Deck 15: Financing Corporate Real Estate

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 15: Financing Corporate Real Estate

1

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years.

a. What is the return from opening the office building under the assumption that it is leased

b. What is the return from opening the office building under the assumption that it is owned

c. What is the return on the incremental cash flow from owning versus leasing

d. In general, what other factors might the firm consider before deciding whether to lease or own

a. What is the return from opening the office building under the assumption that it is leased

b. What is the return from opening the office building under the assumption that it is owned

c. What is the return on the incremental cash flow from owning versus leasing

d. In general, what other factors might the firm consider before deciding whether to lease or own

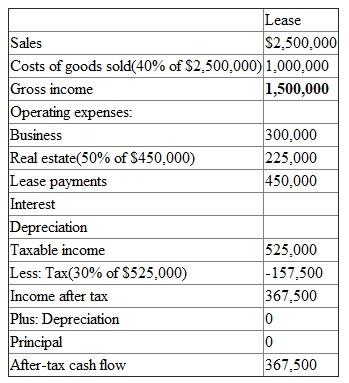

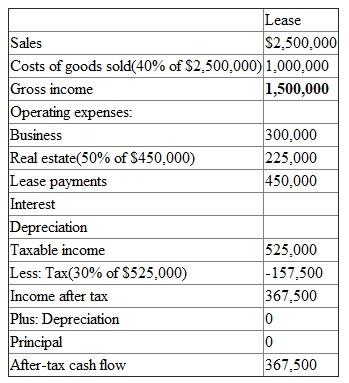

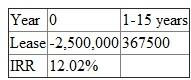

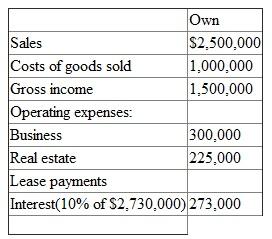

If the building is taken on lease instead of owning then its annual sales will increase by $2.5 million. The cost of goods sold is 40% of sales. The operating expenses are $225,000 which is 50% of the lease payments of $450,000.

a.

To calculate the return from opening the office building lets first calculate the after tax cash flow from lease as shown below:

The after tax cash flow comes out to be $367,500 for 15 years.

The after tax cash flow comes out to be $367,500 for 15 years.

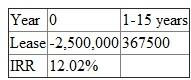

The after tax cash flow comes out to be $367,500 for 15 years and the cash outlay is $2,500,000. Now lets calculate the Internal rate of return from leasing as shown below:

With the help of excel formula the IRR comes out to be 12.02%.

With the help of excel formula the IRR comes out to be 12.02%.

b.

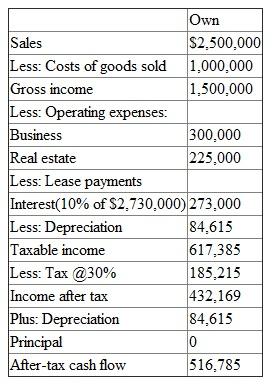

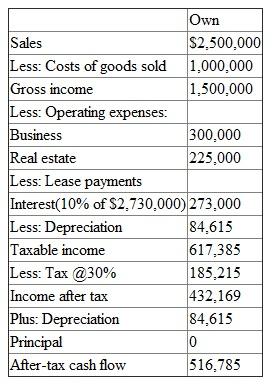

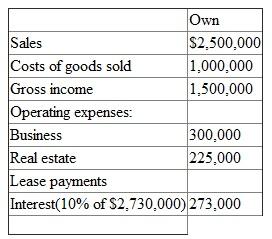

If the building is owned then its annual sales will increase by $2.5 million. The cost of goods sold is 40% of sales. The depreciation is calculated by dividing the $3.3 million by 39 years which comes out to be $84,615.

Firstly, lets calculate the after tax cash flow as shown below:

The after tax cash flow comes out to be $516,785 for 15 years.

The after tax cash flow comes out to be $516,785 for 15 years.

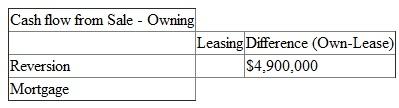

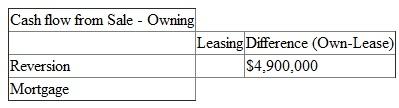

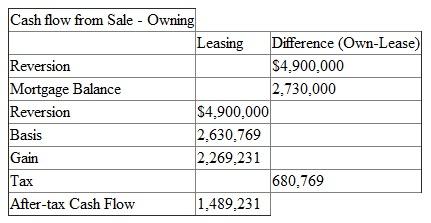

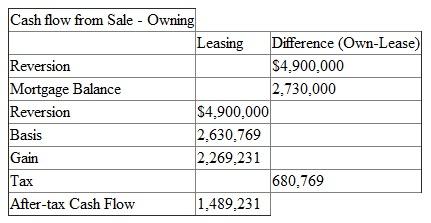

Now its required to calculate the residual value at the end of 15 years of owning. The residual value of owning is calculated below:

Balance

Balance

2,730,000

Reversion

$4,900,000

Basis

2,630,769

Gain

2,269,231

Tax

680,769

After-tax Cash Flow

1,489,231

The after tax cash flow is 1,489,231.

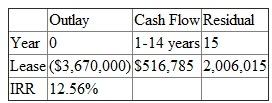

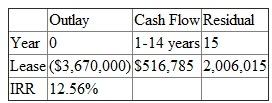

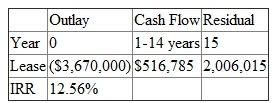

So with the cash outlay of $3,670,000, the after tax cash flow of $516,785 for 15 years and the residual value of $2,006,015 (516785+ 1,489,231). It is calculated and shown below:

With the help of excel formula the IRR comes out to be 12.56%.

With the help of excel formula the IRR comes out to be 12.56%.

c.

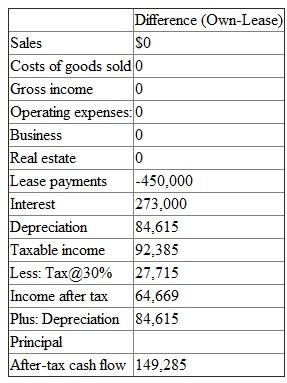

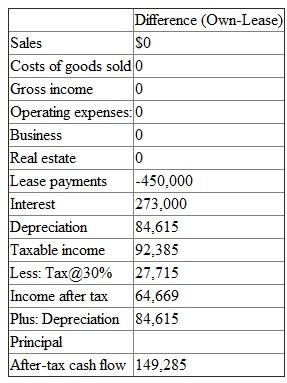

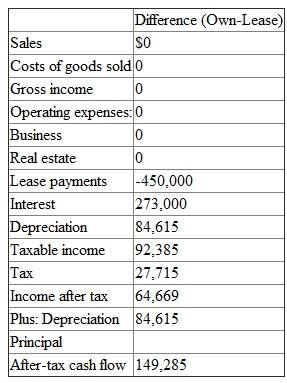

To calculate the incremental cash flow firstly it is required to calculate the difference between owning and leasing. The difference between leasing and owning (after tax cash flow) is calculated and shown below:

The after tax cash flow comes out to be $149,285 for 15 years.

The after tax cash flow comes out to be $149,285 for 15 years.

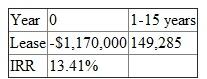

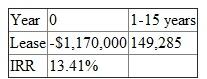

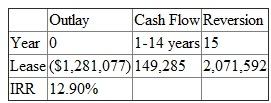

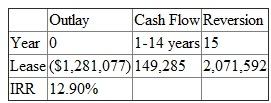

The after tax cash flow comes out to be $149,285 for 15 years and the cash outlay is $1,170,000. Now lets calculate the Internal rate of return from owning -leasing as shown below:

With the help of excel formula the IRR comes out to be 13.41%.

With the help of excel formula the IRR comes out to be 13.41%.

d.

The other factors which the firm should consider before deciding whether to lease or own are firstly how much of space is required to set up the firm. Secondly, a firm also needs to decide the amount of time space is required and the risk bearing capacity of the firm. Thirdly, the maintenance cost and expertise of management. Fourthly, the firm should also consider the effect of leasing or owning on tax benefits and financial statements of the company.

a.

To calculate the return from opening the office building lets first calculate the after tax cash flow from lease as shown below:

The after tax cash flow comes out to be $367,500 for 15 years.

The after tax cash flow comes out to be $367,500 for 15 years.The after tax cash flow comes out to be $367,500 for 15 years and the cash outlay is $2,500,000. Now lets calculate the Internal rate of return from leasing as shown below:

With the help of excel formula the IRR comes out to be 12.02%.

With the help of excel formula the IRR comes out to be 12.02%. b.

If the building is owned then its annual sales will increase by $2.5 million. The cost of goods sold is 40% of sales. The depreciation is calculated by dividing the $3.3 million by 39 years which comes out to be $84,615.

Firstly, lets calculate the after tax cash flow as shown below:

The after tax cash flow comes out to be $516,785 for 15 years.

The after tax cash flow comes out to be $516,785 for 15 years. Now its required to calculate the residual value at the end of 15 years of owning. The residual value of owning is calculated below:

Balance

Balance 2,730,000

Reversion

$4,900,000

Basis

2,630,769

Gain

2,269,231

Tax

680,769

After-tax Cash Flow

1,489,231

The after tax cash flow is 1,489,231.

So with the cash outlay of $3,670,000, the after tax cash flow of $516,785 for 15 years and the residual value of $2,006,015 (516785+ 1,489,231). It is calculated and shown below:

With the help of excel formula the IRR comes out to be 12.56%.

With the help of excel formula the IRR comes out to be 12.56%. c.

To calculate the incremental cash flow firstly it is required to calculate the difference between owning and leasing. The difference between leasing and owning (after tax cash flow) is calculated and shown below:

The after tax cash flow comes out to be $149,285 for 15 years.

The after tax cash flow comes out to be $149,285 for 15 years.The after tax cash flow comes out to be $149,285 for 15 years and the cash outlay is $1,170,000. Now lets calculate the Internal rate of return from owning -leasing as shown below:

With the help of excel formula the IRR comes out to be 13.41%.

With the help of excel formula the IRR comes out to be 13.41%.d.

The other factors which the firm should consider before deciding whether to lease or own are firstly how much of space is required to set up the firm. Secondly, a firm also needs to decide the amount of time space is required and the risk bearing capacity of the firm. Thirdly, the maintenance cost and expertise of management. Fourthly, the firm should also consider the effect of leasing or owning on tax benefits and financial statements of the company.

2

What are the main reasons that corporations may choose to own real estate

Real estate means which is related with the land or buildings. Real estate means the property is physically present. Real estate can be of four types that are residential real estate, commercial real estate, industrial real estate and the land which is vacant.

The main reason that corporations choose to have a real estate or they can get it on a lease, leasing is more expensive in nature but owning is little expensive as compare to leasing. The organisations also want more control on the real estate and it is not possible in the case of leasing. In owning the real estate it also gives the asset base diversification.

Real estate is the popular business; brokers are present in the real estate market. They show the vacant lands on to the customers who want to buy the land. They charge commission from both sides that is seller and buyer.

The main reason that corporations choose to have a real estate or they can get it on a lease, leasing is more expensive in nature but owning is little expensive as compare to leasing. The organisations also want more control on the real estate and it is not possible in the case of leasing. In owning the real estate it also gives the asset base diversification.

Real estate is the popular business; brokers are present in the real estate market. They show the vacant lands on to the customers who want to buy the land. They charge commission from both sides that is seller and buyer.

3

Refer to problem 1. Suppose that five years ago the corporation had decided to own rather than lease the real estate. Assume that it is now five years later and management is considering a sale-leaseback of the property. The property can be sold today for $4,240,000 and leased back at a rate of $450,000 per year on a 15-year lease starting today. It was purchased five years ago for $3.9 million. Assume that the property will be worth $5.7 million at the end of the 15-year lease.

a. How much would the corporation receive from a sale-leaseback of the property

b. What is the cost of obtaining financing with a sale-leaseback

c. What is the return from continuing to own the property

d. In general, what other factors and alternatives might the firm consider in order to decide whether to do a sale-leaseback

(For Reference Problem 1)

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years.

a. What is the return from opening the office building under the assumption that it is leased

b. What is the return from opening the office building under the assumption that it is owned

c. What is the return on the incremental cash flow from owning versus leasing

d. In general, what other factors might the firm consider before deciding whether to lease or own

a. How much would the corporation receive from a sale-leaseback of the property

b. What is the cost of obtaining financing with a sale-leaseback

c. What is the return from continuing to own the property

d. In general, what other factors and alternatives might the firm consider in order to decide whether to do a sale-leaseback

(For Reference Problem 1)

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years.

a. What is the return from opening the office building under the assumption that it is leased

b. What is the return from opening the office building under the assumption that it is owned

c. What is the return on the incremental cash flow from owning versus leasing

d. In general, what other factors might the firm consider before deciding whether to lease or own

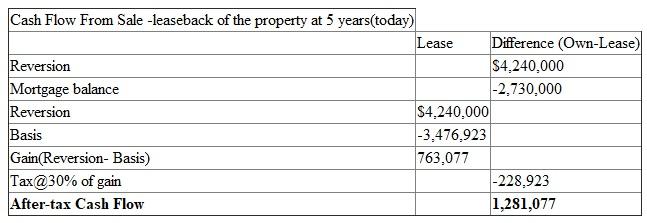

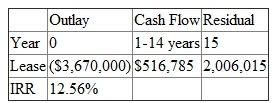

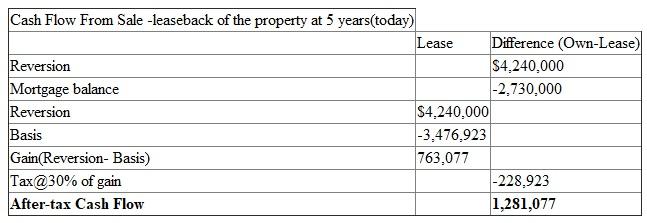

Sale-leaseback is a strategy adopted by corporations who first sells the asset and then leases it back without having the right to own the asset. If the corporation decided to own rather than lease 5 years ago then the property can be sold for $4,240,000 and leased back at a rate of $450,000 per year on a 15 year lease.

a.

The after tax cash flow from sale leaseback of the property is calculated and shown below:

Therefore, the corporation would receive $1,281,077 from a sale leaseback of the property.

Therefore, the corporation would receive $1,281,077 from a sale leaseback of the property.

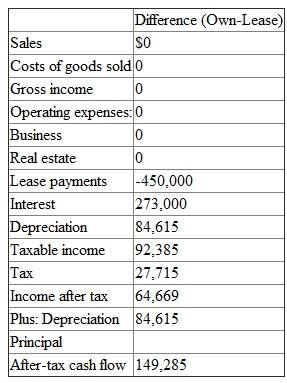

(b) The depreciation is calculated by dividing the $3.3 million by 39 years which comes out to be $84,615. The difference between leasing and owning (after tax cash flow) is calculated and shown below:

The after tax cash flow comes out to be $149,285 for 14 years.

The after tax cash flow comes out to be $149,285 for 14 years.

The after tax cash flow comes out to be $149,285 for 14 years with the residual value of 2,071,592 and the cash outlay is $1,281,077. Now lets calculate the Internal rate of return from owning -leasing as shown below:

With the help of excel formula the IRR comes out to be 12.90%.

With the help of excel formula the IRR comes out to be 12.90%.

c.

If the building is owned then its annual sales will increase by $2.5 million. The cost of goods sold is 40% of sales. The depreciation is calculated by dividing the $3.3 million by 39 years which comes out to be $84,615.

Firstly, lets calculate the after tax cash flow as shown below:

Depreciation

Depreciation

84,615

Taxable income

617,385

Tax

185,215

Income after tax

432,169

Plus: Depreciation

84,615

Principal

0

After-tax cash flow

516,785

The after tax cash flow comes out to be $516,785 for 15 years.

Now its required to calculate the residual value at the end of 15 years of owning. The residual value of owning is calculated below:

The after tax cash flow is 1,489,231.

The after tax cash flow is 1,489,231.

So with the cash outlay of $3,670,000, the after tax cash flow of $516,785 for 15 years and the residual value of $2,006,015 (516785+ 1,489,231). It is calculated and shown below:

With the help of excel formula the IRR comes out to be 12.56%.

With the help of excel formula the IRR comes out to be 12.56%.

d.

The other factors which the firm should consider before deciding sale-leaseback is Firstly effect of sale-leaseback on tax and corporations financial statements. Secondly, the ability of a corporation to protect its capital gains as well as refinance the high priced debt. Thirdly, to provide a source of capital that can be used to fund growth opportunities. Fourthly, corporations can use sale-leaseback as a signaling device to show the shareholders that it is serious about increasing their value.

a.

The after tax cash flow from sale leaseback of the property is calculated and shown below:

Therefore, the corporation would receive $1,281,077 from a sale leaseback of the property.

Therefore, the corporation would receive $1,281,077 from a sale leaseback of the property.(b) The depreciation is calculated by dividing the $3.3 million by 39 years which comes out to be $84,615. The difference between leasing and owning (after tax cash flow) is calculated and shown below:

The after tax cash flow comes out to be $149,285 for 14 years.

The after tax cash flow comes out to be $149,285 for 14 years.The after tax cash flow comes out to be $149,285 for 14 years with the residual value of 2,071,592 and the cash outlay is $1,281,077. Now lets calculate the Internal rate of return from owning -leasing as shown below:

With the help of excel formula the IRR comes out to be 12.90%.

With the help of excel formula the IRR comes out to be 12.90%. c.

If the building is owned then its annual sales will increase by $2.5 million. The cost of goods sold is 40% of sales. The depreciation is calculated by dividing the $3.3 million by 39 years which comes out to be $84,615.

Firstly, lets calculate the after tax cash flow as shown below:

Depreciation

Depreciation 84,615

Taxable income

617,385

Tax

185,215

Income after tax

432,169

Plus: Depreciation

84,615

Principal

0

After-tax cash flow

516,785

The after tax cash flow comes out to be $516,785 for 15 years.

Now its required to calculate the residual value at the end of 15 years of owning. The residual value of owning is calculated below:

The after tax cash flow is 1,489,231.

The after tax cash flow is 1,489,231.So with the cash outlay of $3,670,000, the after tax cash flow of $516,785 for 15 years and the residual value of $2,006,015 (516785+ 1,489,231). It is calculated and shown below:

With the help of excel formula the IRR comes out to be 12.56%.

With the help of excel formula the IRR comes out to be 12.56%. d.

The other factors which the firm should consider before deciding sale-leaseback is Firstly effect of sale-leaseback on tax and corporations financial statements. Secondly, the ability of a corporation to protect its capital gains as well as refinance the high priced debt. Thirdly, to provide a source of capital that can be used to fund growth opportunities. Fourthly, corporations can use sale-leaseback as a signaling device to show the shareholders that it is serious about increasing their value.

4

What factors would tend to make leasing more desirable than owning

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

Refer to problem 1. ABC realizes that the benefits of leasing versus owning may be sensitive to many of the assumptions being made. Management wants to know how the return on the incremental cash flow from owning versus leasing is affected by different assumptions. (This problem is best done using a spreadsheet.)

a. How would the return be affected by the corporation being in a zero tax bracket

b. How will the return be affected if the property value does not increase over time but remains constant

c. How would the return be affected if the mortgage were at an 8 percent (rather than 10 percent) interest rate

(For Reference Problem 1)

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years.

a. What is the return from opening the office building under the assumption that it is leased

b. What is the return from opening the office building under the assumption that it is owned

c. What is the return on the incremental cash flow from owning versus leasing

d. In general, what other factors might the firm consider before deciding whether to lease or own

a. How would the return be affected by the corporation being in a zero tax bracket

b. How will the return be affected if the property value does not increase over time but remains constant

c. How would the return be affected if the mortgage were at an 8 percent (rather than 10 percent) interest rate

(For Reference Problem 1)

The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. Cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $300,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $3.9 million, of which $600,000 of the purchase price would represent land value, and $3.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 30 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $450,000 per year for a term of 15 years, with the corporation paying all real estate operating expenses (absolute net lease). Real estate operating expenses are estimated to be 50 percent of the lease payments. Estimates are that the property value will increase over the 15-year lease term for a sale price of $4.9 million at the end of the 15 years. If the property is purchased, it would be financed with an interest-only mortgage for $2,730,000 at an interest rate of 10 percent with a balloon payment due after 15 years.

a. What is the return from opening the office building under the assumption that it is leased

b. What is the return from opening the office building under the assumption that it is owned

c. What is the return on the incremental cash flow from owning versus leasing

d. In general, what other factors might the firm consider before deciding whether to lease or own

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

Why might the cost of a mortgage loan be greater than the cost of using unsecured corporate debt to finance corporate real estate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

Excel. Refer to the "Ch15 Lease_Own" tab in the Excel Workbook provided on the Web site. How does each of the following affect the IRR on the ATCF difference from owning versus leasing

a. The property can be leased for $175,000 instead of $200,000.

b. A loan can be obtained at an 8 percent interest rate instead of 10 percent.

a. The property can be leased for $175,000 instead of $200,000.

b. A loan can be obtained at an 8 percent interest rate instead of 10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

Why might the riskiness of cash flow from the residual value of the real estate differ from the riskiness of cash flow from the corporation's core business What would cause these cash flows to be correlated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

What would cause the rate of return for an investor that purchases real estate and leases it to the corporation to differ from the rate of return earned by the corporation on the incremental investment in owning versus leasing the same property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

Why might the decision to own rather than lease real estate have an unfavorable effect on the corporation's financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

Why is the value of corporate real estate often considered "hidden" from shareholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

How does the analysis of a sale-leaseback differ from the analysis of owning versus leasing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

Why is the cost of financing with a sale-leaseback essentially the same as the return from continuing to own

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

Why might it be argued that corporations do not have a comparative advantage when investing in real estate as a means of diversification from the core business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

Why has real estate often been a key factor in corporate restructuring

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

Why might refinancing be considered an alternative to a sale-leaseback

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

What factors might cause the highest and best use of real estate to change during the course of typical lease term

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

Why should corporations have their real estate appraised on a regular basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

What factors would tend to affect the value of a lease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck