Deck 15: Long-Term Financing: an Introduction

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/46

العب

ملء الشاشة (f)

Deck 15: Long-Term Financing: an Introduction

1

Mike's Mopeds used internal financing as a source of long-term financing for 70% of its total needs in 2014. The company borrowed an additional 20% of its total needs in the long-term debt markets in 2014. What were Mike's net new stock issues, in percentage terms, for 2014?

A) -10%

B) -5%

C) 5%

D) 10%

E) 15%

A) -10%

B) -5%

C) 5%

D) 10%

E) 15%

10%

2

Different classes of stock usually are issued to:

A) maintain ownership control by holding the class of stock with greater voting rights.

B) pay less in dividends between the classes of stock.

C) fool investors into thinking that equity is equity and there is no difference in control or value features.

D) to extract perquisites without the other class of stockholders knowing.

A) maintain ownership control by holding the class of stock with greater voting rights.

B) pay less in dividends between the classes of stock.

C) fool investors into thinking that equity is equity and there is no difference in control or value features.

D) to extract perquisites without the other class of stockholders knowing.

maintain ownership control by holding the class of stock with greater voting rights.

3

If you own 1,000 shares of stock and you can cast only 1,000 votes for a particular director, then the stock features:

A) cumulative voting.

B) absolute priority voting.

C) sequential voting.

D) straight voting.

A) cumulative voting.

B) absolute priority voting.

C) sequential voting.

D) straight voting.

straight voting.

4

A grant of authority allowing someone else to vote shares of stock that you own is called a:

A) power-of-share authorization.

B) proxy.

C) share authority grant (SAG).

D) restricted conveyance.

A) power-of-share authorization.

B) proxy.

C) share authority grant (SAG).

D) restricted conveyance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

5

The market-to-book value ratio and the Tobin's Q ratio are both indicators of a successful firm when:

A) their values are both greater than 0.

B) their values are both no less than 10.

C) their values are both less than 0.

D) their values are both less than 1.

E) their values are both greater than 1.

A) their values are both greater than 0.

B) their values are both no less than 10.

C) their values are both less than 0.

D) their values are both less than 1.

E) their values are both greater than 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

6

A corporation has 2,000 shares outstanding, and 6 directors are up for election. The stock features cumulative voting. About how many shares do you have to own to guarantee electing at least yourself to one position on the board of directors (ignoring possible ties)?

A) 1,000.

B) 333.

C) 287.

D) 1,715.

E) 343.

A) 1,000.

B) 333.

C) 287.

D) 1,715.

E) 343.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

7

If cumulative voting is permitted:

A) the total number of votes a shareholder has is equal to the number of shares owned.

B) the total number of votes a shareholder has is equal to the number of shares owned times the average number of years the shareholder has owned the shares.

C) the total number of votes a shareholder has can be calculated as the number of shares owned times the number of directors to be elected.

D) the total number of votes a shareholder has is equal to the number of shares times the number of board meetings the shareholder has attended.

A) the total number of votes a shareholder has is equal to the number of shares owned.

B) the total number of votes a shareholder has is equal to the number of shares owned times the average number of years the shareholder has owned the shares.

C) the total number of votes a shareholder has can be calculated as the number of shares owned times the number of directors to be elected.

D) the total number of votes a shareholder has is equal to the number of shares times the number of board meetings the shareholder has attended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

8

The total shareholders' equity of a corporation is determined by:

A) the sum of the capital in excess of par and the retained earnings.

B) the par value of preferred stock.

C) the sum of the treasury stock and the preferred stock.

D) sum of the number of shares issued multiplied by the par value of each share and retained earnings.

E) the market price of company's debt.

A) the sum of the capital in excess of par and the retained earnings.

B) the par value of preferred stock.

C) the sum of the treasury stock and the preferred stock.

D) sum of the number of shares issued multiplied by the par value of each share and retained earnings.

E) the market price of company's debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

9

Retained earnings are:

A) the amount of cash that the firm has saved up.

B) the difference between the net income earned and the dividends paid in a year.

C) the difference between the market price of the stock and the book value.

D) the amount of stock repurchased.

A) the amount of cash that the firm has saved up.

B) the difference between the net income earned and the dividends paid in a year.

C) the difference between the market price of the stock and the book value.

D) the amount of stock repurchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

10

Corporations try to create hybrid securities that look like equity but are called debt because:

A) bankruptcy costs are eliminated or reduced.

B) these securities have lower risk than debt.

C) both debt interest expense is tax deductible; and these securities have lower risk than debt.

D) both debt interest expense is tax deductible; and bankruptcy costs are eliminated.

A) bankruptcy costs are eliminated or reduced.

B) these securities have lower risk than debt.

C) both debt interest expense is tax deductible; and these securities have lower risk than debt.

D) both debt interest expense is tax deductible; and bankruptcy costs are eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

11

Moose Momentos had equity accounts in 2014 as follows: Common Stock ($1 Par Value) $120,000;

Retained Earnings 32,000;

Total Shareholder's Equity is equal to:

A) $90,000.

B) $92,000.

C) $122,000.

D) $152,000.

Retained Earnings 32,000;

Total Shareholder's Equity is equal to:

A) $90,000.

B) $92,000.

C) $122,000.

D) $152,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

12

The market value of the ownership of the firm equals:

A) the market price of the stock times the number of shares outstanding.

B) the sum of the market price of the bonds and the stock.

C) the par value of the stock times the number of shares outstanding.

D) the market price of the stock minus the retained earnings.

A) the market price of the stock times the number of shares outstanding.

B) the sum of the market price of the bonds and the stock.

C) the par value of the stock times the number of shares outstanding.

D) the market price of the stock minus the retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following does not represent a major difference between debt and equity?

A) Creditors do not have voting power as stockholders do.

B) Payment on interest on debt in considered an expense, while payment of dividends is not.

C) Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid dividends cannot.

D) One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt.

A) Creditors do not have voting power as stockholders do.

B) Payment on interest on debt in considered an expense, while payment of dividends is not.

C) Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid dividends cannot.

D) One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

14

A stock certificate often has a stated value on it. This amount is the:

A) book value.

B) stated book value.

C) subordinated liquidation value.

D) par value.

A) book value.

B) stated book value.

C) subordinated liquidation value.

D) par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

15

There are 3 directors seats up for election. If you own 1,000 shares of stock and you can cast 3,000 votes for a particular director, this is illustrative of:

A) cumulative voting.

B) absolute priority voting.

C) sequential voting.

D) straight voting.

A) cumulative voting.

B) absolute priority voting.

C) sequential voting.

D) straight voting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a group other than management solicits the authority to vote shares to replace management, a _____ is said to occur.

A) proxy fight

B) stockholder derivative action

C) tender offer

D) vote of confidence

A) proxy fight

B) stockholder derivative action

C) tender offer

D) vote of confidence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

17

Authorized common stock usually refers to:

A) the stock's par value.

B) last year's retained earnings.

C) book value per share.

D) maximum number of shares that a corporation is authorized to issue and is stated in the article of incorporation.

E) treasury stock.

A) the stock's par value.

B) last year's retained earnings.

C) book value per share.

D) maximum number of shares that a corporation is authorized to issue and is stated in the article of incorporation.

E) treasury stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Lory Bookstore used internal financing as a source of long-term financing for 85% of its total needs in 2014. The company borrowed an additional 25% of its total needs in the long-term debt markets in 2014. What were Lory's net new stock issues in that year?

A) -20%

B) -10%

C) 10%

D) 20%

E) 30%

A) -20%

B) -10%

C) 10%

D) 20%

E) 30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

19

The book value of the shareholders ownership is represented by:

A) the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.

B) the total assets minus the net worth.

C) the sum of the preferred stock, debt and the capital surplus.

D) the sum of the total assets minus the current liabilities.

A) the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.

B) the total assets minus the net worth.

C) the sum of the preferred stock, debt and the capital surplus.

D) the sum of the total assets minus the current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

20

The market-to-book value ratio implies growth and success when it is:

A) less than 1.

B) less than 0.

C) less than 10.

D) greater than 1.

A) less than 1.

B) less than 0.

C) less than 10.

D) greater than 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

21

Long-term debt is sometimes called:

A) secured debt.

B) subordinated debt.

C) funded debt.

D) capital debt.

A) secured debt.

B) subordinated debt.

C) funded debt.

D) capital debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

22

Preferred stock has both a tax advantage and a tax disadvantage. Those two are:

A) in default there are no taxes and dividends are taxed in corporate hands at 70%.

B) corporate dividend receipts are taxed on 30% of the total dividends and a liability is created for arrears.

C) dividends are not a tax-deductible expense but are 70% exempt from corporate taxation.

D) dividends are fully tax deductible but are not equity capital.

A) in default there are no taxes and dividends are taxed in corporate hands at 70%.

B) corporate dividend receipts are taxed on 30% of the total dividends and a liability is created for arrears.

C) dividends are not a tax-deductible expense but are 70% exempt from corporate taxation.

D) dividends are fully tax deductible but are not equity capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a debenture is subordinated, it:

A) has a higher priority status than specified creditors.

B) is secondary to equity.

C) must give preference to the specified creditor in the event of default.

D) has been issued because the company is in default.

A) has a higher priority status than specified creditors.

B) is secondary to equity.

C) must give preference to the specified creditor in the event of default.

D) has been issued because the company is in default.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

24

Based on historical experience, which of the following best describes the "pecking order" of long-term financing strategy in Canada?

A) Long-term debt first, new common equity, internal financing last.

B) Long-term debt first, internal financing, new common equity last.

C) Internal financing first, new common equity, long-term borrowing last.

D) Internal financing first, long-term borrowing, new common equity last.

A) Long-term debt first, new common equity, internal financing last.

B) Long-term debt first, internal financing, new common equity last.

C) Internal financing first, new common equity, long-term borrowing last.

D) Internal financing first, long-term borrowing, new common equity last.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

25

Income trusts are structured such that income is taxed in the hands of the:

A) income trust.

B) operating entity.

C) unitholders.

D) there is no tax on income trusts.

A) income trust.

B) operating entity.

C) unitholders.

D) there is no tax on income trusts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is true?

A) In recent years external equity has been a large percentage of total sources of financing even though this is, by far, the most expensive source of financing.

B) In recent years external equity has been a large percentage of total sources of financing. Some argue that this relationship exists because financial managers think stock prices are too high.

C) In recent years external equity has been a small percentage of total sources of financing even though this is, by far, the cheapest source of financing.

D) In recent years external equity has been a small percentage of total sources of financing. Some argue that this relationship exists because financial managers think stock prices are too low, even though this is inconsistent with efficient markets.

E) In recent years external equity has been a small percentage of total sources of financing in part because of the legal reserves that the firms must hold against equity.

A) In recent years external equity has been a large percentage of total sources of financing even though this is, by far, the most expensive source of financing.

B) In recent years external equity has been a large percentage of total sources of financing. Some argue that this relationship exists because financial managers think stock prices are too high.

C) In recent years external equity has been a small percentage of total sources of financing even though this is, by far, the cheapest source of financing.

D) In recent years external equity has been a small percentage of total sources of financing. Some argue that this relationship exists because financial managers think stock prices are too low, even though this is inconsistent with efficient markets.

E) In recent years external equity has been a small percentage of total sources of financing in part because of the legal reserves that the firms must hold against equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

27

Financial deficits are created when:

A) profits and retained earnings are greater than the capital-spending requirement.

B) profits and retained earnings are less than the capital-spending requirement.

C) profits and retained earnings are equal to the capital-spending requirement.

D) profits and retained earnings are greater than or equal to the capital-spending requirement.

A) profits and retained earnings are greater than the capital-spending requirement.

B) profits and retained earnings are less than the capital-spending requirement.

C) profits and retained earnings are equal to the capital-spending requirement.

D) profits and retained earnings are greater than or equal to the capital-spending requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

28

The written agreement between a corporation and its bondholders is called the:

A) collateral agreement.

B) deed.

C) indenture.

D) deed of conveyance.

A) collateral agreement.

B) deed.

C) indenture.

D) deed of conveyance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

29

Tree Top Toys needs to finance their new production facility for spyglasses. The cost is $12 million. They expect to payout $6 million or 40% of their net cashflow. Any external financing will be raised 80% borrowings and the remainder equity. Unfortunately, the company has no internal excess short-term funds to use. How much total equity cashflow will be used?

A) $0.6 million.

B) $2.4 million.

C) $9.0 million.

D) $9.6 million.

E) $3.0 million.

A) $0.6 million.

B) $2.4 million.

C) $9.0 million.

D) $9.6 million.

E) $3.0 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

30

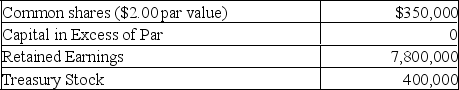

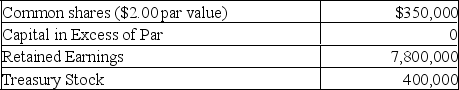

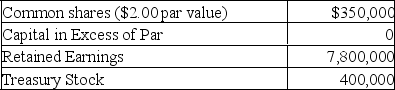

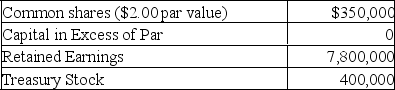

Information on shareholder's equity as currently shown on the books of the Enstat Corporation is given as:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

31

Debt that may be extinguished before maturity is referred to as:

A) sinking-fund debt.

B) debentures.

C) callable debt.

D) indenture debt.

A) sinking-fund debt.

B) debentures.

C) callable debt.

D) indenture debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

32

The amount of loan a person or firm borrows from a lender is the:

A) creditor.

B) indenture.

C) debenture.

D) principal.

E) amortization.

A) creditor.

B) indenture.

C) debenture.

D) principal.

E) amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

33

The written agreement between a corporation and its bondholders might contain a prohibition against paying dividends in excess of current earnings. This prohibition is an example of a(n):

A) maintenance of security provision.

B) collateral restriction.

C) affirmative indenture.

D) restrictive covenant.

A) maintenance of security provision.

B) collateral restriction.

C) affirmative indenture.

D) restrictive covenant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

34

Technically speaking, a long-term corporate debt offering that features a specific attachment to property is generally called a:

A) debenture.

B) bond.

C) long-term liability.

D) preferred liability.

A) debenture.

B) bond.

C) long-term liability.

D) preferred liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

35

Not paying the dividends on a cumulative preferred issue may result in:

A) preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid.

B) additional voting rights are granted to common stockholders if dividends are in arrears.

C) full payment of dividends to common shareholders.

D) both preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid; and additional voting rights are granted to common stockholders if dividends are in arrears.

E) both voting rights are granted to preferred stockholders if preferred dividends are in arrears; and no payment of dividends to common shareholders.

A) preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid.

B) additional voting rights are granted to common stockholders if dividends are in arrears.

C) full payment of dividends to common shareholders.

D) both preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid; and additional voting rights are granted to common stockholders if dividends are in arrears.

E) both voting rights are granted to preferred stockholders if preferred dividends are in arrears; and no payment of dividends to common shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements about preferred stock is true?

A) Unlike dividends paid on common stock, dividends paid on preferred stock are a tax-deductible expense.

B) Unpaid dividends on preferred stock are a debt of the corporation.

C) If preferred dividends are non-cumulative, then preferred dividends not paid in a particular year will be carried forward to the next year.

D) There is no difference in the voting rights of preferred and common stockholders.

E) None of these.

A) Unlike dividends paid on common stock, dividends paid on preferred stock are a tax-deductible expense.

B) Unpaid dividends on preferred stock are a debt of the corporation.

C) If preferred dividends are non-cumulative, then preferred dividends not paid in a particular year will be carried forward to the next year.

D) There is no difference in the voting rights of preferred and common stockholders.

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

37

Financial economist prefer to use market values when measuring debt ratios because:

A) market values are more stable than book values.

B) market values are a better reflection of current value than historical value.

C) market values are readily available and do not have to be calculated like book values.

D) market values are more difficult to calculate which makes financial economists more valuable.

A) market values are more stable than book values.

B) market values are a better reflection of current value than historical value.

C) market values are readily available and do not have to be calculated like book values.

D) market values are more difficult to calculate which makes financial economists more valuable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

38

A standard arrangement for the orderly retirement of long-term debt calls for the corporation to make regular payments into a(n):

A) custodial account.

B) sinking fund.

C) retirement fund.

D) irrevocable trustee fund.

A) custodial account.

B) sinking fund.

C) retirement fund.

D) irrevocable trustee fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

39

Firms follow the "pecking order" in their long-term financing because:

A) internally generated funds are the cheapest source of financing.

B) outsiders will know less about the company and reduce the threat of any takeover.

C) other financial strategies create more agency problems.

D) firms prefer to issue safe securities with less valuation risk first.

A) internally generated funds are the cheapest source of financing.

B) outsiders will know less about the company and reduce the threat of any takeover.

C) other financial strategies create more agency problems.

D) firms prefer to issue safe securities with less valuation risk first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a firm retires or extinguish a debt issue before maturity the specific amount they pay is:

A) the amortization amount.

B) the call price.

C) the sinking fund amount.

D) the spread premium.

A) the amortization amount.

B) the call price.

C) the sinking fund amount.

D) the spread premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

41

Information on shareholder's equity as currently shown on the books of the Enstat Corporation is given as:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

42

If Enstat was to put their firm in place today the cost of the assets are estimated to be $9.5 million. The stock price is currently $120 per share and there is no debt outstanding. Calculate the market-to-book value and Tobin's Q ratio. How well is Enstat being managed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is indenture?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

44

Preferred Stock, as a hybrid security, presents somewhat of a puzzle as to why they are issued. What elements give rise to the puzzle and how is it explained?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

45

Identify the general rights that are commonly granted to common stock shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Knot Knit Corporation needs to elect 9 directors. There are 120,000 shares outstanding. Under cumulative voting, how many shares would you need to own to guarantee that your favorite candidate is elected?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck