Deck 22: Leasing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/42

العب

ملء الشاشة (f)

Deck 22: Leasing

1

Capital leases would show up on the balance sheet of the firm in which manner for a six year machinery lease worth $700,000:

A) capital leases do not have to be put on the balance sheet only financial leases do.

B) Asset-Machinery $700,000; Liabilities-Long term debt $700,000 because of debt displacement.

C) Asset-Assets under capital lease $700,000; Liabilities-Obligations under capital lease $700,000.

D) Assets-Assets under capital lease $700,000; Liabilities-Long term debt $700,000 because of debt displacement.

A) capital leases do not have to be put on the balance sheet only financial leases do.

B) Asset-Machinery $700,000; Liabilities-Long term debt $700,000 because of debt displacement.

C) Asset-Assets under capital lease $700,000; Liabilities-Obligations under capital lease $700,000.

D) Assets-Assets under capital lease $700,000; Liabilities-Long term debt $700,000 because of debt displacement.

Asset-Assets under capital lease $700,000; Liabilities-Obligations under capital lease $700,000.

2

Prior to CICA 3065, "Accounting for Leases", lease activity was only reported in financial footnotes. This off-balance-sheet-financing made firms with:

A) operating leases appear healthier than those with no leases.

B) financial leases appear to have greater liabilities than firms using operating leases.

C) operating leases appear to have greater liabilities than firms using financial lease.

D) financial leases appear to be financially stronger than if the leases were on-balance-sheet-financing.

A) operating leases appear healthier than those with no leases.

B) financial leases appear to have greater liabilities than firms using operating leases.

C) operating leases appear to have greater liabilities than firms using financial lease.

D) financial leases appear to be financially stronger than if the leases were on-balance-sheet-financing.

financial leases appear to be financially stronger than if the leases were on-balance-sheet-financing.

3

In a lease arrangement, the user of the asset is:

A) the lesser.

B) the lessee.

C) the lessor.

D) the leaser.

A) the lesser.

B) the lessee.

C) the lessor.

D) the leaser.

the lessee.

4

An independent leasing company supplies ___________ leases versus the manufacturer who supplies ________________ leases.

A) leveraged; direct

B) sales and leaseback; sales-type

C) capital; sales-type

D) direct; sales-type

A) leveraged; direct

B) sales and leaseback; sales-type

C) capital; sales-type

D) direct; sales-type

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

5

An advantage of leasing is that the lessee does not own the asset and can cancel:

A) only financial leases.

B) only operating leases.

C) only capital leases.

D) any kind of leases anytime.

A) only financial leases.

B) only operating leases.

C) only capital leases.

D) any kind of leases anytime.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

6

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300,000 per year with the first payment occurring at lease inception. The system would cost $1,050,000 to buy and would be straight-line depreciated to a zero salvage value. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. What is the after-tax cash flow from leasing in year 0?

A) -$300,000

B) -$495,000

C) -$852,000

D) -$948,000

A) -$300,000

B) -$495,000

C) -$852,000

D) -$948,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

7

The city of Oakville sold some buildings and used the proceeds to improve its financial position. The city then leased the buildings back in order to continue to use these facilities. This is an example of:

A) an operating lease.

B) a short-term lease.

C) a sale and leaseback.

D) a fully amortized lease.

A) an operating lease.

B) a short-term lease.

C) a sale and leaseback.

D) a fully amortized lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a lease arrangement, the owner of the asset is:

A) the lesser.

B) the lessee.

C) the lessor.

D) the leaser.

A) the lesser.

B) the lessee.

C) the lessor.

D) the leaser.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

9

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300,000 per year with the first payment occurring at lease inception. The system would cost $1,050,000 to buy and would be straight-line depreciated to a zero salvage value. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. What is the after-tax cash flow in years 1 through 5?

A) $126,600

B) $198,000

C) $269,400

D) $287,250

A) $126,600

B) $198,000

C) $269,400

D) $287,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

10

An operating lease's primary characteristics are:

A) fully amortized, lessee maintain equipment and there is not cancellation clause.

B) not fully amortized, lessor maintains equipment and there is a cancellation clause.

C) fully amortized, lessor maintain equipment and there is a cancellation clause.

D) not fully amortized, lessor maintains equipment and there is not cancellation clause.

E) fully amortized, lessee maintain equipment and lessee can acquire assets at end of lease for fair market value.

A) fully amortized, lessee maintain equipment and there is not cancellation clause.

B) not fully amortized, lessor maintains equipment and there is a cancellation clause.

C) fully amortized, lessor maintain equipment and there is a cancellation clause.

D) not fully amortized, lessor maintains equipment and there is not cancellation clause.

E) fully amortized, lessee maintain equipment and lessee can acquire assets at end of lease for fair market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

11

A financial lease has which as its primary characteristics:

A) is fully amortized, lessee maintains equipment and there is no renewal clause and no cancellation clause.

B) is not fully amortized, lessor maintains equipment and there is a renewal clause but no cancellation clause.

C) is fully amortized, lessor maintains equipment and there is a renewal clause and a no cancellation clause.

D) is not fully amortized, lessor maintains equipment and there is a renewal clause.

E) is fully amortized, lessee maintains equipment and there is a renewal clause and a no cancellation clause.

A) is fully amortized, lessee maintains equipment and there is no renewal clause and no cancellation clause.

B) is not fully amortized, lessor maintains equipment and there is a renewal clause but no cancellation clause.

C) is fully amortized, lessor maintains equipment and there is a renewal clause and a no cancellation clause.

D) is not fully amortized, lessor maintains equipment and there is a renewal clause.

E) is fully amortized, lessee maintains equipment and there is a renewal clause and a no cancellation clause.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would not be a characteristic of a financial lease?

A) They are usually fully amortized.

B) They usually require the lessor to maintain and insure the leased assets.

C) They usually do not include a cancellation option.

D) The lessee usually has the right to renew the lease at expiration.

A) They are usually fully amortized.

B) They usually require the lessor to maintain and insure the leased assets.

C) They usually do not include a cancellation option.

D) The lessee usually has the right to renew the lease at expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Canadian Universities sell medical equipment and used the proceeds to improve its financial position. The University then leased the equipment back in order to continue to use these facilities. This is an example of:

A) an operating lease.

B) a short-term lease.

C) a sale and leaseback.

D) a fully amortized lease.

A) an operating lease.

B) a short-term lease.

C) a sale and leaseback.

D) a fully amortized lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

14

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300,000 per year with the first payment occurring at lease inception. The system would cost $1,050,000 to buy and would be straight-line depreciated to a zero salvage value. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. What is the appropriate discount rate for valuing the lease?

A) 2.72%

B) 5.28%

C) 8.00%

D) 12.12%

A) 2.72%

B) 5.28%

C) 8.00%

D) 12.12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the lessor borrows much of the purchase price of a leased asset, the lease is called:

A) a leveraged lease.

B) a sale-and-leaseback.

C) a capital lease.

D) a nonrecourse lease.

A) a leveraged lease.

B) a sale-and-leaseback.

C) a capital lease.

D) a nonrecourse lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

16

The appropriate discount rate for valuing a financial lease is:

A) the firm's after-tax weighted average cost of capital.

B) the after-tax required return on assets of risks similar to the leased asset.

C) the after-tax cost of secured borrowing.

D) the pre-tax cost of secured borrowing

A) the firm's after-tax weighted average cost of capital.

B) the after-tax required return on assets of risks similar to the leased asset.

C) the after-tax cost of secured borrowing.

D) the pre-tax cost of secured borrowing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

17

The reason the CRA is most concerned about lease contracts is:

A) firms that lease generally pay no taxes.

B) that leasing usually leads to bankruptcy.

C) that leases can be set up solely to avoid taxes.

D) because leasing leads to off-balance-sheet-financing.

A) firms that lease generally pay no taxes.

B) that leasing usually leads to bankruptcy.

C) that leases can be set up solely to avoid taxes.

D) because leasing leads to off-balance-sheet-financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

18

For accounting purposes, which of the following conditions would not automatically cause a lease to be a financial lease?

A) The lessee can purchase the asset for its fair market value at the end of the lease.

B) The lease transfers ownership of the asset to the lessee by the end of the lease.

C) The lease term is more than 75% of the asset's economic life.

D) The PV of the lease payments is more than 90% of the asset's market value at lease inception.

A) The lessee can purchase the asset for its fair market value at the end of the lease.

B) The lease transfers ownership of the asset to the lessee by the end of the lease.

C) The lease term is more than 75% of the asset's economic life.

D) The PV of the lease payments is more than 90% of the asset's market value at lease inception.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

19

Operating leases:

A) appear as offsetting items on the lessee's balance sheet.

B) are fully expensed at the time the lease is established.

C) are not included in the lessee's financial reports.

D) are treated the same as a purchase.

E) must be disclosed in the lessee's annual report.

A) appear as offsetting items on the lessee's balance sheet.

B) are fully expensed at the time the lease is established.

C) are not included in the lessee's financial reports.

D) are treated the same as a purchase.

E) must be disclosed in the lessee's annual report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

20

A lease with high payments early in its life which then decline to termination would:

A) provide greater cash flow to the lessee in the beginning years.

B) be evidence of tax avoidance and not acceptable to the CRA.

C) be qualified as a capital lease under CICA 3065.

D) provide a lower residual value and thus ensure a bargain-purchase price option.

A) provide greater cash flow to the lessee in the beginning years.

B) be evidence of tax avoidance and not acceptable to the CRA.

C) be qualified as a capital lease under CICA 3065.

D) provide a lower residual value and thus ensure a bargain-purchase price option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

21

Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. What would the after-tax cash flow in year 9 be if the asset had a residual value of $500 (ignoring any possible risk differences)?

A) $955

B) $1,455

C) $605

D) $1,305

A) $955

B) $1,455

C) $605

D) $1,305

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

22

The risk of cash flow associated with the lease payment and the depreciation shield are:

A) different for taxable firms and the depreciation shield should be discounted at a higher riskier rate.

B) different for taxable firms and the depreciation shield should be discounted at a lower riskless rate.

C) the same and should be discounted at the same rate.

D) dependent on the amount of debt displaced, therefore the discount rate may vary for both.

A) different for taxable firms and the depreciation shield should be discounted at a higher riskier rate.

B) different for taxable firms and the depreciation shield should be discounted at a lower riskless rate.

C) the same and should be discounted at the same rate.

D) dependent on the amount of debt displaced, therefore the discount rate may vary for both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

23

A financial lease is likely to be most beneficial to both parties when:

A) the lessor's tax rate is lower than the lessee's.

B) the lessor's tax rate is higher than the lessee's.

C) the lessor's tax rate is equal to the lessee's.

D) a financial lease cannot be beneficial to both parties.

A) the lessor's tax rate is lower than the lessee's.

B) the lessor's tax rate is higher than the lessee's.

C) the lessor's tax rate is equal to the lessee's.

D) a financial lease cannot be beneficial to both parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

24

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300 thousand per year with the first payment occurring at lease inception. The black box would cost $1050 thousand to buy and would be straight-line depreciated to a zero salvage. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. All answers are in thousands. What is the after-tax cash flow in years 1 through 5?

A) $126.60

B) -$198.00

C) -$287.25

D) $269.40

A) $126.60

B) -$198.00

C) -$287.25

D) $269.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

25

Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. What is the after-tax cash flow from leasing in years 1-9?

A) $255

B) $955

C) $1,295

D) $1,850

A) $255

B) $955

C) $1,295

D) $1,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

26

Debt displacement is associated with leases because:

A) all assets not purchased with equity use debt financing.

B) debt is always a cheaper source of financing and is lost as leasing is used.

C) ICA3065 and the CRA mandate debt displacement.

D) lease financing is all debt and causes an imbalance in the optimal debt to equity ratio which reduces future debt financing.

A) all assets not purchased with equity use debt financing.

B) debt is always a cheaper source of financing and is lost as leasing is used.

C) ICA3065 and the CRA mandate debt displacement.

D) lease financing is all debt and causes an imbalance in the optimal debt to equity ratio which reduces future debt financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

27

Your firm is considering leasing a radiographic x-ray machine. The lease lasts for 3 years. The lease calls for 4 payments of $25,000 per year with the first payment occurring immediately. The computer would cost $140,000 to buy and would be straight-line depreciated to a zero salvage value over 3 years. The actual salvage value is negligible. The firm can borrow at a rate of 12%. The corporate tax rate is 40%. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in year 0?

A) -$100,000

B) $15,000

C) -$15,000

D) -$125,000

A) -$100,000

B) $15,000

C) -$15,000

D) -$125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

28

Your firm is considering leasing a radiographic x-ray machine. The lease lasts for 3 years. The lease calls for 4 payments of $25,000 per year with the first payment occurring immediately. The computer would cost $140,000 to buy and would be straight-line depreciated to a zero salvage value over 3 years. The actual salvage value is negligible. The firm can borrow at a rate of 12%. The corporate tax rate is 40%. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in years 1-3?

A) $15,000

B) $33,667

C) $2,750

D) $1,500

A) $15,000

B) $33,667

C) $2,750

D) $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

29

Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. What is the after-tax cash flow from leasing in year 0?

A) -$6,950

B) -$700

C) -$7,650

D) -$4,865

A) -$6,950

B) -$700

C) -$7,650

D) -$4,865

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

30

Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. This lease would be classified as a(n):

A) operating lease because the asset will be obsolete.

B) operating lease because there is not amortization.

C) leveraged lease because it is being financed.

D) financial lease because the lease life is greater than 75% of the economic life.

E) sale and leaseback because the company gets full use of the asset.

A) operating lease because the asset will be obsolete.

B) operating lease because there is not amortization.

C) leveraged lease because it is being financed.

D) financial lease because the lease life is greater than 75% of the economic life.

E) sale and leaseback because the company gets full use of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

31

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300,000 per year with the first payment occurring at lease inception. The system would cost $1,050,000 to buy and would be straight-line depreciated to a zero salvage value. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. What is the maximum lease payment that you would be willing to make?

A) $170,655

B) $175,000

C) $187,842

D) $210,307

A) $170,655

B) $175,000

C) $187,842

D) $210,307

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

32

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300,000 per year with the first payment occurring at lease inception. The system would cost $1,050,000 to buy and would be straight-line depreciated to a zero salvage value. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. What is the NPV of the lease?

A) $111,690

B) $295,040

C) $305,388

D) $309,690

A) $111,690

B) $295,040

C) $305,388

D) $309,690

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

33

Your firm is considering leasing a radiographic x-ray machine. The lease lasts for 3 years. The lease calls for 4 payments of $25,000 per year with the first payment occurring immediately. The computer would cost $140,000 to buy and would be straight-line depreciated to a zero salvage value over 3 years. The actual salvage value is negligible. The firm can borrow at a rate of 12%. The corporate tax rate is 40%. What is the NPV of the lease relative to the purchase?

A) -$125,000

B) -$36,970

C) $75,000

D) $125,000

A) -$125,000

B) -$36,970

C) $75,000

D) $125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

34

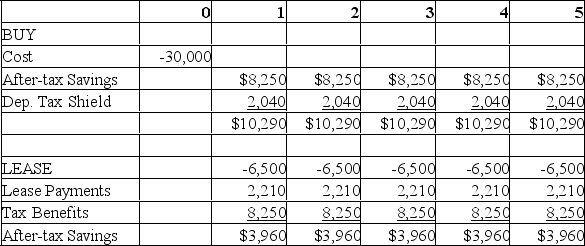

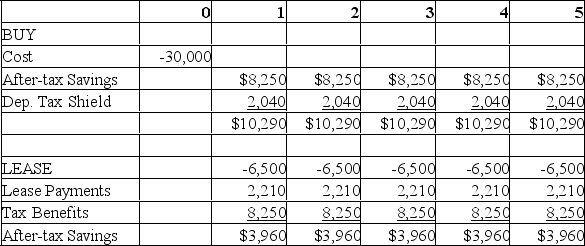

The Blank Button Company is considering the purchase of a new machine for $30,000. The machine is expected to save the firm $13,750 per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $6,500 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 34%, and its cost of debt is 10%.

Calculate the NPV of the lease versus the purchase decision.

Calculate the NPV of the lease versus the purchase decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

35

Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. What is the NPV of the lease?

A) $1039.78

B) $6,610.22

C) -$339.78

D) -$360.22

A) $1039.78

B) $6,610.22

C) -$339.78

D) -$360.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

36

Your firm is considering leasing a radiographic x-ray machine. The lease lasts for 3 years. The lease calls for 4 payments of $25,000 per year with the first payment occurring immediately. The computer would cost $140,000 to buy and would be straight-line depreciated to a zero salvage value over 3 years. The actual salvage value is negligible. The firm can borrow at a rate of 12%. The corporate tax rate is 40%. This lease would be classified as a(n):

A) operating lease because the asset will be obsolete.

B) operating lease because there is no amortization.

C) leveraged lease because it is being financed.

D) capital lease because the lease life is greater than 75% of the economic life.

A) operating lease because the asset will be obsolete.

B) operating lease because there is no amortization.

C) leveraged lease because it is being financed.

D) capital lease because the lease life is greater than 75% of the economic life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

37

Your firm is considering leasing a new robotic milling control system. The lease lasts for 5 years. The lease calls for 6 payments of $300 thousand per year with the first payment occurring at lease inception. The black box would cost $1050 thousand to buy and would be straight-line depreciated to a zero salvage. The actual salvage value is zero. The firm can borrow at 8%, and the corporate tax rate is 34%. All answers are in thousands. What is the after-tax cash flow from leasing in year 0?

A) -$300

B) -$852

C) -$948

D) -$495

A) -$300

B) -$852

C) -$948

D) -$495

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

38

The WACC is not used in the lease versus purchase decision because:

A) the WACC was used in the decision to acquire the asset, this is only a financing decision.

B) the WACC is used only when a lease alone is considered and not a lease versus purchase.

C) the WACC does not include the lease cost of capital and therefore should not be used.

D) tax rates of the lessor may be different than the lessee and therefore the WACC is incorrect.

A) the WACC was used in the decision to acquire the asset, this is only a financing decision.

B) the WACC is used only when a lease alone is considered and not a lease versus purchase.

C) the WACC does not include the lease cost of capital and therefore should not be used.

D) tax rates of the lessor may be different than the lessee and therefore the WACC is incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

39

Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000 per year with the first payment occurring immediately. The computer would cost $7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. What is the appropriate discount rate for valuing the lease?

A) 12.12%

B) 8.0%

C) 5.60%

D) 2.72%

A) 12.12%

B) 8.0%

C) 5.60%

D) 2.72%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

40

The price or lease payment that the lessee sets as their bound is known as:

A) the present value of the tax shields.

B) the reservation payment, LMIN.

C) the present value of operating savings.

D) the reservation payment, LMAX.

A) the present value of the tax shields.

B) the reservation payment, LMIN.

C) the present value of operating savings.

D) the reservation payment, LMAX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Plastic Iron Company has decided to acquire a new electronic milling machine. Plastic Iron can purchase the machine for $87,000 which has an expected life of 8 years and will be depreciated using 7 class ACRS rates of .1428, .2449, .1749, .125, .0892, .0892, .0892 and any remainder in year 8. Miller Leasing has offered to lease the machine to Plastic Iron for $14,000 a year for 8 years. Plastic Iron has an 18.64% cost of equity, 12% cost of debt, a 1:1 debt-equity ratio and faces a 34% marginal tax rate.

What is the discount rate to be used?

What is the discount rate to be used?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Plastic Iron Company has decided to acquire a new electronic milling machine. Plastic Iron can purchase the machine for $87,000 which has an expected life of 8 years and will be depreciated using 7 class ACRS rates of .1428, .2449, .1749, .125, .0892, .0892, .0892 and any remainder in year 8. Miller Leasing has offered to lease the machine to Plastic Iron for $14,000 a year for 8 years. Plastic Iron has an 18.64% cost of equity, 12% cost of debt, a 1:1 debt-equity ratio and faces a 34% marginal tax rate.

Should the asset be purchased or leased? Support your answer.

Should the asset be purchased or leased? Support your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck