based solely on financial factors, explain why NoFat should accept or reject PU's special sales offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

make a capital investment decision, a manager must

A) estimate the quantity and timing of cash flows.

B) assess the risk of the investment.

C) consider the impact of the investment on the firm's profits.

D) choose a decision criterion to assess viability of the investment (such as payback period or NPV).

E) do all of these.

A) estimate the quantity and timing of cash flows.

B) assess the risk of the investment.

C) consider the impact of the investment on the firm's profits.

D) choose a decision criterion to assess viability of the investment (such as payback period or NPV).

E) do all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

time value of money is ignored by the payback period and the ARR. Explain why this is a major deficiency in these two models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

Describe at least one qualitative factor that NoFat should consider, in addition to the financial factors, in making its final decision regarding the acceptance or rejection of the special sales offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

Mutually exclusive capital budgeting projects are those that

A) if accepted or rejected do not affect the cash flows of other projects.

B) if accepted will produce a negative NPV.

C) if rejected preclude the acceptance of all other competing projects.

D) if accepted preclude the acceptance of all other competing projects.

E) if rejected imply that all other competing projects have a positive NPV.

A) if accepted or rejected do not affect the cash flows of other projects.

B) if accepted will produce a negative NPV.

C) if rejected preclude the acceptance of all other competing projects.

D) if accepted preclude the acceptance of all other competing projects.

E) if rejected imply that all other competing projects have a positive NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

is the payback period? Compute the payback period for an investment requiring an initial outlay of $80,000 with expected annual cash inflows of $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Allyson decides to use NoFat's 10% mark-up pricing method to set the price for PU's special sales offer,

a. Calculate the price that NoFat would charge PU for each pound of olestra.

b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its mark-up pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.)

c. Explain why NoFat should accept or reject the special sales offer if it uses its mark-up pricing method to set the special sales price.

a. Calculate the price that NoFat would charge PU for each pound of olestra.

b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its mark-up pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.)

c. Explain why NoFat should accept or reject the special sales offer if it uses its mark-up pricing method to set the special sales price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

investment of $6,000 produces a net annual cash inflow of $2,000 for each of 5 years. What is the payback period?

A) 2 years

B) 1.5 year

C) Unacceptable

D) 3 years

E) Cannot be determined.

A) 2 years

B) 1.5 year

C) Unacceptable

D) 3 years

E) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

and discuss three possible reasons that the payback period is used to help make capital investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

Assume that NoFat pays for all costs with cash. Also, assume a 10% discount rate, a 5-year time horizon, and all cash flows occur at the end of the year. Using an NPV approach to discount future cash flows to present value,

a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of $10,000 per year (i.e., the special sales alternative).

b. Calculate the NPV of downsizing capacity as previously described (i.e., the down sizing alternative).

c. Based on the NPV of Calculations a and b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.

a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of $10,000 per year (i.e., the special sales alternative).

b. Calculate the NPV of downsizing capacity as previously described (i.e., the down sizing alternative).

c. Based on the NPV of Calculations a and b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

investment of $1,000 produces a net cash inflow of $500 in the first year and $750 in the second year. What is the payback period?

A) 1.67 years

B) 0.50 year

C) 2.00 years

D) 1.20 years

E) Cannot be determined.

A) 1.67 years

B) 0.50 year

C) 2.00 years

D) 1.20 years

E) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

is the accounting rate of return? Compute the ARR for an investment that requires an initial outlay of $300,000 and promises an average net income of $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

payback period suffers from which of the following deficiencies?

A) It is a rough measure of the uncertainty of future cash flows.

B) It helps control the risk of obsolescence.

C) It ignores the uncertainty of future cash flows.

D) It ignores the financial performance of a project beyond the payback period.

E) Both c and d.

A) It is a rough measure of the uncertainty of future cash flows.

B) It helps control the risk of obsolescence.

C) It ignores the uncertainty of future cash flows.

D) It ignores the financial performance of a project beyond the payback period.

E) Both c and d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

NPV is the same as the profit of a project expressed in present dollars. Do you agree? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

ARR has one specific advantage not possessed by the payback period in that it

A) considers the time value of money.

B) measures the value added by a project.

C) is always an accurate measure of profitability.

D) is more widely accepted by financial managers.

E) considers the profitability of a project beyond the payback period.

A) considers the time value of money.

B) measures the value added by a project.

C) is always an accurate measure of profitability.

D) is more widely accepted by financial managers.

E) considers the profitability of a project beyond the payback period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

Explain the relationship between NPV and a firm's value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

investment of $2,000 provides an average net income of $400. Depreciation is $40 per year with zero salvage value. The ARR using the original investment is

A) 44%.

B) 22%.

C) 20%.

D) 40%.

E) none of these.

A) 44%.

B) 22%.

C) 20%.

D) 40%.

E) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

is the cost of capital? What role does it play in capital investment decisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

the NPV is positive, it signals

A) that the initial investment has been recovered.

B) that the required rate of return has been earned.

C) that the value of the firm has increased.

D) all of these.

E) both a and b.

A) that the initial investment has been recovered.

B) that the required rate of return has been earned.

C) that the value of the firm has increased.

D) all of these.

E) both a and b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

is the role that the required rate of return plays in the NPV model? In the IRR model?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

measures

A) the profitability of an investment.

B) the change in wealth.

C) the change in firm value.

D) the difference in present value of cash inflows and outflows.

E) all of these.

A) the profitability of an investment.

B) the change in wealth.

C) the change in firm value.

D) the difference in present value of cash inflows and outflows.

E) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Explain how the NPV is used to determine whether a project should be accepted or rejected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

is calculated by using

A) the required rate of return.

B) accounting income.

C) the IRR.

D) the future value of cash flows.

E) none of these.

A) the required rate of return.

B) accounting income.

C) the IRR.

D) the future value of cash flows.

E) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

IRR is the true or actual rate of return being earned by the project. Do you agree or disagree? Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

Using NPV, a project is rejected if it is

A) equal to zero.

B) negative.

C) positive.

D) equal to the required rate of return.

E) greater than the cost of capital.

A) equal to zero.

B) negative.

C) positive.

D) equal to the required rate of return.

E) greater than the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

Explain what a postaudit is and how it can provide useful input for future capital investment decisions, especially those involving advanced technology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

the present value of future cash flows is $4,200 for an investment that requires an outlay of $3,000, the NPV

A) is $200.

B) is $1,000.

C) is $1,200.

D) is $2,200.

E) cannot be determined.

A) is $200.

B) is $1,000.

C) is $1,200.

D) is $2,200.

E) cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

Explain why NPV is generally preferred over IRR when choosing among competing or mutually exclusive projects. Why would managers continue to use IRR to choose among mutually exclusive projects?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

Assume that an investment of $1,000 produces a future cash flow of $1,000. The discount factor for this future cash flow is 0.80. The NPV is

A) $0.

B) $110.

C) ($200).

D) $911.

E) none of these.

A) $0.

B) $110.

C) ($200).

D) $911.

E) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

Suppose that a firm must choose between two mutually exclusive projects, both of which have negative NPVs. Explain how a firm can legitimately choose between two such projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not true regarding the IRR?

A) The IRR is the interest rate that sets the present value of a project's cash inflows equal to the present value of the project's cost.

B) The IRR is the interest rate that sets the NPV equal to zero.

C) The popularity of IRR may be attributable to the fact that it is a rate of return, a concept that is comfortably used by managers.

D) If the IRR is greater than the required rate of return, then the project is acceptable.

E) The IRR is the most reliable of the capital budgeting methods.

A) The IRR is the interest rate that sets the present value of a project's cash inflows equal to the present value of the project's cost.

B) The IRR is the interest rate that sets the NPV equal to zero.

C) The popularity of IRR may be attributable to the fact that it is a rate of return, a concept that is comfortably used by managers.

D) If the IRR is greater than the required rate of return, then the project is acceptable.

E) The IRR is the most reliable of the capital budgeting methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

Using IRR, a project is rejected if the IRR

A) is equal to the required rate of return.

B) is less than the required rate of return.

C) is greater than the cost of capital.

D) is greater than the required rate of return.

E) produces an NPV equal to zero.

A) is equal to the required rate of return.

B) is less than the required rate of return.

C) is greater than the cost of capital.

D) is greater than the required rate of return.

E) produces an NPV equal to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

postaudit

A) is a follow-up analysis of a capital project, once implemented.

B) compares the actual benefits with the estimated benefits.

C) evaluates the overall outcome of the investment.

D) proposes corrective action, if needed.

E) does all of these.

A) is a follow-up analysis of a capital project, once implemented.

B) compares the actual benefits with the estimated benefits.

C) evaluates the overall outcome of the investment.

D) proposes corrective action, if needed.

E) does all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

Postaudits of capital projects are useful because

A) they are not very costly.

B) they have no significant limitations.

C) the assumptions underlying the original analyses are often invalidated by changes in the actual working environment.

D) they help to ensure that resources are used wisely.

E) of all of these.

A) they are not very costly.

B) they have no significant limitations.

C) the assumptions underlying the original analyses are often invalidated by changes in the actual working environment.

D) they help to ensure that resources are used wisely.

E) of all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

competing projects, NPV is preferred to IRR because

A) maximizing IRR maximizes the wealth of the owners.

B) in the final analysis, relative profitability is what counts.

C) choosing the project with the largest NPV maximizes the wealth of the shareholders.

D) assuming that cash flows are reinvested at the computed IRR is more realistic than assuming that cash flows are reinvested at the required rate of return.

E) of all of the above.

A) maximizing IRR maximizes the wealth of the owners.

B) in the final analysis, relative profitability is what counts.

C) choosing the project with the largest NPV maximizes the wealth of the shareholders.

D) assuming that cash flows are reinvested at the computed IRR is more realistic than assuming that cash flows are reinvested at the required rate of return.

E) of all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

Assume that there are two competing projects, A and B. Project A has a NPV of $1,000 and an IRR of 15%. Project B has an NPV of $800 and an IRR of 20%. Which of the following is true?

A) Project A should be chosen because it has a higher NPV.

B) Project B should be chosen because it has a higher IRR.

C) It is not possible to use NPV or IRR to choose between the two projects.

D) Neither project should be chosen.

E) None of these.

A) Project A should be chosen because it has a higher NPV.

B) Project B should be chosen because it has a higher IRR.

C) It is not possible to use NPV or IRR to choose between the two projects.

D) Neither project should be chosen.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

Payback Period

Ventura Manufacturing is considering an investment in a new automated manufacturing system. The new system requires an investment of $3,000,000 and either has (a) even cash flows of $750,000 per year or (b) the following expected annual cash flows: $375,000, $375,000, $1,000,000, $1,000,000, and $250,000.

Ventura Manufacturing is considering an investment in a new automated manufacturing system. The new system requires an investment of $3,000,000 and either has (a) even cash flows of $750,000 per year or (b) the following expected annual cash flows: $375,000, $375,000, $1,000,000, $1,000,000, and $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

Accounting Rate of Return

Eyring Company invested $7,500,000 in a new product line. The life cycle of the product is projected to be 7 years with the following net income stream: $300,000, $300,000, $500,000, $900,000, $1,000,000, $2,100,000, and $1,200,000.

Eyring Company invested $7,500,000 in a new product line. The life cycle of the product is projected to be 7 years with the following net income stream: $300,000, $300,000, $500,000, $900,000, $1,000,000, $2,100,000, and $1,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

Present Value

Holland Inc. has just completed development of a new cell phone. The new product is expected to produce annual revenues of $1,350,000. Producing the cell phone requires an investment in new equipment, costing $1,440,000. The cell phone has a projected life cycle of 5 years. After 5 years, the equipment can be sold for $180,000. Working capital is also expected to increase by $180,000, which Holland will recover by the end of the new product's life cycle. Annual cash operating expenses are estimated at $810,000. The required rate of return is 8%.

Holland Inc. has just completed development of a new cell phone. The new product is expected to produce annual revenues of $1,350,000. Producing the cell phone requires an investment in new equipment, costing $1,440,000. The cell phone has a projected life cycle of 5 years. After 5 years, the equipment can be sold for $180,000. Working capital is also expected to increase by $180,000, which Holland will recover by the end of the new product's life cycle. Annual cash operating expenses are estimated at $810,000. The required rate of return is 8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Internal Rate of Return

Randel Company produces a variety of gardening tools and aids. The company is examining the possibility of investing in a new production system that will reduce the costs of the current system. The new system will require a cash investment of $3,455,400 and will produce net cash savings of $600,000 per year. The system has a projected life of 9 years.

Randel Company produces a variety of gardening tools and aids. The company is examining the possibility of investing in a new production system that will reduce the costs of the current system. The new system will require a cash investment of $3,455,400 and will produce net cash savings of $600,000 per year. The system has a projected life of 9 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

and IRR, Mutually Exclusive Projects

Weeden Inc. intends to invest in one of two competing types of computer-aided manufacturing equipment: CAM X and CAM Y. Both CAM X and CAM Y models have a project life of 10 years. The purchase price of the CAM X model is $2,400,000, and it has a net annual after-tax cash inflow of $600,000. The CAM Y model is more expensive, selling for $2,800,000, but it will produce a net annual after-tax cash inflow of $700,000. The cost of capital for the company is 10%.

Weeden Inc. intends to invest in one of two competing types of computer-aided manufacturing equipment: CAM X and CAM Y. Both CAM X and CAM Y models have a project life of 10 years. The purchase price of the CAM X model is $2,400,000, and it has a net annual after-tax cash inflow of $600,000. The CAM Y model is more expensive, selling for $2,800,000, but it will produce a net annual after-tax cash inflow of $700,000. The cost of capital for the company is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

Payback Period

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Colby Hepworth has just invested $400,000 in a book and video store. She expects to receive a cash income of $120,000 per year from the investment.

b. Kylie Sorensen has just invested $1,400,000 in a new biomedical technology. She expects to receive the following cash flows over the next 5 years: $350,000, $490,000, $700,000, $420,000, and $280,000.

c. Carsen Nabors invested in a project that has a payback period of 4 years. The project brings in $960,000 per year.

d. Rahn Booth invested $1,300,000 in a project that pays him an even amount per year for 5 years. The payback period is 2.5 years.

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Colby Hepworth has just invested $400,000 in a book and video store. She expects to receive a cash income of $120,000 per year from the investment.

b. Kylie Sorensen has just invested $1,400,000 in a new biomedical technology. She expects to receive the following cash flows over the next 5 years: $350,000, $490,000, $700,000, $420,000, and $280,000.

c. Carsen Nabors invested in a project that has a payback period of 4 years. The project brings in $960,000 per year.

d. Rahn Booth invested $1,300,000 in a project that pays him an even amount per year for 5 years. The payback period is 2.5 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

Accounting Rate of Return

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

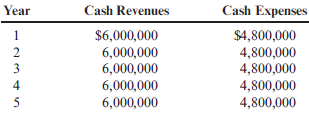

a. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper. The equipment will cost $3,600,000 and have a life of 5 years with no expected salvage value. The expected cash flows associated with the project are as follows:

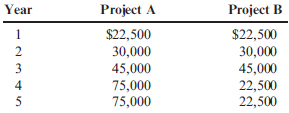

b. Emily Hansen is considering investing in one of the following two projects. Either project will require an investment of $75,000. The expected cash revenues minus cash expenses for the two projects follow. Assume each project is depreciable.

c. Suppose that a project has an ARR of 30% (based on initial investment) and that the average net income of the project is $120,000.

d. Suppose that a project has an ARR of 50% and that the investment is $150,000.

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper. The equipment will cost $3,600,000 and have a life of 5 years with no expected salvage value. The expected cash flows associated with the project are as follows:

b. Emily Hansen is considering investing in one of the following two projects. Either project will require an investment of $75,000. The expected cash revenues minus cash expenses for the two projects follow. Assume each project is depreciable.

c. Suppose that a project has an ARR of 30% (based on initial investment) and that the average net income of the project is $120,000.

d. Suppose that a project has an ARR of 50% and that the investment is $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

Present Value

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Southward Manufacturing is considering the purchase of a new welding system. The cash benefits will be $400,000 per year. The system costs $2,250,000 and will last 10 years.

b. Kaylin Day is interested in investing in a women's specialty shop. The cost of the investment is $180,000. She estimates that the return from owning her own shop will be $35,000 per year. She estimates that the shop will have a useful life of 6 years.

c. Goates Company calculated the NPV of a project and found it to be $21,300. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $45,000.

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Southward Manufacturing is considering the purchase of a new welding system. The cash benefits will be $400,000 per year. The system costs $2,250,000 and will last 10 years.

b. Kaylin Day is interested in investing in a women's specialty shop. The cost of the investment is $180,000. She estimates that the return from owning her own shop will be $35,000 per year. She estimates that the shop will have a useful life of 6 years.

c. Goates Company calculated the NPV of a project and found it to be $21,300. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

Internal Rate of Return

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

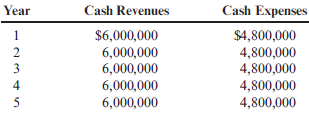

a. Cuenca Company is considering the purchase of new equipment that will speed up the process for producing flash drives. The equipment will cost $7,200,000 and have a life of 5 years with no expected salvage value. The expected cash flows associated with the project follow:

b. Kathy Shorts is evaluating an investment in an information system that will save $240,000 per year. She estimates that the system will last 10 years. The system will cost $1,248,000. Her company's cost of capital is 10%.

c. Elmo Enterprises just announced that a new plant would be built in Helper, Utah. Elmo told its stockholders that the plant has an expected life of 15 years and an expected IRR equal to 25%. The cost of building the plant is expected to be $2,880,000.

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Cuenca Company is considering the purchase of new equipment that will speed up the process for producing flash drives. The equipment will cost $7,200,000 and have a life of 5 years with no expected salvage value. The expected cash flows associated with the project follow:

b. Kathy Shorts is evaluating an investment in an information system that will save $240,000 per year. She estimates that the system will last 10 years. The system will cost $1,248,000. Her company's cost of capital is 10%.

c. Elmo Enterprises just announced that a new plant would be built in Helper, Utah. Elmo told its stockholders that the plant has an expected life of 15 years and an expected IRR equal to 25%. The cost of building the plant is expected to be $2,880,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

Present Value and Competing Projects

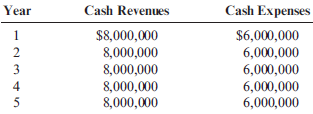

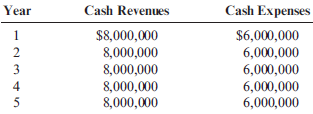

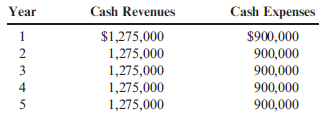

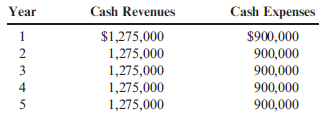

Spiro Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. After-tax cash inflows for the two competing projects are as follows:

Both projects require an initial investment of $560,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Spiro Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. After-tax cash inflows for the two competing projects are as follows:

Both projects require an initial investment of $560,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return

Booth Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $960,000. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Booth Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay required is $960,000. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

Payback, Accounting Rate of Return, Present Value, Net Present Value, Internal Rate of Return

All scenarios are independent of all other scenarios. Assume that all cash flows are after-tax cash flows.

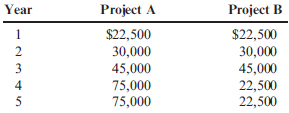

a. Kambry Day is considering investing in one of the following two projects. Either project will require an investment of $20,000. The expected cash flows for the two projects follow. Assume that each project is depreciable.

b. Wilma Golding is retiring and has the option to take her retirement as a lump sum of $450,000 or to receive $30,000 per year for 20 years. Wilma's required rate of return is 6%.

c. David Booth is interested in investing in some tools and equipment so that he can do independent drywalling. The cost of the tools and equipment is $30,000. He estimates that the return from owning his own equipment will be $9,000 per year. The tools and equipment will last 6 years.

d. Patsy Folson is evaluating what appears to be an attractive opportunity. She is currently the owner of a small manufacturing company and has the opportunity to acquire another small company's equipment that would provide production of a part currently purchased externally. She estimates that the savings from internal production will be $75,000 per year. She estimates that the equipment will last 10 years. The owner is asking $400,000 for the equipment. Her company's cost of capital is 8%.

All scenarios are independent of all other scenarios. Assume that all cash flows are after-tax cash flows.

a. Kambry Day is considering investing in one of the following two projects. Either project will require an investment of $20,000. The expected cash flows for the two projects follow. Assume that each project is depreciable.

b. Wilma Golding is retiring and has the option to take her retirement as a lump sum of $450,000 or to receive $30,000 per year for 20 years. Wilma's required rate of return is 6%.

c. David Booth is interested in investing in some tools and equipment so that he can do independent drywalling. The cost of the tools and equipment is $30,000. He estimates that the return from owning his own equipment will be $9,000 per year. The tools and equipment will last 6 years.

d. Patsy Folson is evaluating what appears to be an attractive opportunity. She is currently the owner of a small manufacturing company and has the opportunity to acquire another small company's equipment that would provide production of a part currently purchased externally. She estimates that the savings from internal production will be $75,000 per year. She estimates that the equipment will last 10 years. The owner is asking $400,000 for the equipment. Her company's cost of capital is 8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

Present Value, Basic Concepts

Wise Company is considering an investment that requires an outlay of $600,000 and promises an after-tax cash inflow 1 year from now of $693,000. The company's cost of capital is 10%.

Wise Company is considering an investment that requires an outlay of $600,000 and promises an after-tax cash inflow 1 year from now of $693,000. The company's cost of capital is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

Solving for Unknowns

Each of the following scenarios are independent. Assume that all cash flows are after-tax cash flows.

a. Thomas Company is investing $120,000 in a project that will yield a uniform series of cash inflows over the next 4 years.

b. Video Repair has decided to invest in some new electronic equipment. The equipment will have a 3-year life and will produce a uniform series of cash savings. The NPV of the equipment is $1,750, using a discount rate of 8%. The IRR is 12%.

c. A new lathe costing $60,096 will produce savings of $12,000 per year.

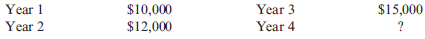

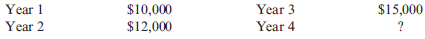

d. The NPV of a project is $3,927. The project has a life of 4 years and produces the following cash flows:

The cost of the project is two times the cash flow produced in Year 4. The discount rate is 10%.

Each of the following scenarios are independent. Assume that all cash flows are after-tax cash flows.

a. Thomas Company is investing $120,000 in a project that will yield a uniform series of cash inflows over the next 4 years.

b. Video Repair has decided to invest in some new electronic equipment. The equipment will have a 3-year life and will produce a uniform series of cash savings. The NPV of the equipment is $1,750, using a discount rate of 8%. The IRR is 12%.

c. A new lathe costing $60,096 will produce savings of $12,000 per year.

d. The NPV of a project is $3,927. The project has a life of 4 years and produces the following cash flows:

The cost of the project is two times the cash flow produced in Year 4. The discount rate is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

Present Value versus Internal Rate of Return

Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow:

Skiba's cost of capital is 10%.

Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow:

Skiba's cost of capital is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

Basic Net Present Value Analysis

Jonathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process is designed to improve environmental performance. On the negative side, the process design requires new equipment and an infusion of working capital. The equipment will cost $1,200,000, and its cash operating expenses will total $270,000 per year. The equipment will last for 7 years but will need a major overhaul costing $120,000 at the end of the fifth year. At the end of 7 years, the equipment will be sold for $96,000. An increase in working capital totaling $120,000 will also be needed at the beginning. This will be recovered at the end of the 7 years.

On the positive side, Jonathan estimates that the new process will save $400,000 per year in environmental costs (fines and cleanup costs avoided). The cost of capital is 12%.

Jonathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process is designed to improve environmental performance. On the negative side, the process design requires new equipment and an infusion of working capital. The equipment will cost $1,200,000, and its cash operating expenses will total $270,000 per year. The equipment will last for 7 years but will need a major overhaul costing $120,000 at the end of the fifth year. At the end of 7 years, the equipment will be sold for $96,000. An increase in working capital totaling $120,000 will also be needed at the beginning. This will be recovered at the end of the 7 years.

On the positive side, Jonathan estimates that the new process will save $400,000 per year in environmental costs (fines and cleanup costs avoided). The cost of capital is 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

Present Value Analysis

Emery Communications Company is considering the production and marketing of a communications system that will increase the efficiency of messaging for small businesses or branch offices of large companies. Each unit hooked into the system is assigned a mailbox number, which can be matched to a telephone extension number, providing access to messages 24 hours a day. Up to 20 units can be hooked into the system, allowing the delivery of the same message to as many as 20 people. Personal codes can be used to make messages confidential. Furthermore, messages can be reviewed, recorded, cancelled, replied to, or deleted all during the same message playback. Indicators wired to the telephone blink whenever new messages are present.

To produce this product, a $1.75 million investment in new equipment is required. The equipment will last 10 years but will need major maintenance costing $150,000 at the end of its sixth year. The salvage value of the equipment at the end of 10 years is estimated to be $100,000. If this new system is produced, working capital must also be increased by $90,000. This capital will be restored at the end of the product's 10-year life cycle. Revenues from the sale of the product are estimated at $1.65 million per year. Cash operating expenses are estimated at $1.32 million per year.

Emery Communications Company is considering the production and marketing of a communications system that will increase the efficiency of messaging for small businesses or branch offices of large companies. Each unit hooked into the system is assigned a mailbox number, which can be matched to a telephone extension number, providing access to messages 24 hours a day. Up to 20 units can be hooked into the system, allowing the delivery of the same message to as many as 20 people. Personal codes can be used to make messages confidential. Furthermore, messages can be reviewed, recorded, cancelled, replied to, or deleted all during the same message playback. Indicators wired to the telephone blink whenever new messages are present.

To produce this product, a $1.75 million investment in new equipment is required. The equipment will last 10 years but will need major maintenance costing $150,000 at the end of its sixth year. The salvage value of the equipment at the end of 10 years is estimated to be $100,000. If this new system is produced, working capital must also be increased by $90,000. This capital will be restored at the end of the product's 10-year life cycle. Revenues from the sale of the product are estimated at $1.65 million per year. Cash operating expenses are estimated at $1.32 million per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

Basic Internal Rate of Return Analysis

Julianna Cardenas, owner of Baker Company, was approached by a local dealer of air-conditioning units. The dealer proposed replacing Baker's old cooling system with a modern, more efficient system. The cost of the new system was quoted at $339,000, but it would save $60,000 per year in energy costs. The estimated life of the new system is 10 years, with no salvage value expected. Excited over the possibility of saving $60,000 per year and having a more reliable unit, Julianna requested an analysis of the project's economic viability. All capital projects are required to earn at least the firm's cost of capital, which is 8%. There are no income taxes.

Julianna Cardenas, owner of Baker Company, was approached by a local dealer of air-conditioning units. The dealer proposed replacing Baker's old cooling system with a modern, more efficient system. The cost of the new system was quoted at $339,000, but it would save $60,000 per year in energy costs. The estimated life of the new system is 10 years, with no salvage value expected. Excited over the possibility of saving $60,000 per year and having a more reliable unit, Julianna requested an analysis of the project's economic viability. All capital projects are required to earn at least the firm's cost of capital, which is 8%. There are no income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

Present Value, Uncertainty

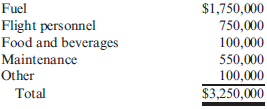

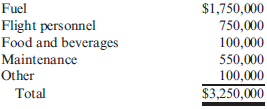

Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will fly one round-trip daily except for scheduled maintenance days. There are 15 maintenance days scheduled each year. The seating capacity of the aircraft is 150. Flights are expected to be fully booked. The average revenue per passenger per flight (one-way) is $235. Annual operating costs of the aircraft follow:

The aircraft will cost $120,000,000 and has an expected life of 20 years. The company requires a 12% return. Assume there are no income taxes.

Ondi Airlines is interested in acquiring a new aircraft to service a new route. The route will be from Tulsa to Denver. The aircraft will fly one round-trip daily except for scheduled maintenance days. There are 15 maintenance days scheduled each year. The seating capacity of the aircraft is 150. Flights are expected to be fully booked. The average revenue per passenger per flight (one-way) is $235. Annual operating costs of the aircraft follow:

The aircraft will cost $120,000,000 and has an expected life of 20 years. The company requires a 12% return. Assume there are no income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

Review of Basic Capital Budgeting Procedures

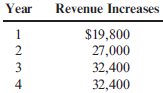

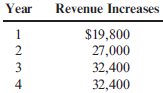

Dr. Whitley Avard, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-load pressures, Dr. Avard is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing $74,000 is needed. The equipment has an expected life of 4 years, with a salvage value of $6,000. Dr. Avard estimates that her cash revenues will increase by the following amounts:

She also expects additional cash expenses amounting to $3,000 per year. The cost of capital is 12%. Assume that there are no income taxes.

Dr. Whitley Avard, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-load pressures, Dr. Avard is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing $74,000 is needed. The equipment has an expected life of 4 years, with a salvage value of $6,000. Dr. Avard estimates that her cash revenues will increase by the following amounts:

She also expects additional cash expenses amounting to $3,000 per year. The cost of capital is 12%. Assume that there are no income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Present Value and Competing Alternatives

Stillwater Designs has been rebuilding Model 100, Model 120, and Model 150 Kicker subwoofers that were returned for warranty action. Customers returning the subwoofers receive a new replacement. The warranty returns are then rebuilt and resold (as seconds). Tent sales are often used to sell the rebuilt speakers. As part of the rebuilding process, the speakers are demagnetized so that metal pieces and shavings can be removed. A demagnetizing (demag) machine is used to achieve this objective. A product design change has made the most recent Model 150 speakers too tall for the demag machine. They no longer fit in the demag machine.

Stillwater Designs has two alternatives that it is currently considering. First, a new demag machine can be bought that has a different design, eliminating the fit problem. The cost of this machine is $600,000, and it will last 5 years. Second, Stillwater can keep the current machine and sell the 150 speakers for scrap, using the old demag machine for the Model 100 and 120 speakers only. A rebuilt speaker sells for $295 and costs $274.65 to rebuild (for materials, labor, and overhead cash outlays). The $274.65 outlay includes the annual operating cash effects of the new demag machine. If not rebuilt, the Model 150 speakers can be sold for $4 each as scrap. There are 10,000 Model 150 warranty returns per year. Assume that the required rate of return is 10%.

Stillwater Designs has been rebuilding Model 100, Model 120, and Model 150 Kicker subwoofers that were returned for warranty action. Customers returning the subwoofers receive a new replacement. The warranty returns are then rebuilt and resold (as seconds). Tent sales are often used to sell the rebuilt speakers. As part of the rebuilding process, the speakers are demagnetized so that metal pieces and shavings can be removed. A demagnetizing (demag) machine is used to achieve this objective. A product design change has made the most recent Model 150 speakers too tall for the demag machine. They no longer fit in the demag machine.

Stillwater Designs has two alternatives that it is currently considering. First, a new demag machine can be bought that has a different design, eliminating the fit problem. The cost of this machine is $600,000, and it will last 5 years. Second, Stillwater can keep the current machine and sell the 150 speakers for scrap, using the old demag machine for the Model 100 and 120 speakers only. A rebuilt speaker sells for $295 and costs $274.65 to rebuild (for materials, labor, and overhead cash outlays). The $274.65 outlay includes the annual operating cash effects of the new demag machine. If not rebuilt, the Model 150 speakers can be sold for $4 each as scrap. There are 10,000 Model 150 warranty returns per year. Assume that the required rate of return is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

Basic Net Present Value Analysis, Competing Projects

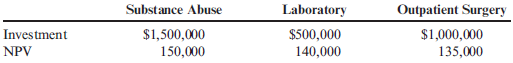

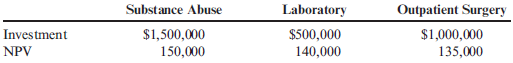

Kildare Medical Center, a for-profit hospital, has three investment opportunities: (1) adding a wing for in-patient treatment of substance abuse, (2) adding a pathology laboratory, and (3) expanding the outpatient surgery wing. The initial investments and the net present value for the three alternatives are as follows:

Although the hospital would like to invest in all three alternatives, only $1.5 million is available.

Kildare Medical Center, a for-profit hospital, has three investment opportunities: (1) adding a wing for in-patient treatment of substance abuse, (2) adding a pathology laboratory, and (3) expanding the outpatient surgery wing. The initial investments and the net present value for the three alternatives are as follows:

Although the hospital would like to invest in all three alternatives, only $1.5 million is available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Payback, Net Present Value, Internal Rate of Return, Intangible Benefits, Inflation Adjustment

Foster Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines (to replace an existing manual system). The outlay required is $3,500,000. The NC equipment will last 5 years with no expected salvage value. The expected incremental after-tax cash flows (cash flows of the NC equipment minus cash flows of the old equipment) associated with the project follow:

Foster has a cost of capital equal to 10%. The above cash flows are expressed without any consideration of inflation.

Foster Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines (to replace an existing manual system). The outlay required is $3,500,000. The NC equipment will last 5 years with no expected salvage value. The expected incremental after-tax cash flows (cash flows of the NC equipment minus cash flows of the old equipment) associated with the project follow:

Foster has a cost of capital equal to 10%. The above cash flows are expressed without any consideration of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

of Capital, Net Present Value

Leakam Company's product engineering department has developed a new product that has a 3-year life cycle. Production of the product requires development of a new process that requires a current $100,000 capital outlay. The $100,000 will be raised by issuing $60,000 of bonds and by selling new stock for $40,000. The $60,000 in bonds will have net (after-tax) interest payments of $3,000 at the end of each of the 3 years, with the principal being repaid at the end of Year 3. The stock issue carries with it an expectation of a 17.5% return, expressed in the form of dividends at the end of each year ($7,000 in dividends is expected for each of the next 3 years). The sources of capital for this investment represent the same proportion and costs that the company typically has. Finally, the project will produce after-tax cash inflows of $50,000 per year for the next 3 years.

Leakam Company's product engineering department has developed a new product that has a 3-year life cycle. Production of the product requires development of a new process that requires a current $100,000 capital outlay. The $100,000 will be raised by issuing $60,000 of bonds and by selling new stock for $40,000. The $60,000 in bonds will have net (after-tax) interest payments of $3,000 at the end of each of the 3 years, with the principal being repaid at the end of Year 3. The stock issue carries with it an expectation of a 17.5% return, expressed in the form of dividends at the end of each year ($7,000 in dividends is expected for each of the next 3 years). The sources of capital for this investment represent the same proportion and costs that the company typically has. Finally, the project will produce after-tax cash inflows of $50,000 per year for the next 3 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

Capital Investment, Advanced Manufacturing Environment

''I know that it's the thing to do,'' insisted Pamela Kincaid, vice president of finance for Colgate Manufacturing. ''If we are going to be competitive, we need to build this completely automated plant.''

''I'm not so sure,'' replied Bill Thomas, CEO of Colgate. ''The savings from labor reductions and increased productivity are only $4 million per year. The price tag for this factory-and it's a small one-is $45 million. That gives a payback period of more than 11 years. That's a long time to put the company's money at risk.''

''Yeah, but you're overlooking the savings that we'll get from the increase in quality,'' interjected John Simpson, production manager. ''With this system, we can decrease our waste and our rework time significantly. Those savings are worth another million dollars per year.''

''Another million will only cut the payback to about 9 years,'' retorted Bill. ''Ron, you're the marketing manager-do you have any insights?''

''Well, there are other factors to consider, such as service quality and market share. I think that increasing our product quality and improving our delivery service will make us a lot more competitive. I know for a fact that two of our competitors have decided against automation. That'll give us a shot at their customers, provided our product is of higher quality and we can deliver it faster. I estimate that it'll increase our net cash benefits by another $2.4 million.''

''Wow! Now that's impressive,'' Bill exclaimed, nearly convinced. ''The payback is now getting down to a reasonable level.''

''I agree,'' said Pamela, ''but we do need to be sure that it's a sound investment. I know that estimates for construction of the facility have gone as high as $48 million. I also know that the expected residual value, after the 20 years of service we expect to get, is $5 million. I think I had better see if this project can cover our 14% cost of capital.''

''Now wait a minute, Pamela,'' Bill demanded. ''You know that I usually insist on a 20% rate of return, especially for a project of this magnitude.''

''I know that it's the thing to do,'' insisted Pamela Kincaid, vice president of finance for Colgate Manufacturing. ''If we are going to be competitive, we need to build this completely automated plant.''

''I'm not so sure,'' replied Bill Thomas, CEO of Colgate. ''The savings from labor reductions and increased productivity are only $4 million per year. The price tag for this factory-and it's a small one-is $45 million. That gives a payback period of more than 11 years. That's a long time to put the company's money at risk.''

''Yeah, but you're overlooking the savings that we'll get from the increase in quality,'' interjected John Simpson, production manager. ''With this system, we can decrease our waste and our rework time significantly. Those savings are worth another million dollars per year.''

''Another million will only cut the payback to about 9 years,'' retorted Bill. ''Ron, you're the marketing manager-do you have any insights?''

''Well, there are other factors to consider, such as service quality and market share. I think that increasing our product quality and improving our delivery service will make us a lot more competitive. I know for a fact that two of our competitors have decided against automation. That'll give us a shot at their customers, provided our product is of higher quality and we can deliver it faster. I estimate that it'll increase our net cash benefits by another $2.4 million.''

''Wow! Now that's impressive,'' Bill exclaimed, nearly convinced. ''The payback is now getting down to a reasonable level.''

''I agree,'' said Pamela, ''but we do need to be sure that it's a sound investment. I know that estimates for construction of the facility have gone as high as $48 million. I also know that the expected residual value, after the 20 years of service we expect to get, is $5 million. I think I had better see if this project can cover our 14% cost of capital.''

''Now wait a minute, Pamela,'' Bill demanded. ''You know that I usually insist on a 20% rate of return, especially for a project of this magnitude.''

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Postaudit, Sensitivity Analysis

Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at $860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of $225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%.

Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at $860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of $225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Discount Rates, Automated Manufacturing, Competing Investments

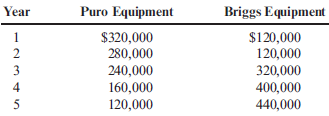

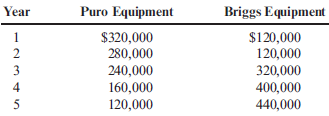

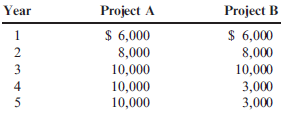

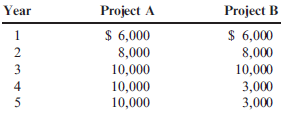

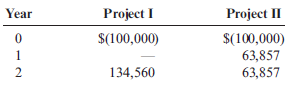

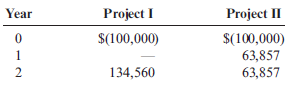

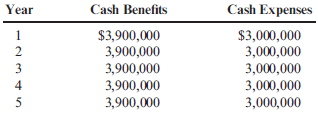

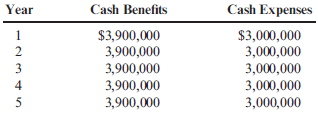

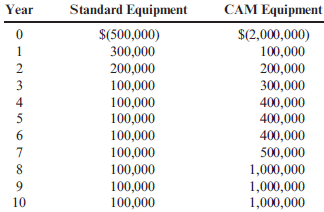

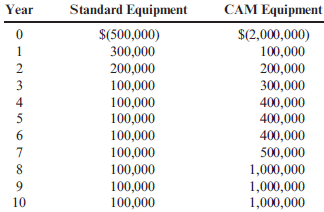

Patterson Company is considering two competing investments. The first is for a standard piece of production equipment. The second is for computer-aided manufacturing (CAM) equipment. The investment and after-tax operating cash flows follow:

Patterson uses a discount rate of 18% for all of its investments. Patterson's cost of capital is 10%.

Patterson Company is considering two competing investments. The first is for a standard piece of production equipment. The second is for computer-aided manufacturing (CAM) equipment. The investment and after-tax operating cash flows follow:

Patterson uses a discount rate of 18% for all of its investments. Patterson's cost of capital is 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

Quality, Market Share, Automated Manufacturing Environment

Fabre Company, Patterson Company's competitor, is considering the same investments as Patterson. Refer to the data in Problem 14-47 above. Assume that Fabre's cost of capital is 14%.

Fabre Company, Patterson Company's competitor, is considering the same investments as Patterson. Refer to the data in Problem 14-47 above. Assume that Fabre's cost of capital is 14%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

Payback, Net Present Value, Internal Rate of Return, Effects of Differences in Sales on Project Viability

Shaftel Ready Mix is a processor and supplier of concrete, aggregate, and rock products. The company operates in the intermountain western United States. Currently, Shaftel has 14 cementprocessing plants and a labor force of more than 375 employees. With the exception of cement powder, all materials (e.g., aggregates and sand) are produced internally by the company. The demand for concrete and aggregates has been growing steadily nationally. In the West, the growth rate has been above the national average. Because of this growth, Shaftel has more than tripled its gross revenues over the past 10 years.

Of the intermountain states, Arizona has been experiencing the most growth. Processing plants have been added over the past several years, and the company is considering the addition of yet another plant to be located in Scottsdale. A major advantage of another plant in Arizona is the ability to operate year round, a feature not found in states such as Utah and Wyoming.

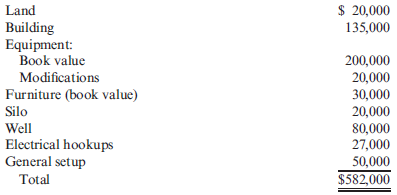

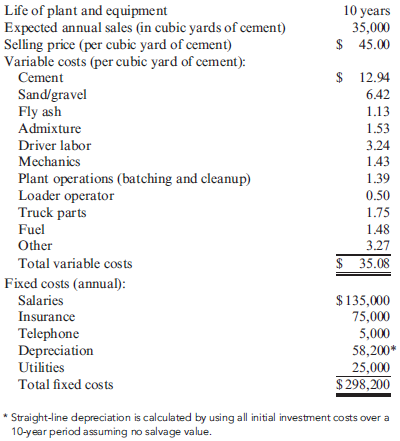

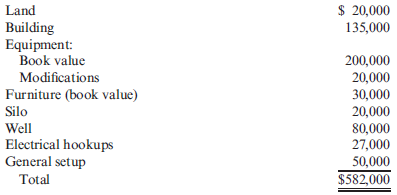

In setting up the new plant, land would have to be purchased and a small building constructed. Equipment and furniture would not need to be purchased; these items would be transferred from a plant that opened in Wyoming during the oil boom period and closed a few years after the end of that boom. However, the equipment needs some repair and modifications before it can be used. The equipment has a book value of $200,000, and the furniture has a book value of $30,000. Neither has any outside market value. Other costs, such as the installation of a silo, well, electrical hookups, and so on, will be incurred. No salvage value is expected. The summary of the initial investment costs by category is as follows:

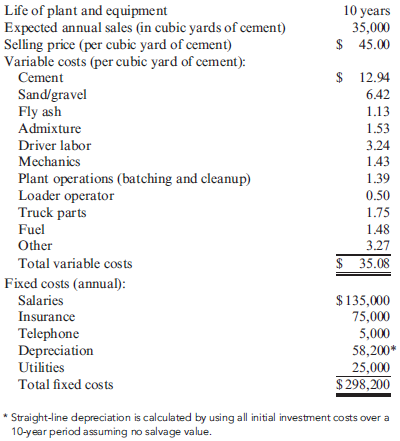

Estimates concerning the operation of the Scottsdale plant follow:

After reviewing these data, Karl Flemming, vice president of operations, argued against the proposed plant. Karl was concerned because the plant would earn significantly less than the normal 8.3% return on sales. All other plants in the company were earning between 7.5 and 8.5% on sales. Karl also noted that it would take more than 5 years to recover the total initial outlay of $582,000. In the past, the company had always insisted that payback be no more than 4 years. The company's cost of capital is 10%. Assume that there are no income taxes.

Shaftel Ready Mix is a processor and supplier of concrete, aggregate, and rock products. The company operates in the intermountain western United States. Currently, Shaftel has 14 cementprocessing plants and a labor force of more than 375 employees. With the exception of cement powder, all materials (e.g., aggregates and sand) are produced internally by the company. The demand for concrete and aggregates has been growing steadily nationally. In the West, the growth rate has been above the national average. Because of this growth, Shaftel has more than tripled its gross revenues over the past 10 years.

Of the intermountain states, Arizona has been experiencing the most growth. Processing plants have been added over the past several years, and the company is considering the addition of yet another plant to be located in Scottsdale. A major advantage of another plant in Arizona is the ability to operate year round, a feature not found in states such as Utah and Wyoming.

In setting up the new plant, land would have to be purchased and a small building constructed. Equipment and furniture would not need to be purchased; these items would be transferred from a plant that opened in Wyoming during the oil boom period and closed a few years after the end of that boom. However, the equipment needs some repair and modifications before it can be used. The equipment has a book value of $200,000, and the furniture has a book value of $30,000. Neither has any outside market value. Other costs, such as the installation of a silo, well, electrical hookups, and so on, will be incurred. No salvage value is expected. The summary of the initial investment costs by category is as follows:

Estimates concerning the operation of the Scottsdale plant follow:

After reviewing these data, Karl Flemming, vice president of operations, argued against the proposed plant. Karl was concerned because the plant would earn significantly less than the normal 8.3% return on sales. All other plants in the company were earning between 7.5 and 8.5% on sales. Karl also noted that it would take more than 5 years to recover the total initial outlay of $582,000. In the past, the company had always insisted that payback be no more than 4 years. The company's cost of capital is 10%. Assume that there are no income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck